How Many People Overpaid for Their Home in Los Angeles County? Trying to get a Raw Number of Households Underwater.

Los Angeles County has witnessed every facet of the housing bubble. From historically lower priced areas such as Compton having homes sell at $500,000 to higher priced areas like Beverly Hills seeing homes sell in the multi-millions. We also were at the vanguard of interest only, option ARM, and other exotic mortgages that made there way into every corner of the nation that are now dragging the economy into the gutter. There are very few people that now doubt that what we had in this decade was a housing bubble.

In looking at Los Angeles County with 10,000,000 people living here, we get an excellent representation of the housing mania. We have cities such as Lynwood, Paramount, South Gate, and El Monte that witnessed astronomical price jumps while the local family income remained stagnant and didn’t come close to keeping up with housing appreciation. We also have areas such as Santa Monica, Beverly Hills, Rancho Palos Verdes, and Brentwood that also saw amazing jumps in prices and even those with higher incomes had to stretch their dollars for these homes. Every market niche went up with little discrimination to the quality of the home, local area incomes, or any practical economic fundamentals.

Now that prices are quickly correcting and are trying to find a bottom based on fundamentals, the reality is such that the market has a very long way to go before we hit a bottom. The purpose of this article is simply to arrive at an educated figure of how many Los Angeles County homeowners are now underwater with their mortgage. We know simply by the massive price decreases and the rising tide in foreclosures that many homeowners now find themselves in the precarious situation of having a larger mortgage than the market price of their home. But how many people exactly? This of course is a difficult number but we’ll try to look at multiple indicators to arrive at an educated number.

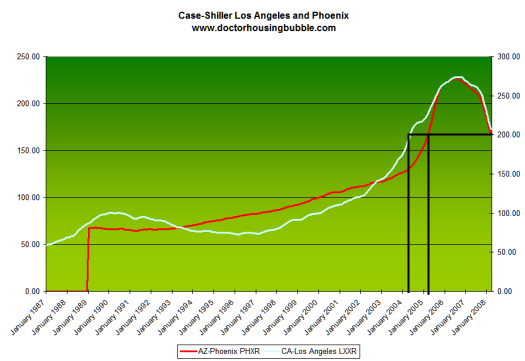

Case-Shiller Los Angeles

As we showed in a previous article highlighting the drop in Los Angeles home prices, prices in Los Angeles County have now reached levels that were seen in June of 2004. According to the Case-Shiller report which came out earlier in the week, Los Angeles now has a number of 207.11 which is nearly the price reached in June of 2004 (206.3). The base year of the index is January of 2000, which starts at 100. So even at today’s price, Los Angeles has still doubled in slightly over 8 years.

Amazingly, now that prices are quickly aligning with fundamentals even data from other sources is coinciding with the above. For example, according to DataQuick the median price of a home in Los Angeles County in April of 2008 was $435,000. If we look at the price in June of 2004, the median price of a Los Angeles County home was $414,000. So for the purpose of this article we are going to use the following data points:

June 2004 start date: Assuming data from Case-Shiller

June 2004 start date: DataQuick Los Angeles County Sales

The way we’ll construct our model will include sales from June 2004 to present. We’ll then assume the following:

2004 Sales: 50% of homes sold during this time are underwater

2005 Sales: 60% of homes sold during this time are underwater

2006 Sales: 75% of homes sold during this time are underwater

2007 Sales: 55% of homes sold during this time are underwater

2008 Sales: 25% of homes sold during this time are underwater

A couple of points regarding the assumptions above. If we look at the median price alone, we can say that all homes sold at median market value in 2005, 2006, and 2007 are underwater. What we are assuming is people with down payments that have a cushion, those that underpaid market value and have some room, and those in areas that are still holding strong. Also, we are giving a higher percentage to 2005 and 2006 simply because of the sheer amount of sales during these years. Even though Los Angeles County did not hit a median price peak until May of 2007 of $550,000, sales had already fallen drastically.

Let us now look at the data:

Total Sales Per Year:

2004: 121,695

2005: 119,050

2006: 100,206

2007: 74,772

2008: 16,145 (*data up until April of 2008)

Total Homes sold in Los Angeles County Since June of 2004: 431,868

So that gives us a raw number of sales. If we are to apply our formula from above, then we can assume the following:

Homes Underwater Purchased in:

2004: 60,847

2005: 71,430

2006: 75,154

2007: 41,124

2008: 4,036

Total homes underwater in Los Angeles County: 256,617

From this number, we’ll also have to cut it down and eliminate 20% simply because of homes being resold. That is, one household buying a home, selling it, and buying another in that same timeframe. As we are constantly told by the realtors out there, the “typical” family will only stay in their home for 7 years. So that will still give us 205,294 homes that are underwater.

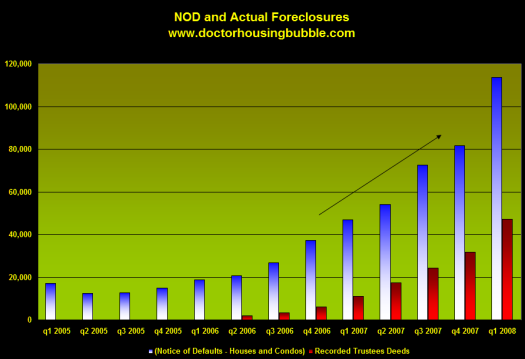

Now keep in mind that we are being conservative here. First, this model is assuming that price drops will not continue. What if the Case-Shiller Index decreases further which all signs are pointing to? What if prices go back to 2003 or 2002 levels? Even with these conservative measures, we can assume that over 200,000 current Los Angeles County homeowners that bought since June of 2004 are underwater. The next issue is that many homes in distress are now going into foreclosure. The number is startling:

Notice of Defaults for Los Angeles County:

First Quarter 2008: 20,339

First Quarter 2007: 8,843

In one year, notice of defaults have gone sky high for Los Angeles County. Yet the more disturbing trend is how many of these notice of defaults are going into foreclosure. What this tells us is being underwater is a key factor in people losing their home:

“(DataQuick April 2008) Of the homeowners in default, an estimated 32 percent emerge from the foreclosure process by bringing their payments current, refinancing, or selling the home and paying off what they owe. A year ago it was about 52 percent. The increased portion of homes lost to foreclosure reflects the slow real estate market, as well as the number of homes bought during the height of the market with multiple-loan financing, which makes ‘work-outs’ difficult.”

That number is startling. What that tells us is 68 percent of these notice of defaults will become foreclosures. Just for a frame of reference, let us look at some California numbers:

California Notice of Defaults and Trustee Deeds

Q2 2006: 20,752 NODS / 1,936 Recorded Trustee Deeds = Raito of 9.3%

Q2 2007: 53,943 NODS / 17,408 Recorded Trustee Deeds = Ratio of 32.2%

Q4 2007: 81,550 NODS / 31,676 Recorded Trustee Deeds = Ratio of 38.8%

Q1 2008: 113,676 NODS / 47,171 Recorded Trustee Deeds = Ratio of 41.1%

These numbers do not bode well. In a matter of two years, we saw statewide only 9.3% of notice of defaults going into foreclosure jump up to the current rate where nearly 68% of the current notice of defaults will go into foreclosure. Interestingly enough, that 113,676 NODs being sent out is quickly approaching that 200,000 underwater estimate that we arrived at.

This is a very rough estimation of course since it is nearly impossible to get a hard number of the actual homes underwater in Los Angeles County. But given the rise in NODs and foreclosures, we have a lot more homes that will flood the market soon:

The only thing that can stop this tsunami is for the housing market to go into bubble mode again but that isn’t likely. What are your thoughts about this? How many people do you think are underwater on their mortgage?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

19 Responses to “How Many People Overpaid for Their Home in Los Angeles County? Trying to get a Raw Number of Households Underwater.”

Doc great post. Is it possible that the number is higher since even some people that didnt sell or buy, refi’d many times and got their balance up there too?

What is bad is the amazing stage of denial people are in. I have plenty of friends and family members who bought at the peak who are now at least willing to admit that home values are going down…”just not here.” I feel terrible for them. I usually keep my 2 cents to myself, I dont have the heart to tell them “You paid $500K but when this is all over your neighbor will buy his for $300K or less.” I was tempted to buy too so I cant really say much.

Thanks and great post doc.

Dr. HB. Your analysis continues to shed great light on this very serious problem. I think many more people are underwater and don’t believe it. If/when they try to sell, or when they hear what the house next door sold for, they will realize what they are up against. I suspect that this problem may require 5-10 years to be cleared up. Much suffering and pain. I also think that the major state budget problems across the country and the erosion of services to follow will be a wake-up call to our rapidly declining standard of living. Housing bubble, crushing debt, spiraling energy costs, food prices, mounting credit card and car loan delinquencies, when taken together, spell years of trouble ahead. Yes, the sky is falling.

Seems like people who own homes are in denial. People keep saying “my home lost value” even though they had not bought in the last decade and are not underwater. They don’t want to realize the their home “value” was artificially inflated and not based in reality(unless they sold). My own mother doesn’t get that home values should be tied to incomes to have a stable market. She’s use to seeing $500,000 prices in a neighborhood where families make about 60,000/year. I’ll just keep paying less for rent in a nicer area than paying more to buy in a cr@ppy neighborhood.

Several, but two relatives in the Bay Area who are going to feel a large impact on their net worth. One bought a 50+ year old home for $950,000 with a 10-year Interest Only loan in October 2006. Comps have that place at below $900k now. And the other relative bought a $1.07m home, with a conventional mortgage, thankfully, but it is farther from the City and Zillow already has it estimated at $982k. Problem is, I can find multiple examples nearby their home where Zillow is overestimating values by 10-20%. They are definitely already quite under water, and will be paying on this debt trap for the next 28 years. They’ll likely be able to “hang on” to this place, but the first relative I mentioned above, will not. Yet they apparently have no concern right now….typical Bay Area Kool-Aid. Both of their long term net worths are going to be greatly [negatively] impacted by their housing bubble purchases.

Great post DHB. Thanks for all the data. I can see the amount of inventory rising every week. The MLS listings in the Los Angeles area under $300K keeps growing everyweek. I will take a wild guess and say that over 80% of new listings are REOs hitting the market. I have seen NON-REO properties stay on the market for over a year because of the unrealistic LALALAND price tags. How hard is it to realize that a 2 bedroom 1 bath 700sqft home with a bad roof in Gangland is no longer worth 500K. These people need to wake up and smell the weeds growing on the REO next door. Speculators have all but abandoned the market and all that is left are buyers who can’t afford to get in.

For the love of God, when are prices in Santa Monica, Beverly Hills, Brentwood and Malibu gonna tank?

They rose in the bubble like everything else. It’s not like incomes on the westside rose 25% year over year…..

Maybe until people start coping w/ the reality & actually selling the homes, the numbers won’t indicate a plummet.

Either that or they really won’t drop. Which would be bizarre….

I know a lot of older couples around my parents age have refi’d and must be hurting now. (Including my parents) There is one house in my neighborhood that was bought around 2000 that has had so many renovations and makeovers all paid for with several refi’s as the market went up up and away. Also many of my friends bought over the past four years as they felt was necessary since having children. They are all underwater but hopeful that things will turn around this summer and they will sell and move up as they have been for the past eight years. One couple often talk about how they have never lived in a home for more than two years and how crazy I am to have lived in the same rent controlled apartment for the past eight years. So I do think the numbers presented in this article are conservative. Especially if the number of homes in foreclosure on homes.com vs. homes for sale is anywhere near accurate.

Knowing the number of upsidedown and distressed homes is pretty important for determining the ‘bottom’ and not for the obvious reason. Replacement cost is probably a good indicator of what the ‘value’ of anything is. Markets can over and undershoot this value but, over the long haul, the cost of home should reflect pretty closely what it would cost to build an equivalent structure at any point in time. My guess is that SoCal could blow right by replacement cost on the way down because of the number of distressed homeowners. Knowing when this point occurs would be the optimum time to buy assuming you wanted to buy a home. It would be interesting to hear from some builders as to what their per square foot costs are and what lots sold for in pre bubble times, adjusted for inflation. If it costs $100/square foot to build a house and a reasonable price for a lot in the neighborhood you select is $100,000 plus building permits etc you can get a good idea of the ‘value’ your home would have. If prices start falling below that… well time to buy.

“They are all underwater but hopeful that things will turn around this summer and they will sell and move up as they have been for the past eight years. One couple often talk about how they have never lived in a home for more than two years ”

*****Dream on gael!!! This SUMMER? Ha hah hahahhaaaaaaaaaaa…… This crash is going to keep right on rolling through until 2011 with the resets on the option-ARMs, the hybrid-option-ARMs and the interest-only loans that will sooner or later kick in to requiring payment of principal.

***** Once the bottom is hit on prices (ie: prices bear some raional relationship to (a) ability to pay the mortgage, taxes and insurance and (b) the ability to have saved up a downpayment) then they will either hang there for a few years and/or then start to appreciate at the historical rate for housing – a whopping 1- 1 1/2% over the rate of inflation. (Interestingly, that 1 1 1/2% is in line with historic population growth.)

****What does that mean for your friends who haven’t stayed in a house long enough to need to change the CFL light bulbs? Inflation has been running around 2.5% a year for the past 10 years. If their values have fallen 20% then they will be around 7-8 years until they get back to the break even point for what they paid. [20 divided by (1.25 + 2.5)] If they lose more value (and all reputable real economists say at least another 10% if not 15% nationally), then they will be 11-12 years geting back to jsut their purchase price.

Of course, they may have trouble finding a buyer even in 7 years if incomes do not increase enough to yield enough buyers for houses at the bubble prices. And there is the real catch – prices will NOT go up until incomes can support such prices and there are enough buyers who can pay the price. Do you really really and truly see incomes rising like that?

I think the denial is something akin to realizing you made a big mistake in marriage. Too painful to acknowledge (the stakes are high, costs of getting out are high – financially and emotionally), you tell yourself it will get better. It has to! Eventually, there is no denying it. Your friends and family realize that you’ve made a mistake. You have heart to hearts with others going through the same thing. You begin to socialize your troubles. Then you accept it, develop a plan. Relief! Then you start over by renting and are wiser the next time you get into a long term relationship.

(Not autobiographical, I swear)

The denial is unbelievable. A savvy couple told me at the peak of the housing mania that only an idiot would buy in this market and that we were smart to rent.

They rented a house… suddenly the owner gave them 30 day notices and they

couldnt’ rent an apartment ’cause just their golf clubs needs a half a garage.

Anyway, they made an insane rush decision and bought an old ranch house which was in a horrible shape but in a good area for 1 million. Spent $300K

remodeling. Before they bought the house they were laughing at all the idiot

buyers, after they bought the house and the prices stopped going up and now

are going down she said to me… “I know real estate is down but not in my

area or on my street.”

Reason they didn’t rent a house… didn’t see one they liked.

Also, their parents gave them $500,000K for down payment.

I would think the price will go below 2003-2004. If you look at the Case-Schiller chart, and sharp move up started from 2004.

One thing bothers me about calling any bottom is that banks now require 20% down and good credit scores, and income statement. many times the banks decline funding to buy. I saw many properties listed pending, but a few days later, they are back on the market again, because the loan is declined. if the credit is not available, we cannot really start thinking about the bottom.

P

Credit scores are a joke, if banks would give money to anybody who had a pulse then you cant say oh, i’m sorry your score is only 690. I’m going to be forsed to reject your loan aplication.

What a load of crap!

Your data is actually pretty rock bottom since it does not include the effect of refi’s during the Greenspan/Bernanke era of great interest rates. I know, we all probably know, friends and family who are underwater in houses that they have occupied for 10 – 20 years (because of multiple refinancings over the years).

From the tilted perspective of our economic policymakers the only way out of this predicament is to validate the expectations of the home folks – bring housing values back to where they were in 2006. I fully expect that Bernanke and the Congress will continue to stoke the fires of inflation until this happens.

Investors beware – virtue will not be rewarded. Idiot speculators who act on the notion that now is the bottom might actually be correct, sadly enough.

AnnScott:

I totally agree with you. No way will things turn around this summer. My friends and neighbors are delusional as is every homeowner I know. I wish I could say incomes will rise but see no evidence of that. What I do see is employers tightening their belts looking for ways to cut expenses and we all know what that means. More outsourcing, more work and responsibility for less money, and fewer benefits. It’s going to be tough for businesses and individuals. Our economy is in a downward spiral and will be for quite some time. It’s gonna hurt everyone. I’ll prolly lose out soon as well even though I’m a renter and a saver. There’s a proposal to get rid of rent control on the ballot next week disguised as an imminent domain issue that will probably pass which will suck not only for me but for many of the elderly folks in my neighborhood who live on fixed incomes. So no matter how insulated one may think they are, it seems like no one is really untouchable.

Hi All,

Until the average person/couple can buy the average house and make the payments relatively comfortably, we cannot call bottom. That, of course, is assuming that the gov’t keeps their hands off things. With the budget in California looking anything but rosy, jobs disappearing and the cost of living going up across the board I dont see much in the way of a rosy future for housing, the economy, or jobs. What can be done? I sure don’t have any answers.

Government will slowly inflate to have wages meet prices.

Not only for the sake of housing, but national debt and outstanding obligations (medicare, social security).

This will probably take 10-15 years. For example, if you salary is 100K now, in 10 years it will probably be 200K. I will leave to someone with crystal ball to say how much a loaf of bread or gallon of milk will be. But I guarantee that you will be poorer with this 200K than you are today with 100K.

Another reason for this is that anyone who can remotely have a home – has one (or 2 or 3). There is not much need for lower prices for those outstanding renters, and there is much need to inflate – not just for housing sake.

So prepare for 10 years (at least) of hawkish inflation. There will be no precipitous drops because of foreign holders, but rather steady increase of money supply (beyond the actual need), with dollar going up and down, but in general going down.

totally agree with you

I am in the business of helping homeowners reduce their property taxes if they are underwater. Are these records available to anyone and how would I be able to reach these people?

Leave a Reply