Mom and pop landlord nation: Small time investors pick up the slack left by large institutional buyers in housing.

The bread and butter of any healthy housing market is having a good amount of first time home buyers. That is what drives new home building and also allows for the homeownership rate to go up. Most of the new household formation since the bubble burst was largely done through new rental households. Institutional investors pulled back from the market starting in 2014. Yet the homeownership rate continued to decline. So who stepped in to fill in this gap? Some of it was filled by first time buyers going in with low down payments thanks to FHA insured loans. But a large percentage was made up by mom and pop investors with a lust for HGTV and their dreams of becoming flippers or landlords. In most manias, once mom and pop are diving in with gusto you really need to think about what is going on. I know Taco Tuesday baby boomers are looking for a little “excitement†in their lives and putting habanero salsa on your Chipotle burrito isn’t going to cut it. So why not take the biggest risk by buying real estate when prices are near a new high?

The rise of the mom and pop landlord

Who knew rental Armageddon would be brought on by smiling and aging baby boomers? So we knew that institutional investors, those that buy at least 10 properties a year, had their fill of buying properties at a discount between 2009 and 2013. Essentially they were the only group with deep enough pockets (and bailouts) to buy up and amass a large portfolio of properties while others were getting kicked out of their homes and losing jobs. As institutional investors pulled back, mom and pop investors stepped in.

A recent report highlights this change in buying dynamic:

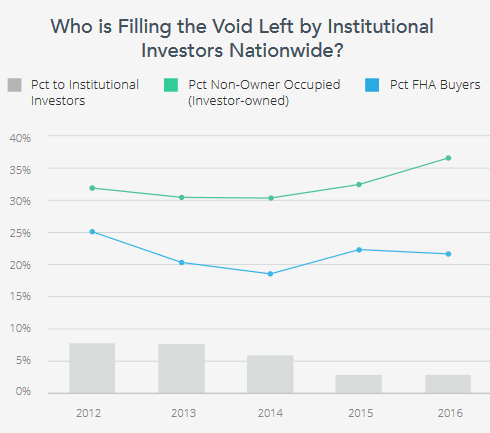

This is really telling here. So you will see the sharp drop off of institutional buying hitting in 2014. Basically big investors were running the numbers on crap shacks and they simply did not pan out. Also, the stock market was presenting many better opportunities for making money. However just at this point, you will notice the green line above picking up signaling that smaller investors were deciding to roll the dice and give their HGVT education a go.

In 2016 the number of smaller investors hit a short-term peak. 37% of all properties bought in 2016 came from mom and pop investors. That is a large number. And this is happening in expensive areas as well. Last year for example, there were many cases that I saw of a house being sold and then suddenly being put on the market for rent. In one case, the property sold for $800,000 and was then rented out for $2,800. This is an incredibly poor investment and that is why institutional investors are out but mom and pop are in it to “win it†because #YoLo housing.

This information is also is useful because it puts the brakes on the house humping cheerleaders thinking that everyone now has deep pockets and are out buying in mass. No, you simply have fewer people able to purchase more properties and inventory is still low. This is very telling regarding our nation where the top is getting very wealthy while the middle class is largely being pushed out. Even in SoCal for example, Orange County has now made a new peak in home prices largely due to new homes selling for $1 million or more. Yet Riverside and San Bernardino Counties are still way below their peaks reached from the last bubble. In other words, wealthy areas are booming and other areas are still lagging behind.

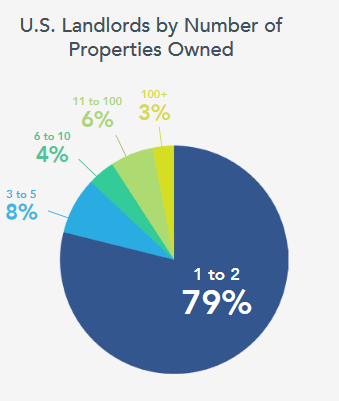

Of course mom and pop investors are the largest by sheer numbers:

What changed in the last bubble however was the fact that institutional investors actually found residential real estate to be an attractive investment. That was new. The fact that 37% of properties sold in 2016 came from small investors is stunning. This group will likely be very fickle and should the market turn as it always does, will they be able to ride it out? How deep are their reserve funds should a recession hit? Reading the comments, some are delusional in thinking real estate is the safest of all investments out there. Most successful investors have 6 months of reserves for each property they have. Meaning, if you have a home that rents out for $4,000 a month you want to have $24,000 in reserves for the property (probably more if you factor in other costs associated with owning a property).

Small time buyers are always last to the game. And as we learned from the last mania, bubbles can last longer than most expect and at this point, most now believe this is a new normal. Each day that passes, many see those crap shacks as a housing Cinderella.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

192 Responses to “Mom and pop landlord nation: Small time investors pick up the slack left by large institutional buyers in housing.”

Are some of these mom & pops just expecting the values to keep screaming up?

I was watching one property in Torrance; sold for $845k and after what I’m guessing is about 10k in fixes, put up for rent at $3,600/mo. I looked up the phone number and it belonged to a lawyer in Redondo Beach; perhaps s/he had a huge down payment to sink? I don’t know what voodoo numbers people are using to make it pencil out…

They’re not using voodoo numbers or magic to work things out. In all likelihood, there’s no numbers being crunched at all. They just dont really care. There are A LOT of people like this in the South Bay and throughout LA.

That lawyer probably has a paid off house in Redondo worth at least 1.5milion, which he likely bought for no more that $350,000 (on the high end). Assuming he makes the average lawyer salary in LA of $173,000 (which is heavily dragged down by all the public defenders making 70K) and has a spouse bringing in another 50-70K, his household income is easily over 225k.

He has seen his investments double or triple in the last 7 years and has a nice cushion to add another property. Having real property gives him peace of mind because if the stock market tanks or “corrects” then at least he has a house that will still rent, albeit at a lower rate. The rental income is almost more of an added bonus to supplement his household income.

They will lose money on a house like this but probably wont even know it. I think people think housing will keep climbing and they can sell it for a gain many years from now. Problem with that strategy is that people are not taking into consideration opportunity costs.

The new homes in Fontucky go for $550k, but then add 200K to that for 750k. Mello Roos at 1% is capitalized for a PV of 100k, same for HOA of 3.6k after tax, which is 5K before tax, for another PV of 100k. The yards are so small that the kids all play at the community center, hence the high HOA fees. This additional 200k reduces the loan capacity of the purchaser. Don’t be fooled by the low price. For 750k, you can buy a house with a real yard closer to work which will also reduce your travel time and cost of transportation. The cars really wear out fast with the long commutes.

Reminds me of the 1637 Dutch Tulip Bulb bubble and 18th century South Sea Company Bubble. Two older examples of human nature completely disconnecting from reality.

Thomas The Tank – don’t forget 1920s Florida real estate.

1980’s savings and loan junk bonds debacle bubble.

Don’t forget people throwing mind hand over fist at any company that had a dot-com in the name, in the late 1990s. When I came to the SF Bay Area in 2003, it was still trying to recover, I stayed in a very nice hotel for less than $40 a night and when I said it was an awfully nice room, they said, “It should be, it used to rent for $120 a night”. My apartment in Sunnyvale was something like $799 a month and the 2nd month free. Things didn’t run up and get crazy until 2005 or 2006, they wanted to raise my rent to $1200 for the same little 400 square foot studio. I moved to a bigger apartment for $1000 a few streets over but then of course the whole economy came crashing down. I bet that studio is $1500 now if not $2000, and the 1-bedroom nicer place right off of Central Expressway (no not the Daisy but right near it) is probably $2500.

Alex is the story of a renter. For both the 2001 and 2008 crash my house mortgage payments for a 3000 SF house remained constant at 1400/month and actually lowered to 1100/month in the last decade due to refinancing. In 5 years, my payments will only be property taxes at $300/month. My crystal ball back then worked well but it seems to be broken now and I can’t tell you when or what will happen next. Based on gut feelings, I wouldn’t buy now unless you know you will be in the same house 10 years from now.

Bob is the story of an old shill. Someone without the advantage of mobility increasingly required in the modern world.

Ha! Probably. Everyone is a shill for something. I call them beliefs and opinions. In summary, I believe in investing in real estate but I believe in diversification and buy low/sell high even more. Sorry Alex, if I offended.

Dot Com Bubble, Credit Bubble, Oh My.

And this from 1984 . . .

http://www.nytimes.com/1984/12/08/opinion/the-day-los-angeles-s-bubble-burst.html

Oh $SNAP

http://www.cnbc.com/2017/03/02/snap-gets-its-first-wall-street-rating-and-its-a-sell.html?__source=yahoo%7Cfinance%7Cheadline%7Cheadline%7Cstory&par=yahoo&doc=104316160

I think we have officially hit the 2nd tech bubble of the millennium.

Snap your fingers and it’s gone in an instant. I would be curious if the markets use these as potential markers to start the reversals? How do we know when to flinch when its time to sell a house or get out of a flip?

“a lust for HGTV and their dreams of becoming flippers or landlords.”

At some point I will inherit a house and though I will rent it out, I have no dreams of becoming a landlord. Ugh!

“At some point I will inherit a house”

I’m not trying to be mean but a buddy of mine recently was watering at the mouth waiting for death and when it came found out that unbeknown to him the folks had a reverse mortgage and he had 30 days to settle up or GTFO. He HAD to sell the house.

He’s a bit taken aback by the fact that he still doesn’t have a house…..don’t count your eggs.

Maybe the good doctor could do a review on how prevalent these are? I’ve heard some horror stories.

A house forces its owners to save…-Not-. Might have had a ring a truth 20 years ago when real estate wasn’t as financialized and commoditized like it is now.

@Prince Of Heck It is better put “it forces a homeowner to choose to gamble on the housing derivatives market where the thing of most value is the borrowers Note”.

yes, I know the story. Adult child of 40+ years moved in with his Mom and provided care for her for 10 years. The deal was (OK’ed by his sister) that he would inherit the house after Mom died. Well, there was a reverse mortgage on the house. It was upside down. They had to give it back to the bank and the adult child was out in the cold. This happens all the time

Gilbert Fleming – I know there are homeless people who are useless crackheads, but in “silicon valley” where I am, I actually make a point of trying to *talk* to homeless people when I can, and so far it’s a lot of ex-engineers, ex-electronics techs, people who owned small businesses, and people who had jobs, not glamorous jobs but jobs all the same, when the economy crashed. It sounds like your friend will be out collecting cans soon, here’s a tip: If he’s clean and presentable, he should get to know companies and get them to save up their cans and bottles for them. I met a guy who does this and he makes half again what I do, lives in a place with running water and a flush toilet, and is done by early afternoon. So, he’s doing better than about half of the people up here.

@Lynn

Well put

An illusion as well. So you inherit a house and get a prop 13 tax break! Your elderly folks lived there and for the last 20 years of their life, they didn’t do a thing to the house. You inherit it, but find the plumbing leaks, the electrical has problems, mold is growing, and there is asbestos in either the floor tiles, duct work, or ceiling, etc., etc. You will have to anti-up some money unless you are real handy. And as soon as you start one project, you realize the building code changed over the last 20 years, and now your project just got way more expensive because you have to meet code! Unless you inherit an updated home or have money, my advice, is to sell!

Some are already getting out! Check out this landlord’s 50% aspirational haircut … from dreams of 1.4 mil to 700,000 https://www.zillow.com/homedetails/2031-Whitley-Ave-Los-Angeles-CA-90068/20803895_zpid/

There is not enough information to prove they are taking a loss. Maybe less profit. Probably picked up the property in 2010 and upgraded before trying to sell it at that fictitious price.

The information is right there! 50% loss of an aspiration to sell for 1.4 mil.

That is fine but it looks like the property taxes are still based on $100k so it appears to be an old house that was picked up in the prior housing crash and recently upgraded but still made $500k profit. I see no loss just less profit.

Dude you’re missing it. Less than two years ago this seller thought they’d catch a bid double what they’re willing to accept today, in no lose Los Angeles for that matter. That’s a 50% loss on their former aspiration. That matters because around here people tend to make decisions based on paper gains.

This is probably not a traditional sale. That house is worth much more than $699k. It may have been sold to a relative at an artificially low price to keep the property taxes low.

Nonsense! If that were the case they wouldn’t have needed to list.

Isn’t the original listing agent (Douglas Elliman) the same POS RE Agents with the Million Dollar listing a$$hats, in LA and NYC?

Agreed. The home is definately worth a lot more then 699K. Could be anything, relative, trade, cash under the table, who knows. There is more going on here then what we can see.

Lol but they still are optimistic it will go up 1.9% in a year!

on a plane heading to the new glory hole. farewell California. thanks doctor.

I hope you meant honey hole.

I sure hope your comment contains some auto-correct errors…

Once the last qualified buyer capitulates and buys a home, it’s the apex of a housing bubble.

I think there is a misconception on FHA mortgages though, and why the numbers are down, in that it’s my understanding that you can get around PMI buy paying a higher rate w/ a non-conforming loan (and right off the whole amount, as opposed to PMI)

The other thought is that even my credit union has 100% LTV jumbo loans available-

15-, 20- and 30-year terms for purchase or refinance

Up to 97% combined loan to value (CLTV) financing

Up to 100% CLTV when combined with UNIFY’s Down Payment Second Mortgage Helper*

$50,000 to $2,000,000 loan amounts

*Down Payment Second Mortgage Helper

Looking for a zero money down option? We’ve got you covered with our Down Payment Second Mortgage Helper. Borrow up to 20% down payment when your first mortgage is with UNIFY.

Look forward to consistent monthly payments with a fixed rate

15 years term

Amounts up to $150,000 (minimum 10,000)

—————————————

What could go wrong?

“Amounts up to $150,000”

LOL, that’s not even a down payment in socal so no worries here.

It only needs to be a 3% down payment, since they will loan you up to 97% LTV. The only immediate problem for these borrows is going to be when things get bid up past their appraised value (and when said bubble bursts) but at that point, just walk and rent for 7 years… Just like the last bubble. It’s not like you would have any of your own money tied up, especially in the first 10 years of loan amortization

Don’t worry, I’m saving up, and with a little help from Bank of Dad (Jim?), I’ll soon buy my dream house!

We’re all gonna buy rentals and we’re all gonna get rich!

Until the music stops anyway.

Don’t you know, staying in your golden So Cal sarcophagus for at least 25 years guarantees riches at the end of the rainbow.

Answer is obvious. Rent while landlords pay RE taxes and maintenance fees. The house that I would want to own would cost much more in RE taxes, HOA fees and maintenance than place I am renting now.

Bagholders locked in. Time for things to Tank Hard NOW!

You tell em dad!

Yeah, I am getting sick of all living in a multi-generational crapshack that we have to rent ever since motel prices went back up from there $40/day rate

Any idea of how long before we see a normal amount of inventory back in socal? 16 offers a property that’s not even that great feel like a bubble to me…

So I bought a small condo in studio city area of LA in 2014 on a short sale after looking for years. I didn’t think it would be great investment but i just had my rent raised 20% in the last year and I was sick of it. Fast forward to now and I have nothing tying me down and it’s probably up 20-25%. My question is should I pull the string and sell now?? This certainly isn’t my dream place but I’m now locked into these low prop 13 taxes and I’m comfortable. My fear is if I sell, I may never get back into the market again if my job situation changes for the worse. I also don’t really think it makes sense as a long term rental either if I hold onto it when I buy by next place whenever that may be. I know I’m all over the place, but any advice would be appreciated.

Sell and do what? Go back to renting and get hit by another 20% increase and maybe be locked out of the housing market in the future.

You even said you didn’t buy for an investment. Enjoy your home and sleep well at night knowing your costs are locked in and you are comfortably resting on a nice equity cushion.

Oh yes, all those excess apartments coming on line in the near future will compete for customers by slapping them with a guaranteed 20% rent increase…

“This certainly isn’t my dream place but I’m now locked into these low prop 13 taxes and I’m comfortable.”

If you have prop 13 keep the place. If you don’t like where you live, you could rent the place out and the money you make, spend it on rent living where you want to live. It’s an easy swap as long as the prices even out.

I agree with Lord Blankfein. You are in a great, stable situation living in a decent property in a desirable location.

If you should relocate for another work opportunity, keeping the studio as a rental would allow it to pay itself off and provide you with a easy to return to home, should you decide to move back.

I know a middle income couple who purchased a house in La Jolla in the 1980’s, lived in Italy for several years while they rented it out; and, were able to easily move back years later into a house/location that has appreciated in value beyond their wildest expectations.

In summary, I recommend you stay put and enjoy, rather then receiving a relatively small short term gain that could be offset by future rental costs.

Google: 1031 real estate exchange rules

I say sell. Stash the cash, watch the fireworks for 2-3 years, then buy the same place for even less than you paid for it in 2014. Rinse and repeat for as long as the Fed and Co. make real estate a “market.”

You can get rich buying and selling the same house if you time it right.

A lot of these small time investors are Mr. and Mrs. Chang from China. They know that the Chinese govt. will screw them over and devalue the Yuan by half at a minimum. They know that China will hit a banking crisis and savings will be in jeopardy. They buy here knowing that even if the market falls by 20%, they’ve still saved 30%, plus Mr. and Mrs. Chang still believe that there is upside appreciation. And not just the Chinese are doing this.

The world is destabilizing before our eyes. It may as well be 1938, and I would love to have reading material, if anyone suggests it, on pre-WW2 asset flows of rich Europeans and Asians, who were smart, connected and knew the game wasn’t going to end well in a couple years.

I think deep down, from India to China to the US, to other countries, nefarious leaders think taking us to war will be the hail Mary pass to juice the world economy, which can no longer be juiced by central bankers in a low rate environment. It makes wasteful large infrastructure projects look like a great idea. Heck, it makes Helicopter money look like a fantastic idea.

Yeah, and they did the same for commercial RE-

http://blogs.sas.com/content/sastraining/2015/03/26/who-paid-500k-for-a-us-visa-over-10000-people/

Yikes…same conversation 5 years after I first started reading here.

Some of these comments are pure fantasy, prices are not just going to come down. something will have to force inventory to market. The banks already figured out the biggest mystery with the last crisis, DO NOT FORECLOSE. If they don’t foreclose, no inventory forced to market, supply cannot meet demand, prices don’t go down.

Before you say, “but it’s not that simple…” Trust me, it is that simple. its the only way it can happen its a market, that is how all markets react. Figure out what will cause the supply to outweigh/outpace the demand and that is where your prices will come down and will come down exactly in proportion to how much more supply there is than buyers. Prices won’t just magically float down because they are “too” high.

Right now there is no indication that supply is meeting demand, no less outpacing it.

Until it does, do not count on a drop.

Go to an open house and sit there for 3 hours…you will see 10 parties per hour come through on a complete fixer with massive work needed, priced only 3% below other sold comps. All wanting to buy, all saying there is nothing to buy, all frustrated paying high rents, all wishing they could find a place to buy and get an offer in before the next guy. It is unfortunate for buyers but it is not a good market especially when trying to get into the market for the first time.

Good luck all, don’t let all the doomsdayers on here talk you out of buying if you really feel like it is your best move. No one knows what will happen tomorrow, but the trend today and the last 7 years has been to buy. If you see the trend change, then change with it. Until then, go with it, until you actually see good economic reasons not to (supply and demand).

“its the only way it can happen its a market, that is how all markets react”

LOL then don’t call it capitalism, call it what it is, manipulation and who can compete with that. I can not wait to see how this all plays out……..and you bulls better not disappear (like last time) when reality comes back to this insanity.

Property taxes are owed by the owners. If the bank forecloses, they need to pay them.

I think you have point-makes a lot of sense and you can see the potential foreclosures on different real estate websites like Zillow-I also think there is another angle. I keep hearing-“banks don’t like to own properties.” However, go on Redfin and look at foreclosures-most of them were bought at auctions by-you guessed it-banks-unless I am reading it wrong-which I might be. So not only are they not foreclosing to help keep inventory tight-they are buying the foreclosed properties-to keep inventory tight. Makes sense-they make money on loans-the higher the loans-the more money they make.

That’s not what’s happening. An auction purchase record by a bank means no bids and as such the bank “bought” their own property back.

When properties go to auction, if they do not fetch more then what is owed they go back to the lender (bank). The seller (bank) can not accept less then what is owed on a property in a foreclsosure auction. It’s the law. Once the title transfers back to the bank, they can sell it for whatever they want.

Dude you’re the real doomsayer with the high rent scare mongering and no end of manipulation in sight narrative!!! We see you added anything can happen as an emergency exit.

I am not sure how I am the “doomsdayer” here…

Trying to time any market is a losing game, its gambling. the premise is, if you can afford to buy, in the long run regardless of timing you will be ahead in 30 years time. It is hard to argue with history. Yes there have been down turns, but in most if not all but the rarest of cases property appreciates over time.

Do with that what you want.

The “anything can happen ‘out'” means if a volcano, 10.0 earthquake, or tsunami makes the land uninhabitable, then you would have been better renting.

The manipulation dooms buyers and you’re saying it won’t end.

Bryan,

Timing the market is not a losing proposition. Buying at the top is a losing proposition.

I made most of my money in RE by timing the market. Yes, I did not buy at the very bottom or sold at the very top, but getting the direction right it did help.

There were more than 7 million who lost their houses in forclosure by trying to use your strategy. Nobody has control over what happens in 30 years.

The market has most certainly been rigged, as you explained.

I know of a couple (now separated) who stopped paying their mortgage 5+ years ago in Portland, Oregon. The soon to be ex-husband still lives in the townhouse to this day! I thought for sure the bank would have foreclosed by now…but apparently not.

The S&P 500 has nearly tripled since 2009. If I were a Mom & Pop and saw that my $350K stock investments in 2009 are now worth over $1M, I would be looking to diversify since what goes up 3X in 8 years, can fall even faster. What else can they diversify in that is showing any return other than real estate? My theory is that home sales are being driven now by people pulling their gains out of stocks. A ready down payment in the case above from stock gains (up to 700K) and low interest payments make it painless. ie I can buy a million dollar house with 700K down and have a 1300/month mortgage. They can either live in it or rent it and show a steady income flow. The stock market doesn’t show any sign of slowing and the cash is still pouring in.

The stock market has been running on fumes and hopium (companies borrowing to do buybacks and increase dividends) for a long time. Prognosticators have been saying that retail investors would be jumping in for past 8+ years.

Yes, but: I understand the underlying theory, but what about property taxes, insurance, maintenance, HOA dues and the like?

Operating a home is not free.

In SoCal, just the property tax on your example would be around $12,500/year. That’s essentially a *negative* 1.5% interest rate on the 700k down. (even allowing for MIH)

I think your true monthly nut would be between $2500 to 3000

Yes, the true nut would be about 3K counting maintenance. However, if you are getting 4-5K per month in rent, you are still beating bond rates(1%) and blowing away CD rates(0.2%). There is also the herd mentality when your neighbor/co-worker/friend is getting a 5K per month income from their rental property now, you’d love to join in. Speaking from personal experience. I’d like to point out, even though I’m an engineering making more than Alex from San Jose’s 30K income, and not an investment advisor, I think a diversified portfolio of stocks, real estate, and bonds is important. On a Social note, I think Alex is correct. There is a division of “Haves” and “Have Nots” that is rapidly growing. I am on the edge of of this and maintaining diversification will prevent me from being a “Have not”.

Correction above. I am an engineer. Given my rant, I own stocks, bonds and rental real estate. I believe in diversification and buy low and sell high so I am buying more bonds now than real estate or stocks. I finally believe Jim Taylor.

I WISH I were making $30k. The way I’ve learned to live, I’d be able to save $20k a year of it.

I’m making $13k and while in years past my employer talked about my income gradually increasing to $30k, we’ve stopped pretending it will increase at all, years ago.

This real estate market just gets hotter and hotter. CNBC has an article discussing a home in the LA area having 60 offers. Clearly, a lot of desperate renters are desperate. With this kind of action, one has to think prices could be headed much higher.

http://www.cnbc.com/2017/02/28/spring-housing-already-overheating-think-60-offers-on-one-house.html

Call it hot if you want even though it’s a classic forewarning seen time and again. Weak demand seeks even weaker supply earlier each year as bidding becomes more desperate.

“Clearly, a lot of desperate renters are desperate. ”

Great line! My favorite line for today. Buy now desperate renters! Kiss your desperation good bye and say hello to happiness! All you need to do is buy that overpriced crapshack today and leave your desperate life behind!

It will be interesting this time around if/when the housing market crashes again will the FED be forced to raise rates at that point rather the other way around having interest rate increases lead to the crash? I recall somewhere FED was starting to rely on market forces rather than they make the changes? Someone or some group is probably already trying to figure how high does a home have to be until you pull the plug?

Be sure to watch the new TV show on HGTV that debuts tomorrow night called “The Deed.” A “professional” flipper helps failing flippers who are in over their heads, and he comes to their rescue and bails them out. Just what the world needs, another flipping, flipping show. Lol.

https://www.youtube.com/watch?v=X0ebI5iGm-c

The Dow just hit 21,000 setting yet another record!

Stock markets and housing markets (especially in places like socal) are tied at the hip. People with money are making more money hand over fist. I have no idea how this could result in a tanking housing market…as jt said prices could just keep climbing and climbing.

@lord blankfein, DOW will soon be 50k. Median house price will be 2mio. So why don’t you buy now and become a millionaire?

Millennial – that’s exactly what was being said on sites like this in 2005 or 2006 … that houses were going to average 2 million so you’d better buy now, don’t remember dow 50,000 but I think they were talking about dow 20,000.

Buy now or forever be shut out!

What are you doing here? Get out there and buy as many properties now. Party like it’s 1929, 1999, and 2008.

Why aren’t you out buying? You’re missing the boat!

As the Lord said, the Dow has now hit another record high. The mom and pops who had stock are now sitting on over 3X gains from 2009. If they are older, they likely had 300K+ in the market then and now have over $1M. Mom and pop are smart and know that what went up 3X can likely crash down. What better way to diversify than to buy or upgrade to a nicer house with that extra cash? Or maybe buy an investment property with that cash because they see their neighbor spending 5K per month on rent and they think “Hey, I can live on 5K per month rental income if I had a rentable property”. A co-worker is basing his entire retirement on having enough rental property to cover his retirement income. And given that, he will have a nice tax-free retirement stash for his kids. So far, it is working.

Dude that’s hope and change. They could more easily rotate into bonds as rates move up.

Not that it’s a bad idea, but that’s such a narrow way of looking at it.

They could’ve had $500k in mutual funds by 1999, then had it go to $200k by 2001….

only to see it go back up to $600k in 2007, and then back down to $300k in 2009, and now they are at $1 million, and they should cashing everything out and buy real estate at its cyclical peak?

They’d be better staying diversified/liquid.

I agree. The stock market is also a roller coaster and prone to frequent derailments. If I had 1M dollars sitting in one car, I would definitely move some of it to a different ride. Some will disagree but with buying a rental house, at least there is some fixed income (likely better than the 1% bond rates or .2% CD rates today.)

Most people don’t want to be landlords.

I was reading that California is heading for 40 million inhabitants soon. That’s a whole lot of people, especially considering the LA metropolitan area alone accounts for over 13 million and population growth is far faster in SoCal than up north.

So OK, supply struggles to meet demand and, differently than in cities such as Miami, where huge numbers of condos, detatched houses, apartments etc are coming on the market as the result of a building binge, will struggle for a long time to come.

Proposition 13 may be great for several categories of homeowners, but it’s not so great for developers, who are hit with some pretty hefty impact fees by cash-starved municipalities desperately trying to raise all the money they can: this further restricts the supply of housing, especially in areas notorious for high fees as Proposition 218 makes it harder to levy new taxes.

In short at the moment California is seller’s paradise, and for good reasons. What will change that? Right now the only two possibilities I see are a Proposition 13/218 repeal and a massive budget/infrastructural crisis in the most populated metropolitian areas.

The former is as remote a possibility as me going back to live in SoCal, the latter is more real and scarier. SoCal already had water and electricity problems when I lived there and I’ve been told they got worse: plainly put infrastructures are struggling to keep up with population growth.

So far investors are willing to put with the inconveniences but how long before the inconveniences become big problems?

You’re on the right path but it starts with the latter to pave the way for the former.

“I was reading that California is heading for 40 million inhabitants soon.”

In a large part these new inhapitants are either filthy rich or extremely poor. The middle class are leaving CA for other states in the largest domestic migration in the state’s history. The majority of those moving into CA are split between those who have no problem buying a mcmansion for cash and those that will rent forever. CA is not attractive for the middle class due to high taxes & high cost of living. The median home price in CA is about 500K with that number being considerably higher in SF, SD, LA, and parts of OC. In order to comfortably afford a 500K home on a conventional you need to make 80K+ and have 100K for a down payment. The “American Dream” is really a nightmare for many people in CA.

I hear you… the costs of living in California, especially the prime areas, is what I can only call “horrendous”, especially if you have small children.

Childcare costs are high everywhere and schools… let’s just say you either buy a (very) expensive house in or near a good school district or have to fork out big money for private schools.

Of course if you make huge money or have big stashes of cash brought in from abroad that’s not an issue. Same if you are an immigrant from some dirt poor part of the world where even basic sanitation is considered a luxury.

But the rest of us… no thank you.

“What happened to the American Dream? It came true, you are looking at it”.

So true. We know a handful of military families who wanted to stay in CA to retire, but the cost of living wasn’t worth it. They ended up leaving for states like Texas, Florida and North Carolina.

My wife and I were in the Monterey area for 8 years before packing up and moving to the Atlanta suburbs. It’s not as scenic as CA, but I have a lot more flexibility to do/go where I want – not to mention ZERO financial stress since paying cash for my home. Worth it? Hell yes.

California’s politics are getting way out of control as the minority of leftwing extremists hold the highest positions of power. It’ll be interesting to see how the next 5-10 years pan out.

MC – I think you’ve got it. People mix up middle-class and middle-income. When they’re talking about middle-class (owning the means of production) they’re really referring to middle-income. Middle-class, where you own your own farmland, junkyard, factory, etc., usually work out to well above middle-income.

But let’s just go with middle-income here. If you’ve got bags of money your uncle McScrooge left you, you pilfered from your country’s Communist Party treasury, etc., the US and especially California, is a good place to stash your ill-gotten gains. If you’re dirt poor, well, for the most part the weather here won’t kill you, and we have a huge and thriving internal 3-rd world here in California. But if you’re middle-income, what so many call middle-class, you’re not sitting on pots of money, you’re actually producing something. Widgets or numbers on a spreadsheet or whatever.

That’s where you’re asking to get hit. The big earners, $500k a year income or more, have tons of ways to get out of paying taxes. And the bottom 30%, where I am, hardly make enough to pay taxes. But the folks in the middle pay a lot of taxes and fees and whoo …. raising kids? That’s gonna cost ya!

If I were making something in a factory, California’s a very expensive place to do that. If I were a doctor, I’d get paid maybe 20% less to go be a doctor in flyover country but my money would go 2X as far.

Hell if I were a right-wing Christian and so, a “real American” I’d have split for flyover country already. Where’s the church with the most fire and brimstone in their sermons, where’s the bar, and when’s the Klan meeting? I kid, I kid!

So the loss of the middle class is going to be more of a thing in expensive areas like California.

Alex, please give us a citation for the following: “middle-class (owning the means of production)”. Because the middle class has never been the business owners….

Jeff you’re mixing up middle-class and middle-income. Middle class means you’re your own man (or woman) you have a lumberyard, a farm, you’re a doctor or dentist, etc. You’re not an employee. Traditionally this worked out pretty well for determining who had two nickels to rub together and who didn’t. However, some employees are very highly paid these days and some independent people don’t make all that much.

The people I know who own two properties rented their smaller home out around 2008-2012 because they couldn’t get a good price for their home but with growing families needed to find a larger place. Most want to sell but it’s the only investment that makes any money.

Complete tangent I know. However if the political will was there. Is there a way house prices could be stabilised? Not increasing but not decreasing. So wages could eventually catch up and reduce the chance of there being a big crash?

Very doubtful. Attempts to initiate a price freeze will cause a lot of economic havoc. Companies will conduct mass lay offs to cut costs due to falling revenues. This will further damage already weak consumer spending.

Due to globalism and technology, incomes will not grow significantly fast enough to catch up to match current stratospheric prices. The best solution for long term stability is to allow prices to return to levels sustainable by consumer incomes.

Thanks Prince.

I love how this works always works out, history always will repeat itself because humans are relatively predictable.

In California there are some winners, but for every winner there are at least 10 losers. Last night I saw someone in West Hollywood looking for parking, had Michigan plates and the car was loaded up with stuff. I was also at Ralphs and there were some people sleeping in their car next to mine when I came out of the store.

It is a totally different game here and most can’t adapt. You don’t just show up and get your trophy. In the rest of the US they are handing out trophies left and right. You get a somewhat decent job and you can get a home in the suburbs with a car and can afford some middle class things, vacations etc.

Here you have to actually work for it, no trophy, crying Millennials and anyone else can move on.

Manbearpig – indeed. There’s all this talk of high-paying tech jobs but for every new engineer minted who gets $100k a year, three other people have to lost their $33.3k jobs. It’s a zero-sum game here. Out in flyover land, there’s always some fallow land you can turn into another corn field or something, but here, if I win, you have to lose. If I lose, someone out there has gained.

“There’s all this talk of high-paying tech jobs but for every new engineer minted who gets $100k a year, three other people have to lost their $33.3k jobs.”

Love those made-up, easily debunked stats! They almost make me want to give up and not work hard or smart, because then I’ll have an excuse.

What you call a trophy is simply a decent standard of living to most people.

Yeah! Demanding a decent standard of living! What are you, a commie? Move to Europe, ya pinko!

Yes, in the rest of the United States, Canada, and most European countries, what you are calling a “trophy” is merely a decent, modest lifestyle in a smallish house or condo that did not cost 10X your income, and where practicing frugality and prudence enables you to put a little money away toward your retirement instead of struggling to pay for a tragically shabby, outdated match-box house. Here in Chicago, a “trophy” is something like a grand apartment on Lake Shore Drive, or a 10-room mansion in Winnetka, not a decaying 4-room bungalow in a neighborhood where every house has bars on all the windows and that costs $750K.

I’m sad that so many people are willing to work so hard and pay so much for so little, that they regard such a crummy lifestyle as a “trophy”.

Hear hear! I am tired of being shamed and judged for balking at these prices. All concerns about the ridiculous real estate market in the last decade are ignored and avoided by just mocking the have-nots as either “entitled” latte-slurping millennials or “loser” boomers/gen-X. It avoids the real issue: why is there no middle class housing in California? No one is asking for a multi-million dollar home on the beach for a pauper’s wage. People are asking why a 3bed 2bath 1970s modest suburban tract home is priced at 7x+ your annual income.

We actually paid off all of our debt and have a real 20%+ downpayment but I feel like we, the responsible ones, lose out because we refuse to pay $800k for a flipped home (no reno) that sold for $600k just 2 years earlier. I am constantly wondering, who is buying? We just assume investors, rich foreigners, and reckless idiots (like my friend just bought a $550k 2b condo in OC with only 5% down).

Meri – You are not alone. In 2012 my wife and I had student debt and meager savings for a down payment. We could have technically gotten into a townhouse in the local area with an FHA loan but it would have been a stretch. Fast forward five years and we now have the 20%+ down, no debt, and two extra mouths to feed. In order to buy a modest 3-4bd home in a decent neighborhood we would have to empty our savings, mortgage $750k+, and pray to god that one of us never gets laid off. If we weren’t tied to CA (family obligations & jobs) we wouldn’t think twice about moving out of state!

Has anybody noticed that the cash buyers are all gone recently? especially last couple weeks? i noticed that open houses don’t get many buyers anymore. i’m talking about new york city areas..

Sure have noticed the same thing in a different market and it’s finally getting interesting again!

Reports that I have read state that prices and rents for luxury properties are falling in over-priced markets such as San Francisco and New York. Commercial loans are also being curtailed for fear that markets are being over-saturated with multi-family properties. Prices are definitely a lagging indicator relative to volume.

Looking – Watch out, I’ve gotten shit for talking about the SF Bay Area. NYC might as well be Pluto on this board.

By the time you are 50, most people fall into 1 of 3 camps.

1) Renter. Desperate to keep their job to pay the bills. Plan to work until they drop.

2) Honeowner. Glad to have a job. Plan to retire by 60.

3) Landlord. Can quit their job anytime. Can retire anytime.

I have several friends in SoCal, all of whom would broadly be categorized as Baby Boomer upper middle class – engineers, attorneys, etc. All invested over the years – some entirely in equities, some in real estate, some in both. In both camps, the RE investor/landlords and the stockholders, some did well enough to retire by 50 and some had bad luck or made bad choices and have had to keep plugging along.

In short, neither being a landlord nor a stock investor is an automatic road to the easy life. Being focused, ready to take advantage of opportunities and perhaps a bit lucky are required however you play the game.

BTW. I consider myself midpack in this group. Never invested in RE other than my primary residence and mostly did the standard, boring dollar cost average index investing. Retired at 55 with a lower net worth than the most successful of my friends, but with no debts or properties or tenants to manage. Works OK for me.

Sometimes just not being greedy is good enough to keep you from ruin. Early retirement with no debt and modest savings is a great accomplishment; we should all be so fortunate.

All you need is a “small loan” of a $1 million or so and you can be a landlord, too.

You post some real goofy ideas but this one was solid!!!

Don’t forget the other camp.

4) Asshole. Trolls like jt who put others down.

That was a little harsh. I’ll try to get more to the point.

4) Unadapter. Gets burned using the baby boomer playbook in the Gen X and Millennial future.

4) House debtor due to a reverse mortgage or HELOC.

5) JT’s telling people to do as they says, not as they themselves do.

“3) Landlord. Can quit their job anytime. Can retire anytime.”

@JT,

AAH! The light bulb just came on… can I please be 3) Landlord? All I have to do is buy now and retire soon after, right? Wish I would have met JT earlier in my life!

I was a landlord, but no longer! Before I started, others said, you’ll regret it, and I did. Very bad experience. I quickly learned that people are ‘pigs’, people don’t give a crap about other people’s property, and people think they are owed and that they don’t have to pay their rent on time. I learned that even normal wear and tear can eat up the ‘profit’ you think you have, and certainly it can wipe out that ‘profit’ when you have to make a place livable for the next renter! I’ve seen what happens when ‘investment’ properties creep into once decent neighborhoods … unmoved lawns, unwatered lawns, fading paint, and crap in driveways! Besides, I’m earning more in dividends that I netted in rental income! And, where I live, new apartments are going up very quickly … I’m thinking many landlords will eventually feel the pinch.

If I had the gob of money it takes to get into the landlord class, maybe a “small loan” from rich parents, say, then it’d be S&P500 all the way, baby!

The Orange Clown would be 2X* as rich if he’d just done that with his own “small loan” of X millions.

*2X as rich depends, he may not have any money at all these days and is just a puppet for Putin’s crowd; rumor is no one else will loan to him because he’s burned too many people.

If you qualify to buy a modest car, and have $5k, you can be a landlord and have a small monthly cushion in retirement. Which could mean food money depending on your ss benefits.

Saying you need a million dollars is just a convenient excuse to not ever do anything to better your circumstances.

This can’t be. JT said that you could have retired early had you kept your rental.

And with all of that working till he drops, there will be no time to troll those youngsters looking for answers on how not to get screwed in their futures.

JNS, there is something seriously wrong with your world. According to JT’s reality, you could have just remained a landlord and retired shortly after. Its so simple. Every renter is a loser but every landlord retires whenever he/she wants to, according to JT.

Future former landlord here: plan to sell my place when the lease is up at the end of the year. My experience (thankfully) wasn’t as bad as yours, but it’s definitely not a zero-effort activity, even with a property manager.

If you’re looking at entering the real estate game, it’s worth considering if you’re just interested in the returns or you actually want the property. If you just want the returns you’re probably better off buying shares in a REIT. Unless you have multiple properties and manage them yourself, it’s almost certainly lower risk with similar returns.

just past 2 days, i have few clients calling me saying their offers got accepted, and they offered about 5% lower than the asking price, and these guys have been looking and offering for over a year now. and suddenly all three of them got it… that really surprises me…new york city areas

According to reports, NYC prices are past peak and falling. Same goes for San Francisco since last year. Gravity is re-asserting itself on prices.

Just wait till the next financial crisis, when interest rates finally rise as they should have long ago, and the various debt bubbles- student loan, auto, and CORPORATE- burst and the grossly over-inflated stock and bond markets have grand mal seizures. As it is, New York has massive numbers of foreclosures from the last credit debacle, that were held off the market for many years. The health of the NYC real estate market is tied to the wealth of the financial community, as well as to rich foreign buyers. Foreign buyers are already disappearing and another financial crisis would cause the wealth to contract drastically.

Laura – this may be a larger reason than we think for the Orange Plague being voted in. Flyover people think the Earth was made 6000 years ago and Jesus rode a dinosaur, but they’re kinda like I like to say about horses: You can’t call ’em smart, but they can sure be sneaky. Probably 2/3rds of ’em realize that regulation, exposure, a little sunshine, on the banks and lending and real estate could make the party end. All those “hidden” foreclosures that have been sitting around empty could really piss in their margaritas. Cheeto Benito will keep the party going as long as inhumanly possible.

Alex sounds like he’s been self medicating and stuffing his mouth with Cheetos.

I love the term “Taco Tuesday Boomers.” I laugh and laugh at that because last Tuesday I was at a restaurant with a “taco Tuesday” menu and it was full of boomers who were lit up on margaritas. To make it even better the boomer next to me talked my ear off on how he was a 1/3 investor on five rental units and how he thinks his property manager is screwing him over. Taco Tuesday Boomer is the best tag line for our era. Old lushes completely blissful as the market keeps bubbling.

Haha cheap taco meat provided by courtesy of the SPCA and those hard taco shells, because that’s what they eat in Mexico, right? And margaritas = lots of alcohol and lots of sugar to get really wasted fast. That’s why champagne works so fast, the sugar.

No tank in Santa Monica.

A year ago I was amazed that TOWNHOUSES were going for $1 million.

Now they’re going for $2 million: https://www.redfin.com/CA/Santa-Monica/941-11th-St-90403/unit-2/home/79038512

It’s not that simple. https://www.zillow.com/homedetails/386-Entrada-Dr-Santa-Monica-CA-90402/20539673_zpid/

That house is not in Santa Monica, despite the address. If you check a map, it’s a block or two outside of city limits. It’s in the Santa Monica Canyon, which is not in the city of Santa Monica.

That said, Santa Monica Canyon (which is really a part of Pacific Palisades) is a very pricey neighborhood. However, that particular house has a lot of problems

That house has been for sale for many years. (I even talked to its listing agent in 2013.)

* The house is very small — too small for a growing family.

* It has no backyard, just a patio.

* The land is very steep, which makes it problematic for building anything decent on it.

* There are MANY steep steps leading up to the house, which older people don’t like.

* I don’t see any mention of a washer hookup. I see no washing machine mentioned in the listing. There’s mention of an “electric dryer hookup,” but nothing for a washing machine.

That house was repeatedly listed in 2010, 2011, 2012, 2013, and 2014. Even at the bottom of the market, it couldn’t be sold off. So it’s not representative of the Santa Monica market.

I stand by what I said. No tank in sight for Santa Monica.

Not sure why you and select others are so obsessed with debunking the idea of tanking because it’s not like that’s a view most people have. All of your additional blah blah blah proves the point that it’s not as simple as the listing you gave.

That is one very sweet townhouse. It’s beautiful, huge, has outdoor space and is in a pretty complex in a coveted area. I can believe $2M for it, given what I’ve seen of house prices in Santa Monica and adjacent L.A. neighborhoods, where any pathetic, run-down 900 sq ft 2 bed 1 bath stucco house seems to sell easily for $1M.

That townhouse LOOKS very sweet. Builders spend a lot on appearance, because it affects the sale price. But how soundproofed are the walls?

Building codes don’t cover soundproofing. And good soundproofing doesn’t improve the building’s appearance. So builders aren’t likely to spend much money soundproofing.

I would hate to drop $2 million on a townhouse, then, after I move in, I hear a high-pitched dog yapping in the next unit. Or kids running around. Or high-heeled shoes click-clacking on a hardwood floor. Or a baby crying. Or music. Or a workout. Or an argument.

All of these I have heard over the years in my much cheaper condo. I wouldn’t want to “upgrade” to much more expensive condo, only to have the noise follow me.

That townhome is nice, but the $545 monthly hoa fee for trash and EQ insurance is a tough pill to swallow. I guess anyone spending 2 million on a townhome has money to spare.

SOL,

What you say it is very true. For a condo, there is nothing you can do to mitigate the noise from left, right, above or below units. However, for a townhouse, it is very inexpensive (in the grand scheme of things) if you have ONLY a wall or two in common and nobody above or below. You can build another wall inside with 2×4 studs sitting 1″ or 2″ inside, use lots of insulation and then sheetrock. That way, if the walls don’t touch (to avoid the propagation of sound by vibration), and if you have lots of insulation, you can scream as hard as you can and nothing will be heard on the other side. It costs few hundred to few thousand dollars depending on the size or if you do it yourself or pay a handyman to do it. You don’t even need a permit because it is not a structural wall.

I did this in the past and it is worthed even if you live for few years in the unit. It has better resale value, too. Just an idea to consider.

I think somewhere along the lines the strict codes for building condo walls became merely a suggestion, or developers found a way around them. I’ve lived in condos with walls that may as well have been paper mache, as well as condos where I never heard a peep from either side. All built in the 80’s.

John D,

Some builders insulate the partition walls and some don’t. They are not required to. It does not have anything to do with energy code or safety (building codes). It is for comfort, ONLY. The building departments do not care about comfort. They care only about the outside shell (energy code) and safety.

Some builders put a cheaper insulation and some very good insulation. Some have only a 2×4 wall and some 2×6 wall. That helps but is not the best. The best way is to have 2 separate walls made of 2×4 staggered and have the walls at 1.5″ distance from each other and have good insulation. This way, you can have a boom box and you can not hear anything from one unit to another. If they are not in contact, the vibration does not propagate.

We know, you just wish the bubble would go on forever….why dont you just buy more RE and get rich?

I personally wish the bubble would burst and had never happened, and that prices would go back to 2011 levels everywhere. Frankly, $2M is ridiculous for that townhouse, but still a bargain relative to other things I see for sale in Santa Monica where the cheapest thing available, for $569K, is a dumpy, run-down 1960 vintage 2 bed condo that I wouldn’t even rent. The entire market coast-to-coast is ridiculous. Prices are outrageous and supply tight in nearly every urban area that a person could hope to find employment.

I’m not in that bracket or anywhere near it, or thankfully, that market, but where I am is bad enough. Where I am, exactly, is in Chicago, scrambling for a reasonable 1 bed condo to spend my retirement in, after being “de-converted” out of a gorgeous condo that I paid cash for a few years ago. Sadly, the place is in a building that was 75% investor-owned, and my fellow owners voted to convert the place to rental and sell it to an investor. When this happens, you have no choice in the matter. Since the price I sold for was a substantial improvement over what I paid, a lot of people would say I made money, but since prices everywhere else in the city have inflated grossly since 2013, and supply is almost non-existent, I will be fortunate to replace it with anything equal to it. As it is, I’m stepping down to a smaller place in order not to have to borrow, after paying my share of closing and legal costs pursuant to the sale, and paying moving expenses. But the alternative is paying rent, and rents are inflating even more rapidly than house prices.

The real estate market in this country was destroyed by the debt rampage of the 00s and will likely not recover for decades, if ever. In fact, the only reason my building came to be mostly investor owned to begin with is because of the debt rampage of the 00s. The building was 100% owner-occupied prior to Y2K, until the long term owners either sold at inflated prices, or pulled the equity out of their units. By 2010, 7 of the 9 units were in foreclosure, and the association was in financial trouble because of the accumulation of unpaid assessments 2008-2011. I bough one of the only owner-occupied units remaining.

All I want now is a nice unit in a neighborhood I like- it does not have to be a “prime” neighborhood- at a price that will not necessitate borrowing, and reasonable taxes and HOA. I’m not in this to “make money” but to hedge against inflating rents and have control over my life- and not end up having to beg for a 400 sq ft CHA apartment in my old age.

Can’t accuse retail buyers and investors of being smart. Although a 27% gain over roughly 5 years is tame relative to those of other properties.

looks like you figured it all out. Thanks for sharing the easy way to get rich. Buy now everybody!

@Brian

It’s a new economic paradigm. Om the 90’s, you made money buying tech stocks that made no money. In the 2010’s, you buy any rental property, jack up rentals, and are “guaranteed” to make money off families with stagnant incomes.

Not even sure what this guy’s point is supposed to be, that shit is still overpriced in overcrowded Santa Monica? Wow what a news flash. Some of these people are so obsessed with the idea of tanking or not tanking. Let’s say someone buys this place today but tomorrow they could just as easily end up being in the same position as the 2006 buyer who sold in 2012. The moral of the story still stands that if things seem overpriced, buyer beware. https://www.zillow.com/homedetails/838-16th-St-APT-10-Santa-Monica-CA-90403/67695588_zpid/

@son of a landlord…why are you so bullish on Santa Monica…?

I’ve long been an unhappy bull.

I want to buy a house in Santa Monica, and I regret that the prices are not tanking. I’m hoping house prices will tank a lot, that my condo will tank only a little, and with my cash I might be able to afford a house in Santa Monica.

But I’m not counting on it, as it’s a wild, Jim Taylor-esque hope.

If I had the money in 2012 or 2013 that I have now, I might have been able to afford a house in SM. Now I have more money, but house prices keeping increasing beyond my cash savings.

You mean they are listed for $2 million but are they really selling?

Well, that condo is already accepting backup offers.

And that front unit of that townhouse complex sold last October for $2.2 million: http://www.realtor.com/realestateandhomes-detail/941-11th-St-1_Santa-Monica_CA_90403_M29444-03747

Yes, they are selling at that amount. Not just listings.

The description says that the condo is seldom used? Who’d buy a townhome for $2.2M other than a foreign buyer who is parking smuggled funds or a drug dealer who is laundering money?

I was watching CNBC. They were saying that interest rate increases mean housing prices will be headed higher. They said rates are being increased because the job market is getting too strong and wages are rising too fast. All the new jobs at high wages is very bullish for housing. I believe it.

Quite the contrary, rising interest rates will mean downward pressure on prices, as they add to the cost of the loan and hence the monthly payment. Even a small hike is enough to kill a lot of loans, since most buyers are borrowing to the last dime of their borrowing power to get a house loan. Keep in mind that there is more household debt- car loans, student loans, CC debt, than even in 2008. In any case, I’d take CNBC and the massaged numbers their talking ‘bots are touting with an entire decade’s output from the Khewra salt mine.

Next thing you’ll tell us that you let Cramer decide what stocks to buy. Only one person on CBNC makes any sense. Therefore I doubt that you’d listen to him.

JT, lol. Rising interest rates means end of the bull market and end of housing boom cycle. From now on it goes downhill. Rising wages?? Thats funny…not on this planet.

By now everyone on this blog knows that JT believes in the ever rising housing market. In JT’s world all renters are always losers, all buyers are always winners…same old same old.

Rates have been rising for a while, and the real estate market just gets hotter and hotter.

RE moves slowly. Those hot numbers numbers most likely originate from deals initiated several months ago. Current reports show slow downs in formerly hot markets due to higher borrowing costs and prices.

After being around all time lows, mortgage rates have risen about a percentage point since the election. Seeing as how it’s winter, many houses were already in escrow, and people tend to rush in when rates initially raise, we don’t really know yet how it will affect this spring’s market.

rates have not risen a lot so if it has to make some dent into housing market, it need to rise much more…

i think fed is in a catch 22 situation…

they should have risen the rates 3 years back… but they didn’t and let the market super heated…

Why aren’t you out buying? Is it because you’re a broke renter without the funds?

muhhahaa, man is that funny….”Rates have been rising for a while” seriously from another planet this guy. We had historic low interest rates for a decade causing the mother of all bubbles. The end of the cycle has begun and the crash is coming.

@Getting out,

“Why aren’t you out buying? Is it because you’re a broke renter without the funds?”

Not sure who you are asking. Personally, I am renting and saving lots of cash. Waiting for the crash to pick up a house or two at a 40% discount compared to today’s market prices.

Wow that is really lame.

Below is a good article explaining what drove RE prices for the last 3 decades. It was not increase in wealth but debt. Debt is not wealth, it is slavery.

http://www.financialsense.com/trump-recipe-disaster

From the article: “Interest rates are really the key to what’s going to happen to the global economy and the US economy going forward,†Duncan added. He noted that since the 1980s, rates have dropped from about 20 percent to 2.5 percent. Lower rates fuels more affordable credit, and when people borrow more, they spend more — in other words, credit growth drives economic growth. On the other hand, when rates go up, credit contracts, people spend less, and recessions are inevitable.”

I recall former Morgan Stanley chief economist Stephen Roach echoing the same sentiments during the RE bubble inflation of the mid 2000s. People were spending much more than they were taking in. Much of it was fueled by cheap and easy credit (credit cards, HELOCs, loose lending standards, etc.). Not much different from now.

it means that interest rate can’t go down as it’d destruct the asset pricing…

Jon,

What it means is the FED does not have a choice. Period. The same way they were forced to raise in 2006-2007.

It is true that the FED doesn’t want to raise the rates but they never raise the rates because they like it. Usually they raise it too late when they don’t have any choice and they have to at least follow the market if not being proactive. The inflation Gennie is out of the bottle everywhere – EU and US.

Do you think that Volker in the ’80s raised the rates to 21% because he liked it????…..They were afraid like they are today of a major crash, they delayed (kicked the can down the road till they’ve got to the end of it) it for too long like they did in the last 5 years and then they overreacted to avoid a Venezuela type of inflation. Never assume that those guys from the FED are gods. They are humans who try to chose between 2 bad courses of action – raise now a good 3% or later more like 10%. In the process they will destroy the bond market which is 3 times the size of the stock market.

We live in interesting times; I should say like never before. Through very low interest rates for too long, they created the mother of all bubbles. The inflation will not raise the price of RE which is very sensitive for many reasons:

1. the higher prices for everything doesn’t leave the new generation any money to save for downpayment.

2. higher inflation will prompt higher rates to provide a positive rate of return for banks and bond holders.

3. higher rates will crash RE prices because most buyers have to borrow, especially for current higher prices.

4. wages for all practical purposes are the same or lower than a decade ago

5. there is no capacity in the economy to serve higher and higher levels of debt.

Prices used to increase not only because the interest was going from 20 to 3% but also because of looser lending standards than few decades ago and also more women (2 incomes) entering the job market. These days all those 3 trends are in reverse: increasing rates, more singles than married couples, and stronger lending standards from the banks because they are perfectly aware what is coming.

Thanks for this Flyover.

I read it and this is why I’m scared as fucking hell to step out of the pond back onto a lily pad. This is why I live in a warehouse with no running water. This is why even holding a debit card scares me to fucking hell.

Because “real” American life is slavery. Buy a car, buy a house, sign your fucking life away…

Living under a bridge seems a wonderful vacation by comparison.

Yes, Trump seems like a great choice to Joe Blow American, just like Hitler seemed a great choice to Joe Blow German – until the firebombing of Dresden and all the other wonderful prizes the Germans won, every one of which they paid for in full and richly deserved.

Play stupid games, win stupid prizes.

I hope to hell I’m out of the US by the time Der Fuehrer starts a major war. Let me be a street bum who teaches/apologizes for English in Tel Aviv and lives on “ground scores” from the shuk (street market)

Alex,

Be happy we just avoided a nuclear war with Russia when Hillary lost. She was hell bend for war with Putin. The drums of nuclear war with Russia where beating in 90% of media controlled by 6 individuals – globalists. They demonized the current president as much as they could (made him friend of Putin, LOL) for daring to seek peaceful relations with Russia. You really must be a demon or a banker to seek a nuclear war. Russia is not Iraq or Afganistan. They have more ballistic missiles and nuclear warheads than we do.

Now, lets hope that the current president has more sense than those globalists bankers. I know he will be pushed into a war if not willingly, then by blackmail. Let’s hope that level heads will prevail. I can’t say that Hillary had a cool head.

Flyover – and therein lies the problem. Hillary screwed over Bernie, and yes, she’s a war-dog, as the lady at my bank put it one fine afternoon. I think the encirclement and enticing into NATO of ex-Soviet satellite states started with Bill Clinton, and Hillary seemed to be dedicated to following the same program.

As I keep saying, Trump by himself just some weird orange-tinted nut. What’s dangerous is all of his millions of followers. Trump won’t want war with Russia; Russian oligarchs are probably his only source of money these days. But war with China might be in the future. Trump’s like a spoiled 4-year-old that’s somehow gotten control of large construction equipment; could anyone at that age resist the urge to play with the crane with the wrecking ball?

Flyover, you’re living in an alternative universe if you think Donald Trump has a cooler head than Hillary Clinton…or anyone, for that matter.

Hi Alex,

Thought you might find this article interesting since you have compared living in SF to living in flyover country in past posts.

http://www.sacbee.com/news/state/california/article136478098.html#2

This the SoCal where houses are over 1 million:

http://www.zerohedge.com/news/2017-03-06/shocking-video-footage-sprawling-california-tent-city

Everyone in the flyover country wants to live in SoCal because “SoCal rulez”

Prices in SoCal never go down because those in the tents are a potential demand waiting to bounce once those houses along the ocean (prime areas) once the prices drop under 1 million. (sarc. off)

The economic problems confronting CA are just the byproduct of the social and corruption problems. You can not address the economic issues while this moral issues are prevalent.

The future of CA looks more and more like Brazil – super rich crooks around the governor and the rest “EQUALY” poor – a socialist utopia where the war on poverty is waged for over a half a century by the socialists in Sacramento.

Are you sure they are homeless and not part of a new Burning Man community?

Seriously, CA is going down the toilet fast. The divide between classes is growing with the middle-class moving out and those that remain divided between the ultra-rich and those that depend on government programs to survive. Meanwhile the music keeps playing and the price of living keeps increasing while the infrastructure deteriorates and our elected leaders concentrate on spending money we don’t have on failed social programs, overpriced trains, and trying to prevent law-abiding citizens from owning firearms.

I believe the increase in homeless encampments throughout LA is a direct result of the pro-growth movement in downtown (DT). With the powers that be eager to revitalize DT and fast tracking new projections and renovations at record speeds they are effectively displacing thousands of homeless people that used to call the blighted areas of DT home. This is why it is now not uncommon to see large homeless encampments under local freeway overpasses, in the suburbs, and along the LA River where there used to be few or none.

And who cares about thousands of homeless people anyways? It’s much more popular on social media to talk about letting millions of refugees into our country and provide them with free food, housing and health care. These homeless people must have been desperate renters before and that’s why they failed. If they would have been smart and bought that overpriced crapshack they could be living the American Dream right now. Do I need to put /sarc at the end?

Flyover I’ve lived in Flyover, and it’s horrible. Making $5 a month, maybe a couple hundred in a prime summer month when there are tourists about, negotiating for a week to get a $50 job painting a wall then having it amount to nothing in the end. Nothing to do out there but collect food stamps, watch TV, and work out. Just like jail. If I didn’t have a friend to live with I’d have had to literally dig a hole in the ground to live in to survive the winter.

I live rent-free in San Jose, sure it’s a warehouse with no running water but if you’re a squared-away individual, it’s no prob. A mere mile walk to the light rail, which I’m going to do when I’m done posting this, study my Hebrew book while riding out to Mountain View and enjoy the foodie delights along Castro Street with the Google-oids.

If I lose my “situation” – the place to live, the part-time work, I’d still not head out of here. Get a storage unit, which I’m doing tomorrow anyway, and camp out with a tent and my bike.

If you want real first-world living you need to leave the US and I’m working on that. but California has a relatively low level of suckage.

Yup. No bubble here (see below). I walk by this PoS on the way to my gym. It looks even worse in real life:

https://www.redfin.com/CA/Los-Angeles/1701-S-Bundy-Dr-90025/home/6756110

Let’s all schedule viewings! BTW “Mike Hunt” is already taken.

Jason, There will soon be a bidding war on this house and it will sell for 2MIO.

The market is hot. Lava hot. California is no longer in a drought. Clearly, that means housing will skyrocket. Spring season is coming up, clearly this means housing could double in value. Millennials are starting to buy this year. Yes, this year for sure. Clearly, this means housing will increase massively. I heard on CNBC that cities are starting to fix roads. Clearly, improved infrastructure means housing could go up further. Everything points to a skyrocketing market. I strongly advise to buy now.

1.2 million to live on the corner of a busy street, what a luxury.

I have no idea why the market is so bubbly, but I know the top selling RE brokers in my area and ask them the same thing…’Who is buying the $1.7m starter homes? Who is buying the new construction $3.5m homes?’ Most of them say the same thing:

1. Tech money (this in on the Westside)

2. Entertainment money (all over LA)

3. Foreign money (good school districts and good locations are esp. high on this buyer’s list)

4. Family money for huge down payments if not outright purchases. (all over LA)

As long as the stock market is strong, I think the money will be there for purchases.

GroovyMom,

“I have no idea why the market is so bubbly”. where were you 2004-2007? Already forgot about the last mania? People are not smart when it comes to big financial decisions like buying a house. They learn the hardway and quickly forget the past. Obviously, if you acknowledge this is a bubble you know it’s just a matter of time until it pops.

“I know top selling RE broker (…) and ask them e same thing” Oh please. The last thing you can expect from a RE agent or broker is honesty. Have you ever met one that does not tell you right now is the best time to buy? I would not be surprised if you are a RE agent yourself.

“tech money, entertainment money, foreign money (…)”. Obviously, the majority of LA people do not fall into this category. And obviously people with money are not the reason why we have a global housing bubble.

I guess realtors are trying new tricks to get us to sell/buy. Got to make that commission some how.

As a native Californian, I enjoy following news about Housing Bubble 2.0, just as I did starting in 2005 with the first bubble. However, I am really sick of being labeled a Taco Tuesday Baby Boomer and labeled as some clueless, selfish idiot, just because I’m over 50. 1) Never been to a Chipotle. 2) I don’t drink. 3) I am fed up with the banksters in this country who ruined the California housing market for people born there who don’t happen to work in tech, and 4) did I contribute to the mess this country is in? No. So don’t stereotype me with the greedy men in my age bracket who are responsible for this mess.

Oh c’mon, the whole point of this site is to give the posters some brief sense of empowerment by making up demeaning little labels for those they envy. Don’t rain on everyone’s parade now.

Leave a Reply