Housing Future: How the American Public Will be the Proud Owner of Toxic Mortgages and Unwanted Housing. A 4 Step Program.

Hope everyone had a great 4th of July and took a break from the torrent of bad economic news coming at us like a flock of seagulls chasing a half open bag of Doritos. Now that we’ve enjoyed our minor respite it is back to the grim reality that equity in homes, once the bastion of the consumption machine is no longer there like a skyrocket bursting in air. The market on Monday reflected the absolute uncertainty and tentativeness of investors trying to figure out what in the world is going on. Initially, the DOW shot up 100 points then quickly reversed downward by 160 points, and closed the day down 56 points.

This market momentum simply reflects the deeper psychological rips that the credit market is causing. The news that ushered in this mania was the fact that, hold on to your hats folks, Fannie Mae and Freddie Mac may need a bit more cash. Now wouldn’t we all like a little bit more cash? Guess what folks? The government has read your mind and is talking about a second round of stimulus checks! Where will this money come from? Who cares! Fire up the printing presses because we are taking a lesson from Zimbabwe here.

So what was the big deal with Fannie Mae and Freddie Mac:

“(Financial Times) Shares in Fannie Mae and Freddie Mac plunged yesterday as investors worried that the two giant government-sponsored mortgage financiers would have to raise fresh capital.

Fannie and Freddie shares were down by as much as 26 per cent and 29 per cent, respectively, at the peak of the sell-off after a Lehman Brothers analyst said an accounting change could, in theory, force the two biggest US mortgage financiers to raise an additional $75bn in capital.

The Lehman analyst, Bruce Harting, said he believed Fannie and Freddie would be exempt from the accounting rule,. However, the sharp market reaction to his report highlighted the continuing worries about the breadth and depth of the credit crunch.”

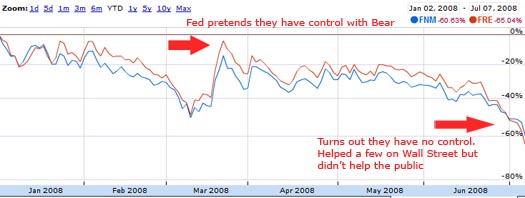

As you can see from the dumb and dumber chart above, Fannie Mae and Freddie Mac are now down 60% and 65% respectively for the year and one Bear was saved, but another bear is now out in full. You see that minor Bernanke bump in March? Helped a few Wall Street firms save face but did absolutely nothing for the American public. Mortgage rates are in fact even higher! Bwahaha! What a cruel joke. The fact that Ben Bernanke simply launched the dollar under a bus (running on hydrogen power) has now caused major unintended consequences. One of the factors for fuel being more expensive is a declining dollar but do you hear the media talking about this? No! They have this Freudian fixation with drilling off the shore which of course wouldn’t help us in the near term.

The reason the market gyrated like a drunken celebrity at a posh Hollywood club is because Fannie Mae and Freddie Mac are viewed by many as our last hope for propping the housing market. How in the world are they going to prop the market if they can’t even support themselves? 60+% drop in 6 months isn’t reassuring to me.

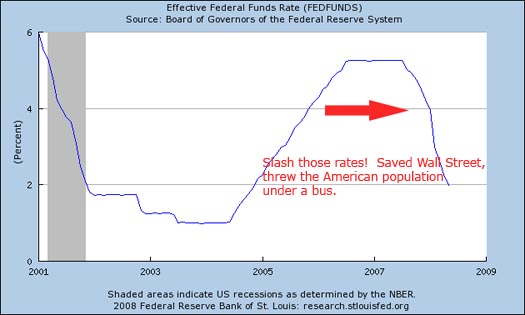

So with that said, hopefully you can understand my dismay at the absurd Frank and Dodd bailout plan. If you need any reference for worthless intervention simply look at the bailout of Bear Stearns and also, let us not forget the massive rate drops that occurred during this time. Take a look at the velocity of cuts:

Now, three short months later they are talking about raising rates! Bwahaha! They are manic and out of their freaking mind. How can you trust these fools? And we are going to entrust them with a $300 billion bailout. Let us now get to the meat of this stupidity. You already know what an asinine scheme the entire program is but let us follow it out and make some forecasts of how things will play out.

Step 1 – Get the Bill Passed

From all estimates, the housing bill looks like it is going to happen. People are running around screaming about all the wrong things as if their favorite American Idol had been voted off.

“Oh gas just jumped up .10 cents. Let us drill off the coast.”

“The stimulus check was fun. Let us do it again!”

“Where is my housing equity? Government, please give me a handout.”

“My 401k is getting kicked in the groin. Could it be that financially irresponsible management from our government and lax lending standards are a culprit? Nah! Let us fire up those printing presses!”

The housing bill although good intentioned (yeah right), is riddled with landmines for fraud. The first fraud pitstop is who is going to implement the bill? Okay, bill passed. Now what? The same nimrods who caused this housing and credit bubble are going to be the same folks that oversee the bill in the trenches!

The hysteria and momentum in the public is leading me to believe that the political pressure is to do anything to save the housing market. You think I’m extreme? Take a look at this article:

“(Yahoo!) Everything seemingly is spinning out of control

WASHINGTON – Is everything spinning out of control?

Midwestern levees are bursting. Polar bears are adrift. Gas prices are skyrocketing. Home values are abysmal. Air fares, college tuition and health care border on unaffordable. Wars without end rage in Iraq, Afghanistan and against terrorism.

Horatio Alger, twist in your grave.

The can-do, bootstrap approach embedded in the American psyche is under assault. Eroding it is a dour powerlessness that is chipping away at the country’s sturdy conviction that destiny can be commanded with sheer courage and perseverance.

The sense of helplessness is even reflected in this year’s presidential election. Each contender offers a sense of order – and hope. Republican John McCain promises an experienced hand in a frightening time. Democrat Barack Obama promises bright and shiny change, and his large crowds believe his exhortation, “Yes, we can.”

The public is being offered shiny things to distract them from the deeply rooted systemic problems we are facing. In fact, most of the politicians realize there is no way we can afford this absurd spending. California’s budget deadline passed about a week ago and guess what? No one gives a damn! We’ll just sit back and wait until the very last second and then throw together whatever we can and borrow some more. Simply jaw dropping. Its as if you quit your job after paying your monthly bills expecting the bills to miraculously stop coming just because your paycheck disappeared. What will happen next month when those same bills come again and you have nothing left to borrow?

So the politics are the same unfortunately. Human nature being what it is seeks to find the easiest way out. So the bill much to the chagrin of many looks like it will take hold in some shape or form. So how will the bill be implemented? This is where the predictability unfolds like a crappy b-rated movie where you know what is going to happen before it does. Don’t believe this will pass?

“WASHINGTON (AP) – A mortgage rescue plan to save hundreds of thousands of homeowners from foreclosure drew overwhelming Senate support Monday, inching toward passage despite Republican objections.

The Senate voted 76-10 to advance the bill, a broad array of housing measures including overhauls of the Federal Housing Administration, the Depression-era mortgage insurer, and government-sponsored home loan giants Fannie Mae and Freddie Mac.

Its centerpiece is a new $300 billion FHA program to allow debt-ridden homeowners who are currently too financially risky to qualify for government-backed loans to refinance into safer, more affordable mortgages.”

Step 2 – Implement the Bill

The housing bill has many absurd line items like giving new home buyers an $8,000 tax credit for buying a home. Of course that means the government will get less in tax revenues, which means more cuts, which means less jobs, which of course is an absurd circle jerk that has come to play over and over. Want to know what they are debating? How about this:

“One key divide is over limits on the mortgages FHA can insure and Fannie Mae and Freddie Mac can buy, which the Senate measure sets at $625,000. The House-passed bill set the caps at $725,000, which is preferable to lawmakers from the highest-cost housing markets, including Speaker Nancy Pelosi, D-Calif.

Also at issue is whether the new regulator and tightened rules for Fannie Mae and Freddie Mac should take effect immediately, as dictated by the Senate bill. The House-passed legislation delays them for six months, leaving it up to a new president to implement the changes.

And the two sides are at odds over which tax breaks to include and whether to pair them with offsetting tax increases to prevent a rise in the deficit – something that conservative “Blue Dog” Democrats insist on. The Senate’s $14.5 billion package falls $2.4 billion short of being paid for, while the House’s $11 billion is fully covered.”

Hello America! Get ready to eat some Pay Option ARM crap courtesy of your friends in the sunshine state. Here is how the bill will pan out.

-Lenders are required to take a 10 percent principal reduction to participate in the program

-In essence, a lender must write-down approximately 10 percent of the current appraised value to participate in the program which more or less will exchange a troubled loan for a GNMA security.

-Now the government (aka you) is the proud owner of a toxic mortgage

First of all, you may be thinking that the fact that lenders will need to eat 10 to 15 percent (depending on the reserve requirement) is a nice chunk of change. But let us pretend you are a lender. Now wouldn’t it make the most sense for you, to keep on your books the most valuable loans (those that pay on time and are performing) and shovel off the nuclear waste loans off your books? Of course! You’d be an idiot not to do this.

Now that is one major abuse that will happen. But this is also putting a floor for falling prices. Let us use a toxic pay option Real Home of Genius example.

Let us assume that you have the absolute worst timing in the world, sort of like the majority of our politicians. You buy a home in Los Angeles County in a lower income area. Ironically, many of these areas had a median price of $500,000 at the peak. So you bought a home with a toxic Pay Option ARM mortgage with zero down. The bill is now passed and the lender seeing that you’re having problems with the loan, decides to shovel this off onto the government just in time for your recast anniversary. But this is a negative amortization loan so the balance has now grown to $510,000.

Loan Amount: $510,000

Current Appraised value: $375,000

10% Reduction Value: $337,500

So the lender takes the one time hits and moves the loan off the books. Two points to make here. What is to stop a lender to find those shady appraisers again to artificially inflate prices? After all, the fact we are having this major housing bubble is because prices weren’t appraised correctly! This is already proven in the theatrics of our current market; those same actors are still out there waiting for more Oscar worthy performances. This is one component of the bubble mania. So now we are letting lenders seek out appraisers that will inflate properties once again. This is big money here. The difference between an appraisal coming in at $400,000 and $300,000 is $360,000 and $270,000, nearly a $90,000 difference. Can you see the fraud occurring here? Absolutely.

Next, we go back to the point that a lender has a major incentive to shovel off horrible loans and keep the best performing loans on its books. This is simply logical. So in the end, the tax payer is going to be left with the worst performing loans in a toxic waste mortgage portfolio.

You also have to remember that prices still have further to fall. The futures market is showing that some areas in California won’t hit bottom until fall of 2010. So say the plan goes through. Takes a few months to implement. That gives lenders 1 to 1.5 years to unload every piece of mortgage crap they can find. Need we look at the $500 billion in horrific Pay Option ARMs that are starting to recast this summer? Want to take a wild guess as to what loans are going to end up in the FHA bailout?

Step 3 – Shovel Crap Onto the American Tax Payer

Back to the $500,000 Real Home of Genius example. We can pick many cities out of the 88 in Los Angeles County but suffice it to say, this is a realistic example. Let us assume that somehow, the lender now has a scheme going where they have an appraiser that inflates prices and is unloading loans like clock work. Let us look a the action:

$510,000 Loan

$400,000 appraisal

$360,000 buyout from government

Not a bad deal. But what if this home is in an area where rents go for $1,300 to $1,500 a month? The futures markets may be seeing the nominal price being 50% off the peak price. So the true value of the home is $250,000 yet the government now has a loan of $360,000 on its books. Welcome to housing bubble redux. You can already smell the fraud happening once again.

So let this process play out over many months and then what?

Step 4 – Maintain Overpriced Home and Get Slammed Again

This will be like sticking your finger to plug up a damn. It will stop the pressure at least for lenders and Wall Street for a bit, until the final tidal wave crashes down and brings prices back in line. The only difference here is you the American tax payer saved the lenders and the perpetrators of the housing bubble for a few more months of false hope. Sort of like Bear Stearns. Has that really helped? Fuel prices are still sky high and housing is still collapsing. Americans have lost nearly half a million jobs since the start of the year. This is the perks of the bailout? Seems like someone got a raw deal here.

And this is how the bailout will unfold and will benefit lenders that can survive long enough to participate in the second great American mortgage swap meet. They are saying that it will only help 400,000 people but the verbal back and forth about the large mortgage amounts is disturbing and tells us they are looking to off load the most toxic large pay option mortgages to the American tax payer. After all, in areas like Detroit where the economy is still hurting, a 10 percent reduction on a home appraised at $90,000 is only $9,000. But what about a banana republic pay option arm of $900,000 in California? You get an inflated appraisal, take the 10 percent hit and pass the rest along to the government. Then when the note goes bad as it will predictably do so, the American tax payer is on the bill.

People keep asking about solutions and unfortunately there is no easy way out of this. Bubbles do not burst neatly. The mania that caused the bubble did not follow a logical or economical pattern. That is why it is called a mania. So the unfolding won’t be predictable. The fraud and shenanigans that will ensue is very predictable. Your options are as follows:

A – Let the lenders, banks, and Wall Street swallow the very bitter pill that they have created. Housing will still fall. The economy will still hurt. And things will still correct.

B – Let this bailout ensue. Relieve a few of these lenders, banks, and Wall Street from their financial mismanagement. Housing will still fall. The economy will still hurt. And things will still correct but at least you made a few corporate executives richer and provided them a golden parachute.

C – Why not go after these firms and individuals financially? Why not hold people individually accountable? Why not setup trusts that’ll take from the biggest firms that flat out committed fraud and use that money to fund a bailout if we are to fund a bailout. That would be a fantastic idea. Setup an independent judicial commission to go after the assets of the biggest perpetrators of the housing bubble and any of those funds will be the money that will be used for any sort of housing bailout. After all, the money was ill gotten so why not go after them? It isn’t like we allow bank robbers to keep their loot after they go to prison. Why not here? Have you seen the checks of some of these CEOs? All you’ll need is a couple of those and you can bailout the entire world!

I love the argument about personal responsibility for borrowers but no responsibility for lenders and Wall Street. The endgame for the borrower is happening; that is, ruined credit and losing their home. What is the endgame for the highest perpetrators on the food chain? Nothing. Employees will get cut just like we saw with IndyMac today but that always occurs to the rank and file. Yet what of the outrageous sums made with hedge funds and mortgage operations that knew and willingly turned a blind eye to risk and the law? All it took was a few kick backs to politicians to soften their hearts. It is deplorable. I can’t believe there isn’t more of an uprising about going after these people! This housing bubble didn’t happen by mistake; it was intentionally fueled and many people got extremely wealthy by using your money as a back stop, risk free. They try to make the public feel ignorant as if they couldn’t understand the intricacies of the market but anyone can understand what is going on. This is flat out corruption. The propaganda machine is running at full speed. Are you really better off? Will this bailout really help the country?

I like option C but that’ll never happen. Option A is preferable but most likely Option B will play out and people will get the theatrics of a helping hand for a few months until things once again follow their natural progression (i.e., Bear Stearns). Whatever does occur one thing is certain, the economy will be in the doldrums for a few years. Unfortunately, there are no other options when it comes to that.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

14 Responses to “Housing Future: How the American Public Will be the Proud Owner of Toxic Mortgages and Unwanted Housing. A 4 Step Program.”

Rock on doctor,

Great article.

What this country needs is A. A few big hurricanes to hit Florida. B. stop the wildfires in Big Sur and Santa Barbara and start some in Merced, Fresno, Riverside etc. The oil markets contemplate demand destruction well the housing

markets ( and commercial real estate) need some supply destruction. Burn down

100,000 homes in the Inland Empire and Central Valley and you get the insurers

to bail out the overstreched homeowners and stabilize the market as they take their insurance checks and look to buy homes left intact by the fires. A few CAT 3 and 4 hurricanes over Florida and people whose homes were Andrewized will look hungrily at a highrise condo sitting vacant in Miami or Tampa. Nevada and Arizona are harder nuts to crack lacking much burnable brush to fuel wildfires and no ocean front property but resuming tactical nuclear warhead testing in Nevada in select neighborhoods could stabilize the Las Vegas real estate market and a much lower cost than the Dodd Frank housing bill. The Defense Department will need to know the likely collateral damage low yield earth penetrating tactical nuclear warheads will inflict on adjoining civilian areas as it prepares to ‘decommission’ Iranian nuclear facilities. Las Vegas offers a wonderful test platform. Oh, gotta an idea for Arizona. I understand prisons can cost over $100,000 per cell to construct. You can buy foreclosed properties in remote Arizona suburbs for a lot less than $100,000 per bedroom Arnold. What an incentive for inmate good behavior too. Do your time in a nice house with your own bedroom in Arizona. The federal government might also want to look into buying defunct exo suburban housing developments for use as terrorist and illegal alien holding facilities. Could the UN complain if terrorist suspects were held in a McMansion outside Bakersfield?

“Loan Amount: $510,000

Current Appraised value: $375,000

10% Reduction Value: $337,500

So the lender takes the one time hits and moves the loan off the books.”

***Sorry but you left offf a step or two. The borrower has to document their income. The borrower has to have sufficient documented income to stay within the DTI ratios of typically not more more than 31% of gross income to principal, interest, taxes, insurance and PMI. And that is a a LOT different than those loans where the borrowers “qualified” with 30,40, 50% of more of gorss committed to the pincipal and interest or interest alone. Then there is the total DTI cap which is usually not more than 41% of gross to housing costs (PITI + PMI) and credit card payments and car payments and all other fixed debts. That rule was not applied on most of the existing loan orgininations and will eliminate even more potential borrowers.

****Tought to shovel off a “toxic waste mortgage portfolio” when the borrowers can not qualify on documented income or DTI. The $337,500 loan in the example will still require a documented income of around $108,000 on a 30 year 6 1/2% loan. Even in CA, having a $108,000 household income puts them up around the top 25%.) Then the DTI cap will knock out a lot of borrowers since the household with that $108,000 income can then only have $900 a month in other fixed debts (credit cards, cars, student loans etc.)

I am curious. Does the bill require them to get a current appraisal? If not, then they may take the $510K mortgage loan in your example, write it down by the required 10% ($459K), and shovel it off to the taxpayer.

Dodd and Frank should be put in PRISON for what they are doing!!! The reason there is NOT an uprising from the people about going after the lenders that caused these problems and the politicians who are in their pockets is that most regular people have their heads in the sand and don’t have a clue about what is going on around them. When I bring these matters up with friends and even family members, the common reaction is “almost” as if I was a conspiracy theorist at best and just a nut at worst. It’s a real downer!!!

Well, Dr. HB, this is an excellent breakdown on the current state of the market. For the purposes of full disclosure, I should note that I am a Realtor. My family owns a rather large real estate corporation down here in deep South Texas, and I left teaching to help my mother run the company shortly before my father passed away five years ago. We deal mainly with repossessed homes, which is to say we market and sell properties for Fannie Mae, Freddie Mac, Option One, MGIC, Nation Star, the list goes on. Needless to say, we’ve been extremely busy of late.

I came into this business right when all the financial sheenanigans were just beginning to take hold. No documentation, no down payment, interest only, adjustable rate loans, you know the toxic stew. Frankly, I was bewildered by it. I mean, I was raised to believe that when you buy a house, you put 20% down on a 15-year fixed rate mortgage, and then you live in it. But that’s just me.

More to the point, the seeds for the weeds of fraud you speak of were actually planted some two decades ago. Well do I remember 1983, when the peso devaluation virtually destroyed the economy of this area. There were over 44,000 foreclosures in the first month, and 1 our of 3 real estate companies went bankrupt and disappeared in the first 90 days. That was when my mother started working with repossessed homes. She and our company not only survived but prospered.

Soon thereafter came the savings and loan debacle. It was then that the seeds were sewn. Congress changed the law regarding appraisals. Before that any licensed Realtor could perform an appraisal, but after only a licensed appraiser could do so. And moreover said appraiser had to be given a copy of the sales contract prior to performing the appraisal. Now, there is something to be said for that, as the appraiser has a legitimate need to know of seller concessions and what not when estimating the value of a house. But the unintended consequence is that the appraiser’s job is no longer to provide a fair market value for a house. His job is to justify the loan! Thus he does not look for comparable homes when performing his valuation, but comparable prices. And therein lies the corruption.

Over the last several years, I have performed literally hundreds of historical price opinions on foreclosed properties, because the lenders are questioning the appraisal at the time of the sale. In fact, now Fannie Mae requests a historical price opinion on every foreclosed property. They send me a copy of the appraisal and ask for comparable sales in the months preceeding the failed loan. I have yet to come across one that did not overvalue the house by at least $25,000.

I’m talking about appraisers going 30 miles away from the subject just to find houses, which are in no way comparable, that sold at a price sufficient to justify the loan on an overpriced home. It’s fraud, it’s rampant, and it sucks.

The appraiser works for the lender. His job is to justify the loan, regardless of the actual fair market value of the home. If he does not do that, then the loan cannot proceed, the sale cannot be made and the deal cannot close, and he won’t be getting paid $300 a pop for any future appraisals by the lender. Therefore, he has every incentive to use comparable prices, not comparable homes, to justify the loan, no matter how unjustifyable it may be.

I had a repossessed home last year. It was a manufactured house in a mobile home subdivision. Big, two-story, two living and two dining areas, a wet bar, five bedrooms (though only one with a closet) and three baths, cheap construction. The appraiser at the time of the sale estimated its value at $230,000. I sold it for $45,000 two years later.

There will be no real correction in the housing market unless the corruption in the appraisal process is addressed. Lenders will continue to make loans on overpriced homes, and appraisers will continue to justify them, until the entire fiasco comes crashing down around them. And the American homeowners and taxpayers will pay for it.

But I wouldn’t look to Congress for any solution to this mess. They created it to begin with. I defer to Mark Twain. “Imagine you were an idiot. Imaging you were a member of Congress. But I repeat myself.”

Msn has an article today on places where it is better to buy and places where it is better to rent. And what do you know, Los Angeles-Long Beach-Santa Ana, comes out as a place where it’s still way better to rent than buy, it fact it’s near the top of the list of such places. Dr HB told you so.

Buy in L.A., are you crazy?

http://realestate.msn.com/rentals/Article2.aspx?cp-documentid=8377648>1=35000

Doc –

I believe that the plan calls for the lender to take a 10% writedown on the current outstanding principal, not the current appraised value. Which, if you think about it, makes the plan even more insiduous.

In your example the lender takes that 510K balance, takes his 10% cramdown so that the loan now has a 459K balance, and in exchange the lender gets top put a big stamp that says “US GOVERNMENT GUARANTEED” right on the front page of this loan. He then sells the loan in the open market because, by all rights, this loan will be an FHA piece of paper, undistinguishable from all other FHA securities.

Except, of course, for one small problem. THE FREAKING HOMEOWNER IS STILL UNDERWATER BY 74K!!! Well, guess what he can do, and will do, if he is underwater? Just walk away. And then guess who pays the bill then? You, me and every other taxpayer. I mean, I guess they think that these idiot borrowers are somehow going to fell more obligated to stay once they get this help, but I don’t see that. If they can rent cheaper (and believe me, they will be able to) they will. Thinking they are going to “do the right thing” well, is just a little naive if you ask me.

This bill is so completely asinine I don’t know how it could possibly get passed, I really don’t. The problems this bill is going to cause will make Hitler look like a pickpocket and the Great Depression a small blip on the radar.

But at least some of us saw it coming, eh, Doc?

Hang the overpaid CEO’s!! That’s an idea, but I want to remind everyone that a mortgage is a contract / agreement between the Borrower & the Lender. I think if you sign on the dotted line, you must accept at least 50% of the responsibility for the outcome. I wish it weren’t true, but the ignorant & stupid will not go extinct, as matter of fact, they keep breeding!!

“You can’t kill captain stupid” (Suicidal Tendicies)

Maybe we’re related. I get the same reaction from my family members and friends.

Why are people just letting this bailout happen?! Send in your letters, call and tell your friends to do the same!

I don’t know anyone who is for the bailout – so we should all be doing our part to stop it!

I think Lifeguard is right… the bill in Congress implies10% off the existing principle… not a “new” appraisal price. I figured originally like the good Doctor that Congress would want a realistic “new” appraisal to stabilize the real estate market. No it truly looks like they really want to protect the bank by having 90% of the existing principle, (yes even including the extra negative amorization amount) paid to the bank and then giving the new mortgage to us tax payers. A “new” appraisal (even a bad one) would at least force the bank to write off more loss. That would reduce the amount of loss to the public by $172,500 (510,000 – 337,500) in the example in Doc’s great article. A “new” appraisal could allow this deflation to work out faster by increasing the write down. But if they go by the principle amount at default…

I just hope they use some lube this time. ;-(

Well if the FHA is able to use traditional underwriting requirements it doesn’t matter what the markdown is from the borrower will not qualify so it becomes mute. But if they are able to do NINJA loans watch out.

Here is one thing you can do to express your frustration:

http://www.stopthehousingbailout.com/keymail.htm

I have sent letters, emails and called a few times. Just do something so that you can say that you did your part to stop this bank handout / bailout / taxpayer scam!

Leave a Reply