The myth of real estate and economic mobility: Americans face lowest geographic mobility in over two generations. Is staying put the new American Dream?

Americans like to believe that they are movers and shakers and will follow the opportunity wherever it may be. The idea of selling your home and moving across the country for a great new job opportunity seems to be a common notion of how things happen. However the data shows us a very different reality. Americans are largely staying put. We can blame this on negative equity but this trend actually goes back to the 1980s. In fact, American mobility is at all-time record lows. What this means is people are staying put like our golden handcuffed baby boomers. I was thinking about this carefully and I think one major reason for this is the massive subsidies given to homebuyers creates incentives for staying put. Think of California with Prop 13 and the ability to write-off many housing items including interest when being a homeowner.  The system is setup to keep people locked in. For a young person in a high cost of living area the best economic option may be to move and start in another state. However the facts point to a very different picture.

Is geographic mobility high in the United States?

From most people that I speak with the underlying prejudice is that yes, we as Americans have tremendous mobility. When I dig deeper most of these people have not moved beyond a couple of counties in their entire lives. Many have never even traveled outside of the US! At least this seems to be the case in Southern California. I suppose they would like to believe that they are the kind of person that is open to change and will follow their dreams no matter the cost but in reality, they are staying put. Inertia is a powerful force.

Some of these people complain that they missed the boat to buy but then don’t end up buying in the market today. If you believe home prices will go up as a fundamental principle, it doesn’t matter if you bought today or 10 years ago. In reality these people at their core are speculators. Yet that word carries a Wolf on Wall Street sort of connotation. They want to believe they are buying “to stay put†but they are no better than Wall Street investors trying to purchase the perfect hedge at the perfect time. If you are truly staying put, a 10 to 20 percent move up or down will not matter in 30 years. Then again, the average length of homeownership in the US is seven years so what does that tell you? Cognitive dissonance is strong in many people.

I think the relatively short time of homeownership plays more into the property ladder game. That is for example, you buy a cheap condo in Culver City, build some equity, and over a few years you move into your starter home in Pasadena. Another few years go by and then you buy your larger home in a better part of Pasadena. In other words, you are simply moving up within a confined region.

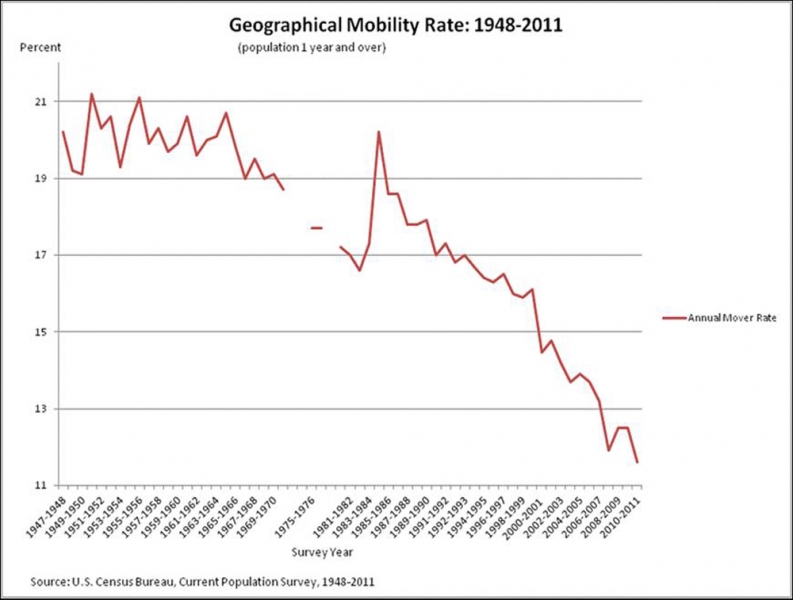

So let us look at Census data on mobility:

Americans are far less mobile than many believe. From the latest Census report:

“(Census) Relatively few of these movers traveled long distances,” said David Ihrke, a demographer with the Census Bureau’s Journey-to-Work and Migration Statistics Branch. “In fact, nearly two-thirds stayed in the same county.”

Even those who did leave their county didn’t move all that far away either: 40.2 percent of intercounty movers relocated less than 50 miles away. Only 24.7 percent moved 500 or more miles to their new location.

Renters were far more mobile than homeowners, as 24.9 percent moved between 2012 and 2013, compared with 5.1 percent of owners.â€

Homeowners as you would expect are far less mobile than renters. But how good is this in a time when people are likely to have multiple jobs over their lifetime? Career employment is becoming more of a relic. For the young, this is part of the reason that the renter nation trend is continuing for lack of income to afford higher prices but also for mobility as many are starting their careers and need to keep their options open. Here in SoCal, you have people biting the monstrous commuting bullet and buying out in cheaper Riverside and San Bernardino counties and making the exodus each morning into Los Angeles or Orange counties.

There is also a bigger trend here and many are realizing that yes, the middle class is shrinking. Part of the middle class dream was owning a home but as the homeownership drops, maybe this is merely part of a much more larger macro trend. The dream is alive and well across the country but maybe not in your pocket market.

Class mobility

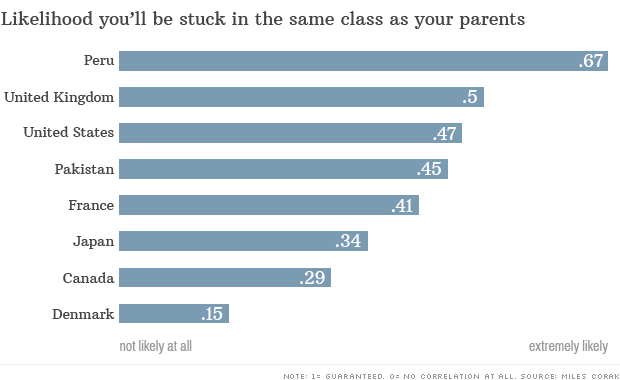

Americans also tend to believe that economic mobility is very easy to achieve. Let us look at some figures:

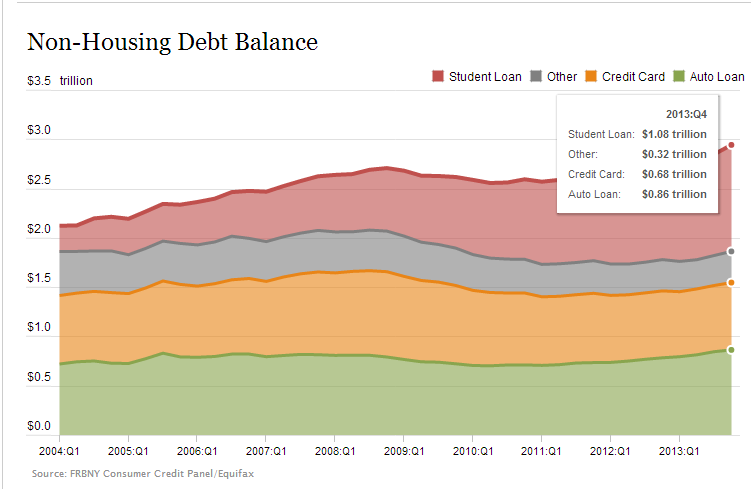

Ironically places like Japan, France, and Canada provide more economic mobility than here in the US. What is interesting is that since the Great Recession hit, many more once middle class households have fallen a rung lower. For example, imagine the baby boomer parents living in a high cost area of California now sending their kids to a private college with big debt. Are their kids going to have the ability to buy in a similar neighborhood? Do they have the same opportunities in terms of career? The amount of college debt in the United States today is staggering:

According to the latest Fed report, student debt outstanding is now at $1.08 trillion. This is far more burdensome for young prospective home buyers and as we recently noted, the first-time home buyer rate is at the lowest rate in a generation. It has been noted that college debt but also earning prospects have made it tougher for young Americans to purchase real estate especially when prices are rising with no subsequent growth in income.

What does this mean overall? I think this goes into our thesis of the handcuffed baby boomer that is going to go down in their World War II granite countertop sarcophagus. For those looking to stay in inflated areas, they will need to deal with a population that is unlikely to move as shown by the data. So you speculate and dive in, rent and adjust, or take the risk and move and leverage gains elsewhere in the country where real estate is modestly priced. The data shows most will simply stay put so the option becomes more of one between renting and buying. In California where only 1 out of 3 households can actually afford to buy based on their incomes, this is a very important question.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

118 Responses to “The myth of real estate and economic mobility: Americans face lowest geographic mobility in over two generations. Is staying put the new American Dream?”

A lot of people have kids and are not married to or dating the other parent. It makes it harder for them to leave, if they are responsible about it that is.

On anoother note, about people not leaving, some don’t want to. I hear kids say they will never leave CA, even to vacation. I find that sad.

One thing that struck me odd when I moved here, was the lack of road trips by people, but I guess I understand why. Within 12 hours driving, your options are SD, SF, Vegas, Phoneix, and SLC. Fine places but few options. Growing up in STL, we could be triple that amount of places in 12 hours. Memphis, Nashville, Houston, New Orleans, Wash DC, Cedar Point, Chicago, Minneapolis, Denver, etc…

I grew up in the Midwest, not far from St. Louis, and now live in Southern California. If you ask me, you can get to a helluva lot more interesting places in 12 hours from SoCal than you can from the Midwest.

The Grand Canyon. Yosemite. Joshua Tree. Napa Valley. The Golden Gate Bridge. Alcatraz. Hollywood. Lake Tahoe. Vegas. Some of the most beautiful mountains in the world. Redwood Forest. The list goes on.

I agree with you, Scott. I grew up in STL too and have lived in the South Bay LA for 15+ years. 12 hours from STL may get you to DEN, MSP, and CHI, all nice cities. Cities is the emphasis. With the exception of the Florida Panhandle and Lake Michigan, not much outdoors.

12 hours here gets you in to pretty amazing natural places, like the Grand Canyon, Tahoe, the Sierras, redwoods, as you mentioned. So does 3 hours. There isn’t much 3 hours outside of STL except fields and the start of the Ozarks, which, while nice, are not mountains.

If you want cities here, 12 hours gets you to SF, SD, Santa Barbara, SLC, Vegas, Santa Fe, Phoenix/Scottsdale.

Everyone I know in STL is envious of me being here, especially my family. No one I know here is envious of people in STL this winter. (or summer for that matter)

Is the envy of someone’s friends and family that’s predicated on perception supposed to be a selling point for purchasing a home in SoCal?

Do they envy our traffic, air pollution, and high cost of living?

Or is it that an attempt to validate a choice to relocate, one can easily obfuscate reality in order to justify a perception of SoCal exceptionalism?

Send this $575K reality check to your friends and family, then let’s see how much envy they have left over.

http://www.redfin.com/CA/Los-Angeles/1420-Hauser-Blvd-90019/home/6904665

@Scott, @SouthBay Dude

You guys crack me up!

After spending 40% to 50% of their gross income on housing, then a huge nut on leased Mercedes, BMWs and Land Rovers, the typical SoCal household is broke and can’t visit any of those places you mentioned.

Also, when family and friends visited me from the Midwest, they were shocked and mortified to discover that most of SoCal resembles a garbage dump.

or you could say within 12 hours are the redwoods, lake tahoe, high sierras/yosemite, sedona, zion and bryce, the great basin, and on and on – guess you don’t get out much

Anon and Blofeld, every place has its plusses and minuses. Think LA has bad traffic? Try Atlanta or DC. Yes, even with the warts, my family envies being near the ocean and skipping freezing cold winters and brutal summers. Unless you have lived in very cold places like I have (Michigan and Minnesota), or very hot (St. Louis and Atlanta), you might not appreciate how nice things are here. Weather is a very underrated phenomena, and Im willing to pay extra, even a lot more, to not deal with those extremes. Sure, I could have a massive house for what I pay here, but then again, I would be stuck there, and have to jump on a plane to go somewhere nice. (and lots of parts of the Midwest are garbage dumps too. You want nice, go to Canada, Australia, or parts of Europe).

As for being broke by buying nice cars, that isn’t just a LA story, but everywhere. My family in the Midwest also buys very nice cars, much more than they can afford. I can afford nicer, but I drive a new Chevy. It’s all about priorities and the choices you make in life. If a nice big house but stuck inside most of the year is your thing, great. If you like being in a place with good weather, with lots to do, but surrounded by lots of expensive houses, traffic, etc, that’s your prerogative.

Even with housing being cheaper in the Midwest, I can assure you from the people in my area that no one is moving back to the Midwest (many of my friends are also from there too).

How can you guys forget that 12 hours will get you deep into MEXICO, including all of Baja more or less. Of course, you’d have to consider Mexico worth visiting for it to be worthy…

Based on my high school reunion, the vast majority of people live in the same zip code that their parents did. Most people will stay near family and friends. For most people, moving is a “non issue.”

In the more affluent areas, kids just wait until their parents kick the bucket. If there are only 2 kids, and parents own a $1,000,000. home, stocks, bonds, etc., both kids can goof off, work at mundane jobs, and still end up set for life.

“In the more affluent areas, kids just wait until their parents kick the bucket”

Most adults live well into their 80’s. The KID, will no longer be a KID by the time both of their parents are dead. The KID would generally be in his mid 50-60’s by that time.

Elderly parents today will consider using a reverse mortgage as a way to enhance quality of life during the golden years… kids expecting the house keys after mom kicks the bucket will be sadly disappointed. The stigma of a ‘reverse mortgage’ is slowly diminishing… especially in SoCal$$$.

As it relates to California, it’s obvious what part of the dynamic is – quality of life, even with well above average cost of living expenses, is much, much higher than in other areas of the country, NYC included. Of course, if you are so hopelessly dense as to be acquiring a new rental in San Francisco at present, this doesn’t apply to you, but access to the outdoors year round – and many other advantages – are pretty big pluses.

People don’t want to leave. Why do you think we still have hippies? They worship the nature.

That said, the housing prices are hopelessly manipulated. People staying put is only part of the problem. The primary issues at hand are public / private collusion between the Fed and banks, supply manipulation (also made possible by collusion), and ZIRP accessible cash fueling speculation and stock

prices. The crash will be epic, especially in the Bay Area, because the fundamentals of the “technology” (marketing) companies blowing the bubble are at best a constantly moving target, and at worst blatant advertising scams based on numbers that are difficult to accurately verify.

Many tech workers can execute their jobs from anywhere, but they stay. Same s#!t, different decade.

“Quality of life, even with well above average cost of living expenses, is much, much higher than in other areas of the country, NYC included.”

-This statement and others (the rich, the smartest, the best, etc will come to Cali bc of the weather) is a little subjective/off. Its correct for some people, but not for most people in NYC and the East Coast in general. People complain…all the time….about everything. That includes snow/cold weather, packed subways, small apts or in cali if it rains just a little (june gloom), lots of traffic, small property lots, etc. That still doesnt mean they dont love where they live or would live somewhere else (even assuming they could as most people need to work still).

I’m from the Northeast originally and most people I know would still NEVER move to cali and still most go to miami in the winter when its cold (flights are short and cheap and no time zone difference) or even puerto rico or the caribbean (both closer than hawaii is to cali). People like having beaches in the summer and skiing in the winter close by. No vegas, but tons of play anything you want casinos on Indian reservations.

NYC is THE city. It really is different. Horrible in many ways and great in others, but absolutely nuts in terms of people per square inch, especially bc there are areas where most people dont go. There are still parts of Manhattan that arent even gentrified yet (thats why I know some LA areas will take a LOT longer than some people think to gentrify). DC and Boston are short drives to NYC and you can hit vermont in 6 hours and there’s a TON of states within 12 hours drive (from maine down to south carolina plus some states west of new york). But the biggest thing NYC has that no other place I have lived/been is a pulse. The city is like a living, filthy organism. Its dirty, smelly and overcrowded like a motherfcker. Its so tiny compared to LA in terms of where people actually hang out-its all vertical. Ive spent time in San Fran and its not close to NYC either. You have to walk in the streets half the time because the sidewalks are so crowded. Not just in some areas, but everywhere. The big thing that drives NYC (besides wall street bonuses) are the bars all stay open to 4am (or later) instead of 2am in LA and there are girls upon girls upon girls (minus the LA attitude bc its not about getting a girl a part in a movie). NYC is the worldwide home to modeling and fashion and media. No one drives, everyone takes cabs so everyone out is ready to have fun. You can walk to 10 great bars in 2 blocks overflowing with beautiful women. Its a walking culture so the streets are always alive-all day, every day. In these people’s eyes their quality of life could be better, but that means make more money, not move to Cali bc for most single people, its about sex, not weather. Took me a long time to shake NYC and I still miss it kinda/sorta. Marriage takes a lot of the fun out of it obviously. Personally, I love the So Cal weather (best in the US, IMO) and the topography is great too. But the nightlife was average compared to NYC and when you’re single and a city person that trumps sun/beach for most, especially when you make more $$ in most jobs in NYC. Pretty sure man, especially those in their 20s and 30s (as people are not marrying young in the northeast as much) has the instinct for woman over sun. Plus, there are BIG cultural differences. Native CA people are not on the same wavelength as many from the northeast as well. Americans are not all the same for sure.

FTB I completely agree with you apart from the fact that NYC is more alive than other major cities. I absolutly hated the place but do admit that all the other things you said are quite true. I guess you are also correct about folks born here would never understand NYC and that is probably part of the problem. Like I said, I just don’t get it… I hate crowds. I grew up with the concept of personal space and there is no such thing as that in NYC or the NE for that matter.

San Francisco is alive as NYC and much more scenic, I can be in the redwoods, trinity alps, lost coast, Carson pass, Yosemite, Mavericks-Ocean Beach, Big Sur, Monterey, Sonoma, Napa, Pt. Reyes Natl. seashore, Sausalito, Mendocino coast and so much more in less than 6 hours…The best penetration of fine food, culture etc..

Along with the best public transportation where I don’t have to deal with the cabbie from hell also..bars stay open to 4AM here too.. Girls, girls girls everywhere as we have high tech, fashion, arts and the Pacific st exchnge…

I wouldn’t touch NYC with my worst enemies feet when it comes to living…hard to find a flat where you can see ships coming into bay, Golden Gate park below ity and the city to my right. You can have NYC…enjoy

Not all young men prefer Manhattan over Los Angeles.

I was born and raised in Queens, but I’m very familiar with Manhattan. I did my undergrad at NYU. After graduation, I worked for 5 years in a Park Avenue office. This was in the 1980s, when I was in my 20s.

I always HATED Manhattan. Always. I didn’t hate Queens, but I thought Manhattan was an ugly, dirty, squalid, concrete and asphalt hell. It was always a relief to take the LIRR or subway back into Queens.

Instead, I longed for Los Angeles, which I saw every night on TV. I thought that L.A. was THE city, the center of the universe. A land of sun, palm trees, pristine suburbs, Valley ranches, and Hollywood glamor — the place where all the REAL celebrities lived.

I moved to L.A. in 1987, but I’m still familiar with Queens and Manhattan, having visited friends and family there each of these past 27 years.

I don’t miss NYC. For me, the shine has worn off L.A., but I still much prefer it to Manhattan. I might move to another city — Seattle, perhaps — but you couldn’t pay me to live in Manhattan.

I conceded NYC is dirty, smelly, overcrowded, too expensive, too hard to move east/west above ground (the subway is what really moves people), too catering too tourists now over people that love there, etc…however, just trust me on this one, it has a pulse like no other-for better or worse. If you stack that many people in such a tight space it starts moving like one filthy organism. I think LA is like 500 sq miles, San Fran is about 230…well Manhattan is only around 33-34 sq miles and many many people from brooklyn to queens to long island to NJ to CT works (and sometimes plays) there. Its a fcking zoo. Its work hard/play harder. Party to 6am on a weekday and roll into work after a shower. Clearly a horrible life for most people, but some people LOVE it (at least for a good portion of their (single) life).

CD-you just made my point…its all subjective. No one cares why you like SF or why you hate NYC; thats your subjective opinion. And no one cares why I think SF is nothing special if you’ve lived in NYC bc the weather isnt good enough to move (like so cal) to a city filled with pompous pseudo intellectuals. You say cabbie from hell-we say drive faster; I’m in a rush. Its about housing and my point was, dont be so myopic/subjective. I think yall overestimate the lure of Cali for most people living in the northeast is all I am saying.

First of all, I’ve been to big sur, moneterey, napa and a few other places you mention. Thought they were beautiful, but i wasnt like I gotta get back there immediately. You may not find the mountains of the northeast as pretty but (somehow) people from the northeast find them beautiful (have you even been to them?). “The best penetration of fine food and culture” being greater in San Fran over NYC? Really? I dont even think the majority of people in SF truly believe that one, but if you say so, sure. Manhattan is an island, btw; its actually surrounded by water. I see boats all the time from peoples balconies-kinda depends where you live and how high up and what blocks your buildings site line. I thought you bragged about girls “in high tech” for a second compared to models from around the world, but I’ll assume a typo on your end. Sounds like you havent spent much time in NYC to be honest.

SOL-sounds like you didnt live in manhattan that long. You commuted to and from queens most of your life, which is not close to NYC. I know queens bc my grandmother is from forest hills and my wife used to live there. That’s like living in oakland and talking about what its like living in San Fran. If you’re not going to bed and waking up there every day, you’re a commuter. NYC is about night life (partying to all hours) often on weekday nights, not taking a subway off the island completely after work or happy hour.

Regardless, I didnt mean to make this an NYC vs anywhere comment as its all subjective, with the heavy majority of americans saying NYC, SF and LA all are awful, horrible, overpriced shtholes. I was just trying to explain the lure of Cali may be strong for those that seek sun at any cost 12 months per year (and dont want Miami), but I think that number is a lot smaller than yall think it is.

I have had the privilege of living in NYC, LA, and SF and I can say without a doubt you are spot on. There is a love hate relationship all New Yorkers have with the city. It’s like a bad relationship that’s crazy intense; you just can’t get enough! NYC is like no other. I sit next to a guy who has been to 90 countries and has lived in Hong Kong, Amsterdam, London and Sydney and he even says NYC is the place to be!

FTB, you hit the nail on the head regarding NYC. It still is the center of the universe. If you are young, single and successful it is definitely hard to beat. Work hard, play hard was likely coined there. Working 70 hour weeks, boozing, womanizing, staying out all hours of the night will catch up with you sooner or later…I imagine a decade of that will be the most any normal person can take. Serious relationships, settling down,, marriage and kids are not ideal for that environment.

I visited a friend there about 10 years ago. I had a great time, but could never see myself living there. Too crowded, too noisy, too cramped, too expensive for my tastes. Everybody has different factors when determining their ideal place to live. For me socal (coastal adjacent) is hard to beat. It’s not just the weather, more importantly the lifestyle that goes with it. To each their own.

“Many tech workers can execute their jobs from anywhere, but they stay. Same s#!t, different decade.”

The only shit here is the kind you’re shoveling, pal. Define “many” tech workers.

Can you tell me what this Magical place, California, had in terms of population growth last year?

(Hint, -50,000 – so much about the thesis everyone wants to live here)

The only people moving to California are those that jump the border or overstay their visa. Taxpaying American citizens have no desire to support California’s welfare state.

According to an LA Times article dated Dec 12 2013:

California’s population grew by roughly 332,000 people in the last fiscal year — its biggest increase in nearly a decade, according to new California Department of Finance estimates.

http://articles.latimes.com/2013/dec/12/local/la-me-california-growth-20131213

Between July 2012 and July 2013, roughly 170,000 more people came to California from other countries than left, according to the estimates. At the same time, nearly 103,000 more residents left California for other parts of the United States than came into the Golden State. The result was a net increase of 66,000 people who came to California from elsewhere.

Depends whom you ask. Based on number of tax returns filed, California is bleeding population. Oh well, maybe it’s non-tax payers that are moving into the state. I am sure they will beam of “pride of ownership” in local communities. Even in the most generous of charts, CA is listed exactly average in terms of this questionable growth. Some of the sources below are a little right-leaning, so take it with a grain of salt.

http://www.newgeography.com/content/003584-california-a-world-hurt

http://www.ocregister.com/articles/california-377207-population-migration.html

http://www.ocregister.com/articles/california-356821-tax-state.html

http://www.manhattan-institute.org/html/cr_71.htm#.UxGYTU2PJ6x

http://www.sciencedaily.com/releases/2012/04/120424142117.htm

http://dailycaller.com/2012/12/12/census-data-reveal-ongoing-exodus-from-california/

http://en.wikipedia.org/wiki/List_of_U.S._states_by_population_growth_rate

http://www.newsmax.com/WayneAllynRoot/Cowboy-Capitalism-Americans-Texas/2012/07/03/id/444329

Wait until the big one hits out in L.A. or S.F., and get back to us, California lovers, about how great it is out there. You’re overdue.

I have lived through the 1971 Sylmar quake all the way to the 1994 Northridge quake. Of course we had no major quakes the nine years I spent in beautiful MA (Yes it is a beautiful place). I agree that after an earth quake many rethink their desire to stay and many actually leave as they did after the Northridge quake. For the native it is no different than the hurricanes of FL or blizzards of the NE. You deal and move on…

Mike M, your comment is just silly. The big one would be the best thing to hit LA (or SF). Uninitiated transplants would flee in horror and the natives would calmly rise, dust off our board shorts and snatch up everything in sight. In the ’94 quake, Santa Monica got hit badly too – Bungalows between Wilshire and Montana were being dumped for $350K, condos and townhouses in the low to mid $100’s. If I hadn’t been flat broke at the time, that was my plan. Some of my friends had the money back then and did just that. Until the next earthquake or disaster hits, I’ll keep saving and waiting patiently. We are overdue for a doozy.

I don’t think the ’94 earthquake was the major cause for the cratering of socal home prices during that timeframe. We were in a decent national recession and major local recession back then. The aerospace industry went bust over night due to the cold war ending. Add in the earthquake, riots, floods, wildfires and RE not yet becoming highly speculative and you had a recipe for a great time to buy.

All true LB. WAs responding to the Big One comment only. But you are so right, nothing is isolated. Blackstone Group is prime example. Would love to hear blert’s and others’ comments about that monolithic squid.

We have not had the “big one’. The earthquakes you mentioned are not big. The big one is SAF, San Andreas Fault. The ‘Big One’ is a hypothetical earthquake of magnitude ~8 or greater that is expected to happen along the SAF. Such a quake will produce devastation to human civilization within about 50-100 miles of the SAF quake zone, especially in urban areas like Palm Springs, Los Angeles and San Francisco. Even those who survive the immediate earthquake will find themselves in danger. The first thing they will need is water, but most water mains will probably have been broken. Utilities such as electricity, natural gas, gasoline, telephones, etc. will be interrupted for days, weeks or longer. Medical facilities will be jammed and unable to handle the casualties. Most people will not be able to get to the hospital because roads will be damaged. Banks will be closed, as will any organization that relies on the internet. Little if any food or medicine will reach the area, and radio/TV communications will be spotty at best. Why is earthquake insurance twice that of fire insurance? WE ARE OVERDUE. Flee while you can.

Seriously, it’s the reason I don’t live in California, specifically, the S.F. area. Lovely place, but, I knew that, with my luck, as soon as I finished unpacking, I’d watch my stuff and maybe life get destroyed in a few minutes. Say what you will about the NY metro, and, I’ll agree with a lot of that, but, we don’t have to wake up every day wondering if an 8.5 shaker or a major tornado is going to visit and wipe us out in a flash. Maybe a hurricane, but, the big killer storms are very rare. It actually rains here, so, fires are not a problem, and, hey, we have water, too! Oh, and, thanks to the fact that we exported all of our manufacturing to China, our air is pretty darn clean most of the time.

I’ve heard some Angelenos say that the Big One could happen tomorrow — or a hundred years from now.

Even so, I too am worried.

@Chicken Little and all others screaming “Earthquake!!!!”

Having survived all the earthquakes in SoCal since the mid 1980s, earthquakes are a non-issue in SoCal (and the rest of California for that matter).

As far as water main breaks due to earthquakes…how is this any different than water main breaks due to a polar vortex, hurricane or a tornado? In the long run, this all balances out.

Good blog, my cousins are stuck in Chicago, they want to move desperately to the sun belt but they can’t. Many folks can’t leave, this trend is worrisome trend for America in general.

America had always been about follow the dream good or bad, now it is about you are stuck and no way out, this translate to depress people, poor job performance, and overall malaise.

“they want to move desperately to the sun belt”

In other words, they want to follow the herd to the promised land. Unfortunately, the grass isn’t always greener on the other side for every sheep.

Maybe he’s talking about Texas and Phoenix too?

Papa – does it really matter? I keep reading these hyperbolic accounts of how miserable people are in other places with the implicit assumption that they would be happy here.

It’s annoying because it’s distracting from discussing the real matter at hand – fixing what’s wrong here.

I suppose that’s what some folks need to hear or tell themselves (and others) to rationalize their feelings about their decision to move here or to be “stuck” here.

If the last few blizzards in the mid west and east is anything it’s even high light more that the west coast is the place to be. Any net lost in domestic population will be replaced with high quality immigrants still wanting to get the California experience. If weather is not a huge factor, home prices in coastal CA will not even be close to where they are today. In fact some warns that there are a global cooling trend in place. If that’s the case, most of the US will get colder temp and while CA would still be basking under the sun. I know I wouldn’t want to spend an hour in the morning shoveling snow from my driveway.

Figure I’d respond to you in the current thread as well, because your Unicorns and Rainbows thesis deserves a response

“We can only reach the top when the supply of buyers has been exhausted which is not even close at this points.”

The current data especially in the frothy areas says otherwise.

ROR in bonds do not justify the risks that investor takes. Rent will probably play a bigger value in RE valuation moving forward.

This is laughable RE industry spin. The US has NEVER defaulted in nominal dollars and never will. If a Treasury note is yielding 5%, which it will shortly, no one is trading that for a 5% at best cap rate. You think rental income is more stable than US treasury interest??? Your either trolling or get your economics knowledge from Kiyosaki.

“You can be certain it is in the best interest of gov to keep RE prices high for tax and to protect the new landlord class which paid those taxes.”

Yet another strawman. If so why did they pop Housing Bubble 1.? Why are they ending QE and raising rates? The actions of the FED COMPLETELY contradict your thesis. On top of that since the government is unable/unwilling to create wage inflation it really isn’t in their hands. Banks are about to turbocharge the forclosure process to get the last group of suckers to buy retail Housing Bubble 2.0 prices.

Investors are going to flock to Treasuries next year when yields get toward 5%. Even if the FED pushes rates below that (which I doubt as it goes against their real mission of preserving dollar hegemony) the CAP rates at current prices + vacancy issues still destroys all Bubble 2.0 gains.

If your gonna troll at least come with something more than anecdotal BS. The real Ben would at least give us some good old FEDspeak lies peppered with cherry picked statistics.

Rushing to buy treasury at 5%? Not gonna happen soon if the other countries like Switzerland, Japan, Germany and UK bond yield is still below the US yield. The Chinese have been selling US debt and buy gold and RE. Why do you think Obama even created Myra for if treasury is so hot.

Wait until us debt goes to 20 trillion and beyond and rates go higher, they will have trouble paying even the interest in that amount. Even though I believe that el dollero is the last to fall it doesn’t mean that it wont. The higher the national debt the riskier it is to hold bonds so yes rates do not justify the risk associated with the steadily rising debt because of the FED meddling. Rates actually rises because people are selling treasury. Please keep that in mind.

No they won’t default, but they going shove those bonds down your throat if you have 401ks or pensions. Paper assets will always be the easiest to confiscate. Look what happened to Cyprus bank accounts and to Poland pension funds. It’s coming to a country near you. Money you stored in the bank is actually money you let the bank borrow and you are the bank creditor if you take a second to read through the agreement. It’s funny you talk about US never default because we heard about the US default scenarios so many times since the first US debt downgrade in 2011 and subsequent debt ceiling dramas. If they default, it will actually be very bad for housing since you have massive deflation. If they keep printing than housing will do just fine it seems to me that they will do the latter. Printing will cause rates to rise but so does rent and asset prices which mean housing will rises. Right now what worry the FED is the lack of inflation in CPI despite all the printing in the last few years.

I’m saying they will try to keep RE prices high but it doesn’t mean they will succeed. Nobody have any real control over an extended period of time.

People say CA govt is so bad, but for the immigrant CA government is still much better than the government they got back home.

I used to be a housing bear, but the events that transpired in the last year or two has changed my opinion in housing. My belief is stock and housing gains is the anticipation of future inflation thanks to the FED printing. They will print until they can’t print no more. When there’s massive default everywhere, housing will get clipped but banks will have no money so it won’t be that easy to take your money out and buy RE then. In fact, I’ll be surprise that no one will loose part of their deposit.

BSB – “I used to be a housing bear, but the events that transpired in the last year or two has changed my opinion in housing. My belief is stock and housing gains is the anticipation of future inflation thanks to the FED printing.” You took the bait my friend. That is exactly what the Fed wants you to believe.

“I used to be a housing bear”

Perhaps it’s that you’re still a housing bear albeit now capitulated? Regardless, forget what you thought before, now you’ve finally seen the light! Praise the lord, you’re born again!

The “this place is different” distraction. Nevermind that regions with a Winter each year such as Toronto and London continue to attract immigrants and higher home prices.

I don’t like NYC, but I do miss the snow. I even enjoyed shoveling snow in our Queens driveway. Good exercise.

So I hate Manhattan, but I love shoveling snow. Go figure.

Things I hate about Los Angeles: crowded freeways, high prices, and WEATHER. (Granted, L.A. summers beat NYC summers, which are too humid.) That’s why I’m thinking of moving to Seattle — lower home prices and lovely gray skies.

I think part of it is the housing market dynamics, and the other part of it that being a working person in America has become such a miserable proposition, with predatory employers who treat as disposable garbage everyone not in the upper management insider’s club.

Why take that transfer to Omaha? In the old days you took an undesirable posting on the premise that you would be rewarded by the company later. Now people know corporate America will screw them as far they possibly can and kick them to the curb the minute it suits them to do so, so why leave a place you like to live and your friends and family support network for that?

for the lower cost of living I suppose. If you knew your employer was going to fire you, you wouldn’t transfer you’d look for another job. Some people don’t have the kind of network you’re speaking of, so for some its a no brainer.

i was once offered a transfer from CA to a lower cost of living state. guess what. company also wanted to adjust my salary downward to reflect lower cost of living.

Little “r” first of all, you make commission not a salary and second of all, you know that the RE money is in So-Cal so why would you move? Duh!!!

Everyone pssst little “r” is a real estate shill/shrill posing as human. Don’t be fooled by his idle chat he is trying to lure you in so that he can feast off of your ignorance, fear and greed.

robert, the salary is lower but the price to income ratio is better.

What: maybe you’re mistaking me for someone else. i admit, my screen name is so plain.

i’ve never worked in real estate. i was just commenting on transferring within a company to a cheaper cost of living area. for me, it was accompanied by an offer of proportionately lower pay (even though vacations, gadgets, etc. cost the same no matter where you live), so in effect they were offering me a pay cut. i didn’t bite.

was just throwing that out there to show it’s not always a no-brainer to take a transfer to a lower cost area.

Don’t tell me there is more than one little “r”. You need to change your handle because we already have a little “r” RE shill/shrill…

Another way to look at this is that the horizontal move is more common now, where the only way to get a promotion is to go to another company. In that scenario, it’s advantageous to rent, because you’re not locked into one region.

However, there’s another dark side to this situation, because some people are expecting their employees to be nearby. Back in the suburbanization days, it was okay if you lived an hour away, because so many people lived far away. This is no longer true in the days of the “fast company”. When a significant fraction of the office lives within half an hour commute, the company tends to expect the employees are generally more available in the off hours.

Assets increasing at these rates aren’t rational, and when that happens will always lead to sharp decreases. This instability is not good for the market — only good for investors who time their buying.

Real estate should not be a quick return for traditional buyers, yet it has been for traditional buyers who bought 2011-early 2013.

The whole concept of appraisals is out of whack and needs to be corrected. Appraisers are monkeys, they just go along for the ride. Builders are scum, churning out new homes and letting people in to $250k homes for $2,000 down.

But traditional buyers see the gains of others and they want in to. They are the same poeple who complain as buyers that prices are unaffordable and too much competition, then when they buy they root for the market to spike.

Real Estate is the most f’d up industry on the planet

BuildersAreScum: “Real estate should not be a quick return for traditional buyers, yet it has been for traditional buyers who bought 2011-early 2013.”

After just a casual perusal, I found a half dozen or so houses in Pasadena that were last sold in MID-to-LATE 2013, and already they’re being resold (after renovations) for markups of up to $300,000.

Flippers, naturally. But if Jim is right, flippers who perhaps came late to the party?

Mobility will rise again if things get really tough, in the greater scheme of things many Americans have had it relatively easy in post WW2 America, myself included…we stay put because we can and I live 50 miles north of where I was born (S.F.) though I have travelled a good bit in the service and on my own. Being a renter will make that waaay easier if the time comes, being shut out of the market in 2011/2012 might be a blessing in the long run.

Being a renter will make that waaay easier if the time comes, being shut out of the market in 2011/2012 might be a blessing in the long run.

My grandparents on both sides were way more motivated by living in “interesting” times and places…civil war in Ireland and the Dust Bowl/Great depression in Oklahoma so they eventually made their way to California and a better life via hard work though it meant leaving deep roots behind in both cases.

Anyway my generation and my parents generation has generally not faced anything near that level of turmoil and hardship and the fact remains that much of Calif. is overall still a great place to live despite all its faults…though what I read here and on other good blogs (like OTM, etc) makes me wonder if that will continue to be the case. Hopefully I’ll have the testicular fortitude to move if times get really hard

Most people move for the jobs. If there is a good job with better earning potential, the geographical concern or weather is less of an issue. There are not a lot good jobs except for the software engineers, and computer science majors. If you are retired, and you are likely moving for the weather, but you need much less housing. So this mobility is really about the younger people. CA real estate is international, and the buyers are from all of the world. We sent our manufacturing and production jobs overseas, what we have left are the low-paying service jobs, like fast food and retails. Healthcare employs a lot people, nurses, hospital workers, but we keep cutting the hell of medicare spending, and hospitals are laying off people now. If there is no job, there will be mobility.

Now, the minimum wage and unequality issues are front and center, and the labor cost in this country will probably go higher from here. So will be the inflation. Its hard to tell if this will be good or bad for the housing in itself. However, US is a safe haven in comparison to other troubled countries. So money and capital will flow to the safe place. That money will go to buy stuff in hot areas such as CA or New York or financial assets such as bond and stocks. So whatever you see in CA is probably unique in this aspect.

Home prices slowing down:

http://www.marketwatch.com/story/home-prices-slowing-down-case-shiller-2014-02-25

And another one:

http://blogs.marketwatch.com/capitolreport/2014/02/25/shiller-home-price-growth-to-slow-down-this-year/

Nice charts in both articles.

This study, linking home ownership to higher employment numbers, was first done pre housing crash. It has since been updated.

“http://www.businessinsider.com/high-home-ownership-is-strongly-linked-to-high-unemployment-2013-11”

“Oswald said the research may go some way to explaining why Spain, with a home ownership rate of 80 percent, has unemployment above 25 percent, whereas Switzerland, with a 30 percent ownership rate, has a jobless rate of just 3 percent.

Germany, another nation of renters rather than home owners, also has relatively low unemployment.

Studies carried out independently by a Finnish researcher produced similar findings for the Nordic nation, Oswald said.”

I have been a renter most of my life, excepting a short period between ’95 and ’01. The ex got that one. Kinda happy about that, because, since ’01, I have moved five times to advance my career, twice more than 200 miles. I can only guess how millions of “homeowners” cringe when they see an awesome job that they are made for across the country on some internet job site, and can’t even think of applying.

In the spirit of Jim Taylor here’s my own RoBoPOST of Housing Bubble 2.0 MythBusters

1. Cash Buyers are a myth. It’s all Other People’s Money and in the grand tradition of Wall Street these specuvestors and Hedge Funds will keep the profits and pass on the losses. The smart money never plays with their own money.

2. SFHs are not nor have the ever been a good institutional rental investment. Even in the current low interest rate environment the math doesn’t work when you figure Cap Rates minus Risk. Renting a SFH BARELY works for Mom and Pop.

3. The FED/.gov cannot reinvent math nor control human behavior. All your recycled arguments from Housing Bubble 1.0 are still wrong. When just one Hedge Fund gets “Margin Called†and liquidates to cover debt the rush for the exits will be on. What happened to the banks in 2008 will be repeated in 2015 amongst the Hedges and specuvestors.

4. The FED gives a shit about RE. Again, THE FED DOES NOT GIVE A SHIT ABOUT YOU OR YOUR “ASSETâ€! The FED is out to maintain the petrodollars reserve currency status and secondarily keep it’s member banks enriched. Now that so much of the toxic “assets†have been removed from the banks balance sheets (with even more cleared by 2015) how will the banks make $$$??? Well buy selling new mortgages and processing distressed properties on the way down of course! How does a stagnant environment of sideways prices make the banks money? It doesn’t. The banks own the FED. Why would they have their little puppets take actions that do not work in their favor? In the aftermath of Bubble 1.0 the top 5 banks are more powerful than ever. The bust ALWAYS follows the boom, but the same entities keep winning on the way up and down.

Please make an argument against this thesis you crazy Housing Bulls LOL

“Please make an argument against this thesis you crazy Housing Bulls LOLâ€

Ok, I’ll bite…

“Cash Buyers are a myth.†– Maybe so but I have been told that Unicorns are a myth and we have documented verification of their existence on this very blog. So, what is a myth in reality? One man’s myth is another man’s religion…

“SFHs are not nor have the ever been a good institutional rental investment.†– Hmmm… Let me get back to you on this one but it will definitely involve things like “rents go up as currency devaluesâ€â€¦ Ummm… “Rich suitcases made out of Chinese moneyâ€â€¦ oh and my favorite “you gotta live somewhere

“The FED/.gov cannot reinvent math…†Oh contraire my friend. “QE works in practice but not in theory†– The Bernanke. So you are telling me that your own belief system tells you that something is not true and you still do it? Their math is telling them that it shouldn’t “work†and when it does they still believe their math is correct… Sound like they are inventing their own math to me…

“The bust ALWAYS follows the boom, but the same entities keep winning on the way up and down.†– This is really a chicken and egg question. Did the bust follow the boom or was it that the boom followed the bust? I will leave this to blert to further dissect…

1. Chinese with suitcases full of gold wearing gold rimmed glasses and driving golden range rovers demand is insatiable.

2. Yellen/Bernacke told me QE was there to help the middle class so tapering it would hurt the middle class so it will continue forever.

3. Sun trumps everything including work and family thereby providing a floor of only 5% less than today’s prices. People want to and can always quit their jobs and move their families to sunny, expensive, pretty far left politically California.

4. LA is some type of new mega, super city immune to local economics. It is listed with such powerhouse as Qatar and Austria as top visitor destinations (see drefsh articles a while ago where he said “bam” or “booya” or something like that) and is listed in some survey about innovation highly.

5. The tech companies like Waaassssuppp that sold to facebook for 19billy and others are rock solid and built on fundamentals. This will led to a new era in Cali with tax revenues and home prices only going up, up, up from here. This is actually the bottom.

6. Fukishima radiation will lead to a new breed of half fish/half man super hero being born and since hollywood is right there, they will be able to capitalize. Aquaman will finally be greenlit and the revenues from parts 1-10 will revitalize LA.

7. This time is different. Duh.

Just kidding. Great posts Nihilist Zero. I’ll just say that I agree with everything. Timing still hard to predict for a real decrease. Feels close, but then it doesnt. Then it does. Roller coaster. Could be this selling season…or next…if its the one after, I sell my house.

“The city is like a living, filthy organism. Its dirty, smelly and overcrowded like a motherfcker.”

That’s all well and good, but you can’t make a right on red lights in NYC. No thanks.

Dfresh-if you purposely changed your name to my misspelling, brilliant. Also, I concur on the no rights on red in NYC. Annoying. All the people in the crosswalk think otherwise, but fck em.

I consider myself a housing bear, but you are irrationally bearish about rental properties “barely working for mom and pop”. It’s easy money for most. If you have 3-4 paid off rental properties, you don’t even have to work. Even if you take out a loan for a rental property, the value of the home has already gone up 15%, plus the rent is twice your mortgage, so you’re way ahead of the game already.

Perhaps I should have been more clear about “Mom and Pop” it barely works for them because the capitalization rate beats other investments by a larger amount than Hedges running SF rentals. If Mom and Pop cash out of their properties it’s hatred for them to find something better. For the Hedges it’s a no brainer to cash out when treasuries rise. Why would you want to tie up that much money in an illiquid asset for a cap rate that soon will trail the treasury rate? Without the specuvestors to keep up rental/sale prices the bottom falls out just like sub prime gave us the 2008 crash. I’m not bearish on rentals as an investment at all. I work for quite a few in REal and property management and know that the math can be quite good. it’s also quite brutal if you go in rediculosly leveraged and tats what today’s market is.

N Zero…

One of the largest ‘hedge fund’ buyers is / was a co-founder of Public Storage.

It’s fundamental structure was to INVEST in RE without borrowing money at all.

Instead, it was structured as a series of limited real estate partnerships suitable for Tax Qualified Monies.

READ that line ^^^ five times.

Public Storage normally held its properties for at least seven-years, often longer. Interest rate swings and the latest action in the mortgage market meant absolutely nothing to Public Storage.

Their operating thesis was to acquire RE assets — WITHOUT debt — that were going to be impossible to replicate at lower prices in the future — and thereby provide current returns — at low cap rates even — while having virtually no risk.

ALL rents were collected in advance, month to month. No leases beyond thirty-days for Public Storage. When the inevitable debasement of the currency occurred, Public Storage repriced its mini-warehouse rents.

&&&&

Folks, this structure, and attitude, has been cloned over to SFH. Just on a grander scale and with pension funds — again — with the tax qualified monies.

His impulse is to stay strictly with bread and butter properties that can NOT be built/ replicated at their price of purchase.

Public Storage built from the ground up. So repairing bread and butter homes is no biggie.

Zero is completely off base about market pressure.

As I previously related, the game is to place a short on the US Dollar. The general partner/ hedge fund is taking that angle as a Promoted Interest in the inevitable nominal capital gains.

Cap rates on income producing LAND have been 3% going back centuries. Deal with it.

Cap rates on an unleveraged RE position can be as low as 5% and draw funding from the Moon.

It has been Public Storage’s thesis that they were actually investing in LAND — not real estate — and that the mini-warehouses were merely a way to pay the cost of holding. Further, at the end of the road, Public Storage expected most of their gains to take the form of properties destined to be torn down and rebuilt to a higher use.

Folks, this is where the big money is coming from. It’s going to be as relentless as the mythic Terminator. It will not stop. Wishful thinking will not stop it.

The prospect of gentrification will only accelerate such ‘professional interventions.’

“Why would you want to tie up that much money in an illiquid asset for a cap rate that soon will trail the treasury rate?”

Let’s say a HF is getting 5% return on it’s SFH portfolio. What would treasuries have to return to make it worthwhile for the HF to liquidate its portfolio of SFH at a break-even point?

I know many people are hoping for housing to tank 20%. Ask yourself the same question again. Let’s take a scenario where home prices fell 20% overnight. What would treasuries have to return to make it worthwhile for the HF to liquidate its portfolio of SFHs at a 20% loss?

As an aside, how high do you see 10 year treasury going by 2015? Do you really anticipate an huge increase?

Blert–

I’ll grant you that AHF is using private funding, and has a keen eye for building on their successful business model… but they are the ONLY ones with over 5k units who are doing so. The rest are hedges with massive loans in place and no real experience.

Furthermore, building storage units in future dev areas is completely different than SFH’s with tenants. I don’t think I need to detail those differences, do you?

Point is, every one of these business models has an exit strategy in place, and has stated as much. I don’t think the model works, but it will take a few years to pan out before plan B goes into effect.. at which point we will see entire neighborhoods go upside down overnight. Good luck with that.

About AHFR’s business model… Let’s assume they aren’t cooking the books (unlikely) and at least currently their rental securities are profitable. It would only take a small downturn to break their model and they surely aren’t getting the 10% annual increases in rent I’ve heard them and Blackstone touting. So what happens when the rental securities fail to pay investors? This is the “margin call” moment that will come sooner or later. As a publicly traded company I expect a few messy meeting once shareholder returns go negative. Liquidation will be swift. Stagnant wages combined with lack of household formation along with the baby boomer demographic time bomb ensure pressie on SFH prices and rents for years to come. AHFR is not immune to this. And I know it’s been a while since the market has seen it, but 5% yields on treasuries are coming. This is going to destroy any and all SFH rental models. The cap rate WILL NOT justify the risk. In reality it doesn’t justify it now…

RE Blert

Shorting the US dollar works, until it doesn’t. The FED will take the dollar to the edge, only to pull it back to save reserve status. Again, we went to war to protect the petrodollar. As for the Public storage guy it reminds me of Bill Gross’ current PIMCO pickle the model was working and then it didn’t we are nearing the end of a pull demand forward cycle that began 30 years ago. Modeling off of this recent history going forward is fool hardy. As to your Cap Rate history it has never been applied to SFHs that are heading into an EXTENDED deflationary cycle. The income and demographic numbers don’t lie. The pundit who called this Housing Bubble 2.0 warned of killing the golden proletariat goose. You can try and hide the debasment of working class income with “rental backed securities” and sub prime lending but thy’s fact remains if the working class don’t increase their share of the national income the oligarchs asset values are fucked. The Public Storage guy made his $ on consumerism run so rampant that people borrowed money to buy more shut than they could fit in their residence. The demand forward credit cycle that created his biz opportunity is coming to an end.

Zer0…

It’s too much to wade through the history of Public Storage — But your responses lead me to believe that you’re conflating the General Partner’s game with the Limited Partner’s game.

The BIG money is coming from tax qualified funds.

If the PS pattern is followed, then the LPs have priority in all cash flows.

The GP is not/ has not pitched the zany idea that any returns are going to be realized in the near term. Quite the opposite is the case. The GP in all of these deals takes a back-end Promoted Interest.

Consequently no investor pool is disappointed in the slightest.

&&&

Next, more than a few of the buys occurred at yesterday’s prices.

These fellows are NOT BUYING AVERAGE properties. They’re sticking with bread and butter homes.

They can NOT be repriced down and lower — unless the entire (financial) world folds up.

Essentially ALL of the published statistics — on the economy — on real estate — use BLENDED averages. The ramp in Palo Alto properties massively skews said figures.

Consequently, you can’t trust any of the popular real estate metrics — for the purpose of this segment. Such distortions are EXACTLY why the smart crowd loves this play.

&&&

To repeat the obvious: the hedge funds knew — going in — that RE is easy to buy — tough to sell.

They know — from insiders contacts — that there is not one chance in a million that the Fedsury is going to back off the printing press. Their dollar short is a LOCK.

In all human history, no fiat printing power has ever reversed course — with one single extraordinary exception. (It proves the rule.)

That signature exception was 19th Century, Constitutional America. Lincoln’s Greenbacks were — in the fullness of time — literally made as good as gold. This fiat currency is the source of the greenback dollars in your bill fold today. (Way back when, green was chosen because it was odd, almost unique, and yet cheap enough. At the time, bank notes in popular use did not use green ink. Hence, they became known as “Lincoln’s Greenbacks.”)

BTW, the term Constitutional America is ironic: by ‘the Crime of 73’ Congress took the nation off of the Constitutionally mandated Silver Standard. That document gave short shrift to gold, specie almost totally unknown in 18th Century America. Congress made the jump to satisfy Wall Street and the City Banks.

( JP Morgan and kin — you read that right. Morgan had already become a huge wheel — and his dad wasn’t even dead, yet. He’d been buying up monopoly positions, step-wise, throughout the American post-war economy. In this, Morgan was a nexus of venture capital — think Edison, et. al. — and vulture capital — as in most of his buys were death-bed take-overs.)

&&&&

Congress — or the Deep State — is NOT going to flip around to suit your tastes.

The smart money is on further debasement… and fiascos.

So Blert, your argument rest pretty much on “They know — from insiders contacts — that there is not one chance in a million that the Fedsury is going to back off the printing press. Their dollar short is a LOCK.”-basically QE forever? Cant say if yellen doesn’t dish more out at some point, but forever? I’ll respectfully disagree. There is enough of a chorus out there now trying to rein them in. Maybe its a show. I know pretty much nothing for sure. However, I can say for sure that your comment is statistically just wrong.

The US Dollar is going to be debased — one way or another.

Traditionally, it never took QE.

Betting AGAINST debasement has been utterly ruinous for a solid century.

I’ll take those odds.

Where is the rent twice the mortgage? My apartment got bought, all cash, and it seemed like a pretty good deal, but not a fantastic deal. It was around 10x the annual rent. If they had a mortgage, they would have around $375 per unit to pay expenses after rent.

Blert-if you mean the dollar will lose value over time due to inflation, I concur that is the very likely scenario. However, you seemed to infer that inflation would come via a printing press (shorthand often for QE these days even though we know its all electronic). Curiously do you believe The fed will continue QE forever and/or create a new mechanism to boost inflation forever basically? At some point politicians step in, IMO. How is housing going to do in your opinion? This whole nominal vs real dollar stuff I feel muddles things rather than clarifies them unless you’re predicting hyperinflation, IMO (otherwise i need to look at that for every other purchase i make like a car, furniture, wtc) so keeping any answer in real dollars would be appreciated.

I’ll play..

1. “Cash buyers are a myth” Not sure what you mean by that, unless you’re trying to imply if you trace the money, there’s leverage somewhere down the line. That’s always been the case, even if Joe Homebuyer borrows from BofA for a loan, BofA is leveraged from the start. Leverage is an integral part of our economy, like it or not.

2. “SFHs are not nor have the ever been a good institutional rental investment” What’s the proof of this? Until recently, institutional investors haven’t explored the investment of SFHs so there’s no historical basis for this comment?

Invitation Homes 2013-SFR1 was completed a few months despite some concerns over “release of properties clause” sold better than expected.

AMH is up 5% since it’s IPO.

I’m not sure how one can evaluate HOW an investment will do if one don’t know the terms of the investment? If Blackstone bought each of its properties at 70% market value, can one simply predict that they will lose money?

3. “The FED/.gov cannot reinvent math nor control human behavior” I don’t believe they’re trying to reinvent math or control human behavior. If you happen to believe they’re irrational, you know the famous saying.. “the fed/market can stay irrational longer than you can stay solvent”

4. ” The FED gives a shit about RE” You’re right, I don’t believe they do either, as long as RE doesn’t affect the economy negatively.

MB…

INRE #2…

Centuries ago, “Institutional Investors” would’ve been referred to as Peers of the Realm.

Renting habitation to the proles was the ORIGINAL form of ‘institutional’ wealth, and that institution was the nobility.

So, what was old is now new again.

The ONLY reason that institutions — in our modern sense — stayed away from SFH is because of Federal interventions. For a full century, the Federal government has consistently moved to block the institutionalization of SFH. You’ll see this when you drill down into the specifics — such as —

Capping mortgage preferences…

Tax code deductions… too many instances to list.

Zoning… (while local) … ruins the ability of slum management…

Rent controls… (while local or wartime) … something the peerage never permitted.

There is a general failure to understand that this influx — the institutionalization of SFH and more — is a COMPLETE reversal of bi-partisan policies going back just about forever.

It’s a fulsome adoption of a European philosophy — that of the landed gentry — now replicated as ‘professional’ management.

Spool up a DVD: Rob Roy, to see how that worked.

Addendum:

Hawaii found the concentrated ownership of the land underneath SFH so pernicious that it enacted a statute that is forcing the Big Five to sell out.

They took their plea to the US Supreme Court… and lost. The Supremes were scandalized by the realities behind the Big Boys.

And to show you just how slow the general — even so-call informed — public was: they didn’t ‘get it’ until the Big Boys ‘re-negotiated’ the land rentals underneath said SFH. It was only at the end, the VERY end, that the entire state woke up and realized that ALL of their real property HAD to be surrendered to the Big Five for $0 when the leasehold was up. Those deals were terminating in the 1990s all over the state.

$1,000,000 equities were about to vanish all over Hawaii Kai. (!)

At this time, Hawaii flatly prohibits any more leasehold transactions. (They got the idea from the English, BTW.) Lord Mayfair — of West End fame — owned commercial properties in the Islands. He knew the game. Though not on Forbes list, he’s consistently one of Britain’s most wealthy men — going back through his ancestors.

The dynamic is that such players are NEVER compelled to sell. So they end up accruing ever more property — kind of like the Papal States!

Regarding student debt…..I am sure this is not the norm, but with my circle of friends that have children, the result is that the parents will actually end up working longer in order to either assist or pay off entirely their kids’ student debt. In addition, I have spoken to many friends who feel it is now their obligation to help their kids purchase their first house because it is obvious they will not be able to do this on their own without the help of their parents.

This is a bubble, the situation in UK and US from a well respected ekonomist.

http://www.theguardian.com/commentisfree/2014/feb/24/recovery-bubble-crash-uk-us-investors

“…The situation is even more worrying in the US. In March 2013, the Standard & Poor 500 stock market index reached the highest ever level, surpassing the 2007 peak (which was higher than the peak during the dotcom boom), despite the fact that the country’s per capita income had not yet recovered to its 2007 level. Since then, the index has risen about 20%, although the US per capita income has not increased even by 2% during the same period. This is definitely the biggest stock market bubble in modern history.

Even more extraordinary than the inflated prices is that, unlike in the two previous share price booms, no one is offering a plausible narrative explaining why the evidently unsustainable levels of share prices are actually justified…”

Stock market gains has little to do with personal income. It has everything to do with profit margin, lots of US companies are global in nature, speculation of FED actions or future economic recovery/inflation. Whether they are justified is a different story. We had 20% inflation since 2007 so at this current price. The market is only around the 2007 high in nominal terms. Overpriced yes, bubble no. The next bubble will not be in stocks or RE but will be in government debt. By then, stocks might even be considered “safe haven”. However after 5 years of gains, stocks could take a significant correction soon but most won’t know until it happened.

It is becuse of the Rich Red Chinese suitcases made from Yuan… And you got to live somewhere so why not on Wall Street…

Housing To Tank Hard in 2014!

Thanks for checking in Jim.

I <3 Jim.

You are correct, that is not the norm.

Pakistan is better than America and the UK when it comes to mobility(I know since we came here. In Pakistan I was near the top, but at least I am alive here in California which counts for something, I think). Denmark is a small country and they have the greatest mobility. Canada is cold, but it looks good. I tell my brother in law to go to Austin Texas. Gov. Perry says that Texas is better than California. It looks like he is right. My other brother in law likes the south Bay, the defense contractors are there.

Yes, Mamnoon. I understand well. My sister in law is from Vietnam and she currently lives in Norway. I like Norway but I hear that the pampas of Argentina is hospitable to my people (although not so much to Butch and Sundance). Gov. Perry has a lot of good things to say although in Arizona I like it better because of the civil rights. It’s a shoot of craps, life, isn’t it?

Iowa has very low unemployment, low housing costs, low crime and top schools. But a lot of people aren’t ready for a farm state, even in the cities like DM, CR and IC. Maybe it’s entertainment I don’t know but my point is that some people say that people move for jobs. If that was the case Iowa would be overflowing. So would North Dakota and Minnesota, and Minneapolis is extremely cultured. Sort of the “California of Cold Lovers” some say.

Funny you should mention Iowa:

* worked for Iowa companies for past 10 years. DSM area. Visit 4x/year. Singles love, love, love their alcohol, particularly beer. Damn they can drink. they also like 10k’s, half-marathons, marathons…probably as a way to train-off the empty calories from all their drinking and as a reason to have a place to go hang-out and drink after they train.

* Hilarious that they even have “traffic cams” and “traffic reporters” on TV. It’s like the 405 at 3 AM…on a bad day

* Everyone seems to have the same shade dirty blond and hazel eyes

* If it’s warmer than 30 degrees, you’re likely to see people in shorts and t-shirts

* sprawl is in full-effect

* farmland has, like, tripled in the past 10 years

* probably would get a big promotion to re-locate, and my COL would plummet, but there just ain’t no way.

Hello Doc, et al.

Prices may be stalling out, but flipping is still on the radar. Check out this one. Is this seller going to be left holding the bag?

http://www.trulia.com/property/3086978431-2124-S-Cochran-Ave-Los-Angeles-CA-90016

Sold for

$678K in 2011 (could it really have been this high 2011?)

$278K in July 2012

$395K in Oct 2012

$490K in Feb 2014 (asking price).

In a lousy neighborhood but with Home Depot remodel

Real unemployment is in the 20% range. Housing is on the upswing because rates got to historic lows while cash investors decided to go into sfr rentals….all the while inventory was shrinking. So demand gets a major boost while supply is suppressed. Of course it will rise and probably rise more in the next year or so. BUT, the sustainability is not there. The chickens of unemployment and non-wage growth will come home to roost and when they do, the bubble will pop yet again.

One strength we had over other nations is the wonderful ability to move anywhere in our great nation for a job, to be near family, etc. That mobility for Americans is now crushed. Instead, we have hundreds of thousands of other nationals with greater mobility moving into and across our nation. It’s a massive demographic shift/change that no ones knows the results of yet. I hope the Yutes of today enjoy their parents’ basements because with over $1 Trillion in student loans and a poor job market, they’re gonna be there for a long time.

You know what? I am tired of the same old arguments with all the bright eyed children pretending to be adults. Sorry to tell you there is no Santa Clause it is really your dad in a clown suit pretending to be something he isn’t. Ok I am drinking the Kool-Aid. This time really is different than the thousands of prior times that were different. The mythical “cash buyer†is real. There is no debt on Public Storage Inc.’s balance sheet. It is all a figment of your imagination. What is really real anyway? What is cash? What is money? What is an investment? What is smart? What is stupid? I guess it is whatever you want it to be, just like the corner street walker. The stupid statements made in a boom never cease to amaze me. It never ends. Stupid people either have really bad memories or they are so stupid they cannot see that history is repeating itself over and over again. How were we as a species able to survive with the inability to learn from our mistakes? So, what is your favorite flavor of Kool-Aid?

Yup no debt here. It all big boys, money and lies…

http://investors.publicstorage.com/phoenix.zhtml?c=111706&p=irol-fundBalanceA

What are numbers really?

http://www.zerohedge.com/news/2014-02-27/reality-behind-new-home-sales-number

Pure baloney! Any resident in CA could have gained great wealth in the stock market since 2009. Too many stupid Californians is more the problem.

Love the blog as always, but you’re only scratching the surface of some of this data.

For example, the mobility data shows that a pronounced difference in mobility between the college degreed (small number but higher mobility) and those without a college degree (higher in number, but far more place bound).

This has implications for the housing and labor markets for a variety of reasons, but particularly in that the degreed are most likely to go on to be CEOs, governors, senators, etc. So they aren’t necessarily going to perceive the broader reality.

But in terms of this blog, if you don’t recognize that there is still a subset (and those most prone to be buyers), I think you risk missing important revelations about market behavior.

In terms of student loans, as I’ve said before, I think that’s ground you need to tread more cautiously on rather than relying on aggregate data. For example, you assume that 1.08B is weighing down young households, but FRBNY data indicates 44% of that debt is held in the 40+ population (19% in the 50+ population). How?

Some part is the debt you see Congressmen and professionals in legal/medical fields still paying off high debts from decades past but generally enjoying higher incomes as a trade-off. Some part is non-traditional students, a number of whom returned to school when the economy tanked in 2007. Some part are ‘parent’ loans students borrowed to help their kids attend.

And of course, in many cases students are borrowing these loans precisely to assist with the high cost of housing while attending school. When you talk about student loans I think you fall into the mainstream media narrative and fall into a diagnosis that ignores how complex the data really is.

I made my money the old fashioned way, I inherited it. Interesting note on investors leaving the RE market:

http://www.zerohedge.com/contributed/2014-02-27/smart-money-quietly-abandons-housing-market

“I think you risk missing important revelations about market behavior.”

WTF??? What “market” are you talking about? Are you talking about supply and demand? If so, spend a weekend with blert and Steve Keen and get back to me. Are you talking about the student loan “market”? This is probably the third most manipulated market in the country. This is a way to get “printed money” into the economy. It has absolutely nothing to do with education just as military spending has nothing to do with war. Please tell me you are not using the term “market” in regards to housing. I am sure no one with a pulse still believes we have a housing market anymore…

Is anyone else having trouble accessing this site using firefox? The links take me to random .com’s.

so you get the government you vote for that serves the few but only notice the changes in the last six years.but people are slowly waking up to that fact,may be to late for a hell of a lot of folks but what is sad is that they did not learned from them but despise them for not having the same.you old timers spend your money and live to the fullest you fought and earned for what you have.as for the kids will i guess its not to late,maybe,but we will have this blog to bitch and complain.

LOL. The Mississippi River is the Beer Belt. I’ve witnessed (and partaken in more blackout binge drinking in Milwaukee, STL, New Orleans and DSM than anywhere in America, and I’d even put some $ on it. You ain’t lyin’

more blackout binge drinking in Milwaukee, STL, New Orleans and DSM than anywhere in America, and I’d even put some $ on it. You ain’t lyin’

Interesting blog comment on leveraging?