Reemerging from negative equity – Over 1.4 million American borrowers pull out of negative equity in 2012. Will this have an impact on nationwide inventory?

The big story of 2012 was the incredible decline in available housing inventory for sale. This trend appears to be continuing and is adding a tremendous amount of pressure on the current market especially for those looking to buy. Ironically, the increase of real estate values will also revive many home owners from their zombie slumber in negative equity. Over 1.4 million borrowers came out of a negative equity position in 2012. This is a large number given the limited amount of inventory on the market. How many of these people will be looking to sell as their homes turn into positive territory? The quest for inventory might come from a very familiar place with regular people selling their homes for a variety of reasons including moving to another place, cashing in, marriage, divorce, new job, or any other factors that cause people to sell. In other words, a more normal housing market. Will these former negative equity borrowers push inventory levels up?

The underwater nation

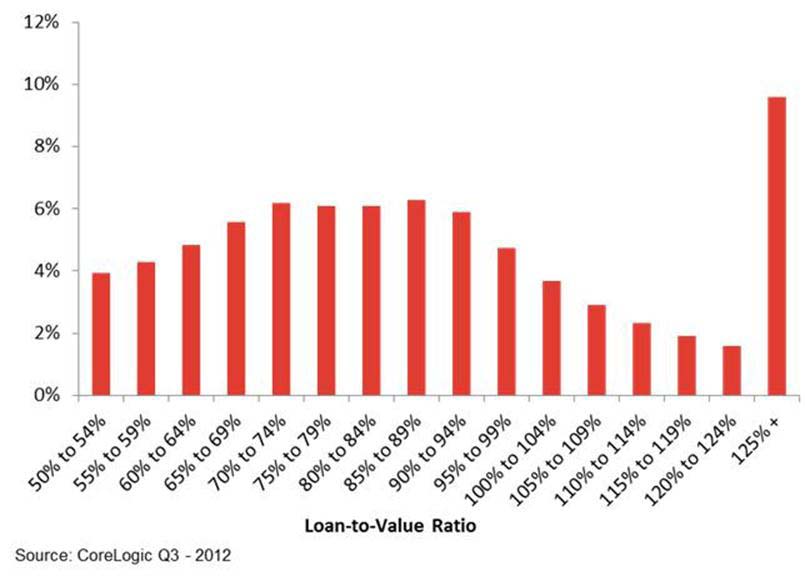

Even with 1.4 million borrowers exiting out of negative equity, we still have 10.7 million American underwater. In many cases, some are severely underwater:

Nearly 10 percent of borrowers are still in deep trouble with loan-to-value ratios above 125 percent. 22 percent of properties with a mortgage are still underwater and this is a sizable amount. The drastic drop in inventory is uncharacteristic but does make sense. Banks are controlling the flow of distressed properties onto the market. We currently have over 5 million homes in some sort of distress (foreclosure or with at least one missed payment). This has been going on since the housing bubble popped. The total completed foreclosure count is somewhere around 5 million.

We also know that most underwater borrowers are paying their mortgages on time:

“(NYTimes) Still, just because a homeowner is underwater does not necessarily mean that foreclosure is imminent. Nine out of 10 are continuing to make their loan payments on time, the report said, with just 10 percent more than 90 days delinquent.â€

This is an older article referencing a Zillow report back in May of 2012 and home prices have gone up from that point (in the article they reference 31 percent of borrowers underwater while today according to the latest report, it is down to 22 percent).

People obsessively check real estate values now that it is so easy to check online, even if they are only estimates. After all, some of the systems follow similar methods used to “comp†properties. For example, many appraisals will look at similar recent home sales in a neighborhood to derive a value for a current home. This misses the bigger picture as we saw with the housing bubble but this is how the process is conducted. With that said, how many people from that 1.4 million group will now sell encouraged by increasing values?

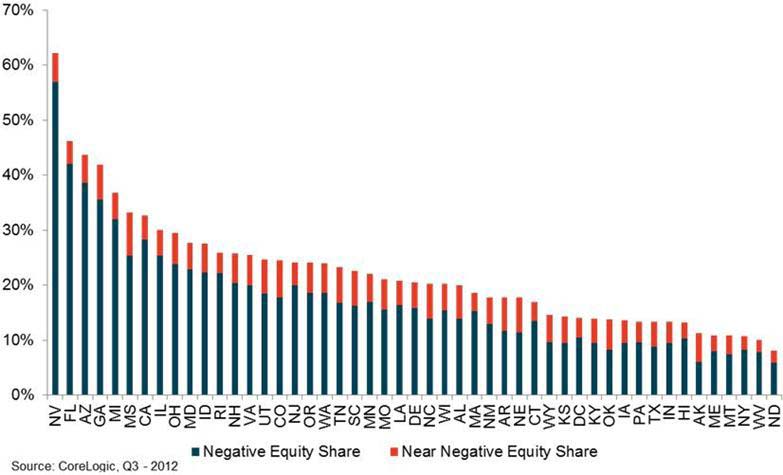

The sunshine states still dominate the negative equity data:

Nevada still has a stunning 60+ percent of borrowers at or near negative equity. Florida and Arizona are in the 40+ percent range while California comes in with 30+ percent. Keep in mind these are figures factoring big price increases which tells you how deep in the well some home owners truly are.

Now taking a look at that first chart, if home prices go up by say another 5 percent, that will bring out another 4 percent of these underwater borrowers. This has the potential of bringing up another 2 million home owners into a neutral position. This additional potential supply is governed from very different forces that we are now seeing with banks and their REO inventory.

On the other side, buyers are now constrained by available mortgages and low interest rates. Investor demand is likely to continue domestically and from abroad.

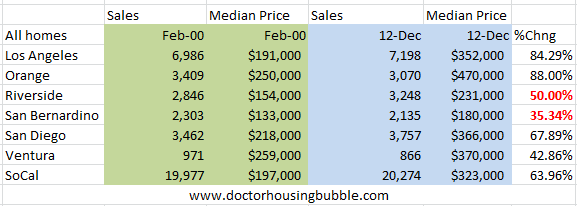

Inflation changes – 2000 to 2012

Let us look at price changes in Southern California since 2000:

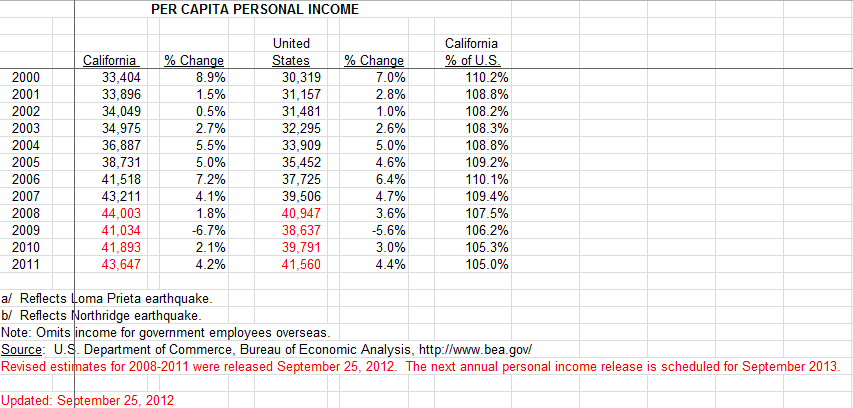

Over this time period, according to official California CPI data, inflation over this period was 37.8 percent. With that said, San Bernardino and Riverside seem priced well within range (even possibly Ventura). LA and OC still seem on the higher end. I dug up per capita data for California and found this:

Nominal per capita income went up 30 percent so inflation stripped away any gains from the last 12 years. When you start examining it from this perspective, you realize that leverage via lower interest rates is the big game in town. Also, incomes are simply not keeping pace with inflation and that is why you are seeing more people allocating a larger portion of their income to housing, both in rents and total housing costs.

Since the bulk of underwater mortgages are being paid for, it will be interesting to see what these newly minted “equity†borrowers will do.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

45 Responses to “Reemerging from negative equity – Over 1.4 million American borrowers pull out of negative equity in 2012. Will this have an impact on nationwide inventory?”

They have to be above what the ripoff commissions, transfer taxes, etc. (closing costs) amount to to avoid having to bring a checkbook to the closing. How many people want to write a check to sell their home – and exactly where are they going to go for cheaper housing unless they change jobs (or mindset and move from a McMansion to a 2 BR apartment)? I doubt any of what has happened in the last year will change much. A few who have no mortgage might be tempted to cash out, but they are trying to time it right to maximize yield for retirement, and that’s pretty tricky. Most who moved above water in 2012 aren’t going to suddenly list their houses. The fun part is going to be watching the latest bubble deflate all over again. Maybe not in 2013, but possibly.

Stop whining! You made choices and now look at the data and are making yet another choice. Good for you. Rent forever, but don’t whine about it!!

Houses were never meant to be a liquid investment!!!!! They are long term, solid investments that do HEDGE AGAINST INFLATION!

I bought my first home in 1984 for $110k (14% interest) sold it for $270k in 1994 when I bought another for $670k … in 2006, I sold it for $1.65M. (with only very minor upgrades). I knew we were headed for a fall. Didn’t understand how huge the debacle was and that it was too big to flush the way we did in the 90’s. I should have bought again in 2009 but thought I had time! Now, self employed, I cannot qualify for a loan and my rent has just been raised… again.

Yes… the low interest rates will have to stay low or values will not rise. So What? If I had bought in 2009, I would have halved my principal balance by 2024, and in 2039… I would own it free and clear.

If I can manage to buy this year… by 2027 I will have 50% equity and by 2042 I will own it free and clear!!! No white walls, no beige carpet or restrictions on pets. I can lease it to someone if I move……

If what I said was whining to you, you and I were raised in different worlds. I was just stating an opinion, and I wasn’t whining. I LOVE renting – -my rent has been the same for 6 years since I sold my house in ’07 and pocketed hundreds of thousands. So I have no horse in this race – just call the landlord and she fixes everything. Bless her.

And yeah, the walls are white, but the floors are WTW oak hardwoods (new), and we have a pet, no restrictions. Plus a view of the SF Bay. Nice try.

Jen, speaking of whining…you did exactly that on how you SHOULD have bought in 2009, could have should have, whatever, you made very nice profits on your houses, hopefully you invested and saved.

Bay Area Renter has very good points, no one ever talks about all the tacked on fees, and where will these people go ? Botttom line, the So Cal housing market is still way beyond overvalued and any one who buys into it right now has no common or financial sense. Yes, owning a home is a hedge against inflation, not a cash machine but greed got in the way so owning a decent home here in LA is impossible right now and so not worth it.

The “Jen” comment seems b.s. to me. If you bought in 1984 and you’re touting being 50% equity by 2027 and owning free and clear by 2042 (when you’re 78, assuming you bought at 22 years of age) you are either making stuff up or nuts.

Shortages tend to ensue in socialist markets like we have with housing where a central authority attempts to fix prices (the Fed through interest rates, buying MBS and its primary dealer banks).

For all the initials after their names, the Fed economists still don’t understand that it is transactions/volume that generates velocity and economic growth. Real estate industry would be booming now if Fed and the banks put all the inventory on the market and let it clear. The nominal price doesn’t matter – it’s the activity and the transaction volume that matters.

I don’t understand how NAR cannot be lobbying for the inventory to come on the market. Do they want real estate agencies to keep consolidating and making less money?

It’s obvious that you’re the one who is “whining” about renting, not BAR.

No one here is stopping you from leveraging up.

Wait a minute…if you bought a house in 1984, you can’t be less than 50 years old (you’d have to be at least 21 in 1984). More likely, you’d be 55 or 60. And you’re planning on paying a fat mortgage until 2042, when you’ll be no less than 79 years old, and more likely in your 80s? What kind of job do you have? Do you have the elixir or eternal youth or something?

Renting = Indentured servitude

Home Ownership = Happy Living

Many home owners are blinded by seeing reality through greed filled lenses; only the dollar value of their homes matters. These home owners lose sight of an alternative reality: a house is where you make a home for your life.

It is a good idea to occasionally check your level of selfishness and maybe stop you from becoming a flipper and lossing a place to make a home for your life.

But you guys just don’t understand – Jen is only saying that anyone who disagrees with her is just a “whiner,” and have no factual basis to hold a contrary opinion. You can also substitute the terms “negative” or “bitter,” and you’ve pretty much covered the bases here.

I have been a Real Estate market timer since 1975(thanks dad). Doing Daily IRR since 1976! Always buy like crazy at the bottom (2010-2013) or later and sell like a devil into the hot market like 2002-2007 or 2017-2022! **** You don’t have to be a calculus genius or graph guru like me, you know when to buy and sell! Read the articles here! He can actually charge for his work & publishing!!!! But it’s free for now!!! I have bought and sold over 23,000 acres! Yup, that’s like the 2x Manhattan Islands or 6.5x sizes of Beverly Hills, or 2x Huntington Beach or 1/2 the size of Oahu/Hawaii! But most of all, enjoy life, Sunday 27th Jan2013 your invited to the CalgunsDotNet Burro Canyon Out Door Potluck BBQ Gun Shoot 9am to 4pm Potluck. Bring your guns & a Potluck Dish. $15 pay to the range master, tell them your with Calguns! Shoot your guns and come talk about “real estate” market highs, lows, when to sell. Etc. I’ll even have Graphs going back to WW2 as to when to sell and buy in So. California! How’s that for a WALL GRAPH YOU MUST HAVE!!! SO, if you own property, join us for guns, real estate, food, BBQ, and Gun Rights.

I don’t remember seeing any spammers before on this blog.

I think most won’t sell…hold on, hoping for more gains. Greed and ego often trump common sense when it comes to money. We all want to believe we’re geniuses.

Ben’s money tide lifting all boats; market well off the lows, fresh 52 week highs. Everyone’s a bull. Multi bids, not making any more land, people do whatever it takes to buy CA house. $1.2mil fixer, bike to beach, get Grandma, Uncle Vito, anyone to live in the house, make the deal happen. New paradigm. A year renting is a year of life lost, life not worth living unless you’re a CA homeowner.

What’s next in this crazy world…maybe Ted Nugent joins the cast of Glee as “Dawn”, a cranky, flamboyant yet lovable cross dressing ex-Broadway dancer?

I think most won’t sell, but for different reasons. I think if one is way in over their head, they will sell, just to get out of the stress and rent. But, if one can afford to keep paying, there’s no incentive to sell because you’d be buying in the same market (unless moving to an area with much lower housing prices).

Speaking of inventory, here is LATimes latest video: “Steep decline in Notice of Defaults and actual foreclosures” here are some of the take-aways:

lowest level of defaults in 6 years but still many distressed properties; competition at trustee sales is fierce; 6 months of inventory from 2 years ago is now 1.5 months of inventory; insufficient inventory not meeting buyers demand; someone who lost their home 4 or 5 years ago can now qualify for a new FHA loan (only takes 3 yrs of building up credit again to qualify for a new loan) so there are boomerang buyers now; cash buyers are beating out those needing loans; if you make a full price offer on 1 house every day in Riverside, you would still not make a deal due to heavy demand and over-list price bidding; is this a new bubble – no, the affordability is high; interest rates are the lowest in our lifetimes; many foreclosures werent necessary (didnt help investor or homeowner only helped loan servicer); California did the right thing by getting loan servicers to behave (short sales, loan mods, etc) this helped the market; where is the next wave of foreclosures? – it wont happen, economy improving, less underwater homes, new legal roadblocks slowed the impending wave; investors still worry about unscrupulous loan services; govt involvement in loans is over 90%, private money sitting on the sidelines; investors fled the market because they felt ripped off by wall street;….

“govt involvement in loans is over 90%, private money sitting on the sidelines” until that fact that changes dramatically in the other direction….prices are in a bubble, or at least propped up artificially high, which to me is pretty much the same thing . Another crash may be out of the question, but a steady decline is what I’m foreseeing.

I’m sorry but I need to rant about two things:

Rant 1: This inventory thing is driving me nuts. It seems like we should be getting to the point where even a dummy can see that something just isn’t right! But alas no one cares/sees it for what it is. In a way, I am hoping that the govern-banks overplay their hand and are exposed for the manipulators they are. But I know that won’t happen, so instead, we must now swallow a mini-bubble and the cries of more people worried about “missing the boat” again!

I have been watching the same two L.A. zip codes for a decade to use as a barometer. Both have behaved similarly , but one in particular has consistently had 150 homes for sale at any given time. All of sudden, in 2012, this number plummeted down to 55. (with a disproportionate number of utter-garbage props in that number, by the way) Obviously, fools are now having bidding wars due to the scarcity.

But now that January is upon us I became hopeful that the historic trend of inventory rising at the beginning of each new year would help the situation out. But now I am even having doubts on that too. Just as the new year started, the number creeped close to 70, but now it dropped back to 60 in a matter of 3 days. What Gives?

Rant 2: Flippers! The other thing driving me nuts is the high percentage of properties out now that are clear flips. It seems that around Sept-Oct of last year, A LOT of homes were purchased at great discount (auction) prices. These homes never made it onto redfin or zillow. The homes are now being sold at about 50-80k profit, after the “improvement” costs are factored in. I don’t begrudge anybody their wealth, as long as it is on the up and up, but who are these insiders? what gives! Sorry I just had to vent.

Flippers upset me too. The only thing I can do, is not to be the stupid person that buys the “New and Improved, Middle Man price.” Arranging a group of people to picket a Flipped Open House with Big Obnoxious Signs, could be another tactic.

Agree

I think that anything can happen. We could have huge price drops, no substantial price drops, or rising prices. I think this because it is all so contrived, manipulated.

I think many on here are trying to figure out when to buy a home to live in, at the bottom, but we’re all frustrated because we don’t know what will happen. And, more importantly, home prices in CA are ridiculous, really.

For myself, I have now set in my mind that a good 3 bedroom home on ~1/4 acre (not trashed w/standard remodels), in a non-inland valley area, should be around $250 to $350K. We all know this is how it should be, even in the desireable State of CA. Instead they are $499K+.

So, as for myself and my situation, it makes sense for me to just wait. I am learning to be happy where I’m at (1000 sf townhouse that’s ranged from $25 to $100K underwater these past 3 years), because I’m not willing to spend the next 30 years paying a huge mortgage to have that 3BR. Ideally, prices will drop and I will rent the townhouse, but I’m not holding my breath anymore that they will drop enough to make me comfortable with it.

…Back to watching the market…Sigh.

I agree with almost everything you say Sadie. My exception is that the $499,000 home comes back with a payment equivalent to the $350,000 home of 15 to 20 years ago. Where you get hurt on it is that the taxes will of course be higher as well as closing costs and the risk of deflation when interest rates rise again. But if you can pay the taxes and hold the house for 10 or more years it should be a good buy. On the flip side if you rent in a quality place you can save a lot of money through 401s, deferred comp and investing giving you a strong cash position when those rated do go up and properties deflate. Bear in mind that with inflation over the long term deflation may not change the nominal price of the property. Yes I am aware I am saying that the house may not increase in dollar value.

As Bay Area Renter points out….where are these people going to go? What are their alternative housing plans?

Also, Bay Area Renter brings up the “ripoff” commissions issue. I am surprised that this issue has not been discussed more. Historically, sales commissions on most average home sales has been in the 5 – 6% range……I remember, growing up in Southern California when you could buy a mansion in Trousdale Estates for $100,000 and you were golden. Commissions back then, in the ’60s, were 6%. So, that amounts to a $6,000 commission.

One could argue that today, that same house in Trousdale would sell for, say, $1.1 million. At 6%, that sales commission would be $66,000. That is a $60,000 increase in commissions. I know that I am going to piss off a lot of my real estate broker and agent friends, but where in G-d’s green earth is the justification for this type of compensation to sell a frick’en house? I doubt seriously that the time a real estate agent must spend in selling a house today has increased from the ’60s to justify this type of increase in compensation.

I can’t believe that more sellers don’t demand more of a decrease…..I know that on the mega-mansion sales, commissions are negotiated down to something that kinda makes sense…..but for the average homeowner/seller….this is just unconsionable.

Thanks for that comment….100% true. The NAR wouldn’t have it any other way though.

commissions are negotiable. If you go for 6%, make it 2% listing broker and 4% selling broker. The old 50/50 split is out. The 4% selling commission really motivates. Any idiot can list a house. It is the selling broker that does the work. By the way, legally, both listing and selling broker owe their duty to the home seller. Be in charge when you deal with real estate brokers. Like everything else in life, don’t hand over control to another. Make it clear who their boss is and who they work for. There are plenty of hungry real estate brokers out there.

It’s totally negotiable. I’ve done plenty of 2%/2% splits and paid as little as 1%. If you have a house in a desirable area and you know how to make is show well, it’s not hard to find a real estate agent to list it for 1%. Just find a new one that’s hungry for a deal. They don’t do very much anyway and they have to work for a brokerage that has the forms and available bonding, etc….

There are a few things new which affect things. Good homes in good locations are doing exceptional, with multiple bids. Why? There is plenty of cash around (booming stock and bond markets, also so many rich and wealthy people around, including globally, which drive such purchases, and also rents for such homes have gone up a lot, making investing more attractive). One home I track in a good area of San Diego was sold for $640K in 2005 and just sold for $505K, while to rent the home in 2005 was about $1800/mo then and now is about $2900/mo…..so, homes like this are dirt cheap for the rent potential.

Interesting concept….pent-up demand to sell rather than buy. Could be, but with 6% commission and other costs…the market price has to actually rise above neutral equity in order to break even on the transaction. But, just like in the stock market, the old top becomes the upper resistance level. Sitting on a negative position for 5 years can cause a lot stress and remorse.

But, if one is employed, they will probably at least try to get a refi at this new 3.4% rate. So, I bet the refi business will really be the first thing that takes off as negative equity starts to go neutral. Mortgage brokers, start your engines.

You’re correct that it’s not just the commission costs that one must factor in when selling – as you mentioned, the “other costs” often become beyond onerous. When I sold my condo last year, the costs went into many additional thousands – aside from the state, county and city taxes due, there were the hallowed “revenue stamp” taxes, which went into the thousands when the closing date was due. Then there was an additional “transportation tax” that was almost $2,000 – this, despite my rarely using the CTA (Chicago Transit Authority), and where they’d already raised their fares over 15% annually for the past decade. That’s what happens when you live in a bankrupt state, bankrupt county and bankrupt city, and only wish to leave.

The fascist progressives in Washington and NYC have created the ultimate market manipulation. No more freedom.

Homes aren’t going down anymore. I don’t think they will ‘rocket up’, but forget about a crash.

This seems to be the more likely scenario.

The game is on again and it is the banker and realtor lobbyists pimping the Feds to pump up the real estate bubble and fill the pockets of the real estate industry. By holding inventory off the market, the banks are creating false demand for homes. In 2005, the shady home builders in Arizona held lotteries for home lots and put 1 year sales restrictions on home buyers so they would not list and flip before the crash of 2007. The dirty banksters and soul-less realtors are doing the same thing, only this time the foreign buyers are the sheep going to the slaughterhouse.

I suspect that you will see the people who have been wanting to sell for non-financial reasons start to list their houses. People who want to divorce or have done so, might be the first of these. Perhaps also the accidental landlords who don’t really want to be in the rental business. And those who just plain want or need to relocate.

Good interesting charts. Thanks

I’m wondering if Bernanke will over heat the economy. Granted they are fighting deflation, but we are seeing incredible asset gains in real estate and stocks.

The run-up in stocks is too much too soon, given the realities on the ground. I see cash advance places, 99cent stores and food for less-es sprouting up in many spanish-tile- roofed areas that always were affluent, and are “assumed” to still be. I know that’s circumstantial and not directly related, but the stock market definitely feels juiced to me.

JQ, that’s the next hardest thing besides stopping the recession, when and by how much to take off the stimuli. I refuse be a fortune teller, always sticking to how things currently are…..that said….I see no reason to panic, just need to be cautious and see how things develop…as for Bernanke, although he was part of the cause of the housing mess (the Fed should have known the banks were taking too much risk and intervened), but, he has been a genius after the collapse happened, being an expert on the Great Depression…..and even if he is replaced, it is reasonable to expect continued competency since ultimately Obama is still president and he has shown to be a great delegater so far.

I think that the coming generations that will be paying off the 16 trillion dollars in debt created by your “genius” Bernanke might have a different opinion. Any central bank, and most are doing it now, can print money to “save” the economy, read bankers. The problem is how do you pay off the debt without creating either hyper-inflation or a depressionary collapse down the road. Bernanke has solved nothing, he has only postponed the reckoning. By the way, his buddy, Timmy, leaves the Treasury today. Want to bet on where he ends up?

I suspect Bernanke and the Federal Reserve are out of economic bullets at this point. They have greased the markets as much as can be greased. Latest home sales data shows a major downturn in month to month home sales. Most of the 4th quarter earnings reports have been quite disappointing. So it looks like if we are not entering a new recession, then we are certainly entering a period economic malaise.

Last time I checked, Nevada was the only state that was under water as a whole. That is, the total value of all residential properties in the state is less than the total mortgage balance due on those properties. Has this changed recently? Here is northern NV it sure doesn’t look like it.

Latest interview with Shiller; his summary is:

“I think that we might have hit bottom, but my biggest sense is that probably nothing dramatic happens either way. If the Pulsenomics survey is right, and it’s up between 1 and 2 percent real, that’s plausible to me. But if it is also down 1 or 2 percent real, that’s plausible also”

Read more: http://www.businessinsider.com/shiller-housie-prices-2013-1

So? Great if a more modest housing recovery, though I do see good homes in good locations pretty hot……anyway, what is most important for housing is NOT interest rates, but employment and just a good housing market is good for jobs, all kinds of jobs. If a person either doesn’t have a job or is unsure about the one he/she has, there is little interest in a home no matter what the interest rates are. And usually when EVERYONE thinks it’s a great time to buy, is just the time when it is probably too late. So, best to ignore everyone, including me, just look at what is the situation now…..and, the recovery has been in place a while now and there is plenty of money around to keep things going long enough for all gears to kick in in the economy.

wow, way to go out on a limb shiller

Underwater homebuyers that are getting above water for the first time should think about doing a no-cost refinance first if they weren’t able to do so while they were underwater.

Once they figure out what their monthly housing expenses are after the refi then they should compare with a similar rental. What’s the point of selling if you end up paying more in rent and don’t accumulate principal every month?

If the comparable rent is lower or they have non-financial reasons for selling, then they will be selling.

What I wonder is whether that will put a cap on prices, because anyone who is able to sell will generally do so just to get out. And for foreclosed properties that’s also a tipping point for banks to sell or auction at closer to the original loan value. All of the momentum seems to be for sellers *waiting* for a price to sell. This includes a lot of investors/flippers too. The trouble is the market is having a hard time reaching the price where volume and inventory becomes large, it’s choked off.

This is how new FED charter should read:

The Fed always acts in favor of inflation and in favor of the weakening of the US Dollar. The Fed always acts in favor of sponsoring asset bubbles and always acts to protect the credit/debt liabilities of the Banker and Landowner/Landlord class.

We need to POP bubbles, not create more bubbles. Bernanke is about creating and preserving bubbles. Pop bubbles and bring prices back down to earth. That’s what deflation is for. Without this deflation process, nothing will work.

How do you pop bubbles? Only one way: higher interest rates.

The Fed Has No Choice But To Expand Quantitative Easing.

So, if the Fed stops QE, the dollar rises, and the asset bubbles finally really pop and we get back to Ground Zero where we can perhaps begin a real recovery and an organic growth again.

So why does the Fed HAVE TO continue QE? Just to keep driving the dollar down and keep stocks and commodities and housing prices artificially inflated.

Japan tried the government bond-buying scheme and then QE also. It didn’t work. Their stock market is down 88% from the Housing Bubble Top in 1989. Why do we need to keep following Japan?

I’m not suggesting any of this is going to be easy or painless. Pain is GUARANTEED. When you take out massive debt you are guaranteed massive pain. So, there is no easy way out. We let the dollar be strong, and deflate all the false prices in the market, all the bubbles cheap money created — or we pretend that QE ‘is working’ for the next thirty years, like Japan.

The Austrians understood this:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.â€

Ludwig Von Mies

Do we let the Fed murder our dollar in order to not have pain today but to have pain and a slow death over a longer period of time. Rome killed its currency and that was the end of the empire.

Good Luck,

Leave a Reply