Real Homes of Genius – Banks listing foreclosures at 30 percent off peak prices. From a $1.5 million home to a $630,000 home. Huntington Beach faces major price corrections.

Huntington Beach is a fun city to be in. But like most Southern California cities, is still largely overvalued. The root of this housing crisis is based on massively overpriced real estate being leveraged with toxic mortgages. It seems like the toxic mortgages have wilted away because of Wall Street’s lack of appetite and their desire to steal money from taxpayers (a much easier source of income) yet prices in many areas still act as if the toxic mortgage market was still in place. It is not. In California option ARMs have been removed from the repertoire of purchasing a home. Even in places that once were seen as “housing bubble proof†the correction is hitting fiercely even with “beach†in the title of your city name. Huntington Beach is the third largest city in Orange County with over 200,000 residents. Let us take a look at why prices are still too high in this beach city.

Huntington Beach – Prices going down like a summer night sunset

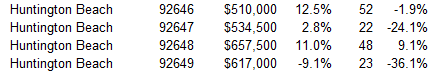

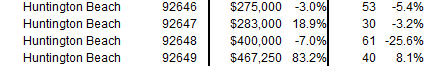

Prices in this city still remain elevated even after the correction:

August 2010 data

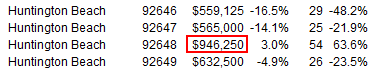

Now these prices are extremely inflated given the median household income for Huntington Beach is $76,000. People forget that the correction is already hitting fiercely in many of these zip codes. Take a look at prices back in December of 2007:

The 92648 zip code had a median price of $946,250 in December of 2007. Today it is down to $657,500. A 30 percent correction in roughly 2 years. And prices are still too high and this is one of the more pricey zip codes in Huntington Beach. As we have seen with over 150+ Real Homes of Genius, home prices can remain elevated longer than people think especially with banks fudging paperwork and keeping the shadow inventory in their back pocket.

So let us walk through an example of a Huntington Beach home that is now in foreclosure:

16572 COOPER LN, Huntington Beach, CA 92647

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1/1

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,280

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1963

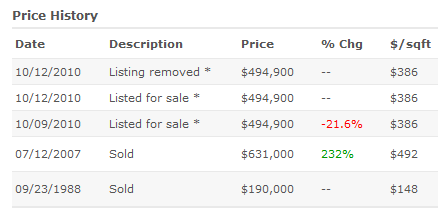

This home has been on the MLS for 8 days now. This is a basic starter home for a young couple (or at least that is what these were in the past). Yet if we look at the sales history, the peak price truly trumped any rhyme or reason:

The current list price is down over 21 percent from the sale price of July of 2007. This is a trend that I have been seeing for months now. When banks put foreclosures onto the market they are no longer delusional that the peak price is even a starting point. Last year practically every foreclosure started out with the peak price as a starting point (as you will see in another home example), and then worked its way down as usual. What the banks don’t get is that even these price discounts leave home prices inflated. And that is why even though you can still find suckers buyers to buy today, sales are trending lower:

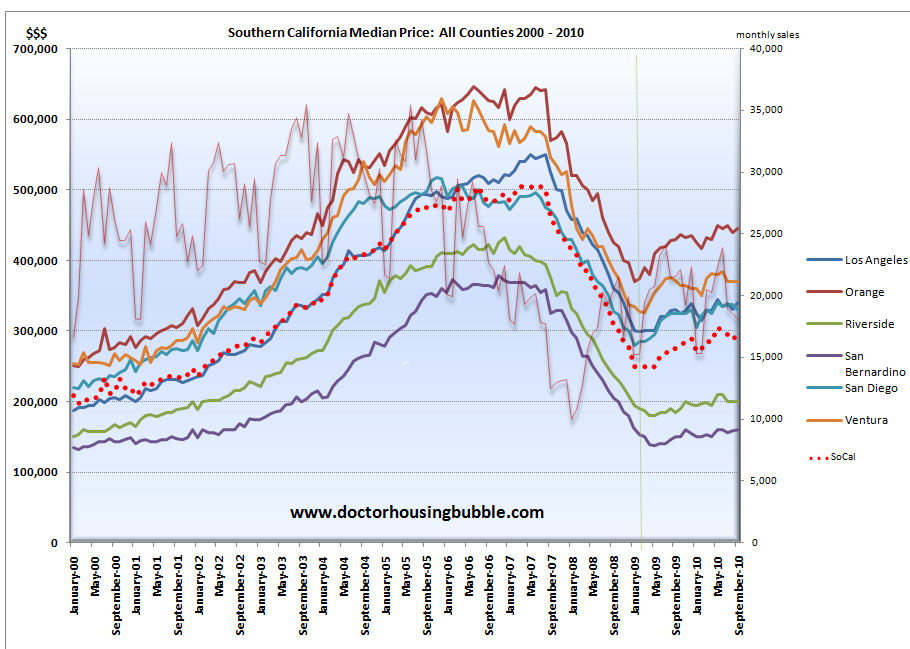

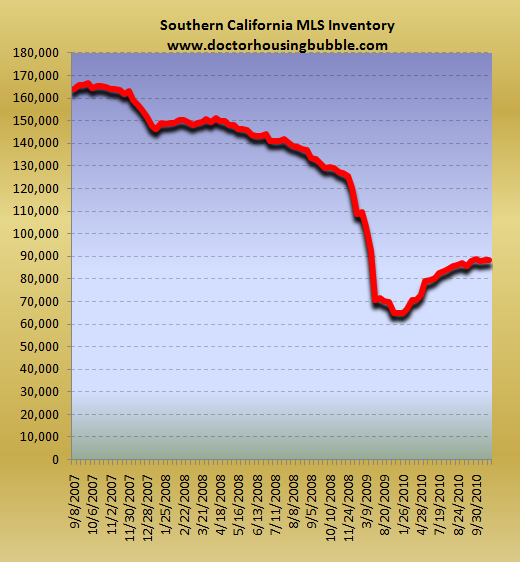

What I believe is happening is you have fence sitters who rushed into the market in spring or summer who gave prices a boost on certain areas. Yet that is now faltering and overall SoCal inventory is still elevated:

Now keep in mind that this is happening while the robo-signing fiasco is unraveling. Banks would like to downplay the mess as it being only a handful of cases but now we hear about people in Florida who were so tired about signing documents, that they authorized other “representatives†to sign on their behalf while they collected gifts for their tough work. While China is having millions of people working for dirt cheap in manufacturing (another global economic issue) we have hundreds of people sitting at desks basically signing complex legal documents that they have no idea about. This seems to be the pinnacle of our economic collapse. We are paying unprofessional people large amounts of money to basically work as white collar criminals. Then you have Wall Street packaging this junk and selling it off handsomely for giant bonuses. Wall Street’s main mission should be to allocate capital to the best places in the economy and it has utterly failed. It is merely allocating capital to their pockets while hiring unqualified people to basically “manufacture†documents, from Main Street to Wall Street.  This isn’t the kind of manufacturing we need in the U.S.

People just don’t get that a fully industrialized nation can experience massive price deflation in real estate for a long time especially in a massive national real estate bubble. Just look at Japan to see what this looks like:

“(NY Times) One of his customers was Masato, the small-business owner, who sold his four-bedroom condo to a relative for about $185,000, 15 years after buying it for a bit more than $500,000. He said he was still deliberating about whether to expunge the $110,000 he still owed his bank by declaring personal bankruptcy.â€

Prices can stay low for much longer than you expect if real wages don’t jump up. The Huntington Beach home is a basic starter:

Even at a foreclosure price it is nearing $500,000. This is way too much for someone making $76,000. So what do you think the price on this home should be? Well let us go back to January of 2001 and see what prices were back then:

This home is located in the 92647 zip code that had a median price of $283,000 back in 2001. Do you really think this home doubled in price in 9 years? It sold for $190,000 in 1988 during another SoCal housing bubble. This Real Home of Genius shows that even mid-tier markets are priced much too high.

But let us pull another example just so you can see that I’ll even pick a home in the priciest zip code:

222 6TH ST, Huntington Beach, CA 92648

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2/3

Built:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2002

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,700

MLS list date:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 10/04/2010

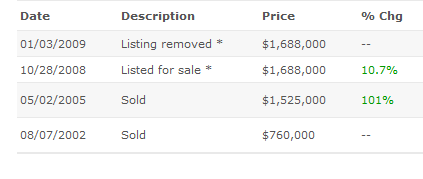

Without a doubt this is a nice place. But when we look at the history we start seeing how the mid-tier market is collapsing:

You can see the two failed attempts to get back those peak prices back in 2008 and 2009 (too late, the musical chairs of the housing bubble have come crashing down). So what is the current list price?

List Price:Â $1,071,000

A $454,000 price discount (29 percent). You notice how banks are automatically slashing close to 30 percent on these foreclosures when they list them? No amount of robo-signing is going to help these homes recoup those peak prices. We’ll be hearing about stories in the New York times in 2020 about homes that sold for “X†in 2006 or 2007 that still haven’t come close to those prices.

Today we salute you Huntington Beach with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

66 Responses to “Real Homes of Genius – Banks listing foreclosures at 30 percent off peak prices. From a $1.5 million home to a $630,000 home. Huntington Beach faces major price corrections.”

“And that is why even though you can still find suckers buyers to buy today, sales are trending lower:”

And posters wonder why homeowners are walking from their property? If it’s bad to buy in today’s market, what would make it good to hold onto a property you paid significantly more for a few years back?

Oh yea, that’s right, not a damn thing. Expect more strategic walks and tons more foreclosures.

RealtyTrac has a nice interactive map feature which allows a person to view an area, neighborhood, zip etc and display current bank foreclosures forsale, then add bank foreclosures not on the market and then add auction homes (next in line) and then Pre- Foreclosures giving a good idea as to shadow inventory in any given area. Very valuable tool!

Mister, I mean Doctor Housing Bubble: there you go AGAIN, saying that a house is discounted (29% or $454,000) when in fact it is GREATLY OVERPRICED. One should look back to its selling price in 2002 to see a more reasoble asking price (which I believe is still far overpriced).

If you put down 20% ($214,200) your balance of $856,800 means a $4600.00 payment without tax and insurance or appox $5500.00 per month for 30 years(incluides tax and insurance). Insanity! This is no double a nice home, but it is only 2700 sq. ft. – not exactly a millionaire’s mansion.

Dr. Housing Bubble (with all due respect) – get this through your skull: any price increase after 2002 was due to a credit free-for-all. Banks were handing out credit (debt slavery) to any person walking through their doors and IT CAUSED PRICES TO SHOOT TO THE MOON. Got it DHB? GOT IT? So please don’t tell us this million dollar house is discounted 29%. IT’S NOT!!!

What’s truly funny/pathetic is, that “million dollar” home really is a “mid-tier” property (at best) as Dr. H.B. says, because what genuine millionaire in their right mind would be caught dead in such a pathetic little shoebox, let alone pay anywhere near the previous (2005 OR 2002) selling price?

It looks like a sorry ass, cookie cutter TOWNHOME, about 20 feet wide with neighbors on both sides looking into your windows. What a joke! You’re completely right that even the 2002 price is mindbogglingly absurd!

And to think it sold for OVER $1.5 MILLION in mid 2005 (more than double in less than 3 years), not to mention the still-too-high $760K price in late summer 2002. This shitbox should be $500K AT BEST, and that’s if there’s a slip/harbor access in the back.

I know of these houses and many of them are within walking distance from the best stretch of beach in HB. I am not saying that the houses are great, or worth the money, but location must be taken into consideration.

That being said, I think that this home will probably settle at about $500,000.

Unless you were being sarcastic…

A discount is merely a price reduction. Discounting a good doesn’t make it cheap or of good value. You could discount an overpriced home and still have it be overpriced.

I think Dr.HB’s point was the same as yours, that these homes are still overpriced. Don’t take the word discount the wrong way. His use of the word to describe the lowering of prices is accurate.

ABSOLUTELY! I say the same thing over and over. I believe that the bubble started in 1997 with dot-com bubble money. From the mid 90’s, everything tripled at a minimum. I think that a more appropriate stance for DHB to take is that rather than crowing about a 30% discount from the peak of insanity that we should be shown what the premium still is with the 1996 price used as a baseline.

The projected rents used are bubbly too IMHO.

Your name suits you well Lazy-Ass-Elephant. Did you even bother to read through the entire article. DHB clearly states ” What the banks don’t get is that even these price discounts leave home prices inflated.” Got it Lazy-Ass! Got it!

People who buy these type of homes are already home owners. They either do a lateral move, or it is a move up. Obviously, first time home buyers with average income can not afford these prices. They belong in Riverside and San Bernerdino county and enjoy the long commutes to work. A large portion of home owners do not have a mortgage and they can buy these “overpriced ‘ homes because they just sold their “overpriced” homes.

Oh please. You just described a housing ponzi.

The people who bought in the 70’s 80’s and 90’s could have just as easily been “homeowners” too.

Duh.

Housing ponzi is right. I recently told a realtor the exact same thing about lateral moves. She had no idea what I was talking about until I asked her, “How else would you explain two offerers in a bidding war, with both of them bringing $500K+ to the table (a $750K fixer REO by the way)? I don’t know about you, but I don’t know too many people that have $500K in savings”. Only the people who bought during times of “normal” financing (70s, 80s, mid 90s) can afford these ridonkulously overpriced homes, because they just sell their overpriced home to another sucker…Ooops, I mean buyer.

We must remember, there are many people that made outrageous amounts of money in many markets because of the bubble spill over. I know some of them, and these people still have $1M+ in savings from the money they made during the bubble years. Yet now these same people are having terrible success generating anywhere close to those bubble year profits. Until all the funny money gets washed out of the system, we’ll have ongoing coastal region shennanigans.

Don’t get me wrong. Every ponzi scheme eventually comes crashing down, but for the good people of the CA coastal regions this may take a whole lot longer to unravel. And since most coastal homes are still being traded like stocks, with the majority of buyers being investors, this scheme will take longer than normal to end. The problem is also that speculation is still rampant in the Wall Street Casino. You can still buy futures and options on RE trends in the 20 major cities. In fact, you can gamble on futures and options on weather patterns in Berlin. All I have to say is what is wrong with this picture? Where’s all the innovation from our country’s top graduates going? It sure isn’t going to anything productive like curing cancer or technological breakthroughs.

He is saying discounted from peak Goofball, which it is. Not a general “discount” as in a reduction from it’s reasonable price.

You need to learn grammar too

I think commentor is correct. Would HB.COM kindly put up a chart of housing prices for the past 50 or even 70 years for California, Southern California if you can find it. It would show that the shenanagans of the Administrations in power in collusion with banking and lending system to hype property values through money give away, much like a drug dealer’s antics, with result of the hyper inflation and the big pile of do do that is being swept under the carpet. Prices are not off a bubble. The bubble is not the standard. The facts are, prices are still too high, way too high. We are in for more decline. Real issue is jobs. Loss of good jobbs. I submit that this crisis was a result of U.S. Trade policies and favoring the mega-corps, sending our jobs over seas. meanwhile it was just keep your life style by tapping your bloated house values til the cows come in and instead the vultures have come to roost.

When mortgage rates increase either due to printing money or a trade war with China, we should further price decreases.

Funny, I have friends at the beach who still believe their homes are protected from the coming downward adjustment in home prices.

Now that you mention inflation, I have heard/read that having a house is good way to protect yourself against inflation. I also believe that once interest rates go up, then less people are going to be able to buy houses therefore prices drop. I kind of confuse. Please advise how these works !!! Thanks

Ha, 92647, aka, “The Slater Slums” is such a dump. Nice to see 92649 (Huntington Harbor) coming down though. 92648 still way too high for the privilege of tourists parking in from of your house and peeing in your bushes every weekend.

92646 still way too high – check that medium income with the median price over the last 30 years. Incomes maybe doubled, houses went up 9 or 10 fold, now maybe are 7 fold.

Keep dropping 92649!

Funny guys – now yelling at the poor doc.

I know they’re jsut being animated about their beliefs though.

The Doc posed a question:

How much do we think house #1 be? (I feel a little like I’m on The Price is Right, except bob Barker is not grabbing my ass)

For house #1 – it’s easy

And i’ll go out on a limb a little too

80K Median income x 4 (being benovolent here) – $240K

or

1280 sq feet x $200/sq ft = $256K

(being overly generous here using $200/sq ft,since the house is over 45 years old and god knows what improvements are needed; it has ONE bathroom, so it is cetainly not a “dream house”

I say depending upon what my view of the neighborhood was, the schools, the local government’s level of dysfuncionality, the walk thru and inspections, etc – somewhere north of $200K but south of $250K – period.

494K? Nooo

Or to put it another way, as we have seen many times, at this price, assuming a normal down payment and 80-90% 30 year mortgage, your income would have to be in the range of $150K+ year.

That’s less than 2% of the wage earners in the United States.

That 494K includes paying 200K or more for the priveledge of the location.

I know HB is cool, but you have to be able to afford cool.

And with the moveup market destroyed, I can’t see who is going to be able to buy this house.

Speaking of which, there have been many a report lately of peopel with platimum credit, waiting forever and a day to try to get approved for a mortgage.

I’d love to know where al lthe Californians are that can qualify and close on this house?

Nice!

It appears as if your math (and my research) both come up with roughly the same value.

Of course, Realtors on commission and Homedebtors that like to masturbate to their “Zestimates” won’t see it logically.

Assuming excellent credit, and that 33% of gross income is applied to the mortgage payment (a stretch but not a death sentence, and not entirely out of linein HB or most of OC and socal), that leaves about $2222/month to service debt. Running with the APR of 4.3125, this monthly could service up to about $350,000-$360,000 in debt, Dividing by 0.8 shows us a down payment of $90,000, which is a little more than a single year’s wage, and adds up to an absolute maximum purchase price of around $450,000. At present conditions, then, fundamental might support a more realistic $375,000-$425,000 at the $80,000 wage point.

Assuming you have a two income house, let’s say a K-12 teacher and an engineer — decent jobs but average college-educated jobs — you can expect combined incomes of $120,000-$150,000. At present mortgage rates, these wages could afford over a half million dollar house. The 3x rule of thumb is oriented toward a more normal market, with interest rates easily double what they are now. And while it is a good safe guideline, that’s all it is. It is absolutely, vitally important to always check the fundamentals.

If you factor in higher property taxes, insurance and less taxes deducted in paid interest, wouldn’t it fall closer to 350K? I do agree that 4x (maybe up to 4.5x) is the new 3x, and given the current path of the Fed, it doesn’t look like interest rates will be going up much anytime soon.

Ed: I did factor in higher property taxes but left income tax deductions completely out of the equation (not intentionally, mind you. Just forgot to consider it.)

they both looked 125,000 to me max………..

So I decided to do a little digging around in the neighborhood of the HALF MILLION DOLLAR (snicker) home in order to help the readers understand the historical values a bit better.

How much in the 60’s?

1967 $22,500

http://www.zillow.com/homedetails/16562-Cooper-Ln-Huntington-Beach-CA-92647/25266201_zpid/

How about the early 70’s?

1974 $17,000

http://www.zillow.com/homedetails/16602-Cooper-Ln-Huntington-Beach-CA-92647/25266204_zpid/

In the late 70’s? (when RE first started going crazy in SoCal)

1979 $86,500

http://www.zillow.com/homedetails/16652-Cooper-Ln-Huntington-Beach-CA-92647/25266209_zpid/

Late 80’s? Well…we can see with this house.

1988 $190,000

Early(ish) 90’s while the first bubble was trending down?

1993 $231,000

http://www.zillow.com/homedetails/16781-Cooper-Ln-Huntington-Beach-CA-92647/25268030_zpid/

How bout the mid 1990’s when the 1990 bubble was fully deflated?

1996 $194,000

http://www.zillow.com/homedetails/16751-Cooper-Ln-Huntington-Beach-CA-92647/25268022_zpid/

Early 2000’s? Well into the last bubble

2001 $336,000

http://www.zillow.com/homedetails/16752-Cooper-Ln-Huntington-Beach-CA-92647/25268059_zpid/

What were morons paying at the peak?

We have our subject house at $631,000 and we have this lucky fellow who paid $703,000 (for a moderately larger home)

http://www.zillow.com/homedetails/16692-Cooper-Ln-Huntington-Beach-CA-92647/25266212_zpid/

And finally, who’s the biggest fantasizer on the block (granted the house is bigger and an example of why you don’t ever want to buy the best house on the block…

This clown with the “Make me move” price of $850,000

http://www.zillow.com/homedetails/16712-Cooper-Ln-Huntington-Beach-CA-92647/25266214_zpid/

This house (DHB’s subject house) isn’t worth more than $200,000.

Take the 1988 price ($190k) plus maybe 50% for inflation, and I might be vaguely interested. Above 300k, no.

I think a lot of areas are going to come down to 300k for average-ish houses like this, being what an average-ish earning couple could or would pay once the illusion of endless price appreciation is gone.

when you consider the factors behind that 50% inflation have evaporated, why add 50% to the price for inflation?

$200K??? I’m going to have to disagree. The informed buyers and experienced investors that are sitting in the sidelines will jump in long before a house gets to that price and here is why.

How much do you think you can rent that house? Looking at houses for rent in trulia.com for the 92647 and you will see that they start at around $2,200. If you run the numbers, the property starts looking attractive around $275k-$300 for an investor that is looking for a dissent return considering the risk that he/she is taking. The potential buyer will be jumping in long before then since they might just be trying to beat renting.

do you think rents won’t fall as well?

Rents have fallen. It would be nice to know which way rents are going to go in the future. But with all this uncertainty , I’m guessing and increase or decrease are just as likely.

I can say from my point of view a little while back there were tons of units for rent and rents went down. Current rental inventories in my area appear to have gone down.

On the other hand according to Lansner’s blog (http://lansner.ocregister.com/2010/10/20/apartment-rents-inch-up-10-a-month/85110/) they have started to rise again. I don’t know which way they are going, but with this economy I would just say, live below your means if you can and if you have any powder, keep it dry. And IF it makes sense based on your personal situation (there a LOTs of things to consider) and the price is near the fundamental value feel to pull the trigger.

You’re absolutely right. Rents are already falling here in Arcadia, Temple City, CA. I’m in a one year lease at $2,200 a month, and i can get a much nicer home in the same neighborhood for $1900 to $2000, with even better perks (gardener, water, trash) comped. I’m 4 months into my lease; by the time it expires next summer, I figure the same house will be $1800 to $1900, a $300 discount from where I signed at in July.

Plenty of 3BR houses just as nice as this one listed on craigslist at about $1800.

I’m sure they’re negotiable also.

Suckers look on trulia for rentals and only Realturds list rentals there.

Funny what the banks are doing. I was just getting poised to make a cash offer on a 4 br house in Sac. The bank had it listed at $90k. The banks representative hasn’t been responsive and we need additional information so that I can make an offer. I was thinking of offering $85k. Well, short story even shorter, I just checked and the bank lowered the price to $80k!!!! Incredible!!! The banks representative is totally unavailable to deal with prospective buyers so the bank lowers the price!!! I love it!!

I just noticed that on Redfin for the 91607 zipcode there are 89 listings. A week ago there were 105, yet when you search for sales you get a listing of only 3 houses. Why did 13 people de-list their properties in 1 week?

There could be many reasons… Some might have simply been taken over by the bank. Some might be owners who decided it’s not worth selling. There are also people negotiating with the banks to refinance, and delist/list depending on progress. Could also be the banks simply delisting to give the impression of less homes on the market. Or perhaps they simply want to reset the days-on-MLS to give the impression that the home was not sitting forever.

Banks and a good number of homeowners are desperate to get the highest payment on their ‘investment.’ This kind of erratic behavior was inevitable

Or it could be that it is the time of year when listings always plunge.

What a bunch of losers. Y’all probably don’t even own homes or got your homes forclosed and now are a bunch of disgruntled cry babies. If you do own homes, you probably would not be wishing your home values go down. Anyway, us people who do make the money will always have a write off owning a home while you sorry people pay someone else’s mortgage renting. Serves you right to lose your jobs and homes. You’re probably all democrats waiting for government handouts.

Write off? Are you talking about the interest deduction? Paying $10,000/year in interest to get $2,500 back from the gov’t isn’t a write off.

With government handouts propping up home values does that make you a self hating liberal?

Hahaha!

Oh, look: it’s angry conservative-man. Look: He’s trying to think! Ain’t he cute?

Hahah! People who don’t think like you are all unemployed? That’s my favorite conservative slur on other viewpoints! You forgot to add that everyone is a dirty hippie, though, so I’ll have to dock you a couple of points for that.

Don’t ever change, man.

I’ll bet HB Home Owner got plenty of Gum’mint subsidies along the way from a GI Bill sponsored education, to Food Stamps and other welfare payments.

Might even be getting a SS disability check?

The biggest whiners are always the biggest hypocrites…

Yeah cambridge02140 🙂

Don’t forget the mortgage interest deduction, Prop. 13, and tax credits – you know, “Homeowner Welfare!”

~Misstrial

HB Homemowner:

I waited a bit to answer, politely, well, because I am embarrassed for you.

I guess you don’t know, or most likely, are a person new to the housing blogs and thus unaware of what you’ve stumbled upon (or across).

To describe myself, a well-to-do renter who has the means ($215k/yr) to rent simultaneously in two (2) states and who is a proud Decline to State independent California voter.

RE: “losers” and “government handouts” – all I can say is “If you only knew.”

Other than that, I am aware that many commenters and readers of the various housing blogs (including DrHB) have significant savings and can afford either a 10 or 20 percent down or in my case (as others here) an all-cash purchase.

We just want to be smart shoppers and not knife-catchers (look it up).

Here is a link relative to why we’re waiting:

http://www.snl.com/interactivex/article.aspx?CDID=A-10770380-12086

In any event, thank you for dropping by.

~Misstrial

HB, maybe you can list your address so we can see how much of a sucker you are. You are correct in the fact that you will never hear a home owner say they hope home prices go lower. You will also never hear a Politian say those words either. And there lies the problem, a bunch of greedy people living in fantasy land crying because their NEVER WAS WORTH $700,000+ home price is dropping like a rock. I pray every night that home prices drop not because I have anything against home owners, but because it is a fact of reality. Home prices must fall to levels that the AVERAGE person can afford to finance.

Hi HB Home Owner, this a Laguna Niguel home owner. Read it and weep, it is was it is…

Hey HB Home Owner (let’s call you HB Homo for short, shall we?), you couldn’t be further off – on ALL counts. But please don’t be bitter – let me guess: you’re currently in the process of losing your home and trying to short sell it for some ridiculously high amount. DSP (Delusional Seller Pricing), anyone? Hey, look on the bright side…you’re not actually losing any value on your shitbox (well, only on paper anyway) unless you do sell…or lose it.

But do us all a favor and on the next holiday, just step out on your own Huntington Beach front yard with an alcoholic beverage so the HBPD can jump over your picket fence and arrest you for drinking in public!

Look, it’s not about wanting prices to go down. It’s about clearly recognizing that home prices are hugely out of sync with incomes in many areas (with CA being an epicenter that has been out of line even before the 2002-2007 runup). Housing got to that level by a generation of people flipping inflated and largely ephemeral equity between themselves, explicit government meddling, financial alchemy, irrational exuberance and 30 years of positive demographics as interest rates dropped from the high teens to mid single digits. At the end of it everyone realizes that somewhere along the way the link between houses and incomes got left behind and without inflatable leverage and constantly increasing equity – there are more homes than those who can afford to buy or move up at these prices. Given massive over-consumption, more debt, not only do people have very low accessible cash savings but their balance sheets are over-leveraged and in need of healing – not another million in debt piled on.

Some people realize this, others don’t. My wife thought I was an idiot who didn’t know what he was talking about from 2004 until mid-2008 (despite an investment career and mtg experience). BTW – ask PIMCO in Newport how many of their mtg traders were renting in 2007-8 and also sidestepped this….The whole issue here is the fact that pricing does not match fundamentals…it’s not an accident or some oddball unpredictable thing that can be righted instantly. What I would do is plan to hold onto your house for a long time. Eventually things will catch up which is the goal the government has in mind, hopefully it goes smoothly.

Not sure what to tell you other than good luck. No one wishes ill on anyone else and its unfortunate that you are involved in the downside of the cycle. Hopefully you bought a long while ago and still have substantial upside from the runup and no need to sell/access equity.

@HB Home Owner

Didn’t you learn at a young age that if you don’t have anything nice to say, don’t say anything at all? I get a feeling that you don’t have nothing to add to this conversation.

@ Everyone else: Nice responses, but lets get back to the conversation regarding the 2 houses mentioned and their fundamental values. Please don’t feed the trolls. Doh! I guess I just did the opposite of what i suggested…

I am also an HB home owner at the present. I bought before the bubble and have not moved.

I think it is criminal that government intervention and criminal banking activity has caused housing prices to increase beyond anybody’s capacity to pay.

Enjoy the house that you bought for $1M when it finally is worth $500K. I think you will be looking for a strategic exit from your mortgage when the houses in your neighborhood could be rented for about 1/4 the monthly rate of your mortgage.

HB, I am a prudent renter cheated out of a decent place at a decent price by the government-driven inflation of housing prices 1998-2006.

I’m one of the people who did NOT borrow over her head to buy some overpriced piece of crap on a pay option ARM or IO or whatever snaky mortgage product that was being offered, that drove house price inflation.

I’m one of the UNsubsidized.

I am one of the people who watched, aghast, as house prices in my area inflated wildly out of my price range by the time I had a decent down payment, and wondered if I’d have to be in the top 10% of area earners to afford a decent 2-bed condo in a “marginal” neighborhood.

I’m one of the people who did not want to spend 50% of her take-home for a ludicrously overinflated property.

Call us losers if you will, but it is going to be a lot of fun to pay CASH for a nice place to live.

The losers are the borrowers who payed obscene multiples of their incomes for some overhyped crapshack on the promise of year-over-year gains of 20& or more in the value of these places.

Why should I be taxed to make their rotten, ill-considered investments good?

Yank ALL government support for housing, from FHA loans for $725K houses to mortgage modifications to Section 8 subsidies. Let housing prices find their natural level.

When are you going to buy…2018. Twenty years to time the market seems a little extreme. There comes a time to buy with a payment you can afford (and don’t tell me you can’t afford it because the average loan payment is lower today that it was in 1989). If you’re diligent enough you will own the home free and clear and never pay rent again. There are 24 million mortgage-less homeowners that have done this. Flippers and serial home movers do not apply in this equation.

HB. I too was priced out watching real estate soar out of control while my salary lagged behind. Our combined income is well over the median in most neighborhoods. You can hate on us all you want. Time, history, and sheer numbers are on the side of us folks waiting on the sidelines. I like to think I am a compassionate person but comments like yours make me want to see hoards of people crying as they get foreclosed on. Corrupt lenders going to jail. Would really like to see some legit free market go to work here. Alas there is no such thing. Markets are created and maintained by governments.

DHB, can you do a piece on rates and the effect on prices, or can you point me to a piece that covers this. I read a piece in the OC register that said prices rise with rates which is hard to believe. No body can afford homes at 4.5 % so at 6, 7 or 8% it would be that much harder unless Im missing something.

Interest rates go up because inflation is high. Real estate is a hedge against inflation, thus home prices going up. The opposite is true too. In the last two years there has been deflation (or close to it) which leads to extremely low interest rates and lower home prices.

WTF?

Based on comments their seems to be a lack of recognition regarding the volume of high end foreclosures that will be impacting Calif for many years in the future. We basically do not have a move up market any longer, those sellers over 500K are stranded and will see an endless number of distress properties hitting their neighborhood over the next 5 to ten years. The banks and Government want to stretch the time period for this process but they may not be successful if Bank Of America cannot stay afoat and needs to be restructured the implications for Calif in that case might be a sudden downdraft of foreclosures rather then trickle either way home prices will continue to deflate for many years.

The Doc does HB! Nice…. yes, have lived around downtown 92648 for years…as a renter… we watched in horror as they ripped down these quaint beach cottages and original homes to throw up the 3 story boxes with about 6 feet of space between each one and a nice little concrete patio “front yard”…. it’s changed the face of downtown huntington forever, no more style — a bunch of cold looking designs (yank the trees & greenery for concrete) and styles that will soon be outdated… For many, “living in HB” is living in 92648 close to downtown – and yes, a few years back – signs went up then down quick — now they linger for awhile… We’re just seeing all the folks who bought into the “we gotta do it now honey or we’ll never get in” get their reality check.. Now, I’m enjoying the expanding inventory of even rental options in this area now — there’s so much opening! and even rentals are having to drop prices ) A steal of a deal here: Next door to me the neighbor had his box mansion listed for 1.2 million !!!! (no doubt what he paid for it about 2 years ago) …note: it used to be a beautiful dark wood 4 plex — with great greenery and trees in the courtyard…All the neighbors in these 3plexs, 4plexs knew each other and friendly — so the defacing done to the neighborhood in putting all these up is reason enough alone to cheer on the pricing drops… It basically just brought a bunch of uptight yahoos in anyway – and the friendly beach community was pushed back inland… maybe things can change a bit now …I would think/hope a lot of these places would get back into the high 300’s low 400’s — which is where many were in late 90’s before the rocket ship took off — in regards to 92648 downtown homes… Also consider, so many of these “owners” were also employed by the inflated job markets: OC is HUGE for mortgage loan officers, realtors…. hence not only did their house drop, but their job did too… We’re just seeing the beginning of all of this…

“What I believe is happening is you have fence sitters who rushed into the market in spring or summer who gave prices a boost on certain areas. ”

In our area there are a lot of investors snatching up foreclosures and sitting on them. They aren’t even listing them for sale, just letting them site, lying in wait for the houseing market to recover.

If you think HB is still ridiculous, check out the 1200 sf 60’s tract homes that sell in Seal Beach for $800,000. While Seal Beach is a great place to live and the school district is one of the best in the state, the prices for these rather unattractive little shacks are freaking insane. This utter madness still has quite a way to go before we are anywhere near some semblance of normalcy.

EconE (above) – wow! I clicked on the last link in comment (the one for $850,000). Preposterous! I then brought up a picture of the house (see link here):

http://maps.google.com/maps?hl=en&tab=wl&q=16712%20cooper%20lane%2C%20huntington%20beach%2Cca

Man the guy trying to sell this home must be totally whacky-on-the-junk!. In fact, his “junk” must be laced with PCP to be asking $850,000 for that house. It’s a decent house. It’s a nice house, BUT NO WAY IN HELL IS IT AN $850,000 HOUSE!

You see the housing bubble, which was caused by a CANCER OF EASY CREDIT (DEBT SLAVERY), caused a very serious disease to infect much of the United States. The disease is an epidemic. THE DISEASE IS CALLED GREED. Too many people believed their house was worth a million dollars, or a significant fraction thereof, and now that the bubble has burst they just cannot accept that their very ordinary house is worth pre-bubble valuations.

Exactly. The people with the egotistical MAKE ME MOVE! listings are the greediest buffoons of all IMHO. In fact, that would make for an interesting post. One that just covers people with MAKE ME MOVE! listings. It’s almost as if they’re daring people to overpay while spitting in their faces.

I wonder if the owner HELOCed that swimming pool.

True dat!

Housing isn’t necessarily as hedge against inflation. I think we confuse housing inflation with increased personal incomes. If inflation hits with absence of growth in personal wages housing will not increase correspondingly. In this environment of STAGFLATION housing price points are still driven by supply/demand. How is demand going to overheat in the absence of increasing wages? I don’t see it as I don’t see personal incomes rising anytime soon. Sure, there may be inflation in pricing of many other products but there is such an overwhelmingly advantage employers will hold for years to keep real wages down. Econ 101.

So inflation may include many other products but not housing which is an assortment of manufacturing goods and technology. People will pay more for appliances, HVAC systems, flooring, windows, plumbing etc. with depressed wages in their current home but not pay more for a new home. I’m not an economist but inflation is inflation. Look at what home prices did in the 70’s when inflation took off – home prices in California nearly doubled. People flock to hard assets such real estate and commodities. High inflation isn’t necessarily a good thing and I’m not predicting the future but the past shows us that this is what happens.

I’ve done some looking at this period. Two things were present:

1) Baby boom demographic clamoring for housing as they formed households and had kids

2) Fast rising wage levels across the board

3) We began the period with a relatively normal link between incomes/housing prices and left the period with the same (albeit in very high interest rates so affordability itself was way down and many people were pushing to try to afford their house – luckily they spent the next 2 decades refinancing and trading up skyrocketing equity)

I’m not saying it can’t happen again but merely that all inflationary periods are not created equal and there are several components from the 1970s that will not be present this time around. But who knows how this ultimately goes.

One way to solve the housing crisis is to give Green card or citizenship to non Americans people who have a decent job history in US . They have a job and would be willing to buy a house but won’t do it unless their have an option to stay longer.

Fast-Paced Foreclosures: Florida’s ‘Rocket Docket’

In the urban dictionary, under ‘tragicomic’, is a rendering of the cartoonish faux-Mediterranean architecture (or lack thereof) exemplified by 222 6th St. HB… hard to feel sorry for the sheeple who pay good money for such SCHLOCK.

PS: The “arches” are actually STYROFOAM pieces, stuccoed over, then painted to match… just say NO to FAUX. ;’) Or put another way, if a REAL-torrr shows you a “home”, and it very much resembles a slice from a shopping center that hosts a Panara Bread or a Whole Foods, DO NOT BUY IT!… you’ll lose value just for bad style.

Leave a Reply