Million dollar foreclosure hunter – The distressed inventory of Beverly Hills. Expensive properties with no mortgage payments. WaMu Alt-A mortgage products reappear in Beverly Hills.

Do you ever wonder how some people are living large, sending their kids to private schools, driving around in leased European cars, and also manage to live in a million dollar home? Sure, you can do it the hard way by earning a respectable income or you can go about it via the new get rich quick path. As it turns out, hundreds of thousands of Americans are living in rather expensive homes without making a mortgage payment. Squatting frees up a nice chunk of disposable income. For years the perception was that only poor low income neighborhoods were filled with REOs and that foreclosure was a Scarlet Letter carried only by less affluent families. Of the two million active foreclosures over 40 percent have not made a payment in well over two years. Just think of all those suckers paying their mortgage on time or making their rent on a monthly basis! Contrary to popular belief, some of the most affluent neighborhoods have these faux money folks roaming around acting like the Joneses. Today we’ll go on a million dollar foreclosure mission in one of our favorite stomping grounds, Beverly Hills.

Foreclosure and no mortgage payment for five years?

The most e-mailed story of the week has to be about the couple in Maryland who purchased a million dollar home in Maryland but have made no payment in five years:

“(Washington Post) The eviction from their million-dollar home could come at any moment. Keith and Janet Ritter have been bracing for it — and battling against it — almost from the moment they moved into the five-bedroom, 4,900-square-foot manse along the Potomac River in Fort Washington.

In five years, they have never made a mortgage payment, a fact that amazes even the most seasoned veterans of the foreclosure crisis.â€

Read the story. Become inspired. The country has largely become a moral hazard sandwich where the bigger middle is forced to bailout the corrupt investment banking sector and also subsidize countless squatters in prime areas.   This is only one case of the hundreds of thousands of homes in the shadow inventory. I’m reminded when I used to hear people arguing that Alt-A and option ARM loans were simply creative financing options for doctors, lawyers, and actors too busy to document their income. “Documenting your income is for suckers! I’m too busy with my auditions to fill out lousy paperwork.â€Â Most of these have defaulted or have become part of the trillion dollar bailouts handed over by the Fed to their banking buddies. Who needs a reset when you can simply not pay?

“The Ritters, who bought their house for $1.29 million with almost no money down, are hardly representative of the vast majority of Maryland’s distressed homeowners.â€

Where are all those toxic loans? Many are simply being ignored and are part of the taxpayer bailout. Makes you feel all warm and fuzzy. Let us examine Beverly Hills for some million dollar foreclosures.

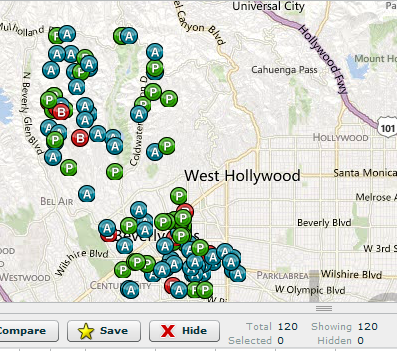

Beverly Hills – two foreclosures listed while 120 homes in foreclosure process

Beverly Hills has one of biggest million dollar shadow inventory of any city in the US. The MLS lists two homes in foreclosure while 120 are in the foreclosure pipeline:

Some people naively think that the toxic Alt-A loans simply disappeared. They have not. Lets go hunting for a million dollar foreclosure.

9994 REEVESBURY DR

Beverly Hills, CA 902105 bedroom, 3 bathroom, 0 partial bath, 2,784 square feet, SFR

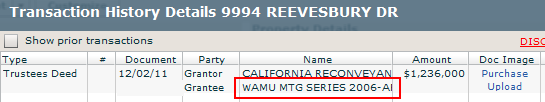

This home hit the MLS in the last week or so. This home is listed for sale at $900,000 and is a decent sized place in the 90210 zip code. But more importantly, let us dig into the previous note details here:

What a shocker! Alt-A and option ARM happy WaMu shows up on a current foreclosure. Read about the rise and collapse of WaMu here:

Washington Mutual Failure and Collapse: WaMu Largest Savings and Loan Failure in U.S. History. The Rise and Fall of Washington Mutual.

Looking at the loan history we find the following:

-1. The loan was made on 5/23/2006 (at the peak of the bubble)

-2. By 05/18/10 the default amount was already $28,092

-3. The first notice was placed on 08/20/2010

-4. The bank took this place back on 11/22/11 for $1,236,000 (original loan $1,155,000)

Do the math here. By the time the bank took this back as a REO the backup in payments and fees amounted to $81,000. If you think the market is so hot in these big money areas then why is the bank listing this place at $900,000 or 22 percent the loan amount back in 2006? This is in Beverly Hills by the way. Remember foreclosures never happen in rich areas as long as Louis Vuitton bags are on the street.

If the place had a NOD filed on 05/18/2010 it had missed at least three payments at that point meaning the last mortgage payment was likely in January or February of 2010 (probably even in 2009). So this million dollar home had zero mortgage payments up until November of 2011 when the bank took it back (over 20+ months in a very prime area).

This brings our first million dollar hunter find to a close. I’ll try to do a routine series on this given how some people in California seem to think that every person is making $1 million a year and has uncle moneybags funding every purchase. 2 MLS listed homes and 120 homes in the foreclosure pipeline for Beverly Hills. Think this case is unique? Think again.

What would you purchase with no mortgage or rent payment?      Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

38 Responses to “Million dollar foreclosure hunter – The distressed inventory of Beverly Hills. Expensive properties with no mortgage payments. WaMu Alt-A mortgage products reappear in Beverly Hills.”

Foreclosures never happen in super-rich areas, but they happen in rich areas. If a movie star or an NBA player makes $10,000,000 a year, he can buy a 5 million dollar house for cash, and therefore there will be no foreclosures. But of course we have a lot of posers who want to buy the most expensive house the banks will give them. Those are the ones who wind up in foreclosure.

A second point is that rich people are better with money than poor people. They know that if they can get away with not paying a $10,000 per month mortgage for five years they save $600,000. What is more valuable, a high credit rating, or $600,000? And, if they start feeling guilty, they can get aroma therapy, a foot massage, a Porsche, and some comfort food with all the money they saved.

Nick, you are so wrong, foreclosures go all the way up into the tens of millions, for all kinds of reasons:

a) the football players and actors who became rich quickly and had some dubious managers make “investment” recommendations – they may have made $10 Million in cash, but that doesn’t mean they didn’t take out loans to make “more” out of their money.

b) strategic default

Remember Nicholas Cage? Or here’s some other examples:

http://www.forbes.com/2011/03/04/celebrity-foreclosures-real-estate-forbeslife.html

“If a movie star or an NBA player makes $10,000,000 a year, he can buy a 5 million dollar house for cash, and therefore there will be no foreclosures.”

No, but they can afford to sell for blistering losses that still affect neighborhood comps. Britney Spears paid $6.75 mil for this in 2007. Today’s listing price: $2.995 mil.

http://www.redfin.com/CA/Beverly-Hills/12094-Summit-Cir-90210/home/5258075

I’m skeptical that a single anecdotal story (or even several such) really captures what is going on. We don’t know if this home is exceptional, for example the paperwork got lost / tied up in some legal proceeding or if they are all this way. This story would be more convincingly be made if we looked at a statistically significant sample size.

I think you are asking for an impossible data set. Banks have an incentive to down play how many people are not paying on properties. The bottom line in Beverly Hills you have 2 homes up for sale to the public while 120 are in the foreclosure pipeline. We also know that nearly half of those in current foreclosure have made no payment within 2 years. That is a big enough sample size for significance.

Banks have to keep the sheeple in line. Imagine if people got wind of this epic moral hazard. Happening on both coasts:

“In New York, the time to complete a foreclosure has almost quadrupled, from 263 days in 2007 to 1,019 days in 2011. Abraham Kleinman, a lawyer in Uniondale who represents homeowners fighting foreclosure, said he counseled a client who felt guilty about remaining in his home so long after defaulting. “He says to himself, ‘I’m sitting here rent free, it can’t go on forever,’ †Mr. Kleinman said. “But the plaintiff has not been aggressive. As near as I can tell, they’ve put this to the side.â€

Sounds like banks are selectively letting hundreds of thousands of those in foreclosure linger while the sheep keep the cash flow coming in.

(As far as I know this hasn’t happened yet, but could it??)

Here is an example of an epic moral hazard paradox:

Could the foreclosure pipeline grow so long [lets say 10 years] that a savvy squatter could save all the missed mortgage payments and at some point have enough saved cash to buy his own house back at a short sale?

That would be a neat trick.

I think people can buy each other’s short sales, then somehow swap back later. So you will need to work with somebody else. But buying one’s own short sale is prohibited I believe. It would be really funny if that happens.

Dr. Housing Bubble, You forgot about all the rich Chinese and all the rich parents and all the kings men…

I believe we have two solid facts. The first is that the median income in these west side communities do not appear to be inline with the perception of wealth. The second is that wealth is becoming more concentrated which means that a lower percentage of the population hold more of the total wealth. So, when I hear “I know a lot of rich people” or “everyone at my work makes at least $300,000” I listen with a grain of salt. Even if these claims are true, it has no real impact on the housing market…

What, I agree with your thoughts there. There is also a huge generational wealth gap that exists between the baby boomers and the under 30 crowd. The under 30 crowd will be much poorer and have much less oppurtunity than the generations before them. Who knows exactly how much a factor “rich parents” in keeping westside prices elevated. I think the ultra premium locations (Malibu, Manhattan Beach, etc) will always be out of reach for the upper middle class. The next rung of the ladder are the Culver City and Torrances of the world. This should be truly interesting to see how this game of ponzi musical chairs plays out…

Ditto from ground zero in Orange County.

No question that some *very* wealthy people live in Orange County.

Many are concentrated in certain distinct areas (ie Corona Del Mar, Newport Beach, Irvine).

Having said that, there is simply no mathematical way that current median incomes can support current median home values. [1]

So, there are only 2 possible outcomes: The few super wealthy can each buy 20 homes OR median prices can decline.

Yet, like the Westside, a common perception is that everyone in these areas is wealthy.

Let me assure you based on some close personal experience that this simply is *not* true. I have no way to prove with hard data, but based on my own observations, 9 out of 10 households are living above thier means in some manner.

Sadly, we seem to live in a culture where many people spend money they don’t have on things they don’t need to impress people they don’t know.

[1] http://www.zipskinny.com !<- excellent income stats site.

Concerning houses in Westside areas that have in the past 12 years become unaffordable and desirable. The people who had bought before 1997, or even better before 1985 when there was previous bubble (http://www.rntl.net/history_of_a_housing_bubble.htm), they are probably regular middle class people, even blue color. Not rich by any means. They bought their little bungalow for 200-250k at the height of the bubble 1985-90. If they bought in the 90s, then under 200k. So by 2005 their little bungalow shot up to 800k or even a million. 1. They either stay put and live modestly. 2. Stay put and take out lines of credit to live better. 3. Use all the equity to by a bigger and nicer place. 4. Or just plain cash out. Those who fall under number one probably were older and empty nesters who will just retire in their old little home. Those who fall under number two could be be okay, or have taken out so much money they might be in trouble to foreclose. People who fall under number three lucked out and basically won the housing lottery. People under four are not doing too shabby. The people who bought too much at the height of the bubble could be in trouble. The median incomes of Westside are low because it wasn’t so long ago you didn’t need much money to live there and many people stayed put. People who traded up probably still have modest incomes, but have a high net worth because of their house. All the people were pushed out of the ritzier beach cities were forced to go looking at Venice, Santa Monica, Playa Del Rey, Marina Del Rey, El Segundo. Which pushed those prices up. I feel like prices are still high in some non-beach areas. When did it become normal to pay 400-500k for a starter home? It’ll definitely take longer than a lot of us will be comfortable with to all unravel, but I try to have hope.

http://www.redfin.com/CA/Los-Angeles/643-S-Sycamore-Ave-90036/home/7091891

dasher you dont understand mortgage are amortized, after ten years at 4% rate on a fha 729,000 dollar loan you have only paid it down to 555,195, and that is if you never refi, the reason are parent paid there houses off is most bought there first house under100k some under 50k, so even in the 70’s and 80’s if they made 20k per year or even 10 they were able to pay off there houses, now we have a class of people who make 120k and carry 700k mortgage, they will never pay off there houses, it wont happen, mortgages were never intended to be paid off, most people i know are way up side down are working for much less then they used to here in california. I just bought my second house in long beach for 425 2 months ago. I is in a nicer area of long beach. My first house i sold in the fall of 2005 for 925k, i bought it for 765 in 2002, but i sold because i had a job change, i was at the time a industrial lighting sales man making about 200k per year. Now i am a selling soft ware to school districts, so i have taken a pay cut of about 100k, last year i made 90k, but i did make a profit on my house, so i had a down payment, i am only 31 so i am still young, but the house i sold is now worth about 650k, I bought this new house because i rented for 6 and a half years waiting for the market go lower,in los angeles and orange county, it wont fall any more. Some kids that have rich parents are just buying there children house cash. it is fairly common, i have a mortgage on my new house of 330k, that is all i really feel i can afford payment wise, plus i have to spend about 35k updating this place. Just realize. some baby boomers road the stockmarket and realestate bull market that started in the mid 70’s an popped in2006, and these people are multi millionairs. I grew up in irvine. My parents are just regular people but i went to school with kids whos parent are so rich now because they were in realestate or the market the whole time they have millions.

If banks had to mark-to-market and/or foreclose on ever mortgage now over 3 months in arrears, we’d only have a government bank. And I guess, in some ways the mortgage industry now it the government.

Yes! When ‘The State’ or the ‘Too Big To Fail’ banks are able to simply ignore the rule of law we have a breakdown. If the banks and state followed the rule of law we would not have had the bubble to begin with because the banksters ignored or changed over 200 years of mortgage and property transfer law in order to pull off their robbery if equity in 62 million houses in the USA in the last 12 years! Don’t people know yet that this was fraud??? They did this to us purposefully and intentionally and then blamed the borrowers duped into putting up their houses in what they were told was a loan contract but instead were simply used in a securitzation of the Note that had been separated from the Deed and never properly secured in a tax fee REMIC Trust PRIOR to the securitization process! Then this was done repeatedly with the sane Notes being sold multiple times! The banks robbed the borrower, the investor, the IRS, as well as county recorders across the country. It’s unbelievable to me how clueless most people STILL are YEARS after the crime and crooks guarding the hen house. The people not payo g their “so called” mortgage don’t know who loaned them the money so who are they supposed to pay? The bank never loaned a dime, nor did the banks serviced, nor did the banks so called beneficiary MERS. The banks zoos trillions in over leveraged assets to investors before the borrowers ever even closed escrow! The banks got 3 to 20 times the entire 30 years worth of the Notes before the borrower ever even closed escrow! Then the Banks turned around and purchased about 70% of the underlying assets pocketing 30% for themselves pass the servicing of the basically unsecured debt and done. Wake up and smell the corruption! Jeez Louise people Americans did not just turn deadbeat overnight! Stop blaming the victims! It’s the banks! Makes Maddoff look like a pre schooler!!!!

What does this mean in plain English?

Very infuriating! When will banks go after such folks – provided they have the ability to pay? The little guy gets evicted within months and his landlord can garnish wages. Such shameless folks deserve to get punished for much longer than 7 years of bad credit!

Many homeowners who are not paying their mortgages also are defaulting on their HELOCs. One of the problems that has slowed down processing of distressed properties has be the reluctance of banks to to report losses on these 2nd and 3rd notes. HELOCs are are carried at full value until the REO is cleared from the books. Perhaps some of the accounting posters can further illuminate banking balance sheet.

As stated by CAE – If mortgates (andHELOCs) were booked at market value, Wells, City, B of A and a whole slew of smaller banks would be fundimentally backrupt The slow release of distressed properties has simply a method to prop up the Zombie Banks.

There has been little mention of the financial institution’s balance sheet regarding booked values of real estate assets on their current financial statements. I believe the banks are not capable of handling a massive write down of assets in one calendar year without seriously effecting their bottom line profits. Foreclosures will be a slow go for the banks to bleed out, those who managed to stay in their homes during this process, are the real lucky ones. They only need to pay for utilities, lawn and pool care to keep the appearance of living large.

DON–

You are absolutely correct. The lender does not have to mark-to-market-value until a transaction is recorded. Therefore, all of those 1.2mil mortgaged Bev Hills houses that are now worth 900K still appear on the balance sheet as a 1.2mil asset. If they mark-to-market, the balance sheet would suffer–and therefore the reserves would need to be increased by the mortgage holder.

If you are a CxO for one of these corporations you will be fired by the shareholders if you liquidate the troubled assets. Your share price would fall, your EPS would fall, 401K’s would take a huge hit. That is what the public does not recognize–the reason the assets are not being disposed of is not some government-bank conspiracy plot. it is simply the fact that to liquidate assets at less than balance sheet value would cause a major liquidity crunch–as in less capital available for loans. This could cause a deflationary trend, further lowering asset values, further lowering capital available for loans, etc, etc, etc.

Hmm…A renter stops paying, and gets eviction notice, 30 days, maybe can drag it out few months past that. The deadbeat homeowner squats for MUCH longer. Hmm…sounds like a “good time to buy”…realtards can jump on this sales pitch right away!!

An acquaintance of mine is at the 2 year mark of squatting. Not paying a 4K per month mortgage adds up quickly (one more year of this and he’ll get back how much he is underwater). He gets the fringe benefits of living in a great house and his kids go to top notch public schools. I’m not sure sure how long this crap can continue…I guess it’s part of the economic stimulus package! 🙂

Great thread. BH goes thru this every so often. Lots of wanna bees in that town. They go broke too.

However, I may be dumb as could be but why should the banks care whether the halpless or helpless or crooked home owner pays or not? After all with the new deregs in place, banks are nothing but loan brokers and speculators. The actual loan and hence “real” lender is in some pension fund. and the fund is holding a mortgage backed security. Yes?????? banks are just agents now with no responsibility. isn’t that the reason for the mess that we’re in?

Suppose the following:

1. Bank foreclosed on a house in 2007.

2. The owner abandoned, and a squatter moved in.

3. The squatter had the utilities turned on and maintained the place such that anyone would know it was occupied.

4. For some reason, the bank or its successor, seems to have forgotten about the house and done nothing to disturb the squatter’s occupancy.

Then, after 5 years (in California), if the squatter paid any delinquent taxes, the squatter may be able to successfully assert a right of adverse possession. While I don’t foresee a flood of A.P. claims, but they could happen.

I also think that an enterprising lawyer could make an argument for what I would call “constructive repossession” for persons who have lived in their foreclosed or “in limbo” houses for 5 years with no payment. If the bank sent an NOD that threatened legal action to repossess the property, and then never did it, then the former owner could argue that at some point, the law will presume that the bank should have taken possession, and the clock should start running on the bank’s right to claim possession (and on the perfection of the squatter’s right to adverse possession).

The legislature could certainly speed up the foreclosure process if it wanted to. If the time for adverse possession could be reduced to two or three years, you can bet the banks would move a lot of cases along.

People should be outraged at the sheer shenanigans that are going on in the residential real estate market. This reflects the sad collapse of ethics and morality in this country, when the thieves walk out the door in broad daylight to a ticker tape parade. Nobody learned a lesson from the fallout, except maybe those who chose to play it safe and wait for prices to be determined by supply and demand. They learned that nice people finish last and are left holding the bag.

Why would anyone buy a house in a time when the prices can vary depending on the whim of the banks artificially withholding supply? How will buyers and sellers determine what the property is worth? Buying now is making a huge assumption on the rate that banks will release inventory. Is that really how you want to commit to a 30 year debt obligation? If the banks needs more money next year, they will drop more houses on the market, collect fees, sell the debt, and walk away. Meanwhile, your 30 year debt bomb drops in value. Seriously? How is this ok?

This is complete nonsense.

Yes, honest and prudent people learned that the government is now 100% in bed with the thieves and crooks, and that if you work hard, save, play by the rules and try to do the right thing, you will be screwed, robbed, and after paying 40-50 cents on the dollar or more in taxes, demonized for not paying for your “fair share” of their corruption.

The ship has totally sailed on the future of the U.S. We have utterly, utterly lost any sense of morality as a society, people lack not only manners but even a basic sense of decency, and when the government becomes so obviously a tool of the corrupt, it’s now plainly evident that it’s every man for himself. This will not end well.

Its a nice expose, with a couple “not so little” problems,

9994 REEVESBURY DR is NOT in the Beverly Hills City Limit. It’s actually an LA address referred to as BHPO (Beverly Hill Post Office)

http://en.wikipedia.org/wiki/Beverly_Hills_Post_Office

The subject property is about 2.5 miles from the BH city line, which makes it worth a lot less than a home inside BH city, with BH city services and access to BH school system. Split level, hillside home, no yard, etc. Probably overpriced at 900k based on the surrounding homes. I could go on and on, but I won’t. Look it up on Zillow, and decide for yourself.

I don’t live in BH, but if you’re going to take a jab at BH, you better come up with a much better poster child than this POS.

This is the address DHB posted in article: “9994 REEVESBURY DR

Beverly Hills, CA 90210”

This is the location he said it was in: “This home is listed for sale at $900,000 and is a decent sized place in the 90210 zip code.”

He never said it was in the “Beverly Hills City Limit.”

It has a Beverly Hills address. If you mail a letter to them, where does it go? The Beverly Hills.

My folks had a house with a Los Altos address (expensive area of the S.F. south bay): it was actually unincorporated Santa Clara County.

Think those homes don’t sell for millions because they aren’t in “Los Altos City Limits”? Think again. They have the very desirable Los Altos address, no sidewalks or streetlights….and you can’t buy a shack there for under a million…even today.

Read more carefully before you dis the example provided.

I’m not going to pretend to know anything about Los Altos, never even been there. Farang, it seems you know about as much about LA and Beverly Hills as I know about Los Altos.

The sample prop is a stones throw from Benedict Canyon drive and would be better suited as an example of the kind or prop scenario in this type of journalistic reporting

http://articles.latimes.com/2007/dec/31/business/fi-homescam31

Clearly a number of people were able to fool lenders that props with a pseudo Beverly Hills address were worth those inside city limits.

And I’m quite sure the Los Angeles Tax assessor does not address the tax invoices to Beverly Hills. Good luck getting the DMV to issue your drivers license to say BH.

My position is that if a writer is going to write about Beverly Hills, the sample prop should be in the city limits. Seems clear to me (and probably everyone else now) that was an oversight.

I’m sure there are a number of props within the BH city limits that are under water and would have made fine examples for the purpose of the article.

I wonder if someone who did not pay their mortgage for years has any tax consequences related to this windfall?

THat is what I have been waiting for. But with so much energy being put into letting the irresponsible off of the hook, I doubt the IRS could take the political heat of trying to tax all the years of free living.

I don’t care how much that house is or what trendy neighborhood it claims to be a part of. It’s at the end of a winding road difficult for emergency crews to access clinging to the side of the hill long overdue for a raging fire in earthquake country. No thanks.

+1

Cantilever homes and those on stilts give me the creeps. And we are not the only ones. They tend to sit on the market for extended amount of time relative to homes built on flat pads.

It appears this home is split on 3 levels. Street level parking, then stairs down to main living area (kitchen, LR, DR), and then stairs down to bottom level with pool. 2,800 SF on 3 levels is going to get a steep discount to a 2,800 ranch home.

One other thing about this particular home is the “eye-sore” utility pole right in front of the property. The broker’s photo above does a nice job of cropping it out of the photo. Pull up the Google street view and you can’t miss it!

Prices are taking a long, long time to go down in the nicer areas of Los Angeles and the SF Bay Area. I’ve been looking for a long time in the Hollywood Hills and Santa Monica areas. Every time a decent looking townhouse comes up for sale in the $600-$700k range, it gets snapped up very quickly. The decent sized houses under a million seem to go pretty fast too. My parents bought their first house in Palo Alto for $29k. It’s now worth well over a million according to zillow. They bought a house in Los Altos for around $69k about 40 years ago. Now that’s a long time ago, but the appreciation has been crazy over that time period. It just sold for $1.8 million in 2010. It’s just an ok 4 bedroom house. Nothing spectacular. I’d like to think that prices are going to drop another 20% or get down to 2001 levels, but I just don’t see that happening. Prices look like they’ve been at mid 2004 levels for a while now. There are just too many people out there willing to pay high prices for homes.

Well, a lot of those 600-700k homes fall well within the FHA limitations. 729k for “expensive” markets. I could probably pick up a place home well north of that limit, with the downpayment I’ve been saving, but I’m not going to play that game!

http://www.fha.com/lending_limits_state.cfm?state=CALIFORNIA

I need someone to explain to me about the real estate taxes. The money for the taxes goes into the escrow, which is paid via the mortgage payment. If these people are not paying the mortgage, they are not paying the taxes. Is the bank paying the taxes? Why is the county not seizing these houses? What about insurance? I know my insurance was coming out of escrow. Are these houses insured?

I have to admit that I am in Buffalo, far away from the madness going on in Los Angeles County. But my interest in the area has to do with a half sister in Ventura County and a woman who has been a close friend out to the northeast in Palmdale. All I know is I don’t dare stop paying my landlord the rent. Not that we would. Our rent is quite low relative to the figures I see bandied about here.

Fortunately, our metropolitan area of Buffalo and Niagara Falls never really blew up to begin with. But there are some expensive areas whose prices we need to watch.

Interesting article

More Boomers Selling Homes, but Who Will Buy Them?

http://www.cnbc.com/id/46667801

oh yea and , thanks always DRB!

this effect is like the gas price effect. We as a group of consumers get used to prices at a certain level, however outrageous they may be. Then prices dip from the crazy peak, and since we are so used to the high prices, starters in Santa Monica for under $1M sound pretty good, at least compared to $1.3. Then you figure that I was almost ready to buy one at $1.3, and now I can get it for 30% off! I can afford it (sort of – that is, the bank will lend it to me) and now its a steal. Anyway, this is the mentality. Figure that you are going to hold it for 5-10 years minimum, and have a great Low rate, and even if it stays flat price-wise, you’ve got equity built up after 10 years of payments, mortgage is 1/3 done. end of day, lots of people jump in and maintain prices at this insane level. Banks will leak slowly, in the prime locations, Inflation may or may not help out to ease the banks pain…

Leave a Reply