Where is the housing inventory? Lack of housing inventory continues to plague real estate market.

Real estate inventory is extremely low in this current market. This has allowed the market to put upward pressure on prices even though sales volume is low. The idea of real estate correcting has once again been washed away from the cultural psychology. Home prices, the media, and house horny shoppers have once again turned real estate into a no lose proposition. Seems to make sense when you look at current home prices. But then you look at the crap shacks you can buy and realize you are on the hook for 30 years with a heavy mortgage around your neck. When markets get feverish you start seeing flowery language on listings on otherwise crappy properties. $700,000 shacks that would sell for $20,000 in Detroit. It is one thing to purchase a nice home for a hefty price but to be convinced that you have to buy a beat up fixer upper for a ridiculous price is a symptom of a distorted market. All you need to do is look at current market inventory.

Inventory is making the ugly look hot

Market inventory is causing otherwise junky homes to seem like Cinderella. Just put on some glass slippers and you are looking at a princess of a home. Of course the cable house porn shows are eating this up. “Buy this home in the hood and with a little TLC you can make that $500,000 box into a $700,000 flipper’s dream!â€

The musical chair mentality is now back in full fashion. “You need to buy that overpriced condo, let equity fly for a few years, sell, then buy a home, let a few more years go by, sell, then buy your million dollar dream home.â€Â Of course all of this assumption is based on maximum leverage and hundreds of thousands of dollars in equity appearing out of thin banking air.

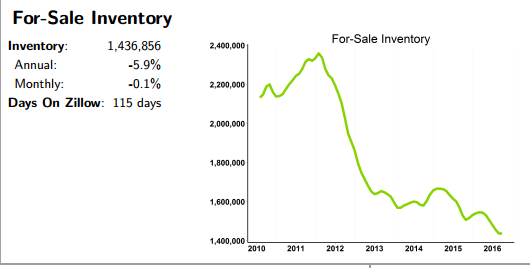

First, just look at inventory:

We are seeing a near record low in inventory. So you don’t need high sales volume right now to boost prices. All you need is a few willing buyers and the market is now into a very exuberant mood. There is a big disconnect of course. We’ve been adding more renter households instead of owner households over the last decade. Millennials are living at home in record numbers. People forget one major thing about the last housing bust: it wasn’t crappy mortgages that pushed people off the edge. It was the fact that people couldn’t pay their mortgages because incomes dried up. It should be noted that most of the foreclosures that happened went to traditional 30 year mortgages.

Once again we are in uncharted waters here. In the last bubble, we had record home sales, record home building, and record buying. This all actually makes sense from a “market†perspective. Today, what is happening doesn’t. What you have is acceptance that this is a rigged system. If prices are soaring, and inventory is tight, you would assume that builders would be out in force like last time. Yet builders don’t believe the market. If they are building, it is in large part for renter households (because they believe income figures – they already got burnt last time chasing hype).

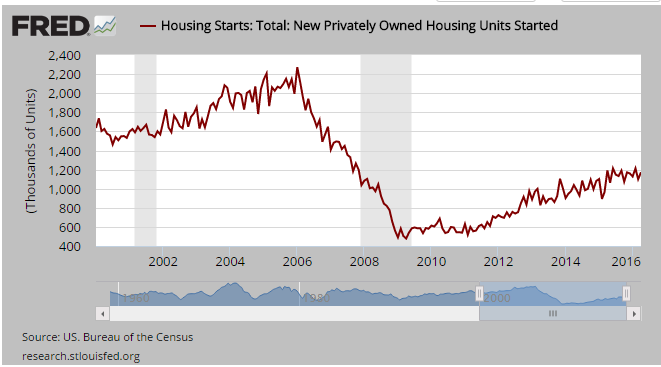

Take a look at housing starts:

Housing starts are coming in at 50% below the level in 2006 with a much larger population. You would expect this figure to be much higher to cater to the large cohort of Millennials in the home buying age range and the fact that inventory is near a record low. It is screaming to build like crazy.

According to Pew Research, there are now 75.4 million Millennials surpassing the 74.9 million Taco Tuesday baby boomers. Yet home buying is weak for this group. Many are still living at home with their parents.

The market right now is driven by hype and prices are set at the margins. Frothy markets can remain frothy for a long-time.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

131 Responses to “Where is the housing inventory? Lack of housing inventory continues to plague real estate market.”

This Woodland Hills Flip-That-Paid-Off is insane: https://www.redfin.com/CA/Los-Angeles/22811-Mulholland-Dr-91364/home/3574204

Nov 2015 — bought for $600,000.

Remodeled.

June 2016 — Flipped for $902,000.

An over 50% profit in just 7 MONTHS.

When I see things like this, I realize I haven’t a F*ck*ng Clue as to actual RE market value. Some houses remain unsold for months, while more expensive similar houses sell for insane amounts.

I was at an Open House for the above Woodland Hills house. You could hear the car whizzing by on Mulholland Drive, from both inside the house and in the backyard.

I saw a house in a so so hood late last year. It was initially listed for 550 and eventually sold for 495 his past January. Mls# 1600270047

A flipper got a hold of it and virtually the only thing they did was ruin the kitchen by pulling out a wall. They did about 5 k worth of kitchen upgrades. The other thing they did was remove an outside barbaque, that was worth about 600.00. This is ALL THEY DID.

15 days after closing it was relisted as a ” wonderful remodel” and a great value at 650k!

Luckily, two months later it is still sitting there.

I know exactly what you mean, it is impossible to know the true value of anything. Appraisers are useless because they are up to their old tricks.

I think there are different types of buyers:

Buyers don’t check the prior history of a place.

Realtor/investors check all history and know what to buy or avoid.

Renters leaving annual rent increases.

buyers with cash and don’t care.

….?

Gotta buy when it’s a slam dunk, and slam dunks only happen when either you have a ton of money you can afford to gamble, or houses are something everyone’s convinced are a poor investment, because RE is way down.

I probably screwed up by not buying a condo in Phoenix for $20k or so, or even got into a house somewhere in that greater area, for $100k or a bit less. That would have gotten me onto the “escalator” upward.

RE is crazy right now though. Yes, I *have* considered leaving California but places outside California are still charging California level rents/mortgages and the economy is much worse. I mean, New Orleans sounds like a fun place, but the costs are like living in Newport Beach with Iowa level pay. No, thanks.

There is just nothing out there for starter homes in decent Los Angeles neighborhoods in the $500k range….unless you want to live 100 miles from your job in LA, or in the ghetto, or next to a freeway with high tension power lines through your backyard, foundation issues, etc…Wife and I have $150k down payment, dual income household, stable careers, great credit, only student loan debt but I am waiting to see what happens in November before I got to any more open houses. Last year we were approved for $715k mortgage a few overpriced houses accepted our offer, we walked on all of them for various reasons, but the main reason was the sale price was overvalued. I gave up going to open houses as of Xmas, but not this summer realtors I worked with last summer have been “checking in to see if we want to resume our search”, one of whom told me “your making a big mistake not buying this house” can’t deny that it is bad time to buy right now.

Ultra low rates have distorted the market where 500K just isn’t that much money when people are only concerned about “how much are my monthly payments.” When you can borrow half a million dollars for a little over $2000 per month, that’s all you need to know. And that is why finding 500K starter homes in decent neighborhoods is next to impossible.

I totally agree. Ultra low rates + 3% downpayment invites a ton of people who see a mortgage as needing $2k to be paid per month. Unfortunately the real debt is the 500k + accumulated interest that they owe. Can’t wait for Yellen to raise rates to weed out these unwise buyers and get the price back to reality.

They did a story not that long ago on Firefighters in the bay area that drive about 2 hours just to get to work since price to live local is not worth it.

I live in Sacramento – know a ton of police and firefighters who rent a bed in a Bay Area flophouse during their shifts (4 days) and drive back to Sacramento on their days off to live with their family. What a life. Sad…

American police and firefighter a hero in today’s world cannot afford to live n their own area. County need to take care of them. That’s a sad life going home every week only. Foreigner living a good life and own a homes that suppose to be own by police and firefighter in thqt city. This is very alarming. Can politicians can fixed this problem?

Dire Straights, don’t feel sorry for cops or fire fighters. They earn six figures with overtime. They retire after 20 or 25 years, and receive a pension at 90% their final year’s salary (which invariably includes LOTS of overtime). Plus free health insurance for the rest of their (and their families’) lives.

We’re talking a guaranteed pension amount, not a 401k income that depends on the ups and downs of the market.

Dire – “Commuter” rooms are a thing up here in the Bay Area.

But my boss, being a true Bay Aryan, intends to go one step more outrageous, in that he’s seriously contemplating commuting between here and the east coast, being here only on weekends. In his late 60s.

That could make sense, but only because they work three days a week and get to sleep at the office.

Soft Serve – the plan is to be “at work” on the east coast 4-5 days a week, and at home in the Bay Area for the weekends. He can fly for free on standby, and the idea is to rent a room, and a car, on the east coast.

I just see it as a hell of a lot of work, and the while it will pay more than he’s getting now, the additional expenses will eat that up.

Firefighters in SD work about 10 days/month and sleep overnight at the firehouse. Many live up in Riverside County in big houses. Some pick up OT and work maybe 12-13 days/month. I also know many that live in SD in smaller houses but they can afford decent areas because the money and benefits are very good.

It is a tough job but they make good bank and live better than the avg. Joe. I’m not hearing many complaints, except when OT is not available….

Dire Straights, don’t feel sorry for cops or fire fighters. They earn six figures with overtime. They retire after 20 or 25 years, and receive a pension at 90% their final year’s salary (which invariably includes LOTS of overtime). Plus free health insurance for the rest of their (and their families’) lives.

We’re talking a guaranteed pension amount, not a 401k income that depends on the ups and downs of the market.

I have relatives who are local Sacramento cops. In fact:

They earn six figures with overtime. TRUE FOR SOME not all. They retire after 20 or 25 years, TRUE THEY CAN and receive a pension at 90% their final year’s salary DEPENDS ON HOW LONG THEIR SERVICE IS NOT ALWAYS 90% (which invariably includes LOTS of overtime) INCORRECT IT IS ON THEIR BASE PAY AVERAGED OVER THE LAST 3 YRS. Plus free health insurance for the rest of their (and their families’) lives. ABSOLUTELY NOT TRUE ANYMORE. THEIR HEALTH INSURANCE NOW AT RETIREMENT IS EXTREMELY EXPENSIVE, AND ONLY COVERS THEM NOT THEIR FAMILIES. IN FACT THEIR SHARE OF HEALTH INSURANCE WHILE WORKING IS PROHIBITIVLY EXPENSIVE NOW. THEIR IS USUALLY NO OUT OF POCKET BUT FAMILY MEMBERS YOU CAN TACK ON ANOTHER $600-$1200 PER MONTH OUT OF THEIR PAYCHECK EASY.

We’re talking a guaranteed pension amount, not a 401k income that depends on the ups and downs of the market. OVERALL THEY GET A GOOD SALARY AND OK PENSION DEPENDING ON HOW LONG THEY HAVE SERVED.

Lord Blankfein is correct about buyers looking only at their payments. When interest rates go up, housing prices go down. In 1983 (wow, that dates me!), I bought a fantastic loft/condo in Manhattan for $100K. Why? During the Carter administration, interest rates on a 30 year mortgage were 21%!!! I got the world’s first adjustable rate mortgage from Citibank, thinking it a gift from the gods–at 13.5% That loft-condo is worth $1.5 million today. Compare with todays mortgage rates. And now you understand what is driving prices…

Don’t know about your neck of the woods, but there seems to be alotta’ inventory for sale in Rossmoor (Los Alamitos-Long Beach-Seal Beach area). In case you are not familiar the area, it is upper middle class with a great school system. Homes range now from 800k to about 1.2 mil on average with some high end monstrosities going for about 2 mil.

40% of the homes (16 out of 40) listed as of June 11 are showing a price reduction. Take from that what you will….

Housing to tank hard soon!

Oh Yeah! Tank baby Tank!

The apprentice is learning.

When in your dreams?

Your Dad Jim owe me money for spreading wrongful information of housing market will tank hard, since years ago.

Following Jim’s advice would have cost you $200K in lost equity and another $40K in principal paydown in my neighborhood, what a visionary.

Locally in El Segundo prices have gone parabolic with home prices into the $700 sq foot for a house that needs work up to $1000 sq ft for a flipped house. Like the first post I just came across a flip that was sold in May for $900 and is now marked as pending for $1.4. Now all the loons think their house is worth that kind of money.

What I have heard is that appraisals aren’t hitting these stratospheric heights and people are having to either walk or the seller eats some.

In the $1-$1.2 market there still ends up being multiple offers of the house has potential.

Me and my zero interest bank account will sit this one out while I pay $4k to rent a town home I hate.

Excellent article as usual from the Dr. However, I would disagree with some of this statement:

“People forget one major thing about the last housing bust: it wasn’t crappy mortgages that pushed people off the edge. It was the fact that people couldn’t pay their mortgages because incomes dried up. It should be noted that most of the foreclosures that happened went to traditional 30 year mortgages.”

It is true that incomes dried up for many people and they couldn’t pay their mortgage anymore. But there is another group here also. After housing prices tanked, many people chose not to pay their mortgage because their home value decreased, sometimes by 50% or more. Since most people put little down and had no skin in the game, this was an easy decision. Having a ruined credit score for a few years was much easier solution than paying a mortgage on a property that was worth half what you paid. Not to mention, rental alternatives made complete sense 10 years ago. Comparable rentals were much cheaper than holding on to the boat anchor house.

Ultra low rates, limited inventory, inflation, skyrocketing rents make it different this time.

As I stated before, the participants (investors instead of organic buyers) are the different, but the results will most likely be similar. Inflated prices lead to manias which then leads to bust — whether .com, real estate, or tulips.

Rents and prices are in both in a bubble.

Are there any ETF’s or put contracts to short the Los Angeles RE market?

The BIG LA Short

Recently saw a report regarding DRHorton, one of the largest publicly traded builders in the country. It was said the cost of land is too expensive to justify building small to medium size starter homes. The profit margin is just not there. Building is concentrated in the high end luxury homes and multi family markets. Basically, the money is in building apartment buildings.

LA’r,

DH Horton is correct 100%. As a builder I said the same thing on this blog many times. Of course everyone jumped on me for lying. They are mad on the situation and they were acting this way for stating a basic fact like I was the one who created this “situation” – I don’t want to call it a market because it is not. It is just the result of a centralized planned economy with few individuals in charge of the FED controlling the destiny of hundreds of millions of people.

I don’t like this planned economy where few guys pick all the winners and losers. But what can I do when most people don’t understand economics and elect based on emotions and no logic? The vast majority elect based on who promise more freebies.

A lot of people don’t want to deal with the maintenance of a house, and a nice apartment, even a smallish one, is ideal. Expect more of this type of person as the baby boomers retire. They’ll want a balcony or a “window garden” setup, and permission to keep a cat or dog, but 600 square feet is plenty of room for a pretty nice place to live and who cares if it’s on the 6th floor – many consider that a plus.

Hide in place, people. Hide in place.

With the median age of 37 years nationally, it’s certain what one will find will be a crap shack with deferred maintenance. Or worse some foul amateur flip that adds 40% to the sale price based on flash.

Yep, a lot of old places are a wreck with lipstick slapped on. Its clear to me we are in the final throes of this bubble, the frenzy and the nonsensical pricing shows a disconnect from reality.

With so much of the market investor owned and returns on rent much better than the securities market I have to ask, “Why would anybody sell in this market unless they have to?” The ones selling are those in the game like flippers.

Put a different hat on and imagine you’re the owner of some property. Imagine you’re collecting rent which is likely to be much higher than the P&I, maintenance and taxes in today’s interest rate market. Would you sell? Of course not.

Exactly. Those who bought during the downturn or before, are enjoying bigger rents with a nice positive cash flow. What others investment can you pay 20% of the 2011 value, and somebody else buys the other 80% for you. Once it’s paid off in your retirement years, it’s solid income.

I would say selling before the value of your RE portfolio falls is a good reason. Especially if you’re beholden to shareholders. Or if rents fall. Just ask Sam Zell.

When did rents ever go down?

How a reminder from the last economic downturn:

http://articles.latimes.com/2009/apr/08/business/fi-apts8

For a preview of the next downturn, look at the recent rent prices in regions that depended on high oil prices.

Only 4% reported drop in rents per LA times? I rented in 2/2009 for $3400 on a new lease (2 years w additional discount of free month each year). The place had previously rented for 4295 but had been on the market so long that this discount occurred. Also 2008-09 was the last time I’ve seen so many rent signs and rent decreases but they are beginning to happen again now. Along with sidewalks littered with sale signs for $1000/square foot home sales including foreclosures coming on the market after years of being held back (or tied up?)

@LA’r

When did rents ever go down? 1991 to 1996. Rents in LA metro were about $1000 per month for a 1 bedroom in 1991. By 1996, rents for 1 bedroom were all the way down to $450 per month.

The big difference between 1991-1996 and today is that apartments in 1991-96 were basic living quarters. Today, they are almost all high end luxury units.

I can only wonder what government entities, retirement funds, etc may have invested into this gimmick.

http://www.motherjones.com/politics/2014/01/blackstone-rental-homes-bundled-derivatives

I have a indirect business relationship with Blackstone. And I can tell you their biggest problem is the overhead. Can you even start to imagine how expensive it is to manage 40,000 rental properties spread amongst multiple states? The maintenance and upkeep alone is a small fortune, not to mention all the administrative costs. They are losing money at the moment, but expect to be profitable in the near future.

Also, Blackstone has started selling off some of their less profitable rental properties. Mostly located in lower income areas, like parts of St. Louis for example. It took them a while to realize that location is everything and high turnover in some areas made it difficult to get consistent rental income. For awhile they were buying everything that was put in front of them.

Blackstone doesn’t only have to maintain their rental housing but has to pay Blackstone’s CEO $810M per year as well as giving their shareholders a large return on investment. There is so much more overhead involved there.

I sold a few condos in the past year, and am a buy and hold investor. At some point, current values exceed rents today by so far, I couldn’t justify holding the property. If there is 0% chance I would buy a property today when comparing rent to market value, then why hold it?

I’d like to add to Fensterlips’s comment.

1) You are a landlord with a positive cash flow on a rental due to low interest rates and a low mortgage.

2) You are a homeowner with an extremely low mortgage payment looking out a market with extremely high rents or an extremely high cost to upgrade to a “nicer” home.

In either case, why would you sell to increase the inventory in the market? I wouldn’t.

I’m actually in that exact boat and just put a SFH rental on the market for sale. I’m taking profits on this one and plan to deploy the gains into other investments. I think the timing is right and am looking forward to closing.

Even if I am an owner of a property and I am cash flow. If I have decent equity, I may like to lock my profit and thus sell the property.

Trailers in a trailer camp in Santa Cruz, California, now go for $190,000 and up – for old, tiny, literal, 50 year old trailers. That is the going price and people are paying it just to live close to the beach.

“Yet builders don’t believe the market. If they are building, it is in large part for renter households (because they believe income figures – they already got burnt last time chasing hype).”

Doc,

This statement is correct but not complete. Where the jobs are, the builders can not make a profit from building single family homes for few reasons:

1. Due to high demand, land prices are in stratosphere.

2. In the last few years all material and SKILLED labor prices went through the roof.

3. Soft cost (city fees, development fees, architect and engineer fees) went up.

Since all four components of house building went up, there is no profit even at these elevated prices. If people refuse to accept these facts, let them build and make all the profit they want. In very high cost of living cities, where the demand is, it is almost impossible to find SKILLED labor. They either charge outrageous prices, or they move out because they can not afford even to rent, forget about buying.

Refusing to accept these facts is not going to change anything. Because of these facts, even the maintenance cost of existing housing stock is very high. Therefore, we see the high rents the landlords have to charge to build up reserves for maintenance. When the tenants call that something doesn’t work, they expect a maintenance guy to appear miraculously.

I think you are a victim of brainwashing.

Being a landlord is supposed to be a thankless job that gives you a negative cash flow for a decade, then breakeven and by 20 years a positive cash flow and 30 years it’s all yours baby!

Now landlords think they deserve positive cash flow immediately with 10 percent annual appreciation! All with zero inflation!

I’m scratching my head on this one.

“Now landlords think they deserve positive cash flow immediately with 10 percent annual appreciation! All with zero inflation!”

Why would anyone invest in rental property if they did not expect to make immediate positive cash flow? Isn’t that the soul purpose? Are we now in the business of losing money? Do you think landlords should rent to you at a loss?

LA’r: Isn’t that the soul purpose?

It is the sole purpose, but not the soul purpose.

Sole — solitary; one; only

Soul — the spiritual essence that survives death; authentic passion as in “having soul” or as used in “soul music”

I stand corrected. Thank you.

People in the SF Bay Area are loosing their jobs, the market has slows considerably, low inventory not withstanding, that is the only thing that will crash the housing market.

Do you mean, perhaps, *losing* their jobs?

I know up here, rents are softening, and there’s new building everyfriggingwhere right now. No piece of vacant land is safe from the developers, and yet we still have a f*ckton of empty lots, lands, and raze-able building up here.

Builder, you are dead on. Skilled labor wages are insanely high right now. I can hardly find someone to do work at my properties. They are all slammed and unlicensed guys are charging what used to be contractor prices. I also see “now hiring” signs everywhere. This is a very confusing market. Real estate markets are a froth-fest of course but seems like every one in the trades (construction) is making a lot of money and busy again. Jobs recession coming? I don’t really see how although I pray to Buddha every night for a housing crash.

About making and not making money on rentals: I am an “accidental” landlord with two Northwest rural rentals. My Brother and I make money on an 820 sq ft cabin on 0.7 acres that gets its water from a well that needs iron removal. It has a garage. I make more than he does because he owes me $18500 at 4.5%.

My Wife and I lose money on a 1900 sq ft house on 1.8 acres that gets its water from filtered and UV treated creek water. It has a woodshed but no garage. There is a well that has iron levels that are too high for the cheaper iron removal method we use with the little house. We probably made the wrong decision when we went with the creek water instead of an expensive iron removal system and a new pump and line to the house from the well. Better reliability and salability with the well. Bad decisions on tenants by a previous agent and higher maintenance costs on a large house have made the property a money loser up until this year. We may go positive soon, but We may also need to build a garage and connect to the well to sell it. We can only get 10-20% more rent out of the bigger house as the rental market has a hard upper ceiling out in the sticks. (25 miles to the nearest small city.)

My Brother won’t use the rental agent for the house he owns himself, and he’s been screwed twice by bad tenants, and I think he’s working on #3. The local “grapevine” brings him castaway losers as tenants. He lived there for over 20 years, so he should know better.

There is a explosion of construction in both commercial and residential including single family and multi-family homes. These activities take along time to fund and get approved. The economy is like a canoe, it will continue to glide forward even after the last canoe stoke.

The downturn is coming. All you have to look at is business profits. Layoffs are and will continue to accelerate as profits erode.

I’d like to believe a recession is coming because it is awful that these home prices are so far out of reach for the average American folks, however, I cannot figure out what the impetus for this downturn will be. I thought it would come from an anemic job market but then I cannot hire a handyman for $25/hour because they are all making double that on other construction projects, also see ‘now hiring’ signs everywhere around metros in CA. Leads me to believe the jobs situation is not as bad as I thought previously.

San Diego is faced with exact same inventory and obscene bubble price issue right now! More reason to leave California.

The influence of a good RE agent (the few they are) and the blind buyers. Went to a open house 3 weeks ago and looked at a rather overprice $1.2 million dollar house that in all realty should be at best 850k. The agent talked it up but you can’t talk up a bad lot and bad desolate location? Then saw a really nice home 1.5 years old with a killer view for 1.1 million ( read on).

I checked this morning for the heck of it and you guessed it the 1.2m is pending. I called a RE friend of mine and ask if he could get the lowdown on this property. Agents who just sold a house are apt to tell you nothing of the sell but this person said more than most. She said the buyers were laydowns from NJ, they knew nothing of values just that she talked it up they took the bait, the agent didn’t disclose the price but said it sold near the asking.

Folks there are dumb people wondering around. Why they buy overpriced property was the same when I own my dealership, they want to believe they can buy anything because they came into money. Yes a $650 to $800 lease is just great for them, they can tell the brother-in-law I made it, what are you driving. These fools are the same ones who later in life usually have nothing left and tell you that years ago they were somebody because they bought a overpriced house and drove a Euro car, like we should really care they were stupid and tell just barely holding on?

Honestly, why would anyone want to pack into a metro area of 15 million like L.A./O.C.? View, beach, you are still a prisoner! The secret is to acquire a skill or start your own business that allows you to live anywhere where there is good internet access, then move! My Daughter and Son-in-Law just built a really nice home for a very reasonable price, with never tiring views of a lake and mountains, with small town pace, yet still 30 minutes from major retailers, hospital, great schools, and lots of healthy fresh air and outdoor activities galore!

JNS,

100% correct. You don’t have to be super smart to do that. All you need is common sense. I did that, too. Never regret it.

I agree with the comments about living elsewhere and using the Internet. In flyover America, nice homes are selling for $100 per foot or less. We feel that we got a “deal,” but my wife and I bought a 4,200 sq. ft. house in a college town for $310,000.

A friend of mine has a very nice 3,800 sq. ft. house in my hometown that he would love to sell for $100,000. That’s about $25 a sq. ft.

I’m sorry guys but where is this flyover America, I’m not from here so please forgive me

Yes it is a big country and there are many fine places to live with much lower housing costs, and I have always said if you cannot afford the pricey areas of CA then by all means relocate and move on with your life. Of course there are also many areas of CA that are not crazy expensive. Values may come down from time to time but the great areas of socal are never going to be affordable for the avg Joe.

Yep. That’s exactly what I did. I own a business that deals with TV production, and, once everything evolved to being all digital, and my actual office shrunk down to a home office, we moved up here to Oregon. Granted, now Portland is in a bubble too, so we’re still waiting to buy, but our rent is low for our income.

Correct. I am looking at places in South America. Same weather as San Diego and homes cost 80k with zero property taxes. Get a lawyer from there and the legal stuff sorted and nice views and friendlier people in less crowded place! I love Chile and Uruguay.

Chile is nice and clean and the most prosperous S. American country. On top of that it has over 2000 miles of shores and mountains and all kinds of weather. In the most remote point you are under 200 miles to the ocean.

Uruguay is kind of flat and it does not have so much geographical (mountains and climate) variety like Chile.

Cochabamba, Bolivia also has good climate, low cost of living, mountains and relatively safe and prosperous for a S. American country. The downtown is also very nice in Old Spanish style.

Talk to any experienced high volume broker/realtor in San Diego who specialize in areas w/good schools and you will find a large percentage of buyers going all cash to whom interest rates are irrelevant. You may find a handful of them who decide to take an unnecessary mortgage due to low rates and seek a better yield in the market but that does not change the view on whether to buy or not.

There are a handful of current projects underway in North County – 56 corridor and Robertson Ranch further north, Mission Valley and Mira Mesa – but not enough to soak up demand and a lot if it high-density and therefore not sought after by the families that are looking for SFRs with good public schools. There is room for more infill (dense) and more room down in Otay (not highly desired). The best land is gone and if you own a piece you are in great shape, if you don’t the price of admission is probably going up. These areas held up very well during the last “crash” and values are beyond the last peak.

All of these trivial complaints about housing prices will seem like the good ole days soon. Look at the effect that a single Islamic Terrorist shooting up one nightclub had on the country. What’s going to happen when the next attack targets a REAL target? Like an airport or a crowded sports venue.

And, as predicted, our Great Leader thinks we have a gun problem. No, the world has a Muslim Problem.

As things get more unhinged, Venezuela is literally falling apart and Brexit looming on the horizon, just when is the other shoe going to drop on this little housing bubble? You’ve got the Chinese building military bases on new land in the South China Sea, Muslim hordes flowing into Europe and the EU ready to break apart.

Our economy is being lifted by magic pixie dust coming from the rearends of Facebook and Uber. All of a sudden, blogs about housing bubbles don’t seem very important.

Oh the irony…..like shooting fish in a barrel.

I would agree with you if other countries were doing better then us. But they are not. Other countries are suffering from more terror attacks, unemployment, crime, economic despair, and rising inflation. That’s why so much foreign money is streaming into US real estate. As of now US real estate and stocks are the safest investments in the world.

Safe “investment”? Ask the Japanese how safe their “investments” were after their bubble popped. What’s the real value of an overvalued stock? What happens to you when the stock you hold tumbles in value?

What happened to Japan when they woke up with a hangover? They’ve never recovered. Same thing will happen here–soaring real estate values buoyed by unprecedented currency manipulations, money printing, speculation and a once in human history event called China.

Nothing is holding up real estate prices here except for irrational behaviour. The Islamic terrorist gay guy who shot up the nightclub is more sane than our housing and stock prices right now.

So yeah, America is fine because we’re better off than Spain and Greece.

Hunan,

The US real estate in the best case scenario stays the same (highly unlikely). Most likely it will suffer another correction. If you pay $10,000 in prop. taxes per year for an average SoCal house, in 10 years you lost $100,000. That does not include HOA dues or Melo Roose – that is extra. Due to high wages for skilled labor to perform maintenance, you are talking about substantial loss.

“Safe” as in, U.S. assets are the least worst off for now. But mired in a mania of cheap debt they are. And economic manias tend to end badly.

zzy: Venezuela is literally falling apart

Well, no. Venezuela is not literally falling apart. Not unless its land mass is separating along fissures, chucks of land falling into the sea, gaping holes appearing throughout the land. Only in that case would Venezuela be literally falling apart.

The piece of earth that is known as “Venezuela” is only called that because of the people who happen to live there. Before humans, that piece of earth was known as ” “. A country is defined by the people, not the piece of terra firma.

The people of Venezuela are rioting because there is no food to eat. There’s nothing in their supermarkets. Inflation is out of control. The place is “falling apart”. The only thing left to happen is that people start shooting at each other, the army starts to mow down the masses and widespread death and famine ensue.

Then Venezuela will have fallen apart.

I would go further and say the world has a religion problem, although Muslims seem to be leading the pack at this moment in time. Granted, we’re now finding out that the Orlando shooter was likely a closeted homosexual, and he probably couldn’t deal with the shame, so it looks like we also have an intolerance problem, again, mostly because of religion. Many of these lone gunman tend to have sexual frustrations.

Actually it is a combo of

1. Gay leftist problem

2. Muslim problem

3. Mental illness problem

The shooter in Orlando was all three! His marriage was a sham and he was a fudge packing homo muzzie nutcase!

SJ. Classic religious homophobe. The sooner you move to South America the faster you can come out of the closet and not upset your family.

Hey mikey, why is everyone who objects to the left’s incessant pressure to define sexual deviancy as being “normal”, in this specific case, homosexual male Muslim nutjob, a “homophobe”?

In reality, it seems far more obvious that the LGBT lobby has a phobia towards heterosexuality. The inability for so many people to accept the scientific fact that sexual reproduction is the lynchpin of all advanced life on earth is puzzling. The only thing natural about sexual “choice” is that humans were designed to be heterosexual. As in homosexual beings don’t ever pass down their genes.

Why are LGBT so constantly defensive? Oh, maybe it’s due to the fact that they are, from a reproduction standpoint, defective.

Looks like Mikey hit a testy spot right on target. You do know what they say about homophobics?

ZZY, can’t say there is a single flaw in your logic above. Hard-hitting but true as hell.

More insanity: https://www.redfin.com/CA/Santa-Monica/502-San-Vicente-Blvd-90402/unit-204/home/6781601

This Santa Monica condo was last purchased in Dec 2015 — 6 MONTHS ago — at $985,000.

It appears there was NO REMODELING done on it. The description says “new-er” hardwood floors. Had the seller remodeled, it should say “new” hardwood floors.

Now offered at $1,149,000.

This “flipper” — is it even a flip if no work was done on the unit? — wants to sell at a $164,000 markup. After only 6 MONTHS.

I wonder if the seller is hoping people won’t notice that the floors are described as “new-er” rather than new?

This overpriced flip is looking for the next suck….er buyer willing to take on more debt.

I think this flipper’s sole strategy is to buy in December, when buyers are few, and re-sell in summer, when buyers are plentiful.

It’s as if RE has no inherent value, but rises and falls seasonally, even daily, like shares of stock. Buy low, resell high a few months later.

@SOL

In the back of their minds, the flippers must have that fear of being the last one standing in this game of real estate musical chairs. The higher the purchase price, the closer they are to this reality.

I can remember when “zero population growth” was the mantra of the Democratic Party. Now it’s “more, more, more, let in more people from everywhere”. Then on top of that California offers the most generous welfare benefits, and free medical if they come illegally, as icing on the freebie cake. What do you expect will happen to housing? The influx like the air flow that makes this balloon grow larger and larger, closer to exploding. When there’s no place left to put all these people, they’re going to demand a redistribution of housing to accommodate them all. Places like New Haven, Ct, once had beautiful large old Victorian homes that got sliced up into small rental units for the masses. Already we have the government push to put low-income housing into expensive neighborhoods. Watch for new laws coming that allow large expensive homes to be converted to many small multiple units without regard to current zoning. You think California is third world now, wait until zoning laws get attacked as unfair to the poor. McMansions occupied by only one family will become as politically incorrect here as a lush humid tropical garden. Eventually you’ll get penalized for taking up too much housing space just like you get fined for using too much water.

Until living in crowded, expensive SF for several years, I never thought I would take this view: the view that, yes, there is such a thing as taking up too much space. And yes, for the same reasons as using too much water.

There are whole neighborhoods in Pac Heights of nearly empty massive homes on deep plots. Low density and low lying. It’s the residents of these homes that ironically tell SF citizens who want housing that it’s just not possible because of the water and other infrastructure. Not possible to support new residents. Oh, the hypocrisy. Their homes, landscaping and lifestyles suck more resources than families living in 1 and 2 bdroom apartments/condos.

So yes, bring on the regulating of how much space resource does any one person need, and especially in dense, constrained job centers. Kicking all the working people to far flung suburbs because the NIMBYs have pulled up the ladder has reached its breaking point.

Actually, the biggest group coming to California is Asians not Latinos anymore. OC posted a 3 percent gain in Asians and only a one percent gain in Latinos. Second and 3rd generation Latinos leave the state. As for other places, OC and LA have lost people to other states for the past 25 years straight. Its a myth that people come to them from other states since they lose more people than gain. Also, Orange County and Los Angeles have a growth rate below the state average for population if you go back to 2,000. In OC it was the Asians going to Irivne that recently gave it higher growth rates but OC and LA are not known for great growth rates. In fact by 2030 they will grow about half the population since younger people will leave them which they are now doing and they will aged faster than the rest of Ca.

I suspect that the last housing bubble created a huge inventory in the wrong places. California probably has excess inventory, while Texas is running short.

On vacation in Phoenix right now and wow – for sale signs everywhere. Seems like a lot of inventory around, even though still at inflated prices. I was here 5 yrs ago (2011) and the same houses were nearly HALF the price. New home builders couldn’t given them away.

My hometown of Sacramento – inventory is very low, with insane asking prices.

Phoenix and Vegas was among the first to fall in the last crash, wonder if its topped out and people are scrambling to sell and cash out….

I’m up in Portland, and I just sat in a coffee shop next to a realtor and potential seller for an hour. The seller said he wasn’t in a hurry, because, although he hears people say we’re in a bubble, he thinks the prices will keep going up. The best part was the realtor’s response: “Yeah, things will keep going up unless something crazy happens, like Trump getting in office and starting a nuclear war.”

I mean, he literally just said that he can’t see home prices falling unless we go to nuclear war!! LOL The most hilarious realtor take I’ve heard in a long time.

Are there any sideline buyers, investors, or anyone on this site who want Trump just in the hopes that his reign will cause a recession and crash RE prices?

“Are there any sideline buyers, investors, or anyone on this site who want Trump just in the hopes that his reign will cause a recession and crash RE prices?”

NO. But there are plenty of sideline buyers, investors on this site who want crooked Hitlery to win just in the hopes that her reign will cause a recession and crash RE prices. Since our economy is already down the toilet, 8 more years will finish what Obama started. Since she is the most corrupt politician you can find and she will represent only the 0.01% who paid for her election campaign, you can be sure that the cronies (0.01%) will get richer and you will get poorer. Stupid people voting against their best interest because the indoctrination centers did not teach them critical thinking.

Anerica will be great again if trump are elected. Imagine if all the immigrant are flushed out to this country. Trump is a good businessman. He knows the budget that goes to care for this illegal.

One more thing, job and section 8 housing voucher will go to hard working American.

I doubt that President Trump could even get members of his own party, much less Democrats, to go along with this agenda. They have their own re-election and special interests to think about.

I support Trump’s idea of exporting the illegals. When I was born, L.A. county had 1 million people, now it is close to 11million and the roads have not kept pace. I am a prisoner in my own neighborhood. Anything to reduce the population and cars, I support. The Dems just want to bring in millions of more people without the infrastructure to support more.

dr wang du: trump will built more tower in America…n hi school name after him….

wang du: not sure if trump will be better…if he won…more hi school will name after him…

Hey Doc, really? When did the term “fudge packer” become relative to the housing bubble conversation? Zzy should move out of the USA as well, seems as though he does not understand this country is not only for his kind.

It does not matter if Trump is elected or not. The recession is coming.

My father just put his house for sale. Should we wait or buy a bigger house? The house is located in Compton. The school near the house has a score of 7 in the http://www.Realtor.com. We want to stay in Compton, but not sure to buy another house (bigger) or wait for the next bubble.

Here in Seattle, particularly Queen Anne, which is right at the foot of the Space Needle, the lack of inventory has as much to do with the trade-around class, that every five years gets a bug up their butt and decides to move. At the same time they got millionaireitis.

Everyone had a MILLION dollar house, or were going to live in one.

Problem is that the inventory is really poor in this range because Seattle was a modest working class city, WAY OUT in the middle of nowhere, before these many hilarious debt-fueled bubbles that we have called progress, basically back to Reagan/Stockman/ Greenspan, have been blown up.

And these poor buggers had the dinky houses to show for it. Small houses on small lots that haven’t been remodeled since the Eisenhower administration.

Many houses on the hill still exist in this state of disrepair when everyone ran off to the suburbs in a state of terror when bussing finally got enforced out here in the mid-70’s.

Perfect example of these poor crap shacks was this perfectly cute Dutch colonial on Tenth, right under a hundred year old elm. Kitchen had the puke green/faux wood panels from the late fifties and a linoleum floor. At the time it was listed just over 500k. Did my mental math (which still isn’t good) and thought I could cobble together 100k for a down payment.

Then I opened the door to the basement. The widow who lived there with her male cats for the last quarter of the century had let them run wild.

The REEK of Cat Urine radiating up from the uncovered foundation walls WILL NEVER go away, no matter what you cat lovers and your products say. When it gets hot…….

I shut the door on that house and I have never thought of owning a house since.

Here is the situation: I bought condo (that was rental dump for 30 years) in 2014 for 430K. Remodeled from top to bottom for 130K, put it on the market for $580 right now. No one wants to buy my beautifully remodeled condo in San Jose :))). Not even Chinese. All hopes were on Chinese. Where are their big suite-cases of cash that everyone is talking about? So there goes your inventory. I am staying put and can’t upgrade. I guess now I have to rent it for 30 years to recover remodel cost.

Because of high HOA fees it is difficult to cash flow positive on condos in today’s market. Also more and more HOA’s are adopting rental restrictions. Those looking for rental income generally avoid them.

In Santa Monica, you can only rent for a minimum 30-day term. That way tenant protection laws kick in. It’s a way for Santa Monica to fight AirBnB.

There’s been talk of relaxing the 30-day rental minimum in Santa Monica, but I don’t know if it has come to anything yet.

So you can rent your property via AirBnB for 30 days. At which point the renter becomes a tenant, and entitled to all legal protections. He can stay put and stop paying, and it’ll take months for you to evict.

However, in my condo, the HOA has imposed a 4-month rental minimum. You can’t rent your condo unit for less than a 4 month term. Even tougher that the city’s rule.

However (again), I think that in California, a HOA-imposed rental restriction only applies to condos bought after the restriction was imposed. (Can anyone verify that for me?)

There are people out there who successfully invest in condos as rentals, but I wouldn’t do that myself. Too many risks. One special assessment out of the blue could completely destroy your profitability for potentially years.

I see more and more condo communities losing FHA approval due to lack of owner occupied units. Many condo communities are now are 60%+ rentals owned by investors. This does not bode well for owner-occupiers, generally decreasing the value and desirability of said units and making them harder to sell.

Yes, if the HOA adopts rental restrictions those units purchased before the restriction was adopted are grandfathered in by law. That is my understanding.

Most investors don’t participate in HOA activities, making it easier for the HOA to pass rental restrictions. Personally, I’m all for a 30 day minimum rental restriction. Most people don’t want to live in a hotel with strangers constantly coming and going.

The real concern with all HOAs is that they rely on people with jobs to maintain them. If the pool of owners lose jobs the HOA eventually dies. Question I have is if an HOA fails to maintain it’s facilities or potentially goes bankrupt does someone like Greystar or Blackstone or some private investment firm have the ability to seize the HOA and then possibly convert it into an apartment complex? I have seen situations where half the complex of say 60 units were foreclosed, but eventually survived unless investors bought up properties to keep it afloat. The next downturn might not likely have the same type of conditions going forward in my opinion.

Homerun, you bring up a interesting point. You often hear about apartments converting to condos, but not vice-versa. According to this article it does happen, and if your a owner you may get caught holding he bag. I wonder how often this happens?

http://www.bankrate.com/finance/real-estate/condo-owner-ambushed-by-shift-to-rental.aspx

Put a link to the listing. Let’s see what your working with.

It was too old. Condo buyers looking to pay over $500,000 around San Jose want a more modern place built in the last ten years.

Been noticing zillow has removed a lot of preforclosure/foreclosures off some areas where there were many to see. Either the properties have sold and Z was slow to clear it up or the problem properties were removed purposefully IMO.

Zillow is notoriously inaccurate when it comes to foreclosure information. Once they label a property in foreclosure they rarely update the status. It’s not uncommon for a property on Zillow to be labeled a foreclosure for years even after it has resolved it’s issues with the lender.

You should have sold it last year.

Just keep it listed for sale escape, there’s still a lot of dumb buyer out there

Lol. Troll.

Vancouverbubble what’s a troll? Are you a troll?

Read this blog lots, but I see so much misinformation here. The previous collapse was not caused by stupid people buying homes they couldn’t afford. The problem was too much cheap capital from around the world. Sure the Big Short makes it sound like it was all dumb poor people, but they never talk about how the commercial real estate market was just as devastated. For those in the industry, how many malls / walmart properties / restaurants were bought / sold by dumb poor people who got a free iphone for filling out the application? None. The problem was that there was too much zero interest money in the global economy looking for any return whatsoever. The brokers of the commercial market knew the risks, but they said “hey, she’s going to go home with some dude tonight, might as well be me!â€

I fear all you guys waiting for SoCal to collapse, are going to be waiting a while. There is no shortage of investors around the world perfectly willing to move their cash from kleptocratic / autocratic state banks into real estate in Socal that, despite all the volatility, will never truly collapse.

For instance if you’re some military colonel in China making millions harvesting and selling organs from political prisoners in China’s gulag system, do you really care if your purchase of your neice’s Irvine Company shit shack you bought in Irvine loses 20% over 5 years? Better to lose 20%-30% of something in California over 100% of everything back in China.

The blessings of California is actually also a curse. By global standards, California is too desirable and well run a place to ever totally collapse as a real estate market. You think Bashir Assad’s crony family give a hoot about return on investment when Damascus falls?

Vancouver too. Great schools, clean air, a real-estate-social-justice-warrior political alliance to call anybody who objects to massive hot-Chinese money flooding into the market by calling them racist. You can’t lose!

You lost me after the first paragraph. The rest could be summarized as: “this time it’s really different. What’s so different between now and back then besides the fact that the amount of cheap debt currently sloshing around the world is several times more massive?

We’re finding out that China’s massively debt-driven high growth is coming to an end and will most likely end in a major crisis. The Yuan is quickly being devalued, and many of their companies are failing. With no consistent source of income, it will be very difficult for its investors to sustain their expensive real estate buying spree.

The Japanese saw their own U.S. buying spree (at elevated prices) go bust and still haven’t recovered from it. 20 years later, we’re not too concerned about their investors.

No one here except for possibly a rare extreme fringe is “waiting for SoCal to collapse”.

“There is no shortage of investors around the world perfectly willing to move their cash from kleptocratic / autocratic state banks into real estate in Socal that, despite all the volatility, will never truly collapse.”

Investors or speculators?

“For instance if you’re some military colonel in China making millions harvesting and selling organs from political prisoners in China’s gulag system, do you really care if your purchase of your neice’s Irvine Company shit shack you bought in Irvine loses 20% over 5 years? Better to lose 20%-30% of something in California over 100% of everything back in China.”

Agree, and if indeed the influence on the SoCal market (or others) by this “seeking safety” foreign cohort over traditional domestic owner occupants is to the degree which is often claimed, the same amount of influence is also possible on the downside. If taking a significant haircut matters not, what’s going to get in the way of doing so?

What’s always implicit in these seeking safety theories is that these people no longer have risk exposure back home. The failure of this assumption could prove problematic for those mortgaging bets on General Tso sticking around next door.

When will Zillow set up straight PtP home sales? I mean when will real estate agents be kicked out of the system entirely? They really are a big part of this problem, bring no value to the game, and just siphon off 6% of wealth and lie, lie, lie. Kevin Williamson of National Review called real estate agents “lawyers too stupid to pass the Bar”.

Real estate agents at the very least provide time value. Not every seller wants to deal with showings and initial communications with prospective buyers/their agents. With property I have far away from where I live, I need someone to take care of that stuff for me when selling. I value my time and sanity more than the commission fees I end up paying.

A lot of buyers like having someone else setup appointments and being driven around. I once decided to sell a rental to my tenants and they insisted on getting a buyer’s agent. I told them it was a waste of time and that I would add 3% onto my acceptable price limit, but they did it anyway. It taught me that first time buyers especially are afraid to do things on their own and I was one once also. I’d like to see flat rate a la carte pricing for various services and options. De-linking the sales price from the fee model would go a long way.

The one positive for california is its anti deficiency statutes. Basically, occupent mortgages are non recourse, so that mortgage ball and chain isn’t too terrible when it goes upside down.

I think the problem is in the California law allowing foreigners to get a green card through investing $500,000 into a US business, or real estate. $500,000 is no longer a large sum of money.

This is what I don’t get regarding inventory. So the 2007 peak was characterized by historically high ownership rates and high prices. This peak, noting that I use the term “peak” loosely, is characterized by historically low ownership rates and high prices. Both peaks had very very low inventory. So on a national level, what is taking up the slack and accounts for low inventory and low ownership rates. Naturally population increases and migration trends need to be accounted for. But I would speculate that am increased amount of investors owning a historically large amount of properties is mostly to blame. Which is a superb sign of a bubble. But given the intelligence and depth of thought from others active on this site I was curious as to other theories.

Leave a Reply