Los Angeles County is becoming a renter’s paradise: Building permits for multi-unit properties in Los Angeles soars to meet renting demand.

People are surprised to hear that Los Angeles County is the most unaffordable location in the entire United States when it comes to renting. Isn’t San Francisco or New York more expensive? Of course they are but affordability is based on income and Los Angeles has a much lower household income base to draw from. Unlike creative mortgage financing, you actually need to pay your rent out of your net income each month. What has happened since the housing bubble popped is that more families in Los Angeles are now renters and rents have soared causing a rental Armageddon in the area. Families are being squeezed in what I would like to call housing purgatory. They have no way of buying an inflated crap shack but at the same time are unable to do anything about rising rents. For those with Taco Tuesday baby boomer parents, many Millennials are opting to move back home. And builders realize this trend is only going to continue and that is why builders are going after multi-unit permits at a much higher rate than single family permits. Los Angeles County is now becoming a renter’s paradise assuming you like cramped living areas, high traffic, and sky high rents. I don’t see permits for new freeways coming online at the rate of multi-unit permits.

The rental revolution continues

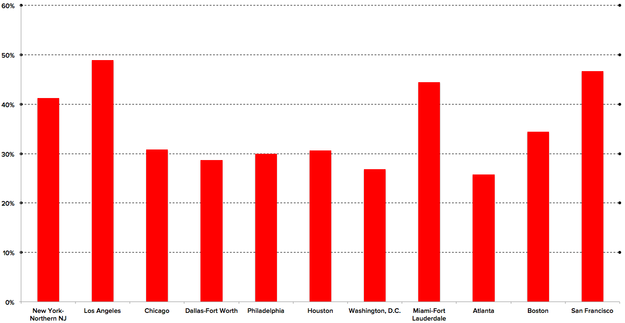

First let us back the assertion that Los Angeles renting households spend the largest portion of their income on housing. The figures show a very clear picture:

The majority of renting households in Los Angeles spend at least 50 percent of their income on housing. That is simply insane and gives very little room to saving for retirement or even for a financial emergency. Of course San Francisco has higher rents but again, households make more so this metric is relative. And what is more important to note is that Los Angeles County with 10 million people is a massive micro universe of what is occurring across other areas in the country. The vast majority of those in the county rent. Today with creative financing, low down payment loans, and crap shack inventory out there people have the option of buying. But they are not in large overarching trends. In some places the big demand is from investors, domestic and foreign. We’ve done deep analysis of streets in Culver City and Torrance and what you find is the vast majority of people living in these hoods have no chance of affording their own home today if they had to buy. So the few home sales that go through suddenly set the market. This goes both ways of course.

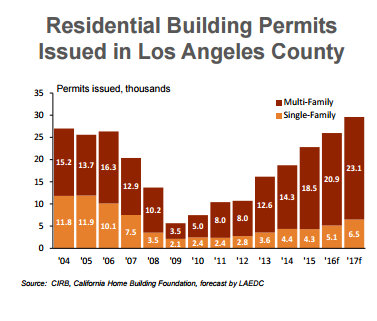

But builders have to build for the trends of tomorrow based on what they are seeing today. And in Los Angeles, they realize a renting paradise is unfolding:

Multi-family unit permits are beating out single family permits almost four to one. Compare this to 2004 and 2005 in the bubble when they were nearly one to one. Ultimately builders are looking at the underlying economic trends and realize that more people are simply going to rent. Pressure on higher rents are coming from demand and the lack of supply. Sure, you can be one of those mega-super commuters that drive in from the Inland Empire but your quality of life is going to be horrific. Yet people make economic choices and millions make the commute from the Inland Empire into L.A. or Orange County just so they can own a McMansion.

There are four rules of thumb you should adhere to if you plan on buying a crap shack:

-

Your mortgage should only eat one-third of you net income per month

-

Anticipating any changes? If you have a child, is daycare going to be an impact? In many crap shack areas daycare can run up to $1,500 a month (or more)

-

Planning to stay for 10 years? Then you would likely ride out any bumps in the rode

-

Do you have at least 10 percent down (ideally 20 percent down)? Don’t buy without an emergency fund in place

Yet even with these simple metrics in place, people are just not buying in mass because first, inventory is also tight and many local families are broke or can’t compete at these prices. So if you are part of the house humping brigade that crap shack is getting more appealing to you. I was talking with a few colleagues in the industry and they were saying for the last year or so it has become more common for people to wave contingencies like not having the damn place inspected! What if the place is termite invested, or has asbestos, or has major problems with the foundation? These are expensive fixes. But who cares right! Housing only goes up. Builders look at balance sheets and household economics and realize there will be more demand for renters even though the housing cheerleaders want to make it seem like there is a giant amount of people waiting to buy in the wings. The facts don’t show this. So what we have is Los Angeles becoming more and more a renter’s paradise with the most unaffordable rents in the entire country. You wonder why traffic is getting worse? Housing density is only going to get worse.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.                                   Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.                                   Â

Subscribe to feed

Subscribe to feed

120 Responses to “Los Angeles County is becoming a renter’s paradise: Building permits for multi-unit properties in Los Angeles soars to meet renting demand.”

I think Renters Paradise it not what I would call it. It should be Landlord’s Paradise IMO.

Housing To Tank Hard Soon!

I’m starting to think its never going to tank, as long as the economy and housing market are being manipulated and market forces aren’t allowed to run their course.

I agree. I foresaw the correction and wrongly sold my house in 2004. The writhing was on the wall, liar loans that would adjust after the teaser period.

This time, I don’t see a clear catalyst that would bring a halt to this. The only thing is higher interest rates and the way they have manipulated the CPI, I don’t see interest rates going up in a meaningful way.

I mean think about it, the CPI is so manipulated that if 10 years ago your rent for an apartment was 1000 and the average person lived alone. However, 10 years from now if the typical renter has 10 people sharing that same apartment and the total rent is 10,000, or 1000 per person, for purposes of the CPI, there was ZERO increase in rent over those years!

I agree Gerardo but jim is still dreaming how soon is too soon Jim??? in your dream

12-24 months; once the tech bubble bursts here in the Bay area the whole thing starts to deflate in every tech hub across the country. The gimmicks used to inflate asset valuations will be exposed as shams and soon enough every will be asking themselves how in the hell they got tricked into mortgaging their future.

MarkinSF: I think (and hope) that housing will crash in the not so distant future, although I really don’t know exactly what the catalyst will be (no one really knows). In that general regard, I agree with you.

However, I wouldn’t underestimate the stupidity of people in general. The next housing bubble will probably start inflating soon after the next crash, and people will likely buy right into the next bubble just like they bought into this one and all of the prior ones.

Market forces always run their course eventually. I mean just look at what’s going on in the world. A healthy global economy it most certainly is not. i will admit that I am starting to suspect we are going to have a drawn out downturn similar to the RE decline of 91-96. I myself have no problem waiting until 2019 or 2020 to buy. Everyday that TPTB try to forestall the building deflationary forces, the worse the over correction will be. In the valleys and Near IE you can look at individual neighborhoods and exact bedroom/SQFT comps within and find YOY reductions in asking and closing. And the recession hasn’t officially started yet. The FED is screwed whether they admit a “policy mistake” or stay the course of gradual raises. Either way the oncoming recession is going to shatter the FEDs confidence game and end this credit cycle. Same as it ever was. 1982, 1991, 2008, etc.

It will not tank in currency terms, only in real terms compared to real hard assets like gold

Existing Home Sales Crash Most In 6 Years: NAR Blames Slowing Economy, Bubbly Home Prices – http://www.zerohedge.com/news/2016-03-21/existing-home-sales-crash-most-6-years-nar-blames-slowing-economy-bubbly-home-prices

“The overall demand for buying is still solid entering the busy spring season, but home prices and rents outpacing wages and anxiety about the health of the economy are holding back a segment of would-be buyers,” says Yun.

Which is odd since President Obama said everything was awesome.

Finally, there appears to have been an odd jump in investor purchases this February, suggesting that the Chinese capital controls evaders are back front and center:”

many are hoping they can save SF commercial real estate. if anyone is interested Twitter is subletting office space. Dropbox did s down round. The alarms are ringing.

It Starts: San Francisco Office Boom Deflates, but Fitch Says It’s “Unlikely to Collapse†this Time

http://wolfstreet.com/2016/03/22/fundamentals-have-cooled-but-are-unlikely-to-collapse-fitch-on-tech-oriented-office-markets/

I own a nice house (1550 sq ft) in the Antelope Valley which is paid off. My job allows me to drive during the off-peak traffic periods so I’m on the road for an hour each way commuting. No traffic and very little stress. For most people in L.A., it takes an hour to go 25 miles during rush hour.

West L.A., for example, is a nightmare now. And don’t even try the Santa Monica Fwy. I bought out in the A.V. a long time ago because I didn’t want to mortgage my life away for a stickin house.

Quality of Life? What kind of “quality of life” do you have living in the hood? L.A. is so overrated that it’s truly pathetic. In my old neighborhood in Mar Vista, there is no “quality of life”. Traffic is horrible on Lincoln and Centinela and there’s no sense of community (e.g., shops, restaurants, meeting places). Hell, I lived there for 40 years and in the old days there weren’t many amenities.

That’s the joke here. L.A. and most American suburb cities have never had QOL or social amenities. They’ve always been just suburbs. Mar Vista isn’t any different from Rolling Hills Estates, Alhambra, Santa Monica, or Lancaster.

So go mortage your life away while I relax. What’s the quality of life of people who know they have to work their fingers off forever and put half of their income into rent payments or their mortgage? Answer: They’re miserable.

I don’t know what you mean by “amenities.”

Shops, restaurants, movie theaters? Every city in America pretty much has these same amenities. The same chain stores and malls. IMO, Denny’s and Starbucks are as good as any pretentious bistro or “authentic” coffee house. Food is food.

You also mention “a sense of community.” I never knew what that meant. People involving themselves in each others’ lives? Sounds like a bunch of busybodies.

My ideal has always been a house in a quiet, tree-lined neighborhood — but within walking distance to a bustling, anonymous, urban center.

There are such places. Santa Monica’s “north of Montana” district. Parts of Pasadena. Certain areas in NYC’s Brooklyn and Queens boroughs.

If you really that think Denny’s and Starbucks are interchangeable with finer establishments, you really are missing out on some of the finer things in life.

“IMO, Denny’s and Starbucks are as good as any pretentious bistro or “authentic†coffee house. Food is food.â€

Ha, I’ve always though pretty much the same thing (although Denny’s and most really cheap fast food places are a little too greasy for me). I’ll go to Norm’s, though (probably just as greasy, but I digress).

Generally speaking, I am just as happy going to Chipotle, Sarku Japan, Togo’s, local Mexican food places (and numerous other halfway decent fast food/ fast-casual restaurants) as I am going to an expensive/fancy restaurant. I’ve been to very nice restaurants in OC/LA, on cruise ships, etc. But I just don’t get anything out of it. The experience always takes a really long time, is typically unnecessarily pretentious, expensive, and the food is rarely if ever more enjoyable to me than a $10 meal elsewhere. After eating, I always feel like I wasted my time and money to some degree or another. Thankfully, my wife more or less feels the same way. I just don’t derive the same value from expensive/fancy restaurants that some people do; I almost feel that they’re a bit of a scam to some extent.

Zzy you make some good points. However, West LA is really the best area to enjoy the weather, cultur,e, and truly have a better quality of life. If you are new to the area or if you have just moved to Southen California you are in for a rude awakening. My co worker who is from Pensylvania complains about how La drivers drive on the road. If you get upset and loose it on the freeway you never know if the other person has a gun. If you don’t understand La politics at work you will soon find yourself out of a job. If you are hard core and voice your opinion you will soon realize no one really gives a shit. If you really came from the hood you would really realize why Certain areas have high obesity, high crime rate, and gangs. When you have highly educated people who want a better life they are willing to pay premium dollar. This is why certain parts of La are so expensive. I mean do you really want to live next to a gang member or a drug addict who stays home and smokes weed all day.

“If you get upset and loose it on the freeway you never know if the other person has a gun”

not to high jack the thread but where did this everyone has a gun and is willing to use it mentality come from? Most gun deaths, by a large margin, are suicides. And the last road rager is saw using a gun was an off duty cop.

just sayin

Totally agree, the thing with LA is that your quality of life has a lot to do with the specific neighborhood you live in. The more desirable neighborhoods are just going to be more expensive, that shouldn’t be a surprise. I think all in all, West Los Angeles is a pretty nice place to live, you just have to know when you shouldn’t be out on the streets if you don’t have to be and the shortcuts you can take to get you where you need to go. But in terms of lifestyle, it’s hard to beat.

It seems like more and more detached SFH are bring turned into rentals. It’s amazing when you consider that at today’s prices the ROI on some of these properties is less then 5% annually. To me less then 5% doesn’t seem worth it. I assume investors are counting on appreciation.

Why does anyone live in LA who is not wealthy (either income $150k+ or wealth over $500k). This is America, where there are endless other cities which provide such a higher quality of life.

Housing bubbles like the California bubble make no sense to me. Just as people who drive cars much more than they can afford, and then wage slave to meet those obligations. America has luxury cities (LA, San Fran, San Diego), and value cities (Atlanta, Dallas, Houston, Chicago). The median incomes in luxury cities and value cities is very close, however the cost of living varies by over 200%, with housing varying by sometimes 400%.

Because the job doesn’t exist in affordable cities.

By “luxury city” I suppose you mean that you must have a luxury-level income to afford a distinctly non-luxury life.

I live in Chicago, a “value” city, but one loaded with affordable and REAL luxury. The architecture is peerless and the cultural amenities are second only to NYC and Paris- we have one of the two most highly-rated symphony orchestras in the world, a great art community and literary scene, and are a major center of live theater. It also has great entertainment venues and scores of walkable neighborhoods, and great transit-is one of the few cities in the U.S. where you can live comfortably without a car. This is, after all, the city in which the skyscraper was invented, and where the first atomic chain reaction took place. It has a fantastic array of beautiful housing in every price range, and if you’re rich, you can get a place for $3M that you couldn’t touch for less than $20M in NYC, like this, which is in one of the city’s top neighborhoods:

https://www.redfin.com/IL/Chicago/2430-N-Lakeview-Ave-60614/unit-11-12N/home/49882143

And we have something else some “luxury” cities distinctly have not: we have 5% of the world’s fresh water supply, known as Lake Michigan, in our front yard.

Don’t get me wrong- Los Angeles is an interesting and attractive city with magnificent scenery and a fascinating history, but it has become ungodly expensive and hence unlivable for anyone who isn’t positively rich. I am old enough to remember when it was quite otherwise- I remember the days in the 60s when L.A. was as cheap to live in as St. Louis, and it was not only easy to score a high wage job there, but it was known to be an easy place to make your fortune. Those days ended in the late 70s, sadly.

Laura-I’m in full agreement with you! While true that Chicago can be expensive at least you are paying for more than ‘sunshine’, which seems to be the case here in “bland’ Diego where I sadly reside. I moved out here-from the east coast-three years ago and cant’ get over how incredibly dull and boring it is here. It has not been for a lack of trying. I’ve gone to the ‘theater’ and it’s merely over-priced, re-cycled “B” average stuff. Don’t even get me started on housing. Trying to find a quality home with personality here is impossible. I suppose it is for some…but not for me.

Laura , I was born and raised in Chicago, you can rave about it all you want (?) my wife and I wouldn’t return to live there and we can afford to live anywhere we want.

I don’t want to post a war on peace about the place but for folks who never been there three days of seeing tall buildings and a always cold motionless lake and you get the idea.

The politics, the narrow minded people, lousy weather except for the (short Indian summer), traffic, pot holes, toll roads, property taxes, flat as a board. Like I said, you have a love for the town no problem, all I can say is many of my relatives and close friends also moved to (Southwest, Ca, Fla, Denver) we always talk about it, the old times, but none would ever go back. stay safe

I know what you mean, robert.

About 20 years back, I had a young friend, an artist who was almost 100% Polynesian in his ancestry, and who went to art school here in Chicago and was involved in the city’s vibrant art scene. Well, after a particularly brutal Chicago winter, he took a job in a small village in Hawaii teaching the original native language, a job available only to those of native ancestry. I thought he’d never come back to our rough winters here, and I’ve never been able to figure out how people from lush tropical climates tolerate them, so I was surprised to see him back in the city less than a year later. He said that there was no way he could get used to the dullness of Hawaii after living in Chicago.

Yes, the weather here sure can suck, but I’m grateful for it, because if our climate were any better, this town would be just as overcrowded and expensive as the coastal burgs. After all, Chicago IS the city where the film industry started.

Sorry but everyone I’ve ever met from Chicago is a total a$s. People from

Chicago who move to so cal stick out like a sore thumb. Loud, obnoxious, entitled, inconsiderate, and oh that horrible accent. Can’t imagine anyone from so cal ever moving to Chicago by choice.

I was born and raised in Rogers Park and went to college in Chicago in the late 90s. I felt like Chicago was an overall much more funky and vibrant city in the 90s. I’m in San Diego now and still like to visit friends and family during the summer. I just can’t imagine living there year round again. The weather is awful most of the year and the “safer” parts of city has become a lot more sterilized and gentrified in the past 15 years. At least that is my perception. Chicago is an amazing city but I disagree with the “world class” label. It may be close but not quite there. It isn’t on the level of NYC or Paris. Chicago does have a ridiculously beautiful skyline and some “world class” cultural entities such as the Art Institute and Field Museum.

Chicago also has one of the highest homicide rates in the whole country due to the large numbers of gangs and drug trade there. Congrats.

That’s why prices up here in the PNW cities (Portland/Seattle/Vancouver) are raising at a rate as high or higher than anywhere else. We have the culture, food, nature, entertainment, coast, etc., and the weather, while certainly not SoCal warm and dry, is much better than the Midwest.

I grew up in the Midwest, lived in LA for 15 years, and now wouldn’t want to call anywhere but the PNW home.

Davey, I don’t think Chicago will ever be on the level with NYC or Paris. That won’t happen unless predictions of rising sea levels in coastal cities come true, and their populations have to decamp to cities further inland. If that were to happen, inland cities would experience stunning revivals, but it is not likely in my lifetime, and I hope it never happens, frankly.

And it’s fine- it’s nice to have a large, top tier, but not quite international city where the rents and house prices are not stratospheric and where a person of moderate to middle means can afford a decent place in a nice neighborhood within easy reach of urban amenities.

If I were to live in Europe, say, I’d look at the “second-tier” cities like Nantes or the smaller cities 40 miles outside of Rome, first, because they are still great, lovely places with prices steeply lower than the great international cities like Paris, London, or Rome.

Chicago is a BARGAIN compared to some other areas, and most definitely NYC and LA. The weather is unpredictable, winters can be rather brutal for a month or so. This city is vibrant, progressive and World Class.

Sure, there are problems like any other city. If there was one perfect place to live, then everyone would want to live there. LA and SoCal are NOT perfect. Far from it. It’s the illusion presented on TV world-wide that it’s paradise that makes people flock there.

Hunan-

Chicago does not have the highest homicide rate. The number might be high, but this city does have a population of 2.8 million people with a metro area of 8 million. The actual RATE is rather low compared so much smaller, more violent cities.

SoCalRulz- “Can’t imagine anyone from so cal ever moving to Chicago by choice.”

Judging by the number of California plates seen in Chicago over the last 7-8 years, I’d say you are wrong.

Because we were born and raised here, and have strong ties? Good enough for me.

Please don’t make the mistake of putting San Diego in the same class as San Francisco, New York and LA. San Diego is a 1940-50s that evidently fell into time warp when it turned 1950. Nothing here. They just got a movie complex in north county. Everything is about shopping and throwing money away. Roads are so crowded that it takes, well you know – a lot of time to get anywhere. It is a military city so nothing going on. People consider Legoland a cultural event. It’s backward as I said. So it takes a long time to get around here and nothing to speak of in public transit. In fact the cities brag that they are completely car dependent so it is a very, very small world here. I hear the schools stink. But education and cultural events are not San Diego style. This place is a throw back to when gas was 20 cents a gallon. Even the beaches are ugly and hard to get to in places. Dogs are hated here – no places to walk your dog off lease except the dog parks. Leucadia is a cool place with old stores and a mix of housing styles. It costs what L. A, costs but L. A has tons of interesting neighborhood and stores, theater, art movie houses and good restaurants.

San Diego county is quite large and contains many beautiful desirable places to live like Carlsbad, La Jolla, San Marcos, Del Mar, etc. Northern San Diego county has beautiful rural areas filled with agriculture and undeveloped areas for enjoying nature. I don’t think you have any idea what you are talking about.

I lived in San Diego for 4 years, and I dont think you should conflate suburban north county with the actual city of San Diego. I lived near Balboa park, and miss it every day. The beaches are absolutely stunning in Coronado and La Jolla, so not sure what you’re complaining about. Also, the area is famous for being dog friendly- heck, all of Fiesta Island is off leash! I do understand some of your points about the military and car dependency, but if you’re not enjoying your life there, I highly suggest moving to Hillcrest or Littlr Italy so that you are surrounded by a more vibrant community.

San Diego is the movie capitol of the world

L.A. is number one in unaffordability, because the weather is so good and the people are amongst the best. Few places have the great diversity of L.A. and the resulting vibrant night life.

Carlos tells me that with little SFR being constructed, that will insure that the existing housing stock prices stay high. Hurry up and buy before the prices go higher.

The new apartment people will take public transit. Most of the new apartments are built in accordance with the “sustainability” goals and close to public transit.

Remember to vote for the new proposed .5% sales tax for L.A. county to further the goals of the “sustainability” movement. Remember, carbon is bad, reduce your carbon foot print today.

You forgot to urge voters to vote for whatever presidential candidate will encourage the Fed to keep interest rates low to try prolonging the housing bubble. “Buy now or be priced out forever” works best when cheap debt is abundant.

I am currently watching a new show on HGTV called “Container Homes.” Shipping containers, that is. Hilarious, this is better than tiny homes any day. Total cost 18K. Security cameras, floor to ceiling windows, dream kitchen, master suite, stairs ascend to a roof deck. Haha. I predicted this scenario a dozen years ago in jest and now here it is, a show on HGTV about reclaiming shipping containers to live in.

From my observation this spring is bringing more bad news, here in San Diego.

I am seeing multiple offers on houses priced 10 higher than last year this time. By the time the year is out it may be 15 to 20 percent.

Retail buyers and investors being last to jump in?

I am in my 40s. Fortunately, I picked up beach fixers when I was in my 20s. I could retire. I went to a high school reunion. Most of the people I went to high school are still renters, or they waited till their 30s to buy. What a mistake they made … especially the ones still renting.

What about those currently in their 20’s and 30’s who are priced out because of artificially inflated prices? Or the younger generations of future potential buyers who are currently in school? A prolonged RE bubble is a long term detriment to the health of the economy as higher housing costs limits overall spending power.

Well sure, but buying in the ’90s is much different than buying after the millennium. The game totally changed.

If you were picking up beach fixers in your 20s, you definitely did something right. I’m guessing you went into something government and unionized. Maybe a family member was a union electrician, plumber, something like that and got you in.

One of the biggest problems with the college scam is, it generally delays any real earnings and the chance to buy a place until you’re 30, and that’s if you’re lucky and don’t just end up waiting tables with your fancy degree.

Agreed. Many males who go to college would make much more money if they learned a trade at seventeen

I think you must have told this same story — about all the money you made on your “beach fixers” — a dozen or more times.

When I was in my 20s, many told me the same stories that are being told today. They all said prices are too high relative to incomes. They said it was smarter to rent or to move somewhere else. Fortunately, I listened to the wealth old people who said the same stories were going around when they were young before prices doubled, then doubled again and again. I listened to the old people. They were right. Nothing ever changes. Inflation is in the cards because the central banks make it that way. The simplest way to make money is buy all you can afford in the best possible zip code, then wait 20 years. You will be ready to retire.

OMG; how many times do we have to read about your sad story of how you made a fortune in real estate then hover over this blog like the ghost of Marley tormenting the souls of young troubled people who just want to have a nice affordable place to live their lives. I

Yeesh. Talk about the “I got mine” attitude. Congrats on being born early enough to buy before the year 2000. If you hadn’t cashed that ticket you’d now be considered an idiot, not the prescient investor you claim to be.

According to your logic, if someone bought beach property 10 years ago they’d be able to retire off of it in another 10. Gee let’s fact check here….

Bought 2006… crash 2008… 2016 = woohoo barely back up to original purchase value!… (sometime in next 5 years another likely crash)…. then 2026…

Will 2026 bring 10x return on that 2005 investment? – roughly what would be needed to retire nowadays?

Umm highly doubtful there, friend. More likely you’d be just starting to break even at that point. But great job trolling. And congrats on gettin yours!

#generationwarfare

True, someone who bought in 2006 or 2007 is just breaking even. However, someone who bought at any other time in history has a substantial profit.

Here is what everyone needs to consider. The system is rigged by the central banks and the politicians. In order to stay in power, they continue to push policy that pushes up asset prices because that makes voters happy. Voters love increasing home and 401K values. So, renting instead of buying is fighting the politicians and central banks … you will likely lose that bet.

Each new multi family dwelling that goes up in Los Angeles raises the cost of rent and displaces elderly folks on fixed incomes who once survived with dignity due to rent control. I’d be interested in the occupancy rates of these new apartments in Los Angeles. The ones asking 3,000-7,000 for two and three bedrooms.

A sizeable number of the multi-family housing being built are condominiums not apartments.

I don’t see a “renters paradise.” I see a landlord’s paradise. The renter is getting screwed.

This dilemma will resolve itself. After elections everything will get more clear. Hillary or Trump – both are bad news. Overall, let’s just pray we have safe environment to live in. Too much violence and war around the world. I am in my late 20’s and I am definitely not in the place of JT to buy fixer uppers and retire at 40. I guess my generation will not swim in chocolate, will not own big houses, will possibly not even see SSI at 66. Instead we will live in small places, work hard until we save enough to move to cheaper place or die (cheaper on the government).

More multi-family housing equals more crime spilling out into the nearby SFR neighborhoods….. especially in or near high density populations. Been there done that. On the East Coast , many of the older multis are now known as ” the projects “.

Surely multi-family dwellings are appropriate in the city of Los Angeles though? LA is a city that happens to have more SFH than most cities. I don’t think it’s reasonable for SFHs to take precedence over affordability and growth concerns.

50% of the working population in Los Angeles are dual renters in one household too.

Which means net renting inflation is already too high and there isn’t enough affordable rental units to start out with. A lot luxury build out in So Cal too which isn’t helping that situation.

In regards to multifamily permits … The only correlation to expansion demand curve economics for housing activity vs builder confidence in this cycle is if

(matched multifamily permits and starts vs confidence)

If you take a step back the Gap in Builder Confidence vs Acitivity has been massive in this cycle

Charts here show this

http://loganmohtashami.com/2016/03/16/builder-confidence-vs-builder-activity/

So Cal … Housing Inflation on Both fronts (Rent Inflation) + (Ownership Inflation)

Impacts both LTI (liability to Income) + (Debt To Income) ratios for everyone.

Unless you make good money

So Cal is no county for poor men

Posters here might have noticed that there is a rental property rampage in progress in almost every major city in the country. Even deteriorated rental properties are commanding premiums far over what potential rents justify, and many condo developments are being “de-converted”, with large entities paying significant premiums per-unit over what they could command as individual condos, to acquire large blocks of apartments.

This doesn’t seem to make sense to me, because the reason so many buildings were converted to condominium to begin with, is that their expenses were too high for landlords to make a decent profit. So how does it make sense to pay a premium over their value as condos for them?

Methinks the rental property rampage is another bubble induced by Fed EZ money policies, that will end as badly as the rampage of the 00s did.

I agree: rental costs are part of the bubble induced by cheap money policies and low interest rates. Too much cheap money flowing into risky investments (rentals and RE flippings) because there are no safer alternatives.

The increase in the number of rental properties as a result of this, doesn’t seem to be helping renters. Rents have to be hiked to make the overpriced property a worthwhile investment.

The effect on poor and moderate- income renters and potential homebuyers alike is devastating. In this city, apartments that languished at $850 a month two years ago, now easily fetch $1100 a month, while first time homebuyers are chasing a shrinking supply of reasonable condos and affordable SF houses. And another class of bubble victims has been created- condo owners who don’t wish to sell their units because A) they bought low and the price their units will sell for in a de-conversion will not be enough to replace it elsewhere, or b) they bought their units at bubble prices in the 00s and have no trouble paying for them & want to stay in them, but will be forced by the deconversion to take a massive hit when they sell their units.

Part of the reason for rent increases in general not just in CA is the cost of maintenance and property tax increases.

Most cities in US raised the property taxes to reflect higher assessed values.

Many people on this blog already mentioned how nice it is to rent when something breaks – just pick up the phone and call the property manager. That property manager has to pay more for plumbers today than 10 years ago; same for painters, HVAC guys or electricians. In turn those trades pay more for their materials.

It is not like the landlords make more money. Their cost went up significantly. The insurance companies ask more for the same insurance policy because they know that replacement cost for RE is way higher today than ten years ago.

I am sure that renters don’t spend too much time to think about all these additional costs going up for landlords.

As some people pointed out, this mania is hurting the buy side as well as the sell side. It has been evident that organic buyers couldn’t compete against investors flush with cheaply borrowed money. Current owners are hesitant to sell because of the exorbitant move up costs. Both contribute to the supposed “supply” problem that the real estate industry likes to tout. Of course, they never mention the shadow inventory and the severe lack of qualified buyers that discourages builders from catering to low-cost market.

The efforts of the government and Fed have mostly succeeded in shifting risk from the TBTF institutions to private investors and the taxpayers. Nobody will be crying over private investors. But Freddie and Fanny’s exponentially risky balance sheet will prove to be a huge issue for the next administration.

I travel all over the US and there are plenty of places that working people are priced out of. Aspen, Beacon Hill, South Beach, Cobble Hill. High prices are a signal that you can not afford it and should move. If you choose to stay in a city where the rent makes you uncomfortable, it is on you. Move to one of the dozen cities where rent is affordable

There’s a bit of a difference between small, wealthy communities being high priced and the entire SoCal area being high priced. It’s not sustainable.

Pretty much the same way response I give to those who try to rationalize the “gentrification” of their own personal neck of the woods.

Welcome to the new American dream! Hopefully millenials and to be retirees can afford their 600sqf condo. And remember this is all by design! Or call it a gift from your idiot government leaders!

We left CA. as many of you know, but I can say other states in our many travels are getting downright crazy with prices, traffic, taxes etc. No utopia exists gang, our friends daughter and husband bought a home in Denver suburb.

Lets explore this great buy(?). 3200 sq. ft. very nice, brand new very nice, 3 car garage, very nice, all new development very nice, some brick okay.

Now the bad news

$849k

8,000 ft. lot

7200 taxes

225 HOA

major interstate 1 mile

NHRA drag track I mile

limited shopping

This couple moved from CA. (Irvine) had a 2900 ft. house, 7,700 ft. lot, house taxes 8,000, HOA $245, no race track in the back yard.

They gave up great weather, great landscaping for what, about the same traffic and a little lower price nothing else what was the get, you tell me???

Robert, I was recently in Denver on a business trip. I too was amazed how hot the RE market was there. Run of the mill old ranch style houses were going for 400 to 500K. A mortgage for one of these houses would be less than $2000/month thanks to super low rates courtesy of the Fed. I think people are finally waking up to the reality that low rates are here to stay and the rent vs. buy equation makes owning an attractive option.

As others have posted, LA is a landlord’s paradise and a nightmare for renters. How much more can renters be squeezed?

Being a landlord is no paradise. Do you imagine that landlords are immune to COL increases?

Property taxes, parcel taxes, liability and property insurance, the rising cost of maintenance and repairs, employee salaries and benefits, utilities (electricity, gas, oil, and water — the latter is getting especially pricey in SoCal), and of course, attorney fees to evict non-paying tenants (who, unlike landlords, often receive pro bono legal assistance). All of this must be passed on to tenants, directly or indirectly, or the landlord goes bankrupt.

“people are finally waking up to the reality that low rates are here to stay”

that right there leads me to believe that rate can only go up from here.

negative rates prove that the Fed has lost control……IMHO

That Fed has not lost control, the Fed is in TOTAL control. Until proven otherwise, those are the facts. Negative interest rates mean home prices go higher from here.

I don’t agree with what’s going on in the financial world, but I (along with everybody on this blog) am just along for the ride. Why do people continually try to swim against a tide that is just simply too powerful. Figure out what is going on and profit from it. This is not rocket science.

Maybe those people run away from “multiculturalism”, liberalism and “progressives”???!!!!…Or maybe they run away from high income taxes and high sales taxes????!!!!…. Or a combination of more reasons than one.

For some climate is everything. For others their priorities are different.

“Why do people continually try to swim against a tide that is just simply too powerful. Figure out what is going on and profit from it. This is not rocket science.”

You can understand what’s gong on at the moment, but that can all change as has been demonstrated in the last housing bubble. I’m sure, therefore, that you can understand the reluctance of many people to jump into housing at the moment.

Colorado is a state that legalized Mary Jane. But nothing is as good as that produced in our own Emerald Triangle. May be that is why the Colorado home prices are so high because they have legalized Mary Jane. Don’t sell Colorado short.

I don’t think that drug legalization is the reason. WA state legalized that more than a year ago and the prices did not jump that much. The little increase would have happened with or without the legalization due to number of well paying jobs.

You left out the current price that house in cali would cost; THATS what makes the cali house the loser in this comparison.

I’ve lived near Denver for over 20 years. There’s a great theater district with Off-Broadway plays, many good restaurants, great concert venues (Red Rocks). It doesn’t have the ocean like CA, Seattle, Portland, but has thousands of square miles of real National Forest (Not like S.CA which is more desert). Lately, the population growth and increase in home prices has been due to companies moving here. The climate is very similar to S.CA. Mostly dry but 20 degrees cooler year round (Hence a little snow that typically melts off the next day). It is even 60 or even 70 a few days in January but mostly in the 50’s and dry. Summers are rarely in the 90’s.

Much like SO CAL weather??? Denver avg 60 inches of snow a year, Denver has many damaging hail storms every year, Denver avg 10 days below zero, Denver has strong micro burst winds very scary, Denver is 5,000 ft the sun is intense in the summer so 85 degrees there feels like 100. That is the facts, that is why we left, nothing even remotely like SoCal, BTW check out today March 23, there is 10 to 15 inches of snow in the Denver metro today, what is it like in in Orange County today?

Probably true about Denver. Orange County is a little older age wise according to the census folks die out in a decade it might help some pricing,

I don’t see prices going down any time soon. In fact as the weather gets warmer I see higher prices then last year and more competition on decent properties from both owner-occupiers and investors.

Case in point, even a major gas leak with media coverage won’t slow down house-horny buyers:

http://la.curbed.com/2016/3/19/11269668/porter-ranch-gas-leak-home-sales-prices

Like I said, the retail buyers and investors are the last buyers chasing prices up. A bubble does not pop until it has sucked in the last hold out investors.

The next housing crisis is here – http://www.businessinsider.com/housing-supply-crisis-is-looming-2016-3

Tolucatom,

That article is a good example about our MSM propaganda who took a bad news and twisted to make it seem good. They turned something depressing into something to give hope.

That hope that millenials will save the day is just empty hope. Over 60% of children these days are born to single moms who can not afford any house anywhere. Those married who delayed having children most likely will not have children even if they wanted. For that reason, I don’t see the millenials supporting the demand for homes.

Agreed, Flyover

In Texas we are now seeing our corrupt property tax system absorb any of the remaining appreciation potential for area homes. Particularly here in the Houston area, local appraisal districts have juiced assessed (taxable) values beyond actual market values in many cases. The odds are pretty good that local CADs will make the problem even worse in 2016, raising assessments when actual market values are declining.

If you are looking at new home construction…Caveat Emptor! Many of the newer communities in the Houston area have property tax rates approaching 3.6 or 3.7 percent. It’s absolutely insane looking at some of the recent assessments on rather modest homes. Now that some of the people in the energy sector are being excised for profits, we have more homes hitting the market in the $300,000 and higher price ranges. $300K for a modest home sounds affordable until you realize the annual property tax bill on this cookie-cutter home can run you $12,000!

The good news for renters is that we are now way overbuilt with multi-family in the Houston area. You don’t have to drive far to find a new development that’s only 50 percent occupied, and we have more projects in the pipeline that haven’t even opened yet!

so the property tax is 3% above the prop 13 Cal rate of 1%, but you get 2 or 3 times the house, so it is chicken feed. It is deductible on your federal and state income tax returns. WAIT, there is not any outrageous state income tax like in California. Feel better now.

Taxes aside, how about running the old A/C 24/7 for three months of summer? How do you like all the little friendly bugs in the humid summer in Houston?

I’ve said it 1000 times before and I’ll say it again: the property tax is one of the most destructive and regressive forms of taxation there is, and should not exist. I say ‘regressive’ in that these taxes hit poorer people far harder than the better-off, and you don’t escape them by renting, especially in large apt buildings that are taxed at commercial rates.

If there must be a property tax, it should at least be only on the land, and should never tax improvements on your property. In most places, any improvement you have to pull a permit for, which is nearly everything from rebuilding your building’s porches to doing a roof tear-off and replacement to replacing a dead furnace, results in a tax hike. As a result, less affluent neighborhoods tend to deteriorate as needed work is not done on buildings for fear of a steep tax increase.

Unfortunately, efforts to limit these taxes, like CA’s Jarvis Amendment, usually have unintended disastrous consequences because they do nothing to limit government expansion and spending.

-Your mortgage should only eat one-third of you net income per month

-Anticipating any changes? If you have a child, is daycare going to be an impact? In many crap shack areas daycare can run up to $1,500 a month (or more)

-Planning to stay for 10 years? Then you would likely ride out any bumps in the rode

-Do you have at least 10 percent down (ideally 20 percent down)? Don’t buy without an emergency fund in place

my X did every single one of those, bought a $415K house (i literally begged her not to, but i was the nutcase and her realtor was not) in 2005 with $85K down, just sold in 2016 for $385K

THAT is how California real-estate really works, it’s all about, timing timing and the most important thing of all, timing.

if the average home price in CA will follows the same trend of the last 40 years then that puts it at about $15,000,000 by 2050…..yeah, that’ll work

The problem, of course, is mass unchecked immigration and the “growth is good” mentality.

How many third world countries can we fit into LA county?

We’re about to find out.

If you listen to main stream media and the establishment, TRUMP is racist for speaking against unrestrained illegal immigration. I don’t like him but that doesn’t mean he is not right in what he says

Good thing that “Sierra Club” who supports all politicians who are pro illegal immigration don’t say a word against immigration. They do speak out loud against population growth but don’t say a word against immigration. Translation – the local population (US citizens) should not have any more children so we can bring all the population from third world countries to LA area. What they want is a replacement of population/demographics. Therefore, the US citizens should be taxed to death to provide everything for the new illegals. If they have to work 2 jobs and the government keep printing money, they are not going to afford anything where they can raise a family in safety. They will never be able to live on one income so the wife can afford to have children and be able to raise them.

It is all by design.

Home sales are way done, affordability and low inventory are becoming huge problems.

http://www.cnbc.com/2016/03/21/national-association-of-realtors-reports-existing-home-sales-for-february-2016.html

Should be interesting to see what the spring and summer brings for real estate.

did a zillow search showing just foreclosures and the dreaded pre-foreclosures….not sure if this map link will work.

http://www.zillow.com/homes/for_sale/fore_lt/pmf,pf_pt/550000-600000_price/1977-2157_mp/any_days/globalrelevanceex_sort/33.993046,-117.656879,33.645635,-118.322926_rect/11_zm/

413 properties. Is that normal?

From my experience, Zillow’s foreclosure information is far from accurate.

I’m one of those millenials living at home with parents right now. While it’s not my preferred setting, I get to save a lot of money and it beats having a bunch of roommates or living in a crowded renter’s ghetto. I’ve been at home for 6 months now and hope to be out within the year, but looking at some of the going rates for a 1 bedroom is truly disillusioning. I have calculated that it would take at least $5,000 for me to move out and get my own apartment. That’s just to get in the door.

Also, it seems like my only options are either a luxury apartment in a new building or a dilapidated, at-your-own-risk tenement in an “up and coming” area. There doesn’t seem to be an in-between for a middle-class guy such as myself.

USA as whole of income not nearly keeping up with just general cost of living let alone home prices and car MSRP’s. everybody from restaurants to the house painter feels the pinch and keeps passing along the cost they have no choice, nobody is doing that well in this nation excerpt for the .9%

The lunch for two, $50 if you want to sit at a decent place in a big city, if you want two beef sandwiches, fries, two cokes or Pepsi and sit at a wood bench or counter with no service figure over $20 plus tax.

We won’t talk about dinner, it breaks the bank for a family of four, oh well just pull out those four credit cards you have and charge away at 25% interest?

Don’t know if many of you read about the auto loan crisis ( repo on the rise), lease cars are being bought like 04′- 06′ house prices, little or no credit check just drive a away and wait for the tow company in a year when you can’t afford $600 a month any more.

I have, it has almost all the makings of the previous housing bubble. Easy terms, 7 year car notes, and high relative to income prices. It’s a used car sellers market right now too. I hope it doesn’t happen but if a recession and the associated job losses happen, the repo man is going to be real busy.

People are too quick to change cars. Not because they need a new car, but because they want the latest.

In 1992 I bought a Mustang for cash. I drove that same Mustang for 14 years. Kept it tuned up, repaired, and in good condition all that time.

I would have driven it for another 14 years — it was a great car — but it was totaled on the 10 freeway. So I was forced to buy a new car.

I bought a Jeep Wrangler in 2006, for cash. I still own and drive that Jeep. I might keep it for another 10 or even 20 years.

I am a baby boomer (56 yrs) who inherited some of my depression-era parents attitudes about money.(they were both young children during the depression). Last time I purchased a car was not that long ago, in 2008 I bought a 2003 Toyota Matrix for $6K, It is due for a paint job, other than that it has been the lowest-cost-per-mile of any car I have ever owned. I plan to drive it another few years.

I dont buy anything I cant pay for with cash, with the exception of my home (30yr fixed) and even there I made sure to purchase a home in 2012 where my PITI would be under 40% of my income, not including the wife’s income.

The wife and I have talked about moving to Texas but we stay in LA because we are from here and we have family all over Southern Ca.

I went to school in LA but I have worked in SC and Texas, so I can grow to like it. Wife has similar experiences while working in NY and went to that famous school in Boston and has a law degree. Based on our resumes/experience, I am fairly certain at least one of us could get a job in Texas to carry the load but again at what price? We value family and our son loves his grandmas… For now we rent and maybe in 2/3 years we will have the courage to move to Texas or FL if we haven’t bought by then.

You say you lived in Texas, how did you handle the humidity. Did your AC go 24/7 during the summer(how are the electric bills)? How about all the insects in a hot and humid climate?

I was there for about 7 months, setting up an IT dept. Lived in extended housing. I wasn’t home a lot but yes I did run the AC a lot. The bills were paid by the employer so I couldn’t tell you how much the electric bill was. Back then the monthly rent was not even $550 in about 2006.

I got used to the climate, maybe it has been too long but I don’t remember it being that bad.

To clarify, I meant extended stay/temp housing. I believe extending housing is for mental patients.

A lot of Californian’s make all sorts of excuses to stay put, and become poor in the process. If you can’t afford the place, move! Quit making excuses! I moved from California to Colorado years ago and made out quite well. I just got back from visiting my Son, who is working on a project in Omaha … there is a lot to like! Sure, it isn’t 75 degrees every day, it snows! But, you only have yourself to blame if after so many years, you can’t get ahead … all your income goes to rent, gas, etc! MOVE!

Just an idea, have you looked at another cities in California? There are cheaper cities that need lawyers too ))

Los Angeles is a cluster f*ck of illegal immigrants. While Southern California enjoys good weather, the sunshine tax is not sustainable by ghetto wages. “Landlords” are capitalizing on the masses of illegal immigrants shacking up together and charging high rents in relation to wages. Quality of life? High traffic, lots of smog, long commute times, Union Pacific Railroad buying both sides of the isle when it comes to getting underpasses “fast tracked”, leasing rail lines to Metro, getting public funding to socialize the loses and privatize the profits, while recking real estate desireability, corruption at all levels as politicians race to sell out to every lobbiyist within earshot, whites being pushed out, out breeded by the sanctuary city of Los Angeles subsidized welfare Mexican population determined to overbreed anchor babies from Mexico who have no problem not listing the father, living together on the system for 18 years, having 8 kids from various affairs to collect that welfare check. Reality check folks, this is not sustainable. The last major earthquake in California was 20 years ago and last I checked good luck getting earthquake insurance for that Mexican clusterf*ck santuary city. I live here, I’ve seen this all my life. Im not a racist Im well traveled, but I know a sanctioned invasion when I see one. Mexico is a failed country that has affected the California real estate market and will continue to do so.

You’re clearly not happy in California, and I really think it would be in everyone’s best interests if you move to another state, but one with fewer social services and more of the right kind of people. I spent a few years in the Midwest, and when I rode my bicycle in some areas people would yell “get the fsck out of this neighborhood, wetback!” It dodging seem like the place for me, but maybe they’d make you feel real welcome.

Berwyn and Cicero in Illinois stand out in my memory, but you’d find your kind of people in most other areas nearby.

Suburbs like Berwyn and Cicero are, if not the pits, still no place for a civilized person.

You should have been at the north end of town, instead. But the rents and prices are a little higher, though not insane.

Oh look even the news paper agrees, it must be true. I guess it really is a Mexican invasion of California, oh no, MEXICANS CAN NO LONGER PLAY THE RACE CARD. AWWWW yeah.

http://www.latimes.com/local/california/la-me-census-latinos-20150708-story.html

If you so attached to Mexico, leave and take your reverse discrimination with you.

Not just Chinese, wealthy Mexican non-residents buying US property…

http://www.forbes.com/sites/doliaestevez/2016/03/22/despite-weak-currency-wealthy-mexicans-are-spending-more-on-u-s-real-estate/#3c54b3f0bc34

I think we’re seeing the acceptance phase – people throw in the towel and feel this bubble will go on forever, which means its probably already in the early stages of popping. I don’t see any particular event to crash everything but sometimes a bubble bursts because it runs out of fools – you need an ever growing number willing to step up and eventually even the foolish push back from the table and say no thanks.

Another thing I see is how people are talking up where they live as the greatest place EVER! Folks, you need to get out and travel. Every place has positives and negatives, and different places suit different people. Go just about anywhere and the people there live in a mental framework that argues for that place being the best place to live – its how we convince ourselves to put up with the negatives of living there. You see me talk up where I live? HEEEELLL NO! I don’t want you chumps in my neck of the woods, I know I’ve got it good (for what I like to do) and those who do keep their damn mouths shut! Its like those guys selling ways to get rich in stocks or real estate or currencies, if it was such a money maker, they’d shut up and just make money. Really, travel and do a comparison – the amounts of money people are paying for housing and the taxes on those places blows my mind. The point of life is to try and enjoy it as much as possible, not spend all your time toiling for a stucco shell!

Will the bubble go on forever? It will go on as long as the central banks and politicians are able to keep the bubble going with monetary policy. Hard to bet against them … it is like fighting city hall. That should piss everyone off, but that is the way the system works. Life is too short to fight them. Sooner or later, prices will drop, and everyone will be surprised, but banks decide to stop making loans without a huge down payment once prices drop, so it becomes even more difficult to get in. It is an impossible situation. Just get in when you are able to secure a good enough property. If you are unable to get a good enough property, I would move. At some point, it is not worth it.

Just, say it, “buy now or be priced out forever”. Easy down payment policies are originating mostly from the government, not from the banks. That coupled with lower prices would not lead to the impossible situation that you portray.

If prices drop were to drop despite near zero interest rate, then central bankers would truly have lost control of the situation.

@junior_bastiat wrote: “…I think we’re seeing the acceptance phase – people throw in the towel and feel this bubble will go on forever, which means its probably already in the early stages of popping…”

You got that right. Acceptance (capitulation) is the final stage. I believe the Kübler-Ross model of emotional states for dying applies equally well to home prices, stocks, mutual funds, oil, or any other investment bubble. We are at the acceptance phase of high home prices. Which means the end is nigh.

When I pull up the February 2016 SoCal sales figures from Corelogic: http://www.corelogic.com/solutions/configurable-real-estate-data-reports.aspx/

there’s a number of flat or negative year-over-year home price changes that would have been unthinkable a year ago.

Housing, while magnified in places like California, isn’t the real problem lurking out there! The real problem that will ‘kill the house of cards’ is household finances, as well as unfunded liabilities, especially in places like California! Several studies recently have touted the fact that roughly a 1/3 of the population have a $1,000 or less in savings … not enough for a car repair! Looking at the breakdown further, about 1/2 of America couldn’t pay cash for a car, and about 2/3 of American’s couldn’t come up with a decent downpayment for a home even in a lower-priced mid-west community, let alone ever hope to own anything in a place like California. Further, sky-high real estate prices are keeping government alive in California … if valuations drop, and home are reassessed downwards, you will see a scramble, much like 2008/09, as governments and pension funds go broke fast, and the infrastructure in cities and the State begin to crumble at a faster rate! Housing is just a symptom of larger issues!

Is it just me or is there a really high amount of foreclosure and preforeclosure listings in Irvine? I haven’t been watching the trend so I don’t know if this is business as usual but it looks like 30% of all listings are in those status.

I think these are the new norms for awhile. At least until the feds raise interest rates a significant amount. Once average 30 year conventional mortgage rates hit 5%+, housing appreciation will slow dramatically and maybe even a correction. But anyone getting a new mortgage at that point will just get less house for the same money. As long as money is cheap the music will keep playing and the dance goes on.

PALO ALTO: $250K Per Year Salary Could Qualify For Subsidized Housing

http://sanfrancisco.cbslocal.com/2016/03/22/250k-per-year-salary-could-qualify-for-subsidized-housing-under-new-palo-alto-plan/

Leave a Reply