Los Angeles is the Whole Foods of Rental Markets:Â Renter households spend nearly 50 percent of their income on rent.

The rental apocalypse continues in Los Angeles. It is interesting to see how far some house humpers will go trying to justify prices. Some are arguing future weed sales are going to create another boom which is somewhat ironic since the benefits are actually to mellow you out, not turn you into a Taco Tuesday baby boomer that becomes a cubicle stressed slave just to purchase a home. And many times people plan on having a family shortly after which means higher childcare costs which they tend to forget. However, Los Angeles once again continues to be the worst place to rent in terms of affordability (and own for that matter). Zillow put out some interesting research and of course as you would expect, those spending nearly half of their income on rent are simply not saving for retirement.

L.A. is the Whole Foods of rental markets

I liken the L.A. housing market to Whole Foods. Great and healthy items that usually break the bank. L.A. has a large number of young and healthy hipsters and Millennials but most can’t buy a home. Heck, most Uber and Lyft drivers have nicer cars than most of us. So we live in this market where the perception is that everyone is well off and healthy when in reality many homeowners are stuck in a ridiculous commute for a crap shack and that is bad for your health.

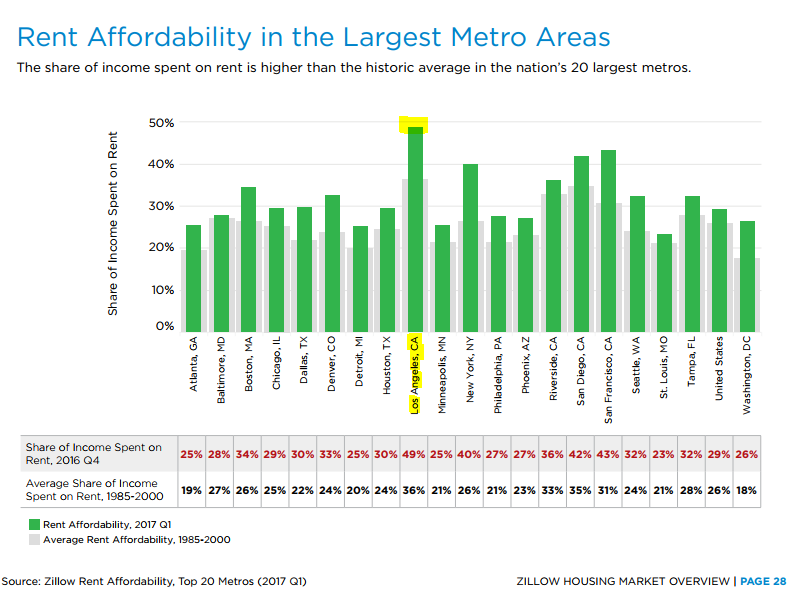

Of course this isn’t some made up figure. Just take a look at how much income is dumped on rent in various markets:

Los Angeles by far is the worst market for renters surpassing even New York and San Francisco. I’ve made this argument multiple times and that has to do with incomes being far lower in this area compared to San Francisco and New York. Of course to house humpers they only see coastal Santa Monica and somehow use this as the reference for every other hood in the area where most of the plebs live. They forget that L.A. County has 10,000,000 people with most not living on the coast.

So it is also telling that L.A. is largely a renting household dominated county. You have millions of Millennials across the state living at home with their parents because rents are too expensive. There is also this romantic idea that many people are stashing millions of dollars away by doing this but the stats show a different story. Some are, but most are not.

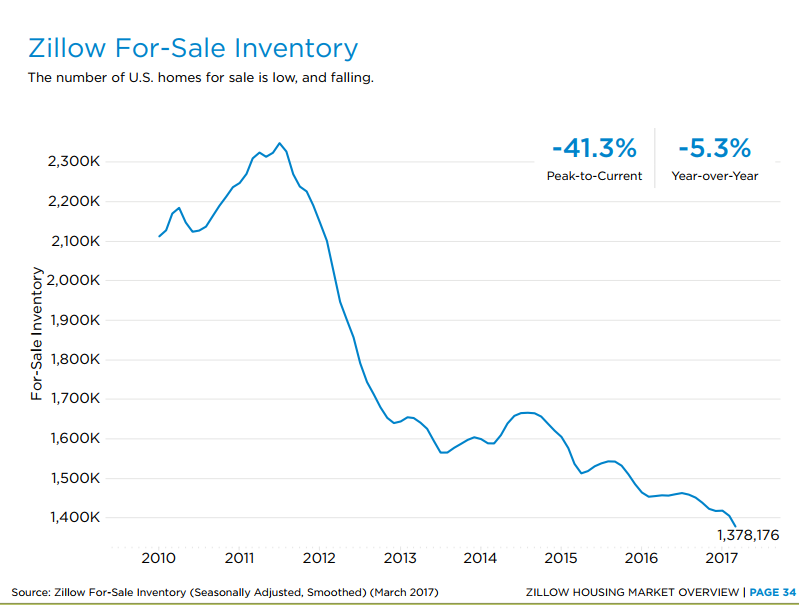

What you have is Taco Tuesday baby boomers now stuck in granite countertop HGTV upgraded sarcophagi that they can’t leave for a variety of reasons including locked in Prop 13 tax assessments and adult children back in their nursery rooms. You also have the issue of low inventory that is plaguing the country:

The low inventory dilemma is not only a SoCal phenomenon but has also impacted most urban metro markets. This is why housing as an entire asset class has soared with the stock market since 2009. Unlike the stock market however, scarcity has been a large factor driving prices up in real estate.

The issue of rents is problematic however. As the percentage of households that rent grows, you are going to get those in the middle being squeezed. What do renter households care if taxes get increased on property if they don’t own? Back in 1978 when Prop 13 passed you had a much larger percentage of California homeowners. Today that is clearly not the case. “Well we’ll just increase the rent and pass it on!â€Â Do you think people think like this? Of course not! Just take a look at New York City where only 31 percent of households own. And look at how they tax people there. That is the future. Where only the uber elite will be comfortable in their homes. Grandfathered in Taco Tuesday baby boomer homeowners will live in million dollar crap shacks and shop at the 99 Cents Store.

The idea that broke Millennials were going to buy in mass in Los Angeles never made sense. Many would rather eat out, work out, and live a more Spartan life (many by necessity). Ironically more are healthier than those pot belly cubicle dwellers that are stuck in obscene traffic everyday having to make that massive 30-year mortgage commitment. But hey, we do live in the Whole Foods of housing markets.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

201 Responses to “Los Angeles is the Whole Foods of Rental Markets:Â Renter households spend nearly 50 percent of their income on rent.”

SoCalRules,

In the previous post you said the JT and I are trolls. I can not speak for JT, but while he is a RE cheerleader (a perma bull), I am not. So, troll for who? In the last 3 years I’ve been probably the biggest bear on this blog. Yes, we both made money in RE. However, I always made my money by buying low and selling high. In the last 3 years it was the best time to be a seller. The previous 3 years were good years to buy.

So, you attack both the bears and the bulls. What is your problem and what is your opinion? Do you want to buy? Go ahead. Your money, not mine.

I agree with JT, that long term, who you marry can be beneficial to your financial well being. I agree, that on a very long time frame, RE investing is good for those who have the money and can afford it. However, I do not agree with JT that RE is good to buy at any time.

When JT was bull on RE at the beginning of this year because Trump is president, I told everyone to cool off and let the euforia die down. He can not change anything by himself.

So, I still can not understand how you put JT and I in the same box. Unlike you, JT doesn’t attack people. He is just posting his opinions in a civilized way even if I disagree with him most of the time.

In JTs defense he doesn’t say it’s a good time to buy anytime, anywhere.

He is very specific to coastal nice communities that are under priced and have long term demand with very limited long term supply.

JT isn’t saying buy a McMansion in riverside for $700K.

I can almost understand the $250k income techie holding onto the L.A. Dream, or the Doctor with the growing practice, but seriously, if you aren’t living in an already paid for home, or were lucky enough to inherit Mom and Dad’s house and a gob of money, what are you thinking? I grew up near and on those south bay beaches … if you aren’t within 15 minutes of the beach, L.A., has nothing to offer! And having returned many times, even those beaches are full of homeless, sketchy people, or packed wall to wall on a sunny weekends … and I wouldn’t put my toe in that irradiated cesspool … Fukushima kind of took the fun out of that!

Disagree a bit Flyover. You don’t attack anyone but jt comes across as a total elitist prick.

Sorry about that. Perhaps when we get closer to the holidays, we could all meet for a quick drink at a centrally located watering hole. That would be fun.

I assume the post you’re talking about is:

“During the last crash, many banks would not lend on condos for less than 50% down, and many wouldn’t lend at all on complexes that were more than 50% non-owner-occupied.

So if you’re planning on buying a condo in the next downturn, better have lots of cash to put down plus a steady recession-proof income.

Most condos in close proximity to the beach went to all cash investors from 2008-12. 50% down wasn’t even close to being enough to get a piece of the action.

And before JT or Fly jumps in, let me just note that this was real world experience in north San Diego county, 2008-12.

Beware anyone posting here “with millions in the bank†and espousing Zerohedge propaganda, or advocating for building a time machine to buy beach property pre-2000. If it walks like a duck, sounds like a duck….. it’s a troll troll troll.”

From Wikipedia:

“In Internet slang, a troll (/ˈtroÊŠl/, /ˈtrÉ’l/) is a person who sows discord on the Internet by starting arguments or upsetting people, by posting inflammatory,[1] extraneous, or off-topic messages in an online community (such as a newsgroup, forum, chat room, or blog) with the intent of provoking readers into an emotional response[2] or of otherwise disrupting normal, on-topic discussion,[3] often for the troll’s amusement.”

By this definition, neither you nor JT are trolls. Political economics is inextricably woven into any discussion of the Real Estate Bubble. One may have been for Trump or Clinton or against both, and have opinions on the origins, life and potential demise of the housing bubble. Not all Trumpist are Zero Hedge folks. Look at all the Goldman Sachs alums in his corner. There are many leftists who rail against investment banks, and they aren’t necessarily Zero Hedge readers. SoCalRules is out of line here and spoiled a pretty good post by adding the troll comments to what I thought was a good take on buying condos in desirable locations during the crash. I’m not even sure if you would disagree with SoCal’s “cash rules” premise.

And no one here believes in time machines!

I’m retired and travel a lot, so it’s too late for me to own rental properties. However, back in the Eighties I did well in real estate, both owning income properties and being a Realtor.

Real estate is unique in that it is most often bought with leverage. You can buy a property with 20% down and the tenants will pay the PITI, repairs, and maintenance. As rents go up over the years, so does you cash flow. You get a hefty writeoff for depreciation as if the property is declining in value when it is actually gaining in value every year.

Example of the advantage of leverage. If you buy a multi for $100,000 cash (just an example) and it goes up 10% in value you made roughly 10% on your investment (ignoring cash flow). If you put 20% ($20,000) down, you made 50% ROI. It’s easy to get that ROI year after year with rental properties. The building can be used as an ATM easily. Get a second mortgage, HELOC, or a cash out refi. Use this cash to buy another property. Do this a couple of times and you will be set for retirement.

I got lucky with my retirement home here in China. We bought a new home in a high rise in a gated community on the edge of the city sight unseen just because it was near friends and family. It turned out that the area is becoming the new financial district for the city. All these people with high paying jobs are moving into the area and driving up prices. Also, the school one block away has such a good reputation that people are knocking each other down to live in the school district. Our modest $120,000 home is now worth $375,000. Sometimes luck is important.

What?!, that guy from Seattle, Lord B, Blert, Apolitical Scientist, QE Abyss, surfaddict, Jim T, lovely Laura L from Chicago, Ernst B, countless Joes and Bobs and now Flyover and jt… this comments section has had a lot of loud voices over the years.

And yes, some have elevated themselves to troll level.. one of the most annoying being the persistent debate troll. Flyover and jt fit this category.

Flyover – pro-Trump, anti-Fed, I-got-mine, got millions yet still post here multiple times per day

jt – I-got-mine, buy competitively-priced well-located beach property and you can’t lose, ever

Try challenging either on any of those points and see what happens.

Contrary to some recent posts, the Doc did used to participate in the comments. A long time ago.

Personally I look forward to every post by jt. He’s a realist. Having said that, times have certainly changed since he made his first dive in the ocean and with real estate the only remaining tangible product the US has to offer buying is definitely a more speculative game that the one he got into.

No, Los Angeles is Trader Joes. Shitty tiny parking lot, cramped store, private label stuff that can be good but has overrated cachet due to false narrative of healthy/whatever but when you look at the label it’s just as full of junk ingredients as the popular brands. Trying to get out of the place involves pain in the ass long lines. Full of douchebag disposable bag carrying crowd.

Orange County is Whole Foods.

Orange County is more Costco than Whole Foods.

“Trying to get out of the place involves pain in the ass long lines.”

I do all my shopping at Trader Joe’s as early as 8:30 in the morning. Only a few people inside shopping and the parking lot is still empty. Just don’t do your shopping after 10:00, that’s when the store starts filling up and parking becomes problematic.

Much of Los Angeles is more of a Northgate Gonzalez Market where the parking lot is full of litter, most groceries are purchased with EBT cards, most of the customers are from somewhere else speaking Spanglish, and the building is run down with walls covered with graffiti.

You forgot to mention that theyre all morbidly obese (even the kids) and have sub-85 IQs. I could go on about how they smell (like ammonia, not sure why) but you get the picture.

People that cannot afford to buy in Los Angeles should leave. A house purchase is simply too important a way to build personal wealth to miss out on.

Is it fair? No. It just is what it is.

I agree with what you are saying. Five or more years ago, that was great advice. Lately, a new issue has arisen. If you are young and have your career ahead of you, only a handful of cities offer good job prospects. My guess is only about 10ish metro areas offer great job opportunities. And, it seems that all of these areas are seeing rocking prices. For example, Boston and Seattle are seeing a real estate frenzy. Thanks to the central bank money printers, it is tough to get in on a great property located in an area offering great job prospects.

You might be surprised what jobs are out there. I’ve been laid off 3 times since 2009 and every time I eventually found a decent job again in a community of about 50,000. Every time I thought there was nothing else out here for me, but it didn’t matter because even though I have a Master’s degree I still hold a Class A CDL from 20 years ago that would pay my bills if it needed to come to that. So far it has not come to that.

Last time I got laid off was December ’16. Got another job in May including a 20% raise! For 3 months I was sure I’d have to start driving again. Rental studio on property pays most of the mortgage, I have no complaints… if I had stayed in California I would be screwed! This is not bragging, I lost everything in the last bust.

goudey, if Trump has his way and changes or knocks off some of those free trade agreements, jobs could get so much better in the middle of the country … that could trigger a flood of people out of the high priced coastal areas to the middle of the country. Personally, it would be great to see the middle of the country catch a break. The only problem is Trump has yet to take much action on his free trade agreement promises made during the campaign.

jt, depends on the job and family situation. Like the doc said, most people in LA area make peanuts comparative with the cost of living. It goes the same for most of the large cities with high cost of living. That is the reality for the vast percentage of people in the big cities.

Yes, there are exceptions. For those I say stay as long as you can. I have a young relative in Seattle area educated and with a very specialized skill and he can not move anywhere without losing his very high income. He makes around $250,000/yr and his wife around $50,000. He wanted to live close to work without breaking the bank so he put 25% down on a $450,000 condo. Very soon he will have it all paid off. He did not buy it as an investment but to have a roof over his head without anyone to kick him out. His investment is his career. With his income and no children, the decision to stay was a no brainer. Later on, if he wants to have children, he will most likely semi retire in a lower cost of living and buy a larger house. He doesn’t want to be a slave on a 2 mil plus house just to be in a decent area in a decent house.

For me, as an investor, I would not have bought that condo. However, he did not buy it as an investment, and he was still very conservative with no chance of losing it.

Unless you are dying to work for a very specific company or are tied to a very region specific market, like biotech and California, many professionals have decent opportunities in many cities.

Personally growing up in San Diego and now working in software and starting to raise a family this market is tough on a single earner family, even if the single earner is doing well. The biggest thing tying me to San Diego, aside from my affinity for my hometown, is not jobs per say. Its family. My parents and siblings live here, by wife siblings and soon her parents will live here.

Even still my stance has been, I will stick it out and save as long as our living arrangements are amicable. But if I am here and rent gets tight, I can’t save money and buying is still bad, I am job hunting in other cities.

If that happened housing prices and rents would collapse!

Or once Trump gets in full gear… the illegals will be driven out …. then there will be room again.

If your timing is right, it’s a great and easy to build wealth. If you buy at the peak, you have to ride your bad investment to the bottom and back, sometimes ten years with negative interest rate. People like you are like the people who won at the casino. They walk out the front door surrounded by happy people. The gamblers who lost quietly sneak out the side door without fanfare.

There are millions and millions of people who lost there homes in foreclosure who will disagree with you. Also, there are millions more who owe more to the bank than they can sell for. They can’t move to a different area to advance their career or for any reason.

Planning on residential home ownership for wealth building is gambling.

Thing is you do not know if you are buying the top or not. There is always the possibility you are and you will not know for a few years. When you buy, you have to assume you might be making a mistake and buying the top … so, you pick your property carefully then work the numbers to make sure you can hang on. Nothing worse than losing your capital. That is called risk management.

Remember, back in 2013, prices were rising rapidly and many were saying too late to buy because it was the top. That was a bad call.

roddy6667,

spot on. In California it’s all about timing timing timing.

I bought in 1991……the “value” dropped almost 40% and I was upside down for 10 years. I got back to “zero” in 2001……by 2005 the “value” tripled. After the divorce and home sale the X bought in 2005….(i begged her not to buy but I was the lone nutcase AND as we know interest rates will never be this low again, renting is throwing your money away, they can’t build more land bla bla bla bla!!!) we know what happened next…same thing as 1991 so she sold that house for $30,000 less than she paid for it in 2016.

She sold to to another one of these “investors” and I see them everywhere, taking out retirement cash or a 2nd to be the next RE millionaire…..like they see on TV or the internet.

If the government every stops putting a floor in RE we could all see what it’s really worth. But fat chance of that ever happening. The thing is, why isn’t my job that important as RE is? I was actually told that my job being exported to China was a “good thing” and i should go get a better higher paying job. BUT WHERE THE FUCK IS THE LOGIC IN THAT? My job was a well paying good job and the reason it was exported to China was BECAUSE IT WAS WELL PAYING.

sometimes I feel like I live in opposite world……the opposite of what “should” be is what is

Roddy and Interesting, i agree with all you said….spot on…Its all about timing. I bet most people here know this too but would not admit it out of financial interest or selfishness.

I also liked the comment about “feeling you live in a opposite world”. With Realtards, lenders, banksters, many employers, our clown-president and many more examples you will find that the opposite of what these jokers are saying is actually happening or true. We have way too many bullshitters in this country. Would be nice to find a way to get rid of these insects.

I don’t know. I am a California native and so are all of my close friends. By our 20s and 30s, we all seemed clued in on how skewed California life was but no one moved. No one is making plans to move. Some of us moved away temporarily for grad schools or job training but almost everyone moved back. This entropy includes wealthy and educated Google engineers and more working class mechanics so it really seems to cut across class lines.

Moving to a new place and starting over from scratch is scary. People feel resentful at the idea that they “have” to move and are priced out of their hometowns. People get homesick and want to be near their aging parents, still living in those suburban homes priced over a million at this point. So they spend 50% of their income on rent and since everyone else around them is doing it, it starts to feel normal.

Meri, that is the predicament many people are in. If you truly plan on staying here and can “afford” housing, your best interest is to buy. Everybody’s definition of afford is different, only you can make that decision.

It is not difficult to move! This is an excuse borne out of some emotionally misguided rationale! For those who can really afford a place like L.A., fine! But for the majority, keep saying it is difficult to move and then ask yourself when you are 75 why you have no savings, no retirement, are a prisoner in your own house eating dog food, or still renting and can barely cover the monthly expenses, while at the same time all that state support you were counting on has also run out of money!

I sympathize. Not only is leaving the place where you grew up disruptive and unsettling, but you are losing many of the most important things in life: your family, and connections that often go back generations and that constitute your community.

I have often felt that the extreme mobility of Americans in the past 120 years or so, but especially since WW2, is the root cause of some of our most intractable social problems. Pundits and “experts” blame such factors as our high divorce rate and family disintegration for our appalling crime and violence, and for the destruction of our poorer classes, but I would submit that the frantic mobility of our citizens, that is often involuntary, and the resulting destruction of our settled communities, together are the root cause of most of our social ills: the disintegration of marriages and families, the destruction of our towns and cities, our horrendous crime and violence, increasing drug addiction, our students’ declining academic performance, and the all-round social malaise that seems to infect every community in the country- if these places can really even be called “communities”. After WW2, you can see the results of the increasing mobility, as small towns and old, settled city neighborhoods emptied out, people began to move very frequently and often to a different area with each move, and the rate of violent crime and most of all “senseless” killings ticked up drastically between 1950 and 1960. I was a little girl when the “Cold Blood” murders of the Clutter family in Kansas happened, and that was considered to be a watershed crime because of the utter lack of any motive or reason for this really vicious crime. When I read Capote’s book in 1966 as a teen, the thing that struck me the most was the rootlessness of the killers, unconnected to anything decent and wholesome, and the utter contrast between them and the great people they destroyed, who were so rooted in their local community and so integral to its workings and essential to its cohesion, that they are remembered with love and reverence by the people who lived near them and knew them, to this day. Since that time, it seems that we have evermore rootless people wandering from place to place, dropping families and old friends and associations along the way, and finally dropping their morals and humanity, if ever they even formed an idea of morality or humanity along their discombobulated way. Many of these people are not criminal low-lives, but are quite successful, but it is too often the kind of success that does more to destroy the local community and the lives of the people who live in it, than contribute to it. Worse, we now have an ethos that says that this is the proper way to live and conduct business, and that stability and community are for losers who are afraid to take risk and live in the world.

People need their communities and they need stability and a degree of certainty. They need the networks of people- immediate family, close relatives, distant cousins, friends, neighbors, and business associates- that provide that stability and that it takes decades and even many generations to build. I relocated by choice 30 years ago, leaving a community that was rapidly disintegrating, with many of my friends passing away at ridiculously early ages, and moving to a city less than 500 miles away because it had the urbanity, amenities, and stability of my old city, and so I wouldn’t be too far removed from what was left of my family. It is sad to consider that remaining members of my family, especially the youngsters, have scattered so far and wide, that it is unlikely that their children will ever even meet each other, let alone form the relationships that will succor them and help make them more civilized, responsible, and humane.

Thank you, Laura. No one is questioning the common sense practicality of living within their means. No one wants to be 75 and homeless because they felt emotionally “stuck” on a particular location. And no one really “deserves” a neighborhood based on some kind of birthright entitlement. No one is that fucking stupid, please.

But for ffs, it is not “easy” for many of us to pick up the entire family and start over in a completely new place where you are a stranger. And actually yes, there are significant cultural differences between regions in the USA that make migration VERY difficult. Taking these intangible differences seriously is not some moral weakness, proof of stupidity, millennial entitlement, or (when considering practicalities) even rational short sightedness. This is not about whining about “sunshine tax.” It is one major reason why families stay put for generations in one area. It is why Americans talk about putting down roots and building communities. It is why people hate renter-majority areas because there is an understanding that hyper-mobile groups do not invest in their neighborhoods in the same way. People tend to want to stay nearby the locations that encompass their entire history, social/family support, and career networks.

Anyway, I just come to DHB to vent. It is frustrating. The terms of successful living have changed so radically from my parents’ generation.

Laura, if American mobility were the problem the 1950’s would have been the generation of social and family decay. It was the hey day of suburbia and the baby boom and the babies had two parent families. California’s population doubled from 1950 to 1970 ( with little of that from foreign immigration) which was more than twice the growth rate since 1970! People moved here and built communities that were more cohesive than the multicultural, polyglot dysfunctional ones we have today.

What BS! The problems with society nowadays is the chasm and huge wealth divide. What do you think immigrants coming through Ellis Island did? They arrived sometimes all alone and built communities. The other problem is the cancer that is social media, Facebook etc. You wonder why there is no sense of community anymore? Because people don’t want to put forth the effort to build communities and TALK to their neighbors. Your thinking has some merit but it’s bigger than that.

Sangell, as one who was alive, though quite young, in the 50s and 60s, I can tell you that that was the era in which most of the major social ills of our era took root, and started to manifest as real problems by 1965:

-Divorce rates rose drastically between the early 50s and the late 60s, and by 1970, the divorce rate was 50%, about the rate it is now

-Violent crime rates took off from about 1960 onward, reaching the level they are at today and climbing far past that level in the gruesome 70s and 80s. There are fewer people left all the time who can remember when it was considered weird to lock your doors, and people here in Chicago would sleep on the beaches to get cool in summer. We didn’t start locking up in earnest until 1960.

-The disintegration of our cities and old towns began in the 50s, and was a direct result of the insanely destructive public policies of the 50s, which pretty much mandated the destruction of closely-knit poor neighborhoods (“slum clearance”), with the stated aim of steering middle and working class people to new auto suburbs, and warehousing the poor in high rise instant slums known as housing projects. Yet, when the results were in by 1965, nobody could figure out for the life of them how our cities had become so trashed.

-This was the era of the “company man”, when large corporations made a practice of transferring their mid-level employees every two or three years ago. The baleful effect of bi-yearly relocations to areas far from extended families and old community networks, on marriages, families, and communities cannot be exaggerated. You do not realize what a boon it is to have your mom around to help with your baby, or the trustworthy neighbor woman you’ve known for years and who went to school with your aunt to watch your house, or your dad to help introduce you to networks of business owners and managers, until you’re 800 miles away and know NObody. The men were tied to their companies and relied on them for their social support, while ignoring neighbors he was likely to leave in a couple of years anyway, while the wives started going to the therapists for the social support they were no longer getting from neighbors, friends, and relatives. Communities suffered as people with no long-term stake in the places voted down school funding, did not participate in the school’s PTO, or in civic organizations and activities, and in general stopped caring about the pl;

-The country became a place in which you were more likely to live among strangers than among people you knew, from families that went back generations in the place. More people grew up rootless and unconnected with any particular place or family.

I have no plans to move permanently out of my native So-Cal, but if someone is forced out, it isn’t as hard to make new friends and valuable connections as many make it out to be – especially if you have kids. In fact, with kids you’d have to work to avoid making friends – keeping your kids out of any conceivable activity and ignoring birthday party invitations. Seven years ago we moved an hour’s drive to a new city, and through schools, dance lessons, etc. there are a half dozen couples we hang out with on a regular basis. This feels more like home than the town I grew up in, and it’s certainly nicer. After another move (same city) to new construction in January, now that the development isn’t so much of a ghost town, there’s a multi-street block party planned for next month where I don’t doubt we’ll meet more. If you’re older and/or single, there are any number of other ways to meet like-minded people without needing to be a social butterfly.

All that said, in my opinion, close friends are more “family” than blood relatives, and certainly more important than saving a few bucks.

Laura, I agree with what you said. Mish below, confirms what I said before – the economic crisis is a byproduct of a moral crisis we have in this nation:

https://mishtalk.com/2017/07/17/another-reason-men-dont-work-imaginary-world-more-enjoyable-than-the-real-world/

Women are born, men are made.

Dang it, where’s the like button? Very well written. Yeah, real estate is crazy here in Socal but otherwise it’s only a little pricier than average. Americans moved in huge numbers in the mid-century, but did that ever make sense? What’s more important, friends and family or a big house? I’ll take friends and family, thanks.

Also, as mentioned upthread, for the most part opportunities exist only in larger and growing cities, and they mostly have high housing prices too. I grew up in a small Southern city and essentially all my friends from school moved away (including me). There just are no decent jobs. Housing is dirt-cheap there, often less than construction costs, but that’s because that’s about what it’s worth, since there’s no work.

John D, yes, moving is easier if you have a family.

One would think otherwise — that single folk have an easier time of moving. Yet ironically, having the “anchor” of a family, in some ways makes moving easier, because when you move, you bring your closest social circle with you.

But when you’re single, especially in your 50s, moving is harder. It is harder to meet new people when you’re older. I’ve considered moving to Seattle — I love the weather — but I don’t know anyone there. I’ve lived in Santa Monica for 30 years. I have many friends and acquaintances in SoCal.

Dear Laura,

Somewhere in the family pipeline my ancestors moved to the US from Germany. They wanted a better life for their children and childrens’ children etc.

They could have stayed in their close community and lived exactly how Laura wants them to. But if they did that they might have been killed by Nazis or worse they could have become Nazis.

People have to move, its part of our human nature. Why was Columbus etc. so interested in America? If we all lived the Laura way the earth would still be flat. You see where i am getting at?

You’re sitting here complaining about things that are 100% out of your control and that is the reason i am calling you out.

All civilizations rise and fall, look at Rome. LA will have its day but in the meantime it’s pretty nice to live here.

-MBP

LOL It’s called GROWING UP! I lived in CO for 7 years, CA for 8 (OC) and now MN. I grew up in MO. The coast is for idiots unless you make gobs of money and can actually afford it. On paper CA is broke as a joke and it will only get worse. As a young person move to another state, build your own wealth and family. And in a few generations your great grandkids will be calling flyover country home! MN is a great state. Boo hoo…..the weather……it’s not really that bad. Look at Scandinavia! Smart people have left CA. I get the family thing but eventually parents die. Most elderly would do well moving out of CA as well.

Agreed. This whole idea that moving is tough and OMG what will I do without my friends?Uhm, I dunno, make new ones?

For those of you who are reluctant to move from your home town, ask yourselves this: if I could choose anywhere in the country (or the world for that matter) to live, would I choose where I am now? I’d bet the answer would be a resounding no for most people stuck in LA.

Agree, the “boo hoo, I can’t move argument” is a complete joke.

Either suck it up and live near your family in a small apartment with ever increasing rent…… or leave and buy a home you can afford in 99% of the USA. Hell you can move out 40 minutes and afford a home.

Do what is important to you. No generation ever had anything gifted to them. Back when housing was cheap in SoCal it was orange groves and cattle ranches. You can move to that now and buy a house if that is what you want. Nothing ever came easy. “Boo hoo I can’t move”… yeah try making your way through Ellis Island like your ancestors may have.

I know of some families that want their house empty of youth because they feel that once you finish high school you are on your own. Some I heard say they were given the door once that happened. Maybe this is mindset, maybe those families were brought up differently or maybe they were not family oriented? I never pushed the subject on them since maybe some things are not meant to be known.

@Flyover not sure who you would be trolling for thats pretty funny ,, buy low sell high is great if it happens for you ( seems to be working for you), (: ,, it happened for a friend of mine recently, sold his place for 10 times what he paid for it and split the state,, thank you weed boom is what he said as he left,,, all people can really do is open the door when opportunity knocks,,,I have been following the good Dr for many years now,and for some reason dont believe that you and Jt are in the same playground:)you champion good investment strategies, as Jt does real estate ,,,it is strange to see this particular market and I myself wonder if its ever going down ( I know it will but when?) or if it is possible for the fed to keep this rolling? currently on 50% loss of value, our homes would still be above water so we feel ok about our situation,,, part of retirement plan was couple of rentals not just one,, trying to find the next one is tough with this market,, thinking that building is better than buying, looking for a lot at moment ,,,,,oh yes 2 over 30 kids at home with us,,hmmm tacos anyone?

Beeman, If you had read comments written on this or similar sites in 2006, you would have posters wondering if prices could ever fall. Posters would have been complaining about missing the boat and commenting about bidding wars for homes. Then in 2007, the market turned on a dime. One day there were bidding wars, and the next day prices were dropping 1 to 2% per month. Patience was ultimately rewarded.

Both stock market bubble and the real estate bubble will pop together soon. What will kill them is the endless build up of debt. Even at low interest rates the debt burden will ultimately prove to be too much to carry.

Trust me. Eventually, the market will go down when the next recession starts. The averages will go down 15+%. That means some areas will go down 30%, while others drop less than 10%. Personally, I think the pullback will happen no later than the Trump re-election in 2020, but I would ask you not to base your investment decisions on my gut feeling. I could be wrong. If the recession does not show up for 5 years, and that is possible, then you would be a fool for not jumping in now. But, if the recession starts in 18 months, you should rent and save like crazy such that you can convince a bank to write a loan during a recession .. that is also a huge problem.

If I was in your shoes, I would be worried. In my opinion, the only way to approach this is only buy right now if you can find something in a great location that held up fairly well in the last recession. For example, in the last recession, small homes on quiet streets near job centers and withing a short drive to the ocean actually held up very well … their prices only fell about 15%. At the same time, prices in the inland empire and parts of the SF valley absolutely cratered. So, if you decide to buy now, pick something that held up well last recession. My favorite … small homes in South Redondo, West Torrance, or parts of North Redondo near the Hermosa Beach border. Good luck.

Also, if you look and look but can’t come up with the right property that you feel would hold up in a recession, then be patient and keep looking. Do not buy the wrong property because of desperation. I have seen people get too worried about missing the boat and they land up with a poor location. Be careful.

jt, your locations for buying RE are right on the money, “small homes in South Redondo, West Torrance, or parts of North Redondo near the Hermosa Beach border.” All these areas are still cheap compared to Manhattan/Hermosa. I would recommend the area of S. Redondo (south of Torrance Blvd). Avenue streets, sister streets, riviera area…you simply won’t lose there.

Aside from the areas of West Torrance, Hermosa, etc

For those of you who want to be on The Westside and not SouthBay; consider the following 2 neighborhoods.

Baldwin Vista where I live and can speak at lengths about. Baldwin Vista is a small area bound by La Brea on East, LaCienega on West, Expo Line on North side. It is a pocket with low crime within the residential area (higher crime along La Brea, LaCienega, the usual shoplifting, car breakins). It has an expo station and 15min to SM beach or DTLA (with no traffic).

Another area is simply between LaCienega and Fairfax, in the area of Venice Blvd. These are areas close the the Westside with lots of young people with money buying into.

Of course, there is not a lot of inventory like everywhere else, but it is becoming a Westside #2 because everything West of LaCienega is priced to high for most people.

If you dont care about being near the beach, then of course, you can find homes in Eagle Rock, Mt Washington, Boyle Heights, all of which are also seeing an influx of young professionals.

Good luck out there.

“…such that you can convince a bank to write a loan during a recession .. that is also a huge problem.”

No, it isn’t.

During a recession it absolutely is more difficult to get alone. Credit is tightened.

Also during a recession more people are buying with cash than even right now… and that is who wins the houses.

I’m not referring to lending standards. I honestly don’t care about people who have questionable credit or short, unstable careers. Top tier does not have a problem getting a loan, recession or not.

Regardless, even that (credit tightening in a recession) wasn’t our experience. The loan process was easy for us in 2009, as were two subsequent refis, but in 2017 we got put through the ringer. In fact, some of the lender’s requests were so unreasonable we simply told them “no.” Got the loan regardless.

“During a recession it absolutely is more difficult to get alone.” Wrong. Lenders want your business desperately because they are selling less loans. The lenders desperation will help you to get a loan at a highly discounted price. You can negotiate the fees.

“Also during a recession more people are buying with cash than even right now… and that is who wins the houses.”

Wrong. After a severe crash house prices are down significantly. More people will qualify for loans since the prices are much lower and reflect the actual value. Overpriced houses are a enormous risk.

I think that the thing that sets LA apart from SF and NY (but not SD and Riverside) is the large number of low income immigrants who are here (both legal and illegal). NY has a lot of large building rentals, and the cost of land for residential units is high. SF has very limited space, and a lot of high income newcomers. NY has some areas that are heavily low income immigrant, but not as vast an area as in LA. I looked at the list of Metropolitan Statistical Areas of the United States of America in Wikipedia, and Orange County is mixed in with LA. That means that if you took us away, LA would be even MORE heavily populated by renters. The Dr’s list has Baltimore (#21) but not Miami (#8). Other tan that glitch

Oops, I pushed the wrong button. restart at “Other tan that glitch”

Other than that glitch, his list is complete. (I for one am more interested in Miami RE than Baltimore RE.)

I live in Atlanta, but spend time in Laguna about 4-5 times a year. I’d move there in a minute if housing wasnt so pricey, LA outta the question, havent spent enough time in SD to make an opinion. What I can say is that I’d never move to CA and finance a house in my early 50’s, my quality of life and financial freedom is to precious at this stage in my life. ZERO debt, house paid for, no car payment, $2.7M working in the market, and Im self employeed making $200k a year with wifes income, and no kids. I love the life style in Laguna, the weather is beautiful, the coastl is breath taking, but the housing, taxes, politics, bumbs sleeping on the beach, Fukashima waiste water killing the sea life and in 20yrs people will start growing 3rd breasts is a deal breaker. Now, with that being said, should the market crash 30-50%, I might think about it. We actually looked at getting an RV and staying in a park for exstended time out there, more cost effective. CA is broke, once it collapses and taxes increase another 20-30%, everyone will be running for the exit, and it’ll be a buyers market. Its coming, be it 2018 or 2022, its coming and nothing can prevent it. Love the site, enjoy the posts. If your a lover of beaches, the East Coast has some beautiful towns, and the cost of living is much cheaper which equates to better quality of life. My .02, cheers.

“Just take a look at New York City where only 31 percent of households own. And look at how they tax people there. That is the future.”

The Future? It’s already been here in Los Angeles for quite some time.

Only 40% of households own in LA… and it continues to trend down.

I was curious how the community viewed monthly payment index data? Here’s a graph for San Diego going back to 1977. Viewing pricing this way, San Diego has room for price appreciation before hitting median historical levels. See linked graph…

http://www.voiceofsandiego.org/wp-content/uploads/2017/02/monthly-home-payments-lower-than-average-doesnt-assure-higher-prices022317-03.png

Robble, that is a great to look at home price values. Yes, home prices are very high now. However, rates are super low. I would guess that 95% plus of Americans only care about the monthly payment of anything (and that includes houses). Unlike 2006, people actually can afford their monthly payment today (higher down payments, lower rates, and lower home prices adjusted for inflation). Also, you need to look at rental parity. Rents have risen drastically in the past 10 years. The plan of renting a place and saving money for a down payment isn’t what it used to be.

Thanks LB. Trying to suss out the SD market as I may be moving there in the near future.

Buyers are paying INSANE markups.

This Sawtelle house: https://www.redfin.com/CA/Los-Angeles/1652-Amherst-Ave-90025/home/6755910

* 2012, sold for $884,000.

* 2017, listed for $1,299,000 — sold for $1,490,000.

===============

This Venice house: https://www.redfin.com/CA/Los-Angeles/1016-Rose-Ave-90291/home/6744917

* 2012, sold for $650,000.

* 2017, listed for $1,495,000.

It was sold within 6 DAYS, so I assume they got a strong offer at asking price.

==============

More insane asking prices.

This Santa Monica townhouse (not even a house): https://www.redfin.com/CA/Santa-Monica/129-Alta-Ave-90402/unit-13/home/6781925

* April 2017, sold for $1,700,000.

* July 2017, listed for $2,395,000.

A nearly $700,000 markup after only THREE MONTHS.

I’m guessing this has to be one of those scams, whereby a realtor gets someone to list high in order to raise the Zillow/Redfin estimates. Who’d pay the asking on that house?

Haha, I read the Venice property listing description. “Only a short stroll to Whole Foods.” There you have it folks, crusty old Venice ain’t what it used to be. Unfortunately I think this time is different for Venice regarding housing affordability.

“I’m guessing this has to be one of those scams, whereby a realtor gets someone to list high in order to raise the Zillow/Redfin estimates.”

Both Zillow and Redfin use recently sold properties for their estimates, not listings. Not to say those scams don’t exist, I’m sure they do.

I understand everyone when they say they don’t have a time machine. Looking back is always easy to see the peaks and the valleys. When I said I like to buy low and sell high, I meant “I am trying to”. Nobody knows the future and that strategy is pure luck.

That being said, most people “feel” when they are “CLOSE” to a top or a valley. If I “feel” I am close to a bottom or top, I act. It is OK if I leave money on the table. Better that way than not “having a chair when the music stops”. Better a month earlier than an hour late.

Most reasonable post you have made.

Whenever I read something like “nothing beats patience”…

I think of all the people (many on this blog) who were TOO patient in 2012… and missed it.

Bottom line is when you buy for the same cost of renting in California….. just do it.

Rent to own cost ratios are a good indicator, but if your house payment (or rent) is more than 25% of your income and you don’t have great prospects for advancement, you’d probably want to skip buying so you can move on easily if things turn sour.

https://video.search.yahoo.com/search/video?fr=sfp&p=moving+day+charlie+poole+youtube+music#id=1&vid=f3d2c22bc1ef3207811b2efc8b324c5b&action=click

There is a time to be patient and a time to act. I’ve been a bull from 2010- 2014 and I bought many properties. I’ve been a bear since 2014 and sold many properties for a good profit. If others who bought from me made profits, good for them. I think my profits had less risk involved.

As long as I can have good profits with low risk, I am happy. If others make profits because I sold to early, I don’t envy them – less % and more risk. For me, the return OF the capital is more important than ROI.

@Tank is in sight,

“Bottom line is when you buy for the same cost of renting in California….. just do it”

Since 2012 there is no more rental parity. You got to wait for the 50-70% drop in prices after the next crash. Then buying makes sense again.

Millenial,

2012 the door closed on rental pariy?

What a joke, 99% of the USA and 99% of CA is still at or below rental parity. Most of the USA is below rental parity.

Sorry if you want to live in Santa Monica, or Newport Beach, or Manhattan Beach…. or wherever it is your are holding out hope for a 50-70% decline…. best of luck.

“What a joke, 99% of the USA and 99% of CA is still at or below rental parity. Most of the USA is below rental parity.”

LOL, you shared that fake news before and i am still waiting for a real life example. Show me the numbers. …..still waiting…..thought so….nothing but empty words. If you think we have anywhere in CA a situation of below rental parity why waste your time here? Go out and buy that treasure box!

1. The rents are absurd. Big minus.

2. LA does offer a lot culturally. The benefits of diversity are quite apparent and a big plus.

3. Many other areas of the country are also very liveable and while they may not have all the charm of South Bay, the disposable income saved can greatly enhance an LA renters quality of life. Big minus for sticking around here long.

Side note, I find it remarkable that my rent consumes 30k a year and for 100k I could own my home with a yard in a decent community in the USA. Better yet, many parts of the E.U. So at some point in the not too distant future it’s Auf Wiedersehen. I miei due centesimi.

The benefits of diversity are quite apparent and a big plus? Maybe if you live in a bubble in Pacific Palisades but venture out and much of LA looks like a filthy third world cesspool full of gang banging thugs.

Brought to you by the cultural (((marxists))) who run Cali, Illnoize, etc. That the sheeple vote these grifters into office time and time again amazes me, but the TV and education (((mafias))) have brainwashed away their critical thinking skills.

Yeah, crime rates are near historic lows and you can buy mexican-style popsicles at the corner store. Oh the horror!

Otter,

Europe is infested by millions of Muslim immigrants. You don’t wanna live in that hell with all those potential terrorists. Plus, the global housing bubble is driving prices up there as well. Yea, your rent is 20K in CA but your income is about 100k+ here. Sure, you could live in northern Utah or Idaho or any other state and buy a brand new home for 200k but incomes there are a fraction of what they are in CA. Rent in CA is still much cheaper compared to buying. All you got to do is wait a couple more month/years until the crash. I would hold on with your Auf Wiedersehen. CA is pretty awesome if you learn how to play the game.

Interest rates still too low. Until that changes….

Ever since the late 90s, RE has been driven by momentum, not fundamentals. Low interest rates created a mania to buy RE and fed speculation, and the train keeps going regardless of whether people can afford it or not. Once the mania ends and prices stop climbing, the momentum will reverse because pyramid/ponzi schemes can’t survive without ever-increasing prices. Once prices stop climbing and start to drop, buyers will clam up because speculation is over…then the deflationary spiral begins. No one wants to catch a falling knife.

That supply graph really does tell the story. I notice also in apartment areas the parking is really tight. I read in a local paper that homeowners and apartment dwellers are now in a parking space war. Back in the 70’s I never noticed a parking problem because apartment zoning required the buildings to provide parking for each unit. My guess is that there are more than one family per unit now, which is probably illegal but not enforced. Maybe they could park on the Freeways; who would notice?

Correction: “Grandfathered in Taco Tuesday baby boomer homeowners will live in million dollar crap shacks and shop at the 99 Cents Store.”

That’s the current reality. However not the future. The future is big asset declines (including housing) where the Taco Tuesdays find out that they’re ruined, busted, and put cold revolvers in their mouths. Or, somehow the Taco Tuesdays survive 2008.2 but still never had that crazy looking mole checked out and, well, the mole eats them.

The future will belong to the liquor store owner.

“The future will belong to the liquor store owner.”

…who gets robbed every other night.

Yeah right. Have you ever seen a liquor store go out of business?

“The future will belong to the liquor store owner.”….and the marijuana dispensaries ….anything to numb the mind which will not be able to cope with the pain inflicted by the FED (our banking private cabal).

Too true – and look at who owns the ganja dispensaries. Many are from the same tribe that runs the banks and the FED.

“stuck in a ridiculous commute for a crap shack and that is bad for your health” Crap shacks are in the city, not in the suburbs. The whole idea of buying a crap shack in Burbank is so that you can walk or bike to work in the city. People who buy in the Inland Empire(e.g. Fontucky) are the ones that will pay the extra gasoline tax of 12cents a gallon so Burbank can get revenue for street repairs. That money will not improve the freeways much. Come to Burbank and save the stress and the expense of the commute, as well as the mello roos fees that are like an extra 100k of home costs, and the HOA fees of a like amount. Burbank has its own airport and rail transit. Close to dntn L.A. and Griffith Park, Hollywood Bowl, and yearly pass at Universal City. Not to mention the golf courses and our own schools. Yes, come to Burbank.

Realtors with listings are becoming increasingly arrogant.

* I went to an Open House in Santa Monica last weekend that was canceled. Notice on the door said when the next one would be.

* I went to an Open House in Woodland Hills today that was (apparently) canceled. No notice. Nobody home. Just nothing.

* I emailed a realtor a few days ago to confirm that another open house was still on for this Sunday. No reply. Just ignored me.

It seems that Seller’s Realtors have become extremely arrogant in this low-inventory market. They figure houses will just fly off the shelf, so no need to even reply to buyer’s emails.

Arrogance maybe. But in general the realtors are arguing for more housing supply. They don’t make any money if there isn’t anything for sale. You make more selling two 500k homes than one 750k one.

That is very accurate. It is sad that people are paying them 3% for that. I would think if there was ever a time to be successful FSBO it is now.

National Enquirer has the latest on the Flip or Flop cheating scandal: http://www.nationalenquirer.com/photos/flip-or-flop-affair-cheating/

Does anybody think Huntington Beach on-the-beach and very-close-to-the-beach properties are extremely undervalued compared to other beach cities? There are condos on PCH starting 500k. Houses are 1.3M. Newport is 4 times that. Why?

Because HB can be a shit hole. I lived there for 18 months and GTO. I’ve had my car broken into 3 times and all 3 were those 18 months in HB.

I’d come home and there were people urinating in my front yard……happened WAY to many times.

HB is the ghetto beach city IMHO

HB is my home and hardly ghetto. Even the “ghetto” parts are nothing compared to what you find in L.A. There are no bars on the windows and thugs hanging out on the corners. Cars get broken into everywhere. There are no murders, gangs, or serious crime. Property crime is everywhere.

I grew up here and the city has gone through a lot of change. It’s now a tourist destination which draws 11 million visitors a year. It used to be kind of seedy and was the home of the skinheads and aryans when I grew up. It’s still a predominantly white middle/upper class town. The downtown area has transformed. People live in million dollar homes but have tattoos and drive lifted trucks. It’s part of the charm. Public schools are good.

I think it’s priced good in comparison to LA. But unless you work in OC, commuting on the 405 is a nightmare.

I bought my first townhome in the late 90s when I was in my early 20s (not too long before the dot com bubble). I was a broke, struggling student. My parents cosigned because I couldn’t qualify with my income. I rent out two bedrooms and even the garage for a while. Fast forward 19 years- I have a little over 10 years left on my mortgage. It’s a rental now but cash flows nicely. The rent on my old 1bdrm apartment a block away is more than my PITI.

The value went down after the dot com bust and the last bust, but not that much. I’ve never lowered the rent (even during recession). A 3bdrm less than 0.5 miles from the beach where you can walk to all the action.

I think back how broke I was. My PITI was more than my take home income. The rent on my old apartment (where I lived alone) was $650/month (it’s now $1600). My first mortgage was over 8%. My two roommates (who I am friends with today) still rent in the neighborhood. They are priced out. They didn’t save the extra money while renting all these years.

If you are young, you can afford to take risks. If you buy in a good, coastal area which attracts young people you can always find a tenant. The rents are never coming down.

This is getting good, we are close to peak, when someone says rents will never go down…..

as someone whom owns in San Francisco and grew up in Orange County. I have lived thru all the booms and busts….

cycles are just a natural part of everything, from finance to nature….

Paul, I’ve also noticed that Huntington Beach appears to be a relative bargain in Southern California. In San Diego Co., Imperial Beach appears to be a similar bargain. Both areas appear to have good long-term investment potential.

dream on is not just an Aerosmith song….

Imperial Beach is the sewage capital of the pacific coast…..

HB is just hot money and fed low rates…..as is the whole deck of cards…..

the joker will be drawn….stay tuned…

In general, large chunks of Huntington Beach can flood … very rare, but it can happen.

Why are prices higher in Newport Beach than Huntington Beach? Huntington Beach was always more of a lower and middle income city. Huntington Beach has many tract homes from the 1960’s through the early 1980’s that were built for middle income workers in the defense and aerospace industries. Now those simple tract homes are going for $600K plus. Crime can be an issue along Beach Boulevard which is kind of junky in certain areas.

https://www.trulia.com/property/9312259-5101-Flamingo-Cir-Huntington-Beach-CA-92649

https://www.trulia.com/property/3273980115-6442-Royal-Oak-Dr-Huntington-Beach-CA-92647

https://www.trulia.com/property/3274042537-6101-Summerdale-Dr-Huntington-Beach-CA-92647

Polish Paul,

HB will never have the prestige of Newport, but that’s what makes it cool. If you look hard enough, you can STILL buy an SFR in HB 2 miles from the water with a price that starts with a 6. That’s where I would be looking. Get that property in a socal beach city while you still can!

I wouldn’t say never.. but it will take a very long time and you are correct it will always be below Newport.

Huntington Beach is a ghetto compared to Newport Beach.

I’ll echo what some of the other posters were saying. HB used to be very blue collar, white trash, surfers, skaters, etc and it even had a reputation of being very unfriendly to non-whites. Times have changed and the city is trying to improve its reputation. HB is a huge city with a population of 200K where you have good, bad and everything in between. The downtown area near the pier is pretty wild due to all the bars, clubs, out of town visitors, festivals, surf contests, etc. There are a bunch of hidden gem neighborhoods scattered throughout HB. You just need to drive around and go exploring. My favorite is northwest HB near Huntington Harbour. Much quieter and has a low key vibe compared to the downtown area, but still close to everything.

Take a look around, you’ll be surprised. HB is still cheap compared to most other socal beach cities. This will likely be a good long term buy in my opinion.

There are still a lot of us surfer/skaters still left. It’s the culture which attracts all the tourists. To me it still has a little left of what CA used to be about from my childhood. Summer time can be nuts but there’s lots of scenery- to be 17 years old again. But lots of events to keep people entertained. It’s mainly the “909ers” who come to town and cause issues. My favorite time of year is Fall when it’s still relatively warm, all the tourists are gone and the bars are empty.

Most consistent surf on the west coast and the longest uninterrupted beach. Everyone is friendly in my neighborhood. People leave their doors open which is in open invitation to pop in and chat, have a beer.

I have many old friends in HB with 2-13 rentals each, bought when pricing made sense, none of them are buying anything in this price range…..

HB is only good if you work close by, if you like sitting in a car for an hour or more each way enjoy…..I never saw any racial overtones in 30 years…that’s just BS…

The market will correct, just depends when enough people have had enough with paying overpriced pension pools that are cracking thru the gunite

For those of you who are not sure where Flyover Country is, click on this link.

Every area that is NOT red is Flyover Country

http://ritholtz.com/2017/07/most-least-expensive-live/

I am new to this post and to real estate so I would appreciate solid advice. I’m a little off topic since my question is in commercial real estate. I operate a small car dealership and have been renting for the last three years. My lease is about to end and a decent size car lot is offered for sale nearby my current location. I am in the IE. Rental rate is about $8000. The owner asks for $1.1 mil. Is it a good idea for me to make the purchase? I already secured financing at 6.5%. What would you guys recommend? Thanks for the advice!

Get a dog named spot and the rest is history.

Are you insinuating that Cal the Car Guy is really Cal Worthington? “Go see Cal, go see Cal, go see Cal.. ” If you stand on your head… they will come.

I am NOT Cal Worthington. lol I operate a small dealership, mostly to online clients. If anyone has any advice for me, that would be great!! Thanks again

The best advice for anyone on this blog is to buy a dog named spot and the rest is history.

So you’d be paying about $70,000 in interest to avoid $100,000 in lease payments? A good deal as long as your business is relatively secure. The main risk is if another big recession squeezes you out and forces you to sell at the bottom.

The auto industry is now beginning to fall from the precipice.

Selling used cars that are now about to depreciate by 50% over the next 2 years is insane.

I have worked in the industry with dealerships for 30 years, Service makes all the money. The only reason the used car market has been good is because of the risk being mitigated by the fed low rate policies..

He will be out of business in 2-4 years. The move he speaks of is insanity at its highest level…

I’m a landlord. Not in LA (nice place to visit, couldn’t pay me enough to live there). I own 4 rental houses. Fairly modest homes, typical middle class suburban stuff. Guess what state all 4 of my tenants are from? You got it….Klownifornia. And all 4 of them have basically the same story…sold their crapshack for $600K, took the $300K equity and decided to get the hell out of the state. And now they’re renting here for a year while they’re either custom building or getting to know the area before buying.

So 1/2 of me is grateful for the constant flow of Klownifornia refugees which are both paying my 4 mortgages and increasing the value of the homes. We’ve been doing 10-15% annual appreciation over the last couple of years. But the other 1/2 of me also knows that these people move here, start voting Democrat and before you know it, we become Klownifornia as well. See Nevada, Colorado and Oregon if you don’t think it can happen.

Want to add my thoughts about real estate in general….

I’m by no means an R/E shill who will say it’s always a great time to buy. But I think generally speaking, there is a group of people who are the anti-Realtors, who will always tell you it’s a BAD time to buy. I’ve been reading r/e blogs for 10+ years going back to housing panic (ahh that was fun times!!). People were saying in 2004 and 2005 that buying was crazy. And they were mostly right, even though 2004 was too early to not buy. But then these same people were still saying it was crazy to buy in 2009, 2010 and 2011. Well sorry kids, but that was plain stupid to NOT buy in the 2009-2011 time frame. There were unreal bargains to be had that are now worth 2-3X more at a minimum. I sold in 2007 and rented until 2011 when I bought again. I timed it pretty much perfectly, give or take 6 months. I bought a foreclosure for a song. And then in 2012 I started buying investment homes and those have been terrific for me.

Now I’m seeing signs that it might be time to start thinking about selling and renting again. I don’t think it’s quite there, at least not where I live. We always seem to be 6 months behind the national trend. We peaked late and bottomed out late as well last time around. But my house has appreciated over 100% in the past 6 years and that screams bubble to me. Although I will say for the 4 investment properties I bought the lending was very strict. I had to produce a lot of documentation for the underwriters, explain a lot of things on my income statements, etc. Plus down payments needed to be 20% minimum. I did 25% for 2 of them to get a better term. But the days of anyone with a pulse getting $500K are long gone, and that’s a good thing. So while the bubble will pop again, I don’t think it will be as bad as the last one, at least given my experience with borrowing money then vs now.

For my investment homes, I bought for cash flow and always thought of appreciate as a bonus, and not the main goal. As long as they are still good cash flow I’ll hold on. As far as my personal home, as soon as I start seeing a slowdown in the national real estate scene, the FOR SALE sign will be out front. So I could well be a landlord and a tenant simultaneously in the not too distant future. That will be interesting but not as crazy as it sounds. My main home is at the high end, and those always get demolished in r/e downturns, while the rentals are mid-level which won’t be hit as badly.

They key to making real estate work is understand that there are no absolutes. Real estate doesn’t always go up and it doesn’t always go down. Different markets react differently, different houses react differently at different times. Figure out when the trends change and you can make it very worthwhile.

Useful post. Thanks for sharing.

I too am a landlord, but not completely by choice. I have houses out in the sticks in Oregon that were in the family, and now one is mine and one is half mine. Rural real estate tanked after the crash and hasn’t come back. Rents are low because of the commute (25 miles to the county seat), and the sort of people who want to rent out there aren’t all that well off.

High end houses did way better around here (Orange Co CA) in the crash. The nicer the area the less they went down. People in the high rent areas didn’t get foreclosed as much, and weren’t forced to sell as easily. Condos in the less affluent areas were really slammed. What matters is how many people in a given area are stretched to thinly, and how many are under water with the loan. There are several houses on my block that I personally know are owned outright with no loans. I’m one of those. We’ll sell when we’re ready to move, but that isn’t going to be soon.

My Wife wanted to get more rental real estate here in the crash but I was having so many headaches with what I already had that I discouraged it. In hindsight I was right and wrong. We would have made a lot of money, but I would have had to do all of the work (she always puts anything about repairs on me to look into). So let her be mad about it.

Where do you live?

It is really irrelevant where you live in flyover country. It is a myth that you have to live in NY, SF or LA or you can’t find a job or the job found pays so much less. Actually the ration between the average RE prices vs. average incomes in SF, NY, LA or Seattle is worse than in flyover country MOST of the time.

When you earn less, you also pay less in taxes and the cost of living in general is so much lower.

Same question as I had.

Landlord and Flyover, question from someone who doesn’t have investment properties but is interested in getting in at some point. When you sell after 5+ years, isn’t there a huge tax impact since a good chunk of your tax basis has been depreciated away? Plus you lose the depreciation deduction going forward and take a hit with selling costs (realtor, taxes, etc). After these, and before accounting for opportunity cost of any appreciation after you sell, doesn’t this mean property values need to decline that much more before a timing play makes sense? Do you think there is an argument for holding, building liquidity when times are good, and riding out higher vacancy rates when recessions hit?

TacoTorent,

Every situation is unique. In CA the Prop13 muddies the water even more. As someone living in WA all I can say is that you have to learn as much as you can from books, but there is no substitute for experience. You don’t even know what you don’t know. Talk to as many investors as you can and see if they want to share from their experience. In commercial RE, due to large amounts, you can’t afford to make mistakes. With houses, it is different, because emotions play a large role and the government is heavily involved. Another emotional couple can bail you out using only 3% down.

In commercial RE there are zero emotions. ROI is everything and that determines the value of the RE. It is good to have a mixture, for diversification. Even if you don’t have a lot of capital, see if you can have a partnership, hopefully with someone more knowledgeable than you are.

Stay away from retail and offices. Warehouses are good only on a case by case basis. Mini storages are good more than 50% of the time. I bought one with someone far more knowledgeable than I am in that field, from another partnership who built it but had zero experience in managing it. In few years the net income went up 300%. Only a small part of that was inflation. It was close to 100% occupancy most of the time while before they could not reach 50%. Still, if you don’t know what you are doing you can lose money. I also like multi family, but even here, there is no substitute for experience and reading. On everything I shoot for 12% year net. With experience and hard work and knowledge, you can get it.

If you have other income, the depreciation helps. You can use 1031 Exchange to defer the taxes but you need a very good lawyer specialized in 1031 or you can get nailed. Or, you can time the sale. I prefer the second. Don’t sell it if you have a very good income producing property – it is like a good stock which pays 12% per year dividend. Why would you sell it? You get appreciation (you are covered) due to inflation, plus good income.

Let’s say, you buy a duplex and in one year it doubles in price (it happened twice to me although I bought for cash flow). It did not have much depreciation. I pay the capital gain taxes (usually 15%). Why would I defer it for later when our crumbling economy might charge 50%??!!!. There are lots of factors you have to consider, when you can write books on the subject. It is hard to cover everything in a simple post.

My decision to sell will be when the ROI falls below a certain threshold. I’m not sure what that is right now. It’s relative to risk tolerance, what alternative investments there are, etc. The reason I got into r/e in the first place was I wanted to diversify. I had all my eggs in the stocks/bonds basket and I wanted something else. Stocks have done really well in the last 5-6 years, but so has real estate. And when taking into account the equity build in my rental homes, appreciation and NOI, I’ve done better with r/e thanks to the magic of 20% down and 100% appreciation!! Buying on margin for r/e is SOP. Buying on margin for stocks is a lot riskier.

As houses get older, they require more repairs and you can rent for less, unless you invest in upgrades, but that hurts the long term ROI as well. So at some point the math stops working in your favor and it’s time to unload.

The best rentals are newish homes that require minimal work, in good neighborhoods, so they attract quality renters. You don’t want the cheapest house, with rock bottom quality. But you also don’t want the top of the line. It’s that middle that is the best balance of cost vs rent potential. To take a basic example, a $200K house has a $1000 mortgage and rents for $1500. A $250K house has a $1300 mortgage and rents for $1700. And a $150K house has an $800 mortgage but rents for $1200. I just made the numbers up as an example. So basically going above or below $200K, you lose $100 a month. In every market there is that sweet spot, whether its $200K, $800K, whatever. Find that sweet spot and concentrate on those homes.

And quality renters cannot be emphasized enough. My strategy is never to squeeze the last dollar out of a house. I price it a little below market to get a lot of applicants, then choose the best one. I’ll give up $50/mo in rent in exchange for having a long list of applicants to choose from, and then I can be picky. Good credit, steady income, fat bank account, it’s golden. And in a competitive rental market, people like that have a definite advantage, at least with me. And it’s not just paying rent on time. Someone with a 740 FICO score is much less likely to leave the place trashed than someone with a 600 score.

I guess you can make money as a slumlord as well, but that’s not my thing.

Landlord and Flyover – just wanted to say thanks a lot for the information. Some really good stuff in there. Plenty to digest.

I wonder if the FED/bankers/Politics want a migration from high priced areas to places that have not been visited in a long time just to spread out the wealth? Time will tell, but if this is being coined Trumps.. making America Great again it sure seems like it fits the narrative.

If the rents stay high for considerable time I wonder if the plan is to hopefully have jobs waiting for these renters. Seems possible. When oil shot to $147 that supposedly marked the beginning of the end of the hi oil prices due to fracking and oil sands coming on line with the increased supply?

I would suspect that as rents increase maybe this might mean a glut in rentals coming as people in mass find better opportunity outside of commonly regarded as places to get good jobs or better pay. Now they have other options. Also companies appear to be moving out of Silicon Valley and other high priced areas. This just signifies what I think it coming with the rental outlook for LA and other large metropolitan areas.

I don’t think the Fed gives a fuck about anything other than making bankers money.

I also think there is a huge fallacy out there that one must live in SF or NY or Seattle or Boston to have a good job. Plenty of good, high paying jobs in flyover country. Tech companies exist all over the place, even though the MSM would have you believe that nobody outside of Silicon Valley knows how to turn on a computer. Plus the real arbitrage is to live in flyover country but work for a coastal company. I do this. I live in the sticks but earn Bay Area money, and with a 20 second commute from my living room to my home office.

That being said, there is a group of people who would rather live under a bridge in Seattle than live a life of luxury out in the sticks with the deplorables. Meh. I’m not going to lose too much sleep worrying about them.

You are so right Landlord. I did what you did, moved to flyover country and live like a king. Now I can live just off passive income if I want to. However, I am still healthy and I find work enjoyable, especially working for myself. I have another brother who used to live in Seattle and have very high income. He now has his own business in flyover country with double the income he had in Seattle with a fraction of the RE cost from Seattle, all that living by the golf course.

There certainly are those who would rather live in a teeny box than a mansion elsewhere. After all location is the most important factor in real estate.