The turning of the worm in the housing market – Weakest May sales volume in California since the crash of the housing market. California home ownership rate continues to fall.

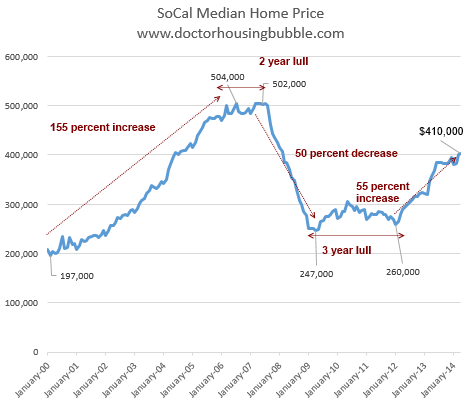

If you want to play in the current housing market, you have to contend with the limited amount of inventory and the delusional salivating sellers going for peak prices. It is interesting to hear about recent home buyers e-mailing me about foundation issues, roofing problems, and generally crappy construction issues after they bought their homes. A few waived contingencies just to get their lusting home buying urges out of the way. Now they are left with major repairs and a 30 year mortgage. No one that moves into a home will suddenly find a hidden gem of cash flow. To the contrary, even if you pay off your property you still have taxes, insurance, and maintenance. That is why we see these Friskies eating baby boomers selling their homes with mega-deferred maintenance asking insane prices but with very poor upkeep. You have to sell to unlock that lottery ticket. It is also interesting to hear the Chief Economist of the CAR hint at some California homes being overpriced. Even this tiny realization should tell you something. Remember folks, real estate agents make better money in a market with a large number of sales instead of a market fully stunted by funny accounting and banking chicanery. Yet we are starring at an inflection point here. Housing markets turn slowly. It is abundantly clear that local household incomes are being stretched to the limit and many are now relying on ARMs and other products that simply manipulate the monthly payment.

Use your logic

While home prices race upwards and in some areas we are seeing new peaks being reached, it is very clear that many Californians are being priced out. 2.3 million adults are living at home with older adults because they are too broke to own (many too broke to rent). So investors continue to be a driving force in this market although their appetite is also waning.

I was surprised to see the Chief Economist of the CAR actually utter that some areas may be overpriced:

“(MND) While home price increases have tempered over the past few months, prices are still nearly 12 percent higher than a year ago, which is presenting affordability challenges to home buyers,” said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. “And though housing inventory is up from last year, it’s still half of what is considered normal, with some of it being overpriced. A tempering in home price increases and the recent drop in mortgage rates, however, should help spark the market in the upcoming months.”

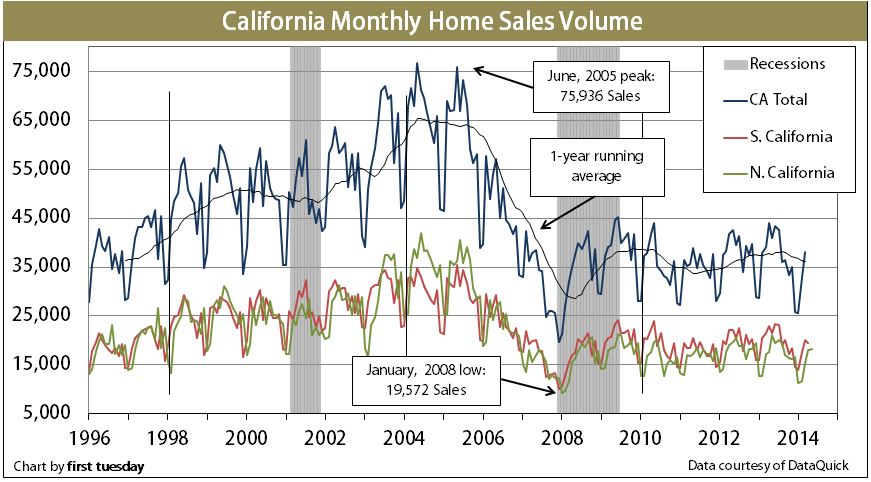

I love of course the final line showing that the mania will resume shortly with lower interest rates. Take a look at sales volume:

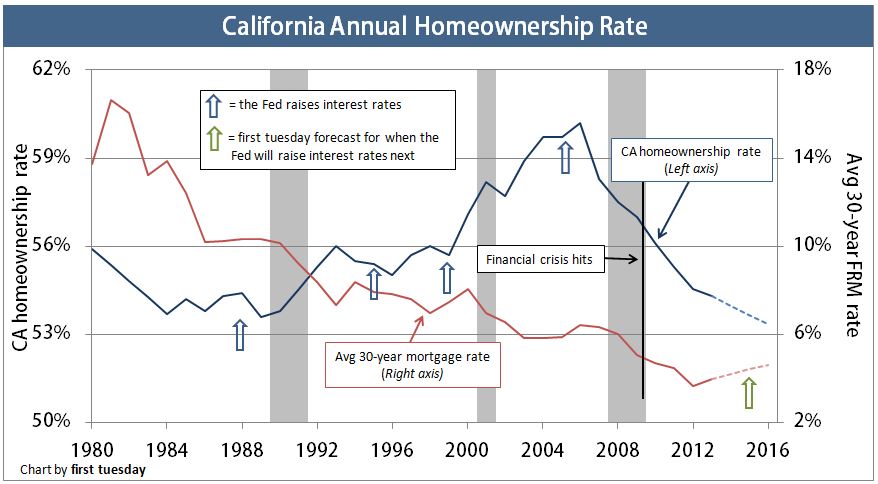

This was the weakest May going back to the implosion years of the last housing bubble bust. In spite of prices going up, we continue to see a full decline in the home ownership rate:

This is not a healthy housing market. Even agents that I speak with have a hard time figuring out what is going on in the head of many sellers. Many are non-business non-economist types with a golden ticket and trying to pretend as if they know something of macroeconomics. Some act as if they care about who they are selling to but in the end, cash is king and the highest offer is usually the winner. Nothing wrong with that. Just don’t act as if you are some sort of business genius and your vetting process is on par with Google’s hiring process. Little do they realize that their glorified drywall superstar with one toilet is merely a pawn in the global hot money game.

The funniest ad I recently read was for this 3 bedroom 1 bath home in Pasadena selling for around $750,000 and a line in the ad stated “you might be pleasantly surprised.†Oh gee, thank you oh mighty seller! You are spending $750,000+ and you might be pleasantly surprised. This is like buying a Ferrari and the dealer telling you “hey, the wheels may or may not come off in the next week. Who knows, you might be pleasantly surprised.†Common sense is out the window right now but things are tipping over:

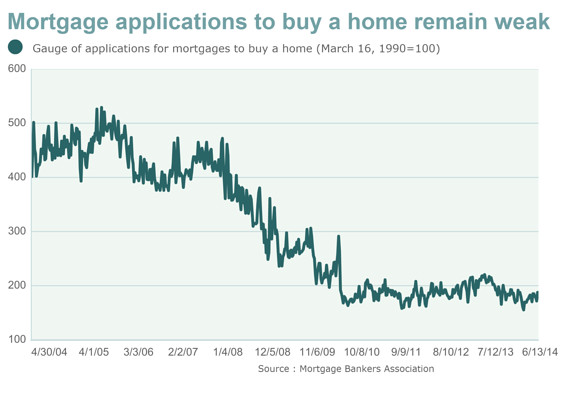

You are seeing those with the ability to buy being more selective in this market. Mortgage applications overall remain at lows last seen in the 2000s:

You think things aren’t crazy? Let us examine a patient then, okay?

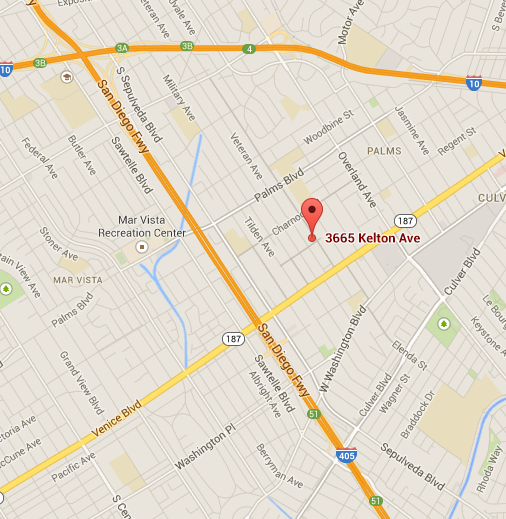

3665 Kelton Ave, Los Angeles, CA 90034

Beds: 3

Baths: 1

Square feet:Â Â Â Â Â Â 1,040

Year built: Â Â Â Â Â Â Â Â Â Â 1930

I love these one bath homes. I’m sure a professional couple is itching to buy a home with 1 bathroom. So what is the going price here? $749,000. What I found interesting is that it does have a “guest†house in the back:

Nice electrical filled skyline. The benefit of this place is that if you are truly house lusting, you can at least turn the back into a rental and generate some cash flow. All of this for the low price of $749,000. This place is also smack in the middle of two major freeways and Venice Blvd which all of you know has very little traffic.

California is reaching an inflection point and the hot summer selling season never materialized this year. We still have July and August right? I’m sure working professionals looking to share one crapper are itching to unload $750,000 on a home built during the Great Depression.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

111 Responses to “The turning of the worm in the housing market – Weakest May sales volume in California since the crash of the housing market. California home ownership rate continues to fall.”

Thanks God….its all gonna crush soon…..”for the love of money is the root of all evil”

for the love of the petro dollar

any chance of a bank holiday in the usa? anyone?

I love bank holidays!!!

what? hahaha

Chance of a bank holiday Ben. 99.9999999999999999999999999999999999999% Nope, no way, nyet. The Fed will continue on it’s mission of destroying the US dollar slowly. There would have to be some kind of financial hurricane for the Fed to close down the banking system. Dude, let me tell you. I was 20 miles from 9-11 and needed to get to the bank. My bank’s ATM’s were down and when I walking back to my truck, F-16’s flew over me. That was a little too scary. My dad always and I mean always kept cash and gold (silver also) at home. He hated every Fed chairman, except Volcker, only chairman who had the balls to save to save the USD and the banks.

Doc, your sample house is walking distance to where I live. The area is actually very nice, not much traffic to speak of, nice trees, etc. But this is why I’m moving to N San Diego county – the house I’m leasing is big and worth about 1.8 million for $4000 mo. and I couldn’t afford to buy in any case. I’ve just locked my loan on my acre and a half with fruit trees, 3/2 1950sf at 4.5% and couldn’t be happier. 100K down on $500k home in good shape and I’m so glad to be out of the rat race I can’t tell you.

Congratulations on the purchase. I wish you the best.

I used to live a few blocks from there. Parking after 7pm was a nightmare. The 90034 (Palms) neighborhood has one of the highest population densities in SoCal. DTLA, Koreatown, Westlake, Pico-Union are the few places more crowded/conjested than Palms (90034).

This. The parking in Palms is absolutely dreadful.

Not only is Palms (90034) one of the most congested neighborhoods in Los Angeles County with atrocious parking, it is also boxed in and bisected by Venice Blvd, Sepulveda Blvd, the 405 freeway, the 10 freeway, Overland Ave and Palms Blvd. This creates a continuous drone of noise that exists about 20 to 22 hours a day.

I don’t know how many have watched the HGTV show on Saturday nights, “Flip or Flop.” A guy and his beautiful wife buy foreclosures and then fix them up and flip them. Each episode shows them finding horrendous problems in the homes which they buy, sight-unseen, and then pour money into the house to flip it. At the end of each episode, after all fees, they somehow walk away with 60 to 90K on the average. However, the last two episodes, which were the most current, at the end of the episode, the houses DID NOT SELL. After dumping massive amounts of money, and lowering their price, their homes are suddenly not selling.

Ha ha ha, HDTV, looks like the good times for ‘flipping shows’ are over once again. It was fun while it lasted.

There is a new theory of what happened on that fateful night of April 15th 1912 in the North Atlantic. Apparently eyewitness accounts stated that the temperature had dropped dramatically a short time before impact. The ship had entered the cold Labrador Current on this calm clear moonless evening. There is a phenomenon known as cold air mirage where the air causes horizon distortion. This type of “lens distortion†made it impossible to see what was ahead of them until it was too late.

Remember that the “experts†stated that the Titanic was an unsinkable ship. Many refused to get into the life boats because they felt safer on the massive Titanic over the tiny row boats. It has also been noted that if the Titanic had struck the iceberg straight on the ship would have survived. It was the attempt to avoid the iceberg at the last moment that sealed their fate.

interesting analogy. So in your opinion, do you think its better if the housing market just continues to plow through this iceberg? The way I see it I agree with DHB everything really is over priced right now due to the investor purchases, mainly the hedge funds and large investor purchases. My guess is things are trolling off due to high prices and the average Joe not being able to get a mortgage. As soon as housing prices begin to soften though, those same investors will be right back at the trough. Again leaving out the regular homeowner that just wants a house to live in and that works 40 to 80 hours per week with husband and wife both working and sometimes now even the kids all working to support a minimal lifestyle where they can just afford to cover their mortgage or rent, the gas and car maintenance and car insurance to get to work to do the job to make the money to pay the mortgage or rent, a little food, maybe an occasional redbox movie. When you only need to sell your goods and services to the hundred forty million people in the top 2 percent, You really don’t need to worry about the rest of us do you? All you have to do is watch the ads on TV, and see the perfect lives where families are actually sitting down and eating breakfast lunch and dinner together in beautiful manicured homes in nice neighborhoods when they are pushing their products to us. I look at those commercials and wonder, who are they marketing to? Who lives like that? Their marketing to the top 2 percent. So if the market softens the regular home buyer will still be shot out and this will go on for probably a decade or three until they finally can unload the stilll vast amount of foreclosures pre-foreclosures and people sitting in a state of limbo waiting for years and years and years for the bank to finally foreclose. But they don’t. These houses are just sitting there while the banks rack up additional late monthly mortgage payments and late fees and inspection fees to the Notes and passed the notes on to third-party collectors and yet the home is not foreclosed on the last bubble burst because it was all about the paper the house is mad nothing. Now the investors are securitizing the rents this isn’t about house flippers they’re the bottom dwellers.. it’s about the paper! paper debt that is derivatized for the next 30 years while they take their hefty 30 percent commissions today.& I hear none of this in the news anywhere but I know it first hand, seeing it with my own eyes and own experiences.

“everything really is over priced right now due to the investor purchases”

Don’t forget about the artificial supply constraint. There are two fundamental forces involved.

“So in your opinion, do you think its better if the housing market just continues to plow through this iceberg?”

I think you missed it… The hard turn to port and engines at full reverse is representing ZIRP, NIRP, QE1, QE2, QEInfinity, etc. Head on would equal allowing deflation of the bubble as scary as it may sound would have actually made it possible for our economy to have been in a pretty good place 7 years later versus what we have now a “recoverless recovery”!

Given that you missed this, are there any other clarifications on the analogy?

BTW – the Titanic findings are actually true! I am not making this stuff up! Like they say, history does not repeat but it does rhyme!

Lynn,

I disagree with u on several points.

A) Lots of people think they work 80 hours a week. Virtually no one does and we are working less and less each year as socialism goes main stream in the US. Average work week = 34 hours.

B) Investors can’t create home occupants. You have to have someone eventually to sell or rent your house to. They will stop buying if they think they can’t sell or if they think rents will collapse. Also remember, a house loses 4% of its value a year as carry/tax/maintenance costs.

C) What will probably sink this market is higher interest rates. Higher rates will also sink investor demand as there will be less free money sloshing around and they can get better yields than housing in US treasuries.

I Fing hate those OC douchebag couples on that show. They basically illustrated what’s wrong with our real estate market and how media help to glamorized that image. I hope they lose their money on every single house they sell then perhaps they can find new source of income by being on the next reality couple marriage boot camp..

What? seems to have really studied The Titanic – including brittle steel/ manufacturing weakness theories.

Lynn wrote: — “As soon as housing prices begin to soften though, those same investors will be right back at the trough.” —

Only very few sellers exchange investment asset for cash at 90% of value into a bear market. Some might sell at 80%, others at 60%, but the vast majority hold all the way to the market bottom.

I know all of – My theory is it’s just allowed the banks spreading the coming house price correction pain out far and wide – away from themselves as much as possible – before they can relish lending on much lower mid-to-prime housing, with a surge of owners rushing out to sell before prices cascade, much more willing to accept ever lower offers in order to exit the market, and bringing down all house prices in mid-to-prime neighbourhoods at the same time.

The alternative is what you set out – which is just ultra depressing – and offers such very little hope for younger people (without rich parents – who rely on themselves) to ever improve their positions.

Brain,

Initially after that fateful night both London and New York conducted esquires to determine the cause. Many claimed that the captain was to blame by reckless speed (roughly 25 mph) or drunkenness. Others claimed that the night lookouts may have fallen asleep and that they did not have binoculars. Others complained that there was a shortage of life boats. Questions surrounded the SS California’s communication with the Titanic.

WhiteStar had chosen their best captain with the most experience with maiden voyages across the Atlantic. It was normal policy to steam at full speed on clear nights through ice fields. Under these conditions, lookouts could see ice burgs on the horizon giving the crew over 30 minutes to react to any impending danger. Normal practice was for lookouts to use their naked eye to spot objects, binoculars were only used to further identification. The shipping industry found that it made more sense to make ships unsinkable buy use of sealed compartmentalization of the hull as opposed to life boats. It was assumed that you would never have more than 1 or 2 compartment breaches. The Titanic was designed to have up to 6 compartment breaches and stay afloat.

The main cause was never determined during these hearings. The result of the initial findings was to add more life boats and improve communications as well as ensure that look outs had binoculars. It was believed at the time that the problem had been addressed. Not until the 100th anniversary of this tragic event was the novel theory of horizon distortion or cold air mirage put forth…

I find it interesting how history rhymes…

strike “esquires” replace “enquirers”

strike “buy” replace “by”

I don’t have a TV, but I’d like to see a show that just has flippers or other folks ruining themselves on every episode, courtesy of the housing market. Probably wouldn’t get sponsored by REMax…

I actually had a pitch for a show in 2009 called Cali-foreclosure-a. It went something like this: the show opens with a McMansion with the family standing in front with big smiles on their faces. Beemer/Benz/Range Rover parked in front. They would walk us through the 4200 square foot house and all the amenities. The message would be look at us! We made it! We are on top of the world.

Then there would be an interview of the family which would reveal the fact that they only make $75k annual household income. They tell their story of how they pulled off the charade.

The sheriff would show up with the notice to evacuate. The camera would focus on the looks on their faces as reality strikes. They would plead with the sheriff that something must be wrong. The show would end with the family packing their “positions” and leaving.

The show would not work now that the housing market and economy has completely recovered and there are no more foreclosures. Too bad. I think I would have made a killing. Train wreck reality really seems to sell…

“A few waived contingencies just to get their lusting home buying urges out of the way. Now they are left with major repairs and a 30 year mortgage. ” – at least they have the glow of being homeowners now, and not wasting dead money renting !

A good read – thanks.

Hello to my USA kindred spirits . I just want to let you know that in the UK, things are finally, after the horrors of house price reinflation for so many years, on top of what were already painfully high prices (in most decent areas) showing some signs of hope for the future. In the sense that we may see a softening ahead. Our markets are interconnected, so it’s worth you knowing.

Look at what the head of our largest house price listing company in the UK – ‘Rightmove’ (like Zillow or Trulia) said a few days ago, in their latest inhouse index report.

_____________________

Rightmove Index June 2014

Shipside notes: “Many serious buyers who were waiting in the wings have now bought and moved in, taking a slug out of the pent-up demand for a few years to come, and the consequent chatter on the street is that quality buyers are now thinner on

the ground. The next wave of buyers may have less motivation or ability to buy and sellers are going to have to be sensitive to their local market and not pitch their asking prices too high as choosy buyers will not arrange to come and visit.â€

_____

There are two sides to the lending equation, requiring willing and proceedable buyers. Seems the market might have finally soaked up nearly all of the frenzied buyers willing to pay silly high prices…. keywords… “thinner on the ground” – and “slug out of the pent-up demand FOR A FEW YEARS TO COME.” !

Also the new MMR (MMR = new bank lending stress test on applicants for mortgages, including checking if they can afford rates upto 7% – we don’t have 30 year mortgages… well only a trace of them… more 2 year and 5 year fixes) is having some significant effects in preventing air-heads buy. Some people, hoping to upsize, are being told they wouldn’t qualify for their existing mortgage amount under the new rules. And they can’t change lenders, to find better mortgage 2yr/5yr fixes, without going through the MMR process it seems.

(Recent press:) “..potential home buyers are now rethinking their ability to make monthly repayments. The MMR is definitely having an impact as it is taking longer to get a mortgage application through and the threat of interest rate rises is weighing on sentiment.” and “The Mortgage Market Review, which came into force in April and put more demands on bank to ensure customers can repay loans, has appears to have tightened up lending. While some of the traditional high street lenders, such as Lloyds, have been using interest rate stress testing for the last six months, the MMR guidelines have now been adopted more broadly across all lenders with anecdotal evidence showing that some credit-worthy freelancers, self-employed people and those with a commission-based income, are now struggling to get a mortgage.”

And there are noises that MMR is going to become even more stringent in requirements to qualify for a mortgage. It’s my understanding the US introduced some tougher lending measures at approximately the same time.

_____

Also the Governor of Bank of England a few days ago at a major speech: (Press) On the housing market, Carney warned that despite mortgage approvals falling in the last three months, “surveys suggest some slowing could reflect would-be sellers holding back properties from the market in anticipation of higher future prices – an early sign of extrapolative price expectations.”

Combined with them discussing new toolbox measures to restrict lending, which to me suggests they want to get some of these complacent owners of higher end stock to come to market. Banks can’t make much money unless they’re writing mortgages, and all the stock owned outright/equity rich by owners, isn’t making banks much money… better to write fresh mortgages on them to new buyers at lower prices.

It’s difficult to say what’s going to happen on this side of the pond, Brain. Lately there has been an awful lot of chatter from politicians to Ol’ Yeller herself about how lending standards are too strict. Perhaps they’re just talking shit.

Although things tend to move in a wave from East to West in this world, the cynic in me wouldn’t be surprised to witness a subprime mortgage redux here in the U.S.

Tired of the BS… stay optimistic; my bet is for a notable downward change in US prime sentiment this year. Followed by softening.

In any economic crisis, you can’t take your bearings from the mainstream media or rely too much on statements from authority. During the US Depression it appears one senior official, in the thick of policy, often claimed recovery ahead, even though he knew the system had more painful deleveraging ahead.

Conjecture: With Yellen, it could be the reverse of that, but her audience a certain VI. Perhaps even deliberately to lure those on the side of things into the market, at the very worst time, trying to prop up their own VI. People have short memories, and Yellen sounds like she’s pushing responsibility for the coming correction away from the Fed. Main banks lending standards, which are now expected to not rely on bailouts, and have to take commercial decisions. And Fed/banks are locked into global Basel II/III and generally the West committed to higher standards. Look at the squealing some European banks have been doing to the US Regulators, past year or so, but only served for those regulators to respond unimpressed and bluntly the Euro banks need to improve their capital positions to operate in the US.

I’m convinced something similar has been at work, whilst the Chancellor of the Exchequer’s parents have quietly downsized from a London mansion (sold for circa £12 million = approx US $19 million to admittedly still a lavish house at approx £8m/£9million… but perhaps with the advantage of still having a home and millions in the bank.) Quite a coincidence the main guy in charge of our economy see’s his parents downsize. Why would they downsize if they only expected forever more house price inflation? Meanwhile one of the largest landowners in London, sold off quite a lot of his London portfolio for £millions recently.

I think they want to spread the problem away from the banks, and when the banks are better positioned, then we’ll have some action with allowing prime housing to cool. So banks can get some real lending velocity going. Cash buyers don’t make banks too much profit (if any at all).

Gone are the subprime mortgage days – not to return for at least decades to come – in my opinion. I hope to read more in coming weeks about the tighter lending in the US.

I’m sorry – but check this out – and expect the same coming in Socal. This was an email just received by a contact from an Estate Agent / Realtor. Ignore their appeal about it being a good time to buy, but instead take pleasure in them pointing out emerging weaknesses in our housing market.

_____

ESTATE AGENT Email (21 June 2014)

Now is the time to Buy ahead of the Bounce

There is a lot of uncertainty in the market at the moment and it is best described as stalling. After working though a number of similar markets I can advise that now is the best time to buy a property. Whether you are a first time buyer, an investor or trading up for a larger property there are a number of reasons to buy now.

1) Viewing levels are at their lowest in 18 months so there is less competition.

2) Vendors confidence in the market has dropped.

3) The media are reinforcing the scepticism in the market.

4) The cost of borrowing is extremely low and most lenders are offering up to 5 year fixed products, that are not likely to be available later in the year when interest rates are due to increase.

The London market has proven to be very resilient and adjustments of this kind are always short lived. My prediction would be for buyers to get to the end of the summer and realise prices have not dropped significantly and then start looking in September. This will result in more competition over less properties and ultimately an increase in prices in the last quarter.

My advice would be to buy now.

______

Estate Agent said: “This will result in more competition over less properties”

If something can be counted, it’s normally the rule to write/say ‘fewer’ properties, and not less. Eg it’s ‘fewer people’, not ‘less people’. People are individuals and can be counted.

Anyway I think I will avoid this Estate Agent’s “Best Time To Buy Is Now” routine, whilst enjoying them admitting some of the emerging pressures on house prices. 🙂

Be prepared for similar dynamics emerging in your local housing markets.

Tired of the BS: “Brain. Lately there has been an awful lot of chatter from politicians to Ol’ Yeller herself about how lending standards are too strict. Perhaps they’re just talking shit.”

Look what I just read in Forbes (considering a short at some point on the major indices – but not yet, as so much complacency means it could run further.) by pure coincidence. A recent history (10 year or so) where they cite the Fed making reassuring statements which you’d struggle to convince yourself they actually believed in at the time.

_____

6/20/2014

…So even as spring weather progresses, the housing reports become ever more negative.

…has the Fed reached the typical point in this cycle where its optimistic projections will continue, but fly in the face of the facts, and will not fool markets?

http://www.forbes.com/sites/sharding/2014/06/20/is-stage-set-for-markets-to-again-be-smarter-than-the-fed/

A 2/1 just sold in my Berkeley neighborhood less than 1 week after bids due. Small, about 1100 sq ft. No garage. Small backyard. Bed & bath windows look into neighbors’ windows. Owners did no updating, no staging.

Sold for $830K, about $150K over asking price. Much as I wish the market here were getting saner, absolutely no sign of that.

Sale prices $500K over asking are common, even when the ask is 1 million.

I’m curious about SF homes. Do the new owners have to take out earthquake insurance?

As far as I know, it is optional. It’s a state-funded program with limited coverage. The Big One(s) will wipe out a lot of equity even for the small percent who buy it. And all-cash buyers, of course, aren’t required to buy any kind of insurance.

Sales volumes in May fell significantly below May 2013 levels in Sacramento, Placer, Yolo and El Dorado counties, according to DataQuick. Decreased demand from investors, who have dropped out of the market as prices have risen, contributed to the lower number of homes sold in Sacramento County and other areas of the state, the firm said.

Sold our home in San Jose. Sits on 3/4 acre and is about 2750 sq. ft. Its in a very nice area with a great commute to most anywhere in Silicon Valley. $950000. Seems to me this area is even cheaper, by comparison, than much of LA.

What about the inland empire? Orange County and Riverside County and Ventura County properties? Seems to me that if LA is experiencing issues these places should also be affected. I certainly do agree with DHB that an inflection point is being reached. I wouldn’t want to be that buyer today who, like in 2006, bought real estate at the top because it always goes up. Buyers who pay all cash may be able to weather the coming storm but what about those with huge mortgages? Red flags are slowly going up. Beware…

I read your blog for a couple of years now and simply I just cant understand where Californians pull those money for a down-payment and mortgage rates ?! My wife and I live in Chicago suburb. We are both professionals, architect and speech language pathologist with no kids making together around 150K a year. We live modestly but it would be really hard to save such a substantial sum of money for 20% down-payment for the 750 k house ! How much money average California professional makes a year ?

Doesn’t seem to matter. Some borrow 100% on ARM loans. Some live off money from their parents. Some actually make a ton of money and can afford a rediculous mortgage on a dump, and the rest: who knows.

In the last bubble (2005) a guy with a gardening and landscape business bought a house up the street from us. $675,000 including Playboy mansion type back yard and pool. I wondered where does a gardener with a SAH wife and 5 kids get the money to live that lifestyle? The wife clearly had an addiction to plastic surgery, drove an Escalade and wore designer clothes. They foreclosed 2 yrs ago. Was a nice run for them while it lasted I guess.

Gardening and landscape business in the bay area… yeah.. that’ll fetch a lot of customers.

Most homes for 30 miles don’t even have a single blade of grass!

Here in Nor Cal, it’s all about high tech.

Not just salaries, stock options. If you’ve been at one of these household name tech companies, (Facebook, Google, Apple, Tesla, Netflix, Oracle, Yelp, Twitter, Yahoo, Sales Force….probably missing at least 5 more) you’re talking instant multi millionaires. Then there are companies w/ a majority of people on this board have never ever heard of (Palo Alto Networks, Juniper, Cisco, Adobe, etc..etc..)

When will you see housing prices in CA come off? When there’s tightening in liquidity, rise in rates, money moving from stocks to safe instruments yielding a decent rate. I know for a fact that Wells Fargo (#1 lender in US) is offering a new 10.1% DP 30 year fix product and rates just dropped. That’s more loosening. They’re trying to keep the music going for as long as possible.

It’s going to be a holding pattern until then. Low sales in housing is a result, not the cause of prices to come off.

I have a couple of observations on the Silly Clown Valley myth. First the majority of “heads” that you see at these “household name tech companies” are contractors not employees. Next, the average employee are well paid but not millions. Further, it is my understanding that the majority of employees receive RSU’s and not options. It is mostly executives that receive options. The old model where admins received huge amount of shares are long gone. The amount of RSU’s drop dramatically as you move down the food chain. VP’s could have millions in unvested shares where worker bees may have tens of thousands. There is way more perception than reality in the valley but hey, anyone from LA would understand this as a given…

What?, you are wrong. A lot of people still get options. I am in enterprise software sales (selling software to other businesses) and get options, over the last few years I have cashed out about $100k of options per year. And I am hardly high level. On top of this, many of my colleagues make $500k+ a year in commissions. There are hundreds of people like me in the Valley, if not thousands.

Bay Area housing is tightly tied to the stock market – with the market hitting all time highs daily, Bay Area housing will not crash. But if the stock market breaks, look out below.

stryker.rx You are not paying attention. I am responding to the following quote:

“If you’ve been at one of these household name tech companies, (Facebook, Google, Apple, Tesla, Netflix, Oracle, Yelp, Twitter, Yahoo, Sales Force….probably missing at least 5 more) you’re talking instant multi millionaires.”

This statement is dead wrong. Are there sales guys out there making good money? Yes, but 90% of the folks working at the listed companies above are in the six figures not the seven figures. I actually work for a “household name tech companies” in corporate finance and know roughly pay, bonus and stock by grade. The majority of the companies above give RSU’s as opposed to options to the majority of workers. I know folks at other “household name tech companies” and their pay is similar. Yes there are thousands of folks in the valley making over 500k a year but the company I work for has many thousands of employees alone. So that is a small percentage of employees/contractors working in “household name tech companies”. Not sure where you are getting your information from but if you do not work at a “household name tech companies” and I do, I will take my understanding over yours…

What? Even someone making $500k can easily support a $2M mortgage, if you have banked $1M or so in option or RSU income over the years on top of that, you can buy a lot of house. The company I work for has over 4k employees in the Bay Area, so isn’t even that big of a presence, and I would estimate well over 1k of them have banked over $1M since our IPO seven years ago.

The bottom line is, no matter how you slice it, the stock market bubble is generating a ton of wealth in the Bay Area. All those employees at Facebook and Twitter are not contractors; many of those people have made good money in their IPOs, and continue to be paid well. Maybe you corporate finance types are not getting the big pay, but the top tech and sales people at these companies are paid very, very well in both cash and equity.

But like I said, if the stock market bubble cracks, the whole thing goes down (which is why the Fed is actively supporting the equity bubble).

BTW, in many counties in the Bay Area, you can easily find out who has purchased a home (including San Mateo and Marin, not so in Santa Clara). So if you want proof, just look up some of the recent $1.5 – $2.5M sales in Menlo Park, and google the buyers. You will find a lot of mid-level managers, professionals, etc. Not even close to C-level execs at these companies. Often you find dual income couples, both of whom made a decent amount of money, not a killing, but enough to put $500k down and support a $1.5M mortgage.

Or look at the recent jumbo MBS deals that, say, a Redwood Trust puts out. 40% of the million dollar mortgages are from the Bay Area, many of them originated by First Republic, the go-to mortgage bank for many high income Bay Area earners.

All of this is supported by the stock market bubble. The entire ecosystem, from the tech companies themselves, to the tech bankers who take them public, the VCs who fund the startups, the lawyers who cross the t’s and dot the i’s, the realtors who sell them those $2M houses, even the car dealers who sell them the Maserati’s (excluding, of course, the Tesla’s). All these people are getting wealthy off the current stock market bubble.

stryker.rx You are still not paying attention. I am responding to the following quote:

“If you’ve been at one of these household name tech companies, (Facebook, Google, Apple, Tesla, Netflix, Oracle, Yelp, Twitter, Yahoo, Sales Force….probably missing at least 5 more) you’re talking instant multi millionaires.â€

You are talking about VC, M&A lawyers, start up founders, etc. those folks have always and most likely will always make really good money here. The average Joe at the companies above are not making millions and definitely not “instant multi millionaires”. The older dot coms are a sea of contractors. I agree that top sales folks have always and most likely will always make a killing. Like housing bubble 2.0, dot com bubble 2.0 is not as wide spread as the prior bubble. Keep in mind that the majority with Apple being number one are in a throes of a stock buy back frenzy right now. That is what is supporting stock price, nothing else. I am not disagreeing with your premise that dot com bubble 2.0 is fueling the silly clown valley housing bubble but to act as if the average employee at Oracle is making millions is out and out false.

There’s not enough housing to support contractors at the level they’re being paid. Some of these companies will be forced to relocate to staff up–probably to somewhere like Texas.

Parents. 9 out of 10 people I know personally that own a house that are my age “burrowed” the down payment from the parents. The reason I put burrowed in quotes is that most of them will probably never really pay the parents back while the parents are alive.

My wife and I are in the same boat as you but are very reluctant to borrow from our parents because I simply do NOT want to live beyond our means. I refuse to live “house poor.”

This market is insane and people pulling financial shenanigans just to get into a home are just making it worse for the people who have financial common sense. Too bad the people who are in charge of making sure people who can’t afford homes don’t buy them were encouraging this practice well before the fall happened.

The only thing I can say is be patient. Make investments in other areas instead of hording your cash. Diversify what money you do have saved in case there is a USD currency crash.

And even if the parents don’t have the cash, there is usually more than enough equity in the property they have been sitting in for 20+ years to pull out only a portion to help with the down payment for the kids. The prop 13 tax savings in California really keeps people in place for the long haul unlike every other location where taxes are the same for everybody regardless of when they purchased their property.

Cut expenses, save money. Rinse, repeat. It’s somewhat challenging, but I started putting $200/month into into savings, increased it whenever I could, and ended up at $2200/month by 2011, by which time my nut hit $132K. Then I put $107K down on a house by the beach while everyone was waiting for the bottom, because I had no illusions about being able to call the bottom. I dropped my post-tax investments (I’ve been jamming 8-12% into my 401K forever) back down to $200/month for three years, and just popped it up to $500/month. It helps if you consider meat to be an optional part of your diet, and if you feel it’s wasteful to own a car for less than ten years. The people who rent the house across the street from me have a Tesla S; my 18 year old car looks quite dingy compared to that. I don’t mind.

Note: it was dumb luck that the house I bought became available at a fire sale price. But my savings were the result of my actions.

“The prop 13 tax savings in California really keeps people in place for the long haul…”

Therein lies the problem. The normal feedback loop of an input within the system (taxes levied) based on a changing variable was distorted. Therefore we have inefficient output (price level not being properly informed by the variable) that have resulted in undesirable consequences. In this case, California RE property tax inequality helps to shut out new entrants into the system. That gives these potential new entrants added incentive to look elsewhere and add their productive value to other economies. Regardless as much as some would prefer to convince themselves and others, California does not exist in a vacuum.

This analysis has nothing to do with partisan fervor or pro/anti-tax sentiment. It’s logic. I get why the pro-13 crowd wanted this and continues to advocate for it, but the problem is that it doesn’t address any causes of certain tax policy, rather it relieves a side-effect. So the cause remains and the other side effects are amplified further. This thing is backfiring. There’s no free ride.

Most people I know in CA are living paycheck to paycheck without the ability to save. The people I know buying these homes do rather well. Two incomes at 100k each or more. Or wealthy parents that give them 500k down. It’s not everyone in CA, but enough of them to keep paying more for these houses. Will it end, as much as I would like to say yes, it really hasn’t in the past 10 years. West LA never has that correction everyone talked about.

To do well in LA means you need a 250k family income, and then the 1MM home doesn’t seem all that expensive.

While on the surface your analysis of looks good there are enough examples posted here of the near to or $1,000,000.00 home in the LA Basin that are laughable, as in plop that thing down in Michigan or Kentucky, etc. and it would sell for well under the annual salary of your alleged buyers. Many have also stated and I agree, why would any person in that income bracket want to pay $700,000.00 or more for a 1k sq ft 30-40s cracker box with wall heat (or even updated central)?

Point is that the market is whack!

Because NOBODY is actually saving up and putting 20% down…

It’s all government backed with tiny down payments… and now it looks like the mortgage improving from places like Ditech are back in style.

Anecdotally, I think there’s a lot of truth to this. A lot of folks I know who’ve purchased in the last few years have been all about the least amount down they can get away with and the largest monthly nut they can stretch into. Then again, that’s really no different than it was during the runup to 2008. My familiarity is mostly with West L.A. tech professionals purchasing from the valley down to the South Bay.

Stan, I believe part of the problem is that you may be viewing this through sensible Midwestern lenses of personal financial responsibility. We don’t have much of that here.

@Stan wrote: “…I just cant understand where Californians pull those money for a down-payment…”

A cash down payment is not required. Wells Fargo and Bank America team up with business partners who provide a 10% or 20% second mortgage that substitutes for a down payment for the cash poor Californians seeking to leverage out to their eyeballs in a pool of debt.

This is what nearly a million dollars buys in Santa Monica: http://www.redfin.com/CA/Santa-Monica/2904-Delaware-Ave-90404/home/6764409

Listed for $995k. Sold for $930k.

2 bed, 1 bath, 1051 sq ft. Built in 1949.

ONE BLOCK from the 10 freeway, in Santa Monica’s Pico district (SM’s worst section, FWIW).

The backyard Bar-B-Q was a key selling point. No less than SEVEN photos of this astonishing Bar-B-Q, including closeups.

Yeah definitely the BBQ is worth a million bucks 🙂

son of landlord, those buyers are going to be sooo pissed when they realize that for only $475,000 more (@ $1.395 MM) they could’ve gotten 100 more sq feet, better curb appeal, landscaped back yard, and new home plans on this 2br/1ba down the street!! http://www.redfin.com/CA/Santa-Monica/2502-Pearl-St-90405/home/6765063

That is crazy. I’m surprised this blog has not highlighted this house. The kitchen is so small the fridge is in the corner?? The bathroom has no tile on the walls above the bath – is there even a shower? And finally, the last picture is of the trashcans in the alley at the back.

The lot is a decent size, I am assuming the house is going to be torn down and a larger place built. But one block from the 10 freeway. Given all the evidence about ill health of children growing up within 200 yards of a freeway who is going to live in this house?

OMG! So love the refrigerator sitting in the middle of the room. 🙂

Heh, these appliances must be some of those upgrades bobby was referring to. $65K stolen.

Love those kitchen upgrades, granite and stainless steel appliances. That’s worth a million right?

They crammed appliances and kitchen equipment into a kitchen that was half the size it needed to be. It just looks off.

The greater fool theory is alive and well in Marin County. Places still selling for prices $100K over those of less than two years ago. Same 3BR, 2BA crapshacks, deferred maintenance, so updating in the last 10-15 years. Yet there are just enough buyers jumping in (often with a woman who is about to have a baby it seems – that’s what happened in the place I had been renting…then the husband/wife have total blinders on to the condidion of the house…just wait for that “flip or flop” moment when they realize they got caught holding the bag- -stuff that they waived when they bought it). Open houses are pretty empty in my Marin hood, but it has been fun looking at a few neighbors’ houses. Asking prices all in the 900s and up for stuff that would have sold in the 700s and 800s a couple of years ago. Not much selling but maybe a third of those that come on the market. Very different from last year. I do think that the current sellers are dreaming big, and the current buyers, what is left of that pool, are being a bit more choosy…but there seem to be fewer and fewer buyers. Sellers, if you can get a deal, take it. It may not be there again for a long time.

Marin is definitely a unique market, there are a lot of really odd houses there. What I have noticed is anything that is near normal and priced well goes quickly, whereas any odd houses, overpriced, etc sit there for weeks/months.

Marin has gradually folded into the San Francisco residential market.

1) George Lucas and Industrial Light and Magic have created a swathe of young millionaires who have had an outsized impact on Marin real estate.

2) Greenfield developments are out of the question in Marin. The powers that be have conspired to stop all further population growth. Their primary weapon is access to water and sewer… which has been capped.

3) Bucolia comes at a price… and it’s steep. As in “Basic Instincts” the dream of every super rich San Franciscan is to have a deluxe pad close by the Presidio (its Arnold Palmer golf course) and a bucolic pad in Marin… could be Tiburon, could be off in rural Marin.

4) Even Lucas has had to fight ‘city hall’ over filling in his own estate with more buildings.

5) Attempts by multi-millionaires to build new mansions adjacent to the Bay — building their own water and sewer systems — totally self-financied, self-contained have been nixxed by ‘city hall.’

6) With time the entire county will take on the character of Mill Valley or Sausalito.

7) The ultra-high prices have driven common ghetto crime entirely out of the area. You have to go to Richmond to attain diversity.

Thus, Marin is to San Francisco what Beverly Hills is to Los Angeles… and Mercer Island is to Seattle and Redmond.

None of these locations is linked to the average Joe. They appeal to the rentier class and the hyper entrepreneurs. (If not retired recreational drug distributors…)

Rather than Mercer Island, I think that Medina is more appropriate.

Bill Gates and Jeff Bezos have their waterfront mansions in Medina. I don’t think Medina has had a single burglary in the past 5 years. It’s partially because all license plates entering off the highway are photographed and kept in a database for several months.

Medina is where the .01% live in the Seattle area.

Wail until it sinks in that California is being inundated with Fukushima radiation.

It’s already killing all the sea life on the West coast.

The highest risk is to pregnant mothers and small children…it soon won’t be a place to raise families.

Maybe I’ll come back to CA to spend my last few years on earth and buy a Malibu beach home for $50,000, once everyone has either died or fled the state.

Stay informed at enenews .com for radiation updates.

Couldn’t help but notice the “HOUSING TO TANK HARD IN 2014!!!” moron went back under the rock he came out from.

“Nobody knows how stupid you are until you open your mouth.”

Beware the ides of March though!

“Nobody knows how stupid you are until you open your mouth.â€

—-

The slide is beginning. Transactions, inventory and mortgage apps are down significantly. You might want to zip those lips.

Housing to go up 30% in 2014!!!

Why so conservative?

One of my Jan., 2014 predictions was that Jim Taylor would stop posting by June. The other was for a 10% correction in NASDAQ.

We appeared to have also lost Tim Jaylor and Jam Tiylor!!!

So when you say correction you mean a 10% increase, right!?!?!?!

Tanking To Begin Soon!

Hey big john “housing to tank in 2014”! before you quack more stupid shit why don’t you read some actual data or statistics by reputable research firms! I’ll give you a tip since you are a beginner. Redfin.com

I also want you to think about something really hard, if housing prices go up 30% in 5 years and actual wages fall 0.5 in the same time do you think two people can afford that 30% rise in housing?

“I also want you to think about something really hard, if housing prices go up 30% in 5 years and actual wages fall 0.5 in the same time do you think two people can afford that 30% rise in housing?”

NIRP! Hello??? Of course they can if they are paid to borrow money! There we go. Problem solved!

BTW – it is 30% in 2014! We won’t have to wait 5 years for a 30% increase…

Whoever this person is, he/she just stole my username. Seriously, get your own, it’s really easy. Ugh.

A mortgage on a $900K loan at 4.5% is over $4500/month! That’s not to mention the property taxes that goons like Pelosi, Waxman, and Moonbeam have locked in. Plus insurance in earthquake and wildfire regions… How do people do it? Over $55,000/yr just to pay the mortgage?!? That is insanity…. I know the weather is nice and everything, but seriously?!?

CA property taxes are actually not all that high as a percentage of home price – it’s just that the prices are so high. The CA Democratic leadership can be faulted for many things, but a high property tax rate isn’t one of them.

Funny as I am looking at about a $900K mtg after $200K down. In the early years of the loan that equates to about $40K/yr in interest and $12k/yr in taxes, so a tax write-off of about $52K/yr as opposed to $12/yr married filing jointly standard deduction, so a $40K net write-off which in our bracket reduces our taxes by about $16K/yr or about $1300/mo. So a gross mtg/tax monthly pmt of $5500 ends up being a net pmt of about $4200. Not bad. On top of that, in the early years of the loan principal is paid down at a rate of about $1200/mo. or $14,400/yr. Again not bad. So out of a net pmt of $4200/mo, $1200 is put back into the homes equity, leaving just $3K/mo. going out the door.

Yes there is insurance and maintenance but the core fundamentals numbers are not bad on a $900K loan for a two-professional household with each pro earning low six figures, or a one pro household income of a bit over $200K. These are not crazy income levels in SoCal.

You forgot something my friend… AMT!!! All those deductions vanish way before you finish your taxes. The folks who can “afford” that million dollar shack are making enough to “qualify” for AMT. ALL of my deductions vanish with via the gift of AMT!!!

I was exactly in the situation you describe in 92130. The problem for me was that I had too much of my “net worth” in the house and not in liquid assets. You can’t eat a house; your house won’t pay for college. When I figured out that upward mobility is dead in CA and that the “greater fool” game was coming to an end, I bailed for the west coast of Florida. Now, instead of paying $2k in Mello Roos to DMUSD and San Dieguito, hearing incessant pleas for more money to pay for minimalist Art/science/PE courses, and then digging up another $1k for bus service, my kids now sit in 20 student GATE classes with free bus service, free breakfasts and $2.50 hot lunches. They even bring home all of that clay art that we remember from our childhood.

The bottom line is that the cost of living/quality of life ratio is out of whack in CA, even in “prime” neighborhoods. I believe that Californians will increasingly awaken to that, particularly with Jerry’s solution to the CalSTRS deficit. Those that have the means but aren’t super rich (e.g. Have to still work for a living but can choose where to work) will vote with their moving truck.

Insurance isn’t that high if you are not in a wildfire area, which most places in CA are not (despite what you see on the news, most of CA does not burn every year).

And earthquake isn’t covered, so you aren’t paying for that (and that risk is way overblown – Loma Prieta “damaged” 18k houses, only 963 were destroyed, not many compared to the size of the Bay Area housing stock).

My homeowner’s insurance is actually a bit lower than it was in WA state, even for a house with a higher replacement cost.

I would actually say that the vetting process is on par with Google’s hiring process. Then again, I worked for Google, and I have a low opinion of their hiring process. It’s basically an upper division computer science midterm. That selects for a certain kind of person, and leaves Google with huge blind spots, and a big problem with ageism.

How is living near a highway more harmful to your health than say living in a landlocked area like West Hollywood.. where street traffic and cars idling constantly feet from your front door have no effect. How about walking or jogging daily on along busy streets like Sunset, Santa Monica Blvd.. ect..

Way more exhaust, brake dust, noise, heat, odors, etc than an arterial street will have.

Definitely true IME, I lived a few blocks from 101 for several months and everything outside was covered with a fine black grit…diesel soot, brake dust, tire material, etc, no way that can be good for you….have not experienced that anywhere else even when living near arterials, etc.

Actually, Delaware Avenue in that part of Santa Monica is North of the 10 and nicely tree-lined, near the new Expo line and high tech firms. But just South of the 10 and going toward Pico, that’s the truly nitty gritty part of SM.

And nearby Delaware Ave., here’s sharing a WOULDA…COULDA…SHOULDA moment: did anybody here consider the following or were we mesmerized and bamboozled into thinking that prices would forever keep dropping?

http://www.redfin.com/CA/Santa-Monica/1812-34th-St-90404/home/6764521

http://www.redfin.com/CA/Santa-Monica/1808-34th-St-90404/home/6764522

http://www.redfin.com/CA/Santa-Monica/1811-Warwick-Ave-90404/home/6764512

(this last one probably was an all cash foreclosure sale at $500K).

Compared to the recent $930K sale, I’d say those prices are pretty nices!

This is an even better comp, this one is two doors down, sold for $690k in 2012

http://www.redfin.com/CA/Santa-Monica/2914-Delaware-Ave-90404/home/6764411

Delaware Ave is in the Pico district, despite being North of the 10. Indeed, it’s only one block N of the 10.

Opinions vary on where the Pico district begins. Some say it’s South of Santa Monica Blvd, or South of Colorado, or even South of Olympic. But by any of those definitions, Delaware is in Pico.

But either way, that house isn’t in a particularly nice section of Santa Monica. It’s in this weird little “SFH island” amid a concrete, commercial wasteland. The neighborhood is just a few blocks, sandwiched between the 10 freeway, the Stewart Street trailer park, Centinella Ave. and Exposition Blvd.

Yes, the train will soon come down Exposition Blvd. Is that a good thing? To be near a train rattling down the tracks every few minutes, bringing in people from the ‘hood?

I’m an ex-New Yorker. Most New Yorkers don’t like living next to elevated train tracks or the LIRR. That’s what living on Exposition will be like when the Expo Line is complete. 24/7 train noise, to offset the freeway noise.

Well my landlord has jumped on the bandwagon too. Got an email today saying they are going to sell the house I rent. Been here 3 yrs.

What I found amusing is they are not using a realtor, and wanted to “offer” me first dibs on buying it. Same floorplan around the corner, full of upgrades and fully landscaped bank yard just went pending for $360k. Zillow states my rental is valued at $407k which is laughable, It has no backyard in just bark and a concrete slab, no irrigation no drainage (floods in winter) and the paint is peeling off. Many more things wrong that does not affect me living inside comfortably. The kitchen is builder grade – oak cabinets with exposed hinges and white tile counters. The flooring was a DIY hardwood job that is crooked, has gaps, and where the wood butted up to door jambs they stuck a whole bunch of caulk in.

So I emailed back asking how much are you “offering” it to me for? Response? $395,000.

When I rented it I went to the County recorder and looked up their loan docs. They borrowed $405,000 9 yrs ago on a Interest Only ARM. So I’m betting no principal has been paid down, and the fact they are not using a real estate agent screams to me they have a very tight bottom line to meet.

Good luck with that…

I’m cool with it, I’ll move to a nearby apartment and save myself another $450 a month. Only issue I have is to wait it out and see if it ever sells, or just move now so I’m not stuck scrambling for a place to live.

The market going to spook out more sellers – shame it was your rental – but at least the dynamics are good, suggesting more owners/investors looking to cash out. Only takes some to accept lower prices to affect values of other houses.

And in a softening market, buyers are way more picky about what they will buy, and be less likely to accept significant defects. Especially as more inventory begins piling up on the market.

This final surge of frenzy has seen a lot of “buyer regret” for paying top whack for a house which requires a lot of money spent in improvements. As per Doc’s article here. I don’t think it’s going to run on much longer from this point.

You sound like you could be in a superior financial position to him. Good luck with your move to a new rental – even if you cut your cloth and save a bit with renting an apartment during the transition. The vested interests thought to buy up all the stock away from the young, at ever higher prices, but very few buyers left willing/able to pay these market prices, light-years from affordability. We’ve got the market under siege.

Brain! “They borrowed $405,000 9 yrs ago on a Interest Only ARM.” They ALREADY cashed out!!! aaaaaaahaaaaaa!!! ROTGLMAO!!! They will have to pay to get out!!! aaaaaahaaaaa!!!

There are currently listed “active-for sale” 228 houses in my little zip code of 28,000 people, and 94 pending sales. I have not seen this much inventory for many years, really since about 2006-2007. Currently in my neighborhood within a 1/2 mile radius there are 6 rentals on the market. Not including the one I live in. Basically 2/3 of the rental properties in my small neighborhood is on the market to be liquidated.

I have no problem moving to an apartment. I looked at one this morning, 3 bed 1300 sq ft in a gorgeous setting for $500 less per month than what I pay here. They will take my dog too with only and extra $300 deposit. One of my workmates lives there – states it is safe and quiet and clean. I’m good with it, think I’ll put a deposit on it Monday.

Interesting times.

Spare your nerves and move right now, since you’ve spotted a reasonable rental that you like and that saves you money. It’s too much a drain on a person’s energy and concentration to be constantly worried about where you are going to live. That is the main reason I bought- so I wouldn’t have to worry that the next day’s mail would bring the notice that the building was going to be converted to condos, or vacated for rehab, or something.

You’re overstating the issue because for every story like Calgirl’s, there’s a story of a renter who stayed in their rental for years.

By the way, switching from renting to deed holding simply trades one set of worries for another. There’s no free ride.

I rent as well in an area where renting can be almost half of the cost to buy. The funny thing was when a “friend” was leaving the state for a job offer back east she offered to sell me her house for bro deal price of $750,000. I passed and she ended up selling it for $680,000. I lost out on a bro deal mark down of -$70,000 (sorry cwa, I just had to reuse something that F’ing brilliant!)

Feel free to keep it going, howzing to go up (sometimes negatively) 4’eva!

Falconator, your calculations are interesting. I buy the reasoning up until you get to the $14k a yr principal buydown that you somehow count as an additional reduction of $1,200 per month from your mortgage.

$14k a year towards principal on a $900k mortgage is is a flea on an elephant’s back. For $5k a month you can rent a beachfront high rise condo or a view home in the Hollywood hills.

Mike it’s not a reduction but the $1200/mo. goes into equity, it does not vanish like the other $3K. 5 years in with ever increasing amounts going toward principal and you have another $100K in equity even if prices stay flat. 10 years in and over $200K in additional equity with a completely flat market. Point being there is great value in principal paydown vs. interest pmts.

Buyers keep waiting to buy???

What do you think is going to happen in 2015,

Mortgage rates will go down?

Houses will decline 25%?

Foreclosures will increase?

property taxes will decrease?

core inflation will go back down?

Ask yourself this, if you can afford a house today @ 4.25% interest, and bargain a

house down 5 to 8% off, what is the world don’t you see?

robert: “Buyers keep waiting to buy??? What do you think is going to happen in 2015,”

You forgot…

* Wage deflation will prevent buyers from paying the exorbitant markups demanded by sellers/flippers, forcing said sellers/flippers to lower their asking price (or pull the house off the market and eat the holding costs).

Ask yourself this, if you can afford a house today @ 4.25% interest, and bargain a

house down 5 to 8% off, what is the world don’t you see?

—-

I see the part where the fundamentals of economics for the geographical area are way out of whack.

You know, like why is the median household income has nowhere near the buying power for the median home price for even the low-end neighborhoods of LA?

Robert, prices in the area in interested rose 27% from 2013 to 2014 alone- when they should be in the 2009 price range- so that means even IF I bargain the house down 8% (and that’s a big if, even with the homes sitting 90+ days) that still means I’m overpaying by 19% (from 2013) and over 32% more than prices were in 2009. Yay me.

I can’t wait to find a seller just itching to turn a 30% profit just because I should consider myself lucky that I bargained him down 8%.

http://www.nbcnews.com/feature/in-plain-sight/poll-fewer-americans-blame-poverty-poor-n136051

Looking outside the context of our present debacle, what’s the difference between a person renting and trying to save for a down payment, and a person living in their parents house and paying all that (otherwise) rent money toward their student loan? For example $1,500 going to rent and $1,000 going into the down payment fund versus $1,500 going to student loans and $1,000 going to the down payment fund. 5 years out, that’s 60k in the down payment fund, and if a significant other were doing the same, that’s 120k.

(Yes, I know in the real world the down payment fund will be sacrificed to entertain the BMW lease, foodie restaurants, mocha lattes, etc. which is why our ‘problem’ is just as much a social, cultural, and psychological one as it is a financial one; further aggravated by the indifference to homeownership by the younger folk as a function of being priced out for so long, the shift in long term job prospects, &c.)

Also, in the real life… unless you are a hermit… there’s tons of things that take you money away… Ofter the lack of responsibility makes you spend more, when you are a young adult..

Also, typical to have friends who are getting married at that age… bachelor trips to vegas, destination weddings…. getting old trip… money leaks. You have to be very diligent, and very few people save a lot in short time.

I still think something’s funny with North San Diego market – inventory way, way down – nothing new coming on the market, and prices holding steady, some on the market for several months refusing to lower their price. Few buyers I guess, but when looking for my place I was following several couples who were looking in my price range (500-ish). One place I tried for and “lost” is still on the listing and my realtor mentioned several recent buyers “can’t perform”, so maybe those people were just looking, but the offers were coming in, but property still on ML

It’s probably because of the weather in China. We will get back to normal once it clears up in Shanghai…

I hate to tell you this, Doc- but you got one fact wrong in a big way in this post.

I’ll have you know that my baby boomer parents only dine on Fancy Feast.

Friskies is for boomers of low character.

Lmao

Leave a Reply