If Everyone is Leaving California, why is it that Home Prices Keep Going Up? Education and Politics are a Driving Force.

Depending on what you read, you are living in parallel universes regarding what is happening in California. On one hand, you have the world is ending narrative and that people are moving to greener pastures to places like Texas. That narrative took a hit when the Texas grid went off the rails because no man is an island. On the other hand, you look at California real estate prices and they are going up as if no pandemic ever happened. This applies to most metro areas. Real estate supply is low and house humping people are willing to FoMo since they fear they will live in an apartment for the rest of their lives if they do not act now. Also, California’s budget is now flush with cash which reinforces the idea that things are going well. But when you look at the data, something is very clear. California is drawing in people with college degrees and those that do not have a college degree are largely leaving. Let us look at the data.

Education and Politics

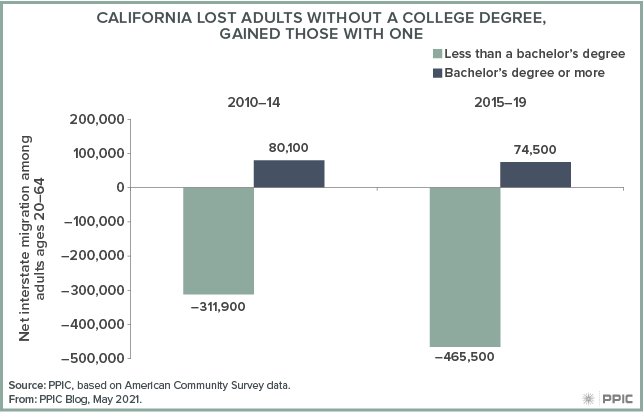

While California may not be growing as fast as it once did, it is certainly growing. But you can look at this chart and see what is happening:

California is losing many adults without a college degree. My sense is that many of these people want the “American dream†which means owning a home. And for many, looking at crap shacks for $1 million just doesn’t seem within reach. So these people are leaving to cheaper places like Texas and driving prices up there as well. However, you will see on the chart that those with college degrees are still coming to the state. We still have companies like Google, Apple, and Facebook for example that are technological powerhouses and pay very well. But you are not going to work there if you do not have the required skillset (aka a technical college degree). Then you have companies like Coinbase which are riding the $2 trillion crypto currency wave (that story is still yet to be written).

So California is not done by any means although that fits into a convenient political narrative – especially for those wanting to avoid taxes. Yet that is the beauty of the US. We have 50 states with a variety of flavors and you are able to leave very easily. Get a U-Haul and take off. But what this tells me is that people want the Tesla lifestyle of California but want it on a Pinto budget. So that is where the cognitive dissonance comes in. “Oh, you mean you want good schools and colleges but don’t want to pay for them?â€

Orange County just announced that the “typical†home is now $1.1 million. This is for a county with 3 million people. However with cheap rates and two professional working couples, swinging a $4,000 or $5,000 mortgage payment is doable. It means a sizable portion of your cash is going into your home but you can eat McDonald’s and live in a nice crap shack. That seems fine for people that are leveraged up to their eyeballs in debt.

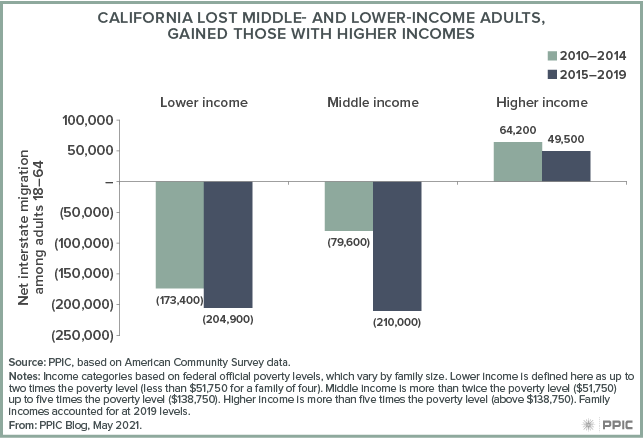

This migration out is also seen among income lines:

This isn’t surprising. California is expensive. Even within the state, you have those that move more inland to afford homes. But the appeal of California is largely on the coastal areas and tech hubs like San Diego, OC, LA, SF, and Silicon Valley. Those areas are expensive because you have limited supply and people are still pumping out kids and once that clock starts ticking, people are willing to FoMo into anything. Last I checked, tech people still want to pop out kids in the real world and not the virtual world.

However I do want to point out that people are leveraged to an insane level. A minor recession can crush this market. I do want to share a history lesson that the vast majority of foreclosures that hit during the Great Recession were vanilla mortgages, not your NINJA mortgages. It is a nice narrative to say the bubble popped because of subprime borrowers (aka those floozy losers that conjure up whatever propaganda image a person may have in their mind) but what happened is that the economy hit a grifting wall and everyone was impacted. And the largest grift was from Wall Street where sitting next to a Bloomberg terminal is glorified and picking up a hammer is looked down on.

So yes, people are leaving and coming into California. But what is driving this is education and politics. Net-net things are still growing but there are so many variables out there like inflation, Fed policy, and other factors since this kind of stimulus we are doing is unsustainable long-term. As we open up things are going to get really interesting.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

108 Responses to “If Everyone is Leaving California, why is it that Home Prices Keep Going Up? Education and Politics are a Driving Force.”

Thank you for another great article.

I work in tech and my co-workers who moved to CA and now rent an apartment in CA are:

1) New college grads who were offered an enormous salary out of college.

2) Not married so they rent a one bedroom apartment.

3) They didn’t even have enough stuff to rent a Uhaul. I saw pictures of new hire who had packed his entire worldly possessions into his Toyota for the move.

The enormous salary is not enough to buy a house yet, but it comfortably rents a one bedroom apartment near the beach. You are only young once.

If they stay, gain experience, and job hop for higher salaries, then they may at least qualify to buy a house.

To buy a house in CA since the late 1980’s, a buyer has had to stretch and live frugally. This is not a new thing but it seems to me that more stretching is going on today than ever before.

Historically, if you stretched and purchased a house in the 1990’s and lived very frugally for 15 years, you are likely OK now. Actually, you are probably a millionaire with all of your equity tied up in the house. If you still live there, it would be hard to move to a cold/hot strange place that isn’t close to the beach.

If you rented for the entire time, you are likely poor and have to move due to rising rents.

I went to high school in S. CA in the 1980s. All of my classmate’s parents who purchased a house in the 70’s and 80’s are still there and aging in-place. The parents who rented in the 80’s have long moved away to cheaper places.

If I was just married, in my 30’s, wanted kids, and had no college education and flipped burgers for a living, I would leave also to somewhere where I could qualify for a house.

“it would be hard to move to a cold/hot strange place that isn’t close to the beachâ€

The numbers suggest it’s not that hard for a ton of people and more people every year are doing it.

Because most don’t have a choice. They have to lease.

>If I was just married, in my 30’s, wanted kids, and had no college education and flipped burgers for a living,

The only problem with this narrative is that even the rich need someone to flip their burgers.

I think that the first place I’ve felt this exodus of the the working/gig-class has been in Uber and Lyft: there are far fewer drivers available than there once were. Maybe that’s what we want though: driverless cars to run the rich around.

The just the size of population makes it a hard place to predict. Many leave because of many reasons one being, you are always a small fish in a big pond?

“However I do want to point out that people are leveraged to an insane level”

Really? I thought a lot of people were supposedly buying with all-cash…? I mean, all the homes we’ve bid on we consistently get beat out with all-cash offers or down payments much higher than what we put in.

What data are you seeing that shows these “insane levels” of leverage that people have?

There are ways a buyer can get an all cash offer without the cash. I have read several examples of buyers getting this then it appears the buyer has all cash so they can compete against truly all cash offers such as or foreign national buyers An example is the couple in Riverside who bought “all cash†but in reality took out life savings and a hard money loan (they were the ones who were reported on widely the seller wouldn’t leave for months and they couldn’t kick him out due to eviction moratorium)

https://www.foxla.com/news/couple-buys-riverside-dream-home-but-seller-refuses-to-move-out-in-eviction-moratorium-loophole

I’m under the impression these began to give buyers a chance to compete against deep pocketed foreign buyers who truly were bringing suitcases of cash in to buy a house but I could be mistaken.

https://www.homelight.com/cash-offer

I wonder how we track people coming from China and buying in CA with cash?

Ok, so people might be getting hard money loans etc but is that a popular thing? Who’s providing the hard money loans and is this a high-volume business?

The other thing I wonder about, when we talk about people being “over leveraged” is how that can be reconciled with everyone else who points out how this is different from 2008 in that lenders have much tighter standards when it comes to approving the loans (e.g. if your debt-to-income ratio is not good then you’re not going to get approved). The only thing I can think of is people buying their expensive dream home FIRST and then creating lifestyle inflation immediately upon doing so (e.g. financing a complete home renovation of their new place with high-end upgrades, new Teslas, RVs, boats, and whatever other toys they plan to fit in the new place)

The only decrease in debt was credit card.

https://www.cnbc.com/2021/05/12/household-debt-climbs-to-14point64-trillion.html

Maybe the good Dr can answer this.

If I was selling my home and I had multiple offers:

1) All Cash at full price. (How does someone prove they have the cash? Text a copy of a bank statement?)

2) A pre-qualified loan letter from a major lender and an offer 20% over full price.

I’d take number 2. I know that cash is king but I’d trust any major lender to deliver the same. The buyer may be highly leveraged, but the lender has qualified them.

The questions are:

1) Are the lenders doing a great job of qualifying? As a seller, once the deal is done and escrow has closed, it is not my problem anymore. I got my money.

2) How much the appraisal comes in at. Can the buyer cover a shortfall with cash?

3) How big is their down payment? Can it cover any shortfall in the appraisal.

I suspect that the people buying houses are in tech, finance, or have a successful business. M is a good example.

I also suspect a buyer has a high enough salary to qualify and more than enough bitcoin (5X increase from 2020), Tesla stock (6X increase from 2020), or any tech stock (2-3X increase from 2020) to come up with a 20-30% down payment to easily qualify with a lender.

If they are older and already own a condo, they can also take the gains and ladder up.

I believe there are more people in this situation than there are houses on the market.

I agree – thinking about it more, there are obviously a ton of people who got in on discount homes during the Great Recession. I know a couple who have ‘laddered’ their way up to much more expensive homes now. Although, I still think a number of people might be overleveraged (even some who laddered and were buying more home than they needed or should have), not maximizing savings or retirement/401k, and if they were to lose their jobs they’d have little to fall back on.

When I see these irrationally exuberant house-horny people jump into the RE pool (never mind the piranhas), I remember as a younger man, being desperate to get laid, finally “scoring,” only to wake up from my stupor, looking at the snoring hood-booger laying next to me, thinking…”my God, what was I thinking?”

Hahahaha, that’s called a one-night stand. And there’s a lot of *that* kind of activity going on currently, I presume. A few people might be in it for the long-haul though 😀

Friends don’t let friends over bid on hood-boogers.

Hands down, that was one of the funniest comments I’ve read.

Ha. Did you waive the inspection on the hood-booger?

Hahaha! I’ve made the same analogy to my friends who make poor investment choices.

One of the ‘bailer-outers” here. Lived in OC since ’82, bought a house in Westminster in ’87, and several more (for flips) after that. It took a lot of scrimping. I sold my last house in Long Beach in 2018 and moved east.

The mantra followed the Kyosaki and Trump maxim–it’s cash flow. And, apparently, it still is, with the hope of a large payout in the end. That payout comes at a price, via suffering financially at times along the road and then knowing you’ll have one final move to make before you ‘rot in place’ in your high-equity mausoleum.

I was lucky. Made my equity (and then some), sold at a temporary ‘upper’, and waved goodbye. Some people won’t have the nerve to do that as they age. They’ll die ‘rich’, and the kids (if any) will have to throw out the cans of pork&beans when they come over to clean it up for the sale.

Pretty sad cycle, fallen into in order to ‘live the good life’ during your best years…

My goal is life-balance.

Have enough liquidity to live comfortably in my warm comfortable mausoleum house and do the things I want during retirement. I am fortunately not an excessive person, but I have my hobbies which entails some expense to keep me busy.

If my house is worth multiple times my cash by the time I pass into the great CA sunset, then my kids will have the same comfortable retirement by selling the house and the remains of my stuff (I am careful not to have an overwhelming amount of burdensome stuff). If I pass in my 80’s, my kids will be at retirement age and mature enough to know what to do with a windfall. Currently it will be at a stepped up basis, so the house I bought for 200K will bring them millions in tax-free retirement. Not fair, but that is the way it is now. I don’t want to sell my cozy mausoleum now and send most of the gains to taxes. Stepped up basis is the great inheritance tax avoidance for any asset: houses, stocks, art, collectibles……… Mausoleums included.

As an additional note: When I die it will be of natural causes.

Not from heat stroke in Phoenix , Texas, Florida, or any town in Flyover.

Not from comfortably freezing to death in the North or any town in Flyover.

It will be from natural causes near a beach in my mausoleum in CA.

I visited Coeur d’Alene last winter. Saw some houses. They actually had open houses, and people walking about without masks.

It snowed while I was there. A beautiful, light snow. Nothing heavy, but it made everything pretty.

I also noticed that many of the houses had fireplaces. And heating systems. So no worries about any of them Idahoans freezing to death.

I also have friends in Arizona, Florida, and Texas. They have air conditioning. So no worries about them dying of heatstroke.

I’m tempted to move to Coeur d’Alene. Friendliest place I ever visited. But most of the people I know are in SoCal, and I’m used to it. So I’m torn.

Us older people (ie: baby boomers) are astounded at home prices, yet shouldnt we be astounded at the amount of money out there in the hands of young professionals?

As ‘seen it all before Bob’ says

college grads with enormous salaries.

I saw an ad that was from Verizon for entry level network engineer, salary $85K

As far as who is NOT leaving California.

I sit back and watch my right winger friends here in LA, LA, LAnd constantly complain about liberal California and talk about the wonders of AZ, TX and FL but DONT leave California. haha.

You seem to think cost of living adjustments can only happen during your career, pensions and social security. $85k is not typical but still worth less than $55k just ten years ago

Entry Network Engineer for 85k? Sorry, that’s the low end. Tier 1 (FANG) / Tier 2 and Tier 3 companies are fighting over college grads like there is no tomorrow. New College Grads for Software engineering at $125k starting, with $30k signing bonus, and $60k RSU. (This is a Tier 3 software company not located in bay area) Work for a few years, promote to level 2 or senior level, and you will get to $150k base with 10-15% bonus with RSUs.

My teammate with 5 years of experience was offered a package at facebook, $200k base, $200k equity, annual bonus 10%. BTW.. he is an interesting case, he didn’t go to college, and decided after high school to get into the sw/it industry. College is not always the path, but perhaps it may be the easiest in a tech field.

FYi, I have been here for 30 years, went to high school/ college in the 90s, been very fortunate to end up in a tech company not in the bay area. I have a family, and I am also very concerned about the rise in housing prices.

QFS anyone?

People always want to put down the things they can’t afford. That being said….CA can be a wonderful place to live IF you can afford it. If you can not than you are wasting your time here and will have a dismal existence. This is a sad reality than many must face.

People have to I’m here young, with a skill, and or with money.

As a former IT professional I made 6 figures but never really felt “rich” living here in SoCal. I worked with peers who were “house poor” and didn’t feel like they had enough equity to make homeownership worth it. I also knew people who bought deals and then were miserable living in a neighborhood/city they would not have chosen otherwise. I knew people who had 2 hour one-way commutes because of where they could afford to buy.

Meanwhile I have a friend who was laid off years ago, owns two homes, rents out one and lives in the other, and lives off his equity. He doesn’t own either one outright so he is prepared to have to sell one day. Meanwhile he keeps pushing me to buy before I’m priced out, but my rent is so cheap I’d be crazy to move. Basically I’ve lived in the same apt for 8 years and my landlord has never raised my rent.

I don’t even know what my point is, it’s just interesting to consider these very different situations/choices.

“… I’ve lived in the same apt for 8 years and my landlord has never raised my rent.”

No offense, but that’s so atypical that it’s not helpful, not to mention borderline not credible… unless “landlord” is charitable family member? Here in So-Fla, tax increases alone the last 8 years would put me in the red with static rents.

Just for context…I am in the middle of the loan docs needed for a modest loan for a triplex. We are stable, long time high earners and own 2 homes in Santa Monica free and clear. But here is the problem with getting a loan at a good rate (4% for an investment property). We do not have W2 income. The underwriting is brutal. Over 50 documents I have sent to them, and they keep asking for more. All this for a 500k loan.

So what I can see is that the mortgage loans these days are very well vetted. No one is giving money away freely. This will not be like 2008.

“Oh, you mean you want good schools and colleges but don’t want to pay for them?â€

Exclusionary policies are self-fulfilling prophecies. If you exclude the riff-raff with their disruptive and dysfunctional children, the schools will be good. Exclusionary suburbs have always been based on this reality, Glaeser himself says if education policy included school choice or vouchers; or was funded from the Federal level rather than local property taxes, the exclusionary-zoning problem would largely disappear. It is the USA’s unique way of funding schools that has given it this unique problem of exclusionary zoning. Nowhere else in the first world, is there such absurd levels of exclusionary zoning.

But you don’t need large-lot mandates to become exclusionary; you can make an entire State exclusionary, with even the smallest homes being twice the US home average price, simply by rationing the supply of land for urban growth and creating a whole new dynamic in how urban land prices are derived. One of the ironies of all this, is how the same advocates and apologists condemn exclusionary suburbs rather than congratulating them for correlating with “successful people”; but when it comes to an entire State like CA, they invert this to claim that the “Green vibrant urbanism”

that drives up house prices, “creates a socio-economic system of success”. If it were not for the option of fleeing, CA would be like Britain, with all the priced-out people being either homeless, or living in lofts and crawl spaces or crowding 4 to a room with complete strangers.

Can u go over who’s buying these houses is it foreigners and investment banks I think the goal here is to make us a naton of renters

In terms of cash, you don’t necessarily have to have all cash. You can get a loan making it appear as if you have all cash. One example is the couple in Riverside who it was reported bought “all cash†but more detail provided is they used life savings and a hard money loan to put down the all cash 580,000

—this was the widely reported case of the seller who wouldn’t leave several months after their purchase due to eviction moratorium.

https://www.foxla.com/news/couple-buys-riverside-dream-home-but-seller-refuses-to-move-out-in-eviction-moratorium-loophole

There are many places out there who will do all cash loans if you Google. I am not sure the process but it basically makes you able to put the money up front then you take out mortgage on this hard money.

California’s middle class is being gutted. I’m a techie who loaded up on real estate in 2010 so doing well but my nieces and nephews have no chance to stay. Importing rich guys is fine but having a population composed of super wealthy and a bunch of serfs will not be good for anyone. See Brazil for the social problems this creates crime, corruption, favelas and the divide only gets worse with automation/robotics/AI.

CA leaders better figure out ways to strengthen the middle class maybe create economic incentives to move companies inland where housing is affordable. There’s still a lot of cheap land to build on, just can’t have everyone squeezed on the coast.

The only way to really enjoy most of SoCal these days is to be quite affluent. I’m a millionaire in my 30’s earning $300K (thanks in part to leaving CA for TX more than a decade ago) and I don’t like the lifestyle I’d have by moving back. What you get for what you pay for a home and in taxes is just not worth it at this point.

The quality of life is downright nasty for middle class families in coastal California these days. A correction is badly needed but still the problem will repeat itself if policies don’t change. California is the dumbest state in the union. I love what it was but hate what it is. maybe there will be brighter days, but I’m doubtful.

You can blame the Federal Reserve for the constant devaluation of our currency but buying our own debt. Wages have not been keeping up with true inflation rates. What you have are people going into debt to survive, student loan, credit card, car loan, personal loans. It is false prosperity in this country. It is all based on massive amount of debt that keeps piling up and up. Inflation eroded and destroyed the middle class.

To solve this problem is the world needs debt jubilee.

https://www.jubileeusa.org/faith/faith-and-worship-resources/debt-cancellation-a-biblical-norm.html

I agree about middle class debt. Part of it is just consumerism and a refusal to live frugally because it’s not as enjoyable, but another part is just that regular life costs more than what many families earn, especially in SoCal where disposable income is a at a tragic level.

My wife and I took Dave Ramsey’s Financial Peace University course and it was incredibly helpful. I realized, though, that for a middle class family to do ALL the things they are “supposed” to do, they would need more than the median household income. I’m finally doing almost all the “supposed to do” Ramsey things and it’s primarily because my income has increased, not because I stopped a Starbucks addiction or canceled cable. You can only cut back so far before realizing it’s your income that is the limiting factor.

Pay off credit cards, pay off student loans, pay off car payments, put down 50% on a 15 year mortgage, then pay off your mortgage, save cash for a car, save for kids’ college, save a six month emergency fund, contribute 15% to retirement, tithe 10%, additional giving and so on. All of that at the same time is just not possible for the average middle class family (half, yes, but all – not realistic on median income). Wages are too low and housing and medical care is too high.

About the Jubilee, Israelite lenders would’ve known about the Jubilee before they lent the money. That’s fair because they could understand the risks and tailor their timing and terms accordingly. But springing a Jubilee on lenders in the US after the fact today would basically be theft. Lenders are people taking a risk proportional to their hoped for reward (the money didn’t come from nowhere). It would create an economic crisis that ripples pretty hard.

We need higher wages (blue collar workers used to be able to earn what in today’s inflated dollars would be six figures with no college degree and great benefits), more efficiency in healthcare, more practical education (please, no more acronym-shaped pools or European vacations), delayed gratification and self-control, contentment, and the abolition of the Fed.*

* Paid for by the Turtle for President 2024 Campaign.

Vote for Turtle! He always wins the race.

I believe in Ramsey’s basic tenets with regards to debt. Debt is very bad except for possibly the house you live in (and that has limits). You are right, though. It is hard to live by Ramsey’s principles when there isn’t enough after working a full-time job to cover rent, food, medical, clothing, and transportation. Thank goodness there is Social Security since I have read most don’t make enough to save and become Bogleheads. I believe the good old days were when manufacturing was strong and wages were high so the majority could be middle class. Manufacturing will likely never be strong again do to automation and cheap labor elsewhere. There has to be something else to replace it in the US to drive higher wages and create more Bogleheads.

The wealth disparity is too wide now and the middle is dwindling. Some becoming the wealthy but many falling into the poor.

There can be a gradual balancing and and growth of the middle again. FDR did this with Social Security and a minimum wage. The horrific alternative was Russia, China, Cuba, Vietnam. Even worse was Nationalist/Fascist Germany, Italy, Spain. All at the same point in history. The US took a good path at that time and can do it again.

Vote for Turtle! He always wins the race.

I believe in Ramsey’s basic tenets with regards to debt. Debt is very bad except for possibly the house you live in (and that has limits). You are right, though. It is hard to live by Ramsey’s principles when there isn’t enough after working a full-time job to cover rent, food, medical, clothing, and transportation. Thank goodness there is Social Security since I have read most don’t make enough to save and become Bogleheads. I believe the good old days were when manufacturing was strong and wages were high so the majority could be middle class. Manufacturing will likely never be strong again due to automation and cheap labor elsewhere. There has to be something else to replace it in the US to drive higher wages and create more Bogleheads.

The wealth disparity is too wide now and the middle is dwindling. Some becoming the wealthy but many falling into the poor.

There can be a gradual balancing and and growth of the middle again. FDR did this with Social Security and a minimum wage. The horrific alternative was Russia, China, Cuba, Vietnam. Even worse was Nationalist/Fascist Germany, Italy, Spain. All at the same point in history. The US took a good path at that time and can do it again.

SIABB,

“Even worse was Nationalist/Fascist Germany, Italy, Spain.”

In the case of Spain, this is laughable. The Spanish Civil War had many atrocities committed by both sides. George Orwell documented the Communist’s war on other leftists in “Homage to Catalonia”. The Spanish Communists executed thousands of Spanish Army officers in the early days of the conflict. The Nationalists also brutally suppressed Loyalist supporters and hundreds of thousands of them fled; the Socialists fled to Mexico and the Communists to the Soviet Union. I once met a child of one of the exiled Communists, whose family packed up and left the Soviet Union when Franco died. She had no illusions about Spain under Franco vs life in a truly repressive regime like the USSR. Franco provided for a return of a constitutional monarchy on his death that made her family’s return to Spain possible.

Wikipedia on Franco’s politics:

“The Nazis were disappointed with Franco’s resistance to installing fascism. Historian James S. Corum states:

As an ardent Nazi, [Ambassador Wilhelm] Faupel disliked Catholicism as well as the Spanish upper classes, and encouraged the working-class extremist members of the Falange to build a fascist party. Faupel devoted long audiences with Franco to convincing him of the necessity of remolding the Falange in the image of the Nazi Party. Faupel’s interference in internal Spanish politics ran counter to Franco’s policy of building a nationalist coalition of businessmen, monarchists and conservative Catholics, as well as Falangists.

Robert H. Whealey provides more detail:

Whereas Franco’s crusade was a counterrevolution, the arrogant Faupel associated the Falange with the “revolutionary” doctrines of National Socialism. He sought to provide Spain’s poor with an alternative to “Jewish internationalist Marxist-Leninism.”…. The old fashioned Alfonsists and Carlists who surrounded Franco viewed the Falangists as classless troublemakers.”

Franco repressed socialists of all stripes, but as an ardent Catholic, allowed a lot of political freedom in the center and right. Note that “Alfonsists and Carlists” were two rival Monarchist groups. And the Spanish economy was not top-down controlled like in Nazi Germany or Fascist Italy.

I know a couple with a young school age child who recently bought a house (~$800K). One got a down payment sized inheritance from a relative. The Wife has a blue collar job with a company that is currently fighting unionization, and is paying better to make sure of it. The Husband has a government job that pays well but doesn’t require a college degree. Overtime pay will help with the mortgage. They may not be typical of non-college graduate Californians, but certainly this situation isn’t all that rare.

JoeR,

Thanks for the clarification on Spain. The Spanish Civil War was brutal but Spain didn’t

strongly take the Axis side during WW II so there wasn’t a Spanish Front and Spain escaped the Allied bombing that Germany experienced.

Franco was a ruthless dictator but Hitler, Mussolini, and Stalin were worse.

Good thing we had that Socialist, FDR.

JoeR,

Thanks for the clarification on Spain. The Spanish Civil War was brutal but Spain didn’t

strongly take the Axis side during WW II so there wasn’t a Spanish Front and Spain escaped the Allied bombing that Germany experienced.

Franco was a ruthless dictator but Hitler, Mussolini, and Stalin were worse.

Good thing we had that Socialist, FDR.

This is odd. After all the trillions Biden has spent, he’s reneging on his promise of student loan forgiveness: https://www.dailymail.co.uk/news/article-9610777/Biden-drop-student-loan-forgiveness-weeks-Budget.html

This will prevent many Zoomers and Millennials from buying a home.son

I think he’s got a new plan. It’s kick the can til the next presidency. He’ll make loans 0% interest for the next 3 years. (Which is fine by me… I’ve socked away $20K in student loan payments saved since the pandemic began). Hell, by the time I have to pay interest again, I’ll have a lump sum to pay the whole thing off

It’s the easy plan. No one will fight him to just extend the 0% on student loans another year. In reality, he can actually give student loan forgiveness without actually doing so by making zero interest permanent. But making high income earners pay like 5% other income toward servicing of loans at 0%.

That won’t be popular because a lot of people actually pay for what they agreed to.

California is special, and if you are smart and rich, we have a place for you. If you want to live here, you have to be ambitious, it’s not easy to live here.

I’ve tried living other places, too hot, too cold, too muggy, too buggy. I don’t own an air conditioner, an umbrella, or a fly swatter.

No fly swatter?

“No fly swatter?”

Not many. Our cats get them before we hear them. 🙂

To my point in my first comment above. It is hard to move from the nearly perfect coastal CA 70 Deg Summer/Winter weather. Everything grows and nothing bakes or freezes. It has been this way since the early 1800’s for CA.

If you are in a house now worth millions, is it worth downgrading your lifestyle to move somewhere else and cash in when you can live the rest of your life in these conditions? I suspect renters do not have this same opinion. They have no skin in the game and may be starving to death. They are likely fleeing in one-way UHauls.

However, family trumps weather. I know several CA homeowners who moved out of CA to be with family who fled long ago. It is hard for the reverse and the kids to move to CA.

Bob: It is hard to move from the nearly perfect coastal CA 70 Deg Summer/Winter weather. Everything grows and nothing bakes or freezes.

Things only grow if you have water. And droughts appear to be an increasingly common phenomenon in California.

Droughts are an increasingly common phenomena anywhere in the West. Including massive fires in ID, UT, CO, AZ, and West Texas. Houston is downing in water lately with more hurricanes. And people are freezing to death from lack of natural gas management by the state.

Coastal CA may have rolling blackouts due to too may people, but at a perfect 70 Deg temp year round, nobody is dying from cold or heat. Unlike Texas.

Right, exactly. Rain is a blessing and most of the US doesn’t get so much that it’s a problem, but SoCal absolutely does get too little. I remember growing up having to collect water from our showers to water plants. My Dad just asked me to pray for rain because Lake Mead is so low and that’s a supply for SoCal. Meanwhile, our local reservoir is overflowing in a plentiful and fun kind of way.

CA is expensive, but for anyone that bought in 2011… we are ALL GOOD. Our home price doubled in 10 years. Our mortgage payment dropped with a 2.5% fixed refinance.

I bought in 2012, 2014, and 2105. Almost all the properties have at least doubled since then. Would I buy at today’s prices…..no way Jose. What is going on today in all the markets (not just RE) is ridiculous, reckless, and out of control.

You aced it. 😉

“CA is expensive, but for anyone that bought in 2011”

Today it is but I don’t think it takes a crystal ball to see that there is a high probability housing will crash again. And then in 10-15 years be back higher than it is today. Just buy for the long term.

This blog was full of bears back in 2012-2015 that predicted another imminent crash like 2008. They were just off in timing back then.

We’ve Seen it All before. Multiple times.

“CA is expensive, but for anyone that bought in 2011”

Today it is but I don’t think it takes a crystal ball to see that there is a high probability housing will crash again. And then in 10-15 years be back higher than it is today. Just buy for the long term.

This blog was full of bears back in 2012-2015 that predicted another imminent crash like 2008. They were just off in timing back then.

We’ve Seen it All before. Multiple times.

Here is a history of a typical CA house close to the beach.

1987- purchased for 200K – with a 30K income. Co-signers required. 200K? They said we were crazy to spend that much on a tract house. Sound familiar? Definitely house-poor.

2000 – 400K appraisal

2006 – 700K appraisal

2011 – 450K appraisal. Oops

2021 – 1.1M appraisal. – Mortgage paid off. 3K in Prop 13 taxes for life No problem with retiring.

2022? – 600K appraisal?

2046? – 2M appraisal after riding off into the great CA sunset? The kids all retired after selling the house.

Long term and Turtles win races.

CA is losing a congressional seat in 2022. First time that has happened in the state’s history.

Yeah, this article by Richter gets it right:

https://wolfstreet.com/2021/05/09/california-housing-market-first-ever-population-drop-meets-biggest-home-construction-boom-since-2008/

“The state lost 182,000 people in 2020, but added 100,000 homes, for 270,000 people. Los Angeles lost 52,000 people, added 18,000 homes. San Francisco lost 14,800 people, added 4,000 homes.”

People who leave CA do it for monetary reasons, aka they don’t make enough here. They are being replaced by people with money. People are buying millions dollar houses like hot cakes in SoCal. Traffic hasn’t died down at all. No inventory, interest rates low,rents are high. Chronic housing shortage…..prices continue to climb. Now add inflation to it.

Despite criticism of CA government, it seems to have made more millionaires and billionaires than any other state in the US.

CA coastal home prices are insane, but the people who grew wealthy there are driving up prices and the extremely successful CA economy has made some residents extremely wealthy.

Texas says “Send us your poor, tired and hungry”. CA is saying “Send us your smartest college educated successful people. Everyone else, please go to Texas.”.

It may sound snobbish but the data says it is true.

Becoming a millionaire in CA is easy.

You buy RE and live in it for a while. Done.

>>> Texas says “Send us your poor, tired and hungryâ€.

The richest man in the world just ditched California for Texas. What Texas actually says is “send us your HQ’s” and that makes some Californian’s cranky. Maybe your dear leaders will finally understand why. It’s not complicated.

M: Becoming a millionaire in CA is easy.

Troll.

M: You buy RE and live in it for a while. Done.

Even when M was King Bear, he claimed it was easy to become a millionaire. Of course, back then he advised people to save money by renting.

Hey M:

“People who leave CA do it for monetary reasons, aka they don’t make enough here.”

Political reasons, too. There are real estate firms setup in TX by former Californians that focus specifically on helping conservative Californian’s move. They do tours. LOL

It’s not so much that people aren’t making a good wage. It’s that the cost of living is so out of proportion that a decent wage puts you in a crappy ‘hood. Poor people actually have a hard time leaving CA because they can’t afford to move. That takes several thousand dollars. It’s mostly middle class people that are leaving CA.

“They are being replaced by people with money.”

Immigration is what keeps CA’s population from dropping hard, both legal and illegal – but mostly illegal.

“People are buying millions dollar houses like hot cakes in SoCal.”

There aren’t very many hot cakes on the market. The minority with means are buying from a small selection. Don’t forget California’s household disposable income is less than Alabama’s. It shouldn’t be that way, but it is – because of failed leadership for way to long now.

“Traffic hasn’t died down at all.”

No kidding! A taco run still takes 45 minutes. But I know what you’re saying. Guess what, homes are selling like hot cakes in most metros. Low interest rates and FOMO.

It’s interesting that you never hear about a Texan moving to California and trashing Texas. It’s always Californians moving to Texas and trashing California. And no, it’s not because they were poor and bitter. It’s because they wanted a middle class life that was actually middle class. Read your man Mr. Landlord’s post above. He gets it.

M: Becoming a millionaire in CA is easy.

Troll.

M: You buy RE and live in it for a while. Done.

Its not trolling. Its the truth. You buy a house in CA and HODL. Then you buy a second home etc. I should say, its relatively easy to become a multi-millionaire in CA. As long as you buy RE.

“Don’t forget California’s household disposable income is less than Alabama’s. It shouldn’t be that way, but it is – because of failed leadership for way to long now.”

Whenever I travel to other states I dont see how you get this amazing discount somewhere else.

Yes, sure, gas is cheaper. But not groceries or eating out.

Also, If you live In Alabama you dont have tons of job openings in tech that pay 120k starting salary plus bonus and RSU’s. Sure, the rent and house is cheaper in Alabama. But in other states RE prices are skyrocketing too.

considering all factors, I think the standard of living is great in SoCal. As long as you have an above avg household income. Poor people are fuc***. In SoCal and everywhere else.

To be successful in life you need to own a house, buy stocks, buy rental investment properties and Bitcoin. The best time to buy was yesterday. the second best time is today. Sitting on cash is the worst thing you can do.

“Oh, you mean you want good schools and colleges but don’t want to pay for them?â€

__

CA is ranked #20 for education. It’s ranked #50 (dead last for those of you counting at home) for Opportunity. Compare that to Utah (#10 Education) and Florida (#3 Education) both of which have significantly lower taxes and cost of living. CA spends a ton on education, but doesn’t get great results.

https://www.usnews.com/news/best-states/rankings/education

CA should be Top 10 in the US at everything with that GDP. My education was ridiculous. They had us using crayons and plastic tiles in 12th grade. I’m not even joking. If we spent 6 hours in school, maybe 1 hour was actual learning. The rest was just sitting around while the teachers were doing the same or even missing from the classroom altogether. Dull as could be; I hated it.

Here Comes The Hangover: Soaring Prices Result In Record Crash In Home, Appliance Buying Plans

https://www.zerohedge.com/economics/here-comes-hangover-soaring-prices-result-record-crash-home-appliance-buying-plans

It’s different this time, suckers are trapped and what’s coming will wipe out the uneducated home debtors. Don’t tell us you did your research before signing on the line, you are the research.

ZeroHedge: the place that has been predicting a crash every day for 10 years. Any day now…..

I haven’t been on this blog all year and it’s good to know that the entertainment value in the comments section is still going strong.

Let me ask you a question Realist. It’s been over a little over a year since you and I went back and forth about the state of the RE market and after the dust has settled, it seems like I was spot on (yet again) and you…fell short. What are your thoughts on that? Do you believe that your logic and reasoning is still sound and your research is still reliable or is it time to recalibrate your method? At what point will you be fed up with your predictions that never come to fruition? They say the definition of insanity is doing the same thing over and over again and expecting a different result. Do you think that definition applies to you?

i doubt prices are going up much further, but i still laugh at how many years now these delusional people have kid themselves with “20XX crash any moment now”. How much hundreds of thousands or millions in wealth they would’ve generated themselves if they stopped with their ego of “paying too much” and watch the world pass them by.

Banks, scummy politicians both with D and R attached and scummy realtors are to fault for insane house prices. The ones profiting don’t care about those who aren’t. It’s anti-American and not the way this country became successful.

The us fed will never be able to fully stop artificially suppressing interest rates. Once they got involved they will never be able get out with the debt as high as it is without causing an economic Depression. This is especially true when you consider the looming insolvency of Medicare and social security over the next decade. So look at what benefits from low interest rates and get in front of it.

Who knows, but the Fed isn’t all-powerful. Refer to massive inflation, massive mortgage rates and massive CD returns when that peanut farmer was President. If the market doesn’t force interest rates up, the Fed will probably have to in order to keep America from turning into Venezuela. All I know is that my Korean car is worth $3,000 more today than it was in 2019 when I bought it new – and that’s not a good sign.

Stay Diversified,

Turtle

That’s a scenario that I have considered in my periodic analysis. Inflation runs too high, the fed has no choice but to jack up rates to levels not seen in decades. That would INSTANTLY crash the RE market. The fed is currently having a hard time coming clean about the true inflation figures. They’re putting out press releases that say that the current inflation is within the average range (as they always have) except some consumer staples companies are coming out and calling out their bullshit. If the official inflation figure for this comes out at less than 5% than the Fed has just as much credibility as Realist.

Bob who has seen it all before is so typical of a myopic Californian who lives in an MSNBC/Vox bubble. It really is fascinating to watch.

Tesla, Oracle, Toyota, HP, Mitsubishi, Nissan, Schwab, Digital Realty, Coldwel are but a few of the companies that left CA in recent years. The CEO of DropBox moved to Texas from SF. Which means the company will eventually all be in Texas as well. Google announced a $600M investment in a new data center in Dallas and well on their way to building new campuses in both Austin and Houston. Ya think those companies employ “tired and hungry and poor” or college educated high income earners?

And those are just the big names you hear about. There are hundreds if not thousands of small businesses moving out as well, every year.

Bob probably has no idea since anything 20 miles away from the Pacific ocean doesn’t exist to him. But Salt Lake City is booming with tech startups, most of it with investors from CA. I could go on and on, but it wouldn’t matter. Bob will live in his little bubble. Which isn’t a bad thing I suppose.

Google is opening a data center in Midloathian TX that will employ (drum roll).. 40 people.

Something needs to change before California’s young middle class quality of life totally evaporates. It only makes sense for the affluent and [maybe] the poor right now. Boomers, OK. Gen X and Millennials – not so much. One reason (other than taxes) companies are leaving is so their workers can have a better quality of life. Happy people are productive.

It’s interesting, if you go to AreaVibes’ “Best Places in America” and slide the Population bar to 100K+ so that tiny towns that nobody would relocate to are weeded out, there are only two California cities on the list (Carlsbad and Irvine, rightly so but got $1.2M for a virtually yard-less tract home?). There are 20 in TX, 5 in CO, 3 in AZ, 2 in CA and 0 in NY.

“Livibility” is determined by data on amenities, cost of living, crime, jobs, weather, user ratings, etc. Many California cities do fine on amenities and weather but the rest is ugly. I’ll only move back to CA if I can live in a Carlsbad-type place. Not going to blow ~$1M for Escondido or Vista because it’s true: location, location, location. M-mmm… wink, wink! 😉

Has Mr Landlord even noticed the insane home price increases in Coastal CA?

Who does he think is driving up these prices?

Poor Uber drivers or burger flippers? Nope. They are moving out of CA.

They are being purchased by highly successful people who made millions in CA’s economy or people with a lot of money who are moving to CA.

Like I said above.

Has Mr Landlord even noticed the insane home price increases in Coastal CA?

Who does he think is driving up these prices?

___

CA is like Brazil. A small slice of ultra rich who have the coastal mansions surrounded by ultra poor. Congrats LA, you are the new Rio.

Salt Lake City, as a former ball player I have been to all the towns. Utah in general is a narrow minded place.

Moving make sure you want to wake up there?

I live in Cali and the housing market has been rebounding since later last

year. As is the national housing market with low inventory and double

digit price appreciation. But I have to admit, Tx is not just rebounding, but

growing big time. Partially from the rise of remote work and Millennial’s

seeking more affordable housing. I have a friend who purchased a

Dallas townhome in the Bluffview area last year for around $360k and

he’s getting $2k+ rent. In the So. Cal coastal areas it would cost about

double for a 2 bdrm rental to garner that kind of rent or better. Seen the

downtown Austin skyline lately ? It’s dotted with cranes. Some pundits

are saying Tx is now like Cali in its 50’s and 60’s growth heyday, and

investors are taking notice. Their biggest worry is if overbuilding kicks

in. But so far, the demand is outstripping the supply.

Meanwhile our fearless Governor is spending our budget surplus trying to buy

his way out of a recall with $600 stimulus checks and housing the homeless on

our beaches. Forget about using the surplus to lower our tax rates. The next

census, maybe we’ll lose 2 House seats, then 3, then ….

Nearly all the people I know who left SoCal, went to Arizona rather than TX.

There is a wide range of climates to choose from Tuscon at the hot end and Flagstaff at the cold end, however, most are somewhere in the Prescott = Cottonwood = Sedona region along Hwy 89.

More socialism aimed at driving up home prices: https://www.foxbusiness.com/money/house-bill-would-allow-teachers-first-responders-access-to-no-down-payment-mortgage

Members of the House of Representatives recently introduced bipartisan legislation that would give teachers and first responders – including law enforcement officers, firefighters, Emergency Medical Technicians (EMT) and paramedics – access to a mortgage without having to make a down payment.

The Homes for Every Local Protector, Educator, and Responder (HELPER) Act seeks to aid those individuals in purchasing a home in the current competitive housing market. The bill was referred to the House Financial Services Committee, which has yet hold a markup on it.

Biden is the new FDR.

So glad I bought in q1 2020. Market is red hot. I made so much equity since I bought. It’s awesome! What happened to all the bears? Remember “bigrecessioninsight†? Lol, never heard from this guy again….he told me I bought the top. Muahahahahahaha

Millie, be thankful you bought when you did. According to the OC Register, your average OC home went up in value by 118K in the past year (that’s $13 every hour).

https://www.ocregister.com/2021/06/07/orange-county-home-prices-jump-117750-in-year-or-13-every-hour/

For anybody who still thinks they can predict the future or outsmart/outlast the Fed…how did that work out. I have said umpteen times, owning a primary residence in socal is a requirement. If you can afford a home, go out and buy, enjoy your home and tune out the noise. If you honestly think homes here will be cheaper in 2030 or 2040, you are crazy!

Yep. Any investment strategy should contain “tune-out-the-noise” planning. It is crucial to recognize what you can and cannot control, and focus on the former.

Soooo freakin thankful! My house appreciated so much that it would be a difficulty stretch to buy it at today’s prices!!! Just over a year later! Man am I happy I bought during Q1 2020. It’s so hilarious that sooo many people cheered and called the top back then!!!!!

REAL HOMES OF GENIUS

Here we are again. A horribly overpriced home with the ubiquitous trash can in the front yard in mid-shitty (Mid City) of LA.

You too can own a home for a measly $1.3M in a neighborhood that is unsafe to walk through at night. $5K per month, mortgage? sign me up!

https://www.trulia.com/p/ca/los-angeles/1700-west-blvd-los-angeles-ca-90019–2077232096

It is truly a Real Home of Genius. Trash can included.

It sold in 2014 for 455K.

What kind of lipstick improvements were made for that 845K gain?

It does look nice, Maybe we could stretch it and buy. 🙂

I’m sure by 2045 it will be worth at least $1.3M. Again.

Columnist Lansner of the OC Register says that houses in SoCal appreciated in Feb-Apr of this year at a rate of $1 per two minutes. That’s about $5K per week. This is one of the faster spurts in SoCal history according to Lansner. He now has his “Bubble Watch” at his maximum 5 bubbles

I am not entirely convinced that he is right. The current annualized inflation rate is in a swing upward that is threatening to go exponential. So the increase may not entirely be a bubble, but could actually be reflecting the tanking dollar. Personally, I hope he is right, because the alternative is worse.

There really is some inflation going on. My car is worth $3,000 more than what I paid for it in 2019. The dollar is losing buying power. Still, don’t regret moving my cash to crypto at 55K when one of the bulls here suggested it.

Cash will be king when interest rates rise – and they will have to, to stop inflation from running out of control. Maybe I’ll get 17% on a CD. 😉

My car is presently “earning” $166/mo. If that’s not a sign of significant inflation, I don’t know what is!

Nah burh. CNN and CNBC say all this inflation talk is just silly internet conspiracy stuff.All is well. Now, if you’ll excuse me I have some $80 sheets of plywood to pick up at Home Depot, you know the ones that were $25 a year ago. But any talk of inflation is just silly.

Mortgage forbearance ends June 30th. How bad will the foreclosures be? Maybe the inventory will go way up in the next year.

Kent,

There is always some catastrophe lurking around the next corner.

Yet, the Fed has always had some gift to avoid the catastrophe once it starts happening.

Grab your popcorn and let’s see what the magicians pull out of their hat this time.

I’m very curious as well. If it does actually expire, certainly a number of borrowers will be forced to sell (the ones who are unable to resume payments). Whether or not that makes a dent on inventory will have to be seen.

#NoCyrstalBalls

I’ll eat my hat if anyone has to pat back a penny of that forbearance. You all know Stimulus 5, 6 and 7 will have a few hundred billion to pay it all off.

There is no housing bubble…

More than half of homes in the US are selling above list price. People are playing a lottery to see if they’ll win the honor of spending hundreds of thousands of dollars to build a home. The Case-Shiller US National Home Price Index looks like a rocket ship launching into space. You’d be forgiven for flashing back to the aughts but listen closer, that’s not Fearless playing, it’s Fearless (Taylor’s version).

There’s a growing sense of unease. Renters at the lower end of the market have seen their rents rise in some places even as they’re more likely to be suffering the economic harms of the last year. Would-be homeowners are furious as they lose bidding war after bidding war, looking for someone to blame as they watch their peers land a home and lock in a low mortgage rate. And homeowners are riding high for now, exhaling sighs of relief that they made it into the exclusive club and eagerly watching their wealth skyrocket, worried about what might happen to change that.

The last crisis, when a housing bubble and risky behavior by Wall Street took the blame for the Great Recession, looms large in our collective memories. And with America’s unemployment numbers still not where we want them and the unequal economic recovery from the pandemic, the fear of another crash looms. It’s unsurprising, then, that the questions “are we in a housing bubble?†and “will the housing market crash?†saw a “tremendous increase†over the last 12 months, according to Google Search.

https://www.vox.com/22464801/housing-bubble-market-crash-supply-shortage-great-recession

-cheap loans

-forbearance

-irrational behavior

-lender and buyer desperation

-profit seeking

-a flood of millennial first-time buyers

-buying sight-unseen

-waiving appraisals

-bidding wars

-increased migration due to remote working

-pandemic-induced low supply

-inventory down 37% YOY to a record low

-record low of 17 DOM

-prices up 24% YOY to a record high

-homes selling 1.7% (on average) higher than asking, another record

Not sure if the current climate is a bubble but it is definitely an unsustainable frenzy.

No kidding, Butch. People are either uninformed or delusional. Mania is off the charts. Folks actually think this is sustainable. My little house in Texas is “making” $11,000 *per month* according to Zillow. My Korean SUV is “appreciating” $160/mo. This is NOT normal. An airplane that is bubble plus inflation cannot land safely for everyone, especially not over-leveraged, debt-loving gamblers in SoCal.

Stay diversified,

Turtle

IRS seeks authority to regulate crypto: https://www.msn.com/en-us/money/taxes/irs-chief-asks-congress-for-authority-and-resources-to-regulate-cryptocurrencies/ar-AAKQ4ev

I don’t get why people care about beaches and beach cities. They are expensive and you almost never have time to go to the beach. I grew up in the Cali deserts along with a lot of other people. The people who settled in the deserts are doing fine. It was affordable for a long long long time in the desert until the beach city people started moving to the deserts… to get away from the insanely expensive beach cities I guess. I’ve never been a beach person and I don’t care about that nasty polluted water off the coast. The desert is the place I want to be as it is way more affordable, better people, way more space, and more things to do and you never have to pay for parking and my kids are safe walking around at night and the public schools are better than your stupid expensive big city private schools. Oh, and there is way less crime.

I used to be a computer programmer back in the late 90s up in Santa Barbara for awhile. Made a lot of money, but it wasn’t worth it at all. Gave it up and happy that I did. The tech industry careers suck no matter how much you make and living in those places double sucks. Unless you are tech baron with billions what is the point.

The desert is … way more affordable, better people, way more space, and more things to do and you never have to pay for parking and my kids are safe walking around at night and the public schools are better than your stupid expensive big city private schools. Oh, and there is way less crime.

I live a ten minute walk from Santa Monica beach. I agree, it’s over-rated. But even so, your statement is a silly over-generalization.

Desert cities are safer? ALL desert cities? No methheads, gangbangers, cholos, bikers, or drug traffickers in Arizona or New Mexico?

You’d rather live in Slab City than in Malibu?

“You’d rather live in Slab City than in Malibu?”

I know it’s a joke but it doesn’t make a point. Come up with something apples to apples.

For $600K, nearly every sane person would choose Rancho Mirage over Compton.

But if you’re gonna live in the desert, why pay California taxes? One of the nicer Phoenix ‘burbs makes more sense.

Are still companies with a full staff of employees. They have marketing, accounting, ops, HR and yes even janitors. The idea that only tech degreed guys work there is silly

Leave a Reply