The inefficient and fragile housing market: How trying to increase homeownership can backfire and add costs to regular home buyers.

It was interesting to see that this week, the Nobel Prize, the biggest prize in economics went to three US economists, one being “irrational exuberance†Robert Shiller.  Markets for the most part are presumed to be efficient and what Shiller points out is the weaknesses inherent with this model.  The housing market is a perfect example.  The market is extremely inefficient when it comes to housing.  We massively subsidize this sector of the economy with the outward notion of helping regular buyers but do the opposite.  For example, the Fed’s QE initiatives have caused asymmetrical bets from financial institutions into residential real estate.  Largely because of this financial structure we went from a real estate market in free fall to one highly subsidized by low rates causing investors to crowd out regular buyers.  Prices now surge while the homeownership rate falls.  Of course how can the market be called efficient when the Fed provides this below market interest rate to a select group of people?  Is the public privy to this?  What use is a low rate when a bigger player comes in with all cash?

Housing affordability falls while wage growth is weak

It was interesting to see the comments regarding the “least affordable state article†on California.  While this may seem obvious for California the data shows how quickly in one year affordability dropped (courtesy of prices surging nearly 30 percent over this time).  The reason for this shift was an increase in rates, investors flooding the market, and limited supply.  Note that economic growth in the form of good paying jobs, new industries, or higher wages were absent as the catalyst here.

This trend is not limited to California alone. Â Affordability across the nation has been falling because of higher home prices largely driven at the margins by investors.

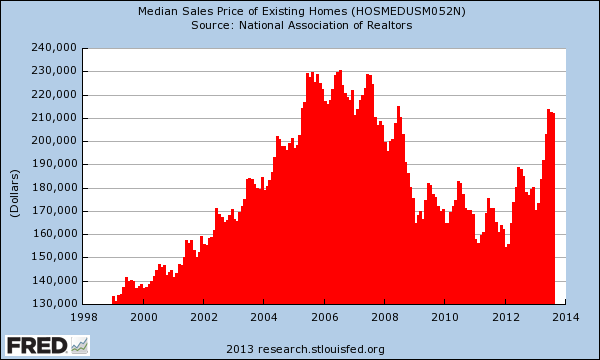

Median price surging

The median price of existing sold US homes is inching closer to its previous peak:

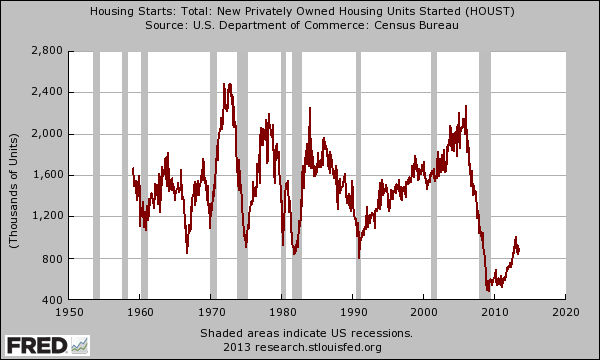

This incredible rise in home values unaccompanied by similar wage increases is startling. Â You would expect that in an efficient market, that builders would be up to the task of adding more inventory but that is not the case:

Why are builders so reluctant to build more homes in the face of rapidly increasing home values? Â A large part of this stems from the reality that investors are seeking out lower priced properties for rentals typically from the existing home pool and new potential buyers are economically in a position or motivated to rent instead of own. Â The market is inefficient because we heavily subsidize homeownership when in reality, many families would be better off renting. Â But we do subsidize this section of our economy and essentially handout a massive gift to big banks and Wall Street that have leveraged these financial conditions.

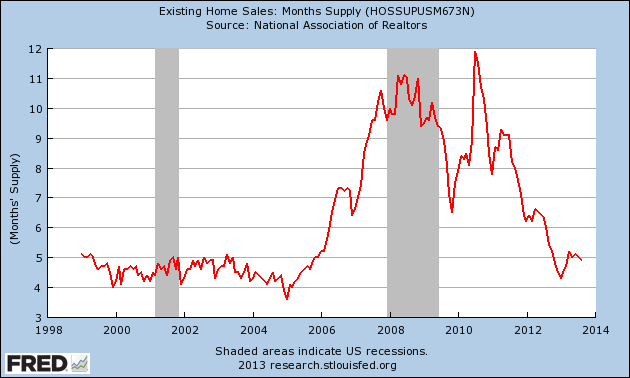

Months of inventory still historically low

While inventory has increased in the last year the number of homes for sale is still very low:

A healthier market would be closer to 6 months of inventory. Â The government shutdown talk has put the fragility of the housing market back in the spotlight:

“(Redfin) First, the government shutdown is robbing precious end-of-season selling time from home sellers. As we said in a special report this month, furloughed buyers across the country are stepping back from the housing market until their paychecks are restored.Washington, D.C. has been the hardest-hit; since the government shut down, the number of Redfin clients making offers on homes in the D.C. – area dropped 42 percent. Other buyers are throwing in the towel completely. According to Redfin Washington, D.C. Agent Kimberly Pace, “With so much economic uncertainty, several of my clients just don’t think a home is a good investment right now and are pulling the plug on their home buying plans.â€

I’ve heard from contacts in the industry that a backlog has developed for some loans and some buyers (and sellers) have pulled back to see what will happen with our government.  Does it bother people that our government, the main champion of the housing market, is unable to come to agreement on how to pay our basic bills?  Do we really need this unlimited housing subsidy when there is apparently more important issues than housing?  It has been many years and it is obvious that this course of action has largely benefited banks and large investors while the public is largely on the sidelines watching housing values surge and paychecks stall out.  There is now news that some food stamp payments will be put on hold because of this.  Yet the Fed keeps on with QE but millions are about to struggle to find food?  Interesting priorities we have here.

Fed balance sheet approaching $4 trillion

The Fed has been flirting with a taper but their $3.8 trillion balance sheet tells us something else:

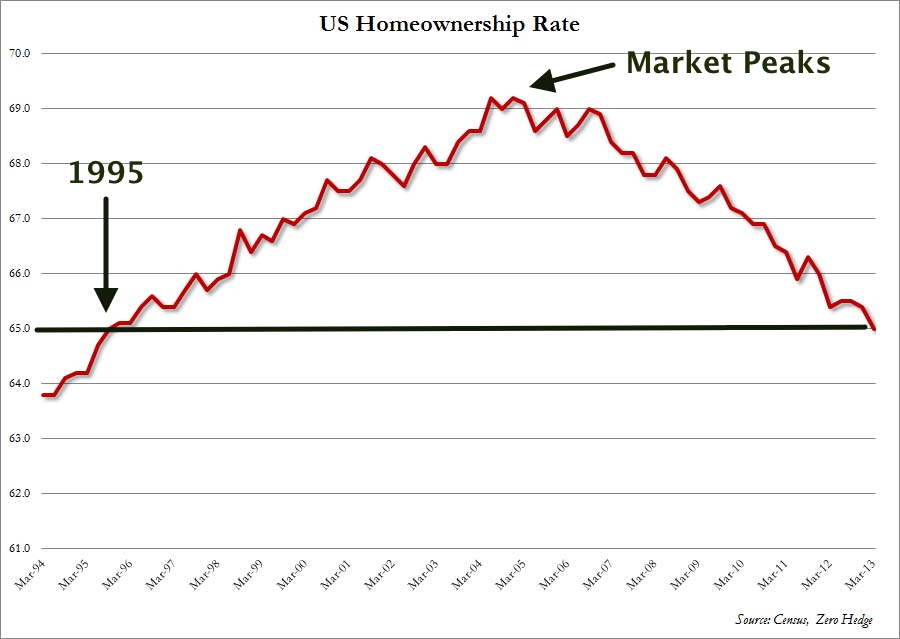

The Fed isn’t tapering at all.  Given the current dysfunction in D.C. I doubt we’ll see a taper anytime soon.  The Fed is and has always been an advocate for big banking interest in the US.  In the late 1990s, housing was allowed to become a casino like market and we had the biggest housing bubble the US has ever seen.  The bust should have kicked some sense into the system but here we are, doubling down on real estate only this time, the spoils are going to one group (and homeownership has gone this way):

Simply engineering housing values to go up with massive subsidies doesn’t seem to make sense for most families.  Inefficient is the current real estate market.  Giant mortgage deductions for those that have mega mortgages.  Artificially low rates that have created a massive flood of investors into real estate unlike anything we have seen in the past.  Affordability plummeting in spite of all this market intervention.  It is sobering to see one of the few economists that saw the housing bubble coming winning a Nobel Prize for pointing out the obvious holes in the efficient market theory.  Just look around you and ask yourself if people act rationally all the time.  If that isn’t proof enough, look at our elected representatives in D.C. and then try examining human rationality.  Oh, and you think you have access to all information?  Good luck trying to get a peek into the Fed’s balance sheet or try to go up against a high frequency trading machine jolted up with sophisticated algorithms.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “The inefficient and fragile housing market: How trying to increase homeownership can backfire and add costs to regular home buyers.”

These are my two cents on the housing market: it is nothing but an absolutely manipulated (to the upside) casino right now, and anyone buying right now will end up being a big loser. The ONLY reason the powers-that-be reinflated the housing bubble was to save the ****ing banks and to keep this absolutely fake economy floating, giving the perception of economic stability. IT’S ALL FAKE! It’s all a manipulated casino. This is all going to end very, very badly. Housing prices will come crashing down big time, but sadly when they do, the American economy will be in ruins. There is no such thing as a free market in housing in the U.S. anymore. No way!

I concur 100 percent. I was one of the unlucky that had 2 extremely over appraised homes so when the market crashed my life savings was lost and I was underwater by six hundred thousand dollars, (that money having already been stolen from the banks the day I closed escrow). I have one question what are the folks like me that had great credit scores, put down huge down payments, still ended up underwater on my house by six hundred thousand dollars, lost my job, went through all of my cash reserves (about 2 years worth, very stupid of me but I thought things would get better before I understood what had happened) trying to keep up with the payments until eventually it was all gone and I filed bankruptcy, now there’s no lending available for someone in my position of course and by the time I will be able to buy a home, I mean is the bubble going to go up double the size it was in 2005 and then crash? Or will it crash within the next couple of years? Or will it crash when the program that the large image institutions have to follow to purchase large vats of homes at once and turn them into rentals, are allowed to sell them after 5 years, so will that be the time that we have too much inventory? high interest rates? And

housing prices crashing? Ok I guess that’s more than one question. My point being, we have better odds in a Vegas casino. Especially the Sportsbook. At least you have a chance. It isn’t rigged (that we know of yet). It’s more fun too! Oh and they give you free cocktails while you are gambling. With Wall Street, they get ALL the fun. they get to gamble with other people’s money if they win they throw

a big party, snort cocaine, buy hookers, (they are a classy lot) really have a grand old time! However if

they lose they turn to us taxpayers and say “oh gee, I’m sorry that was your bet, (shrug) sorry you pay.

I concur with everything you said except the notion that there is no lending programs for someone in your position. There are programs available for those that went BK or had a FC.

@Lynn Chase wrote: “…is the bubble going to go up double the size it was in 2005 and then crash?…”

The answer is already out there: “…For the third straight month, the median home price across the Southland stayed essentially flat, at $382,000…” (http://www.latimes.com/business/la-fi-1017-housing-slowdown-20131017,0,611728.story)

The whole run up in home selling prices over the last two years is entirely driven by:

1.) inventory that is tightly controlled by the banks, and trickled out when it is to their advantage

2.) interest rates going to all time lows (courtesy of the Federal Reserve)

The U-6 underemployment rate for Los Angeles country was 18% in July. The U-3 was over 9%. The SoCal U-3 and especially the U-6 are numbers only seen during periods of extremely deep recessions or a shallow depression. The “housing recovery” is/was as fake as a three dollar bill.

@Ernst Blofeld Yes I know but what we don’t know it’s what the next scam the Fed will perpetrate on the markets. Love the phony as a3 dollar bill line since all the Federal Reserve notes are phony. Lol they are iou nada notes.

Good lord, you were underwater by 600,000 dollars!! What the hell? Listen, I concur with the original poster here, that all of this was a casino and still is, game rigged, blah blah, but, holy mackerel, am I supposed to sympathize with someone who obviously was spending WAY too much money for one of those bubble homes?? If you were 600,000 grand under, what, pray tell, was the purchase price?? I’m guessing, oh, 2 million? OK, 1.5 million? Were you really in a position to afford that? My guess is, you were just barely (but probably not at all buy historical standards), and did not consider the downside at all, like, hey, the damn thing was way overpriced, and, duh, you could lose your job any day now.

btw, what was the job you lost? If you tell me mortgage brokering or RE sales, my head will explode.

@MikeM: You said it best, hit it on the nose. When these suckers’ investments go up, they take credit for it “I’m a financial genius”. When it goes the other way, they don’t hesitate to cry victim.

Yes Mike, I think that Lynn used to be a Realtor(tm), she stated that her self in past posts. It’s ironic but I’ve heard of a lot of people who were in the RE field getting hit the hardest because they

a) were the ones drinking the most cool aid

b) had access to the craziest loan products

c) made some good money in their job and thought they could be big players

So many of them got greedy and went “big” 🙂

So Lynn’s $600k is probably not even an extreme case in those circles…

While I do wish girlfriend would attempt paragraphing her posts, she did mention putting down a large (open to interpretation) amount and exhausting savings before filing BK. Thats worth some bit of sympathy in my book. The play that bothers me most are the low-down FHA back stopped homes at the top of the conforming limit where the “owner” stops payment and lives rent free for as long as they can.

10-1 that “large down payment” was just pyramided equity from other homes. I live in a very expensive place in America (Upper Westchester, NY Metro), so I don’t really flinch any more when a co-worker tells me that are looking at $800,000 homes. I know what she makes, which isn’t a ton, but, OK, and her husband is in finance, but, he ain’t no Goldman Sachs employee, so, they’re probably laddering up from some smaller home that is still inflated in value from the bubble, probably “putting down” 2-300,000 in equity from that house. Problem is, they have to sell to do it. I think that’s loosening up around here. Schools are awesome, and, the 1% breed here.

The Nobel Committees (including Peace) are schizo. They gave the award to Shiller, while at the same time giving a share of it to two guys from Chicago who believe the exact opposite. Lewis Carrol’s Nobel in Wonderland …

I presume the committee recognizes that the study of economics is not a perfected science. By recognizing contrasting perspectives, they empower the idea that a multi-pronged approach of understanding is most optimal.

“Good luck trying to get a peek into the Fed’s balance sheet ” AUDIT THE FED.

Contact your elected representative and tell him to audit the fed.

the unintended consequences of government intervention to make homes affordable by guaranteeing loans, forcing reduced lender guidelines and buying mortgages from loan originators has resulted in increased prices making homes less affordable.

The government is accomplishing the same trick with “higher education” by guaranteeing loans so everyone can go to school, they are guaranteeing higher tuition cost. The colleges know they can raise their tuition because the students can get the loans to pay for it

I 100 percent agree that’s why we had the last bubble currently its manipulated but instead of giving people loans cheap money they’re only doing it for you know large banks and leaving the homeowner out on the sidelines. The new racket is student loans! You nailed it that is exactly why the cost of tuition are going up because those notes are money! That’s money the banks monetize the debt and they get paid up front no matter if the loans are actually paid back! Cuz they already got paid! The real trick with the student loans is they cannot be discharged from bankruptcy for any reason except maybe total disability for real not the fake kind. So they’re on the hook debt slaves for ever.

The amount of agency debt and MBS as a percentage of the funds used by the Federal Reserve is staggering. It’s really astonishing that we let a central bank controlled by a bunch of bankers use federal money to save their own asses.

Anytime the government gets involved financially in any market segment the prices go up. You can see it not only in housing but in college funding with student loans and in the costs of medical treatments. It means well but anytime the dollars available greatly exceed the costs of the product or service you have the basis for an inflationary spiral.

Well-stated.

Yes. But, we must keep in mind the government’s motivation here, which makes perfect sense. People who own houses are more politically motivated than those who don’t. They have a common interest. They want prices up-up-up. If they go down-down-down the politicians in power lose…and lose hard. Current homeowners don’t care who they sell their current home to–be it Chinese or investment funds or whatever. Just pump up prices and open the doors to any buyer who’s got the cash. Politicians will gladly oblige. Prospective home owners are like frogs in a pot. They will boil to death and never know it.

**HEADLINE NEWS**

Fensterlips says — “Anytime the government gets involved financially in any market segment the prices go up.” Let me add a very current and stunning example of this and how it HAS GOT to indirectly affect housing.

I’ve purchased my own health insurance for a decade…..no problem. Blue Cross about half that time and Aetna the rest; good companies with competitive pricing. Just yesterday, I got gut-punched as I priced my options for 2014 after Obamacare kicks in. Jesus!! My exact Aetna plan will no longer be available, a close but slightly “worse” one will be and the monthly premium is 70% higher than what I’m paying now!! And, yes, it’s all b/c of the idiotic non-Affordable Care Act.

That’s an additional $2200 out of my pocket next year and with the highest deductible plan I can buy!! This is not just me. Several people commenting on another blog said similar numbers. One guy mentioned for he, wife and 1 kid — the premium will go up $4500 next year.

This has GOT to murder the economy! It must total in the many billions of dollars of LESS consumer money for restaurants, retailers, entertainment, etc. Which means there will be lots of layoffs, business closings and, therefore, fewer people who can afford to buy houses.

Many of my friends don’t know what their increases are going to be yet b/c their employers haven’t provided the info yet. They will be shocked. This is going to be back-breaking, folks.

that is horrendous news! The employers got a little bit of a break temporarily so for now employees of large corporations should get a little reprise from this tax hike. The only people that will benefit from Obamacare are people who are broke and they would qualify for Medicaid anyway. People that are self employed, and have to buy their own policies, are the ones going to be the most devastated especially if they actually are fortunate enough to make a little money cuz da gubermint wants its hands on it! And they’re out to get it! O, it doesn’t matter if your healthy either whether you never use your health

insurance and you got a healthy family your insurance rates are going to go up too and the quality of

care will go down. I believe this will be the proverbial nail in the economic coffin, especially when employers costs skyrocket when their AHC act exemption expires. Holy Cesspool. People just don’t have the money to buy the insurance or pay the IRS fine! What are they going to do? Lock everyone up in prison for tax evasion? Who will pay for that? It costs the taxpayer about 50k per year to house a prisoner or more than most Americans earn in a year. Our system is broken.

I’m not going to buy any health insurance and I’m not going “pay” the penalty because the penalty is only collectable if you will be receiving money back from the IRS.

Your post doesn’t mention if you’ve been on the exchanges to shop around or are available for a subsidy. So, your post doesn’t directly address Obamacare.

But, who knows, maybe the self-insured people like yourselves (and your friends) are not well represented in the law and it therefore needs to be changed to accommodate. It’s a massive law.

Fact is that health care is broken (spiraling costs and too high #’s of uninsured), and nobody in DC had the nads to do anything for decades. Republicans had House, Senate and Presidency from 2000-2006 and only managed to pass another massive, unfunded entitlement…Part D.

The exchanges is a conservative idea to bring in market forces/competition into health care, and having individuals “decide” that they’ll use the emergency room as their primary care physician is irresponsible. So, I’m 100% fine with a mandate to have insurance. Otherwise, change the law so that people will be kicked to the ER curb and see how that looks on the TV.

Obamacare is doomed because it is all about paying for health care, not insurance, and it does nothing to lower the costs. It was written by corporations who are vested in high medical prices. It just makes it easier for the insurance and health care corporations to extract money from the people. I guess you did not get the memo about corporations owning this country. Who do you think the Fed works for as well as the Real Estate industry? If you are a worker you are a slave, be an owner of big corporation and see how the doors open for you. The old Robber Barons were amateurs compared to today’s big boys. That is why the middle class is all but gone. The 50’s and 60’s were an aberration. The natural order is like today, small percentage of elite with all the power and wealth until the masses reach a point where they are disparate enough to revolt. Throwing in a war or two can delay the process.

Obamacare is a parallel progressive income tax disguised as a healthcare funding mechanism. It has so many taxes spread over so many income types and income brackets that if and when Washington DC gets the website working tax revenue will flow like water over Niagara Falls. New money will ramp up new DC spending the likes you’ve never seen.

Factor in inflation of abt 20% inflation since the previous top, median home prices are not even close to previous highs. Plus, globalization means newer demand for homes in the US. Plus, Income distribution in the US has changed so that more rich people. So, no reason for top locations to not be in continuing demand.

since my wage didn’t increase 20%, this is stagflation. And the buying power of US dollar has dropped internationally, that make this a early hyper-stagflation. Whoever didn’t convert their US dollar to hard asset for the past few years got screwed by the FED over and over…

@Joseph agree. When armchair experts announce there will be crashes or drops it seems to: 1) be a guess 2) by how much (no one knows) and 3) location. A crash is defined as a 20% or more drop in prices. I can easily see a 20% drop again in Inland Empire but a 20% drop in Venice or Santa Monica, Culver City, Beverlywood, (or just about all of the 310 area code) very doubtful.

“Plus, Income distribution in the US has changed so that more rich people. So, no reason for top locations to not be in continuing demand.”

Inflation and upward income distribution can explain the rise in Silicon Valley, Manhattan, etc. But it comes no where near justifying the overall increase. I swear a worm hole took me back to 2006. The same stupid arguments backed by not a ‘lick of empirical data.

If this was true then the FED could end QE tomorrow and prices would remain stable. No one is making that argument. Even more darkly comical is that the FED is now in a liquidity trap and the economy is seizing up IN SPITE of their interventions. They can’t stop the coming asset deflation anymore than Japan has been able to. In fact they are making the inevitable shock worse. Can’t wait to see tyhe look on Yellin’s face when 150B a month of QE RAISES the unemployment rate. Good luck to everyone.

@NihilistZerO, The Federal Reserve is following the exact same game plan that the central bank of Japan has followed. Apparently the Federal Reserve did not learn that 20 years of quantitative easing in Japan is a failure. All QE has done is turn dead banks into “Zombie” banks.

In the same breath you claim that a highly subsidized market fueled by low rates is causing investors to crowd out regular buyers, you also assert that all cash players are keeping regular people on the sidelines. What gives? How can you say that investors are being assisted by low rates when the same investors are purportedly all cash buyers. This does not make sense. Am I missing something?

@Debt Before Dishonor wrote: “…How can you say that investors are being assisted by low rates when the same investors are purportedly all cash buyers…”

All cash buyers is a misleading term. All cash buyer is the initial transaction.

I know of a handful of investors who have purchased properties in the L.A. region using 100% cash, and within a few months of closing the sale then turned around and refinanced at an LTV of 80% (equivalent to putting 20% cash down payment).

On the books this shows up as an all cash purchase. But down the road, this eventually gets recorded as a refinance.

Exactly, the big investors don’t get mortgages – they have access to the low-interest rate money through other channels. So those “all cash” purchases are usually funded by low interest leverage. That’s how the big players both exploit the low rates AND outbid regular buyers.

An alternative explanation. Since the crash, builders are reluctant to create more housing, reducing inventory; foreclosed properties have been increasingly bought by investors and turned into rentals, thereby reducing viable inventory even further; the remaining housing is being purchased by high-income earners, some of whom have either benefited from, bounced back from, or were never affected by the crash; voila, although median income (your preferred barometer) does not appear to be growing, price increases are a rational response to reduced inventory being bid up by the wealthy with the help of cheap money. While low interest rates are one component of this equation, it is not the entire story. I wholeheartedly agree that lower-interest rates are not assisting moderate income buyers as touted, but I disagree that low-interest rates are fueling cash investors. Perhaps some low-level flippers are cashing in on low-interest ARMs, but that cannot account for the majority of investors, right? Perhaps I am missing how this is supposed to work here. Can someone explain?

DBD, I think you’re not understanding that “cash” activity is still influenced by rates and debt expansion. The word “cash” is a bit misleading as it is a misnomer for liquidity in this environment.

Another great post, Dr. HB!

You all know that the FED is a private organisation? Around 1913, its formation was the bank heist of the millenium.

Low interest rates plus inflation will continue to hurt the savers

Not sure if the link will be added when it’s outside the message box. Here goes again:

http://www.businessspectator.com.au/article/2013/10/15/economy/how-spot-housing-bubble-it-bursts

Federal subsidies are a sham, especially for housing. Unfortunately, a small group of homeowners in high cost and leveraged areas (with the help of the real estate industry lobby) are unwilling to accept the temporary pain that would result from their elimination.

Builder confidence lowest in 4 months:

http://www.marketwatch.com/story/builder-confidence-lowest-in-four-months-2013-10-16-101031231

My favorite line from the article: “Either…home builders see real fundamental strength in the market and are unworried about the rise in rates and the weakness of consumers’ confidence, or they are kidding themselves and are headed for disappointment.â€

House Flippers making a comeback on the high-end properties:

http://www.marketwatch.com/story/the-return-of-the-million-dollar-house-flip-2013-10-17

All you need to know about the so called ‘housing recovery’ as far as retail buyers is concerned was contained in FHA Commissioner Galante’s request for a $1.7 billion bailout, the first ever, for loans made after the housing bubble burst. If people are still defaulting in large numbers on homes bought at the BOTTOM of the market what does anyone think is going to happen to the loans the FHA has been making during the pseudo ‘reboom’ in prices. The FHA is going to be the next mega bailout and it won’t be in the single digit billions when its books are really examined in part because the all cash buyers who dominate now do not buy mortgage insurance from the FHA.

Housing prices have gone up dramatically. Yet the fundamentals do not support that dramatic rise. Incomes have not gone up, the unemployment and underemployment rate still is stubbornly high. I am not a perma-bear. Perhaps I am not seeing something?

Depends on what you define as “fundamentals.” For SoCal housing, they no longer mean income, growing economy, unemployment/underemployment, lending standards, etc.

The new fundamentals are:

Supply (restrained) = higher prices

Demand (high) = higher prices

Interest rates (low) = higher prices

Money (high) = higher prices

Yields on competing investment vehicles (low) = higher prices

@Nimesh Patel, what you are not factoring is is interest rates.

Examples for 30 year loans:

Interest rate: 5.5%, loan $460,000, monthly payment is: $2611

interest rate: 3.25%, loan $600,000, monthly payment is: $2611

Dropping the interest rate from 5.5% to 3.25% means that the selling price can jump 30% but the month mortgage payment does not change. This is what we have seen happening over the last few years.

The 30% jump in selling price is not the result of a healthy economy but in fact the product of interest rate changes.

Ernst Blofeld, what I mean by fundamentals are two pillars that support sound housing valuations; income growth and employment. For most people (not counting the ultra rich areas) they support their house payments via income and employment. Income has gone down since the great bust since the Great Recession ended. Unemployment is still abysmally high.

Now I do understand that very low interest rates allow a buyer to buy more house or to have lower payments. But I don’t know how or why someone would want to buy if income is not growing but declining and the job market is not stable.

If someone is in a good position to buy a house and they feel comfortable with their own situation then more power to them.

“Why are builders so reluctant to build more homes in the face of rapidly increasing home values?”

As a builder, I would like to answer this question posed by the DOC. First, all construction materials went up a lot, with lumber as much as 100% in one year. Labor cost went up a lot, because the real inflation for what the labor is using the most – food, housing and gas – went up way more the the published numbers which exclude these 3 items.

Another component – land – in the desirable areas, where everyone wants to buy because of safety, weather and jobs, is almost non existing, unless someone buys a house and adds the cost of demolition to the original cost, – …land is super expensive. This is nothing new; Lord Blankfein explains this in almost every post, and he is right.

For this reason, builders can not build a lot, to make a difference, in the desirable areas where the whole demand is.

To buy in IE, does not make any sense financially as one of the bloggers mentioned on the previous post – AZ and NV offer the same thing without the financial difficulties to be faced by CA soon. In IE you have all the disadvantages of being in CA with no benefits.

As many of the bloggers accurately stated many times before, the real demand pushing prices higher are for the costal areas which are global markets where most of the liquidity in the global financial markets creates an enormous pressure on prices. For those small/narrow areas along the coast, the median income is irrelevant. All the factors accurately stated by the doc are true for more than 99% of RE in US, except few pockets of incredible high demand – LA, Orange County and SD county along the coast, San Francisco, NY.

and just think all those builder cost for all of those necessary commodities the builder needs on top of the land have also increased due to manipulation by Wall Street manipulating the commodities market the equities markets virtually every market is nothing but a rigged Casino! That’s why I said earlier you have a better shot at the sportsbook in Vegas! And there’s proven stats to back that claim up as well! there is a reality show about a guy here in Las Vegas Steve something, he has a sports betting call center he has some very wealthy clients that fly in on their jets and from their own mouth said they’ve done 30 percent better with Steve then they have investing on Wall Street. 🙂

Lynn, you are right. I totally agree with what you say. However, that is not going to make the builders to build more. Because of the factors I mentioned, prices in the areas with the most demand will continue to increase till new supply can come on line – that is old small houses to be demolished and new ones to be built. For that to generate a profit, the prices have to be really, really high.

Building is also like a casino gambling in this economy. You make a decision based on current market, then, by the time you finish the demolition and the building you have to sell in a totally different market, constantly manipulated by the FED up or down. Also, the % return has to reflect this high risk and increased uncertainty created by the FED and the politicians – otherwise, there are no risk takers.

Directly or indirectly, the FED is the main one responsible for the price levels.

Punctuation? The run-on sentences don’t really make sense.

“To buy in IE, does not make any sense financially as one of the bloggers mentioned on the previous post – AZ and NV offer the same thing without the financial difficulties to be faced by CA soon. In IE you have all the disadvantages of being in CA with no benefits.”

^ This. I am earning a ‘median’ income level but due to high rents I am driven out of the Metro areas (luckily my job is in software so I can do everything remotely if need be). Once I started looking outside of the Bay Area at like Visalia and out in the central valley, then I realized I might as well move to Nevada which I think will be more stable when sh*t hits the fan. It’s also better for starting an LLC (business friendly as opposed to CA) and some personal income tax savings. Still within driving distance of family in CA for holidays.

The Fed has become the much heralded “Bad Bank”. Holding tons of garbage and buying more every day. It’s all been to save the member banks and big institutions. This has helped lenders to get new loans that have more chance of being paid bank onto their balance sheets.

I’ve noticed that reverse mortgages and HELOCs are now being pushed by the banks again. But with tougher qualifying stds.

Is it just me, or is the architural designs of the 1980s the most attrotious style of all time? I mean, if you took a poll for architectural stylings (ie, midevial, gothic, neoclassical, etc) I’m fairly certain the 1980s stylings would be comparable to mud huts with dirt floors.

100% agree. The worst part is that it’s not just the outside style; the interior layouts are equally horrifying. I can imagine it now:

“Hey Phil, working late again tonight? Wanna split another 8-Ball? I gotta finish the blueprint on this sweet octagonal master bedroom and figure out where I can frame in a 20ft wall of glass block.”

Lol too funny! You should see the shi* boxes that were built in 2006 here in Las Vegas! Square stucco boxes with maybe 3 tiny Windows selling for 300k! Lol they would dream of a glass block wall! These height of the bubble houses were truly a prime example of – no one cared at all about the underlying asset, the Bubble is all about the notes! Because the notes are money! So they monetize that 30 year note make there million dollars off the $300,000 30 note that’s been monetized upfront the day you close escrow, you think they really give a crap about the underlying asset!? The houses became no

different than the tulip bulbs of Holland s tulip bulbs bubble. Its the same scam they do it over and

over and over again just changing whatever underlying asset is backing the debt. That’s why we are

turning into this feudalist society where a handful of people have all the wealth and all the people that

produce all the actual real assets have nada its a scam! The entire monetary system is rigged not just

the housing market.

Speaking of poor construction, in case you have not heard, moldy drywall from China made its way into the US and into homes built in US from 2001-2007. If any of you own or are considering purchasing a home built during that period, buyer beware. You can google the topic or here is an example

http://inspect-12.com/mold-remediation/chinese-drywall

90% of EVERYTHING built in this country since World War 2 is absolute shit. Since the architecture from the post-war era onward is mostly hideous, it’s not so sad that it is unrcyclable trash built to last one generation, if even.

I personally will live in and buy only homes built between 1920 and 1935, a period that produced some of the most beautiful homes and spectacular apartment buildings ever built.. or that ever will be built.

Modernism wrecked our cities and suburbs. For every modernist gem such as the homes of Neutra and Lautner, or some of Wright’s more beautiful and livable homes, most of the ordinary ranch houses and-argh!!-split-levels of the 50s, 60s, and 70s, are ugly, unlivable crud- temporary fads that were sad and outdated in a decade.

This whole housing debacle is a complete and utter mess….like five monkeys trying to f*** a football. I want/need prices to come down but I’m not sure they will.

Here’s a new game that I think the banks will play so the masses can afford a home: 40, 50, 75 year mortgages. So many people in SoCal buy based strictly on the monthly payment (not the total real cost of asset) And these longer-term mortgages would allow them to buy a home otherwise unaffordable with today’s 30 year terms. So homes keep going up in price, no problem, just add years to the mortgage.

Mortgage is set to 30 years max for a good reason. 30-year olds will retire in 30 years, willingly or not, due to age or job availability. Even with the same monthly payment, take-home income is no more. Not to mention many expect to feed on their homes in retirement years, not the other way around.

the powers that be have been in damage control mode since the crash. the banks stand to lose too much money on the collateral that they are holding in the form of foreclosed homes. this past summer’s market was engineered so as to reduce the discounts the bank would have to accept in the sale of their reo properties. we are near 2005 levels and so the time to act appeared to be feasible.

what was forgotten was the needed wealth production that would fuel the needed effective demand. that wealth production was curtailed by obamacare and internecine wrangling in congress. the powers that be have recognized their mistake and have begun to capitalize the business and production sectors while hoping the pricing levels for housing remain stable and unchanged. sadly, there are some in congress and in the federal bureaucracy that wish to destroy this country and are working at cross-purposes with wall street’s attempts at economic recovery.

In short, gentlemen, and ladies also, we are in the midst of a civil war that is being fought on a totally different battlefield. making the monthly payments and avoiding homelessness is now the new daily struggle. expect more to be demanded by employers, especially in demonstrations of company loyalty. despite the myths taught in the public schools, slavery and cheap labor built this country. we have called the tune for the past 150 years, it may now be the time to pay the piper.

Leave a Reply