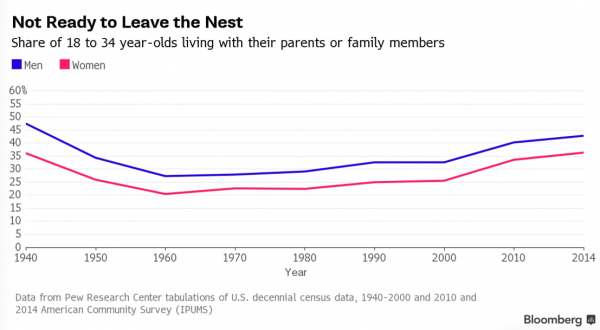

Millennials not ready to leave the nest: A record number of women age 18 to 34 living at home with parents. Millennial men living at home near 75 year record high.

The number of young adults living at home continues to hover near record levels. Just last month we found out that a record number of Millennial women are living at home with their parents. This dates back to when modern day record keeping began in 1940. Millennial men are tracking with this trend as well but are just a few points off the record set 75 years ago. In other words young Americans are having a tough time forming households. And this isn’t a shock for Los Angeles where renter households spend nearly half of their income on housing payments and makeup a majority of households. Those that buy inflated $700,000 crap shacks in many cases are spending 40 percent or more of their income on housing payments. In reality what is happening is that many young Americans are too broke to even set out to find a rental, let alone purchase a home. This is why the homeownership rate is reaching generational lows all the while investors are pushing up prices in markets with low inventory. Local families and young buyers are being priced out.

Millennials are staying at home in record levels

Part of the house humping meme was that young buyers represented this hidden treasure trove of pent up demand. Once the economy got out of recession, these young lustful lovers would get hitched and start popping out kids in their newly mortgaged property. The recession officially ended in the summer of 2009. Over six years later young adults are staying put at home in record fashion:

“(Bloomberg) Some 36.4 percent of women age 18 to 34 lived with their parents or relatives in 2014, the highest since records began in 1940, according to a report released Wednesday by Pew Research Center in Washington. While the share of young men was even greater at 42.8 percent, it wasn’t quite as high as it was some 75 years ago.â€

A record number of young women are living at home deep into adulthood. Part of this is a deep generational difference. Men are living at home in record numbers as well. Looking at more recent years you can see how prominent this change is:

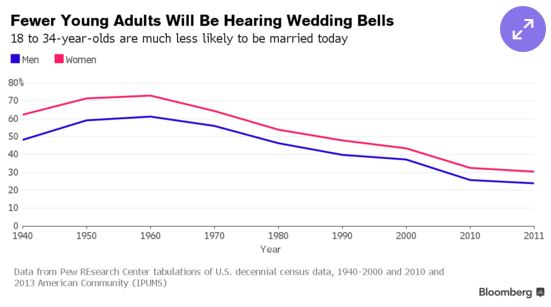

What is the point of taking on a ridiculously large mortgage if you aren’t even married or plan on having a small family? Younger people value mobility, going out, and education much more than buying a home. They also are putting off starting a family:

Young Americans today are less likely to be married than their counterparts of the 1940s and 1950s and they are definitely having smaller families. These are merely practical aspects. But more importantly, Millennials in many cases don’t have the money for rents let alone buying a $700,000 L.A. crap shack or a $1 million tech endorsed box in San Francisco.

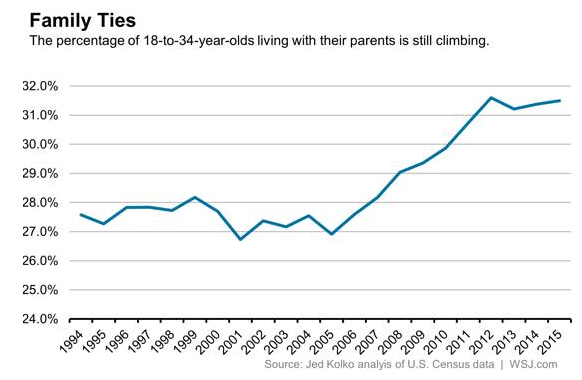

And Millennials that aren’t living at home are shacking up with roommates. This is happening nationwide:

“(5280) More millennials (typically characterized as those between the ages of 25 and 34) are living with roommates than ever before, and we’re pretty sure no one told them life was gonna be this way. Between 2005 and 2013, the percentage of young adults sharing living space shot up by nearly 40 percent nationwide, according to a recent analysis by Make Room, a nonprofit renters’ advocacy group. Almost 12 percent of Coloradans in this age group have roommates, a figure that ranks second in the country, behind Massachusetts.

Entry-level salaries and cost of living have always limited housing choices for young adults, and it’s likely that some elect to live with roommates simply because they enjoy the company. But these limitations can become self-reinforcing in cities with tough housing markets, leaving some young adults with little choice in the matter.â€

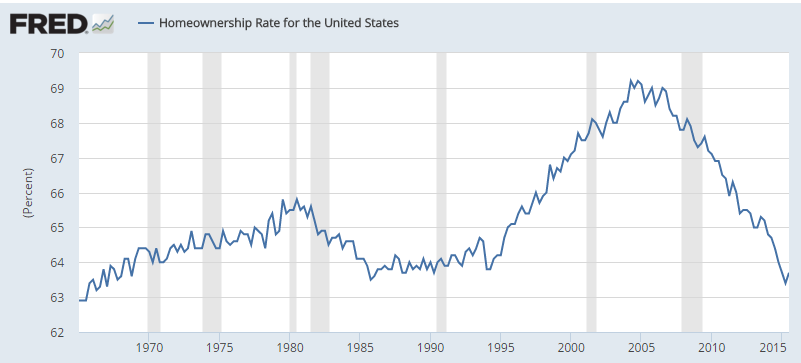

A large number of Millennials are living at home with their parents or out in rentals with roommates. Yet that massive “pent up demand†never materialized. This is why the U.S. homeownership rate has done this:

The US homeownership rate is at 30 year lows and near the 1965 lows as well. The reason prices have gone up recently is courtesy of low inventory, investor speculation, and foreign money in specific coastal markets. Also low interest rates have created massive asset inflation as investors chase yields and buyers leverage every penny they have to cram into the monthly 30 year nut.

And then we see that mortgage rates make their biggest move up in 2 years courtesy of the Fed now hinting at moving interest rates slightly higher. What is moving this market is massive speculation and young Americans are getting crushed in the housing market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

113 Responses to “Millennials not ready to leave the nest: A record number of women age 18 to 34 living at home with parents. Millennial men living at home near 75 year record high.”

It’s the Second Great Depression, what do you expect? We’re all living on Walton’s Mountain these days.

Alex, I agree with you, but I am a conservative. Your liberals, along with the savior from the WH don’t agree. They said we are in a recovery, jobs are plentifull and increase everyday, everything is better since we are blest with Obama. We just have to increase taxes and spend more and we’ll live in a Nirvana. At least that is what I read in MSM.

However, according to Obama, HufPo and all other liberal media all we have to do is to bring in few more millions from Middle East and south of the border and the economy will improve dramatically. According to them, more people means higher demand (regardless if they have money or not). I am sure if we add few more millions residents (when the number of jobs created don’t even absorb the natural growth of population) will help with wage increases. Based on the liberal media, the more people you have fighting for a limited number of low paying jobs the more the wages increases. Based on their “logic” (or lack of it) high supply of labor and low demand for labor increase wages. If the real life proves otherwise, just order minimum wage increases and the government creates miracles.

I am sure that Sierra Club is happy for Obama to bring more millions of people in US; after all they support population increase and for that reason they endorsed Obama for president.

I am sure that the union leaders are happy to see more competition on labor wages – after all they fight for higher wages and for that reason they endorsed Obama.

I am sure all this make sense to you because it doesn’t to me, and liberals and conservatives think oposite.

lately, it seems the conservatives only care about religion,sex guns. wall street has the “politics” of it under their belt.

Nobody,

In my comment above I did not mention anything about religion, sex or guns. However, as a typical liberal you are obsessed with all three.

If the liberals would just leave the constitution alone because it is the best in the world, then nobody would be discussing guns. Also, since the president promissed to uphold the constitution, he should be quiet and don’t bring changes to it. Actually he can not change it even if he wants to. All he can do is to trample on it.

Flyover – Fine, you vote for Hoover (Republican nutbag of the week) and I’ll vote for FDR (hopefully a ticket with Sanders on it) and lets see how we do. Hell, we even have a republican-started war against what amounts to Nazis; who else would shoot up a retarded care home and proclaim themselves heroes for doing so? So are we going to have another world scale war to perk up the economy?

Flyover – just because it may be the best constitution in the world, doesn’t mean it never requires revisions to keep up with modern times. The amendments are certainly valid, but with antiquated ideals since it was written 200+ years ago.

Flyover a few years ago the Sierra Club got in hot water for saying immigration should be stopped completely.

@Flyover. Get out of your bubble. Both parties are bought and paid for by the real owners of this country, the George Soros, the Koch brothers, and god knows since Citizens united. Most people I know who are liberal saw Obama for what he was before he took office. The fact that he kept the same stance on Fed / treasury policies should show any thinking person that wall street (and israel) own washingtion. Taxes need to be raised on anyone in the Forbes 400, and CEO compensation needs to go back to the levels around where it was before Reagan. We also need to get the SEC to prosecute fraud, and change capital gains tax, and remove loopholes like the carried interest tax.

Also, what do people not get that allowing corporations like Walmart (largest private employer in the US) to not pay a living wage is a direct subsidy to the Walton family and their shareholders, and board members (like Hilary) I don’t think the vast majority of people that are on public assistance, or relying on charity of friends and family want to, and would love a job that paid a living wage. That’s why minimum wage needs to be at least $15 and the government needs to be the employer of last resort. How to pay for it? Gut the military. Even the drone operators know its just making things worse-

http://www.workers.org/articles/2015/12/06/usaf-veterans-stand-strong-against-drone-warfare/

Jon,

I agree with you that the 2 parties in the present form are two heads of the same beast. The so called “RINO”s like BUSH, McCain, Trump and Romney do not have anything in common with the conservatives. The neocons are indistinguishable from the progressives. If you leave the rethoric aside, the agenda they pursue is the same – globalism and one world central bank.

You also said: “That’s why minimum wage needs to be at least $15 “. If you really believe that that $15 is better than $9, why not making minimum wage $50???!!!…. Wouldn’t that be better????…and if not, why???… Then maybe they can hope to buy a house….or will they?????!!!!…..

@Flyover

“Why not $50/hr min wage, why not $100?…” that rhetoric gets old, and is the same response always given to a very simple argument, that has a very simple answer.A $15/hr minimum wage would force employers to pay the MINIMUM it takes to not have the tax payers pick up the tab for public assistance; food stamps, housing assistance, etc… their employers would otherwise qualify for. Even the Washington Post and Forbes have published facts to this extent-

http://www.forbes.com/sites/clareoconnor/2014/04/15/report-walmart-workers-cost-taxpayers-6-2-billion-in-public-assistance/

https://www.washingtonpost.com/posteverything/wp/2015/04/15/we-are-spending-153-billion-a-year-to-subsidize-mcdonalds-and-walmarts-low-wage-workers/

-FTW

i turn on the tv,pick up a newspaper and read whats posted on the internet and then state a fact about the republicans. so,you being the conservative that you are (which is just a educated guess) call me a liberal destroying the Constitution. now read this carefully,your thinking of what you read in my comment is what is wrong with some people. critical thinking is a lost art that need to be taught again in our schools cause i read nothing in your comment that adds to the conversation.

Alex, when you say that this is the Second Great Depression, what do you mean? Are you saying that living conditions now are similar to those of the ‘first’ Great Depression? I haven’t studied the first in detail, but my image of it includes deaths due to starvation or homelessness. Are you saying that we’re now in similar times, or is it some other comparison that you’re drawing?

I understand that conditions are difficult for many people, but there are also many people doing well. I’m just saying that from the anecdotal perspective; trying to put together numbers isn’t worth the time as most all stats seem to have too much bias within.

if you look at the labor participation rate and the fact that if it wasn’t for welfare and social security and disability many more people would be homeless and hungry

Jeff there are a wide variety of metrics arguing just this. The number of homeless people, people living in cars, barns, sheds, shantytowns, etc. is simply amazing. The number of people getting by on irregular work, cash-only work and so on is astounding. If it weren’t for ebt cards, the breadlines would be around the block.

I feel like I’m in the upper class of my social stratum, but even I don’t have running water, own one pair of “go outside” pants, and will likely never own a car again, unless I get rich enough to buy a van to live in.

The signs that were are in a Depression are all around.

Jeff – On and were having a cold winter up here in the bay area. Even under a roof, I have to wear my knit cap to bed and have pinned a towel over the top of my sleeping bag for another layer of warmth. We’re going g to lose, I estimate, about 25 people to hunger and homelessness this winter, sad to say.

@Jeff, the second (technically sixth depression) depression has been papered over with debt and transfer (welfare) payments. Remember 46 million Americans are on food stamps aka SNAP/EBT. SNAP/EBT, and Section 8 has replaced the soup kitchens and tent cities of the previous depressions.

It’s the same thing on this site over and over again: Prices are ridiculously high and wages are just too low. The Soviet style command economy grip on the real estate market continues….anyone for a little communism?? (sarcasm)

Nyet, comrade.

I can’t speak for others but a return to a housing market with prices set by actual demand and not by specuvestors and furreigners (sic) would be a start!

god forbid price and value actually have a relationship!

BooshiDooshi – You know that would mean a Soviet style command economy, right?

Yuri we’re approaching the time when a large swathe of the public will realize they will be better off under socialism. It’s a big Monopoly game here.

Funny you wrote that on December 7, the day after Finland’s Independence Day. (Hyvaa Itsenaisyyspaiva to those of you who celebrate it.)

I would say that an incisive test of your hypothesis that everybody would be better under socialism has already happened.

You need look no further than the state of Finland’s society and economy versus, say, Latvia’s or Lithuania’s.

Finland was the only small Baltic republic to refuse to be subsumed by the USSR (though had fealty to The Neighbor forced on them after WWII) and to have fought bitterly to retain her national sovereignty.

Today, Finland’s GDP/PCI is just over $49,000 USD, Latvia’s and Lithuania’s, just over $15,000, Estonia’s, just over $18,000.

Finland’s is depressed relative to Sweden, Denmark, and Norway–Norway has all that oil bling, but Sweden and Denmark didn’t have reparations to the Soviet Union hanging around their necks after WWII for 40 years. Finland is still recovering from that.

Today Finland ranks continually in the top two or three of Transparency International’s assessment of nations’ corruption; Latvia and Lithuania never in the top 30.

http://www.transparency.org/cpi2014/infographic/regional/european-union-and-western-europe

Compare Russia and Eastern Europe:

http://www.transparency.org/cpi2014/infographic/regional/eastern-europe-and-central-asia

See a pattern here?

Scandinavian style socialism only works with Scandinavian ancestry/genetics populations. When you have any other genetic pool than one harshly selected over thousands of years for the traits of altruism, cooperation, honesty, forward time orientation, hard work, and K-breeding strategy, socialism quickly turns any society into nepotism, amoral familialism, and rampant, society-destroying corruption. Because what you end up with is people wanting gibs and never thinking about what they owe.

The idea that you can impose Bernie Sanders on Gabon or Belarus and end up with Vermont is batguano nutters. Christ, even Bernie Sanders didn’t want to live in New York City after growing up and going to college there. He got out to Vermont as soon as he possibly could (in his early 20s) and never left. He loves socialism but for some reason never returned to his grandparents’ Russia, eh?

The emerging issues are not left versus right, socialism versus capitalism, this party versus that party, or any of that 19th century political fossilthink.

The emerging issue is that THIS IS BIOLOGY’S CENTURY.

The nascent dimension of economic and social success isn’t political. It’s genomic. And it is batguano nutters to think that corrupt, violent, not-very-smart people will turn into Swedes or Vermonters simply by dumping them on Sweden’s or Vermont’s Magic Dirt.

The emerging issue is that the nations of the global South–after many years of demanding Europeans/Americans go away (horrible colonialists!)–now realize what a mistake they made in shedding the people who made the food and electrons appear as if by magic. So now they want to come North–as though the North will stay the North when it is demographically re-engineered by the globalizers.

http://thosewhocansee.blogspot.com/2015/05/why-re-colonization-future-orientation.html

California’s housing prices are nuts because people are willing to pay a premium for certain things. Blogger Steve Sailer (another son of SoCal) has done a very good job of laying that all out over the past 10 years or so.

I’ll stop now. As a quant and biology geek, and ordained minister in the Church of the Flying Spaghetti Monster, what I’m saying above is unlikely to reach people still grounded in 19th century romanticism about the blank slate nature of humans. This liberal creationism–the notion that evolution doesn’t exist where humans are concerned–is showing no signs of acquiescing. That concerns me way more than housing formation among millennials.

4% increase of a 16-year long live period… So, that’s an extra 8 months or so delay before leaving the parents on the average… If one spends 50 years of his/her life renting/owning, that translates to over 1% less houses needed in the USA. Guess it’s the same everywhere in the western world.

Oh we’re “ready” alright, but like you said options are slim. Moving to a less expensive town for many of us would be a career reset, and it’s hard to justify that. Also this survey doesn’t account for those of us receiving rent assistance from parents or not exactly living at home but living in secondary properties owned by parents while we scramble to save the quarter of a mil needed for a downpayment these days. Also not often discussed – many of us are self employed or hold non-traditional jobs which means we’re additionally asked by loan officers to have up to a year in cash reserves! We figured we can keep on with the tense parental judgement for another 2-3 years and get our own home (and maybe even take advantage of the bubble burst) or start renting now and effectively make our 2-3 yr buy plan into a 7-10 year buy plan. The FHA limit for LA is a joke, and if wages aren’t increasing and interest is going up, the gov should maybe revisit housing programs if they think millennial home ownership is important to the economy.

I disagree that the gov needs to intercede – there’s been enough damage done already. As a fellow millennial looking for housing, I feel your pain, but the whole approach to keep housing ‘affordable’ has done the exact opposite: all of these incentives only increase the sales price of the home while the monthly payment remains at the limit of what people can pay.

I’d like to see FHA loan limits reduced back down to the mid 400’s, AND I’d like to see down payment requirements rolled back up to 20%. Hell, let interest rates rise too. Obviously this is hyperbole, but something needs to change.

Nuke it from orbit, it’s the only way to be sure.

+1 for the Aliens Reference. I bought a home this past year but I would like to see this whole thing blown up and then some. I don’t know who it benefits. I just would like to see normal people buying homes and having neighborhoods again like when I was a kid. Today’s world just seems like everything is permanently temporary.

HB Reader: “I feel your pain, but the whole approach to keep housing ‘affordable’ has done the exact opposite: all of these incentives only increase the sales price of the home while the monthly payment remains at the limit of what people can pay.”

Isn’t it the same with the student loans? “We are from the government and are here to help you get in bondage/slavery to the banks” – for life.

I think that the student loans are the best possible deal for the banks: the only loan which can not be discarded in bankruptcy, super safe because it is backed by the taxpayers and high interest at the same time. Get the money from the FED for zero and lend them in super safe bonds guaranteed by the taxpayers – can it be any better than this???

We have the best governement the bankers can buy.

Flyover I hate the bankers at least as much as you do.

I’ve been thinking about this a few days and think I’m onto something. I went to college where, being white, I was in a small minority. Yet, I was only given, extremely grudgingly, the very minimum financial aid (this is decided at the federal level; if it were decided at the state level, whites would not go to college there at all). I was very poor, so I certainly qualified, and God good grades. There was, and is, a hatred of whites there, and I felt like I had to sweat blood to get the minimum help, but discrimination against whites is mandated at the federal level. So I have been thinking, why?

Yes, I must ask, why is this? Why did my nonwhite friends get money thrown at them, even though they were better off financially? How would the bankers benefit from this?

We whites are suckers for several scams, one of them being college. We do t have the sense to quit when we’re ahead; we like to finish something we’ve started. Thus, a white student is a better cash cow. Deprive them of all but the most bare bones aid, and they’ll look into bank loans, as I did, which the (non white) bank officer cheerfully told me went from 8% to 13%. I was smart enough to walk out. Longer times in college plus predatory college loans make us whites excellent cash cows.

Whites can’t get good jobs where I grew up, but even there, we tend to join the military which pays very well, ór have friends on the mainland who can help out. But even in areas where being white isn’t a setback, IE most of the Mainland USA, this federal-level discrimination against whites is in place.

And I know now its not just some misguided attempt at racial justice, its because we can be squeezed and milked harder. The bankers benefit.

@Flyover. It’s the FED and bankers, not the government setting these policies. These quasi government institutions like Fannie, Freddie, Sallie, etc… are all privately held now. I agree with you though, making things more affordable is doing the EXACT opposite. Just look at the UK housing market with its help to buy program…. It just benefits the ownership class and the cost of the tax payer, and the sucker willing to overpay for a house because of artificially low interest rates and QE for the past 7-8 years now

I am wonder if these REITS and banks have a vested interest to slow down opportunity for people to own. If REITS lose because people don’t rent from these large apartment complexes what is a REIT to do in order to maximize the rental capacity. Shareholders are expecting good returns if they think these millennials won’t be buying soon.

Why are you :scrambling” to get a down payment for a house? What is the hurry to put yourself a half million dollars in debt? The housing market is at an all time high, measured by all the metrics. As soon as you lock yourself into that house, the price will drop 20 to 50 %. You will lose your down payment and more. You will owe more than the house can be sold for. It will become a millstone around your neck and you will be in a worse situation than you are now. .I know all the cool kids are buying houses.

Don’t be a lemming Save for 10 years and buy a house cash when prices are down.

“tense parental judgement”

Either real prices or perceptions have to adjust, anything else is can kicking. The can is looking pretty beat up at this point.

Home prices in SoCal always drop during recessions, and explode upwards during economic expansions.

The simple rule to buying property in SoCal is wait for a recession (about every 7 to 10 years).

Since banks are allowed to keep foreclosures off of the market for a period of up to 10 years, and the last recession hit in 2008, we are several years from seeing home prices crater in SoCal.

Ernst – So, a real RE crash in 2018?

@Alex in San jose, housing crash in 2018? Not really. The Federal Reserve did a study of over one hundred localized housing bubbles over the world, not just the U.S., and came to the conclusion that it takes 3 to 7 years peak-to-trough for home prices in bubble areas to bottom out. So home prices do not crash. They slowly deflate over a 3 to 7 year period.

The current economic expansion is in year 7. No economic expansion has ever lasted more than 9 years before recession/depression hits. Based on history I would put years 2019 to 2024 as the years to watch in SoCal real estate.

Slacker lazy young people need to pitch in and pay rent and buy groceries too if they stay with parents. Younger folks appear to be irresponsible, enabled by loser parents. Back in the mid 20th century, kids couldn’t wait to leave home and did. Many worked in factories, sales, retail and shared rent with another person if needed, also married younger than today. People also migrated to other places like we did several times because of better jobs. Get off your lazy butt and get a life if your out of school , parents won’t live forever, so give ’em a break you sorry losers.

yes, a great portion of the millennials are losers because their parents were enablers. The millennials will not have many offspring because they are lazy , hence the need to import people south of the Rio Grande to populate.

You tell ’em Laura! That was my good laugh for the day.

And get off my lawn!!!

I would blame the parents for bringing a kid(s) into this world unless they can financially support them. No more anchor babies either. Wasting our tax money to support people for their own self interests has to stop.

Looks like cnbc has a different opinion about hard working, saving, no debt accruing millennials.

“The report contains several surprises. Among them, Providence, Rhode Island, ranked as the hottest market for 2016, and millennials are expected to make up the biggest demographic of homebuyers next year.”

https://www.yahoo.com/realestate/2016-home-sales-will-be-best-1312889097642038/photo-realtor-com-hottest-markets-for-1449099755905.html

Although I (and many here) obviously disagree, with the anatomy of lending standards slowly reverting back to the previous bubble like days, this may actually come to fruition. These millennials will probably be talked into an ARM and/or a 40 year mortgage to add to their already 8 year car loan(s) all the while making their student loan payments.

Cue the:

$15/hr minimum wage will put a floor under housing; this time is different because the price inflation is based on solid fundamentals; stringent lending practices make it difficult to obtain a loan (although I have at least 3 counterexamples for that meme) crowd.

Laura – A classic example is the 40-something manchild son of my boss. Lives at home, works as a massage therapist, spends all of his money on beer, good times with friends, etc. so he has zero savings. Doesn’t help out with bills at all. I stay over there a day or two a week so I see this close up. I bring wine and other things, do some chores, and if I ended up living there i’d fork over a few hundred a month because I know a person living in a place costs money. I try to be an asset wherever I am, maybe because I was kicked out at 18 and was carrying more than my own weight from about 16 on? This manchild dude is living in the same house he grew up in, and is settled in tighter than a limpet.

You know Laura, I laugh when your generation calls my generation entitled, lazy, leaches, etc…Wake up and realize, YOU RAISED THEM!!!! Our generation is pissed, not entitled. 1) Most of my generation came out into a workforce that was completely destroyed by the great recession. One that YOUR generation helped create. Nothing was more difficult than graduating college in 2009, getting your student loan bills, and trying to find work all at the same time. 2) Education is important. However, let’s not forget YOUR generation was the one that shoved education down our throats. You were the ones that encouraged a 17 year old to take on tens of thousands in student debt. You were the ones that trashed and convinced us growing up that good labor jobs like welding were worthless. Now, my friends doing these jobs are making more than most with degrees hanging on their walls collecting dust. If this generation is entitled, you have no one to blame but yourself.

My wife and I have busted our asses to battle through a difficult recession and we did so handsomely.

You were the ones that encouraged a 17 year old to take on tens of thousands in student debt.

Your parents pressured you to attend an expensive college? Did you also attend a college in a distant city, so that you had to live in an expensive dorm?

There are plenty of local, inexpensive, community colleges. But many young people fall for those glossy college promotional catalogs. The ones that make college seem like a four-year party at a holiday resort. Student clubs, sporting activities, entertainment options, beautiful dorm housing with wifi, cable TV, and all sorts of hotel amenities.

Many students want to enjoy a four-year party at a resort hotel. And because there’s no cap on student loans, they spend to the non-limit. Students don’t look for ways to save. They borrow and spend all they can.

In the 1980s, I attended a local college. Lived at my parents’ home, not in the dorms. Took the subway to college every day, returned every night. That saved money.

Now I do see issues with the entitled generation, but there are good ones obviously. I don’t see anything wrong with letting them live at home so they can purchase a home sooner. That’s a no brainer. I don’t want my kids paying rent, giving their hard earned money to a landlord and delay their home purchase by 5 years. They can help pay my bills instead. But ultimately, the better off they are financially, the better of my future grand kids will be. So I’ll definitely let my kids live at home as it’ll financially benefit not just my kids but my future grand kids. Now if my kid is financially irresponsible and can’t save, then out they go, I ain’t stupid.

These numbers significantly under count the number of multiple generations and families living together. While working for the US Census we noticed many homes with tents and RVs with families living in them. In apartments you have people doubling a tripling up and the number of complaints of families living together are increasing.

As many of these arrangements are illegal – we had people who refused to admit family was living with them even though it was pretty clear they were living together.

The problem is the landlords will likely look the other way as long as they are getting paid.

Yes, it would be much better if those people were living in their cars, or under a bridge.

Something I’ve noticed throughout SoCal are garages used as in-law suites. Sort of like Yogi Berra’s nobody goes there anymore, it’s so desirable it has become undesirable.

The market in CA is still insanely overvalued. The Chinese are jumping out of securities from China and are buying property in the USA. What happens when the Chinese stop buying? We are clearly in another bubble.

Anna, I’d go a step further. What happens when the Chinese start selling?

Move to an affordable state.

…. And be homeless because you can’t even get e minimum wage job unless you grew up playing football for the local high school. No thanks.

Marriage rates are declining because maybe, just maybe Millennials are waking up and questioning this age old societal institution. Just like in the 1960’s young people questioned sexual mores. Perhaps it has nothing to do with the economic picture.

In a modern day Western society, the whole marriage and kids thing is not very feasible. Both economically and practically.

Not so in Texas, if you want a traditional family with all the trappings. East and West coasts are in a world of their own. From a Darwinian standpoint, the coasts are deadenders. In the South we are procreating (Utah included) and the South will raise again(no Stars and Bars this time), from a pure demographic standpoint. The coasts can pay the taxes, and we will spend it on our kids.

I know how it’s done in red states: Have 5 – 7 kids and collect those sweet govt benefits, welfare, food stamps etc, for extra points drink a lot while pregnant and get one or more kids with fetal alcohol syndrome, collect extra benefits for that. Life on the government dole. If it werent for us Californians you’d all starve or, Oh the horrors, have to work.

A little observation: At Thanksgiving there were five millennials at the table. Four women and one man. They all had graduate degrees and the only one who hoped to marry eventually was the man. Everyone was doing very well with their careers and three were living with their parents. They, and the parents, didn’t have a problem with that. They said they work so hard they would only be coming hope to a cold, empty apartment and sleeping for a few hours. They were saving a lot of money, had all the amenities of a home and actually enjoyed the companionship. They plan to buy a house eventually but everyone agreed we’re in a bubble right now. No one disagreed with their assessment.

This is great as long as they are actually saving. The manchild I mention above is blowing all his money, has zero savings, and only an approaching glacier is likely to displace him from Mommy’s and daddy’s house.

Fine, stay with your parents, I’d sure as hell have done so if it had been possible. But save up. Come up with a plan. And stick to it. Don’t be a lazy limpet.

Alex: Sounds like Baby Boomer parents who are just waiting for their own parents to die to put the keystone of their “retirement plan” into place: an inheritance.

Dweezilsfv – Indeed, the guy I work for and his wife are Boomers, actually she’s older than him and may be borderline Silent. She grew up like a Silent, his life was prototypical Boomer. His wife and I think much the same, as we have both known poverty. Silent and X’ers tend to have the same cautious views. The manchild is about 40, was always coddled, and just takes it for granted that he’ll always have a free place to stay etc.

I should clarify, yes they’re Boomers, they have just inherited the last bit of whatever they’re going to inherit, and are working on frittering that away.

Ah, yes, Alex. We’re on the same page. The amount my Generation has saved for retirement is incredibly small given what I’ve read. All that twaddle about their Depression Era parent’s empty materialism and there they are: their parents x 10.

I say “they” because I rejected their gluttony and “wealth on my sleeve”, instant gratification “lifestyle” choices in my own life.

Also grateful I have some of that Depression Era DNA in my veins passed on from two generations that still values financial prudence and thrift as valuable tools for getting through good and bad times. Debt is not wealth. Sloth kills your soul.

Hoping 16 brings better prospects for you. You’ve got your head on straight and skills.

I have seen the same thing. Some kids in the neighborhood have graduated from college and are living at home. They have good jobs in the tech field, working a lot of hours, saving up money. One just moved out and bought a home after living at home for 2 years. None of them bought a new car when they graduated and are still driving their 10 to 12 year old college clunker cars.

Life is not about keeping up with the Jones’s .

I don’t think millennials living at home is necessarily a problem, but the underlying causes are! Multi-generational households are commonplace in a number of cultures. However, a slowly fading economic future is at the heart of this and most other problems we face today! The dynamic of globalization and technology, along with an ever increasing population looking for a paycheck, are creating huge problems for main street and making it increasingly difficult for our tax-based government to sustain itself as well! Those rich Chinese real estate buyers, American’s inability to afford housing, decades of stagnant household wages and fading benefits, limited housing supply, millennials living at home, are all part of the same problem! All those jobs that sustained so many people during the boom years are now in China or elsewhere, or have been completely eliminated due to advances in technology. Increasingly, we are left with a small but well paid specialized workforce, while everyone else is fighting for a predominance of lower pay simply because there is someone somewhere in the world who will do that same job for less, and there is always the threat of being eliminated due to automation as well. This is unprecedented in modern times, and the future is very uncertain. We are left to making educated guesses and gut instinct to predict what will happen to things like housing, etc.

We currently rent from my parents. They have an investment home and have rented it out over the years. It’s paid for (I think they paid it off about 10 years ago.) We give them rent money, which gives them a little extra cash to travel and maintain our rental as well as their current home. We also watch their dog when they go on vacation; they are retired and like to travel throughout the year, so it saves them from having to pay for doggie day care. When all is said and done, we are paying less than we would in an apartment. We decided to go this route for one year and save, save, save as much as possible, not for a home necessarily but just to have a nest egg and build up some retirement (we are both in our early 30s). The other goal is to finish paying off my husband’s student loan debt from professional school. After two layoffs, he is self-employed while I still work a salaried job. I finished off my loan debt last year by living frugally, only taking camping vacations, eating almost 100% of meals at home, and drastically lowering my expectations around when and how we will eventually start a family.

Speaking from personal experience – due to the recession, it took a very long time (2 years) to find a full time, professional job in my field. The same is true of my husband. Our careers have been quite delayed and has made it harder to save, despite our frugal lifestyle. Being laid off twice also put us behind in terms of saving for a down payment on a house. These experiences are not just about money. It has taught us to take nothing for granted; jobs, careers, and income can change in an instant, so frugality and caution are paramount. Buying a home feels risky considering what we have gone through in the last 3-5 years. Sure we could move to cheaper parts of the country, but that requires yet another job/career reset.

It seems there is no easy answer right now, and with home prices as high as they are where we live, we will be lucky to be able to rent a decent apartment later this year when we transition out of my parents’ place. Unless we get jobs in a less expensive part of the country, I don’t see us buying a home for the foreseeable future.

Anon – Sounds like you’re feeling it. Nice you can help your parents out so they can keep up the Caribbean Cruises lol. Meanwhile for those like us, going 30 miles away on the train is a big deal.

We are feeling it, for sure. My parents worked really hard and earned everything they have. I hope they are able to enjoy this chapter in their lives. They have helped me so much and have given me a lot. But they also expected me to work hard. I hope that I can follow in their footsteps. I think it’s been an exercise in changing expectations, knowing that the order in which we do things will be different from how our parents did it.

All the best to you. 🙂

Ok, after being in the market for a home but reading this blog everyday I am finally posting. I am 34, have a steady union film industry freelance career that keeps me working year round with a $95-115k a year salary, have been doing this 5 years and make more money every year. My fiancee 28 has a stable 75k a year job at a college she too has made more money every year in the 4 years we have been together. We love our non rent controlled condo which is a steal at $2500 a month (been here for a year and half) but worry when the rent will go up and also hate building someone else’s equity. We have been in the market for a $550-650k house since July and are just so depressed at what our price point buys us in LA. Most are what this blog calls crap shacks. The ones like get sold over asking upper $600s to medium $700s. We go to open houses every weekend, write offers, have been accepted at houses from the southbay to north valley to west valley to Highland Park to mid city to westside condos and walk away because we do not love them for the mid 600k prices they come in at. Fear of overpaying at the top of the market is foremost. I am cautious and want to wait to see prices go down with the rate hike and unstable economic trends, but I do not want to be priced out. We have worked so hard to save up our down payment and it would be devastating to sink it into an overpriced home at the top of the market. It would be equally devastating to sit on the sidelines for a year or two, and watch the houses we have looked at for $550-650 turn into $750-850 houses and be priced out and our landlord wakes up and raises the rent on our place to what it should be like $3500. We have offers on houses right now and am losing sleep as to whether to pull the trigger. So to this wise forum I write…

Hello lamrational;

Sounds like you need to decide whether or not to really wait (be cautious) or take the plunge at all, ie: whether or not to write offers or not. The powers that be wont admit if a tank is eminent nor do the armchair economists on this site know when housing will tank. when I joined this blog in 2011, the consensus was that that the ‘dead-cat bounc’e was just a few months way and that anyone who purchased a home would be a ‘knife-catcher’. needless to say anyone who purchased in 2010-2012 will probably do well assuming they purchased a home for a long term projection. Wish I could say more, the housing bears on this site will someday be right (but at what cost of paying rent which can never be recovered through equity).

Do you and your wife have a good estimate of how long you think you can live in one area without career relocation?

“the consensus was that that the ‘dead-cat bounc’e was just a few months way and that anyone who purchased a home would be a ‘knife-catcher’”

Disagree with that interpretation. Many commenters here in 2011 were primarily focused on (and still are, as is Iamrational) lack of value relative to price. Being skeptical in this regard is not the same as making prognostications.

“at what cost of paying rent which can never be recovered through equity”

The numbers don’t always work out for the equity proposition. It’s situation specific and requires assumptions on future unknowns, so therefore it can easily get complicated. I think first time purchasers are done a major disservice by the promotion of this as a given outcome which further promotes emotion-based decision making.

Three things…

If instinct brought you here, do you trust it?

“hate building someone else’s equity”

A clever real estate industry marketing point many succumb to. Think about it. Do you also hate adding to other businesses’ profit (equity) in exchange for products and services in the free marketplace? You wouldn’t hate adding to a mortgage bank’s equity in the form of interest payments? A selling agent’s commission when you sell? Homeowner’s insurance, maintenance and repair costs, etc… all have profit margins built-in to the pricing which provide equity to those businesses.

“do not want to be priced out”

Fear of missing out combined with fear of buyer’s remorse sucks, but seriously, unless the concern is missing out on a once-in-a-lifetime gain, markets go up and down, that’s just what they do… unless it’s different this time and historical precedence chose this point in time to diverge on the timeline of human history.

I don’t know what prices will do, just like everyone else. However, I wanted to point out that if you’re making a combined $190K or so and only pay $2,500/mo in rent, that’s obviously not so terrible. Even if your landlord raises the rent, you could probably be creative and find something halfway decent for a comparable price. If you were to buy a $700k house, your property tax would be in the neighborhood of $650 or more per month, you may or may not have an HOA for an additional $300+ per month, you may or may not need a gardener for $100/mo, and you will undoubtedly have various housing-related expenses. When you add it all up, you’re probably only paying $1,500 more per month or so for your condo than you would if you owned. For $1,500/mo or so, it’s probably worth it to wait.

lamrational – Congrats on being smart enough to get into Unionized jobs!

Just watch and wait, real estate swings in price, above and below the long-term average, like the tides swing higher and lower on the beach. There’s a ton of historic data you can study with pretty charts. You want to buy during a low tide.

I’ve noticed on the west side a large amount of rental SFH inventory coming to market in recent months. Especially the so-called Silicon Beach area. Several different scenarios appear to be playing out. A good bit of these are purchased at highs and then sit on market with reductions. Others are organic sales and flips that don’t sell even after numerous reductions, so the sellers apparently capitulate on to the rental market as a last resort. I’ve even seen a few that have been reduced down to asking rents below what appears to be previous contracted prices from one to three years ago.

It’s a bit early to identify strength in trend but this wasn’t happening in the past few years.

The new inventory playa vista will be adding to the market soon won’t help these properties that aren’t selling in Silicon Beach. The greed has out priced the buyers that are left. More properties are for sale now than the hot season. If we make it into next spring with these prices, we may be looking at a price reduction frenzy. The story is current residents want to sell to new technology heads rolling in. I don’t see it, they can’t afford your over priced house either.

Do you know how many homes are nearing construction in Playa Vista and the timeline to market?

I’ve noticed this too and it has been accelerating since Oct. Prime example of a flip in my neighborhood in Playa del Rey/Westchester. Listed at 1.75m and reduced to 1.6m and still no buyers. They are asking an astronomical 10.5k/month for rent. They’re going to lose money. These are clear indicators of a market top where mom and pop flippers lose money and then exit…

http://www.zillow.com/homes/for_sale/20384919_zpid/1_days/33.96477,-118.421301,33.96121,-118.426075_rect/17_zm/

12/03/15 Price change $10,500/mo+51.1% $3 Coldwell Banke…

11/24/15 Listed for rent $6,950/mo $2 Coldwell Banke…

11/23/15 Listing removed $1,599,000 $561 Coldwell Banke…

09/19/15 Price change $1,599,000-5.9% $561 Coldwell Banke…

08/04/15 Back on market $1,699,000 $596 Coldwell Banke…

06/04/15 Pending sale $1,699,000 $596 Coldwell Banke…

04/24/15 Price change $1,699,000-2.9% $596 Coldwell Banke…

03/27/15 Listed for sale $1,749,000+136% $613 Coldwell Banke…

Your example reminds me of this one: http://www.zillow.com/homedetails/139-Westwind-Mall-Marina-Del-Rey-CA-90292/20487962_zpid/

Their pricing is all over the place and clearly they have no idea what to do. It appears that the property has been sitting for about a year at this point wasting opportunity to earn income. Another “tell” is how the listing agent changes, subsequently repriced much higher, and then comes back down. Many of the listings I’m referring to share this characteristic. Some brokerages tend to promise the landlord they can list for higher but then the market says otherwise.

What’s also interesting is that the rent repricing action to the downside isn’t just coming from the new landlords but also apartment complexes. It’s to be expected for new landlords to be clueless on pricing but the complexes should have experience and internal comparables to better inform their decisions as strictly business entities.

This can’t be shrugged off as “make me move” style pricing as some do with sale listings because vacancies shred the bottom line for income properties.

It’s one to watch because repricing action on rentals are less prone to stickiness, so quick downside movement here could foreshadow other things to come. Also keeping in mind this would be happening in the face of otherwise traditional rental inventory held off for airbnb in certain locales. If rents reverse course for this cycle, it would be one less incentive for people to feel the like they need to buy now or be priced out forever.

I’m one of them. Just waiting for the pop. No way in hell am I buying at the bubble.

We are near the end of the lull in the market. When drop begins , which i believe is just about under way, expect an 18 month to 24 month length of collapsing prices. Look at the extreme boom bust areas around you to see when it will start. For example , look at the inland empire area first for southern california. Crash starts there , then proceeds to L.A. and San Diego area then over to Orange County. Appreciation after crash flows in reverse.

Why would there be a bust, as opposed to a plateau?

The last bust happened because buyers couldn’t keep up payments on their liar loans. Are there all that many liar loans this time around? People bought with cash, or 20% down in many cases.

Prices may stop rising. But that doesn’t mean they will fall.

This Pasadena house was listed for $875k in August. I asked the realtor if the seller would consider $800k. She said no. The house sat for nearly four months, but the seller refused to go below $875k. Instead, the seller delisted the house: https://www.redfin.com/CA/Pasadena/244-S-Parkwood-Ave-91107/home/7014309

I might have paid $800k. Oh well.

This Santa Monica condo sold in 2013 for $610k. In 2015, the seller wanted $849k. Then relisted the condo at $845k. It still hasn’t sold in two months: https://www.redfin.com/CA/Santa-Monica/1120-24th-St-90403/unit-B/home/6767870

Many houses aren’t selling, but still, sellers refuse to lower their ridiculous asking. Instead, they’re delisting or holding firm. Often, they bought in 2013 or later, and expect prices to keep rising massively.

This Santa Monica condo was listed in summer 2015 at $899k. I told the realtor that an identical condo in the same building sold last year, 2014, for $789k. He insisted that Santa Monica home values rose enough from 2014 to 2015 to justify an additional $110k hike. https://www.redfin.com/CA/Santa-Monica/2625-Arizona-Ave-90404/unit-4/home/6763131

Well, that condo was taken off the market, refurbished (more money), and relisted at two price drops. Now it’s at $799k. Still not selling. There’s no garage, just a carport. And no in-unit washer/dryer, just an outdoor community washer/dryer. All this, for only $799k.

Still, another unit in that building sold for $789k in 2014. Be interesting to see if the above condo eventually sells now that it’s in the 2014 ballpark.

I see a plateau. Prices haven’t risen all that much since 2013, yet people who bought in 2013, 2014, or even early 2015, expect to reap huge profits. Not happening. But also no drop below 2013 levels.

@son of a landlord

“Why would there be a bust, as opposed to a plateau?”

Because the recipe for not only the last but the previous busts is alive and well.

“The last bust happened because buyers couldn’t keep up payments on their liar loans. Are there all that many liar loans this time around? People bought with cash, or 20% down in many cases.”

I see that you continue to perpetuate misinformation about the current bubble. The last bust occurred because prices were pushed up too high due to excessive debt. Although subprime was an issue, the majority of defaults were from prime loans. Before the last bust, it was touted how different things were because people were “buying” homes to live in — and not for investment. So now it’s different because the current “recovery” is investor-led?

Today, corporate debt is at its highest level in decades — even higher than during the last bust. The “cash” used by REIT’s were actually low-interest loans that need to be repaid.

And yes, subprime is back. 3.5% down payment FHA loans. FHA insurance premiums lowered to less than 1%. Fannie and Freddie accepting down payments as low as 3%.

You have no idea what you are talking about. Unless you are actively pursuing properties in the market, you are just a sideline quarterback. I just closed on a SFH in the IE last week. It is a small starter home in good condition. There were 9 offers in the 1st 24 hours it was listed, many over list. There is no shortage of demand for good properties in the IE. In fact, as more and more people get priced out of LA, OC, etc. they are moving to the IE, where prices are more reasonable. Also, major companies like Amazon, Kaiser, & FedEx are choosing to expand big in the IE, which brings job opportunities and more home buyers.

The people in the IE are not like the Westside people or the people in Pasadena, and etc. Don’t be so concentrated upon the price. As Big Tex keeps touting Texas for “traditional family values”, people that live on the Westside and other places would feel uncomfortable in Texas or Fontucky(IE).

IRA, the people of the westside don’t enjoy having a house paid off. They confuse debt with wealth. They have only one life and they live it like a slave to the bank – the mortgagee is the slave of the lender. I am not saying some of them don’t have it paid (the smart ones). However MOST are in debt to their eyeballs. I pity them.

By the time they end their slavery (pay off the mountain of debt), they are ready to go to the nursing home. Of course, only the smart westsiders are choosing that!!!…The “dummies” move to the flyover country, take vacations whenever they feel like it, travel wherever they like; after all they live their lives free – slavery is for westsiders.

FLYOVER don’t forget the leased BMW’s, Mercedes, and Audi’s that they drive. The young ones who drive these live with their parents. Yes, it is a different life style than the pickup culture of the IE.

There is a massive amount of building construction going on in the Culver City – Playa Vista – Hawthorne – Gardena areas. All of it geared towards luxury dwellings. The bust is going to horrendous.

What happens when all these millennials want to move out. There should be a big demand for housing. Maybe mostly apartments but housing will see an increase in demand too.

Demand itself doesn’t lead to increased incomes to offset mortgage/rental costs. It’s qualifiable demands that counts. We’ve heard about a supposed pent-up demand from sideline buyers for almost 5 years now even as the the home ownership rate continues to fall.

You do realize that boomers (you know the actual generation that represents a population bubble) won’t need a house when they are dead right?

It would be nice when doing analysis people could encorporate at least some simple math.

I too am a mid thirties type who wants to buy for 500-600k in LA, I have 20% downpayment in the bank but my get says wait and see what happens next year. What that buys you is pretty sad but am I crazy or are prices starting to dip a little. The inventory out there is sad but overpriced places are just sitting. Do we think the Fed rate increase, coupled with a volatile world economy and political situation will change anything in prime LA City, Valley, Southbay, Pasadena adjacent markets?

500-600k is a sad amount right now. You and a large amount of capable buyers are on the sidelines wanting better value for what they worked hard for. If in a year prices drop $100k, the floor gates will open to these buyers and investors once again prop the market back up.

A world recession with job losses is what will push the market down drastically. Keep your job fresh and marry a spouse that is in industry different then you (ex: healthcare). If you want a deal your gonna have to buy when the market is crap and everyone is scared/unprepared. If you buy now, the only time you you can sell with gains is in another bubble. If your buying for family then just deal with it.

“investors once again prop the market back up”

We don’t know if it’s going to play out quite the same because that would depend on the chess board remaining arranged the way it has been for the past several years, which has little to no historical precedent in terms of certain particular central bank actions.

If the Fed does indeed liftoff, it broadly indicates a change in direction from what we’ve had for the past seven years. The details and scope might not be significant but the impact to sentiment could be, which runs the risk of unknown chain reaction effects.

We have had an unorthodox (borrowing that term from Mark Hanson) rush into RE over the past few years thanks to central bank intervention which has propped up RE and pushed down the traditional fixed income market, thereby creating a compounding distortion in price discovery in both areas. As others have been apt to point out, nobody knows the future. We’re only left with long-term patterns as any sort of reliable guide.

But hey, far be it from an “armchair economist” to be skeptical when all of the expert economists are in absolute agreement with each other and maintain such fine track records of accuracy in their projections.

Very skeptical that investors, especially the ones from Wall Street, jump in front of a freight train without assurances from the market makers. The stock market dropped 46% from then its all time high until the government and Fed stepped up their intervention. RE prices dropped 30% in many areas before the government and Fed created their put.

Tell you what, when I was early-30s I was looking to SELL a house for 600K, not buy one. My house wasn’t worth half that to me, so I was happy to sell it. Putting my cojones on the chopping block for a ~3-400K loan on a 30-40 year old place was the equivalent of financial suicide in my book. I’d feel like my soul was getting crushed in a trash compactor every day I had to feed that kitty. Freedom!!!!

I would be curious what the next census will look like. more millennials living at home this time around? I would be curious if REITS maybe betting on that the next census will determine if they need to continue buying up apartments or start liquidating them in the event these millenials are intending to stay home or move out.

the more money you make the less empathy you have for the 50% of working americans who make less than $30,000 a year

Ben, how about the close to 40% of working age who don’t even work? Some of them are parents, where one spouse stays at home to take care of the kid(s) due to the cost of child care and the graduated income taxes on the additional income. Some are just on various forms of taxpayer subsidized benefits. Some, undoubtedly, are part of the vast underground economy(I am not speaking of gophers and moles) that do not pay taxes to support the food stamps, and all the other government benefits you get when your income tax returns reports low income.

The .1% don’t need these useless eaters to work in their factories anymore. Time to kill them off with drugs,junk food,suicide, etc.

I could live like a king on $30,000 a year!

Jon, you say “@Flyover. It’s the FED and bankers, not the government setting these policies. These quasi government institutions like Fannie, Freddie, Sallie, etc… are all privately held now. I agree with you though, making things more affordable is doing the EXACT opposite. Just look at the UK housing market with its help to buy program…. It just benefits the ownership class and the cost of the tax payer, and the sucker willing to overpay for a house because of artificially low interest rates and QE for the past 7-8 years now”

I think we are pretty much on the same page. I am not sure if you understand that the congress and white house are puppets to the top bankers and Wall Street. First they need their money for their campaigns. Second, if the politicians don’t want to be bribed by money (positive enforcement) they will be blackmailed (negative enforcement). After all the bankers needs to control just over 50% to pass whatever laws in their favor.

The real power in this country lies in the FED (banking cartel). They have enough money (print at will) to buy all the key positions for themselves. Also, they don’t get ellected, they are not accountable to anyone (in theory, yes, practically, not) and they stay in power as long as they want.

All wars are banker’s wars. The middle class pays for all of them directly or indirectly.

Flyover-

No, we are on the same page, and I know Wall St and the Wealthy control our politicians, with Citizens united being the end game for our democracy. What I don’t agree with you on is the use of liberal in a derogatory way, or how a lot of ‘conservatives’ use the word entitlements when describing social security…. Hell ya its an entitlement, its a forced insurance / pension program that we are forced to pay into.

What really gets me is how the 1% / gov’t / FED / OWNERS of this country are able to divide and conquer by using the constant wedge issues, and pitting the middle class against the ‘rich’ and poor, while their share of wealth just continues to increase as we enter the second ‘Gilded Age’. Keep in mind when I say ‘rich’ I am not confusing it with wealthy, e.g. people that actually plan their death around the estate tax, like the matriarch of the family that owns the corporation which owns one of the subsidiaries of that I work, which is a company with household name that had been a mult-generational family business in its own right for over 80 years, that they acquired a few years ago. These are the type of people that run our country, and write the our laws-

http://www.bizjournals.com/atlanta/news/2015/11/23/bloomberg-drops-anne-cox-chambers-from.html

http://www.forbes.com/sites/abrambrown/2015/09/30/this-billionaire-knows-the-secret-to-saving-a-family-business/

This family has been able to concentrate wealth at a breathtaking pace. This is no free market situation here, its a privately held company, and everyone should know by now that industries this large don’t directly compete with each other and have insane monopolies. This is not unique, corporations are acquiring each other at an alarming pace, and just like Futurama, there will just be the Mom corporation a thousand years from now.

/rant

They wouldn’t be able to do it without the FED assistance. A clear example happened in the last few years when FED policies increased even more the income inequality.

As a conservative I am against concentration of power and centralization. I am a conservative like Ron Paul not a neocon like Bush, Cheney and McCain. I hate globalization, oligarchy, imperial wars and everything which sucks life out of middle class.

What we have is not a free market. Since 1913 we have an oligarchy which rules.

@Flyover.

Yeah, I am with you, I voted for Ron Paul and not Obama in ’08. Not a huge fan of his son, but he’s still better than the other republican candidates. That whole party is in tatters. They are having a harder time getting people to vote against their self interests, but Trump does a pretty good job w/ his xenophobic rants, scaring people into voting for a narcissistic sociopath like him. All things being equal I would have liked to see an independent ticket with Bernie Sanders, and Elizabeth Warren, rather than what will invariably be a Hilary ticket for the democratic nomination, since the primary elections are a farce, and are run by the DNC which is backed by Hilary supporters who plan on getting what they bought and paid for

If you truly believe your statement then why are you looking at this site. The IE is still a bedroom community, sure strives have been made in certain industries but the fact remains it has never recovered from the last downturn. Go drive though crappy San Bernardino, its in worse condition than the 90’s recession left it. The IE is still demographically 15 to 20 years out from holding its own self up. Read up on John Husing , look at the demographics , income , etc. The drop in FHA loan limits hurt this area. Now the new disclosure requirements from Oct.3 have slowed the market as well. Canadian housing market is toast because of the oil bust, next is Texas, and any other oil industry benefiting area including California. Look at the industry that popped before the last real estate bust. Oil!!!!!

I c the latest Zillow estimate…next year could c housing appreciation of about 12.5% in oc… higher rate yet higher price?? housing inflations is here, at least 3 to 5 years for this circle?[ they usually come in 7 years]….

Zillow (and the NAR, for that matter) ALWAYS forecast appreciation for the year to come. It’s in their job description.

Have you ever looked at their ‘Zestimate’ charts, it’s always going up, even though the past few months prices have been dropping, or the houses (unless priced realistically) have been pulled off the market. Seriously, the NAR has more juice than 2 NRA’s. Probably the most powerful lobbying group simply because the need to inflate housing coincides with municipalities and their ability to collect property tax, the federal government with their massive amount of underwriting w/ FHA, HUD, Fannie/Freddie, et al, and the institutional investor, or even the majority of just owner occupied property owners. They all want you to think housing will go up, that land is very limited, interest rates being this low is a good thing, etc…

Never mind that they have been working for the past 7 years to shift massive amounts of paper debt around from the MBS’ and CDO’s that the investment banks were leveraged to the hilt with. When things crashed, it wasn’t because of massive amounts of subprime loan defaults so much as it was collective faith in the system of insurmountable/unserviceable debt stopped at the same time, to the point that investment banks like Goldman bet against the very securities they were selling-

John Paulson, the hedge fund manager who pulled off the greatest trade ever by betting against subprime mortgage securities, has experienced two difficult years. But even though his Paulson Advantage funds were down substantially again in 2012, some of his other funds did pretty well. According to an investor letter, the weighted average performance of all of Paulson’s funds for 2012 was up 1% net of management fees. Because Paulson has such a huge personal stake in his funds, he made $275 million.

http://www.forbes.com/sites/nathanvardi/2013/02/26/the-40-highest-earning-hedge-fund-managers-and-traders/

I find it interesting when a home is listed on Zillow I see a correlation between the price the home is being offered at while the zestimate shows it equal or a bit higher. However, after the property sells it seems the zestimate all of sudden changes course to even or barely bugging. It make me think that these numbers are being played with in order to incite a sale. Almost causing a chase so that realtards can justify the price being offered. I would bet they think buyers are using zillow or other sites to justify a purchase. which is why I think these sales are being supported by creating some type of sales numbers. -all imo

Jon,

You say that $15/h would cover all the expenses so people would no longer need the taxpayers for their expenses? Is that your point? No more foodstamps, no more Housing Section 8, no more school financial aid, no more earned income credit, no more medicaid???? Are you sure that someone in Seattle or LA would not access those freebies if they make $15/h and have five kids at home???

If they don’t cover all of the above, why not $100/h like you said? After all the idea is that the greater pay is to eliminate the taxpayer subsidies. And if the minimum goes higher, would the other pay for the rest of the workers go higher (at least somehow)??? After all you can not pay a skilled electrician $18 if the minimum is $15/h – do you agree with this ???

Now, if all wages go higher what makes you think that prices for everything will not go higher? Would that push more companies to leave US creating more unemployment??? If prices go higher would all level of government need to raise taxes in order to operate the same as before? If the Fed Gov. doesn’t collect more in taxes because they are less people working and they have to pay more in unemployment wouldn’t they borrow more??? More money printing wouldn’t increase the prices to ofset any benefit from those minimum wage increases? Money printing is the biggest tax everyone pays.

Do you REALLY believe those people who now have higher minimum wage will be better off in terms of purchasing power?

I am just asking to give you food for thought. If eradicating poverty would be that easy, it would have been eliminated by now (50 years of war on poverty and 20 TRILLION spent). The problem is way more complicated and deeper that you are willing to admit.

See, I lived under socialism, and the poverty in terms of purchasing power (after taxes and based on net income left and prices) was far worse than in US.

Like most people, I would like to have poverty eliminated, honestly I do. After geting a master in business, runing many businesses relatively succesful I can tell you that is not easy to build wealth, especially if the government becomes too powerfull and centralized.

The government can create money but they don’t create wealth. They consume wealth. You have to understand that money are not wealth – it is a measurement of wealth.

In conclusion, it doesn’t mater what you make per hour or per year. What matter is what can you buy after all the taxes. By that obvious definition, most in SoCal are poor; same as those in Zimbabwe who are millionaires. You get the idea. Extra money don’t mean extra wealth. It simply mean more inflation and less jobs.

@Flyover- You are right, its not that simple. just like world hunger is not a result of not having enough food, but the will and means to distribute it equitably. Similar arguments have been made by Monsanto, that without GMO’s we wouldn’t be able to feed the world, when the WHO admits-

http://www.theguardian.com/environment/2008/feb/26/food.unitednations

Capitalism needs to be reigned in from time to time, and when wealth inequality is at is peak, and when there are millions of people unemployed, or under employed, or can’t afford to live in an area because corporations have monopolies in most markets, and NAFTA/CAFTA and soon to be TPP, have put the majority of people in the US in a race to the bottom, something needs to change. I can argue the merits of allowing corporations to pay less than half what it actually costs to live. Walmart is the prime example of what I am talking about and the largest private employer. Even they finally are capitulating to $15/hr since stats like this have been out for quite some time. From the WSJ, not exactly a liberal rag-

Walmart is a net drain on taxpayers, forcing employees into public assistance with its poverty-wage structure. . . .

Walmart, the nation’s top private employer and the world’s largest public corporation, is a big part of the problem–and could be a big part of the solution. Their humiliating wages force thousands of employees to look to food stamps, Medicaid and other forms of welfare. A sign appearing at a Walmart in Ohio last year, asking people to donate food so that the company’s employees “could enjoy Thanksgiving,” was a perfect symbol of what’s wrong with the nation’s most despised retailer. Working at Walmart may not make you poor, but it certainly keeps you poor–at the expense of the rest of us.

By one measure, done by House Democrats last year in looking at data from Wisconsin, the average Walmart superstore cost taxpayers $904,000 a year in various subsidies, or more than $5,000 per employee.

http://www.wsj.com/articles/best-of-the-web-today-walmart-and-welfare-1403554687

Meanwhile-

http://walmart1percent.org/family/

http://www.thelocal.fr/20140903/france-sees-spike-in-older-mothers

Financial family non-sustainability. No, worse, non-startability.

Manipulated supply was aimed at reflating bank assets.

0%/QE’s in place of S & L / Resolution Trust.

TBTF’s leadership didn’t just pretend the bubble sellers

were in the room right in front of them.

Some probably couldn’t even conceive they existed.

Leave a Reply