Mini Option ARMs – Second Mortgage Homeowner Program: Bailing out the Home Equity Withdrawal Machine.

Last week U.S. Treasury Secretary Timothy Geithner and HUD Secretary Shaun Donovan sent a forceful letter to mortgage servicers that essentially stated that they were not pleased with the amount of loan modifications taking place. Now I find it hard to believe that our U.S. Treasury with its brotherhood with the Federal Reserve has a hard time advocating such a simple policy. They have the power to circumvent the mortgage industry and Wall Street given that they have bailed out these sectors of the economy. Did they conveniently forget that we nationalized (whoops, put into conservatorship) Fannie Mae and Freddie Mac which now is the U.S. mortgage industry?

Yet in this bread and circus show we get another example of who is really running the show. The U.S. Treasury and Federal Reserve are working for Wall Street and the banking industry, not the American public. One of the baffling items in the Making Homes Affordable initiative is the desire to help out with second lien mortgages. After reading the details of the program, I couldn’t help but have the Jack in the Box commercial theme running in the background, “…mini option ARMs!” First lien, second lien, and what else? The solution apparently is to make these loan mods into Alt-A or option ARM products. By the way, those Alt-A loans are now imploding at a higher rate than subprime with bigger balances. Who would have figured giving out toxic nuclear waste mortgages would cause so much pain?

The irony must be clear to others because people take out second liens on their homes to make them more unaffordable. That is, they increase the overall debt they owe. In the real world people are still doubtful of the future of housing:

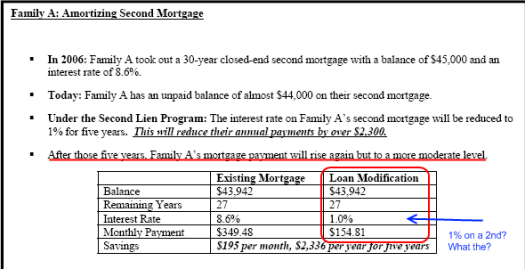

Now I have stated in a few examples, like a home Culver City and another in Palms how people used their homes like equity ATMs. There is no basis for bailing out second liens. It is incredible that we are now moving down the path of bailing out loans in which people took vacations, added Jacuzzis to their homes, or even bought a luxury vehicle. Their idea of fixing this problem is making you pay for your 60″ flat screen 30 years into the future. What does that have to do with making homes more affordable? The tragic consequence of this housing bubble bursting is that in fact with prices falling, homes are indeed becoming more affordable. If the goal is for homes to be affordable then trying to prop home prices up is a bad decision. Yet aiding second liens or as I like to call them, mini option ARMs, is a very bad financial decision. Let us examine two scenarios presented to us from the U.S. Treasury:

My first argument would be what in the world was “Family A” doing taking out a $45,000 second on their home? Heck, I’ve bought homes that are cheaper than $45,000! But let us set aside those tidbits for a moment because the government here is lowering the monthly payment down to $154 a month for a $45,000 note! How many of you would like to get $45,000 for $154 a month? This is insanity. What is being implicitly stated here by the U.S. Treasury is they don’t expect this family to ever pay this mortgage back. Their idea is that by giving someone a mini option ARM that they’ll be able to sell the home in 5 years for a higher price and the new buyer will simply roll the 1st and 2nd into one note and all will be well. I am amazed that our idea of fixing the mortgage crisis is by modifying loans to become option ARMs. And what will the rate be in 5 years? It will certainly be higher than the 1 percent teaser rate. In 5 years (2014) the balance will be $37,000 yet who is paying for that low interest rate? If the government is backing this up it is pure highway robbery.

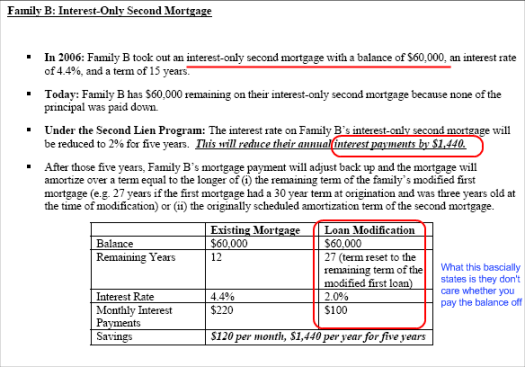

Let us look at another family example:

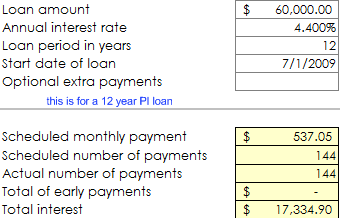

If you thought the first case was insane just look at “Family B” who took out an interest-only second mortgage to the tune of $60,000. Maybe they needed a new pool with a water fountain (hey, if we’re going to be in a recession you might as well stay cool). Interest-only loans are absolutely toxic junk and many Alt-A loans went this way yet here we are looking to modify this crap. You really have to be careful here because the devil is in the details. First, the initial term was over 12 years at 4.4%. Let us run those numbers first:

The data above is for a 12 year note that includes both principal and interest. So if this is an interest only mortgage, the payment is not $537 (P + I) a month but is set at $220 (I only) a month.  This is the same backward logic that has now setup the Alt-A and option ARM tsunami yet our solution is to just increase the term. They make this example play out so well. Their solution? Increase the term to 27 years and drop the rate to 2 percent. One tiny question? Who is making up the payment? Now from the perspective of a lender, why in the world would you want to give someone a 1 percent note? This is like the government forcing a landlord to push rents down to $400 yet he is paying $700 on the mortgage. Any investor is going to want to recoup that additional loss. If the government is making up that shortfall, this would be simply another crony idea to help the housing industry. And the underlying theme is what is even more disturbing. What is being said is that no one has the intention of ever paying this money back. Is anyone concerned about taking a 12 year second and taking it to a 27 year term? This is a second mortgage by the way, not a first mortgage which is even more baffling. Time to create millions of renters not only on real estate but on televisions, pools, vacations, cars, upgrades, etc. Because when you only pay the interest, you are basically paying rent.

This kind of thinking is financially irresponsible. As a general rule, any money you can get your hands on for less than 3 percent is usually a good take. That is why these 1 and 2 percent mortgage refinances are flat out giving money away and not doing anything to adjust the principal. I mean think about it. If I had access to $1,000,000 in cash right now at 1 percent with a 30 year term, I’d take it in a second. After all, the intent is never to pay it back at an accelerated pace. Just more logic from the banking and housing industry.

And if you think the crony banking system is going to shoulder that additional gap think again:

“(Bloomberg) It is well understood that the four major banks would likely need an additional capital injection should they be forced to mark the second-lien mortgages on their balance sheets to a realistic value,” Greenwich Financial’s Frey said.

While under the Home Affordable program, servicers must offer the Hope for Homeowners aid to eligible borrowers, the plan otherwise doesn’t call for first-mortgage balance reductions, focusing instead on reducing housing payments to 31 percent of borrowers’ pay. Lawmakers authorized the FHA program last year, and then revised rules in May after limited use.”

This is such absolute nonsense. They’ll need additional capital injections? Screw them. Seriously, are we now going to bailout second mortgages on top of all the trillions committed to the utterly corrupt banking sector? The fact that you might have some lenders taking capital injections to reduce 2nd liens while leaving 1st mortgages intact is simply backward beyond any sensible financial policy. My gut feelings when the private-public investment program was announced are being sadly confirmed. That is, the government is going to stretch these toxic mortgages out long enough until they can figure out a way to dump these into the taxpayer’s wallet. And keep in mind, lowering rates does have a cost. How so? With all the capital injections and debt you will be paying through this from loss in savings (since rates are artificially low) and also through the annihilation of the US dollar. This was done with the S&L crisis and will be done again. Here is a chart with a very subtle trend:

I think the next prudent step to take is to jump on some interest-only seconds and load up on wheelbarrows since that is probably how we are going to be paying for groceries in the next decade. The fact that a plan for second mortgages is even on the table is pure lunacy.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

17 Responses to “Mini Option ARMs – Second Mortgage Homeowner Program: Bailing out the Home Equity Withdrawal Machine.”

DHB, Thanks for the info you put through. This 2nd mortage ordeal is a bunch of BS. When will the credit card epedimic come forward sure these are next on the horizon? If everyone has tapped out house atm surely the credit cards are maxed. Maybe a good time to go on a spending frenzy if you are not tapped out- sure government will take care of this too.

But, esteemed Doc, of COURSE they are giving them teaser rates and 30-year terms.

~

This resets the interest curve of their loan back to the beginning and it ensures a fat and predictable income stream for the lender starting in year three, or whenever the new tease expires. The interest curve on a 30 leaves the borrower paying more to interest than principal till sometime at or after year 15, depending on your rate. Deferring payments to principal only defers the day of reckoning for repayment.

~

This is a strategy for getting banks out of the Obama administration and back on their feet in 2012. I don’t say that as a slam on Mr. Obama, just saying.

~

If all these crap mortgages–first, second, and other–are refinanced in this way, the banks will suddenly show huge interest income profits again at the future resets. Assuming people can repay them then.

~

But you are exactly correct. It is a stupid, stupid answer. Many more people will lose jobs in the interim. If they’re in over their heads now, a new Crap Loan is hardly going to help that in any substantive way.

~

This is like accidentally pouring gasoline on a fire, then reaching for the gas to put it out. You are also exactly precisely no-shit-really correct that the REAL issue is the purchasing power of a US dollar, and how that is being systematically eroded. Welcome to the Third World.

~

rose

In India (yes, even today) millions of people live their entire lives in a form of slavery called debt bondage. For a lot of them, the original loan was taken out to cover the costs of a wedding no one could afford (this is also a big reason why so many girl babies are routinely aborted or killed in infancy–to avoid the debt of paying for their dowry/wedding–but I digress).

Point is, whether for a wedding or a house, living your whole life under debt is old-fashioned slavery (ironic, ain’t it?). I am with you, Doc. The insanity must stop.

I think we are all aware we are under the power of Goldman. There is not plan for Everyman. More Arsenic for the dying. There’s another giant sucking sound, and it is sucking more every day.

They should all be killed.

This plan, like all the plans presented are ultimately doomed. With no job, no one can make their payments. What we need are jobs.

What will the rate be in 5 years? Well considering inflation eventually drives up interest rates and we are devaluing the currency at the rate we are, maybe 18%? The very people taking advantage of these resets are probably going to be ruined financially and worse they are making the rest of us go down with them.

I live in Los Angeles, and I know exactly what happened: the vast majority of people who are currently “underwater” on their mortgages either bought a house they couldn’t afford at the height of the bubble because they were cheerfully expecting this to pay off big at the real estate ATM window; or they simply refinanced a couple of years ago and took out a lot of cash to have a good time with, as the essay above clearly illustrates. The rest of us, who realized that this was an insane bubble, stayed frugal and responsible, and figured that when the bubble popped, we would be rewarded for our patience and ethics. No such luck, obviously.

The government is all about the banks; they are as untouchable as the Pope. All their greed and foolishness is being covered by us taxpayers. And since keeping home prices inflated by bailing out homeowners is good for the banks, that is what the government is doing. This is also a form of welfare for people who actually lied on their loan applications, have virtually no money to pay theirs or anybody’s mortgage, but are now being allowed to camp out in their nice houses while the government fixes up a plan to allow them to rent at bargain-basement prices. Of course many of them will default even on that low obligation; but hey, that’s a few years in the future, and meanwhile the people in office get to look real good and win some more elections.

Their hope is that a second wave of sucker buyers, but with better credit (read, us), will buy the houses at inflated prices and bail everyone out. Maybe we will even be foolish enough to believe that since the first wave made out great, we will be bailed out too, if necessary. But of course this will not happen; we will be stuck forever. Or we could keep our money in the bank at 1% and watch while the dollar is worth less and less, and the housing market is rebubbled. To sum up, I think that what is going on now is the worst thing this country has ever done in terms of breaking economic faith with its constituents. The lesson is that irresponsiblity, greed and even crime pays; while “buying only what you can afford,” and “responsibly paying off your debts” is something that only useful dupes fall for.

Gael – Right on! I have been saying (screaming) that for months

now. Without jobs, all the rest is (1) BS and (2) moot.

I don’t think the purpose is to help anyone out. The purpose is to smooth out the default from a 3 yr crash to a 10yr steady sink.

This is not to help borrowers but rather ‘save’ banks and important contributors.

If you want to help people, change back the personal bankruptcy law so that people can really start over. Right now the only ones getting bailed out are the rich.

Open your eyes

2nds have been the American way. I remember my parents in Long Beach taking out 2nds while I was growing up, and treating their home like an ATM machine.I don’t know anyone who owns their own home that hasn’t taken out 2nds. Its going to take a lot to stop Americans from laboring under debt. The story about India is deplorable, as well!

P.S. “Housing” refers to rental housing, as well as other kinds of housing, Including low income housing.

Tax Receipts Plunge

Maybe the most dangerous indicator that the impetus for Hope and Change is petering out is from Bizzyblog (hat tip: Tigerhawk); it’s a chart showing that tax revenue from the corresponding period last year is down.

The source data from Treasury is here.

fyi – Off topic, but better to laugh than cry:

Organizational Chart of House Democrats Health Plan.

India has both savers and slaves:

Phenomenal rise of India’s savings

In India, amid all the news of the dogged rise of the nation’s foreign currency reserves, the obduracy of inflation, and the waxing and waning of the Sensex (not to mention Shilpa Shetty’s moods), what has gone unnoticed is the phenomenal rise of the savings and investment rates.

These now stand at 32% and 34%, respectively.

I feel sorry for the people that took out seconds and are making their payments on time, but must sell their houses because they are being relocated for work. They go to sell and now their house value is upside down to the mortgage–these are the people that should be helped out!!!! Then we have the ones that were called by LO’s and promised that in three years they would be able to refi the 100% mortgages that they took out into 80% loans because without a doubt that’s what your home would be worth compared to your mortgage. Let’s face it we can blame the people who took out these loans; but, not all borrowers are smart!!! They relied on other people for information and most of the time the info came from LO’s. Our government was set up by the people for the people; the people in this case did not step in and prevent this from happening; so, therefore we must pay by being taxed.

Oh dear God, with each day that passes by, I get more and more sick! I make a decent buck, I lived below my means, I knew that this housing bubble was irrational when I saw ridiculous prices.

I always wanted to buy a home of my own. But not at irrationally high prices. So I didn’t buy. And what do we get for our patience and frugality? Well we get to pay the bill!

I am really upset and sad to see this going on in our country. And the worst part is that the average Joe buys the “oh we have to bail out the banks since they are too big to fail or else the world would fall apart”.

Dr. Housing Bubble,

I’ve been reading for years now and truly appreciate what you’re doing. I’ve never commented before, but I wanted to now just to say that you should look into bankruptcy law. I’m a little rusty, but I seem remember that 2nd’s get wiped out in a Ch. 7 bankruptcy if there’s no equity backing the loan. If that’s accurate, the government’s play here is simply to shovel a few dollars into the banks’ pockets courtesy of those who took out 2nd’s they couldn’t afford, essentially by making it slightly less attractive to declare bankruptcy. This means, rather than declaring bankruptcy today, the mortgagees make a few more 1% payments, maybe 24 to 60 more, before giving up and declaring bankruptcy. Banks get a few more $$ (not tied directly to a government bailout–which is completely infeasible now from a political standpoint), pols get to say they lowered the foreclosure rate, and people get to rent, sorry, own, their homes for a few more years. Only suckers are those waiting to buy at a realistic price.

On another note, I still don’t see why we don’t go to the system that’s worked for over 110 years, bankruptcy law. Let those underwater declare, wipe out the bad debt, the banks buckle and a few more crash, and the system clears out in 5 years. What we’re doing now is simply “prolonging the magic” into a 20+ year drift downward slope.

Leave a Reply