Millennials are unable to save the California housing market: Inflated prices and a labor force that is aging.

The housing market now sputters into the summer selling season with very little momentum. Home sales are at post-recession lows and the labor force participation rate is collapsing because you have an army of Taco Tuesday baby boomers roaming the streets of California enjoying inflated real estate values while enjoying Whole Foods delivered to their front door without taking more than 5 steps on their Apple Watch. Yet many of these same boomers are now getting frustrated as their adult children are unable to purchase homes in the area and over 2.3 million are living at home. This notion that Millennials are going to save the market is simply not going to happen. You already see growth in other more affordable markets but in places like California, we’ve become a renting paradise. Let us look at some recent Millennial figures and understand why they are not going to save the California housing market.

Millennials to the rescue?

Millennials are the most educated cohort we have had in the U.S. but the challenge is that this education has come at a cost. There is now over $1.5 trillion in student debt in the U.S. And in many cases this debt is going to programs that simply do not align with careers that pay well. Take for example USC’s Master of Social Work. The program expanded online and can cost over six-figures. Keep in mind that social workers earn very little yet somehow, these students are paying as if they are pursuing a graduate degree in computer science, engineering, or say business where the salary may support the underlying degree cost. This is just one example where cheap money (aka, student loans) inflates an underlying product. I just want to note that a six-figure student debt is roughly what your mortgage would be in many parts of the country.

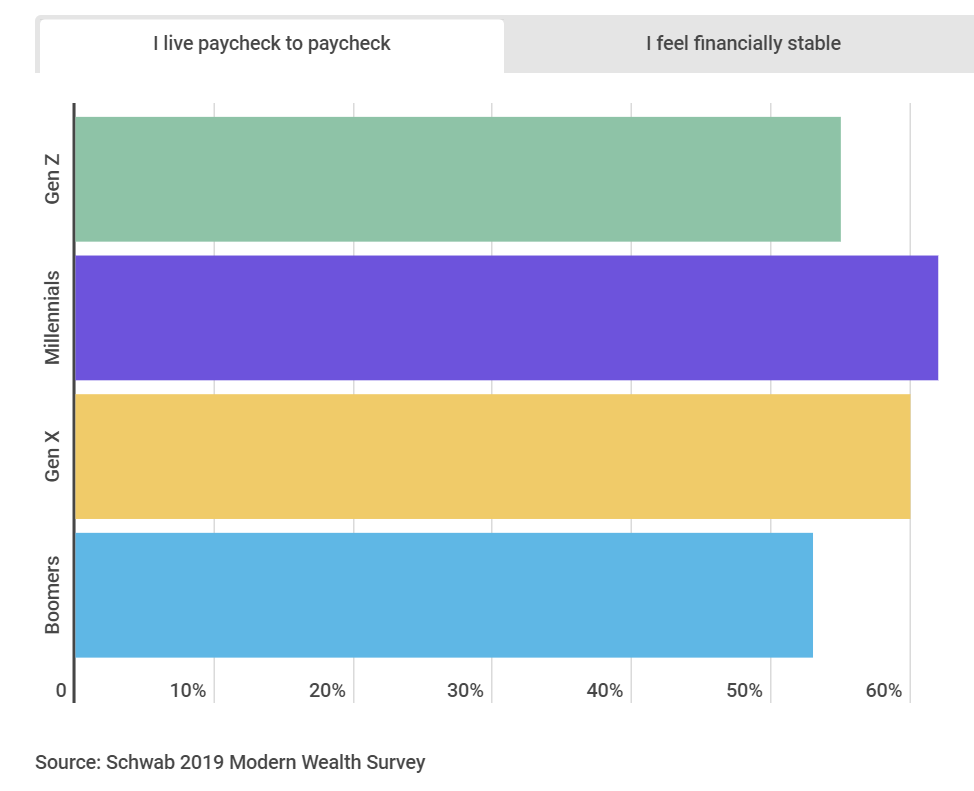

Millennials are having a tough go when it comes to buying homes. In inflated California, this is even tougher. Most Millennials are living paycheck to paycheck:

62% of Millennials surveyed said they are living paycheck to paycheck. So if you are to buy say a starter $600,000 condo in California, even coming up with 10% down is going to be difficult for this group. So the result ends up being Millennials getting roommates or simply living at home with their boomer parents. Many Millennials are simply sitting it out with their siblings waiting until mom and dad pass on to boomer paradise so they can inherit the family home.

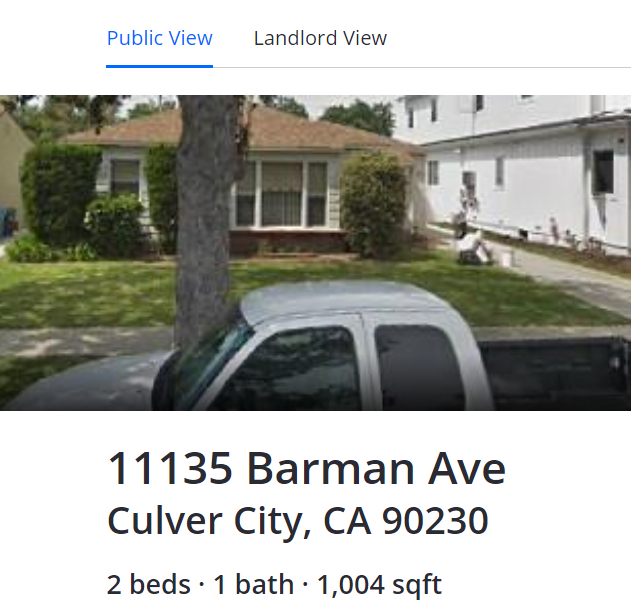

Then you have the distorted property tax system in California. For example, take a look at this home in Culver City:

Modest home. The home has a Zestimate of $1.2 million but is currently paying taxes as if the home was valued at $330,658. But let us look at a new updated home next door that is on the market:

Based on current tax figures, that means that one home is going to pay $4,736 per year in taxes yet the neighbor next door is going to pay over $46,000? They both have access to the same public schools, the same street services, and all of the exact public services. Yet somehow, just because someone is buying “now†they are going to pay nearly 10 times the annual property taxes. So what you do of course is that you penalize Millennials at the expense of boomers here.

And let us forget about the grandma being kicked out argument. These property values are arguably going up because they are in hot economic centers. So the person living in the $1.2 million home can sell and cash out their million dollar ticket. They can rent in the area if they wish or move to a cheaper location. This is the “apocalyptic†scenario that people used in the 1970s to pass these laws. But now, you limit the number of homes for sale in the market, reward a first come first served market with subsidies, and then we are surprised why Millennial adults are stuck at home living with parents? And keep in mind Millennials and now Gen Z are the future workforce so we want these people living where they work – when you are retired you have more flexibility as to where you live and you are drawing down on local services less – that is public schools, parks, streets, etc.

I’ve mentioned this before but the state is leaning to a renting majority and you are already seeing legislation looking at Prop 13 and similar structures. There is now talk about doing a similar Prop 13 in Texas, a state with very high property taxes. If Texas goes this way, all you will do is inflate property values and tax revenue will need to come from somewhere else.

Very few young professionals can purchase California properties. This is why sales are pathetically low. Summer should be a hot selling season and this is the momentum the housing market will need going into fall and winter. But don’t expect Millennials to save the market.    Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

222 Responses to “Millennials are unable to save the California housing market: Inflated prices and a labor force that is aging.”

“The housing market now sputters into the summer selling season with very little momentum. Home sales are at post-recession lows” . . . . “Very few young professionals can purchase California properties. This is why sales are pathetically low” . . . “[D]on’t expect Millennials to save the market.”

Here in the Santa Barbara area (Goleta though Carpinteria), both MoM sales volume and the MoM median selling price of SFHs have flattened since late 2018. But, sales volume and selling prices of condos continue an unabated ascent. Here are my latest data regarding sales of preexisting SFHs and condos on the South Coast:

Santa Barbara Area Home Sales, May 1–15 (2019)

An expanding workforce at technology start-ups here is expected to put a solid floor under prices of condos and “lower end” SFHs. At least that’s the theory.

Cheers, Barb

Santa Barbara Bubble

sbBubble.com

There are Prop 13 bandits all over the South Bay. Most of these homes turn into rentals where the landlords collect market rate rent but pay 1980s era property taxes. What a racket, you just need to be on the rent collecting side of it. Gotta love Prop 13.

Envy will get you nowhere. How much tax do you suggest we all pay?

Perhaps a better compromise is to limit Prop 13 to primary residential units with inflationary adjustments, which keeps the ‘grandma’ in her house.

You hit the nail on the head and this is my reply to surfaddict above (and I benefit from Prop 13 also). Prop 13 was sold to keep grandma in her house. Ok, grandma gets Prop 13 at retirement age. No investment properties, no gifting property tax basis to heirs. How about that.

Anybody with a room temperature IQ realizes Prop 13 distorts prices, this is magnified in certain areas. Houses will not be sold just due to the taxes. This affects supply and demand and corresponding prices.

Yes to that. Primary residence only, at retirement age, no heirs.

Don’t give government one more dime …they spend $23 billion on illegals.

That’s exactly how Florida’s Save Our Homes (SOH) prop tax scheme works, i.e. we observed what was wrong with Cali’s Prop 13, and eliminated the gross oversights. I’m guessing there’s a powerful ($$) Lobby preventing this in Kalifornia???

First!

The 2020 election in California will have a ballot initiative to limit Prop 13 on commercial real estate: https://www.sfchronicle.com/politics/article/Change-in-California-s-Prop-13-makes-2020-13314983.php

A ballot measure that would overhaul the state’s tax-cutting Proposition 13 by charging companies in the state billions of dollars more in property taxes will go before voters in 2020.

The measure, which is backed by community groups, education advocates and unions, qualified for the November 2020 ballot on Tuesday when the secretary of state determined that the supporters had gathered more than the needed 585,407 valid signatures of registered voters.

Proponents call it the first proposed change in commercial property taxes to qualify for the ballot since Prop. 13 passed in 1978.

The company I work for leases their quarters in LA County. I don’t know how long the lease is or if it contains a tax increase clause. I doubt they will close up shop if that law change goes through, but a lot of small businesses can expect rent increases eventually that will hurt their profitability. It is one more reason for California’s industries to hit the road for Texas.

There is an alternate scenario where commercial real estate takes a huge hit in value, and where property taxes do not go up as much as feared. Those landlords with deep pockets will survive but more marginal holders will be forced to sell commercial property at fire sale prices. With on-line retailers locating warehouses in California Flyover zones, retail space in urban/suburban coastal CA will be completely smashed down.

Statewide rent control failed at the ballot box in 2018.

No matter. In 2019, the California Assembly ignores the will of the people and passes rent control: https://www.mercurynews.com/2019/05/29/california-rent-cap-bill/

In a dramatic victory for tenant advocates, the California Assembly narrowly passed a statewide rent-cap proposal on Wednesday night amid mounting pressure for lawmakers to protect renters from the steepest of increases in a hot rental market.

If the bill clears the Senate, California could become the second state in the nation this year to limit annual rent hikes, covering millions of properties not covered by local rent control rules. …

Assembly Bill 1482, which passed 43-28, would apply to most properties not covered by local rent control ordinances — including rented single-family homes and condos in cities with rent control.

It was amended last week to exempt properties that are less than 10 years old, and — because of an 11th-hour handshake deal with a powerful trade group — it will undergo more key changes in the Senate.

New York City has had rent control forever. And NYC is like one of the cheapest cities in America right? A 2 bedroom apartment is what, $700 a month, I think.

LOL

Silly socialists never learn. They also never put 2+2 together like understanding that $15/hr minimum wage laws lead to higher prices on everything, including housing. Or that implementing thousands of environmental rules increases prices on everything, like, oh I dunno, housing. Or welcoming millions of illegals increases demand for and prices for housing. It’s an idiotic vicious cycle where the socialists implement rules that increase costs, then implement laws to fight the price increases resulting from those rules. And it will never “fix” the problem since the problem at its core is socialism itself.

But hey, have fun with your new rent control. It will be interesting to see how the socialists spin it when it fails and prices increase even faster than before.

Mr Landlord: I could not agree more, with the possible exception of the $15 minimum wage. I’m not OK with slave wages, and $15 (or maybe $12+) seems like a fair wage for menial work. Even if it means prices increase a bit.

In any event, what you described is not a problem at all for democrats (they get votes). And with regard to illegals, many republicans benefit as well (cheap labor). As is typical, the middle/ upper-middle class gets burned while the poor and rich do better.

Here in Chicago, another renter-majority city, there is also a major push for rent control. Thankfully, our newly elected mayor opposes it (my major reason for supporting her), but she will have a major battle with some newly-elected alder-critters, who are blatantly socialistic and ran on the rent-control issue. You’d have thought people would have learned how rent control really works to destroy the rental housing market from the sorry examples of NYC and San Francisco, but the two IL legislators promoting it say that their law is “different”, which it surely is- the proposed IL rent control legislation is far more sweeping than that enacted in any other municipality, as it will apply to the whole state of IL, not just Chicago. And it will not even permit rent increases above a state-set increment even if a tenant moves, or exempt ANY residential property used as a rental except high end properties.

You can easily predict the results. First, all development of middle tier rental buildings would seize up, and the only new builds would be either high-end luxury developments for people who make $300K a year or more, or government-subsidized low income “affordable” housing. The second thing that would happen is a rapid and drastic shrinkage of available supply, as supply is pulled off the rental market- condo buildings like mine are already passing new bylaws restricting or eliminating rentals if they have not already done so, while small landlords who own rental detached homes and other detached structures used for rental pull them off the market and either sell them, or occupy them. The third thing that happens is that owners of multifamily buildings that are not eligible for conversion to condo or co-op in this soft market will start “unbundling” services and utilities now included in the rent, and start levying surcharges for heat, trash pickup, common area cleaning, or service calls to your unit. Renters will not be able to believe how very unfriendly their formerly accommodating landlords become.

The moral of the story is that no one works for free, and no one takes the investment risk and hassle of owning rental property to have his profits limited or erased altogether.

Property Taxes is 1% of sales of house. So the property tax will be about $28,000.

Assessed property values should be based on a starting point say 1978, and then add 2% inflation rate, to current date.

Property Taxes is 1% of sales of house. So the property tax will be about $28,000.

Are you sure? I heard there are various add-ons, depending on the locality. That 1.25% of sales price is a better estimate of what your property tax will start at.

I noticed the overstatement on taxes also. While the state property tax is 1%, local voted indebtedness is typically another 0.25% which is why loan underwriters qualify people using 1.25% annual property taxes. This makes it easy to calculate taxes as 1/1000 of value per month. So a $2,749,000 sales price equals $2,749 per mo. in taxes and I can leave my slide-rule in my pocket.

Property tax will vary city-by-city depending on voted bonds, etc. Here is an older article dating to 2010 from LA Times showing the discrepancy.

https://www.latimes.com/local/la-me-city-property-tax-table-htmlstory.html

Note, City of Industry is at 1.93%, Bell at 1.55%, Compton at 1.53%… Los Angeles at 1.22%… down to Bellflower at 1.02%.

As you say yourself Doc, prices are inflated. You cannot expect people on a fixed income to pay crazy high property taxes, just because they now live in a “hot” area.

If hipsters want to spend their trust fund money (thanks mom and dad…I’m now self made) on over inflated places like let’s say a “cool†city like Echo Park(Los Angeles) be all means be my guest.

Just remember that many people of normal means just happen to live there…

Don’t make the family next store have to cover the cost of their trust fund gentrification. I mean who pays $750,000+ just to be in Echo Park?

MANY PEOPLE DO!

As you say yourself Doc, prices are inflated. You cannot expect people on a fixed income to pay crazy high property taxes, just because they now live in a “hot” area.

If hipsters want to spend their trust fund money (thanks mom and dad…I’m now self made) on over inflated places like let’s say a “cool†city like Echo Park(Los Angeles) be all means be my guest.

Just remember that many people of normal means just happen to live there…

Don’t make the family next store have to cover the cost of their trust fund gentrification. I mean who pays $750,000+ just to be in Echo Park?

MANY PEOPLE DO!

Jake, please proof your post before you hit Reply.

“Millennials are the most educated cohort we have had in the U.S.”

LOL. I suppose if you consider a degree in Woke Studies “education”. Too many people confuse a degree with an education. A typical high school grad from the 50s or 60s was exponentially more educated than a typical 24 year old with a degree today. Sure they high school grad couldn’t explain why white men are evil 1000 different ways. But they could give you the basics of world history, English literature, etc. Today’s recent grad thinks WW2 took place in the 1890s when the Union fought Japan.

“A typical high school grad from the 50s or 60s was exponentially more educated…”

LOL

24 is not Millennial. This is what’s wrong with the Boomer Generation.

Shane,

1. I’m not a boomer

2. Millenial is generally defined as those born between 1982 and 2000. Hence, a 24 year old is….wait for it….A MILLENIAL!!!! Some stop at 1995 as the end of the milenial generation, even so 2019-24 = 1995. Math can be hard, I know, but come on.

3. You perfectly proved my point about your generation and “education” You have a lot of “education” and zero critical thinking skills or ability to do even basic math. Thanks for demonstrating it.

Millennial has been defined as those born from 1981 – 1995, so 24 is Millennial, even if on the cusp.

Wake up California! You are being duped by bad politics! Raising property taxes on rentals or anything else for that matter will do nothing to help renters or affordable housing. It will only serve to create more government , more regulations, more homelessness, more unemployment, more inflation, more unaffordability, less housing and more CORRUPTION in government. These are only tactics used by politicians to get elected, promising you things that you will never see.

We need to change the way we think in California. We are going in the exact wrong direction. Open borders, reducing criminal law enforcement, raising taxes, and creating massive regulation and entitlements will destroy our beautiful state. Chicago, New York, and Detroit, to name a few are perfect examples of what we will create in California. It is happening all ready. Open your eyes California and face the hard cold facts! We need to hunker down, dig in and get to work, hard work!

“We need to hunker down, dig in and get to work, hard work!”

Lol. We need to pack our bags and leave this sh*thole.

#doyourselfafavor

Yep, the big dogs all benefit from the current disaster so it wont change until they’re 6′ under. You could fix this whole thing by kicking out all illegals – every last one – and cutting public pensions to no more than 50k payout per year and scale everything down from there – the money was never there in the first place, lets be honest. Prop 13 for owner’s residence only with no pass on to heirs and voila – middle class thrives again. Aint gonna happen though so the smart folks like me bail to better places. Lots of places with better beaches, better mountains, better infrastructure, lower/less taxes, far less traffic/crazies/stupid laws. All those who remain, have fun in the gladiator pit – yes, we are entertained – I hear the new Typhus diet is tough but produces undeniable results!

Wow, its like this guy can read my mind:

https://www.citywatchla.com/index.php/2016-01-01-13-17-00/los-angeles/17826-garcetti-la-times-and-their-sinking-nanny-state-credibility

Not a single straight white Christian in the mix anywhere in that den of thieves that clutches ironically if not desperately to its namesake the city of angels. Don’t be fooled by the undercover cheese pizza lovers either – they aren’t fooling anyone.

Turn out the lights, the party’s oooover

So go already and stop whining.

Agreed. The system needs to be more transparent, clean, and efficiently operated. Unfortunately a lot of Californians want soft living, handouts, and no hard work so it will be tough to make that happen.

I think Andy and UltraMan have great observations.

“You could fix this whole thing by kicking out all illegals – every last one – and cutting public pensions to no more than 50k payout per year and scale everything down from there – the money was never there in the first place, lets be honest. Prop 13 for owner’s residence only with no pass on to heirs and voila – middle class thrives again.”

1) Massive illegal populations are driving down wages. Unless government raises minimum wage by law, we won’t see workers wages rise. However, paying legal and illegals a much higher minimum wage will create a massive drive for illegals to enter our state. It will also raise the expenses of Trumps hotel staff and Brentwood homeowners gardening expenses. Both wealthy Republicans and Democrats don’t want that. Also, prices will rise for the commoner’s Big Macs. The 90% doesn’t want that.

2) Prop 13 Tax rates to be passed down to heirs is not MAGA. It is an aristocracy.

3) If you work 30 years for the state of CA, that means you likely bought a house in 1988 when they were 200K. CA is paying wages based on keeping people who are hired today which is pushing up the 25 year old employees wages. Great! But why should someone who bought a house 30 years ago for 200K and paid off the mortgage , be entitled to a 100K+ pension? To make matters worse, many are selling their 200K house for 1.5M and moving to NV, AZ UT, OR, CO and paying for a new house with cash and using their 100K pension outside of CA. There should be a drastic reduction in pension payments if the pensioner moves out of CA.

I don’t see the purpose of raising Prop 13 taxes. It doesn’t help the renters and it doesn’t help the economy. And don’t tell me that they will use the money to fix the roads and finish the high speed rail. It will just go to grow more bureaucracy and regulations. We should be lowering taxes and promoting business, to create more jobs and affordable housing.

“you have an army of Taco Tuesday baby boomers roaming the streets of California enjoying inflated real estate values while enjoying Whole Foods delivered to their front door without taking more than 5 steps on their Apple Watch. Yet many of these same boomers are now getting frustrated as their adult children are unable to purchase homes in the area and over 2.3 million are living at home.”

What I see in my middle class social set is people staying put but not extravagant living. Taco Tuesday is by definition for cheapskates who want to go out on the cheap. I’m also seeing people selling high priced houses and moving to other states where their children (or other relatives) have moved with lower housing costs. And also boomers taking their inheritance money and helping the kids buy here in Socal with a big downpayment.

There are currently no signs of dropping real estate prices in Orange Co., CA where I live. A home just down the street from my home just sold for a record price of $915,000 in one day. The previous record for my street set last year was $885,000. Both were highly upgraded and the same model. However, the $915,000 one had a larger lot and a few more upgrades. The selling prices appear to be basically the same if one adjusts for the slight differences between the two homes.

What really caught my eye was the speed with which both homes sold. They sold in less than a week and at record prices. A real estate crash may start next year, but for this year, sellers appear to have the upper hand as far as prices are concerned. As long as investors, aka flippers, are buying up all the homes they can find, prices will not fall.

Spoken like a realturds….”the compression of home prices continues”

In OC, lets see OK Gary

https://www.movoto.com/anaheim-ca/market-trends/

https://www.movoto.com/garden-grove-ca/market-trends/

https://www.movoto.com/huntington-beach-ca/market-trends/

https://www.movoto.com/orange-ca/market-trends/

https://www.movoto.com/fountain-valley-ca/market-trends/

https://www.movoto.com/costa-mesa-ca/market-trends/

Prices werent down by much but this is with interest rate lower than last years, stock markets near high, and sales still collapsing…. Just wait until the recession. The FED better starts cutting soon LOL!!!!

I think the writing is on the wall. The Chinese monopoly money is evaporating and that means all their invasion tactics of buying up the prime real estate areas will dry up taking the industry with it.

I am one of those people cashing in on the Prop 13 tax benefit. I (and my siblings) inherited a 2500 sqft home in Santa Monica (North of Montana Ave). The estimated sale price would be $3.5M. My grandparents paid $16K for it in 1955. We rent it out for $8.5K per month (free and clear since 1980). Our Prop 13 tax base is $3.5K per year. If we had to pay market rate taxes on the home (which would be about 1% of $3.5M it would be $35K per year in taxes) it would make no sense to keep it as a Prop 13 inheritance rental.

You are only making a 2.9% return on the gross rents of the house. You should liquidate that under performing asset. Even 3 month treasuries are a better place to park your money.

Thanks Woody. I am considering alternative investments to park my money.

“You are only making a 2.9% return on the gross rents of the house.”

What percent appreciation return has that property yielded in the last decade. I can only imagine it is astronomical. There are many variables to look at.

If the property is already overpriced based on it’s utility (rents) what rational reasons would it further appreciate unless it’s a speculative bubble?

Woody, the same argument could have been made in 2009. The return on rents was a bad investment. But somehow the property appreciated 1M plus. Areas like SM defy gravity. The old stupid rules of home affordability and local incomes don’t apply there.

Could the owner sell and make a better return on investment? Maybe and maybe not.

Lord Blankein which means the prices are increasing for irrational reasons and is indicative of a financial bubble.

H may only be making 2.9% but the appreciation has been astronomical. If he had taken your advise 10 years ago he would have given up a huge amount of money, no? No one can predict the future but short of nuclear war that property would be very hard to beat.

Dan Starjash…no he would have 2-3X what the house is worth. Appreciation of housing over the last 10 years is 40%. The equity/reit market is up 300% and at much lower carrying costs (no maintenance, taxes, insurance, or management fees).

Redfin data center has Santa Monica at 1.15 million in January of 2012 (as far back as the data set goes) and at 1.37 million as of January 2019 (20% return). VTSAX which is a total stock market fund is up 167% over the same time period.

Wow. What a steal under the prop 13 umbrella. You and many others will never sell. But I have to think Santa Monica and state of California will need your property taxes soon enough. So how many more years will it take before the State can legally try and pass a ballot measure to re-assess these properties like yours protected by Prop 13? By re-assessing these types of properties it would surely result in a mass exodus of property owners such as yourself. Which would result in a huge supply and lower prices. So I’m not sure Prop 13 repeal will ever happen because that route could result in an epic price meltdown.

I’m not sure Prop 13 repeal will ever happen because that route could result in an epic price meltdown.

People who vote on ballot initiatives don’t know or care about economic consequences.

As renters increasingly outnumber owners, rent control and Prop 13 reform will become inevitable, consequences be damned.

Prop13 is like cancer. However, there is a simple cure. Repeal and replace. The housing bubble will pop and you will have plenty of affordable homes.

son of a landlord: you classify lower property values as a (presumably negative) consequence? Why? It would seem like a benefit to me in CA.

OC Register columnist Lansner’s article this Sunday is on falling demand for homes. An 18% uptick in listings with appreciation up but less so than in the previous year. Days on the market is at 79, up 12 days on the year. Lansner says a buyer’s market starts at 90 days on the market. He gives the market 3 of 5 bubbles on his bubble scale which is unchanged as I recall from his last bubble rating. He feels that some buyers may move to fence-sitting if they think that a price drop is imminent . This in turn could have a cascading effect.

This is all getting weird as inland empire is still getting price reduction and homes are taking a long time to sell or not selling at all. Now interest rates just came down so I’m watching to see what happens. I should note that homes above 600k and the ones not selling very fast or at all. Mid 500’s go pretty quickly given the right area and upgrades.

I heard rates may drop again at the end of this year.

In Mission Viejo, the compression of home prices continues. The expensive homes are dropping in price, those in the middle remain unchanged and the lowest priced homes are appreciating rapidly. At the rate things are going, 1,000 sq. ft. homes will soon be selling for more than $700,000 and 3,000 sq. ft. homes will be selling for less than $850,000. Eventually, they will all be selling for the same price!

Buyers seem to be willing to pay anything for the cheapest homes but can’t afford to pay even a penny more for much larger one. The major lesson I have learning from the real estate market in the past 15 years is that in a real estate crash, it pays to buy the smallest, dumpiest homes you can find since they eventually appreciate at twice the percentage rate as nicer, large homes.

Every $1 of property tax I pay, I pass along to my tenants. So you can raise my property tax all you want, I don’t care, my tenants are the ones paying it. It’s like any business tax. Consumers pay them, not business owners.

Sure, but market rate rent follows wages not stock prices. If you get reassessed with an additional 12k owed to property taxes each year are you going to be able to charge an extra grand a month? Probably not.

The Doc has shown how prop 13 became a tax on Millennials. It is unfair for property 1 to pay 4k in taxes and the house next door pays 40k in taxes. That being said, I don’t know if I would vote to repeal it. The state and city will just waste more tax money on pensions and bloat. Example — Massive accounting fraud and unsustainable salary increases at Sweetwater Union School District (Chula Vista) perpetuated by the “borrowing” mello-roos taxes. The voters don’t pay attention to local issues so something else needs to limit the wasteful spending and that’s prop 13 right now.

The ONLY way to make Prop 13 fair for everyone, old and young is the way Switzerland did it – they have a maximum cap set by voters and then it is scaled down based on value. That value can be adjusted by 1% per year or by the published CPI.

In the case of Switzerland, the voters decided that the maximum to be paid per year is $1,500 regardless of the value; yes, a castle waterfront in Interlaken is taxed maximum $1,500. Other more normal houses are paying less. That way, the politicians have less to steal and less to offer to the illegals. Even with those low property taxes, everything in Switzerland is better than in CA: schools, road conditions, fire stations, hospitals and libraries. I know that Bob and other followers of socialist democrats like AOC will have their heads explode if they will see that, but personally I like that. Then, everyone can improve the outside appearance of their property without being penalized by the tax assessor. Also, that would prevent the market distortions and wired politics we see in CA. Also, the democrat governor elected in CA by the majority will steal less to offer free medical care to illegals; oh, I forgot about free housing, free food, free college education, while charging those born in CA a mountain of money to be paid back with interest all their lives. Somehow, people like Bob think that it is normal what the Democrats are doing in CA and I am strange for pointing out the obvious truth.

Flyover,

I absolutely do not think that obscene Tea Party CA Prop 13 Bill in 1978 was good for CA. It was a Republican travesty which is partly why I wonder why anyone voted for the Republican Tea Party a few years ago. Did you?

CA pensions are also out of control. CA needs to raise wages for new hires to attract and keep government employees. This is needed. However the downside is that the longer term employee wages also must go up. You can’t have the supervisors making less than the new employees. The pension system is based on paying a percentage of the top salary of the employee after 25-30 years.

Now you have pensioners collecting 100K per year when they had bought a house in 1988 for 200K and paid it off. That would be fine if they stayed in CA and spent their pension in the local economies. However, many are selling their houses for 1.5M and moving to other states and spending their CA pension cash not in CA. This will lead to disaster.

That is not how it works. You already should be charging the maximum rent you can. If your costs go up you cannot raise your rents to compensate. What instead happens is the value of your capital good (the house) will decrease. The property tax reassessment will hit your margins without affecting your gross revenue.

If your like most landlords, the rents are already at the top end of the area, so good luck boasting it $1k per month, as would be the case on each of my rentals that I bought 30 years ago.

What would happen is I would 1031 exchange out of what I have into areas with better returns if N/O/O properties were re-accessed and lost their Prop 13 tax rate.

The whole Prop 13 thing is a red herring. I am a baby boomer, and I purchased my current home 30 years ago. Prop 13 has reduced my property taxes by about $3,700. In other words, someone who purchases my home today would pay only $3,700 more a year than me in property taxes. That additional cost is a drop in the bucket compared to the other costs involved in buying a California home like mine for say $780,000.

If I paid $3,700 more in property taxes per year, it wouldn’t amount to much and wouldn’t reduce the future taxes on anyone else by a single penny. The government would just have a little more money of mine to waste. The thought of paying $300 more per month doesn’t stop me from moving. I just happen to like to live where I live.

Renting is great for us. We moved into a nice 2500sq ft home in Riverside in November, pay $2200/mo for about a $475,000 house in today’s market. Have had a few fixes needed, and no out of pocket money from us, and landlord is quick to respond. But buying the very house we rent with 20% down would carry a $2800/mo mortgage, not including maintenance. Why on earth would I ever buy? Rent where you live, and buy rentals in cheaper markets.

Renting is very cheap compared to buying. That’s why RE cheerleaders avoid to get into a rental parity discussion. Doing math is the last thing they want to do as it shows how overpriced RE is.

@ JA, agreed. I’m in the same boat. We pay $2400 for a nice house in a great neighborhood with pool, park, tennis courts, green space, clubhouse, etc.

If I were to buy the house I’m renting, it could easily cost me $3000+ per month if I add up the mortgage, prop taxes, HOA, etc.

While we rent, we have been investing $1500 per month in investments, and we feel more secure having a nest egg outside of a house rather than building up equity inside a house.

If/when the housing market tanks, we’ll be in a good spot to buy property, if that is what we decide to do.

Whereas, if the market does tank, and all our equity was in the house, we’d be stuck and unable to do anything, except wait for the the value to come back many years later.

Whether you rent or own, the main thing is to have discipline to save money every month.

Looks like Redfin is blocking previous asking prices. But here’s a remodeled “Canary in a Coal Mine on Cattaraugus†which I have passed by over the last year. The home sits within earshot of the 10 and along the Reynier Park neighborhood’s southern perimeter.

https://www.redfin.com/CA/Los-Angeles/8871-Cattaraugus-Ave-90034/home/6785846

05/17/18: $1,200,000 Irrational Exuberance

07/21/18: $1,150,000 Less Exuberance

08/31/18: $ 995,000 School Starting…Folks Should Already Be in Their New Homes

10/10/18: $ 975,000 Holidays Fast Approaching

05/06/19: $ 899,000 Spring Buying Season Here!

05/17/19: DELISTED ONCE AGAIN

If the home were relisted at a more “realistic” price and even if a Millennial couple were to have a good down payment and credit, would they not be outmaneuvered by all cash vultures like those who swooped in soon after the last crash in 2008/2009?

And, of course, the home could ultimately end up being a rental — like the nearly 40 percent of all single family homes already are in Los Angeles County.

Redfin does hide previous asking prices. For that, go to Zillow.

Use Redin for initial searches; they have a great map layout. Then check the house on Zillow for its price history.

Trulia has crime maps, so that’s a good place to learn the safety of a particular neighborhood.

We looked at this place just South of Santa Monica Blvd. and just South of the Mormon temple:

https://www.zillow.com/homedetails/1811-Manning-Ave-APT-302-Los-Angeles-CA-90025/20501182_zpid/

$1.3Mil -> $1 Mil. The unit was built in 1990 and it hasn’t been updated. The painting was done by amateurs and the fixtures are in bad shape. bathroom grout hasn’t been cleaned and the “hardwood floor” (laminate) is not in good shape. the place has FOUR bathrooms, which is ridiculous.

Location-wise, it’s next to a UPS facility; the noise from SM Blvd. is noticeable. Entrance to the garage is via the alley and if anyone parked in space 101, you wouldn’t be able to get past the car with groceries or boxes. The hallways smelled bad and the central air unit on the roof is probably original (so, 29 years old).

All this, plus whatever hidden issues for $1Mil!

Bora Horza: Same buying climate here in Newport Beach. $1M+ for a halfway decent condo (and some not so decent ones). While it’s really nice here (I rent currently), sometimes I think about throwing in the towel and moving to Mission Viejo where I can buy a decent house with 3-car garage for $850K or less.

I also wonder if homes near the beach will ever drop in price. The most expensive one’s over $2,000,000 may drop a little, but those even close to $1,000,000 may have too many potential buyers waiting in the wings for their prices to drop very much. Stranglely, the best way to buy a beach house is buy 3 or 4 homes in a place like Riverside Co. after those homes drop 50% or more. After those homes double or triple in value, you will have enough money to buy that $2,000,000 home since it will appreciate much less percentage wise during the recovery. Mr. Landlord has the right idea. Buy low and rent and get rich.

I mentioned previously a home in Riverside which sold for $325,000 during the last mania, then sold for $80,000 3 or 4 years later and in 2018 was for sale at $300,000.

Gary

Gary

Responder,

Pretty funny you say that. I was in the exact same situation. Renting a nice condo in Newport, then bought a nice big house in Mission Viejo.

Although Newport was nice, best decision ever! Huge yard with pool, huge house, perfect for our family. Maybe I bought high, but, it was way under what I could afford and I was truthfully tired of watching kids grow up in a condo. So, ultimately time was worth more than the risk of buying high.

Not to mention traffic in that area which is horrible. There are some streets now in LA where the homeowners are demanding that the streets only be accessible to residents due to these residential streets becoming short cuts of the main streets.

4 bathrooms in 1700 sqft?!?!

I can never live in a sh*t hole like this.. guess i am different..

IMHO, it is a student ghetto.

For the parents that are saving biggly bucks by paying local tuition at UCLA as opposed to Stanford, Harvard, Yale,Princeton, it makes sense to take the beaucoup bucks saved and buy a place for their kids close to UCLA instead of paying 5K per month for rent.

This is a college student dwelling so nice paint jobs and some outside noise are a don’t care. At a 4K/month mortgage PMI compared to a 5K per month estimated rent, rental parity has been achieved.

I read some of wha is going on globally. What really stood out to me was the absence of Gen X. Wouldn’t the millennials be kids of Gen X more or less? I admit I struggled to read beyond the first paragraph because the adult children of Boomers would be Gen X and the adult children of Gen X would be baby boomers – more or less so don’t come at me with 1% differentials, it’s just an observation.

Wouldn’t the millennials be kids of Gen X more or less?

Not necessarily. Generations cover a broad range of years. Plus, people have kids in their teens through 40s.

Someone born in 1964 would be a Boomer. That person would be 16 in 1980, the last year for Gen X. So Boomers born in the early 1960s (and even later 1950s) would more likely give birth to Millennials.

And I suppose many Gen X people are children of the Silent Generation.

And many Gen X people are giving birth to Gen Z, not to Millennials.

“Wouldn’t the millennials be kids of Gen X more or less?”

It would span both GenX and boomer parents, but a lot more on the boomer side. I’m GenX and my kids aren’t even in high school yet. I can’t think of any friends or family members in my age range who have kids older than 15 either.

The oldest GenXers, those born in the mid to late 60s, probably have milenial kids, but still the vast majority of milenials have boomer parents.

I’ve Seen It All Before, And It Starts With Programs/Policies Like This, Look Out Below.

Amazon Launches Credit Card For Deadbeats

https://www.zerohedge.com/news/2019-06-10/amazon-launches-credit-card-targeting-deadbeats

I have a question for the masses. For the last 5 years I have been trying to understand the value of Zillow/Redfin and all the others. I have been watching what people pay for homes and then what they sell them for. These are middle america homes between 1.2 mil and 375k depending on where the house is located. These are people I know so can verify data. Most of the sales started with an aggressive ask and took between 60 to 120 days to sell. These are properties all over the country. Most of the properties sold for less than 80 percent of the ask. I don’t understand how Zillow/redfin can give estimates that are greater than the original list when the homes took months to sell and sold for a 20% discount. This is especiallly true of the deals done in 17 and 18. One example is a home in a very nice area of Palm Springs that listed for $475k end of 18 took 4 mths to sell and sold for $350. Now estimated on zillow fir $535. I can give at least a dozen more examples of scenarios like this all over the place. How does Zillow have any credibility?

If if look at homes that sold within a couple years of the 08/09 crash and assume a 3% compounded annual gain(which is crazy considering we have at best 2% annual GDP growth) from their zillow estimated floor value I get values that are between 30% to 40% less than what any of the web sites say the home is worth.

So can anyone help me understand how zillow or any of their competitors have any value and why we shouldn’t expect to see at least a 30% drop in prices in the near future.

You’re right. Don’t ever think of buying. Rent forever. My kids will appreciate the extra money I leave them when I croak, thanks to people like you who buy me houses every 15 years.

I agree with landlord. During a bubble, buying makes no sense (financially).

After a correction, buying is a good idea. You want to buy when values are realistic and you have rental parity. We should see a correction within the next few months/years. Then you just buy 50-70% off of today’s highly inflated values.

Real estate prices in CA can never go down

we are different and we are awesome

So what the volumes are done but the prices are still remaining high.

Dont ever think prop 13 would be repealed

Common sense wise, prop 13 should not be allowed on properties other than primary residence.

I can see Prop 13 slowly being eradicated on commercial properties, however, doenst that pose a big problem for the landlord and economy? Most commercial properties are Triple Net rent – the tenant pays the taxes. If Joe Blow Pizzeria gets hit with an additional tax bill of $1K or $2K per month, he will fold up shop and then we will have massive amounts of empty retail space…..

As far as Prop 13 being eradicated on SFH, it will never happen. I can see a 5% increase in taxes each year, perhaps on homes that have not been assessed in over 10 years or 20 years… there will NEVER be a sudden-death increase in property taxes for the foreseeable future.

I had dinner last night with a friend of mine who owns several commercial properties. He had some water damage to one of his buildings. His insurance company got a crew in there to do the initial mitigation, the fans, tear up the floors, etc. But now he can’t find anyone to do the repair work. His best estimate is 3-4 weeks before the work even begins. That’s because every contractor, every painter, every drywaller, every plumber, etc. is booked solid months out.

And yet here Millie is telling us how real estate is crashing 75%. LOL

It’s very true, the economy is going to crash. Housing will be crashing by 50-70%.

It’s around the corner. Keep the powder dry. The party is almost here.

Housing is not going to crash 50%. The GSEs funded 95% to 99% of all loans since 2009. They will make all kinds of modifications to keep owners in the house.

Refinance

Payment forgiveness

Principle Reduction

6 months of payments for 100 hour of community service (Far fetched but maybe not)

They GSEs will do what ever they can to keep people from defaulting. They can take losses on the loans if people miss payments. Banks just don’t own the loans anymore. Prior to 2009, the GSEs backed about 55% of home loans and the banks owned 45% loans. Now banks own about 3% of all the new loans since 2009. Banks just service the loans.

Total BS….if you can’t pay your mortgage you default. You might stay a couple of months in there until they evict you. Have you tried not paying your bank? I haven’t. And I never will. But I have seen the homeless who got evicted. I guess, they weren’t technically homeless, they still got their car.

This is an honest question: assuming it’s true that contractors are busy in whatever area your friend’s commercial property is located, what does that have to do with the likelihood of a residential real estate bubble bursting in the U.S. broadly and/or California and LA specifically? The question of how busy are contractors who do water damage repair, seems irrelevant to the value and market for residential real estate. Can you elaborate on your point?

You’re right. The two have nothing to do with each other.

MJ,

Drywall is drywall. Plumbing is plumbing. Electric wiring is electric wiring, whether it’s residential or commercial, it’s the same people doing the work. The reason they’re all booked out is because they’re all busy either working on new construction or reno jobs. That doesn’t happen in a supposed real estate crash, like so many here believe is happening.

Commercial work generally pays better than new construction residential. So if commercial workers are booked, there are even fewer workers looking for residential new construction jobs.

I wonder if the reduction in the number of construction workers has anything to do with this. See: https://www.wsj.com/amp/articles/young-people-dont-want-construction-jobs-thats-a-problem-for-the-housing-market-1533029401

Assuming it’s true that contractors are busy in whatever area your friend’s commercial property is located, what does that have to do with the likelihood of a residential real estate bubble bursting in the U.S. broadly and/or California and LA specifically? The question of how busy are contractors who do water damage repair, seems irrelevant to the value and market for residential real estate. Can you elaborate on the point your making?

Housing sentiment is at a 5 year high. Thanks to sub 4% mortgages and sub 4% unemployment (thank you Prezzy OrangeMan), housing is on fire once again. Sorry Millie, looks like a few more years before your 75% crash shows up.

Agreed, the 50-70% crash is basically here. Could be here as soon as 12 months. The market has already turned. You can see it by looking at the data or talking to realtards. I am daily bombarded by emails from Zillow and Redfin showing me price reductions.

A couple years ago we were told by the RE cheerleaders that there is no inventory and prices can’t go down. Now, most RE cheerleaders put down the cheerleader gear and stored it in the garage. Nothing to cheer about and the daily news are a constant reminder how housing is going down. No more foreign money means the market is now depending from organic growth (local incomes). It makes sense that prices will revert back to fundamentals. Experts (like me) have stated that prices will soon be down by 50-70%. This is more valid than ever before. Just have a bit of patience.

12 months? LOL. The crash is always just over the horizon for perma bears. It was 12 months away in 2012, 2013, 2014, 2015, 2016, 2017, 2018 and now 2019.

Prediction: A year from now the crash will be….wait for it….12 months away!

That’s correct. 12 month is basically around the corner. Just have some patience and keep the powder dry. You will be able to pick up some steals when the crash is here. If you buy now you benefit everyone else in the process and screw yourself (financially) I can’t recommend that. I’d advise to buy when it’s low (half off).

100% correct. We are almost half way through 2019 and there is NO TANK IN SIGHT. There needs to e a catalyst for a major housing correction, right now there is nothing. Record low unemployment, record high stock prices, super low mortgage rates, owners swimming in equity, etc.

There will be a correction sometime down the road, nobody knows when. Unlike Millie, most people don’t have an unlimited time horizon to hunker down in a cheap rental in a sketchy part of town. I’ll be looking to add another beach close property to the portfolio too when the time is right.

I would argue the stock prices are only soaring in anticipation of a rate cut by the fed and that rate cut in and of itself is sign of a weakening economy that is being forced to cut rates due to fears instilled by trade tensions/uncertainty, increasing unemployment statistics, weak inflation and a general sentiment of an impending recession. I don’t think the economy is on the verge of tanking but I also don’t think the picture you’re painting of the current state of the economy is even close to correct.

Can you name the last time we had sub 4% unemployment and sub 4% mortgages? I don’t know if it has ever happened before. We are in a one in a lifetime economy right now. Anyone who wants a job has a job with virtually no inflation. And yet perma bears still find a way to complain.

Sub 4% unemployment and sub 4% mortgage rates. Sounds like peak of the bubble type numbers. What else is there to keep the house of cards propped up?

Mr. Landlord, a friend of mine is selling his Orange Co. home and just had his first open house today. Dozens of potential buyers showed to view the 3 bd., 2 ba., Orange Co. home which is listed for $849,000. People started showing up an hour before the open house was scheduled to begin and demanded to see the home. One couple came from as far away as Sacramento to view the home.

Also, my nephew is the CEO of an Orange Co. home builder, and he told me that he cannot meet the demand. He also said that he has no bargaining power with contractors because there is so much demand for their services.

LOL – Sure it is!

https://www.bloomberg.com/news/articles/2019-06-17/u-s-homebuilder-sentiment-unexpectedly-posts-first-drop-in-2019

Read this article and especially the comments by people

https://on.mktw.net/2Rg9kQr

The article asks: mortgage rates are dropping why do people not buy homes?

Lol, everyone who commented said the same: because mortgage rates are not the issue. Overpriced homes are the issue. If a house price is 1mio but is only worth 400k it doesn’t matter if the rates are 3.2 or 4.8. The house is massively overpriced. Why buy something at 1mio and watch it go down in value to 400k? That doesn’t sound fun unless you hate your money and want it go to waste.

Millie,

Do you even read these articles? You are entitled to your opinion but that article supports nothing what you said.

There is a picture of a “For Sale†sign and below the caption it reads “Signs like these are still a rarity across much of the country, as existing homeowners continue to hold off on moving to newer or bigger homesâ€.

The article sums it up- there is a lack of inventory. I know you don’t believe that is the case so it’s funny you post an article to support that idea.

The reasoning behind why rates haven’t created more recent buyers is debated (buyers already locked in low rates, tax changes, cap on property/state tax deductibility) can be argued but the lack of inventory is factual. There are no homes for first time buyers to purchase. The few that are on the market are getting a premium. The luxury market ($1mil plus) has inventory and where you see the price cuts. At least that’s all I’m seeing in my neighborhood.

Not another joker who tries to tell us there is no inventory. Dude, RE cheerleaders have been telling us that for years. Yet inventory is up yoy, sales are down yoy, people ain’t buying even if you drop rates. I get bombarded with price reductions daily from Zillow and Redfin. RE cheerleaders will never look at data but always spin a story and make up shit. The comments on this article say it all, everyone of them says, housing is overpriced, and sellers are asking too much. I fully agree, once houses sell for 50-70% off today’s prices I am in.

I don’t see any of those liberal-minded Californians dropping the prices of their homes to make them affordable to the next generation! Bottom line, a lot of ‘flapping the jaws’, finger pointing, self-delusion, yet all it takes is for people to say I’ll drop my price by 10%, 15%, pay it forward, so someone else has a chance!

SoCalGuy, I also see no real evidence ot a real estate crash. There is a small decline happening in the million dollar plus market, but that is it. However, the inability of home prices to increase, when the inventory is so low, is perhaps the cannary in the coal mine. If home prices can’t go up now, what will happen when people have to sell in the next recession.

Home prices might decline 10-15% next year, but is only a likely possibility. There is no evidence suggesting it will happen at this moment.

With regards to current news:

1) The Fed is being pressured by Trump and Wall Street to lower rates. If it happens, equities will blast beyond ALL-TIME highs and people with equities will continue to drive house prices up to buy their current dream home OR buy more investment rentals. Since I am a Boomer, I will benefit with more equities and will refi my current homes at below 3%.

2) If the Fed leaves rates the same, housing prices will flatten or drop 5-10%.

3) If the Fed raises rates to hold equities from further bubbling, The market will fall 10-20%.

Millie, I and all the other real estate bears have to face the fact that home prices are not falling.

At this point, I am discounting the possibility of negative house prices occuring this year, apart from perhaps a minor temporary dip below zero to say -0.5%. Nevertheless it does appear that US house prices, in momentum terms. are going to have a rough 2019. However, 2020 should see a resumption of 4% plus home price increases per year.

Since the near inversion of the 2 year and 10 year U.S. bond rates during December, the Fed has clearly implemented some measures to PREVENT inversion, in attempts at bolstering market sentiment. Any recession is unlikely to occur before 2021 or 2021 since one does not normally occur until a year or more after the inversion occurs.

Millie, I and all the other real estate bears have to face the fact that home prices are not falling.

At this point, I am discounting the possibility of negative house prices occuring this year, apart from perhaps a minor temporary dip below zero to say -0.5%. Nevertheless it does appear that US house prices, in momentum terms. are going to have a rough 2019. However, 2020 should see a resumption of 4% plus home price increases per year since no recession is in sight.

Since the near inversion of the 2 year and 10 year U.S. bond rates during December stock market correction, the Fed has clearly implemented some measures to PREVENT inversion, in attempts at bolstering market sentiment. Any recession is unlikely to occur before 2021 or 2022 since one does not normally occur until a year or more after the inversion occurs.

If a Democrat wins next year, there will be a severe recession in 2021. Want cheap housing? Vote Democrat. Downside is you won’t have a job either.

The Democrats have been in charge in CA for decades. All we see is increasing house prices, higher wages, and low unemployment.

The last major crash happened after Republicans were in charge for 8 years in 2008.

We have seen this before.

I wish it would be that easy. Would vote for Democrats in a heartbeat. But I don’t think it’s that simple. You would not be able to provide any backup for that claim either. Housing just goes in cycles and we are overdue for a recession. Downturns are normal. Wait and save!

Overpriced Homes Continue To Languish On The Market For Months If Not Years

http://housingbubble.blog/?p=1907

‘3,750 newly-built homes went unsold in Orange, Los Angeles, Riverside and San Bernardino counties during the first quarter of this year. That left unsold housing inventory up 22 percent from last year and 37 percent above the five-year average’

Wa happened to my shortage California?

‘Then there’s the steady increase in the number of existing homes listed for sale, up this spring by about 23 percent from last year as owners try to cash in on boomtime real estate prices’

Here’s your speculators. Where are they gonna live? Are they crazy, after they sell, they’ll be priced out forever! It’s like they were gambling all along just waiting to cash out at the top.

I have about 9 realtards that email me regularly and think they are my realtard lol

In the last few years I have only found two that I will work with. This one guy is top.

I’d say 99% of realtards are trash.

Anyways, the Realtards are now coming up with all kinds of “incentives†in order to get you to buy. Refund you x, Ask for lower commission etc.

We have historic low sales. No wonder they can’t survive in this crashing market. Right now you can easily ask for 50k-100k off of asking price when making offers. It’s not enough for me. Savvy buyers buy when prices are 50% off of peak prices. That’s when I will get active.

“Right now you can easily ask for 50k-100k off of asking price when making offers.”

LOL. Well sure, anyone can ask for anything. I can ask Kate Upton for date. Doesn’t mean it’s happening my friend. 🙂

Hehe, but it IS happening….in California!

Sure, someone like you, who lives in spokanistan doesn’t really see stuff like that. In spokanistan you can probably buy a house for 100k. In California that is chump change (when it comes to buying RE).

The stock market appears to be have begun its final bull market rally. I will let everyone know when I believe that the top of the final rally has been reached. Right now I believe that the top will likely occur in August.

This is also when I expect to see the Housing Stock Index underperform the SP500 Index. If this DIVERGENCE occurs, we will know that real estate bubble has topped out. However, if the Housing Stock Index rallies along with the SP500, that would suggest that real estate prices may not start declining until next year and that the recession will have been successfully delayed by “the powers that be” TPTB until late next year.

The Federal Reserve will rain down an ocean of QE before it allows market-based price discovery in stock or housing. The big price drops people fantasize about here are just that, fantasy. The Fed create an everything bubble post-2008 and there’s no way to taper those asset prices without crashing the entire world economy. There’s an old saying — don’t fight the Fed. And here, the Fed has made it abundantly clear that it will not tolerate asset price deflation.

I don’t doubt what you say. However, looking back at history, the bankers from FED are looking for their own interests before the interests of the Main Street economy. What they do once in a while, is harvest of the main street economy – transfer real wealth of the main street economy to their own accounts by crashing, buying everything in sight for pennies on the dollar, reflate, rinse and repeat. At least that is what they did since their inception in 1913. I don’t think that they accumulated the whole wealth of the nation in the hands of 0.01% through hard work and honesty.

What makes you think that suddenly they became morally upright and virtuous by looking for yours and mine interests, or the interests of the middle class. Personally, I hedge my bets based on the history of their actions (infinite greed). Actions speak louder than words. Those who don’t know the history are bound to repeat it.

Cheap money leeches wealth out of working America steadily. (1) It keeps housing prices sky high (favoring existing rentiers over renters and aspiring purchasers), (2) it keeps stock prices sky high (less than 10% of Americans own virtually all of the stock). Cheap money also forces savers into riskier investments, putting them more at the mercy of the financial industry.

In short, there’s absolutely nothing about cheap money that big money dislikes. The crash-and-rinse cycle you are talking about made perfect sense before the consolidation of wealth occurred. Now that the 10% have the 90% completely by the throat, elite interest is served more by inflated asset prices than crash-and-rinse. The Fed has clearly signaled that they regarding propping up prices with more QE (dumping money on the rich) as inevitable. The current asset prices were created by QE and Powell has made it VERY clear he’s going to keep those asset prices propped up.

What I think you are missing is that the class war is over. Now that the assets are mostly consolidated, the strategy changes to protecting and inflating the asset valuations.

Brixton77, you have a valid argument. I was thinking about that, too. However, wealth is produced all the time. 300 million people don’t ALL stay idle. Also, what they do here, they do world wide by raising the value of the dollar and lower it. One way or another, they still transfer wealth from world over. I don’t think that their old habits died and they no longer use those methods.

There are also factors beyond their control (black swans) and catch them off guard. While they are very powerful, they are not gods. In conclusion, I would never dismiss completely higher interests or QT. Recent history, proved that they can still go that rout fully aware that asset prices will be deflated like it happened in December.

Whether Real Estate goes up, down or stays flat, there are big things happening in the Real Estate business. The OC Register writer Jeff Collins in the Sunday RE section wrote about large RE companies closing big offices in OC. Century 21 & Coldwell Banker (aka Realogy Holding Corp ) are closing offices near the beach. There has been a downward adjustment in the values of brokerage firms and thin margins for brokers are getting thinner from competition with more high tech competitors. Hundreds of agents may be scrambling for new gigs. I see signs for on-line companies now in my neighborhood like “Purple Bricks”.

“….thin margins for brokers are getting thinner from competition with more high tech competitors….”

I am amazed that wind down even took this long.

Should of happened years ago.

BTW, Someone remind me why I even need a R/E agent?

What do they do that I (or my R/E attorney) can’t do myself?

Where is the value added?

“BTW, Someone remind me why I even need a R/E agent?

What do they do that I (or my R/E attorney) can’t do myself?”

RE Agents are good for the seller during down markets.

They sit at Open Houses every weekend for months at a time and listen to Our Millennial tell them that your house is worth 50% less than you are asking.

You couldn’t pay me enough to endure that.

This Topanga house just had a price drop … by ONE DOLLAR: https://www.redfin.com/CA/Topanga/2365-Old-Topanga-Canyon-Rd-90290/home/6849895

* Feb … Listed for $1,300,000

* April … Price dropped to $1,290,000

* June … Price dropped to $1.289,999

That’s one Stubborn Seller. Does he really think that dropping the price A WHOLE DOLLAR will attract buyers?

I like that you look at the price history son of a landlord. I can teach you how to expand the price history and see a complete picture. This house is a good example. If you expand on the price history you will find that the seller tried to sell since over a year now (Feb 2018)….it started with 1.4m, than 1.5m and ultimately dropped from 1.5m to what you are seeing now. Don’t let them foul you so easily.

SOL, at that price point even $10,000 drop is symbolic. In terms of percentage it is nothing. The reason they drop it or make a change is to get the property on the “Hot Sheet” list to draw the attention of all agents and potential clients.

It is used as a marketing tool to project their product into the people’s minds.

For a reduction in price to have any meaning (to be called a reduction) it should be 3, 5 or 10%.

Irvine, Tustin home sales tumble 16% in O.C. worst slump since 2012

Home sales in these nine months totaled 3,767 vs. 4,503 a year earlier.

https://www.ocregister.com/2019/06/14/irvine-tustin-home-sales-tumble-16-in-o-c-worst-slump-since-2012/

Homebuying in Newport Beach, Laguna Beach, Costa Mesa tumbles 20% in worst O.C. slump since ’12

Home sales in these nine months totaled 1,800 vs. 2,259 a year earlier.

https://www.ocregister.com/2019/06/11/homebuying-in-newport-beach-laguna-beach-costa-mesa-tumbles-20-in-worst-o-c-slump-since-12/

Stocks at an all time record again.

10 year under 2%.

Unemployment at 3.6%

Mortgages under 4%

On what planet does this economy point to a housing crash?

Mr landlord,

On planet earth?

You might want to look at some housing data. I get daily emails showing price reductions in my area. If the economy is so healthy why don’t people buy homes? I thought this is supposed to be the red hot spring selling season? Yet sales are down?

http://www.ocregister.com/2019/06/19/o-c-housings-worst-slump-since-12-cut-sales-by-13-in-brea-buena-park-fullerton-la-habra-placentia-yorba-linda/amp/

Why would sellers reduce prices and why would sales be down? Mr landlord can’t explain it. All he can do is tell you everything is awesome. Unemployment is low, stocks are high. Go out and buy people? All he wants is a red hot spring selling season. Summer is here. You MUST FU**** BUY NOW!!!!!!!!!!

Exactly! The economy is on fire right now, all systems point to go. Why on earth is the Fed talking about cutting rates?

Best economy ever! Why the f do people not buy homes? RE cheerleaders told us this will be an epic spring selling season?! Is it the weather or seasonal?

Because the economy is obviously not all go and a recession is coming soon if it hasn’t already started. The crash started in November of 2017 and they have been doing everything to increase aggregate demand. The tax cuts did not work and the fiscal stimulus has failed as well.

One day I hope our overlords learn you don’t solve a debt problem by increasing the amount of debt.

Millennial is right, Mr. L. You should be out there scooping up those awesome real estate deals in this booming economy. You can’t lose.

Until you do.

The Fed is considering lowering rates because the economy is faltering right now.

Sales down but median price does not.

https://www.ocregister.com/2019/06/19/no-bubble-chapman-u-forecasts-mild-housing-rebound/

Interesting WSJ article today about housing. In 2018 11% of all homes were owned by investors, the highest ever on record. And a lot of that is attributed to AirBnb type ownership. People are buying homes simply to rent them out as vacation homes. Which is causing an in increase in rents, since pre-Airbnb, those homes would have been rented as long term rentals.

The irony here is people who most use Airbnb – hipster millenials – are the ones getting hurt by Airbnb on their rent. What to do, what to do? It will be interesting to watch this play out. Ban Airbnb and the hipster millenals will whine that they can’t travel as much as they used to or that they will have to stay in hotels and that’s like sooooooo 2007 man. But. keep Airbnb going and the hipster millenials whine about rent prices as more and more housing supply is taken off the rental market.

I know what I’m doing….loading up on popcorn as this plays out!

I thought of getting into the vacay rental biz, but decided it’s too much work and too much risk. Do I want drunk/stoned 27 year olds in my properties night after night? Nah. And unless I do the work myself, the numbers aren’t there if I have to hire a management company to take care of things. Plus the airbnb vig of 3% (I think it was 3). All those costs add up, plus the time spent dealing with inquiries, etc. Too much downside and not enough upside for me.

You better be really cool with your neighbors to get into AirBnb. AirBnb renters are on their absolute worst behavior when they think there are no consequences since they can just leave. My neighbor tried running an illegal hotel for awhile. One man blocked the one lane street and I told him to move his vehicle and he became irate and tried to ram my car in the driveway. We got into an argument and I thought he was going to start punching me…I’m a petite female btw… 3 houses came out intervene and afterward my landlord and i started bothering the city council to do something about AirBnb. We got the city to issue code violations on all the unpermitted mods the owner made faciliate the AirBnb. Everything unpermitted had to be torn out. Neighbor probably lost money after all that but I’m happy because now the house is rented to nice, friendly, long term tenants.

No bubble:

https://www.ocregister.com/2019/06/19/no-bubble-chapman-u-forecasts-mild-housing-rebound/

(also written by Jonathan Lansner)

Absolutely!

The perma bears don’t understand (or refuse to acknowledge) the impact low interest rates. 30 year mortgage rates have dropped from 4.75% to 4% (even lower in some cases) this year.

Take an $800K house with 20% down. That’s a mortgage of $640K. At 4.75% that’s a payment of $3350. Take that same $800K house with 20% down at 4% and it’s a payment of $3050. A $300 discount, which is the equivalent of the $800K house falling in price to $735,000, with a 4.75% rate. That’s a 10% price drop equivalency.

And I have been saying this forever. Home prices only tell 1/2 the story. The other half is interest rates. Which is why all the nonsense about 3X median income ratios are 30 years out of date, from an era of 10% mortgage rates.

Couple that with record low unemployment, record high stock prices and we are headed into another leg of a housing bull run.

Rofl!!! Hey landlord, I got an idea, why don’t you buy the bargain right now? Why waste your time trying to convince others? It’s maga (eh mega) cheap right now! We are too stupid to understand. Don’t waste your time?! Buy houses! Interest rates are low. This is the best time to buy! It will never get better?!!

Yet you’re here on a housing bubble blog trying to convince yourself there’s no bubble. Cute.

Mr Landlord,

In response to a 20% down payment on an 800k property ($160,000 cash + a little more cash that would be required to be left in the bank to show the bank you still have a bit of liquidity left after financing/purchase.

There are a very limited number of new buyers who do not already own a home with this kind of liquidity. (And Very limited amount of people who already own 1 million dollar homes who have this liquidity). Sure there are existing home owners who might now have $160,000 in equity in current home who can roll it into an upgraded $800,000 purchase. In my opinion there are not many potential buyers renting right now in California with $160,000+ in the bank as well as having a consistent paycheck with a history of solid W2 earnings.

Trump tax law now makes it even more difficult to accumulate cash as W2 employee. I would assume any W2 buyer or buyers looking for a 600k+ jumbo home loan will need to show the bank at least 300k annual in gross income. And that money will be hit at close to 40% between Federal, State, SS, and Medicare. And I believe your loan example left out property taxes and HOA fees. So a buyer for that 800k home will also pay an additional 1k-1.5k per month in property tax, insurance, HOA to add to that 3k monthly mortgage payment. Now add in children costs, student loans, and just daily living expenses. Rates can be 4% all year long. But even earners over 250k annual are having a hard time these days accumulating cash. And you need cash for a down payment and to stay current on a 5k monthly housing mortgage nut each month.

The pain just continues for those who continue to rent. Here is the first sentence from WSJ’s story on today’s housing story: “Sales of previously owned homes rose strongly in May, a sign that demand for housing picked up as mortgage rates continued to ease last month.”

And, here is a more pain for the renters:

“The national median sale price for a previously owned home last month was $277,700, up 4.8% from a year earlier and the strongest monthly pace of growth since August 2018, the NAR said Friday. It marked the 87th straight month of year-over-year gains.”

Ouch.

Def of pain: when you buy a house at the top and then the market crashes and you lose your job

Def of beauty: when you rent and your rent is much cheaper than buying

Def of awesomeness: when our rent is cheaper than buying and doesn’t increase. And you have cash and wait for the housing crash.

I will tell you of some pain. You decide not to buy that south bay beach fixer in 2013 because you say the market is going to crash and homes are going to drop 70% in value. You get to 2019, that south bay beach fixer has tripled in value. To make yourself feel better, you change your handle you post under and you once again claim prices are going to drop 70%. OMG. The pain.

That’s correct. Prices for houses are highly overvalued and will easily fall by 50-70%.

Renting for cheap is almost like a freebie. Buying at the top is financial suicide. You might as well just kill yourself. There is not a single reason to buy high. You can easily pick houses up for 50-70% below today’s prices in a couple years. That’s called winning! Really only the dumbest people buy overpriced real estate.

RE cheerleaders are pissed. They know it’s crashing and there is nothing they can do but watch…..get the popcorn ready

87 straight months with year over year gains. That is pure pain for the people who have been on the fence for that time period. I know several and let’s just say they aren’t too happy. We’ll have that 70% correction any day now!

Correct, the housing market will easily crash by 50-70%.

Meanwhile, renters can enjoy the bargain. Renting is much, much cheaper than buying. Housing has peaked and can only go down from here on.

If you want to make money, invest in bitcoin and get rich.

If you hate your money, buy overpriced real estate and watch it tank.

Yup, Nothing To See Here- Existing Home Sales Tumble YOY 15th Month, Worst Run Since Housing Crisis

https://www.zerohedge.com/news/2019-06-21/existing-home-sales-tumble-yoy-15th-month-worst-run-housing-crisis

That doesn’t fit the narrative of RE cheerleaders. There is only one story for RE cheerleaders. Now is a great time to buy. Don’t wait. Buy now!

Disclaimer: don’t complain later when you bought the top and the market dumps. Nobody forced you to sign!

Funny how how folks will post a zero hedge slugline and then not read the content Thanking it supports their argument

I myself do believe that the housing bubble will pop, but how does one respond to this comment….

“Stocks at an all time record again.

10 year under 2%.

Unemployment at 3.6%

Mortgages under 4%

On what planet does this economy point to a housing crash?”

America is finally great again! Thank you trump!! Everybody is wealthy and the economy couldn’t be better. Let’s not think about why the fed wants to cut rates or why we have lower housing sales YoY. That doesn’t fit into the picture. Everything is awesome. Keep buying!!

Samson, These are Indicators for a recession. Do you think there was HIGH unemployment in 2007 right before the crash? If the economy is doing poorly there can’t be a crash. If you would have taken an economics 101 class you would know that the economy moves in cycles.