Mortgage Equity Withdrawal Syndrome. The 3rd Rail of the Housing Led Boom.

Step one, you call the bank.

Step two, you decide between a home loan or home equity line of credit.

Step three, you get a 2nd on the home after an inflated bubble market appraisal.

Step four, your off to the spending races.

Making Your Home a Bank

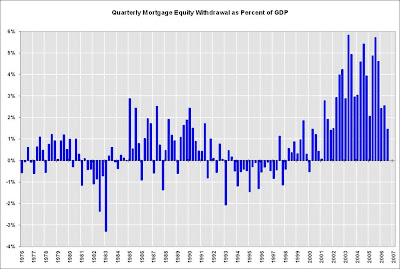

During the 1990s, in terms of tapping out equity, mortgage equity withdrawals (MEW for short) were roughly flat for a decade. It was flat for a couple of reasons. The collateralized debt obligations market wasn’t as streamlined as it currently is. This made it more difficult and a longer drawn out process to extract money from your home. The next major point is home prices were stagnant throughout this decade. How are you going to extract money out of a dry well? And finally we have declining returns and world wide investors chasing stronger yields. Keep in mind it was very normal to see 35% year-over-year gains in the technology sectors. Why in the world would you want to invest in housing where over a century of gains have trended with inflation? This all changed after 9/11.

After 9/11, we suddenly saw a progressive campaign of rate slashing to keep the economy afloat. Of course, when you decrease the fed funds rate, you increase the money flowing through the economy. Take a look at the below chart:

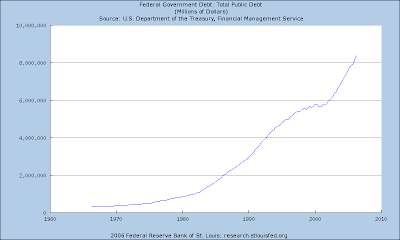

As you will notice, we have a normal progressive growth of public debt from the 1970s to about 2000. Then we see something odd happening. We see the angle trajectory of the chart suddenly shift. Somehow I doubt the majority of folks were paying off debt. If anything, they were consolidating credit card debt, only to reuse the damn things again! Kind of defeats the purpose of debt reduction if you are moving your money from different pockets in your pants and thinking you are richer.

What Will Happen when Home Bank Forecloses?

Since the dollar is worth a lot less because of inflation and irresponsible monetary policy, you are now able to purchase less with your current income. Think about the nature of inflation. When you print too much money, you devalue the worth of the current money supply. This is basic economics. What makes something valuable? The amount and scarcity of an item in relation to the demand. Money for a few years was so cheap, it made no sense to save and the public followed. The leaders of this consumption used every advertising medium available. If you drive a two year old car you simply were an old school idiot with no taste for the finer things in life. Have you noticed those credit card commercials where the person paying with a check or cash is seen as a leper? Everyone is having a merry time paying with their Visa and Mastercard but god forbid you show cash you dirty rotten animal. How dare you stop the flow of credit to the rightful owners of consumption!

But you can only spend so much and grow an economy on pseudo-wealth. Eventually someone will have to pay for it. And at a certain point, there will be no more money left. Take a look at the below chart:

You’ll notice that suddenly as we hit the housing peak in 2005/2006, MEW dropped off the map. Why did this happen? For one, housing is correcting and coming back down to Earth. Another reason is the Fed was forced to tighten credit standards, otherwise we were on our way toward paying for orange juice with wheel barrows of dollars at Ralphs.

So the perma bull arguments are absolutely false. Housing was artificially inflated by investors looking for higher returns, a Fed that dropped rates faster than muscle growth in the MLB, and finally a society that is based on 70 percent consumption. If you read your history books, you’ll find many great empires collapsing because of massive deficits. However, this is a worldwide glut in credit so this will impact the entire planet. Have any doubt about the bubble? Take a look at these 10 homes and then come back and let us know your thoughts.

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to Dr. Housing Bubble’s Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to feed

Subscribe to feed

18 Responses to “Mortgage Equity Withdrawal Syndrome. The 3rd Rail of the Housing Led Boom.”

Excellent analysis. One more variable to consider, Texas did not allow Home Equity Loans until 1998. When that changed, billions of untapped equity was suddenly available. In about 2003, HELOC’s were made legal in Texas.

http://www.window.state.tx.us/specialrpt/homeeqty03/

I don’t think many NY analysts understand that the “growth” in home equity was inflated by a hundred years of equity from one of the largest states flooding the market at one time. I would like to know if the Dr. has any thoughts on this possibility?

Interesting. I look back at what I was doing with my home that appreciated from $135K purchase price in 8/99 and to the sale price of $182K in 7/03. I had CC debt and used a small $5K HELOC to transfer the balance to bring the interest rate way down. It never crossed my mind to use the equity to start buying stuff. Thankfully, when the house was sold due to a divorce, the equity paid off the HELOC in full and I was debt free. Well, not for long because I unemployed at the time and the unemployment rant out. I spent the cash out on survival and then ran the CC’s back up.

I have now worked hard to be debt free, have a rather healthy stash of cash in 401K and savings and will never abuse money that again. I like getting paid on my money, not losing excrutiating amounts pissed away to paying ridiculous interest rates. I fell like an idiot only making 4.5% on mine while the CC companies make 25% on theirs, but oh well…

Dr.

Those charts are sobering. What is fascinating is how well they seem to correlate to the unnatural upticks in home values that you see on Zillow. I remember discussing the Zillow plots with friends, saying that something fundamental has changed in the equation and it is not right, natural, and/or believable. It all seems to be coming together, now.

HELOCS, Ala ‘Sixth Sense’

Cole: I see people getting HELOCs.

Malcolm: In your dreams?

[Cole shakes his head no]

Malcolm: While you’re awake?

Cole: Walking around like regular people. They don’t see each other. They only see what they want to see. They don’t know they’re stupid.

Malcolm: How often do you see them?

Cole: All the time. They’re everywhere.

Home equity loans have been the game for quite a few years now. The bad thing is that the market is so unstable, to take one now could end up in foreclosure down the road.

It’s not a good time to be speculative about the housing market.

Rex

Criteo Tech Evangelist

http://widget.criteo.com/?s=E&i=R

Debt does not equal wealth. It’s that simple. Sorry, correction: debt = wealth for the rich bankers!!! Paying 7-8% on a HELOC for 30 years is not smart. That’s mean the 1K Plasma TV you buy actually cost $3K in 30 years. I bet the TV will not be there in 30 years. The wealthy people do need to borrow money. That’s why they are wealthy.

I wonder if you have any info about the international housing market. I was under the impression that it was just Americans living on their CCs and buying houses they can’t afford. But I’ve read that Australia and Spain are both on the verge of a major housing bubble. What other countries does this apply to? And is China funding all this growth internationally? If a lot of these CDOs are owned by international conglomerates, are they going to take a bath on all this as well?

brian_b,

The UK might be in rough shape as well.

Huge increase in those forced to default on mortgages payments

-Buyers are being forced to borrow record amounts of money to finance their property purchases

-Number of people defaulting on their payments this year has doubled to 77,000 each month

-Fears are growing of a dramatic increase in the number of houses that are repossessed

http://tinyurl.com/yuo6ja

“Debt Time Bomb†Set to Explode in United Kingdom

http://tinyurl.com/29eqof

Could you maybe run for president Doctor Housing Bubble…I will vote for you once for your awesome economic analysis and once for this line:

“a Fed that dropped rates faster than muscle growth in the MLB”

Always an education at this site…thanks as always!

All,

I’ve added a short sale column on the right hand side of the site that will show short-sale inventory in relation to the overall total market inventory for the following counties:

Los Angeles

Orange

Riverside

San Bernardino

Ventura

It’ll be interesting to track this over the next few months.

Dr. HB

Dr. HB –

Great post. MEW is tanking and with it consumer spending. The argument that people actually used MEW to pay off debt and or invest/play the arbitrage game is absurd.

People cashed out to fuel unsustainable lifestyles with money from unsustainable house prices.

When we hear the tales of woe surrounding foreclosures we have to remember that all of the 100% serial cash out refinances that racked up the unrepayable debt.

Morgan

blownmortgage.com

Allow me to add fuel to the fire. Consumer debt was up erlier this week to the point of doubling from May. The MSM touted this as hey look the consumer is spending.

Fast forward to the end of the week and we saw how retail spending tanked.

All the bulls will deny the impact of MEW but they do not realize the impact when the fools of 2004 are stuck with 2004 prices for their homes. From there it keeps going down year by year.

Great post as always.

@mitch,

Many names have been associated to the equity rich states flooding other markets. Equity locusts, equity rich sellers, and the name I’ve given to these in California called the CEGs (California Equity Giants). We’re already starting to see 2nd home purchases fall because of the market conditions in bubble metro areas. This coupled with the proliferation of real estate guru propaganda, people were buying homes with easy credit. Unbelievably, many would be investors bought property site unseen. I’ve been to a few places in the South to look at investment properties and there isn’t a person to be found. Gorgeous home, specs look good online, but once there nothing to support the home.

Now that we are seeing these CEGs become CEDs (California Equity Dwarfs) we are also seeing the impact in other states. NY analyst are consumed by new home numbers even though this is a small percentage of the overall resale market

@foruml8,

Thankfully you sold in a market that was trending up. Just imagine that you bought the place in 2005 and had to sell now? Not a pretty picture. Being debt free is great. I’m not averse to debt as long as you put it to good use and leverage it to make more. Yet the majority of people use it for consumption.

@tyrone,

Zillow plots out on previous home sales and some other algorithm. Either way, in bubble markets the prices are largely off. They look backward trying to focus on the future. Previous home sales cannot tell you what the price will be tomorrow during a market shift. Great tool for stable markets; after all, this is essentially what a local market analysis is.

@rex,

We’re in uncharted territory. Yes, we’ve always had home equity loans. But not to this extent.

@quang,

Banks don’t get rich by losing money. Money is made on those who don’t understand basic finance (maybe that’s why it isn’t taught in high school). Instead we get basic economics with lame “bread and guns†supply and demand curves. No wonder why kids get bored. Need to link it up to tangible current events like “you just spent $100 on that iPod. How much would that be worth in 20 years at 10% compound growth?â€

@brianb,

The credit bubble is international. The way it is playing out varies from country to country. There are bubbles in Vancouver, Germany, Stockholm, Sydney, and the UK. There are other places but each with their own bubble dynamics. China needs to keep the US consuming the goods they are throwing at us; hence they are all the more willing to prop the dollar with Japan. Yet they are having their own issues and yields need to increase to make investments viable. We’re in shared mutual success/destruction.

Most people like to think we can close off the borders and be self-sufficient. If this happens, you can kiss cheap goods good bye. Most expensive costs are labor costs. Think someone in the US is going to work for minimum wage in manufacturing? Employers would simply pass the cost down to consumers.

So this credit bubble ties everyone together by the hip.

@tulipboy,

That’ll be in my stump speech. I was watching some late night infomercial and I saw some ads marketing to senior citizens reverse mortgages. The company tactic was interesting. They had an aggressive looking repo man taking the person’s car and walker away and you hear a serious voice say “is Social Security not enough? Facing foreclosure? Why sit on equity when you can get paid for living in your house!†Reverse mortgages have a purpose. The advertising slant was a bit shady.

@morgan,

Agreed. The pundits want you to believe everyone consolidated high debt credit cards, cut up the old Visa and American Express, and suddenly over funded their 401(k) accounts. The opposite actually happened which I’ll show in the next post – people are not funding their retirments adequately. Folks did consolidate debt. Yet they went back and maxed out the credit cards. Good fashioned spending.

@graphrix,

How much can we spend via debt? This is the major question. How long can an economy supported by housing speculation, lax credit, and negative savings keep on spending?

Dr. HB,

Are you referring to that commercial where everyone is buying donuts to the music from 2001 A Space Odyssey? Then the guy uses cash, and the orchestra stops?

I caught a glimpse of that same commercial on Saturday during of all things ‘Flip that House’ (not a show that I watch, but TV was on in the background).

I was so horrified by that commercial for a myriad reasons, to name but a few:

1) The shameless propoganda of Visa/Mastercard to encourage consumers to buy donuts with credit cards so that that merchants can pay them the nice transaction fees (which will eventually show up in higher priced donuts).

2) The actual fact that some people with eventually refinance these donut purchases on a HELOC and pay for them over the course of 30 years.

3) (a bit of a tinfoil hat theory here) But, the stigmatizing as ‘cash’ as ‘bad’ and thus making it easier for the eventual removal of ‘cash’ from our system (and all the wonderful anonymity that goes along with it). I would like them to try the showing the same commercial with people buying adult magazines from a ‘spank shop’ in Times Square using said ‘Visa/Mastercard’.

Dr. HB – good point about the lack of basic financial education. If the schools aren’t teaching it, and the parents don’t practice it, then we are stuck in a cycle of being financially illiterate. It’s strange that we live in the richest country in the world yet a good chunk of the population doesn’t understand the basics of growing personal wealth. Any theories to explain this disconnect?

Your photo is great.

ABN-AMRO LaSalle Bank actually ran an ad with a similar picture, of a glossy home kitchen with an ATM positioned next to the frig, with ad copy that said “it’s like having an ATM right in your kitchen”.

This ad appeared in 2004 and was a really good clue that the inmates were running the bin and that the housing boom was on borrowed time.

I hope this article helps your clients who need to quickly raise their credit scores for the loan approval process or for the best possible interest rates.

How Credit Expert Frank Bruno Raised His Credit Score 40 Points in 24hrs.

Also your clients may be interested in watching Free Credit Tip Videos here

“Crapgar bank, technical services may I help you?â€

“Yeah, my equity ATM isn’t working. everytime I try to get money out it I get an ‘Insuficient Equity†message.

“Have you tried remodeling, maybe granite countertops?â€

“Yes, and a SubZero refrigerator, nothing seems to work.â€

“Okay, I’ve found your problem. You’re effed. Take the box that the fridge came in and put it out on the curb. You’ll have to move into it while we repo your home and belongings. Have a nice day.â€

Leave a Reply