The new American Dream of renting – 5 reasons why renting is a better economic choice than buying a home in 2012. The benefits of renting are rarely promoted unlike the large lobbying groups for home buying through the banking industry.

Washington and New York have no organized lobbying groups for renters. Yet for 2012 renting is likely the best bet for many of those that still have yet to purchase a home and are thinking about diving in. The machine wants you to be a homeowner even if it devours every last cent of your disposable income and blindly following the herd will get you economically slaughtered. The new economic landscape brings benefits to those that rent. The homeownership rate now has erased all the gains of the last decade because going into massive debt for an asset many cannot afford is simply not a smart move. Household incomes have not grown over the past decade. Many of the new jobs have relatively low job security and resemble more of the large temporary workforce that has dominated Japan for the last two decades. I see five major reasons why renting in 2012 makes financial sense over purchasing a home even with every banking and government subsidy being thrown your way.

Reason 1 – Flexibility for employment

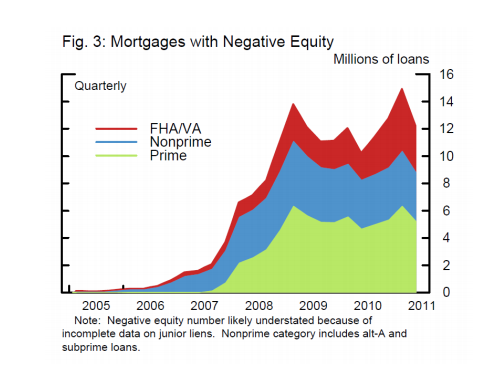

One of the big reasons for renting is the flexibility of mobility. Many young professionals do not have the security of longer term employees. They also may have to move out to move up. For all the talk of economic recovery, the number of job openings isn’t too positive:

Back in 2000 there were over 5,000,000 job openings. Today that number is slightly above 3,000,000 but we have added 30,000,000 people to our country. Many of the new jobs do not pay as much as they once did and benefits are being stripped down by companies. For many young professionals, being able to move from New York, Chicago, San Francisco, or Los Angeles may make the biggest difference in progressing in a profession. The fluidity of the modern workforce seems to benefit renters in many cases. Those long-term good paying manufacturing jobs that provided stability for many decades seem a thing of the past.

Reason 2 – Low rates artificial

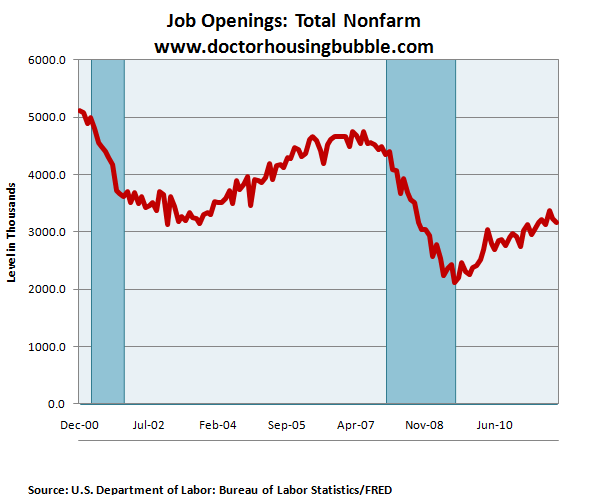

Even with the Federal Reserve artificially pushing rates lower, the home ownership rate has erased all the gains of the past decade:

Now why is this occurring with record low rates? First, the demand for housing is on the lower end of the spectrum because American households are on average, poorer than they were a decade ago. The large gains in home ownership over the past decade were largely artificial and brought on by absurd and bubble based mortgages. Those mortgages will never come back in the next few decades even though the FHA with 3.5 percent down insured loans is trying to fill the gap of the zero down mortgages. At least they are checking incomes this time around.

Keep in mind that the Fed is limited on how long it can keep rates low. Europe is an example of how little power a central bank can have once things go into the next stage. Once people start losing confidence rates will have to rise. We all realize that the $15 trillion in national debt will never be paid off right? The zero bound has already been reached and home prices continue to fall. So why does this benefit renting in the short term? Rates cannot go any lower. Even if they dip a few basis points they will do very little in terms of monthly payments. However rates do have a long way to go up even if they hit the 50 year average of 7 to 8 percent for the 30-year fixed conventional mortgage.

Reason 3 – Selection of property

Over the last year the selection of properties hitting the market are of better quality and at lower prices. This is the case in places like California where people are finally waking up in mid-tier and upper-tier markets. If you lived in the Inland Empire you can have the pick of the litter at a great price right now. This goes for Florida, Nevada, and Arizona as well. We are seeing breaks in more selective markets and better properties are being pushed onto the markets as short sales and REOs.

During the bubble days I remember many agents convincing people to buy in questionable areas because “you have to pay your dues, build your equity, and trade up.† You had people loading up their homes with flat screens, giant fridge freezers, and other high cost items.  This nonsense permeated the market for far too long. As most are realizing, home prices can and do go down for extended periods of time. If the argument was to buy just to build equity, well what happens if appreciation is non-existent for a decade? Of course this is simply bubble logic that is still around. Many are realizing that leasing in an area you like might be an excellent trade off especially if you have two working professionals in a household. I can’t tell you how many couples bought a place just because of the “nesting†instinct and one partner is left with a life sucking commute just to own a place. This is very common in commuting happy Southern California. Yet the low sales figures in mid-tier to upper-tier areas shows us that many people are waking up (or simply don’t have the money to buy).

Reason 4 – Shadow inventory

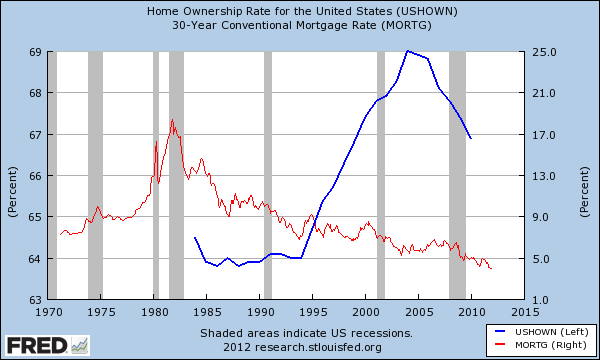

Another reason why renting in the short-term makes sense is the large shadow inventory. Over 6,000,000 homes are still in some form of distress. Over 12,000,000 home owners are in a negative equity position:

4,000,000 loans are either 90 days past due or in some stage of foreclosure. This is inventory that will hit the market in the next few years. Why would you rush out to buy when there is a built in supply that will be coming online for the next couple of years? Distressed properties sell for less and this is what the market is craving. You even have prime locations with massive amounts of shadow inventory. If you know prices will not be going up in the short-term what is the large impetus to buy today?

Reason 5 – Home prices still dropping

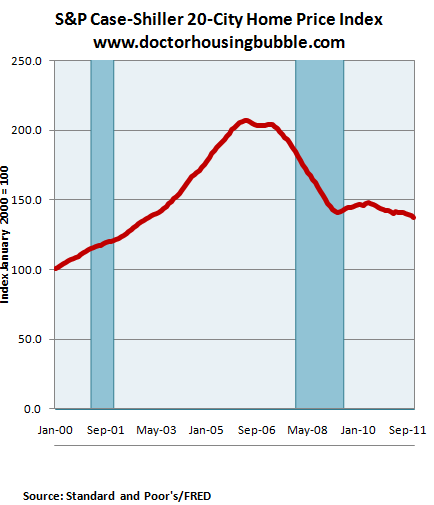

Despite all the subsidies, bailouts, and cronyism between Wall Street and DC home prices continue to make post-bubble lows:

All signs point to lower prices well into 2012. So why the urgency to buy right now? The fact of the matter is household incomes are incredibly weak and many of the new jobs come with lower pay and stripped down benefits. Younger Americans don’t have favorable demographics for the stock market and they are forced to pay larger amounts of their paychecks to items like student debt, healthcare, and other daily cost of goods. In the end they have less to spend on housing than baby boomers did.

For these reasons renting in the short term is likely a good option for many especially those in the first time buyer group that live in high cost metro areas. Now if you live in say Nevada, Florida, or Arizona and have a solid job then you have a plethora of homes to choose from at rock bottom prices. Places like California however still have inflated pocket markets but these are also starting to correct. No lobbying group is going to take out ads to champion the benefits of renting but many are figuring it out all on their own.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

55 Responses to “The new American Dream of renting – 5 reasons why renting is a better economic choice than buying a home in 2012. The benefits of renting are rarely promoted unlike the large lobbying groups for home buying through the banking industry.”

In New York City there is a powerful renter political force. Just try to change the rent-control laws and you’ll feel its power… Same thing in San Francisco and Berkeley.

Rent Control in NYC covers about 40,000 apartments occupied largely by an elderly, low income population who have been in occupancy since July 1, 1971 or by their lawful successors. Apartments under rent control become decontrolled upon vacancy. If the apartment is in a building with six or more units it will generally fall under rent stabilization upon vacancy. If in a building with five or fewer apartments it will “go to market,” that is, leave rent regulation and become a market-rate rental. Even if the apartment is in a building with six or more units, and it rents for more than $2,500 it will be fully deregulated. Whether or not the legal rent has surpassed this $2,500 threshold may be determined in what is known as a Fair Market Rent Appeal.

The political trend is to make home ownership more costly by reducing some of the tax benefits of owning a home; the reason being, the government wants a highly mobile workforce, as do corporate interests and, at the same time, very large corporations are interested in owning, investing and managing significant amounts of housing stock; people have to eat and they have to live somewhere. What you will see is that large corporations owning large amounts of housing stock will be consumed by bigger fish so that real estate is increasing concentrated in corporate hands. What you will see in the future is that you and your friends are all paying rent to a certain given number of corporations, all of which you will probably be able to name independently, especially if your bank owns a lot of it and they are automatically deducting your rent from your checking account, especially if it makes it easier to obtain a lease if you bank with the financial institution that owns your rental unit. Get the picture?

I expect this article to be deluged with trolls proclaiming rents are going up. So, I’ve decided to preempt them. Here’s a short list of homes on the market in the SGV (only three cities used in the sampling). Most are asking $2k/month, which is what one could expect back in 2010 and 2011. Rents aren’t budging. And with so many homes on the market, I’m sure one can negotiate downwards.

W12016230

H12016216

C12013775

A12013606

A12005725

W12004822

A11156571

W12002221

H11160855

A11146636

A11131503

I can continue with additional examples, but I think you get the idea.

I agree with you on rent prices, in fact now that bulk purchases by institutional investors is being pushed, with the plan to turn the bulk inventory into rentals, I think it will push rental rates down. Also, in case anyone missed this story, please Google for details, Attorney General Erik Holder and the appointed head of the justice departments criminal division both worked for a Lawfirm that represented bank of america, JP morgan Chase, wells Fargo, etc and wrote the opinions regarding MERS! In other words the guys that should be prosecuting the banksters that robbed the equity if 62 million mortgages in the last 10 years are the guys that helped the banksters do it! This is huge and it should be front page news! Google it and help share the story!

I am a renter in an upper-tier market and have watched the home values half in the last few years. My neighbors may look down on me because I am a renter (loser) but both our cars were bought with cash, my college degree was paid for in cash and I have never had any debt. My winner neighbors paid over a million for their houses, drive leased Mercedes and BMW’s and have a negative net worth. I would rather be a loser renter than an indebted slave winner any day…

Uh… if you keep your place looking nice I doubt that your neighbors think you are a loser.

Nope… us renter losers are shunned among the winner debt slaves…

You are the winner, financially by far ! We are right with you, we live on the Westside of LA, Brentwood, sold our home in the Palisades two and a half years ago, been leasing since. We own both our Mercedes, have not a penny of debt and have alot in the stock market which is booming, and can be liquidated at any time. Still cannot justify the prices of real estate here… for now, we are the winners.

I agree with you in a lot of areas it makes more sense to rent, but there are also areas where renting if you plan on staying any ammount of time is just as stupid. In many areas of Riverside and SB county you can literally buy a house for about half of what it costs to rent that same house. If you have a stable job and don’t plan on moving anytime soon its stupid to rent in an area like this if you hae the credit to buy. I’m not sure why rents are so much higher than a mortgage here(probably because no one can qualify for a mortgage), but it doesn’t seem like rents are going to be coming down anytime soon.

Oh, the normal situation is for rent to be higher than a mortgage. Most of us have to carefully consider the cost of ownership vs the freedom of renting. If you are a government employee or someone with stable employment then it’s not as horrible of an option to buy. A lot of areas are possibly at the bottom but hard to tell. Places like Murrieta, CA… not sure how much economic life a place like that really has left (hey , I like the place it’s just a long drive and limited local jobs plus Cali is a mess). When things start to fray, it’s often worse near the edges.

Remember you have to pay fees, inspections, improvements and sales costs if you have to move again soon. Takes quite a few years to get that 6% hit plus you have blown a lot of capital.

Renters just up and leave with a downside of one months rent. Your losses on a home sale could easily exceed that little 3.5% down if prices are flat and you move after 1-5 years.

According to my imprecise calculation, you are at even pretty fast at 4% rate.

Boomers free of mortgages are another stealth pressure on pricing. The urge to downsize is compelling for the 65+ group. Those who cannot wait it out will be in direct competition with the shadow inventory as it is being released. It is getting much more difficult to find supportive reasoning for a floor in valuations over the next 3 years at least.

I agree. It is crazy when you look back at the predictions of the bottom being sometime in 2012. I remember thinking, “now that is a realistic predictionâ€. Would it surprise anyone if we do not see home prices start to increase until 2016 or later?

Ask Japan…

“Despite all the subsidies, bailouts, and cronyism between Wall Street and DC home prices continue to make post-bubble lows”

I’ll guess because all the cronyism between WS & DC has focused on throwing money at the stock market to propel it back to 2008 highs, media can endlessly report on solid recovery, Americans getting back to work (not sure where those FT career jobs with bennies are…most employment challenged people I know in CA are surviving on contract jobs, or collection of low pay PT gigs). Inflation, huh, what? Perhaps the Gov could create a program to buy distressed properties from banks regardless of the loan amount…underwater homeowners could apply to the program as well. Fed prints billions to fund program, shadow inventory cleared out, housing problem solved! Gov agrees to buy foreclosed properties at bubble values, becoming a landlord (Section 8, anyone?) Banks clear the books, underwater homeowners walk away with big check for new home purchase (Man Cave, granite countertops a must), new cars, etc. Onward!

Oddly enough, two people I know casually announced last week they are getting their RE licenses, time is right to get into the game. Interesting.

I know someone who bought a vacation condo on the N. shore of Kauai a few years ago (not exactly sure how many years ago). She says it is now worth $150K less than when they bought it. Ouch.

Probably true, nonetheless, pay it off, and they will have a good amount of value.

In one of the world’s economic power houses renting is very normal. Germany. Something like over 50% are renters. In the English speaking world renting is what you do when you can’t afford to buy. It’s not accepted as an alternative life style to buying. One reason may be the poor quality of rentable homes, and quality of landlords who see it as easy money, and not a service provided. Just my halfpennies worth.

Maybe because the English speaking world puts so much value on “my home is my castle” mentality? Or is it because the safety net in the English speaking countries is less instinctive and has to be forced on the public?

My 2 Cents worth.

US, Canada, Australia and in Spain the English sun seekers?

How liquid is the German real estate market? Renting as a way of life can also occur in societies where property is something that is handed down through the generations for 100’s of years, and it is shameful to sell.

I really have no reason to believe Germany is like that. Just asking.

When will be the right time to buy if you dont have much to put down? What are the signs? the common ahole has only so much per month to pay regardless of what happens to interest rates. Is is better to buy when interest rates are high and prices are lower?What about private mortgage insurance? It is a scam but…what can you do? I think if you are able to get a really good deal on a home it can offset the downsides. How do you get a really good deal if you are FHA? What website out there teaches you to play the game instead of bitch about it? The game is no different than all the other games we play in life. Can you game the system or does it just destroy all who play?

Joe Blow

Read this blog and you will be well ahead of 95% of the people. Find a neighborhood that you like and can afford. Find a property where you can negotiate a ShortSale. Come to an agreement between yourself, the owner, and the Lender. Get all your ducks in order, be patient, and you will find a place that worksThere are a whole new set of smoke and mirrors out there right now, learn what they are and how to avoid them. To me the biggest one is Real Estate agents putting “Foreclosures” up for sale and then creating bidding wars for the property. Avoid this by doing the work yourself.

You can do it

Jason

Something else to consider…..what do you think is going to happen to home prices when interest rates begin to rise. And, they will rise eventually. The pressure for interest rates to rise are much greater than the opportunity for interest rates to go down. What this means for the “average” homebuyer is that given the same mortgage, their monthly payments will increase, thus making it harder to qualify for a loan. The only way to deal with this is to either purchase a lower price home, put more money towards a down payment, or negotiate a lower purchase price.

Even though prices have decreased, given the fact that there is a likelihood of future interest rate increases, you can expect further pressure on prices. Does anyone remember 1981? Interest rates were 17, 18%. That was actually not a bad time to buy, because you had to expect that interest rates could go nowhere but down, allowing average buyers to purchase more expensive properties. As a homeowner, that means the value of your home would increase.

Today, however, the tide has turned and we are the opposite of those 1981 days.

I don’t think we’ll see 17-18% interest rates in our lifetime again… For that to happen houses would fall to 1970s prices or lower… because the monthly payments would be ridiculously high.

I could buy 5 houses in cash by the time rates are 17-18%…. The top 1% would be able to buy up all real estate on the planet based on the wealth disparity alone.

If prices do crash to 1970s prices… A) it will take 15 years or more. B) there will be another bubble soon after we reach bottom.. It’s inevitable… especially since if home prices crash that hard.. all sorts of new government policies that create bubbles in the first place.. will be created on the way down to stop housing free fall… that will possibly create a bubble bigger than 20003-2007.

At the very bottom… Most people will be renting and paying downpayment size security deposits for the privilege of not being a part of a hopeless housing market.

A generation will think owning a home is synonymous with contracting CANCER… that will definitely create a RENTING bubble… and a homeownership opportunity of a lifetime.

I dont’ think any of this will happen.. because i don’t think we’ll see 17% interest rates in our lifetime. We might have a new currency though.

Caliowner,

What are the components of interest rates? I am pretty sure one of them is inflation. There is no way to have the inflation rate higher than long term interest rate over the long term. I am absolutely dumfounded at why people think that you can get currency deflation and lowering interest rates in the long term. This is like saying you can go both up and down at the same time. I am still waiting for Japan’s housing/stock/etc. market bubble to come back…

There is a substantial possibility of major reversal of flow of funds from out of the US to back in. I think if the Euro collapses we’d have some consequences but then a recovery with the Nuevo Euro.

There is a potential for a dollar collapse but more likely deflation continues. Also think that Euro collapse is far more likely. Possibly when Greece goes, so go the rest of the PIIGS. Washes out that bad debt.

Anyhow, in that chaotic event a lot of cash or equivalents might flow back quickly pushing the dollar way up. We could have all sorts of weird scenarios there with respect to rates and money supply.

The other thing on top of that is Japan might decided to get in the party as well. Sharp depression followed by expansion.

Not sure how that would play out.

Same questions as JoeB.

I’m renting in Vegas, paying over twice what it would cost to own the joint. It’s now at a pre-1998 price, has the original 1978 kitchen in a so-so neighborhood, but it’s fine for us. We can afford better, but we’re risk-adverse (frugal and oh so ‘umble.)

At this rate, is it worth waiting for the bottom? Even the newspapers admit a further 14% drop is likely (though maybe not for a house in the median range.)

The real question isn’t whether you should wait for the bottom, because no one can be sure what that is. Me? I stick with my original estimate of the pre-1985-1990 bubble prices under Reagan.

Especially in light of the fact interest rates may EXPLODE upward soon….and they will…because like the good doctor says: We ain’t going to be “repaying” $15 trillion in debt” to the bond markets, no way, and when they finally figure that out, we become Greece, we become Portugal…and their bond interest rates EXPLODED the last few years from @ 5% to 34%! Only…the US is MUCH WORSE OFF than Greece or Portugal…..and when interest rates explode, so will the Reserve status of the dollar: more deflation of RE ahead.

The real question you should ask yourself is why is the price “…now at pre-1998 price….”, where it is likely to head (up, down, sideways….from the looks of Vegas’ economy, I’d say downward, wouldn’t you?) and should you be looking for a better place, nicer place to rent at a lower cost :”I’m renting in Vegas, paying over twice what it would cost to own the joint” ….and save up even more money “We can afford better….”

You’re in a “so-so neighborhood” (never heard the term “location, location, location” before? Read the article again about that trap) with a 34 year old kitchen, paying twice” the mortgage costs (are you sure about that? Have you figured in all the costs of homeowner-ship, taxes, insurance, maintenance….including the fact you may piss away a 10% or 20% down payment if the market continues to drop in value?) with “even the newspapers admit(ing) a further 14% drop is likely…”

Sound like you and the hubby need to cruise the areas you like, armed with local newspaper ads for rentals, and either get a better deal on same type rental, or much better place to rent for same amount until the s stops htf….speaking home price wise.

I am guessing you are quite mistaken in your belief that you would save 50% of your rental costs by purchasing this home, unless you are way overpaying what the market average is for rentals there….and you do not tell us what the average rent is in this “so-so neighborhood”…..

Thanks for the reply; I appreciate it. I guess I have renter fatigue. We sold mid-2006 (top) in NY and moved here. In our second rental, our (wacky) landlord went belly-up and we didn’t pay rent for a year. This is our third house here, chosen for its proximity (less than 5 min., kid with spec needs) to UNLV. I figure we’re overpaying by about $100-200 ($1,400/mo, 1999 sq.ft., zillow est $120K). There are very few decent areas near the college, so I guess that’s worth something.

Lease ends at the end of October, so we’ll probably move again. Right now, we need a few minor repairs. Prop Mgmt company says landlord is taking care of repairs himself and that he has one than one rental prop – calls to the landlord are not being returned, so we may be in the same situation again.

I agree – it would kill me to see my down payment evaporate. I console myself that much nicer properties will probably be available by then for lower prices.

I guess my perspective is different. You don’t own your house until you actually own it, outright. What’s a down payment in that context. The person who will evaluate whether the purchase was a good one is the one who sells the property 20-30 years from now to do something else with the money. It doesn’t matter what happens to the down payment between here and there. It is not actually a realized loss until you sell. Not to many people believe it is going to take 20-30 years for the housing market to recover. Even if you sell sooner, it is to sell one house at market rates to buy a different house at the same market rates. Different house. Same market trajectory.

I’m pretty sure that overpaying on rent by 15% is worse than losing a 20% down payment (temporarily, on paper!), especially considering that rent will go up through inflation, but the housing payment will not over time.

That said, I would not be buying a house in Las Vegas. It is hard to imagine a worse market right now, and I don’t buy into markets that don’t contribute constructively to meeting the needs of people — e.g. gambling or tobacco. In my ignorance about such things, it is not apparent to me what merit Las Vegas has in existing in the first place. So, buying a house there seems like a exercise in the greater fool theory.

Its interesting how so many people on this blog are certain interest rates will rise. Will they rise before or after housing prices bottom? I’d bet on after…

Mr Average,

Interest rates rising will cause home prices to go down. How can home prices bottom and then have interest rates rise and have home prices rise or stay the same holding all other equal. Now, if you are suggesting that we are going to have true wage growth to offset the rise in cost of money, I am all ears. But we have not had wage growth in over ten years….

I agree that rising rates will cause home prices to fall. But I think home prices will fall even if interest rates don’t rise, just like they have the last 4-5 years. And they may fall to a point where buying a home makes economic sense, prior to interest rates rising.

I’m not at all convinced rates are going anywhere. A lot of this is conditioning. You have everyone from 60 forward who during their careers saw rates go from sky high to rock bottom. They have been calling for rates to go up forever because that’s what they are used to. And hell, wouldn’t it be nice to get paid to sit in a safe investment like you used to.

Unfortunately want and hope have nothing to do with it. Look at Japan’s rates…Look at US rates post WWII, how long did they stay ultra low…20-30 years? Newsflash, you raise rates and not only housing but the entire world will explode – all developed governments which means those super cyclical emerging market supplier nations are done for too.

Money needs to shield itself somewhere and when the world explodes, people will run back into safety thereby lowering rates again. This is predictable and time tested, go ahead, explode the world or get close…what happens? If it comes even remotely close you will see large negative rates in the US with everyone globally stashing money, because what people really want is to hold on and return of capital even at a known or forecast loss is infinitely preferable to a potential total wipeout.

Now the gold bugs will cite the case for a hard metal but look at the returns from 1980-2000, not only were they horribly negative but there was steady inflation the entire time so incredibly bad on a real basis (not total loss but damn close peak to trough). I’m not saying gold is bad but the case I’m making is that your return is unknown in gold or anything else (what happened to correlation with inflation – it went negative for decades here). It is no different for reserve currency, there’s a printing press, you are going to get something back but on an inflation adjusted/real basis – you don’t know what that is. Let me tell you, I’ll take a known something over nothing and so will everyone else on this planet. The most likely country to return something (last man standing) is the US for better or worse. Hence, I don’t believe rates are going anywhere anytime soon.

That said, I admit that the potential variance around my base assumption is historically high so we will have to wait and see but that is my 2 cents.

I completely agree with you.

I agree that rates are not likely to go anywhere short term which is really speaking to the overall health of the economy. If we are to believe in economic theory, then really low rates represent really low inflation or even deflation as the cost of money can never be negative. I am not convinced that this is always true in the short term, but in the long term this seems to pan out as the case. I am not clear why so many try to separate cost and inflation from price. They are both components of price which makes comparisons difficult over time as both are changing. So, when you say “And hell, wouldn’t it be nice to get paid to sit in a safe investment like you used toâ€, economic theorist would argue that you are confusing inflation with cost of money which both end up in the price/interest rate that investors are getting paid.

We need to remember that the majority of Japanese government bonds are held by Japanese citizens versus the US where a large amount of government debt is held by foreign interest/investors. The US model is much closer to Greece than Japan in this one area. The Fed can signal all it wants but market confidence can change on a dime as we have seen repeated over and over in the “EU crisisâ€. We probably will land somewhere between Greece and Japan as the Fed attempts to offset market confidence with bond purchases…

And yet so totally different! Unlike the US, Greece can not print money to service its debt. The US on the other hand can print money to cover the shortfall now. This will have the beneficial side effect of inflating away some of the debt in real terms. This is why Greece must do what the ECB and other European countries tell them to do — surrender sovereignty! — whereas for us all that will happen is that prices will rise.

In many respects Greece is now a conquered country. It was conquered by accountants with briefcases instead of soldiers with guns.

Sure, rising rates will put downward pressures on housing – but, if we have inflation, you’re better off in a house. If you’re careful, now is not a bad time to buy. Be prepared, however, to sell for less than you bought for. I call it the midwest model, as long as you’ve built equity by paying down the mortgage, you’ll have some cash to take away from the closing. There is more to life than an economic equation.

That is a pretty bad assumption on many counts. We currently have food and fuel inflation with house deflation and wage stagnation at best. I am not convinced that you can have wage inflation when you have slack in the labor market. I do agree that the flyover state model in housing economics is a better approach. At the end of the day, a house is consumption, not an investment. Once everyone else realizes this, the flyover state model will apply to the bubble locations…

Just saw this:

Vegas Rental Market Is In Trouble… Saturation Point?

http://patrick.net/forum/?p=1208481

I think the big issue stifling the Vegas housing market is also what’s stifling Southern California’s housing market…high UE, and few living wage, secure jobs being created.

petroldollars may be a more pressing matter then interest rates.

For the conspiracy theorists (e.g., the NWO believers). This editorial plays right into the NWO master plan. That is, the money controls the real estate, ergo the working class must become renters–and when the tipping point is reached with [a critical mass of] the renters being happy renting, and establishing a lifestyle based upon their renter status, then the ruling class starts raising the rents and squeezing the working class standard of living. The working class–now indebted by consumer debt and other living expenses–is now forced to tolerate substandard living conditions dictated to them by their landlords.

Think this has never happened?

Check Dickensian England, Imperial (1st & 2nd) France, or the sharecropper American southeast.

Now, you still think the NWO believers are wrong?

Fine, but explain to me how the REITS are not this generation’s version of the “landed gentry” of our ancestors. And who controls the REITS? And what are the REITS buying right now? SFR’s.

Now you are catching on.

The largest investors in the market are groups like CALPERS and Fidelity / Vanguard. These are not gentry. They are the 401ks of ordinary people. If they are pushing the average prole to live a more meager lifestyle, it is so that he can afford to retire.

http://en.wikipedia.org/wiki/File:Pogo_-_Earth_Day_1971_poster.jpg

Just for the record, calculated risk called housing bottom. the guy has a lot credibility.

http://www.calculatedriskblog.com/2012/02/housing-two-bottoms.html

He also had this to say in the previous post:

“Of course these are national price indexes and there will be significant variability across the country. Areas with a large backlog of distressed properties – especially some states with a judicial foreclosure process – will probably see further price declines.

And this doesn’t mean prices will increase significantly any time soon. Usually towards the end of a housing bust, nominal prices mostly move sideways for a few years, and real prices (adjusted for inflation) could even decline for another 2 or 3 years. ”

So if you are buying in most flyover states the bottom may be near but don’t expect any price appreciation soon. However, in bubble markets prices will continue to decline. Not exactly a bold statement and nothing groundbreaking.

I would like to see him do the same “analysis” on Japan and explain that the bottom would be in year X and see if it really happened…

Discussions of Rental Parity are BS. Right now, Landlords are able to charge the maximum that renters can bear… in coastal areas, renters are paying almost half their income to housing when the historic norm is 25-33%. IMHO, Rents are artificially high due to a shortage of available units which is a temporary issue due to the held back “shadow inventory” and lack of new rentals build during the boom.

Both those situations are in flux.

If/when the gov’t goes through with allowing “investors” to buy foreclosed houses in bulk for conversion to rental, that will put more units on the market and rents will drop. Add in the number of newly constructed rental units in the pipeline (All the action in CRE right now is multi-family building!). I have started wondering if rents are the next (R.E.) popping noise. This may have already started in outlier crash areas such as Las Vegas and Tampa FL.

If rents GO DOWN, what happens to “rental parity?”

Another big issue here in Los Angeles are the wannabe investors that are flipping houses. The big problem is they work with brokers and buy up the fixer homes before they even hit the market, remodel and sell for a huge profit. There should be a new law that you have to hold onto a property for at least a year, would allow buyers to afford a house and let the housing market rebound naturally instead of greedy folks trying to make a buck.

I know what you mean. I found a reasonably priced 3-plex in a nice area in OC, called the listing agent the next day but his voicemail didn’t even pick up. I called back the next day and the voicemail is full. I texted him and got a reply that said ‘the owner accepted an offer yesterday’. What? After being on the market for 3 days? Something weird is going on….

Reason # 6 : After the mortgage origination-pack-slice and dice scam who the hell knows who really owns the property title of this dream home!

Should i buy in Las Vegas right now? 3 years ago my home was foreclosed but now my credit is good and i now qualify to buy a home. Im a 100% disabled veteran so im on a secure perm fixed income and now can get up to a 417k house with zero down. ( with my wife’s income to qualify) I am completely debt free and my wife has a pretty secure salary federal job for 9 years now.We are living in a 1 bedroom apt for the past 3 years to get ourselves out of debt but now stir crazy to run out of this place. Should i buy? How Big? or Rent a small cheap home for a 12 month lease? At the min i need to leave as smart and quick as possible. Working on having 1st child so like to find a stable long to solution where i can be a stay home dad.

I live in New Jersey, the epicenter of high property taxes, and all I can say is that when the local public sector unions need to finance their rather bloated compensation packages, they will tax every blade of grass on your property, or slash services, but they will get theirs. Be three months late on your property taxes, and your house gets put up for Sheriff’s sale, where someone can step in and pay your taxes at 18% interest (plus costs, of course) and you have three years to pay it back or your house is auctioned off. A GOP Governor is keeping the taxers at bay, but he may very well lose to a Democrat next time around due to the large poor populations in the cities.

Housing prices in highly selective areas of California, Arizona, Nevada, North Carolina, Georgia, Florida, Washington, and a few other states are that way because they are also the hardest hit areas of foreclosures. Home owners are turning into renters now more than ever, and as such the world’s largest hedge funds have come in to buy these distressed homes in foreclosure and other markets, rehab them, and rent out to this new market. It has driven up prices like mad, cutting the supply of homes in these states and serving a new rental class. I do believe that there is a housing bubble created by income not going up fast enough as home prices, however the current mortgage rates are so low that any capable buyer should consider a buy and hold strategy. Especially as mortgage rates go up, and they can rent out their current home at a cash flow positive position, and rent or buy a new place at a lower or higher value.

Leave a Reply