Real Homes of Genius 2016 Edition: Searching for Deals in “Prime†Huntington Park.

Los Angeles County is massive. It is also a renting majority county. L.A. County is the least affordable county based on price-to-income ratios. And when things get out of control, all of a sudden every area is gentrifying and every property is one step away from being a Taj Mahal. This summer the housing hounds have been released and all of a sudden real estate is the greatest deal in town. Housing can do no wrong and for those priced out, you must dig deep in those wallets and make that bet! You only live once! Carpe diem. No one ever regretted buying California real estate aside from all those that regretted buying California real estate. Today we’ll take a trip to Huntington Park. According to the real estate gods, gentrification should be happening in every niche of L.A. County.

Huntington Park

What is interesting about Huntington Park is that it was incorporated back in 1906 as a streetcar suburb for workers. To this day, about 30 percent of people living in the city work at factories in Vernon and Commerce. If you’ve seen the second season of True Detective you will see the story revolves around what is Vernon.

Huntington Park has about 60,000 residents. The median household income in Huntington Park is $36,397 and about 28.7 percent of the population lives below the poverty level. In other words, it makes complete sense that housing prices are out of control here as well.

So let us take a look at our Real Home of Genius today:

2 beds, 1 bath at 1,360 square feet

“This property won’t last.

LOCATION! LOCATION! LOCATION!

Prime ‘Walnut Park’ 90255 Area (off Seville Ave.)

WOW!! Good size 2 bedroom home at 1,360 Sqft. with possibility of using as 3 rooms. Good size living room with fireplace & good size formal dinning room & bedrooms. Fenced backyard & big front yard. More info to comeâ€

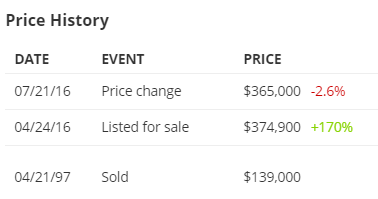

Thanks to all the house horny rhetoric, everything is now prime. The ad starts out with “this property won’t last†although it has been listed for 113 days. They’ve also needed to cut the price recently:

I’m not sure where they are getting the third room here? I also love the “location†line since we know this is the first thing you learn about in HGTV marathons.

People usually email me saying “where can I find a $400,000 or $500,000 home in L.A.?â€Â Well here you go. You can have this place for the low price of $365,000.

Here is another view:

Who said there were no deals to be had in prime L.A. County? Today we salute you Huntington Park with our Real Homes of Genius Award.

Is this a deal? Inquiring minds would like to know.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

120 Responses to “Real Homes of Genius 2016 Edition: Searching for Deals in “Prime†Huntington Park.”

I am now in a position where I have to buy. My lease is up and I am done with renting. Sucks since I KNOW I will lose 30% equity in the next few years but then again, I would lose it anyways if I were to rent. The real shitty part is that I have to settle for a town home for my family so I don’t get gutted by the monthly nut. Would love to time the market but that’s out of the question now. What is interesting is all the pre-foreclosures in LA. Who knows how far behind they truly are and with mark to market tactics by the banks, there is no need to kick these squatters out. Obviously, this has created scarcity and makes it seem as if there is high demand.

Hi B;

Where do you want to live and how much house can you afford…?

I live in Oxnard which is an hour north of LA. Much better value here than LA but still high. My parents bought a new 5br 3bath in 95 for 350k. Now it’s worth 650k even though wages have actually declined? My dads use to work for The Gap distribution but the my decided South America was a much better place to be.

@B,

350K in 1995 to 650K in 2016 isn’t that bad when factoring in 21 years of inflation (yes, we’ve had plenty of inflation) and rates going from 8% in the mid 90s to the low 3% range today. What have rents done in those 21 years? I guarantee you they have gone up significantly. Stagnant wages are only part of the equation, inflation and interest rates need to be taken into account.

If I were in your situation, I would do a rent vs. buy analysis for the area you are interested in. Also, are you able to save money while renting? If so, this could be huge if your 30% correction becomes reality.

I’d buy if I were you too. You can get a place really close to the water for not that much compared to LA or bay area. Plus its a quick and gorgeous drive to SB. Kinda envious.

What Inflation Lord Blankfein? The imaginary one created by the fed? Please don’t confuse the newbies with false narrations…

That home price is 50% out of whack, there has been no inflation, it’s been deflation like Japan for 8 years now and we are just getting started.

Anyone buying today and not waiting until after elections and the prop is finished is just impatient and I have to be tough here-making a dumb financial decision.

cd, you are doing the newbies a big disservice by claiming inflation doesn’t exist. It’s the only way this whole system keeps propped up. The cost of everything has gone up in the past 20 years, to think this cycle won’t continue in the future is foolish. Even small 2 or 3% yearly inflation over the long run is a killer. Buying a home and locking in a fixed payment is a great equalizer to this.

If you know for a FACT that you will lose 30% of your equity if a few years, renew your lease and keep renting. The last decade has told us that NOBODY could have predicted how things played out. Predicting the future is a fool’s game, base your decisions on logic and simple math.

Gets much harder to continue leasing once you have a family. The way I figure, if economy takes a fall harder than in 08 and into a new dark age, no one will be around to kick me out. Same can not be said if your renting someone’s place.

@ B… come on man. Don’t cave in… **At least wait till the election is over and the new president is in place…nobody knows the futures but it is pretty clear that things always change after the elections with policy and budgets. Most people are broke and rents are coming down just a bit…

Just sign a new 12mo lease and by next year with new president and you can see the direction of the economy…

I’d hang tight.

I’m trying to wait until after the election, have to deal with a nagging wife though. Renting a room at my parents for now, been there for 5 months. Lmao

You want to “settle” for a town home? Settle?

In Santa Monica, I found 5 homes being offered for over $2 million. The most expensive is offered at nearly $3 million: https://www.redfin.com/CA/Santa-Monica/2811-Arizona-Ave-90404/unit-3/home/6763071

Oops. That one was $1.2 million. This is the $3 million one: https://www.redfin.com/CA/Santa-Monica/1032-3rd-St-90403/unit-104/home/39627073

I was “certain” the housing market was going to go down in 2014 when my rent went up too. Because of it, I bought a small condo in a prime area instead of a more substantial property just to dip my toe in. Well, here we are two years later and its up over 20% for sure. Shows what any of us know

If you KNOW you’re going to lose 30% equity then buying would make no sense for you. When you send in your mortgage check each month it’s going to be primarily interest plus you’re throwing away money on HOAs (if it’s a townhouse) and paying for insurance other utilities a landlord picks up. Who’s really driving this decision?

What a steal at under $400k… and the yard comes with freshly mowed brown grass !

Is that what they mean by “ZeroScaping”?

Nothing wrong with brown grass. Best to let it naturally die in the Summer. We are in a drought of epic scale, you know.

Just read an article on the 10 highest incomes required to rent. The article used the government’s 28% of household income threshold. San Francisco topped the list at $216k, and Los Angeles was $145k. Since I know median household incomes are considerably less, unless you’ve owned a home for a while, my guess is that most of those living in these two cities, can’t afford them! The potential negative consequences of people living on the financial edge, draining their pocketbooks just to live, rather than saving or having ample disposable incomes to spend, are staggering! Anyone who thinks all of this will end happily, is a fool!

Yeah, sadly there is so much of the general population right now that cannot save and spends every paycheck paying for simple, basic cost of living (along with student loans, CC debt etc). I cannot see how our economy can possible thrive and expand if the majority doesn’t have disposable income to spend on superfluous consumer goods. RIP Middle Class…

Hang on B! I am seeing the same thing. Look at how long properties are sitting on the market? I believe that So Cal real estate is going to take a big dive after the election. The folks from China are no longer buying. There is no new household formation, (which should be the base of a solid housing market), as they are saddled with loans or low paying jobs. The bubble is about to burst because it is unsupported. Nothing is breathing air into it. Sellers are not getting their asking prices. I say wait until after the election. First quarter of 2017. Just my 2 cents.

FED has already embarked on debasement with ZIRP and QE. Next crisis FED for sure will go negative interest and push the melt up. Mark to market ensures the bubble won’t pop soon however, Trump winning could be the catalyst.

Catalyst to what? A sound economic future? Because what we don’t need is another Obama term. I’m not sure we need Trump either but definitely NO on Obama’s 3rd term.

Give yourself 6 months, reevaluate then. Even with negative rates, the govt will still be behind the curve and you will see 2-4 years of pretty strong downward pressure on housing prices. Its already started in earnest in places (like where I live) that started to roll over about a year ago. Patience, grasshopper!

@FutureBuyer I am of the opinion that it doesn’t matter who gets elected so long as the FED is at the helm of monetary policy. Trump’s protectionist policies and economic cabinet could actually speed the death spiral of the economy which, will happen at some point anyways. I don’t think the US will ever bring back production, invest into infrastructure or anything that will raise real wages. Which is why I think hyperinflation could be the result and thus having any asset, regardless of liability, could be a win since there might not be anyone to collect. All I want though is to work and provide a place for my family, I am a simple man trying to live honest.

“I think hyperinflation could be the result and thus having any asset, regardless of liability, could be a win since there might not be anyone to collect.”

I’ll bet a lot of people are thinking the same thing, however I worry that is the narrative.

If you are truly a simple man with a family and have skills, if you haven’t got a $200k income, MOVE! This blog is full of people with dilemma’s over California housing, that often sound like excuses! Life is about choices and sometimes change! I grew up on the beach, love the ocean, but left, and now own a home and 2.5 acres within 5 minutes of a huge lake, with a view of the mountains and lake, in the inland northwest … great public schools, hospitals, shopping, and smaller town feel … all for $300k, plus a boat. One of my kid’s bought in the Denver area, held for 2 years, sold at a huge profit, bought a lot and built a beautiful home 2 miles from mine, for a bit more. My Son-in-Law has hi-tech skills that don’t require an office or daily commute, and my daughter was quickly grabbed up even in a smaller community setting! My Son moved to Omaha for a very good job … he doesn’t especially like the weather there, but is stashing money away, giving him eventual flexibility, and options! The point is, options abound if you truly believe in your abilities and are willing to make a change!

@JNS Blasphemy!

“One of my kid’s bought in the Denver area, held for 2 years, sold at a huge profit, bought a lot and built a beautiful home 2 miles from mine, for a bit more. ”

Be VERY careful with these get-rich-quick stories from people who timed the market. The denver area is starting to level off and houses there are not a sure bet. It’s great that they were in the right place at the right time but it doesn’t apply to the current market.

Yeehaww! Housin’ to Tank, Ride it Down!

Housing To Tank Hard Soon!

Go Jim!

But when will these crazy prices come down?

There are a bit of pre-foreclosures on the market which if were to go into foreclosure phase, would increase supply and drive down prices. With mark to market regulations (think Enron) being allowed for banks, there is no reason for them to write down these liabilities. They are probably trying to work with these squatters to keep them in the home.

Use this for what its worth. I use what I call the mcmansion indicator to detect real estate price drops, or at least the beginning of the phase. I have found at least in the last 2 drops for southern california that the downward pattern begins in the Inland Empire and filters out west later on (6 -12months). I look at the 3000+ s.f. property listings and look for a trend in pricing. Normally prices would vary for example zip 92508 3300 sf asking price $750,000 then down the street another house in the same zip shows $550,000 aggressively pointing to the downside. Look at the value history of the properties to find the all time highs and all time lows. Eventually over multiple listings you will notice a pattern to the downside. As time goes on, more houses will lower their asking price and eventually will influence the smaller s.f. homes. Appraisers will eventually take note of the price per s.f. drop from the big homes and will cause stress on the overall price per s.f. for the area. I study the Riverside, San Bernardino, Palm Springs and Moreno Valley areas. Up north I would probably research Sacramento. Look at Real Estate cycles (8 year trends). This is just a theory and have no clue if it works anywhere else in the country. I dont even know if it will work this time around but at least its what I call an indicator.

Iceman that is a great theory. It makes sense. In a market rise people will buy further out if they can’t afford closer. So the reverse should be true for a market decline. As prices are more affordable further away, people are less likely to pay more closer in, so in turn they have to drop as well. I bet your right that SAC is a good indicator for the bay area.

Greater Sacramento area is exploding right now, bidding wars with cash buyers on everything. What is weird is that historically the SF bay area would turn first and then Sac gets hammered. This time around SF has been softening for some time and Sac is rocketing to the moon. Even in rural areas around Sac with zero job base or local economies are booming.

There’s a guy around here who keeps harping on how he doesn’t “see” a slowdown in Sacramento. It’s looking like the slowdown is getting under way in the Bay Area, so maybe there is something to the general idea you’re presenting. Might also work for rents. Check out the link I’ll post further down about renters gravitating toward NJ in the face of NYC rents.

Have you started to see this pattern emerge yet this time, if so do you know what stage it is at?

How is Inland Empire looking right now?

Finally! A thread that I can contribute greatly to. I’m an expert in the IE specifically Riverside and even more specific the wonderful 92508 zip code. I lived in this zip code for over 20 years and have been tracking the prices very closely. For the most part, what you’re saying is true. The theory part…I have a different outlook.

Within the 92508 zip code as it stands, real estate does vary wildly as iceman claims. However the swings are warranted because there are multiple types of homes in this zip code. Before a list them I want to say they are all amazing homes with the best schools so the quality of life is more or less the same throughout.

First off, you have the entry level homes. These are the homes that are a bit on the older side and sit on 7000-10000 SF lots. These would be like the homes on Van Buren and Cole surrounding Bergmont park or the older homes around Amelia Earhart Middle School. Those homes are about 30 years old. For a 3300 SF house, you’re looking at $300000-$400000 depending on condition and additions.

Surrounding that neighborhood are newer homes built more recently, less than 15 years old. For a 3300 SF house, you’re looking at 425000 to 550000 but that ranges from a basic tract home on 8,000 SF lot on the low end of that spectrum to a house with all the bells and whistles on a 15,000 SF lot on the high end of that spectrum. Bigger homes (4000+ SF) are rarely sold over $600,000 these days. For reference, these homes topped out at $900,000 during the housing crisis. My parents bought a home like this in 2002 for $470,000 present day value (~$320,000 not adjusted for inflation).

And then there’s the premier homes. These are newer homes custom built on large lots (0.5- 4 acres). These homes go for $650,000 to $1,000,000. Again that ranges from a custom 3000 SF home without a pool sitting on 0.5 acre lot to a 4000 SF home with a killer view, all the bells and whistles sitting on a 4 acre lot

For the most part the 92508 zip code does vary wildly but you get what you pay for relatively speaking. Swings on comparable homes in the same neighborhood would be no more than 7% difference. Overall, a great zip code to raise a family in but entry level homes are a bit steep for what you get but there’s more value the higher you move up IMO.

And finally for the theory part, I believe that if and when the next dip in homes happen it would vary depending on what factors involved. I don’t believe it will be like the 2008 crisis as the factors involved in that crash will be different than the ones in the next crash. I would say due the heavy foreign Chinese presence in the buyers market, a withdrawal from them for any reason, be it Chinese economic collapse, money laundering regulations enactments, tax increase on foreign buyers (yeah right), would greatly affect the coastal areas due to their heavy presence there. The more inland you go, the less of an impact. I guarantee you that foreign investor presence in cities like Riverside are far less than cities like Irvine. The only thing I can see impacting those homes greatly would be an increase in interest rates which would increase the monthly mortgage payment which would then price out a lot of potential buyers. Other than that, I don’t see prices in the inland empire dipping more than 15% in the next 5 years. But it’s anyone’s guess depending on which factors come to play at what time. If anyone has any questions about Riverside real estate specifically the 92508 zip code feel free to ask away and I’ll do my best to answer them based on my experiences!

I’m not convinced New Age, but am not certain either way.

Below isn’t for SoCal, not even for the US, but I tend to think it holds true for many housing bubbles. (Read about similar in Japan as well).

———-

>> In the 1989-95 crash these were the people that got hit the hardest. They’d bought in a huge rush in the late 1980’s as they were fearful of being left behind. But all they could afford was something really cr@p in a terrible location.

When the market’s booming some people can convince themselves even the worst place “has potential” or “is good enough for now”.

When the crash came it didn’t hit all properties equally, if you had the dream house on a lovely street there were still buyers, just at a lower price.

But the couple in their ghastly property on an awful street didn’t have that option. Their property didn’t just suffer a fall in price, it was quickly rendered very very very low value.

When the market falls all that “potential” and “good enough” stuff goes straight out of the window, everyone suddenly becomes very discriminating about property, the slightest flaw and a property is blighted and not worth viewing. <<<

I see what you’re saying and it holds true in most cases, however, I do believe this time it’s different…and not in the “prices will just keep on climbing!” sort of way. I mean that there are unique factor involved in this bubble. I believe the opposite will hold true in the event of crash. Properties on the high end of the scale that are being bought up by Chinese investors will crash the hardest because of the fact that the average American won’t (or can’t) pick up the slack. Homes on the lowest end of the spectrum will also hurt badly because wannabe slumlord investors will not make the profit they were expecting when they based speculations on high rent. Properties in the middle will dip but no where near as dramatically as high and low end. The whole reason houses in Riverside were on the rise during this boom was because it had to agree with the laws of economics in the sense that there’s no way that a house in OC would sell for $1 million yet the same house sells for a quarter of that 50 miles inland so appraisers took that into consideration and factored that into Riverside real estate. The problem is that no one is actually buying in Riverside at the rate people are buying in LA or OC so there’s an upper limit to how far prices could go in Riverside and we’re about there. And with interest rates low enough to keep the mortgage affordable, the blue collar homebuyers slowly bought in maybe out of fear of missing out or maybe because rent was increasing that it “made sense” to buy. You’re forgetting that 2008 hit this demographic of homebuyers the hardest and that’s evidenced by how hard Riverside in particular was hit (which is a blue collar city). Sure a few investors lost money here and there but it was the middle class that lost the most so they’re not too keen on buying back in. The way I see it, every $2 in home value increase for OC real estate is a $1 increase in Riverside real estate out of formality and I believe when the crash happens, the same could be said on the way down as well.

Hi I wanted to know which are the good areas to buy a single family home in Riverside.

How about Temecula is is good to invest.Which areas have good school districts in Riverside.

If we buy a home for 450000 to 500000 will there be any apprciation in the future.From your post it seems that the prices have never appreciated in Riverside.Owners are selling for less than what they purchased.Are the prices in Riverside inflated or on the higher side and if so by what percentage.

You article was very interesting especially for people who are planning to invest in a new first home.

In my opinion, this is a logical way to look at how this market will end. If the driving distance to your job forces you to buy in areas that are beyond what the average buyer will be willing to do is likely the epicenter will the market will correct first as Ice indicates. All these homes that are in response to many variables but usually comes down to having an income to survive on makes contractors build in areas that used to be open land for a while and don’t have much to say close by stores , schools, or are bit further from first responders. This would help answer some of these clues.

Mr Miyagi is really old now and no longer teaching Karate but his former self would be telling you to wax off or keep your hands off real estate.

The Sacramento region is not red hot and it has price peaked…..price reductions were apparent as of yesterday in multiple searched conducted. Sure their are sucker buyers, just like their is an ass for every seat. 20% correction is coming for that hood….

Don’t throw tomatoes at me, but I think this house is a great deal for someone wanting to enjoy the S. CA lifestyle and climate for the rest of their lives. If someone has saved the 20% down payment (73K) and they have a 290K loan, the mortgage payments are about 1200/month(1550 with property taxes). Not bad considering a few miles away, they are paying over 3K per month for rent. At $1550/month, their combined income needs to be about $60K to satisfy the 28% recommendation. That seems doable. What am I missing.

Bob,

I’d be concerned for gang violence.

Which is PC for, “don’t want to live near minorities.”

Hardly. It’s nearly impossible to live in LA without living near minorities, as it should be. There are certainly still sketchy areas of gang violence.

GH: It’s nearly impossible to live in LA without living near minorities, as it should be.

Why should it be like that? Is it not enough for a white person to be color blind? Is there now a moral obligation to seek out minority neighbors? Is it a moral failure for a white person to live in an all-white neighborhood (assuming there is such)?

I don’t care what race the gangs are. I just don’t want to live by them. Huntington Park gangs are pretty bad. Florencia 13?

Here’s more:

“As of 2000, speakers of Spanish as their first language accounted for 90.77% of residents, while English was spoken by 9.17%, Chinese by 0.05% of the population. As of 2008, the total population of Huntington Park is 61,155. 48.8% of residents are White, .6% are Black or African American, and .5% are Asian.

51.2% of residents are foreign born. Only 6.5% of residents have a bachelor’s degree or higher and 45.7% have a high school degree. 21% of families and 22.9% of individuals live below the poverty line. The median family income is only $37,035, which is nearly half of the national average.”

Now granted that was 2000. But I don’t think there’s been some sort of educational or economic miracle in that area.

(I hope I’m not coming across as snarky as my intention is to sincerely answer your question.)

That’s old data but Huntington Park is a smaller version of Santa Ana, not much changed.

The 2010 census showed that Huntington Park had a population of 58,114 and was over 95 percent Latino.

https://en.wikipedia.org/wiki/Huntington_Park,_California#2012

http://maps.latimes.com/neighborhoods/neighborhood/huntington-park/

I think what you’re missing is that first time home debtors can no longer count on staying anywhere for the rest of their lives anymore. Have you been to Huntington Park? It’s a lifestyle of lowered expectations. Pretty much cancels out any positives of living in a smog filled climate of sameness with increasingly more uncomfortably hot days.

Housing To Tank (REAL F*CKIN) Hard Soon!

Yes! 🙂

“Real Homes Of Genius” ! How I’ve missed you.

And a really really cheap one this time as well /sarc.

After a quick Google street view of the surrounding neighborhood, I can only see buying this if I could get a permit to fly in and out by helicopter.

I also did a google street view of the closest major intersection to that house, and I would only buy this if I could move it somewhere else.

Things that make you go hmmmm……

Did You Know?

The overall crime rate in Huntington Park is 27% higher than the national average.

For every 100,000 people, there are 10.27 daily crimes that occur in Huntington Park.

Huntington Park is safer than 13% of the cities in the United States.

In Huntington Park you have a 1 in 27 chance of becoming a victim of any crime.

The number of total year over year crimes in Huntington Park has increased by 2%.

“you have a 1 in 27 chance of becoming a victim of any crime”

Can I pick the crime? I’ll take a gentle groping, please.

Wrong, because most crime is not random. It is intentional. Look at Chicago and you will see almost all their murders and violent crime involve either gangs or people buying/selling drugs.

I know many people that live safely in crime ridden area because they simply stay out of the drugs. Yes, there are stray bullets and those couple of deaths each year make headlines, but when you consider crime, you need to take in actual consequences.

Sure, one can live in a crime ridden area without being a victim, but at what cost? Your going to need a fence, alarm system, big dog, and a gun. That’s just to protect your property. Not much you can do when your coming and going. I have lived and know people who do live in questionable neighborhoods and no matter how much you try and separate yourself from your surroundings, the crap eventually creeps in. That’s why better neighborhoods cost more. What’s peace of mind and a good night’s sleep worth to you?

Rent slowdown not contained to SF and LA.

“NYC home vacancy rate hits July record, benefits renters”

http://touch.metro.us//new-york/new-york-city-home-vacancy-rate-hits-july-record-benefits-renters/zsJphj—0aNmzbQv2oR1M/

Huntington Park is home turf of the Huntington Park Locos: https://www.youtube.com/watch?v=DputupP0yZ0

Nice neighbors.

Funny, they don’t look like railroad enthusiasts.

The same could have been said about Venice or Echo Park in the 90’s. Now look at them.

It helped that Venice is near the beach. However, parts of Venice Beach are still bad and crime infested.

Echo Park is still gangland with at least six gangs: Echo Park Locos, Diamond Street Locos, Frogtown, Crazys, Head Hunters, and Big Top Locos. The median household income in Echo Park is only $37K and a high percentage of households earn $20,000 or less. Renters occupy 76% of the housing units in Echo Park and 53% of the residents were born abroad.

http://www.lamag.com/citythinkblog/the-gangs-of-echo-park/

https://en.wikipedia.org/wiki/Echo_Park,_Los_Angeles

Hey Doc, speaking of Huntington Park, here is an article from LA Times on home prices in which HP is mentioned as an area with strong price increases.

————————-

From LA Times today

Southern California home prices kept surging last month, with the median price rising 6.2% from a year earlier, according to a new report. The six-county region’s median clocked in at $465,000 in July and has increased every month for more than four years, real estate firm CoreLogic said Wednesday.

Regionally, prices are still 8% below their bubble-era highs, but in some communities — such as Highland Park in northeast Los Angeles and broad swaths of the Westside, including Santa Monica — the combination of record low mortgage rates and a shortage of homes for sale has pushed values beyond levels seen last decade.

Sales, meanwhile, dropped 10.7% last month from July 2015 — the largest decline in nearly two years. That could be a sign that would-be buyers are finally balking at forking over an ever greater share of their income for housing.

But CoreLogic had a more benign explanation: Compared with July 2015, there were two fewer business days last month in which to record sales with county authorities. “The average number of home sale transactions recorded daily in July 2016 was only about 2 percent lower,†CoreLogic analyst Andrew LePage said in a statement.

Many experts predict prices to level off more — in large part because only about 30% of California households can reasonably afford to purchase the state’s median-priced home, which last quarter was $516,220, according to the California Assn. of Realtors.

For now, there is plenty of demand — and cheap financing — to push values higher. Prices rose in all six counties tracked by CoreLogic.

Those kinds of rising home values in Southern California and across the nation have improved the outlook of builders. This week, the National Assn. of Home Builders said its confidence index rose two points in August, and the Commerce Department reported that builders started 2.1% more homes in July than a month earlier.

Still, developers are not constructing homes at historically normal levels — one of the factors experts blame for the shortage of houses for sale and strong price appreciation.

That’s HIGHLAND PARK!!!! not Huntington Park. Highland Park borders Pasadena and South Pasadena. Huntington Park borders Bell and Cudahy. I grew up in Highland Park, and there are hills with houses on them that are somewhat secure. Huntington Park is flat as a pancake. That being said, I’d rather move to the Cayman islands than to Highland Park. And I’d rather move to West Hell than Huntington Park.

If you move there, just remember that sound you hear at night is firecrackers. Just firecrackers. Never lived in the ghetto but I’ve heard that as long as you mind your business, things should be fine.

Just don’t buy anything nice in there. You may want a cage to lock up your electronics when you’re at work.

Hello everyone…

I am a long time follower of this blog and read all the comments religiously. I find it a good source of learning.

First time time posting. I’ve posted a similar question on a different blog and received some great responses. Most of the responses did not pertain to Southern California and more specifically San Fernando Valley. I wanted to see if anyone can provide an empirically driven opinion as it related to the below mentioned cities/area?

I missed the boat buying in 2010/2011. Had a nice down saved, but lost my job and would not be able to get a mortgage. I have been reading, researching, analyzing, and waiting for the right time to buy. I feel like the prices have definitely stopped rising, and in some areas are actually falling.

Variables:

– Have 20% down (maybe more for a right opportunity)

– 800 FICO

– Stable job with low six digit income

– Looking in San Fernando Valley, CA (Sherman Oaks, Studio City, Encino, Tarzana, Woodland Hills – only for a house, not condo/town house)

– Would like to have kids, so school district is important

Given the above variables, I assume the recommendation would be to wait a little until the prices drop. How long is a while? When should I be ready to jump in? End of 2017, early 2018?

I don’t mind paying higher interest rate but buying at a lower price. I can always refinance down the line, if need be. Don’t want to miss the boat again. I think if I miss it this time, I am going to be priced out of anything reasonable until like 2025/2026.

Any advise would be very much appreciated.

Thank you.

I thinknk you’re too pessimistic on your situation. I bought in 2011 and while the grass is greener for me, I can’t help but see the delusion driving the market today. At best, I see pricing stabilizing from here on out, so you won’t be priced out any more than you are now if you wait for short/medium term, but will have the option to buy IF prices go down if you wait. My advice – be patient. Everything (including CA real estate) is cyclical.

The Analyzer…I have been in the RE game a long time, you are correct to believe that paying a higher interest rate to get a lower price can happen. I believe at present where banks are in no hurry to finance homes at 3.50% for 30 years. they will be in a loaning mood at 5% or better when it happens.

CA has to be taken as a different animal, housing can change rapidly you must be on the prowl to look for opportunities.

No matter who gets elected I feel the economy and market may crash sending us into the dire spiral, than you have no jobs and no way to pay for lower house prices, pick your poison, all looks rather dark to me?

if anyone gives you a date like end of 2018 they’re so obviously full of it; the market will move when it moves, be it by demographic shift+necessity, change in policy/president or pure mania — and it’ll do it with or without you, irrespective of what anybody on this comment section has to say

you say things like ‘refinance down the line to a lower rate,’ ‘when rates rise’ and ‘lower prices’ as if any of this is a given; i’m firmly in the –no analysis is given– camp, but the data (if it can be trusted) very much is .. so unless you know an insider (hint: they aren’t commenting on this blog), don’t play that game

do your own analysis and have courage in your convictions. even if that means not buying until 2025

Just wait until six months or so after the election. If the election results are going to cause a price change, it’s a good guess that would happen in the months immediately after. I’d also say that it’s a good guess that whoever is our next POTUS won’t cause a sharp increase in prices post-election. So, maybe you see things go down, or maybe they stay the same.

Can anybody see any other milestones in the next few months or years that would impact pricing? I can’t. Of course pretty much nobody will see the black swan prior to its arrival.

I live and drive around the valley. I see for sale signs, but they’re usually on busy streets. I can’t imagine living on a busy street. I think the placement and location of the house would be the most valuable thing for me. Especially if you can be shielded somewhat from loud and noisy neighbors, barking dogs, traffic noise. Hard to find but if you can find a place to find refuge, peace and quiet, it might then be worth the price.

“– Stable job with low six digit income”

how is it that everybody makes over $100K and yet I’ve not had a raise in 20 years? I don’t know one person…….NOT ONE….that could afford to buy the house they live in on their current incomes which is not even CLOSE to $100K

Motel California, prices are not falling in Sacramento, there is not even more unsold inventory. I am just calling a spade a spade. I know you want the situation to be different but this is just simply what is occurring right now. Prices are nuts, you and I both agree on that, but we cannot project our desires onto a marketplace. It is what it is. No matter how hard you want a crash the fact is at the present the greater Sacramento market is on fire more than ever. Ask anyone who is plugged in and tracks this market and they will tell you the same.

Mrs Miyagi, I’ve never claimed prices were falling in Sacramento. Not sure where you got that from. I couldn’t give two shits about that area.

hmmm, I did search last night and had 15 price cuts in last week….

prices are falling, as someone whom has owned in Roseville and knows the town and salary range, a 20% correction is looming in next 2 years….

Curious; for those that believe there will be a pullback/correction, how much of a drop would you require in order to jump in from present prices?

10%? 15%? 20%? 20%+?

If there was a 20% reduction from current prices I would purchase more investment property.

Really? That’s where the prices were just a couple of years ago. We’re you buying properties in 2014?

If I can get a house for 12 times the annual rent I would buy it.

Yes, I found good deals up through 2015, but outside of LA in the IE. They were few and far between but they were still around if one could move fast enough. Since Spring 2016 it’s been brutal. Properties going pending in days with multiple offers over asking. I’m hoping it slows down as we get closer to the holiday season.

Wife was looking at a house in South Orange County.

Listed at 900k

Bought for 550k in 2012

Insanity!

There is an old saying in Sacramento. When State Government employees can not afford to buy a home, or can not afford to buy up, prices must correct.

We are currently at that point.

there is also an old saying here in L.A. “If the glove don’t fit, you must acquit.”

Very true. Agree with that.

i think B is a troll….this is so F’ing 2006 all over again. He’s almost going word for word.

i wonder if he’s just doing a copy/paste thing?

also, I’m sure 2 “professionals” both making over $100K each will pick up this property….LOL

Agree. Just like the iterations of Jim Taylor, false flag posts I recall from the prior bubble run-up as well. Seems to me there likely is a proportional relationship between the non-sustainability of the bubble and how desperate they become to convince us skeptics of what they “see” in their crystal ball.

Thank you everyone for the comments…

Looking at the valley’s YoY prices, the better areas closer to Ventura are hovering at an approximate decrease of 8-9%.

Is that a beginning of a correction or has a correction taken placed?

Looks like the bubble burst has officially commenced, Vancouver being ground zero:

http://www.zerohedge.com/news/2016-08-18/vancouver-housing-market-implodes-average-home-price-plunges-20-1-month-market-devas

here’s what doesn’t make sense:

you go pending at $1m

tax of 15% instituted

deal falls through, price goes down 20% (if it can be believed)

with the 15% tax on $800k + $80k + $40k = $960k

and yet people are waiting for prices to fall even further?

btfd

Just need that to blow over to Cali 🙂

The slowdown in Canada can be attributed to a new 15 percent property transfer tax for foreign nationals buying real estate there. Party is over for Chinese investors in Canada.

According to Garth Turner, the Chinese contribution to Vancouver’s bubble has been blown way out of proportion, so the bulk of it has been driven by good old fashioned domestic leverage. He’s also claiming that the recent burst was baked into the cake long before the tax. I’ve no idea if he’s right, although it seems to me that marginal buyers can still be enough of a catalyst to set the trajectory for a market, but time will make it clearer. One thing is for sure, he made the call to get out not long before the tax was announced.

http://www.greaterfool.ca/2016/08/19/vicious/

Craziness!

Los Angeles is known for many things, and unfortunately, its expensive housing market is one of them. Despite this, real estate plays a huge role in the LA area, and it’s no surprise to see that reflected in Silicon Beach, where a booming real estate tech community is growing to meet any consumer’s needs. Here are some of those companies helping out.

http://www.builtinla.com/2016/08/15/real-estate-tech-companies-changing-how-we-buy-homes

Yeah but La is more complex than Silicon Beach it still is way behind Orange County in Median income which means that LA has more areas that pay like Huntington park and not Santa Monica. LA’s median income is pretty low for as expensive as it is about 56,000 versus only at 76,000 and San Diego at 62,000. I read stats from the US Census. So, both OC and San Diego can’t have that many more people that have double income households compared to LA.

Long time lurker here. Enjoy the news out of California. I’m like B, but in Atlanta. Currently looking to buy but think I should stay put in the rental I’m in. Anything remotely affordable north of the city goes in an immediate bidding war. Houses are much more affordable here. 280- 300k gets you a 4-5 BR 2-3bath, nice place. Houses selling in the range of 250-280k are snapped up very quickly. 350k and up are not selling as fast. Anyone on here live in Atlanta? Would love to get your thoughts on the market here.

Turns out that young people aren’t priced out of this market. This young lady just bought her third house.

https://www.yahoo.com/celebrity/m/fd5efa82-d23d-334d-bec7-fbc430ee4867/19-year-old-kylie-jenner-just.html

Even China is cracking down on illicit money leaving country: http://www.bloomberg.com/news/articles/2016-08-17/china-crackdown-on-illegal-money-flows-sees-450-people-arrested

Friends n Vancouver told me few months back that housing in Vancouver would never go down.. hahaha

This new listing in Highland Park made me nearly spit out my coffee this morning! Purchased in 2012 for $350k, now listed for nearly $1.5 mil! Over $1800 per sq ft!

https://www.redfin.com/CA/Los-Angeles/631-Cross-Ave-90065/home/7078706

I am finally ready, financially, to purchase in LA but definitely waiting for the insanity to stop before I do!

But you forgot to mention that it’s a whooping 813 sq ft!

That’s a whole 23 sq ft more than my condo!

Technically, that’s Mt Washington not Highland Park. Even when I lived in Highland Park, Mt Washington was considered separate, and more expensive. They may have put in that staircase up the cliff to upgrade the little old cabin at the top. That could upgrade by 50K I suppose, or maybe more depending on how much it actually cost. The quarter acre lot isn’t a real quarter acre as a lot of it looks to be at a 45 degree angle. Mt Washington had a lot of Bohemians living there when I was a kid, and may still have hipster appeal.

The City of LA has split some neighborhoods like the old Hermon district off of Highland Park to help Real Estate agents dress up their sales pitch.

This South Pasadena home listed for $945,000 — and sold for $1,200,000.

https://www.redfin.com/CA/South-Pasadena/1705-Mission-St-91030/home/7006668

Wow. No Hard Tank in sight. Not that I can see.

That’s on a street that is a commercial street west of Fair Oaks. This is about a block and a half east of Fair Oaks, the commercial main drag of South Pas. I used to go over there with friends when I was young to the Rialto Theater. Saw a Beatles movie there. Wee were PO’d at the girls for screaming when we wanted to hear the music. That was in a cheaper area of South Pas. when I was there. There were huge old homes in SP that were expensive back then. Plus the new houses in Altos De Monterey tat were built on our old adventuring grounds.

No slowdown in sight here either. Booming more than ever.

Slowdown and tank are two different things.

This Santa Monica house goes for nearly $900,000: https://www.redfin.com/CA/Santa-Monica/1415-23rd-St-90404/home/6767527

No garage. 1 bathroom. 828 sq ft. Built in 1913. All for $899k.

The problem is not sellers, it’s buyers. Until people stop throwing stupid money at every semi-decent property, causing bidding wars and eventually pushing prices even higher then the already ridiculous asking prices, this current sellers market will continue as-is.

Bubble won’t burst until all the stupid money has been sucked in.

It feels like the last throes of a market topping out but the levers that cause a crash aren’t here yet. We need a big increase in interest to kill sales and adjustable rate loans. A big loss of jobs might do it too. As long as people can hunker down and make their house payments they may not sell but they’re unlikely to be foreclosed on either. The Fed is extremely reluctant to raise rates because they don’t want another crash on their watch and don’t want the federal debt to go crazy. The motivators to sell aren’t really here. People need to live somewhere and as long as they can hang in their they know the benefit of hanging onto their house for the long haul. You can sense the pressure for more inventory as you read the posts but who wants to sell? People want to tough it out unless they have to sell or get forced out. I’d like some correction so I can buy some more property at a reasonable multiple but I don’t want to sell what I have. Maybe there will be desperate sellers next year – or maybe not? What do you see driving houses onto the MLS?

Tech bubble 2.0 bursting and resultant job losses.

@Hotel – Agreed. It will be the most likely catalyst. I am waiting for the NASDAQ to crash any day now.

Slightly off-topic, but if a single person were looking to buy in the next couple of years, with the following guidelines, what areas would people suggest looking into?:

A) Distance to job is not a factor, but would generally like to be within an hour-ish of LA (but will consider other nearby options).

B) ~400-450K ish

C) Space, and the ability to have/build a personal workshop/artist’s studio at home. So, it can’t be a tiny shack, and no condos or townhomes, etc. Would also consider some sort of building conversion project if possible/appropriate.

D) Doesn’t have to be a pristine neighborhood, but I don’t want to be scared for my life everyday, either.

And before anyone mentions it, I’m not moving to Texas. I’ve already lived near those parts. I’m definitely not going back. 🙂

Leave a Reply