The Great Housing Squeeze: Available homes for sale remain tight while rents continue to go up. When capitulation turns into mania.

“Capitulation: the action of surrendering or ceasing to resist an opponent or demand.†There seems to be an air of capitulation floating around the air. No, not the toxic fumes floating over Porter Ranch but something akin to giving up. It is actually a weak form of giving up since you are talking about hipsters and house humping adults looking to overpay for a crap shack. Forget about the fact that last month the median price on your typical California home fell. No, it is time to buy now or be priced out forever. You get the selection bias going: I bought at X time and now I’m X times richer. Let us ignore the 7,000,000+ households that recently lost their homes to foreclosure. At least some are willing to admit their “investment†was basically blind luck. At a few open houses, you can see people as if they were entering a cult with their eyes dilating like the cat in Shrek. “Can you please let me buy this place and take on a massive mortgage? Pretty please?!â€Â To be honest, it is rather shocking to see people waiving contingencies and throwing caution into the wind. In many cases, people are buying old crap shacks that actually have a ton of deferred maintenance. One open house, a standard SoCal stucco box, looked like it hadn’t been touched since the 1970s and the aroma of cat urine and dog poop whiffed around the room as people elbowed each other to “examine†the place. The only sense you had was of panic of missing out. In other words, mania.

Low inventory and rising rents push people off the fence at the top

You’ve heard it before that the masses get skewered at peaks and troughs. Well it very much looks like the masses are capitulating but many simply can’t afford to buy. This is why sales volume is low despite rising prices. Low interest rates have magnified purchasing power but how much lower can you go if the Fed is already near zero? High priced mega metro areas are completely detached from what most Americans are feeling. And that is why this year politics are trending to the extremes on both sides. Why shouldn’t day? We live in an extreme economy. You either have big bucks or you are leveraging every penny you have to maintain the pretense of a middle class lifestyle. You can feel it at open houses in “good†areas. The sense of desperation is palpable.

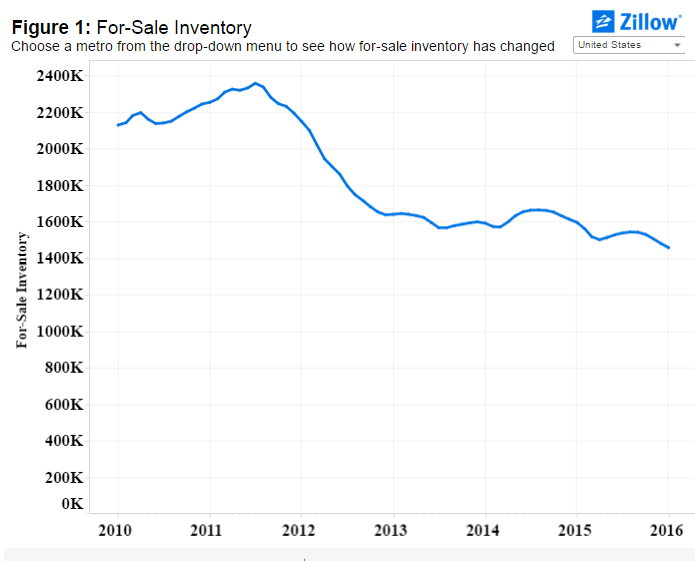

A big part of this simply comes from constrained inventory:

Inventory is incredibly tight. You want to buy? Good luck with what is out there. This is why large metro areas from Denver, Seattle, Las Vegas, Los Angeles, San Francisco, Miami, and New York are all seeing similar trends. Prices are rising on normal sales volume thanks to tight inventory. Over the last few years, a large part of the buying went to investors. Now with sky high prices and investors pulling back, you are seeing people stretch into homes with no down payments or very little down – all to get a piece of the crap shack dream.

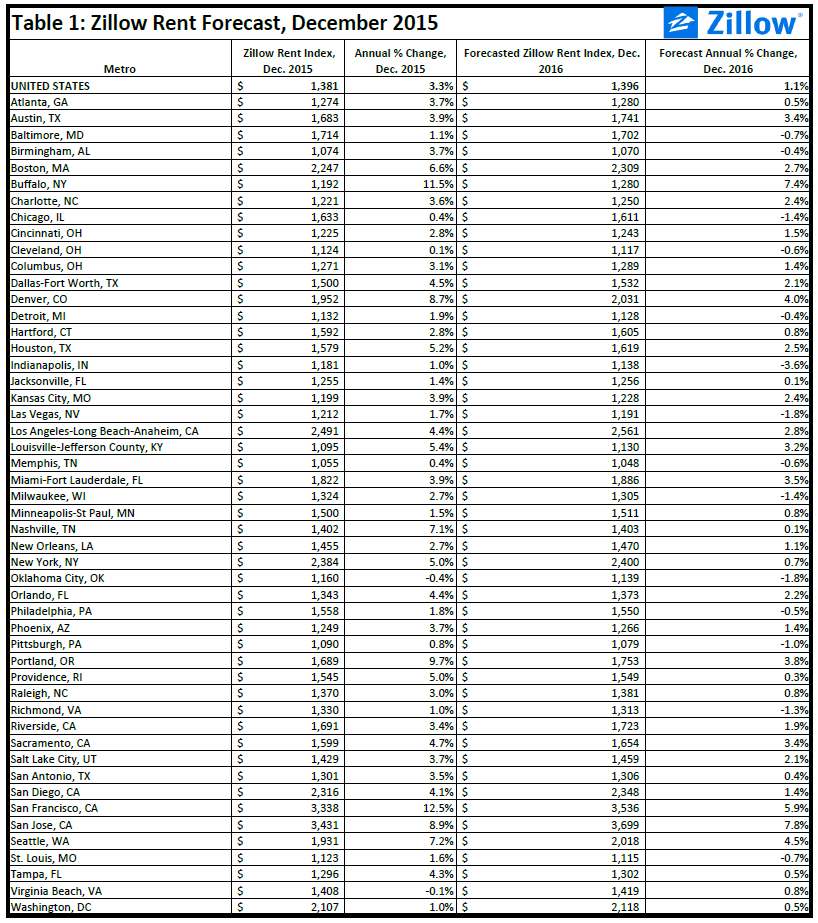

Investors, those that bought up the inventory are doing well on the rental side of the equation:

Rents are rising in this tight market as well. Millennials, the next large cohort to buy homes actually opted to rent or live at home with parents because they simply cannot pay current prices. Of course we have seen a bull market in stocks since 2009. It is yet to be seen how this market will respond to your typical recession that appears every 7 to 10 years.

There is this misnomer that desire is equal to demand. Of course many Millennials or prospective house lusting shoppers want to own a home. That does not mean their income can justify a $1 million crap shack. Even in many L.A. “hoods†prices are in the $400,000 to $500,000 range. These are areas with horrible schools. And let us be honest, many that are buying are looking to procreate and pop out some kids if they have not done so already. Once that stage hits as seen in many open houses, hormones and emotions take over and goodbye to rational financial thought. And some people equate volume at open houses as somehow meaning people are acting rational.  Open houses were packed in 2006 and 2007 as well. Go to an open house and see how rational people are acting. People are acting like the desperate 40 year old trying to flirt with younger girls at the club. After all, isn’t it worth it to spend $700,000 so you can paint your kids bedroom?

The only problem with this logic is that people wanted these housing “amenities†years ago as well. What is different this time is probably what we are seeing in our politics. Extreme choices. No middle ground. No middle class. The investor class and the debtor slaves. You can have your crap shack but the bank is going to own your life. And what about that next recession? Of course human psychology being what it is, an open house smelling like a rescue pound has people trying to buy without seeing what is directly in front of them. People drank the Kool-Aid again. Those of us who have lived through previous bubbles recognize the chorus but on a different soundtrack.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

108 Responses to “The Great Housing Squeeze: Available homes for sale remain tight while rents continue to go up. When capitulation turns into mania.”

I am so tired of this rental and housing environment.

U.S. Home Prices Are 14% Overvalued According To Bank of America

http://www.zerohedge.com/news/2016-03-30/us-home-prices-are-14-overvalued-according-bank-america

I had a good laugh talking with a local builder sales rep this weekend. This was in a new development not far from my office. New homes are stacking up and the amenity center looked virtually vacant. Sales reps are putting on a good show though, trying to make “demand” look stronger than it is in this overpriced master-planned neighborhood.

When I stopped in to say hello to this particular sales rep, he didn’t have anything to say about recent sales, but instead crowed about all of the incredible “foot traffic” he has seen in recent weeks. I just smiled and went on my way in the comfortable knowledge that foot traffic doesn’t sell houses. As Sinclair said…

“It’s difficult to get a man to understand something, when his salary depends upon his not understanding it.”

It’s just a gully.

I worked a few years at a large mall. It could look very busy, but people were not buying. They were either empty handed or bought a card at Hallmark. Nobody lugging bags of merchandise to their car. Foot traffic doesn’t pay the bills.

buying a house in the suburbs around houston is a bad investment.there’s too much land so prices go up very slow,sure youre able to get a mansion for $250k-$400k but those areas are not in a central location,houston is the fastest growing city in the nation and by 2020 a million more people will come to the city.i bought early in the heights area in December 2011 and im already sitting on $400,000 of home equity.there isn’t much land in neighborhoods close to downtown,so buying a house in a central location is the best choice not only your house will go up a $100k or more per year.youre close to everything and the medical center,the world’s biggest medical area is spending $2 billion dollars on bio tech.

at least one person gets it, all RE is local, buy in the right place…

Typical RE lie, most lots are empty and they tell you many are sold we just can’t get the workers to start on them? No matter how bad the market they always smile and tell buyers and sellers everything is coming up roses, what they really know is, everything is coming up weeds because these lots are sitting empty.

As long as banks refuse to foreclose the “real” value of properties will continue to be distorted. I know folks that have not made a payment in years. That single fact should be enough to keep buyers out of this market. That is unless one is a speculator.

As long as banks refuse to foreclose the “real†value of properties will continue to be distorted. I know folks that have not made a payment in years. That single fact should be enough to keep buyers out of this market.

Why? If I knew for sure that I could buy a house, stop paying the mortgage, then live in the house for free, for umpteen years, I’d buy right now.

i know of someone that lived mortgage free for 48 months.

This is probably banks way of getting even with strategic defaulters and perhaps flippers as well. Make it hard for them any which way they can in my opinion.

I too know someone in S. CA who hasn’t made a mortgage payment in over 2 years. The bank has tried to foreclose and send to auction numerous times, but the homeowner uses all kinds of tactics to keep delaying the auction and living for free. A lot of this is because of federal programs like “Keep you home CA” which end up getting abused with the majority of the money going to the wrong people. No reason why someone who made a bad financial decision and live above their means should get a taxpayer bail-out. What happened to taking responsibility for your actions? I guess this country can’t have “Losers”.

California is raising the min wage to $15, which is good for landlords, now we can get our 50% of the increase. The fools will not be better off, but the landlords will be. I love this Feudalism. Thank you Gov. Brown and friends. Check’s in the mail.

The funny thing (in a sad way) is that you’re probably right – part of the move to raise the minimum wage is to prop up high rents. Hard to see how this doesn’t end up with blood in the streets.

There won’t be blood in the streets. The exact opposite will happen since more people will be able to afford their rent or buy more stuff.

Its an attempt at a placation of sorts really.

If you do the math you’ll realize its also a bit of a sham. They’re going to raise the min. wage to $15 in 2022 with small increases. After that it’ll get raised automatically every year indexed to inflation. Which sounds good at first until you realize that by 2022 $15 will be worth $13.50 or so in real dollars if inflation holds at its current rate.

Really if the politicians wanted to help people they’d raise the min. wage to $18/hr for high cost of living states like CA, adjusted to inflation of course, and then implement policies to slowly force housing costs down over time. It would be hard to do either of those things but the economy and people would be better off within a decade or so than they are now.

I was thinking the same thing, but I wasn’t going to say it out loud.

I am late to the discussion but I had to interject because no one else was saying it. the only reason minimum wage is being raised is for political clout. That’s why this is one of the few instances where business interest groups AND politicians differ. Just think of all those votes you will grab as the incumbent who “saved” the poor by raising minimum wage never mind the whether the bloody thing even does what its supposed to.

Yikes.

Housing prices can keep going up because rent keeps going up. As rent goes up, people feel even more pressured to buy, further increasing prices which pull rents up and on and on. The tech industry isn’t going away so Bay Area homes will just keep rising.

Until tons of people start missing their rent payments, I don’t see this cycle breaking.

the tidal wave of tech jobs here in the Bay Area will recede and the 90,000 new residents to the area will be washed out to sea with it. Might even happen this year.

are you talking about a big earthquake at Market and Castro streets? Better start building my raft.

Nothing last forever. The tech industry could go bust like it did from 1999 to 2001. The tech industry in the Bay Area could be destroyed from an major earth quake or some other disaster.

How about something more realistic, like debt saturation and the realization that those tech unicorns will never make a profit?

The stock market and tech sector are in a bubble due to cheap debt. So are rental and real estate markets.

@None

Prospective buyers getting off the sideline to sustain an artificial real estate has been wishful thinking for the last 7+ years. They don’t have the access to cheap money that other investors have. Flippers selling to other flippers. That’ll end well.

We live in an era of sheep like mentality. At least half of the people have no clue what is going on, and just care what their monthly payment is going to be still, just as if it were a car payment.

I visited SoCal in 2007 before moving here 4 years later, and I swear, I get the same feeling of irrational exuberance now, as I did back then. I give it 6-18 months before either a catalyst or the 100th monkey effect comes into play-

https://en.wikipedia.org/wiki/Hundredth_monkey_effect

“What is different this time is probably what we are seeing in our politics. Extreme choices. No middle ground. No middle class. The investor class and the debtor slaves.”

Well said. I think historians 30 years from now, will look back on the booms and busts of past 15 years as a consequence of extreme wealth inequality. Look at any society where there are massive riches, you will also see massive poverty. Indeed, we keep seeing recessions occurring more and more frequently, with each collapse lasting longer, and deeper in intensity than the last. As the middle class and well-paying, stable jobs shrink, consumers have less and less disposable income to spend. How does a consumption-based economy function when the majority of consumers have no more money? A small, millionaire class blowing excess income on luxury goods like sports cars and Louie Vutton purses an economy does not make. And now, lets also categorize a roof over your head as a luxury good that only a few can really afford, and well, the proof is in the pudding (as your blog has clearly been demonstrating these past few years…)

Good post. It confounds me how some pat themselves on the back for just being born at the right time to be able to buy a house at a time when real estate wasn’t a primary speculative investment. This “I got mine so screw you” attitude is one of the reasons why overall economic growth is anemic. Ruling interests want their current lifestyle subsidized by pushing their debts onto younger generations. Instead of paying for their own excesses, they expect bail outs and subsidies. Instead of creating new and innovative businesses, far too much debt and resources are used to keep unprofitable industries (i.e. tech unicorns, real estate, oil) on life support.

What people can not figure out is, when price is obviously beyond current average income affordability level; yet we don’t know if the inflation would trigger thing get much worse and much longer than it should be. And would it be to a point that when the market correction finally hits, the drop of home price might not be lower than the current market value, after some potential QE and other tricks the FED might pull to keep the housing market at flow.

When there are so many tricks the government could do, to manipulate market to award the irresponsible, things can no longer be that easy to predict.

Hi Dr HB community. I’ve been following this blog for a while, but don’t really comment. Would love your opinion now, though.

I’m the breadwinner (my wife is a stay at home mom) and I have a growing family and we really need to move out of the semi-crappy two bedroom condo we’re renting in OC for super cheap into a 3 or 4 bedroom house. However, our rent is going to bump up by at least $1,000/mo to do it. We can afford it, we’re pretty frugal, but I keep thinking of all the things that we could do with that cash other than blowing it on higher rent: save more for retirement, put kids into private school, replace a car, take a trip, etc.

We also have the option of completely moving out of CA to Georgia and I can keep the same job with the same company (and same income) I have now. We would be moving far from family to do that, but we could keep our expenses where they are now and own a beautiful home – and continue saving for retirement, taking trips, etc., that we enjoy now. Georgia is a nice state, but it isn’t our first preference.

What do you think? Blow another grand or more on rent for a house in SoCal, or just move out of CA altogether? What would you guys do in my situation? This has been a really tough call for us.

This is a pretty easy choice, move to GA and enjoy a nice home with a yard. With the savings you can take a trip to SoCal twice a year, save for retirement, and buy a new car.

Sounds like Georgia is the smart financial decision.

It boils down to How much do you love SoCal over Georgia? How much extra money are you willing to spend and borrow in order to stay in SoCal?

Which do you prefer? More money (and all the stuff that money buys — health care, travel, private schools, etc.), or SoCal living? Only you can answer that.

I’ve been to Atlanta. Nice people, but I wouldn’t want to live in the South.

That’s a no-brainer…..move out of state and buy a house or rent for cheaper! According to what you said you will never get ahead by continuing to live in CA with it’s high cost of living. Parts of the OC are nice, but traffic sucks and housing is way over-priced. The future of CA is dismal at best with a years long drought and increasing divide between the have’s and have-nots. IMO leaving would be the best thing you could do for your future.

Stay and pay the additional 1k. I know folks who left ca and almost all of the came back or are planning to come back.

I have the exact opposite experience. I know several people who left and zero have returned. They send photos of their $300K mansions (compared to what you get here for 800K) that they bought outright when they sold out of Orange county.

So should you move to Georgia, keep the same job with the same company (and same income), own a beautiful home – and continue saving for retirement, taking trips, etc., that you enjoy now?

If you wanted to punish yourself and your family, you would stay in California, pay $1000 more a month for a 3 or 4 bedroom rental, and have no money for retirement, taking trips, etc. California needs you to stay and pay your taxes to support California’s enormous welfare and entitlement costs.

Perhaps get loft beds, consolidate and wait.

We just left all of our family and friends in LA for Oregon last year for the same reasons. It’s fine. Between Facebook, FaceTime, email, texting, phone, and everyone wanting to come visit, we still feel like we see everyone too much. LOL

Hi Joe,

Make sure you and your wife visit and think about it real good. I have friends who left and will never come back, friends who left and came back, and friends who left and love it but the spouses hate it.

The obvious choice based on logic is to move to Georgia. It looks that your family from OC can not afford to pay for your increased rent. This is based ONLY on one criteria – cost.

But there are other considerations – safety of the neighborhood, rating of schools, commuting time, peace of mind (stress level which can not be quantified in Dollars).

If your extended Family assists with child care (for dates and special events), and family holidays are a must, you will be spending a few thousand dollars on babysitting and air travel (not to mention vacation days).

If the public schools are great where you would move in GA, and you do not have the compulsion to spend every holiday with your family, and they give minimal assistance with child care anyway. Go to Georgia. You can always come back, and it may be more affordable when you do. Rent for a year in Georgia. The weather and traffic sucks. But the food and people are great. You will also find that the predominant hobby for many people is “I watch SEC football”.

Babysitting depends. We were shocked to find out that teenagers babysit for relative peanuts up here in Portland, which was something we were worried about when leaving our family in LA. My next door neighbor has three daughters who all went through Red Cross babysitters training and it’s only like $20-$30 for an entire evening. Jackpot!

I left CA in 1993 and haven’t looked back. It was life changing for the better by far for my family. My wife misses her family in CA, but we are far better off than virtually all of them now. We have enough money that she/we can visit two or more times a year. My advice is to leave. It won’t be easy at first, but if you save your money, etc., in a few years you will be glad you did.

California is not the state I grew up in (’70’s and ’80’s). As I have posted before, California has the largest percentage of citizens living in poverty when adjusted for cost of living. I don’t see how there can be any defense of the living conditions in a state with that statistic.

Yeah, I read that California in 1970 had population of around 17 million. Today it’s close to 40million(?). My grandpa and grandma bought a beach shack in Newport Beach in the mid-50’s and raised 5 kids in it on 1 income (and that was even thru bouts of my grandpa being unemployed according to my mom). He would drive to downtown LA every morning from the OC on newly built highways. The property that they once owned is certainly worth millions now (the kids sold it in the late 90’s when my grandma passed away). Could anyone imagine such a lifestyle now? Easy commute, raising a large family on one salary, simple, yet affordable housing close to the beach??? It’s almost laughable if it didn’t want to make me cry. Contemplate leaving Calif all the time, the only thing keeping me and my wife here is my own aging parents…

Good feedback, really appreciate it. How it’s worked out for you is how I envision it for us if we move. Yes, it will tough adjusting at first, but the payoff is that we will be much better off financially in the future. I know people that are taking on insane mortgage payments in CA or paying ridiculous rent just because that’s what people do around here. But ten years down the road will they be better off than they are today? How much will they be able to save for retirement? So much of their income in their prime working years will be lost to mortgage interest or rent.

BTW, what state did you move to?

If you move to GA with an open mind, ready to explore/embrace what GA has to offer, meet new people, perhaps rent for a year to make sure its a fit and find a suitable neighborhood, I’ll guess good decision.

If you move to GA and constantly compare it to CA, missing Disneyland, surf/ski, celebrity culture, etc., obsess over bugs/snakes/weather, and often find yourself telling GA neighbors/coworkers about how special CA is and how superior CA people/culture are, stay in CA. Otherwise I’ll predict a return to CA within 2 years, w/lots of embittered stories to share about unfriendly/inferior GA people. Go to Thai restaurant, become upset no lasagna on menu, same feeling.

Best of luck to your family, and with your decision.

You raise great points. I think that moving with the point of view of enjoying what it has to offer is how we would approach it, though we would miss certain things about CA. We’d be living in an area of the country we’d never lived in before and would have the opportunity to explore all it has to offer. My wife and I love to travel, so it would be fun to be relatively close to FL beaches, Myrtle Beach, DC is a short flight away, etc. I think both my wife and I would really enjoy that. The kids are young enough that they wouldn’t really care where they were living. The hard part is how far away we would be from aging parents and the friends we have here. If we do it, I think the plan initially will be to live there long enough to build up our assets (perhaps 5 or 10 years), then maybe move back to the West somewhere – perhaps central WA, OR, or ID.

“I think the plan initially will be to live there long enough to build up our assets (perhaps 5 or 10 years), then maybe move back to the West somewhere – perhaps central WA, OR, or ID.â€

Why not just skip Georgia and move where you really want to live? Yeah, you’ll have to change jobs, but people do that all the time. It would offer a lot more stability in many ways, including allowing your kids to develop long-lasting friendships (as opposed to moving thousands of miles, twice).

Pew Research just released a study showing that family expenditures have crept up by 25%, while incomes have stagnated. And, the study indicates that the bulk of the increases in expenditures are for core items such as housing! And, those in the lowest 1/3 are actually in the red, spending more than they earn! The study eludes to the fact that this increase in expenditures is also at the expense of families financial futures! Seems to me, we are hurtling toward an immovable wall unless there are some major changes!

Housing to tank hard soon!

Soon as in under 10 years?

So where is all the forclosure inventory? Sitting in limbo waiting for a next decline the QE4….then another hedge and private equity sweetheart deal for cheap bulk buys with fed window money at near zero or zero. We can be Hard Working Americans and give all our labor to our rental lord’s. Maybe after the TPP is in full working order enough lucky winners in Vietnam can come park money in our new homes like the Chinese. What a sad joke!

The foreclosure inventory is probably long gone. For the next wave of foreclosures – wait for 6 – 12 months after the next job loss recession…

Hardly. Outside of the “prime” areas a lot of short sales and foreclosures came to market starting end of last year, and more are coming on since. Place next door to me has been vacant for about 4 years now and there’s been a little prep on it a couple months ago so I assume its going to hit the market sometime. Talk to friends and everyones got 1 or 2 in their neighborhoods as well. Right now I see it mostly in the 300K and below segment.

http://www.zillow.com/homes/make_me_move/pmf,pf_pt/550000-600000_price/1984-2164_mp/any_days/globalrelevanceex_sort/33.978812,-117.552509,33.631344,-118.218555_rect/11_zm/

greater OC showing only foreclosures and the dreaded pre-foreclosure.

1.) The Federal Reserve changed banking regulations in April 5th 2012 so that bank were now allowed to become landlords rent out foreclosures: http://www.federalreserve.gov/newsevents/press/bcreg/20120405a.htm

2.) Federal banking laws allow banks to keep foreclosures off of the market for a period of up to 10 years: https://www.law.cornell.edu/uscode/text/12/29

3.) ZIRP. With the bogus but official inflation rate at or around 2.5%, zero interest rate policy by the Federal Reserve means that the Fed is paying banks to keep foreclosures off of the market.

4.) The peak years for foreclosures were the years 2008, 2009, 2010, 2011 and 2012: http://www.statisticbrain.com/home-foreclosure-statistics/

With all these factors in mind, we are several years away from seeing banks release foreclosed inventory. With home prices in SoCal plateauing and approaching or exceeding the peak in of summer of 2007, we may see banks selectively leak inventory on to the market.

Based on the above factors, we are not going to realistically see inventory return to normal levels until maybe the year 2020 or later unless home prices start to fall, banks panic and then start dumping foreclosures on the market.

Last I heard a while ago with all the inventory at the time it would take 40 years to get through it all. I guess that depends on the type and quality of the home if that number were for real or even banks would ever hold property for that long.

So what do you go? In the Bay Area the rents are rising fast and buying is out of reach. I wish I had bought in 2013.

Housing market to crash hard soon. Can’t wait

Bill Bonner is recommending you sell your homes and buy gold. He has made many good calls, including the last top in gold. Ignore him at your peril.

Well even Bill crapped out on this one brahfessor

The median home price fell last month, and inventory continues to decrease, according to Zillow. That points to a weaker buying side. An increase in inventory could pop this bubble, finally.

As many people have pointed out, there isn’t much for new inventory because home builders don’t get much out of building new starter homes, and existing owners can’t afford to buy their own home at current values, let alone move up the property ladder. While ‘every real estate market is different’ I see this trend all over the place right now, leading me to believe the FED overshot with all the QE, ZIRP, et al, and now we have an economy that’s like a meth head, that needs a fix just to get out bed

Seriously, there will be no major correction in home pricing in San Francisco or most of the Bay Area. Even if jobs decrease, home prices are more solid than gold, especially within San Francisco City and County itself. It is, frankly, impossible for home prices to ever go downward, or if they would, it would be teeny tiny at most and short lasting before they go back up again. San Francisco is one the most unique cities in the entire country with very limited land and land conservation laws that would never permit anything but a few more expensive million dollar high rise condos built in the downtown corridors maybe, but otherwise will see increasing prices – and many, many buyers for all those units, as the millionaire class flocks to San Francisco proper and takes it over – forever. San Francisco already is the New York City of the West Coast and will continue to appreciate in value until the only people left will be the millionaire and billionaire class owning all the real estate in town, then the class of servants, maids, butlers, nannys and chauffeurs who will live- in or rent from the lords who own all the property. Add to that the class of younger highly educated from wealthy families who will be able to rent and eventually buy and that pretty much sums up the remaining economic and cultural elites who will dominate all of San Francisco housing, at robust price levels that never decline, long, long into the future, for generations to come. Not even an earthquake will dislodge this reality from continuing to happen as it already has begun and is unstoppable.

Except, when you go to Zillow and find the most expensive listings in California, the vast majority are in the LA area. Wealthy people usually live in LA and NY. SF is not in the same league.

Heard this logic many times over the last 30+ years; but in most of the 90’s you could have gotten a deal and 2009-2011 was an even better buying opportunity. Once the tech boom starts to crash there will be opportunities. The downside to what you’re thinking is that the Bay Area is a one trick pony when it comes to private sector employment. Who’s going to run the city?

Exactly. It’s a city built on hugely overvalued tech companies, and it won’t have a pretty ending.

“Not even an earthquake will dislodge this reality from continuing to happen as it already has begun and is unstoppable.”

Nope. If Mother Nature decides its time, sixty seconds from now San Francisco, LA, etc. could be a smoking rubble pile that would take decades to rebuild. Food for thought.

Sounds like most of the premiere cities in Europe. In Paris for example, 99% of the population rents from the 1% which own all the property. That’s something to look forward to.

Yes, that is exactly it. That is what San Francisco is turning into, is maybe the most European socially and economically stratified city in the country. LA is not and if there are more high priced listings there on Zillow right now, that is because people are desperate to sell or move around a lot. But in San Francisco proper, people hardly ever sell some of those homes worth millions to tens of millions of dollars, mansions really, and they stay in families for generations, along with all the rentals they gobbled up along the way to rent out to the tech boomers or whoever else is in vogue at the time. And the job base there is able to change on a dime and has gone through many metamorphises, from military and industrial to computer hardware, then to software and engineering, now on to internet. When the earthquakes come and go, like after Loma Prieta, not everything falls down and life goes on, people do not flee in panic. And when the internet hub bub dies down, then something new will come to the economy there in San Francisco, just like so much comes to San Francisco first before the rest of the nation ever catches on. So no, San Francisco real estate is a solid investment, better than gold – no earthquake, no slow down in the job markets, will ever shake it down. Simply, never, just like in Paris, Rome and London, high prices are there to stay, forever in San Francisco.

not sure your data is truth about 1% renting to 99%…. if is fact, they need culture revuluation….

You got to be a troll or completely delusional.

I have lived over 35 years in San Francisco Bay Area, most of it in San Francisco and for another long period, in San Jose. I know both those cities quite well and all the areas in between. I am not a troll and I know what I am talking about. If you have never lived nearly a life time in that area, then do not compare it to more run of the mill locations elsewhere in the country – because when they drop precipitiously, San Francisco will bare budge. Yes, it might drop a tiny bit in a few markets, but for the most of it, it will hold steady and as I said, owning San Francisco, the city, proper, real estate is worth more than a pot of gold. I’m not a troll and I mean what I say, from experience.

http://www.housingwire.com/ext/resources/images/editorial/Charts/San-Francisco-home-prices-sustainable.png

“It is, frankly, impossible for home prices to ever go downward”

That was the logic in 2006 as well. That sentiment is exactly why you will be wrong.

Switched on the tv the other day and re-runs of PROPERTY LADDER were playing. HA! From 2005 – so sat back for a laugh. The old crapshacks amateur flippers bought for $800,000 hoping to flip for over a million. Amateur is an understatement. Fugly el cheapo finishes and deluded dim-wit flippers. I laughed every few minutes.

Seems like history is repeating itself and there is a never ending supply of dim-wits hoping to make a quick buck as a “real estate investor”. The current bubble (and it is a bubble) is completely unsustainable. But when comes the crash? It should have come already but same old MO with the return of fog a mirror loans, pick a payment loans and NINJA loans keep the boat floating up river.

Wonder what happened to those Property Ladder flippers?

I seems like the market is trying to keep noobe flippers in the game just a bit longer when I see these old shows playing. It’s basically advertising in my opinion. Easy way for someone to see what all the commotion is about with these homes.

Sweden tried to cool its housing market by reducing mortgagesfrom 140 to 105 years !

The UK allows for 40 year mortgages. With the US government already providing most mortgage finance extending mortgage terms might be the only way to keep housing prices up should the Fed start to raise interest rates.

It used to be that loaning money for more than 30 years was difficult because there was no comparable financial instrument ( US government bonds) upon which an interest rate could be based but does it matter now since banks do not have to provide anything beyond completing the paperwork and servicing the loan? Extend mortgages to 40, 50 years so young people can get on the property ladder and baby boomers can downsize.

I’m not sure how much that would help. My quick excel calculation shows that increasing the mortgage term from 30 to 40 years would reduce the total monthly cost for a $600k condo (basically entry level price for a small condo in a decent part of the Bay Area) from $3531 to $3174 (assuming 4% interest rate and including estimated taxes and insurance). That’s better, but it still means a household earning the median income of $93k/year would be spending more than 50% of their income on housing.

It’s diminishing returns from there on out. Extending to 50 years only reduces the monthly payment by $193, and extending it out to 60 reduces by another $113. Extending from there all the way out to 105 years only reduces the payment by another $170, and from 105 to 140 years reduces the payment by only $23! At this point you are approaching the limit – the “interest only” mortgage (essentially infinite in term), which would be only $7/month cheaper than the 140 year mortgage.

Extending mortgages only goes so far – bottom line is housing prices need to go down.

So hypothetically speaking if the plan is keep rates low while keeping rents going higher to the point where these late time buyers cave in and buy at these frothy levels only to see a market crash in the next two years who gains from this?

What happens in foreclosure this time around?

Is the new buyer worse off than before?

Been reading here but never posted. Baby boomer. Own 5 properties, two inland, three coastal. Bought an inland San Diego county house, five bedroom, on four acres in the mid 80’s for $220K. It’s now worth a little over $500K. Terrible return. Had we, for a similar price at the time, purchased a two bedroom shack a block from the beach in Cardiff, it would be worth over a million and a half now. Price inflation has been far greater on the coast. Water has been poorly managed in this state and consequently, inventory in places like Fallbrook or Ramona is plentiful. Drive through and what used to be lush groves and green pastures is now barren brown dry dirt. Even Rancho Santa Fe has high inventory for the same reason. The eucalyptus got sick, water restrictions kicked in, tropical gardens died, pastures turned brown. Nobody wants to live on what used to be the American Dream in the 1970’s, when up and coming professionals moved their families to a “gentleman’s ranch”, where they could raise Arabian horses or avocados for the tax write-off. Now the millenials all lust only for the coast and a few trendy hot spots. So prices reflect demand. People here post what is, a tiny tear-down crap shack. Buyers see what can be once they tear it down. It will only get worse unless the water situation improves, which under California politicians is highly unlikely. There will always be some buyers with money. They now only want coastal homes.

Couldn’t agree with you more. The water issue is a big one statewide. But up until this point it seems like the rest of the state is subsidizing water costs in LA. Water is so cheap in LA compared to the rest of the state. I would often see people in LA running sprinklers during the rain or watering sidewalks and streets. Not to mention the lush grass yards requiring almost daily watering. That can’t continue forever. What happens when water rates increase dramatically in LALA land? Here in San Diego county we pay four times more for water then in LA and unlike LA we have our own sources due to desalination and forward thinking preparations prior to the drought.

Actually, Hunan, it’s quite the other way around.

Los Angeles’ water use per capita is rather modest, and urban rate payers in CA pay their freight. Los Angeles denizens should not apologize for their modest use- they pay the taxes that builds (wasteful) water projects to supply super wealthy agribusiness with steeply subsidized water. This has been going on for the better part of 80 years, and it constitutes corporate welfare on a scale so massive, that most people can scarcely grasp it, especially when you consider that the chief beneficiaries are not small farmers, but major corporations that have holdings of 500,000 acres or more.

You all who inhabit CA’s large urban areas, AND the taxpayers of the U.S. at large, are ALL subsidizing western agriculture. Growers in CA and AZ buy their water for one tenth what it costs to store it behind dams and move it to the growers, so they can grow low-value, water-guzzling crops. Los Angeles’ swimming pools and lawns are a drop in the bucket compared to the use by agriculture. In fact, once a pool is full, it uses very little water, and you can reduce use further by covering it when not in use, to prevent evaporation. All this, for crops that could be much more easily grown in water rich states like AL and MS and LA, where there is ample water falling from the sky and where growers are paid to NOT grow these very same crops.

Start studying water use in the western states, and who really uses how much and what they pay for it, and you will be furious.

Without the copious watering the entire southern california coast looks like Camp Pendleton. La Jolla looked like that just 60 years ago. You can grow your handle, euphorbia, no problem with little water.

Friends’ family owns an organic avocado/grapefruit farm in fall brook, they are definitely worried about water and have been downsizing the farm as a result. I don’t get the madness around the coast, crazy costs and traffic but to each his own. Left almost a decade ago and my quality of life went up orders of magnitude.

Bigger farms with enough capital are investing in this:

https://www.deere.com/en_US/products/equipment/ag_management_solutions/field_and_crop_solutions/john_deere_field_connect/john_deere_field_connect.page

Automated soil water content measurement. I know someone who worked on R&D for this stuff. That and subterranean drip irrigation are the future of dry land high value crop farming out here.

Certainly it’s about the incredibly low inventory, but at some point, no one will be able to afford rent, let along buy! Somewhere the fact that incomes/wages aren’t growing, the fact that our economy can must only a 1.4% GDP growth rate, and all the costs associated with living and raising a family, will finally break the proverbial ‘camel’s back’!

There is an alternative (but still terrible) outcome: as rents continue to go up, those that were living on their own and find themselves priced out of the rental market will just double up with family/friends/strangers. That process is of course well under way already.

So welcome to increasing population density, lack of parking in residential areas, more street congestion and increasing commute times, etc.

Not that anybody asked, but I believe that Prop 13 is only going to exacerbate the situation and it’s an incentive for retirees to stay in place rather than move on to retirement communities in places like AZ. When I lived in Santa Clara the folks on one side of me were in this situation and with the kids and their kids, there were three generations all under one roof (and in the garage). Great neighbors and the kids were all well behaved – they simply couldn’t afford to buy their own home…

It looks like we are well on our way to becoming a 3rd world country with mulit-generations of families living stacked on top of one another. New New Mexico here we come!

https://www.flickr.com/photos/joshobrightphotography/6402255799

I heard on the radio the other day, a story on the increased number of units for sale in Palm Springs, due to Canadians selling out or staying away because of the Loonie drop. More sellers, fewer buyers. External forces can reach out and touch California RE sometimes.

When did you hear that is palm spring a good location to get a house

And what do you mean by loonie drop a price correction I don’t think it will happen anytime soon

Have you looked at an FX chart of USD/CAD lately? They were at parity a couple years ago. Now the loonie is about .73 USD. That makes buying a home in Palm Springs alot more expensive for Canadians, and a big incentive to sell what they purchased a few years ago.

I never said I was looking there. I hear it on the radio. I assumed y’all knew that the Loonie is the nickname of the Canadian $ and that it has already dropped big time. Markar & Junior_B got it. Sorry you were clueless.

I’ve noted the pressure that the decline in the price of oil and its impact on Canadians buying RE in the past. They were the biggest buyer of real estate in Hawaii, Manhattan and probably other areas the previous few years. Much of that will be unwound.

Exactly what the program I heard said is happening to Winter resort property in P.S.

Techies ‘solve’ affordable housing problem with no-sex sleep pods…

HAVE you ever stayed at a cheap hostel and thought to yourself, ‘I wish there were more pretentious millennials here — and there’s far too much sex going on’?

Then PodShare might just be for you.

The Los Angeles-based start-up is the latest craze in the low-cost short-term accommodation market, billing itself as a ‘co-living space’ for social travellers and mobile workers.

Founded in 2012 by entrepreneur Elvina Beck and her father, PodShare is a basically a co-working space with 10 to 30 beds which turn into desks by day, Motherboard reports.

For $45 to $65 a night, $295 a week or $1180 a month, ‘Podestrians’ get access to all the amenities including a napping station, Xbox 360s, laundry and community kitchen.

(more)

http://www.news.com.au/finance/business/travel/no-sex-allowed-in-communal-living-startup/news-story/a9580c545a488215ebb0c569c0dd607f

Oh no I’m….. http://pricedoutforever.com/

$15 minimum wage is going to be a disaster. If you think the cost of living in CA was high before, wait till this takes effect. I predict thousands of job losses and mass inflation statewide. Hopefully I’m wrong.

Hunan and Fatima… You are right not wrong, the min wage is a political tool, $15 or $20 what ever is not the issue, companies will always find a way not to pay the min wage like part time only or you didn’t meet a quota so we had to let you go etc.

The concern is salaries are not even close in keeping up with price increases on everything in this country, just a matter of time before the masses really wake up and wonder, we will never get ahead and the system is rigged for the 10% of the population, Europe is the new America folks, we lost the industry war to foreigners some time ago, sad, sad, but true?

Mass inflation means higher housing and rent prices. Locking in a fixed price is not a bad idea when inflation is the only way out of this mess.

The minimum wage hike will most likely cause rents to increase. Not sure what effect if any it will have on housing. If inflation increases due to the wage increase, then yes it will most likely prop up housing prices as well. What many people don’t realize is that many of the working poor in LA receive government subsidies like SNAP and Sec. 8 vouchers. When their pay increases these programs decrease. I believe this is CA’s real game plan to deal with poverty, pass the responsibility to the employers and local business. This way CA pays less welfare and collects more taxes on earned income. So essentially they give with one hand while taking with the other.

@Hunan, you seriously overestimate the effects of a minimum wage increase. Minimum wage workers are concentrated in the food service and hospitality (janitors, cleaning services, maid) sectors.

The minimum wage increase will hammer Millennials since they love to eat out, go to bars, check out the latest hottest restaurants/coffee shops/eateries/movies.

Overall minimum wage increases tend to increase the cost of food services (i.e. eating out at restaurants) by about 10%.

If you do your own grocery shopping, cooking, cleaning, etc. you should see no impact of minimum wage increases.

Ernest, I tend to disagree. The minimum wage hike will have further reaching effects. For example, Walmart has closed two store in LA this Jan due to increased pressure from labor unions to unionize and increase pay. Walmart claims the impeding minimum wage increase helped them make the decision to close these two stores and five others in CA. Now those consumers who shopped at Walmart will now be forced to shop at other more expensive stores. It’s safe to assume that other business will close, relocate, or choose to open in neighboring states with lower minimum wage requirements. It is also safe to assume that many skilled workers will want a raise when minimum goes to $15. I mean why get a degree and accumulate student debt if you only make $5-$10 more then minimum wage out of the gate? The bottom line is that a large minimum wage increase points to increase in inflation. Which ultimately means EVERYTHING costs more.

Increasing the minimum wage may help move people off of food stamps and thus save everyone in taxes? Not sure if that angle has been researched.

Walmart can afford a minimum wage increase considering they have 500 Billion in sales and 15 billion in profits. It may mean less profits and bonuses for its executives though?

America will be owned by the rich foreigner very soon most of the big hotels apartments houses owned by the foreigner or they have a big investment wake up americans one day u wake up and realize america is for a rich foreigner not for a working americans

Ashes to ashes and dust to dust

If the Camels don’t get you, the Fatimas must

Foreign money. In some of these metros, a majority of the homes are being bought by foreign investors. That is why prices go up when American incomes are not….but when prices do start going down, they will hit the exits fast. Combined with a Trump presidency, meaning 10-20 million fewer people in America, the coming bust could be worse than expected.

Leave a Reply