Marketing Consumerism in the Boom and Bust Economy: 4 Advertisements Showing the Shift in Consumer Buying Habits: Pizza, Airlines, Real Estate, Toxic Assets, and the Simpsons.

As we slowly grind into the 20 month from which we can see the August 2007 stock market peak in the rearview mirror of our nearly bankrupt American automobile, the market is hesitant in which way it wants to move after the little bull market we are experiencing. Yet the public has no doubts about the nature of the current economy. The perspective of the average person on the street is more accurate than the tomes being pumped out from Wall Street analysts. That is, there is a second class system for the unconnected. There is a tiny safety net and most are falling right through the weak netting. This is not your common recession. This is now the longest recession on record since the Great Depression. In other words, most people alive have never gone through an economic crisis this profound.

The advertising world is catching on. I’m sure many of you have seen the Dominoes commercial in which someone tells the audience that they don’t need any stinking bailout like Wall Street folks but they’re going to give you on Main Street a bailout through better pizza prices. A slap to Wall Street and cheap pizza? Talk about a winning combination. Other advertisements have also highlighted the recession in different perspectives. Jet Blue runs an ad where CEOs who have fallen from grace now need to learn how to fly on commercial airlines with all the regular people:

*Click on image to watch video

So some companies have taken a more comedic angle. Other companies have even harkened the dark days of the depression. This one minute ad from All-State called “Back to the Basics” drives the point home clearly:

The point of this ad? Time to focus on what matters and that includes family and security – preferable without spending tons of money. They even mention their history of starting during the Great Depression. Contrast these current ads with some that were run during the boom time. Like this very popular Century 21 clip:

This 30 second clip basically shows a guy receiving a browbeating about buying a home. In the background, a realtor attentively listens given a commission is riding on the sale. The underlying message of this ad is buying a home is a no lose proposition. I can only imagine how many times this sad scenario occurred in America during the bubble. Watching this ad drives shivers down my spine.

Or what about this great ad from Countrywide where you can combine practically every piece of debt you have into one loan. Fantastic idea!

An advertisement by its structure has a desired reaction on an audience. The Domino ad for you to buy pizza. The Jet Blue ad to make you fly. That All-State ad to make you feel secure with an insurance company. The Century 21 to buy a home. The Countrywide ad to consolidate your 4 toxic loans into one nicely packaged toxic loan. They all had their method of achieving their results. But the current ads reflect a more cautious, more reserved, less wealthy, and more concerned population. A price conscious society that no longer believes in many of the bull market mantras. A new generation will emerge from these ashes and will never forget this economic calamity just like the generation that lived through the Great Depression.

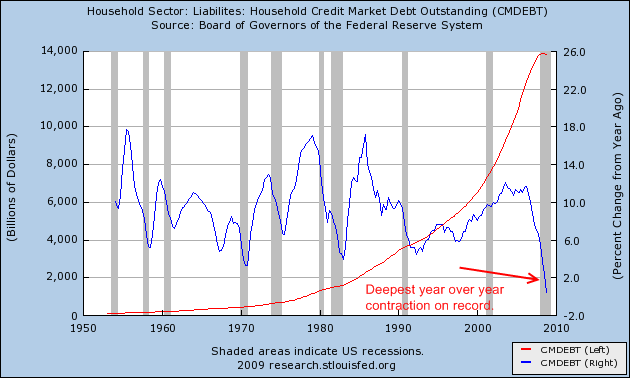

To a large extent, Wall Street and Washington for a decade have missed many key points. The average American did not participate in the boom in real terms. Many are now worse off pre-bubble. Wages have been stagnant for over a decade and now over $11 trillion has been wiped off the balance sheet of Americans. This kind of real wealth destruction etches long lasting scars. Many of you have seen the graph of household debt which combines mortgage debt (the largest line item) and also revolving debt (through credit cards, student loans, and auto loans). But what you may not have seen is a graph showing how quickly debt is contracting in the market for the average consumer:

As you can see from the chart above, this is the steepest year over year contraction in household debt on record. Given that much of the last decade could have been described as the pseudo prosperity decade, now with debt being extinguished from the system more and more Americans need to save to buy goods. Hence these ads are a reflection of this new found reality. Now an issue with the new public and private program with the U.S. Treasury backed by FDIC non-recourse loans is the assumption that the last decade did see real wealth gains. The flaw in their bet, which by the way is 93 percent financed on the taxpayer dime if they are wrong, is the current market pricing of toxic assets is low only because of the fear in the market. This is incorrect. The gains for the last decade in large part where fueled by a massive global debt bubble. The concern in the market is well founded. Those gains are gone and never coming back. The bubble was so massive and lasted so long that people are slowly awaking to this reality.

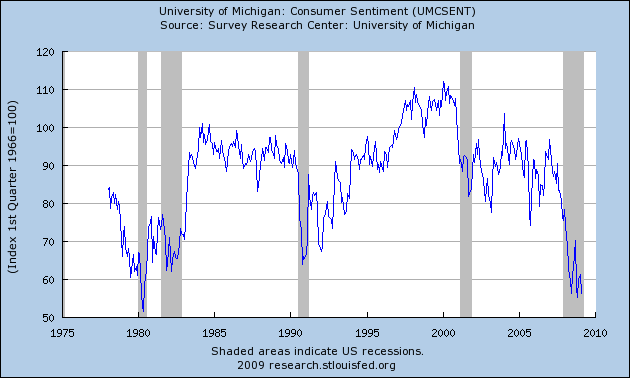

As I had discussed in a previous post, nearly 50 percent of American households are one paycheck away from falling behind on their financial obligations. What do you think this does to consumer confidence? It crushes it:

Consumer sentiment is at record lows matching those from the early 1980s. The reality is we are not going back to the good old days anytime soon. And they really weren’t that good for many if you stripped away the massive debt. Now that the masquerade of debt is withdrawing, we realize how phony much of the “prosperity” really was.

We also recently found out that credit card companies have pulled 8 million credit cards from consumers’ hands. Lines are being cut down to the tune of $320 billion. In a society with 13 million Americans unemployed and 9 million working part-time but wanting full-time work, consumption making up 70 percent of our GDP is going to take a direct hit.

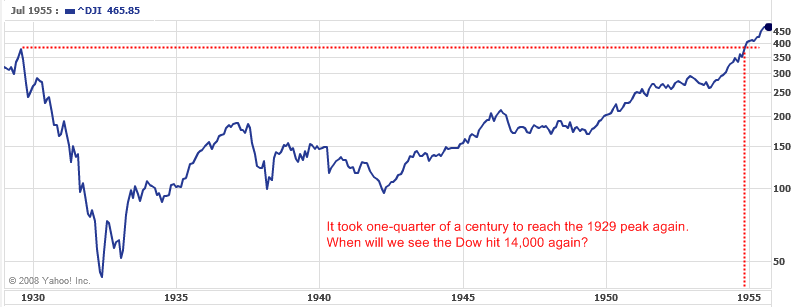

Psychologically consumers will not buy big ticket items if they have misgivings regarding their future. With the rise in unemployment many more Americans are going to be more cautious buying these items in the future. And this recession is deep enough and wide enough in reach that many will no longer believe the mantra that “real estate is the best investment” or “stocks always go up in the long run.” If you look at the Great Depression and invested at the peak, it would take you nearly 25 years to get back to your initial point:

And many recent newspaper outlets have suffered as well because of the drop in advertising revenue. Many of the large print newspapers have cut back severely and many have gone under. So it is important to pay attention to these sentiment indicators because they reflect what Americans are going through. Consumption is down. Excessive consumption is being looked at with disgust as many saw with the outrage over the AIG bonuses. Yet this isn’t something new. This anger toward prestige occurred during the Great Depression as well:

“The Depression sharply lowered the prestige of businessmen. The worst sufferers were the bankers and brokers, who found themselves translated from objects of veneration into objects of public derision and distrust – the distrust being sharply increased by the evidences of financial skullduggery which came out in successive congressional investigation. But even business executives in general sank in the public regard to a point from which it would take them a long time to recover; and in this decline the conscientious and public-spirited suffered along with the predatory.”

Frederick Lewis Allen presents the scene of the 1930s yet we can directly apply this to our current climate. The Jet Blue and Dominoes ads merely reflect this new disgust and mistrust of Wall Street and the pinstriped suit crowd. Take heed of these signs. Advertisements are only reflecting the public sentiment. In fact, many of your favorite sitcoms have now had episodes were part of the major theme revolved around how bad the economy is. Heck, even the Simpsons made light of this when Homer’s annual Mardi Gras party comes home to roost after financing the celebrations on home equity lines of credit:

The recession has gone viral.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

23 Responses to “Marketing Consumerism in the Boom and Bust Economy: 4 Advertisements Showing the Shift in Consumer Buying Habits: Pizza, Airlines, Real Estate, Toxic Assets, and the Simpsons.”

I really thought the “CEO’s Guide to Jetting” was really quite entertaining, I found myself laughing threw out the entire skit, which i think was the point of the video, and than the craiglist line at the end hit the spot!

As far as the Allstate TV Ad: Back to Basics ad, I am not sure if I liked it, I thought it was kinda of ehhh.

“debt is contracting in the market for the average consumer”

Guess where it’s going. Hell no, forget it, I’m not going to pay for it! I’ll work only off the books, grow my own vegetables, hunt rabbits and live in a trailer. I have no debts. I SAVED. I wanted my own home but a mortgage would be too high, so I saved and saved. And now the government is going to tax me for this appalling mess?! FORGET IT.

I have a FICO score of 830.

Recently, I have had the strange experience of credit cards, that I cancelled years ago, flooding me with offers of “we want you back.”.

I only use cards for convience purposes, and pay them off every month. Why would credit card companies want me back?? They don’t really make any money off of a person like me, do they? Am I missing something?

Well its about time. Once the collective consciousness gets turned around, we will see lasting recovery. Not until then. The unsustainable spending habits of Americans – with little savings – will eventually change but unfortunately, not until we all endure the pain of the ‘realignment’. I’m one of those who followed the rules – with one exception. I never let the sexy seduction of paying interest to a bank for a new (insert item here) sway me. I knew that I’d be dancing to that banker to pay it back. This nation can once again become great if we re-prioritize and get off being addicted to ‘things’. Good article.

Its clear the “11 trillion wiped-off-the-Books” was based on debt and asset appreciation, or paper gains. So what harm is it to print $11T in monopoly money? Wont these “new” dollars just replace the fake wealth we built up, and we’ll be back at even-Steven? My $400,000 mortgage will be chump-change, as the hyper inflation takes-over. Sounds like a plan to me!! But wait, how will the new $$ be distributed/controlled??? I guess the little guy gets left in the dark, holding the bill again.

I totally agree with the shift, but what I don’t understand is that the YOY retail sales has shown an increase.

I am a pat living in Baja Mexico. One of the most profound nuances is the cultural differences in how we and Mexicans view money. In the US, you are what you OWE but in Mexico you are what you OWN. This makes for very different perspective when it comes to how you view the world. Many fellow neighbors will save until they can buy a plot of land out right and then build what they can afford (wood, stone, concrete block, etc). but they OWN it!

Sadly, many recent immigrants with the same mentality about money were preyed upon during the housing bubble here in the US and are now losing everything.

So Americans are no longer able to afford what they owe. What happens when you realize that you OWN nothing? And you realize that your government is corrupt? And you realize that there are no safety nets in place?

Welcome to Mexico.

Saludos,

Do you mean prey or pray?

Robert, credit cards make a small fee that they charge the merchant on your purchases. Even if you don’t go into debt they make money. If you do go into debt it’s icing on the cake.

Credit cards are unsecured debt. If you default there isn’t a asset like a house they can take in return.Now they really want people like you who pay off their card every month because those with massive debts are defaulting and they are losing money to settlements.

Robert – credit card companies love consumers like you as well as those who carry a balance. They still make money on everything you buy by charging vendors transaction fees (fixed amount + a %) that they are legally obliged NOT to tell you about.

That is why deep discount outlets like Costco and Aarco AM/PM don’t accept them as a form of payment, and a lot of stations on trucking routes give a discount for cash payment.

Since credit cards are unsecured debt, credit card companies stand to lose when consumers declare bankruptcy. With a history like yours, they know that this is unlikely and are willing to settle for the transaction fees (and occasional late fee or whatever) and forgo the usurious interest fees that are their bread and butter in times when mass bankruptcy is a little bit less of a worry for their bottom line.

They have lots of ways to trap you. They got me by those, “Add another person to your card, it’s easy and fun.” Well, it was fun for her, while it lasted… then I got the not fun part, paying back the card over the next 30 years. If I live that long.

Up until then, I had been one of those guys with credit cards that were completely paid off every month and hardly used. Beware the midlife crisis!

The simpson’s predicted the future of america back in the 90’s when they played an episode where lisa was president in the future and bart had to help her get america’s creditors of her back by telling them they used to be cool.

Comment by Robert Cramer:

Love this Robert, I am as confused as you are…really, why would they want you back?

Answer:

The powers that be are trying to regenerate a failed paradigm…the sheeple MUST be encouraged to spend again to maintain the “staus quo”

BUT it aint going to happen…because the Sheeple now know the scam…thanks to the internet and such wonderful blogs like this…so their “guns have been spiked” BIG TIME. Silly thing is the powers that be don’t even know, that the sheeple know, YET!

Remember the six-sigma mantra: ; ” If I don’t know, I can’t act”!

See my website for illumination….I rest my case, with one reservation:

It has been noted that the USA is considering (heresay) to impose a censorship on the internet because one high profile congressman (or senator) stated in public rencently:

” the most serious threat to the USA is the ‘domestic terrorist” who is defined as an “American citizen who knows too much” Source: Strafor”

Oh boy, Orwell here we come:

http://my.telegraph.co.uk/therockcalledpeter

Go well dear friends..I do know that we will prevail….10% inspiration, 90% perspiration!

Well, it seems you hit the nail on the head with this one. But I’m surprised you haven’t spoken about the Boom and Bust of education.

http://www.huffingtonpost.com/keli-goff/a-scandal-more-shameful-t_b_184728.html

I’ve been pondering: If the government owns all or part of the “bank” and I have a mortgage with the bank, then is the property actually owned by the public? Private property rights are being threatened in bits and pieces. I havn’t heard anyone discuss this lately. That is where we’re headed, right??

Well, it’s more like a little dead cat bounce, Great Depression style. Fun for the whole family.

Again, excellent article doc. I think the people are beggining to “get it” while our politicians do not. Their purpose it to make the stock stock market go up short term by any means possible. This is why they are “relaxing” mark to market accounting rules and bringing back the uptick rule in regards to shorting stock. All this will do is to prolong the agony. Our economy is a mess and will remain so until we start saving more, stop consuming so much and start producing more.

Just a little error on your prose, the year-over-year difference in debt still looks to be positive, although just barely. So the overall debt has not retreated, just flattened.

Given the way that credit card debt has been falling, the overall debt curve might actually begin to decrease, and the year-over-year number go negative.

Its a cultural shift… avoiding debt. This cultural shift is a reprise of the 1930’s attitude towards debt.

An advertisement is an advertisement. What is important is that business owners would know how to maximize the leads that these marketing campaigns are going to generate to them. They need to implement an effective lead management system—one that is easy to perform (by the sales team) and monitor (by the owner).

Robert, the banks make anywhere from 2.5% to 4% in merchants fees everytime you use your credit card. The banks and payment processing compaies are robbing small businesspeople and independent merchants blind.

I’d really like to see Part II of that Century 21 commercial, set two years post-sale, when the exploding ARM those people took out to buy that house goes off, and now that wretched wife is the one receiving the browbeating from the husband, who is clutching a foreclosure notice in his hands.

Well then…every purchase from a small bussiness person and an independent merchant which was paid for in cash…would mean from 2.5% to 4% more money

than otherwise to that independent bussinessmerchant person right there. If no “merchant fee” is paid by the merchant for payment recieved in check form, then the same is true for payment by check. So paying for purchases by check or cash, not credit cards, might give small bussinesses a survival advantage. If enough people do it often enough for long enough to make a difference to those small bussinesses.

I’m confident to say that I’ve always been a discplined credit card user. It’s helped me in some types of emergencies. I pay my bills on time and haven’t had to pay any late payment fees. But after reading your comments, I may have to close my credit card account and use cash instead.

Using credit cards is all about discipline. If we have a tendency of accumulating debts, we shouldn’t trust ourselves to have credit cards. Avoiding debts starts from within, just like most of everything else.

Leave a Reply