Half of loan modifications re-default within 18 months – California usage of ARMs at near record lows signifies home buyer psychology.

The spring and summer have reinvigorated the housing market nationwide. In California sales are up and so are prices. A combination of low inventory, better quality properties selling, and historically low interest rates are propelling sales. Yet a bounce in sales and prices always occurs given seasonal factors during this time. The sustainability of this trend is the bigger question. The California economy is still struggling. The recent budget that passed on time hinges on voters approving tax increases in November. Hard to tell how things will play out given how polarized the nation is and how discouraged people have become with their representatives. In California, new data shows that modifications on mortgages were largely a stalling effort as predicted. Most of the bounce has been manufactured behind the scenes. The figures on modifications are particularly fascinating.

Modifying the inevitable

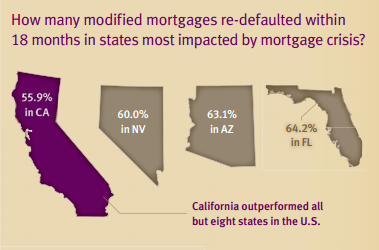

A recent study conducted by TransUnion found that over half of all modified loans re-defaulted within 18 months:

Source:Â TransUnion

This is not a positive rate. Keep in mind that if you looked at re-defaults say out to 36 months the rate would skyrocket even further. Yet what this does is takes more inventory off the market in conjunction with banks leaking out shadow inventory. In other words, in the dark rooms of banking balance sheets, you have at the latest count 2.8 million Americans that are now 12 months or more behind on their mortgage payments (if we add in those 90 days behind the figures jump even higher). These properties are very likely to end up as foreclosures. Even if stalling efforts are made, many will re-default. This is still an incredibly high figure.

There was a recent analysis that stated that housing for the next few years will go up in down in spurts. The logic was that as prices rise, those on the sidelines will jump in including putting online more inventory. More inventory will likely drive prices lower with additional distressed properties hitting the market competing with other inventory. Those with the option will pull back and we’ll be left with the current market where banks essentially control inventory. Also, with so many people with a foreclosure on their credit report each year we are removing over 1.5 million potential home buyers from buying for at least a few years.

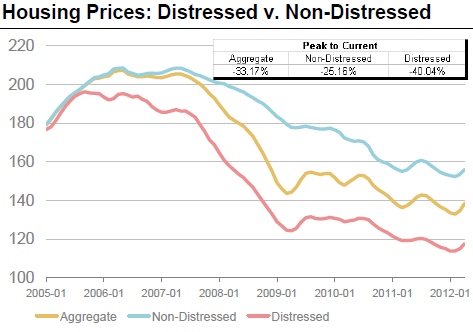

Distressed properties do sell for much lower prices:

Source:   Morgan Stanley Research. SoberLook

These are interesting figures. Distressed property is down roughly 40 percent from the peak while non-distressed property is down 25 percent. Yet underlying this data is that many who are not in a distressed position are likely to have pulled back from selling even if they had this in mind. So the sales that do occur are pre-selected to be favorable for these sellers. Even in this segment, prices have fallen. The distressed figures simply highlight what we already know and that banks are slowly realizing prices will not bounce back and have become more aggressive with pricing action including approving more short sales.

The ARM-less California

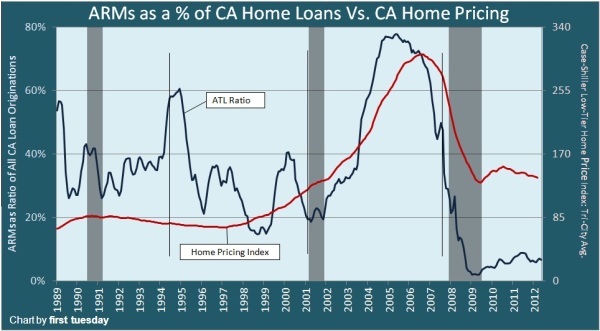

During the heights of the bubble nearly 80 percent of all loan originations were part of the ARM variety in California:

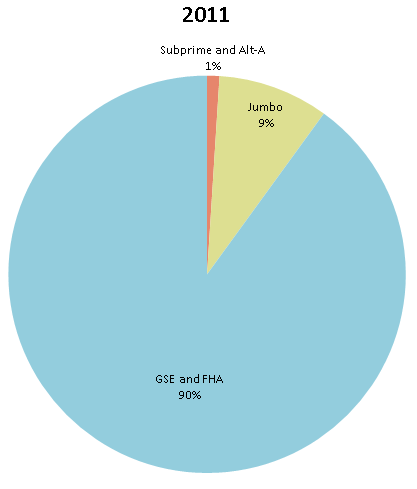

Even in more stable times, ARMs would typically make up 20 to 25 percent of loan originations. Today it is in the single-digits even though ARMs have some outstanding terms. A 5/1 ARM has a rate of 2.6 percent! These are all time low rates and these aren’t your no-doc NINJA loans either. Since many outwardly talk about their starter home, why not buy a place with an ARM and wait 5 years to get on the property ladder train again? The reality is most of these loans require strong income and a good down payment which very few actually have. So the market is virtually dominated by investors buying lower priced distressed properties and other buyers using FHA insured loans with 3.5 percent down. Yet these are 30-year fixed mortgages.

This is very telling about how people view the future. If you really thought prices were stabilizing or moving slightly up, why not take on that ARM and when you go to sell in 5 to 7 years you saved yourself some dough in that monthly payment. Of course home buyers for the most part lack anything resembling a 20 percent down payment and are essentially taking what they can via government backed loans:

Those that believe rates will stay low for a long time and believe the market will move up in the next few years should jump in head first into ARMs. The above chart demonstrates that people will simply follow the short-term trend without even realizing what kind of signaling behavior they are performing. Would you consider using an ARM in today’s market?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

43 Responses to “Half of loan modifications re-default within 18 months – California usage of ARMs at near record lows signifies home buyer psychology.”

About the “tuned out” question from the other day: I read Dr. H as often as I ever did, but I have added a link to my Google toolbar. About living on the Westside: what a miserable place unless you “belong to the club”. I can’t stand renting, yet here I am, doomed to rent for who knows how much longer.

It is funny, here in AZ, folks are bidding up to 30% over market value (comps), and raiding their 401k’s to pay enough down to make the deal work, the same folks that made peak buying decisions in 2005 and 2006 are far enough away from their foreclosure that they are ready to take on MORE NEGATIVE EQUITY AGAIN. (What could go wrong?) Value is set at the margins! The least informed, least sophosticate set values!

Ha Ha, they have forgotten about the bubble already. It is so easy to make money from these fools. Spin a little story and they will panic and bid up the prices. Well, we need alot of fools so the rich can get richer.

Excellent point! Top it off with the banks holding a ton of inventory off the market to keep the inflated home price and like magic they create the illusion of value and demand for a low inventory. The uninformed (the majority) will jump in and voila, the paper keeps churning and the world , which is built on paper, continues going round and round. The deal is, as long as the music plays we can all dance around and sing, it is when the music stops (as in 2008) that someone is going to be left without a chair, and it won’t be the banks. So, we have 2 choices, either start the music again, or stop manipulating the market and let it be based on reality, and then EVERYONE could afford to buy a house because it would cost about the equivalent of a sandwich!! (if ALL the pre and post foreclosures were currently on the market at the same time) That’s not going to happen, the banks can’t allow that to happen because they pre sold securities based on these homes being of a certain value. Unfortunately they did not quite OWN the Deeds or Notes when they sold these to the investors. All they had was prospectuses saying they had these types of “pools of Notes backed by houses) unfortunately they way over valued the underlying assets and also did not fund the amount of the Notes for houses that they told the investors they had, due to the 30% off the top in their fees. For example, they would sell 1 billion dollars worth of mortgage backed securities in a pool then AFTER they collected the monies from the investors would THEN table fund 700 million dollars worth of Notes backed by over priced houses, pocket 300 million for themselves for their fees for being such good criminals, (of course the banks had Erik Holder and Lanny Breuer to help them pull it off, by creating the MERS straw man mechanism and changed and created laws to protect themselves etc., like Fast and Furious) and now, the houses are worth a fraction of what they told investors in their prospectuses. So it was all fraud. Now Erik Holder is found in Contempt of Congress for Fast and Furious but there will be NO criminal prosecution! Should not the Attorney General and the President of the United States be held to a HIGHER STANDARD?? Didn’t Nixon have to resign for listening in on his competitors over at the DNC? I mean really, listening to people’s conversations is what he was forced to resign over but currently the government can now bug anyone anytime. Now we have our atty general who is a crook and that’s okay? Our president appointed a crook to represent us against the criminals that used to employ him. Isn’t that great? Are people this dumb. blind, and apathetic? Are we really going to just sit here and let crooks destroy our country, lives? My guess is yes.

sophisticated

Treasury rates can not ever go back up again otherwise the borrowing costs on the almost $16 trillion debt would quickly eat up the federal operating budget. Also who is buying the trillions of dollars of USA debt every year? What sane person in their right mind would buy 10 year treasury bills at the highest price ever with a yield of 1.6% while true inflation is running at 8%? I believe that the Federal Reserve is secretly buying all the debt. The Federal Reserve, aka private central bank, has never been audited in its 100 year history. So, if you want to get a 5 year ARM, it would be safe to state that the interest rate will remain low for years to come. However, your purchasing power to buy fuel and food will be eroded every year. You have to protect yourself and buy gold and silver bullions.

Well, the Chinese are buying US$, as hedge against their own inflation, combining with their stagflation brought on by extra large rural to city immigration caused by draught stricken agricultural lands, the remainder of the BRIC countries: Russia because world gas glut that has cut deeply into Gazprom’s profit weakening the Ruble along with other Asian Tigers (who have not over spent and find themselves in reasonable positions) and Brazil – all of whom remain modestly successful.

Despite the difficulties we have faced in the U.S., They appear small to the upheaval faced by the Euro countries and the tensions over austerity or further development. Despite all of this, the U.S.$ with its planned low interest rate till at least 2014 (FED speak), it appears the U.S. has dodged the bullet and that the U.S.$ remains the world’s reserve

currency.

One final note, the U.S. seems to have become the new Saudi Arabia in natural gas. We actually have somewhat less reserves than Russia, but we have more advanced technology and engineering and our fields are literally under food and not thousands of miles away in Siberia.

*Despite the Euro being on the brink of “collapse” (record number of short positions per CFTC) it’s still higher than the USD. What does that say about the mighty USD?

*Don’t believe everything you read about the US being the new Saudi Arabia of natural gas and the the coming natural gas paradigm shit. It is an accounting gimmick to attract investment money.

Sure, there quite a bit of nat gas to be extracted but it is not 100 years worth (at current consumption levels).

Let me share with you a small snippet of what most new discoveries do after going into production.

Chesapeake paid $185 million for this DFW Airport (DallasÂFort Worth) 18,000 acre lease in the Barnett

Shale Play, and they predicted that they would be producing 250 MMCFPD by the end of 2011, with an

EUR upper end estimate of one TCFE (including some allocation for liquids) from the lease.

Production peaked in October, 2009 at 77 MMCFPD (from 93 wells), and they were down to 32

MMCFPD in May, 2011. What is interesting is that the decline rate accelerated in the first five months

of 2011.

The overall annualized decline rate from October, 2009 to May, 2011 was 55%/year.

From October, 2009 to December, 2010 the annualized decline rate was 46%/year.

From December, 2010 to May, 2011 the annualized decline rate accelerated to 81%/year.

In any case, at the 55%/year decline rate, the DFW Airport Lease would be down to 23 MMCFPD in

December, 2011, versus Chesapeake’s projection of 250 MMCFPD.

Well, the Chinese are buying US$, as hedge against their own inflation,

Actually China has been dumping US Treasury bills.

http://www.treasury.gov/resource-center/data-chart-center/tic/Documents/mfh.txt

combining with their stagflation brought on by extra large rural to city immigration caused by draught stricken agricultural lands,

China just cut their interest rates so why would they do that if they are experiencing stagflation?:

http://money.cnn.com/2012/06/07/news/economy/china-rate-cut/index.htm

Despite the difficulties we have faced in the U.S., They appear small to the upheaval faced by the Euro countries and the tensions over austerity or further development.

USA has almost 50 million on food stamps, largest housing asset bubble bust in the history of the world, wages frozen, health and retirement benefits cut since 2008, $4 a gallon gas, 21% unemployment according to U-6 figures, and finally according to Shadowstats.com inflation is running at 8% using government calculations prior to Clinton changing them

U.S. seems to have become the new Saudi Arabia in natural gas. We actually have somewhat less reserves than Russia, but we have more advanced technology and engineering and our fields are literally under food and not thousands of miles away in Siberia.

Are you talking about fracking? Using corporate secret chemicals poisoining underground water, cracking rocks causing earthquakes? Communities throughout USA are fighting oil companies to stop fracking. Google it.

Me thinks you read Bloomberg way too much…america’s premier Pravda propaganda news site.

Re: new Saudis of Natural Gas. To that I ask “At what eco cost?” I suppose the designer water industry will profit….just to get a drink of h2o that doesn’t self ignite.

Matt said:

“Also who is buying the trillions of dollars of USA debt every year? What sane person in their right mind would buy 10 year treasury bills at the highest price ever with a yield of 1.6% while true inflation is running at 8%? I believe that the Federal Reserve is secretly buying all the debt.”

Where do you think the bottomless pit for FHA funding is coming from? You don’t think that perhaps a lot of that money/debt creation, which is pushing “8% true inflation”, might be funding new knife catchers in a new bubble?

The Fed can only sit on it for so long, i.e. before they find a buyer, and what better con then to buy hard assets that will, even if lagging” reflect hyper-inflationary “adjustments”?

15-30 years is a long ways to kick cans…

Dr. HB wrote:

“So the market is virtually dominated by investors buying lower priced distressed properties and other buyers using FHA insured loans with 3.5 percent down. Yet these are 30-year fixed mortgages.”

Too bad, so sad…once again malinvestment will be stuck in illiquid RE, while the perfect storm of outsourcing, wage arbitration, + out-of-control .GOV regulations and taxation will finish off job creation for a generation, and thus making wage inflation impossible.

Win-win for the politeers and banksters!

The laws of math can only be suspended for so long – How long can TPTB and TBTF survive without a massive U$D currency devaluation event?

Will they continue to succeed in inflating commodities and assets at the expense of the avg. iSheeple?

Of course they will, and without HUGELY deflationary correction(s), the Rentier Class will emerge, and the feudal lambs will continue grazing on pastures of ignorant bliss…

Ivan, the gas well depletion rate is like opening a bottle of soda pop. The fizz goes off pretty rapidly. The gas resource claims are inflated. Last year the EIA chief told congress the industry claims for the Marcellus field reserves were accurate, and then one month later the USGS said the real reserves were only 20% of what was claimed. The industry wants land owners to think gas is plentiful, to drive down the leasing fees. Reality will soon become apparent.

A 30 year, fixed rate mortgage is not a bad way to buy when home prices are rising. In the first few years you aren’t paying much principal, but you get equity in the form of price appreciation as well. If you have to sell, for whatever reason, you can pay the real estate broker and your share of the closing costs and at least get out even, if not a little ahead.

But since prices are not rising, I don’t see the point of a 30 yr. loan. As Dr. H. would say, you are basically renting. Very few people can see that far into the future, so this is a recipe for disaster. Look at the 15 yr, fixed rate loan instead. For one thing, you get a lower interest rate. You get at least a half of 1% lower rate. Probably more in most cases.

A with fixed rate loan, you are making a series of equal payments, monthly, for the term of the loan, 15 or 30 years, although lately I’ve seen 20 years too. The way these loans are structured, you don’t pay much principal until you are about a fourth of the way into the loan. With a 30 year loan, that is 7.5 years. With a 15 year loan, it is only half that, less than 4 years. So with the latter, you start making significant headway towards paying down the principal much sooner, which gives you some cushion if you have to sell.

Completely disagree. With 30 year rates at less than 4% mortgages amortize much quicker. People with such low rates will find principal much earlier in the life of their loan then ever.

The spread between a 15 year and 30 year is about .5% Get the 30 year fixed and pay 15 year type payments if you’re interested in paying it off quickly. You’ll pay it off almost as fast, but have the flexibility to do so if you choose.

When inflation finally comes around whenever that may be, you’re sub 4% 30 year fixed may be so good you won’t want to pay it off in whole even if you were able to.

I don’t know, MB. Even with a 4% fixed rate 30 yr loan you will still owe 64% of the principal after 15 years.

My guess is that at some point they are going to do away with the tax deduction for mortgage interest, perhaps phased in over many years. Perhaps a lot sooner than you might think.

~40% paid off halfway through is amazing. I guess it’s all about perspective though. At 8% rates, you’d still have ~75% of principal remaining halfway through a 30 year loan.

I think the key is the first 7 years though since that’s the average age of ownership (though I bet that number will increase in the next decade)

At 8% you still have you’ll barely cover selling costs. At 4% at least you have something to take away.

I didn’t mention anything about MID because I don’t think that should be taken into consideration when deciding between the 15/30

However, cash-flow is important. A 30 year also gives you the ability to rent the home out at (hopefully) cash-flow if you’re unable to sell or want to keep it as an investment property. I think that flexibility is important.

If you get a 30 year fixed and pay at 15 year sized monthly payments you’ll pay it off in 16 years. Is that one year worth the flexibility? I believe it is if you’re disciplined.

Sorry, but most people that take out a 30 expecting to make extra payments to retire the debt early don’t do it. If you are VERY disciplined, you can do it, but it is not common.

All good points. Like was mentioned most people aren’t that disciplined to take a 30 yr loan and make consistent 15 yr payments. They see that new car, new gadget, vacation and soon revert back to the 30 yr payments. If you truly are that disciplined, take the 15 yr loan up front.

Because even with a recast, they still bought over their heads!

A healthy housing market should begin around $75k for the poor, get up into $150k to $300k for the middle class, and of course have it’s rich mansions for those that are able.

Period.

I am interested in a short sale which has been on market for 400+days. The seller is firm on the price and not willing to make any price reduction. I was told because he put a lot of money in the property so he’s not willing to sell lower. I’m not that convinced – this is a short sale, he won’t get a dime, right? Is squatting a more likely explanation? But he at least needs to have an offer on the table to delay the (potential) foreclosure, right? Maybe he’s waiting for the foreclosure process start before getting serious? I know he’s stopped paying the mortgage but don’t know for how long.

I wouldn’t consider using an ARM in today’s market, because I have no confidence that I would be able to sell for a high enough price to break even (even factoring in what I saved on monthly payments) let alone make a profit. And I wouldn’t want to have to refi and stay, at the interest rates then, which almost certainly will be higher.

In other words, I’m almost certain that interest rates will go up, probably a lot, in 5 years. I’m doubtful that the real prices of residential real estate will go up much in that time frame.

Of course, hyper inflation could completely change the above scenario. But I really don’t know which way to bet on inflation.

A 5/1 or 7/1 ARM is a great way to go. At this pace, the housing bubble excess probably will go out to 2020 or longer, the incumbent Congress/Fed/Treasury thought “leaders” won’t be changing anytime soon unless we have another spectacular bank blowup (Citi/BofA?) where they finally have to institute a new Glass Steagall.

Low rates will likely last much longer than the 2014 target. If rates start to inch up, refinance. With recent history as an example and $15 trillion+ in national debt, what’s to stop The Fed from enacting QE20, monetizing more debt to further suppress interest rates for the benefit of the US Govt and the TBTF banks?

I’d roll the dice on this one with an ARM at 2.625%. When it goes adjustable in 7 years, big deal. It can only rise so much within a year, which will still be very affordable. Who knows, maybe in 2019, the LIBOR will still be rigged by the banks and the rate will be in the high 2s?

Hey Gerry,

Don’t waste your time trying to figure out the sellers’ status. All realtors lie.

I bid on a raw piece of land up here in Napa county. Sellers wanted 500K.

I offered 260. They told me to get lost. No problems.

4 weeks later they call and ask if I my offer is still on. Sure.

Find out afterwards the couple is getting divorced and want to make a clean split of their assets.Point is you NEVER know what the seller’s true situation is.

Hey Fred not all Realtors lie! I was a Realtor and have a blog and website devoted to telling people what happened to the housing market, the economy and why and by whom. In fact I recently hung my license up because the market is so manipulated I ca not honestly inform my buyers and sellers because the market is so controlled by the banks it is now impossible to tell someone what their homes are worth! It’s all fantasy. Oh and Realtors are lied to BIG time to “get out there and find buyers and sellers”!! Yeah it is lame. I used to love real estate, I loved everything about it. I love architecture and homes and land. Now it is like a big cess pool. The banks took a perfectly great industry and crushed it. It was a giant equity stripping ponzi scheme and they got away with it. Most people still to this day don;t know how it was done. check out my website http://www.economicsurvivalguide.org

SFR inventory in desirable, coastal CA is down 40% yoy in many places. It’s not a grand conspiracy but a constellation of inter-related factors:

* many home-owners have taking advantage of historically low interest rates to refinance their loans…creating a “we’re not going anywhere now” mentality (analogous to Prop 13 lottery winners)

* foreclosure moratorium due to robo-signing scandal and ensuing litigation/settlement has been a pig in the clearinghouse pipline

* upside down home-owners who can’t unload if they wanted to

* “command and control” shadow inventory management meant to keep prices high in the face of a poor economy and deflating RE bubble

* poor CA economy (high unemployment, slow growth, public worker lay-offs, debt and deficit) is squeezing money out of the system (with higher taxes yet to come) and keeping psychology grim about the future

* Squatting home-owners who game the short-sale process

* HAMP, HARP, etc. are long, poorly managed process

* Cash investors gobbling up inventory and converting into rentals

* Lack of new construction (running out of land to build and difficulty in financing high-rise complexes) limits supply

* Sweetheart deals by insiders that never see the MLS artificially limits supply

* Suspension of mark-to-market accounting creates balance sheet incentive for banks to not sell distressed under-water properties

* Prop 13 lottery winners

* Lack of move-up buyers to create “churn”

* Absurd $745k limit on FHA loans in CA has allowed 3 percenters with excellent credit to prop up the middle-upper market, which has kept prices inflated, which in turn limits the number of people in the sane, 3-4x income demo (i.e., reducing the supply of buyers)

Miss anything?

Nice work Dfresh!

You mixed the fact that when a certain segment of the population prints money and ‘lends’ huge sums to their friends (after bonuses to themselves and small kickbacks to politicians in the form of campaign contributions ) then it is basically stolen money that wants to look legitimate and needs to be laundered into the system some how. Prices don’t really matter to these types.

Nice summary Dfresh. I’ll add a few things here:

* Landlords are very aware of the low inventory. Even if most renters wanted to buy, there is virtually nothing out there. Landlords can reem renters via rent increases until the inventory changes. This is getting more renters off the fence and adding to the frenzy.

* One of the most important things we have learned in the last four years: there are many gray area benefits to being a loan owner. Put little skin in the game and if shit hits the fan…you can live for free for a few years. Americans has a whole are ignorant at simple math and finance; however, they are definitely above average at “getting something for nothing.” Most Americans are aware of these fringe benefits now.

Dfresh-I don’t think you mentioned Harp-2. Unlike its predecessor, I think it is going to help a lot of people refinance. However, I don’t have any actual stats in terms of number of houses refinanced so far.

I think this will keep a lot of houses off the market in coming years.

I qualified for Harp -1, but all it would do, at the time (2009 or 2010) is knock $100 off my payment and reset my loan back to 30 years fixed, from 26 remaining on the original loan. Plus pay points, fees, etc.

With Harp-2 I’m actually paying slightly more per month, but going to 15 yr fixed from 24 years left on a 30 yr. Very nice!!

DR HB,

Love your data, but I think you’re still stuck in 2003-2006 with your analysis. People generally aren’t buying with an eye to home appreciation.

Investors are buying to hold and rent out. There’s not really a safe haven for the dollar anymore. Here are your cash-only buyers.

Regular people are buying because housing prices in many cases are lower then rents.

In both cases an ARM makes no sense. Given the above, inventory for the near future will probably be comprised of a greater percentage of distressed properties. Why would one sell if there’s little price appreciation, but still lower than rents. This is probably especially going to be true if interest rates go up. Those that own have no incentive to sell if they’re below rental parity.

The research on failing loan-mods is a little old. “Researchers examined data on five million mortgages including 600,000 borrowers who received a modification between January 2008 and July 2011” If the study were done between 2010-2012 I’d expect much lower rates of redefault

Sign of a distressed home owner, on the private remarks(MLS) they mention showing times that are ridiculous. Monday from 12:15- 12:30, NO SHOWINGS-Tue, Wed, Thur., Fridays 5:00am to 5:30am, no weekends, exaggerated but close. Pretty obvious they aren’t trying to sell. Once you find out what they owe every time I see they are upside down. Im guessing they want to stay in their home for free. I have heard up to three years mortgage free. What really gets me is when they go purchase the new car, but quit caring for the lawn. It’s true every situation is different, divorce, death or job loss. Is it true that three years after demolishing their credit, they will be back in the market to buy? Well, I guess they will have their 20% down.

I speak with many different people in different areas of the business from , lending, appraisal and agents. One common thread that spooks me, they are all told to try and spread the word how the markets taking off, Go ahead push up appraisals. I tell people focus on the facts and figures not what your neighbors doing or what someone told you. Brings back to mind Grandma always asking me “Well if your friends ran and jumped off a bridge, would you just follow them?” As a child yes, today NO, I would not take a huge loan.

I would ring the doorbell at 5am on Friday morning just to see their reaction. 🙂

The housing market is fundamentally busted right now because the mortgage lending market is completely underfed. In 2008 global investors learned what prudent economists and financial advisers have known for decades–the only reliable, risk free asset you can easily buy is a Treasury note backed by the full faith and credit of the US government. Right behind this in terms of safety and availability is an insured Certificate of Deposit in a Federally insured institution. Yes, there are assets that are perceived to be more reliable. Swiss Treasury securities for sure. An ounce of gold, maybe. If you can find them. There’s not enough of those out there to supply the real demand.

The only mortgage securities with any genuine value to institutional investors are those which are backed by the US government. There are hedge funders who will buy the risky stuff, but not many. Bottom line is, there is no faith in financial engineers to produce AAA securities, and no faith in any insurer other than Uncle Sam.

Prices will eventually recover. Population growth will see to that. But there will be no “bounce back” unless one of two things happen:

1) The US Congress recognizes the massive global demand for US treasuries and meets that demand in the form of greatly increased deficit spending

or

2) Institutional investors decide to trust private MBS issuers and insurers

It’ll be a lot of Old Milwaukee and Hungry Man dinners before either of these things happen. The upside is that for a person who is able and willing to work and think, there are opportunities in any economy. Cheers!

The US Congress recognizes the massive global demand for US treasuries and meets that demand in the form of greatly increased deficit spending.

Where is your evidence that there is a massive global demand for US treasuries? Carribean Banking Centers?

In case you didn’t notice, the real return on US Treasuries is below inflation. Even with a $1 trillion + deficit, investors would rather lose money buying American Treasury debt than pursue alternatives. If that’s not indicative of massive global demand, I don’t know what is.

Here is what a real market shoudl look like:

http://blog.chron.com/primeproperty/2012/06/what-170000-will-buy-you-in-the-houston-area/#6052-2

Well, 3.7% mortgages have had a stellar effect here in San Diego. On the sub 700K housing, prices in the good neighborhoods are now just 5 to 10% below Peak Price!

I don’t think it is a stretch to say 3% mortgages will bring us to peak and 2.5% will send us on our merrily way to the stratosphere!

The devaluation of money can occur apparently in many ways and the current preferred method is via interest rates. Anyone can borrow a million dollars if they can prove they can pay it back at 4%, when that is too much, 3%, then 2% and son on.

Foreclosure inventory? What does it matter when the opportunity cost to keep it off the market is near zero and in fact the economic incentive is to let the dead beat live for free?

I am really surprised to see this blog advocating the use of 5.5 year ARMs. Thinking you can see into the future is part of what got us into this mess in the first place. I remember people telling me that stocks go up 20% a year in 2000 and that housing can’t go down in 2006. Predicting interest rates is a fool’s game and only a fool would play it.

I agree predicting interest rates is a fool’s game. However, the Fed has painted themselves in a corner with their current ZIRP. If rates rise rapidly in the near future, we will have another ugly recession and probably another global economic crisis. That’s why most people (myself included) think we’ll have low interest rates for years to come.

I’m mostly a cash buyer, so I wouldn’t mind a severe real estate price decline…however, I realize I am in the minority. I expect the Fed to keep bailing water from the sinking ship until moments before it sinks.

In Burbank the sales are mostly bank, and distressed junk. The other sales are due to death, divorce, and job transfers. The inventory is ridiculously low(1-2months) and the number of sales are at a record low for this time of year. The regular sellers are on strike and holding together in solidarity and singing “solidarity forever” and “we shall not be moved”.

I just flew in from Los Angeles and boy are my ARMs tired.

FHA absolutely DOES have a super low rate 5/1 and 7/1 ARM! They do NOT just have 30 year fixed. Do your research!

Well, the good news is I almost made 30 months before I re-defaulted. 5 months and counting…..safe deposit box is getting some use again.

Leave a Reply