The lower bound of the housing market – many locations in California will see prices decline in 2012 since banks and government intervention are maxing out. How can home prices go higher if household incomes are moving in the opposite direction? 21 percent underemployment rate in California.

People tend to forget that $100,000 is a lot of money but when it comes to California housing many just sweep it aside as chump change like finding a quarter in your sofa. You realize how much it is when the nationwide median home price is $150,000 and a $100,000 can go a long way when homes are priced at that level. In Las Vegas you can pick up one home or two condos for that price. Yet we have reached a critical juncture in home prices for California. For over a decade exotic mortgages stretched the stagnant wages of households and allowed many to feed into the bubble with borrowed time and money. Once this was removed and incomes were actually being verified, the Fed had to make up for the phony debt based decade and forced mortgage rates lower and the government throttled up the FHA insured 3.5 percent down mortgages to juice the market. However with rates at all-time lows and down payments at pathetically low levels, the legal leverage has reached a pinnacle and yet home prices continue to fall. Why? Because household wages have gone nowhere for over a decade and potential new home buyers have different goals in mind when it comes to owning a home. We’ve crunched the numbers below and you will be surprised to see that $100,000 does mean a lot in the overall scope of a household.

Measuring real changes and value

I wanted to run a hypothetical between buying a “nice†starter home in 2001 versus buying that same home today but at current inflated bubble prices. Below are the numbers:

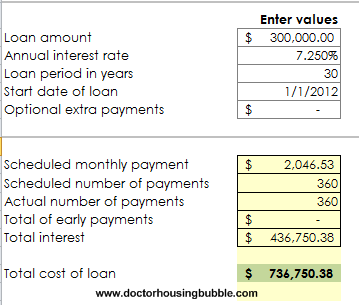

The first case shows someone buying a home with a $300,000 mortgage back in 2001 with a 7.25 percent interest rate. This rate is below the 40 year historical average but is closer to long-term averages. The total cost of the principal and interest over 30 years comes out to be $736,750. Let us now assume this same home is in a bubble market like Burbank or Culver City and now sells for $500,000 today:

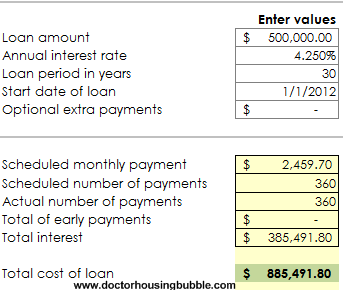

The total cost of this mortgage is now up to $885,491. This is a very real scenario in many bubble cities in California. In the end, this family will end up paying $148,741 more than the family back in 2001 even though mortgage rates have fallen to rock bottom levels. That amount by the way, is the entire cost of a US median home price. Let us not complicate things by throwing in taxes, insurance, and general maintenance costs of owning a home.

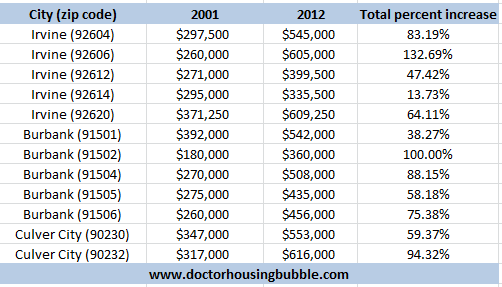

You might be asking, but let us see the zip code data for some of these hypothetical cities. Sure, we’ll look at data from 2001 and current 2012 data for three locations: Irvine, Burbank, and Culver City:

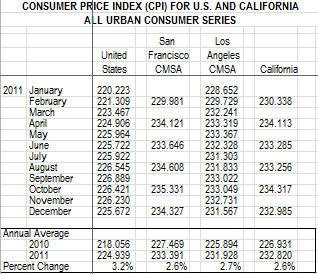

Keep in mind that it is very likely that the housing bubble was already a few years in starting in 2001 but this is as far as my data goes for zip code specific markets. You’ll notice that each of these zip codes has seen incredible amounts of growth. But growth should be measured by the overall inflation rate being factored in:

Over this decade long period the California inflation rate was 28 percent. In recent months it has moved gently lower. Take a look at the chart again. Do you see 28 percent gains for those zip codes? The only area is the 92614 zip code in Irvine. Every other area is still massively above the statewide inflation rate and as we know, over the very long-term housing tracks the general inflation rate.

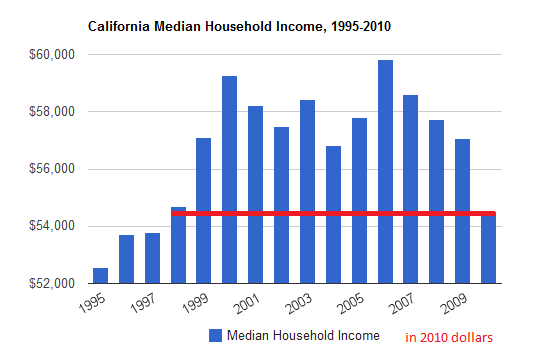

So you might say, surely incomes in California have surged over this time. Think again:

California household incomes are back to levels last seen in the late 1990s. Once I control for all these other factors you realize that housing in many mid-tier cities is still massively inflated. Multiply 28 percent to the 2001 median price and figure out how overpriced each market above is. This is why we showed many zip codes in 2011 falling significantly even though the government, banks, and Fed are trying to juice the market.

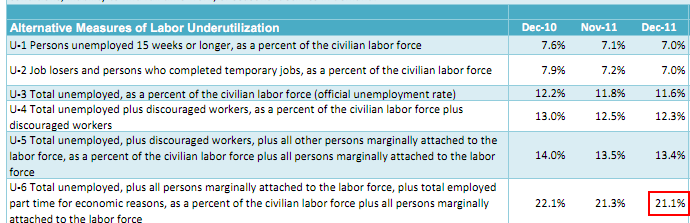

California’s underemployment rate by the way is above 20 percent which will only add additional pressure to household incomes:

The little lull we are feeling is because of Fed, banking, and government policy trying to keep the housing market together. Now the likely impact is that it will have a big say in markets where home prices are $150,000 which is most of the country. But here in mid-tier California cities with loads of shadow inventory we’ll continue to have a slow and steady correction to the downside. Some say they don’t care if they see their home values drop 10 to 20 percent but for a $500,000 place you are basically lighting on fire $100,000. Most would have an issue with that especially when there is little data showing household incomes in California are rising.

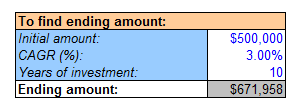

And just run a thought experiment. Assume home prices go up 3 percent per year in one of these markets and household incomes remain stagnant (they have for a decade and we are looking more like the Japanese model here). So that $500,000 home today is going to cost this much in 10 years:

That $500,000 home will then be worth $671,958 in 10 years (a $14,000+ annual price increase). Do you think incomes will keep pace for this? Of course not! This is why it is complete nonsense for those that understand the math and we need only look at the shadow inventory to realize many are now unable to afford their mortgage payments.

Here in California you still have many in the delusional property ladder mindset. They think that they will ladder up to their dream home at some point. This is bogus. Who will many of these pre-bubble buyers sell to? The young are less affluent and guess what, many aren’t as motivated to buy:

“(The Atlantic) Consider the declining appeal of homeownership. The idea that a couple should participate in an ownership society by buying a home has dissolved. Just 12% of whites between 18 and 34 told Pew that owning a home was “one of the most important things” in their life. In a nation where homeownership rates peaked at 67% just seven years ago, that’s a remarkable shift in expectations. And what is the declining appeal of a massive mortgage if not the natural result of an economy that has stiff-armed millions of young students, stuck them with thousands in debt, and forced up to one-third of them into living with their parents when they expected to be cultivating a career?”

Even more startling in the data above, one in three between the ages of 25 to 29 is moving back home. These are your typical first time home buyers. Hard to sell your inflated home when your potential pool has moved back home with incredible amounts of student debt.

The fact that home prices continue to fall in these markets in California is no surprise. Expect more of the same in 2012. Unless we see household incomes rise, which is a big stretch with a 20+ percent underemployment rate, good luck trying to see those inflated homes go even higher. The bottom line is the market intervention is running out of steam and you really can’t get rates any lower. The Fed is basically the only game in town buying up these mortgages. And what use is a low rate when households are simply poorer? Ultimately home prices need to reflect local household incomes and a $150,000 home price nationwide with a $50,000 household might make sense. But a $500,000 home would require a minimum of a $160,000 household income and the data is not showing that. In other words expect mid-tier and upper-tier markets to face additional price declines.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

40 Responses to “The lower bound of the housing market – many locations in California will see prices decline in 2012 since banks and government intervention are maxing out. How can home prices go higher if household incomes are moving in the opposite direction? 21 percent underemployment rate in California.”

A bit off topic, but just got back from Sydney. FINALLY! It is starting to smell like California 2006 down there. In recent months the consumer economy has fallen off a cliff. There are stores going out of business from Oxford Street to Bondi. The real estate escalator has stalled and is slipping into reverse.

The wishing price on even a crappy 3/2 in the remote Western Australian desert seaside village of Carnarvon (think of some dusty hamlet in Mexico’s Baja) might still be AUD 750k, but nothing will ever change hands again at that absurd level.

Now that the Australian bubble is done, it truly is The End of the World As We Know It…

Now all I will have to do is wait 20+ years for prices to very, very slowly revert to mean, unfortunately, I will probably be dead by then.

So long as the Chinese are still buying every cubic meter of dirt from the Pilbara Australian real estate along the whole west coast will remain overpriced. The Australian economy is such a natural resource dependent one-trick-pony that this could single handedly keep the bubble inflated for a while yet. Should China’s economy contract and the demand for iron ore decline, though, the bubble in Australia may pop more explosively than anywhere else on the planet.

The Aussie government encouraged RE speculation with their individual income tax policy. Earned income (e.g., from a job) was taxed at the usual rate while profits from real estate transactions were not taxed. I found this stunning reality when I visited Aus in 2006, and the speculation in RE was on par with Cali.

Hi KIwi,

Another kiwi here. Live at mt. Albert Auckland. Many friends in aussie telling us the same. Here in Oregon we haven’t seen the price decline as sever as cali. My wife and were looking to buy a winter house in southern cali, During the boom, as a builder CRAZY i thought, what do these people do for a living? Well now i guess we know.

DR HB,

Thank you once again for the analysis. I have one comment regarding the delta (Change in housing cost). The true delta could be about $110K-115k and not $149K since you can write off the interest payments. But here are some other negatives from buying at peak prices:

1. High home price = high property tax

2. Lost of interest earnings due to higher down payment requirements

3. Higher insurance premiums

I know you did not want to overcomplicate things, but buyers should know.

Buying at a low interest rate/high price environment is detrimental especially if you have some cash to put down. I would rather put $150K down on a loan at 7.25$ ($150K principal) than put $150K down on a $500K house ($350K @ 4%). People forget….you can refinance your rate, but your principal is locked for good.

Rumor has it that speculators these days are giving green lights to properties that are 20-30% under rental parity in OC. Either housing is going down or we need to make more money. So which one is more likely to happen in a deflationary, Japanese style market. Door number 1 please.

You are over-stating the value of the tax deduction. In a high interest environment, the deduction could be worth 30% of the purchase price. In our current low interest environment, the deduction is worth maybe 9%.

I think given the lower rates of today, the adjustment price for a 300K home back in 2001 would amount to 400~425K in today’s market. This factors in having less tax deducted from interest, higher property tax, etc. Also, given that getting 20% down in this decade is much harder, I think for practical purposes, PMI would put the adjusted price closer to 400K.

One tiny point about FHA home loans and condos that gets missed: once the 30 day past due association (HOA) dues delinquency rate exceeds 15 percent, the condo complex is disqualified from those 3.5% down payment FHA loans. Freddie Mac, Fanny Mae and VA loans use the same funding criteria as FHA.

One of the very first things that people in condos in financial trouble stop paying is their monthly HOA dues. This leads to a death price spiral for condos as the only way to get a loan funded will be with a conventional loan with a 10% or 20% cash down payment. Many people in the mid-tier 310/818/626/714 area codes have little cash available for a down payment. That is why there has been a sudden movement down in condo prices in the mid-tier areas of Burbank, Glendale, Pasadena, Sherman Oaks, Studio City, Torrance and Anaheim. Two bedroom condos for under $150K in Anaheim are plentiful. And sub $100K two bedroom condos in Anaheim are now popping up on the MLS.

Why is saving 20% depicted as being so hard? Because we are a consumer nation addled by retail therapy, unwilling to make a sacrifice in our personal comfort levels? No…I’m guessing there’s just less house flipping and move up buyers which is where most of those chubby down payment came from. I mean, we certainly do not want to use “our” own money! Not “real” earnings that we actually worked for!

Well, I am not rich or austere by nature, and I managed to save 20% — and while it might not have been tons of fun saving most of my earnings left over after bills for almost three years, it also did not kill my ass. I have a little more than 80K set aside (earnings set aside — not pennies from heaven!) and I can tell you, if people had to actually buy with their own cash as a 20% down, they would do a helluva lot more homework than what they presently do.

I’ve actually become increasingly turned off by housing and all the hype, consumerism and especially the fraud surrounding it. I can say that I am much less inclined to buy today than I was when I first set out to start saving.

Judgment is severely impaired at best when using OPM. Easy come, easy go.

I agree, I’m amazed how the societal attitude toward a prudent 20% down payment has changed. This is one of the remnants of the bubble that has lingered. I think this shift in attitudes is consistent with the attitude towards consumer credit, mainly that if you can afford the payment, you can afford the purchase. I see so many posts in non-bearish housing discussions where people say, “why does 20% matter if somebody can afford the payment?†The problem with this is, that most people buy something assuming they can afford the payment, and they can..until they can’t and 30 years is a long term to predict. In my opinion the credit score based on short term borrowing is a poor indicator of a 30 year mortgage. With a small down payment, these buyers may be stuck without equity and unable to get out should anything happen.

When you combine the tendency toward low down payments with low interest rates, you create an environment of over-leveraging and speculation. You have some people that have the money, but don’t want to tie it up in their house, especially when they borrowed at 3-4%, when they could make better returns somewhere else. So the tendency is to over-leverage, and not commit (your money) to your house. Low interest rates have also killed the incentive to save, savings accounts pay very little, as do other safe investments for saving.

Part of the reason 20% has become so hard, is because we’ve made it too easy and incentivized financially not making 20% mandatory. I’m with you, we are on our way to 20% by the end of this year, having put money away and it’s aggravating to see such little emphasis put on saving. And it’s especially hard to put so much of your own money into a place that really feels overvalued.

Well, in my particular case, saving 20% for a dp is tremendously hard because my household gross, though near 100K, will never allow me to save for a house near work in the Bay Area. My rent eats up over 50% of take home income, and has for my entire working life. I have never been in a work/living situation where this is not the case. I will never be able to save for a down payment because when my income goes up, so does my rent. Transportation costs eat up a huge amount, as does food. I live cheaply – one car with $130K miles on it, eat at home, hardly go out, but the cost of living is just too high. Am a lifelong Californian but trying with all my might to leave.

I don’t buy this economic recovery one bit. It’s the new normal. Low wages, high cost of necessities with sky-high property values (government-sponsored bank protection). It’s been the case for the last 5 years, and I don’t see it changing because if was going to, it would have already.

Banks make political ‘contributions’ for favorable legislation that inflates real estate prices. Inflated real estate prices inflate taxes. They will pull out all the stops to keep the game from unraveling.

bwahahahhahhahahahhahaha! Propaganda galore: http://finance.yahoo.com/news/home-buying-most-affordable-decades-150500530.html

in re to Hamsun – I too have managed now to start saving a good amount of my money to make that 20% down payment to avoid the PMI. Getting rid of cable tv (500 channels and nothing worth watching), cooking more at home, renegotiating my fees to internet provider, buying the seasonal clothing (ie: heavy jacket, etc) at the local thrift shop, owning a high mileage car for under $6K, etc; has allowed me to have a good down payment on a house, but now the more I save, the more confounded I am about what to do with the money. This site, helps me keep level headed about the home ownership idea and at least wait another half year or year to see where the market is headed ( my interest is somewhere between Pasadena and WLA).

Saving is liberating, it is “paying yourself”. With cash, you have many more options than the fool driving the nice new leased car, or “profiling” in the fancy house/condo…

Daniel — I wonder if you find yourself as I do, where, the longer you hold-out and defer your standard of living, the greater your expectations become? That is by no means to suggest they become grandiose, but I definitely find myself scoffing aloud at residences that I would have readily considered just a few years ago as being doable.

BTW — I drive a 1989 Volvo wagon. The thing is un-killable and long ago paid for.

can’t speak for Daniel but I find myself in your situation. I was saving as I came to the end of a career in a municipal govt agency. I grew some mid 5 figure savings through deferred wages, lost a bit of investment in the crash of 08 but in the 18 months I’ve been out on a modest pension I happened into an income stream that allowed me accrue near $200,000. I made belt tightening choices in this period that put me in the Inland Empire (after a brief stint in Carlsbad). The difference between what I can buy here with my money for cash and the run down tiny old places they want for all my money in San Diego county is astounding – and honestly enervating. I want to move there near my family but I will no longer give them all my money for what I could have bought for a quarter to half back in the day a little more than a decade back. So now I wait and watch the market. I know in the end I can buy a decent home with my savings something that was only a hope when I decided to leave an unhealthy workplace and I won’t just jump in and pay top dollar so to speak for what I see as areas still over priced. Areas that are least desirable in my targeted geographic region.

I was throwing some numbers around in excel over the weekend and came to a conclusion that home prices at their current levels given the rock bottom rates are still too expensive. Here is my hpothetical scenario:

Rent:

$1500/month rent (all utilities except electrity paid, very close proximity to work)

Total = 18K/year

Own:

Looking at houses in 450K range, let’s say I pay all cash, this is what I’m still left with:

Property taxes = 5K/year (probably not enough to write any of it off)

Insurance = 2K/year (this includes earthquake insurance)

Utilities = 1K/year (need to pay water/trash/natural gas, etc)

Upkeep and Maintance = 2K/year (this pays for gardener, repairs, etc)

Commuting = 2K/year (no longer close to work, factors in additional costs)

Total = 12K/year

Holy smokes, the difference in costs between renting and owning and having ZERO mortgage isn’t very much in my case. Factor in declining home prices and no appreciation for years to come and buying doesn’t sound very attractive. Depending on your family situation, there are many variables to this equation. For me, this sounds like a no brainer!

Finally mass media realizes this is true as well: “As Investment, Does Renting Beat Owning 100% of the Time?”

http://finance.yahoo.com/news/new-american-dream-is-renting-to-get-rich.html;_ylt=Auap5z2NlJxlpWwAPojOLYuiuYdG;_ylu=X3oDMTNyODlncHZiBG1pdANGUCBUb3AgU3RvcnkgTGVmdARwa2cDYTU3NGVjODYtYzA4MC0zM2Q4LThmYmQtMGRlMjllM2NlYjQ0BHBvcwMxBHNlYwN0b3Bfc3RvcnkEdmVyA2JiZWYyYjE0LTU4YzUtMTFlMS1hZjJhLWY3MmVmYmMyYWY5Zg–;_ylg=X3oDMTFvdnRqYzJoBGludGwDdXMEbGFuZwNlbi11cwRwc3RhaWQDBHBzdGNhdANob21lBHB0A3NlY3Rpb25zBHRlc3QD;_ylv=3

These either / or rental arguments are rather pointless. One of the most important factors in determining whether a real estate purchase was a good financial decision is the price paid. Like the Dot Com of 2000, those who bought or traded up at the peak (2005-2006) have subsequently found it to be a poor decesion.

For the vast majority of people who have purchased homes over the last 30 years, home values have kept pace with inflation and has been a reasonably safe and predictible means of accumulating wealth. Long term graphs of home prices show a fairly steady upward linear increase. The numerous ups and downs that get smoothed out over the longer term.

No offense to the Good Doctor, but sometimes the negativity of the postings are way overdone. Its not that data is inaccurate, it more the implication that not only is everything awful, it is only going to get worse. Yes, home values still have downside in many, if not most markets, but they will not go down forever. Those postulating we will have a Japanese type housing market for another 20 years are just wrong. US and Japanese demographics and projected population growth rates are completly different.

When the Home Price Index gets below 100 in ones market, it may be a good time to begin looking at properties. If the market had been allowed to correct without governmental interference, prices probably would have already dropped to 80 on the index. and rebounded some by now. With the feds involved, I doubt sub 90 will ever happen except in those places nobody wants to live.

Excellent comparison.

I did similar math and concluded renting is better for the near future.

Renting:

1800+100 for utitlies =1900/month or 22.8k a year.

Buying a condo with 300k loan (assuming at least 20% down to avoid PMI):

Interest at 4%: close to 12k for the first year and slightly less every year after that.

HOA: 5k a year (in the area I’m interested in)

Property tax: 5k a year.

Total of the above (non-equity contribution): 22k a year

I’m tired of people telling me, “oh but when you buy a place, you put money in your equity.” Really? Look at my numbers. I understand other places may have lower HOA dues, but it still doesn’t make a strong case for buying with only 20% down when you consider the risk of depreciation, insurances, repairs, etc.

I’m going to sit tight and see where housing prices go, or rather, how much lower they will get ’cause they ain’t going the other way.

You are single and live alone.. Let me guess.. and you are in your late 30s. early 40s?

Sure renting makes perfect sense for you!

For the rest of us with families….2 kids, 2 dogs and cat and maybe a grandparent at home watching the kids want 4 bedrooms / 2baths and a yard to keep them busy…

Not a 2 bedroom apartment on the 4th floor with paper thin walls.

So yeah, your 2 bedroom may be cheaper.. but you get half the space, no yard for kids/dog, no entertaining family and friends….

That’s what your paying extra for in larger cities…

I rent a 4 bedroom 2700sf sfr in a nice neighborhood. I don’t think you have to live alone to rent. I grew up in apartments and my mother never drove huge suv’s. Neither did any of the neighbors in the area of Santa Monica I grew up in. I am absolutely dumbfounded at the belief that you need 900sf per kid/dog/hamster/etc…

We have two kids and rent a nice rent controlled Spanish duplex. Our monthly payments are low and we manage to save money each month. It is actually possible to raise a family and rent.

LordLivingAlone? I must have hit a sensitive spot there. BTW, there are plenty of families with kids that live in my complex. They seem to do just fine. Kids really don’t care if they live in a apartment, townhouse or Mcmansion. Let me guess, your wife calls the shots and YOU do whatever she says and that means “own” a house with X bedrooms, Y bathrooms and nice yard for the kids and dogs.

You’re right about being single…by choice. There are certain things in life where short term leases make sense if you know what I mean!

Stop confusing me with your math and facts. I want to talk about how debt/home owners are winners and renters are losers. I heard that you can’t even get a date in China if you do not own your own home… BTW – how am I supposed to impress the neighbors without buying a house I can’t afford, leasing cars I can’t afford and dating super models I can’t afford?

The problem with all your assumptions on housing being a bad investment moving forward… You are also banking on a continued economic decline…

Unemployment has been dropping steadily the past 9 months… Jobs openings are increasing and a double dip recession is looking FAR less likely.

Most of the unemployed went back to school… And I’m positive most went back to school to learn an in demand trade… Because only morons would go to school for a liberal arts degree in a horrible economy.

So most likely.. the first round of unemployed who went back to school will be graduating and getting jobs in more in demand medical fields starting this year or next… All paying $75K-$100K….

We’ve got an aging population that is gonna need twice as many physical therapists and nurses to care for them…

Once everyone is retrained.. employment will boom… and housing will follow.

I hope you are joking! I believe that the unemployment number going down is more related to people falling off the work force. The so called increase in net jobs does not even cover the growth in new folks that would normally be entering the job market but are too discouraged to try.

It may be true that a number of unemployed went back to school but your assumption that they are learning “an in demand trade†is a little silly. What exactly is an “in demand trade†in the current job market that you can go to school for say less than 4 years and start off with $75 – $100k? I personally know doctors and RN’s that have recently graduated and cannot find jobs at that starting salary.

You are also forgetting the school loans that these folks need to take out to get these specific degrees. Some of these folks have 6 digit loans which they will be paying for a long time. Even if employment “boomed†housing payments will be crowded out by high food and fuel cost as well as student loan payments.

Most of the people that take care of the “aging population†are very low paid immigrant workers. Visit a home for elderly if you don’t believe me.

School is the answer

Just ask the out of work computer programmers training to be welders and the out of work welders training to be computer programmers.

Why pay 75K to a US nursing school graduate when you can import nurses from the Philippines that are used to making $200-400 per month? I’m betting that we’ll export our Baby Boomers to Southeast Asian countries before paying healthcare graduates the salaries that they think they are “worth” here in the U.S.

Optimist – “So most likely.. the first round of unemployed who went back to school will be graduating and getting jobs in more in demand medical fields starting this year or next… All paying $75K-$100K….”

Really? Did you bother to find out who did all that hiring? In nearly every major metro area in the U.S. the top 3 companies hiring are Staples, Pizza Hut & Jack in the Box.

If the BLS used it’s standard January adjustment like last year, there would have been virtually zero job “growth” in Janaury. The easiest way to show an increase is to scam the base.

Besides, tax data shows minimal growth. What good are “jobs” with zero wages?

@patsfaninpittsburg – I agree with you on the zero job growth and the government’s cooking the books on the unemployment data. I’m just pointing out that the jobs being created are low end minimum wage. Nothing that will get the economic engine cranking, much less revive real estate.

taz

I agree with your insight.

Interesting how so much focus is on “jobs”…..much less on “salary”.

Yeah

A booming economy through “healthcare”. What about “education”?

Sounds like this one can be had on a pair of prized breeding unicorns.

The eternal dummies of real estate.

@ Dirtbagger – I agree, but for different reasons: I think that Japan’s middle class has actually fared much better than the middle class here in America. With it’s status as creditor nation and its thriving and highly regarded manufacturing sector, Japan was much better positioned for experiments in fiscal easing than America, which was already looking over the ragged edge. Granted, America may have demographics on its side, but since we long ago planted our seed corn in trade for a mostly FIRE economy, the middle classes here will very likely enjoy even less security than the withered middle classes in Japan.

As for housing — to really be compared to Japan, we would need to see 40 year mortgages. Otherwise, I think the comparison is really not a stretch.

just a little insight. we have forty year mortgages. just about every loan modification is waterfalled to lower the intrest rate and extend the term to 40 years. most recent dodd frank bill will outlaw 40 year mortgage except in high cost markets, the good doctor will love that one. mass amount of 4o year mortgage were sold during the asset bubble. more out there than you think, 😉

A lot of good comments. My thought is we haven’t seen rock bottom but we’re very close. interest rates don’t generally go up over night, thus rising rates may not necessarily mean declining prices (albeit it likely means prices will not go up very fast in an increasing interest rate environment). I did read an article a while ago that stated that historically speaking, there is NOT an inverse-correlation between interest rate and housing prices. I’m not buying it completely because I think we’re in a situation that we’ve never seen before, so trying to apply history to our current state I think is a little pointless, but never-the-less, another perspective.

What I do think is that people are still making money. I agree that median incomes are stagnating (if not falling). and that isn’t even taking into consideration the real inflation for the average family (rising healthcare, education, transportation costs). Companies are ever-smarter at getting a larger slice of families’ budgets/income, much smarter than workers are at getting raises. Back to my original point, somebody is still making the money, its just not the average citizen. I think that is why we’re seeing such a disparity in the declines in housing, with more blue-collar/working family communities being harder hit than white-collar communities. I do think the income-gap in this country will have dire consequences in the long run, and it will manifest itself in many ways, including the housing market, much like we’re seeing toda. So I think when we see some areas where housing looks expensive, we can’t necessarily assume stagnating incomes, it just depends on the demographics.

Those are just my 2 cents, I’d be interested to hear other peoples’ feedback. thanks all.

Your example of the $500K home is off. You say that the mortgage will be the same amount. As we know, there has to be a down payment. 20% down is usual. So the loan amount would only be $400k(30 year rates are under 4%). A middle class couple with income of less than $135k can purchase the home. People with income less than that could move to Riverside county and enjoy the long commute and high gas prices. Don’t tell me that getting 100K for the down is a problem. There are relatives who will contribute to the down payment. People can save 100K. Today, a 500k house is not for losers.

Leave a Reply