Investors pigging out in Las Vegas Real Estate: Investors pay 50 percent more for housing over last year yet rents remain the same. The mechanics of rebuilding a bubble.

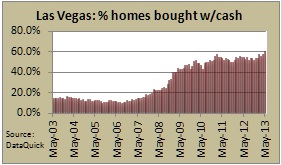

The flood of investor money going into Las Vegas real estate is amazing. It really is. The proportion of investor buying is ridiculously high and has kept a steady pace since recession ended. In fact, Las Vegas is a market purely driven by speculative demand from investors. Last month 58 percent of all purchases in the Las Vegas market came from “cash†buying. These are large and small investors buying up properties with no mortgages being recorded. This isn’t your typical Las Vegas family buying a home. When you look at the reasons for investor buying, many are in the market for rentals but you now have people going after flips. In fact, for investor purchases the median price is up a whopping 50 percent over last year. There is a mania occurring when it comes to Las Vegas housing.

The rising prices of Las Vegas

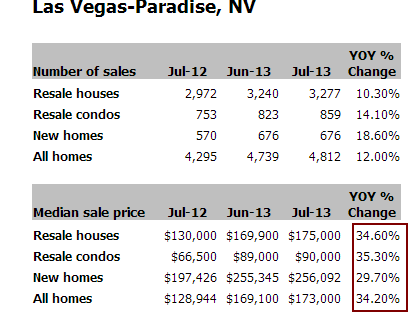

Las Vegas is seeing some of the fastest appreciation of any real estate market in the US:

Source:Â DataQuick

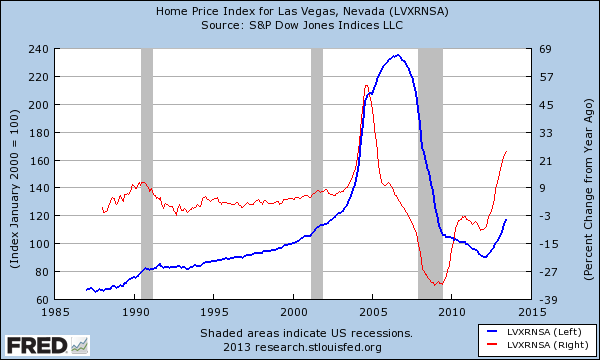

The median price for all homes is up 34 percent over the last year. Even if we compare this with Case Shiller data we find that prices are rising at a stunning pace:

The Case Shiller Index is registering a 25 percent year-over-year increase in the market nearly replicating the rise during the last mania. If money flowing into the market is being driven by rental demand, let us look at the prices being commanded for rentals in the market:

Rental prices for the Las Vegas market have stayed relatively stable since the recession ended. Yet investor money continues to flood into the market. Why would investors pay 50 percent more this year than they did last year if rents are virtually stagnant?

Median price paid by Las Vegas cash investors

July 2012:Â Â Â Â Â Â Â Â Â Â Â $105,000

July 2013:Â Â Â Â Â Â Â Â Â Â Â $155,000Â Â (+47.6%)

Of course flipping is also increasing:

Percent of homes flipped (selling twice within 6 months)

July 2012:Â Â Â Â Â Â Â Â Â Â Â 5.7%

July 2013:Â Â Â Â Â Â Â Â Â Â Â 6.2%Â (+8.8%)

The Las Vegas market has been dominated by investors since the recession ended:

Starting in 2009 the number of investors in relation to regular buyers never went below 40 percent (the average has been solidly over 50 percent). This is a market fully drive by investor demand. The fact that flipping is picking up is telling you we are reaching a frothy point in this market. Of course, irrational buying can go on for many more years. Yet run the numbers on investment properties here and the return isn’t all that great. What is making the market look good right now is the incredibly high number of investors buying keeping prices inflated. How much longer does this trend have?

A place like Las Vegas will be the first to show signs of a top for investor buying. The market is essentially driven by investors. This is clear. Plus, Las Vegas is largely a luxury based economy (does well on booms, contracts heavily during recessions). The stock market rally since 2009 is one for the record books and real estate prices are now increasing at double-digit rates (all the while incomes remain stagnant). This disconnect cannot last. When I look at the Las Vegas market I’m reminded of all the buying that occurred from California households picking up properties and second homes during the last boom. This time the money is coming from institutional buyers and investors with deeper wallets.

While prices are higher, locally the housing market gets poor grades:

“(Las Vegas Review Journal) In its second-quarter Nevada Housing Stability Index, the state Department of Business and Industry gave the real estate market here a D+. That’s the same grade it earned in the first quarter, when the department launched the index.

…Plus, the share of homes bought by investors fell to 54.2 percent, though researchers still found that number abnormally high: The market earned a D- for its percentage of investors.â€

Yes, the percent of investor buying is abnormally high. This is an understatement. It means the market is being dictated by hot money. What are your thoughts on the massive price increases being seen in Las Vegas real estate?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

60 Responses to “Investors pigging out in Las Vegas Real Estate: Investors pay 50 percent more for housing over last year yet rents remain the same. The mechanics of rebuilding a bubble.”

“The (Las Vegas) market is essentially driven by investors” aka Gamblers. Go figure!

Perhaps all of this money is coming from the winners of the Wheel of Fortune slot machine?

Why anyone would want to live in that dry, land-locked area with no greenery anywhere is beyond me. I think I would rather buy a few hundred acres in southern Missouri that sits on a river, in the middle of nowhere – and pay Billy Bob to grow my crops and run my cattle farm. People gotta eat!

I know the purpose of this blog is not political, but I do find it funny when I listen to my Republican friends talk about how they hate big government… except when it comes to keeping interest rates low, and protecting the mortgage interest tax deduction, and protecting Fannie and Freddie, and bailing out the auto industry, and creating jobs… and… and… and… and… and…

Your friends aren’t conservative.

You are confused. Lay off the MSNBC.

New York Times, 9/17/13, according to recent census figures: “Median household income, adjusted for inflation, halted its fall at $51,017, about where it was the previous year. That is down about 9 percent from an inflation-adjusted peak of $56,080 in 1999, though the real economy has grown about 28 percent since then. Income is also down about 8.3 percent since 2007, when the economy started to contract.”

DG1, you are so wrong on so many levels I had to respond. I absolutely dispise both parties, but let’s look at your argument:

Keeping interest rates low is the only thing keeping this boat upright currently. If interest rates skyrocketed, what would that do to paying interest on the national debt?

Regarding the MID. The MID is largley used by people on the affluent coastal metro areas. Who largely inhabits those areas? I’ll give you a hint, it’s not republicans.

Regarding auto bailouts. That was largely supported by democrats. Where do you think UAW union dues and votes go? I’ll give you a hint, not the republican party.

Pleae take a moment to think before you type. Thanks in advance.

YOU ARE RIGHT . THAT IS WHY I MOVE FROM CALIFORNIA TO THE GREAT STATE OF GEORGIA

Georgia’s loss is California’s gain

I just watched an episode of House Hunters on everybody’s favorite station HGTV. They were in Atlanta and townhouses were going for almost 400K. Either they have a RE bubble being inflated down south or LA is pretty cheap in comparison.

Don’t be naïve. The hotels don’t build and maintain huge resorts by letting people win much money very often.

We recently sold a multi unit we bought in 2010, not in Vegas. A total rehab, we did a quality job; its now a nice building in a solid rental area. We bought with the intention of holding for the long term. However, after much thought, decided to sell. Too many eggs in the RE basket; market conditions favorable, interesting economic times, diversify.

No regrets…hope it performs well for the buyer and is a solid long term investment.

YOU CAN INVEST NOW IN THE SOUTH AND PAY CASH WITH VERY LITTLE

I don’t have any knowledge or comments about Vegas – I read this blog for S CA. Although, I can appreciate that Dr. HB is looking for signs in NV regarding a trend change. Historically I don’t like to wish ill on the stock market, but I do today. This madness needs to stop so that normal people sitting on the sidelines, who can qualify for a mortgage, can purchase a home. I am not going to purchase into this market, which is disconnected from fundamentals.

@An Unhappy Renter,

You may thank or curse the Federal Reserve for this bubblicious mess that is brewing. The Federal Reserve controls the overnight rate (aka federal fund rate). This rate affects things like savings account interest rates as well as short term money market, certificate of deposit rates, car loans, etc.

The current overnight rate is 0.09%. Before the stock market crash of 2000, and Federal Reserve interference, investors could get 3% to 5% on short term money market, CDs or savings accounts. Now they get zero. Technically, net savers are losing money when inflation is taken into account. They can’t go into the stock markets because quantitative easing (QEI, II, III) has pushed the stock markets into nose-bleed territory.

If you want to know why all these mom & pop investors, small-time investors and institutional investors are chasing after LV real estate, see the paragraph above.

Also, the bond markets have been completely messed up due to interference by the Federal Reserve. Many parts of the commodities markets have also been distorted by the actions of the Fed. So that leaves real estate as the least bad choice for investors at the moment.

In my opinion the FED playing games with the QE and interest rates is only going to make things go higher for housing in select locations until it reaches another peak which my guess will be where the next crash will begin. I guess the FED is hoping the next fall in housing values will not drop below or equal to the 2011 low? Perhaps the new low the FED and NAR is looking for is property values that we have now or next year? That is the only way they could ever justify the value of real estate. It has to keep creating Higher highs and higher lows in order to keep this ponzi going. At some point if incomes have not kept up with inflation this will implode a lot more than we have seen since the last crash.

YOU ARE RIGHT, BUT YOU CAN PURCHASE A HOME FOR A SMALL PRICE OF $ 3600 AND UP ALL CASH PRICE. FLORIDA,GEORGIA, NORTH CAROLINA AND SOUTH CAROLINA. OVER 30 YR. AS A REAL ESTATE BROKER IN CALIFORNIA , NEVADA AND THE STATE OF GEORGIA

STOP SHOUTING!

Having lived in the Uk, Florida, Texas and California I now live in Summerlin Las Vegas. It is by far the best place I have ever lived. Fabulous climate, low taxes, Entertainment capital of the world we are never bored and the quality of life is considerably better than we have ever had. Mortgage free mansion with a swimming pool and snooker room. Vegas is truly paradise on earth.

I agreed with everything you said, Gary, except for the “Fabulous climate”. It is SUPER-HOT there. It is a great city to live in when you are single and just living life for the moment or the very near future. Temptations, there are many and they are everywhere… and expensive. A lap dance is at least DOUBLE what you would pay locally. So, Las Vegas is not called Sin City for no reason. And furthermore… it is still hot like HELL there.

Anyways, I hope all the investors get killed after this new housing bubble pops. Maybe then, the average American can make a home purchase to live in without having to compete with these all-cash investors.

It is hot for 25% of the year and even these 3 months are not that bad as the humidity is very low. I am married 33 years and me and my wife are having a great time. Unless you leave the strip you have no clue about the real Las Vegas.

Gary, what have you been smoking pal?

You couldn’t pay me enough to live in that city. I would rather move to Syria then live in Vegas.

I find it funny that people visit Vegas during the summer, never leave the strip, then come onto message boards then repeatedly say, “Who wants to live in the awful place!?”

We have zero state income tax, relatively low cost of living (which is more than just housing…like gas, food, utilities, etc), almost no traffic due to well-developed freeways (just stay off the strip!), limitless entertainment and more good restaurants than you can ever visit. The heat in Vegas last a whopping 3 months while the rest of the year is temperate.

No earthquakes, tornadoes, hurricanes and 300+ days of sunshine. We get the occasional wind storm, but I’ll take wind over landslides, etc. any day.

But whatever, people at pessimistic and self-righteous as you I don’t want living here anyway….

YOU ARE RIGHT , IF YOU ARE MORTGAGE

MORTGAGE FREE, NO HOUSE PAYMENTS

I caught the sarcasm.

define “entertainment.” Or, “capital.” Or, “of the world.”

“Vegas is truly paradise on earth.”

Wow, maybe you should hope that you go to hell instead of heaven. It will be nicer than Las Vegas.

No need as I lived in the Hell that was California for the worst 2 years of my life. How I wish I would have gone directly to Vegas from Texas and bypassed that cesspool California.

I’m now firmly convinced these ij V estment companies are DIRECTLY complicit with the banks. I’ve accepted for a while that the FED is blowing Housing Bubble 2.0 for the sole purpose of clearing the banks toxic assets. However I now view the investor groups not as useful idiots and greater fools but rather direct participants in a price fixing scheme, colluding with the banks, and the FED acting as a middle man. Know group of investors would be so short sighted as to flood Las Vegas, one of the epicenters of Bubble 1.0, with this much capital so soon after the crash. I call shenanigans.

Yup, these guys are master of psychology. They know the price gains will get the plebes to salivate again over dreams of easy riches, and once enough of them are suckered in, they will pull the plug by dumping their houses (for gains, of course). I give the likes of Blackstone a year before they decide the landlord business sucks and they start selling.

Saw this coming 3 years ago on first foray into bulk sales by the housing agencies. Price fixing by our own govt. and the same ilk that put us in the mess. Anyone buying a home today is smoking hopium and looking at Apple at $700 thinking it’s a deal….

The puppet masters have lots of sheep to sell too, then the boom hits and 2014 is going to be ugly. Without the fed stripping savers of their money and giving it to gamblers the nation would have been on a much better recovery. 16K dow is the time to get out, next month begins next bear market…the economy is not doing well and the end game for the dollar reserve is coming fast….watch for wars both currency and blood letting to create inflation.

Pigmen will always burrow in well plowed fields…This bubble is easy to see..just a different angle.

MB-this message is for you. The petro dollar is losing it’s battle at an accelerating pace. A basket of currencies and commodities is close…5-10 years for sure..

There was this about Vegas in yesterday’s BusinessWeek:

http://www.businessweek.com/articles/2013-09-12/after-las-vegass-housing-crash-fraud-ferraris-and-gun-fights#p1

Things can change suddenly again, and by definition more likely to, given the mad house price inflation seen recently, against fragile economic conditions.

Well there is the Las Vegas Springs Preserve and the flower show inside the Bellagio. Not sure if those count. (Or which has more concrete than flowers.)

Not so interesting that history is repeating itself but that its repeating so close in time that it can hardly be called history!

The duration of the boom/bust cycle is shrinking as the Fed employees ever-more aggressive money printing tactics. In the latest iteration they went from simply suppressing interest rates, to outright money printing.

Prices in Vegas still look cheap to investors that live in much more expensive areas (practically anywhere else). That said, it is easy to see how money is flowing there to me. If you live in So Cal and sell your over priced rental to exchange the equity into 3 houses in Vegas, was it really such a bad call? Only time will tell. Good news for the renters in Vegas is with so many rentals being purchased, supply and demand should keep rents stable to maybe down a bit if the market gets hit again.

it’s pretty obvious to anyone with any knowledge of real estate and the financial markets that housing prices do not normally go up 30 percent per year unless its only based on the gambling by Wall Street investors. So now the average person that wants to buy a house to, you know live in, can’t because they’re competing with gamblers that gambling with other people’s money. So this decade will be called the great transfer of wealth. This was done purposely and intentionally and now the average American can no longer afford to buy a house not because of sound economic principles like supply and demand because that’s all being manipulated by the banks that are holding all the properties waiting for the next pop when the investors are sitting on rentals with no rent income due to the glut of rental properties. .

I heard the same “overheating” argument 12 Months ago in July. Since then the market is up 35% and inventory is still at a 2 Months Supply. The Trend is Your Friend.

Another thought is what if the mania in Vegas is being driven by people in California looking to save on taxes somehow? Could someone from CA buy a place in NV and establish residency to save? I don’t know much about how this all works, but I have some maps from the Tax Foundation showing this info:

Corporate tax rate in NV is 0% whereas CA is 8.84%.

State income tax rate in NV is 0% and CA is 10.55%.

I’ve heard a few people mention Nevada Corporations, but have never looked up the pros and cons. Anyone know what the benefits are of having a Nevada corporation?

Depends on how the copany is incorporated, but in our case we paid taxes in all the states where we had a corporate presence (office, people, etc). Same applies to income tax: You are taxed on the state where the income was earned, not where you live. So if you live in Nevada, and work there, plus California, Arizona and Utah, then you will be taxed in each for the portion of your income earned in each.

@ niner there are significant tax savings for Californicators living in Nevada, however, there are strict requirements – somthing along the lines that you must prove you actually are living in NV for at least 6 full months a year. Perhaps someone else knows the details, but I looked into it and my lawyer advised against it unless I really wanted to live there.

Yes, we came here from CA. California’s Franchise Tax Board is even more aggressive in chasing taxpayers than the IRS, believe it or not. They will check cell phone records, question neighbors, check credit card purchases to see where you are.

I used to work in their IT division. They are one of the most sophisticated tax collecting agencies of any state.

You are correct Lynn. The only way the average American can win in this game is refuse to play. I’m staying in my rental. It will all fall apart, again, in a few years. Maybe then a regular person can buy a home to live in.

San Diego, refusing to participate in the casino isn’t an option for most. The desire to “own” a home runs pretty deep. In some cultures, renters are viewed as complete losers. The lesson is to buy anywhere close to rental parity. Get your financial life in order so you can act when the next buying opportunity presents itself.

That’s funny, I see no reason to buy an overpriced asset so I can be a Jones. I own a condo in the city that is way overpriced. I think that is funny too. Keep smoking hopium, the kondratieff winter is near…be ready..

“In some cultures, renters are viewed as complete losers.”

Oh, dear. I believe most mature adults choose a living/household situation based on what works best for their, and/or their families, unique financial and personal needs. I highly doubt worry or concern about being “viewed as complete losers” by a “culture” is a factor most rational adults consider when choosing to buy or rent a property.

Galatians 1:10 – Am I now trying to win the approval of human beings, or of God? Or am I trying to please people? If I were still trying to please people, I would not be a servant of Christ.

——————————————-

Pride is the worst of the 7 deadly sins. The 10th Commandment says “Do not covet a home”.

Now what’s that about renting again? Sheesh.

Seriously ? Renters viewed as losers ? The real losers are the ones who bought real estate in So Cal in the past several years. The insanely overpriced homes here make no financial sense. Why would anyone put all their money in real estate ? Much easier to sell a stock than a house. Houses require constant maintenance, property taxes, etc. It’s a much better rental market. Sorry, homeownership is not such a wonderful thing anymore and as a native Los Angelino, we are all laughing at the sheep.

The Government knows and the Bankters know. For Every sound individual that knows what’s going on there is 20 sheep. Greatest majority in America are the people in debt, people living paycheck to paycheck, and yet the jump a the newest 0% offer from sears to buy a new plasma TV. typical… “It’s $1800 bucks and 18 months 0% interest, no problem, i’ll pay 100 a month…”

Most people live paycheck to paycheck and the consumerism is a systems that keeps it going.

This is why the financing gimmicks exist. FHA, 1st time buyer state assistance, low income buyers…

Yet, in california, every new fucvkcking house the builders build is upwards of 600K with granite or other sheite.

Why nobody builds a starter home (3bd, 1 1/12 ba,) no luxury for the people that don’t make 100k?

I make $75,000 a year, have no other debt, and I still can’t buy a small house in my area. I don’t qualify to borrow enough to buy. A condo is the only thing in my sights, but when you add in the HOA fees ($250+ a mth) you may as well buy a house.

If someone with a good job, a good down payment and no debt on my income can’t buy a house in CA, who is buying all these houses?

We are still watching the south Reno area. Just in the past couple of days we’ve seen 8-9 houses reduce prices. The avg prices seem to be dropping all over this area.

Money will continue to flow into the US as the rest of the world gets worse. Real estate, equities and other assets in the US will get bid up over the next year. But rates will rise and make it more and more difficult for the average person to buy a house. The bubble is getting reconstructed, again, but now it’s for different reasons.

I live in Chicago and love to give a Midwestern perspective. I have noticed that since 2011 investors are ready to overpay for an income property. Even when you plug in the numbers, the numbers do not make sense. Yet investors are willing to over pay for an income property. Obviously they believe that rents are going to go up.

Chicago, as much as I live it and the Midwest, is not a true indicator of the Midwest as a whole. In fact you know it’s the ‘coastal wannabe’ of the Midwest. I used to listen to AM talk radio and people from Champaign, DeKalb, et all would call in complaining about how the state only cares about Chicago and not the rural population, and that the way Chicago thinks is not the way the rest of the state thinks.

I believe this is a reason Minneapolis, St Louis, Omaha, Des Monies, etc didn’t have a housing bubble like the rest of America. Prices there didn’t fluctuate much more than 10% vs. the 25-75% that happened in coastal and heavy investment areas.

My Dad always said Midwesterners don’t engage in the financial tomfoolery that a lot of NYC and CA fakers do. And there is truth to that. I believe that is also another reason transplants find CA difficult…we are not born and bred to leverage 5X our income to a home, anything over 2.5X causes sleepless nights and unnecessary stress. I guess that’s why the IE exists.

Nimesh,

“Over paying” for an income property can be due to reasons other than thinking that rent will go up. Just imagine that you’re somebody (in the US or a foreign country) and you have a few hundred thousand in the bank. There has been no interest earned via savings, and you’re concerned about volatility in the stock market. You’re even concerned about whether that money is safe in the bank. So, change that money into a hard asset. Real estate is a way to diversify, get some tax write offs, get some rental income, and perhaps realize a gain if the value goes up.

I do think we have investors jumping in to RE just because other investment classes all look like crap at the moment. So it’s a “best of the worst” scenario.

No fed taper of QE. As I’ve been saying, no one can predict this stuff and anyone that claims to is a bs artist. Might as well keep inflating and then have an even bigger downfall later. Fck it. World is upside down and fundamentals mean nada for now. I give up.

I’m in Vegas. The owner of the house we rent has always been open to our purchasing the house we’re in; he doesn’t want to be a landlord. To have an “in” to do so in this lower price range, without competition, is rare here. (I don’t know what he wants now, though!) The rent is easily twice what we’d pay monthly for a conventional mortgage. We have the 20% down. This place isn’t everything we ever wanted; there are signs of the neighborhood going bad.

Local RE agents are predicting a downturn (five that I know of, all very successful). I’m hoping the inventory will continue to increase so there’s actually some choice but what’s to stop whoever is left of the investors to beat out a regular buyer?

Lynn C., you’re here, any thoughts?

FTB, you are correct, NOBODY can predict what the outcome will be. As I have preached many times, you need to base your decisions on what you know today, not what you THINK or HOPE will happen in the future. Most people simply don’t have the patience to outlast the Fed, especially when their mission is to prop to certain assets come hell or high water. This was another hammer blow to renters and savers everywhere. Maybe we’ll get the taper next year…and maybe not!

Yeah it looks like we will be seeing lowered projections of growth next year. I wonder if it is because the mortgage rates are going up?

Leave a Reply