How many McDonald’s jobs does it take to purchase a California home? 10 to 25 percent price decline over the next five years will prove to be optimistic. Can Americans stomach a second housing crash?

Professor Robert Shiller, one of the founders of the Case Shiller Index has made recent headlines by stating rather calmly that home prices will likely fall another 10 to 25 percent in the upcoming years. Of course, this can happen either through a nominal drop or through an inflation adjusted drop where prices may remain the same but inflation eats away housing value as the years go rolling by like a tumbleweed. Now for the agitated nation, I do believe that we will see a further decrease in nominal values but more of the adjustment may come in real terms. However in states like California prices remain extremely inflated that a nominal drop is all but assured. A 10 to 25 percent drop in nominal terms for California seems optimistic. In the U.S. we seemed to pre-programmed to assume that just because prices fall that a strong rebound is assured. I’m always struck in U.S. movies how the hero always wins no matter what. If you watch foreign movies you realize this isn’t always the case (or just look at life in general). Although we can find many cases of markets rebounding after hard falls, you also have places like Detroit or the NASDAQ where we are eons away from peak prices both in real and nominal terms. Many do not care if things rebound in 30 years especially if they are looking to buy in the next few years. Although Shiller’s statement seemed to be taken as apocalyptic by the media I believe he is being too optimistic. I’ll go into a few reasons moving forward.

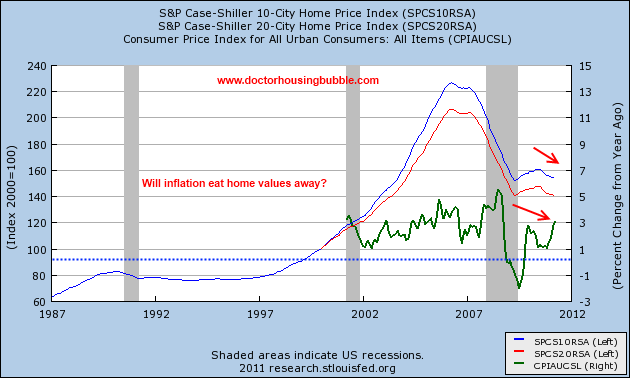

Case Shiller and inflation measures

The Case Shiller Index tries to reflect home prices after adjusting for inflation. This is a good measure as well because it exams repeat home sales so you get a better sense of home prices moving through the channels of history. Looking at the median price tells you about what is selling today and is crucial as well but the above index gives you a broader sense of what is happening to the housing market. From the peak in 2006 home prices have fallen by over 31 percent. Another 25 percent drop would put prices back to the mid to late 1990s in real terms. This would make the fall in prices nationwide come in at over 50 percent.

Professor Shiller has a recent example in history which may be a model:

“(Bloomberg) A model for the U.S. may be Japan, where home prices fell for 15 years after that country’s real estate bubble burst in the early 1990s, Shiller said.

“They lost close to two-thirds of their value,†Shiller said. “Then they went up for one year in 2006 and then they started going down again.â€

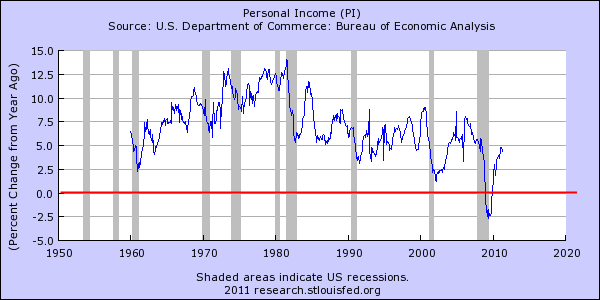

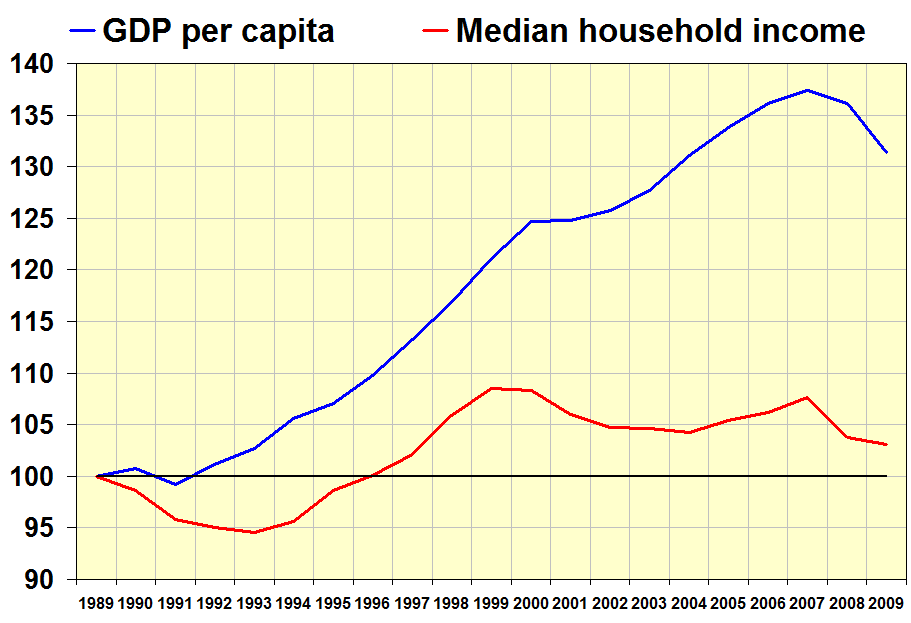

Can Americans stomach a second decline in the housing market? There really is little choice given income growth (or lack of it):

For the first time during this recession did we see personal income decline year-over-year since record keeping started. How do people pay their mortgage? From actual earned income. So this is an important point here. Household income has been negative for well over a decade. Some of the charts on income or wage growth only measure those working and as we know we have a large number of people in the shadow employment sectors. And for those that are saying that “big†cities in Japan did not track nationwide prices they should look again:

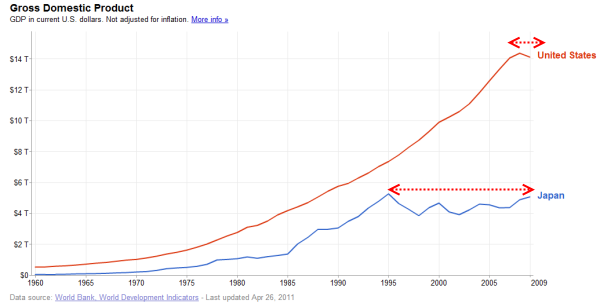

Land prices in Japan in 2009 are back to levels of the 1980s in real terms. Is this our future? So far it seems likely with the government allowing the banking sector to go into zombie mode with a massive amount of shadow inventory. Japan also attempted to create inflation by massive fiscal and monetary measure but nothing really happened in terms of home values except a slow and steady decline from their peak. As a result their GDP has been slow moving since:

There was troubling news this week that for the first time since WWII Federal debt will exceed actual GDP:

“(Chicago Tribune) A recent Treasury report noted that national debt will exceed the size of the economy this year — a first since World War II. A year ago, the Treasury had estimated that notorious record wouldn’t be hit until 2014.

Now the expectation is that total debt to GDP will top 102 percet this year, up from the earlier estimate of 96.4 percent.â€

It is clear that the Federal Reserve will continue bailing out banks even if it requires magical tricks like buying up mortgage backed securities or simply suspending mark-to-market. The Fed is holding trillions of dollars in assets on their balance sheet, many of those assets are questionable to say the least.

Why Shiller may prove to be optimistic

I believe Professor Shiller will prove to be optimistic in his assumption that home prices will fall 10 to 25 percent in real terms over the next few years. First, as we just mentioned our debt is becoming increasingly large and a burden on society. What is rarely mentioned is that after World War II Europe’s industrial sector and also Asia’s sat in ruin. The U.S. had a near monopoly in terms of manufacturing and a massive competitive advantage for decades to come. Today, we have wars that are just as expensive (large parts of the wars remain off balance sheet like shadow inventory) yet will do very little in an economic sense aside from drowning the nation in debt. This I think will be a major point moving forward.

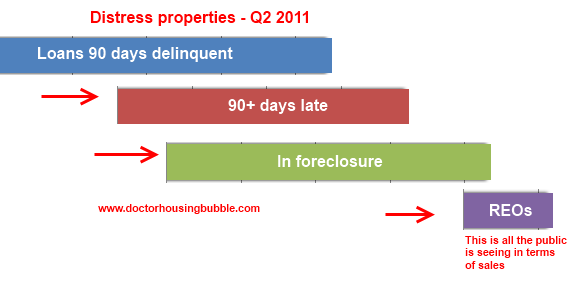

Next, relates to the chart above. There is an incredible amount of shadow inventory. Unlike Japan where culturally there was more internal pressure to pay debts Americans are more prone to walking away and strategically defaulting on mortgages. Take the below:

Of the over 2 million loans in foreclosure currently over 675,000 people have made absolutely no payment in over 2 years! You might be thinking how absurd this is but that is how things operate today in the Bernanke Matrix. You will also notice in our first chart that actual foreclosures are only a small piece of the pie in terms of distressed inventory. Over 6 million properties are delinquent or in a state of actual foreclosure. REOs, that is banks now owning the property, are a tiny amount since banks don’t want to hold properties on their balance sheet passing homes off like hot potatoes since they will now be forced to mark-to-market (aka come to grips with reality).

Why I think Shiller might be too optimistic is that foreclosures are selling for over 30 percent price reductions and in many areas including California foreclosures are a large part of the market. And what is more important is household income:

Household income is the most important factor and there is little data showing it going up. So home prices will come down because the only inflation that will help home prices even out is income inflation. It is amazing that all these “grim†predictions are coming in what is usually the beginning of the hot selling summer seasons. 30 year mortgage rates are at historical lows yet needing to show income justifying home purchases even with FHA insured loans where a pathetically low 3.5 percent is all that is needed to buy is proving harder and harder. How many McDonald’s jobs does it take to purchase an overpriced California home?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

84 Responses to “How many McDonald’s jobs does it take to purchase a California home? 10 to 25 percent price decline over the next five years will prove to be optimistic. Can Americans stomach a second housing crash?”

I am a ‘potential’ first time home buyer (now a renter in Santa Monica)… thanks for helping to clue-me-in on rational for not buying for the foreseeable future. But with all the scare of another meltdown – will the money I have in savings in US banks going to be safe in the coming years?

No. There is no safe place to put your money, whether it’s in a Bank or a House. This is the theme that you should get used to.

First, if you have any doubts as to whether we’ll see a repeat of the 2008 meltdown, here’s a “must watch” interview by Dan Rather:

http://www.hd.net/blogs/2011/06/barofsky-more-bailouts/

This segment is especially important if you are thinking about using a mortgage to buy a house.

Neil Barofsky was one of Hank Paulson’s (the Treasury Secretary at the time) key people. When he says that he’s scared, that should be a clue for everyone.

Consider also that absolutely nothing has been done which will prevent a repeat of what happened in 2008. Nothing.

The theme we’re facing is that of Capital Destruction. That means your money. No asset class is immune and there is no safe place. The best that you can do is to become knowledgeable about what’s going on, and be nimble.

If you want to know what to expect, take a look at history. For recent history, look to Argentina of 10 years ago. Or watch what Greece is going through now (note the current run on the Banks going on there).

Welcome to Ronald Reagan’s legacy, courtesy of the push for “Free Markets”.

Stop blaming “Free Markets”. If the USA had free markets real estate would have bottomed already/ Wall street banksters would be broke and headline unemployment would have gone over 20%, but we would be on the road to recovery today. There would have be one giant “reset” in the global economy.

Questor:

You are correct in your assessment of where we are today – and where things are going. I applaud you for being informed and aware – sadly, you are in a minority.

Unfortunately, I believe you are mistaken about the causes of our problems. They are not Reagan’s policies, or free markets, as you state.

To begin, we have not had anything even closely resembling free markets in this country for many decades. The regulatory costs in 2010 were upwards of $1.25 trillion – nearly 10% of our GDP. And after you exclude Government spending from the GDP number (about 24% of GDP now), that percentage is even larger.

What we do have is a caustic crony capitalism, an unholy and destructive marriage of government and big business.

What suffers most are the small businesses (those with under 500 employees) who pay an even larger percent of the regulatory/bureaucratic burden. They also don’t benefit from lobbyist/legislative carve outs and special treatment, as do their larger brethren.

Free markets (not unregulated, but wisely regulated) do work.

What we need to do is 1) get the federal government out of most things its entwined itself in, 2) institute the Fair Tax so everyone has skin in the game – and no one can game the system – everybody pays when they make purchases, including government, and 3) put state and local governments back in charge – closer to the people and more accountable.

A Constitutional Republic – what we are supposed to be – works. It elevate and exalts the individual, not the state. And rule of law ensures individual rights.

I hope you will reconsider your assumptions.

Strange, the clip was taken down from the site!

Philip:

Look, this is not just some academic exercise in theory. People’s lives are at stake, and right now newborns seem to be at immediate risk due to your “less regulations” ideal. The CDC this week is reporting a recent increase in infant morbidity by 35% on the West Coast, with radioactive fallout being suspected. Less regulations won’t solve this.

I do hope no one you know is pregnant right now, or planning on starting a family.

Regarding the points you raise, you can only justify them by completely ignoring what took place over the past 25+ years in order to make your point. That is not a sound basis for coming to a conclusion.

The Reagan Revolution was brought to us very loudly under the banner of “Free Markets”. Indeed, Reagan dumped Volker for the high saint of Libertarians, Alan Greenspan. It was only after Greenspans’ watch (at the helm of the Fed) when he admitted that he was shocked that the markets didn’t work.

Seriously, how much better evidence do you need? Really.

I’ll also remind you that the impetus of Reagan’s Free Market efforts lasted far longer than his Presidency. For it was this view that led to the repeal of Glass-Steagal, which in turn resulted in the current financial disaster which is upon us. We had over 80 years of a solid banking system until then.

So much for the ideal of a “Free Market”. I could go on, but hopefully you won’t be insistent upon ignoring history and reality. Otherwise your view becomes one of religion, and not facts. Certainly not reality.

As far as US history before then, since the creation of Corporations, the experience there is also quite damning. The less regulated periods over the past 150 years have always resulted in either either crony capitalism and/or monopolies; along with significant financial implosions along the way. It is only State intervention which has limited or prevented those.

So yes, the problem is indeed with free unregulated markets.

“Wisely” regulated markets is a questionable term. I would somewhat agree. But those are not “Free”. So which is it?

Even the term “wisely” is problematic. Who decides what is wise? Industry leaders working with officials who later are hired by the industry? That’s just one aspect of Regulatory Capture, which is currently so pervasive.

But the lessons from history stand very clear. We need more effective regulation, not less. How many times does your approach have to fail before you get a clue? Seriously. You’re right in the middle of its biggest failure of all time, and you are arguing to repeat it.

One definition of insanity is to repeat the same behaviour, over and over, and expect a different result.

By this definition, the concept of less regulations are clearly insane. And people will die from it, as they always have. And appear to be doing right now.

I sincerely hope that no one you know is impacted. But if they are, try explaining to them how less regulations would’ve helped them.

@Offthebooks: That’s strange. It worked just now for me. The story should well be in Google’s cache, so a search there should turn it up.

@constrman:

Sorry, the but the changes brought about under the banner of “Free Markets” are precisely to blame for the current mess that we’re in. I agree that if the Banks had been left to fail, that we’d be coming out of this recovery. The best option would’ve been to nationalize them, split them up and sell them off.

Letting them fail completely would’ve wiped out businesses, state and local governments, who keep a lion’s share of the $8 Trillion in deposits there.

But the point is, if we didn’t have completely free markets in the securitized financial field in the first place, we’d never have gotten into this mess. The repeal of Glass-Steagal is living proof of that.

Phil Johnson blthers on with the ‘fair tax’ nonsense – annother zombie crackpot idea that will NOT die…..

If taxing were ‘fair’ those that control over 85% of all wealth in the US would pay 85% of all taxes. That would be the top 1% and they DO NOT pay anywhere near that much.

The following data is from the CBO and US Treasury:

18,000 of the top 1% paid ZERO in federal income taxes or payroll taxes.

The top 1% controls 85% of all wealth but the top 400 households only paid an average of 17% in all federal taxes.

The single indidviual working at an $8 an hour job 40 hours a week pays 7.65% of their income in payroll taxes, 5.82% in Federal income tax (no deductions besides the standard – no kids, no mortgage at that income…) and, in my state, another 3.73% in state income tax. 17.2% of a $16640 income is pretty damn stiff!!

And compare it to a trust fund baby like Jacqueline Mars (Mars Candy fortune and enormous source of money to try to end the estate tax on her -got-lucky lifetime income from daddy) who got lucky in the sperm and uterus stakes and won a lifetime of income and wealth from daddy and mummy and whose money is in TAX -FREE municipal bonds — and they pay NO payroll taxes, no federal income taxes and no state income taxes! (Such as the 18,000 of the top 1% who paid NOTHING!)

Low-income households as a whole do, in fact, pay federal taxes. Congressional Budget Office data show that the poorest fifth of households as a group paid an average of 4 percent of their incomes in federal taxes in 2007 (the latest year for which these data are available), not an insignificant amount given how modest these households’ incomes are — the poorest fifth of households had average income of $18,400 in 2007. [4] The next-to-the bottom fifth — those with incomes between $20,500 and $34,300 in 2007 — paid an average of 10 percent of their incomes in federal taxes.

When all federal, state, and local taxes are taken into account, the bottom fifth of households paid 16.3 percent of their incomes in taxes, on average, in 2010. The second-poorest fifth paid 20.7 percent. About half of taxpayers paid no federal income tax last year. It does not mean they paid no tax at all. Many shelled out Social Security & Medicare payroll taxes. In fact, only 14 percent of Americans didn’t pay either income or payroll taxes. 17 percent of the 14% of those people who did not pay federal income taxes in 2009 are people aged 65 or older (Soc Sec only) & 13% of the 14% are unemployed are unemployed and a substantial percentage are students who make their $2000, 4000 or $5000 a year in a part-time job to pay for school.

Alan Greenspan was the high Saint of Libertarians? Because what, he read some Ayn Rand when he was younger (never mind that objectivism and libertarianism are not the same)? None of his actions as fed chairman, playing god with interest rates or expansion of credit onto the “free market” until the whole system was teetering on debt would be considered libertarian ideals of a free market.

@Michael D.: You might want to become a bit more knowledgeable about Libertarianism. In particular, Greenspan’s relationship with Ayn Rand.

The “high saint” is being charitable. Although the Libertarians are trying to cover their butts from their latest set of failures, and distance themselves from him now, it would be far more accurate to call him the Poster Boy of the Libertarian movement. As he and his philosophy were heavily loved during his peak, when he was fawned over unquestioningly as “The Maestro”.

It’s rather ridiculous for Libertarians to try and distance themselves now, as much as they’d like.

No, Put some of it on gold and silver. Physical gold and silver. If you can’t hold it in your hand then you don’t own it. That is what I have been doing.

Daniel, I’ve been wondering the same thing. I know the FDIC is closing banks about every Friday, but I really expected more bank closures from the housing bubble. It was my assumption that if the Feds hadn’t stepped in to bail out the banks that some of the biggest banks would have failed and there would have to be a pretty massive FDIC insurance pay out. I”m also assuming that banks are slow to act on people not paying their mortgage because they’re avoiding having to sell too much inventory and put the loss on their books. Though that in itself seems like it could increase their losses –several years of lost mortgage and interest payments and then a house that’s worth quite a bit less by the time they kick the free loaders to curb and sell the house. It just makes me wonder if, when all is said and done, the banks don’t end up having even worse losses. We’re on the fence waiting to buy, too. And at some point I’d like to buy rental property. But my big fear is that I might wait too long to get the lowest price and end up seeing half of my savings wiped out by a massive bank failure.

NO PAPER INVESTMENTS WILL SURVIVE THE COMING DISASTER!

Any investment made of paper will be destroyed. (Stocks, Bonds, CD’s etc.)

Buy silver & gold coins and take physical delivery of them. Find a local coin dealer that will help you with your purchases. Silver prices is about 36.00 today, one year ago it was 18.00…see what I mean.

I see the gold/silver bugs are out in force.

FUnniest nonsense I have heard in years comes from that crowd.

(1) GOld/silver have limited real uses. You can’t eat it. can’t wear, can’t stay warm with it. It is only useful for things like filling teeth and certain types of electronic circuitry. Good luck trying to take a few grains of gold dust to the store to buy bread.

(2) It is only worht what same damn fool will pay for it on a given damn. And i sue the phrase ‘some damn fool’ in the same context as the idiots who thought house prices could only go up.

(3) Gold/silver prices have been going to insane and unprecedented or nearly unprecedented heights. The prices increases have been driven solely by the belief that it will group. It certainly hasn’t gone up because of an increasing demand for jewelry or teeth filling!

(4) It is apsychologially-friven bubble —- just like houses and stock markets. What goes up can, and will, come down.

Pretty funny to see all those who think themselves so clever about a housing bubble falling straight into the gold/silver bubble driven by the same psychological mania.

From one bubble to the next, if the markets really come to what you describe nobody is going to care about your gold and silver.

Daniel, it’s in the numbers. Is it better to buy a house at a lower price or lower interest rate? The answer is a lower interest rates. Yes, you might have a lower price in awhile, but if the interest rate is higher your monthly payments will actually be higher. Also you should be shopping now, because chances are you are not going to buy the first house you see. Besides the more homes you see the more you will know a great deal when you see it. Even investors are buying now, not because the price is not coming down more, but because even they don’t know the “bottom.” My suggestion is if you can afford to buy now and you find the house you like then buy now and get the best rates ever……one big concern….it’s the loan they are harder to get…..they will be very easy when the rate goes back up. Good Luck

Great discussion backstopped off a great piece by DHB.

Daniel, with all due respect, the point I think you’re missing is this: you may have such a monetarized mindset, that you cannot conceive of other forms of value. That’s common enough these days, as demonstrated by the replies which advise you to move from one form of symbolic wealth to another.

We are in a much deeper set of problems than that. And until we consider how this all came about, we are open to extending the same thinking and problems in any solutions we think we’re pursuing.

There has been an expectation bubble, dating to perhaps the 1970s, and put on steroids under Reaganismo. People came out of the WWII experience with the expectation that life would now afford them certain benefits in return for certain efforts. I personally think that was a reasonable expectation.

But there was a problem: the military-industrial complex had so much global power, and Wall Street was ascending on the power of telecommunications, advertising, and automated calculation of the Capitalism Casino. Rank and file people did not have this power.

Then came the late ’70s and ’80s, when people like Les Quick and John Bogle sold the idea that there could be “retail” involvement in the stock market. I.e., that you and I could trade and invest and make out in the long run just as our money masters did. When personal computers and the Internet were factored in, suddenly it seemed that individuals had all the power of institutions to play in the casino. Individuals who did well were cherry picked as the new religious idols: if it happened to them, it could not only happen to any of us, it could happen to ALL of us. And for those it didn’t happen to, or who were destroyed as others pursued their dreams of bling–pooh, who cares about them? Lying outside the narrative, its losers, made them pariahs.

This was the religion of this nation, under Greenspanomics, with its strong and highly rational roots…in a pathetically awful series of fiction books by a disaffected femdom Russian immigrant who fancied herself a saloniste and drew a peculiarly ballsless and immature circle of men as her adherents.

This has accounted for every bubble that formed and popped, or is in the process of popping. It was always irrational, always doomed to fail. But those who furthered it had the power to do so, and the power to ignore any other narrative. They also had mass media instruments of convincing the masses that this was the way things were and the only way it could be.

This worship of money and power touched and infected everything. It led people to think that everything they did was an economic choice or decision that could be managed for profit and used to assure higher class standing. Nothing had value on its own. Everything became a token in a Gourmet Designer Elite Fashion Lifestyle. For remember, after WWII, most people’s expectation of return on investment was quite modest: work hard, fight for your nation’s boundaries and your people’s values, and hope to be left alone by the powers of empire to be a human being, living the dream of liberty from despotism.

What we have inherited instead is a thoroughly monetarized view of the economy and indeed of all human endeavor. Our house isn’t a place where we live–it’s a vector for our investment and for others to get rich selling us goods and services. Our marriages or partnerships aren’t a blessed bit of intimacy in a rude and crowded and indifferent world–they are the means by which we climb socially. Our children aren’t people–they are consumerist possessions by which we exert power over one another through wealth transfers (it takes your village to raise my sprogs!). Our clothing isn’t cofmortable protection against the vicissitudes of climate–it’s the way we signify our aspirations and pose as who we want others to think we are. It’s not our car–it’s our freedom.

We have invested ourselves in a semiotic religion of wealth that is obsessed with permagrowth, comfort, display, consumption, and uber-status. All of this has no end. It just is. It’s like fireworks: a lot of shiny sparkly boom, then nothing. And the fish in the harbor swallow the heavy metals.

This has infected everything. Not just economics and our home and work lives. For gods’ sake, this is what you learn if you study the “social” “sciences”–a bunch of postmodern claptrap about Signification and Semiotics and Social Place and Mapping. And nothing about what you do when your species is outbreeding its resource base, and can’t stop, and not only can’t stop, breeds all the harder to prove it’s on top. Saving the planet through jetting to Bali to get knocked up. Sustainability through a second house in Peru built by the eco-peasants and paid entirely for by American taxpayers, so that one can be the richest people around SOMEWHERE, if not back in the US.

Meanwhile, the human ability to defer whims and work for longer term ends was devalued entirely, in favor of scamming, speculating, gambling, and the Big Hit (lottery, Mob, American Idol, New York Times bestsellers…).

What we are facing is a truly transformative time in human history. It’s no wonder so many people feel at sea, though, given their habit of thinking with their possessions and status, most have a hard time sorting out what is real from what is passing. Yes, all life is passing, but in the end, what we own is not the measure of our lives. This isn’t carte blanche for larceny and exploitation. My point is only that, we are having to reach back to something deeper than the crap we came into possession of, through the magic of pixels on some lender’s screen.

DHB has been trying to get people to think about this, as regards their views of their houses, since 2006. He was a much more ebullient fellow back then. It was a good time to let others know that that box emitting the grunting and squeaking and gibbering noises was dangerous, and not to be opened. It’s a lot harder today to live with what flew out, when the lid was raised.

Daniel, your money is not safe. How could you ever think it was? It is a token of value in a system that you do not administer. ALL tokens of value in ALL systems run by others are like that.

The real question is: what do you value above all things? What is the currency of YOUR life? If you hand that over to others–like the Federal Reserve, Wall St., and the banks–you are destined always to be at sea, disappointed, and subject to depressions and recessions. That’s how those systems work: they ebb and they flow, systematically, for certain ends, and those ends don’t generally involve whether Daniel can afford the kind of house he likes, and whether compass rose can afford to solarize the cottage, and whether Doctor Housing Bubble does whatever Doctor Housing Bubble dreams of doing. Their systems may spin off privileges for you or for me. But that’s not why they exist. They exist to concentrate wealth, socialize costs, and build empires.

You have the choice to buy some shiny metal, and cling to it with the fantasy of doing better than all the schmucks. Before you choose that, do review what the Eddas had to say about Fafner in his dragon-guise, obsessed with guarding the Nibelung hoard. You have all sorts of choices. But what you are asking us for is the magic formula to exempt you from something you don’t want to live through. It’s understandable. Just bear in mind that we are powerless. In times like this, all we can do is try to avoid the pitfalls. That, in my view, is what DHB has been about from the beginning of his blog.

Check out this blog:

http://247wallst.com/2011/06/06/ten-signs-the-double-dip-recession-has-begun/

It presents the arguments that good doctor has been showing us these last several years. Why would anyone buy a house in this climate? You get more and lose less in a rental. Period.

For me the bigger question: where is the safe harbor. Domestic Stocks look shaky. Real estate, forget it. Cash? No way with inflation just around the corner. Commodities? maybe, but I personally know little about them. Metal? My dad always said gold bricks never made a dime. He meant that they can be a useful anchor to hold against the tide, but they cannot drive you forward. International equities in china or india might sound appealing, but in the absence of transparent banking laws (especially India) they are risky.

I can admit that I am confused and apprehensive. I hate that.

yes glisten, I hear you – all the options are fraught with red flags – it’s truly a time like no other any good options Dr?

See my comment above. It’s understandable to be apprehensive. Psychological preparedness is arguably the most important thing. Without that, you’ll be left in shock. Indeed, people count on that and make money off of it (see Naomi Klein’s “The Shock Doctrine: The Rise of Disaster Capitalism: http://en.wikipedia.org/wiki/The_Shock_Doctrine).

Understand that the biggest threat that we’re facing is Debt Deflation, which is a form of Capital Destruction. During deflation, cash is king; all other assets are secondary. What you can expect during the next meltdown is another huge “margin call”, where people dump everything to raise cash. Precious metals, stocks, etc. are all sold in order to raise money. And the money which is available goes towards what is needed most. Like food.

You won’t see serious inflation (money supply, not prices) until all of the bad debt is wrought out of the system. After that though, watch out.

People are also nervous about the ongoing decline in the Stock Market. As I’ve mentioned over the previous weeks, IMO this is just a Kabuki dance in order to justify more money printing. I don’t think things are going to crash like in 2008 just yet. But I do expect the market to head downwards with the end of QE II. And this will be used to justify more printing.

However, I could well be wrong; and absolutely wouldn’t rule out a sudden crash. The whole financial system has been exhibiting odd behaviour lately, requiring more and bigger coordination.

My apologies to everyone for taking up so much space on this. I do try to keep things limited, but people seem to be unsettled by what’s going on. Hopefully this offers a better perspective.

Gold and silver sold off in 2008, along with everything else but cash and treasury bonds. However, debt levels of the USA federal govt. have increased considerably, and sovereign debt has come under a cloud during the last year or two. Therefore, I think that gold and silver might hold up better this next down leg that is approaching (or already started).

For example, the DOW and other major stock market averages have dropped 6 weeks in a row, while gold and silver have meandered sideways. Over the last 12 months, silver is up 100%, gold is up 25%, and the S&P 500 is up about 15%.

Any further weakness in the economy will force them to run $2 trillion deficits and the fed will have to expand their balance sheet some more. Hard to see gold dropping and the USA dollar rising. Short term, however, the Summer is a seasonally weak time of year for gold, so I wouldn’t be surprised if it sort of continues this sideways action we have seen recently. Any one that has neither gold nor silver should consider slowly averaging into the monetary metals. Do jump in all at once, but rather spread your purchases out over a few months.

@Jason:

I agree that Gold and Silver will hold up better. There is evidence that Gold is now being used for the “flight to safety”, instead of dollars. However, during a big margin call, accounts are settled in dollars, not gold (though there are a few exceptions).

I also agree with your advice about slowly averaging into PMs. But I wouldn’t put all of my eggs in one basket. For the record, I do hold PMs myself.

Gold and silver sold off in 2008

I don’t quite understand this comment. I don’t believe there was a selloff. In fact, in was difficult to obtain physical gold and silver during that period, silver more so. Some would say that the physical market went into hiding due to an artificially low “paper price”.

In 1933 people were denied gold in exchange for paper.

In 1971 the world was denied gold in exchange for paper.

In both instances, there was not enough gold to back the paper.

Lets see what happens next.

A timely article given the 2008 sell-off comment. Concentrated buying all the way to the bottom. And if you look close, you might be able to see me at the bottom in ’08 with a truck. LOL

Silver Preparing For Another Shock And Awe Move

Silver’s next move has the potential to be “shock and aweâ€. Smart money is buying long contracts hand over fist. This type of concentrated buying has not been seen since late 2008 (see chart below). The concentrated buying of 2008 foreshadowed nearly a doubling and quadrupling in price by early 2009 and 2011. In other words, the money flow setup foreshadowed a ‘shock and awe’ run that few experts saw coming.

I came here in US in 1997. At that time US dollar to our money is about 1: 35. For more than 10 years, the ratio had kept the same until about late 2007 which it drops to 1: 33 or 32. However, for just last 12 months, the price of US dollar had drop to 1: 28 something to our money and it’s still dropping. It’s not because of my country’s money is increasing its value internationally, it just simply because US dollars are dropping the value.

Perhaps currency holds up value (I highly doubt it), I don’t know. But I’m sure that currency IS NOT US dollars.

“For me the bigger question: where is the safe harbor.”

This is a hard question and while I had the same problem for a while, I decided to support my hobbies with all that cash (not much, really): I bought a couple of old cars, early 60s. Probably won’t make profit but they as probably won’t lose their value a lot and meanwhile I get to drive them around, much better than gold brick. 🙂

Much, much better than cash anyway. We’ll see about 20 years if this was a good choice or not.

Your Dad was wrong about gold. My grandfather said the opposite. Look at the price of gold 5 years ago and look at it today. You would have more then tripled your investment. My grand dads gold coins have help save my butt. Thanks Fred! RIP.

I am with you.

It is pretty simple, in 1972 you could buy the dow, which was around 800is or you could buy 20 ounces of gold at around 40.00 an ounce. Today, the dow would be worth 12K and your 20 ounces of gold would be worth 30K.

Yes, the dow paid dividends so that ups the number quite a bit. But…..what people fail to really think much about is that the dow number is manipulated higher while gold was not.

How was it manipulated? Simple. Check the companies that made up the dow in 1972 versus today. Half of them went bankrupt or were simply moved out because they didn’t “fit”.

If you were to go back and recreate the dow from 1972 that would include the bankrupt companies the dow would actually be somewhere around 6K today.

These days “investments” are really about only protecting your “true purchasing power” with little chance of REAL growth. In fact today, protecting your true purchasing power is increasingly becoming a pipe dream.

The developed world is in the process of major debt repudiation. Personally, I don’t believe the 11 year old Euro experiment will survive it. All assets will reprice, and in many cases the resets will be dramatic and long lasting. If you discover a safe harbor, please share the news with the rest of us. I am stumped.

I definitely understand your concern. I am going to try make this as simple as possible. The key to investing in a deflationary environment is locking in a cash flow stream for as long as possible that is constant (ie. not declining). If you’re able to lock-in the same stream of payments while the value of $ is depreciating then, in theory, you’ll end up ahead.

Here are a couple of very good examples of locking in a long term cash flow stream: ATM machines investments, where the surcharge is held constant over a long period of time and where you’re on the same side of the table as banks (ie. fees heading upwards). I won’t get into the fact that banks will likely continue to raise their fees and the private label ATMs will be able to follow suit (you can read more about this via the govt’s decision this week to limit debit/credit transaction fees). Another example in Commercial real estate would be very long-term leases with “A” class tenants (ie. Target’s distribution centers, for example), such as your typical Industrial property lease, while properties with very short-term leases (ie. self-storage) will have downwards pressure in their future cash flow because owners will be chasing prices down as new customers come in. I am using these examples to illustrate a point so you can think about long-term cash flow, as opposed to pointing you to a specific type of real estate, as commercial real estate has many, many issues right now (I am specifically pointing this out so no one replies and tries to tell you not invest in Industrial properties, as I am not trying to make the argument that Industrial is a good idea right now). I could go on and on with more examples (ie. Long-term fixed-rate notes, long-term fixed-rate leases, etc) but I will stop there to try to keep it relatively simple.

Anyhow, I hope this helps to put you on the right track in terms of what to consider and what to stay away from. It’s all about locking-in long-term consistent cash flow to beat declining prices.

One final note: We are VERY CLEARLY witnessing a slow-motion train wreck of great proportions. Between the US debt levels, the economic stagnation, unemployment, and the Euro debt crisis, things are going to be ugly. PROCEED WITH CAUTION. Being careful is always the best way to go and that is particularly important right now. And don’t be fooled by the media and the govt’s money printing (both US and Euro). Politicians and govt’s can kick the can for only so long before the market realities become an overbearing force. Without very major actions, you’re liking witnessing the US and Euro losing control over their economies and currencies slowly but surely. They can only “extend and pretend” for so long…

Good luck to everyone,

Investor J

http://www.meetup.com/investing-363/

http://www.meetup.com/FIBICashFlowInvestors/events/17426967/

http://www.meetup.com/FIBI-Commercial-Real-Estate-Los-Angeles/events/17427003/

Population of the U.S. is still growing at around 2-3 million per year. Over the next 10 years, those extra 20-30 million people will need to live somewhere. This will quickly absorb the excess inventory.

With historical low mortgage rates, and lots to choose from, this is a great time to swoop in and pick up a bargain.

You’re joking, right?

By this reasoning, the slums of India shouldn’t exist, if it was only about population growth. And a mortgage of 4.5% is really bad, if your house is going down 5,10,20% per year in value.

I’m curious, Mike. Where in the world do you see the economic growth coming from, that will boost jobs and income? It sure can’t be from the Fed’s money printing, because even with having put Trillions in the economy, revolving and non-revolving credit is still declining. Except for Student loans.

So please, do show us the money.

Student loans. That’s a whole other problem. I can imagine what they were saying in washington. “Housing prices are unaffordable, and now prices are coming down. What should we do? I know lets get more people more educated, so they can get a good job and keep home prices up.” Result: more young people overwhelmed with college debt and they’re either unprepared for work or the work isn’t there.

is this even worth responding to or are you just a troll?

If they have no job, they will be living in the street. If they are at McDonald’s they will be with mom.

Mike,

I’ve heard the same stat. I would love to see the Doctor factor that in to the mix.

Oh for heaven sake! Enough already with the dumber-down kindergarden level population increase nonsense!

Housing can only be priced at what incomes can afford. PERIOD!

If there are 10,000 people and 1,000 houses priced at what they can afford and 9000 houses priced at 2, 3 or more times what they can afford, they will crowd into the 1000 houses they can afford.

To put it another way, you could fill every stadium int eh US and try to sell the Hope diamond to all present. ANd unless there is someone there with a few hundred m illion to spare, all those millions in the seats can’t buy and will instead buy the zircon imitations — and you can’t sell your diamond.

It is INCOME, INCOME, INCOME that is the determinating factor.

As the one poster said, that is why there are slums – huge numbers in a population can not afford more than a shack.

The population is increasing, but I don’t know about household formation. The latter is the key to housing, not the former.

One key to population is the stability of Mexico and other Latin American Governments. If Mexico continues to deteriorate, that could boost immigration, but that would just tend to depress wages.

About 7.

Are these part time jobs or full time jobs? Because I’m guessing McDonald’s employees are mostly part time.

I don’t see inflation helping CA home prices, and in fact it may cause steeper falls in nominal prices. Inflation has to raise wages and incomes, but that looks unlikely in CA in the near to medium term, thus inflation will hit energy, taxes, and interest rates. An inflation premium in the home mortgage rate will send bid prices down considerably, just like an increase in real rates would. In an inflationary environment I would guess 30 year mortgages would completely dry up, reducing credit for buyers. There is no light at the end of the tunnel for CA homeowners, just a gradual fall or a steep one into the abyss. High end homes better sell to foreign buyers now.

Wow! That chart from the US Department of Commerce, showing Personal Income – can that be right? It’s showing an average of about 6% annual increase in personal income in the 1990’s, around 5% annually in the 2000’s, and around 5% right now.

That seems a bit high. And it doesn’t square with other measures of increases in income, like the last chart above, showing median household income.

That chart shows the change from the previous year. The 5% increase if from the previous year where it took a big hit. So the net is not an over all increase. So your right, wages are not up 5% overall, but they are up 5% over last year. But that still seems high. Could be McJobs gave a 5% increase from $7.00 to $7.35 an hour. Now that is something to get excited about.

Squatter’s rent is a creative form of personal income ( sarcasm ).

Yes, that is correct. Most of my relatives work for the government(teachers, engineers,etc.) . Govt. workers during those years got annual inflation adjustments

3-7 percent, annual raises of around 4-6 percent, and every so many years, the entire salary schedule is adjusted upward, bumping up the entire salary range.

Since govt. workers comprise around 30 % of the workforce, overall effect was in the range that you citied.

I Think 25% IS REAL optimistic. Keep in mind there are millions of foreclosed(and to be foreclosed) that are not on the books. The economy will continue it’s death spiral(by design). About 25% of motgaged homes are under water. Jobs still being expoted. No jobs. No money. There is no recovery.

That is what’s really concerning. Not so much the foreclosures and defaults we know about today. But as the economy slows and more people lose jobs –how many more people will default in the few years? Also, when I look at homes for sale, I’m seeing homes that sold in the last few years (post bubble) coming back on the market. Even homes that sold as distressed sales last year are coming back on the market as short sales again. It doesn’t help that banks are still asking for small downpayments on rather expensive homes.

Did I ever find a real home of genious!

In Wilton Manors Florida there’s a 2300 plus square foot 3 bed/ 3 bath town house currently on the market for $96,500. Last week it was listed at $165,508, a reduction of $69,008. The listing indicates “may have defective drywall,” despite the fact that the house was built in 2007.

Doing a little digging, I found an old web site from that time that indicated the prices started at $550,000 & now we are looking at sub $100,000. Oh BTW, the property taxes are $7044 with a $230 maint, equalling a tax burden of over 7.5%. The real property tax rate is 2.3035% acording to Broward County.

I’ll call you on that one. Here we had this:

2005 purchase price $2,600,000 and mortgage of $2,100,000

Divorce and owners try to sell in early 2007 – starting at $3,200,000 (ROFLOL!

Drop price, drop price and now it is mid- 2008 and price is $2,100,000. Owners threaten to walk and stop the money; BOA starts foreclosure and backs off (think deal was cut the owners would pay the property taxes which are around $42,000 a year.)

Drop price drop price with bank setting it – down past $1,800,000, $1,500,000……

Now fall ’09 and it is at $999,999.

Owners say to hell with it and bank forecloses in summer ’10.

Bank gets it back in Jan ’11 (redemption period is 6 months.)

Bank FINALLY sells it April 2011 for (drum roll) $365,000. (And no it is only 6 digits.)

House was 3200 sq ft by some well-known modernist architect + 3 car garage + 1.5 acres + 160 ft of PRIVATE beach on Lake Michigan and shared beach on an inner lake.

Bank netted maybe $325,000 after realtor, lcosing costs, paying some buyer closing costs BUT not counting all the taxes and incsurance. Not bad – final sale price was 86% of the 2005 purchase and BOA ate over $1,800,000 on the loss.

Why I think Shiller might be too optimistic is that foreclosures are selling for over 30 percent price reductions ….

Doctor, actually the 30 percent price reduction is truly the new price of houses in a particular neighborhood. Any person that pays for a house in a neighborhood 1-30% higher than the foreclosure price is a sucker.

What percentage under market do foreclosure prices represent in a normal market?

the 2nd housing crumble is just around the corner and its gonna be super special to see all the slimebag builders/realtors who have been screwing dumb people for years buy selling them houses that were way overpriced and living the highlife driving around in their new trucks thinking it would never end.the only builders who are left are robbing peter to pay paul and i cant wait to see them all driving around in a 1981 lincoln town car with a compressor,saw and a vinyal siding color cards in the trunk looking for work.dont be fooled.

Dear DHB,

What do you think the general state of the economy will be in 2 yrs, 5 yrs, 10 yrs? You are very good at looking forward with regard to housing. What about the rest of it?

Public sentiment is reflected in popular media. Ever notice how many end-of-the-world movies, like Planet of the Alt Apes and Ben and Hanks horrible Adventure. Shiller is again an optimist and dark ages may understate thebleak future beyond 2011.

“No comments” yet. So I couldn’t resist. I think this post, like nearly everything you write, is entertaining, well-reasoned, and sobering. I don’t even live in SoCal (I used to, though). I think we are in for a world of hurt and things are not getting better everywhere. I am fortunate to live in an area that’s not the worst in the country, but we here in Tenn. are not doing all that great. I have a glass-half-empty type of world-view in general, but I also want to know the truth–not the ridiculous spin from the real estate shills and the bankster apologists from the controlled, corporatist media. (For a recent example of the latter, see Andrew Ross Sorkin’s revolting piece in the NYT, in which he basically parrots the Goldman Sachs line. The “blog” he writes for, as Matt Taibbi and others have pointed out, is “sponsored by” in part by — well, you know . . . .) At any rate, you provide a great service, along with a few select others, e.g., Jesse’s Cafe and Naked Capitalism. Keep up the good work.

Brainwashing is an art and the means of perfecting it comes through Hollywood..

The US is a bankrupt nation due to excessive military expenses..noting more nothing less..

I wonder if these things are part of a bigger cycle. In the 1500s, India had the largest GDP of the world. India and China were global economic powerhouses. China was a leading innovator. In a few centuries, they went down and the west surged. Perhaps the cycle of life is ready to embark on the next cycle? Who knows-but I think our dumb politicians on both sides of the aisle don’t help. Nobody talks about jobs and what to do-end free trade, anything. I am not saying do it-but at least have a national discusssion on what to do. The only discussion we seem to have is to lower our costs and social net to a third world nation and then compete at that level.

Squatter Nation: 5 years with no mortgage payment

http://money.cnn.com/2011/06/09/real_estate/foreclosure_squatter/index.htm?iid=Lead

So, 650,000 households not making house payments x 24,000/yr each family approx money they are thus spending in our economy = 15.6Bil that will permanently shift to landlords soon, once freeloaders are foreclosed upon.

If they do not have jobs they will soon be a burden on taxpayers.

Permanent shifts in spending in the US.

Where on earth do you get the wild number on the amount of missed payments?!! LOL!

Even during the height of the bubble, they would have needed an income of $75,000 -100,000 a year to get a loan with a principal and interest of $2000 . That is the TOP 15 -25% in the US. Assuming the total PITI was $2000, that still would have needed an income of $65000 -72,000 —- the top 30% in the US

Try it is probably more like a median income and the typical payment was around $1000 -1200.

Basically what everyone is saying nearly 70% of the us that own houses are f*…. And all renters flush with cash will rule the world in 10 years when they can afford to buy all real estate with their gold coins they are collecting in their parents basement or studio apartment.

Do you realize how nuts you sound? If all homeowners wanted they could all squat and like a game of musical chairs… When the music stops… We have houses and you dont!

LOL

You’re funny.

The scenario of another 25-40% drop being thrown around on this site are apocalyptic for our economy… It would bankrupt generations of people who bought a home in the last 20 years.

The solution of lower asset prices for housing won’t help our economy grow anytime soon… Would we be better of without a housing bubble? Sure, but it happened and undoing it much further would be the end of us all… Say hello to a true Depression.

I don’t think people are really considering the ramifications of another 40% drop in real estate?

You have houses in a state with deep deep fundamental problems. It might not be such a win afterall.

California is still the 9th largest economy in the WORLD… Not the united states.. but the WORLD. As long as silicon valley (Apple, Google) and the Hollywood film and tv industry don’t pack up and move out of state… CA will remain a powerful economy…

Our wealth disparity is growing.. that’s California’s main problem… If CALI would spread the wealth some then we’d be better off…

You nailed it, the kids in the basements with the coins will be buying property for peanuts. As will the folks at the top who prepared the right way and have enough gold / silver / cash to pick up everything on the cheap.

Yes we know how crazy it sounds but normalcy bias has you blinded.

I’m with Kevin on this one, the real estate market might not look too good as a whole, but if you look closely on certain areas, the price remain stable for well over a year or two. I live in the SF bayarea. Some area has a huge demand on good housing at a good school district. And kid you not, the job market actually quite promising for young profession. In comparison to 2008, barely any new job listing, it was like a desert. And today, more than a dozen of companies are hiring at all level jobs.

However, I don’t think the real estate will go back to the peck level any time soon or ever again. maybe in 10 years.

I made my choice years ago. And I’m very pleased with the decision…

Link: Priced in Gold, Is Housing a Buy?

I hate to tell you this but even the gold bugs and precious metals nuts on Zerohedge ripped that article apart. Housing has fundamentals which have been discussed to death here. Gold has sentiment alone keeping it above industrial use prices (sub $500) where fundamentals play a factor. That’s not to say gold will go down or up from here, that’s just stating facts.

Please don’t believe for 1 second gold is this stable anchor in a sea of uncertainty and everything should be priced in gold. Look back at the 1980 high, we’ve had nothing but inflation since that point and even with the last 10 years of gold spike you are almost $1000 oz away from breaking even against CPI. Lots of other periods work out to have gold negative over 5 to 10 year periods of nothing but steady inflation.

Like all things, gold pricing implies a view of the future as opposed to being solely a present anchor- if that future doesn’t work out, gold can and does lose value. The view right now is that while velocity is low, we will have no inflation but with all the base currency created when (and if) velocity does increase, we will have a lot of inflation. I don’t think many of them realize how hard it is to get velocity after a credit collapse. Not sure what happens this time but examine post-gold standard history…not a stable picture in the least.

Now if people can accept all that and still want to buy/own some, then that’s fine but a lot of the people out there are real sheisters playing on fear to create sentiment only to move their own positions. They are no one’s friend and are in it solely for themselves.

You’re not really telling me anything that I don’t know. My move years ago was a hedge against risk. I considered it insurance, and, in fact, I mentally accepted it as a loss of 50% to justify the exchange.

Now, I watch, wait, and look for signs of things to change, reverse, and improve. I don’t see any of these signs. Quantitative Easing seems to be the only alternative. Where is the recovery?

I say we all just squat in our homes, rentals, whatever en masse… The entire banking system would collapse and like a game of musical chairs… When the music stops.. You get the seat(home) you are in free and clear!

I’m with you Kevin – let’s all take the banks down. F* the banks. They have ruined this country. We could take our country back and kill off the banks by not paying. Banks (and the people who control them) are blood sucking parasites!

I rent in Santa Monica in a one bedroom apartment – costs me $1250/month. I’m not one of those rent-control ‘lifers’ either; my wife and I have lived here for about 18 months.

A new listing in the adjacent building just came on the market. A 2 bedroom condo for $819,000. So I did the math and if we wanted to buy this place it would require $164,000 down and a monthly mortgage pmt of $5000/month.

Keep in mind this is a large 2 bedroom – but seriously ….. This is crazy!!!! These prices are insane!

Dr. Housing Bubble, I am a follower of your highly informative blog. I live on the East Coast and work in NYC. I pay my property taxes directly to my municipality away from my loan servicer (Wells Fargo). From what I understand, the loan servicer will step in and pay any property taxes that are unpaid after some time. I haven’t read any material related to this factor and it’s impact on the banks and or loan servicers. I assume they do so to keep any third party tax liens out of the equation. Can you add some color to this for us? Not only do the banks/ls have to be concerned about the mortgage payments not being made, but also the property taxes.

This economic problem was totally made in America. There can be no blame put on other countries or other areas of the world. The US decided to expend more money than it was generating for useless things like making war. Once that happened the rest of the economy went into the doldrums and the problems created by expenditures with no tangible results compounded and created a crisis for all Americans. If you look at an economy that is closely connected to America’s. that of Canada, you don’t see any of the major problems that the US has. There are no bank failures, the national debt is being slowly but inexorably paid down, there is a maximum of 7% unemployment, housing prices are bid up in many areas by offshore buying with homes selling for more than asking price, infrastructure is being created and repaired at a rapid rate and the people are content and satisfied with how things are going. Why such a difference? I personally believe it is because Canada doesn’t get involved in useless and worthless wars everywhere ( except Afghanistan where its troops are leaving shortly). Perhaps a good look at US foreign policy might be helpful at this juncture.

I’d be surprised to see stuff drop another 25% in CA(Riverside County is already down 60%), but then again we are about to take the #1 spot from Nevada in terms of Unemployment Percentage. At least we are the best at something.

Doctor as prices are falling again and accelerating are we going to get your banner that shows year over year decline for each of the SoCal Counties? I rather enjoyed the monthly updates on that.

No offense Dr Housing Bubble but the actual bubble is land value not housing. Improvements depreciate over time. The problem is land attracts an enormous response as the value rises, eventually starving the economy of cash. The Fed goes into a reactive mode trying to keep the economy afloat because the cash going into land investments is basically, gambling. You cannot create more land, it is a fixed factor of production. Productive people have to pay more for cash wasted on land speculation.

This time around, 2008, we had a bunch of free marketeers turning mortgages into casino chips, regulators putting blinders on, CEOs looking the other way passing toxic securities on, etc. All this criminal activity exasperated the underlying cause of the financial bubble, land speculation.

What is interesting about land value is it is created by the community, not the landlord. We pay for police, schools, roads, bridges, courts, jails, sewers, etc. and the wealth is transferred to the landlord. Productive effort as in businesses is also transferred to land values.

The only solution is to recapture the rental value of land by shifting the property tax off improvements and applying the levy on land value. In fact all taxation on productive human effort, like investing, getting a job, working, running a business, should be shifted to land value, minerals, oil, airwaves, etc.

I don’t think people understand if they haven’t travelled throughout the world. I hate to say this but we are stuck in a left/right debate which is crazy. If you go to many countries in the world that have smart public policy – they give examples like this is what singapore, norway, canada, etc… do on a particular problem. They call it best practices, and they get results. We are stuck in this debate about crony capitalism, and whether government is useful or not. As the rest of the world catches up and passes us by we will have only ourselves to blame. Housing is just another example, and unfortunately we have to do what other countries have done, and instead we are debating the essence of being an american. I don’t think this literalism will bring us to the right directions.

Shiller is deluding himself. We’re headed to 90% value loss and he knows it.

Plant potatoes and arm yourself.

We haven’t even begun to feel even the beginning of this meltdown.

Teach your wife and kids to shoot and gut game, including things you may have been used to calling pets.

It will mean the difference between the survivors and the dead.

Get ready.

In your crazy apocalypse scenario i would rather buy NOW and enjoy my house, pool, yard ect while i still can! Any scenario where prices drop more than 20% from here would lead to mass riots… Squatting in homes en masse and horrible scenarios where it wont matter if you have $0 in the bank or $200k in the bank… The only survivors would be the uber rich.

I am an immigrant from a former Soviet republic. Survived a collapse of the USSR. Came to the US 5 years ago. You guys are are talking about apocalypse in the US. It is so funny. Believe me, there is so much wealth in this country that we are not even near apocalypse. I know what it’s like. You have no idea. I know how to survive on $10 a week. I know how it feels when all you can afford is 4 washing detergents with your monthly salary. Believe me, this country is way ahead the rest of the world. Yes, lifestyle will worsen since there are no jobs; however, it will take very long time to approach a level of former Soviet republics where people have to save money for months to buy a coat or boots for a winter. Here…go to the store….People are still buying junk they don’t need every weekend. Have you ever compared closets of homes built in 60th and in 90th? Eating out instead of cooking home. As I mentioned, lifestyle will change. People will buy less, attend discount stores (which report great profits during recession) , travel less and live in smaller homes, move in with parents, relatives, roommates etc. Americans will learn to live on less. Just like the rest of the world learned. And owning a house…may become a privilege. It used to be that every family should have a house. This mentality will change. More people will move in with parents and relatives, learn to share, live in smaller and more crowded homes. Did you notice that many people are buying homes for cash and having multiple homes, while others have none and have to rent. Social stratification is increasing….. It has reached very high levels in Russia in recent years. Small amount of people accumulated great wealth while the majority is extremely poor. I don’t think that this country will collapse one day, but lifestyle will worsen and people will learn to have less luxurious lifestyle. There are still a lot of reserves here….

Leave a Reply