The last to the party: Investors and flippers competing for small amount of inventory. Home prices increasing at fastest rate since 2006. A case analysis of a Burbank investment property.

The data coming out on home prices is rather clear. Home prices are moving up steadily in the last year now increasing at a rate last seen in 2006. Of course, little of this is coming from wage growth but more from easy access to debt, investor demand, and historically low supply. One thing that people fail to remember is that during the last housing bubble, people were supplementing a lack of income growth with easy access to debt to add fuel to the housing market. This time, the easy money is being supplied to banks and hedge funds that are simply chasing higher yields. Anyone that has a hand in the housing business, especially in the grind it out rental business understands that it is no hands off endeavor. This is why it is surprising to see how much money is now being funneled into the market by brand new small time investors, especially in places like California. You know things are getting frothy when new money is willing to chase the rental business.

Investing big in Southern California

I saw this interesting post over on Redfin:

“We are a working couple first time buyers in La California. We have 300K$ down and were preapproved for 900K loan.

We never owned property before so we are seeking expertise advice and answers to these questions

1.   We were wondering about what people who have gone this route have to say or give advice on that.

2.   Is this the right way to go?

3.   As we understand how important location can be, we are debating whether we buy it in Burbank N Hollywood Sherman oaks, La near USC or West Hollywood? Investment wise what would make the most sense?

4.   Also for maximizing investments and cash flow what’s best 2, 3, 4 units or more is best?

5.   What things do we look for when we go see the apartment?

6.   What questions should we ask the seller?

7.   What to look for in the surrounding? Besides school public transportation and safety obviously?

Any comment and/or advice is greatly appreciated!â€

Think about what is being asked here. A first time buyer is looking to dive into a $900,000 investment property (almost $1 million) and has many questions that are basic for most investors even considering a $100,000 investment. So let us just pick a place in Burbank that fits the $900,000 mark:

283 N Florence St

Burbank, CA 91505

# of Units 4 Units

Beds 4 Bed

Baths 0 Bath

House Size 2,088 Sq Ft

Lot Size 7,379 Sq Ft Lot

Year Built 1947

The above place is a 4-unit property. The place is listed at $895,000. From the income sheet we find that the property will produce a gross income of $41,580 with expenses of $5,633. The expense amount is incredibly low in my estimation. From practical experience by the time all is said in done with taxes, insurance, vacancies, repairs, and just the operation of a mulit-unit you are likely to get a net operating income of something close to 50 percent of your gross income. Even with that said, the rents here are essentially $3,465 per month (or $866 per unit).

Let us assume this investor goes with this property. In more expensive areas of California investors are now buying to flip whereas in lower cost areas like the Inland Empire, more are buying to rent. From the initial notes, this potential buyer will put down $300,000 for the $900,000 property. Let us be generous and say that everything goes well and they manage a 60 percent NOI on their first year (meaning they kept expenses at 40 percent*). What is the cap rate here?

$24,948 / $900,000 = 2.77 percent

*Mortgage payments and depreciation are not considered operating expenses so that does not impact NOI

Keep in mind the above assumes a very optimistic scenario. In the end, this investor is going to be putting $900,000 at play for a 2.77 percent rate of return and they will be working for that money. If not, they’ll certainly be paying someone for that rate of return and this will cut into the overall rate.

Keep in mind we still need to factor the actual $600,000 mortgage payment. It looks like they were pre-approved and with everything said and done, the APR on this thing will likely get close to 4 percent on an investment property. So here is the principal and interest:

PI:Â $600,000 loan at 4% = $2,864 per month

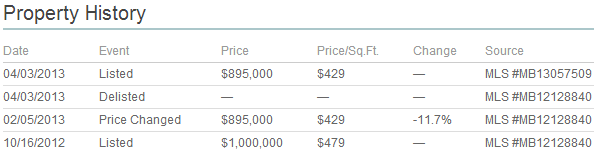

The place is only producing $3,465 gross per month! Not factoring anything outside of principal and interest, which is big for a multi-unit, you are looking at a gross minus PI amount of $601. Bwahahahaha! What is amazing is they tried to sell this place for $1,000,000 last year:

Any seasoned investor looking at this is probably shaking their heads. Even the press now understands exactly what is happening:

“(Reuters) Home prices have been rising since last year, helped by investor demand and tighter inventory. The top five states with the biggest gains in prices were Nevada, California, Arizona, Idaho and Oregon.â€

Helped? The market is being driven by this. In SoCal 35 percent of all purchases last month came from the all cash crowd.  The only reason you would buy a place like this example is if you believed in solid appreciation. This is what many of the flippers are doing. Buying a place, fixing it up, and selling it into the current momentum for a quick profit. The fact that people are considering diving into the current game in LA and OC for rental cash flows boggles the mind, especially new investors looking to put down $300,000 on a $900,000 property that will throw off a yield lower than you can get in regular bonds.

Saving $300,000 is no small task. I’m curious as to what the perspective would be on buying a place like this?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

89 Responses to “The last to the party: Investors and flippers competing for small amount of inventory. Home prices increasing at fastest rate since 2006. A case analysis of a Burbank investment property.”

Flippers have a pretty short window of opportunity here. The future is a real crap shoot these days. Make hay while the sun shines.

What happens when the Conservatives win back the WH and Senate? Obama is setting the stage to destroy America and can make it look like a change in just the Senate to Conservatives will be the fault of the conservatives.

I don’t trust this market or this Administration. Interest rates will rise soon by Fed action or if the Senate flips to Conservative…. Buyer be ware.

Don’t you mean what happens when a Democrat like Paul Volker takes over the FED from Republican money printer Ben Bernanke? It is all about interest rates and the last FED governor who cared about the value of a dollar was Paul Volker.

You guys still don’t get it. Republican, Democrat, George Soros, the Koch brothers, Faux News, MSNBC, blah, blah, blah. This is just theater to distract the masses. Both parties answer to the same masters. NO changes will be coming anytime soon. Count on it!

Like the Republicans are any better stewards of this ship? We are sunk no matter what party ends up in the White House!

“Obama is setting the stage to destroy America…”

Based on your use of hard facts, deductive logic and analysis of the data at hand, you’re as good as any to be the voice for the “Conservatives” on this board, as the rest seem to have gone into hiding.

@mlimberg: Please take the Extremist-Obama-hating-drivel back to FAUX news. I’m with the others that have replied to you. Neither party seems to have handled this mess properly but I’m getting tired of FAUX’s bull…. As others have stated, there is only party when it comes to big money: the corporate party. They will win at all costs and the average Joe is either along for the ride OR is be to be taken for a ride, depending on whether you are in their way, or are riding their coattails.

I’ve been saying this for years now, Volcker is still sitting just a few doors down from the WH these days, twiddling his thumbs as allegedly smarter people run the economy. I was hoping against hope that when Obama appointed him, real monetary management was finally coming to our country. Alas, it was just window – dressing, business as usual. Depressing as hell.

Additionally, Romney’s campaign was a joke from the start, if he had been smart he would’ve realized that a true populist campaign would’ve won the thing, provided he had laid out a blueprint for genuine reform right down the line, from eliminating corporate welfare along with a flat tax proposal. My former hero of politics (Bill Bradley) actually sat down with Tip O’Neil and Ronald Reagan and enacted the last real financial and tax reform in my lifetime. It won’t happen again.

This one’s for you, DFresh:

http://freebeacon.com/frank-abolish-fannie-mae-freddie-mac/

Nice of Frank to tell us this now, after he’s out of office and the damage is done.

In matters of finance, there is but one “party”. If this is not obvious to anyone by this time, they have not really been paying attention. The US is run by large corporations and bankers. Whatever is needed to keep them whole and running the show, will be done.

The fed is at the end game. They can’t raise interest rate anymore. If they do, US gov’t won’t be able to finance their exponentially growing debt.

It’s over. It will be 0% forever until something blows up and end it all.

After that, there will be war to utilize the military prowess that we have been putting money on.

That’s what I keep questioning….why are people buying at these ridiculous high prices….home values have already appreciated. Do they think it will further rise? plus the rents are also not rising. I live in Irvine. My apt comm had same rent last may that it has now…most of the investors are counting on making a huge profit from sale. I am just wondering how much more the prices would rise??

Live in Irvine also. Don’t understand what seems to border on panic buying.

Maybe it’s those .01% interest rates you get on CD’s at the local banks?

When interest rates do rise (and they will – just that nobody knows when) the market may do a 180 and morph into panic selling. Especially if the hedge fund/syndicates start to get out.

There’s a lot going on: Investors trying to make short term money (check out those REITS), the State wanting higher and higher property taxes to feed its unquenchable thirst for spending what it doesn’t have, the real estate brokers and realtors who want more and more fees and who need to show their former clients they “really” didn’t sell them something that is 3 times more expensive than it should be. We know there are very few jobs paying what is needed to afford these houses (and there won’t be this money for the next 10 plus years based on projected growth rates, the Feds 10 year is 1.8%). The State has aligned itself (conspired) with the real estate associations, developers (and their “environmental” industry). The State needs the realtors to keep propping up this house of cards. Anyone want some tulips? The investors don’t see what’s coming. When interest rates rise (and the federal government will need this to happen), these properties are going to lose their luster like a bond. When you see the European Central Bank cutting it’s rate to 0.5% (the German 10 year is at 1.1%), and they are even talking of going to a negative rate, you can see they are like a drug addict who keeps taking more and more to kick the habit. Investors have to go somewhere. We can see these guys are out to destroy the American and European middle class. Something’s going to happen. The bubble will have to bust. There goes the housing market.

I’m an Irvine/ South County resident. Bought a condo in Laguna Hills, prices on that condo since Dec. have gone up 75,000 on a 172,000 condo…good numbers. You have to sell at the right time. I expect 100,000 or more out of this deal before I sell. The government/Fed/banks are going to put forth new home buying programs that will sucker in more buyers into the mix and at about that time the investors and hedge funds will be the sellers and the bubble will pop once again with the regular folks getting screwed again. The banks can’t let housing crash before they let out more of their pent-up inventory and to take advantage of rising home prices. Everything surrounding housing is very strategic.

Here are some examples of incredible flip situations. One only need to look at the current list price (given the eventual sale price may be slightly less) and then look at the ‘price history’ section of the details.

This house likely sold in a backroom deal with the bank to an investor for $295K, now 4 months later with remodel on the market for $484K.

http://www.trulia.com/property/3098870460-3601-West-Blvd-Los-Angeles-CA-90016

This house sold for $260K last Fall and now listed for $435K.

http://www.trulia.com/property/3090886860-2009-West-Blvd-Los-Angeles-CA-90016

Both appear to be decent remodels. In any case, simply shocking for those of us who were thinking in 2010 or 2011 that the market would continue to drop for several years and that houses in this dismal part of 90016 are listed at such a high price. But worse yet is for any of us to think we can secure these bank backroom deals…

That was my thinking as well and if we had a real free market it would have been going lower. There can only be so many rentals or the prices for rent will be pushed down. Then the Investors will want to sell. This too will push sale prices down. The large institutional investors must hold the properties for a minimum 5 years and can extend an additional 10 years. They are scrutinizing the rent rolls. Depending on sucker er, investor demand will determine what the appraisal on these homes will be. Its time for some bubbly! Buying a house these days is more of a gamble than gambling because with gambling you depend on Lady Luck. With buying a house you depend on the manipulations of Ben Bernanke and Jamie Dimon, Brian Houlihan et al.

Correction: I meant they are securitizing the rent rolls not scrutinizing! Also institutional investors can extend for additional 5 years for a total of 10 years before they can sell.

My hat is off to this seller…bought house, remodeled it, now flipping…all in less than two weeks for a potential 88K profit? Dang! Sweet! FHA okay!

http://www.redfin.com/CA/Compton/708-S-Bullis-Rd-90221/home/7362313

That is what we call “makin eazy money in the CPT.”

The local gangs need to reevaluate their business model. Selling drugs on the street corner is very dangerous, against the law, likely prison time if caught and not nearly as lucrative flipping houses.

Will “Flipping Houses 101” be offered in high school or college? Seems like a good career. 🙂

I live in one of the Oregon communities most influenced by the Southern California real estate flipping mentality (not that you’re all like that but you know, in most of the country people pay 2-4 times their salary for a house to actually live in). We had the highest appreciation and depreciation during bubble years in Oregon. Prices are up 20-30% from a year ago in most neighborhoods and 50% in the most desirable neighborhoods – at least with respect to the more entry level family homes, luxury homes are still moving very slowly. We are seeing some FHA buyers trying to get out ahead of the FHA changes. To beat out the other FHA buyers and investors and because they have to get the deal done before June some are clearly resorting to offers 10-25% over the current reinflated values. It will be interesting to see how the FHA changes will play out. If they reduce FHA buying power by X percent will the market similarly reflect that change?

*Oregonreader

July should bring interesting numbers. Seeing similar things in Southern CA. This may be the piece of yarn that starts the unraveling, although I am not holding my breath. I think we are in this bubble for a while. The Fed is stuck, painted into a corner, nowhere to go.

I’ve read many times on this blog about how LA is a magical land filled with wealthy young professionals. Interesting USC study on LA demographics: 1 in 10 L.A. County residents in U.S. illegally.

http://www.latimes.com/local/lanow/la-me-ln-usc-immigrant-study-20130507,0,2036311.story

“Immigrants residing in Los Angeles County illegally make a median wage of $18,000 a year, compared with $47,000 for U.S.-born residents. Only 33% have health insurance, the researchers found.”

Drinks, LA County is huge…these numbers should be taken with a gigantic grain of salt. The prime locations everybody is frothing at the mouth over represent a small sliver of the county. Needless to say if you are making the 47K median salary, buying a house here isn’t even on the radar screen. These people are probably living paycheck to paycheck worrying if they can make the next rent or car payment.

“The prime locations everybody is frothing at the mouth over represent a small sliver of the county.”

A ‘small sliver’ of SoCal occupied by wealthy boomers, foreign cash buyers, trust fund babies, etc….low income demographic in SoCal rapidly growing, in no position to buy a house (unless multiple people pool together to buy, rent out rooms, etc. to pay mortgage) Many low income likely require some form of govt aid, not to mention infrastructure strain, overcrowded schools, clogged roads, etc. Who pays the majority of taxes to fund this…working poor? Businesses? Under thirty crowd loaded with student debt, sub $15/hr jobs, moved back with Mom/Dad, has three roommates? In some neighborhoods one in three adults in the US illegally. 33% of the pop makes $18K/annual average. The “small sliver” can hide from financial/social realities of a bifurcated society for only so long. Boomers who bought decades ago huddling in wealthy enclaves, multiple low income piling in together to rent houses owned by investors/hedge funds everywhere else.

http://www.latimes.com/news/local/la-me-ff-immigrants-study-20130508,0,126530.story

Maybe these factors were part of the reason Raytheon just announced 170 jobs with average 250K/yr salary departing El Segundo for Texas. Maybe this could free up some inventory for those “young professionals”. Twenty years ago this would have been a major story on local news. Nowadays latest yoga craze, celebrity news are top stories.

Drinks, I’m going to bet that small sliver of society living the high life will do just fine. As I’ve said many times, the divide between the haves and have nots grows everyday in this country. This is yet another reason why people will do almost anything to “own” property in some of these protected wealthy enclave areas.

Regarding those Raytheon jobs. I would bet that most of these folks won’t be selling their Manhattan Beach or Palos Verdes houses when moving to Texas, they’ll probably just end up renting them out. As the saying goes…when you sell here and move out of state, coming back is almost impossible!

Got to agree with LB on this one. I am seeing the highly desired areas at or above 2006 prices in the SF Bay area. Palo Alto has houses in the $1.5M range getting multiple over-bids the moment they hit the market. The rich are doing quite well in this economy. They are very picky and don’t consider anything less then AAA real estate. And that’s why the highly desirable areas are seeing bubble level prices while the lessor areas are seeing stagnate to small price rises.

Actually, these folks (the ones making less that $50K a year) are living 6 to 8 people in a crappy one or two bedroom apartment, pooling money to make rent and make ends meet. Now, why they even hang to do this is a question that I really don’t have an answer for.

Met an electrician (non-union) down here in Houston who had moved here from LA. Said one of the many reasons he moved down here was he was making less money per hour than here and pooling his money with 5 other guys just to survive in LA. He moved to Houston, is making more money per hour, less taxes and has moved into a home that he bought.

As long as people keep thinking the living in LA is all that and a bag of chips, the cost of living there continues to go crazy.

It’s full of both. That is part of the ugly truth about L.A. that its promoters never dare to mention.

I can tell ya from my ‘survey’ of the Los Angeles dating websites, that young professionals seem to be throwing a lot of their money away on fine dining, over seas leisure travel, leasing overpriced automobiles, and any other number of other things that make me question their retirement capabilities. Also loads of 30 something women on the sites just now starting college (WTF did they do for 10 or 15 years?).

One of my interns, after graduating, back in 2006, bought a 600k home in Porter Ranch, a BMW and decided to have a baby with a live-in girlfriend. He’s only making 130K per year or so.

Has anyone ever been to that Lucky Strikes Bowling place in Hollywood? I went once for a colleague’s birthday. 100 bucks for the group to bowl for a few hours, 20 dollar drinks at the bar. I don’t drink so it didn’t phase me any, other than to question the sanity everybody around me. Another birthday I showed up to, down at another Hollywood lounge, had $40 drinks! That’s a shot of alcohol, some ice and some juice or whatnot. $40!?

From someone not originally from LA, this whole place seems like an unsustainable and insane money waste.

You have to be exaggerating. $40 for a standard alcoholic beverage? I’m in NYC all the time and even there amongst billionaires I never see a place that charges you $40 for a standard alcoholic beverage. Or do you mean a 20+ yr old Scotch?

We have been conditioned to live in a bubble society. Everything becomes inflated during the run-up. Whether it’s stocks, gold, or housing, you need to learn to ride the waves as they grow and get out before they pop.

You got to know when to hold em … and know when to fold em.

You guys STILL don’t get it. All figures you quote here are in little pieces of paper called U.S. Dollars. The Federal reserve can make those little pieces of paper WORTH WHATEVER THE WANT. They have signalled quite clearly that under no circumstances will they allow the value of those little piece of paper to go up. They are bound and determined to “reflate” the value of homes, which are an all-important asset on the balance sheets of the TBTF banks, as measured in terms of those little piece of paper.

You absolutely MUST STOP THINKING ABOUT HOMES PRICES FROM THE PERSPECTIVE OF WHAT YOU THINK THE HOME IS “WORTH” IN REAL TERMS. The “real value” of the homes is not what’s really moving. What’s moving is the value of the little piece of paper (moving down, that is).

The prices of most everything else measured in terms of those little pieces of paper will eventually move higher as well. What you are witnessing in home prices is the FIRST STAGE of a REFLATION PROCESS which has been the Fed’s goal all along.

The savvy speculators know this, and the ones you detail here probably have some vague sense of it, perhaps sub-consciously, but THEY ARE NOT SPECULATING ON HOME VALUES. They are speculating on the value of the little pieces of paper (from the short side). Housing is merely the vehicle.

The “investor” ends up with an income-generating real asset on the one side, and on the liability side he gets SHORT a fixed stream of payments in those little pieces of paper called U.S. Dollars. As an added bonus, this trade can be executed with 5x leverage AND NO MARK-TO-MARKET.

THE “ACTION” IN THIS TRADE IS ON THE LIABILITY SIDE, NOT THE ASSET SIDE. If you focus on the asset side – ie home prices and what you think they’re “worth” – and fail to internaliz the FACT that the unit of account in which you’re quoting the price IS NOT ITSELF FIXED IN VALUE, you’ll fail to understand the entire phenomenon.

This “housing rally” is in the VERY EARLY STAGES.

Absent wage inflation, which is happening exactly NOWHERE, your argument holds as much water as a thimble. The hedge funds can’t turn a profit without a corresponding rise in RENTS which cannot rise without WAGES increasing. Duh…

Sure they can. People will just continue to adjust up a higher percentage of what they outlay for housing. It is a basic need. Not a good sign of the economy, but maybe that is what this country needs. A younger generation being actually forced to choose between housing and a new ipod/flat screen in order to comprehend the utility of each.

I don’t think it’s lost on most commenters here that we’re witnessing price inflation in the face of a dollar printing party.

As NZ mentioned, how can the demand continue unabated when the numbers show real wage deflation? Absent even more extreme creative financial products for wage earners to buy than we’ve yet seen, are there enough foreign buyers and will investors simply stay put to hold the trajectory?

There seems to be an implicit assumption that The Fed operates in a global vacuum. There’s a finite amount of manipulation that it can wield. If The Fed is so omnipotent, then why didn’t it prevent the last bust?

So basically savvy investors are buying property as a hedge against inflation.

Yes…right… but ….”What can you do against the lunatic who is more intelligent than yourself, who gives your arguments a fair hearing and then simply persists in his lunacy?â€George Orwell

Bernanke: Ladies and Gentleman, I give you, Subprime Bubble 2.0

http://wallstreetfool.com/2013/05/07/subprime-bubble-2-0/

Nihilist: a common misperception. It’s a tenet of Economics 101 that “wages lag.”

The “you can’t have inflation with wage rises” stems from the illogical notion that inflation is the result of too many people working. It’s not. It’s the result of a decline in the value of the unit of account, which causes all prices to rise over time.

Home prices basically tripled in the 1970’s. Why do you think that was?

Wage inflation? Nope, real wages collapsed?

Oil crisis? Nope. The Arabs only quadrupled the Oil price (in dollars) after we devalued the Dollat against Gold by a factor of 4 (and didn’t stop there).

It’s was pure inflation, engendered by a supply of Dollars well in excess of demand, resulting in a decline in the value of the dollar – AGAINST EVERYTHING.

I can never understand why this is so confusing for people to grasp. It’s happened time and time again throughout history as tired and ineffectual government resort to currency debasement to mask their inability to keep financial promises to the electorate.

THIS IS NOTHING NEW OR UNUSUAL!

If there is a decline in the dollar across the board RE will be the last thing to benefit if their is a glut of rental supply. People will pile in as many as they can into SFR while paying exorbitant energy and food costs. Supply and demand rules are not thrown out the window in an inflationary environment, in fact they are enhanced!

We’re headed for a deflationary spiral one way or the other, globalization assures this.

I recall in the 70’s that wages did keep up with inflation. We got easily 4 to 5% wage increases every year. I recall it going up to 8% in late 70’s.

Nowadays, inflation is purposefully underreported and wages are not going up much due to destruction of unions.

We have become debt slaves since the 80’s and it gave us a false sense of prosperity.

Hyperinflation will not hit houses. It will hit food, gas, and everyday products. House prices will continue to collapse.

Home prices also fell off a cliff immediately following while rates went up. In the late eighties, prices spiked and fell off a cliff again while rates averaged lower.

Wondering what your point is supposed to be.

nothing is the matter with flippers. they fix up places and increase the value of the whole block when they sale for the inflated prices(whoever moves in is usually an improvement over the prior resident). I wish them Godspeed.

The market is what it is. This is the reality at the present. When the banks recover enough, then Uncle Ben will pull the plug and then God help us all.

There is nothing wrong with people investing in housing. Particularly when that investor is skilled at taking a blighted fixer and doing a quality remodel – that person provides a legitimated and helpful service to the community. This enhances the neighborhood and is an efficient use of land and resources.

The flipper on the other hand is a far more insidious breed. The flipper will cut every corner imaginable in a rehab and will quickly resell the house- destabilizing a neighborhood with a bunch of crap. In order to make a profit doing this one often has to cheat. During the first bubble some flippers had zero income but kept purchasing house after house by falsifying mortgage applications. I know of another that converted an attic space into living space to double the square footage with out the proper permits and in direct violation of zoning regulations. I know of another that beat me out of a house that I wished to purchase as a primary residence despite the fact it was a homepath.com “first look” forclosure that forbade investors from bidding on the property until 14 days had passed. This was designed to give the person simply looking for a home the first crack at it, so they would live in it and help stabilize the neighborhood. “Flipping” is always a Ponzi scheme and the flippers that lost in the first bubble are doubling down this time – they often walked away with fistfuls of cash by renting out their depreciating properties last time while they stopped paying their mortgages.

Oregon reader, what do you know about southern California? It is up to your real estate broker to check the permits. If they don’t exercise due diligence, go against their errors and omissions insurance coverage. Go against their license as well. That always gets the attention of professionals. That is always my first angle of attack. There is no room in the profession for cheats and dumb licensees. I have met my share of the dummies and cheaters, but they can not fool the white rabbit. You can also go against the flipper if they were less than honest on their disclosures. Boy, you may even need an attorney if you get serious into buying expensive property. Here again, the white rabbit knows a shark.

I hope you’re being sarcastic.

I’m sure those folks that over leveraged last time around on lipsticked pig flips and eventually couldn’t keep up with the debt service are really making the neighborhoods great!

I guess I will just leave it up to the very well regulated realtors, mortgage brokers, and the morality of the flipper – what could possibly go wrong? Is there any empirical evidence that would indicate this might be a bad idea?

I don’t have anything against flippers per se. A flipper always returns the inventory to the market so no problem there. A flipper in many instances can rehab a place, sell it for a profit and do it all for less than a regular Joe because of their “connections” with contractors.

The problem I do have with flippers is most, 90% at least, take short cuts, hide problems, absolutely destroy the character of houses. When I walk into a flip and it looks like Home Depot just puked all over the house, I just get sick, but that is not the problem, it is shoddy workmanship that is usually the downfall with flips.

should anyone who asks those kinds of questions be leveraging ~$900K to buy rentals???

It’s always seemed to me that a naive investor is far, far safer to invest in a basket of apartment REIT’s, rather than buying a single, highly-leveraged property.

You get diversification and professional management. And — based on the numbers for this Burbank property — the REIT pays a distribution that’s comparable to what you can get on your own. And the most you can lose is the amount of your initial investment (if the REIT goes bankrupt).

Of course, REIT yields are low right now, and prices are high.

. Charles

holy cow!!! 4 units in “House Size 2,088 Sq Ft”

@can’t afford

4 units @ 2088 sq ft yields 522 sq ft per unit. This would be consistent in size with other 1 bedroom units from the same era (Great Depression to post-WW2). Here in the LA area, 450 sq ft would be typical for a junior 1 bedroom unit, 700 sq ft would be a large 1 bedroom unit. Supersizing did not take place until the 1980s. A typical Great Depression to post-WW2 SFR house would have been around 1000 sq ft with 3 bedrooms.

Back then the typical American probably weighted about 50 pounds less than today so the smaller square footage would not have been a concern.

Brian McCarthy, thank you, i now have a name to go along with the market top in housing….you could have wrote this in 2007….actually i think i did read something almost word for word like this back then…you remember don’t you? it was right around the time when oil was $147 and going to $200

The money for housing “investment” is coming from people who have pulled cash out of the stock market(which incidently is why I can’t figure out why the stock market keeps going up) and from savings.

I think theres gonna be a lot of blood on the street not too many years from now. If interest rates go up substantially, then really watch the stampede.

“why I can’t figure out why the stock market keeps going up” – The rise is very similar to real estate i.e. leverage/ investment yield/ foreign buyers/ pension funds/ and even Central Banks are buying stocks.

The race is on, and no one is raising the caution flag… yet

I think it keeps going up because the people participating in it think money printing will lead to asset inflation. Whether it does or not is not relevant, but if you get enough people thinking it will, then you have a real big party. Also there is the conundrum of what the heck to you do with your money while you wait for bad things to happen – the old irrationality can outlast one’s solvency problem. Also a while back, things looked fairly priced. Heck there’s probably hundreds of reasons, both logical (based on what information is at hand) and illogical, that people keep bidding up stocks.

Interest rates don’t even need to move up substantially for this to happen. A 100 basis point move will get the ball rolling. The market keeps going higher simply because of POMO. The Fed has been active in over 80% of the trading days since QE infinity started.

Just found 146 Million buyers for overpriced homes.

http://bostonoccupier.com/infographic-the-absurd-contradictions-of-capitalism/

http://www.youtube.com/watch?v=Rr_DTozbH8E

If you’re gonna dump 900k in apartments, might as well pick a town where property isn’t bubbled up. Go to some small town where you can afford one of those 20 or 30 unit deals and give free rent to someone in exchange for dealing with all the crap that comes with the apartment. Newly retired people living solely on social security love free rent.

Or do some research and buy some farmland in a place where wind turbine development groups would enjoy renting yours and your neighbors’ land. ‘Course, JPM et. al. are muscling in on that junk too, jacking up the prices.

Maybe if you’ve lived in LA for 10+ years, it’s hard to think outside the bubble.

Let me try this one more time…

Let’s say as a though experiment, the Fed decided to enact QE4 in the form of DIRECT PURCHASES OF HOMES WITH INK MONEY.

So the FED ITSELF decides to engage in the “spec / rent” trade by buying lets say $3trl in homes nationawide over the next 12 months, financed with funds they simply printed out of thin air.

Would home prices rise? YES.

Would that mean it was a “housing bubble?” NO

Would other prices soon start to rise in tow? YES

Would wages EVENTUALLY rise to equilibrate with the new price level? YES

Would home prices subseqnetly crash again? NO, becuase the price level would have risen to meet home prices at the new post-inflation equilibrium.

This is essentially what is happening, save for the fact that rather than acting directly, the Fed is acting indirectly by providing cheap financing to speculators as well as a free PUT on home prices through its committment to QE infinity (or at least until they get what they want, which is a REFLATED price level).

I’ve never seen such a false and misinformed post in my life.

“Would home prices subseqnetly crash again? NO, becuase the price level would have risen to meet home prices at the new post-inflation equilibrium.”

I think you meant the “wage level” not “price level.”

That said, I don’t see the wage level rising. The unemployment rate will keep that from happening. From a stock charting standpoint, this home price distortion is what is known as a gap in the price chart; a spectacular rise on low volume. There is no actual support under this pricing from a wage standpoint and there won’t be.

This is a bull trap. When the investors pull back their cash purchasing due to a lack of yield the lever on the trap door will be pulled and I believe prices will collapse back down into alignment with wages.

There are no historical parallels to this situation.

That might work Brian, then again it might not. History teaches us that Government attempts at price stabilization have be volatile.

QE is not a cure for economic pain, it’s a pain killer. A better way to reflate would be for the Treasury to issue stimulus checks on a monthly basis.

“Let’s say as a though experiment, the Fed decided to enact QE4 in the form of DIRECT PURCHASES OF HOMES WITH INK MONEY.”

Would home prices rise? YES, not because of some natural consequence of printing money, but because the Fed overpays for everything.

Would that mean it was a “housing bubble?†Depends on the outcome right? If the Fed bought up homes and competed against normal buyers on limited supply, it may drive prices too high. And if the Fed bought homes but couldn’t monetize it, it may sell a bunch back and create deflationary environment. Answer would not be an absolute NO, but a conditional one.

Would other prices soon start to rise in tow? Prices of what? Cars? Food? Whatever it may be, the answer is maybe, maybe not. Remember that expanding the balance sheet does not mean the difference transfers directly to the consumer. If anything, inflationary trends are based on access to cheap credit, and not some monetary injection into the economy.

Would wages EVENTUALLY rise to equilibrate with the new price level? In general, more than anything, net worth will rise for those who have invested in the proper assets. Wages will stay stagnant for the lower class, but may increase in certain industries depending on their performance within the ecosystem. In fact, it’s happened already and is still happening right now. We’ve already gone through 3 rounds of QE, have wages really gone up in relation to the expansion of the balance sheet?

Would home prices subseqnetly crash again? Depends on what the Fed does. Fundamentals would say yes, but the Fed seems to have a million bandaids to patch that leak. perhaps patching it a million times will be long enough for the pipe to magically heal itself.

Wages aren’t supporting any sort of inflationary environment in our economy. Maybe some pockets here and there (e.g. silicon valley), but overall, the economy is still being driven by credit. When credit becomes less accessible, you will start to see contraction unless it’s supported by REAL wage growth across all social classes, and not just the elite or select industries

Brian, the Fed has been trying to reflate for close to 6 years now, and it hasn’t worked…all that they have done is bought some time…NOTHING has gone right except to maintain a low-level status quo (and the stock market is rising only because traders and trading bots need to do something all day – it’s no secret that the market does not reflect fundamentals). What makes you think that at some point, all of Ben’s attempts will magically “work” and that wages will rise? No news here: wages are declining and have been declining for a long time. Easy debt only works for a period of time, until it doesn’t. And we are about to find out what happens when it doesn’t work (this IS new Brian – -the Fed/gov’t has never tried this kind of intervention previously).

I’m seeing homes in the $1M range not selling. Cheap money is only getting the bubble reflated so far.

http://finance.fortune.cnn.com/2013/05/08/bank-lending-profits/

From the article above:

“After rising for all of last year, bank lending dropped in the first three months of the year

…

What’s more, nearly half of the profit jump at banks came from fewer loan charge-offs.

The problem is loan charge-offs are dropping faster than delinquencies. That may be producing unsustainable gains, and setting the banks up for more losses down the road.

“They are delaying charge-offs,” says Moreland. “And they are doing it more and more.”

“[for a 3 month period] Collectively, U.S. banks earned $40.3 billion. That was up $5.5 billion from a year ago.”

“The drop [in lending] comes as low interest rates are squeezing how much money banks can make from their traditional loan business.”

“A portion of the profit jump came from banks selling their loans to investors rather than holding them on their books.” [could one of those be … the government?]

http://en.wikipedia.org/wiki/Quantitative_easing : “The third round includes a plan to purchase US$40 billion of mortgage-backed securities (MBS) per month”. (it was 30 billion/month before I think).

So they can’t make any real money on lending with the current rates … so instead they will just take their cut and sell it off… to a government who has guaranteed to buy it… by de-valuing everyone else’s money. Is that about right ?

Can someone explain to me why the Canadian housing bubble hasn’t popped yet?

Perhaps the same reason can be applied to US housing.

Mom and pop are in the home rental business. Mom and pop are typically stupid and always late to the party. Own to rent is alread deat in the water at these prices.

Despite the ridiculous increase in prices over the past year in a half in LA County, prices will probably still continue to increase over the next 1-2 years at least. With mortgage rates at record lows, inventory at a fraction (20-25%) of what it was a few years ago, and buyer demand coming back in a big way, it’s hard to see this ship crashing any time in the immediate future. The way I see it, once momentum gets going ( in either direction) it usually goes for at 5-6 years. This swings both ways, of course. Back in 2010-2011 you couldn’t convince anyone to buy a home ( that certainly applies to many people on this blog). Now that housing is back in a big way, there will always be fools who will purchase at prices above what they should pay, and it will continue for years before the market eventually reaches a point of collapse. Unfortunately, the game is either 1) stay put and be a renter forever or 2) take some risk, buy a house, and hope your not on the sucker buying at the peak making everyone else money.

If peole can buy at parity with rent, its a good deal. If not rent for a while longer. This is unsustainable and when the collapse comes from the recent disconnected stock market, it will make 08 look like a picnic.

It’s a simple math of supply and demand. Why is it so hard to understand? Obama administration came up with those crazy laws to slow down foreclosure. Ben helicopter keeps dropping money into the market to lower rate to zero, making another bubble. Wall street hedge fund managers bought thousands of homes, creating the shortage of supply. Price got no where to go but up for at least 2 more years. Forget the wage growth, economic cycle, migration, population, house-hold formation, or any if those none sense statistics that don’t work in a manipulated market. It will end badly as always, but in the meantime, we’re making money and ENJOY THE RIDE!!!

You got that right, fundamentals really don’t matter in a rigged, manipulated market. As long as interest rates and inventory stays low, this market isn’t going to reverse. I’m sure it will blow up again sometime in the future. Based on past history, I don’t see much of a different outcome from Housing Bubble 1. Banks, lenders will get bailed out. Homeowners who got in over their head will get a slap on the wrist. Renters keep getting the short end of the stick.

What’s the point of picking a listing that’s been languishing on the market for over half a year.

It probably would have been a better exercise to run it for past sales in that price range, which would be a more accurate comp. There are two I can find in 91505.

http://www.redfin.com/CA/Burbank/3914-W-Heffron-Dr-91505/home/5391319

http://www.redfin.com/CA/Burbank/214-N-Cordova-St-91505/home/5392620

The first will probably get you a cap rate around 5%, the second around 4%. Not exceptionally impressive, but I can understand why a mom and pop investor might go for it.

Under 4 units means they can get a owner-occupied rate (if they live in there for a while) and not only do they get a cash-flowing property with 300k down, they’ll accumulate principal over time and more than likely get the benefit of several tax deductions as well.

You are definitely stretching MB. I know you are a perma-bull when it comes to housing but come on. Did you even do a careful analysis on those properties? Even you are optimistically putting a pie in the sky cap rate. By the way, if you live in one unit there goes the nice change from the top unit and you’ll probably live in the $2400 unit instead of the tiny 1 bedroom that rents for $1100.

“Front house is a 4 bedroom 3 bath divided into a 3 bedroom 2 bath, which is rented for $2,400 per month, and a single which is rented for $1,100 per month. ”

So much for pride of ownership but hey, it’ll only cost you $915,000.

“Rear building was bulit in 2004, consists of a 2 bedroom 1.5 bath over garage which is rented for $2,000 per month and a single unit with no kitchen rented to a fashion consultant (doesn’t live in it) for $900 per month. ”

Good god. That will be fun to manage. This place isn’t on the market and sold for $915,000 in February. Even your second option is a mess:

“Currently 1 bed and 1 small single vacant.”

Income sheets on multi-units are always optimistically high but you already knew this.

“Easy access to debt” ?? …hardly,

FHA guidlines are extremely strict, and conventional loans even more so. People who qualify for loans today are a FAR cry from the lending standards in ’05-07. Mom & Pop investors (stated income and VIP programs) have practicly no access to capital as they did in the past.

BTW: FreddieMac just posted a 7 billion dollar profit to the US government! I bet next quarter even more!

In one sense, the uninformed person who is desperate to find an investment and knows the stock market will implode doesn’t care about CAP rates when buying with cash. You only need enough cash flow to cover living expenses, which could be low if you own a primary residence.

I still think that $300k is better off buying a 4-plex in a cheaper area, and no loan. I can’t even imagine how many buyers will just do what the broker/agent says. How did they get $300k and not learn basic investing?

Buying a 2-year+ long put (deep-in-the-money) on market indexes in about 1 year seems like a good play (you can also roll it over until the inevitable crash if it takes a couple more years); synthetic short basically, if you do a real short don’t leverage it too much. The carry cost is not that high in this case. I can’t call a top, but in 1 year we’re more likely closer to the top 25% that the bottom which is what matters. It’s more about how government policy changes beyond 2015. Why are most people long the markets? Because they don’t know any other way, and that is how the sheep get slaughtered. Also most people’s retirement account only contains long mutual funds or cash or bonds anyway by design.

Mortgages suck. Low rate, high balance, good luck. That’s pointless right now. Any scenario where the housing market doesn’t crash is probably a really bad one anyway because it means we went even more overboard on printing money and policies to prop up prices at the expense of all else.

Be glad all the foreign (often stupid) money is coming in and overpaying cash for houses, that’s how you absorb the most currency when it comes home to roost (perhaps because we printed too much). You don’t want them buying twice as many houses after the crash do you? Timing is everything.

From what I have witnessed, most of the cash buyers are foreign money. So let them buy at CRAZY prices, Cali needs the roll taxes! Then when jobs get better, and homes prices come down, those foreigners won’t be able to rent at high prices, then they will either sell or pour money into their own little “money pit” that they have jumped into.

The taxes which are currently $981 will increase to approx. $9,000. That makes this property completely unworkable at these rent rolls.

Dear Potential Investor,

Forget California. Google “Williston, North Dakota Housing Shortage”.

Now your talking jobs and wage driven.

My wife and I recently stopped looking for houses. We were looking in Corona area. Most houses were either REO that had a lipstick make over by throwing soe cheap carpet and paint and all of the sudden it became a “freshened up” house, or some investor “remodel” with the cheapest materials installed by the cheapest labor. Everything else was a short sale. One house we looked at needed about (no joke) 50-60k in real repairs to make it right. The bank that owned it threw carpet and paint. My realtor was pushing for us to buy and make a offer 10k OVER asking price. Against my better judgement I did. My realtor wanted me to use their home inspector. i went ahead and used a home inspector that came recommended and I knew will work for me. We ended up walking away after getting the report. One other house the other guy offered 50% down on a 500k house. I laughed and walked away when asked if I was willing to do 55% down add another 10k to my offer AND give the owner a 60 day escrow and 2 weeks after closing to move out. I actually laughed at my realtor when she said this is their counter offer if I want the house. I decided instead of buying a house now to remodel my garage. Realtors all spew out the same lines.

Life isn’t about waitng for the storm to pass. It’s about learning to dance in the rain.

That sounds like one of those boringly vague phrases that “creative” housewives script stencil on their walls these days.

Doc

I think you missed two things in this analysis. The couple said they were approved for $9000000 loan so they could be going for a 1.2 mil property. Perhaps at that magic number they will actually positive cash flow but I doubt it. Simply put you left out the taxes (not to mention landlording insurance) in your calculation. Say prop 13 leaves them a tax rate of 1.2%. They will be paying a minimum out of pocket in your figures of $300.00 a month to be landlords – on top of throwing their $300 grand on the table. Someone please cue Barnum.

Leave a Reply