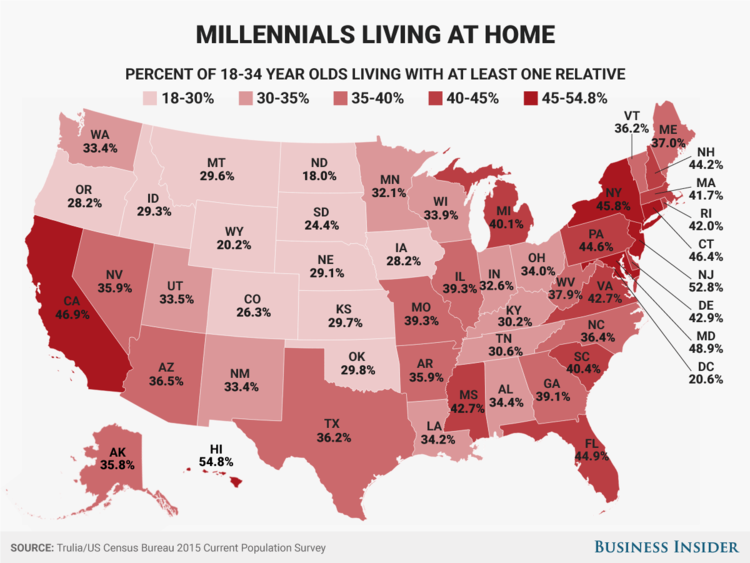

Millennials are not going to save the California housing market: Nearly half of California’s Millennials live at home with parents.

The housing correction has arrived. This should not come as a surprise given that the level of affordability is near historical lows. The real estate cheerleaders continued to mention that money from China and other factors would keep prices moving up at an unsustainable pace. However, you need more traditional factors to keep the housing market moving up. Historically in the U.S. the number one factor in housing demand was household formation. The other was economic growth. Household formation has favored rentals and also moving in with parents in the past decade. The economy on paper looks good but for every one good paying job created you had two new “gig†like jobs popping up with lower wages and fewer benefits like healthcare. Millennials are now in their prime home buying years yet the trend is not supporting the housing market. And in California, nearly half of Millennials live at home with their parents. How will that save the housing market when they can’t even afford a rental let alone buying a house?

Millennials at home in California

The trend of Millennials living at home is a new generational one (for those in the same age category in previous generations). This has been a national trend but in California it is the standard way of living.

Take a look at this chart:

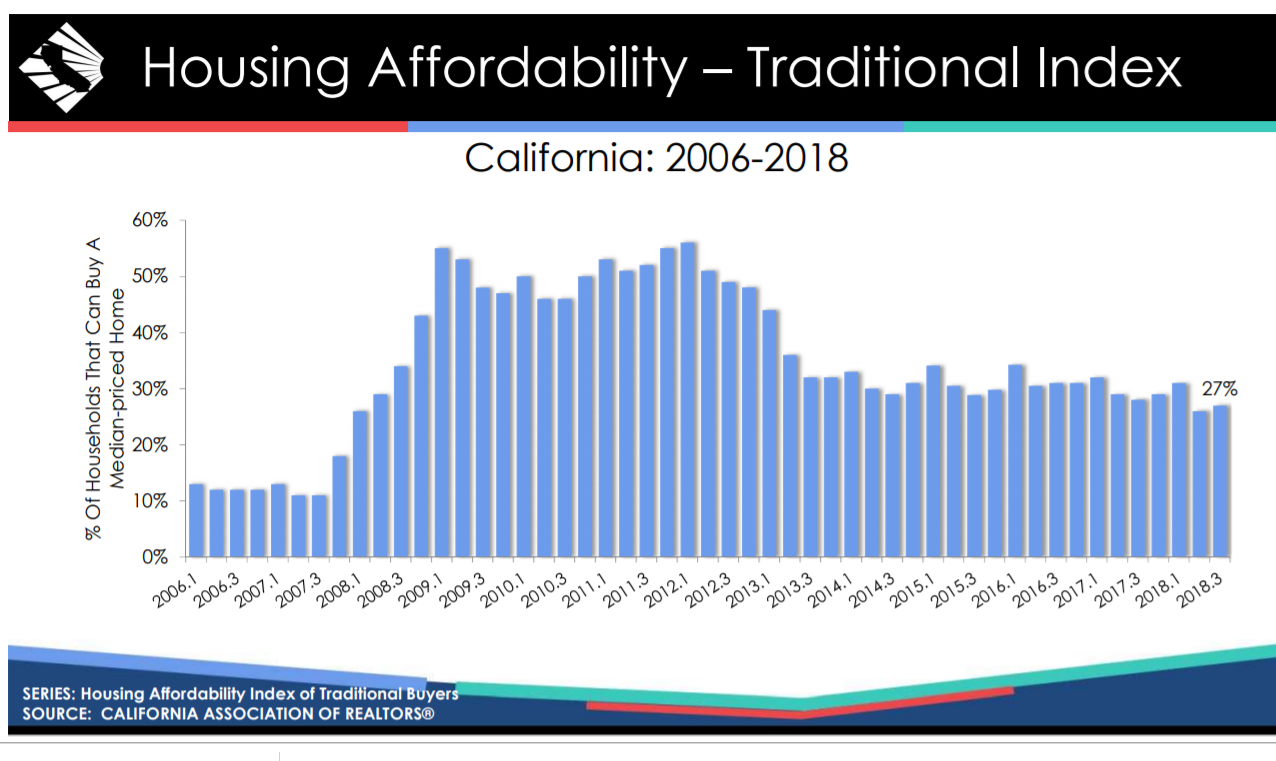

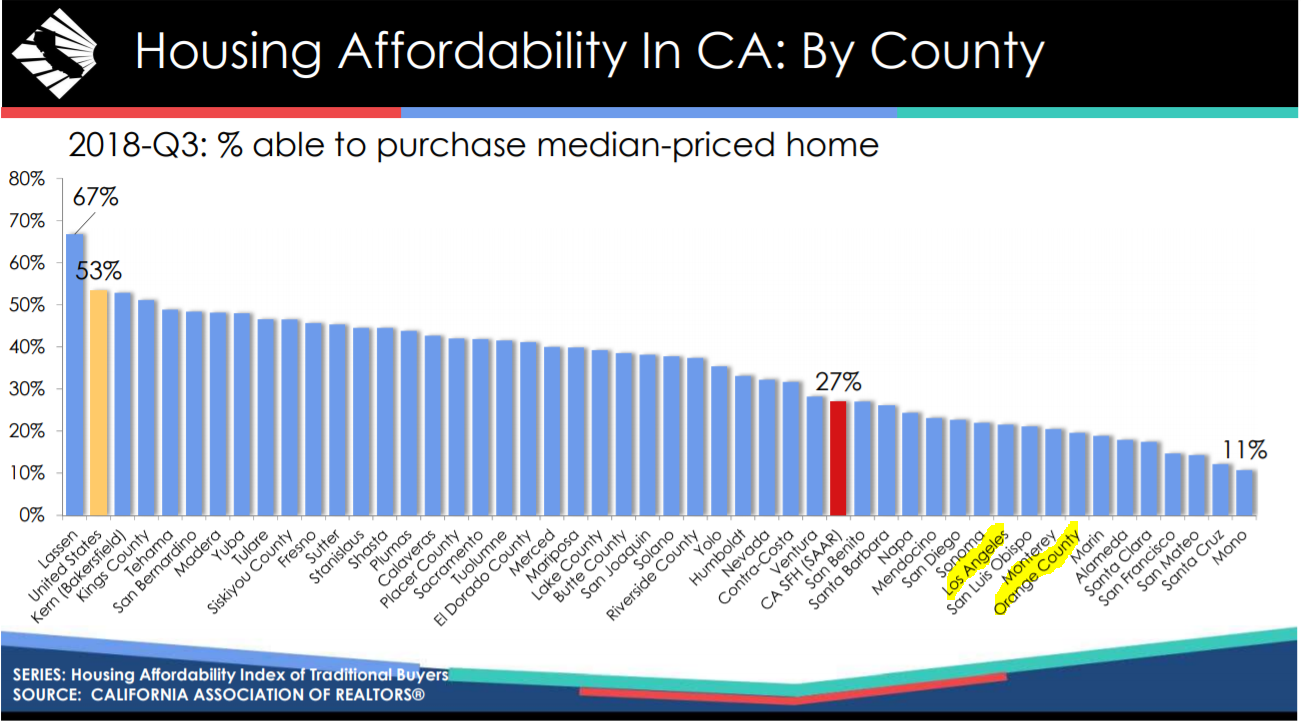

Nearly 47% of Millennials live at home with their parents in California. Only New Jersey and Maryland have a higher rate. Housing affordability is very low in California with only 27% of households being able to afford a home (a level last seen in 2008):

So of course the trend has now changed and inventory is rising at a rapid pace during the slow fall and winter selling season. The stock market is now taking a breather after a nine-year bull run. But what is telling is that during this period, Californians largely opted to form households in rentals. You have your older Taco Tuesday baby boomers that purchased pre-2000s when the housing market was still sane in California. We see this in many expensive areas in California where you have people living in homes valued at $1 million or more but shopping at the 99 Cents Only Store to stretch their budget. House rich and cash poor. And of course their Millennial “kids†are living at home because they can’t afford to buy. But people are living way beyond their means given that we see that credit card debt and auto debt are both over $1 trillion each. I see this in some of the neighborhoods I observe where late 20s and 30 year olds are living at home but driving around in BMWs or Teslas.

And the affordability crisis is even worse in counties like L.A. and O.C. (forget about S.F.):

So what you have is inventory spiking and prices moderating. And we are now seeing this reality hit the ground:

More listings and more sellers willing to lower prices. Will Millennials save the housing market? Unlikely and definitely not in California because affordability is based on household income and wages have simply not kept pace with real estate gains.

And with recent California elections, taxes will not get lower and with the new tax plan, it is actually set to hurt coastal areas like California with their massive subsidies for mortgage interest on million dollar crap shacks largely being capped. Many owner-occupied households are going to be surprised when they see their tax bill but given California is a renting majority state and most don’t live in inflated coastal areas, the masses are going to see a net positive on their tax bill.

The slow-down is here and we have yet to see where this will go since many in California buy only for price appreciation. The psychology is going to shift over the next year and Millennials will not come out in droves to purchase homes.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

165 Responses to “Millennials are not going to save the California housing market: Nearly half of California’s Millennials live at home with parents.”

adapt or die to the new normal.

This is going to be an epic crash. My popcorn is ready!

Why would you make such a statement? Tens of thousands of renters are saving down payments waiting for a chance to jump on a deal. Any price drop at all will be met with buyers. That means no price crash.

Party’s over. Sorry, not sorry.

https://www.bloomberg.com/news/articles/2018-11-20/free-vacations-100-000-discounts-homebuilders-get-desperate?utm_campaign=news&utm_medium=bd&utm_source=applenews

LMAO, you can’t be that nieve? are you ? Housing run in cycles, like everything else, the correction has started, it will take its course over the next 5 to 10 years, deals will be had over this time. Low paying jobs are not whats going to save the housing correction, maybe lower rates to new historic lows, but thats the FED’s last hope.

No price crash? How old are you? Were you living under a rock 10 years ago!? Houses in 06 that were 600k were selling for 280k a couple years later. The 08 crash and recovery has been due to speculation. Dead cat bounce. All the orange county money thought they missed the boat and have caused this one to be a bigger bubble.

I am one of those renters with a saved down payment. My time horizon to buy is at least 3 years out. Renters who have saved up a down payment to buy aren’t going to be jumping into the market at the first sign of weakness. Usually if someone has the discipline to save, they have the discipline to recognize that they shouldn’t buy until the property they are looking to purchase is somewhere close to rental parity.

It will take those renters another 20 years to save enough money for a down payment on the current prices. Smart people see blood in the water and are waiting for the bottom to drop out, again.

Even renters are too smart to buy in a falling market. They only need to sit tight and buy at a lower price as time goes on. Why jump the second you can afford a house. Wait until you can REALLY afford it.

JT you are either very dishonest or you are a dense bubble-denier unable to see realty. The market is crashing. Learn to accept the bubble. Don’t fight realty. It is too difficult.

None of my tenants are ‘saving money’ and getting ready to buy. You are delusional. They are living paycheck to paycheck and I keep all of my rents soft too. I manage a lot of units, this is the rule not the exception, tenants are totally strapped. JT you must be a House Jockey (realtor) or Lawrence Yun. I can’t figure out which.

All of these excuses about why “this time it will be different” are EXACTLY the same as every other crash. It’s amazing how strong the herd mentality is. Of course, that’s what gives the inevitable crash so much momentum, and why prices drop so far during crashes. Prices always go too high and dip too low. There will be some fantastic buying opportunities in the coming years.

You are Millie! Quit posting using a fake name. We already caught you several threads back. Knock it off or admit you use fake names to back your posts many times.

Jed: Are you asserting that JT is Millennial?

I’m not Millie. I’m 44 years old, far from a millenial. But I do agree 100% with his assessment of the real estate market. The crash is underway.

No. jT is not Millie but that would be priceless. Joah is.

Millie uses fake names to support his claims. You can bet that Joah is Millie.

First of all, I misspelled my name the first time I posted. Secondly, I’m not Millie. You RE cheerleaders will think of anything to keep your dream alive. Amazing. There is a MOUNTAIN of data in front of you and DECADES of history showing you that booms and busts in real estate are the norm, yet you still believe that somehow “this time is different.”

Man, this blog, this market, RE cheerleaders….it’s better than watching my favorite show!

So friggin entertaining. Had to laugh so hard at JT and Jed’s posts. The market could correct by 30% and JT would deny it. He used to be a lender or maybe he is still one. A professional RE cheerleader trained to deny. And Jed….as soon as someone posts he or she waits for a nice crash to buy low it must be Millie (me). As if there are only RE cheerleaders on this blog and one millennial who waits until the market crashes.

The next months and years will be a gift. Thanks in advance!

Home prices will continue to slowly rise while the inventory continues to stay low. A little more inventory means nothing as long as inventory remains below 6 months. And, a whole bunch of renters just lost a big portion of their down payment in FANG stocks. Looks like people that did not do a purchase several years ago when prices and interest rates were lower made a mistake. OUCH.

Well unfortunately for you inventory is now over 7 months as of September.

https://fred.stlouisfed.org/series/MSACSR

Nope. From the NAR California report released weeks ago:

“The unsold inventory index, which is a ratio of inventory over sales, increased year-to-year for the seventh consecutive month in October from 3.0 months in October 2017 to 3.6 months in October 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.”

3.6 months is low inventory.

Also, the report said prices in the Los Angeles metro rose 5.3% year over year.

This is not a crash.

I am using data from the US Federal Reserve. You are using data from a real estate trade association.

Always love when woody takes him apart with one sentence and/or a link.

Woody’s data is for the whole US. I assume jt’s data is for California. Apples and oranges? The sources of the information aren’t necessarily the problem here.

Joe,

JT doesn’t provide data, ever. None of JT’s forecasts/predictions were right. Ever.

He is great for gauging the market. When he is silent the housing market is healthy. When he posts high volume of crap you know the RE market is in serious trouble. JT is in The RE business. Low sales volume means RE cheerleaders have more time to post propaganda.

“It is difficult to get a man to understand something, when his salary depends upon his not understanding it!” Sinclair

Jeered a good example of absurd prices in LA. This hit the market this summer at $3.9million and now at $2.58 Million.

Yep a $1.3 million reduction in 4 months…and still on market so expect it will go lower…

https://www.zillow.com/homedetails/1222-Electric-Ave-Venice-CA-90291/2088662799_zpid/

Alert JT and jr, this is the deal you want, and since you saved up the deposit, your high paying job will easily afford the monthly payment, enjoy home debter. lmao

PS, Venice is a shit whole

JT, are you just trolling? A “little more inventory”, really? There is a ton more inventory where I am (Coastal Orange County). Where I’m looking to buy (Newport Beach), there were times in the last 5 years where there were as little as 12 homes (condos) for sale in my price range ($900K and less). Currently, there are 51 for sale, and that excludes mobile homes, homes with land leases, etc. There are also quite a few listings with price drops, something I haven’t seen much of in the last 5 years. Granted, my data is only a small sample, but it’s likely more or less reflective of the overall market. Also, my down payment money is not in stocks and therefore it’s not subject to any volatility.

The only mistake I made was not buying in 2010-2012 (though I did buy in 2009, which is currently used as a rental). I wouldn’t be at all surprised to see prices dip below 2013 levels, at which point I’ll buy.

Probably true that there are more listings.

“And, a whole bunch of renters just lost a big portion of their down payment in FANG stocks.”

…that means less buyers will be available to buy. The more the stock market goes down, the less people will be able or willing to buy.

You bet! it’s always about timing. Timing is everything.

Some points on the data:

1) This chart is from 2015

2) I noted that the third lowest rate of Millennials living with relatives is in DC. This is not a low cost area, but probably it is due to a lot of young out-of-towners living in DC for Government work. They have no relatives to move in with. The DC Millennials will probably be less able to buy due to having to pay rent.

3) The good Dr missed the highest rate of all: Hawaii!

4) The only Millennial member of my Parents’ descendants who is living at home lives in one of the bottom states for living at home. This is due to lack of ambition in a state where you can get a house for < $100K and jobs are available.

5) Mississippi is one of the states with cheap housing and one of the states with the highest rates of Millennials living with relatives. Maybe cultural factors, or maybe Millennial poverty is to blame here?

6) A lot of situations I've heard of are people taking advantage of family generosity, and making a conscious decision to save a lot of money until the affordability numbers match up to their resources.

There will be a crash unlike any we have seen. So you’re saying that people have money saved up ready to pounce? Who does? The millennials? They’re living at home with their parents busy paying off student and auto loans.

They only people ready to buy those homes are investors.

There will not be enough investors to save the market from crashing.

Plus the economy is slowing. The waves upon waves of college graduates exiting school ready to join the work force will be fighting for jobs that was promised to be there for them after taking on all that debt.

Those will be the first to cause a ripple. Defaulting on student loans. Then when it gets real bad, they will start firing the people who have been there the longest and tailgate replace it with younger inexperienced people.

That means people who are older with a mortgage. You will have multiple crashes happening at once

Most Millenials are poor as can be and won’t be buying anything other than a new iphone. There are a small minority that are savers, entered the right career field or have help from parents…these people will likely buy.

Just like last time, the people with cash and connections will get the deals on properties. And the rich have done fantastic the past decade. I would welcome any correction so I can finally purchase my beach close rental property.

At 70% off; right?

There will be a crash unlike any we have seen. So you’re saying that people have money saved up ready to pounce? Who does? The millennials? They’re living at home with their parents busy paying off student and auto loans.

They only people ready to buy those homes are investors.

There will not be enough investors to save the market from crashing.

Plus the economy is slowing. The waves upon waves of college graduates exiting school ready to join the work force will be fighting for jobs that was promised to be there for them after taking on all that debt.

Those will be the first to cause a ripple. Defaulting on student loans. Then when it gets real bad, they will start firing the people who have been there the longest and tailgate replace it with younger inexperienced people.

That means people who are older with a mortgage. You will have multiple crashes happening at once

HI Bee. I think there will be enough investors/bankers to gobble up all the homes when the market tanks. They bought like crazy from 2011-2015 (I still see homes that were bought in 2015 then remodeled and flipped in 2016 and 2017).

Remember when BlackRock bought tens of thousands of homes sight unseen? it will happen again.

https://www.kcet.org/city-rising/financialization-of-single-family-rentals-the-rise-of-wall-streets-new-rental-empire

The difference is they won’t have QE and 0% interest rates this time.

QE Abyss – I think you are spot on. The wall street firms were able to get the government to back their MBS. So they will continue to buy properties, bundle then mortgages into MBS, then sell the MBS (This is one place they make money is selling the MBS), then they get the government to guarantee the MBS and offload all the risk to the government (who cares if the tenants cannot pay), then they make money also servicing the loans.

Good deal if you can get it. Essentially there is no risk if you pay too much for the home or get bad renters as all risk has been moved to the GSE who now guarantees the MBS. Lots of money is made on the MBS fees and the servicing of the loans. QE or 0% interest rates will not stop them from raising money from investors to buy MBS that will be guaranteed by the GSEs.

This almost implies that Blackstone or other Bank entities will want to see cyclical housing corrections to repeat this process for decades to come. On the side as more homes fall into foreclosure slowly shrinks the availability of homes to sell affordably. I guess everyone will eventually see the “Road to Serfdom” at their doorstep if this were to continue.

I have heard anecdotal stories of SoCal houses that crashed by over 80% from 1929 to the bottom of the Great Depression. Here is an article on values in the Depression:

“According to Scherbina and Nicholas’ working paper, “Real Estate Prices during the Great Depression,†the prices for a typical Manhattan house increased 62% in a run up of the 1929 stock market crash and then lost 51% of that value by the end of 1933. By 1932 and 1937 the stock market showed signs of rebounding, but real estate did not, according to Scherbina. A house purchased in 1920 would have lost 51% of its value (in inflation-adjusted terms) by the end of 1939. Scherbina and Nicholas report that it wasn’t until 1960 that housing prices recovered.”

Compared to that, 2008 was a middling recession. So we have seen a big time Real Estate crash before here in the US.

Millennials “save” the housing market without even knowing it.

They pay ultra high rents, room up 4 to a 2 bedroom if they need to… in the most expensive areas of the country.

In Southern California 60% of housing stock is for rent.

This is going to be epic, as epic as watching paint dry. Get a few huge costco boxes of microwave popcorn. I feel bad for the folks who think this is 2008. It’s going to be an epic LOL.

It is hard to gauge where rents will be in the next couple of years as an economic slowdown will hammer what rents a landlord will get. Right now, the price of housing is too high in my opinion to make money as a landlord if the real price of housing does not appreciate. You cannot currently borrow money to buy rentals and not be subject to slippage from hedged to speculative to Ponzi level financing as rents drop in a slowdown. Better to wait until you can do mostly cash or all cash deals when they happen again.

I do agree that a higher percentage of rentals will help buffer real estate prices to some extent. Of course landlords who picked up properties at fire sale prices will sit tight in any slowdown, and they will be able to take a cut in rents to keep their places full up. People who have investment cash who are looking for an income stream may get back into the market if prices drop from where they currently are. But of course that happened in 2008 and we still saw a fairly big drop.

TankInSight,

Yep, the RE crash will be epic. Much bigger than 2008.

Rents go with incomes. Therefore, rents are dirt cheap compared to buying. No RE cheerleader mentions rental parity anymore besides surge who believes rental parity is paying 20% down AND still 1,5k more than a renter per month. But you got to have some dimwits too for entertainment.

My rent for instance has never gone up. It’s a gift from my private landlord. When the RE market crashes (next two years) I will buy at a big discount. Experts (like me) believe a 50-70% price haircut is coming in housing.

I must be a dimwit also.

I got a good deal on a house in 2010 and took out a 15 year loan.

When Our Millennial finally buys in 5-6 years, my mortgage will be paid off and I will be living rent-free for the rest of my life (hopefully 50 years). OK, thanks to property tax limits, I will be paying about $300/month for the next 50 years for “rent”.

I doubt Our Milleninial’s rent is even close to $300/month.

He apparently forgot to calculate the part where living 50 years rent free is better than paying an ever-increasing rent until he can get 70% off on a house.

I can forgive him for being too young and naive in 2010 to recognize an opportunity. He may be correct that housing will drop 70% but it will likely only drop 25%. The question is whether his crystal ball is better than my broken one before the bottom is reached.

Our Millennial is in a dilemma. I am in a similar dilemma about the stock market. Where is the bottom? Is there a bottom?

Seen it all before, bob,

Buying in 5-6 years sounds good to me! Just depends on the market. I am ready. actually saw a really nice object last week, large backyard, great school districts, good location etc. I could easily afford it but don’t see a reason to buy. By renting I save a ton of money and even if I would put 20% down renting still wins. I wasn’t able to buy in 2010 as I just started my career. Good thing the market crashes every ten years. Looks like the market is going down already. Maybe it won’t take 5-6 years, more like 2. We’ll see. Just have a little bit of patience.

I agree with the 50% to 70% drop, in places like San Diego, LA, and the Bay Area. Inland areas won’t drop that much though.

Josh and your younger Millennial brother have got it backwards.

Remote areas like the Inland Empire have unrealistic price gains when the bubble is blowing up because the majority of home buyers want to live close to the coast but they can’t afford it so they drive up home prices further away and suffer the commute. When the crash happens, nobody wants the commute, or a house 60% underwater so they foreclose and wait.

The Inland Empire crashed 50%-60% during the 2008 bubble but the coast only crashed 30%-40%.

I am old enough to have seen this in the late 80’s/early 90’s when Victorville was the overflow for the San Fernando Valley and LA. Victorville crashed 70%-80% while the Valley and LA only dropped 10%-15%.

There were only 2 crashes over 40% in Coastal S.Ca in the last 100 years. The Great Depression in the early 30’s and the 2008 crash. ie a major crash every 80 years.

If you are young enough to wait another 80 years to buy, your grandchildren will thank you.

You should know when to hold them and know when to fold them. When a 20% drop in housing happens in Coastal CA, take it. Or like with earthquakes, wait 80-100 years again for the Big One.

The only exception would be a big fat Black Swan flying in. Then wait for your 50%-70% price cut.

Seen it all before,

Yep, I agree, the inland (e.g. inland empire) will crash the most. Coastal areas will crash by about 50%. No black swan needed. The upcoming job loss recession will take care of it. My expectation is this will happen within the next few years. Lots of time to save even more. I should be able to buy a very nice house in all cash by then. Until then I enjoy my ridiculous low rent.

I don’t think the inland areas will drop as much this time, because this time they didn’t see the gains or “recovery” that the coastal areas did. The 2008 bubble and crash was fueled by speculation and loan fraud, so more people were able to participate. This time it’s a QE and ultra-low interest rate bubble, combined with a ton of foreign (Chinese) investment.

We’re going to have multiple bubbles popping at the same time, and the coastal, more expensive areas, are going to be hit harder – because that’s precisely where the majority of the money went in fueling the current bubble.

https://www.latimes.com/socal/daily-pilot/news/tn-dpt-me-school-closures-20181018-story.html

HB is closing schools due to lack of enrollment. Why is that? Those who live there are old, holding on to their large family crap shacks and their Prop 13 discounts. There kids are long grown up and moved away unable or unwilling to pay the unreasonable prices. And now we see schools closing and the district is selling off the land.

What happens when these old people die and inventory surges and prices are affordable to young families?

@JD

I’m a long time HB resident. I’m also not a boomer but I enjoy prop 13 tax benefits. I bought during a “bubble” in the late 90’s when I was a broke college student.

If you are going to draw nonsense conclusions at least read the article you reference. I have a young child at home who is not even school age yet. I have multiple friends/neighbors with young children at home as well.

HB has been eyeballing closing those schools for years. One of them (Perry) was actually voted to be closed due to low enrollment when I was a kid in 1985. The city changed their mind and closed another school instead which is mentioned in that article you linked.

The school district allows you to send your kids wherever you want and not bound by geographic boundaries. One of the schools they want to close is where the “economically challenged” kids primarily attend. It gets less help/parental volunteers/donations then some of the wealthier schools hence the lower rating. If you are a parent and have a choice why not send your kid to the better school a couple miles away.

The city is targeting to close another school (but reopen one in its place) due to soil problems that will cost millions to fix. It’s cheaper and reduces liability in the event of an earthquake.

@ SocalGuy

“If you are going to draw nonsense conclusions at least read the article you reference.”

Look at the first two sentences of the second paragraph in the article:

“A standing-room-only crowd filled the district boardroom Tuesday night in response to the possibility of Joseph R. Perry Elementary School being sold “due to declining enrollment,â€

DECLINING ENROLLMENT

https://www.scag.ca.gov/Documents/HuntingtonBeach.pdf

Look at page 5:

“Between 2000 and 2016, the age group 65+ experienced the largest increase in share,

growing from 10.4 to 16.9 percent. ”

Those 65+ generally do not have school aged kids.

“The age group that experienced the greatest decline, by share, was age group 21-34,

decreasing from 22.6 to 18.4 percent. ”

Those 21-34 generally have school aged kids.

You can’t tell me declining school enrollment is not correlated with a city with a documented aging population.

@JD,

Correlation doesn’t equal causation. I don’t argue the statistic that the median age is increasing.

http://articles.latimes.com/1985-02-09/local/me-4093_1_perry-elementary-school

This article was from 1985! The city voted to close the school back then due “low enrollment” but changed their mind at the last minute. Did it have to do with the age 65+ population 30+ years ago? Or when HB property was relatively cheap, the downtown area was seedy and littered with oil wells everywhere?

So fast forward to today. The overall city population hasn’t increased that much (+25K people or so). You have Seacliff elementary that opened in 1999 which is just 2 miles away (5 min drive) and it has nearly double the students than the one they are trying to close (Perry). The average home price is that community is 1.2m+. Someone is still having kids.

So the school they want to close (Perry) has roughly has the same amount of students today that it had in 1985 when they wanted to close it the first time due to low enrollment. In the meantime, the city builds another school and packs it full of kids all during this time of a rising 65+ population holed up their prop 13 fortresses.

School enrollment is increasing just not at THAT school which is under performing. The “standing room only crowd” at the meeting was full of teachers worried about their jobs and pensions while their test scores keep going down. Parents have a choice now. I know where I’m sending my kid.

An epic crash? Maybe but beware of a natural confirmation bias. As you get to wealthier parts of the planet (Singapore, London, Paris, Hong Kong) you get an even higher percentage of renters. We are reverting to that norm.

I think a lot of the softening is interest rate hikes as the Fed tries to keep the frothiness down. Will they be successful? We will see. Place your bets.

Investors have become a much larger part of the market. They figured out that real estate is a nice counterweight to securities.

My money is on a softening as rates go up but not an epic crash. There are no NINJA loans and the economy is doing well. I’m betting on another rental property pickup when I see a good deal. Prices will be soft because of higher rates but I can always refi when rates drop. Now an epic crash would be great for me too. I just don’t see anything that big in the cards.

No NINJA loans, yet. Stated income, no doc loans are back though. Lol! You can’t make this stuff up. People never learn.

https://www.equinoxfinancing.com/?gclid=CjwKCAiA0O7fBRASEiwAYI9QAqDfrXgAE1EfDM2cXlbmEodFwuSk_kaRDc0ZDIDE5sDIDACJvSFUEhoCFMQQAvD_BwE

Stop with the sound bite mass hysteria links. Stated is not back in any form from the previous decade.

There are bank statement loans available where the owners deposits (% of) are used for income; I am doing one right now.

24 months business bank statements (must be 100% owner)

20% down minimum

730 fico score

45% max DTI

primary residence only

That is a far cry from the stated of the pre-crash. The non-QM programs have loosened a bit recently and paradoxically the conventional loan guides have tightened up. There is no doubt the market has shifted from a sellers market to a more balanced market with inventory increasing and price reductions happening. This is not a crash however, just some normalcy has returned and seller no longer have maximum leverage.

While it’s true that the stated income loans are “the same” as they were in 2008, they are still very risky for banks. I have a friend in the industry who says he can get a loan done with 12 months bank statements, 700 fico, 10% down, 45% max DTI. That is utterly ridiculous and totally unsustainable, but this is what lenders have to do to continue making loans – reduce lending standards.

Besides, the 2008 bubble was purely speculation, today’s bubble is mainly fueled my QE and ultra-low interest rates. Sure, on paper, the loans “look” better. But the underlying metric of income-to-price is totally out of whack. Loan owners are completely dependent on monthly payment, and as interest rates rise, prices will fall. That’s without ANY economic event like a recession, stock market crash, etc. All of which will happen, because they always do.

Dan the man!

Our friendly lender from OC! When is that pot boom coming again that will lift the California housing market to the next level? As a lender you have “inside knowledge†don’t you? All your analysis pointed to lower inventory but recent articles, stats and the human brain suggest otherwise. What went wrong here?

@Fensterlips – I may be in you camp.

Also, 95% to 98% of all loans made the past 9 years are backed by the GSEs. The big banks just service the loans. I refinance twice in the past 9 years and each time the loans was bought by Fannie within a month. So if there is a recession, the GSEs can ask all the banks to create a forbearance plan/bailout to let all the people who fall behind on their loans to get caught up.

I think the GSEs will do all they can to keep house prices from dropping to0 much. The will not want people to walk away from their loans. They will have a lot of ideas I am sure. During the housing bubble 1.0 crash, 65% of all loans were owned and packaged into MBS by non-agency firms ( Bears Stearns, Lehman’s, CountryWide…etc). Those were the ones that caused much of the problems for banks, pension funds, etc. Now, almost all loans are backed by the GSEs so you will not see any MBS fail or need to be bought up by the FED. MBS are probably one of the safest places to be since they are guaranteed. Even all of those homes bought by Wall Street firms like Invitation Homes are backed by the government. Now that the GSEs own almost every loan made since 2009, they can put prevent a 2009 housing crash.

IMHO….If there is a recession, they will kick the can down the road just like the Central Banks did with Greece…etc.

Just some ideas with no merit at all:

1) Loan Forbearance or 6 month or 1 year. Just like they do with Student Loans

2) Refinance the loan to a longer term to make the payments smaller. 20 years to a 30 year loan. 30 years to a 40 year loan.

3) Do 10 hours of community services a week to reduce you payment 20%

4) Public employees like Teachers, policemen, Fireman get principle reductions on their loans.

Just some wild ideas. But since the GSE’s own all the loans, they can make up any program they see fit.

Fact … the only way home prices drop is in a recession. At this point, nothing indicates a recession in here. Jobs are everywhere. Interest rates are very low. People are spending money. Rents are rising. Home prices are grinding higher and the inventory is low. Sure, the inventory is a little higher than it was, but it is low. And, much of what is for sale is defective property … bad locations, bad structures. The slowdown in home buying is mostly seasonal. In the spring, another surge of homes will enter escrow. In one year, prices will be another 5% higher.

“Real estate always goes up forever and ever!! I guarantee it!!!” -JT

JT is right. 5% next year, no recession in sight. Exception being luxury homes which have headwinds due to SALT deduction limits, mortgage deductibility limits, downturn in overseas buyers.

Breeze, “No recession in sight� Rofl! Some people can’t see the forest for all the trees!

I bet you didn’t go far in your career and are now into flipping homes. The last flip didn’t sell and so you must post all this BS to ease the pain and in order to sleep at night.

Check out the price history of this house in La Mesa, a suburb of San Diego. Sold for $1,055,000 in 2014, built brand new. Listed in September of 2018 for $1,179,000. Reduced to $999,000 and now a “range” of $935,000 to $999,999. I should put in an offer for $450,000 since that’s about what it’s worth and will sell for in 2-3 years.

How is this not a crash?

https://www.redfin.com/CA/La-Mesa/8915-McKinley-Ct-91941/home/58185213?utm_source=android_share&utm_medium=share&utm_nooverride=1&utm_content=link

Hi Josh,

There are 12.2 million housing units in California. One overpriced model home built in 2014 selling for 10 % below the original sales price doesn’t indicate that the median home price in California next year won’t be 5% above this years price.

Download the Redfin app. Favorite a bunch of homes in your area (or whatever areas you want), and watch what happens to the listing prices. I’ve been tracking multiple areas and hundreds of homes for over a year, prices are going down. It’s not a free fall yet but it’s obvious to anyone paying attention, and anyone who isn’t a blind RE cheerleader.

Yes, and that home has 300k in upgrades which you can never recover on resale.

Absolutely worst example to make a statement for anything

Surge: that home has 300k in upgrades which you can never recover on resale.

How do you know that home has $300k in upgrades? Because the listing says so?

I thought we’d long ago established that Realtors lie. Their listings are lies. Realtors lie. Sellers lie. And finally, Realtors lie.

Are you saying that Josh Altman is a liar?

The house is relatively new and fairly large by SoCal standards. The only drag on the price is that la mesa isn’t the most popular location for people buying homes in that price range.

Gaining property value in the price range of $1million + has been dicey for awhile. Probably because there are plenty of decent sized homes to chose from in that price range in far more popular areas for families who would be in the market for homes with 3+ bedrooms.

New construction isn’t a good indicator because improvements (i.e. new builds) depreciate as time goes on. Only the land appreciates. Thus, it isn’t uncommon for two identical houses, built five years apart, on identical lots to have different values because one is “new” and the other is now discounted due to depreciation.

OC Register RE Section Headline: “How Housing Shifted to Buyers Advantage.” Mr Lansner credits the buildup of unsold new houses and a slowing resale market. And a smaller but real effect of California’s political climate thrown in for good measure.

https://www.marketwatch.com/story/regulator-for-fannie-mae-freddie-mac-lifts-mortgage-loan-limits-2018-11-27?mod=bnbh

Big Mac in 1986. $1.50. Big Mac in 2018 $4.50.

Median home price US in 1986, $100,000. In 2018 $221,000.

The real bubble is in hamburgers.

Funny BS. in California, home prices are 10-12 times what people make (median). Back in the day it was 3-4 times and people had no student debt. RE bubble will crash just like every time. Wait and see

You can also do the LA street taco analysis for local SoCal inflation…. there’s about a 200% increase over the past 20 years.

real inflation is a crap ton more than 1-3% a year.

TankInSight,

It’s not the Big Macs or tacos….it’s the avocado toast! Millennials could easily buy large house if they wouldn’t have spent 18dollars on avocado toast for the last decade.

Little did you know every millennial eats that daily! Just ask dr google. You are in for a surprise.

So you use inflation adjusted figures for homes, but then nominal figures for Big Macs? Lol wow, how can anyone take you RE cheerleaders seriously?

But you’re right, the Fed’s easy money policy created bubbles everywhere. Which is why now that the spigot is turned off, the bubbles are going to pop.

Both nominal. “We could be in the middle of a mega 15-20 year boom cycle in housing.” This has as much likelihood as any to occur. US is innovating today like never before. Innovation provides tailwind to economic production. Economic production = wages = disposable income to purchase RE.

Breeze, in other words the tech boom is upon us! It can easily be validated by looking at the FaNg stocks! Good job breeze, keep up the good work. By posting propaganda you will be able to turn the market back into hyper drive. The 1 Mio crapshack will soon cost 2 Mio. All you need to do is post more!

Wrong. The median home price in 1986 was $66,350. The $100k you cited was adjusted for inflation. So you’re correct, both housing and Big Macs are artificially inflated due to the Fed’s predatory money practices.

https://www.cnbc.com/2017/06/23/how-much-housing-prices-have-risen-since-1940.html

Will this translate in lower prices?

https://la.curbed.com/2018/11/26/18112822/los-angeles-inventory-how-many-homes-for-sale

Short answer = Yes

But; I don’t think this means there is a “crash” happening nor do I believe that a 70% crash is imminent (like a few handles from the same person believes).

There is no doubt that inventory has increased and coupled with higher rates that has put downward pressure on prices. More competition for buyers = lower prices. I think this is good as 1 side (sellers) had too much leverage, so seeing it balance out a bit is healthy. Sellers need to be cognizant of the market change and price their properties appropriately.

A property priced too high or not in a great location or not turnkey will sit. Conversely when you have a property that has the turnkey status in a nice location will still sell FAST and with multiple offers.

There is too much extremism here; where 1 side says 70% crash coming while the other side says RE cycle up for the next 10-15 yrs.

I think we will stagnate and/or see a slow dip but I dont expect either of the 2 extreme scenarios above to play out.

Yes Dan, nothing to see here. Those giant, mountainous price run-ups (see link) will just flatten out.

https://wolfstreet.com/2018/11/27/the-most-splendid-housing-bubbles-in-america-deflate/

Read an RE agents blog this morning that specializes in foreclosures – theres a pretty good amount in my neck of the woods right now. Anyway, she has to write a monthly report to the banks as to why the properties didnt sell and she is frustrated because they are overpricing them by 100K!

Good thing about Trump telling GM to give back its bailout money is that this could mean if the banks try any nonsense in this downturn they too will be told to pound sand. MAGA!

Unless the bank is owned by Russia.

You’re one of those morons who think that Russia stole the election for Trump.

I remember when Russia was the Soviet Union. In the 1980s, the Left praised the USSR, and worried that Reagan might start a war against the Soviets.

But now that the USSR has reverted to Russia, and become less Communist and more Orthodox Christian, suddenly, the American Left wants to renew the Cold War.

News flash: Russia did not steal any U.S. elections. And if you want to criticize foreign nations that have too much influence in U.S. elections, Israel tops the list.

You’re one of those morons who think Trump won WITHOUT Russia’s help! Lol!

I know 2 couples who over extended themself buying a house the last 2 years. They borrow friends and family to get a down payment.I can’t imagine paying $3000-4000 for 30 years.

It’s hard to find a steady job let alone for 30 years. I think automation will likely take away some of their job.

I can’t imagine paying upwards of $3000/month rent for the next 30 years or longer. But people will do it. That’s the going rate for renting an SFR in any decent part of town.

Maybe after the 50-70% decline predicted by many, these houses will rent for $1500/month. 🙂

No, Millie’s rent will Never change! It will never go up. It will never go down.

3..2..1..

Spot on Jed! For those of us who like math and look at actual numbers it’s obvious that renting is a steal compared to buying. Sellers can’t find a buyer anymore as the property is overpriced (sometimes by 200-500k). People who must move often try to rent out their property without losing more than 1k per month. Even if you put down 20% you can’t rent out your property and break even with PITI. So, potential buyers have to ask themselves: why waste your money by buying? You can easily buy 50% off during the next crash just like every time. As most of us know, the market crashes after each boom cycle in California. You can go back in history and see the 50% discount each time the ten year cycle ends. Again, why not wait a couple of years and save hundreds of thousands of dollars? Nobody on this blog is able to answer that question. I asked several times!

You cant imagine because your time horizon is limited

In 30 years, 3-4k / month will be like 1-1.5k today

Your rent on the other hand will be more like 8-10k

Ore

Fed Powell signals rates are right where they should be, don’t anticipate much higher from here. Freddy and Fannie are also raising loan limits which gives more room for prices to go up.

I would say we have another 5 years for the 2nd leg up on this housing run before prices start coming down.

Just be careful listening to what everyone says, in 2013 I was buying a property and everyone at the time was saying “Prices are so high, just wait they will come down”.

We could be in the middle of a mega 15-20 year boom cycle in housing.

LMFAO…Was it one Jug or Two Jugs of Carlo Rossi Tonight?

LMFAO..Was it one Jug or Two Jugs of Carlo Rossi for Tonight?

Whatever RE cheerleaders are smoking, drinking or whatever… I welcome that. Life expectancy is going the right way. DOWN. Often caused by drug abuse.

https://on.mktw.net/2E448LS

One of the real estate issues I am seeing is boomers that seem to live forever. That is very costly for next generations. If we would repeal prop13, at least we would battle against one of the RE market issues: Boomers enjoy freebies, don’t pay their fair share in property taxes and live very long.

Yep Johnny! You got it, the boom cycle just started!! Don’t waste your time here. Buy your flip now! While the bears wait for prices to come down you are the one smart guy if you invest heavily in RE now! Prices will soon quadruple. Don’t miss that once in a lifetime chance!

Prices would have come down from 2012-2013 levels had the Fed not interfered. Instead, they decided to re-inflate the bubble to where it is today. For anyone to think this is sustainable is lunacy.

Josh, the Fed has been in charge and calling all the shots for DECADES. So to think that this will all stop tomorrow is ludicrous. When the times get tough (like 2008), the Fed and other PTB can do whatever they want to generate their desired outcome. You guys keep renting and buying gold, it’s worked out splendidly!

LMFAO

Johnny could be right. A movie ticket cost $1.00 in 1964, and $10.00 in 2018. Inflation alone is good reason to own real estate as a multi decade investment.

Nothing wrong with owning real estate. But why buy high? Just wait for a nice crash and buy half off?

I can’t tell if this RE cheerleaders are stupid or blatantly pretending to not understand what we’re saying. NO ONE in here is saying to never buy real estate. We’re saying to not buy it when it’s artificially high, like it is now. Prices go up and down, that is NOT debatable. So why buy high? It makes no sense. And there is simply no way that prices can go any higher. Rates are already as low as they can get, and incomes are not rising to match the higher prices. Once the prices start to fall and the psychology changes, the market will return to normal – which is housing prices in line with local incomes.

You make a lot of sense! You must be Millie!

Sales volume is crashing, builder stocks are plummeting , inventory is increasing sharply:

https://on.mktw.net/2E3DNxA

But folks, the bull run has just started. Don’t listen to the bears who were wrong since 1975.

Everything is fine. House prices have just started to move up. Millions of wealthy Chinese are coming to buy our luxury homes. And all the little 1mio crapshacks will be bought by millennials. Homes prices will never, ever go down again. If you don’t buy this year you will never, ever buy in your lifetime!

https://www.zerohedge.com/news/2018-11-23/foreign-investor-burnout-sparks-miami-real-estate-slowdown

Disappearing foreign cash buyers??? Can’t be! There must be a temporary roadblock. We heard from very smart RE cheerleaders that there are thousands of buses filled with Chinese millionaires who can’t wait to buy that 2mio home. They will arrive any minute now. The Chinese will save this market just like the Japanese did in the 80’s. Oh wait, that didn’t work out last time. Scratch that! This time is different was what I meant to say!!

Home builders have never been happier

https://wolfstreet.com/2018/11/28/supply-of-new-houses-spikes-to-highest-since-housing-bust-1/

“New-Home Prices Drop Nearly 7%, Supply Spikes to Highest since Housing Bust 1â€

“With an inventory of new houses for sale at 336,000 (seasonally adjusted), the supply at the current rate of sales spiked to 7.4 months, from 6.5 months’ supply in September, and from 5.6 months’ supply a year ago. Suddenly gone is the previously hyped “shortage†of inventoryâ€

Weird! So weird! Smart RE cheerleaders told us during summer that there is no inventory?! They also told us interest rates have no impact to home sales volume and price. How the fu** did we get all this inventory over night? All of a sudden you have a spike in homes for sale and asking price reductions? How can that be??? We were told illegal immigration is the reason there is no inventory and everyone in the world wants to move to California?! Also, we are not building any new homes because there is no more land!!! It makes no sense that we have higher inventory?! There can’t be any inventory!

It’s all fake news! It’s all fake news!!

Good news. Or, should i say great news. With the Fed chairman’s comments yesterday, mortgage rates will be headed lower. Ouch.

Actually the FED chief said that he will raise again the rate this coming month. Too early to say what he is going to do in March. He no longer said that he is going to raise 3 times in 2019, but who knows. Probably he doesn’t know. But that gave some hope to the investors that he will stop after the raise next month.

The market is struggling at the current interest level. With another raise it is going to be worse, not better – that is for sellers not buyers.

Mortgage rates are falling. The 10 year Treasury is now trading at 2.99% … down more than 20 bps from recent highs. This is also flowing through the mortgage market.

JT, 30 yr. mortgages increased a lot in the last year and they will continue to increase. It is not just the interest increase; the QT is also mopping 50 bil./mo in liquidity. In a year we are talking over half a Trillion dollar. These are monumental amounts which will make all the players in the economy to scramble for cash.

Many of the so called “cash buyers” use HELOCs (I do). Rates on HELOCs increased a lot, too. That is a fact. If you or I like it or not is irrelevant.

Flyover, mortgage rates have fallen substantially as of late. That is what matters.

Our RE cheerleader cuties are praying hard lately…â€please, don’t let the FED increase rates even further!†Their last hope is negative rates. God forbid the market is turning and prices are falling! Let’s see who wins 🙂

Several articles suggest more rate hikes are coming. Don’t fight the FED. Better accept reality, it won’t hurt as much later…

https://wolfstreet.com/2018/11/30/my-fed-hawk-o-meter-still-redlines-but-slightly-less/

Who are the chearleaders of RE? the cheerleaders have been right for almost 10 yrs. Now perhaps the permabears will be right for 5 years. Prices rise and fall. Permabulls and permabears are both wrong. Nothing to see here…

The perma bulls, aka RE cheerleaders:

“QE infinityâ€

“Negative interest rates comingâ€

“We will never see rising interest ever again in our lifetimeâ€

“Millions of Chinese millionaires are lining up to buyâ€

“Upcoming pot boomâ€

“Your 1 Mio crapshack will soon be 2 Mioâ€

“Rental parity means paying 20% down and still pay 1.5k more a month than a renterâ€

“Every tech employee has stock optionsâ€

The list goes on and on. We have yet to see one statement by perma bulls that turn out to be remotely true.

Sam Zell, the famed real estate investor, said recently that he is selling commercial / multi family residential real estate holdings. However, given the cost inflation for building materials, labor, and permits, I still think median single family residential home prices will trend higher in the next few years.

Are higher rates killing the housing market?

https://realinvestmentadvice.com/rising-rates-are-killing-the-housing-market/

Look at the data released by CoreLogic today:

“So far, the cooling is just that: a pullback from a red-hot housing market, not a full drop-off.

Aaron Terrazas, an economist with Zillow, noted in a recent statement that, though price cuts are increasingly common, they so far aren’t very steep. Inventory is also rising, but from rock-bottom levels.

The median home price in the six-county Southern California region jumped 6.1% from a year earlier to $525,000, CoreLogic said. In Los Angeles County, the median — the point at which half the homes sold for more and half for less — increased 5.3% to $595,000. In Orange County, it rose 3.9% to $720,000; Riverside County, 6.1% to $380,000; San Bernardino County, 3.4% to $330,909; Ventura County, 9.1% to $595,250; and San Diego County, 5.4% to $558,000.

“While the pendulum is slowly swinging back in favor of buyers, make no mistake that sellers and current homeowners still have an advantage in this game of tug-of-war,†Terrazas said”

You can read the article in the LA Times. I think this throws cold water on many statements in this blog. We have rising sales prices … and you call this a crash?

Hell yeah! A massive crash is coming. Housing has lagging indicators. YoY doesn’t mean much without context. You can have MoM declines and still be up YOY. Because YoY is averaged out. By focusing on just one indicator you can be dead wrong in your prediction which you prove daily to us.

Here the article

http://www.latimes.com/business/la-fi-home-prices-20181129-story.html%3foutputType=amp

Holy smokes:

“Southern California home sales tumbled 7.5% in October from a year earlier, extending a broad slowdown in the housing market, according to a report released Thursday by CoreLogic.â€

“Last month was the third straight month of declines, and the 19,193 homes that sold were the lowest number for an October since 2011â€

“As a result, homes are sitting longer and more sellers are scaling back ambitions.â€

“Seventeen percent of L.A. County listings on Zillow had at least one price cut in October, the greatest percentage in at least eight years.â€

“The number of listings was up 30.5%.â€

Real estate agent:

“It’s really been kind of slow,†said Suzie Titus, a real estate agent who specializes in Lakewood. “There is not a lot of activity.â€

No shit it’s slow! Lmao.

Have you guys walked in to any open houses lately? I am doing it on weekends to check out neighborhoods and to talk to these poor agents. It’s dead, no walk in traffic at all.

its you and your script for a playwright “Agent vs. Millie” again?

A slowing of the rate increase of home prices is NOT a crash.

A flattening of the price of homes (similar to the 2018 stock market) is NOT a crash.

When you expect a 30% YOY increase in the value of an asset and complain about a 6% increase, you are a whiner.

We haven’t seen the 25% crash that I predict.

We haven’t seen the 50%-70% crash the our Millennial is predicting.

Mainly because the Black Swan hasn’t flown in. There isn’t any Black Swan on the horizon. However, Black Swans are easier to predict after they swoop in and poop on you than before.

The economy is overheating. Since the economy is overheating, the FED is putting on the brakes with higher interest rates. The FED can just as easily step on the accelerator if the economy starts to drop instead of flatten. ie when Powell said he “might” ease up on rate increases, the stock market roared back into life and recovered most of its losses.

There is nothing wrong with your television set. Do not attempt to adjust the picture. We are controlling transmission. If we wish to make it louder, we will bring up the volume. If we wish to make it softer, we will tune it to a whisper. We will control the horizontal. We will control the vertical. We can roll the image, make it flutter. We can change the focus to a soft blur, or sharpen it to crystal clarity. For the next hour, sit quietly, and we will control all that you see and hear. We repeat: there is nothing wrong with your television set. You are about to participate in a great adventure. You are about to experience the awe and mystery which reaches from the inner mind to… the Outer Limits – The FED

The only two Black Swan events that had an impact on the US in my lifetime were the collapse of the Soviet Union and 9-11. I don’t consider 2008 to be a Black Swan because smart money was shorting the debt instruments that led to the crash. If people are preparing for it, it isn’t a Black swan event.

Job-loss Recession will come between 2019-2020. No black swan needed. Housing will crash by 50-70% in California.

You don’t have to call what happened in 2008 a Black Swan. A few people saw it before it happened. At the time, just like now, I saw it could happen but I was not over-leveraged in housing at that time so I didn’t care.

I will still call the event that wiped out 2 major banks that were in business for 100 years, required bailing out the rest, and wiped out millions of homeowners a Black Swan.

Whatever we want to call it, if it happens again, Millennial will see his 40%-70% crash.

I know people who are all-in cash now or gold. Do they count as the people who can predict the future? Our Millennial is heavy in Bitcoin, does he see the future?

If housing crashes due to some silly swan, we can say it was predicted because our Millennial was in Bitcoin and my golden friends have gold?

The odds of someone out there being right at this point is 100%. I just hope I survive with the positions I am currently in and not end up like the millions who lost their homes in 2008.

The last jobless recession we saw in the 1970’s only caused a flattening of real estate prices. True that inflation was at 13% but that is only an effective 13% drop. That could happen again. Hope for a 13% raise if that happens again or we will miss out.

It will take a Black Swan (or whatever you want to call it) to repeat a 40%-50% 2008 drop.

JT, the problem with that article is the talk of y-o-y. The RE bears look at what happens to RE today and in the near future while you look at what happened till past MAY (which was the peak). I sold a house at the end of April and I think that was pretty much the peak (it was a good profit).

You look in rear view mirror while they look forward. That is the difference in perspective.

Too much seasonal adjustments to trust MoM numbers. Everyone knows this. Usually, the late spring has the highest sales prices of the year … more often than not, fall and winter prices are a little lower than the preceding spring season. This is the way the market normally works.

Spot on Flyover….as always!

JT, I know very well the seasonal fluctuations. What we have now is not seasonal. Summer is peak season for Seattle. This year the market slowed down during peak season (for sales). By Fall, prices of sold (not listed) properties started to come down. So, that was not just higher expectation for sellers when they list.

Also, the number of listings increased a lot when the inventory was supposed to decrease.

I hope I am wrong, but that is what I am seeing.

JT, this is what I mean by you looking back instead of forward:

https://www.builderonline.com/building/seattle-home-prices-now-in-a-freefall_c

This are not listing price decreases. These are sold price decreases. It is true that Seattle is not in SoCal. However, Seattle is a very wealthy city, with lots of very well paying jobs in the most advanced industries. This shows that contrary to popular opinion that interest rate do not matter, it does. There were bloggers here stating that you can have interest increases and prices still to go up. However, these are not 70s. The amount of debt in the economy is monumental and increasing rate while moping 50 bil. per month via QT DOES have consequences.

someone having a hard time ripping off the band-aid.

Nov 26, 2018 Price Changed $439,500 —

Nov 19, 2018 Price Changed $439,750 —

Nov 6, 2018 Price Changed $439,995 —

Oct 11, 2018 Price Changed $449,000 —

Sep 4, 2018 Listed (Active) $455,000 —

someone having a hard time ripping off the band-aid.

Nov 26, 2018 Price Changed $439,500

Nov 19, 2018 Price Changed $439,750

Nov 6, 2018 Price Changed $439,995

Oct 11, 2018 Price Changed $449,000

Sep 4, 2018 Listed (Active) $455,000

lol, the best thing i have seen so far, is a flip that is going really bad….bought in the 600 in Q1, shit ton of upgrades and back on the market for wait for it…..over 1 mio!

after 6 months of sitting and price reduction after price reduction its now offered in the low 700! they are already selling at a loss. The fun beginns when it still doesnt sell until Q1 of next year. Watching the flips or going to their open houses and pretending i am interested is fun.

yap, i am starting to see the same here in Roseville, CA

price drop few hundred /thousand dollars…

While Millennial awaits a 70% crash in SoCal beach houses, so far this year Bitcoin has crashed 80%: https://www.bloomberg.com/opinion/articles/2018-11-27/bitcoin-crash-is-a-real-currency-crisis

Bitcoin is in crisis. You can never really declare it dead — the idea of an electronic currency that is theoretically borderless and lawless will always live on somewhere — but its price has slumped 80 percent in less than a year, wiping about $700 billion off cryptocurrency markets.

Don’t worry about Millie. He cashed out on his crypto fortune at the peak of the market. All those funds are now in a 2% CD under lock and key. All that money will be put to work in a year or two. Today’s 1M house will be between 300K and 500K by then. And you can take that to the bank! 🙂

Impressive! You got it down!

The only small correction, the cd is making more than 2% now.

@soal – you have red herring for lunch?

thats a great thing, no? buy low sell high….

Bitcoin’s #1 reason for existing is getting money out of places quickly ahead of government regulators, and its #2 reason is paying off ransomware demands. As there is no honor among thieves, sooner or later some criminal will figure out how to counterfeit cryptos, leading to a big windfall for that criminal and bankruptcy for all the other holders.

A wise guy once said that the Chinese will lose their short just like the Japanese in the eighties. Remember, RE cheerleaders said back than and today that foreign cash buyers will save the California real estate market. Looks like Hong Kong is crashing hard:

https://www.zerohedge.com/news/2018-11-27/hong-kong-home-market-headed-big-correction

Global housing bubble is popping

https://wolfstreet.com/2018/12/01/update-on-property-price-declines-sydney-melbourne-australia/

Three interesting articles in today’s OC Register Real Estate and Business sections.

Lansner’s column is on net migration for California (2017 data). 523,000 moved in from other states, 661000 moved out to other states and 319,000 moved here from other countries. A net 0.8% increase in population was seen. 87% of Californians remained in the same home with no moving at all. So California is in a fairly static situation for population changes.

Another article by Mr Lazerson details the increases ( fro the third year in a row) for conforming and “super conforming” loan limits for agency (Fannie/Freddie) loans. VA loans will match the new limits also. OC and LAC received the maximum high balance limit increase going to $726,525. FHA will announce their limits in early December.

Mr Lansner’s Business Section article is on the discrepancy between CA EDD monthly tabulated job growth statistics (from June) for Orange County and Federal BLS quarterly data (from November). For Orange County, the leading State data is lower than the trailing Fed data for the same period two years in a row. LA and Inland Empire Counties missed in the opposite direction. So different Government agencies with different counting methods can come to different conclusions, not just private industry groups vs the government statistics.

All over the web, the left is smearing the housing market in an attempt to bring down Trump in 2020. They figure if they are able to suppress the housing market with negativity, the Dems have a better chance of winning the white house. Hell, it worked with Obama in 2008. Left wing operatives did a lot of damage to the housing market by fueling a financial panic in housing with negative news and that helped Obama. They are trying it again. I think Millennial is one of the operatives. Their are many others operating all over the web.

JT, you are wrong every time you post.

Sure, I am an operative, but not paid by dems. But, if they want to pay me, they can Venmo me some money. I’ll take it!

I am very non-political. I actually like trump for increasing the std deduction to 24k for married couples. Since then you don’t hear the RE cheerleaders talk about tax deductions anymore, do you? Back in the day RE cheerleaders would tell you, “buy real estate, otherwise you miss out on tax deductions ..as if it’s somehow better to pay much more dollars each month for interest and property taxes because you are getting a small portion back. You don’t make money by paying a dollar for taxes and getting a few cents back. But, the avg hoe doesn’t get that, so RE cheerleaders had it relatively easy to sucker people into buy high. Luckily, trump dialed back these socialist programs. Now, most people have no reason to itemize! They Just take the std deduction. Renting was already much cheaper than buying during this extreme bubble but by doubling the std deduction the savings by not buying are even greater now. Of course, this all changes when the market crashes hard (2019-2021). If House prices crash by 50-70% it’s okay to buy a house. Most operatives….sry I meant experts…..agree with me on that assessment.

Some conservative posters on this blog also think the Democrat Rothschilds are shooting US Military laser beams from space to start the CA wildfires. They think that the Republicans and Trump are innocent and just like when the Republicans controlled the House, Senate,, and Presidency in 2005-2007 before the greatest recession since the Great Depression, the Republicans are just too stupid to notice what those evil Democrats are doing.

Personally, I like to leave politics out of it and just focus on the blatant greed that I am seeing.

It is reality. In the game of politics, the MSM tends to operate on behalf of the Democrats and will say whatever is necessary to win. For sure, the Republicans are also mean spirited, but the Democrats bring even a bigger dose of mean spirited behavior to the table. These guys would have no problem fueling a financial crisis in order to win an election.

11 years ago I was a high volume apartment broker at a top commercial brokerage in the US which will remain unnamed (sold multifamily in CA.) I saw the bubble coming a mile away but investment horny buyers kept buying at valuations that made zero economic sense. I had one client that owned almost a thousand unit of housing and he kept buying compulsively at 5-6 caps despite my advice to the contrary.

I saw him around 2009 after not seeing him for years and I was living in another region altogether. He was living out of his van. Had to turn his dog into an animal shelter too. I don’t know what his cash flow was at the peak of the last bubble but he had gross rents coming in at around a half million per month. He was a nice guy, an immigrant, but got way too hungry and reckless.

There are a many stories like this from the last turn. Why on earth would anyone gamble by buying real estate at these current prices when on a nominal basis they have exceeded the last bubble prices? The answer is the lemming nature that many humans possess. Animal spirits. And HGTV, a multi-billion dollar (I think) industry. I will wait and buy at extreme discounts in 2019 and 2020. I got rich doing it last time. This party is over. Betting on a 20 year mega-cycle to save you is so hair-brained. It’s like waiting for the Hale-Bopp Comet in your black and white Nike shoes. Good luck with that.

You said: “Why on earth would anyone gamble by buying real estate at these current prices when on a nominal basis they have exceeded the last bubble prices? ”

Answer: Because they are betting on inflation. With the national debt skyrocketing, the only way is inflation. The debt must be slowly inflated away over a period of many years. So, the smart money will put some chips on inflation.

JT, this is the typical boomer response…..inflation is coming, inflation is coming. We have heard it for a decade now…. and inflation hasn’t happened the way you boomers want it to. You have a bubble in stocks and housing but the house prices are not real. The true value is somewhere between 50-70% below today’s prices. Watch housing to come down to its value within the next few years. You are spot on with the rent statement. There is no way rents can go up as we have so much oversupply. My cheap rent never increased. Do a rental parity calculation and see how you save thousands of dollars by renting. That’s why I want more rental units. My commute to work is short and I don’t live in LA. The traffic stories from LA don’t impact me. Build more multi-family and keep my rents low. Thanks!

I agree at some point that inflation situation will be out of control. I just disagree that buying RE at peak valuations at the end of an economic expansion is a good inflation hedge. I think it’s a bankruptcy formula. Seen it before.

Illusion is born when perceived reality doesn’t match up with what’s really happening.

If you drive around Boston, LA/OC, and even Columbus, OH, one thing is clear. The amount of high density apartment building is off the charts. This is the bubble in real estate … high density apartment building. Too many new apartment units will be available over the next several years and apartment rents will come down. Some people will opt to rent apartments over homes since the oversupply will drop apartment rents. In coastal locations, renting a home will become the American dream for the next generation. Renting an apartment will be the starter.

And this is why I stay in the older , well established neighborhoods , well maintained homes , quiet streets , and I treat my homes as if I were the occupant. Sooner or later the millennials will show up with their 2.6 kids and a dog wanting to live in a good school district. They will discover quiet evenings , no police helicopters at all hour’s of the night ,and a welcoming community of new friends and neighbors.

This is exactly true.

Population growth (and not socialist tendencies as some here are imagining) will drive higher and higher density.

Nobody will ever be priced out of real estate. But quality of it will change -> more dense and lesser quality will become a starter. Renting/Owning an SFR will be less achievable for many.

The very stable 6% year over year price increases Southern California has been experiencing for a decade…..

declining to only a 3% year over year price increase this spring and summer is going to be absolutely BRUTAL…

Brutal I tell you… it’s going to be EPIC

Tank in sight, This must be your first rodeo of RE cycles. YoY averages are just that …an average. We already have declining MoM RE prices during a strong economy. If the market is already turning so rapidly what will happen within the next few years? A housing market doesn’t crash 50% in price over night. You are doing the right thing by looking at the market. Keep watching it and see what happens. Keep reading my updates to stay informed. It will be educational for many newbies and older people who learn about the cycles the first time.

Isn’t it crazy how bad some people are at understanding math? Lol

Millennial, I was shocked how fast real estate prices declined during the last crash. Here is just one example for what happened to the price of a home in Riverside between 2006 and 2010;

Year Selling price in that year

2006 $330,000

2007 $200,000

2008 $120,000

2009 $ 84,000

That same home was held by the last buyer until now, and he is currently trying to sell it for $290,000, Declines of over 60%, within a few years, were normal in Riverside during the last crash. The decline from $330,000 to $200,000 occurred in 10 months during a time when government statistics said that prices were still going up!

🙂 thanks

If the stock market recovers we have a really good chance of hearing from Spokanistan again(mr landlord).

I have to admit, I used to not like Millennial. I thought he was obnoxious and a loser of sorts. But he is like a fine wine, he gets better with time. I am a Millennial fan now.

I am particularly a fan of his ‘you must be new to RE’ and ‘As a RE expert I advise that you..’ I think he has effectively turned the silly RE bubble humper rhetoric that is so common back into the faces of Bubble Hummers themselves.

Pre-Millennial it was as if the RE agents of the world had a corner on these sort of statements, but no longer. This is maybe too red-pilled of a comment for the PC crowd amongst us, but it is almost like how the African-American community took the “N-word” and now use the term themselves amongst one another.

That is Millennial, he has turned your weapons against you. I’m a fan.

And no I’m not Millennial posing under a pen name as suggested or a Russian Bot.

Keep annihilating the Bubble Humpers Millennial, you are gaining a fan base.

I am afraid California housing will have a big decline… I don’t own any houses in California. I want to buy when the price becomes more affordable.

Leave a Reply