Come for the rents, stay for the flips: Cash investors continue to flood Las Vegas real estate market with promises of real estate wealth.

Las Vegas is a fascinating case study of a market that can boom, then bust, and then boom again all within the timeframe of one decade. It is telling that for the first time in history we are living in a global real estate market where booms and busts follow one another like a giant game of telephone. We seem to rise and fall together. Of course this makes sense since there is one major player largely behind the financing of this system in the US. Easy money is flowing like the Amazon and visions of quick wealth in real estate pepper the mainstream press. Flippers are back with a vengeance and investors have become the market in many areas. Las Vegas is one of those specific locations. The share of all cash buyers is stunning and even more astounding is the resiliency from this group sustaining multiple years of all cash buying. Many came for the rents while now many are staying for the flips.

The valley of real estate dreams

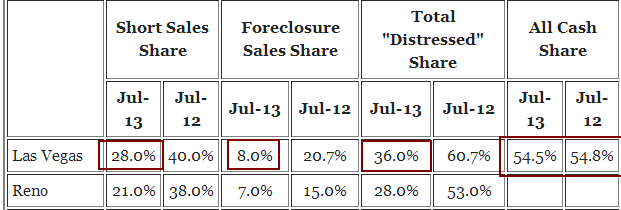

It is hard to claim that Las Vegas is now a distressed market given that the majority of sales are now “non-distressed†transactions:

All you need to do is go back to last summer and 60 percent of sales were coming from the distressed pipeline. Today, it is only 36 percent and of this, only 8 percent are foreclosure re-sales. We wrote in a previous article that Las Vegas had a large number of vacant homes. According to a study from the University of Nevada at Las Vegas found that 40,000 homes are vacant. This is an incredible number given that the latest month of sales figures produced 4,739 sales.

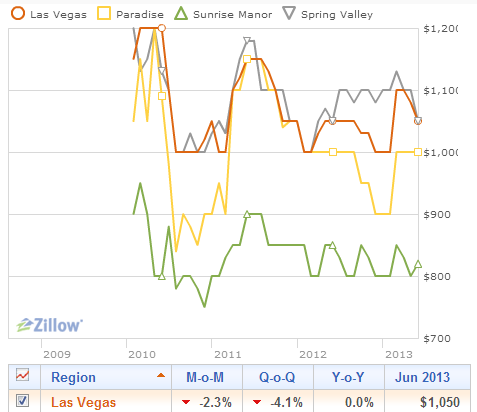

Prices continue to soar even though rents have held steady since 2010 (and have dropped in the last quarter):

So rents are down 4 percent over the last quarter yet the median price is up a whopping 35 percent year-over-year. Forget about buying homes to rent, it is time to buy homes for flipping. Clearly the rental yields are not warranting a 35 percent jump so something else has to give.

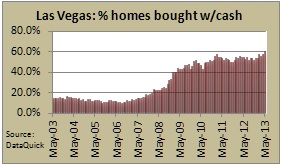

What is astounding is the amount of all cash buying and the resiliency behind it:

Source:Â DataQuick

Since 2008, the amount of all cash buying has remained above 40 percent (over 50 percent since 2009). This is a first for the Las Vegas market. Half of the market has been all cash investor dominated for the last half decade.

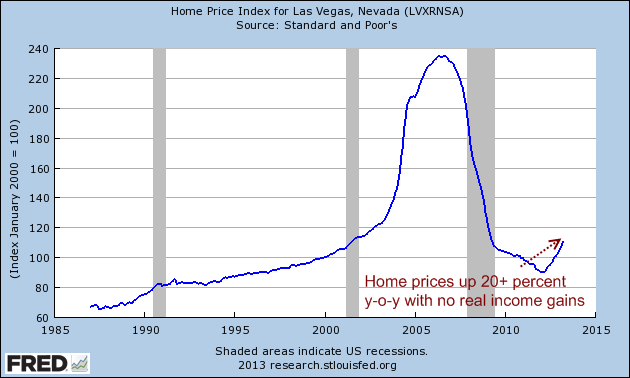

While home prices are up and percentages seem spectacular, we are bouncing off a very dramatic low:

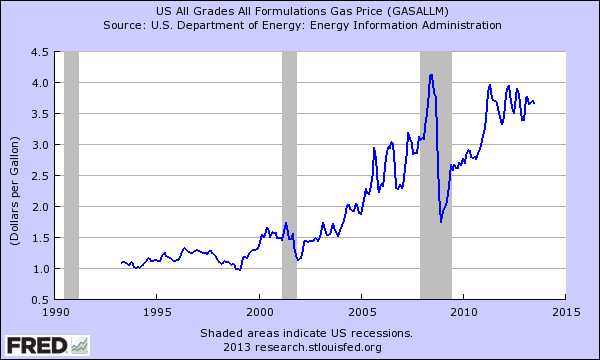

With these low rates, I bet many out in Las Vegas have utilities bills that are larger than their actual principal and interest payments. For a place like Nevada, the end of cheap energy is going to make it difficult to sustain solid growth. You devalue the purchasing power of many and you see real estate values go up yet you also see energy maintaining a new plateau:

Why does this matter? Well look at the rent chart. The typical rent payment is $1,000. If you are spending $200 to cool your home and another $200 to $300 on gas, a large part of your budget is going to these items. This is what is missed by the flood of investors. For the moment, it is another game of musical chairs with investors selling homes to one another. Yet the underlying fundamentals are still weak and wage growth in Nevada is not great. It is certainly not enough to justify a 35 percent jump in prices.

Las Vegas is definitely experiencing a mania. Over half the market is dominated by investors. Yet you might be exchanging one mania for another. After all, some may rather have an investment home in Vegas compared to hanging onto their money in a bank earning 0 percent thanks to the Fed. It is actually very understandable why those with money are flooding the real estate market so aggressively. However the euphoria mixed in with the underlying disconnect from local economics is very familiar. Dust off that history book regarding manias and put on your amateur psychologist hat for a moment. Does Las Vegas seem like a normal market to you?

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

44 Responses to “Come for the rents, stay for the flips: Cash investors continue to flood Las Vegas real estate market with promises of real estate wealth.”

We are seeing even more price reductions and houses sitting on the market in Reno, NV. Some sitting are short sales. More reasonably priced houses with desirable lots and better neighborhoods are still going fast, but tons of houses that would have, even a few months ago, sold instantly are sitting on the market with no offers. They wait for a few weeks or a month and then the price reductions start…

Here’s an article in the 8/14 LA Times about July home sales — prices are flat compared to June while sales volume is up as people try to jump in at the last minute.

The ratio of more expensive homes sold increased, which means average prices are not holding up.

Sounds like were seeing the last gasp of this mini-bubble, and then prices will start to fall again —

http://www.latimes.com/business/money/la-fi-mo-home-prices-20130814,0,2245562.story?track=rss

The dataquick reference can be found here:

http://dqnews.com/Articles/2013/News/California/Southern-CA/RRSCA130814.aspx

Initially, “distressed” takes down values. However, once rehabbed and resold as essentially “new” they lift all house values. In fact, the house value engines out there have no way to break out materials and labor making it appear house values are going up more than they are…all because of distressed. For example, I buy a beater for $100k and put $33k into it and resell for $160k. House price gauges will pick this up as $60k appreciation when in fact $33k was materials and labor. The buying of distressed, rehabbing and reselling has been a huge boost to house values. And the lack of distressed will have the exact opposite once it’;s all factored into the mix.

I was just thinking about this today. I agree Vegas is experiencing a mania, but what about places like San Francisco? Is the recent run-up in prices there sensible given limited inventory and relatively high incomes, or is San Francisco also experiencing a mania?

I have been following this site for the past few months now. I want to thank Dr. Housing Bubble for posting these housing topics and for providing a forum for those interested to speak his or her mind.

My wife and I are interested in buying a house here in Vegas. We actually came out here early last year because of the housing market, but we soon discovered it was unlike others (historically). We did not think house prices would be cheap forever, but we figured that with at least 20% down, we would have a shot at getting one around 100k. That was so last year.

Now, we have about 30% saved up, but we cannot get financing because I am working two part-time jobs that have nothing to do with either my BA or masters. So, the 2-year clock reset, and in the meantime, I am trying to get a teaching license out here (another crazy process) so that I can get a contracted job that will allow us to obtain a loan quicker.

We were presented with the option of going with a cash investor who would hold the 1st lien on the house while we pay him interest every month (10%). This would not be such a bad deal if we knew house prices were only going to rise. People out here keep comparing the prices to those highs in 2007, which were quite inflated and do not seem to represent new value.

So, we’re not sure what we will do. I suppose if we find a nice house that we feel we can live in for five to ten years, then we will go for it. That is assuming we can win a housing bid and that I will have a contracted job in a year or so…so that I might re-finance. Hopefully, the banks will not make it even more difficult for the Average Joe to get financing by then, but who knows?

Watch out and act fast, Jason B, because all-cash iebuilder covets that $27k he’ll earn by “boosting home value” of that $100k “beater” you could buy rehab yourself.

Oh, has anyone ever seen a flipper put $30k to a $100k beater? Maybe install wall-to-wall granite counter-tops? lol

We are renting until things improve. It won’t stay like this forever…

We’ve seen the return of the Vegas housing pump, and now we’ll see the return of the Vegas housing dump. These hedge fund “cash buyers” are actually leveraged buyers. Blackstone, alone, borrowed $2 billion to use in its SFH purchases. The Vegas bubble is about to burst, and here is only the latest guru telling speculators to get out while the exit door is still open. Fun stuff:

http://www.youtube.com/watch?v=SuHwemXJMys

And, sooner or later, that town will run out of water to waste.

First you want California to fall into the Pacific and now you’re giddy over prospect of Nevada running out of water. Sweet.

California takes 10 times the amount of water out of lake mead than Vegas. We can also return used water to the lake and pump that amount aswell california cannot. Nevada could build a desalination plant on the Pacific for california and get the amount this produces out of lake mead also. So we are in no danger of running out of water.

I don’t find that fluctuation in rents all that large, and I’m sure there are some fundamentals to support the chart. Clearly they tried higher rents, it didn’t work, so they lowered them. And being a global city (attraction wise) there can be heavy fluctuation on traffic coming into the city. A few good months, a few bad months, etc. So if people make more, spend more, make less, spend less.

If you can work on the Strip at a good job, it’s easy to live in Vegas. Just look at the buffet attendants…they automatically tack on tips when you buy your food ticket at the new automated machines. Given buffets are $25 to $50, that’s $3.75 to $7.50 per person, per table that attendant is making. I’m sure it’s easy to walk out with minimum $100 in your pocket every night. Same for dealers, valet, etc…they all get tips. So say $2000 a month in tips, plus wages, plus the potential for multiple income sources in a home, Las Vegas is much more Midwest priced than West Coast.

There is also a number of manufacturing companies, Nellis related jobs, and others in North LV and Henderson. “The Strip” is the gold mine but as I believe i said on another DHB article, you must be ON the Strip for the gold. Hotels 2 blocks off charge 1/2 as much. People taxi from the airport to the strip, they don’t leave it. The rest of Vegas is very much an average American city. Too many people, perhaps, and not enough jobs to support them, but I digress and speak of the gainfully employed. Make $15 to $25 an hour and you are doing fine in LV.

The market is manipulated and manic, yet still much more affordable than CA.

There are not many people making $15-$25 in Las Vegas – or buffet servers getting 20% tips. And as far as “doing fine” on that, what do you base it on? The only thing cheaper in Nevada than in California is rent. Utility rates are 2nd highest in the west, gas isn’t cheaper, you don’t pay income tax, but sales tax and fees are relatively high. Wages throughout Nevada are lower than California, in many cases significantly so. My son graduated from UNR with a degree in Accounting, the highest paid job he found in Nevada in 2 years was 28k. He moved to Northern California and his starting wage was over 50k, the only thing that costs him more is his rental, which would probably cost him $400 less in Nevada and a few thousand in extra taxes in California., and both of those are offset by the generous employer paid benefits he receives which were pretty much non-existent in Nevada

I guess I’m just a lot better at getting jobs than most people.

Lynne is right that wages in NV are pretty low. There is one other thing, though, in Nevada that is cheaper than CA and that is taxes on wages. Zero in Nevada — while CA has the highest tax rate in the nation.

“40,000 homes are vacant”

Assuming this figure is accurate, what more does one really need to know in order to not touch that “market” with a million foot pole?

“The rest of Vegas is very much an average American city.”

Not really. It’s a small city built in the stinking desert with absolutely no natural water source and highly dependent on one industry, gambling, and the unsavory businesses that accompany that industry. I really can’t think of any other American city that compares.

well said, the whole state is like that, and to make it even better we have a legislature full of ALEC zombies. If you hang out in Nevada long enough you will know why it is frequently called “Mississippi of the West”

Actually, Reno is changing drastically, probably due to the influx of outsiders (mostly from California). There is urban renewal, they are recycling, there are sports enthusiasts and outdoor activities, festivals, etc. Gambling is fading and is no longer the main economic force it once was. Definitely different from Las Vegas.

Well, I never saw Reno before your “change”. but, as an Easterner, I visited it the winter before last as a possible retirement home, due to it’s proximity to world class skiing, cheap bubble crashed houses, and super low taxes. The place actually made my girlfriend cry. Sure, the homes are cheap, but, downtown is just depressing, because the only business seemed to be casinos, which I find incredibly sleazy (and the only place where you have to breathe cigarette smoke inside these days), and pawn shops, with unsavory homeless and parolees lingering about. The homes out in the “burbs” are nice, and, as said, incredibly cheap right now, but, I’m sorry, I can’t live in a place where I’m surrounded by dirt and dry hot sun most of the time, with no culture to speak of. I will admit, I almost broke out in tears when I walked away from a few nearly brand new homes in the 150,000 range just a half hour or so to Tahoe skiing. Location, location.

Glad they are paying all cash. Mortgages are drying up

http://www.zerohedge.com/news/2013-08-14/mortgage-activity-plunges-50-april-2011-levels

While limited water and increasing energy costs probably do doom Las Vegas in the long term it’s hard to see these factors significantly effecting real estate values on the 2-5 year time scale most here are concerned with. People have been giving up on fossil fuels since the 1970s, and been premature every time. These energy sources will certainly run out (or, more realistically, grow prohibitively expensive and force the adoption of alternatives), but betting on this to influence short to medium term economic decisions is risky at best.

Took a few trips to LV since 2009 to check out multis to buy/rehab. I’ve spent a bit of time looking at multis in middle/lower income areas of Phoenix/KC/LA; I’m not dissuaded when it comes to a total rehab project…if value is there, I’m interested.

Las Vegas wasn’t for me; I saw too many blighted neighborhoods, no shortage of people aimlessly “milling around” all hours of the day/night; transients, families begging, UE, crime, prostitution, drugs, aggressive panhandlers. Scary poverty.

I mean no disrespect. I want to like Vegas, and true, you can find all things I mentioned above in any major US city. But to me it all seemed magnified in LV. Vegas has some beautiful areas, gorgeous homes; surely it’s a fine place to live for many. But for prices asked for properties offered I viewed, I believe better values exist in other more “boring” US towns w/better economies, more stable populations, less crime, blight. All just my humble opinion, folks; I may be totally wrong.

When you’re feeling that housing prices in So Cal are out of control, check out this 700 square foot house in Toronto. Ellen DeGeneres calls the realtor about it, who acts like it’s a great house for the money – $173K to be exact. Quite humorous video highlighting the ludicrous nature of the housing market.

http://www.huffingtonpost.com/2013/08/13/torontos-tiniest-home-photos_n_3749572.html

$173,000 / 700 is like $250 CAD/sqft

How is that a number that is out of whack? You can rent that small apartment for no less than $1,700 monthly in Toronto at the moment – not familiar with taxes and insurance so I won’t comment what the net looks like, but still….

GEEZ — Don’t know where Sadie got 700 sq feet and why Karl didn’t open the link to see the detail for himself but the house is 312 sq feet and the price of 173K was when it was For Sale in 2008!!

C’mon people…..slow down, take a breath, READ and check details.

That house is really only 312 sq. ft. not 700..for $173,000?Ouch

Oops on the 700 square feet (should be 312 square feet). I think I confused myself, with the fact that the house is 7 feet wide.

Dear Doctor Housing Bubble,

Nothing puts a smile on my face more than when I hear “all cash buyer” thrown around as if there are people with suitcases of cash showing up at open houses. I think it is important to distinguish between financing contingent offers, non-financing contingent offers and real all cash offers.

I am willing to bet that there is very little cash out there. I believe some of the other commenters have noted or posted links related to how “hedge funds†are financed by large banks which get the money for free from the Fed and purchase the houses with non-financing contingent offers. These appear in the stats as all cash offers, but in reality they are financed. Their ultimate goal is to sell these funds to 401k plans, pension funds, etc. and make a big profit. Any losses will be socialized.

We have also seen that flippers get short term loans to purchase, rehab and resale properties. I have even heard grumbling that the rich Chinese are getting loans from their home countries to finance their all cash offers.

I have friends that had enough assets to go to a bank and get financing independent of the house they plan to purchase so they make non-financing contingent offers. They then refinance the house so that the house becomes the collateral. A lot of folks do this just because all cash offers trump finance contingent offers every time.

I agree that there is some real cash out there but it most likely is not the majority of the all cash offers that everyone goes on about. The name of the game is to leverage what cash you have. I think cash started its long and slow death after the 1987 home loan crisis and we have been leveraging up ever since with cheap easy debt.

Following your train of thought, only the cash flow investor who buys with a cashiers check and doesn’t refinance, is a true all cash offer. This person is looking for income from rents, that has been unavailable in CD’s, bonds or the stock market. I’m not sure how many of the sales are to cash flow investors, but I’m sure it is significant. Some folks refer to this as mom & pop landlords.

I have also noticed that prices have been dropping and inventories rising. Seems like everyone wants to be a landlord. Whether or not the top has come and gone again time will soon tell us. But Uncle Ben’s little QE experiment will not end well. I’m kind of shocked that this is occuring given some of the great deals out there.

This is a great time to buy a place like this one.

http://www.redfin.com/CA/La-Verne/1861-Walnut-St-91750/home/7912909

Kudos to your perfect tongue in cheek.

As a real estate investor who has invested in Vegas since 2011, I can say that while the huge jump in the last two years is thanks to the government and the banks working together to tighten supply. We are seeing a switch of a market filled with foreclosures to a market now filled with people reselling the homes. The market composition is different and so happens the prices are changing. In addition, home prices are still below the cost of replacement. In other words, you can’t build on the prices right now. To say Vegas homes are unaffordable would be like saying only Bill Gates can afford to live in San Francisco. The market is merely rebounding from a “once in a lifetime you can never buy something that cheap again” opportunity. It still has room to grow. It is a mania only if the prices go beyond the cost of replacement and mortgage payments go far beyond the cost of renting.

I don’t know about Vegas cause I don’t follow, but in OC, keep telling yourself that mate.

The said that in Long Beach in 1993 also…

Assumption is not a winning strategy…good luck with that one in a lifetime deal…

I say get ready for the K winter on its way..

What happens in Vegas, stays in Vegas. Talk about a place with no real traction. It’s gonna blow. And soon.

Meanwhile, back at the ranch (per LA Times, Aug., 14):

“Orange County prices were the most overvalued in the country — 12% above where the website’s analytics said they should be. Los Angeles County came in second, with prices about 10% overvalued.

Both counties are still way less overvalued than during the height of the bubble, Trulia said. Orange County was 70% overvalued in the first quarter of 2006, while Los Angeles was 78% overvalued at that time.”

http://www.latimes.com/business/money/la-fi-mo-housing-overvalued-20130814,0,6184676.story

I said the exact same thing months ago.

Meanwhile, back in reality…10Y yields hit new highs and mortgage rates keep climbing.

heres an interesting one near where I Live. Sold for $232000 IN May flipper repainted and put granite in. It is now pending for $375000 Prices are going crazy here.

http://www.redfin.com/NV/Las-Vegas/7820-Magnolia-Glen-Ave-89128/home/29164313

Would it be fair to say that housing is being traded like a commodity. If so, then absence of renters is good thing, since uninhabited houses do run up utility bills…

*edit “uninhabited houses do NOT run up utility bills”

We are at the high end of the real estate cycle now but, I believe we are still 2 years out from a bubble.

Leave a Reply