Housing Minsky Moment: 3 Factors. Prime Contagion, Record Foreclosures, and Publicity.

Then we have the inability of the mainstream news media to inform us regarding critical issues. Instead, we have the morning news plastered with Lohan up to her usual debauchery and athletes gone wild. As a matter of fact, while

In this article we’ll examine three critical factors that propelled housing into its public Minsky moment; prime contagion, record number of foreclosures, and negative publicity.

Prime Contagion

Mozilo likened the housing market to a gigantic ship needing to turn in the ocean. It will take time was his underlying point. I like to think of the housing market more like a NASA mortgage rocket with no turning back. Have you ever tried turning back a rocket-propelled vessel? His statement seems to offer some hope that housing will return even though he unloaded millions in his company stock. Maybe he forgot to mention that the ship he was referencing was the Titanic. Either way, housing is passed the shaky ground stage. I’ve shown countless examples in our Real Homes of Genius series that clearly highlights an outrageous bubble housing psychology. We also discussed a few months back the subprime implosion as credit suddenly tightened and subprime lenders started dropping like moths heading toward the light. In fact, I felt this was the watershed event and would set the tone for the summer.

Yet glorious housing bull pundits at this time championed the amazing summer rebound and the silo mentality of containing the subprime debacle. Ignoring rising inventory, $1 trillion in mortgage resets, and a stagnant market they decided to jump on the housing Pollyanna bandwagon. After all, this summer was housing’s last shot to demonstrate continued bubble resilience. Unfortunately, this summer is only the beginning of a very difficult downturn in the housing market and most likely the overall economy. The market has ballooned beyond any economic model of sustainability. I discussed the pseudo $5 trillion in wealth created by this housing bubble and all credit linked to it. How much of this wealth will disappear is yet to be seen.

Yet now we are realizing that prime loans are also taking a hit. No longer is this implosion contained to one segment of the housing market. For a large part, we have this entitlement mentality of folks thinking their homes are worth more than what they truly are. Say you bought in 1997 for $200,000. Now your home is worth $600,000. This is a very typical scenario in

This housing market followed no economic rules and like the Minsky moments of past, greed and irresponsible credit will once again collapse another bubble. Chalk it up to history repeating itself. Which leads us to the historical moment set in

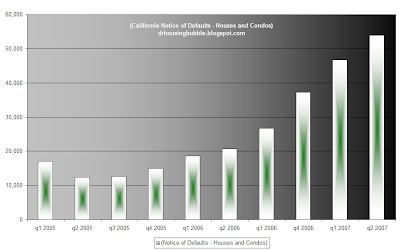

Record Foreclosures

The interesting tidbit of this information is NODs are turning over and going into foreclosure. If anything, you can consider the NODs as a canary in the mine; and if we are to read the data correctly we are in for some massive foreclosures. As stated by DataQuick:

“Most of the loans that went into default last quarter were originated between July 2005 and August 2006. The median age was 16 months. Loan originations peaked in August 2005. The use of adjustable-rate mortgages for primary purchase home loans peaked at 77.8% in May 2005 and has since fallen.â€

Now if you examine the rate reset chart in conjunction with the foreclosure data, there really isn’t anything stopping this train. Over 75 percent of loans originated in August 2005 were adjustable-rate mortgages. Given the hot product was 2/28 teaser suicide loans, what special date are we approaching? That is right, August 2007 where a massive batch of these loans will be resetting in a declining market with higher rates. So even if these folks want to refinance, they will be hit by higher rates and a larger payment.

Amazingly, these loans are also fairly new. With a median age of 16 months. Clearly the problem here is people jumping into homes they cannot afford by horrible mortgage products. In addition, the rate of default on second mortgages is also skyrocketing. This would seem obvious since missing the payment on the primary loan implies you are not paying your second. But guess what? In the midst of all this there is good news. The median price for a home keeps on going up! We won’t go into exposing the inaccuracy of using a tiny sample size of higher priced homes skewing overall market stats. We want to leave you with one piece of good housing news for the day.

Negative Publicity

This may turn out to be the only good news left for housing. The media is fickle and suffers from long-term memory loss. Even a year ago, we were reading about stories of people making thousands in real estate transactions. People were racing over like NASCAR drivers ready to become brokers and agents as reflected by the number of licenses issued by the Department of Real Estate here in

The issue is the real estate industry employs countless people, pays high amounts of money for advertising, and has many politicians bought. So of course they carry clout. But this will only get you so far. You can only fool the market for so long. It is becoming apparent that this system will collapse on its own weight. In a way we haven’t felt the ramifications of what is to come. We are only getting a sneak peak of the real housing bear market. I was looking at old LA Times articles and the positive rhetoric from housing peak to negative bubble chicken little print took about 3 to 4 years. So given this past reference, you can expect a bottom somewhere in 2009 or 2010. Employment numbers still do not accurately reflect the coming job losses we will face. Our economy was based on this bubble via credit, mortgage equity withdrawals, trading houses up like baseball cards, and a cultural neurosis on all things housing.

When do you think we will reach a housing bottom?

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to feed

Subscribe to feed

24 Responses to “Housing Minsky Moment: 3 Factors. Prime Contagion, Record Foreclosures, and Publicity.”

Nice post

Dr. Housing Bubble

I do not think that we will see bottom in 2009/2010. Rather, due to the fact that prices will be sticky on their way down, we would most likely see the bottom in 2010/2011 at the earliest. In the IE, we might even have to wait until 2012. I also think that we will see 2001/2002 prices again in the IE and OC. What do you think ??

If a person bought a house in 2005 for 400k and now it’s worth at most 350 (The Realtor and Zillow say that it’s worth 440 k). However, that person only owes 360 on it. Should he let it go back to the bank, try to sell it, or just simply stay put and wait for the market to turn around? In my opinion, he should walk away from the damn house and rent a smaller place to save money and buy in 2010/2011. What you guys think ?

The last bubble which peaked in 1988 lasted until about 1997. this bubble peaked in 2005 (This bubble is bigger by the way). I think we have a ways to go before we can say that we are in the state of recovery. I would not want to be in the residential real estate business right now.

Clearly the bubble is happening. If we’re sitting on cash, how can we profit from it? Short housing and lending related stocks?

Any other indirect ways like betting against the dollar or something?

@kevin,

Thanks. Hard to believe the media is still underreporting this.

@calhousing,

I tend to agree that housing is slow on the downside in most normal markets. This is not one of them. We have never seen this amount of foreclosures and potential foreclosures in history. As you noticed with the Lakewood case example, it is possible that a home will be reduced by 20 percent or more in a few months simply because the bank wants to unload it. All this tough talk about banks digging in is simply jawboning because they are afraid of seeing what they suspect. Mortgages being kicked back on properties that have inflated values.

In terms of the exact date, who can predict this with 100 percent accuracy? I wish I had some Nostradamus gift of giving you the exact date but I don’t. All I have is countless books and economic data telling me we are looking for a bottom sometime in 2009/10. But I can assure you with certainty that the market will fall. How hard and far is the question we should be asking.

In regards to walking away, they are still going to have a 1099 and owe the government. You may escape the bank but the IRS isn’t so forgiving. Which is another issue we will be facing statewide, falling tax receipts.

@tpir,

Anyone talking about recovery right now is delusional. We are simply entering stage one of a five stage bubble. It only takes 2 or 3 horrible quarters to shake a market to its foundation.

@r,

Absolutely. But I wouldn’t short housing or lending stocks across the board. Look for companies with low cash reserves and high rates of risky loans. It is a matter of time before they come tumbling down. I made this recommendation many months ago with New Century Financial and NFI. If you play the market right, you can make some good money. Also, look at ancillary industries such as Home Depot and Lowes.

In addition, the dollar is going down but other currencies are over inflated. In my view, the Euro is overpriced. They have housing and credit issues as well; in some cases even worse. I’d be cautious about playing the currency game. There is also pressure on the Yen and Yuan.

Clearly my recommendation is due your diligence before investing. Don’t put all your hope in one area. Keep your investments across the board. Heck, I own real estate and understand that there is a high likelihood that it may depreciate in the next few years. So you don’t want all your assets in one silo. The scary thing is most Americans have their wealth in housing equity.

tpir,

The last bubble’s entire up and down cycle ran from 1988 to 1997, however, it was a downcycle from 1990 to 1994, stabilized in 1995-1997 and then shifted in late 1997 to an increasing trend. In 1993-1994, as an appraiser, we were using negative 1-1/2%/mo. time adjustments to keep up with the freefall. My crystal ball tells me that our next down cycle will last a good 3-4 years, until 2011. Just a guess.

Each market will reach bottom at different times. I actually think the IE will hit bottom relatively quickly due to the amount of inventory and inability of owners to pay their resetting mortgages. Skyrocketing foreclosures will send prices into a free-fall. However, I think we will spend several years in the trough before there is any appreciation. This will be fine for people who want to buy a home to live in rather than to flip for a quick buck.

In my opinion, coastal areas may take longer to hit bottom and ultimately may not lose as much value as inland areas. Schools are better, there are more amenities, less land, better weather, etc. I wouldn’t be surprised to see IE values drop by 30-40% and coastal areas to drop 15-25% (though I would like them to drop more).

Doctor,

To your last point about why the media is underreporting the financial impacts of the housing bubble, I’d add the greatest entrenched interest — homeowners.

I live in San Francisco, where “affordable housing” is a permanent point of discussion. But “affordable housing” specifically means a two-tiered system where certain people get subsidies, not “making housing more affordable.” Because that would mean making housing worth less. And nobody who owns a home wants to see that happen.

The other problem is that journalists are notoriously lousy at independent economic thought. While the market was going up-up-up, they could quote Lereah or someone who stood to gain from a real estate bubble and call that an “expert opinion.” Now that it’s stalled, maybe they talk to Shiller or Thornburg or another economist, but they still can’t piece together how the bubble deflation will impact the broader economy.

Overall, a very good post, Dr. Bubble.

Seamusfurr, I agree that the media is probably the worst place to go for objective analysis and forecasts. I read yesterday that Coldwell Banker was cutting their advertising budget by 70%. No wonder the newspapers tend to always pump up housing until they can no longer refute the facts. Even then, they’re always calling the bottom.

The Good Doctor said

But I wouldn’t short housing or lending stocks across the board.

Why not? It would appear that people who were holding SRS are making a killing right now, what makes you think it won’t be very painful sector wide? It’s hard to imagine the end result of this is already priced in given the level of denial out there. Thoughts?

like the weather, the bottom and move down to the bottom is going to depend on the area. There is and will continue to be carnage in Cali/Mass/Vegas/Florida. How much carnage and depreciation do you really think is going to hit the states that lagged for years in appreciation?

One thing I predict is that similar to the effect that the stock bubble keeping burnt casual-odd lot investors away from stocks or hesitant to come back to the market for years, we will see people more cautious about homeownership? It could be even worse with the psychological effects of being removed from a home.

@igotabooboo2,

You are right. The trough was hit somewhere in 04 and 05. Again, deals were being made in 02 and 03 that reflected general market numbers of 04 and 05. As we are seeing with the up tick in the median, sometimes historical numbers do not reflect the inside scoop of the market. If we were to look at current prices, we would believe that housing is trending up!

@peppermint hippo,

The IE economy isn’t as diverse as LA County or the OC. Given that many folks in the IE actually commute into LA or OC for work, these markets will face harder declines. After all, why would you want to buy somewhere with a 2 hour commute especially if the market is declining. I know many folks that bought out there saying, “well we plan on selling it in two years for $100,000 more.†Guess that isn’t going to happen.

And now they’re stuck. In down markets people are less mobile because even homeowners who bought during normal times, see their phaeton equity slowly slip away making them feel poorer. It is an impact on the psychology of consumers.

@seamusfurr,

Agreed. Even in the Republic of California homeownership rates hover around 57 percent. Nationwide it is 70 percent. So the majority of folks are home owners. The last thing you want to do is alienate this core group.

In addition, we need more affordable housing units in California. This question is brought up about the need for housing but we really don’t need anymore $1 million McMansions. That is the reason we are over leveraged to the max and ready for a credit correction.

@jimatlaw,

I’m hesitant to say EVERY housing stock because of a couple of reasons. For one, the case with NFI. I tend to go longer as a hedge on stocks I feel will go down. Many folks went extremely short and guess what happened? NFI had an infusion of $150 million and many people got slaughtered. If anything, this is more of a gamble and I am playing it. Yet I wouldn’t advise it as a general across the board recommendation. Keep in mind the majority of the nation is homeowners so who knows what kind of bailouts we’ll have propping the market up.

It is an intelligent gamble. Yet I see it in the same ball park as those who made killings riding real estate stocks up for the past decade. I totally agree with you in terms of sentiment over the market. If anything, I see housing in all areas going down. But pockets of infusion will keep certain stocks up for longer than they should be. The market will enter stage 2 when Fannie Mae and Freddie Mac start having issues. That’s when I may go all out with an across the board shorting of the market.

@son of brock landers,

Case and point. Fort Myers Florida had an auction where new homes that sold for $300,000 last year sold for $145,000 at auction. Talk about a hair cut. In addition, states like Florida have a heavy reliance on real estate where 1 out of every 5 added jobs is part of the real estate industry.

With 530,000+ agents and brokers in California, tons of construction companies, and major credit institutions we have a large part of our economy based on real estate.

I believe that one of the major reasons for the way the cycle is working out for Real Estate is demographics. The peak of the rate of change in the baby boom (second derivative) is May of 1958. The peak of a mans income rate of change is around 47 years. The baby boom started in 1946 add 47 to that and you get the start of the real estate up cycle(1993). Add 47 to may of 1958 and you get May of 2005, which turns out to be the top of the real estate market. Also, here in California the average age of a buyer of $1mm homes is 47. In general people start to down size when they are about 60 years old. Adding 60 to 1946 puts you at 2006 so that every year from now untill 2018 there will be increasing numbers of seller and decreasing number of buyers. Thus, most of the seers who are talking about the market turning around anytime in the near future because that is what it has done before are not looking at the real drivers of the market. Regards Errol

@Dr.H “@kevin,

Thanks. Hard to believe the media is still underreporting this.”

Would you expect anything less? Its a ponzi scheme and they’re all in on it. Left or Right, both sides lie and tell half truths. I’m just waiting for a “blip” month when things might look better and then the media will go crazy and talk about how strong the market is, etc… 1 BPS is all the media needs to get a hard-on. Viagra can’t even help what the market is really experiencing…if I couldn’t get it up, I don’t think I would want to talk about it either.

Dr.HB.. I found this on a blog called:

http://www.thesimpledollar.com/

Now, this scenario can bring on a lot of arguments about which is better, but it’s leaving out one factor: inflation. The cost of the insurance, the utilities, the taxes, and the rent will go up at the same rate as inflation, but the actual payments on the house will not. So, in the first year, it is correct that the home will cost $767 more a month than the apartment. Let’s keep going with this – given 4% interest, what will be the difference between the two at various points?

At the five year mark, the difference is $693.06 in favor of the renter.

At the ten year mark, the difference is $583.23 in favor of the renter.

At the fifteen year mark, the difference is $449.61 in favor of the renter.

At the twenty year mark, the difference is $287.03 in favor of the renter.

At the twenty five year mark, the difference is $89.23 in favor of the renter.

At the thirty year mark, the last year of mortgage, the difference is $151.42 in favor of the homeowner.

After the mortgage is done, in year thirty one the difference is $1,405.47 in favor of the homeowner, and in each subsequent year that gap grows by about 3%.

So, the only possible way for the renter to get ahead here is to really hit a grand slam with those investments in the early years. Each year that passes, the monthly advantage over the homeowner dwindles, and in some cases (like this one), the late years of the mortgage can actually see the homeowner paying less for housing, including their mortgage, than the renter. Obviously, when the house is paid off, the homeowner is way ahead.

So when is it preferrable to rent? If the monthly home payments are three times your rental payment or more, then you’re better off renting, but if they get closer than that, you’re likely much better off buying.

Any thoughts on that?

I work for CurrentForeclosures.com, a foreclosures site and have seen a huge increase in the number of foreclosures in the past 7 months. I believe it is a combination of not only sub-prime and ARM mortgages, but also the high number of people who have gotten loans with interest rates at an all time low… in addition to the rapid depreciation in some areas and the difficulty some are experiencing in selling their homes.

All,

What did I tell you about NovaStar Financial (NFI)?

NFI Collapses

Hope some folks put this information into action and are making some money. That $150 million cash infusion just went up in smoke.

Here is part of an email I send to our builder almost 2 years ago. I emailed HUD and other regulatory agencies over and over again. Nothing was done, nobody cared.

I consider myself lucky because we bought the property way below what other regular neighbors(meaning not investors in the neighborhood) paid. I truly hope there is a huge outcry if idiotic politicians want to bail these gangsters out who destroyed our neighborhoods from the beginning…

One of the big problems in our development is with people who pretended to buy houses as primary residences, signed and notarized affidavits on their mortgage application that this would be their primary residence but clearly do not live in the house and in some cases live out of state. Not only do we have to live with their garbage but have to worry about our real estate value as well and nothing is done to address this issue. I have been researching public records here in XXXXXX and I find it disturbing to see this stuff go on all over the place. Here is just one example of many here in XXXXXXX:Mortgage is $298,734 Down payment: $0 Signed affidavit: to be occupied by owner or family member.Tax mailing address is the property address but these owners are living in San Diego and the house is empty almost a year. This is just one example and if you would start an investigation, you would come up with thousands of houses in all neighborhoods in the greater XXXXX area! As a homeowner and investor in the bond and stock market, I am deeply disturbed about this and I fear that over the long run we see massive losses for the mortgage industry, investors and taxpayers who usually have to pickup the mess, not to mention the losses to honest real estate owners who bought into these neighborhoods. I am not accusing anybody of any wrongdoing and I could read the official documents on the County Assessor website wrong but making a false statement on an “Affidavit of Occupancy” is a Federal Crime under Title 18, USC,Section 1014.If I, during my research, come across a FHA financed house, I will file a complaint with the United States Department of Justice and HUD. I think they would be also interested about this when it comes to conventional mortgages.

this bubble bursting will burn it’s way into the hearts of people. it’s not like the nasdaq bubble. the carnage is going to be much, much worse. the fed has used all their bullets. in places like California, it will take a minimum of 10-15 yrs. AFTER the bubble has burst for people to recover psychologically, if they recover at all.

i have a question: i hear a lot right now how it’s only the upper end of the market that is selling which explains why median prices hold steady even though sales are dropping. wouldn’t this mean that the 25th percentile average list price would therefore be going down, while the 75th percentile is going up? yet when i look at the chart for la-long beach-glendale metro division (segment of la-long beach-santa ana msa)on housingtracker.net for april-present, the 25th and 75th are tracking even with the median. that would seem to indicate to me that prices are holding steady throughout the price scale. anyone have a different interpretation? here’s the link:

http://www.housingtracker.net/askingprices/California/LosAngeles-LongBeach-SantaAna/LosAngeles-LongBeach-Glendale

sorry, that’s may 21 to present..

Dr HB, do you have a source for the 5 Trillion in imaginary wealth that you quote? I read your other post and didn’t see anything, but would like to track down and look at the numbers.

Thanks

Zot

http://www.potterzot.com/blog

” The risk posed by a slower rate of home equity growth was also discussed by the FDIC roundtable panel. It should be noted that in only the first six years of this decade, the value of net housing wealth (or owners’ equity) held by U.S. households has risen by over $5 trillion.”

FDIC website

Leave a Reply