Lying Dirty Scoundrels of Housing: 3 Additional Factors to the Housing Explosion: Money Supply, Consumer Inflation, and Celebrities?

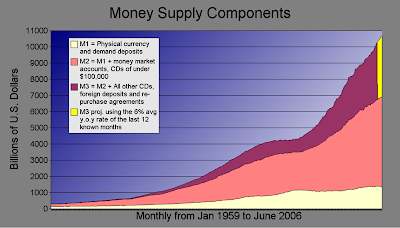

Many modern day monetarists would argue that the money supply should be fixed at a stable growth rate. This rate may range from 3 to 5 percent and assumes there is a concrete definition of what constitutes money. For all intents and purpose the provided chart shows the growth in 4 critical areas of the money supply, M0, M1, M2, and M3. Here is a brief description of each:

- M0: The total of all physical currency, plus accounts at the central bank that can be exchanged for physical currency.

- M1: M0 + the amount in demand accounts (“checking” or “current” accounts).

- M2: M1 + most savings accounts, money market accounts, and certificate of deposit accounts (CDs) of under $100,000.

- M3: M2 + all other CDs, deposits of eurodollars and repurchase agreements.

Money Supply and Inflation

As of March 23 2006 stats on M3 are no longer published by the Federal Reserve. Legislation is currently being presented by Ron Paul trying to reverse this. However this is critical since M3 is an important indicator of money growth and also includes foreign investment that has fueled a large part of this credit bubble. Monetarist would argue and have you believe that a controlled money supply is central to having a sustainable economy. They believe that a healthy economy is predicated on a key interest rate equaling the prevailing funds in society; essentially equilibrium between stable money growth and a prospering economy. Yet when these statistics are fudged or for all intents in purposes not even reported, this theory becomes much harder to stand by.

The fact that inflation is so understated by the Consumer Price Index (CPI) is laughable. For February of 2007 the current inflation rate is 2.42% annually. Oh really? Need we take a look at current house prices? Or maybe we should take a look at healthcare costs. And if you happen to drive you may have noticed that gas prices are not going up 2.42% a year. This again demonstrates the unbelievable measures that the Federal Reserve relies upon to calculate interest rates which directly impact the money supply. Lower interest rates create a higher money supply, the relationship is inverse. This is how the monetary exchange equation explains this:

Velocity x Money Supply = real GDP x GDP Deflator

Basically if the money supply grows at a faster pace than real GDP we would experience inflation. But this is another fabricated lie because we are no longer keeping track of M3 and the CPI is as reliable as Howard K. Stern. Any equation with corrupt variables renders the answer as negligible. From 2000 to 2007 during the Fed pants dropping of interest rates we’ve nearly doubled the money supply; now how is that for moderate inflation and free flowing credit? This actually explains why you may be making a bit more but don’t feel richer. The Fed actually is ingenious in pulling the wool over the publics eyes. How can you increase consumer spending, postpone a recession, and keep inflation moderate? Easy. First you need to distort inflation statistics. Next, you need to keep the public bamboozled by thinking cheap money equals wealth. Yes rates are at 1% but that $10,000 car now will cost you $25,000 and you’re income has only increased at the “real rate of inflation.†Next, you increase foreign investment via CDOs and remove M3 stats. See! Shouldn’t we all be working at the Federal Reserve, otherwise known as the Wizard of Oz.

Now that sub-prime is heading toward the light, the focus shifts to the ominous Alt-A loans. You know, the grey matter between prime and sub-prime. Take a look at this chart:

As you can see defaults are rising sharply partly because rates are resetting and housing prices have become stagnate. Countrywide and WaMu are some heavy hitters in this group but all eyes will be on IndyMac to see whether they follow the path of big brother sub-prime. This free flowing money again is because of lose monetary policy that encouraged credit creation and the populations incessant fascination with all things real estate. Just look at the sharp rise of 30 day lates; this will parabolically explode because we are resetting at approximately $100 billion per month and housing is going the opposite way. Otherwise we are in a perfect time bomb with no remedy.

Celebrities

Then we face the celebrity status of housing. Unless you’ve been living under a rock, housing is the talk de jour in becoming an instant millionaire. TV commercials proclaim the benefits of no money down, flipper shows, and even radio ads talking about diversifying your portfolio with foreign real estate. In their view, a diversified portfolio would include houses in

Damn Lying Housing Pundits

And then we have the Real Estate syndicate machine trying to convince the public that housing is not on its last leg. They point to worthless inflation numbers fudged by the government and they focus on easy credit as your vehicle for wealth. Let me highlight an example regarding the Apprentice. Currently four people remain. What are their occupations?

James: Technology Company Owner

Stef: Defense Attorney

Nicole: Real Estate Broker

Frank: Real Estate Developer

Last week their task was promoting the new 2nd

Subscribe to feed

Subscribe to feed

13 Responses to “Lying Dirty Scoundrels of Housing: 3 Additional Factors to the Housing Explosion: Money Supply, Consumer Inflation, and Celebrities?”

Excellent, excellent column today!

The money supply chart completely exposes all the noise from the Fed and various financial talking heads as being just that, noise. Can there be any better proof of inflation and dollar devaluation?

The CPI, a total lie and I dislike using such language, but how else can you characterize an inflation measurement that does not include food and energy. Are you kidding? What difference does it make if the price of plasma TV’s is dropping and bread is doubling. What does one call real price increases amidst currency devaluation?

Ron Paul had a good column over at 321gold or SafeHaven, can’t remember just now, but it was about how clueless the other members of Congress are on the committee he sits on. Scary.

And now Helicopter Ben isn’t going to publish M3 anymore? It’s like Brave New World out there. Everyday I am more relieved I am carrying no debt load.

Good stuff today, thanks.

Excellent article today as always. I just wanted to ask a question. Do you think that people really want to know the reality of realestate? I’m not convinced. I still remember back when Jimmy Carter was president. He was running against Ronny Reagan. Ronny was all positive… Jimmy was all negative. Now Jimmy may have been more realistic than Ronny but I don’t think people wanted to know.. or hear… about hardship and sacrifice. People just wanted to hear that “all is well…party on”. I think ignorance is bliss is alive and well in America.

sed,

Inflation is probably one of the few ways we can tax people without any political ramifications. Yes you earn $100,000 a year but your home will now cost $600,000 and energy and healthcare will cost $1,000+ a month. So in end, you are poorer for it. It is a dirty tool of the Fed.

Why would they publish this data? It will only show what we all know and the majority of the public is concerned about American Idol. Well at least they’re voting.

anon,

Most don’t realize this but most depressed people have a better reflection of reality than the common man. In the US, people don’t want to be concerned with all things financial. There was a recent teen survey and most answered that they expect to earn $125,000 to $150,000 a year. Well given that only 5% of the population hit this, they are in Wonderland. When asked about the details such as 401(k) and IRAs, only about 15% had any idea of what they were. You want to drink fine wine but many are running on a Zima budget.

Congratulations, Dr. BH, your blog has been cited today by The Mogambo at http://www.safehaven.com/article-7342.htm

The Mogambo is watching you!

Doc,

Have read many of your blogs and love the brutal honesty that you bring to the table. Although I disagree with you on some aspects but I really only wish that this blog was read more, that it could some how be posted on a major news site for all to read.

Keep blogging, keep it real, and keep showing these “day dreamers” the doom and gloom is upon them.

Thanks again for your great insight.

I agree with you that there is huge inflation going on.

Does that mean that housing, food, energy have kept up with inflation?

Does that mean that the savers actually lost their buying power and have become poorer because they couldn’t buy as much as they could before?

If this is all true, Do you believe hat the housing prices will go down? Don’t you think it should stay the same or go up still?

Don’t you think everybody, including the government, banks, home owners, would want to keep the prices up? Sounds like conspiracy to me. Redistribution of wealth (in favor for the rich and the business), and I think middle class are getting screwed( should I say squeezed).

By 2010-2012 Prices will be “Trash” Values:

50-70% off for Homes

60-80% off for condos+town homes+zero lot line homes

80-95% off for land, lots, acres

30-70% off for commercial buildings (all types)

My Track Record:

Average 1160% Gross profits last 10+ years

Average 2 year hold last 10+ years

Almost 200 buy/sell round trips completed

BBA Finance+Real Estate Ccim Cria Cam Ems Gri xTaxLicense

xParalegal xRealtor xInsurance xStockbroker

http://www.johnjasonchun.com

I live in Bermuda and recently we’ve started seeing the “no money down” and 100% interest mortgages. With the average price well over a million, it makes sense, who could afford even a 10% down payment. Many people here feel Bermuda is immune to the liquidity crisis but isn’t this whole debacle connected?

Anon,

My wife is Bermudian (we live in the states now) so I know the real estate market there quite well.

Bermuda is a highly insulated market. The BS about “they aren’t making any more land” is actually true there. This would indicate the market is pretty safe from a total collapse. However, I think there are a few reasons to be concerned about BDA real estate (I liquiated my Bermudian holdings, but mainly because I am concerned about the BDA dollar).

1. The PLP. I could leave it at that, but I will elaborate. One of the main drivers to the BDA real estate market historically has been foreigners, and in particular Americans. With the new rules that only real estate currently held by non-Bermudians can be sold to foreigners, the demand for property will dry up. This is a problem for many Bermudians with smaller homes that are still worth too much for most middle class Bermudians to buy.

2. The Bank of Bermuda. Since the President of the Bank of Bermuda is related to the Premier, the Bank has been making some questionable loans. If the finances of government collapse, the Bank may be dragged down with it. Also, since it is now owned by HSBC, there is much less incentive for the bank to bail out the population in the case of a real estate panic.

3. The exempt companies have been bidding up real estate values since the late 1980s. If tax law in the US or UK changes (as has been threatened), the desirability of Bermuda as a business center could decline. Then, fewer expat workers would lessen demand in Real estate.

All in all, I think BDA real estate is VERY dangerous… but I’m not a seer and I can’t see the future. I would say, however, that the emergence of exotic financing in Bermuda is NOT a good sign…

you’ve got to see this article over at yahoo finance:

http://biz.yahoo.com/brn/070412/21076.html?.v=1

sed,

Nice article. And I thought I had a sarcastic view of economics. Glad to be in good company of a respected housing bear. Thanks for keeping me posted.

anon 7:30,

Thanks for reading. If you have some disagreements please post them. It’ll help the discourse. The only thing I can’t stand is pundits that leave no room for error in their analysis. For example those in the REIC claiming that housing always goes up no matter what.

repo4sale,

Thanks. Do you accept Paypal?

anon and carlgrace,

Hard to believe that Bermuda is getting caught up in this action. I remember the story of the couple in Automatic Millionaire and how they retire to a far off island. Again this is a global crunch and prices will fall internationally.

baddriver,

Thanks for the article. Bankrate normally puts out some good tips. The one tip that I think is absolutely crucial is skipping due diligence in researching a purchase. That is why we are hearing all these sob stories of people saying “but my broker didn’t say my loan would reset 150%.” Oh really? I think that was a minor detail to look into.

Thanks Dr. Housing Bubble!

The portion of your post pertaining to Casey Serin is about to become fodder for discussion at a site devoted to debunking Serin’s dishonesty: ExUrban Nation

http://exurbannation.blogspot.com

It’s LOOSE, not LOSE.

Leave a Reply