Survey finds housing market in mania: Two-thirds of potential buyers willing to use ‘aggressive’ buying tactics. Is the real estate market overheating and is the CPI missing it once again?

A recent survey of potential home buyers found that many were willing to use unconventional purchasing methods. The term used was ‘aggressive’ buying tactics. Yet when we look at what was found is that people are willing to overbid and almost beg for buying a home. This has been the case for the last couple of years in California as regular home buyers compete with flippers, big investor money, and foreign buyers. The chorus of housing bulls has grown especially in the last year as flippers are now on late night television shows and flip-this home type shows are now filming on US location instead of using the hyper-Canadian housing market. What the survey found was that many were willing to overbid, borrow a down payment from loved ones, or eat up many of the seller’s costs in the process. This manic like behavior at a time when inventory is rising and some flippers are starting to see that buyers are unwilling (or unable) to pay whatever they wish may signal a turning point.

The rise in inventory

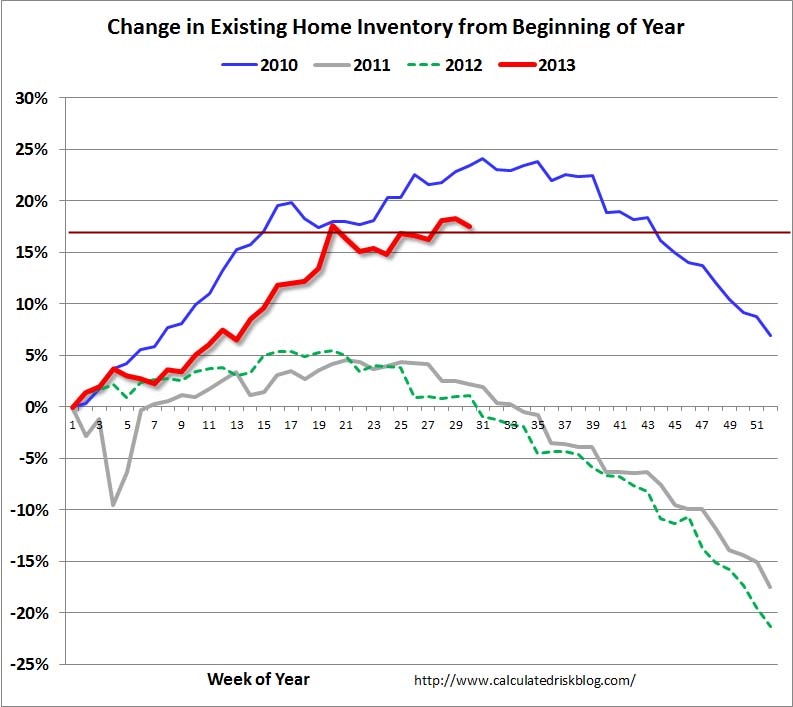

The amount of inventory available for sale is now up over 17 percent for the year:

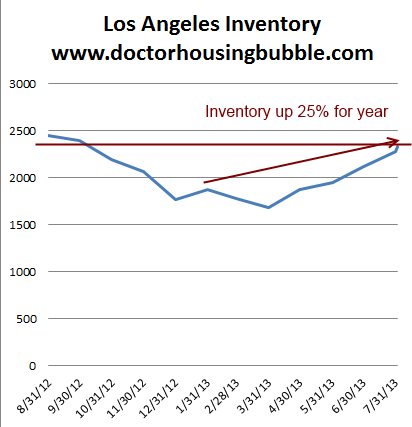

This is the first year since 2010 that overall a steady supply of inventory is being added to the market. We are even seeing this for places like Los Angeles:

Inventory for Los Angeles is up 25 percent for the year. This is a new trend that has not happened for over two years. We are starting to see properties sit on the market and more supply slowly being added. It is also part of the reasons banks have become more aggressive in putting out REO inventory onto the market to catch some of the manic like momentum.  Â

What constitutes a mania? Take a look at this:

“(LA Times) According to the survey, 25% of respondents would bid 1% to 5% over a home’s asking price, and the same percentage would offer to cover the seller’s closing costs.

Trulia said young adults — ages 18 to 34 — are more willing to resort to tactics the firm labels aggressive, with 30% of those respondents willing to pay the seller’s closing costs and 31% willing to bid 1% to 5% over asking price.â€

Another point was borrowing from “loved ones†for the down payment which clearly means you are not ready to buy since you can get an aggressively FHA insured loans and be on your way (plus, if you don’t have the down payment you are not ready to buy). It is odd but not surprising given the historically low supply of housing for the last few years. Many buyers are emotionally pressured to purchase (even though the national home ownership rate is at multi-decade lows). What occurs is that many are simply willing to use low interest rates as a method to make-up for stagnant income growth. Lower rates allow you to purchase a more expensive home and keep your monthly nut the same. Tax assessors are happy, banks are happy, and ultimately a buyer is simply paying more because of interest rate voodoo.

Two major things happened this year that have started challenging this trend:

-1. Interest rates seem to have reached a bottom (going from the 3 percent range to 4.5 percent)

-2. Inventory is rising given major home price gains

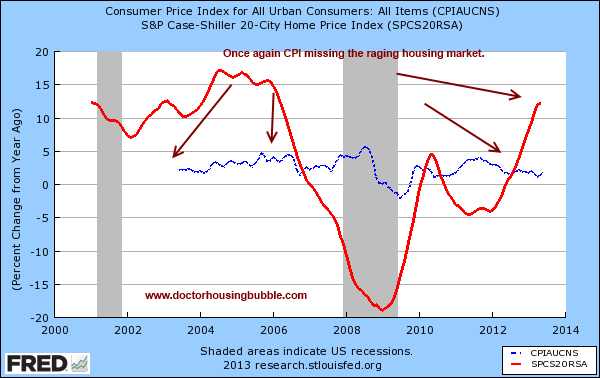

Once again, the CPI is missing the massive rise in home prices thanks to the owners’ equivalent of rent (OER) measure. Take a look at this:

What is odd is that we know that the CPI is a poor measure of inflation especially the housing component. Americans spend something like 40 percent of their income on housing, most own a property, yet we use the renting equivalent figure? When you look at the above chart you miss the prior housing bubble yet here we go again. Then, the Fed which points to the CPI for evidence that inflation is low continues to use incredibly aggressive tactics to keep the game going. Home prices are obviously rising many times over the rate at which incomes are rising. Yet again, the reason we are seeing some tipping point activity is that interest rates have reached a bottom and inventory is steadily increasing.

The next phase is one in which inventory rises and home prices sit much longer on the market. Buyers will begin having more of a choice. This is an ever changing situation and things do not happen fluidly. Even as housing bubble version 1.0 burst the market did not turn over in one night. It took years. Similarly, the recent hot momentum will take some time to play out and national psychology is now back to believing housing is unstoppable and will never go down again. This trend is completely unsustainable and by definition will change. The only question is what will that result look like?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “Survey finds housing market in mania: Two-thirds of potential buyers willing to use ‘aggressive’ buying tactics. Is the real estate market overheating and is the CPI missing it once again?”

I’m really the first! You guys like me, you really do!

What happened with the announcement back in 2009 that the recession ended? Why more stimulus needed?

– FED QE for Stocks in 2009 leads to recession ended..

– FED QE for MBS in 2012 leads to house recovery is on track.

Seems comical what is going on. What’s next?

QE tapers/interest rates up. Economy is roaring back or does it falter again?

The housing boom will never end…or will it?

http://www.zerohedge.com/news/2013-08-02/why-another-great-real-estate-crash-coming

Yep inventories will rise and demand will fall-there can’t be real demand with a poor economy and fake high prices driven up by manufactured short term inventory shortages won’t last

As interest rates rise and home sales continue to be meager, the banks will be looking for revenues as refinancing dries up….enter the lowing of lending standards to allow more “demand” able to participate in the marketplace.

This will likely reduce demand for rent if more renters become owners.

How will inventories rise? If you bought in the past 3 years and aren’t a flipper and rates are 6% or higher in a few years… who in their right mind would sell their home? And if you bought in 2006-2007… And prices drop from here, they literally can’t sell.

Sure their will be weak hands that sell… But most of the weak hands already folded.

This rise in home prices won’t last.. And they will probably fall back to 2012 prices.. MAYBE 2011 late-summer prices. But that was the bottom in most parts of Los Angeles… that is why we had such a hard bounce off the bottom.

I guess the question is then, can the supply manipulation outlast the buyer who has already been very patient?

What about all the buyers that have been consistently outbid the past 12 months and quit looking? I think that is a large pool.

Will they jump back in if inventory starts to loosen a bit? That’s the question.

College grads are leaving school with an average $30,000 in debt, delaying household formation.

Baby-boomers are retiring and downsizing.

Job creation is not keeping up with the size of our workforce.

The country is $16 trillion in debt.

At some point the Fed is going to get out of the interest rate business and market forces are going to normalize.

What is that going to look like?

Feudalism. 12000 people will own 80% of houses in the US. learning Mandarin yet?

Yeah right. Patriots will declare civil war before that. Do any CA people on this board know what the rest of America is really like? They are heavily armed and don’t take kind to foreigners. I know many east of the Mississippi

Is that really what you think “all” of the rest of America is like? no wonder you hunker down and are willing to pay through the nose to live in Calif. News – many parts of the “rest of the country” are not what you described. Some are of course, but many are not. Your choice.

Yes Paps, if this is what the rest of the States is like then the significantly higher prices in California are definitely justified 🙂

I’m not surprised to hear that the Waltons’ have adopted Chinese as their primary language.

Still takes a job and a down payment to get a mortgage. Something more and more people are losing.

Looks like Full Time work is not necessarily a requirement for a mortgage. However, it maybe harder to get approved.

http://work.chron.com/mortgage-fulltime-job-11942.html

http://homeguides.sfgate.com/can-mortgage-working-part-time-46021.html

I wonder what the banks and politics might do to make sure that anyone can afford a home?

I wonder that often myself. I’ve lost count of people I know in SoCal over 40 who held solidly middle class/high paying jobs who are now long term UE, work as independent contractors, or work PT, living off savings or help from elderly parents. Nobody makes what they used to. And their adult kids? Either left the state; the ones still here live at home/roommates and work sub $15 jobs. I can’t imagine any of these people buying a house anytime soon.

I agree. For me and my wife buying a house was very emotional and after a while of putting bids in and ‘losing’ we ultimately put in a bid significantly higher than asking price. We were only looking at Fannie Mae “Home Path” properties. Because we wanted to take advantage of 0% down on no MIP. This way we could use our money to fix up the foreclosure.

The first one we put a bid in for January 2012 for $265k. It sold for $287k

http://www.redfin.com/CA/Los-Angeles/5050-Almaden-Dr-90042/home/7081413

Then a bid for $357k. which sold for $300k.

http://www.redfin.com/CA/Los-Angeles/3390-La-Clede-Ave-90039/home/7065258

Then we put a bid in for $399k, It sold for $410k. We decided not to counter offer since it had a pool and there was an unpermitted garage/apartment that needed to be taken down. This was before the flip.

http://www.redfin.com/CA/Los-Angeles/3264-Garden-Ave-90039/home/7065883

Then we put a bid in for $369K and countered with $372k with $11k ‘credit’ = $383k

http://www.zillow.com/homedetails/4546-Verdugo-Rd-Los-Angeles-CA-90065/20850355_zpid/

I got permits and fixed up the place myself. I ‘claimed’ the place on Zillow and it shows some before and afters.

But yes, after 9 months of looking and seeing the place we liked get scooped up for more (or all cash) we decided to pay over asking.

We have a four year old and she will go to Delevan Elementary school, she currently goes to Montessori down the road, I work near by (usually) and my wife works in Pasadena. we moved from Atwater Village.

Don’t you have to pay a higher interest rate with that type of loan? My understanding is that you are just paying the bank a higher interest rate so they can pay the MIP.

These types of loans and FHA loans are for fools that lack patients and the dedication to save.

Save money in SoCal? If you have a family, you need well over $100k in income to do that. We make that and had to pull from our 401k and family to buy, and its still in the IE. And I think I have $10 in the bank until I get paid Thu, then after bills its gone anyway.

Joe, you are right we have a 4.25% interest rate, when we closed in October, a person could get 3.5-3.75%. And, yes you are right I did not have the “patients” or dedication to save for both 20% down AND the cash for rehabbing the foreclosure.

Joe, we pay 4.25% on our homepath loan. At the time of closing 3.5-3.75% was the norm. there is definitely some merit to your comment about these loans being for “fools that lack patients and the dedication to save.”

Joeknowit wrote: “…These types of loans and FHA loans are for fools that lack patients and the dedication to save…”

Very true. Unfortunately, ask a person who has graduated from high school during the last 20 years to calculate compound interest and you will be shocked that very few of these high school graduates can calculate compound interest. Many of these HS graduates also cannot tell time using an analog clock.

Andy,

Didn’t you have to put 3% down? I did not think Homepath allows 100% financing.

2500 properties for sale in LA. Zillow says 11k homes in Metro LA the past 12 months. I wonder how many of them have been flips? might be 2 sales for the same property. Sounds like a low number of families buying homes.

Next time when you are buying 6pack of beer or one lbs of turkey or ham ask your self if we have hi inflation or not.

Yes WE DO, MONEY IS NOT WHAT IT USED TO BE.

It is all because of the fraud Mr. Bernanke. It is disgusting how this country is being run.

I’m 38. when I was a kid in HS, 16-18, we would buy a 12-pack of Busch light for $6-$7. I just checked on line, a place is selling it for $9.49. not bad for 20 years.

http://www.superiorliquormarket.com/BUSCH–LIGHT-12OZ-CANS-12PKC_p_11542.html

Also, when I was 22 I worked at a deli in FL. It does not cost much more for deli meat now, 16 years later.

NOW, GAS, it cost $1.30 when I was 22 buying diesel for my VW rabbit in Fl.

College,housing, insurance, the big ticket items, those are drowning most people. Not 6 packs of beer and lbs. of turkey meat.

Unfortunately, an article of faith with many around here is that the government is lying about inflation and unemployment rates and thus the actions of “Helicopter Ben” are fraudulent and treasonous. A close reading of of actual historical commodity prices or objective measures like MITs Billion Prices Project rather than sites like Shadowstats might modify some of those opinions.

Gas and housing cost a ton more, and it equates to the beer and turkey. They know we absolutely have to buy the gas and pay mortgage or rent. Those are always first in the pecking order. That leaves a lot less for trinkets, vices, etc and a lot less money chasing those. They habe no choice other than to lower prices and compete. But unfortunately that ultimately drives down wages from the pressure as well.

Oil is the life blood of modern society. In the late 1990’s it was $20/bbl, now is around the mid $90/bbl. So costs associated with it, which is almost everything, are 4 times higher in a little over 10 years. I don’t know about most other people, but I’m not making 4 times more money than I was in 1998.

Andy,

Better check your packaging, I highly doubt the sixpack is the same price and who drinks busch? Inflation is running, sometimes what you can’t see sneaks up on you..

College tuition, taxes, water, electricity, mail, food, drinks, gas, cars, homes, lumber, paint, maintenance…I see very little deflating and the ben b experiment is going to now show its true colors…Ben aka Dr. Moreau has now set us on a course where the poor and middle class will be crushed…I’ll check back in 4 years if we can get on the Internet…

CD – I certainly DON’T drink Busch beer, but I think all the people living above their means might consider it 😉 I am glad to see you are agreeing with my post. I wrote 50% increase in cost of Busch beer in 20 years and about the same for deli meat. AND I wrote “College,housing, insurance, the big ticket items, those are drowning most people. Not 6 packs of beer and lbs. of turkey meat.” AND I definitely don’t think we have deflation.

Housing is about to TANK HARD

I hope you’re right.

We will know for sure when the September home sales numbers come out. July is the first month with the higher (4.5%) rates. Since escrows on mortgages take anywhere from 45 days to 75 days to close, September sales figures will be the canary in the coal mine.

“It is disgusting how this country is being run.”

Yes, and what is more disgusting is that there’s no way to change that by voting: A pseudo-democracy.

Better than EU though: Here the Commission is making all the rules and none of them is voted in to office. Parliament (people who are actually voted into position) can disagree but it doesn’t matter at all.

Funny thing is that bribing a Commissar is totally legal, too.

Doesn’t look like a democracy to me at all, more like feudalism.

The problem has existed long before Bernanke. It just takes about 100 years to reveal what is basically a ponzi scheme. Read history.monetary policy history. FractIonal reserve banking itself is founded in fraud.

Income down. Morale down. Anger up. America is a train wreck heading to war. Could be outside to wag the dog, or could be civil patriots.

I see apathy, not anger, as what’s growing in America, which is just what the duopoly two-party system, the oligarchical media, the TBTF financial powers and the global corporations want…as they see their constituency not the 350 million Americans but the 7+ billion person global marketplace. America’s 0.01% is firmly in control of the message and expertly rewarding the 10% enough to stay quiet and manipulating the bottom 90% to fight each other on social issues and placate themselves with plentiful, tasty (yet unhealthy) food, abundant legal and illegal drugs, puerile entertainment and perpetual fear of unknown oppressors (aka terrorists).

Once the 10% wakes up there will be change…but that just isn’t happening.

Excellent summary Sir!

When people are making money arrogance and ignorance prevails. Try to tell the media now is not a good time to buy a home with the market conditions we have?

And the beat goes on…..

I remember visiting Maui back in the late 90’s/ early 2000’s and noticing that housing prices were lower than San Diego, California. I thought to myself that I would look into moving to Hawaii in 10 or so years. I was also quite surprised that Maui could be affordable. Of course with the housing bubble it is not. But look at this example from Zillow. Could have moved into a really nice place for under $300K (which is now well over a million). To me, this kinda puts more perspective on the craziness of the market.

http://www.zillow.com/homedetails/30-Kuulani-Pl-Kula-HI-96790/734943_zpid/

Chasing the Market down. Hey Doc, I remember years ago when you wrote about ‘chasing the market down’. Here is a fine example, but perhaps the result of overpricing rather than the market tanking. After remodel was listed at $649K, then $624K now $599K. I dont really consider this chasing the market down though because it was over priced to begin with by an insane amount, given the neighborhood and lot size. I expect this to sell for about $550K.

http://www.trulia.com/property/3069359095-2107-S-Curson-Ave-Los-Angeles-CA-90016

This house sold for 380K or so in March and you think it’s a value at 550K at 70 years plus old and in a marginal neighborhood. Move this lower income property to a fly over state and it will command at most a whopping 200K.

@ Wyeedyed let me rephrase that.. I dont think that is the VALUE of the house, but it might SELL for that.

200K? I’d tell the reeltore let’s move on.

I have been trying to buy a home for 1 year. I have made about 10 offers, with the last 5 over asking price. In southern california, you literally have no chance unless you are making above asking offers. Its an emotionally draining experience. I do see a little more inventory so I would love to see a correction. It is a little disheartening when you see the Chinese investors come in and pay all cash. It reminds me of my trip to Venice, Italy in May, when I saw a ton of Chinese there speaking Italian. I was told they have already bought up half the buildings there. I guess this is just par for the course.

I tried to buy for a year in Norcal from mid 2011 to mid 2012 and made several offers (at full price or slightly higher) but it was basically hopeless as I was competing w/ 100% cash speculators and flippers, finally gave up in disgust. Prices where I live in Sonoma Co. are now up at least 30% so I’m on the sidelines waiting for Bubble 2.0 to pop, fortunately am reasonably happy with the place I’m renting in the meantime.

Marco T, now you know how the rest of the world felt the past 50 years when Americans would bring their dollars and buy “cheap” foreign real estate, outbidding locals and driving up the prices. It is truly a global economy today. The day that a middle class family could easily afford real estate in desirable parts of coastal California is long gone and will never return.

The Chinese would have a point in saying that people such as yourself who are making above-asking bids are the ones responsible for inflating the market, not the Chinese making all-cash offers at asking.

We say we want “free market capitalism”….well, here it is!!!

if housing undergoes a small correction now, there won’t be the huge crash that everyone is hoping for. as the saying goes, the bigger they are, the harder they fall. unfortunately, the last rally wasn’t THAT big. y’all can keep wishing, but I’m drinking the stagnation flavored cool-aid, not the one that tastes like the-sky-is-falling

You maybe right, but who knows. The market seems to play like any market. You have an escalating climb in prices over a period of time and then a sudden drop. Perhaps that won’t happen. However, I am curious what Obama has planned for the other buyers who want to buy in with subprime mortgages. The hedges probably see this interest rate hike as an opportunity to unload homes and are probably thinking now is the time to unleash the last stage of this housing climb. This will reach a peak, but how high should the price be?

Seems odd to loosen standards to get more people into homes after they jack the house prices up. I am curious what the average buyer may think when they see this happen.

There is still a frenzy and plenty of buyers here in SD. The good houses get snapped in a few days and are selling above list price. I know this since I am looking for a house. So higher interest rates seems to have no effect and there is really not much new inventory.

It looks like the plan is coming together for the next crash. Probably going to provide special mortgages for the illegals who probably won’t even care as long as they get their piece of the American Dream. Who cares if they fail to pay their mortgage. It’s all covered by us tax payers. What a joke this US is.

http://finance.yahoo.com/news/obama-urge-congress-shutter-fannie-000245816.html

“The president will also look to link his housing proposals to immigration reform, his top second term legislative priority. “

Just anecdotal — I bought my dream house in Mt. Washington a few months ago after sitting on the fence for years and years. Even if inventory is technically up in LA, there is not a recent uptick in the quality of homes out there in the 700k-999k range. This is just one man’s opinion, but we are still in a restricted inventory situation when it comes to quality homes if you ask me.

There’s maybe been one house or two since my purchase that would have gotten me off the couch.

You got one thing right, a lot of the homes in SoCal are overpriced junk with respect to DTI ratios.

I should add with respect to my house, I took several steps that would be considered moderately aggressive:

(1) worked with the listing agent

(2) went to brokers open and bid that day with 24 hour expiration on my offer (to avoid the house getting to the open house not under contract.

(3) ultimately paid 9% above list, though list was intentionally low

Pretty typical tactics that I understand are the norm for motivated buyers in LA.

@dwntwnatty

I purchased a home in Baldwin Hills last December. I have been watching the MLS ever since and have not seen any homes I would have rather purchased ( I purchased a home with a fantastic floor plan for my wife and I who are both self employed) AND prices now are 10% higher than 9 months ago. From the information on this blog, I believe my purchase was well thought out: wife and I are both self employed, meaning no need to relocate, and I purchased in a neighborhood we can live in for the rest of our lives (ie: we did not purchase just to purchase and hope we can resell after a few years). Also, financial situation is such that the DTI is about 2.8.

Today when I look at the inventory it is shocking how many houses are near a freeway or alongside a busy street, or next to a school or have lousy floorplans, tiny backyard, etc.

@QE abyss

I imagine you then have the similar peace of mind that one gets when buying not merely at the right time or the right price, but the right place. Price could be 15% higher or lower and it wouldn’t matter to me because I wanted THIS house, and this house will only be on the market at this time.

I have an idea.

With all this worry of part time jobs and falling wages, why don’t they just lower the price of everything, so it’s affordable, then people don’t have to worry anymore?

Why do homes in the IE have to be $250k or $450k? Make them $150k again and life will go on much happier.

PapaNow, in a perfect world without greed, that is possible. Society forces people to want to get ahead… and so you want to buy low and sell high. For company, you want to pay your workers low, sell everything high, to maximize your profit.

But yeah, if government wants to protect the American Dream of owning a home, they need to keep the price low and affordable. We have to tax these flippers’ profit like crazy and tax these foreign money like there is no tomorrow.

Pap,

Your saying devalue the dollar overnight? Knock zeros off your wages left of the decimal? The IRS would not stand for it since it would reduce the effect of the progressive income tax. Income taxes on 50k are not what they are on a 100k.

IMO: New Headlines coming…”No American Dream for the middle class family”

or

“Middle Class…a new generation or new minority?”

If you look at the data-prices are rising but sales are not.

This is unsustainable.If employment is weak it doesn’t matter how low rates are and it certainly doesn’t help if rates are rising!

This housing bubblet ends soon without dramatic improvement in the full time job and wage situation

I agree!! Unsustainable is truly the ‘key’ word herein! The fundamentals are not there!! At some point (soon) even the “investors” will figure this out.

My guess is, that when the music stops, there will be many asking–“what happened!”

As a PS to my previous post, and with some anecdotal information…..

I have been looking at Eastvale in the IE for the past year or so, and in this regard, the past 6 months or so, there have only been about six to maybe ten homes on Redfin, at any given time–and most with quick turnover. I checked today, and there are now well over 125 (single family) homes for sale within the parameter of Eastvale–an incredible surge of inventory!!

In the early part of this year, the average home was in the upper 300K range, and now they have moved well into the 400K range, many in the 500K range, and with several even in the 600 to 700K range; moreover, I noted one yesterday, which the day before, had recorded a 50K single day price increase since the initial listing date, late last month!

Added to this, a close friend visited us for dinner yesterday and he related that his ex-wife had recently sold their (now hers) previous home (listed at 500K in a nice city in Riverside County) and that two days ago it fell out of escrow, and without any backup offers, she must now relist it.

As others here have observed, this may be the first Canary in the mine observations of a larger trend, spawned by domestic flippers and foreign investors, and fueled by sellers with the highest of expectations; wherein, now a flood of late to the party inventory coupled with investor unease, and prices so high the ‘math’ does not work, has slowed the SoCal express down sharply!?

Again, just an observation, and a perception; however, I am by no means a RE guru. 😉

Leave a Reply