Millennials still enjoy living at home with parents and are reluctant to reignite the McMansion Baby Boomer Utopia.

City centers from Los Angeles to Miami to Seattle have all seen a massive revitalization thanks to hipster loving Millennials that enjoy good restaurants and access to nightlife versus the white picket fence McMansion propaganda brought on by the baby boomer generation. Zero lot condos and homes make up the new housing demographic where builders try to max out every square inch of their buildable land so they can pack new buyers in like sardines and you can hear your neighbor’s sleep apnea roaring at 3am. This is the modern day dream. Being able to waste your entire paycheck at Whole Foods and eating organic falafel at your new trendy restaurant. But Millennials are choosing to go their own way. For one reason, many can’t afford to buy an overpriced particle board crap shack so they ended up staying at home living with their parents deep into their late 20s and 30s. Many are also addicted to housing lust shows where reality star wannabes flip or flop on big real estate purchases. A modern day Lifestyles of the Rich and Famous. Yet most are not famous and many are certainly not rich. Ideals have simply changed and the market has transformed for Millennials.

Living at home and loving it

The percentage of young adults living at home has hit multi-generational highs. This isn’t by choice but because of financial necessity. There was a recent study conducted by the Federal Reserve that showed inflation adjusted, Millennials are financially worse off than baby boomers. So this notion that Millennials are simply a bunch of whiny good for nothing crybabies isn’t exactly true. Funny that is the perception when many baby boomers are somewhat technologically illiterate and are screaming how “dumb†Millennials are on Facebook and Twitter (technology built and managed by younger Americans ironically).

Looking at demographic data for this site, most are baby boomers and older Americans although we do have our share of Millennials. Most look at housing prices and realize that it is a pipe dream but also wonder if they even want a big home given their varying lifestyles.

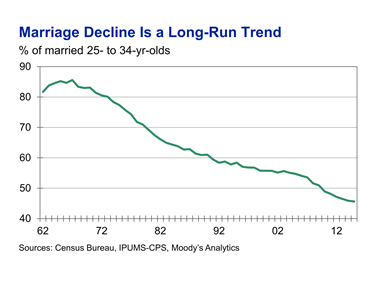

Typically buying a home was pushed by emotional reasons and “doing the right thing†especially when it came to starting a family. But marriage rates are changing for this group:

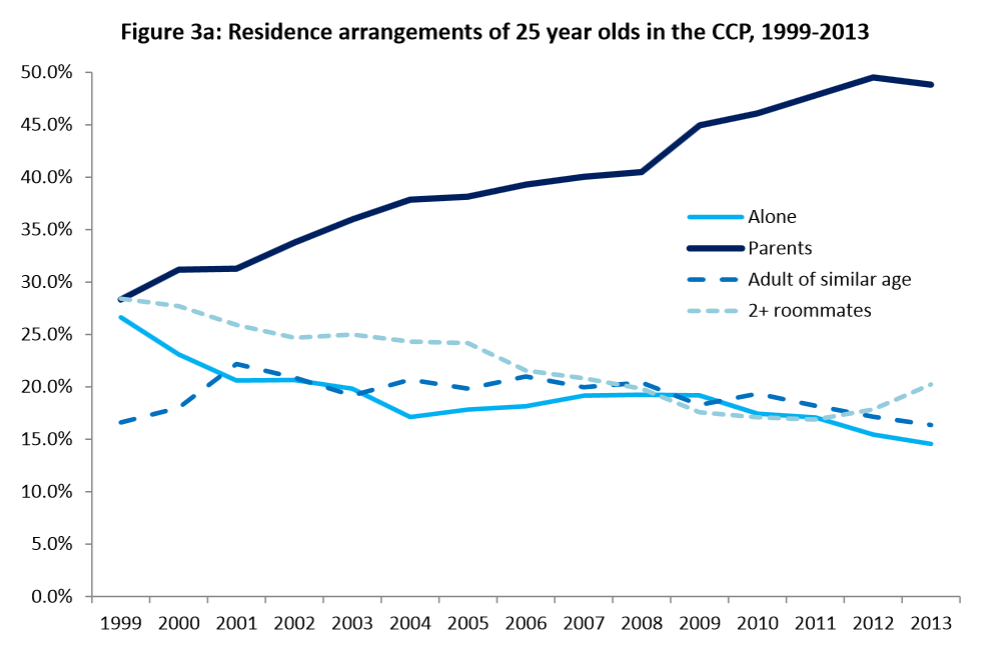

Less marriage and smaller families. And you even see this with reality house humping stars getting divorced and each going after each other and their money. So much for that equity. What is so funny is that they need to pretend all is well to keep ratings up so there is another legal battle there. So the notion that buying a home is a sure bet, marriage is a sure bet, long-term jobs are a sure bet, are all based on this phony utopia ideology brought on by the 1950s and 1960s. But many Millennials don’t want this as their end all goal in life. Some baby boomers seem to have the ultimate goal of buying a crap shack and that is that. To quote a very Twitter happy politician, “Sad†– and the dynamics are going to be interesting with many older adult kids living at home with parents:

These changes are important. So a lot of the new building in recent years has come in the form of multi-unit construction (condos and apartments). Yet there is a danger in this too. Since most Americans are notoriously bad savers, a home is a surefire way to build equity over the long run. In fact, when we look at net worth figures for households, the biggest source of “wealth†here is equity in a home. It serves as a forced savings account and human nature being what it is, most just don’t have the discipline to invest in other more profitable ventures. But again, you need to sell that property to unlock that equity which many Taco Tuesday baby boomers seem to miss.

For many of the open houses I’ve been too recently (areas with homes in the $1 million range) you have investors (foreign and domestic), older buyers, and a handful of late 30s professional couples. And these homes are mediocre at best – a slight step above a crap shack. Let us call it a shining turd of real estate potential. Millennials just have different tastes and this is impacting decisions on home buying and where they choose to live.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

161 Responses to “Millennials still enjoy living at home with parents and are reluctant to reignite the McMansion Baby Boomer Utopia.”

Hello Doc;

Ineresting article on Venice, once probably the roughest beach town in LA, and its transformation into Silicon Beach and home price averages of $1.6M

The article portends another jump in home prices when SnapChat stocks go public.

http://www.laweekly.com/news/how-venice-became-the-most-expensive-neighborhood-in-los-angeles-7831779

The article lies. Venice is not “the most expensive neighborhood in Los Angeles.” Bel Air, Hombly Hills, Pacific Palisades, and Brentwood are way more expensive.

Encino, Sherman Oaks, the Hollywood Hills, and possibly Tarzana are also contenders, with bigger celebrity mansions than those in Venice. They have poorer areas too, but so does Venice.

Venice is the most expensive on a per foot basis. God is not making anymore beach front property.

Venice Beach is still rough area with a large burgeoning homeless population living outside those $1 million plus mansions.

http://www.latimes.com/local/lanow/la-me-homeless-bathrooms-venice-20160415-story.html

http://www.scpr.org/news/2015/05/08/51559/homeless-population-in-venice-has-increased/

Having homeless people right outside your mansion is a sign that you’ve made it, and you get to rub it in the face of “sinful” poor people every day. This is why “The Jungle”, a pretty much self-governing homeless encampment in San Jose California was broken up – now the people from that are sleeping in doorways downtown, so the rich folks in their Teslas can look at ’em with derision every day. One night I was riding my bike around downtown and on one single corner, you had homeless people bedding down for the night, and literally 25 feet away, an art auction with pieces going for $20,000 and up. It was set up outside because if it were conducted inside, how are you going to rub the poors’ noses in it?

So yeah, trust me, the rich folks in Venice don’t mind that there are homeless people going hungry and shitting on the street right outside their multimillion dollar windows. They’d have it no other way.

I’m not so sure that home equity is a forced savings account anymore. I think it used to be when people were more disciplined. Now you do a HELOC because your bills are too high. A good hot yoga studio can charge a lot, then you have your lattes every day with the fancy art work on top “look it’s a leaf.” So many daily expenses for so many people. The new i phone every so many months, etc.

Home equity is like a safe with a broken lock on it, just like 401Ks. Someone posted on a previous article that you just have savers and spenders. Our grandparents generation went through the depression and war rationing so kept buying the cheap toothpaste, the cheap coffee, the cheap towels on sale. Everything in their lives was about driving a bargain. Anyone born after the war doesn’t have this experience. That’s 90+% of the population now.

Maybe after WW3 and the next depression people will be a lot different.

Just surviving the 70s was good training in getting by on very little. Mending clothes, at the very least knowing how to sew buttons back on, having one phone for every 2-3 houses, people did NOT just “chat” on the phone. I’ve said this before, but that thing on TV, “That 70s Show” notice everyone’s skinny? That’s how it was. There were not a lot of extra calories floating around, and those were middle-class people on the show. Imagine how it was for the 75% of the population that’s working-class or poor.

Something happened right around 1980 or so. Some theorize it was the beginning of the use of high fructose corn syrup. Suddenly there was food for all and serving sizes got much larger. Clothes got cheaper too. Shopping in thrift stores didn’t mean getting by wearing clothes literally from the 1940s and 1950s, but wearing stuff that someone had bought and it didn’t fit ’em or they didn’t like the color, but it had been made within the last decade. And regular people started having things like computers, in many cases even with modems. That’s a big change from one phone per 2-3 houses and a visit by the bookmobile once in a while.

It was due to Globalization, HFCS, and Monsanto pesticides and later GMO’s;

“This increase in use is contributing to the development of diseases such as diabetes, obesity, lipoprotein metabolism disorder, Alzheimer’s, senile dementia, Parkinson’s, multiple sclerosis, autism, and cancer. The report details how there is a direct correlation between the incidence of these diseases and glyphosate use.”

http://naturalsociety.com/americans-suffering-chronic-disease-due-glyphosate-herbicides-new-study/

Monsanto invented the herbicide glyphosate and brought it to market under the trade name Roundup in 1974, after DDT was banned.

http://www.ecowatch.com/15-health-problems-linked-to-monsantos-roundup-1882002128.html

Tell Jon that Glyphosate is an herbicide and DDT is an insecticide!! I’m a chemist who has performed assays for glyphosate, which is an organophosphorus compound, not a chlorinated hydrocarbon like DDT. Also, the water solubility of the breakdown products is much different. The environmental half lives are way different, too.

Around 1980… wasn’t that when we were in the early stages of no wage/salary increases but we’ll make it easy to borrow? “Just put it on the card!”

@Joe R,

I don’t think I called it anything, I merely linked to, and quoted articles, which I don’t believe called it an insecticide either. That being said, Monsanto is the devil, and people that work for them should kill themselves, immediately.

Jim – you might be onto something because I believe 1980 is right around the time the lines on a graph showing American worker productivity and American worker pay, inflation-adjusted, diverge.

Just talking to a friend of mine.

He was commenting on how popular jeans have holes in them. He said remember in the 70s as a kid about 1/3 of the class had patches on their blue jeans. Your parents would never let you go to school with a whole in your jeans. They would not buy a new pair they would just sew or iron on a patch.

@JR I beg to disagree a little in re to HELOC loans. But maybe I am in the wrong age bracket (I was born in 59, making me a certifiable boomer). I bought a house in 2012 and admit that several of my friends have seen that our kitchen is not updated and have said ‘ “you can get a HELOC loan and remodel your kitchen!”. FOr me, growing up in an Irish Catholic family (my parents were children during the depression) the thought of a HELOC is a recipe for financial disaster. My parents didnt own credit cards or debit cards and as children anything that my father could not fix in the house, he would call my uncles or grandfather to help him (except roof repair). In my home, the only loan that was talked about was the mortgage. My point is there are some of us boomers whom the thought of a HELOC is insane, we just live with the home we have.

Me too! (Except for the Irish & Catholic thing.)

“”Maybe after WW3 and the next depression people will be a lot different.””

Things will definitely be different if we win WWIII, but they’re gonna be really different if we lose (actually, the next world war will be World War VII, not WW III, but hey, who’s counting).

“..The percentage of young adults living at home has hit multi-generational highs. This isn’t by choice but because of financial necessity…”

Yes indeed. Not only for cash strapped Millennials, but for cash strapped parents themselves who are living *much* longer and look to their kids for in-home assisted living.

We are quickly morphing into a Japan like model, it which multi-generations live under a single roof.

In fact, overloaded households are so common, that the City of Laguna Niguel is considering a fee and limit on the number of cars that may be parked on the street to ease impossible parking conditions brought on by too many people living in units designed for single families, not extended families..

http://www.ocregister.com/articles/city-741762-parking-laguna.html

That’s where you just get a 250cc scooter and keep it parked behind a gate in the side yard.

octal77,

take a drive thru Santa Ana some day after 5….or anytime other than street sweeping days, not a parking spot in sight on the street or even in the driveway. The city even had to make laws that said you couldn’t park cars on the front lawn.

I have millennial kids so I have occasion to ‘ overhear’ their conversations with their peers. They always talk about adopting a MINIMALIST lifestyle and how it helps them to be free to travel .. that is their # 1 spending preference. They are incredibly thrifty. I guess a lot of college grads are living on barista wages and house buying is just not on their radar. Better to just have a good time.

You have to be careful to not over generalize the Millennials.

The Millennials are a larger generation than the boomers.

What I have observed is that there are segments.

You have the Minimalist are you point out, but even they come in all shapes and sizes to the low income folk living at home to higher income tech workers.

Then you have Millennials who already have kids and own a home or rent you standard 4 bedroom home.

What i have observed is that many minimalist move into the second bucket… when surprise surprise…. Oooopps they have a kid. Life gets real.

As a GenXer myself it’s fun to watch the stupidity of generalizing both the Baby Boomers and the Millennials. You have winners and losers on both sides.

GenX FTW!

I think that a lot of our views of Millennials is based on our perspective. If you visit an Aircraft Carrier, you will find these young folks operating nuclear power plants and launching multi-million dollar aircraft from the decks. This will give you a good positive impression of the next generation. However if you visit a Youth Correctional Facility, you will think that all young folks are violent tattooed criminals.

I saw a segment on 60 Minutes a few years ago about young Italian men who continue to live at home well into their 30s. I think they are called Mamonis ma-mo-nes or something. Mama does the laundry, ironing and cooking and junior goes to work,parties on the weekend and takes his girlfriend to a short time hotel for sex. Everyone seems happy with the arrangement. Maybe multigenerational housing is the way to go, it used to be that way, why not do it again when the economics of globalization is bring down the standard of living for Americans to a new global average. Mean regression in action.

It’s the same problem Spain has: if you think Millenials in the US earn less than Boomers, think again.

It’s a toxic combination of extremely high unemployment and underemployment among people 35 or younger, low wages and local politicians and housing speculators trying to find a scapegoat by blaming Millenials instead of looking into the mirror.

Plainly put these Italian and Spanish Millenials on the average work irregular, low paying jobs which are nowhere near enough to both pay a mortgage off and lead a normal (read: thrifty) life. These Millenials are smart enough to understand, differently from their parents, a house costs a whole lot of money. It’s not just a matter of paying off your mortgage. I am reminded of that each time the taxman comes a-knocking.

As the saying goes, makes a virtue of necessity.

Those slandering these Millenials are not unlike those who fail to understand why they are now “stuck” with Trump: they make absolutely no effort to understand others and believe consequences don’t exist.

The slandered Millenials are mostly giving the polling station a wide berth, and rightly so, but those who bother with voting invariably end up voting for those nasty “populists”, such as Italy’s M5S. They care far less about the manifesto than flipping their collective finger to those blaming them because they aren’t buying overpriced “crap shacks”.

Slandering and ridiculing people has consequences.

+2

Policies that promote extreme wealth concentration for the select few at the expense of the majority tend to lead to undesirable social upheaval. Even the progenitors of families who hit the RE jackpot will reap the consequences of these unconventional and radical economic manipulation within a couple of generations.

@PrinceO’Heck

Think the security guard in their gated communities is going to take a bullet, or a pitchfork for them? Or how about some of the houses in Newport along Back bay loop with a fortified courtyard;

https://www.google.com/maps/@33.6274274,-117.8915817,3a,75y,203.12h,78.4t/data=!3m6!1e1!3m4!1skbve80H37d0jtRvY0W_sdg!2e0!7i13312!8i6656

It’s like they know something…. (FIRE economy is largely a house of cards)

I don’t see much “blaming” of millennials. Attacks on their work ethic or poor decision-making ability, sure (sometimes justified, sometimes not, but the same can be said of any generation). For the most part I see the blame being pointed at the 1%, corrupt politicians, boomers, and the Chinese. And let’s not forget the left, who are entirely to blame, and the right, who are also entirely to blame – depending on who you talk to.

Jon – I looked at that Newport place and …. it’s on the Newport river/creek/swamp/slough, once used to evaporate salt, and reputedly the watery home of the occasional floating turd. I’ve done a bit of rowing out of the nearby aquatic center… and the last time I was around there, that area full of houses was all mobil homes so I guess those got bought out and now it’s places for people who want to say they live in Newport. I guess it’s OK but a million or more OK I dunno. I hardly think anyone’s going to be storming that place for some boomers’ back issues of the National Geographic and a crappy “collectible” serigraph or two. Frankly the places that get stormed are in Little Saigon and Koreatown because a lot of older Asians have money due to a lifetime of working their asses off and saving, and they don’t trust banks.

I’ve got a soft spot for the ol’ Back Bay but if I’m gonna live there it’s gotta be cheap-cheapy-mc’cheap.

The very best thing that could happen to the millennial’s is a massive stock and RE crash to get the prices of those assets in line with their incomes. Couple that with the massive importation of the lowest skilled lowest earning immigrants and that must mean that at some point that is exactly what is going to happen.

Who are the boomers going to sell their assets to? Other rich boomers from overseas looking to retire in the USA?

I’ve heard it said that demographics is destiny……..

mumbo jumbo……

“The very best thing that could happen to the millennial’s is a massive stock and RE crash to get the prices of those assets in line with their incomes.”

For maybe the 20% of millenials who would keep their jobs… and actually already own a home LOL

If they don’t have savings and live paycheck to paycheck….In which case they were living on the edge to begin with. Otherwise, they’ll benefit from the foolishness of those who gambled with too much debt.

Gee, I wonder how past generations survived after each subsequent economic crashes?

Dr. – I am extremely curious how large of an impact the proposed elimination (essentially) of the mortgage interest deduction will have on the housing market. Also, the elimination of the state income tax deduction? The combination of these two tax changes should most impact high state income tax and high home price states (blue states esp. CA). What are everyone’s thoughts? These two factors could really move the needle on housing and deserve some serious discussion.

You will see most of the impact in the very expensive cities: NY, LA, SF, etc.

Trump is planning to increase the standard deduction for couple to $30,000. Therefore, for most of the country the interest deduction de facto becomes irrelevant.

The only state with significant income taxes is CA and that state would be impacted severely. The lower income people are not going to be impacted because they don’t pay state taxes and they can’t afford to buy houses. The rest will be affected.

Exactly.

A Trump standard deduction increase is going to impact renters in a very small portion of the country.

They aren’t going to like what it does though.

Their rents are going to go up because they have more disposable income to contribute to rent in high demand and low supply areas.

There’s no free lunch.

California the ONLY state with high income taxes? Huh? try Oregon, try Hawaii, try Minnesota (my Brother lives across a river from there and saves a bundle), try NY & NJ… all have 8+% max rates.

All “liberal” & “progressive” states.

“All “liberal†& “progressive†states.”

NJ is liberal and progressive? They’ve had a republican governor for more than half of the last 30 years. Similarly Wisconsin and Iowa (which weren’t mentioned) have among the highest state income taxes, but more republican than democratic regimes in recent decades.

And lets not get into property taxes. Even the Randian utopia that is Texas has among the highest property taxes.

Since MSM is now evidently considered “fake news”, but folks here apparently still value data from DHB I figure it’s incumbent on us other posters to keep it real, yo.

Apolitical,

Just because someone has an “R” after his name that doesn’t make him a republican in the sense of a constitutional conservative. People like Christie, McCain, and Romney for me are just Democrats with R after their name – or RINOs.

With TX, I agree with you – property taxes are too high. That is the reason I don’t like TX.

apoliticalscientist, New Jersey’s been ruled by ultra-liberal regimes for many decades now.

Republican does not automatically mean non-liberal. Republican NJ governors such as Kean and Whitman have been quite liberal, in the Northeastern Liberal Elitist Rockefeller tradition.

FWIW, my tax rates were higher in Nebraska and Utah than in California. Basically the difference between a graduated tax code like California and something very close to a flat tax in the others.

I always read about how CA is such a high tax state because of the highest income tax rate… which kicks in after the first million. How many people does that actually apply to? For most of us, income tax is pretty average — overall it’s low property tax (Prop 13), moderate income tax, and high sales tax. Most Nebraskans have no idea that they would pay less tax in California. You could probably make a case that the sky high property tax in Nebraska goes a long way to limiting bubbles — over 1/3 of my payment there was property tax.

TiredOfManip – I grew up in Hawaii and Hawaii has very low taxes especially for the little guy, California has much higher taxes, and Red states, whew, forget it! They tax everything that’s not moving, and if it is, they nail it down and then tax it. They tax food. They’d tax breathing except I suspect some politicians with asthma are keeping that away for now.

Hawaii. Lowest taxes. Let that sink in.

I love the shrewdness of the Republican tax plan to not eliminate the mortgage interest deduction, but to increase the standard deduction for all. Being a renter, why shouldn’t I get more of a tax deduction like homeowners? 🙂 This will likely cause momentum buying to stop, and yield a reversal in housing as no longer a speculative asset.

A $30K standard deduction is actually just going to be a driving force to drive rent up in a very small portion of the US around high demand, higher income areas.

In 99% of the country a $30K standard deduction will help the home owners who’s home value and loan are so low they don’t even benefit from the mortgage interest deduction.

Overall this will impact a very small slice of the US.

In high rent areas the renters that this benefit are going to pay for this in higher rents.

Also home loan qualification does not include the tax deduction so there is absolutely no impact there.

Making rent tax deductible or raising the standard deduction accomplishes the same thing without too much ideological drama.

With you Bob.

However, cynicism brings me to the hope in one hand in something foul in the other and being left holding something foul – high rent and no housing price adjustment with QE infinity in a kleptocracy that takes from labor to feed the corporations and .1% oligarchs.

The $30k standard deduction for married couples, especially with 1 or no kids will definitely save a lot of us a little bit of money and drive down our effecting federal income tax probably by around 2-3% a year.

But the changes are a bit tricky. They don’t really emphasis the removal of personal exemptions which make up $4k per head in a family and can be taken while itemizing. In this way families with kids who were getting a break on itemizing with one home may end up paying more for awhile.

Also the change kills head of household single parents. Not sure why they went that route but I suppose it doesn’t effect me.

At the end of the day I am not sure I like tax breaks being tied to home ownership. It just drives up prices for everyone. I really don’t want to encourage people to buy second homes as investments they can leverage to get some tax breaks and sell down the road for a profit. I feel like if I were just competing for homes with working families buying homes to live in price would be more reasonable even in SoCal. But we have to compete with older investors buying homes to rent to us… Makes getting started rough for sure.

Mortgage interest deduction has almost no influence on the RE market. Taking the standard deduction is a better option for most people, and they don’t itemize to take the RE interest deduction. Also, Canada and other countries don’t have any special treatment of interest for houses, and they have similar markets.

The fact is Millennials would want the big house, if they could have a steady job and not be loaded with debt. The funny thing is, the baby boomer parents consistently voted for less education funding, cheaper goods from China and lower taxes, and now their own kids have a ton of College debt and can’t trust a job to stick around longer than a couple of years.

The problem is that now the Millennials won’t get married and they won’t have kids because they won’t feel secure and the Boomers will be in big trouble finding suckers to fund Social Security and Medicare. Just watch, in a few years we will be like Germany begging for refugees so they can work and support our social programs.

SoCalBaker,

You are right on some and wrong on others. Let’s see:

“the baby boomer parents consistently voted for less education funding” If you refer to 1-12 education, US is spending one of the largest amount per child in the world. Also, the cost of living is one of the lowest in the industrialized world. Therefore, the cause of poor education is not the funding. I have my own long list of causes, but that is another subject. For now, funding is not an issue. For college education funding, I agree with you – US is underfunded. The reason for that is because the globalists (those coming from CFR) are more interested to fund the imperial wars than funding the US colleges. It is a matter of priority of funding, not lack of funds. There is also a mismanagement component for the meager funds the colleges receive – that is the administrative side.

US does not need more refugees. It already has close to 100,000,000 of working age (18-65) without work. Automation will produce even more people without work in the near future. I know some don’t want to work and some can’t work, but that number is very large even if you consider those. What we have is a government mismanagement of human resources.

Your figures are way off. Have a look at the EPOP chart here, which shows what percentage of the prime working age population is working:

https://data.bls.gov/timeseries/LNS12300060

This is overall, not broken down by race and gender.

Etherist,

My number is rounded up but very close to the real number. I didn’t make the claim that it is an exact number. I said that “it is close to”.

Also, you brought the graph for 25-54 years old and I said 18-65 (active working age). So we are talking about apples and oranges. I also said that some are not looking for work for one reason or another, but there are tens of millions who would like to have a job and can’t find it.

I don’t agree with the department of labor statistics on unemployment for the following reason:

The DOL counts ONLY those collecting unemployment benefits (aprox. 6 months). After that, they “ASSUME” that they are not interested in work. That assumption is BS. Just because someone lost a good job and was not able to find anything except flipping burgers at McD, it doesn’t mean he is no longer interested in work because he doesn’t want to work for minimum wage.

That “low” unemployment number published by MSM is a TOTAL BS. Without the additional 10 Trillion dollars borrowed by Obama in 8 years the economy is in Great Depression. How any president (including Trump) is going to pay higher interest on 20 Trillion and do anything for the younger generation is beyond me.

All the imperial wars (always paid for by the middle class for the bankers) and globalization will decimate the middle class to extinction. All that has to stop.

The low unemployment number published does not fool any person with 2 functional brain cells. It is a numbers used ONLY by fools and retards.

I wouldn’t say that the unemployment number is for fools. At worst you could call it a measurement that doesn’t hold much meaning these days when presented in a vacuum. It is just misrepresented and parade around as some magical number that says everything is great for everyone. When we really it is more or a half or quarter truth.

Job markets do appear very good to some of us depending where you live and what kind of work you are trained for. But just as many other people are underemployed, dropped out of the job market and not being counted, or in a profession that is rapidly drying up.

Most k-12 public education as we know is paid for by local taxes, with some trickle down funding and rules from the fed which generally harm the function of the poorest districts while most with wealthier districts already over perform and get full funding. We are basically still in the zip code lottery which is only winnable if your family is sitting somewhere in the top 20-30% of the income bracket.

I haven’t seen anyone get excited for any reform or programs for K-12 under the last 2 presidents at the federal level and this one isn’t shaping up to make anyone any happier.

Having gone to a poorer school district k-12, as long as the school is physically safe, you can still do just fine if you have a stable life at home and access to the libraries and the internet. Premier high schools are a overrated. With motivation and support you can still get into decent state colleges right along side the people who went to the better k-12 programs.

I blame all those EST seminars they went to in the 70’s and 80’s, not to mention all the self help books. “It’s good to be a selfish prick.” “You should strive to be a selfish prick.” Go ahead, get that divorce, you need to “find yourself.” Of course they were just searching for what they wanted to hear. You can have it all. Fast forward 20+ years and their kids (my age group) are tatted up emotional basket cases.

Isn’t that sort of the underlying theme of this blog? We’re living in the aftermath of social changes that happened a long time ago. That generation will be very hated when it passes on. Locusts who left us with nothing.

“Who moved my cheese” = My cheese! Mine!

“what color is your parachute?” = F-You I have mine! Let me watch you hit the ground!

I’m not sure what the term is for my parents, born 10 years too early to be Boomers and 10 years too late to serve in WWII. In other words, born in the mid-1930s.

I know the term “me generation” was bandied around when I was a kid, in fact anyone with a functioning memory will remember that term as being very popular.

In any case, while my parents were busy raising us by the time the hippies were turning on, tuning in, and dropping out, we certainly had a lot of weird self-help books. There were some by some hairy ol’ psychologist guy named Fritz Perls, who I think was the model for “Dr. Marvin Monroe” in the first season of The Simpsons. There was one about the art of intimidation, with a little picture of a turtle wearing a red tie. Remember that before the hippies, who were Boomers, there were the “beats” or “beatniks” and they were big on living at home, hitch-hiking across the country, playing bongo drums (badly) and reading tons of goofy self-help books.

So I think the “me generation” may have been boomers and the tail end of the pre-boomers.

Now if we can just figure out who in hell the Pepsi Generation were supposed to be. Bet they spent a lot of time in dentists’ offices.

“Fast forward 20+ years and their kids (my age group) are tatted up emotional basket cases.”

I blame it on cable tv, beginning in the 80’s. MTV did not help! Our culture slowly but surely was defined downward, ignorance and illiteracy was celebrated and elevated. A whole generation grew up with this cable TV nonsense becoming their reality…

35 years later, here we are – a game-show host, who can barely form a sentence, as our President. Ain’t life grand.

Alex, your parents belonged to the Silent Generation: https://en.wikipedia.org/wiki/Silent_Generation

http://www.wisegeek.org/what-is-the-silent-generation.htm#didyouknowout

http://study.com/academy/lesson/the-silent-generation-definition-characteristics-facts.html

While the dates vary, I’d say the Silent Generation are generally those who were alive during World War 2, but too young to fight in it.

Some call the Silent Generation the Lucky Generation — luckier than the Boomers: http://www.stltoday.com/business/columns/david-nicklaus/financially-speaking-the-silent-generation-is-the-lucky-generation/article_10a81c5a-bbe3-59af-8618-6dca77b758a3.html

…Silent Generation, born before and during World War II, won the birth lottery in several ways. Birth rates were low during the Depression and the war, so a scarcity effect helped push up wages when the war babies entered the workforce in the 1950s.

They also were lucky enough to come of age when American industry dominated the world and unionization rates were rising. And they were lucky enough to retire after the introduction of Medicare in 1965 and inflation-indexed Social Security benefits in 1975.

Most of them were out of the workforce by 2008, when the Great Recession hit. Heavily indebted Gen Xers saw their home equity evaporate, and many younger people who lost their jobs still haven’t recovered.

Son of a landlord – That sounds about right. And “lucky” is right too, since ideally, I was telling a Boomer friend a while back, you’d get born near the end of the Depression, be in time to experience the “Neat-O” things about WWII while being far too young to fight in it, then catch the gravy train that went up and up from the end of WWII up into the mid-70s, be retired by the time “the last good time”, the 1990s, were ending.

Of course my parents ended up poor, the 1970s were a hard time and it only got wore from there. Idiot Dad decided he was going to program computers, when he had some pretty decent carpentry knowledge. I mean, program computers if that’s what you want to do, but don’t bring kids into the world if you’re going to be that irresponsible.

“the imperial wars (always paid for by the middle class for the bankers) and globalization will decimate the middle class to extinction. All that has to stop.”

Flyover,

Will wonders never cease? I actually agree with you!

Dan, why the wonder? I am always consistent in my message. I am not for republicans or democrats. That is childish.

My message is simple – against the F.ED (banking cabal, financial arm of globalists), against CFR (the political arm of the globalists) and for the US and respect for it’s constitution. What’s wrong with that? Do you like our current economy dominated by FIRE?

Yup, us boomers ate our young. This boomer saw it coming, when Reagan & Tip O’Neill changed Social Security in what, 1983?

Former Texas Governor Perry was right — Social Security IS a Ponzi scheme. Still, after paying outrageous payroll taxes to keep it going, we will be dependent upon it in our, er, “Golden Years”

That’s why I didn’t want kids, and the kids who were spawned from my generation are certainly wise not to have any more. I feel sorry for them. Our parents truly were the “Greatest Generation,” the pinnacle of the Western standard of living. It has been and will be all downhill from there.

I get frustrated when the Ponzi Scheme meme gets brought up when discussing Social Security. I did the math and what I have paid in the last 40 years compounded at 6% is pretty spot on. I know the recent years are much lower but the ’80’s were triple that. I think the problem is Social Security is funding dubious things like Disability and being in the General Fund dilutes it. Why can’t we discuss outright handouts as “running out of money”?

I think the Millenials are suffering from having it too easy. The Greatest Generation was toughened by the Depression and WWII. We Boomers had it too easygoing also. Vietnam didn’t toughen most of us, it just taught us progressive thinking and marching. Many of us became soft and raised softer children. There’s few with an understanding of discipline and delayed gratification. Many can’t budget, save, or plan well.

I think this will raise generations of renters because that becomes the default when your folks throw you out or pass on. I’m in the North Bay at the moment and there is so little for sale that once a home comes on the market it gets snapped up quickly – at full price or more even as it cools down elsewhere. A house a few doors away went on the market for a couple weeks was purchased and then listed as a rental. Still the numbers are weak. Buying a house for $600K and then renting it for $3000 seems quite a bit underwater. Maybe betting on the future?

Fensterlips – this is why we lost bigtime when Gore didn’t get elected with his “lock box” that’s the idea of the century. Social Security would be just fine if it wasn’t being raided for a lot of other things.

Noodle, I couldn’t agree more. We are a generation of locust. I was born in 1962 to parents who were raised in the depression and then went to war. Their generation built: we consumed. And for that matter we have hypocritically become what we stood against.

Housing To Tank Hard in 2017!

A sad state of affairs! But, let’s not blame it all on the new economic reality! The breakdown of traditions, values, and a general dumbing down of society, has contributed as well! While no doubt, the new norm of economic realities are harsh, it is just as true that many use this as an excuse! Just look around and you will see some very highly motivated people working in technology, medicine, many are of immigrant families, who get the American Dream, and succeed! Then look around at all those wallowing in self-pity, making excuses, who seem to find time to protest and complain, but never seem to be just worn out from a long day at a job!

Those “very motivated people” have their whole family backing them up. They came over from Viet Nam or what have you, and you know what? The kid wasn’t pressured to get out working a job from age 15 on, as long as they studied, Mom would feed them sandwiches and tell them what good kids they were. They were not pressured to get the hell out of the house when they were 18. If living at home until their mid-20s got them that PhD, their parents were behind them 100%. Their parents busted their asses to create conditions where their kids could do better than them.

Compare and contrast your standard American kid. Pressured to work a job, go mow lawns, whatever, and studying too much makes you a “nerd”. Think you’re gonna get to save that money from mowing lawns for college? Think again! Think going into the sciences, or something like becoming a CPA is cool? You’ll be pretty alone in that, because your Dad played football and by God you will too. And once you’re 18, you’re kicked out of the house, or nagged to leave the house so much you leave anyway – your parents want to “live life” and there are all those EST courses to take. And cruises. This kid has to borrow money to go to college, and more so, has to borrow money so they can live while they go through college.

And people wonder why we stick our parents into those awful care homes and hardly visit them.

JNS, you are perfectly right in your assessment. I am an immigrant (legal) and when I came to US I was shocked by the moral crisis (full definition) here. The economic crisis we have is a direct result of that moral crisis at all levels in the society. You can not fix the effect without addressing the cause.

For Alex – you are totally wrong. If you think that help from the family is monetary, you don’t know what you are talking about. The parents where as poor as they can be and they died poor (too old to learn the language to take advantage of the opportunities here). However, I did have a greater inheritance from them – to know right from wrong and have common sense. Those values learned from parents and a stable family with a mother and father where worth more than all the money which can be wasted on drugs. That’s where the democrats did the greatest damage to the blacks. They replaced the father with the state and everything went downhill from there. No amount of money the government spends will fix that. The blacks bought a lie. The government help didn’t give them freedom; it gave them bondage on the democrat plantation. They are not poor because of millions of whites like me who came here after the slavery was no longer in place. I don’t owe them anything. They had the advantage of knowing the language which I didn’t when I came here. It is true that my non monetary inheritance was far more valuable that the language.

I went to university with zero money from my parents, in a different state, worked hard while in school and borrowed the difference to have some time for study.

Flyover – First, where did you immigrate from? And how do we know it was legally? I’m 4th generation on my mother’s side and apparently all the way back to the Revolution on my father’s side, so you’re going to have to explain yourself to me.

Secondly, you read what I wrote wrong. These families are NOT rich, what they’re giving their kids to a bunk bed that won’t go away, sandwiches that will always be there, nagging that will never happen (except nagging to get A’s, the best kind of nagging). It doesn’t take a lot of money, at all, to help a kid all the way up to PhD.

Going to college costs a lot. We all know that. But costs are doubled at least for the average American kid with a “fuck you, I’ve got mine” family. But the Joe Blow Vietnamese family doesn’t roll that way. They’ll let the kid stay at home, where will always be some rice and pork and cabbage, if the kid earns any money it’s not taken from them; they get to keep it, etc. These things do not cost a lot of money. As I keep saying, if the average set of parents will let their kid live in the garage and be in line before the dog for table scraps, the kid can get through college very easily. Guess what? The average American set of parents do NOT do this. It does not take a million dollars to produce a 20-something PhD. It just takes thinking in terms of the family, rather than just for yourself. And guess what? You help your kids, and your kids will help you out when you’re old, instead of sticking you in some low-budget old folks’ home to rot.

The difference isn’t financial, it’s cultural. This everyman-for-himself American culture deserves to die.

“First, where did you immigrate from? And how do we know it was legally? ”

From East Europe. I could not swim over the ocean to come here illegal. On top of that, I would have been killed by the communists at the border before even leaving the socialist paradise you so much desire.

While some parents helped their children (I don’t deny it), I was not helped. Like I said, I lived in a different state and I supported myself. The help, is just help even if it comes.

Since coming to US I saw more children born here being helped financially by their parents or grandparents that children from immigrant families – for the simple reason that the first generation does not have too many financial resources. And I exclude the children from the Chinese Communist elites.

Coming here legally it helped and I agree that it was a tremendous opportunity to be able to work legally, a privilege most children here take it for granted. For that I am most grateful to US government during the Reagan era.

Flyover it sounds like you came here in the 80s or came of age in the 80s. The 90s were “the last good time” it was possible to do all kinds of things in the 90s, and the 80s except for a short depression in 1981 or so, were a great time too.

Bush tanked the economy so badly, that we’re in a completely different regime now. Obama was able to keep things from becoming an utter smoking crater, but now we’ve got Reagan’s retarded cousin in the WH and who knows how bad it’s going to get.

Alex in San Jose, you can’t really blame Bush alone for “tanking” the economy. He inherited the Dotcom Crash. And Clinton helped set the easy lending practices that led to the Real Estate Crash in 2008.

I know those of us who were adults then will look fondly back on Slick Willie’s time in office, but yes, he presided over the dismantling of many New Deal regulations on banking and that’s come around to bite us bigtime. I’m really hoping Chester Cheeto to Orange Plague gets an advisor who’s a big New Deal buff, because all of those 1930s New Deal restrictions and regulations were put in place because of a crying need for them, and we’re only going to get back on an even keel when they’re back in place.

BTW JNS,

Sorry to dredge up your comment from the previous DHB entry, but I think it’s worth pursuing. You had stated in regard to CA income tax that: “the average income tax rate is 7.5%, higher than any other state”. I did a quick calculation using the current CA tax brackets and a total tax rate of 7.5% requires an income of about $143K for a single filer – somewhat higher for a married couple. I hadn’t thought that our average income was this high in CA, but maybe those Silicon Valley billionaires bring it up.

In any case, my point is that while the highest state income tax rates are indeed very high in California the tax brackets are structured so that people in the middle income ranges are taxed rather mildly. I found this out when looking at retirement options from a tax perspective. If your earned income is low (i.e. if you’re working class or living off savings and investments as a retiree) California’s overall tax rates aren’t particularly high. (and BTW I’m one of those scrupulously legal fools who pays every cent of the taxes he owes every year)

This isn’t a liberal or conservative position – it’s just numbers. You may very well be correct regarding the long term implications of California’s debt, but it’s taxes just don’t aren’t that bad unless you make a pile of money.

Now that Trump is in the white house, interest rates have gone up. But, surprise surprise. Home sales are surging on the higher rates. The lower end of the market, which means under 1 million, is red hot, as long as the area is safe.

Once Trump removes illegals who are felons, dangerous areas may become much safer and those prices will surge. You should try to figure out which areas will improve. I would think the area of Santa Ana close to Costa Mesa will become desirable and gentrify quickly once the illegal felons are removed. People will be making some big money here.

http://static.giantbomb.com/uploads/scale_small/0/26/9976-koolaidman.jpg

Nope…housing bubble peaked and market is on the way down. Nice try though.

Amen. It’s going to probably be the stock market / Increasing rates that brings down the housing market this time. I usually don’t like to link to Zero Hedge, but thought this graph was worth sharing;

http://www.zerohedge.com/news/2017-01-25/how-much-longer-can-market-go-without-correction

Brian,

You don’t have to excuse yourself: “I usually don’t like to link to Zero Hedge, but thought this graph was worth sharing”

I would quote anytime from Zero Hedge than from CNN, CNBC, MSM, HuffPo, NY Times, etc. Why would I be ashamed to quote from a media who is not PC and be OK with MSM who deliver only lies and propaganda???!!!!…I don’t see any reason, unless you want to be PC, eat BS all day long and say that you like it. Personally I would not fall for that. I lived under communist propaganda a good number of years and I left because I could not eat BS all day long and say that I like it. I didn’t come here to have the same BS served daily by MSM.

While a couple of the MSM channels have skewed liberal, like MSNBC, in order to match FOX, much of the MSM is pretty centrist.

Zero Hedge is certainly far right. I read it every day, because I try to get a balanced combination of news from various places, but I see them skew right and/or not report certain things all the time. I think Wolf Street is a more balanced source, but caveat emptor.

Im a millennial. Have a job making 90k yr. Live at inlaws apartment home with my wife of 8 years and 9mo old son. Wife is a self employed veterinarian. We went to community college, 2 yrs, 2 years at a state school with no debt. Wife went to grad school @ UCD which cost 120k. Had to go into debt, and pay way more than baby boomer ever had to to buy a home. Tuition cost was 3x more than 10 years earlier. Piece of shit homes sell for over 500k in a shitty school district where i live. Why would i buy a pos when i can live with family, invest in a business, get out of debt, save money and wait to get somthing i really want? Its not that i dont want a home. I owned one, which i bought at the bottom of the market, and recently sold. Ill wait and buy a home in the next crash that is under 1500sf. Why anyone would want somthing larger is a mystery to me.

“Why anyone would want somthing larger is a mystery to me.”

-Cus this is ‘merica. Land of hummer’s and more guns than people. I like to go on the talk irvine realestate blog;

http://www.talkirvine.com/index.php?board=5.0

And it’s pretty much nothing but the ‘buy now or be priced out forever crowd’… It never ceases to amaze me the power of groupthink. I posted how I had just gone biking around half of Irvine, in particular around where most of the new construction is taking place, and how much land they still have to build on, and how a lot of it is being built near one of the top 10 landfills in the country, with another 20+ year expected lifespan;

https://goo.gl/photos/GVbp41Cmejp9LtPz9

But nobody wanted to hear how I will just wait patiently until prices get closer to $350/sqft for something in Northwood (no HOA/MelloRoos) or $300/sqft for some of the new construction (not near the landfill)

@HappyFamily, could not agree more. I am millennial too, no debt, make good money, great credit score. The last thing I plan on doing is becoming a debt slave. Buying overpriced crap shacks makes no sense. You save a ton by renting and just have to wait it out until the market crashes again. Nobody believes the BS of “buy now or be priced out forever”…..I rather believe in make this market great again (by crashing it).

You mean you’re not willing to plunk down the necessary $100+K just for the privilege of obtaining a 30-year mortgage that is supposedly equivalent paying to rent? <>

Too funny. RE shills have been saying that millennials were ready to get off of the sidelines for 8+ years.

I do hope millennials stall the market. An over tapped generation should slide us all right into their reality.

I am right on the cusp of GenX/Millenial, and my wife and I are in the same boat. I am simply not wiling to buy when this out of whack from rental parity. I’m getting a 2br/ba for about $2/sqft a month, which would saves me about 50% for the monthly nut on a comparable mortgage, HOA, property taxes, etc… and that’s after putting 20% down. That’s not the part that bugs me though, it’s that there is a high probability that the next correction will occur before I would want/need to move, but would be immediately underwater with just a 15% correction when you count for RE agents commission if/when it could be sold.

And for those that think we are close to rental parity now, think what will happen once interest rates rise, MID becomes largely moot, and people no longer believe in home values continuing to rise in perpetuity. I mean, seriously, look at this @$$-

https://www.redfin.com/CA/Irvine/58-Livia-92618/home/45378806

Date Event Price

Jan 17, 2017 Listed (Active) $1,849,000

Jun 25, 2013 Sold (Public Records) $1,198,500

Trying to make an 80% return, or 26% YoY. Market rents have only gone up about 10%, it’s insanity.

Forget about Millennials, what about all the Gen X’ers who are living paycheck to paycheck and still renting well into their 40’s because they can’t afford to buy? I personally know many Gen X’ers who already bought and lost homes during the last crash and some who just can’t come up with an adequate down-payment for their first starter home. One difference I see is that GenX’ers generally follow the baby boomer generation in having a strong desire to get married, have a family, and purchase a home ASAP, while the Millennials seem to put less emphasis on these things or delay them all together.

“I’m getting a 2br/ba for about $2/sqft a month, which would saves me about 50% for the monthly nut on a comparable mortgage, HOA, property taxes, etc…”

This sounds like you are taking gross numbers when doing your rental parity calculation. What about principal and tax savings? And until there are changes to the tax plan, all we are hearing is rumors. Base your decisions on facts. I assume you are prepared for yearly rent increases also and have added this into your calculation.

Despite fear and uncertainty, socal RE was a smoking bargain just a few years ago. And we had/still have people crying the sky is falling. I’m not a buyer right now, but a 20% decline would get me back into the market.

Same boat, I hate hoping for a crash but prices are just wacky in San Diego. And I refuse to listen to real-estate investors telling us to buy now or forever be priced out bullshit.

Just gonna keep saving and their will either be a correction or I will take our money and move to a city with sane prices when the time comes to buy.

“…under 1500sf. Why anyone would want somthing larger is a mystery to me.”

Because entertaining 20+ people in a 12×14 living room and/or a 10×10 kitchen is a pain in the ass for hosts and guests alike.

That said, I will be retiring in 1,200sf or less.

Good point, however living in California or another mild climate area it is nice to take it outside. I suppose in other climates some more SF is justified.

Housing to crash soon due to these reasons:

1. Mortgage rates going up and will continue to go up.

2. Trump halting Obama’s FHA mortgage insurance cuts.

3. Trump defunding sanctuary cities (LA, San Francisco)

4. Under the new Trump tax plan, Mortgage interest may not even be tax deductible.

5. Wages are flat.

Housing to crash soon (?) due to just this reason: Wages are flat and flight of high paying jobs…

And also because manias tend to end badly….

OTOH; cutting taxes (both personal and corp) = more disposal income and more jobs.

That means more demand and higher prices.

“OTOH; cutting taxes (both personal and corp) = more disposal income and more jobs.”

Those claims have been debunked so many times. Many corporations have been paying 0 taxes for several years. And personal tax rebates have usually gone towards paying down debt. But job and income growths have continued to weaken after each subsequent recovery for the last 2 decades. Globalization and technology has ensured that capital would flow to the cheapest labor markets (obviously not the U.S.).

“That means more demand and higher prices.”

RE and stock prices are currently as high or higher as they were prior to the last economic downturn. Yet the participation rate (demand) in either markets have been lower than during the last cycle. The current “recovery” has far more to do with financial engineering (artificially low rates and over-speculation) than with consumer demand.

Obama’s FHA Mortgage insurance cut proposal was never even implemented. So it affected no one and thus will have zero impact.

I have 2 daughters, both in college. One is an engineering student, the other majoring in media technology. Both want to live and work in the city and neither wants anything to do with owning a home. In fact they don’t even want to own cars. They see them as an economic drain and would rather rent them as needed. Young adults see the world in different and in somewhat more sophisticated ways than my generation did. Mobility will be the key to job security in the future. It already is. Home ownership will become an impediment to going where the jobs are or where the next promotion leads too.

Blackstone/Invitation Homes 50,000 SFH rental business is having IPO next week with the help of Fannie Mae. Even the US government thinks housing is unaffordable and is betting on a booming rental market.

http://www.housingwire.com/articles/39026-blackstones-invitation-homes-prepares-15-billion-ipo

http://www.cnbc.com/2017/01/25/governments-fannie-mae-will-back-pe-giant-blackstones-rental-business-debt.html

For housing cheerleaders, well the final data is in and Janet Yellen’s “hot†economy is a disaster. The US finished 2016 with GDP growth of 1.6%.

This is flat out embarrassing. And it confirms what we have suspected all along: that the 3Q16 numbers were completely fabricated in an excel spreadsheet for political purposes.

This game is run every election cycle. This time around it was just worse than usual.

By the way, the 4Q16 GDP numbers were largely generated by accounting gimmicks as well. Without the inventory buildup and healthcare (Obamacare) real GDP growth was 0.7%. Put another way, without companies stockpiling stuff and Government mandated socialism, real GDP was barely positive.

Let’s be blunt. The last 8 years were an economic disaster. End of story.

This is not a political attack. This is an attack of this fantasy land nonsense that somehow the numbers are GOOD.

Let’s run down the last 8 years in numbers. Since 2009, the US debt has risen by $9 trillion, doubling. Bear in mind, this debt increase occurred despite record tax hauls from 2013 onwards.

Put another way, even while taxes raised more money than ever before, the Government still found a way to grow the debt to the fastest pace in history.

The wonks like to point out that 11 million jobs were created during this time period.

But with the debt increase this comes to ~$900K spent per job created.

If your idea of success is spending $900K to create a single job… with the odds being that the job is part-time (94% of all job creation were in part-time positions), you should not be allowed anywhere near the economics profession or any kind of Government advisory role.

Again, the math process, point blank, states that the last 8 years were an economic disaster. Sure, if you live in a Keynesian echo chamber where you don’t get fired no matter how wrong you are, this looks fine.

Anyone who ran any business like this would have been fired or gone bankrupt LONG ago.

I agree with all that except your last sentence, “Anyone who ran any business like this would have been fired or gone bankrupt LONG ago.”

The problem is nobody has been held accountable for anything for a very long time now, and if any of these CEOs or leaders are shown the door, it is usually with an absurd compensation package to reward their failure.

I have been saying that for years; nothing has fundamentally changed in our economy from Bush to Obama, in fact it has accelerated the decline of the middle class with the ACA. No body could figure out where did all the gas money savings go, i will tell you where, medical insurance premiums and deductibles, higher gas and electric, higher housing cost, higher education cost.

Us to be a time when state and federal parks were free to go to, now you have to get a permit to park or to camp, not to mention all those security fees when you travel. Heaven help you if you get a traffic ticket, I know people that have been ticketed for not coming to a complete stop before they make a right turn and are hit with a 600 dollar ticket.

When you add up all the nickel and dime ways the state and the fed tax and fee you, no wonder why the GDP number won’t budge, there is no extra money for personal consumption.

Reagan liberalized credit cards and that led to a boom in the 80’s, Clinton liberalized HELOCS and the banks and that was the boom of the 90s and Bush W put the housing bubble on steroids with his goal to make everyone a homeowner. In the end it was all about debt and finance and we are still trying the same thing with cheap money.

If I saw some big beautiful Obama Road or a Obama train or Obama airport, I would say, what a waste of money, but at least I have a new Obama express lane, but I don’t even have that for all the money spent.

Nope.

The “wonks” like to say things like “The last 8 years were an economic disaster. End of story.”

Seriously dude? You’ve sourced one set of numbers and claim you’ve won some mighty economic argument?

I, for one, am tired of Flyover’s constant self-congratulatory drivel about “only reading true and non-MSM news” …. so is he here looking for a medal, or a pat on the back?

Either way, alex in San Jose is a much better and more interesting troll. Go Alex!

Congratulation! You won! Are you happy? Does it make you “FEEL” good?….:-))) Today, everyone gets a prize for being present and believing in unicorns.

Or, are you upset because I did not explain more about how this fake economy works??!!!

Do you want me to post books on this blog? The Doc would not let me – I am already taking too much space as it is. My purpose is to give food for thought for those with inquisitive minds and prompt them to do more research on their own; I guess the Doc is doing the same thing. He was writing for years and he just scratched the surface. All you see is the tip of the iceberg.

For those who just like to “FEEL” good, I am sorry – sooner than you think you will have a rude awakening. I had those before, and from my experience ignorance is not bliss.

It’s pretty clear who’s the snowflake.

11 M new jobs over 8 years equates to an atrocious 114.6K jobs/month. It is a much lower than what is needed to keep up with population growth. Concurrently, income growth for the 99.999% has been relatively stagnant. With consumers clearly tapped out economically, it can be concluded that much of the asset price inflation has been powered once again by unconventional, unorthodox means (cheap and easy debt for speculators and investors).

Don’t put too much heat on Obama’s economy or the snowflakes will melt. If you bring too many facts on the table their head will explode.

Seems like California is exploring succession from the Union.

It is already a third world nation, is there such a thing as 4th world country?

It’s secession not succession.

As a real estate owner of 3 CA properties, and experience in both the commercial and residential mortgage field, I always find this site amusing. CA real estate and frankly nationwide there is a cycle of typically 7-10 years. Therefore, it’s very easy to predict that there will be an adjustment (referred to as a bubble here) since it is guaranteed to happen. I do agree that there are over zealous folks who think they can flip a bunch of SFR’s and then get burned. We all saw what happened in 2008. But don’t let the doomsday posters scare you from buying property. If you are a typical W2 employee, you will never obtain true wealth just by saving. If you make 450k gross wages, you will net only 279k in CA! It will take you decades to save up for a commercial property, and probably at least half that time to buy a primary home! Every day, I see tax returns and financials statements with real estate investors with $10-100 million net worth. And yes, the ones that are super leveraged risk getting burned when there is an adjustment. But even those guys are back from the 2008 slaughter and have re-build wealth. Use good judgement and common sense of course, but don’t try to time the market. If you can afford to buy real estate now, buy it! The same folks that said they would wait in 2014 are kicking themselves now! Yes, you be unlucky and perhaps there will be a correction of 10-15%. Guess what? If you can afford the payments, and you have increasing rents every year, you will be fine!

Meloman Aste….trying to follow your post but you are all over the place. Lets see if I can decipher it….you are basically saying:”Don’t time the market, buy now. RE cycles of 7-10 years are guaranteed but the next downturn will only be 10-15% so buy now” Aren’t you contradicting yourself? According to your expertise we are close to the end of the cycle which brings potentially a 10-15% correction but we should buy now?

In addition, you are stating “True wealth cannot be obtained by saving money”? So, buy that overpriced crap shack now to get wealthy because your saved cash is false wealth? May I ask what you do for a living?

Lets see if I can decipher it….

It’s let’s not lets.

Let’s is a contraction for let us. You’re essentially saying, “Let us see if I can decipher it.” So you can either write let us or let’s.

Awe millennials, got to love em’! Thank for taking a few points that I was trying to make and mushing them all into one that allows for insults and sarcasm! You are so smart and witty! If your attention span was better than a lab rat, you may have been able to dissect the points I was making a little better. You know what, stay renting in your loft for $3000 per month that offers all the amenities someone with no social skills appreciates. Keep believing real estate is overheated, and stay on the sidelines. And when the market corrects, you will be saying the same thing. “It’s going lower, its overpriced blah blah blah”…as you pass up another cycle. You have the business acumen of a ground squirrel. Let’s face it the real reason you won’t buy an “overpriced crapshack” is because YOU CANT AFFORD IT.

Too funny. Another RE bull who believes that the next RE correction will be capped at 15%. Is that part of the RE investment handbook? BTW, rents can go down — look at the S.F. and NYC markets.

Ever consider stocks and bonds as investments? They’re liquid, offer a higher ROI, offer diversity, and provide better returns. Warren Buffett’s portfolio would attest to that.

An income of $450k is 1%’er or even 0.5%’er territory. Believe me those richies have ways to avoid paying taxes at all. What you’re talking about are things no real person has to worry about.

Hey all! I’d like to chime in with another perspective from a millennial in the Bay Area. The career trajectory of many millennials took a fat kick to the pants from one of the worst financial crises in generations. Of course that’s going to impact household formation in the medium term. But I think the impact will be fleeting.

Look at that last graph. The trend line starts to dip in 2013 and then stops, 3 years short of current. Since that time the regional economy has grown. Flyover, I agree this has come at an exorbitant cost, but before getting into a macroeconomics debate that will make me sad, let’s just note that asset prices skyrocketed and job opportunities flourished in the Bay Area between 2013 – 2016 compared to say, 2009 when you see the biggest jump in “parent housing.”

Since then there has been regional wage inflation, and six figures is not the milestone it once was. Heck, it’s basically a mid-level SF corporate salary. (And I’m not talking median salary here – clearly not all of the 3+ million bay area residents over median income can afford to get into the market). So we end up here; down payment plus an emergency fund for a $700k home is not a stretch for a fortunate and frugal dual income couple that saves for a few years. Nope, it’s not cheap. Yes, this means they are commuting. But we are talking first time home buyers in one of the most expensive parts of the country.

I’ve heard parallels drawn here to 2007. But to borrow a popular phrase on this site, people have short memories. Bubbles don’t always result in 30%+ nationwide declines – they rarely do. More commonplace are 5 – 15% local dips, which today would net you allll the way back to… mid 2015. Show me a market with absurdly high turnover, IO/negative amortization terms, grossly underqualified buyers combined with zero lending standards, CDO’s insured without regards to risk, and I’ll change my tune.

Just like I’d imagine in any era, buying a home is a personal decision. You have to look at your family’s situation/needs and crunch the numbers. Good luck to everyone out there with your real estate strategies… imma eat some tacos!

Your whole argument is based on this:

You take the historical data and extrapolate to the future. Many investors do this.

I don’t think you can extrapolate the historical data to the future because we had a major shift in the last decade in how this economy is run. As an example, look at Japan. The last 25 years is nothing like the previous 25 years. Why? Major shift in the way the economy got manipulated.

Like I said many times before – we live in a debt based economy and there are limits in how much debt can be serviced in a global economy. We did not have this before 1913 with the creation of the FED and the madness went on steroids in 1971 when the dollar went off gold.

We no longer have money (money are a store of value) – since 1971 we have currency (no store of value) – just units of measurement (blips on the computer). Then, pushing the can down the road we did well using the credit card till the point that we can no longer pay on the credit card unless we borrow to infinity to keep the payments. For the debt curve look at the exponential curve to infinity after 1971.

It is something the US never had before, therefore you can not expect the same conditions in the next 20 years like in the past 20 years.

In short, Fed intervention has never been this blatant and intrusive in history. We are in uncharted waters where massive financial engineering is attempting to usurp consumer demand as the main engine of American economic growth. Thus this increased frequency in booms and busts where economic growth for mainstreet has been stagnant.

Flyover, it’s immigrants like you that make this country great (if your story of immigrating from E. Europe is true which I will assume it is.) The new patriots of America are not crawling in from the third world with TB and refusing to assimilate. It is people like you that work hard, embrace American exceptionalism, believe in God and grab your piece of the dream. Too many lazy Americans complain about how hard things are or how things are ‘different now’ and success can no longer be realized for any number of BS excuses. Props to you my friend.

PS Alex, I’ve become a multimillionaire exclusively through real estate since buying my first property in 2006 and profiting throughout the ‘great recession’-which I coincidentally I found to be quite lucrative. excuses are setting you back my friend. I’m sure you’re a good guy but you have such a defeatist mindset and will never succeed unless there is a paradigm shift in your mind.

Miyagi,

I told Alex many times, that his biggest enemy in life is his mindset. He doesn’t want to believe it and therefore doesn’t want to change his way of thinking. You have to be open minded for that.

My best years in business where 2009-2015 when everyone gave me thousands excuses why nothing works. I also made most of my money in RE. I am a RE bull and very bearish at this point in the cycle, like most bloggers here.

The only problem in my corner is the lack of a “small loan” of $1 million dollars, then yes, I too could make money in RE.

I really don’t care which if you writes the check, really, just stop talking and write the thing.

When I get something going I will do the right thing and take the business, and myself, out of the US.

There Alex goes again with an excuse. Now he needs $1M from someone and he will make something out of himself. Nobody gave me a cent, much less $1M, so you don’t need that to be succesful.

Alex have you read The Millionaire Next Door? If the statistic still stands something like 90% of millionaires in this country are self-made. Your greatest enemy is your defeatist attitude. But apparently, despite an onslaught of people telling you that, you refuse to acknowledge that you are your own greatest enemy.

A million dollars? Alex, you can buy a house in flyover country for about $5k down. Even if it was only break-even on the rent, someone else would be paying for it, and it would be an ATM for you in retirement.

I’ve been holding back but now I’m gonna make you all cry by posting this about your hero:

http://www.johntreed.com/blogs/john-t-reed-s-real-estate-investment-blog/61651011-john-t-reeds-analysis-of-robert-t-kiyosakis-book-rich-dad-poor-dad-part-1

BTW the author of that web page, John T. Reed, is someone I’d actually take advice from, since he seems to dispense actual advice not the tinfoil hat nonsense that’s peddled here.

And yes. People. Give me a million dollars. That’s how you all got going, you got some kind of family hand-out that you’ve told yourself isn’t anything, but with extremely few exceptions, people don’t end up owing much of anything without a substantial boost.

Alex:

A) I seriously doubt anyone here has any respect whatsoever for Kiyosaki. You’re imagining that they do.

B) Just because you don’t lift a finger to help yourself doesn’t mean everyone else is the same way and therefore must have been handed a huge chunk of money. When is the last time you took a free (or nearly free) class to boost your skillset? Or tried to learn a skill on your own? You disparage your dad for wanting to be a programmer, when there is no more easily obtained or marketable skill to have. No degree necessary. Have you applied for a new position (ANY position) since you found yourself living in a warehouse? I lost my parents at 15 and they left me NOTHING. I’ve worked my ass off for 30 years and will continue for 15 more. That has somewhat canceled out the stupid decisions along the way, and I’ll probably end up with a little into the 7 figures when I retire. Could have done a lot better had I been wiser in my youth. No handouts, ever. And you want that 7 figures for doing nothing? In five years you could be making $70k+, or you can continue stewing in your own bitterness and be in exactly the same place. Either way, keep your assumptions to yourself.

Too many people wait for that silver bullet instead of go out and find their ‘pot of gold’!!!

Great comment. Last spring I met a guy who had grown up in some war torn middle eastern country (I can’t remember which one) and had lived in Australia for a while and was now living in SoCal. He had his own business he was running remotely in Dubai and appeared to be doing really well.

As we chatted, it really struck me how incredibly grateful he was for the opportunity in this country. I remember him saying “God bless America” emphatically and with a grin on his face. He had a nice home and good schools for his kids to attend and he was GRATEFUL. He’d seen first hand the lack of opportunity that exists in much of the world so he didn’t take for granted the life he has in this country.

The Mizzou protests had had happened shortly before, so they were on my mind as we were talking. He honestly couldn’t believe it when I told him there are many Americans who don’t believe opportunity exists in this country.

This guy is the kind of immigrant that adds to America: he works hard and he’s grateful for the opportunity he has here. This is the kind of immigrant I’m a descendant of. My grandfather came from a family of Scottish coal miners – which is a hard life. He came here as a kid, served in WWII and became an engineer and built a really great life for his family. I don’t want immigrants here that just come to take advantage of all the “freebies”. I want immigrants who want to become Americans, who work hard to make something of themselves, and who are grateful for the opportunities this country offers.

The reason I am bearish at this point in RE cycle is this: