Los Angeles County is least affordable place to buy a home in the entire United States: Latest research catches up to least affordable place to rent as well.

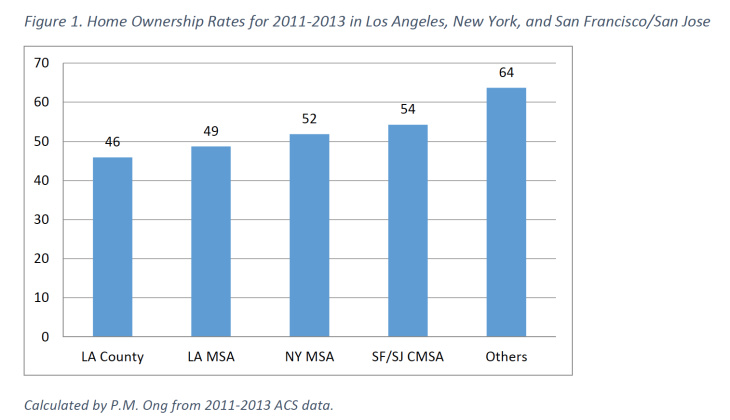

Last year there was research showing that L.A. County was the least affordable place to rent and this imbalance was leading to rental Armageddon. The research of course highlighted what most of us with reasonable minds already knew and that was based on local household incomes, prices were out of control. Prices were being driven up by outside factors like investors, flippers, foreign money, and those willing to leverage every penny into a 30 year mortgage. A more recent UCLA study continues with this trend showing that L.A. County is now the least affordable place to buy a home as well. Wait, isn’t San Francisco or New York more expensive? Absolutely but households earn more so their ratios aren’t as in insane as in our all hat and no cattle beach paradise. Someone I know that lives a few miles from the beach spent one hour driving to the beach this past weekend and another 30 minutes fighting to find parking. We do have great options here but 10,000,000+ people fighting for the same spots can add some constraints. So now that we know L.A. County is the most unaffordable, what else did the study find?

Rental Armageddon or House Poor

The study is recent and was only released this month. One of the lead researchers basically pointed out what we’ve been talking about for some time:

“(SCPR) Ong said there is a strong relationship between the rental crisis in L.A. County and its low homeownership rates. An earlier UCLA study found that the average renter in the L.A. area devotes 47 percent of his or her paycheck toward housing.â€

We did the math in our heads when your typical crap shack is going for $700,000 and a 20 percent down payment amounts to $140,000, it might be tough for a household to save this dough especially paying high rents.

“If you have high rents, and high rent burdens, it makes it hard for people to accumulate the savings to become homeowners,†Ong said.â€

Makes sense right? And this is why the homeownership rate has collapsed.

In the end this means more renters. It also has created the boomerang phenomenon of adult kids moving back home with parents. Not only are we the most unaffordable place to rent and buy but we also have the worst traffic congestion:

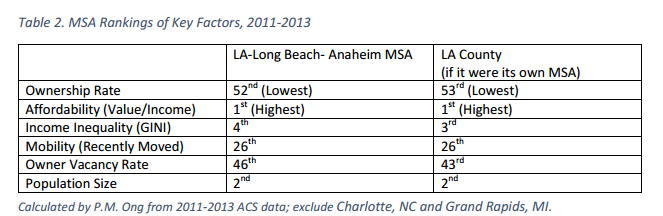

“The population size of Los Angeles is a major factor contributing to low ownership rates. The region ranks second in population counts among all metropolitan areas. The diseconomies of scale are evident in the region’s traffic congestion. In 2011, Los Angeles was ranked number one in the Texas Transportation Institute’s Travel Time Index, meaning that Los Angeles had the worst peak-time traffic in the country (Lomax, Schrank, and Eisele, 2012).â€

Try going to the beach on a weekend and you’ll find out for yourself how many people live in SoCal. Or just take a glimpse at rush hour on the 405 or 10 freeways:

Ironically this study comes from UCLA, a school near the absolute worst traffic in the nation. In all, this simply means more money is siphoned off into housing from other segments of the economy. Take a look at this chart:

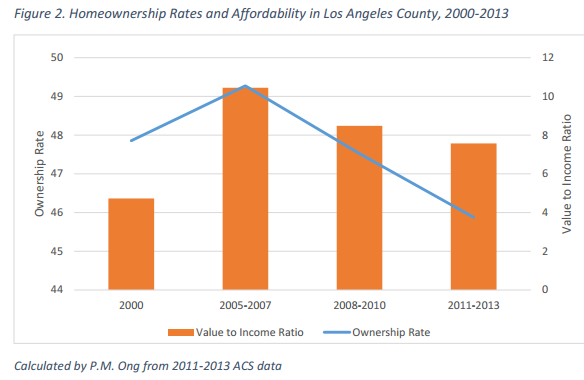

In 2000, not too long ago the income-to-price ratio was about a 4. At the peak, it was over 10 in 2005 to 2007. In 2008 to 2010 it dipped to about 8. Today, it is still close to 8 yet the homeownership rate continues to decline. The big jump from 2000 to the peak was driven by toxic mortgages, many that had their origination here in SoCal. The low interest rate factor has meant very little to your typical prospective buyer aside from jacking the price up. As we have noted, the bulk of the movement after the bust has come from the investor crowd. The fact that incomes overall are still relatively weak tells you a lot about the local economy. Many middle class Californians are simply leaving the state. Others are renting and some are simply leveraging up to the hills.

The study also found some massive income inequality in the region which should be no surprise:

Which brings me back to the trips to local hot spots. I know of someone near a SoCal beach hot spot and he commented how ridiculous it is for locals now to enjoy their old stomping grounds. They enjoyed the sleepy days of yonder instead of the Black Friday like atmosphere of people trying to stick umbrellas in the sand and marking their spot for a couple of hours. It is what it is. Try going up to the mountains after the first snow. You think you are the only one that recognized that we have beaches and mountains nearby? Near is relative when you have insane traffic.

Congratulations to L.A. County for now officially becoming the least affordable place in the nation to buy a home.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

76 Responses to “Los Angeles County is least affordable place to buy a home in the entire United States: Latest research catches up to least affordable place to rent as well.”

I live in Westchester. If you bike along the water, 10 mins to Beach. 30 mins to edge of Malibu (Will Rogers Beach) which is much less crowded. Would easily be 60 mins if you drive and park. Lower priced housing further East isn’t within bike range. If you do have an above average income rents are similar if not less than New York rents.

It’s nothing but crowds and stopping through the Marina/Venice and Santa Monica unless you’re doing it at 5am. Limited storage and the issues that come with biking I might as well just take my car for a couple of additional minutes so I don’t see how you’ve hacked the too many people at a high cost problem.

When is this bubble gonna pop? I’m getting tired of it.

It won’t.

LA is overpopulated (immigration) and it’s going to get worse.

“10,000,000+ people fighting for the same spots can add some constraints.”

What did California voters expect when they voted for Hart Celler (i.e, voted for the left in 64)?

The bubble is and always will be in the price based on qualifiable demand, not simply population growth. Few of those immigrants are arriving with a suitcase full of cash.

“The bubble is and always will be in the price based on qualifiable demand, not simply population growth. Few of those immigrants are arriving with a suitcase full of cash.”

I think this statement is mostly correct; however, I think it has a significant omission, which is the following: I think what has happened is that many middle class and lesser neighborhoods have been populated with immigrants of limited means. The consequence of this is that formerly well-kept, safe neighborhoods with decent schools are no longer such. It’s not racist- it’s just reality (just take a look at Great Schools ratings in any area with a substantial population of Hispanic immigrants). The middle and upper-middle class people who once populated those neighborhoods now desire to live elsewhere (or have already moved). However, due to the influx of immigrants, there are less and less safe and desirable places to live. This, in turn, results in higher prices for the shrinking number of desirable areas with good schools etc.

In summary, it is quite plausible that immigrants (despite their lack of money) have caused an upward trend in pricing in desirable areas.

Responder might be onto something as it’s along the lines of what we’re told that immigrants with lower standards (and increasingly natives) will double-up with multiple generations co-habitating together – in other words the multiple income sources will provide support to the price level, much in the way that we saw price levels pushed up and supported with the dual income household curve.

The other thing I think Responder is onto is that there are options and as the feedback loop of higher price to value ratios persists in areas such as SoCal, competing areas will capitalize on those seeking alternatives and better value. The climate preference is not enough and as the other factors which contribute to the livability of an area become more acute, the climate factor holds less weight.

@Responder

No doubt that the middle class, if able to, will flock towards more desirable areas. I think that economic opportunity could be as powerful factor as immigration is for the flight to more desirable enclaves.

However, my point is that Fed and government policies are the far bigger culprits for the colossal price run ups during the last bubble and the current echo bubble. For instance, currency devaluation of the dollar and the lack of better investment opportunities due to global ZIRP made U.S. RE more attractive to immigrants.

@Seriously. I am not holding my breath for that until either the S&P 500 is at 1000 or there is a major unemployment event in CA.

When I left L.A. for the last time in 2014, it took 2 1/2 hours to get out of town. I sold the family home largely for two reasons. First, it was silly to have so much cash equity tied up in a non-liquid asset so when people are being silly and bidding prices up ridiculously, it seemed a good time to cash out. Second, the family home had become a prison, albeit a nice neighborhood. Unless you lived you life in the immediate vicinity, you quickly became entangled in traffic, congestion, and often when you got to your destination, either no parking or too crowded. The beach, which was 20 minutes away by car … well good luck with finding parking. And, for what it’s worth, the beaches in L.A. County simply aren’t what they once were.

Where’d you move?

Sounds like my story JN, sold the overpriced house with view. Hit the Jackpot, retired early and bought the home in New Mexico, where the only thing really missing is the traffic and the ocean.

My story also has an interesting angle, in that we started a trend that ended with 3 couple friends, all empty nesters, listing their homes with the same agent. I met this super salesman at a neighborhood open house who out of the blue brought me an offer the next year that was beyond my wildest dreams. Of course I recommended him to the others!

Many are moving out, and many, many more are moving in from all over the world.

That was my thinking back at the (first) bubble peak when I sold – I couldn’t go anywhere because there was too much traffic. I was a prisoner in my own home, and my world had shrunk to a 1/4 acre. Thats no way to live people!

Junior – I agree with you. I completely changed what I want in a house. I view it as nothing more than a piece of equipment. I currently rent and am working on a down payment (with a long way to go). The house I buy will be ‘fit for purpose’. I recently became debt free and REALLY enjoy the peace of mind that comes with not stressing on debt. My wife and I are not big spenders, however, we do like Hawaii (where her parents live). Visiting isn’t cheap, but it’s not that expensive either. For now, we go when we go annually (whenever airfares dip) – and we have no worries of the cost. We pay cash … no cards.

I look forward to having a modest house with a few nice things – to finish my job as a dad – and not worry so much about cash. Fortunately my daughter likes to fish … cheaper than many other activities and were outside.

Now … I just need to reign in my work hours and life will be good.

Best of luck to you.

Dont despair. I dont think we have more than six months more before you start seeing seriously layoffs. The cracks are starting to appear in the dot coms and tech.

I work for an insurance company. 100 people got laid off last week. OUTSOURCING to India. And more to come we were warned. Professional jobs mostly with about 25% of them clerical. Well paid people, mostly over age 50, will be unemployed in a few months. These same people admit they live way beyond their means, and one mistake of a few dollars by payroll they are crying for blood (they are living paycheck to paycheck).

Expect to see them putting their homes up for sale soon. Sad but it is the reality of the economy we live in. Thank god I rent, live way under my means and save every penny I can. It can happen to anyone. If I had a huge mortgage weighing on my shoulders, school loans, car loans and credit cards – I can’t imagine what I would be feeling or thinking.

So much for our 5% unemployment, heh. What the Bureau of Lies and Scams never tells us is that workforce participation among people in their prime working years, is lower than ever.

How smart you are to live far below your means. I highly respect your discipline, especially when you dwell in a super-consumerist milieu that values image and looking “rich” above anything else, including sanity and health. I wish I had done the same in my youth.

Nothing sad about it. Markets are markets. If they have to try and sell their houses due to change in employment conditions, so be it. There are few such owners posting on housing forums how sad it is that you’re so priced out.

@Laura “How smart you are to live far below your means. I highly respect your discipline, especially when you dwell in a super-consumerist milieu that values image and looking “rich†above anything else, including sanity and health. I wish I had done the same in my youth”

Well I’m no spring chicken but…. I also have to contend with my peers – the area I live in is in an excellent school district. Most of the women around here do not work. Every day at school drop off car line I see them lining up in their Mercedes SUVs, Coach purses, obvious plastic surgery and designer clothes. They all have the obligatory coffee container glued to left hand, coach purse in the right. Thing is, most of them are married to State workers, cops, landscape contractors and the like. I have no idea how they maintain the spending and lifestyle they do, I can only suspect they are in hock up to their eyeballs and the SUVs are leased.

This is a relatively newly built area so its not the golden sarcophagus ATMs at play. They all try to outdo each other – who has the fanciest house, newest Mercedes or Lexus, etc. I could not care less. Me – I pull up in my Toyota Rav4, in my Target sale outfit with purse bought on Overstock (with free shipping lol). I’m glad I have zero debt. I’m in hock to nobody, The house I rent is really nice but small, perfect for our needs and about 60% of what it would cost me to buy and carry it with 20% down. Life is good…. If I do get laid off I can bail and move to a cheapo apartment.

All the evidence is lined up for major crash in all the gov’t inflated bubbles. (stocks, housing, bonds) etc. This time is no different than any other time in the history of civilizations. Perhaps the power might be more concentrated in even less hands than ever before. Just waiting for an event to spook all of the big fish, and than watch all the schools of little fish follow.

Remember, big fish make the money on the way up and the way down. We don’t have any real markets anymore, just casinos that are rigged in favor of a few. You might want to take some of your chips off the table if your happy with your winnings.

http://Www.westsideremeltdown.blogspot.com

Why don’t people have the sense to leave? Can’t they read or watch TV? Don’t they know there are other places to live and work?

No kidding. If I’d purchased a house in LA in the past, and I could make a killing on it, I’d be jumping on that right now. For $450K, you can live in the Meridian Kessler neighborhood in Indianapolis, and it would be in a 3000 sq ft. tudor beauty. I was just there a couple of weeks ago, and I was shocked at the neighborhood. It’s about as nice as it gets in the country, with perfect streets, walkable restaurants, and beautiful old homes. Unreal.

I was recently in Indiana (flew into Indy, then drove I-70 east), and I have to say that the roads in Kuwait City, in 1991, were in better shape. Winter is no excuse. I’ve travelled all over the Midwest — including Chicago — and nothing is that bad. (Shreveport, LA, on the other hand … worst roads ever.)

We’re talking about very different parts of Indiana. I’m talking about the nicest neighborhood in Indianapolis, and you’re talking about in the middle of nowhere east of Indy. I grew up in Indiana, and I’m not sure I’ve ever even been east of Indy, except to drive to California. LOL

My point is simply that one can leave LA right now and spend $400K or so on a house in Indy that would be the equivalent of $2 million+ house in Toluca Lake or the West Side, and we’re talking about a neighborhood as nice as any you’d see in LA. One could take a job making a third of their LA salary, and it would still be positive.

…and then you would have to live in Indiana. If you are not white then it’s not worth it. The weather in the winter time is awful. It’s cloudy most of winter so it’s also depressing. The one nice thing I do miss is the pleasant rainstorms, thunderstorms really aren’t a thing there such as in Oklahoma where I was born and raised. I now live on the West Coast and the only thing I wish is that house prices would drop to something sane and I don’t mean 50% drops, I’m talking 20-25% drops from current levels.

Doesn’t appear to be….does it?

@Roddy6667 wrote: “Why don’t people have the sense to leave?”

Some of us, due to college education and technical skill set, were constrained to living in SoCal, SF Bay Area, Washington DC or New York City. With changes and advances in the rest of the country (aka the fly-over states), this is no longer the case.

I graduated from college 20 year ago. A family friend obtained the same college degree 6 years earlier. They moved to Honolulu Hawaii. They spent the entire time in Honolulu unemployed. They were unable to land a job until coming back to California.

The rest of the United States has gentrified to the point where a person with my educational background is not longer restricted to SoCal, the Bay Area, DC or NYC. There used to be a huge salary difference between the SoCal and the fly-over states. That gap has narrowed significantly in the last 10 years.

Hi Ernst,

I agree and feel your pain a bit. My wife and I are consultants for publicly traded companies. Unfortunately, you can’t make a living away from major metro areas. We make decent money and JUST gout ourselves completely out of debt. Unfortunately, to continue our career, means making good $$ and being forced to live in rather expensive areas.

After squirreling away a few dollars, I may go for a career change, the effort for what I get whilst being away from my kids (6 and 7) is not worth it.

-James

Its not about “good sense”. People stay for weather, family and jobs. The traffic and prices are miserable but move to the South or East Coast and get stuck in miserable humidity with a gajillion bugs and 2000 miles from family.

You pick your poison and hope the housing values will continue to inch up.

“People stay for weather, family and jobs.” Couldn’t have said it better myself! Those three things are exactly what I’m still here.

Traffic is becoming unbearable. On the 4th of July at midnight, it was a nightmare to go from Long Beach to the SF Valley. Quite often now I think of going somewhere, and then rethink it and stay home. It’s sad.

Oops, “why” I’m still here obviously…

@Fensterlips, “jobs” would be the answer for some of us. However, due to changes this is no longer the big issue it once was.

20 years ago, comparing SoCal to the Midwest was like comparing the Jetsons to the Flintstones. This is no longer the case. The rest of the U.S. has caught up to SoCal. Except for weather, everything we have here can be be found elsewhere in the U.S. So any advantage SoCal once had is now gone, except for weather.

It’s strange that you link East Coast with humidity and bugs. That sounds more like Florida, which most East Coasters consider to be a different part of the country. Ever heard of New England or the Middle Atlantic States?

Meanwhile in Britain…

http://www.politico.eu/article/the-immoral-housing-bubble-london-house-prices-housing-shortage/

All that complaining about the issues, and he’s buying at the very PEAK imo. The tax-relief changes going to decimate so many landlords, and hopefully, bring on a big house prices crash. Is he totally oblivious to tax-relief changes. Seems many in UK still are. The landlords have only just passed 10,000 names for their petition to Government to prevent the changes… weak. Most landlords no idea about the changes coming in, and obviously journos still pushing to buy at silly prices.

Journo says: Loose monetary policy, reckless bank lending, and demand far exceeding supply — especially here in London — has caused property to be one of the most reliably rising asset classes anywhere. Because it is liquid, too — that is, you can always sell your house — it has been an invitation to mass speculation on a scale hitherto unseen.

Peak bubble silly thinking, imo. :rolleyes:

Even Governor Carney at Bank of England is warning so many asset classes are only liquid in practically the best market conditions of all time, due to global Central Bank easing, and warning what is liquid today, can quickly become illiquid. Housing is liquid eh, geeeez. Bubble-heads.

God No. You Californians made this mess now you stay home and fix it. Don’t export your ridiculous political philosophies to the other 49 states.

Staying single now is a must…

Ninth Circuit Gives Unmarried 2X the Mortgage Interest Deduction Available To Married Couples. This will be a game changer…

http://taxprof.typepad.com/taxprof_blog/2015/08/ninth-circuit-gives-unmarried-couples-double-the-mortgage-interest-deduction-available-to-married-co.html

How is this even legal? I cannot believe this judge’s decision will be allowed to stand.

Actually, NO one should get a mortgage deduction. It does no buyer any good, and only drives up prices and drives debt creation.

“I know of someone near a SoCal beach hot spot and he commented how ridiculous it is for locals now to enjoy their old stomping grounds.”

We used to live near the beach in Huntington Beach. Traffic and parking in our neighborhood on the weekends was a nightmare! We can only imagine what it’s like now!

I’m 64. Raised in Pico Rivera, I had lived in Whittier, Newport Beach, Norco, Costa Mesa, South Pasadena, and Riverside. In addition I delivered beef throughout southern California by truck from 1979 through 1984. I left California in 1985. Looking for a decent place to raise a family my ex and I moved to the southern Oregon coast after 5th wheeling around the nation. Oregon has the climate, good people, natural beauty, and general quality of life we were looking for. We have 5 kids. 2 valedictorian, one salutatorian. The schools are great! At the time we moved here jobs were more plentiful. I obtained a real estate license in 1988. 3 years later I opened a small firm in a very attractive sea side town.

Southern California’s economy is getting squished. I wonder how the folks there can be so distracted as to not realize their future is at risk there, and why they stay? It’s a poor immigrant community where numbers and problems will only increase. Good luck for those who stay. You’ve been warned a million times.

Many many states have nice warm weather year round but folks in CA, think that is the only place.

@js357 “God No. You Californians made this mess now you stay home and fix it. Don’t export your ridiculous political philosophies to the other 49 states”.

What ridiculous political philosophies??? Pretty much everyone I know is a fiscal conservative and social libertarian. You think that is whacky?? Just tell me what state you are in and I promise never to visit it and spend my vacation dollars there helping the local economy.

Except none of the people you know are running the state: sanctuary cities, bullet train to nowhere, open borders, no new freeways policy [Jerry Brown, decided in the 70s], Jerry Brown himself, constant looting of the gas tax fund to dump money into the general fund. The list goes on.

On the education front: whole language, fuzzy math, social promotions, low ranking schools. at one point 17 support staff for every teacher, yet there’s never enough for education even with the 40% of the budget set aside just for that purpose.

I lived in LA for nearly 40 years. You know exactly what he’s talking about.

Yesterday, I visited a Golden Sarcophagus in Santa Monica. Listed at $1,325,000.

You’ll notice there are no photos of the house’s interior, and with good reason: https://www.redfin.com/CA/Santa-Monica/2020-California-Ave-90403/home/6767932

The interior looked like a slum dwelling. The kitchen was small, with vintage 1950s or 1960s appliances. A water heater stood in the corner.

The carpeting was both thick and thin. Thick, in that it was shaggy. Thin, in that it was worn. It appeared yellowish, though I’m not certain of its original color.

Plaster was peeling in places, from both the walls and ceiling. Some old wood paneling. Sad, old furniture. Beds without sheets. A walker in a corner.

A realtor sat in the middle of the living room, playing with her smart phone.

I said to her, “I guess this is a tear-down.”

The realtor looked up from her phone, glanced about the room, then said, “Yup. Guess so.”

She didn’t even try to sell me on the house. I guess she figured I either wanted the land or not.

I asked if the previous owner had died. She said no, that he had been taken to a nursing home. The house was being sold by the trustees.

Zillow reports that this house had originally been listed at $1,550,000 last July. It’s now come down to $1,325,000: http://www.zillow.com/homedetails/2020-California-Ave-Santa-Monica-CA-90403/20474261_zpid/

And look at the property taxes — in 2014, only $1,316.

And, according to the link: no laundry, heat or cooling. But close to

walkable restaurants and shops where you can press your nose against the glass and dream on your way to the laundromat.

L.A. county, like California, and L.A. city are Democratic Party managed and controlled. Some people like living in a progressive place. The “all hat and no cattle” state is not accepting of marriage equality like California. That state even likes Donald Trump who speaks foul about some women, after his conversation with Bill who told him some funny stories(unfortunately they were true). Their former Governor Perry is not progressive like our Governor Brown who went to Mexico and give them a California welcome of “you all come” to the golden state. Yes, the problems you mentioned in the peoples republic of Santa Monica are all true, but they are politically correct which is more important. Keep the Red Star in the California flag.

China’s government is absolutely lying about its economy

“China’s economic model is one of the most unsustainable things in the global economy today. Worse, it’s heavily contributed to a massive real estate bubble that will burst with global consequences.”

Read more: http://www.businessinsider.com/chinas-government-lying-about-economy-2015-8#ixzz3iScVpmgI

Read more: http://www.businessinsider.com/chinas-government-lying-about-economy-2015-8#ixzz3iScNBvlT

When you quote Business Insider, you lose all credibility. That has been a China-bashing rag for years. I doubt if you or the writers from that publication have ever spent any time in China.

I noticed you didn’t write a word about the reams of data in the article. So I suspect you didn’t read it. It has charts though which are kind of like cartoons so you might want to take a look if only for that. Please bless me with your prodigious economic mind and point out where the author of the article is wrong, okay? Oh by the way, did you notice China devalued the Yuan? it’s what the article said would happen one day before it happened. Anyways, since you infer you’ve spent time in China — and you’re right I haven’t — what happens there now?

Reads like it’s peak frustrating! Traffic, ‘black-friday’ packed beaches.. although I didn’t understand the mountain reference.

Mandy Moore and Minka Kelly went for a 9 mile hike in the mountains a few weeks ago, but on the Malibu side.

http://www.dailymail.co.uk/tvshowbiz/article-2990900/Mandy-Moore-steps-BFF-Minka-Kelly-two-months-split-husband-Ryan-Adams.html

Doh! I get it. For the ski-ing / snowboarding. Yes; California at peak popularity?

Yes, try to hit the beach on a hot holiday weekend and you’ll wish for death, but other options do exist. I’ll often head over the hill to Zuma or one of its less well traveled neighbors on weekday afternoons and find it pretty empty. I’m not saying this makes LA any kind of bargain, but it IS a nice feature that locals still enjoy.

Have you been in LA over Thanksgiving or Christmas weekends? LA turns into a ghost town. All of the transplants go and visit there relatives leaving people who choose not to travel and/or the poor people who can’t afford to travel anywhere.

Staying for family? My parents left as soon as they retired. They sold their home and moved to the east coast. During the summer they stay up around Maine and winter in either Florida or Washington D.C. Although it seems as though Washington D.C. likes to close down for any and all snow or ice. Kind of funny – Maine gets like two feet of snow and the kids still have to go to school meanwhile the CIA closed their headquarters for 1/2 inch of snow.

Who in the world can retire in California and why would you want to?

@Anna I have few friends who have retired in SoCal from the big cities of LA and SD. They opted for Joshua Tree, Palm Desert, Yucca Valley rather than flyover country… or the east coast. One purchased a 2bedroom mobile home in a park overlooking a golf course for $18K. his land lease is $350 per month. He loves the desert environment.

I love JTree and have been going there to camp/hike in the winter and spring for almost 40 years now. Culturally/socially too there’s something to be said for the oddball individualistic tweaker vibe in the high desert communities.

But seriously… how do you live there in the summer and fall? Even the lizards and tortoises pretty much just crawl into a hole in the ground and wait it out.

You can retire in California if you have income property. You want to retire here if you like the weather, the food, your friends, your family

Anna – this blog focuses on LA and the bay area, a small percentage of the state. LA is a pit, period. It has no redeeming qualities whatsoever, and the corrupt city government seems intent on driving it further into the sewer and bankruptcy. I get embarrassed when I imagine those who visit and think LA “is” California. It represents the worst of the nation, not just the worst of the state. A large portion of the bay area is a pit, too, and the parts that aren’t are not affordable to anyone but the 1%.

However, California is not entirely coast, desert, and overpriced ghetto, as this blog could make you believe. Much of the rest is beautiful and even relatively affordable. My mortgage is $884/month for 2,000sf (bought in 2009), and I live in one of the top ten lowest-crime cities in America. I can BBQ without bugs or sweating profusely, keep the windows open at night year-round (avg electric bill $60), send my kids to great public schools, and retire years earlier than my engineer buddies on the coast. They do get a shorter commute, along with about six months of June Gloom and the massive numbers of conceited and entitled people to be found there.

6 months of June gloom sounds like what we have in the Emerald Triangle, redwood country. You can get housing cheap here. You can also teach at Humboldt state. There are good jobs here, but my primary job is doing the Lord’s work as a farm advisor.

Not everyone values money. Different people value different things. If you just count dollars and cents then it makes sense to not live in an expensive city like Los Angeles. But a lot of people apparently are paying huge money for rent and don’t mind it. So I really don’t know what the issue is.

“and don’t mind it”

Are you sure about that?

I’m in LA bc of job and don’t expect that to change soon, and I live below my means. I bought in 2012 at the bottom in a “transitional” neighborhood (condo under 300K), amongst lots of working & poor, and all the tagging, dog crap and furniture dumping that entails. I want to live in a cleaner quieter neighborhood. Do I sell now (it’s a peak time right??) and take my 200K and place as down payment? I think I have job security but you never know and I’m pushing 50 – single person so no dual income. If something were to happen I’d be sooo stressed out. But when is a good time to leverage equity and trade up?

That my friend is the problem — the only way it makes fiscal sense to me is to cash out and move out. You sell at the top and buy at the top. I suppose you can cash out and rent for a while and then rinse, repeat when the market crashes again. And it will. China was the engine and it be sputtering. Why do 27K people show up for Bernie in LA? Income inequality.

30 year rates at 3.77 15 year under 3 and most folks till can’t buy or qualify for a home. The Fed wants to raise rates, the ecomony is barely moving forward despite a Fed rate policy of near zero rates. China just decides all of a sudden devaluate money, do you really need a reason to watch pundits dissect these numbers, the country, the world, is in a big hurt? BTW, if there are any houses left expect more Chinese to flood to the flight they think is the safety of the dollar, more house buying , so those who thought real estate will tank in CA. You have a long wait.

If their economy continues to tank, the source of income for would-be Chinese RE would drastically be cut off. The current deterioration might pull forward demand. But long term, it is not sustainable — especially if the $ continues to gain strength.

The Chinese government is very much against it’s own people sending money over seas. They haven’t been strict with the capital controls but if their economy continues to falter look for those controls start to become enforced with an iron-fist. The Chinese government gave the people of China a taste with the “rules” they put in place for selling stocks to try and stop the stock market from hemorrhaging.

My sister and her husband just listed their 4 bedroom/3 bath 1950’s era tract home that they had bought in Rolling Hills Estates in 2009 for $1,005,000. They asking $1,300,000 for it. They are retiring and leaving SoCal. In the last three days, almost 50 people looked at it–most of them are Asians from China and a few Indians from India.

Google should start equipping self driving cars with a nice bed and storage so the commuters just go to bed in their cars and wake up at work.

I’ll check w my attorney if this idea can be patented. Lol.

lol SoCal is a third world dump!!!! Most of SD, all of LA, etc. Lived in Ladera Ranch in the OC for 8 years. Awesome place but way overrated! CA is getting absurd. We are in our mid 30’s and are now living in MN. Went from a tiny 1600 sq ft house with zero yard and zero privacy to 3 acres with 3700 sq ft of space. We swallowed the propaganda of how miserable the weather is in MN! lol its been absolutely beautiful here all summer! And fall is usually the best season. Ive missed seasons so much! The green lush forests and grass is nice. Beach living all sunny year round med climate is so overrated. We are looking forward to winter. Snow mobiling, pond hockey, skiing, ice fishing. We are active outdoorsy people. Amazing water recreation and boating. MN is the best decision we’ve made. Great local economy and amazing schools. Our town is 90% white! lol. The America i believe in and want to raise my kids in still exists. Liberals here are relegated to the city which is nice. I see all these californians flocking to Portland, Denver, etc. bringing their big government, multicultural, politically correct attitudes……stay away!! You’re not wanted!

Nick, you are obviously ignorant and mis-informed. There are many, many beautiful parts of Southern Cali that are not LA or SD with better RE prices as well. Obviously you want to make yourself feel better about moving away. I hope you freeze ur a$$ off in MN!

God, just having to listen to the people there say Minn-E-SODA is enough for me to stay away. If I wanted that cold weather I would move back to Anchorage, where the typical winter is more mild than most of the northern Midwest.

LA and the surrounding area has always been image conscious but now it is just ridiculous. People are walking around with the latest and greatest phone and tablet but with a broken screen. People who drive their expensive car/SUV around the block and then park it again in the same spot it has sat for years. People walking around with expensive but threadbare clothes. It is as though the entire area is living in the Matrix and everyone took the blue pill.

All good things come to an end, and fortunately, so do the bad. The currency wars that we are likely to enter into as a result of China’s off-the-cuff devaluation means one of the central banks is about to blink and devalue their currency. So far it looks like it may be the Bank of Japan or the ECB. Any talk of the Fed raising rates is insane. The Fed is pretty much locked in a Catch 22 as interest rates are already near zero with a still sluggish economy. Raising the rates would completely crash the market when everyone else is devaluing their currency. But perhaps, they actually want to crash the market.

The cover of The Economist in 1988 predicted a world currency by 2018. We are close. All we need is on more great cataclysm. I fear the misallocation of resources and malinvestment from the 2008 bubble was never allowed to correct itself and the can was kicked down the road. The oligarch class profits from the upturns and downturns. The Taco Tuesday hipster crowd will be left holding the bag in their “sustainable” house.

Leave a Reply