The real estate gamble in Las Vegas: Year-over-year inventory up 51 percent in Las Vegas. Cash buyers fall by 20 percent from last year.

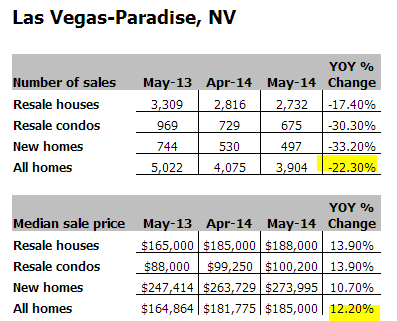

If you really want to see the impact of cash buyers pulling out of a market look no further than Las Vegas. Las Vegas was the poster child of real estate mania and many California home owners contributed to the previous boom by tapping out equity and purchasing properties for flips or for the occasional gambling trip down the I-15. The latest boom is being driven by large Wall Street cash and lusting investors coveting “cheap†properties. That boom appears to be turning. A recent report from Zillow shows that inventory in Las Vegas has jumped up a whopping 51 percent year-over-year. At the same time, you see cash buyers pulling back from the market. Back in May of 2013 roughly 60 percent of all purchases went to the “all cash†category while this year it is closer to 40 percent. So it should come as no surprise that home sales are now down by 22 percent year-over-year during the hot summer selling season. What does the future hold for Las Vegas real estate?

The gamble in Las Vegas real estate

Prices out in Las Vegas must still look modest compared to the house horny buyers of California. A median priced home in Las Vegas will run you $185,000 and this is after the massive jump in prices over the last year. If prices are solid, why the sudden jump in inventory and big drop in sales? Most of the buying occurred because of investors looking to purchase properties for renting out. If this is the bulk of volume, you have to rent out to local families that generate income from local employment. Obviously investors are not seeing the cap rates that they once were seeing.

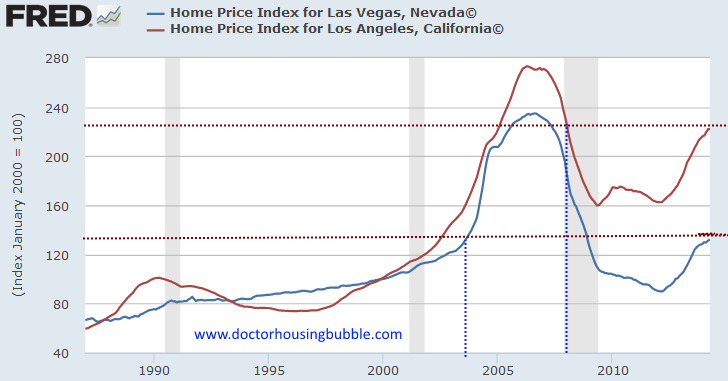

Take a look at the Case Shiller data for the L.A. region and for Las Vegas:

Home prices in Las Vegas are now where they were in 2004 while in Los Angeles, they are back to where they were before the recession hit. The big drop in sales and increase in inventory is simply a reflection of a market fully dominated by investors. After all, only one year ago nearly 60 percent of all sales went under the “all cash†buyer variety and even a middle class family in Las Vegas is not going to come up with $185,000 in cash to purchase a home.

So the end result is this:

Source:Â DataQuick

A big drop in sales while the median price hits a plateau. If the past is any indicator, a big drop in sales usually means a nice jump in inventory within 6 to 12 months followed by prices correcting within 1 to 2 years (that is, 2015 and 2016 for Las Vegas). The real estate worm turns very slowly and Las Vegas has had a nice run up from the trough.

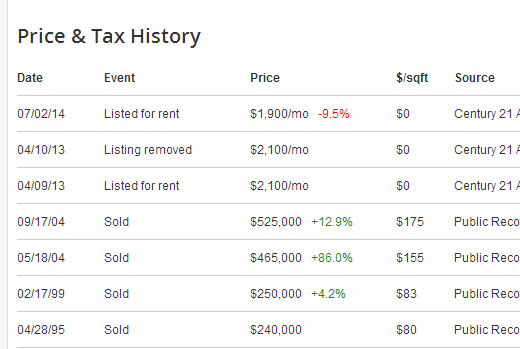

You will find 3,086 rentals currently available in the Las Vegas market. There is a big disconnect going on here. Take a look at this rental:

7904 Bridge Gate Dr, Las Vegas, NV 89128

4 beds, 3 baths , 2998 square feet

This home sold for $525,000 back in September of 2014 2004. It was listed for rent back April 2013 for $2,100. Today you can rent this place for $1,900.

Does this seem like a healthy market here? The Zestimate on this place is currently at $440,000. There is no way this is a good investment as a rental if this is the kind of rents you are going to yield. Of course if you go in with a 100 percent all cash purchase, you will cash flow. Anyone can cash flow as long as your down payment is big enough. If you take your $525,000 and yield 5 percent in the market, you will outperform this rental (keep in mind we are not factoring taxes, insurance, vacancies, maintenance, and all the other costs that go into being a landlord). And as I mentioned before, you have plenty of options for rentals in the Las Vegas market.

Is it any shock that investors are pulling away from the Las Vegas market? Who are you going to flip to here? There are many examples like this. Investor lusting is slowly waning and we will see if the market can stand on its own two legs. When you see action like this, you know something is going to give and things are pointing for a correction for Las Vegas.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

61 Responses to “The real estate gamble in Las Vegas: Year-over-year inventory up 51 percent in Las Vegas. Cash buyers fall by 20 percent from last year.”

What does anybody do in Vegas to make money besides work in the gambling industry? You know, enough money to afford a half million dollar home.

Vegas is doomed. Not only is it’s reason for being, gambling, a very unprofitable industry these days and that town no longer has such a monopoly on the business (Just one example – NY state is opening seven fully operational casinos very soon, and that may be a big mistake, since nearby Atlantic City is dying, slowly. There are way too many casinos), but sooner than most expect, there may soon be no water available for those fountains and golf courses. Have you seen the bathtub ring on Lake Mead? Next year, it will be worse. Party over, ghost town soon.

I doubt Vegas is doomed. To many interests at play. Water issue will be expensive to solve, but it will be. Watch Detroit gentrify once it becomes a water distribution hub for the south west. The bigger issue is Vegas has and will continue to be a money laundering hot spot. With .gov all over the world starving for revenue, and finding new ways to extort it, places like Vegas will continue to serve the purpose of the .01 percenters.

“The bigger issue is Vegas has and will continue to be a money laundering hot spot.”

Well, that’s something to base the future of your city on. Money laundering. Nice.

Just some considerations….There are some research facilities on the outskirts of the city, weapons industry, some federal government including strong drug war and counter “terrorism” representation, and I don’t think people should underestimate the influence of Chinese tax evaders and gamblers. To many Chinese, the gaudiness is familiar and exciting and being part of that is rather enticing.

Regarding the water situation; ironically, I think Las Vegas will face the least problems regarding water. Las Vegas has had a long con in the works for decades now, to lock down water rights and sources from far flung places. Las Vegas will soon be revealed as having the rights to water that is taken out of ecosystems that will then, against all logic, face water shortages.

“…and I don’t think people should underestimate the influence of Chinese tax evaders and gamblers. To many Chinese, the gaudiness is familiar and exciting and being part of that is rather enticing.”

You shouldn’t overestimate the Chinese, as they are NOT going to Vegas in the numbers you would think they would be. Why should they, when they have Macau (among other southeast Asian gambling spots)? Macau makes Vegas look like Atlantic City or Reno…while Vegas makes them look like stateline or some shitty Indian casino or riverfront operation.

As for the ones already here in the states, they have a variety of

To finish, “as for the Chinese and other Asiatics already here, they have plenty of gambling options to choose from much closer than Vegas, from spots like Hollywood Park Casino, Commerce Casino, Hustler Casino, to the Indian casinos.

I wouldn’t say Las Vegas is doomed YET, but if they don’t get control of sprawl development they’re going to have serious issues soon. Been there enough times to take notice.

Mike M has a point regarding money laundering since that’s what the mob did when they ruled the city. That said I never thaught Las Vegas was a place that the 1% would give a crap about since there are more worthwhile ventures that they could exploit like funding both sides of wars since they win no matter what.

Not doomed, always will be loved by criminals and people loving intellectual waste lands. Bill and I love paying high taxes.

Las Vegas is an international city full of foreigners coming in with buckets of money! Especially the Chinese, they’re all trying to preserve their wealth from confiscation, they’re not speculating or gambling on anything. Therefore, incomes don’t matter. Oh wait, in “prime” areas incomes don’t matter… unless it’s a shitty area, then incomes matter… until it starts getting better thanks to all of the money coming in, then incomes matter.

Where have we heard that before? Oh yeah, SoCal… it’s different here and everyone wants to live here so fundamentals that apply in other places don’t apply here, except when they do, but those can always be explained away as well.

Bottom line — rents in Vegas are low (i.e., tied to median incomes within historically normal ratios) whereas that’s not the case in SoCal. So, it IS different here.

@DFresh,

Two years ago we’d get 20 to 30 calls for our rentals in the upper/mid-tier 310/323 area codes, and 2 to 4 applicants for the vacancies. For the last couple of months we are getting a smattering of phone calls and if we are lucky 1 applicant.

This looks to be the start of a r.e.c.e.s.s.i.o.n.

Los Angeles is different, until it isn’t, then it’s just like anyplace else except with higher debt levels, more poor people, more welfare recipients and homes with ugly lawns.

Good feedback ernst, as a fellow landlord I know that we have a much better idea of where rents are at any given time compared to surveys of asking rents. Everytime I see or hear rent price index numbers tossed around, I just want to shake my head. It’s not that simple.

The “this place IS different” and “everyone DOES want to live here” crowd doesn’t get it.

It just could be that word is getting out , finally , that Las Vegas lies in the middle of a vast desert. The water waste there is phenomenal …. and the water is running out.

http://www.zerohedge.com/news/2014-06-30/las-vegas-screwed-water-situation-bad-you-can-imagine

What the don’t seem to realize is that Las Vegas has all kinds of contracts, rights, and options in place that will be triggered as water shortages reveal themselves. It is not Las Vegas that will be the one that runs dry, as it drains water from all kinds of places around the country and even Canada.

Actually LV’s Water supply is in the hands of California since they largely as a state funded Hoover Dam. Same for Arizona.

If it doesn’t fall on your head it flows through the court house steps.

The “long con” only works if others have the water to spare and no lawyers are around to rack up billable hours trying to prevent your long con.

The swap with Mexico only works if no one in Mexico realizes that they can shake down LV for big big $$ with constant repair bills and invoices for reimbursements made out to the Desal Plant managers second cousins for consulting fees and $50,000 “UV light bulbs”.

If they try to do proactive cost control by keeping the Desal plant in CA or AZ, the deal will fall through.

Las Vegas for real estate is in a word – flaky. As developments were being built one after another, buyers always wanted the newest property & not the home built five years earlier even if the home specks were identicle in every way including golf courses.

I don’t remember where I read it, perhaps here – there were several large housing developments built up into North LV prior to the downturn with prices starting in the $400’s. By 2010, those same houses could be had for around $100K. Most of them were either unoccupied for one reason or another or were turned into section 8 units. In many cases both were happening within the same development. I think 60 Minutes did a story on this as well.

Impossible! Many experts on this blog said real estate’s only goes up!

Plus we are in a recovery.

sarc

Don’t forget rents, those keep going up also. They #never go down so today’s rental parrot calculation will #always be justified.

“This home sold for $525,000 back in September of 2014 2004. It was listed for rent back April 2013 for $2,100. Today you can rent this place for $1,900.”

Title = Dr Housing Bubble

Sub-Title = How I Learned to Love SoCal and Forget the Housing Bubble

You’re welcome.

I’m sorry, have you missed out on all of the rental parroting that’s gone on in the comments section here over the years?

Monthly Rent will always be > Monthly Home Purchase Expense = Always a great time to buy

Go back and have a look. You’re welcome.

To make things worse, I keep reading how Las Vegas has almost tapped out its drinking water sources. If the drought in the South West continues, things could get interesting for Vegas, So Cal and much of Texas.

It feels like we hit a market top a few months ago. It will be interesting to see what happens going forward. Will prices hold steady or slowly start to leak down?

Yet I’ve heard that in California most of the water goes to agribusiness. Drinking water is not threatened, because the state can always cut back on water for farming.

Or just change what’s farmed. Almonds are said to require much water. Plant something instead of almonds, and much water is saved.

I see much water wasted here in Santa Monica. Lots of people watering their lawns — and the sidewalk along with it. Even when it rains. There’s room to cut back.

Right now Austin is the “hot” city in Texas, but it’s water supply comes from lake Travis & maybe threttoned if the metro area keeps sprawling out & no aditional sources are found. The entire southwest is in the same boat more or less plus Atlanta who’s own water supply comes from a lake that nearly dried up a few years ago.

Cost of living in Austin now is higher than L.A. I was just talking to an artist type this weekend who visiting Austin from L.A. and could not believe it. Rents are cheaper in Los Angeles now. Everybody in Austin who isn’t wealthy has two jobs and three room mates.

One of the top zoom cities, interesting.

They have a few great lakes,and mountains for skiing.

A lot of businesses there not just gambling that’s for sure.

But gambling runs that town & everybody knows it.

May I suggest a fantastic book entitled “Winner Takes All” by Christina Binkly a reporter from the WSJ. The audiobook is read by Cynthia Holloway. It gives a fairly good depiction of the wheeling & dealing that goes on behind the senes outside the view of residence & visitors.

As for the spreading of gambling in various states is concerned, the NYT ran a story that posed the question – are these states becoming overly dependent on casinos to fund state opperations? And in many cases the answer was yes, but there’s little they can do if such casinos fail as New Jersey is finding this out.

ECONOMIC desalination of brine and seawater has finally been solved.

http://www.popsci.com/article/science/pure-genius-how-dean-kamens-invention-could-bring-clean-water-millions

Dean Kamens is an inventing genius equal to Tesla and Edison. ^^^

The above device can do its magic from solar energy — as in PV arrays.

Its output is medical/ pharma grade water. Look to see these devices going into mass production — for (Third World) hotels worldwide.

&&&

Elsewhere Israel has ECONOMICALLY solved desalination to the point that 20% of that nation’s fresh water is now coming from sea side plants.

http://www.mcclatchydc.com/2014/03/20/221880/israel-no-longer-worried-about.html

“Each of Israel’s plants cost between $300 million and $450 million to build. The plants are privately owned and operated, under a contract with the government, which buys the water from the plants. The budget for water purchases comes from water charges to consumers. The plants are not subsidized.” ^^^ cited

“Desalinated water at the Soreq plant is produced at the price of 52 cents a cubic meter”

That price is low enough for hydroponic agriculture. (under glass)

Many brackish waters are even cheaper to desalinate.

So Las Vegas, with no agricultural demand — lawns don’t count — is well set to continue on.

&&&

As for the drought:

This is entirely due to Red China’s massive soot emissions.

They are causing epic snowfalls in Alaska and the Yukon. Up north that’s all that the natives can talk about. You would call it premature precipitation.

That snow should’ve fallen as rain over the Sierras and Cascades. That the epic snowfalls up north are NOT correlated to the horrific droughts in California — it’s what you’d expect from the Green movement.

The Red Chinese soot is not only blacking out Beijing — it’s screwing up the Arctic ice cap.

1) Each Summer the soot causes a fantastic melt tempo. The soot has changed the darkness of the snow and ice.

2) Each Winter the soot causes a fantastic snowfall that regrows the ice cap at astonishing speed.

So each side of the Al Gore religious debate has supporting evidences — growing and shrinking with the seasons.

This soot trend first hit its stride in the mid-eighties — exactly on cue from Beijing.

That the melting glaciers are absolutely filthy with soot particles goes unremarked by the Greens. Even their opponents don’t make the connection.

Famously, 60 Minutes did an expose about a melting glacier in Patagonia. Right in the background the footage captured a fuming volcano emitting mega tons of ash. The glacier was visibly brown. The connection went un-noted. Idiots.

Until Red China cuts down on her air pollution, the rest of the northern hemisphere is going to have truly weird weather.

VDH has a piece up on the California drought. He doesn’t make the connection, either.

This is the problem with getting your science from non-scientists… from clerics of the neo-pagan faith.

funny you bring this up. i was in seoul in april, during which time for at least a few days there was an extremely thick dark gray smoggy haze over the city which the locals said was from China. i had never seen anything like it, and I live in socal. puts socal smog to shame.

I live in a low-income neighborhood in East Las Vegas. Nearby, Lennar is creating three new communities, D R Horton and Beazer Homes are each finishing a development that was halted after the housing bust, and lastly, Genesis Development, an unknown builder from Oregon, is erecting new single family homes right in front of my bedroom window (they are the cheapest builder and offer 1600sf homes with all appliances for $169,000 and up). I walked through all the model homes except the ones by Beazer. They all have their no money down advertisements, and Lennar (prices start around $200k) is offering an interest rate a full percentage below market rate as long as you commit immediately (they let you choose from certain lots that are ready to be built on).

You can buy nearly identical homes that are 6-10 years old for $145-160k. The big advantage of the used homes is that they come with an assessed value that is half of the new homes. The property taxes are half of that of the new homes. This is not California, so the property taxes are not based on purchase price, but the assessed value. The assessed values were crushed by 2012 and while the assessed values are now skyrocketing, the taxes will only go up by 3% a year. The way I understand it, it doesn’t matter if the ownership changes, you just need to send in your forms to get a 3% cap on property tax increases for both owner-occupied and rental properties. Otherwise the cap is 8%.

As the new homes are selling at around a 20% premium right now, they should sell at a discount as soon as they are resold because at that time they will no longer be new and they’ll come with higher property taxes ($2000 a year instead of $1000 a year for your typical 1700sf house). Anyone buying a new house is practically guaranteed to lose.

With foreclosures and short sales dragging out forever (I waited over a year and a half to close on a short sale) little progress is being made getting the vacant properties sold.

Why buy in Vegas when you could buy 2 two bedroom condo rentals in Orange Country for the same price with cash for 3200 a month in rent that is easily achieved. Higher taxes and HOA fees but demand for rentals is good, you don’t want your place to sit. Time is money. I wasted time looking at cheaper markets before I realized because of jobs and incomes, the cheaper places to buy like Arizona and Nevada did not work out. January 2012 here in Aliso Viejo you could easily buy 1 and 2 bedroom condos for 125,000-150,000. These places rent 1300-1800 a month and are now worth 100,000 more now. Price, timing and location are all important. Now is not the time to buy anything and the market is showing that now. When investors start rejecting current housing prices look out below.

Nobody cares…

What? It seems like you care…thanks!

Nope…

“”January 2012 here in Aliso Viejo you could easily buy 1 and 2 bedroom condos for 125,000-150,000.””

Except for the fact that with a condo “purchase,” one is not buying the walls, the foundation, the roof, nor the land, one only gets the right to the airspace within the structure. Who in their right mind, knowing that, would eva consider a condo (not to mention the politics in the association, etc.). LA condos, fugget about it, lol.

Good take Christie incomes in places like Vegas are suspect at best.

PS What you say counts, no matter who agrees or disaree.

Same ol’ cycle. Vegas falls first, then Phoenix, then CA.

Was out in Lake Las Vegas, east of town, a few months ago and … *wind* … at noon the parking lot at the hotel/promenade was empty. I’m being optimistic if I said there was another car there. The shops were all abandoned, but maybe one. A few dog walkers, that’s it. Sand traps on the golf course paralleling the road in were choked with weeds; no players.

Speaking of LV, here are my predictions for 2014.

Housing to go up 30% (but you already knew that)

GDP to go up 7% (bold but beautiful)

Dow 20000 (probably will make this by next week)

S&P 2500 (hell lets just up it to 3000)

NASDAQ 5500 (we have been waiting a long time for a new all time high in the NASDAQ)

TBI (Tulip Bulb Index) 1,000,000.00 Guiders (of course this will lead to a economic surge in the land of windmills for all you currency traders…)

Hilarious. Where do you predict rents are headed for LV? Perhaps sideways and a steady gradual tapering, but definitely won’t tank?

Another stupid comment from What?

Just because you don’t get it doesn’t mean that the comment is stupid…

Yep I get the comment, you are not all that deep…another stupid comment from What?

I really don’t think you do but if you tell me what the real meaning is you may actually impress me…

Nope

The prosecution rests your honor. Christie Simpleton has been sentenced to life in ignorance without parole…

Funny,

You are so damn funny “What”. My wife and I have been laughing at your posts for months. Keep it up man.

Sone new advice from Karl Case of Case-Shiller:

The advice Case gives to first-time homebuyers is familiar to most. Be sure you can afford the house and don’t expect a quick profit.

“If you’re not buying it for the long haul, don’t buy because there’s a good chance you’ll have to sit through some down cycles. But when it goes, it’s very nice,” he says.

You gave a nice summary of Karl Case – here is the entire Karl Case article from yesterday.

http://money.cnn.com/2014/07/07/investing/housing-market-case/

Economic Question of the Day

Is it possible in a pretend economy to have both deflation and high interest rates?

I was taught that this is impossible but I believe there was a time when it was impossible to have inflation and sagging growth…

If you can isolate deflation to pricing power and interest rates to the fed, I think it’s possible. It would even lead to a “stronger” dollar, namely from a) foreign entities chasing our Fed-induced higher interest rates (inverted yield curve?) and b) deflation leading to increased buying power.

All 7.whaterver billion people live in a pretend economy right now and some places have deflation and some places have high rates. Is there anyplace on the planet where that is happening to the same person at the same time? Not yet.

But when I do find that guy, I will let you know.

Oh wait, I found him.. It is actually about 14 people so far. They all purchased hard back editions of books form Hillary, Geithner and the Economist de jur. at over 40% off list on a Discover Card with 28% interest. They read the books between breaks of the CNB”s” Jim Craemer program.

Anything is possible when it’s pretend.

Why Housing will Crash Again…

http://charleshughsmith.blogspot.com/2014/07/why-housing-will-crash-again-but-for.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+google%2FRzFQ+%28oftwominds%29

The big problem with this article is that it assumes that the “theory” of mathematics is fact.

Hedge Fund Owned Rentals: http://www.salon.com/2014/07/09/one_percents_rental_nightmare_how_wall_street_scheme_blew_up_in_its_face/

Hah! Doc predicted this one

Anyone see this news about Atlantic City? I guess gambling isn’t recession-proof: http://www.reuters.com/article/2014/07/10/usa-gambling-new-jersey-idUSL2N0PE1LM20140710

A little late (for this post) news…

http://vegasinc.com/business/real-estate/2014/jul/25/banks-moving-more-aggressively-against-delinquent-/

It’s hilarious to read this post today, in 2017, when for each property below $150,000 there are at least five offers. And when properties aren’t remaining on the market for extended periods, but selling quickly. Most of them cash buyers. And how do people make that money? Some have AIR BNB properties, which in Las Vegas earns a good income. Some own limousine companies. Some sell timeshares. There are so many supporting industries in Las Vegas, beyond gambling. But Las Vegas still draws in gamblers and now, we draw in Millenials who want to pay to party. And this city was founded on partying. Beyond that, we have a huge wedding industry here, not to mention sex industries. And when you compare that to Los Angeles, which grew on movies, sex industries and many of the same principles, originally, anyone with an eye to the future sees potential. Why would anyone move to Las Vegas? Well, we have two sports teams now. There are plans for the Vegas Xpress West Train, a high speed rail that will take people from Las Vegas to Los Angeles. And there are people so fed up with Southern California and San Francisco Bay Area trends that they simply want to buy a home in an area that hearkens back to an Americana feeling. Who will be able to buy the expensive homes in Las Vegas? Clearly, like any other city…those who invested in real estate and made money, wealthy foreign investors and celebrities. And that is exactly what is happening here.

But I had to smirk at the assumptions of people from 2014.

Leave a Reply