Rents rising, home prices up, yet Millennials continue to be priced out of the housing market: Homeownership rate not tracking gains in prices.

Millennials as a group defined by an age range, are one of the largest cohorts of people right alongside baby boomers. Millennials have already reached their prime house humping age range but somehow, the homeownership rate in this category is not moving. The thought was that Millennials would soak up all the excess demand and continue to push prices upwards. In reality, what has kept prices up is artificially low interest rates, investors buying, and a low supply of property out in the market. Many Millennials are forced to rent or to live at home with their parents well into adulthood. Controlling biology has worked out nicely that new households tend to be smaller so many adults can just move back into their childhood room and have tasty tacos with their parents. The end result is that the housing market is moving for many different reasons beyond household formation. In fact, major household formation has come in the form of rentals since the Great Recession ended. Let us look at the latest data impacting Millennials.

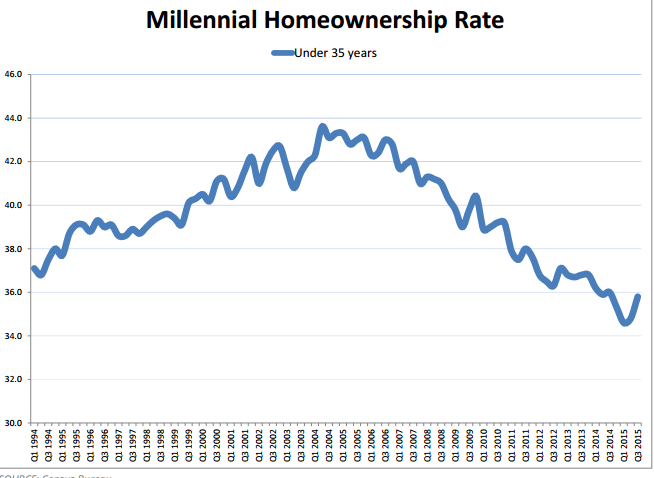

Millennial homeownership rate

Millennials are now deep into their prime home buying years assuming they were following the path of their boomer parents. In many cases the needs and wants of Millennials is very different from that of baby boomers. Also, the transient nature of employment makes it more likely that multiple careers are going to be the common path versus lifetime employment at one company. The stats point to this. Sure, you have your anecdotal baby boomer talking about his lifetime gig in one company or a friend coasting it out in a government job. But those are not typical – and that is why the homeownership rate has plunged.

The latest figures really highlight this:

Why did the Millennial homeownership rate plunge starting in 2005, before the housing bubble burst? First of all, when home prices peaked many Millennials couldn’t afford to buy even with toxic mortgages. Now with toxic mortgages out of the picture, prices being driven up by investor buying, and limited inventory has forced the homeownership rate even lower. Many are living in rentals unable to save up for a down payment. Many others are living at home. And we’ve looked into the figures and the surveys point to people simply being priced out. The nonsense notion that most are living with their parents to save up $200,000 for a crap shack is simply not true outside of a few house humper anecdotes.

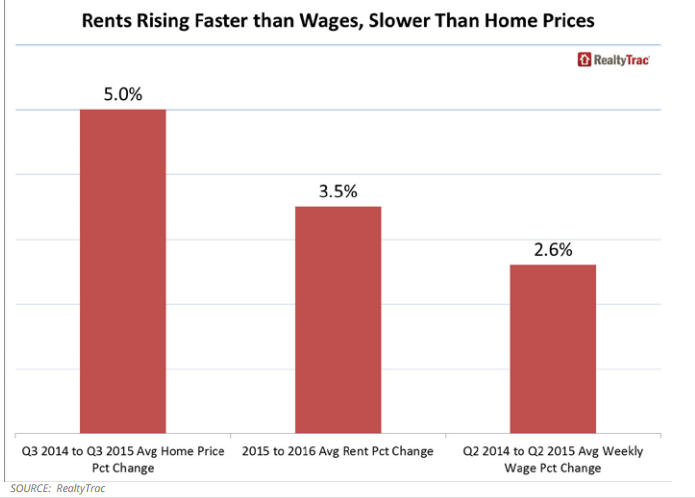

And since many are in rentals, with rising rents that means less money for a down payment:

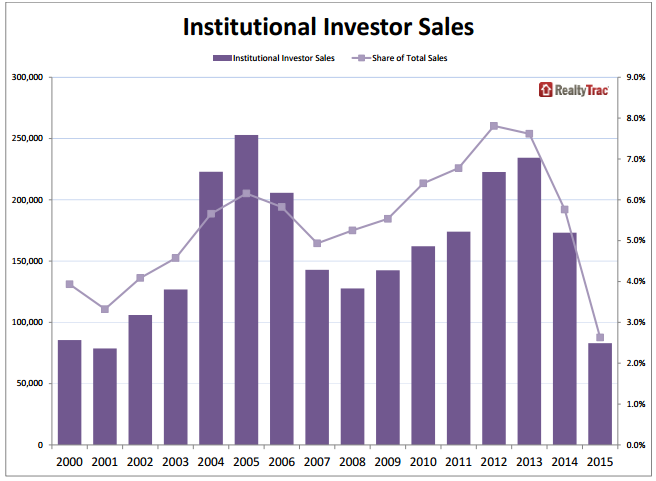

Rents are moving up faster than wages. So that is not exactly a positive thing. And home prices are moving up faster than rents and wages. So buy now or be priced out forever! As you can tell, this is not your typical audience. The typical audience was investor buyers and also new to this boom, large institutional buyers:

Institutional buyers pulled out of the market dramatically in 2015. This is big money talking here. This isn’t some one-off example but real data. If real estate was such a sure bet don’t you think institutional real estate buying would continue to go on with all of their research? Certainly they have the money to buy additional properties if they like.

The stock market correction is also going to impact real estate especially in tech mania areas like San Francisco. You always get the “well prices continue to rise†but just look at the crap you can buy for inflated prices. Go for it and sink your money into these places to chase your dream of owning overpriced and poorly built properties.

Millennials continue to be priced out because their wages are simply not keeping up with changes in the overall market. This is the end outcome of having higher home prices courtesy of investors and low interest rates but slamming the door on the upcoming generation. So guess what? That generation will simply move back in with baby boomers. Typically the folks cheering for this are house humpers that live in inflated crap shacks thinking this is somehow good. It is interesting that some of these people also email me and rail against a market that is pricing out their kids. You can’t have it both ways. But markets reverse rather quickly as we have seen with stocks. Real estate can edge lower slowly but people forget historical events and of course, this time is different.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

151 Responses to “Rents rising, home prices up, yet Millennials continue to be priced out of the housing market: Homeownership rate not tracking gains in prices.”

The Mayor of San Francisco gave huge tax breaks to Twitter, Facebook, Google, etc. The VC money poured into start ups. A shell game really as none of them has a business plan other than to sell advertising. Snapchat is valued at about 10bn. Leaked docs show they generated 3.5MM in revenue in 2014. Many Unicorns are going to die. How about Theranos valued at 10bn? They have been discovered to have little or no tech and have been sending blood samples to old school labs while claiming the work is done on their new tech. A lot of people fortunately placed at Stanford and Harvard made a lot of money. Some of the old dotcom guys who made money in 2002 were able to get in on the shell game. The rest of us lost out for a variety of reasons. When unicorns start dying this year they won’t be able to pay 21 year old programmers 250K a year right out of Stanford. Twitter is sinking. Facebook stock will follow imo — they are fudging numbers like a Chinese CPA. It will all come back down to us.

I hope the government will not bail out wall street again in the expense of the taxpayers money. Enough is enough. They need to start raising interest rates soon as planned.

The big companies like twitter have golden parachutes in cash reserves in the billions thanks to ipo money they hung on too which will provide them running capitol so that they can continue to lose money for decades and still be a company. This also lowers their ability to be bought out by bigger companies like google which will eventually happen.

Betting on those companies boards to burn their own capital to be “zombies” for decades would be foolish. If they can’t borrow it they’ll let the companies go under. Corporate debt issuance for these companies will get more an more difficult as the ponzi unwinds.

Don’t expect this cycle to run that much longer. The FED has to prick the bubble just as they did in 2006 as the consequences of it growing any larger are exponentially more detrimental than letting the correction commence. They should have taken away the punch bowl in 2012, but Bernanke had to keep his “legacy”. Yellen gets the glory of being the first female FED in exchange for the indignity of taking away the punch bowl and unwinding this cycle of the ponzi.

But, but, but….all the bloggers were saying that the FED has our back and they will print to infinity and house prices will go up forever. They said, for sure this time it is different because Obama saw “green shoots” everywhere.

You are just a “right winger” trying to spoil the party….Mr. Obama promised us to give hope and change we can believe in. For sure you can not be right.

If the change is not to your liking just wait till January. Hilary will finish the change started by Mr. Obama – a change you can believe in – the biggest transparency ever and she will put behind the bars all those crooks from Wall Street who paid for her campaign. What’s not to like!?

Also, Mrs. Yellen wants only our good. She and Lord B. are just doing God’s work for us. You just don’t understand how well all us average citizens live since Mr. Obama and Mrs Yellen take care of us. Was unemployment ever lower than this? All of us have jobs, salaries increase all the time and green shoots are everywhere. You are unhappy because bush left us with a big debt and high unemployment; did I miss something?

Typing it in bold makes it true.

Absolutely. It’s going to start coming down.

A good friend of mine got an FHA loan on a place in the Bay Area in 2010, and his house was recently appraised at double what he paid. He has been considering a move out of state someday, and I’ve been telling him that he won the lottery by investing a measly $16K and potentially making $450K in only five years, so he should cash out, but he refuses to sell, because he thinks things will go up and up and up. He seems to think that he’s now a brilliant investor, rather than someone who got very lucky.

I also occasionally talk to guys in the Bay Area on sports car forums, and there’s zero sense of a bubble. This is going to be ugly.

he’s not wrong. even if the market crashes it will eventually go back to parity and then higher again. Even if it’s 10 years the point is that it will not go down in the long run. Let’s not delude yourself just because you’re desperate.

Point being that he’s not planning on staying 10+ years. If that were the case, it doesn’t matter how much the house is worth now. Granted, seeing as how the tech industry has gutted the vibe of San Francisco the last 5 years, it’ll be interesting to see how desirable of a place it is, once the tech bubble pops.

I’m not sure why you’re saying I’m desperate???

@EZ

It’s quite easy to be blusterous about high house prices with trillions in Fed funny money backing up the real estate industry.

great post. I have been telling people this for the last few years and most times I get blank stares. You have these app companies supposedly worth billions of dollars, will only have about 15-20 employees, and will bring in 10 million in revenue annually. I don’t get how a company that only makes a few million a year is worth billions.

I’ve heard that the value of some of these social media and app companies is not in their ad revenue, but their database. Tons of personal data about users, their names, ages, sex, consumer preferences. And that marketing companies will pay much for that data.

How true that is, I don’t know. I can see how Google and Amazon have valuable consumer databases. I can’t imagine that most of these fly-by-night app companies have such valuable databases.

“…they won’t be able to pay 21 year old programmers 250K a year right out of Stanford” is an exaggeration. base salary will probably be >100k but not 250k. They may get additional $$ in stock grants (or options to buy stock) but those vest over yrs and could end being worth $0.

“Silicon Valley talent wars: Engineers, come get your $250K salary”

http://www.cnet.com/news/silicon-valley-talent-wars-engineers-come-get-your-250k-salary/

“Snapchat is paying college grads almost $500,000 to work there”

http://www.businessinsider.com/snapchat-entry-level-salaries-2015-4

I’m pretty sure the “engineers” getting that kind of money are the founder’s cool friend from high school, or nephew. The people doing that actual work are not making anything near that. Source: been around tech far too long.

The only question now, is when?

“The Mayor of San Francisco gave huge tax breaks to Twitter, Facebook, Google, etc.” Understatement of the year good sir! Twitter was given not just a huge tax break- but won’t have to pay taxes for something like 10 Years!!!! The idea at the time was that Twitter moving to SF would spur job growth and revitalization in a blighted area during the last recession. Instead all that has happened is that housing prices have octupled, and all the much-vaunted tech jobs seem to go all to high-specialized outside hires from Ivy League schools. Us locals are still scratching our heads wondering when the benefits are going to “trickle down” to the rest of us while we moonlight for Uber in our off hours trying to make rent…

This. Tech companies are hiring the real workers for maybe, if they are lucky, $30k a year, then their best frat buddies are getting the big wages that are bandied about.

donpelon: “Us locals are still scratching our heads wondering when the benefits are going to ‘trickle down’ to the rest of us”

The “trickle down” comes when those wealthy, imported tech workers spend money on local groceries, stationary supplies, hardware, home improvement, restaurants, movies, hair salons, etc.

Additionally, even if Twitter is not paying taxes, its highly-paid tech workers are, so that money too is trickling into the local economy, paying salaries for police, teachers, etc..

In the trenches of Northern California, we are seeing a drop off in the sellers market or activity in general. The inventory is very low and nobody wants to sell right now so its in limbo so everyone is renting out their places which is causing a little slump in rental prices. Not sure this will last but I hope to take advantage of it soon as Im not buying a new house anytime soon. Ill save up by renting and look to buy within the next 5 years while paying off all my debt. I dont see value in home ownership for myself, but I am sure others think differently.

What amazes me is the sheer acreage of vacant land, and the many many vacant houses and buildings here.

The building I’m in is 1000 square feet with high ceilings and a finished office, and the rent is $500 a month. If the guys in back move out, I’ll rent the back half myself for $500 so we’re talking half a buck per square foot. I’ll have tons of room to work in, possibly a sign business. And I’m only a couple miles from the airport.

Small offices here are cheap, couple-few hundred a month for a couple hundred square feet and often building WiFi too.

We have enough empty houses here to give each homeless person one or more,and enough vacant land that we, a city of a million, could grow all of our own vegetables.

So there’s no reason for these high prices unless housing is being treated as a speculation instead of as a place to live.

“I’ll rent the back half myself for $500 so we’re talking half a buck per square foot. I’ll have tons of room to work in, possibly a sign business.”

Now you’re talking.

2000 square foot building. I knew the owner, who could not get a good tenant for the front half, so I got the guy I work for in. No running water, portajohn but at least we have the electric. No internet, this is San Jose after all.

The back half has a loft, nice finished office, and plenty of room to paint signs, build bike trailers, or anything like that.

How can I post on here with no internet? Same as if I were in Namibia, I have a shitty very low bandwidth tablet. This is San Jose after all.

“How can I post on here with no internet?â€

More importantly, how do you live with no running water/ shower??? What do you do for meals?

Alex,

Your story is interesting. Out of curiosity do you notice other people living out of office spaces?

I did a well thought out write-up of how/why I live and this system will not print it.

So suck it.

I’ve love to reveal to all the life in Neo-Dickensian Silicon Valley. Really, I’d have a cup of coffee (tea wif milk in) with you all.

But I guess the truth is too painful, when the going gets weird, the weird are censored.

So wait until you lose it all and have to cobble together a post-industrial life and you’ll find out on your own.

OK heres wuts wierd. I posted as al??..

My older brother tried self tattooing himself, Alan, got as far as “AL” because shit hurts.

AL.

I wonder if the Chinese money will be pouring more quickly into Southern California housing now that the country is so shaky and there is no safe place for their money in China. I’m sure the wealthy Chinese are scurrying their money out the door and looking for a safe place to go.

What never seems to be considered is the possibility that this cohort of Chinese nationals might actually have planned only for the short term and kept ties back to the homeland.

It’s simply too good to be true that Chinese with buckets full of money are going to save SoCal real estate from itself.

Everyone wants to live here… until they can’t.

http://libertyblitzkrieg.com/2016/01/28/hsbc-curbs-mortgage-options-to-chinese-nationals-buying-u-s-real-estate/

“Currently, about 40 million Americans owe $1.2 trillion in student loan debt, and it continues to grow. According to the Institute for College Access and Success, students who borrow graduate with an average debt of $29,000 for a bachelor’s degree. In 2014, 69 percent of graduates had student loan debt, and from 2004 to 2014, the average college debt grew at more than double the rate of inflation.” – from “Betrayed by the Dream Factory”.

If I’d not dropped out, I’d have been on the hook for $30k, in mid-1980s dollars. I’d probably have paid it off OK though because there were tech jobs then.

These days kids are graduating and finding themselves working at Starbucks with that BSEE. College no longer has a positive ROI.

What to do instead? Well, my golden words are Government and Unionized, but I’m not doing those myself, so I guess I’d advise what they say on a farm – Make Yourself Useful. Find something people need and provide it.

For years I tried to find a city government job anywhere south of Riverside all the way to San Diego. Without a degree, I couldn’t find one that I was willing to do for the rest of my life – happy to be a librarian, but not a road worker. It was actually easier for me to find work writing technical manuals than it was to find work putting books on shelves in numerical order.

School jobs for districts or county is a good way to get in. Im in tech so an AA gives me a lifetime job with a calpers retirement. I could have increased my debt load, gone for a BA and worked in the Bay area as a consultant, but having a life and a good retirement means more to me than working my ass off for someone else to get rich. Plus six up to eight weeks of paid vacation and sick time is a great benefit to me and my family.

Discgman I rue the day I set foot on a collage campus, its the main reason I’m so poor now. But an aa, preferably in a trade, might not have been bad. I’d happily have been a road worker, too, although those jobs are well paid and thus not open to whites where I’m from. Now i’m too old and beat up to be a road worker, or I’d pursue it tomorrow.

Oh not a college, or even High school. Way too much attitude and politics.

Housing market is beginning to sound like a variation of an old movie theme: “Suppose they gave a bubble and nobody came”

I am a firm believer there is no “pent up demand” with the Millenials. That’s an old sales tactic, like going to look at a used car and having the salesman say “Someone is coming over in a few hours to look at this car”. Yeah, THAT guy.

Take a Millenial now, in 2016 who is at “buying age” if you will. Age 24-34. In 2006 they were 14-24, and have either seen or been through traumatic experiences with housing. They have seen friends get foreclosed on, divorces over a huge home loan, suicides when the police went to serve an eviction notice, financial ruins when their parents HELOC didn’t pan out. The list goes on and on.

So why would they put themselves through this? Good for them for not locking themselves up in a mortgage! I applaud these younger folks. (By the way, I’m an Gen Xer, not a Millenial)

I’m a Gen Xer too. We are like the forgotten generation. Everyone either talks about Baby Boomers or Millennials. Its like “Hey can we get some attention” lol.

I’m a Gen-Xer by one year!

I don’t get it either. I live near downtown Oakland. At my place that we rent it I’m the only without a master’s degree. It’s crazy. My girlfriend has a MA in Marketing and works at a startup in Milbrae, the roommate has a MS in Accounting and just passed his CPA and is working in SF (he’s a Millenial)…and I just have a normal undergrad BS and commute out the San Ramon.

Our rent did go up…but we still have a entire house close to BART of $2300 with a driveway so parking isn’t an issue.

None of us have any friend buying in the bay area. I see houses in Berkeley, parts Oakland and Alameda going for way over and just don’t get it.

This is crazy to me…I’m about 4 blocks away and this sold for 800K! Like the good Doctor says…have fun sharing a bathroom with you kids! And that is a busy street.

https://www.redfin.com/CA/Alameda/918-Buena-Vista-Ave-94501/home/1948007

I really don’t have a comment other than I don’t see lots of people my age buying…or even talking about buying. Maybe a few co-workers that are starting families, and all they talk about is trying to figure out a way to work from home so they can move to Sacramento. My supervisor bought 2 years ago out in Tracy.

I’m a Gen-Xer currently working alot with a millenial. She works with me and pulls in 60k a year but has 2 student loans for 20-30k. Her boyfriend is a lawyer and just got a decent job but he has over 100k in student loan debt. She is not concerned about a house at all and they have a ton of debt to service. Their only outside interest is traveling really. As for Gen-Xers, I think we are good. We will take over the Baby boomer jobs (there aren’t enough of us) and be managing the millenials. And people can forget about this, we are used to that and ok with it.

Sean I went through that growing up in the seventies. Middle class to deep poverty, because my dad had the idiotic idea that money could be made in real estate. At a deep level, the thought of buying a house unless I could just fork over cash, fills me with horror. Even if I had cash, the house would have to cost maybe a third of my cash reserves.

The great depressions are becoming less far apart.

Another Gen-Xer here. Can’t afford to buy in this manipulated market and preparing to leave the state.

Taxes rising, home prices in the stratosphere, regulations rising, salaries stagnant for a decade or more unless you’re in the pubic sector (oh, and public sector pension liabilities that are unfathomable, with even higher taxes on the horizon to support retired public workers while the private sector starves). I make $200-300k/yr but amazingly this will not allow me to buy a place that would be even remotely reasonable to live in here in the Bay Area, which seems insane to me – who are all of these people who can afford and are willing to pay $1.5M for a crappy 3/2 five feet from the neighbors on the Peninsula? Don’t know, and can’t say don’t care but all I know is I have to plan to be able to retire someday, and paying $4000/mo in rent will not allow that to happen, nor will I be able to save a $300,000+ down payment to buy a place, basically ever. (I get the “keep saving” lectures but this is horse hockey – I take home $10k/mo, almost half of that goes to rent and utilities, another $1.5k/mo to school if I want my kid to have art or music, etc., so I’m out two thirds of my take-home before I spend a dime on food, transportation, etc. Saving $250-300k+ to buy a place would take 25%+ of my take-home pay for a decade, on which I would obtain zero interest, and by which time the real estate industrial complex will have done their best to inflate the requirement to $600k – simply not going to happen. A weird state of affairs, I’ve been here since the 80s and I’m going to miss it but CA has grown out of my reach and making no effort at all to keep people like me, a hopelessly expensive, overtaxed banana republic with a future that looks much worse, not better.

You’ll be able to have a much better quality of life elsewhere for half your current salary. I’m not sure how you manage that step down in earnings with respect to hunting for a new job though – maybe employers understand that you’re coming from a bubble and outside of it everything is cheaper, including your labor.

Say good bye to Hotel California – I did over 9 years ago and couldn’t be happier. They should rename it from the golden state to the golden handcuffs state, because thats what it is for most at this point.

Damnit, well put! I try to convince my husband of this on a regular basis. He’s in that income range too–I have a bit to add when I work full time(though about to have second child under 3). He claims it’s easy enough for us to move and find at least a 2 br to rent–I’ve succeeded in dissuading him from buying at these atrocious prices. I say, no way does it make sense to pay 3 times current rent (stabilized) for 30% more space.

The point is that the cost of living runs away faster than wages, safe savings returns are nil, and the pension liabilities are horrific (falling heavily on the newest homeowners.) (Slightly resentful of my brother in law who works unionized for medicare, retires with nearly full salary and benefits at 20 yrs service (age 56 for him), and doesn’t even vote progressively!).

What a crappy deal. SF views CAN be pretty, but it ain’t all that. I cannot wait to convince him that we leave this behind for the dreamers.

I’m a young Gen-Xer (my sister is a millennial,) and I was in a similar boat. I make nearly as much money as you do, and we finally had enough with California and left all of our family for Portland. Now, Portland is in its own bubble up here, but it’s still in another universe in terms of pricing, and the schools are great where we are, so we’ll be sending our son to public school. We’ve only lived in Portland a year, and I managed to save around $80K already in that time, so I’m hoping we’ll continue that path and buy a house in a couple of years.

The guy I work for makes 15k a month all told, and pinches pennies, runs gas tank down to reserve, wife shops at the dollar store. They’re coming off of a bankruptcy and champing at the bit to get back on those credit cards. Savings nonexestant.

Ya know, if I need money, I can grab my awareness ribbon stuff and hustle em in Santa Cruz and come back with a hundred bux. But this guy doesn’t have that luxury because he’s working at full capacity now. He’s retirement age and working full blast and can’t afford to stop. If anything happens to him everything comes crumbling down. Really makes me want the American dream (nightmare).

Addendum: if something happened to my boss, knowing the building owner, I’d liquidate the electronics surplus in here and keep the rent paid up and there’s my sign shop. Sad to say it would be good for me if something happened to him.

I say you wait it out or move east to Tracy or Sacramento for a year or so. With decent schools and lower rents (1500 for a decent 3/2 house) you could save up enough to buy and then relocate, get a government, state job, get a decent retirement and have a less stressful life.

I’m an Xer and my observation of Millenials is that they have too much college debt, rent is too high and good jobs are scarce. Buying a house is but a faraway dream for most. Many are living with their parents. Boomers created completely unsustainable systems to enrich themselves – a housing ponzi, a health care ponzi, and an education ponzi. Each one of those alone would make things difficult on future generations, but combined they are fatal.

I often think similarly about the boomers—I’m even secretly annoyed with my parents for not fully recognizing their generation’s gluttony (yes, I know that plenty of boomers are scraping by—but they have yet to imagine the future generation’s elder year austerity). Health care ponzi, housing ponzi, and education ponzi–it is awful.

My mom will still tell me to just “buck up” and get thru these years of poverty when one is first married and with a child to raise. She said that she and my dad suffered similarly to save up for their first house. The big difference–I was married and had my first child at 37 after working and saving nearly 20 years. She was married at 25, with child at 27 and really never worked most of our early childhood years.

I wonder if she realizes the absurdity of her comparison. It was very “Anne Romney” and tone deaf of her. I truly think that many of her generation just want to avert their eyes from the reality.

Junior B., you are correct in what you say if you replace the word “boomers” with the “FED”. Boomers, individually or collectively, do not have any power to affect the economy and the financial system. The FED on the other hand, is the place where you should lay your blame.

You don’t have to believe me. Just read “The Creature from Jekyll Island” by G. Edward Griffin” and you will understand. Otherwise you might as well blame it on unicorns.

It’s basically what’s happened to us, but more so.

Sean, I could not agree with you more. I am 30 and graduated college in 2008. (Went to city college, lived at home, worked full-time while getting my degree and took summer classes to reduce the amount of time I spent as a student.) Did not party it up like a lot of my friends who now owe $30k and much more for their B.A. in whatever. I feel like I did everything right by avoiding debt, and yet – housing is still NOT AFFORDABLE. Should have bought in 2010, but was not working full-time yet due to major job prospect setbacks in my profession, mostly due to the recession. Am working full-time now, but prices are so high where we live (Denver) that it seems close to impossible for us to be able to save enough for a decent home. Very discouraging. Waiting for a correction OR to find gainful employment in a more affordable part of the country. Renting here is outrageous as well.

The Chinese should start investing properties in Porter Ranch 🙂

There’s a devastating, funny, very sad, documentary in “computer” schools in China. It’s in Chinese with subtitles, I wish I knew how to find it on YouTube easily but its there. Whole villages saving up for the brightest kid to go, the schools are actually fake, pictures of buildings but no buildings, no computers etc. The lo g and the short of it is, yes you could sell mainland Chinese houses in Porter ranch.

If its cheap enough, it might be worth a buy to get some sort of fedgov settlement. I wouldn’t be surprised if it happened.

“The nonsense notion that most are living with their parents to save up $200,000 for a crap shack is simply not true outside of a few house humper anecdotes.”

How do you know that is not true? Isn’t that just like your opinion, man? Do you have a survey that backs this claim up?

Interesting that investors are pulling out. If that is not a premonition I don’t know what is.. And no one will obviously say on the news that housing prices will dive because they are trying to buy time for their fellow elite while they grab the remaining life vests.

Something structural is happening too. The peak year for new US housing construction remains 1973 with 2.1 million. 2006 came close with 1.980 million but the US had added almost another 100 million people.by then. In between those bookends new housing never dropped below 1 million units per year. It hasn’t come close to a million per year since 2008!

Obviously something has changed and as the existing housing stock wears out the idea that we can make housing more affordable when we don’t build more homes is rather fanciful. My guess is that the single family home will be a luxury for most as the US is built out in the job creating urban centers. Toss in rising property taxes as pension costs come due, zoning restrictions and rising building costs we have probably left the days where a median income will ever again qualify for a median priced home.

The days of median income buying a home are gone, never to return. Everyone I know who is a Millennial or Gen X and bought a house in OC had their parents kick in for the down payment.

All of them.

If you don’t come from a family of means, you’re pretty much doomed to rent, move inland, or move out of state.

Same here. Outside of a couple of FHA loans, everyone I know that’s purchased a home in a West Coast city over the last six years has received a big chunk of down payment cash from a family gift or inheritance.

“If you don’t come from a family of means, ….move out of state”

That is not as bad as it sounds. I used to live in CA and I thought there is no quality of life outside. I moved out and realized that there is life outside of CA, and that of much higher quality than most people in CA have or dream. I am not saying that for 100% of people; just for those with less than 5 million.

It’s called a class based society, get used to it. We’re much more classbound than england or Europe. Intelligence and hard work have almost nothing to do with how far you go.

There is a new reality for millennials and perhaps all workers. The entire premise of cutting down orange groves for subdivisions 3 or 4 decades beginning in the 50’s, was about widespread growing prosperity … California was one the primary beneficiaries. People had ‘steady’ jobs, were receiving regular pay increases, had increasing benefits, and felt secure. That is what created the housing boom! Fast forward, we are now faced with more uncertainty than at any time in recent memory … will it last, will I have a job 6 months or a year from now, will I ever see a pay raise, should I start saving for my retirement, how will I ever pay off my student loans, I can barely pay my rent let alone save for a downpayment, and on and on! While many nations live with a high percentage of renters just fine, the underlying reasons for the change in the American Dream which used to include a house, are of more concern. Will foreign money and low inventory be enough to keep housing prices going up?

IMO some concerns I see with buying power is that if prices of homes stay as they are or continue to fluctuate higher while rent potentially increases it is another concern that should be considered. Where can someone live if they can’t find reasonable rent or a safe place to rent? Would they be forced to leave the area if they can’t afford to live in their neighborhood. This is assuming if the person has no one to fall back on for assistance or they many not get HUD assistance. The way I see it people will fear being the forgotten generation.

“Would they be forced to leave the area if they can’t afford to live in their neighborhood?”

Homerun, you make it sound that it is such a bad thing. That is not as bad as it sounds. I used to live in CA and I thought there is no quality of life outside. I moved out and realized that there is life outside of CA, and that of much higher quality than most people in CA have or dream. I am not saying that for 100% of people; just for those with less than 5 million. CA has few nice spots for those with more than 5 million. As I said many times, I am not just talking about house price. I am talking about overall wealth.

Flyover I think living in MN-St. Paul or Chicago could kick ass. Denver … lived in the Springs for a couple-few years and never got up to Denver except for gun shows so I dunno.

The thing is, it’s a matter of having a situation, if not an ideal one, in California or going to the Midwest and being homeless and living in a hole in the ground. I have to have some kind of skill that works anywhere. Electronics surplus dealing isn’t a very transportable skill. I’d have become a tattoo artist long ago but I don’t want to poke people with needles and make ’em bleed. Sign-painting has my interest these days and may enable me to get somewhere. It was good enough for Muhammad Ali’s dad.

At Davos, the Americans said that they will lower the American worker wages to that of China or the jobs will go to China. Chinese wages do not support high housing prices. It does not take much to spook the xxxx to all run to get out of the little door at the same time. Then prices will really plunge.

IRA,

Given the fact that those from Davos are psychopaths and they have all the power (62 individuals more than half of the world wealth), I don’t think they were kidding when they said that they have to lower the wages of those in US to those from China. Based on Agenda 21 I really believe they meant what they said. Through taxation and inflation it should not take to long to bring us all to that level. It is “hope and change” we can believe in.

The average Chinese factory worker is making $300 a month and sending HALF of it back home. They work their asses off for 10 years and then pay off their family farm and I dunno, do farming stuff or something. It’s not as bad – for them – as it sounds.

Sadly, for Americans it’ll be min. wage grind until the heat death of the universe.

Been millennial sucks! Hardly any of my friends want to have kids…I have two and I am not quite 30 yet…that makes me weird in their eyes. Truth is, they can’t afford raising kids, give them place to live, educate them etc. I am very worried, that I wont be able to provide that too. For me its easy…I can always return back home to Europe to at least educate my kids for free.

Three of my favorite traits of Millennials:

1. they over dramatize everything

2. they expect everything to be easy

3. soon they will be old and be complaining about the next entitled generation

I bet anything you are just one of those rich guys who sits and counts profit on all rental properties and does not really cares about others and families. Most likely you do not have kids either…

I have kids

I worked hard for my wealth

buck up and get through it, work hard, don’t complain…. whatever you view as wealth will come

Escape,

I can sympathize with you. I used to live in CA, then Seattle, and I had 4 children relatively young. I am also from Europe. If you follow what is happening throughout all Europe now, I think you will jump from a puddle into a well and your problems will just compound.

There are many places in US with low cost of living, beautiful, safe and with good schools where you can have a much better standard of living than anywhere else in EU. How much you make per month is irrelevant. What counts, AFTER taxes, is your purchasing power. Nowhere else in EU can you find what US offers outside of big metro areas like in CA. You might not have the CA “cool factor”, but the quality of life will be much greater. The nice spots in CA where you can have a life and not be just a slave, require you to have more than 5 million. The rest is just a third world country.

When I started to work, in my company I was the only employee with children, ever, and it was a good size company. All others had dogs or cats. When my son was born they were looking at me like I was growing horns. Therefore, I do understand what you mean.

You are right….there are better places in US. Unfortunately we signed up for mortgage in San Jose in 2014. We are thinking of selling and moving to Sacramento suburbs. There are a lot less work, but better chance to own a house and walk in a decent community, plus good schools. We really love Colorado, but housing is going to unhealthy point there too….too many Californians are moving there…

Escape, if you bought in 2014 in San Jose… you must be up 25-30%.

Nice job, I’d hold out for at least one more year. +6-10% to tank up hard

Facebook earnings and stock options looking solid

Flyover you know what works well in “the rural’ is, farmin’. Grow your corn and squash and so on in summer, grow fava beans (crop, really fucking tasty deep fried, try ’em at any Chinese store) and keeps the weeds down, plow under for soil amendment, keep chickens, maybe have a pond and grow tilapia, learn to carpent, weld, etc *make yourself useful* and you can live the good life.

Sadly, the place I lived was more about farming drama, and I just had to GTFO.

But buy 3-5 acres and put some crafts and shit on Etsy for cash-money, and it’s the good life.

I’m an X’er, have four siblings and none of us have kids. Personally, its because after experiencing the fruits of wonderful American capitalism, I don’t want to bring children into the world who will have to dig in garbage piles to eat.

Hey! I really respect that! Thats why none of my 30 years old tech friends are having kids…can’t raise them – do not have them.

You’re what, 53? You’re a tail-end Boomer, same as me.

You might not have enjoyed the benefits attributed to Boomers, but then, many Boomers didn’t do as well as the stereotype suggests.

Yup, 53, and I refer you to the *excellent* book, “Revenge Of The Latch-Key Kids” by the excellent cartoonist Ted Rall for more on this matter. Sums up us X’ers beautifully.

“It was not cool to be a kid in the 70s” – Ted Rall.

My oldest sibling was 5 years ahead of me, and got the quintessential Boomer upbringing. Private school (with Obama!) and had shit like show cats and a million ribbons from idiotic cat shows, the whole schmeer. The rest of us had shitty public schools, poverty, foraging for food, etc. It’s amazing how sharp the demarcation was. The guy I work for (typing this from his house lol) is 14 years ahead of me and it’s like he’s from another planet.

It seems that, due to the Porter Ranch gas leak, methane levels have risen as far away as Orange County: http://www.latimes.com/science/la-me-porter-ranch-greenhouse-20160124-story.html

State regulators and scientists monitoring methane from the leak throughout the Los Angeles region emphasized the gas is not at concentrations that pose a health or safety risk to residents.

But its fingerprint is evident far and wide, said Riley Duren, a researcher at NASA’s Jet Propulsion Laboratory in La Cañada Flintridge. A network of gas-detecting instruments across the basin, including one sensor atop Mt. Wilson, has detected noticeable increases in methane levels as far away as Orange County and San Clemente Island, he said.

Duren thinks estimates gathered by airplane represent a “reasonable lower bound” and that total methane emissions from the leak could be higher.

I remember standing on a pier in Newport Beach and seeing … bubbles … rising from the water.

“What the hell is this?” I thought.

Since rents only make up a third of incomes typically…. it’s easy for rents to rise faster than wages. Landlords essentially shake you down for as close to 100% of salary increases as possible…

This is why you should always buy when prices are at rental parity and you know you will live in an area for 3 years.

In la-la land (your father’s estate)maybe. In the real world rents are often 2/3rds income, before taxes. This is why bankers and landlords will end up swinging from lampposts.

See now? Godamnit I can type of a long well thought out post and try to post it TWICE about how I live, why I live, how others around me live, how I make it in the neo-Dickensian reality 90% of us live in, and it gets “disappeared”. But drivel about bankers swinging from lampposts (not that that would not be a delightful thing) goes right up on here, every time.

Interesting article about how the poorer majority live in China (hint: They can’t even afford a wife, or a house in China, much less a house in the U.S.): http://www.spectator.co.uk/2016/01/chinas-brutal-one-child-policy-will-be-catastrophic-for-us-all/

American capitalists are taking notes.

CEO of Zillow: Worst is behind us; buy near Starbucks; Texas will be hot property area.

http://finance.yahoo.com/video/worst-behind-u-housing-market-121932394.html

Yeah right.

My husband and I live in Huntington Beach. It use to be a nice place, but now it’s quite dangerous. We rent in a 4-plex and three of our neighbors don’t work because they are either on disability or some type of government housing program. Most of the people who live by us are either on drugs or mentally unstable. One of our neighbors was stabbed to death a few years ago! I checked a crime map for our neighborhood, the one that goes from green (safe) to red (very unsafe); well we live almost entirely in red and orange. The funny thing is just across the street there are million dollar houses, I can’t imagine paying that much for this area.

We’d like to move to a safer community, but we can’t afford the high prices. I can see the drive for some people to buy a property when the alternative is renting an overpriced crap shack in a bad neighborhood. A couple of our friends just moved out of the neighborhood and bought a 3bdrm in Brea for $600k. I keep telling myself to wait it out until prices are more reasonable but it’s hard when I worry about our safety all the time. We both just got new jobs so our only hope is to safe as much money as possible and get the hell out of here.

I’ve noticed this, essentially you have parents who are really solid citizens, work hard, etc. They are able to buy a decent house in a decent neighborhood. They eventually die or get turfed out to the o!d folks home and their kids end up with the house. The kids are crackhead losers. Living in a million dollars!at house and burgling your garage.

Haha! I notices same thing. Sometimes some drunk, half naked woman come out of the big house in front of our condo and I keep wondering how could she afford buying $1M home and we can’t. She probably just inherited….poor dead parents…

This 1000X.

The crackheads, nutcases, lay-abouts, wandering useless wastes of skin and oxygen, who inherited … it’s a plague.

Some of my clients who live in Beverly Hills, Beverly Hills adjacent, Beverlywood, century City, Santa Monica,and Culver City are unemployed. They stay home to care for their elderly parents and grandparents who do not want to go to nursing home. These people also converted their home in to an unofficial board and care home taking in mentally ill or debilitated residents. The inside of these homes are run down. They cannot afford to fix the interior. They also take out reverse mortgage or HELOC / home improvement loans and using it as their income. Things are not as rosy as they look.

Those red/orange/green safety maps are misleading. Much of Santa Monica is dark red. But that’s because those maps only measure the quantity of crime, and not the quality of crime.

If you check the actual crimes in Santa Monica, much of it includes:

* Identity theft.

* Shoplifting.

* Creating a disturbance at a business. (i.e., unruly homeless people in a store)

* Municipal ordinance violation. (tickets for minor infractions)

Pasadena is much greener. Only a few crimes. But those include gunfire and even gang shootings.

So which is the safer area? Red Santa Monica? Or green Pasadena?

Those crime maps are useful. But you can’t just look at the colors.

Similar crime situation where I live in Baldwin Vista which is between LaCienega and LaBrea; South of the Expo line and goes all the way to the hills of Kenneth Hahn Park – the majority of crime is ALONG LaCienega and ALONG LaBrea. grand theft auto, car breakins, vandalism, bus stop harrassments, shoplifting. But crime in the residential areas between those major streets is nil.

33 and making six figs not including bonuses which at times can be sizable, I still can’t afford a house and never felt poorer. When I made 65-70k flat in 08/09 and with significantly less down payment I felt richer and plenty of houses I could afford in decent neighborhoods, but was scared to lose my job since I was only a few years experience compared to others in my company, don’t forget those were scary times. I remember co-workers getting laid off, I was telling myself that it should’ve been me or how in the world did I get saved, but I think what saved me was that I didn’t make as much compared to more seasoned veterans, sometimes making too much is bad when it comes to layoffs but now I’m a seasoned vet so you never know but I try not to ask for raises and what not in preparation for the next down turn.

I do have a more established career that I’ve worked hard to grow in but I’ve never felt so powerless, my cash increased but my buying power decreased relative to home prices. Home prices rose so quickly I couldn’t save 20% because home prices kept going up, even with 20% now next month it might be 15% so I’ll be out of luck again. But even with the required down payment, it barely puts a dent on the monthly payments if you do the math it’s discouraging, you have to consider taxes. Hindsight is 20/20, in my mid 20’s could’ve done things differently, I chose to tread lightly, way too careful so never jumped in and it was also inexperience since I grew up poor and was only raised to work hard, pay off bills, and save so that’s been my only focus, but what are you going to do… some people win, some people lose.

I lose… for now.

Don’t worry too much, hindsight is 20/20 and you’re in a good position – keep socking away money and in the interim take advantage of your freedom and enjoy life, get out and travel or something. Owning a house is like having a second job sometimes – you don’t know that until after you’ve signed the papers.

The Feds just announced to keep interest rates unchanged.

Imagine, a near zero rates, cheap gas, inflated housing, equity and bond markets and the economy still sputters.

“Anyone claiming that America’s economy is in decline is peddling fiction.”

I feel that Negative interest rates are coming just like in Europe. God Bless us all responsible savers!

Responsible saving means silver, preferably buried in the backyard. I am not joking. But do not buy at market price! Buy at garage sales and such things. There’s a ton of silver out there, and yes gold too.

stagflation….

courtesy of QE and low rates….

Savers are enemies of the state…

What we are seeing is NOT stagflation. We are in a global liquidity trap. Deflation is the monster at the bottom of this drain, not inflation.

And never forget that Housing/Equities inflation is a different animal from real inflation because the more that people attempt to cash-out/sell, the lower the valuation falls. This is why QE has pumped up stock prices/housing prices but not real inflation.

Just checking listings and saw a house 4 lots down from the one I sold in 2014 just went on the market. The asking price is higher, but the home is a bit bigger than the one I sold, but the price/square foot is less than what I sold for. This one also has a pool and a .2 acre larger lot. Everything else about these two homes is roughly the same, large lots, great views, etc. Just wondering if this is a one-off, or a sign that that prices may have hit their upper limits!

We’re in the functional equivalent of 2006. A long slowly declining plateau and then I guess in 2017 will be the plunge.

Only good things about buying is that you control (for the most part) when you leave the house and you pay something down and have equity that can be traded in for cash (assuming the house does not go to $0 someday).

Renting is great, its best attribute is flexibilty, its worst is you cannot be sure you will be able to afford the place you live in or when the landlord might tell you to pack it up and leave because they want to sell.

Neither choice fits everyone, paying to fix up broken stuff in your house and taking the time to fix it all sucks, but only paying taxes and insurance once the house is paid off and owning a % or all of a house and being able to liquidate it for cash at some point in time is a great benefit.

Despite prices being above what many think they should be, they are where they are and it is what it is, right now, it may change and it may not. manipulation is at an all time high and at some point you break it down to a 4 year rent total will get most the down payment they need to buy a house and keep their housing costs at what they currently rent for. so as rents increase and inflation rises although it seems expensive now, in 30 years houses will be worth much much more than they are right now and you will have equity in that house, and if you rented the entire time you will have 0 equity.

As stated buying is not for everyone, the whole process and owning is gigantic headache as well, but high prices or not, buying for the long term is generally the best choice one can make if you can afford it.

Equity only matters to the extent that it is net above savings in an alternative. When it comes to most parts of SoCal that are actually worth living in, there is no net benefit.

Check out the chart generated by this URL:

http://tinyurl.com/ze7muj7

It shows the Fed’s balance sheet. Here’s the theory. See how the Fed’s balance sheet has swelled to $4.5 trillion in MBS?

I believe this is the hot potato being passed from the banks’ balance sheets to the Fed’s. They know prices have to Tank Hard but the banks don’t want to take the loss obviously and they don’t want the specter of a treasury bailout so the Fed will take the hit and ride prices back down to historical norms for the banks.

Unlike commercial banks, the Fed doesn’t have depositors whose money the Fed used to buy MBS as the Fed just invented the money – it doesn’t need to get the money from anyone. The Fed can take the loss resulting from foreclosure or short pay without the loss of capital hitting any pension fund or other institution or your 401k.

I think we haven’t comprehended the plan they’re unfolding which is why we don’t understand what’s keeping prices up. The Fed has been called on to dive on the depreciation grenade because the Fed is an immortal.

Once America’s mortgage debt has been moved to the Fed’s books through MBS purchases, the collapse will commence and by the looks of that chart; $4.5 trillion in MBS, it’s starting to look like the stage is set. Watch out…

And where did the money go? To all the sellers who sold at the top of the last bubble. There was a giant transfer of wealth from the fed gov’t (as debt) to the pockets of thousands of people who sold. Who then were able to use that free money as down payment when the bubble popped. Everyone always talks about the people who foreclosed, who short sold, who stopped paying the mortgage. No one ever talks about the SELLERS that they paid inflated values to when they got into those homes. Who then were free to run away with all the cash. Lucky, or smart, whichever. Still ridiculous and enabled by the greed of the banks.

The bubble has already burst. Luxury home are not selling. Here is an excerpt from a Bloomberg article talking about Arcadia, CA and London real estate properties where all the criminals parked their money: http://www.zerohedge.com/news/2016-01-26/luxury-housing-bubble-pops

It is nice reading this article while eating my rsnap, crackle and pop Rice Krispies lol

Tyler Durden’s a busy little bee, isn’t he?

Multi-generational new homes is the new thing in the Central Valley. Buy a new home and have a separate entrance and privacy for your grown children. Almost everyone in my neighborhood has their adult children living with them and prices are very reasonable here. $300,000 to $400,000 buys you a beautiful home in a lovely neighborhood. The next door neighbor’s son just got a job with American airlines paying minimum wage.

Hot damn how’d he get a job that good?

In my shop I have a 1932 and a 1940 copy of Popular Mechanics. The ads for correspondence school, sheesh! I remember wishing I had the money for ICS, etc training in the 80s.

I feel the housing market will decrease. Just how much nobody really knows. Waiting for the opportunity but understand the dynamics behind the economy and politics. I lived in Los Angeles my entire life and have seen people thrive economically and fall of the cliff into bankruptcy. Overall you just need good common sense. If you live in Los Angeles long enough you will see people lack that trait.

Just curious, if the housing market decreased by approximately 20% across the board today how many here would seriously go out and try to buy immediately? If not, what would it take to get you off the fence? I’m specifically addressing this question to current renters and non-owners who would be looking to purchase a principal residence, not investors.

20% is the bare minimum it would take to pique my interest, but I would definitely not be buying immediately. To buy immediately, I would probably need a 30%-40% discount or more. I currently rent (but would like to buy), despite owning a rental myself. So I guess I more or less fit your criteria.

Good luck waiting for 30-40%. If it ever gets that low again, unless you’re coming in with a suitcase full of cash, you’ll be beat out by all cash offers and investors.

I didn’t say I wouldn’t buy at a 20% discount- I just said I wouldn’t buy immediately. And by the time prices come back to reality (which I’m assuming will happen sooner or later), maybe I’ll actually be a cash buyer. My down payment fund is (thankfully) continually growing.

A healthy market doesn’t force consumers into the position of making an immediate purchase or “be priced out forever.” If at a 20% discount there’s a sharp snap back, then the market is still manic. People tend to make erroneous decisions when under pressure to buy something. You certainly seem to be more prudent than that, but some of these comments, oh the humanity.

Simply amusing how real estate bulls would have us believe that investors hoarded a pile cash in the eventuality that prices would fall ~30-40%. Did they also know in advance that the Fed would suppress interest rates for 7+ years so that all other investment options would be rendered useless? Did they also foresee a Chinese economic downturn that would drive hundreds of billions of laundered dollars into international real estate?

I agree that a 20-30% haircut despite historically low interest rates would portend to real economic problems. In such situation, all forms of lending tend to become constrained, including the loans used by large real estate funds to make their “all cash” purchases.

Oil has already taken a 70% haircut from its highs. Where are the “all cash” investors ready to swoop in and buy up all the near bankrupt oil companies and form a bottom?

If housing decreased 20% tomorrow I would buy ASAP.

Been sitting on the sidelines for a bit now, have $200k+ saved up for a down payment but don’t want to buy at absolute top and have a decently sweet deal on our rent on the front house of a in-law property.

Work in SM but will be pushed to either South Sherman Oaks (ugh 405 traffic) or North Redondo (ugh South Bay). Would love to stay around work on the Westside but we are priced out at this point.

There won’t be a day when you can definitively see an overall number that says, “the market is now 20% off peak.” You may get, “last month the market in this or that zip code was down 20% from 2014 peaks, if you go by this and that metric, though these numbers are disputed by X and Y sets of data.” You’re going to have to start looking several months before the market drops to your desired level, because at the moment when it’s affordable for you, you’re going to have had to become an expert at knowing of all of the possible houses you might want to buy. I looked for 18 months starting in 2009, because prices were heading downwards, and ended up paying for a membership in redfin dot com to become familiar with (and obsess over) dozens of houses in my preferred neighborhoods, and pulled the trigger while the market was still falling. I’d had to accept that the market would probably continue falling for some unknown number of months after I bought, but I’d found a property that fit my finances, and that I could live in for the long haul.

I bought a “$700K crapshack” near the beach in the spring of 2011, on “the world is falling apart sale” for $535K after looking for 18 months. As could be expected, the property went pending before it hit the MLS, but I submitted a full price back up offer anyway. I didn’t expect to get it, because by that time, I’d put in backup offers for other properties that went nowhere. Basically, you have to do better than hit the ground running — you have to be on the ground already running, and be prepared for disappointment in the case that the market doesn’t fall to meet your desired threshold. It was a frustrating 18 months. And even then, you have to get a little lucky — I hold no illusion that I controlled the circumstances; it’s more that I put myself into the place where I might be more likely to see a lucky break if one were to appear, and eventually one appeared.

Here’s the thing, based experiences such as mofa’s anecdote, if the competition to consume is that extreme, it’s a huge red flag that something is very awry with the market in question. Fools rush in.

We’re continuously told here by some commenters that the speculators will come in droves at price level x, which is another way of saying buy now or be priced out forever. If that indeed does happen, there’s still a problem with the market.

My husband and I would buy immediately in the area we currently rent in. We have the down payment and one secure government job and one secure unionized health care job. We plan on buying for the long term with no plans on changing jobs/moving elsewhere. We just can’t pull the trigger now with these inflated prices- but a 20% decrease would for sure do it for us!

Depends on the neighborhood. Some places went up higher than others. 20% might do it in some areas…..35% in others. If your annual rent adds up to around 15 times purchase price…it’s time to consider buying.

I would…if I was employed, and the economy was doing well.

Trouble is…if the home prices go down, usually a bunch of people are struggling or will be struggling.

I guess I’m not the only one who would jump at the chance to buy at 20% off today’s prices. I highly doubt rents will go down anywhere close to 20%. Look at the rental parity calculation, if it pencils out…you need to buy! End of story!

I’ve been through multiple recessions as a landlord and it’s actually rather common to have to reduce rent by 20% or more when filling a vacancy during such times. 2008 and 2009 in particular were rough.

Again with the rental parity argument as if all diligence can be made on such a simplistic model. It can’t. Rents go up and down. Cost basis of a real estate purchase will not move down short of principal reduction in a mortgaged scenario, historically unlikely. Rent parity is not accounting for transaction, maintenance, repair, and replacement costs, also subject to price inflation. I wouldn’t expect an “owner” with only a couple years of experience to have full perspective on this.

My wife and I would buy but as some stated above, some areas went up more than others. I look at every property differently, price isn’t the only factor. Look at safety, schools, and proximity to metrolink (to commute to work), and retail. I’ve said before it wouldn’t take much of a drop for us to jump in, a 10% to 15% but things have gotten way too high than a 15% barely makes a dent into these over priced properties.

A 20% fall in home prices would not happen in a vacuum. More likely it would happen as the result of an severe economic recession. In that case getting a mortgage would be difficult even if you had a 20% down payment as credit dries up.

I’ve said before ‘careful what you wish for’ because when good property gets cheap it is because NO ONE can afford to buy it.

In that case it would continue to fall to a level that the market can support, not really a problem for non-speculators.

@HC

Yep. Such economic recession would likely also strain the balance sheet and real estate portfolios of investment firms. “All cash” buying would dry up as financial institutions would cut back on corporate lending. With fewer investors involved, real estate becomes appealing as a commodity.

I’de jump on a 20% decrease. My wife and I gave up our search after looking all last year because the houses we liked in LA were all over $700k and we only felt comfortable spending under $600k so that we could put 20% down. If those 700k houses became 500k houses I would be in…and until they are I will continue to rent and save more.

BUT THIS TIME ITS DIFFERENT!!!!

I agree there is some truth to what you are saying. We have high demand and low supply of housing. Foreign investors have come in and bought a lot of property. However if people weren’t greedy and bought houses cash or homeowners who felt there home is worth a million dollars when they bought it for a 100 k we wouldn’t be having this conversation. Ultimately you have to decide where you want to live. Freedom of choice.

TOO POOR TO RETIRE, TOO YOUNG TO DIE! This is what Doc is talking about. What a sobering read. Good people who just wanted to live a decent little life with a few pleasures. http://graphics.latimes.com/retirement-nomads/#nt=notification

Excellent article. A real dose of reality. Everyone should read it. I do think the article makes it sound like what happened to these people was inevitable, when it reality they probably made some very poor financial choices in their past.

My parents had it a lot harder than this lady and they didn’t die in dire straights. They worked at small companies with no retirement plans. They lived through WW II with my dad having been in combat in the infantry. People have the freedom to make choices in this country. You aren’t entitled to anything–responsibility and freedom cuts both ways.

Dude during that time frame if you could fog a mirror you did fine. Upward mobility was baked into the cake!

Alex, so true. What’s easy is making a comparison between two situations using the experience of only one as the basis. What’s difficult is seeking deltas between them and accounting for variances. It’s human nature to opt for the former.

Alex, if you spent 1/1000 the amount of time actually working (or looking for a job) instead of hanging out at internet real estate forums, you might be able to get yourself out of the self-pity prison you’ve built for yourself. Virtually NOBODY in America today has it hard compared to previous generations of Americans and the vast majority of people in the world who really are living in poverty.

Find a hard luck story in Ameriica today and you’ll find a self made disaster which was caused by affluence and wealth. What’s wealth? Here’s a hint: I know a PhD post-doc fellow from India who came from a small village where the children didn’t even have shoes. No running water or sewers and no refrigerator or phone lines.

And this guy was fortunate by Indian standards. This lady living in her motorhome would be considered rich in most of the world.

Like I said, self-made prisons.

Zzy no shoes was he norm when and where I grew up. Bet you weren’t fishing and foraging to feed your family when you were barely into your teens, either.

A good friend of mine had a house in Huntington Beach, left him by his father, guess what his father did? Infantry in WWII. Then put in a career selling I dunno, curtains and stuff at Mervyns. Not the brightest bulb, just got born in a lucky time.

OK so your Indian friend got a PhD etc. Great to hear, did you know college is free in India? Just be smart and show up.

I dont consider myself badly off. I have enough work, at enough pay. I have a place to live that’s in a decent area, and free time to work on projects of my own. The rules are just different now. Society is class and inheritance based, not merit based. It is not wise to strive above ones station.

The Bank of Japan just implemented Negative Interest Rates. The end is here people!

I’m a millennial here. I would buy if there was a 20% correction.

-100K down-payment

-No student loans. (I went to community college before public university here in Cali) -I graduated college in 2005 (debt free thanks to junior college for $33 bucks a class back in 2000-2002. and lived a home while working part-time. I laugh at those idiots paying dorm fees to experience college (and fraternities…Lol) they have no Idea they’ll be indebted slaves..

-10 years at my Job.

-95K job (+ whatever the wife brings… no college)

In a recession a lot people will lose their job. YOU should know where your stand in your company and how important you are to them. if you are just a #number you’ll lose your job. Meanwhile I’ll rent. my tiny apt and travel with my 400K airline miles 😉

Tequilini: don’t kid yourself. Pretty much every employee in existence is also just a number, including you. With a salary of $95K (assuming you don’t have some super-niche non-government job that requires extensive education/experience), you are probably ripe for a layoff with a salary of $95k. I agree that you were smart in graduating from college debt free, but I find it almost comical that you feel so confident about your job security. With rapidly increasing automation and an over-supply of workers, virtually everyone is susceptible to a layoff.

Btw, $100k is a mere 20% down on a $500K house. Although $100K is a commendable sum to save for many people (especially someone who likely has a pre-tax household income of <$140K), good luck finding a halfway decent $500K house in any area you’d actually want to live. Looks like you’ll be waiting for the next crash like the rest of us, and hopefully you’ll be able to hang onto your job in order to qualify.

Tiquililliniillitochichiquito- you were smart enough to become a bus mechanic or something, bul!y for you. If only the rest of us had been perspicacious enough to go into the trades.

http://www.latimes.com/local/california/la-me-homeless-national-numbers-20151120-story.html. La tops nation in chronic homeless population. I’m sure these people aren’t worrying about housing bubble or high rent. I’m sure they wished they just had a roof over there head and a good meal.

I honestly think something is happening like ‘Enclosure” where serfdom transitioned to proletarianism, where even having s roof over ones head is no longer any guarantee..

Read your Marx, people, and act!

Hipster dollar carries heavy weight as millennials come to market

Organics, grooming and flat white coffee profiting from ‘cool’ segment

The hipster revolution has driven sharp rises in sales for some food, drink and personal grooming brands

http://www.ft.com/cms/s/0/bfce2878-c691-11e5-b3b1-7b2481276e45.html#ft-article-comments

Very interesting article but what’s even more interesting is they never mention home ownership or where and how they live, only what they consume.

Good point, since housing is consumption.

Here’s another article on how Millennials are more about spending money on experiences, rather than owning stuff. http://www.theglobeandmail.com/globe-investor/investment-ideas/stock-markets-starting-to-reflect-millennial-priorities/article28491112/

Questions about what price will it take to buy don’t go far enough. One of the biggest problems with the SoCal market has to do with volatility. It’s one thing to buy and hold, quite another to be in a position to sell. Buyers, especially first timers and those who’ve never sold tend to over-discount the timing of selling. Sure, it’s been boom bust in this market for a long time, but what we’ve observed in more recent history is extreme. Price movement matters as much as price level. People tend to make mistakes when faced with pressure to buy anything and people tend to think they’re an exception.

Leave a Reply