Lords of the shadow inventory – over 3 million homes locked away in shadow inventory near peak levels. Prices must fall to prevent massive drawn out drag to economy. California sold 38,000 homes in June but added 43,000 foreclosure filings.

The infamous shadow inventory is still very much with us. It is this distressed mass of inventory that is destined to create a massive drag on the economy for years to come. As we saw this week the revised GDP figures were weaker than expected. As stimulus funds are drawn out of the system the economy is quickly showing that it is unable to stand on its own two feet. The only reason banks appear on the surface to be better off is the suspension of mark-to-market and other financial gimmicks. Although banks are working through troubled inventory they are trying to do it in a controlled fashion that essentially only helps their own bottom line. Yet the housing market is still faltering and shadow inventory is still near peak levels. We have interesting new data showing that the shadow inventory problem has not improved and is likely to cause problems for many years to come.

The shadow inventory landscape

Source:Â The Atlantic, Amherst Securities

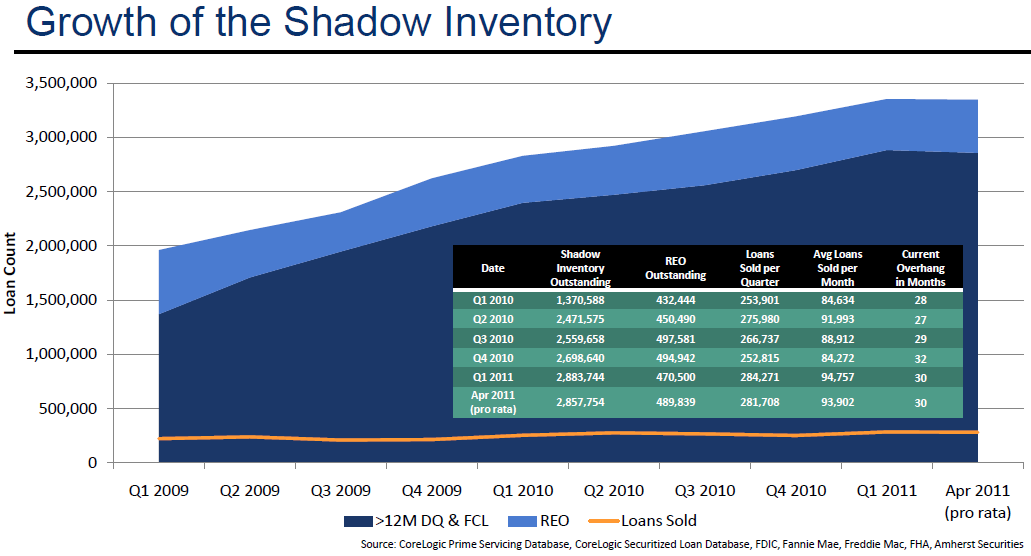

This chart is both troubling and illuminating. Laurie Goodman from Amherst Securities has tracked the housing market for years and has provided excellent data on the shadow inventory issue. As the chart clearly shows not only has shadow inventory grown, we now have 3.35 million homes in this category. It is worth spending some time explaining the chart above because it gives us a good sense of what is happening in the market:

Dark blue:Â loans that are 12 months past due and foreclosures

Light blue: REO (bank owned homes – foreclosure process completed)

Yellow line:Â Loans sold each month

What was found in the data was that since January of 2009 the shadow inventory has increased on average by 60,000 per month. The liquidations of 90,000 per month have done very little in making this pool to go down. What this tells us is that banks are willing to sacrifice the economy over the next decade to leak this inventory out to market. Keep in mind the banking system has the full attention of the Federal Reserve by buying up mortgage backed securities and trying to keep mortgage rates artificially low. We also have the government purchasing up loans with programs like those with FHA insured loans that simply keep the market inflated.

The best solution for the economy would be to move property on a significant level even if it meant home prices additionally fall. The big losers of course would be the banks and given that the financial sector carries heavyweight in this country, that is unlikely to happen. I heard a politician this weekend say, “if you run up debt, it is your obligation to pay it down and stick with your commitments.â€Â The caveat of course is exempt from the banks.

The solution is to let home prices fall and reach a natural bottom

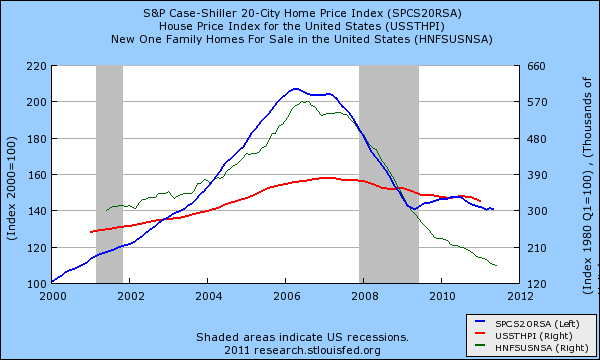

Basic economics would tell you that if supply is increasing too much then you may want to look at price to move inventory and create more demand. The market is desperately trying to find lower prices. It is the banking system and the government that ironically tries keeping home prices inflated even though many American families cannot afford to purchase homes with their current incomes. The only benefit of low mortgage rates and low down payment mortgages is that it allows banks to continue the game of keeping their balance sheets comfortably inflated. This does nothing for the overall economy except continue a charade that is clearly cracking. This is why shadow inventory is still near a peak even though we keep hearing that everything is fine. If you look at home prices versus new homes for sale you realize that the market is looking for cheaper properties:

The above chart shows the drop of home values yet also shows that new homes that carry higher prices has also shrunk in terms of inventory. People can only afford so much. The market would be able to filter some of the problems out if prices were allowed to correct further. Yet the market we currently have is really a large benefit to investment banks and the government with a smaller impact on the rest of Americans. At this point the banks and government are largely fused into one. The typical American is simply squeezed in the middle. Home prices are still too high for their largely stagnant incomes. They are cajoled into taking on larger and larger mortgages simply because mortgage rates are artificially low. We have the lowest mortgage rates in history even though we are facing debt default! Try explaining that.

The report also found that we will need to create an additional housing demand of 3.6 to 5.7 million units over the next 6 years if we are to remotely begin solving the shadow inventory crisis. People are willing to buy if the price is right and that is why even low mortgage rates are not enough of an enticement to lull buyers into the fold. Keep in mind we also have regional bubbles in areas like California where home prices are still radically out of line with local area incomes. Inventory on the surface looks to be falling yet shadow inventory is still high:

Non-distressed homes for sale:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 172,000

Bank owned (REO):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 73,000

Auction + notice of default:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 136,000

This is the problem. So even if you clear out the current inventory you still have a pipeline of distressed property that will come online soon. If it doesn’t, it simply is added to the already staggering shadow inventory figure. Now last month some 38,000 homes were sold in the state of California. Now this might sound good but look at this figure:

First half of 2011 foreclosure filings California:Â Â Â 263,500 (average 43,916 new filings per month)

This is exactly why the shadow inventory keeps moving up while the public property data seems to be going lower. Banks are simply hiding the shadow inventory and hoping the government keeps bailing out the banking system while letting the overall economy sink.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

58 Responses to “Lords of the shadow inventory – over 3 million homes locked away in shadow inventory near peak levels. Prices must fall to prevent massive drawn out drag to economy. California sold 38,000 homes in June but added 43,000 foreclosure filings.”

Despite the evidence provided by these numbers and charts, Obama recently said that he had expected a housing rebound by now. Surely his advisors must see the same charts and data that Dr. HB displays. There can be no recovery until housing stabilizes, especially for California…..and as California goes, so goes the Nation.

I was just looking at property prices here in Los Angeles yesterday… 800 square foot house built in 1930 for $250,000 in an area that will make it a pain to get to work is still the norm. By comparison, you can now buy an 1800 square foot, 3 bedroom, 3 bathroom house with a pool built in 2002 for $80,000 in Las Vegas. How can California “stabilize” at prices like that? Our wages are not that much higher than anyone elses’s. I would not want to take on that kind of debt to live in an inconvenient shoe box.

Tim, I agree with you it does not makes sense the home prices here in California verses wages earned here. The system worked in the past because there were new buyers coming into this bubble market for years were willing to pay the price to own a home. Homeowners knew when they went to sell that their home it would be worth considerably more than their purchase price. It was a great investment despite the steep buy-in. Will current homeowners keep reaping the same rewards of homeowners of the past? I think not. It’s a whole new world.

I would not buy a home in an unstable market with current economic uncertainty. Wait for things to level out even if that is uncomfortable. Our stock market could crash again, the charts look exactly like 2009 right now, the debt problem, unemployment ect. Everyone wants to start a life and get settled in a home but it’s a gamble.

No surf in Vegas…..

You mean to tell me that you have found an 800sq house in a safe neighborhood in Los Angeles for 250K? Where on earth is that? Maybe the middle of Compton has such a house. . . .

250K Home in Granada Hills.

Sure it’s close to the highway, but I know this neighborhood and it’s not bad. It’s not the Westside, but it sure isn’t Compton. $250K is possible.

@zz

I guess they all believed that if they threw enough money on the problem, then the fire would go out…they don’t get it and they never will…worse, they do get it and they will say anything to keep death star fueled.

Americas financial sustainability begins with Made in America

Why should American taxpayers help build China into a global power.

The outlook for the future forecasts a breakup of the United States as we know it.

The Chinese in time will control the West Coast from San Francisco to Alaska and the Hispanics will govern the lands east from Los Angeles to Houston.

No nation or civilization lasts forever.

Americans must wake up and take action to protect our liberty and way of life.

America must rejuvenate itself and become the huge industrial power it once was.

It starts by re-inventing the wheel and building manufacturing facilities in the United States that employ Americans who produce quality goods at a competitive price with space age technology and modernization.

Organized workforce and benefits has to be revamped to meet today’s economic conditions.

Government ant its bureaucracy must be reduced and streamlined. Rules and regulations must be revamped to be conducive to business growth and development.

YJ Draiman

Even the surface deficit approaching 15b is out of control, but the obligations, which as mentioned (FHA, Fannie, Freddie, Sallie, Louisa May Alcott, and all the rest) will just be piled on. There is also the VA, with the staggering number of GI’s needing long-term help (and what is the default rate on newer VA loans?). There are the pension funds. The next downturn that is already baked-in (all major fuel spikes hurt economy) will surely sink the autos again. Unemployment insurance with no end in sight, Post office, railroads, states, cities, counties–they’re all broke when the bonds come due. Although this particular debt fight is about whether or not the next debt drama will turn the 2012 elections, it is still real and daunting. Still paying off the S&L crisis of the 90’s. Oh yea, Iraq and Afgan still bleeding billions…Going to take more than a tea party to fix all this…Someone tell me how this is not the dark age of housing.

Relax, all the bills get paid off with paper money, the consequence of which is the dollar gets hammered, your purcahasing power dwindles, and your standard of living diminished. It is just done slow enough, that out of ignorance the masses just keep voting for the same scheme which is actually raping them.

Serf City here we come!

Sorry 15t…

Anyone who engages in a free market, supply/demand type business realizes that if the supplier tries to dictate the market level in a downturn, he will always fail. Let’s say you had an auction and tried to sell off the shadow inventory. Buyers bid lower than the seller wanted and he refused to sell and held firm at inflated prices. Well, the buyer goes home and waits. If the seller refuses to meet the buyer’s price he is creating a false market, and in the next round of sales the prices can only go down (excluding some very unusual circumstances). It is not until the seller will meet the market that sales will become brisk again, and actually, the sooner he does so, the better. Until then, it’s just a game in the seller’s mind and no one with any sense will buy, because they have no faith in the market. That is our situation today.

So until they meet the market, it will be a slow painful death for all involved. The best idea would be to face up to the facts and meet the market. However, I guess the Wall Street dudes doing coke and hookers are too smart for that and will continue to play their shell game. Buyer beware!

That is so unfair!

Wall Street guys are NOT doing coke and hookers.

Wall Street guys are giving money to your elected representatives so THEY can do coke and hookers.

LOL… sorry, just watched the movie ‘Inside Job’ last night, and–according to interviews with a NYC madam who knows–it *IS* the Wall St. types who are doing most of the coke and hookers… at least in Manhattan… LA and DC, different strokes, err, I mean folks. ;’)

Only using my personal situation it really does seem like this problem is isolated to certain areas, mostly larger cities that had larger bubbles. Obviously prices in CA are completely out of line with most Californians incomes. It’s not like average people here make 10 times as much then elsewhere. But if you look at a place like NV it is very affordable, if you have a job. We own a property in CO that we inherited, it’s a nice 4 bedroom in a great area, it’s worth 200K, very affordable given incomes are not that much lower, if at all.

I agree, Candace, that the problem is isolated, to an extent. For example, NYC has high prices. They also have one of the finest public transportation systems in the world, certainly in the USA. For a couple of bucks you can take the subway to just about any employer for miles around.

Most of the country, whether in CA big cities or in small and medium sized towns nationwide, don’t have this mobility. Therefore, the amount you can pay for a mortgage is tied to the wages paid near you. If a lengthy commute is necessary, then you have to start adding in commuting costs to the equation.

This brings us to the one of the major problems with all of this shadow inventory: Location, location, location. Most of of it is in the outer suburbs of metro areas, poorly served by public transportation. And of course high gasoline prices aren’t helping matters. In cities of less than 200,000 population, a LONG commute might only be 20 or 30 minutes. These places will have a much easier time working through their shadow inventory, all other factors being equal (such as the unemployment rate).

With all due respect, that’s a pile of crap. I’ve been to NYC enough times to know that *IF* you lived in Manhattan the transportation is great but if you live anywhere outside of, you will face the same dilemna had you lived in LA. It takes forever to get anywhere outside of the city and the cost is not much less. NYC the lines go a bit later in the evening, that’s about the only upside. It’ll take you over 2 hours to get to suburbs 60 miles outside of the city (including wait times between connections), just as it would in LA.

Whenever I hear anyone spout the line “if you run up debt, it is your obligation to pay it down and stick with your commitments” or something to that effect, I know that person is just trying to convince others to put on the hair shirt of slave morality. Wealthy folks, successful companies, and smart investors know that when you take a big loss to walk away. Hell, even the Mortgage Bankers Association walked away from their underwater property as Jon Stewart pointed out so hilariously.

The 30 year mortgage made sense when one could expect virtually lifetime employment in a relatively safe job with union employment, annual wages increases that outpaced inflation, a solid pension, and a reasonably same neighborhood. Yes, one had to tow a tough line for the first 15 to 20 years of his or her working life, but still a great deal. That deal has not existed for 40 years. Through the political and free market process, the American public decided that way of life was not worth the trouble to maintain. That age is gone and not likely to be repeated for the next 100 years in the United States, if ever.

I read the other day that the average worker works in 10 different industries by the time he or she is 38 years old. Not just 10 jobs….10 industries. I didn’t see the numbers beyond that age but 5 or 6 seems more than reasonable. When the average worker can expect to have to find a job 20+ times during the course of a 30-year mortgage, the 30-year mortgage makes very little economic sense. A doctor, lawyer, in-demand artist, some engineers, skilled architects……these folks can expect to be able to find the money even if they lose a job. But most trade workers, and certainly those with easily replaced skills simply should not plan to buy until they have the cash in hand. Chances are that they never will. It makes so much sense for most Americans to rent that it cannot be hidden any longer.

When I started seeing the majority of home purchasers were buying houses they didn’t really like not so they could live in them and eventually die in them, but as an “investment” I knew the buy a house paradigm was in its twilight. I reached this conclusion in 2002. I remember walking down the street with my brother noticing the houses in our neighborhood were selling for 33% more than they were when we’d moved in a year ago. Our conversation was somewhere along the lines of “prices have moved up 33%, but the standard of living here isn’t 33% higher. It can’t continue this way for long”. Things have happened much more slowly and much more catastrophically than we thought they would, but the shift is occurring. Right now investors are the main buyers, and rightly so. Most of the people I know in the 30 to 50 year old cohort have no desire to buy a house and most are looking to leave the place they’re in. And rightly so.

California, like New York, is a “Dream State” and has been since 1849. People don’t move there to push their kids down the street on a bike and take lemonade on the porch. They move there to strike it big, live on the wild side, and retire (at worst) in a double wide overlooking the Pacific. Most find that the reality is not much like the commercials California pays so much to broadcast across the country. The Big Dream is, in truth, a Bare-faced Fantasy. In the face of the post-1960’s world, the thinking person must become as ruthless as the dream sellers. Walking away from bad investments, refusing to pay debts one can’t afford to settle, and keeping mobile must supplant the annuated sensibility right and wrong.

Great, thoughtful post.

It’s all about jobs, jobs, jobs. It’s tough to afford houses even at current prices with burger flipper wages. Last week I took my son to his last BSA summer camp, Emerald Bay and we had to go to pier 95 Long Beach for the Catalina Cruiser. What we saw was mountains of cargo containers at the port, just mountains of cargo containers. To me and my son Warren (an economics honors student) , each one of them represented an American job. What we get instead is cheap Chinese crap, I know, I’m an amateur radio operator and the electronics from China is dismal compared to what was produced here in America. It’s jobs, jobs, jobs stoopid. That will be the cry in 2012 not more ridiculous pie in sky stimulus programs that are gamed and doesn’t help you and me. meanwhile they’re screwing with Warren’s Pel Grant for college.

The top trading partners in 2010 were

1.China ($120.7 billion)

2.Japan ($35.3 billion)

3.Taiwan ($10.7 billion)

4.South Korea ($10.1 billion)

5.Thailand ($7.2 billion)

The most imported types of goods in calendar year 2010 were, in order: furniture; footwear; toys; automobile parts; and women’s and infant apparel.

Port of Long Beach (partially owned by China??) In 1980, with United States and China’s improved relations, the Port sent officials to the People’s Republic of China for the first time. Less than a year later, the China Ocean Shipping Co. inaugurated international shipping and designated Long Beach Port as its first U.S. port of call. Relationships were forged wih other international powers and South Korea’s Hanjin Shipping opened a 57-acre (who owns the land??) (230,000 m2) container terminal on Pier C of the port in 1991.[4] Following this, COSCO, a Chinese international shipping carrier, secured business (??) with “the Port of Long Beach” in 1997.

From the late 1990s through 2011, the Port of Long Beach has seen increased traffic and growth with the “leasing” of terminals. In 1997, approximately one million containers were inbound to the Port.[citation needed] The total amount of containers had also increased from three million containers in 1997 to nearly 6.7 million containers (now?).[citation needed]

… the top port listed is Port of LA

Hey, and Prop 13 probably helps them keep their property taxes low

The best advice Warren could get would be to study Chineese.

25 years ago there was a lady at my work who had her kid study Japanese because she thought the Japanese were going to be top dogs. I wonder if they remember any of that now 🙂

Think things are bad now? Take a look at the future of Southern California defense jobs: http://www.businessinsider.com/revealed-the-first-industry-to-lose-big-in-the-debt-ceiling-fight-2011-8

The banks are only just beginning to figure out ways to hide the shadow inventory from the market. As long as they can mark to fantasy there will be no cleansing of the system. Distressed and non-distressed sellers will be spit-balling their asking prices for years to come, with no real idea of how much they can get for their homes. Buyers will have a wide array of conflicting comps to wade through, making the bidding process even more confusing. I’m not confident saying we’ll have anything resembling a “normal” housing market until 2020.

Common sense and logic, of course housing prices have to decrease for more than one reson, but the most important is long term economic stability. (which was forgotten about in return for short term gains, also known as greed)

There is a solution that doesn’t involve free houses, principlal reductions or wiping out the banks financially found as a petition at: unitedinprosperity.org

Thank you for your consistently brilliant analysis. Than God that I have reading your blog for long time and didn’t jump into the band-wagon.

I waiting and waiting and waiting for the day when home prices to drop to a level when they actually make sense, to purchase a place. Until then, just keep listening to you and enjoying your gifted insight.

Thank you for your outstanding contributions.

Obama, like any president, is in a perceptual bubble of his own. He only sees what his handlers show him. They know damned well what those charts mean, but their bosses have done a wonderful job of rigging the game in their favor. With all of these things: money printing, direct bailout, GSEs soaking up garbage, crooked accounting, media propaganda, etc, etc.

We’re on a storm-tossed ship at risk of sinking but the “captain” can only see a placid sea, birds flying and only the occasional driftwood to steer around. It’s madness. Right now Obama is being told that he’s doing a great job on the political positioning of the “debt ceiling crisis.”

Sadly, my parents and relatives are signing mortgages for 2nd and 3rd homes in the Riverside area. I tried to explain to them that if mortgage rates are at historical lows, then there is absolutely no way housing prices will “recover” when fed rates are nearly 0% and we are still experiencing stagnant and high unemployment. They are clearly suffering from illusions of grandeur. It seems that the Chinese have been sold the American Dream, where wealth, comfort and happiness are based on perception rather than real value.

Buy into the hype and miss out on the lowest interest rates and home prices in a generation? No thanks! This article PROVES the banks won’t let prices decline further. So why not jump in now, the market is great!

BobMAX from reMAX? Is this supposed to be a joke?

You should clearly not jump in now because rates are low. When the rates go up, home prices will come down, and it’s always better to buy a less expensive home then buy with a lower rate.

How will you ever refinance if these are the lowest rates in history?

BobMAX is undoubtedly that douchelord real-turd/real-tard from the OC who posts on the redfin forums. You should read some of the nonsense he spews.

Fellow Doc Housing Bubble Readers

At this time, is it wise to purchase a property – paying totaly in cash or take advantage of a healthy down payment, a super high credit score & current low interest rates – investing the remaining cash long term…?Â

We are being forced out of a great rental and with the limited supply of rentals here in Ventura County, we feel we have no choice but to buy. This will be our primary Residence and we plan on living there for at the very least 10, more likely 20 years.Â

Paying off the house now would prevent risking this money given current and possible future political uncertainty & devaluation of the dollar. No Risk no Reward right? I’m not a gambler. The amount of Interest on the loan, even at today’s rates would be huge over the life of the loan and any tax advantages of having a mortgage may be lost to politics…Â

Our FDIC protected Bank Savings account interest rates are extremely low – so even though the money is safe there would be little gain. Â

I’ve run the numbers and although I still believe it’s to soon to buy and home prices will drop further, we have to act now. The quality & quantity of homes in our price range on The MLS is low and we have watched this property sit listed for more than 80 + days. We are making an offer which is far below what the seller’s paid back in 2005 but still at Bubble value.Â

I may have just answered my own question. Well, there are many very inteligent individuals at this site and I value your insights. What do you think, have we missed something?Â

Thanks and Good Luck to you All!

If you think prices are going lower, then you should wait to buy. You will be the one who takes the first hit as your downpayment will be effectively wiped out with a ten percent price drop, once you factor in transaction costs. Of course, you could console yourself that it is only a “peper loss” until you sell, but that has always been cold comfort to me.

Somis guy I hear you- but want to add that your circumstances dictate this decision to purchase a over valued home. But Value is the important part of this equation. Would you rather purchase a home for 500K 3% interest with payment of $2200.00 or the same home for 250K at 10% interest for $2200.00. Id take the latter.

So im thinking how can home prices go up?

1.Interest rates at historic lows

2.Inventories are high

3.Unemployment issues

4.Government eventually cannot contain the deflationary pressure

5. I know very few people sitting on large sums of cash, most I know have large debt.

6.A bit gun shy to buy a home:)

good luck with your choice!

for now I will wait a bit longer……

I’m in So-Fla, not So-Cal, but I’ve been following DrHB and related blogs for 3+ yrs., and the CORRELATION IS VERY HIGH between the shenanigans in both Bubble-ized Markets.

Thus, I would say your first mistake is confining yourself to the MLS, as this SMALL SUBSET of the market is going to contain the props with the most corrupt pricing, perverse incentives, and slimy people attached to them. MLS should be the LAST source you should consider, IF AT ALL. You’re not missing that much.

Plus, Dear Gawd, if you’re really inclined to sink huge down payment, then START with courthouse foreclosures, unless you/spouse simply can’t stomach anything but turnkey. Licensed repair/renovation costs haven’t been this low for 10+ years. Then there’s all the online FSBO listings.

Then think about WALKING a neighborhood you desire. Write down the obvious deserted houses you spot, talk to neighbors, approach banks directly, and/or approach owners directly–be PERSISTENT. Hand out your phone # to peeps who seem to have a clue. Believe me, when word gets around that a nice couple/family, who is a CASH BUYER, is interested in LIVING in that ‘hood–NOT flipping and bolting–sellers will be CALLING YOU. Well-maintained, lived-in houses will start popping up on your radar, Boomers looking to bail, etc.,

Besides, why would you want to make a 20 year commitment to an area, without getting a feel for who lives there? I know this is heresy for an Angeleno, but PARK the car, WALK around, TALK to the folks out walking their dogs, tending their yards.

Time to drive a stake into the heart of the Soviet cartel known as the Nat’l ASS’n of Real-Turds… do NOT play their game, esp. in this buyers’ market. That’s 5-6% off the top, wasted in “fees”, plus you probably paid 12-20% TOO MUCH! SOD THAT THINKING! Wall St. corrupted and ruined this market. There’s no such thing as a low-ball offer anymore, just deluded sellers. Your comps should be based on the year 1999.

OK, so when do you think that we will clear out the foreclosed shadow inventory in California(assuming 2% or less GDP growth). 5 years?

Some caution on the Case Shiller chart: this version may not be inflation adjusted. It says it is “indexed” but I think there is a separate chart for inflation adjustment (how we normally use index). Their two methods and naming them, can get confusing, but the dollar inflation adjusted one (if this isn’t it) is even more stunningly bad, I think. Thus the “cheaper” new recently built homes are likely much cheaper than you estimate, as adjusted.

The shadow inventory problem raised here again states the overhang of non-foreclosed defaults is accepted (it seems) as being a result of “the banks” conspiracy to drag theforeclosures out; but I have yet to see one study, one banker, who says the “bankers” have this great conspiracy with each other or even within banks, to drag it out. The sheer volume of foreclosures and problems have overwhelmed the banks, investors, lawyers, everyone. Could be true it is a conspiracy or perhaps there are other causes, such as that each bank slows up the process for internal financial results, just as one example.

Three forces were supposed to have solved the shadow home inventory by now, in any event: a)continued record low interest and no/low down payments (still); b) population growth of two million a year and c) very real and aggressive inflation caused by the FED, both to accelerate inflation-caused home and raw material asset values; and with that, most important when inflation is intentional, motivate investor-landlord types (of every size) and homeowners to jump back into the asset class.

One important thing is that we have ten million more people in the US than five years ago when this downturn started, where are they living?

As to the shadow inventory, please note that it is occupied by this new term I propose: “shadow people”. Those in-default units still occupied hold millions of people total, the “shadow people” and these families MUST live somewhere when they move out of the foreclosed homes, finally. Thus the shadow inventory isn’t as powerful a force as you think; by the time the banks finish the foreclosures, five more years, total population plus shadow people could easily be twenty million population plus let’s say, ten million shadow people. One number of some force needing adding, to the shadow inventory of homes, is the massive number (estimated at twenty million), of seasonally used second homes. The housing bubble was as much about those second homes being overbuilt during the last years of the bubble, as pure residential. The rich stopped buying, the middle class uppers couldn’t borrow more to buy that second home, so they had enough homes, finally; the building industry kept building. Those homes are by definition always deemed “empty” and many are in foreclosure, many/unknown numbers yet to be foreclosed are suitable for shelter year round occupation, when the price or rent is low enough.

The banks have us by the huevos, as long as the government keeps em propped up with cheap cash to fund it’s own crisis. They can simply wait for years while they lock out a whole generation of buyers from decent middle class neighborhoods. What may help turn the table is that Boomers who need to liquidate for a variety of reasons are becoming more realistic in their asking price. The government will be forced to contract (layoff) due to the deficit issue, and there is no new bubble to prop up the economy any time soon. Interest rates will go up (home prices come down). China will crash it’s own bubble and have less capital to buy US debt. Who wants to catch a falling knife, even if it is in slow motion!

“At this point the banks and government are largely fused into one.”

So true—there’s the nub of it. Too bad it’s the banks that own the people’s government, rather than the people’s government nationalizing the banks. That stark fact renders the ‘government-versus-free market’ debate utterly moot and pointless. It’s all over now but the fighting, as the Chicken Little debt theater plays out in the DC-media snake pit. This coup by the financial elite under Obama was one of epic proportions, and it can’t end well if we all remain passive.

Oh you sick, sick, sick people. You know you want to (Suzanne researched this) video clip: http://www.youtube.com/watch?v=Ubsd-tWYmZw

Even better: Rage Against the Machine “Killing in the Name Of” (Housing Bubble Crisis) Parody

Atomic, that’s OUTSTANDING, MadTV quality parody! Thumbs up! Can’t believe they’re not getting more views… friends of yours?

My God I wish they had the 3 years later video that shows them sitting at the table pordering the mountain of credit card debt that they took on because the mortgage took 60% of their combined income, and now the house is worth $150,000 less than what they paid for it and it needs a new roof at $9000 dollars, plus she works for the state of California and her hours have just been cut. But… Did you see the size of that garage… Well you can park the Hummer that you can’t afford gas for in it.

I mostly feel sorry for the kids cause no matter how good the schools are, Mom and Pop won’t have to nickels to rub together to help them with college so they can be debt slave too.

Thanks for the refresher. Laugh of the day. I would bet that the family in that commerical lost their home that Suzanne helped get them in because it was “such a great opportunity.”

This week I watched the dvd that’s out, Inside Job. It’s very informative on to what Dr. HB has been explaining from the begining, and how this mess was created.

With interviews and such, One truly sees how wall street sleeps and governs over our politicians with the help of money being stuffed into their pockets and campaigns.

How many other readers have seen this movie? What did You think?

I’ve been reading the good Dr. for 3 years, and have been blessed by stumbling across it, ever since I read my first article.

With this political crap going on, it is only us taxpayers who are hurt either way.

Really where is our say???

Which one of us are getting fattened by wall street, and our pockets lined with contributions?

I’m for no party anymore, because neither party can do their job!!

What if we can’t do our jobs, are we afforded the same privilege as them.

This situation should never have gotten this far.

I knew at the last moment they would come up with something, too many pissed off people on their hands, or blood!!! These are Voters!!! Election around the corner!!!

Like I told Dr. HB it’d be like the beginning of the cartoon, Bullwinkle the moose and he pulls out Rocky the flying squirrel out of the magic hat, as if it were magic.

So now they passed something for our good. What a surprise!!!

What’s sad is they are supposed to work for us and not wall street.

Like many of You, it’s just good to know we have Dr.HB to give us the truth and keep us informed to what is really going on behind the curtain in this housing market, from the banks, realtors, politicans.

Thank You again Dr. for your hard work and truth,

victor

Saw ‘Inside Job’ for the first time last night. Seems the theme is that for 3 decades, certain dangerous predators, completely lacking in Western Christian ethics, have been dismantling longstanding and EFFECTIVE legal and regulatory frameworks, with very predictable results. This is how South America became South America. =:O

Was glad to see the filmmaker, who obviously has a Left-leaning/DNC bias, totally turn on Obama, and expose him as the banksters’ captive sellout that he is.

Great flick.

I am going all in. Interest rates are at an all time low. Prices in most areas of California are cheap. Even if I’m wrong and prices drop further, rates will most likely be higher. Give me the cheap rates every time.

D

So you would take:

350K home at 4.5%

vs.

250K home (same as above) at 5%

Got to take those cheap rates every time hey? I just can’t see that your basic take on math is a truism.

What area are you buying in?

What is you effective interest rate if prices decline another 25%?

It depends on what area of California you are talking about. Bubble areas still exist in mid to affluent areas. If your buying in Riverside/San Bernadino, jump in! If your buying in West Los Angeles, jump out! Culver City, one of Dr. HBs favorites is now taking it on the chin. Due to surely aeat up one’s down payment, if you buy now. Interest rates are not as important as price.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Buy?? In Riverside/ San Bernardino California?? Huge unemployment rate, crime skyrocketing to twice the national average, tweekers running around town breaking into homes for their next fix. I saw a home in Hemet drop 36k, another one dropped, 20k, and another 16k+ all on the same day, 2 weeks ago. This is the trend all over Riverside/San Bernardino. Jump in??? I think not. I’m going to wait for the additional 25% drop in the next 2 years while I save more and then buy in OC with cash. Got Silver ??? 😀

ive seen houses that have fallen low enough that buying in cash is easy enough but thinking of a 35 percent value tax yearly as normal, …………………………………

Leave a Reply