The housing market is addicted to the easy financing juice of Wall Street: What happens if the juice is taken away?

While the stock market can turn on a dime with the agility of a cheetah, the housing market has the nimbleness of the Titanic. That is why the slowdown that started in the summer of 2013 is actually now resulting in on the ground changes for buyers and sellers. The stock market has taken a bit of a reversal early in 2014. This is important for housing since much of the hot money is coming from excess funds from Wall Street and investors chasing yields like hungry hippos. The euphoria of a stock market juiced on Quantitative Easing has leaked into many areas outside of stocks including real estate once again. Yet the resulting re-inflation was largely based on investors cramping out regular home buyers. Regular buyers unlike the last bubble, are the last folks to the party. That is, the last bubble was because of too many regular buyers over stretching with toxic mortgage junk (and prime mortgages with weak income due diligence) while this cycle is because of Wall Street using easy money from uncle Fed. This is why the rise in adjustable rate mortgages (ARMs) and jumbo mortgages so late in the game tells you that families are simply unable to compete with big money and once again, are stretching out their budgets for as much as they can get. Many even with low rates cannot compete so they have taken the next alternative in the form of renting. One thesis I think largely being missed is that the real estate market has caught a ride on the coattails of the non-stop stock rise since 2009. Four years of stocks only going up with QE as a backstop have conditioned people to believing that stocks and real estate only go in one direction. What happens when the juice no longer holds the same kick as before?

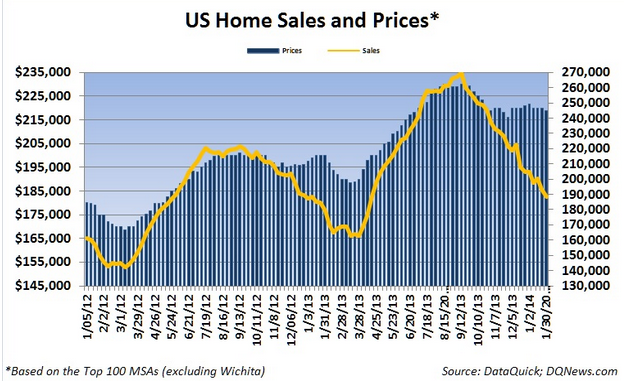

Prices and sales stalling out

Home prices and sales have hit a snag since the summer of 2013. Investors in many areas are actually pulling back since yields are no longer generous. There is only so much you can squeeze out of the public when incomes are not going up. Many younger Americans, the future home buyers, are essentially getting by on lower waged jobs and are deeply in debt with college loans. Many are living at home with mom and dad. Since the summer of 2013 the rise in interest rates with prices getting out of control has put a stop to the short-term QE induced investor mania. Investors have been purchasing close to 30 percent of all properties nationwide since 2009. That is simply unsustainable. There does appear to be some sort of slowdown approaching:

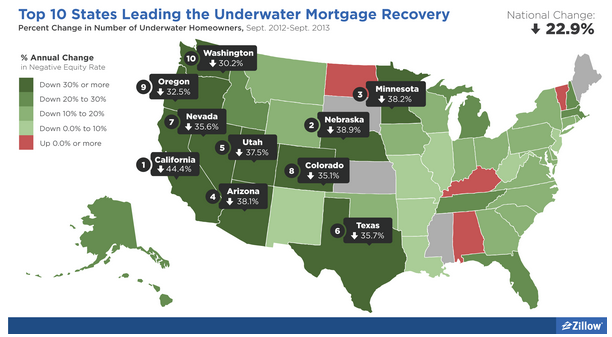

Sales have taken their usual seasonal hit and prices are stalling out. There is no way prices will rise this year similar to what we have seen. The notion is that prices will simply stall out for the year which is very likely. Depending on the stock market, they will likely have a year-over-year negative hit by the second half of the year. Inventory remains very low and you have millions of people in underwater properties still trying to get by paying their mortgages. Even with the fast rise in prices, we still have about 10 million homeowners across the country underwater:

What is interesting is that many of the distressed properties are now back in the hands of financial institutions. These financial institutions depend on a healthy stock market for a variety of business income. The recent stock correction, if this is something that is going to stick, will add additional fuel to the downside of a housing market that was already stalling out. After all, we have many of these big investors trying to sell their rental securitization streams on the stock market.

Sales in December for California were the slowest on record since the market implosion of 2007:

Beyond the massive drop in sales, this is important to note because it happened during a time when prices soared. Of course they soared on low inventory, massive investor buying, and regular buyers going manic by diving in with ARMs and jumbo mortgages. For places like California, a large part of the euphoria comes from booming markets. The rise in the stock market and sales has increased tax revenues, property taxes, and will result in solid capital gains. Yet these are fickle sources of income. What happens if there is even a modest correction in the stock market? Say stocks dip 10 or even 20 percent this year? What about home prices retrenching 5 to 10 percent? For a place like California based on non-stop growth, this can be enough to reverse things quickly. More than likely though, is we will continue to see a bi-furcation of the market where the majority of the state is pushed into the unaffordable crowd while those capturing most of the QE induced income gains will have the ability to leverage the low rate environment.

One quick lesson to take from this however is that real estate does change tides very slowly and the stock market can reverse very fast. It can also reverse on seemingly innocuous news but you would expect some kind of correction after going up by 150 percent from the lows in 2009 right? Yet some don’t bother to look at price-to-earnings ratios or even the fact that people can actually afford homes at current prices based on income. What is certain is the juice needs to keep coming for this to continue. So far, some of the juice is running out in 2014.

Do you think the stock market will have an impact on housing as a leading indicator?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

101 Responses to “The housing market is addicted to the easy financing juice of Wall Street: What happens if the juice is taken away?”

No. I think that housing and the stock market are completely separate species now. The average American household has divested itself of any meaningful stock investment in favor of freeing up money for child support and housing payments. As best I can tell, the stock market mostly represents a gauge of the investor class’s optimism in A) how much automation/outsourcing can boost the yield of a given company, B) how much untapped global market share is available to a given company, and/or C) how much pricing power can be captured via M&A within a given industry.

The only degree to which the stock market relates to housing is that A, B, and C all tend to suppress (or even reverse) the earning power of the average American household, meaning that the more the markets climb the worse the long-term position for housing will be. If the market peters out, it merely indicates that most of the immediate gains from A, B, and C have been exhausted until some new technological of financial instrument spurs another round of up-distribution of income.

“The average American household has divested itself of any meaningful stock investment ”

They never had any stocks in the first place. They didn’t save any money, except for the “forced savings” they put into the house. That’s where most have put their money in thirty years.

“As best I can tell, the stock market mostly represents a gauge of the investor class’s optimism in A) how much automation/outsourcing can boost the yield of a given company, B) how much untapped global market share is available to a given company, and/or C) how much pricing power can be captured via M&A within a given industry.”

Yes, that’s right. American corporations are fabulously profitable right now because they have learned to churn and hide capitol and exploit rapidly dropping labor costs worldwide. Amazing that American RE is still elevated considering most people make less money than twenty to thirty years ago, in real terms.

This would only be true if you do not have a pension or a 401K. I believe there is a significant percentage of the population that has one or the other.

The United States has 38 million working-age households who do not have any retirement assets. For people 10 years away from retirement, the median savings is $12,000. Of the people between 55 and 64, one third haven’t saved anything for retirement.

http://www.usatoday.com/story/money/personalfinance/2013/07/01/retirement-savings-shortfall-crisis-catch-u0p/2464119/

Chris D. did write, “stock investment,” so I think he left out retirement stock holdings on purpose. Plus, aren’t the bulk of large retirement accounts held by the near-retired (if that?)? So, those funds aren’t going into the real estate market.

And, yes, if the stock market Jim Taylor’s on us this year, the real estate market will follow this time (because many of the new buyers are flippers and investors who DO have sizable “stock investments”).

@What?

“This would only be true if you do not have a pension or a 401K. I believe there is a significant percentage of the population that has one or the other.”

No, hardly:

http://www.economicpolicyresearch.org/guaranteeing-retirement-income/528-retirement-account-balances-by-income-even-the-highest-earners-dont-have-enough.html

A very small percentage of Americans under the age of 70 have a traditional pension. And, I don’t have the numbers, but, I really doubt that more than 30% of their paltry total savings are invested in the stock market. American savers were always too cautious, and, after the financial crash. most money went into safer investments than equities.

@DFresh

“Chris D. did write, “stock investment,†so I think he left out retirement stock holdings on purpose.”

Well, what other savings are we talking about? Are you telling me that Americans have some substantial savings outside of traditional retirement accounts? Really? I see the opposite. Massive credit obligations, no savings. Americans are broke. They have no assets. If most lost their job tomorrow, they’d be in major financial trouble in a few months. Most are much more concerned with their credit rating than their retirement accounts, because credit is their currency.

“Most are much more concerned with their credit rating than their retirement accounts, because credit is their currency.”

So sad, so true.

Three Trillion with a T in US 401k accounts.

http://www.onwallstreet.com/news/401k-spark-2672713-1.html

This does not include outstanding pensions. It is true that the pension is waning but there is still a sizable investment in these funds as in 12.7 trillion with a t…

http://www.theactuary.com/news/2012/09/total-assets-of-worlds-largest-pension-funds-hit-127trn/

I think it is generally beneficial to do at least a little research before you make a counter argument. I do agree that there is a large number of folks with little to no retirement savings and this will most likely have a negative impact on our economy in the long run but it is truly false to say that the average Joe is not invested in the stock and bond market indirectly…

@What?

“I think it is generally beneficial to do at least a little research before you make a counter argument.”

Really?

If you didn’t notice, I gave you a link to a study that says that most Americans don’t have squat saved for retirement, and tenantincommon also gave you a link to a similar study. There are many more out there. You gave me a link to a site that requires a subscription to view entire articles, a site that seems to be a product of the internet pay wall financial media. If the irony of that, being charged for bad information by the financial industry, went over your head, it didn’t mine.

Now, about that number. Three trillion. Really. Now, stop and take a deep breath. How is that even possible, without pensions? (the large state pensions might make three trillion, combined. might. I still doubt it. Your link includes the entire world. Every European and his sister has a state pension.) Do some simple math. But, if you insist going down this road, I have some wonderful income producing real estate for you to buy in the South Bronx. Killer views. Call me.

Ok, let’s try this again…

http://www.pionline.com/article/20130626/ONLINE/130629908/ici-us-retirement-assets-hit-record-208-trillion

Total US total retirement assets equal 20.8 trillion with a t. I don’t understand why you would not look and find something that disputes the numbers I give. I am open to you showing that we do not have a large amount of “average Joes†as bond and stock “investorsâ€. Quite frankly this IS the market… Individual investors are an insignificant part of the market these days.

Here is more reading material. The last is from the 2010 census and the number has grown 17 to 20 since. Are you arguing that we are not at roughly 20 trillion with a “t†of total US retirement assets?

http://www.federalreserve.gov/releases/z1/current/accessible/l116.htm

http://www.gabrielroeder.com/total-u-s-retirement-assets-increase-4-6-to-20-8-trillion-in-first-quarter-of-2013/

http://calderadvisors.com/retirement-assets-total-20-9-trillion-at-the-end-of-june-2013/

http://www.census.gov%2Fcompendia%2Fstatab%2F2012%2Ftables%2F12s1216.pdf&ei=ePzzUtypDMjroAS96YGIAw&usg=AFQjCNEeXfL_z1rRjBN8heO_B2O8HUHUZA&sig2=BUn6aN6gpVUt-hmK9E0QbQ

I could go on all day as well…

Last link did not work. Here is link to the 2010 Census data…

http://www.google.com/url?sa=t&rct=j&q=&esrc=s&frm=1&source=web&cd=18&ved=0CFUQFjAHOAo&url=http%3A%2F%2Fwww.census.gov%2Fcompendia%2Fstatab%2F2012%2Ftables%2F12s1216.pdf&ei=QwP0Uq2GD5GDogTe9oL4AQ&usg=AFQjCNEeXfL_z1rRjBN8heO_B2O8HUHUZA&sig2=8rkRzCK1pXRWDyx9cCEL7g

I’ll bet you work in the financial industry. Investment planner? Annuity salesman? Broker?

I do not work in the finance industry per se. I am not an investment planner nor an annuity salesman (which in my mind is an insult) nor a broker. I work in corporate finance so you are partially correct. I am not clear how that changes the fact that many Americans are “invested†in the bond market and stock market, and the folks you mention above are fleecing the average Joes of the world with innovative investment “opportunities†designed to make the broker richer and the client broker…

I love this title:

Where Are the Customers’ Yachts

http://www.amazon.com/Where-Are-Customers-Yachts-Investment/dp/0471770892

If stock market gets % 30 correction in the coming months then we will see a huge slow down in RE market. Investors are not buying distressed properties as they were between 2009-13.

I think stock market has one more leg to go up then prob in May we will see huge down trend so as the RE prices will go down with it.

I know a lot of Investors made $$$$$ in stock then bought a few houses Cash for the last 5 years.

I am ready to buy by this summer end or year end if current prices drop %30.

Maybe after all Jim Taylor was right all along.

TR,

So you are going to buy after a 30% drop at what would most likely be a 6% or higher interest rate? Eh, I’m good with my 2011 purchase that is 20% higher than my purchase price and locked in at 3.85%…

It’s financially more attractive to purchase when rates are higher due to the downward pressure they put on the price level. You can always refinance down. But, eh, some people don’t get the bigger picture and only think in terms of monthly payments.

By the way, when do you plan on selling to lock in that 20% gain? Point is, until you take your profits, talk is cheap.

Anon,

I agree it’s better to purchase at a lower price… But what got me off the fence in 2011 was something called Rental Parity.. we crossed a threshold in 2011 where it was quite a bit cheaper to be in a 30 year fixed 3%-4% mortgage than to rent the same property.

Those days are gone for now. Let me know when rents start dropping below the monthly nut for my mortgage again.

Anon, I’m sure everybody agrees that it’s better to purchase at high rates and low prices. That hasn’t been the case for over a decade and likely won’t be for years to come. Unless you have an unlimited time horizon to purchase a home, you better come up with Plan B. For most people that is “what is my monthly payment?” And if that monthly payment is at or below rental parity…it’s time to buy.

2011_Buyer

I have bought a house in mid 2009 when price & rate was low.

I am planning to buy again if prices drop like a rock

“But what got me off the fence in 2011 was something called Rental Parity.. we crossed a threshold in 2011 where it was quite a bit cheaper to be in a 30 year fixed 3%-4% mortgage than to rent the same property.

Those days are gone for now. Let me know when rents start dropping below the monthly nut for my mortgage again.”

I thought we were debating TR’s strategy for the now and future. It sure is interesting how you keep steering the focus to your past decisions.

“Anon, I’m sure everybody agrees that it’s better to purchase at high rates and low prices. That hasn’t been the case for over a decade and likely won’t be for years to come. Unless you have an unlimited time horizon to purchase a home, you better come up with Plan B. For most people that is “what is my monthly payment?†And if that monthly payment is at or below rental parity…it’s time to buy.”

In other words, buy now or be priced out forever. Spin it however you like, it all leads back to the same old tune.

Anon, it’s not “buy now or be priced out forever.” It’s “buy when it makes financial sense to you.” Rental parity makes lots of financial sense. I don’t know when we will next reach rental parity again in the future, your guess is as good as mine. However, expect another mad rush to buy when that time comes. Locking in a fixed housing payment for the next 30 years with super low rates isn’t a bad idea.

What is your perfect time to buy? When we see really low prices, high rates, little or no competition to buy, etc. You aren’t the only one hoping for this outcome. If prices fall dramatically in the beach cities, I will add another property to my portfolio…something tells me I won’t be alone with that thinking.

Have to second Anon’s comment there buddy. You fell for the car salesman trick “so, how much monthly payment can you afford? “. I say none of your business, how much is the car?

DHB,

I think housing is more “brittle” than previously. This is evinced by the ability of things to get 25% more expensive very rapidly.

Housing was slow to swing when it was full of regular buyers buying a home as a necessary good and not as an investment vehicle.

When you have a lot of hot money and investors on the housing scene, I suspect it can turn more quickly than previously. I mean over 2 to 3 year cycles and not over 10 to 15 year cycles.

Through successive rounds of QE followed by a taper, the Fed can make stocks go up and down indefinitely. They announce a 10B taper, then another 10B, and if stocks over-react, then they will just take the last taper and reverse it. Up and down. Forever. Why not? I’d be curious what others here think about whether or not this would work and for how long. This is going on the assumption that the Fed wants, more than anything else, to prevent the bottom from falling out of the stock market. Do you think that such a strategy would become less effective over time?

With the FED infected with a fatal case of Mad Cow Disease, there is no question they will increase their printing soon and in a big way if the stock market tanks.

I think FED QE will remain fairly effective until it doesn’t and when the market starts falling despite the FED promise of endless printing, the depression that should have been to clear out the excess will finally take place. Except, not only will we have a Depression, we may not have a monetary system in which to rise from the ashes.

They are going down an unsustainable road.

I would be amazed and surprised if the stock market goes into a major correction and the FED does not react but continues to withdraw QE, although highly unlikely.

We’ll see what Ol’ Yeller does.

So many expect the Fed to be predictable but it’s not always in their best interest to do what’s expected – ask Dick Fuld how that worked out for Lehman.

Hank Paulson was surrounded by Goldman Sachs people at the time Lehman went down and caused a run on all the banks. They were not very objective about those bailouts. Nobody really knows what Ol’ Yeller is going to do.

Something that occurs to me is perhaps the rushing in of Chinese buyers could be a negative signal. The idea is that the interests of these buyers don’t necessarily align with traditional buyers and the existing homeowners. Much as is the case with institutional investors buying the house next door, is it ideal to have the neighborhood exposed in a way that is not well understood or without historical precedent? Comments here often surmise that Chinese buyers are either looking to transfer capital away from risk and/or establish residency for their offspring to be educated here. Problem is, I can’t find any empirical evidence that proves these claims.

There seems to be a sense of relief sought from the idea that these non-conventional buyers will insulate parts of the SoCal market from fundamental domestic pressures oft mentioned in Doc’s postings. I’m not so sure there is any less risk when one takes into consideration the possibility that these Chinese buyers could be exposed in unimaginable ways to what we are increasingly becoming aware of as a very precarious situation in Chinese credit markets.

The same could possibly be said for foreign nationals from Latin America in the South Florida market. How do we know that these folks aren’t immune to the recent contagion?

Good points Anon. I’ve been thinking the same lately.

The same is true of institutional all cash investors. These non-conventional buyers distort perception of real value and change the landscape of communities. They are not long-term members of the community, and will be out the door at the first sign of higher risk-adjusted returns elsewhere.

I don’t know about that. I manage 45 SFRs and condos for an All Cash Investor. ACI bought foreclosures, rehabbed them and rents them. ACI refianced the whole valley portfolio and currently has zero capital tied up in the houses. ACI plans to hold them for a long time, after all, they cost him nothing and I do the work. I was thinking while making the 10-99 list of contractors and local businesses I use that ACI contributes quite a bit to the economy of the valley. We paint, carpet, tile, landscape, repair, redo whole kitchens, rescreen, yada. If the houses were owner occupied I am sure much of the work would be done by the owners or not done at all.

“[All cash investor] refinanced the whole valley portfolio and currently has zero capital tied up in the houses.â€

All, pay attention to the only important statement made by Land Lord. I believe that this is the fundamental issue with the “all cash investorâ€. They are leveraged. Does everyone realize that leverage is truly a double edged sword? It exponentially increases the rate of growth as well as rate of decrease.

Land Lord, I wonder that your “all cash investor” might have had a much easier time of it if he/she had bought a couple of large apartment buildings instead of a bunch of SFR’s. More bang for the buck, fewer locations, easier to manage/maintain than a string of SFR’s in the “valley”. Oh well, just my humble opinion.

Japan… It’s like déjà vu all over again…

Interest rates have dropped, the 10 year is down to 2.6%. Low rates will help stabilize RE prices. I guess the “rates are going up” crowd have some spaining to do.

It was just 2 or 3 months ago that we heard rates are almost 5% and will be 6% before you know it. A 30 yr mortgage as of today is 4.25%. Who knows, maybe we’ll have 3 handle rates again soon. Trying to predict anything today is a fool’s errand!

Correct. And since mortgage rates are benchmarked to the 10-year Treasury, you can see that each time the 10y yield approaches 3% it has drawn back down. This is a resistance point the Fed will definitely want to hold on to ….. or housing tanks hard due to elevated costs related to financing.

Also of note: do not ignore the flight to safety in Treasuries if/when the equity markets correct. I think the Fed wants to take some of the air out of the equity bubble…including EMs… to feed more demand for their full faith and credit instruments, thus softening the blow from gradually tapering Treasury and MBS purchases. I just have a hunch that is the plan.

Prepare for a hard landing and pray for a soft landing.

Yes you are correct that making predictions in the short run is truly a fool’s errand. The fact is that as time marches on the pressure is building on the fault line. Some of these fault lines are blind thrust faults that we only learn of their existence by an event. I would say that only a fool believes that an event will never happen again or that the next event will not be worse than say the Northridge event in 1994.

Given the dynamic of building pressure it is true that one will eventually be correct if they predict that an event will occur tomorrow each day. But I would argue that there is no true predictive value because they where wrong more than they were correct.

Speaking of interest rates, I believe that there is a problem with the belief that somehow an asset bubble will stabilize if a falling interest rate stops falling and holds at a given rate. This assumes that there is a natural homeostasis for asset bubbles. The problem is that we would need continual decreases in the interest rate to continue the asset inflation to “sustain†the asset bubble. The point is that asset bubbles are unstable by definitions and to hope for asset bubble stability would be the ultimate fool’s errand…

Alternatively, if there is a large correction in the stock market, the money could pool back into the “safe haven” of real estate. That is essentially what the Chinese have done, i.e., moving money out of the Asian stock market and into U.S. real estate.

I just don’t see any scenario where there will be a significant drop in real estate prices. The growth may stall for the coming year(s), but I would assume inventory will also continue to be low.

Those pools of money might evaporate due to leverage. As Warren Buffett says, “Only when the tide goes out do you discover who’s been swimming naked”

Housing To Tank Hard in 2014!

Thanks for checking in Jim.

Is “Jim” a real person or just an algorithm?

Good old Jim.

DHB wouldn’t be the same without him.

You can’t live with out food and shelter. But you can live without stocks. Housing will go up 20-25% in Southern California in 2014. Keep dreaming that housing will tank.

Bitter renters.

I’m also wondering if Obamacare will unintentionally take out additional discretionary income from the purchasing power of the regular home buyer.

The CBO believes that the ACA will lower worker participation impacting GDP. I would assume less aggregate work equals less aggregate income…

It’s been popular lore in the Titanic story that the iceberg was spotted 37 seconds before impact and the ship was too large and under ruddered to avoid it. This may not have been the actual fact on the night of April 14, 1912. A willingness to believe Titanic couldn’t turn quickly may have served Harland & Wolff and the White Star Line to hide the fact that the berg simply wasn’t seen until Titanic was nearly on top of it.

Same goes for the financial markets. We are global now. Anything can happen. Be ever vigilant. Don’t be complacent.

I’d read that one of the Titanic’s errors was that it saw the iceberg and tried to avoid it by turning. Thus, it was hit in the side, creating a huge gash.

If it instead had aimed straight for the iceberg, suffering a direct hit on the nose, its bow would have crumpled, killing some of the people in that area, but the ship itself would not have sunk.

Of course, this bit of Titanic trivia no way analogizes to the current economy.

Love these Titanic analogies!! Keep it up!! Bubbles have been part of life throughout history: German Tipper and See-Saw Bubble (1621), Dutch Tulip Mania Bubble (1637), South Sea Company Bubble (1720), British Railway Mania Bubble (1846). Florida Land Boom (1920s). Each time, people convinced themselves everything was okay and prices would either continue to go up or flatten out. But each and everyone burst with devastating fury.

Although the Titanic incident wasn’t an asset bubble, it is an example of what inevitably happenss when mankind succumbs to irrational exuberance. In this case with the ship’s safety features. The Titanic was considered by many as the ultmate crowning achievement by man 102 years ago. It was billed by Haarland and Wolf as “practically unsinkable” but J. Bruce Ismay and White Star Line chose to dismiss the “practical” part of that.

I am currently buying a home in Garden Grove as a for sale by owner (relative) so I’m saving at least 6% worth of commission as a start. There are some outrageous flips in this part of town i.e. bought in October for 450k than gone to some cosmetic fixes and back in the market for 520/530k etc…

I believe that there is a paradigm shift in the various Asian immigration groups viewing real estate as a place to sock away money much like a bank saving account. Many Chinese have taken their gains (legitimate or ill gotten) from China and park it mostly in metro areas. I don’t think they care if housing drops 10-20% (versus loosing 100% in China). We [the US] have been exporting the dollars every where due to the trade deficits and they are now using those dollars to buy physical goods i.e. gold or real estate plus others to hedge against future inflations. When the rich start to view real estate as the store of wealth due to the mistrust in government debts, the middle and lower class will continue to get screwed via high real estate and rent prices. Real estate is very local in the US (coastal vs ghost towns a la Detroit) and there is definitely some bifurcation in prices between desirable and on desirable area. Since interest only loans are not coming back, we won’t get to 2006 prices in most areas for some time to come. However, it will be very naive to think that housing prices will tank considerably in the near future given the recent and future monetary issues that financial institutions and countries will continue to have.

Only this time, housing will not crash but act as a hedge against governments & banks fiscal irresponsibilities. If you look at peak land prices from 1800 in the US, the average cycle (peak to peak) will be around 18-20 years. If the peak is 2006 it is likely that we wont get another bubble until at least 2020 or later though prices might rise very slowly in the near futures or not at all due to the rising in interest rates.

We have gone through many financial panics even worst in the past but housing prices always rebound to the upside due to inflation though sometimes it could take many years. Similarly if you bought an index fund during the peak in 2007, if you have the balls to hang on, you would have been okay in 2013. These cycles repeat time after time and the different between a loser, a pig, and a winner is timing.

Guest: “Since interest only loans are not coming back…” Dude, they ARE back, as are dangerous ARMs. I can get an IO loan…maybe you can’t. Call a few mortgage brokers and look around – IO loans are available. Just about anything is available to someone with a good credit rating. Which means we are bubbleicious again.

Yes, interest only loans are back – in a somewhat more limited way. I think you’re missing some important differentiation from the Bubble Years. In those days an interest only loan was frequently also a NINJA loan. There was really no hope of getting the principle paid off. There was only an impetus to get as many loans as possible for the loan tranches that were securitized by the originators.

Today there is a requirement for a down payment as well as a credit history that can support the underwriting. This is an important difference.

“There are some outrageous flips in this part of town i.e. bought in October for 450k than gone to some cosmetic fixes and back in the market for 520/530k etc…”

That’s nothing. In the current run-up, we’ve seen flips in parts of LA going from 300’s to 600’s in marginal parts of the Valley.

“I don’t think they care if housing drops 10-20% (versus loosing 100% in China).”

Where’s the proof? For all we know, things in China could come apart at the seams and these buyers liquidate their US assets in order to stay afloat over there. I could be wrong. The point is that no one really knows. An anecdote here and there really doesn’t amount to anything either.

Then there’s the underlying premise that this will somehow buoy the market should other fundamentals come into play. It’s based on the belief that they won’t sell.

“interest only loans are not coming back”

Where’s the proof?

I thought Dodd Frank Act banned most of those interest only loans. Like the previous commenter said, interest only loan (limited availability) will only available to highly qualified buyer. If China is coming apart than they will definitely coming here and be your neighbors and living off the fat they gained to escape prosecution/revolutionaries look at Hong Kong around 1997. The environment in China is atrocious and just another reason to pay cash and live in these San Gabriel valley mini mansions. The proof is in real estate prices in the San Gabriel Valley which have gone even higher than 2006 prices in areas such as Arcadia. When you compare to Beijing or Shanghai prices per square meter, they are still a bargain.

Yes, they can loose 100% of properties in China if the government decide take it away for the “good” of the people. I’m sure those Chinese buyers are well aware of that from their Maoist experience.

There are a lot of corruptions going on in China. Even the Chinese people can’t trust their own government (kinda like a growing number of Americans losing trust in our own government) and the government can rob them of their money. So taking their money out of China is consider a safe haven for them.

The Chinese government has set a limit of $50k a year to leave their country for investment. So they have Chinese family pooling their money together to buy say $700k home in Irvine. There are even Chinese companies that will find people for buyers so they can launder more money out to other countries to buy real estate. Remember it’s only $50k per person so you will need 14 people to buy that $700k home. It’s reality! China is buying a lot of the world’s premiere real estates. It’s not just Southern Cal.

http://online.wsj.com/news/articles/SB10000872396390443507204578020272862374326

>>> We have gone through many financial panics even worst in the past but housing prices always rebound to the upside due to inflation though sometimes it could take many years. <<<

Only wage inflation can push up house prices. Inflation in anything else (food, energy, ect ect) gives people less money to spend on housing… both for renting and buying.

Overpriced housing is KILLING the economy. Americans are leveraged to the hilt for over-priced housing or are paying HUGE rents and have no money left over to support the consumer economy. Keeping housing costs inflated means the depression cannot end, and more American companies will go bankrupt because of it. And more Americans will continue to go bankrupt also.

Housing gained from 150-300% from 2004-2006. The average annual gain of American housing is 1-2% a year. We need to dry out that 2004-2006 abberration so we can afford to live and support our economy again.

Time to wake up. Fake housing inflation ruins the economy.

Homes are overpriced everywhere….no wonder demand has been crashed.

Well put. Before any real recovery can take place, real estate prices (in some locations) must fall first, and then not be “saved” by some gov’t scheme.

True prices must be revealed before true investment and economic growth can happen.

“Americans are leveraged to the hilt for over-priced housing or are paying HUGE rents”

You have to specify which Americans. I believe you refer to the Americans from Southern California or NY. They are only a small fraction of Americans and it is true that they are leveraged to the tilt. To be in SOCAL it is a choice. Nobody forces you to be on the CA coast. You decide, you have to live with the consequences. Most US pay 2-3 times the average income or less; however they are not in SoCAL; again it is a choice.

concur, my addiction is a choice, an expensive one.

Same logic drives the price of cocaine, etc….expensive tastes, I’m guilty of..

Las Vegas market update and another housing bubble.

Please copy and paste the link below.

http://www.youtube.com/watch?v=dX_rqTATgVI&sns=em

Ironic that with all the talk about how $4 trillion of QE has boosted the real estate market, it really hasn’t – its just been a period of rising home prices against a back drop of low sales, low demand, low labor participation rates, low household formation,low new construction, and low first time home buyer sales.

These two charts show what a farce the housing “recovery” has been

http://smaulgld.com/why-the-housing-recovery-is-a-farce-illustrated-by-two-charts/

.Excellent article and charts. After the repeal of Glass Steagall and intro of QE, it put free trade on steroids and lawlessness It’s all fake and fraud now with loss of US sovereignty for we, the people.

Great article Doc. However, the juice isn’t working for American households, just Wall Street and foreign investors. http://confoundedinterest.wordpress.com/2014/02/05/mba-mortgage-purchase-applications-drop-4-while-refi-applications-up-3/

A serious discussion on housing and economics here.

My interview with David Lyyken on American Economics and it’s relationship to housing

http://loganmohtashami.com/2014/02/03/my-interview-with-david-lykken-on-american-economics/

Folks have been going into houses because the market is too risky and they cannot get any return with bonds or cds. Stocks tank? Who cares. That is why folks went into housing, to escape the stock market. If stock folks run to bonds (because they are cheap) then bond prices will rise and yields will drop. This will make mortgages cheaper and help homeownership. Not sure I see a downside to housing with the market dropping. If anything it would help housing. Interest rates rising would hurt housing and I do not see that happening if the market crashes.

Are you sure folks are going into housing? Aren’t sales still dramatically lower than historical norms? Aren’t we back in early to mid 90’s volume?

One point here is that this a low volume housing cycle caused by low houshold formation, underwater owners and owners who locked in a low rate and don’t want to lose %15 in purchasing power from when the rates went from 3.4% to 4.5%.

Sometimes I feel like we are the 6 blind men describing an elephant. We see the market to support our expectations in the light of our personal educational background or experience. I always enjoy this blog because the varied backgrounds and observations when taken in total can be very enlightening.

I like to assume most investors (home buyers of all stripes) are acting rationaly – at least from their perspective. It’s safer to assume this no matter how you really feel about the masses.

I personally believe the Chinese are doing several things. Those with money (and there are millions of millionaires in China) are diversifying their assets, buying a hedge against inflation, getting money out of China and buying in a beautiful place with a Mediterranian Climate. They are doing this with Remimbi that are favorbly priced against the dollar. What’s not to like? Look at the San Gabriel Valley. Look at Diamond Bar. The County Estates in Diamond Bar where no house is less than $2M is all Chinese. The real estate signs are in Chinese as much as English. Seriously.

If you study Ben Bernanke and the whole QE thing you’ll realize he has supplanted the missing consumer dollars in the economy with government dollars to avoid deflation. He is a student of the Great Depression and believes this was one of the primary reasons it was so hard to unwind.

Southern California real estate is high priced for several reasons. I think the climate and locale are the most obvious but look at the subsidy created by Prop 13. Go purchase a $500,000 house somewhere else in the country and see what you pay in taxes. In California you will be paying $6000 a year but in a lot of the country you will be paying $20,000 or more. Tell me that won’t give you pause. In addition, the mortgage interest deduction is giving homebuyers a discount for having a mortgage. Talk about dubious public policy. This should be on the list.

Look at the chart the good doctor posted. He shows 2020 on there with flat prices. Talk about splitting the difference. Some here think it will tank. In adjusted dollars I think the doctor is right but inflation hasn’t been factored in. You cannot pump trillions of dollars into the economy for years and not end up with inflation higher than desireable. Look at every time the government has overspent and pumped the economy and within 10 years there is very close to hyperinflation in the economy. Real estate is probably a better place to park your money than gold. True it has reoccuring costs but it also provides immediate value as shelter or a rentable space.

My folks bought a 4200 sq ft house on the Westside in 1961 for $35,000. The rental I was living in around Crenshaw (it wasn’t a ghetto or undesireable in 1974) was sold out from under me for $11,000. You could buy a new VW Bug in 1972 for $1,250. We tend to forget how insidious inflation is and how we forget what nominal prices used to be. Finally, look at real estate prices in an international “desireable” city. What does nice housing sell for in London? Paris? Hong Kong? Singapore? We have a long way to go. We are sitting on a tinderbox. The match will be lower unemployment. When the Middle Class finally has money and jobs again it will take off. You can tell your grandkids, “In my day I actually bought a place in So Cal for less than $1M.”

I guess we’ll see what happens…..

“When the Middle Class finally has money and jobs again it will take off”

When does this occur? When we are no longer a global economy, there is less competition for wages/products produced outside the US? When there are no longer unchecked masses of low income individuals illegally immigrating (millions in CA) in a political climate that to me seems very welcoming? What type of CA businesses will hire huge numbers (niche high paid tech workers re: Google/Facebook engineers are NOT a common representative of CA “Middle class”) of employees for stable career jobs paying salaries that support million dollar CA mortgages? Please explain.

I think DRHB has an error in his chart referring to 2020. I think that’s supposed to be the end of January, current year.

It’s a shame, because I agree with many of your observations but reach different conclusions. There’s a big difference between the policies found in Los Angeles and the other “world cities” you list. 64% of the wealthy Chinese have already moved their money offshore, i.e. into real estate worldwide, so there’s not a lot of demand left…or, at least, it’s on a downtrend.

In terms of the “middle class” reinvigorating itself in Southern California for pre-bubble salaries, fuggedaboutit. Unless you’re a public servant, median salaries will be flat or fall, simply because there’s nothing special about the local labor force that can’t be replicated somewhere else for far less. I now live in Florida and tell the tales of high school-trained CHP officers routinely making $100+k a year, and folks think I’m exaggerating. There’s a reason that you see businesses relocating to low-tax states. But I digress…

London, New York, Singapore, et al, have a very finite footprint, which makes living in the actual metropolitan area pretty constrained in terms of available space. At 4,000 square miles, Los Angeles County doesn’t enjoy the same exclusivity. Will the coast always be popular? Of course. But in aggregate, there are far more Carsons and Inglewoods and Lawndales than Manhattan Beaches. And nobody’s moving to Southern California to live there.

My prediction is an ongoing bifurcation in real estate. The “high priced” stuff will remain relatively flat as enough trust fund kids absorb existing supply. The low priced stuff will continue to go down in value.

The population of Los Angeles has increased by 1,000,000 in the last 30 years. You could argue that creates demand. Unfortunately, the job count has only changed by 165,000–and that’s how many FEWER jobs there are today.

The population of Los Angeles has increased by 1,000,000 in the last 30 years. You could argue that creates demand. Unfortunately, the job count has only changed by 165,000–and that’s how many FEWER jobs there are today.<<

I wonder how accurate those "fewer jobs" statistics are?

Perhaps more people are working off the books, and in black market fields. It happened in Communist countries. As the above ground economy grew more regulated, the underground economy grew and thrived.

Immigrants, especially, are known to work off the books. I've a friend in New York, who teaches adult immigrants in Manhattan. He says that many of them work in all-cash businesses, and keep most of their money in cash rather than bank accounts.

I wonder who many of those all-cash home purchases in California are paid with ill-gotten gains?

I think there is a bit of misconception with the Prop 13 thing. First of all, nobody I know pays just 1% of the purchase price. With all the props voted in, other voter indebtedness in any particular city it gets to be 1.25% or such.

Secondly comparing a $500,000 home in California to other parts of the country is like comparing apples to oranges. What I purchase for a half a million here I can get for probably 250k- 300k elsewhere. Therefore my taxes in other parts of the country would not be substantially higher. I realize there are lots of variations in taxes from state to state and city to city but you also have to accurately compare the price of housing.

Zillow predicts prices will rise 11.8% this year in Simi Valley, CA.

I’ll have some of what they have in their pipe.

11.8% ?? Heck the geniuses at Zillow predict housing in my zip code will go up 14.5% this year.

At the end of last year prices were up 30% from the bottom in 2010-11. No I don’t live in Beverly Hills or San Jose or San Fran. I live in outer Metro Sacramento. Nice area, low crime, but not people rolling in money.

Yep Zillow has their statistical models was off.

What’d you expect zillow to say? That it’s going to drop? They might a well say “don’t bother using us and helping us generate revenue.”

“Do you think the stock market will have an impact on housing as a leading indicator?” Who the hell knows? The mental illness that seems to possess a lot of people makes prediction a fools game. I hope you’re right about prices going down doc.

One other thing to think about as communities shift from home owners living in neighborhoods to renters moving in, is that renters don’t really care about the neighborhood. If the neighborhood goes to sh#t, that is somebody else’s problem from a renters prospective. Think about it if you own a home and the house across the street goes up on the market as a rental, how do you feel? It only takes a few bad renters in a neighborhood to start bringing down property values.

The more investors buy up properties the bigger the problem becomes since nobody wants to live next to a rental.

I went to the barber today and we were talking about real estate. He told me he had recently purchased a home here in San Jose. Interestingly, it turned out to be a few houses from one I owned back in 1996 and, in fact, was the same floor plan. These homes are 1200 square feet and touted to be 4 bedroom 2 bath single family homes. They are cheap slab floor, have sub standard electrical, galvanized pipe plumbing and some have flat roofs are in a not so nice neighborhood. In a word, they are pure crap. He told me he paid $587,000 for the thing and he was happy to get it. I was blown away. This whole real estate thing is going to a bad place again, its just a matter of time. Incredible!

How in the hell is it possible to pack 4 bedrooms and 2 baths into 1200 sq ft? The rooms must be the size of closets.

My Chicago condo is a 1200 sq ft 5 room 2 bed 1 bath 20s- vintage, with large rooms, medium-sized closets (and barely enough of them) a small bath, small kitchen, and a pantry. It’s a GREAT place for a single woman like myself, but it’s barely adequate for a couple and cramped as hell for a family.

It also has beautiful architecture and lovely vintage details, plus a very high level of comfort- all things notably lacking in 50s vintage, cheaply built slab houses. But I cannot imagine paying anything like $587K for it. Or even $287K.

Most of the cost is land, not the building. You need to separate the two. As an example, in the Beach Cities of Los Angeles, a reasonable lot is over $800,000 and then you need to factor in the house (which costs about $250/sq. ft. to build new). Other areas of California are similar. You calculate the lot cost first and then add in relatively normal costs for the building.

Come to San Jose Calif. and you will see. This is not exaggeration!

How in the hell does a barber afford a nearly $600,000 house?

This fellow is Asian and, believe it or not, more than one family lives there.

I’ve decided the risk of falling interest rates is probably equal to that of rising interest rates. The US Government would love to inflate the hell out of the dollar but with the split Congress, that can’t happen. Looks like a possible Republican sweep of the Congress or a split Congress again with a very slim Democratic lead in the Senate (maybe with Joe Biden as the deciding vote?). I’m not sure if QE would do any good in the face of a worldwide economic slowdown to prop up the stock market. To get real inflation would require wage inflation, and the US Government policies to drive up wages might backfire with increased unemployment which negates the higher wages. Besides, without a Democratic majority in both houses, a minimum wage increase won’t go through. (If minimum wage increases actually worked, there would be no need to keep upping them year after year. I think they just cause inflation in the not very long term and quickly become outdated.)

Whether falling interest rates will ignite a housing price spike is another argument. I’d say that in the face of a slowing economy, they wouldn’t, but if the recovery continued, they would.

Fall to what?

http://www.mortgage-x.com/x/ratesweekly.asp

Well, at the bottom, the 30 year fixed was about 3.3% and now it’s about 4.4%. So I figure the 95% chance range for interest rates this year would be between 3.7% and 5.0%. My guess is as good as yours. By the way what’s yours?

Just Reduced! ( GL Homes)

Click to find out more…

I just received email from a builder.

Prices are coming down.

I was interested in a new home and builder agent told me 5 months ago no discounts available in this market conditions etc etc

I smiled and said I will see you next year :)))

Taper talk… Some Interesting observations from a mad man.

http://www.zerohedge.com/news/2014-02-06/final-swindle-private-american-wealth-has-begun

“I stand more on the position that the Fed taper was actually begun in preparation for a slowdown in global markets that was already in progress. In fact, I believe central bankers have been well aware that a decline in every sector was coming, and are moving to insulate themselves.â€

I question the validity of the “globalist†plan to take over the world but I think this guy is spot on when it comes to the observation that the Fed is tapering before anyone notices that QE3 no longer has any simulative mojo left.

Here’s a great website that talks about the Case-Shiller 100 year index and references a similar study in the Netherlands over 300 years. Both found that when adjusted for inflation. House prices didn’t actually go up at all. It’s a Canadian site but it really applies to the U.S. too.

http://www2.macleans.ca/2013/03/04/return-of-the-bubble-2/

Below is a quote from one of the respondents who really summarizes it well.

“Shiller has charted American home prices from 1890 to 1990 and found

that when adjusted for inflation, prices didn’t actually go up at all

over the entire 100 years”.

Dutch studies have confirmed the same result for housing in Amsterdam over a period of 300 years.

Think about it. If housing appreciated faster than inflation, by now none of could afford to live anywhere! A house is shelter, period. It’s an expense,with maintenance costs and taxes. It goes up in price for basically the same reason bananas do. It’s not an investment. That is, unless you think a good suit or Gucci purses are an “investment”. In which case you can go back to your TV. Another product placement is waiting for you.

Incredibly, after years of inflation-left-in-the-dust increases, many think that houses in Canada are still reasonably priced, and that prices will continue to increase.

You’re a newbie buyer. Your real estate agent points to a graph showing housing prices escaling upwards. Did the agent mention houses built before 1970 were tiny compared to today? That most older houses were built with one bathroom, a much smaller kitchen, little or no insulation, single pane windows, and a miniscule electrical system?

The chart does not compare apples with apples.

At this point, the only reason house prices keep escalating is because people believe they will sell their recent purchase for even more. Salaries have not increased, unemployment is not low, and there is no world boom demanding even more of our resources.

It’s called speculation folks, and it’s a question of when, not if, the bubble bursts.

Yours is a common enough misperception.

Since the FDR era, the real angle on owning ones home is the ability to marry the asset to a short position on the US Dollar… namely: to carry a mortgage.

This short is not marked to market.

The reason homeowners feel so much wealthier at the end of the day (1935-1980) was that their fixed mortgage terms did not adjust for the depreciation of the currency. This wealth transfer ended up in their pockets — and untaxed — to boot. (!)

One could roll-up into a bigger home, a bigger mortgage, and not incur ANY taxable event. This mechanism became the primary wealth generator for a huge swath of Americans.

Because of Volker, home owners had a second bite at the sandwich: they could refi over and over during the period 1981-2007, at declining rates.

Since the currency was STILL being debased, there were mega profits yet still.

Indeed, the ramp ended up in a bubble. This mega move was predicted in 1982 by yours truly. No-one believed me at the bottom. No-one believes me now. That’s how the world is.

%%%

Cut to the present.

The hedge fund crowd is into real estate for the EXACT SAME REASON. They’re putting on a mega-short position against the dollar. THAT’S IT.

At the end of the run, they’ll have a massive capital gain in nominal dollars. The REAL gain will come from the debasement of the currency.

Most posting here still do not get that. They keep fixating on all other, second order, events.

The hedge funds are NOT going to leave. They want, and need, to hold their short for the long haul. While it’s on the books, every other opportunity is used to lay out other shorts — issue even cheaper debts.

This is the basis for parting out rental streams.

All of their designs are over-the-heads of most investors and speculators.

Even now, most ‘informed’ viewers think that the action is in being a mega-landlord. Such a status is merely a requirement to establish the mega-short.

Life is not easy: the hedge crowd will lose if today’s hyperinflation finally breaks loose into a flight from the currency. This mass movement kills the debt markets — including trade debt — which then causes an immense contraction in the national economy.

The same disruption, traditionally, causes tenants to skip rents, causes rental properties to sell out, sell off — and ultimately crash in market value. The associated debts (mortgages) crash to zero real value — but the TAXES balloon like crazy.

The hedge funds have to get out before that eventuality — or get the Fed to stop printing so much money. I expect that Yellen is getting plenty of kick back — even now.

What the nation needs is sound money, sound policy and sound government.

In short, a total reversal of current attitudes.

Truly sound money would drive policy towards sound government.

The national credit card would be ‘cut-up.’

BTW, most of the government’s debt is shockingly short term. We really do finance the government on a credit card.

ZIRP permits Congress a much, much, much larger pen than it should have.

Current policies are in complete contravention of those embedded in the US Constitution — the tattered old rag that demanded payment in SILVER.

(Gold was a secondary option, almost never used in 18th Century America.)

So, Blert, you’re a genuinely really smart guy, and I’ve never considered your observations before as the underlying current in the housing market. (And yes, I actually understood what you wrote.)

So, this is what make me think we’ll actually have a fairly strong/stable dollar in the near future–I’d love your feedback.

a) I think the Fed is looking to exist QE as quickly as possible. I think Fisher is much more powerful/persuasive than he is assumed to be by the market. I believe 6.5% is the arbitrary unemployment rate at which the Fed might start raising its rates, and aren’t we now at 6.6 or 6.7? I don’t remember the exact number from this morning.

b) The velocity of money is low. The money supply is huge, yes, but it’s all on balance sheets and not being used in the economy. Inflation will remain low.

c) Relative to the rest of the world, I believe the U.S. stock market is considered a “safe haven” at the moment. Emerging markets money is coming here. Europe is still having problems. That’s going to put pressure on stock prices to rise in the year ahead, in my opinion.

d) I still think cap rates matter, and when the ten-year goes over 3% later in the year, I think enough fund managers will have to seriously look at the risk:reward of being a landlord versus the “safety” of government notes.

The dollar, no matter how much printing the FED does, will be the last to fall. Currency wars/ trade wars will ensure that nations debased their currencies in lock step so more dollars printed means more ____currencies being printed to kept pace. Much of the printing in the last few years actually did not reach main street yet, so inflation is still some what subdued but go to the market and you will see real inflation that is now spilling over the housing sector! Living standards in the US and EU must be reduced for the rest of the world to catch up before they can be improved eventually. It’s called globalization and to think that any government can stop that is just pure silly. Housing is a dollar short also insurance against currency reset should we go that far. Plenty of currencies have reset numerous times before and if I’m not mistaken the dollar have not been reset since its inception 200+ years ago so (even the pound got reset in 1992 in the famous Soros 1 billion dollar trade). If the dollar go than we will be looking at a truly international currency that do not belong to any particular government.

Wow. Nice post. There is also the angle of getting the government to pay part of your mortgage through the interest deduction, which you don’t get if you rent.

I think that is among the most significant information for me.

And i am happy reading your article. However wanna statement on some common things, The

website taste is perfect, the articles is in reality nice : D.

Just right task, cheers

Leave a Reply