Real Homes of Genius – Huntington Beach HomePath Property. Fannie Mae Moving on Property in Mid-tier Markets. Low down payment and weak credit okay!

It is hard to keep up with the countless government programs trying to keep the housing market artificially propped up.  In the last few weeks however I’ve noticed many more homes being offered for sale qualifying for “HomePath†financing which is a program apparently offered by Fannie Mae. These homes are real estate owned homes by Fannie Mae and many also qualify for additional renovation loans if the home needs additional work. In other words, the inventory bump is now starting. How much will hit the market is hard to say.

Now I’ve seen some beat up properties in lower priced neighborhoods being offered through HomePath but recently I have seen more and more homes being offered in mid-tier markets. Today we’ll look at a home in Huntington Beach California. Today we salute you Huntington Beach with our Real Home of Genius Award.

HomePath – The Other EZ Housing Loans

The above home is a 3 bedrooms and 1 bath home in Huntington Beach. It is listed at 987 square feet. It is in the 92646 zip code. Let us examine sales data for that zip code first:

March 2010

Median Price:Â Â Â $499,000

Sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 55

Three bedrooms from 987 square feet is really using space efficiently. If you wanted to find a HomePath property, the ad doesn’t do a good job highlighting that point:

“- this is a fannie mae homepath property. – purchase this property for as little as 3% down! – this property is approved for homepath mortgage financing. – this property is approved for homepath renovation mortgage financing.â€

I think this is a HomePath property. So after seeing more of these properties hit the market, I decided to go to Fannie Mae to see what it takes to qualify for one of these properties:

“Low down payment and flexible mortgage terms (fixed-rate, adjustable-rate, or interest-only)â€

Wait, we’re pushing more adjustable-rate and interest-only loans? I’m glad we’ve learned our valuable lesson! Let us see what other “benefits†are included with HomePath properties:

“You may qualify even if your credit is less than perfectâ€

Well that is reassuring…

“Down payment (at least 3 percent) can be funded by your own savings; a gift; a grant; or a loan from a nonprofit organization, state or local government, or employerâ€

Say what? I like how we are provided a variety of “creative†options on how to line up that low down payment. This sounds very familiar (I think I might have seen the same pitch in some of those option ARM commercials).

“No mortgage insuranceâ€

“No appraisal feesâ€

Seems like the bar is set fairly low to qualify for one of these properties. But wait, there’s more! You also have access to additional funds for renovations:

“Financing to fund both your purchase and light renovationâ€

So to get the market moving again, we’ve reverted back to the days of EZ financing. Didn’t we get the memo that a low down payment hikes up risk to another dimension? Apparently looking at a W2 is now what qualifies as due diligence. What is interesting on the above home is that the last sales data I can find is back in 1998:

09/01/1998:Â Â Â Â Â Â Â $196,000

So what probably occurred is the property took on a refinance and it was hard for someone to make those payments. But the neighbors of this HomePath property are actually in preforclosure:

The pre-foreclosure is slightly bigger listed at 1,132 square feet with 3 bedrooms and 2 baths. The first mortgage is listed at $608,000 and a NOD was filed on January of 2010.

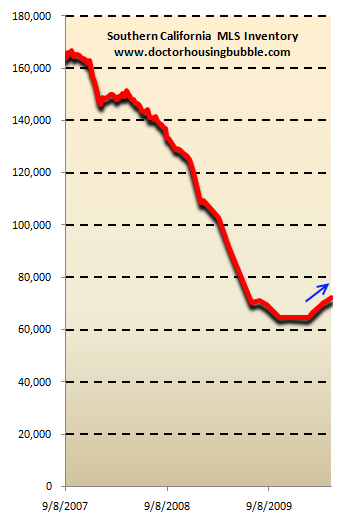

One thing is certain with Southern California and that is we are now seeing more inventory enter the market:

And for a place like Huntington Beach with 606 MLS properties, there is much to grow. On the MLS only 27 properties are listed as foreclosures but if we add in REOs, NODs, and scheduled auctions we’ll find a shadow inventory of 790 properties. People ask when the market will be back to normal. One simple thing to look at is the shadow inventory figure. When it drops down to say 10 percent of the total MLS listings for an area, then maybe we’ll get closer to a more normal market. Until then, the market is basically being artificially propped up by a litany of programs. In fact, I only stumbled upon HomePatch because a few in the industry pointed these properties out to me explaining that Fannie Mae and Freddie Mac are now getting more aggressive on cleaning out inventory.

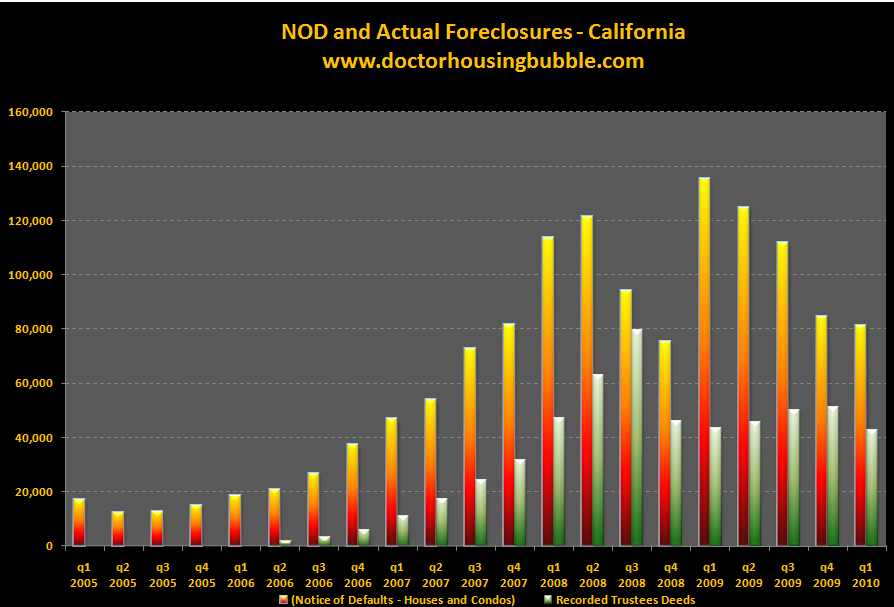

So is now a good time to buy? Probably not given the California budget and our current employment situation. But I’ll tell you this, there is every kind of one time incentives out there (i.e., the $10,000 state tax credit, the $8,000 Fed credit, artificially low interest rates, GSE flexible terms, etc). California foreclosure numbers came out for Q1 and they are still elevated but moving lower:

The numbers still remain elevated and we have yet to move a solid amount of shadow inventory. But now it looks like we are seeing more movement in mid-tier markets. The question is, what will this do to prices?

Today we salute you Huntington Beach with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

29 Responses to “Real Homes of Genius – Huntington Beach HomePath Property. Fannie Mae Moving on Property in Mid-tier Markets. Low down payment and weak credit okay!”

This would be all beyond frightening…except one has to remember that the principal people/organizations who started and grew the bubble have not had to suffer the repercussions of that behavior. The buyouts will continue to grow, money will be loaned recklessly, until we are at the point where we can’t recover because no one will put a stop to this at the gov’t level.

The sickening thing is that its really simple to do, raise the lending requirements to the consumer to levels that weed out the trash and non-funded home buyers, and we will begin to see some fiscal restraint.

Until then, its anyone’s guess how big this next bubble of debt will be, and how long it will take to break over the sheeple.

Wow, “HomePath”. You have to admit, that’s a great name somebody in marketing came up with. At least we’re getting our money’s worth from that cubicle at Fannie.

Almost nothing down and a W2 will get you into one of these homes. At least it’s not a total liar loan. A W2 is still proof one can make the payments. So the question is,”How many people can really afford the mid tier level prices given they must now show proof of income?”. I’m thinking this number of people is much lower than most think.

The reason there is no appraisal fee on Home Path is that there is NO APPRAISAL! When your buyer wants to bid up over the asking price no problemo there is no value check on Home Path properties if you use their financing. Home Path is doing exactly what Wall Street and the Bankers are sitting on Capital Hill being grilled by Congress for doing that got us here in the first place. I guess what is good for the Goose is not good for the Gander when you are the Government.

A law is desperately needed to remove any explicit or implicit government support of Fannie and Freddie. There’s no way those albatrosses will do anything but balloon the national debt further.

Wow…this HomePath sounds like the Acorn arm of Fannie Mae/Freddie Mac, what with all the “how to” tips on qualifying without having any skin in the game. I’m surprised they don’t also give you help in laundering drug/prostitution money to use as a down payment.

Doc, you didn’t tell the whole story on this HB house. Here is the link from redfin

http://www.redfin.com/CA/Huntington-Beach/20051-Moontide-Cir-92646/home/3784518

It seems it has been foreclosed in December 2009 for $400K (or may be was lingering like short sale from August and this struggle finalized at December officially). Now the greedy bastards put it for sale in march for $550K, expecting to make a profit of $150K (who said banksters make profit on the way up and down?) and later same month (not so greedy anymore) price is lowered to $525K. It seems that the only result of the gov bailouts is removing this urgency for banks to sell which gives them the opportunity to exercise their greediness and careless attitude on the back of the same taxpayers, which have paid for their economic survival … And in this situation is sickening to think that there is fool that will buy this house (and will default 1 year down the road) and prolong this agony and that feeling that smart is stupid and stupid is smart. I don’t k now how to keep myself sane. What good is to be smart (and still unhappy) in 2011 or 2012 (let say bottom), but stupid (and happy) in 2004, 2005, 2006, 2007, 2008, 2009 and 2010? Thank you my government for the new rules of this old game. If somebody is confused smart-stupid it is OK, but I cannot explain better now…

Actually, Freddie and Fannie will not increase the national debt. Mr. Obama wisely is keeping them as a serperate entity, so that their debts do not count toward the deficit.

OMG!

~

“Financing to fund both your purchase and light renovationâ€

~

So now Fannie is actually doing toxic mortgages–next-to-zero-down, with built in HELOC!?!?!?!?!?

~

Doc, I think you missed the point. We know what a sociopath is. We know what a psychopath is.

~

This is a homepath.

~

rose

For every action there is an equal and opposite reaction. Just as we saw unprecedented psychological mania re: CA RE during the boom, we MUST reach abject psychological malaise re: CA RE before the real bust is in desirable markets.

These will be some tell-tale signs:

* People who have mortgages will be envious of people who don’t (i.e. renters)

* More than half of Californians who bought in the last 10 years are underwater

* Unemployment will dip, stocks will be up, the economy will be mended and RE prices will still be going down in Culver City

* People will rather put money into their IRA/401K and continue to rent than save money for a down payment

* RE prices will steadily go up in areas outside of CA (AZ, NV, OR, etc.)

All these and more signs will conspire to snuf out any remaining RE mania embers that may be burning in desirable areas of CA.

Then, and only then, will it be time to buy a RHG in Culver City. Then, you see multiple 1,500 sq. ft. homes in Culver City selling for $390,000. This day will come. It will be sometime in 2014 when interest rates are 7%.

I’ve looked at some HomePath offerings and they all were really bad and over priced, but this one took the cake. Go to the Homepath web page and look up this property: 191 Walkley Hill Rd, Haddam, Connecticut 06438. There is a notice posted on the door that says you have to sign a release of liability before entering due to mold and mildew in the house. The place is vacant and gut wrenchingly rotten, yet they hype the low down payment and want you to close by May 1 to get the $8000 credit. FNMA has to be the most corrupt government supported business in the country.

talk about kicking the can down the road. Somehow we need to get this info to the MSM.

Doc: Like always nice post!

da-di-da: Thanks for the link!

Has anyone else noticed that even though prices are moving slowly in Huntington Beach, the visible house inventory has been creeping up for a while? The total number of houses currently for sale in the 92646 zipcode is close (~180) to the 2008 peak(~189).

http://www.redfin.com/zipcode/92646

“So now Fannie is actually doing toxic mortgages–next-to-zero-down, with built in HELOC!?!?!?!?!?”

Yes, I think compass rose has it right, 3% down, interest only with built in HELOC courtesy of Fannie. History isn’t just rhyming, it is repeating itself near perfectly, only this time with public lenders rather than nominally private ones (the banks). And we found out how nominally private the banks were anyway when they all got bailed, didn’t we?

–

So is this the economic recovery we are hearing about? The exact same repeat of our past unsustainable bubble behavior? Fool me once shame on you, fool me twice shame on me? Then this economic recovery is a lie.

–

Maybe nobody in power even cares if anything is going to work out in the “long run” anymore (and by “long run”, sadly I mean a mere 5-10 years from now). Maybe it is all about kicking the can down the road for a few years until we are faced with the mother of all crises, as instead of enduring a bit of pain with the original crisis, and using it as an opportunity to build a more sustainable economy, we just kept adding to our problems, we just kept digging, unsatisfied with having to bail out the bank loans we added 3% interest only Freddie loans to our future debt.

–

Outraged isn’t even a strong enough word for how people should feel about this. The government is selling us down the river by allowing Fannie to do this. It’s not just that renters who want to buy are getting screwed (although they probably are!), it is that all of us, renter or home owner is going to pay with no end of economic pain when these follies finally eventually catch up with us. I don’t know what anyone should do about the obvious corruption of our leaders: maybe take to the streets in protest (although the tea parties have been coopted and are not effective, we need better protest movements), maybe save themselves and their families and leave the country as this country is going to crash, maybe just focus on their own community as Washington and Wall Street are completely rotten to the core and we’ll need community when it finally all caves in.

–

By the way, I think buying a house may have become an utterly ridiculous thing to do. It wasn’t always so of course, but the housing market is now more fake and rigged than any soviet market ever was and it seems likely to remain so for awhile. I don’t think anyone should waste their money betting in such a fake market. Is housing overpriced? Probably, but who even knows anymore, it’s not like we have a legitimate market mechanism at work to determine housing prices anymore, and without a real market who even knows what prices should be? It’s not just that the housing market may be slightly distorted by government interference, that would be no big deal, no it’s more that it’s so distorted beyond all sanity that we might as well be the USSR.

Oracle,

If the government is responsible to keep Fannie and Freddie afloat, then losses from the 2 will end up as national debt. F & F are basically off-balance-sheet SIVs for the US govt. The accounting treatment does not reflect reality.

This is hilarious! But what about me? I saw the bubble in 1999 and started saving for my 20% down payment with conventional mortgage. I am still renting. But have enough saved to PAY CASH up to $300,000. Guess what? I worked too hard and already paid taxes on my income. I will offer $ 50,000 on these cheesebox with contingencies such as building inspection title insurance termite inspection and warranty for 5 years on roof, structure, foundation and utitlities. This is a CHEESEBOX tract house. I am paying $825/mo rent for a 3 bed 2 ba house on 1/4 acre in California and the rent is dropping ( BTW EMPTY 5000 sq ft lots nearby are listed for $225k. NO one is buying. Why should I downgrade my std of living for more than our GROSS income in mortgage payments. There will be no money for food or water bill. I offer $50K CASH for this cheesebox. No loans no origination fees, no points, no Realtor commissions, no W-2’s no stories, No Helocs, or coulda woulda shoulda Realtor dreams. And this offer is contingent. This bubble won’t be over until it is POPPED!

This entry at Charles Hugh Smith’s site is worth reading:

~

How we get ahead now: gaming the system

http://www.oftwominds.com/blogapr10/gaming-system04-10.html

~

Simon Johnson, Michael Hudson, and others have been saying this all along.

~

rose

Buying a house now is ridiculous.

And it will all work out in the end.

Panic not necessary only patience.

Our culture is changing from one that worshipped the hare to one that admires the tortoise. Slow and steady wins the race.

Doc, Why home sellers are raising prices on their homes? Here in Santa Clarita Valley are about 10 homes for sale in my neighborhood and they all have raised their prices from $319.000 to $379.000, I don’t get it!, House next to me was for sale when I moved in for $306.000 and now going for $336.000, If it didn’t sell at the lower price why raise the price? Theese homes were build in 2006 and were sold in the high 400’s. Are these people in denial or what?

Doc, I have been reading your blog since early 2009 and I have found it very interesting and accurate. I concur with your opinion about the uncertainty in the CA real estate market. Last June, after being sick and tired of renting in the West Side and being priced out of the market for years due to the speculation of the early 2000, we decided to buy a single family home in Santa Clarita. So, why buying made sense to us?

Renting an old 2 bdr. apartment in West LA – $1500/month

Rent for single car garage for extra storage (motorcycle, etc.) – $200/m

———————————————–

Total:$1700/month

Buying a 3 bdr. + 2 car garage home in Valencia – $345K w/t 20% down at 4.37% 30-year fixed ~ $1380/month

HOA – $130.00/m

Property Tax ~ $370/m

———————————————–

Total: ~ 1900/month

Yes, there is a small difference when you add insurance and utilities, but after the 8K Obama money, the tax shelter, and the improvement in the quality of life, we just could not pass the opportunity. Additionally, in a few years when the rates rise, this deal would seem even better. In the short run, I just don’t care about the home prices – with a first-grader at home we would stay put for years to come. I guess it is all in the circumstances…

In health and keep on blogging!

This is consistent with my observation that the government, as an extension of Wall Street they are in the game for good this time.(Goldman has multiple executives on the government payroll. Blankfein is laughing so hard he spilled Manischewitz in his helicopter. What a fun game this is!) They already have the vehicles in place to soak up all the phony CDO-CDS toilet paper the Wally’s are coming up with. Now they even have the players.

Folks, it’s a gambit. Buy now and you’re the sucker. Do you really think an eighty-year-old play house is worth half a million? Here’s how it works:

1) Crony ‘buys’ the lowest ‘equity’ tranche of a CDO for 10 Million so it can be made

2) Wall Street then creates that CDO of mortgages. Crony buys CDS insurance for 300 Million.

3) The faster that sucker explodes, the sooner they collect their $300 Million.

4) The worse the mortgages, the faster it explodes. Not to worry, America has created an entire generation of materialistic morons that will buy anything they are allowed to and everything they are told to.

5) Payoff the right folks and the game goes on and on…until it doesn’t.

6) Only works if government bails out banks and backstops all the worthless paper.

What’s wrong with this picture? Why not let all the felons out and give them their guns, ammo, and let them know it’s OK?

The country you have seen the last 40 years will be nothing like you have known in a few more years when all this debt has to be rolled over…and it does. Anyone can be N-rich until the landlord comes knocking for the rent money…

I agree, I think 300-400k might be a good price for some of these properties/shacks selling for 700k. I myself am waiting to buy. But honestly at these prices, just am glad to have a stash of cash rather than a big house!

For this economy, this is just vastly overpriced. Luckily I waited out the bubble-many of my friends thought I was crazy to do so. But now I am just happy! But I think I am just looking for some solid reason fto call a stop to the slide. Employment stabilizing, just something. Stocks look to be quite overvalued too by historical standards and if we do have a brief dip, this time I think the govt will have less options.

prices have come down heavily-but then we have Detroit and Japan as an example and I guess just am trying to figure out where we are in the grand scheme of things. Well meanwhile living in a rental with no responsibility is actually quite liberating!

The government will do whatever it takes to keep housing and the stock market on an upward trajectory, so people will feel a sense of wealth, and pay their bills. The government fears moral hazard; if housing begins to decline once again, more people will stop paying their mortgages (strategic default?…those don’t seem to be bad words anymore), squat for months/years, blow off credit card payments, and the financial system could truly collapse. And there will be little or no shame in it at all, who really cares anymore? Food for thought.

@Mike Actually when interest rates rise, the price tag for homes and all other properties will go down even more, making your home deal seem worse rather than better. The way home prices are calculated is by monthly payment so when interest rates go up, prices go down but monthly payment on the house stays the same. Basically, if you need to sell your home in the next five years and interest rates are at 6-7%, then you might not be able to sell for what you paid. Yes, this is a stupid way to price houses because it rewards only those who already own property. When interest rates drop, buyers buy less house for more money than they would have before the rate drop.

Having said all that though, I think you probably made a good decision on buying considering your overall circumstances. I know several young families in LA with decent incomes who can’t afford central LA so they move out. Most are pretty happy with the decision, I just hope your commute isn’t too bad. Also, your rent seemed outrageous. When I moved to LA, landlords offered apartments at what people could reasonably afford, and if you rented a two bedroom, you got two parking spots. Now it seems landlords set prices to suck every last penny out of their tenants. At least now your landlord isn’t getting any more of your money.

Mike, it is easy to say from your little math exercise you are not smart renter and you are not smart owner also. (West LA is old housing, ridiculously expensive, cramped, high crime low school grades city living) On other hand the only good thing is you buy in far exurb where prices somehow are corrected and more in line with reality (meaning they have less to go down) than the west side. (Although not familiar with Valencia I am assuming it is less than 30 miles from your job (or the job hub – LA) and it has reasonable schools. If this 2 things are not true it turns you in a moron, which will be used by the system to prevent price correction as people like me wait. I am sorry for the harsh words, but I taught you might want to know how it looks form here. )

I want to see yet this buyer who believes buying in Westside, South bay or Orange beach is a smart decision. I am sure this guy exist but I want to hear from them in this blog. Ha-ha-ha!

getting sloppy, you didn’t even list what the price is for the RHoG in Huntington.

Also, what might be worth your while, is investigating whichever gov’t financing program is causing all these investment funds to buy cheap Fannie houses and hold them on their books while the market recovers. I’ve heard of one that promises investors (the gov’t is their main investor, as they are offering 40:1 lending on any equity, so say $2bn on $50mm raised) make is to NOT list on the MLS if they intend on selling, and they also promise to not offer the home less than Fannie’s appraisal value (which equals market prices). Fannie, or the banks, get upside participation if the market comes back.

Not sure which program has set these up, maybe the PPIP is starting to get used for residential? But a lot of these Fannie sales are occuring to investment firms backed with Gov’t debt at 40:1 ratio.

My suggestion is you find one of these investment firms and get the skinny.

By the way, apparently the Xmas Eve QB sneak worked, none of you realize the gov’t gave INFINITE funding to Fannie and Freddie on Dec 24th, 2009. Google it.

The gov’t waited until we were all drunk on Christmas Eve, and quickly passed a bill of unlimited funding for Fannie and Freddie. This allows them to buy virtually ALL the bad inventories on bank balance sheets, and simply absorb the losses as a gov’t entity– your tax dollars essentially, but not in the form of future tax payments persay, but in the form of eventual inflation (like we’ve seen with stock market and oil prices since Q1 2009 for instance).

So please explain how this ends badly, because house prices are going up bc FNM and FRE are removing the bad inventory, and only releasing it in small dribble to prevent too much inventory on the market. And it seems to be working, which may explain why some of you are talking about rising ask rates.

Inflation, US dollar in trouble, that’s how it ends, as the poor won’t be able to afford corn, wheat, oil, silver, a house, a car, etc… since his salary won’t climb as quick as good prices, and companies won’t hire fast enough because those still employed will become more productive to keep their slow-salary-rising job.

So trying to write/fight a rising housing market is fruitless, give up. Fannie has infinite funding as of December 23, 2009. Go read about it.

Maybe it would be worth buying the property and fill it with Illegal Immigrants – if each pay USD 100 per week, cash-in-hand, then thats a profit of USD 1000 per week. No need to pay the mortgage; since no checks are done I would get some wino to sign for the mortgage.

I thought I was the only “nut” out here that saw this?! I am not even in the mortgage business, I just had to short sale my home in Colorado for $100,000 less than I payed for it however. I am glad to see that someone will be able to take advantage of my misfortune to get the same kind of loan, on the same house, for $100,000 less!

This must be what ACORN has “transformed” into? The former head of the SEIU, Andy Stern, will be the kingpin in charge of every one of these mortgages too I suppose? We truly are a bunch of sheeple, they just do whatever they want with us. No wonder the illegal immigrants continue to pour into the country. Who else is going to continue to fall for these scams time after time?

Leave a Reply