Housing Bread and Circus: Foreclosures, Employment, Bazookas, and the World’s Largest Mortgage Bailout.

Even though the first week of September started with a short week for the market, there were plenty of financial fireworks to go around. During the week the Mortgage Bankers Association reported that on mortgage loans on one-to-four unit residential properties that 6.41 percent of all outstanding loans in the second quarter were delinquent. This rate increase had support from California and Florida that accounted for nearly 40% of all foreclosure activity. This again is record territory and points to signs that housing simply is not recovering. Given that much of our economy is dependent on housing and foreclosures are the direct symptom of a poorly performing housing market we can safely say that housing is still ill and getting worse. Most people for the last two weeks have been captivated by the circus of both conventions while the markets are still slumping.

As I discussed in a previous article, the baby boomer generation demographic shift almost assures that we are going to see a decade long stagnation in our economy. The challenge for the current economy is the ritualistic cleansing of bad debt. It has been my position that most economists and mainstream media folks severely underestimated the extent of toxic credit that was floating out in the market. The assumption of a quick drop and pop for the housing market was not justified by any unbiased data out in the market.

In the week, we also found out that the employment situation is quickly deteriorating and sent the market plunging on Thursday:

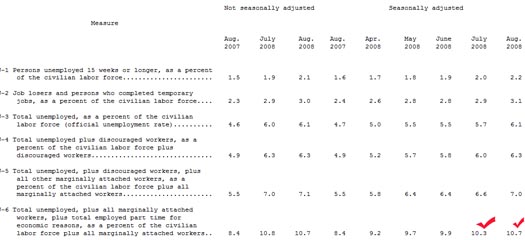

The unemployment rate surged to a five year high hitting 6.1%. Of course if we look at a more useful indicator of employment which includes part-time workers looking for work and those who flat out have given up looking for work the number jumps to 10.7%, a jump from 8.4% from August of 2007:

Most people do not get their information from blogs or alternative media so the number they keep hearing is that 6.1%. Yet if someone spent a few seconds to explain that people looking for work and those who have given up looking are not counted in the mainstream number, they would probably question the actual measurement. That is why our economy feels much worse because it really is. Inflation is another figure that really underreports the cost of living increases most Americans are battling on a daily basis. We are now in our 8th consecutive month of job losses and if we total all the job losses for 2008, we arrive at 605,000. Keep in mind that 100,000 to 150,000 jobs need to be added each month simply to keep pace with our economy growth and population shifts.

You are not a Crony

On Friday, it was curious to see many financial stocks rally seemingly on no news at all. After all, earlier in the week we had horrible foreclosure reports and on Thursday found out the economy is only getting worse. So why would financial stocks pop on Friday? As it turns out, we now know that Fannie Mae and Freddie Mac are going to have their bailout. Interesting that our new form of crony capitalism with the Housing and Economic Recovery Act of 2008 was scheduled to go into effect on October 1, 2008 and here we are using the Hank Paulson bazooka which of course only a few weeks ago was not going to be used. The mere threat should be enough to reassure the world that craptastic mortgages somehow had any intrinsic value. Early indications are that common stockholders (aka the retail investor, aka you) are going to get reamed. So if you own some of these inflated mortgage stocks you may feel even more pain. As if you can get more painful than this:

Both Fannie Mae and Freddie Mac are down approximately 90 percent from only one year ago. For all intents and purposes these stocks have been hammered. According to the New York Times and Washington Post all leadership will be replaced, the companies look to be put into conservatorship, and the deal will try to be announced before the open of the Asian markets. Remember that pop in financials on Friday? Well it appears some folks had advanced notice of what was going to happen. If you aren’t a crony you probably had no idea this was going to happen. The reports are still coming out and it still isn’t completely clear but it looks like the government is going to turn these two into zombies and let them fizzle out. Welcome to the U.S. version of Japan.

A few years ago people questioned that something like this would happen. Fannie Mae and Freddie Mac were simply too large to be taken over. After all, they own nearly half of the $12 trillion mortgage market. Yet the fact of the matter is this deal does nothing for the average American citizen. If you own common shares of Fannie Mae and Freddie Mac in your 401(k), IRA, brokerage account, or anywhere else you already know that the government is not going to help you out. That is how it should be. Yet the early reports look like the government is going to use some of that $800 billion debt ceiling to prop up some of the toxic mortgages in their portfolio. Take a look at some of the Real Homes of Genius and you’ll quickly find out that there needs to be zero support on some mortgages. Essentially the U.S. government is making foreign investors happy and part of the crony inner circle happy by doing this. What needs to be done is these 2 enterprises need to be taken over and split up into multiple entities. Foreign investors never had a 100% guarantee even if it was implied. The government now looks to essentially quell any global problems for fear that foreigners will take our credit card away. Yet this will do nothing for the average American citizen. Why should citizens be asked to live within their means and the government is somehow exempt from this?

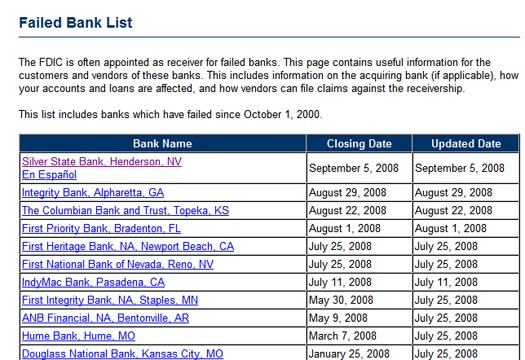

Actually it will do something. It basically will allocate a large portion of our debt to totally unproductive parts of the economy. Money that can be used to further research and development, infrastructure, and our economy will now be used to fix horrific bubble mortgages that should be allowed to collapse on their own. Somehow letting go is hard. As if trading homes to one another and putting granite countertops was the epitome of a fully functioning economy. If that wasn’t enough, another bank was taken over on Friday which is now becoming a typical Friday ritual. Silver State Bank in Nevada was taken over and has $2 billion in assets. This is 11th bank to fail and it won’t be the last.

If we are to bailout every institution the FDIC fund is now quickly being depleted. Indymac Bank took up nearly 17% of the entire fund! Silver State will cost the fund from $450 to $500 million but the money is quickly adding up.  Should a larger bank and there are a few that are on the list should crumble, it could be enough to wipe out the fund. FDIC chairwoman Shelia Bair has already implied that they may need more money from the Treasury. Get in line! This Fannie Mae and Freddie Mac debacle is going to play out like a slow motion train wreck.

If it is already this bad, how do you think things are going to look in 2009? Heck, states like California won’t hit a bottom until May of 2011 and I’ll give you 10 reasons as to why. If you think this isn’t possible, California can’t even agree on a budget! The year of records is now seeing another record in which the state has now gone into the longest period without a budget in place. So how are things in California right now?

July 2008 Home Sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 39,507

Foreclosure Resales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 44.8%

July 2008 Notice of Defaults:Â Â Â Â Â Â Â Â Â Â Â Â 36,373

July 2008 Notice of Trustee Sales:Â Â Â Â 12,506

July 2008 Real Estate Owned:Â Â Â Â Â Â Â Â Â Â 23,406

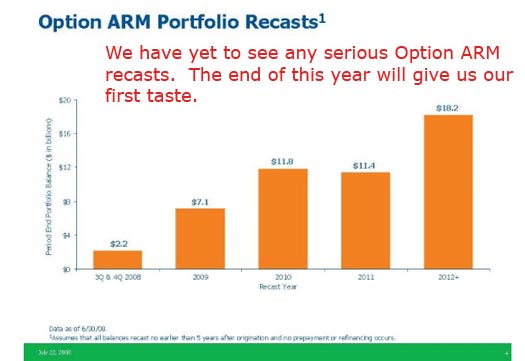

Just look at that. July which is normally one of the best home sale months for the state has simply kept pace with the onslaught of problem housing. Since pretty much all of the notice of defaults will become REOs soon, you can rest assured that these homes will be on the market during the poorest selling time which is the fall and winter. And with $300 billion in Option ARMs here in California, we are going to enter uncharted territory. The financial markets reacted as if these loans will be taken into the dumping ground bailout of Fannie Mae and Freddie Mac but that does not seem to be the case. If we look in the details at the FHA program which starts next month, many of these loans will not qualify because they are underwater. If these lenders should bring these mortgages on to their books it would shred apart their balance sheets. Take a look at WaMu’s exposure to this:

In the meantime, the saga of the Ed McMahon house is still going strong. As it turns out, it looks like the current buyer is no longer in the game to purchase the home. Donald Trump was reported to make an offer but you have to wonder what that bid looked like and he also offered to be Ed’s landlord. Only in SoCal folks. Even a home with a $1.9 million price reduction in the 90210 is having a hard time in today’s market. The place is still active so if you have $4.6 million, this may be your chance to reemerge just like the 90210 television series.

While many get distracted by the shiny things in our country, we have some serious issues to confront. This is not going to be easy. It is amazing that some people still think things aren’t that bad or all this is some kind of fabrication by the media. If that were only the case. Most of the people which claim this probably don’t go shopping for groceries, or talk with neighbors, or have any idea what a good college costs today, and yet they think things are great for everyone since they are fine for them. The data simply does not reflect this. It hasn’t for years. We are only seeing a convergence between data and reality now. The time for bread has passed and now it is time for the big circus under the tent.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

33 Responses to “Housing Bread and Circus: Foreclosures, Employment, Bazookas, and the World’s Largest Mortgage Bailout.”

I have tremendous respect for what you have to say. However, one area of disagreement. “Yet this will do nothing for the average citizen.” As you point out, it is being done “for fear that foreigners will take our credit card away.” That is exactly what this does for the average citizen. This country is no longer independent. In my lifetime it’s gone from being the world’s biggest creditor nation, to being the world’s biggest debtor nation. Foreigners could easily pull the plug on our economy and often I wonder why they don’t. Of course it would hurt their economies badly, but it would bring us to our knees. We have to wean ourselves off foreign credit, but it can’t happen instantly. Well, actually it can, but it would be devastating. We are addicted to credit, and like any junky, there are going to be withdrawal symptoms. Maybe “cold turkey” is the best way to handle it, but I prefer a methadone approach.

Money moves from private American citizens and goes to foreign banks. This happened because we left our economy to “experts”. Unfortunately we thought they felt a fiduciary interest in watching out for our welfare. They don’t. They are bought and paid for.

I’m convinced that the big reason we aren’t building a border fence is because America is not intended to be a sovereign nation any longer than it has to be. Destruction of the dollar is the most important hurdle to overcome to justify the introduction of the Amero.

Here in California we have all these budget and unemployment problems and we still import millions of non-citizens and give them benefits and services that citizens don’t even get in the countries they came from. And we look the other way as they take jobs from the finite employment opportunity pool.

Perpetual children who take from anyone trying to live like a responsible adult to fund their juvenile fantasies of how their world should be.

This country didn’t just inhale it stuffed its face.

I agree with Stan. We as a country must ween ourselves off of foreign credit just like foreign oil. It can be done and should be done “cold turkey”, not a methadone approach. I am still on the sidelines watching all this crap unfold and just can not beleive my eyes when looking at how the Fed Govt is handling this and to see how out here in NorCal there are areas that are just not budging price wise when it comes to the price of homes. I am just fine were I am now, not being in debt with cards, cars, or a HYPER INFLATED mortgage payment just because some realtard agent pushed me into a home. My family and I live within our means and now its time for the Govt (Both Fed and State) to do the same.

Not sure if it will take as long for USA to get through this compared to Japan. I surely hope not. We have the ability as a nation to learn from this HUGE mistake and make things better for the future IF we have leaders who beleive this and citizens who beleive this also.

As far as Dave’s post is concerned, I pray we never see the Amero and I predict that if it comes to that we will all see “Possse Cometatis” come back into action. Read the constitution folks, that provision is still in the Great Document and it will be put into action if we as the USA are in the position were this bullshit merger talk with Cannuckvolle (Oh Canada) and Mehico ever comes to frution. Like Heston said, “from my cold dead hands” is my motto likewise. We need to keep and protect our soverignty at all cost. We are the greatest nation on the planet and need to remain so. The Great Architect of the Universe knows this like many Americans know this and we must protect ourselves now and into the future.

Keep up the great work Doc. I always get a good laugh with some of your comments in all your articles.

Ever Onward Brothers and Sisters.

If I were of a Gen Y’er, I would be mad as hell at the “leadership” of their parents’ generation for leaving them to foot the bill. We have exported the wealth of this and future generations off-shore so that we can enjoy shiny new things (especially houses) that we can’t really afford. As a recent article in the NY Times said, the Baby Boom generation may be looked at in the history books as the generation that wrecked America. What a legacy.

Better days are ahead but we have quite a storm to ride out.

Dave, I forget who, but a wiseman once described America as the ‘world’s colony’. That was 20 years or so ago but he knew of what he spoke. Here’s the deal as I see it. The GSE’s have over 5 trillion in mortgage obligations. Most of them are ( or were good) but they have less than $100 billion to back their obligations up with. Were they a federally chartered bank they would have been told long ago to raise capital or shrink their ‘assets’. That’s 50 to 1 leverage. The mortal equivalent of you buying a Ed McMahon’s house on an income of $100,000 per year. The US Treasury has agreed to spend up to $200 billion to back that $5 plus trillion in mortage obligations. So that brings our leverage ratio down, if the Treasury has to make good on its total ‘public’ commitment, to about $275 billion capital backing $5.5 trillion ( because the GSE’s have been authorized to back another $350 billion in mortgages by this same ‘bailout’ package. We are now down to a 20 to 1 leverage ratio. Yet we are in a declining market with rising unemployment and ‘asset deflation’. Consider that a mere 4% decline in mortgage valuations, would wipe out both the GSE AND the US Treasuries capital maximum proposed capital infusion we can see that this in not only a reasonable development but, given current market valuations, a likely one. $200 billion isn’t what it used to be but what Paulson et. al. are counting on is that, somehow this will restore valuations to ‘Real Homes of Genuis’ to what they once were and thus end the stress on GSE obligations. That is, as DHB has elonquently photographed, charted and written about, simply not possible.No one who can qualify for a current $500,000 mortgage is going to bid on a Real Home of Genius. Paulson can throw all the money he likes at this issue but he cannot decree that 1950’s Los Angeles bungalows or Florida condos are properties worth one half a million dollars!

@DAve: “[A]nd we still import millions of non-citizens…Perpetual children who take from anyone trying to live like a responsible adult to fund their juvenile fantasies of how their world should be.”

You mean, like those responsible U.S. citizens who took out negative amortization loans to finance their fantasies of soaking tubs and travertine floors and open-to-below-foyers? (I’m sure there is a constitutional penumbra that protects an American’s God-given right to granite countertops and a 3-car garage.)

Don’t forget the Blacks. Or the Jews.

blutown. it pains me to say this but yes, the babyboom generation did squander the national inheritance. From our parents we were given the world. Victorious in WW2 we grew up in an era of ever increasing affluence. We even did some good things, The Beatles endure, and though you might have been to young to have known them they were, as a critic observed, God’s Christmas Present to the World, and Bob Dylan still remains the greatest living tunesmith of modern times.

Quibble if you will that both were born in the 40’s they remain as the icons of the Babyboomers. To imagine that Britany Spears, Michael Jackson or M.C. Hammer types have anything near the talent and lasting influence of Lennon, McCartney, Harrison or Dylan is to imagine that Real Homes of Genius were good values. The PC,internet and cellphone were also developed by the babyboomers. Not exactly small beer. Where babyboomers failed was in our greed and unwillingness to become the adults our parent were. We didn’t replicate ourselves and the shortage of ‘human capital’ in our society has become manifest. We have to ‘import’ a peon class to do our work as we no longer require our own poor to do menial labor.We invest far too much of our wealth in symbolic fashion. How odd for the generation that gave us the ‘hippie’ to sink into a spiritual poverty where granite countertops and stainless steel appliances signify ‘success’. We failed is my conclusion.

Scott – your comments were of interest until you exposed yourself as a racist. I hope bad karma finds you well….

Scott

“a turd colored president” ??? WTF??

oh, and the Beatles were from England not America.

geesh, I’m surprised to see such a stupid and hateful comment on DrHB’s site.

Easy now Scott! I generally appreciate your posts, but that last line goes a bit too far for me! The color means nothing, it’s the policies that count. Please!

“This country didn’t just inhale it stuffed its face.”

Well said Dave.

>>Hope you can do better but electing a turd colored president isn’t the answer.

The issue is not his color, the issue is that he is a zionist puppet just like McInsane. Let’s all admit it the jews have been running USA into the ground for profit. And now is their star moment when they milked this country to the last drop and ready to move on to some other host nation.

I harken back to a conversation with a not too intelligent colleague who made the most remarkable comment that continues to haunt me.

The conversation was about progress current versus past. She quite innocently stated when we rehashed the improvements of contemporary past say 50 year advancements with turn the 20th century advancements, why are we not advancing anymore.

Now I was quite taken abake by this apparently rubic statement. But upon further reflection I thought “shes absolutely correct!”. How can you compare the internet to say the industrial age? Or cellular communication to the telephone? How about the hybrid to the model T? The value added of those earlier innovations are FAR more significant than anything as of late, we’ve just been immune to that fact through the buttress of easy credit. We have continuously burned through the legacy of the pioneers who came before us.

We have been in a prolonged period of absolute stasis! We are not productive, we are living on credit which is drying up fast and as Warren Buffet says, we’re going to see exactly who’s swimming naked when the tide recedes. We are going to see VALUE again. No more mirages, no more gimmicks, the time for that is past, value will reign and it will be TANGIBLE, not some phony balogny subjective goolosh.

The type of decisions we’ll make in an atmosphere of limited to no credit will set the tone for our next evolution. When we have to part with CASH for goods and services we’ll be much more discerning. Iam MUCH more worried about our reaction to this crisis. Namely will be embrace the “broken window fallacy” that war is actually GOOD for an economy.

Recessions and cutbacks force people to use valuable resources in the most efficient manner which is a good thing. If we can overcome the societal strife that comes with such a massive parodigm shift (from fluff to value), then I think this will be a time for great rejuvenation.

Whether Iam being overly optimistic or not, only time will tell. But as they say “hold on this is gonna be a bumpy ride” cannot be understated.

DAve and JC,

Regarding the Amero and the idea of merging Canada, US and Mexico: there isn’t any interest here in Canada. The failed attempt to take over Canada in 1812 has left a bit of underlying paranoia about merging our two nations. If there was any kind of vote on this in Canada, it wouldn’t happen.

Truthseek,

WTF? What kind of SMUCH leaves those kinds of remarks!

This discussion is starting to sicken me! The blame game is how we got into this mess and it certainly is not going to get us out.

As the Dr. has pointed out in a recent article, we are at a dangerous crossroad that could leave us with a decade of despair. One of our strengths as a country is our ability to roll up our sleeves and git ‘er done in the face of long odds. If we don’t remember this, the hard work of our founding fathers and all who have sacrificed for our common good will have been tragically wasted. Seize the moment so that we don’t steal a brighter future away from our children.

All you racist, antisemitic sub-humans need to crawl back under your rocks.

Wow. DHB posts on the GSE bailouts and the comments seize this as an opportunity to spout xenophobia and racism. I’d say this is a good occasion for the delete button.

All of these so-call-gifts are just mass marketing consumer products. It is really amazing to see how some people are really blind to their own BS.

I don’t know what made me laugh more. The turd comment or people shocked and sickened that there are racists out there. But I think this is a crack up at 2:15 into this youtube link.

http://www.youtube.com/watch?v=cOxOR3x8FBQ

Perhaps we need some more moderation of this blog, all things in moderation as they say, but really I don’t want this blog to degenerate like frankly so much of the internet has. I swear, much of the internet has become an intellectual wasteland invaded by “retard memes” like some foreign species destroying an ecosystem.

DHB has always been an exception. I don’t mind criticism of illegal immigration or of Obama’s *policies* but um a “turd colored president”. Geez.

Guys,

ENOUGH! There’s no place here for the crazy RACEIST comments. I don’t like it at all!

Wow, that last post really brought out the tinfoil hat crowd.

I wholeheartedly agree that “turd-colored president” is utterly racist and lame. I will point out that the other overtly racist crap in this thread has been by the trollies who have been trying to paint at least in my case any discussion of the effect of illegal immigration on the unemployment rate and government expenditures in California as racist.

It’s not. It’s a matter of citizens and non-citizens. A hispanic American for instance seems to me to have a far greater claim to access to the finite pool of employment opportunities in a struggling economy than the whitest of non-citzens. What kind of racist does that make me???

Upon review I can see how someone might think that when I was talking about

“Perpetual children who take from anyone trying to live like a responsible adult to fund their juvenile fantasies of how their world should be.”

that I was talking still about illegal immigration. I apologize for my poor writing. I was referring to exactly those idiots who borrowed so very much money to buy vanity items like granite countertops, mcmansions, skiboats and BMW SUV’s. Those who so love to have and enjoy the consequences of wealth without accomplishing or comprehending its fundamentals and who now are going after people like me and most of us who work so hard to be financially responsible and adult.

I was gonna go off on someone for daring to accuse someone like ME of being a racist but I’m going to go ahead and blame the tone of some responses on my deficiencies in expressing myself and not just people playing the race card here.

I and my family of eight live in 1500 square feet. Kinda cramped, but that’s living within your means and why it’s kinda annoying I have to bailout people who have a quarter of the population density my home has.

I’m selling my dad’s old house in La Verne, a VERY nice socal community. $319K to start a month ago, $289K now, probably $269K next week. Still no takers or interest. Nice people are getting murdered in this market to feed the greed, selfishness and immaturity of a bunch of punks.

In fact I’d like to offer this up by someone much more eloquent than me

http://www.youtube.com/watch?v=PbOIg1Wy9Zo

..and in hopes that all of you my friends might find some positive moments in all this misery, future misery and potential misery which must be plaguing and disturbing and worrying you like it does me.

Thank you also so much to our generous host- I so appreciate it

All the best-

David,

What happend, I thaught this was a blog for intilectual discussion, not racial hatred. Please DRHB remove this garbage from here, even my own remarks if nessessary.

Doctor,

Why all the effort on precise research and reporting but no effort to moderate comments? In any case, you’ve been discovered by the cancer cells, start zapping them in the future or your blog is a lost cause.

Normally the discussion on here is civil even if people have differing points of view. I’ve edited a few of the remarks. Let us keep this related to housing and economics.

I don’t think the “Great Creator” is the reason this country is great…it has to do with tremendous opportunity and a strong work ethic. Just within my 40 year lifetime, this has disappeared. Americans are becoming lazy entitled whiners who sue each other at the drop of a hat. The opportunities are gone as we now have an established upper class that pulls the strings in government to save itself at the cost of common people. Like the Doc says, there is a privileged inner circle of cronies who benefit, but it is always couched like it is helping the average American. We have become a nation of patsies for whatever Ponzi scheme they want to sell us. The immigration thing is just a wedge issue and is miniscule compared to the real problems we face due to the spendthrift mentality of the political party in power.

I’m stunned how everyone blames the individual, but nobody bothers to look what is driving our society. It’s easy to blame the individual, but be honest, it’s all around us: You can’t turn on the tv without a shiny ad telling you how inadequate and unhappy you are without a certain product, and you should get it, because you “deserve” it.

This is a consumer society where growth is measured in consumption. Wall Street economics warned in 2005 that we were heading for trouble, and the Fed had to stop in, raise the interest rates (http://www.bloomberg.com/apps/news?pid=10000103&sid=aD88.sUId1IM&refer=us), but it didn’t happen, because that would have slowed “growth”. This disaster didn’t happen only because individuals took out loans they couldn’t afford. There was a whole slew of institutions, supposedly full of experts, who should have known better, who not only allowed this happen, but actively participated and benefited from it.

Check out this ad by Countrywide: http://www.youtube.com/watch?v=Uk5Op5lsZgo – Ironic isn’t it?

Or the CEO of Re/Max telling people in 2007 (!) that this is the time to buy, appreciation is guaranteed: http://www.youtube.com/watch?v=TD2_NmPevVs

Issues like illegal immigration are red herring. If you want to get on your soap box, keep it relevant to the subject of real estate. Once you start spouting racism, bigotry, you lose credibility for good.

Complexity frightens most people. Also, as a nation, Americans seem to be both primarily trusting (good) and gullible (not good, or as Orwell might say, ungood, even double ungood).

200 years ago few people traveled further than 50 miles from their residences more than a couple times in their lives. 100 years ago, long distance travel was constrained to the still rather pedestrian pace of railcar. 10 years ago more people used snail mail than email, and landlines still outnumbered cell phones.

At core, I think even the most misguided racist, anti-immigrant, and anti-semite “contributors” recognize that there is something profoundly amiss with the economic system in which we all reside. I feel more pity than rancor towards them; they’ve misapplied their valid displeasure and mis-identified the true miscreants who are responsible.

That is, the Martians. No, wait! Just kidding. It’s the ‘ownership class’ that created mechanisms like CDO’s, and which successfully distract people with, for example, crap on TV. For the anti-semite, I dare you try to get a Jew into the Skull and Bones at Yale. For the anti-immigrant – um, where exactly did YOUR ancestors come from? Also, are YOU willing to pick strawberries for $2 a flat? For the racist, what happens to your pigmentation when you go into the sun?

The level of complexity – so much information running through our brains (Police lyric, modified) is now so enormous that IMO most can’t handle it, and revert to the simplest explanation. It’s the “other’s” fault – immigrants, races, generations, gender.

But do they turn off the TV? Do they seek out solace in solitude, reflection, and service? Or do they believe that ‘freedom’ is equal to having a gasoline powered vehicle running at 85 mph down route 66?

Math is not a rumor. Complexity is rampant in our lives. Accept this, and accept that there aren’t any “answers” to the economic malaise that grips the world economy, other than letting the rigged game fall, and starting fresh.

Do some people really think that to be against illegal immigration is racist? wow.

Yeah, much too easy to dismiss the info here by calling us “conspiracy theorists” who wear “tinfoil hats.” Facts are facts. An elite does have control of our government, and it’s been this way for a very long time. Special interests have been running/ruining things for a long time now. What’s to be done about it? These problems are way beyond partisanship. Both “sides” seem to kowtow to the money. What’s to be done? In certain circles, one cannot even talk about such things, without being branded a “racist” or an “antisemite.” I’m not sure that name calling will be so effective if things get much worse.

It just makes me sad, so very very sad, to see authority abused in such a horrendous way, without any repercussions.

Leave a Reply