Millennials shun the new home sales market: in the face of tight inventory, why are builders not building new homes?

One of the many interesting dynamics of the current housing market is the lack of new home sales and also, new home construction. New housing construction tends to be a boom for the economy across all income levels. Why? People when buying a new home also tend to fill the house with the general crap that occupies a place (i.e., new beds, stoves, microwaves, televisions, etc). This crap filling exercise sets off an avalanche of economic activity. You also have construction and the inherent supplies that go into building a new McMansion. Yet the new home buying audience in Millennials tends to be in a tighter economic position than their Taco Tuesday baby boomer parents. For these reasons we have an unusually large number of grown adults living at home with parents. It is highly doubtful that these grown adults are suddenly going to cause a surge in more expensive home buying. But the new home buying that is happening is going to a smaller group of people pushing prices higher on a small amount of inventory.

New home sales dynamics

With inventory in the market still being tight, it is surprising but not shocking that home builders simply are not out in the market aggressively building homes. You have this big group of younger adults but are they going to mimic the trend that followed the baby boomers? That is the big question and so far it doesn’t seem to be the case.

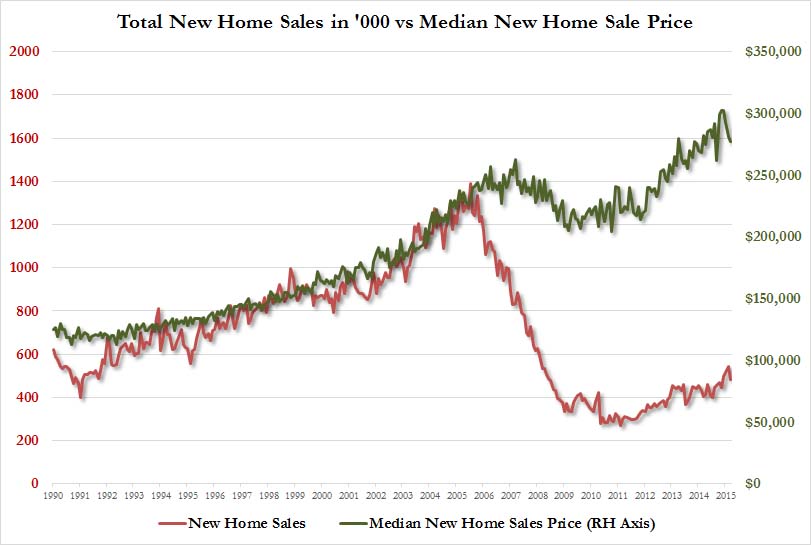

Take a look at this chart:

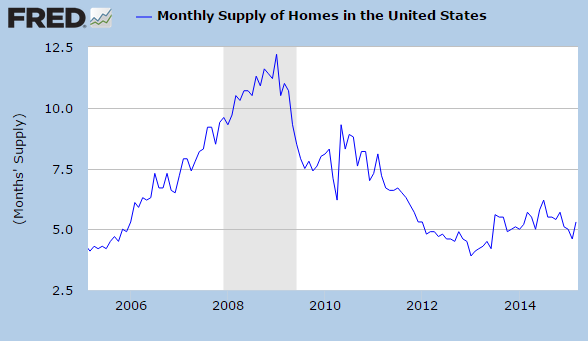

You would think with the price of new homes going up that builders would have an incentive to build. Yet new homes sales are still lagging. Adding to this, the months of supply is constrained:

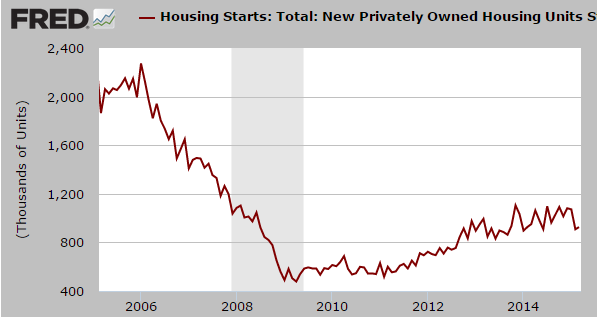

This would seem like a simple enough reason to motivate builders to go out and create floods of new homes. But the big push is coming from metro areas that are already built out. Good luck trying to create a flood of new homes in San Francisco for example. Builders have a good sense and realize that there is simply little demand for new homes overall. Plus, they need to make money after factoring labor, materials, and other costs associated with building a new home. So future housing starts remain weak:

Builders are betting that many of these adults are either going to live at home for many more years or are going to move out into rentals. The rental bet by Wall Street has paid off big time. Of course Wall Street has pulled back dramatically in the last year from the rental bet. Not a bad move given we have added 10 million more rental households since the crisis hit and have seen a net loss in homeowner households. The new housing market is also a reflection regarding stagnant income growth across the country. The low interest rate play has already gotten all the juice it can get. The troubling thing is that the market is now fully accustomed to low rates (artificially low rates at that).

New home building and sales are a big part of fueling our economy. Yet this is not an ordinary housing market. It hasn’t been an “ordinary†housing market for probably 15 years. I’m fascinated by the impact this is going to have on a sociological level. There are many young adults living at home driving fancy cars but foregoing new homes. Apparently the symbol of wealth is not a McMansion but an iPhone 6 and a nice leased car.

If you really want to look at a truly robust recovery indicator, new home building is a good place to look at. So far, Millennials don’t seem to be rushing down the road to purchase new homes.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

126 Responses to “Millennials shun the new home sales market: in the face of tight inventory, why are builders not building new homes?”

It’s not only that we don’t want to buy, it’s also that we are getting outbid andout-cashed by others. Guess I’ll keep on renting…

And I drive a 12 year old car, and have an LG G2 (dinosaur of a phone in tech years)

Good job, that’s the way.

That’s more the exception than the norm these days in SoCal.

The widespread notion of bidding wars and cash buyers purchasing up all the supply might have been accurate in 2012-2013, but today there are many properties in L.A. County that languish for weeks and months with price reductions and failed escrows. These include flips and organic sales across all neighborhood types and price levels.

Not here in Westchester, CA 90045. Homes in my neighborhood typically sell within a week or two. Don’t know about the prices.

On a very quick and cursory past 3 mo sales history search of 90045, just to name a few…

https://www.redfin.com/CA/Los-Angeles/8414-Reading-Ave-90045/home/6636370

https://www.redfin.com/CA/Los-Angeles/7924-Cowan-Ave-90045/home/6613491

https://www.redfin.com/CA/Los-Angeles/8735-Mcconnell-Ave-90045/home/6635222

https://www.redfin.com/CA/Los-Angeles/6116-W-75th-St-90045/home/6606300

https://www.redfin.com/CA/Los-Angeles/7843-Hindry-Ave-90045/home/6639261

https://www.redfin.com/CA/Los-Angeles/5428-W-77th-St-90045/home/6639378

https://www.redfin.com/CA/Los-Angeles/8056-Kentwood-Ave-90045/home/6613093

https://www.redfin.com/CA/Los-Angeles/7575-W-80th-St-90045/home/12281836

https://www.redfin.com/CA/Los-Angeles/7532-W-88th-Pl-90045/home/6633815

While there are some properties here and there that sell over ask and/or within a couple of weeks, there appear to be plenty of others such as those listed above that don’t. Westchester doesn’t appear to be much of an exception to what I stated.

@siggy “…but today there are many properties in L.A. County that languish for weeks and months with price reductions and failed escrows.”

Have you seen any of those properties that languish for weeks? They really aren’t anything someone in their right mind would jump on. They are languishing for good reasons. Maybe I wouldn’t call them “crapshacks” but they are pretty crappy for the money … or they would be sold. Not much has changed since 2014, unfortunately. I keep reading posts hoping for encouraging predictions, but it doesn’t look like change will come this year.

Locally ( Sarasota) the boom is back. At least for condos. 4 towers going up in downtown Sarasota plus a 5th tower that was emptied for structural reasons a few years back and is now being rebuilt. My guess is mostly public sector baby boom workers retiring and doing the traditional move to Florida. They would be the ones who would have money to buy $500,000 and up condos. While Miami has traditionally been the place for Latin Americans to buy in Florida it maybe that Gulf Coast Florida is now seeing some of this too from Canada who are big ‘snowbirds’ locally and have a lot of inflated equity from the housing boom there. New single family homes don’t seem to be going up though. So far its all condos.

“There are many young adults living at home driving fancy cars but foregoing new homes.”

After years of paying little or no rent to their parents, a couple that brings home over a 100K a year will be able to purchase in time. They just keep saving and saving, year after year. Cash is King.

Do you know how EXTREMELY rare a 100k earning couple living at home is??? Now factor in they get no mortgage tax deduction and probably have no child credits either. That’s a lot of taxable $$$ for the feds. And if they are the prudent types you imply, they are certainly going to wait out Housing Bubble 2.0. Cash will indeed be king as having a nice down-payment always helps the monthly nut. Even more so when you’re not competing with specuvestors. Market momentum died last year (you were right Jim Taylor) price adjustments should happen steadily over the next 3 years. We’ll be back to 2011 prices soon enough. Their aren’t enough money laundering Chinese to save these valuations. No Specuvestors = Burst Bubble.

I dont think Millenials are doing as bad as we think…

http://www.pewresearch.org/fact-tank/2014/02/28/for-millennials-a-bachelors-degree-continues-to-pay-off-but-a-masters-earns-even-more/

“Admittedly, the earnings figures above only reflect young adults who can find work.”

most of them who are non-stem are underemployed

from your link

“The median monthly earnings of young adults with master’s degrees rose 23% from 1984 ($3,875) to 2009 ($4,772)”

and yet homes have gone up 300%…….in other words, they’re fucked…..AND that’s a masters that cost them 1000% more to get than 1984

at some point an equilibrium to prices and wages as to return, cause they are seriously outta whack

Good point:

“The median monthly earnings of young adults with master’s degrees rose 23% from 1984 ($3,875) to 2009 ($4,772)—

This is less than even official inflation during that period so their inflation adjusted income is now _less than 1984_. And we know how false the official inflation number is.

No, these people aren’t buying houses, probably ever. Unless prices fall to less than a third from current prices.

This is not even accounting those who don’t have work at all or masters level pay for their work, probably the majority.

A monthly income of $4700 will allow a mortgage of up to $250K (using the PITI formula of housing expenses not to exceed 28% of gross monthly income). This $4700 a month income largely limits one to buying in East LA, South Central, Compton, Paramount, Lynwood, Van Nuys, South Gate, Watts or the north Valley unless a one or two bedroom condo is an option.

The well paying jobs are generally in metro areas. The jobs market still hasn’t returned enough that builders feel it can sustain or justify growth outside of metro areas.

I said many times on this blog. The builders can not build if there is no profit. Based on construction cost and price level, there is no profit.

I know there are some pockets where builders make a profit and build, but there are only few.

The dynamic between cost and price level is different for every local RE market. In some areas where prices are high, the cost of land is even higher, therefore builders lose money. In some areas where land and skilled labor are in abundace, the price level for houses is so low the builders can’t even break even.

It is this misalocation of resources which is the result of a central planned economy we have in this country. Untill the market is left free of bankers and politicians manipulations, we just go downhill – both builders and clients. I should say that eventualy the whole system colapses, but bankers (the 0.01% at the top) are too blind and thirsty for power and control to see, till they lose the whole system.

Nothing allocates resources as efficiently as a free market system. Many on this blog blame the current deppresing economy on capitalism and free markets but we had none for over 100 years. It is not the free capitalist system that failed but like always it is a failure of a central planned system. It just got REALY bad in the last two decades because the chrony capitalists no longer fear anything and anybody. It is not a failure of Bush or Obama, but a failure of both, because they both pursued the same corupt system.

i blame wilson and the creation of the fed

“Nothing allocates resources as efficiently as a free market system”

Absurd. The 2006 RRE Bubble Peak and subsequent 2008 Stock market crash we’re caused by a “free market” in unregulated securities.

When someone in the Government wanted to regulate the “dark market” in these securities, they were shouted down, ridiculed by Phil Graham and Newt Gingrich. The lack of regulation of “free markets” creates bubbles and monopolies (see Enron).

The securities market is anything but free. The SEC surely does a poor job with regulating. So the solution is to abolish it. If you take away the false legitimacy of SEC oversight investors will have to investigate on their own and government should make clear there will be no bailouts, ever. Nothing is systemically important enough to be saved from failure. It’s not free markets that failed. It was the lack of letting free markets work and participants taking deserved losses. Capitalism is a system of profit and loss and the losses are just as important, if not more so, than the profits.

Depends on the definition of free market. He is referring to an actual, real free market, Then there is the Wall Street and their bought and paid for puppet politicians and the private Federal Reserve manipulation, referred to as a free market.

What’s free about QE, a committee devising interest rates, bailouts, too big to fail, skewed government statistics, taxes, and coverups?

“Absurd. The 2006 RRE Bubble Peak and subsequent 2008 Stock market crash we’re caused by a “free market†in unregulated securities.”

Seriously? Congress votes to make home ownership more obtainable, by manipulating Fannie/Freddie/Financial Institutions, etc.. Wall Street responds by creating a secondary mortgage market for foreign investors, among others.

Where’s the “free market,” when you manipulate interest rates?

The only “Free” was the borrowers decision to borrow, and the investors finding ways to fund the frenzy! Everything else was tweaked and played out for short-term gain, and eventual bail-out of toxic assets by the Federal Reserve.

Government, from start to end!

You don’t have a free market under federal decree. Free markets happen on their own, and with free will and inspiration. Hence, the word free.

Anything the government creates will cost more and deliver less.

You bureaucracy types, are filled with good intentions, but usually create unintended consequences. Just get out of the way! The bubble would never have happened, under a Free Market!

Rocky,

Wrong, wrong, wrong!

You can’t have a central bank doing whatever they want without congressional oversight and a “free market ” system at the same time. You either have a central bank (FED) or a free market system but not both at the same time.

You, like many spewing non sense on the blogs do not have any notion of what a free market system is because you never had one in your life time. A central bank implies central planning which is a characteristic of comunism and socialism/fascism/crony capitalism.

If you can tell me that in the last 2 decades or even ten decades we had free market system/capitalism, I stop commenting because you don’t have not even the basic notion of what that is. Everything was manipulated and distorted to the max.

Rocky, Apollo Creed must have landed too many head blows, you’re delusional. When interest rates are as centrally planned as they are in this economy, we have anything but a free market. Do us all a favor and look up the concept of moral hazard, http://en.wikipedia.org/wiki/Moral_hazard

It’s a textbook illustration of our current and past housing market…

Government intervention failed:

Try repeal of Sarbanes-Oxley and government intervention in the mortgage market to force lenders to approve ninja and balloon loans. for poor people who could never repay these loans (fannie mae and freddie mac, HUD, etc………).

And it is a KNOCK OUT punch for Rocky, folks!

And when he came to, he was very confused.

You are right on. Good post

Building costs are higher in California, including the cost of labor, government fees and compliance costs. According to a recent national survey cited in a report from the Legislative Analyst’s Office of California, California’s government fees on new development are 260 percent higher than the national average. The added cost per unit from government fees alone is roughly $22,000, compared to the U.S. average of $6,000.

http://blog.civinomics.com/2015/03/30/the-future-of-housing-in-california/

The cause of the 2008 crash was unregulated “Free market” in Derivatives. These derivatives are not created by government, but are created by Capitalism. These securities have little to no no regulations imposed upon them by government, therefore are almost a “pure” free market, as any Libertarian could define.

While people whine about government debt when Democrats are in power, if you look at who racks up the most government debt, it’s Republicans by far.

Yet no one cares about the enormous derivative debt, which will be the root cause of the next crash:

“Officially, roughly $604.6 trillion in OTC derivative contracts, more than ten times world GDP ($57.53 trillion), hang over the financial world like the sword of Damocles, but to the average investor the derivatives bubble is invisible. ”

http://www.businessinsider.com/bubble-derivatives-otc-2010-5

Did you ever hear about the term “moral hazard”? Look up the dictionary. The TBTF run up those derivatives because the government and the FED have their backs as soon as the system implodes.

If they would know that they are on their own, they wouldn’t do it. If the fascist system we have in place now looks like libertarian to you, then any further comment is useless. You must be a young/”green” fellow who still belives in the left/right paradigm – left, right, left, right, the sheeple march over the cliff…you being just a sheeple.

….and I thought that only adults post on this blog!!! …another mama’s boy singing praises to Obama from his mom’s basement…

flyover:

TBTF popped up well after the bubble started to bust and was initially instituted by Bush. Later it was supported by Obama too, which is also bad, but you’d have to get your facts straight about why.

If you look at history pre FED and central banks there were plenty of booms and bubbles. Every 10 yr or so there was a Depression, they called them Panics back then, almost as bad as the Great Depression all throughout the 1800’s. The Long Depression of 1873 was actually worse than the Great Depression. It was a fear of a repeat of the Long Depression that prompted the creation of the FED.

You almost never hear about this stuff though.

http://www.socialwelfarehistory.com/eras/the-long-depression/

Also Rocky never praised Obama. Weak insults aren’t going to change anyone’s mind either. Nor are they informative.

we live in a corpacracy….

democrats and republicans, same shit 2 different piles..

Central planning did just that, by letting ratings agencies, banks, wall street, congress create the bubble, keeping clear, then coming up with ways to enrich PE, Hedge and wall street by using QE, rates, bulk RE sales, FASB 157 suspension..the list could go on and on and on.. It was the greatest heist of money in the history of mankind…

Debt pushers are much worse than drug pushers…

i thought we lived in a fascist state

Builder… when is the system going to collapse? especially the 0.01 % – bankers… I’ll tell you… I will be celebrating! can’t wait for that to happen.

It is not a matter of IF but WHEN. That is the million dollar question. If I would be God I would tell you. Nobody knows the timing because there are too many variables interacting one with each other.

My point is that we have a highly unstable system due to government and FED manipulations.

“It is this misalocation of resources which is the result of a central planned economy we have in this country”

It didn’t work in Soviet Union either, yes.

“Nothing allocates resources as efficiently as a free market system.”

Yes, but that’s as much utopia as working communism is: “Free market” doesn’t exist in reality, anywhere. Only cartels, monopolies and oligopolies: Shared markets with negotiated prices.

Because “free market” leads to capitalism which leads to cartels whose only function is to obliterate “free market”. Unless you have laws to stop that.

But the big money on top want a monopoly and as long as Congress is for sale, it always will get it, one way or another.

That’s the situation we have now: Corporations buy the laws they want and the rest whine: Voting is totally irrelevant and corruption is the norm.

EU isn’t any better, probably even worse.

“A central planned economy” !?!?!?!

WTF are you smoking buddy? Or are you talking about the now long defunct Soviet Union? The US does not have a planned economy. Go read your econ. 101 books again.

Not true. It costs $100-200/sq ft for a traditional house. Many urban areas will allow for small lot subdivision, so land cost is not a huge hurdle. And these types of houses still sell well. If local government can get behind these types of construction and keep NIMBYs at bay, I don’t see why we can’t increase development of new homes.

Irvine company going nuts on old el toro marine base property.

And my argument for Prime RE bifurcation finds more evidence. The areas where the syschophants of our oligarchal command economy reside will do okay. All those lovely upper class free market GOP types in South OC who make their $$$ off of the FED’s bubblicious policies can keep the prices in their little enclaves high while botching about being oppressed by Obama. You couldn’t pay me enough to live around those motherfuckers. Completely blind to the fact that the source of their wealth is the worst kind of welfare.

True with the South Oc county people but the old republicans there are aging. There average age is in their 50’s. They benefited from prop 13 if they didn’t younger conservative types have left OC for Texas In fact Mission Viejo is being pushed in China now not just Irvine, so in 15 years not as many republicans in South OC One of the birth toursim cities to have children in the Us was in Mission Viejo.

NZero. Dude, lay off the MSNBC. Are you telling me all those arrogant rich douchebags who live in the Westside voted for Bush or Romney. I hate Obama and everything he stands for, but I would vote for him in a heartbeat if he could run again. Why? He has been very good for my wallet and that is all that matters anymore. It’s every man for themselves from here on out. That means pull your head out of your ass and look after yourself and your best interests.

LB, quit being an asshat. Just because I express disdain for the South OC GOP’ers doesn’t mean I have any less disdain for the limousine liberals. If you had bothered to read the previous comment regarding Irvine Co developments at El Tori, perhaps you would have understand the context. If it had referred to development in Santa Monica I would have used a different analogy.

Lame insults about MSNBC or FOX news after assuming someone’s political leanings is trite. Though I have disagreed with some of your posts in the past they weren’t quite this sophomoric. I’m sure you can do better 😉

Lewis Homes is going insane in Rialto on the closed airport.

What a deal!!! live between the 210 freeway and 4 million+ sq ft of giant tilt up warehouses.

Crazy stuff in Canada Toronto

https://ca.finance.yahoo.com/news/home-renovation-shows-having-profound-impact-home-buyers-155126323.html

A house is nothing more than decaying box ALWAYS eating money Just get a condo and ENJOY your life I am 59 years old have always owned my own home If i knew what i know now about owning a home at 25 I would NEVER have bought a home! Your weekends are ate up with mowing, weed wacking shitty neighbors, High taxes

name it! never ending expenses! Take it from an older person RENT or get a Condo

ENJOY your life while you are YOUNG : home ownership makes you a SLAVE to the ‘system” …. trust me!

Haha, you honestly think you won’t have shitty neighbors in a condo. And you are sharing walls unlike a house which can make things much worse. Condos are great for first time buyers (single or couples) and make good rentals down the road, SFRs will always be held in higher regard.

“Haha, you honestly think you won’t have shitty neighbors in a condo. And you are sharing walls unlike a house which can make things much worse”

‘Can’, yes, but a bad house can make it _much_ worse. So basically a void argument: You don’t buy just ‘a condo’ just like you don’t buy just ‘a house’.

Or do you? I don’t.

I’ve been living in both (tens of years, not just short time) and I can say that moving from a condo with idiot neighbours is much easier and _much_ cheaper.

But if the ideology is ‘a house or bust’, there’s not much that can be done: Reality doesn’t apply.

A condo is just a smaller box with annoying neighbors and an HOA…

Worst part of renting + worst part of owning = condo

If you rent, you at least know who you can go to if you have a problem: The supervisor and/or management company. Costs are included in rent.

If you own a home, you at least have some separation from neighbors, varying from 10 feet to hundreds of feet, depending on urban, suburban or rural. If you have a problem, you call the cops. You pay for everything.

Condo? No one is responsible and special assesments are a killer.

Owned a condo once. Never again. Will sleep under bridge instead …

Condos are the worst of both worlds. Couldn’t agree more. Ever been on a jury? HOA people come from the same population , people who think they know something, but don’t. You are lucky if you get a competent board. Even if you serve you are only one. At least with a house you are in charge . Pay yourself an HOA fee and hire the right people with it. End of maintenance and other headaches. Then you get the best of both worlds. Voila

Have 1 condo as rental,best investment I ever made. Long term tenants, Low Hoa mows the grass, paints the place, replaces the roof and cleans the pool. Which I had bought more when prices were low. Best $59k I ever spent. Paid for itself years ago. Love condos. Not all of course.

Last time I checked you can also rent a detached single family home.

I own and live in a condo. Never again.

I and others have stated why.

To those who’ve never owned and lived in a condo, if you don’t want to listen, then go ahead. Buy a condo. Live in it. Live and learn.

“Buy a condo. Live in it. Live and learn.”

How long, is >20 years long enough?

Owning a condo isn’t much different from owning a house, except less work and less cost: The risks are the same, mostly related to the price.

Benefits are also the same: Price may rise and you have a roof on your head. But no snow plowing or leaf raking. Central heating instead.

Quality of building varies a lot: You can’t just by ‘a condo’ by price or location alone, but if sound proofing is ok and neighbours are friendly, why not?

I find the idea that having your own house doesn’t mean neighbours, when you can touch the wall of the next house while standing on your own lot, quite ridiculous.

And that’s the reality for most of the houses: Basically condos with 3 feet of grass around them. I wouldn’t ever buy something like that.

My grandparents had a house in the countryside, that’s quite different as you couldn’t even see neighbours there, nearest one was about half mile away.

Nice but not feasible in rural areas.

owning a home is awesome. if i could have done it at 20 i would have.

My wife and i got married about the same time as my brother in law and his wife. They bought a nice condo and we bought a house. EVERY weekend they had GOOD TIMES, lots of travel, FUN FUN FUN My wife and I on the other hand Almost EVERY weekend ; working around the house, remodel , mowing, painting, spending money never ending SPENDING on the decaying box! Our first home we lost our ass because of my job loss be caused of endouring our ‘first’ recession, moved to another city got job, bought home and AGAIN not long after lost our ass AGAIN to realtor commissions! ….. you get the drift……l.; brother in law and wife STILL in same condo nothing but GOOOOOOD TIMES!!!!!!

Dave bs. a home is way better than a condo. I have a big home on a big lot, we work in the yard maybe 2 to 4 days a month, NO HOA fee’s, no connection to neighbors, shred space. We can make noise, park as many cars as we want. CONDO or that living you talk of is stupid. I have 3 other homes in HOA setting, they all look alike, nothing unique, MADE FOR SHEEPLES. I paint rarely, I”ve been here 12 years. and I”m talking about a 6 bed 4 bath home, it’s not that difficult, It’s not a box.

Be unique, own a home not a part of an HOA,,,, you are told what color and have no yard, you are under dictators with HOA’s or small space.

Greetings!! bought my current home in 2001 and nice one year old home since I bought this nice new one year old home I have spent 13,000 dollars on a new roof, 6000 dollars on a new heating / air conditioning pack, 500 bucks on a new water tank, home owners insurance now at 1500 per year ( NO CLAIMS) YES it’s a decaying box and when we sell it next year when I retire 7 % to the realtor to sell my decaying box figure in the lawn tractor, weed wacker the painting new carpets, EVERY weekend mowing tending to the yard and every time you turn around my brother in law and his wife are taking ANOTHER cruise! or going to Europe

RENTING or a condo it the way to go

” NO HOA fee’s, no connection to neighbors,”

And obviously you live in countryside. “no neighbours” alone drops anything even remotely rural from the list.

How many condos in your neighbourhood? Zero? They don’t tend to build those in countryside.

Farm arguments in a city discussion, sorry.

“Be unique, own a home not a part of an HOA,”

Why I do read this like “Inherit a farm like I did!” …. I wonder if anyone else does the same?

Or just “Be rich like my parents who bought me a nice house”.

Some of the worst places I have lived have been condos. Having to deal with overly expensize HOA’s, boards run by entrenched power-mad lunatics, special assessments, shared walls, dead-beat neighbors, unkept common areas, etc. No thanks.

I think that many people buy homes and do not foresee the amount of time & money that is needed for upkeep and maintenance.

Ah … satire. Brilliant!

I had a condo once. Never again. The HOA was a killer and it always went up. Even if paid off, the HOA plus taxes and insurance are the same like rent.

If you have to be in a condo, you are better off renting always.

Condos don”t appreciate

They do in Los Angeles. Condos that were $75-85K fifteen years ago now cost $325,000.

According to the latest Case-Shiller report, L.A. has had a 4.3% *real* annual appreciation rate over the past 15 years. I don’t know the breakdown for condos. Anyway, 4.3%, yawn.

I suppose condos might be good for people who don’t actually want to LIVE in it. Just use it as a base to store things, but spend all your time outside, traveling, biking, hiking, dining, exploring, etc.

But if you want to spend most of your leisure time IN your home, enjoying it as a place of quiet refuge — reading, writing, watching TV, inviting a few friends over — then a house beats a condo.

“But if you want to spend most of your leisure time IN your home, enjoying it as a place of quiet refuge — reading, writing, watching TV, inviting a few friends over — then a house beats a condo.”

So you can’t watch TV in a condo?

Now that’s one of the most stupid ideas I’ve seen in a long time.

I see more a denial: Because the writer owns a house, a condo _must_ be absolutely bad and horrible. Also we are comparing a 3000 sq ft house to a 300 sq ft condo, are we?

I’ve had both and both have serious disadvantages. Being a lazy guy I chose condo last time, not too bad: Only one idiot neighbour and he isn’t too noisy.

That’s one less I had in previous house.

Surprisingly enough, I’ve been renting a condo for 3+ years now and it’s been a pleasant experience. Absolutely no noise from neighbors, hoa is high but I’m not the one paying for it, and my landlord hasn’t raised the rent.

But I can see if you are to purchase one, it’s like a coin flip since you cannot live in the unit before buying it.

So true, condos are not for families or people who like to entertain guest. They are for old people and people who travel a lot on business or leisure.

I lived in a condo/townhouse for 10 years growing up. Left a bad taste in my mouth after that. The noise complaints just walking up and down the stairs regularly… the bitching neighbor because your dog barked for a minute or you had friends over for a party on a Friday night. Add in the HOA restrictions….. yeap thats not living its called restrictions on life.

If your going to be tied to the system paying property taxes and doing the treadmill… you might as well cherish the free time one has (instead of dealing with more bs and restrictions on living).

HOAs can be good or evil. I own an SFR in a tract built in 1997, $46 HOA obviously hasn’t gone up much in that 18 years, and it pays for a clean pool and beautiful private park behind my rear fence. I fired my gardener so I could spend that $40/month on good microbrew, and now average maybe an hour/week on yard work during the growing seasons. Almost no work during late fall and winter. AC just failed (after 18 years) so we’re happy to replace it with the same brand. Condo HOAs don’t cover that either, if it isn’t shared with other units. I’ve also lived in the other extreme – an old neighborhood in Vista with no HOA, with a life-sized horse statue behind a hideous chain link fence in one front yard, a tugboat on blocks in another, and another house literally falling apart (e.g., several square feet of stucco gone, roof a shambles, 2 foot tall weed yard, etc.). Those were just the ones within rock throwing distance. Non-HOA color and diversity in (for example) a beach community with little to no yard can look great – but give someone 1k+ square feet of lawn in suburbia with no rules and they’ll find a way to make it look awful.

Condo HOA fees seem to start crazy high and increase rapidly, and how much of a problem you have with the neighbors depends greatly on the construction of walls between units. Even having lived in one that was so well built we never heard the neighbors, I wouldn’t remotely consider living in a condo again, for the parking issues alone. I’m sure it could be great if you never have visitors.

My fence is ready to be replaced, too – but before I let that get me down, I just think about a buddy of mine who lives in a condo. The HOA finally replaced his fence, 30 YEARS after it was put up. All 10 feet of it. He pays nearly $300/month for that kind of service. He will have paid upwards of $100k in fees by the time they replace his roof. I assume it will be embossed with gold leaf. He’s also paranoid about the volume of his TV, lest the neighbors complain, and has become a ninja with the remote during louder portions of movies. It’s sad, really. I don’t worry about that sort of thing.

New home size from 2000 to now … expansion is size is big and in systematic they have created a MI2MP model that makes it impossible for first time home buyers to buy homes.

And …. now … they blame tight lending

My recent article going against

Laurie Goodman thesis who wants to ease lending standards

http://loganmohtashami.com/2015/04/09/tight-lending-and-other-urban-legends/

My recent Media Interview going against

Mark Zandi

Laurie Goodman

Jed Kloko

Talking specifics why lending standards aren’t tight, Americans simply don’t make enough money

http://loganmohtashami.com/2015/04/13/interview-with-david-lykken-slaying-the-tight-lending-myth/

But incomes don’t matter because everybody wants to live here. It’s true because rich Chinese arriving with buckets of money global international world class weather capital and eating outside of the home.

Also, don’t forget that recessions never happen, especially in CA because the economy is so diverse.

First, in California’s large urban areas, there is little vacant land to develop unless you go 100 miles out. The economics and the cost don’t justify it. In the Denver area, currently there are new homes going in everywhere, plus condo’s/apartment projects going up in more dense parts of the metropolitan area and the now hip lower downtown of Denver. But, my guess is the music has to stop at some point, and it will be as painful if not more than the last crash. Just about everywhere one looks there are signs of out-of-balance conditions that need to re-adjust at some point. The latest an article in the L.A.Time about the pay of City workers. Once these unsustainable bubbles begin to burst, they will have significant ramifications for local economies, housing, etc.

You’re wrong because everyone wants to live here. Trendy eateries and web 2.0 disruption forever. Rich Chinese with buckets of money forever. Global international world class. No consequences and free rides if you’re prime. Come on in the water feels great and don’t mind the chemicals.

I live in Denver too and have been interested in hearing what others think of our RE market. There are some who say that Denver is immune to a crash because so many people are moving here. I beg to differ…I don’t see how the market can continue the way it is. Feels like a ticking time bomb.

3rd gen builder. it is illegal to build affordible homes. Any plumber, electrician, framer..skilled trades will tell you the building codes are crazy, especially for modest homes. Even remodel, if a requred permit is pulled, are near requiring the entire house “come up to code” . It’s less obscenely expensive to rip the fine house down.

I could go on..

But my realtor told me one of the intangibles of owning was that I could do what I want to the place when I own it, you mean to tell me that we still answer to someone as owners? The home purchase promotion club doesn’t mention that in the brochure.

Your sarcasm throughout this thread is both childish and repetitive.

Siggy: “But my realtor told me one of the intangibles of owning was that I could do what I want to the place when I own it, you mean to tell me that we still answer to someone as owners?”

You know very well (or should, if you’re older than 9 or 10), that the owner of a house enjoys far more freedom and control than the owner of a condo, especially if the house is not under some HOA’s jurisdiction.

The fact that you don’t have absolute, 100% control over a house does not change this. I’ve lived in both houses and condos. Houses allow for far more freedom and control. Your realtor is right on that score — and you know it.

No less childish and repetitive than the message it mocks. Which is the point. Congratulations for making it this far.

Where you failed comprehension is that there was no distinction being made between a detached house or condo in regard to the “intangibles of owning” talking point, but rather against the backdrop of renting versus purchasing.

sounds like the problem of stable jobs and moving at the wrong time was the problem, NOT the homes themselves. People I have hated every Condo complex I”ve owned in, you have no say and HOA can go up, I was paying 393 mo for one, its not the way to go if you don’t have too. Sounds like brother jelousy, maybe he makes more or made better choices. Its not HIS condo that made his life wonderful. look at all his choices.

my Brother law was smart! he got a good city worker job retire at 50 90 % pay SMART!

Maybe, if the builders built some entry-level homes they’d sell but all that’s going up in my city (Huntington Beach) are new rental buildings. The only single-family housing tract is Brightwater featuring million dollar+ homes.

Lorrie,

You can’t build under that price due to cost of land, materials and skilled labor. All went through the roof.

You might buy for less where the demand is lower.

Millennials are into electronics and some like nice cars; otherwise they don’t appear to be as materialistic as previous generations. With less “stuff”, they should not need that much space, which is a good thing.

Dennis, those millenials living with mom and dad have no place to put ‘stuff’, ergo, they don’t have stuff. It’s not from a lack of materialism.

Even these sales figures are ‘goosed’ by government connections or those to the Medical/Pharma/Insurance/Attorney cartel — super guild.

If you could tease out these buyers from the stats — you’d be bowled over!

At current prices, on current economics, no-one (to speak of) is able to buy a new home.

The occasional professional athlete media personality does not make a mass market.

This sort of real estate distress has been a fixture in the Third World for eons.

The desire is ever present. The where with all — not so much.

Holy shit! A 6 line comment from blert! An amazing new level of succinctness we’ve never witnessed before!

Hahaha

Something is GONNA give, eventually. http://ronpaulupdate.com/?cid=MKT033949&eid=MKT038370&gclid=CIjUjr2BlcUCFRSUfgodPFUAUw

Current “economy” is simply a result of smoke and mirrors. Completely unsustainable.

YOU are right !!! ding ding ding you get the prize! America is going down the tubes FAST

Young people DO NOT need to tie themselves down with a decaying box ( house)

The decaying box eats money buying the house is EASY!!! free gov’t money but the UPKEEP will eat you alive! go out and price a gallon of GOOD paint! RENT is the way to go stay fluid be able to GET OUT at a moments notice the job market is so unstable you do not want to be caught! ‘owning’ a home trying to sell when every one else is trying to get out. The city /state pension time bomb is about to go off

WHO do you think is going to PAY………that’s right the sitting DUCK home owner that’s who! Pay some city/ state worker to ‘retire’ at 55 draw 90 % of their pay & bennies for thwe next 30 PLUS years for NO WORK

Young people reading this ENJOY ENJOY your youth! do not be sucked in stay free just rent STAY FLUID!

Wow, great video. Thanks for sharing. I admit that I haven’t always been a huge Ron Paul fan but this may have convinced me otherwise. I read somewhere else that the Fed has never created this much money artificially at any other time in our history, at least not on the current scale. It’s sure to have an impact, and the fact that most people are unaware is scary.

California and the Bay Area are being over-run by wealthy immigrants looking for the American dream. Invited in by the Feds under pressure from banks and the NAR lobby.

Remove this factor and you would probably have a normal real estate market.

The Feds, along with the State and cities, need that foreign money to keep the party going.

Some day the party will end.

Just wait until the state/ city worker pension time bomb goes off ‘owning ‘a house is going to be a mill stone around your neck.

Nope, everyone wants to live here, therefore this place is immune.

QE infinity is now part of the FED permanent tools for “financial stability”

http://www.zerohedge.com/news/2015-04-26/boston-fed-admits-there-no-exit-suggests-qe-become-normal-monetary-policy

It worked so well in the past…I am sure it is going to work wonders in the future…of course in the name of financial stability (no other reason!!!…:-) The big five, the owners of the FED don’t look for their own interest. It is all for our own good (sarc.) ….and of course, Ron Paul is a “crazy” guy for daring to request to audit the FED.

remember Paul is not crazy, the people whom didn’t want him to win painted him that way….if this is crazy bring it on….someone with a bit of sense in government is a enemy of the government….this will blow you away

https://www.youtube.com/watch?v=ifJG_oFFDK0&feature=player_embedded

“…home owners insurance now at 1500 per year ( NO CLAIMS) YES it’s a decaying box and when we sell it next year when I retire 7 % to the realtor to sell my decaying box figure in the lawn tractor, weed wacker the painting new carpets, …”

David Frantz,

Did you read your post before submitting????!!!….Do you pay commission ONLY on houses but not on condos? Do you paint and change carpet ONLY in houses but not condos??? Is the association painting the inside of your condo, change the carpet inside of your condo and is the association changing your water heater or washer or dryer if they fail???…Or is the commission 7% on houses and 1% on condos??? You can list your condo or house on MLS for a negotiated flat fee and offer the buyer’s agent whatever % you want to offer to make your listing attractive; at 3% it is very attractive.

What a bunch of non sense!!!

Frantz, isn’t your condo a “decaying box”? The house is too; however, with the house the land value ususaly goes higher than the depreciation on the building so usualy you get some appreciation if it is very well located and over a long period of time.

As an older 59 year old man I am warning young people on what home owner ship is:

Quality of life is much more important than anything! ENJOY your youth!: travel if you can enjoy your weekends mowing and weed wacking every weekend is not enjoyable my current home was built in 2001 it’s all brick on one acre so far 13 grand for a new roof, 6 grand for a new air conditioner/heat pack like i said a decaying box

The condo allows you to be free……. yes it to has cost but guess what every weekend is GOOD TIMES! and FUN!

“… yes it to has cost but guess what every weekend is GOOD TIMES! and FUN!”

Good point. What is the price of a free weekend?

As a house owner I didn’t have too many, esp. in winter time: Snow everywhere. Probably easier in milder climates.

We drive 10-15 year old cars. Our phones are so old that my husband and I joke that the only apps we have are the am/fm functions on the radios in our car. We are 30 and 35 years old, respectively, and wanted to buy a home between 200-250k. We could have “afforded” more but wanted to be cautious. Every home we liked was bought with cash by an investor and either rented out or scraped to build a modern McMansion for someone willing to pay 500k.

We are now looking at a new home but the prices are still double what we ideally want to spend. Choices are limited and we have to ask ourselves if it’s worth the risk of going broke just to own a home, when we have other goals like having kids, retirement, paying for our kids’ education, etc.

You stated it well….we don’t want to pay double…..but your still thinking about it….

you are on a blackjack table and your doubling down on a pair of 4’s….good luck….the odds are not with you…..the fed induced surge is over, the slow trickle down will begin….

time is on your side….I know it’s hard to believe but are you a day trader or an investor….

Reading a comment like that… you seem to have the right general attitude for making it in live. Pity the deck is a bit stacked against you at the moment, but then in a few years time things may change completely.

Condos are “air estates”. What you “own” is the space between the walls. And they do appreciate. Just not at the same rate as SFRs.

All that “free” paint, the landscaping, maintenance and other upkeep is paid for by ever increasing HOA fees.

Done it. No escaping the nasty neighbors across the way [bubble dancer and her mooch of a boyfriend] and it was a blessing when I sold it and moved on.

“No escaping the nasty neighbors across the way”

And how is that different from a house? To me it isn’t and you haven’t done your homework: Find out who the neighbours are before you buy.

“Research” about who your neighbors will be isn’t too helpful, because neighbors change over the years. You might move into a condo and have good neighbors. A year later, a good neighbor might leave, and be replaced by a neighbor from Hell.

It’s true with houses too — BUT it’s much better if you don’t share walls. Even a few feet between houses is a big improvement.

Oh yes, next time I’ll interview them all, like everyone else does. Absurd Commet Of The Day” Thomas.

From my experience living in multiple single family homes and condos, houses can have bad/noisy neighbors exactly as condos can. I guess you’re generally slightly closer to them in a condo, but the difference is pretty negligible, at least in most places in So Cal. Doing homework on neighbors can help a bit, but people move and change (such as acquiring barking dogs etc). So even though the place might be nice and quiet when you move in, it’s quite possible it wont always be that way.

It’s really too bad there are so many idiots out there. My family and I are very quiet and are cognizant of the quality of life of those around us. All we really want is for the favor to be returned. Unfortunately, there are untold numbers of morons with barking dogs, loud home theater/stereo systems, wood working tools, wild/screaming kids, you name it. This applies to both condos and houses; it makes no difference from my experience.

At least in a condo you can contact the HOA, in addition to the police, for noise and other issues. In a single family house, there’s generally no HOA to help with such issues. Not that they ever take any meaningful action, but they’re there.

Responder: >> houses can have bad/noisy neighbors exactly as condos can. I guess you’re generally slightly closer to them in a condo, but the difference is pretty negligible, <> At least in a condo you can contact the HOA, in addition to the police, for noise and other issues. <<

They can be pretty useless when you need them. I complained about a neighbor playing music loudly at 2 and 3 a.m. a few years back. I called the doorman to complain, who called the neighbor. The neighbor ignored the complaint and went on playing the music.

HOA's will often just write a letter to a noise-maker, but do nothing else. They're certainly not sending up security people to silence the noise. So if the noise-maker chooses to ignore the letter, he will.

That space between houses is golden, because a LOT less noise reaches you from the neighboring house. And no cooking odor.

Curious if there are any studies that show AirBNB impact on the RE market. per this LA Times article there are over 1,700 short term (AirBNB or perhaps VRBO) rentals in Santa Monica. It is my belief that in the last crash, many an entrepenuer purchased homes with the express intent of short term rentals.

http://www.latimes.com/business/realestate/la-fi-santa-monica-airbnb-20150427-story.html

I am involved in an organization and we needed a weekend away to brainstorm. We rented on AirBNB, a Santa Monica 3 bedroom condo. we paid $1,000 for the 3day weekend. The mortgage on this place must have been under $2K. And this condo we rented was booked nearly every weekend. Someone is making money, let alone the boomers in Santa Monica with homes that are paid off, seeking offset in monthly expenses through short term rental. It does not take much to add an entrance to one of the bedrooms and bathrooms in an old house in fetch $100 per day.

Anyway, it would be interesting to see the effect if any that AirBNB and VRBO are having on housing – esp. the Westside.

The HOA in my Santa Monica condo forbids rentals of less than 4 months.

The City of Santa Monica forbids rentals of less than 30 days.

Since 70% of Santa Monicans are renters, I assume that most of those AirBnb rentals are illegal. Rent-controlled tenants subletting their units at market rates. Which the city won’t crack down on, because, while it loves to punish landlords, it hates to displease tenants.

Homes vs Condos argument can go on forever. Both have valid pros and cons. As a senior 75 year previous owner of both, I finally found the answer – buy an RV. Eliminates taxes, yard work, assocation fees, etc. Best of all, with shitty neighbors, you simply get up in the morning, start the engine and move to a better neighborhood. Oh and I forgot Another biggy – you are always on a vacation

@ lolo4u

funny, but sounds good in some ways. But along the same lines as the various cities banning short term rentals (ie: AirBNB) arent there lots of cities that have banned overnight parking of RV’s….

Places in the desert like ‘slab city’ an old military base are havens for the RV life

http://www.slab-city.com/

but places like Venice have banned overnighting for vehicles over a certain size that includes most RV’s. Of course, many of the RV folk deserve it because of their trash and defecation in the streets…

http://www.latimes.com/local/la-me-venice-parking24-2009feb24-story.html

BINGO! give that man a cigar! THAT is EXACTLY what we have done! We bought a RV a Rialta!!! SWEEEEEEEEEEEEEEET( check it out google : Rialta RV) I am going to RETIRE at 59 stop WORKING like a fool paying taxes I have had ENOUGH of supporting MOOOCHERS! health insurance cost me and the wife 13 grand a year PLUS the 6 grand deductible……. so BEFORE it kicks in I am out 19 GRAND but if I stop working and RETIRE now….. I get ALL of the obama care subsidies so life in the RV free loading is just what I am going to do! I like the sound of MOOOCHER! This is what my government encourages! Hard work is PUNISHED! as soon as I am 62 I want my social security! hey my health insurance for me and wife will be about $100 per month SWEEEEET by the way that BS about ‘pride’ and working ‘hard’ take that to star bucks and see if it will get YOU a cup of coffee!!!

Because this time is different.

https://www.redfin.com/CA/Inglewood/3520-W-80th-St-90305/home/6425616

Apr 9, 2015

Sold (Public Records)

$360,000

Apr 17, 2015

Listed (Active)

$449,000

What a POS. The listing says it has a new roof. From the picture it looks like they scraped off the old roof and never cleaned up the debris in the yard.

Love the “Great buy in a fast appreciating market.” No need to hurry on this one, I doubt there will be any bidding wars. 🙂

Oh man, that’s shocking. They want a 25% markup just for buying it?

And when the next price drop occurs, remember that the short sales will go to the connected and that your big down payment will mean bupkis when the 100% all cash plutocrats come out of the woodwork again, like they did originally in 2009 – 2012 to gobble up crap shacks on the desirable westside of Los Angeles County. History does tend to repeat itself. So for those salivating for a tantalizing price drop, save your shekels to compete with the all cash kings and queens. And in the end, it is more about the precious southern California dirt than it is about the actual chicken wire and stucco mud crap shack that can be easily replaced…as long as you get the land.

Are those facts or feelings? The parts of history that repeat tend to be the abstract fundamentals, whereas the attributes are more dynamic. There could become new details applicable to the next major price correction event that cannot currently be accounted for.

Facts and Feelings: Of course the all-cash buyers will be out in force if a big price drop happens. If you’re not a cash buyer, you would obviously have to make a big enough non-cash offer to make it worthwhile to the seller. Yes, you’ll pay more than the cash buyer, but you still might be getting a deal, relatively speaking. In 2011-2012, we had genuine opportunity to buy several places (non-cash), which we stupidly passed up. I believe the next time around will have similar opportunities.

You do know that a very large portion of those cash kings are using short term, high interest loans to come up with the cash, and then refinancing into a traditional mortgage once they have the property? You could do the same thing.

That’s what those KFI flipper commercials are about. “Hi I’m Joe Schmoe from HGTV’s Obnoxious Flipping Personalities show. We can’t find any more good deals, so we’re looking for a select group of highly motivated suckers to take crazy risks so we can collect commissions from the lender.”

Leave a Reply