The new California Dream involves renting – 5 reasons why renting in California today makes sense over buying a home. Home prices still in a bubble, mortgage rates, and economy.

Renting has always gotten a bad reputation with the general population. Even in the current housing environment where it is obvious that home prices can fall and fall dramatically in Hollywood fashion, many still cling to the simple notion that buying a home is always better than renting. This multi-decade mentality tied in with the American Dream of buying a home allowed a fertile land to sprout out toxic green mortgages to a population that believes more in the myth than actual mathematics. Whenever someone tells me that buying a home is also emotional I just roll my eyes. Even last week I was telling a colleague that renting today in California makes much more sense than buying (I’ll provide the reasons later in the article). His response was that renting was the same as flushing money down the toilet. Try telling that to people that are underwater by $200,000. I don’t see many renters walking away from their homes but we do see many so-called homeowners strategically defaulting. The answer isn’t so clear cut but I’m going to give you five reasons why renting in California today makes more sense than buying.

Reason #1 – Home prices are still in a bubble

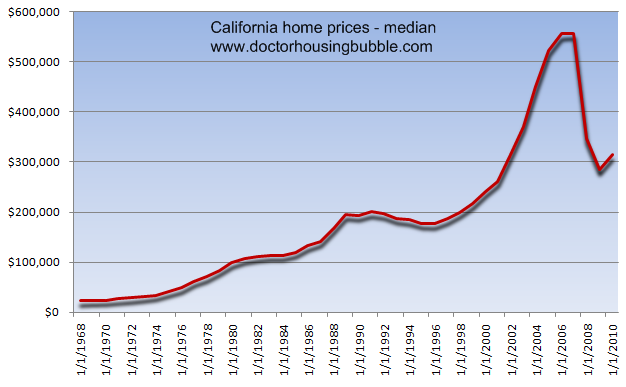

Source:Â CAR

The first and most obvious reason why you shouldn’t buy today is that prices are still inflated. According to the California Association of Realtors (CAR) the median California home price peaked in 2007 at $558,000. Today it is down to $318,660 (a decline of 43 percent statewide). Now many might think that a 43 percent correction would make buying a home right now a wise decision in the state. It is not. Sure this plays into our love for a bargain consumer appetite but get something off the dollar menu instead of committing yourself to a giant debt albatross. Banks are flooded with shadow inventory that is now finally being leaked onto the market. It is also the case that the current median price is too high.

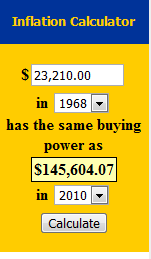

Back in 1968 the median California home was selling for $23,210. If we plug in this figure into an inflation calculator we get the following:

Do you still think prices are affordable? Back in 1968 the California median household income was $9,302. So we can run a quick estimate here:

1968:Â Â Â Â $23,210 / $9,302 = Â Â Â Â Â Â Â Â Â Â 2.49 times annual household income

2010:Â Â Â Â $318,660 / $61,000 = Â Â Â Â Â 5.22 times annual household income

In other words, home prices are still inflated. And let us not even discuss the actual underlying economy. As we will see later in the article, unemployment was much lower in 1968 as well.

Reason #2 – Shadow inventory leaking onto market

It looks like more housing inventory is leaking onto the market but now in more strategic higher priced areas. This outcome wasn’t ever in question (at least from our perspective) and now that homes are hitting the market why would anyone want to rush out and buy? Demand was pulled forward because all of the government programs but with those removed, we have seen sales collapse. Prices are also trending lower. No need for a degree in economics but growing supply with less demand equals falling prices.

Renting makes complete sense for at least the next year. Why? Because the market is shifting out. As we discussed, California still has an incredible amount of option ARMs outstanding. These are typically made on higher priced areas (subprime seemed to be the product of choice in lower priced markets). Renting is the way to go right now since vacancy rates are sky high (thanks to the misguided government policies that shifted renters into buyers creating a flood of rentals). In many cases you can find good deals on rentals. Yet whenever I point this out, someone will respond that rents are still high in Malibu or some tiny niche market in Newport Coast. Well of course! People need to be more realistic with expectations but it is safe to say many areas are going to face a correction in the next few years. Areas that are full of millionaires and actors (these are small niche markets and not Culver City or Pasadena) will always command a stronger price.

Reason #3 – Home prices don’t always go up

This should be apparent but the psychological implications are much deeper than many will expect. You now have a generation of Americans who view housing with caution (as they should). No longer will the mantra of “housing always goes up†stick in this market. This is another reason to rent. You should only buy if the numbers make sense. How do you figure this out? Run local rental rates and compare them to the carrying costs of buying. Buying will always be more expensive but it shouldn’t be a dramatic difference. For example, in areas of Texas you will find rentals going for $1,000 with a carrying cost of $1,050 to $1,100. The premium is slight. Here in California you have places renting for $2,000 that have a carrying cost of $3,500 just to give an example.

Having a high homeownership rate just for the sake of it is not prudent. Take a look at homeownership rates around the world:

Spain has an incredibly high homeownership rate yet how is that helping out their economy? They have an unemployment rate of approximately 20%! Ireland has a very high homeownership rate as well and their economy isn’t so hot right now. Look at Germany with a 42% homeownership rate. Their economy is doing much better in this recession. My point here is that going for a high homeownership rate is misguided and doesn’t always coincide with a healthy economy.

Reason #4 – Employment mobility

The above chart is important to understand. Back in 1968 the unemployment rate was below 6% for the state and the home price to annual household income ratio was approximately 2.5 without the need for toxic mortgages. People also needed a decent down payment and that didn’t seem to stop the market. Today, we have an unemployment rate of 12.4% (underemployment over 23%), a home price to annual household income ratio of over 5, and home prices are still inflated. Why would anyone make the biggest purchase of their life in such a weak market? Even asking for a 10 percent down payment seems to be too much because people don’t have this available so the government is keeping low down payment loans alive (even though this was a cause for our current housing mess).

Given the weak economy, renting gives you the flexibility to move around. If a new and better job opportunity pops up, you can pick up and leave. Today if you buy with an FHA insured loan (4 out of 10 mortgages are now backed this way in California) and home prices drop even by 5 percent, you are now underwater and will need to bring money to the table to move. Even a 10 percent reduction for the state translates to $30,000. Too much risk is involved in purchasing right now especially going into the fall and winter months.

Reason #5 – Mortgage rates

Low interest rates are the worst reason to buy a home:

Back in 1970 the 30 year fixed mortgage rate was around 7.5%. Today it is below 5%. But this is only because the Federal Reserve has purchased over $1.25 trillion in mortgage backed securities. In other words, this is artificial and temporary. Plus, if you buy today what will the future buyer be looking at when you go to sell? If rates go up to their 40 year average of roughly 9 percent they will not have the latitude that current buyers have. So the only option then will be to lower the price to fit into the monthly payment. The market is so inflated right now that low rates are actually a bigger reason to rent. You wouldn’t finance a Ford Pinto for 10 years just because you can get a 0 percent loan would you?

Renting in California right now makes the most sense. Give me a 10% mortgage and a lower priced home over a 5% mortgage and an inflated home. This is the game here. If you have a cheaper priced home and a high mortgage rate, you have more latitude in paying down your mortgage. Each $1 will go longer in terms of paying down the mortgage with a lower balance (i.e., sending in an extra $100 a month will cut your loan lower much quicker this way).

Buying a home just doesn’t make sense with the current numbers. Renting is the way to go in California given the current market metrics. For now the California Dream involves renting.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

94 Responses to “The new California Dream involves renting – 5 reasons why renting in California today makes sense over buying a home. Home prices still in a bubble, mortgage rates, and economy.”

“Give me a 10% mortgage and a lower priced home over a 5% mortgage and an inflated home. This is the game here. ”

Awesome analysis. At 10% mortgages rates, some investors will probably keeping their money in the bank earning a good rate of return instead of risking in housing. It will probably dry up demand more than what people think.

i’ll be curious to see how the banks do at selling all of the stealth inventory they have. this one in San Diego deserves a salute. the bank’s been trying to sell it since 2007!! originally listed at $1.3M; now they’re hoping to get $799K. its in a desirable beach neighborhood too. From what i understand they had some decent offers when it initially listed, but they were greedy..

http://www.sdlookup.com/MLS-076024654-1040_Van_Nuys_St_San_Diego_CA_92109

http://www.sdlookup.com/MLS-100035301-1040_Van_Nuys_St_San_Diego_CA_92109

1040 Van Nuys St, San Diego, CA 92037 is a mile from the beach…

This house is basically on the border of La Jolla, a wealthy beach community, and Pacific Beach, a much less exclusive neighborhood that’s mostly known as a place where people go to party. During the bubble years, this house would have probably sold for well over a million, but it’s difficult to say what people are willing to pay for it now.

I checked it out on Google street view and it’s surrounded by a bunch of tacky looking mcmansions.

If renting is flushing money down the toilet, what exactly is paying interest on a loan? Oh gee, paying 3x what the home costs is not wasting money I guess. People need to wake the hell up.

For every 1% that mortgage interest rates increase, home selling prices decrease around 10%. I am awake and hoping for rates to go up at least 2-4 points next spring: After the election, when the cows start to come home and monetary inflation and rising oil prices against a dropping dollar force the US into a second recession, interest rates will spike. By then the banks will be dumping a significant number of their shadow forclosures, mark to market, and comps will be getting recorded (belatedly). Simultaneously, silly sellers who have been sidelined, watching the housing prices drop, in anticipation of rising prices will be jumping in to sell. However, home prices will not rise to their horror. Inventories will rise. Buyers will head for deep cover. The federal government will be unwilling and unable to re-inflate housing prices again. I will step in with cash and buy my house on the water with acreage. LOL!!

I don’t know if rates will rise that quickly but, people should plan on slowly rising rates for as many years as they care to wish. $13.5 Trillion in debt, borrowing 50% of the money our gov. spends on a yearly basis from foreighners and tens of trillions in unfunded promises like SS and Medicare will keep rates rising essentially forever. This will make housing grind lower for at least a decade. Don’t think it will happen?? Take a look at what happened to Japan or ask the Greeks why they have to pay 10% for a 10 year bond.

My .02

BD

From a strict financial balance sheet angle, I completely agree with you. There are a couple things that are worth paying a REASONABLE premium for, though:

– The ability to customize your home as you see fit (paint, remodel, recarpet, etc)

– Many rentals are older and in worse condition vs newer tract homes

– Eventually, your monthly payments will cease

Now, we just sold our home (for a profit), and are going to wait the next 1-2 years until we feel the market has stabilized to buy a larger place. So your advice in this article is still sane. 🙂

1) Your taxes won’t cease.

2) Maintenence costs will only go up.

3) The temptation to remodel will cost you $$$$. Most renters don’t pay to remodel their landlord’s property, haha.

4) People who don’t move very often tend to accumulate more STUFF. The more STUFF you have, the bigger and bigger place you will “need”. Hence, homeowners have to buy a bigger and bigger place to keep their STUFF.

Homeowners basically have a very expensive, climate controlled storage unit that they live in the corner of….

Owning means that one can customize the lot/house/additional structures in a way that permit a shift from a totally consumerist (cosmetic crap) to a PRODUCTIVE way of living. That’s the piece left out here: home as a place of productivity rather than consumption.

The money and labor capital we’ve put into building productive and conservation capacity at our place is saving us money on food, energy, entertainment, fitness, clothing, and transportation. It also lets us barter skills and products and grew or hone new skills and networks.

I’d bet that if I’d ever had a landlord who was open to my building this kind of productive capacity at his/her rental property (without having to commute 40 miles to some remote rural location) she or he would be all too happy to evict us and claim it for herself or himself.

It’s not cheap to live more self sufficiently, at least not up front. And if we ever have to rent again, we will. But we surely wouldn’t be able to do anything but consume and save while hoping for something more productive.

I waited and dreamed for over 40 years before buying this house, so I do understand the frustration of people who want a house and want it NOW. Had we bought 16 weeks later, we would have been priced out of our fundamentals, and would not have bought. So I do understand.

And I shudder when I remember moving six times in six years for all those wonderful Mobility Opportunities (most of which were forced on people of my generation). Or having to pay other people for goods and services we can produce effectively for free. Or having a landlord say “No, you can’t compost your fruit and vegie bits.” Or having the grumpy neighbor downstairs or next door refuse to allow me to feed migrating native birds in the spring and fall, while their giant hounds dump and whizz everywhere. Or being told I have to waste drinking water and petroleum watering then mowing a stupid little strip of suburban rental house lawn. Or not being allowed to chain my bike out front–where the HOA has determined the three to five cars belong. Or having a house designed for nothing but shopping and ass sitting.

Still, Doc’s correct, as are many of you. For probably the vast majority of people, this is not a good time to buy unless the numbers really work. Make sure they do. Or that you’re ready to live with the long term consequences if they don’t.

What major part of this article did you miss? Was it the RIGHT NOW portion? Like from 2007 to 2011 BUBBLE!!!!

Some people. No wonder we are in this predicament.

I so agree with this. I’ve spent a lot of sweat and $ to turn my 4 acre place into a working farm, with livestock that feeds me, mows my pastures, creates fertilizer for the gardens, and controls the bugs. I also put in a large garden that feeds a more people than myself as I donate or give the extra produce away to those who need it. Its a committment though, and you have to make decisions on a daily basis to give up what others have or take for granted. Like eating out (that money goes to building/barn repairs) and new clothes, and new cars. I live cheaply now, eat very well, and enjoy the fruits of my labor. It was not an overnight thing, but 5 years to get from A to B.

I bought in 2006, when property was up, but I don’t regret is as the land prices have held up here. But the key is that I’ve made the committment which includes working at jobs that I don’t want to stay put here and make a difference.

Not all of home ownership is measureable. I know that none of what I do could be done in an apartment or a home owned by someone else.

New tracks are also rented. The year of the house has nothing to do with renting, the market does. This is California, so you know that a major portion of the buy ups were from investors and not for primary residence. You would also know that California has one of the fastest growth of new homes, Stockton area, Inland Empire, and San Diego suck up most of that pie. So technically renting in this state leans to newer homes.

I finally moved to Palm Springs, CA last January from the East Coast (Princeton, NJ – not a cheap place either by the way). After flying here monthly for 6 months looking to buy and being flabbergasted at what you get for a $1 million price point, I decided that renting was a real option. I can tell you that I live (rent) in an amazing 3 bed, 3.5 bath home built in 2007, intimate but exclusive community in a prime location that was selling for $1.2M and I pay $2500/rent. By the way, the home is completely furnished with high-end furnishings very similar to my own personal style so in fact, I feel perfectly at home and have no desire to “remodel” anything. The owners went on a buying frenzy during the boom and had 4 vacation homes around the world and caught themselves in a financial bind like a lot of folks. Flexibility is important to me and renting provides me with a lovely home without the financial straight-jacket that the owners are in. I’m not against owning and DHB is right on with his reasoning as those are my exact reasons for not buying. Please note that I understand that not everyone has the ability to pay what I do but my point is that there are beautiful new homes available for rent because owners would rather have responsible people living in them and getting some money rather than have a vacant place. Renters also have to do their own due diligence and ensure the owner is not already in some form of default and is milking the money out of the house.

Oh, I forgot to mention that my $2500/mo rent includes the general HOA fees ($325) in addition to personal gardener, pool maintenance and water paid for the home.

We have painted our entire place, replaced the light fixtures, refinished the wood floors, installed a dishwasher, etc. We have a rent controlled apt. Our rent has not gone up for ten years and counting. We have the same amount of space and pay a quarter of what our friends do each month who bought homes so we can continue to save while they languish in their underwater homes. Even have a sweet little spot for our garden.

Hey Doc, thanks for giving me some independant facts to back up my argument with friends and family on Rent VS Purchasing a Home right now. With Mid-Tier Home sales stalled here in Ventura County, realtors continue to play games advising Sellers to raise thier asking price. Some things has to give soon, the inventory is stale and unimpressive with larger homes on tiny lots with extremely close neighbors on all sides for a million plus… Please, get real Sellers! Time is Money!

Patience. Here is a great Ventura example.

Link: Ventura County Blues

Be sure to watch the video. I love their diligence in clipping coupons to enjoy the “american dream”.

These people, like a lot of other Californians out there, have their priorities totally screwed up. It reminds me of one of my acquaintances who threw a BBQ at his fancy L.A. condo and then requested that each guest contribute $10 for the cost food. This, despite the fact that many of us brought things that cost a lot more (I brought several bottles of decent quality sparkling wine).

I don’t sweat the small stuff. If I want to eat a steak, I’ll buy one whether or not it’s on sale. It’s the big purchases that I’m wary of. It seems like many people I know are the exact opposite — they penny pinch in their day-to-day lives but occasionally splurge on a new lexus coupe or a luxury condo.

Interesting video clip Tyrone. Thanks for posting it.

I saw parents who want to provide a good life for the children. Noble parents.

Sure the math doesn’t add up, But ignorance truly is bliss ! I hope they can make it work. God bless them.

A very wealthy man told me. “If you don’t clip coupons you’re not an investor”

Yesterday I saved 50 cents on the dollar buying 2 cases of pork and beans with a coupon. Pork and beans is something my family will eat.

Where in the market today will I recieve an instant 50% return on my money ?

Clipping coupons is not shameful. Clipping coupons is prudent. I know plenty who have lost plenty in the stock market yet won’t clip a single coupon to help themselves.

No one ever became wealthy by cutting coupons.

I don’t question the motivations of the parents in that story. Noble intentions, indeed, but noble intentions alone won’t provide a good life for your family. The adults in the family need to be mature enough to understand that.

Doc, you should write a definitive guide to why renting in California is better than buying. I’m sure many people would link to that and send around to their friends. It would be super helpful to me too as I’m still arguing today with friends and family about why it’s not a good time to buy. Their argument is always that prices are down 50% – it’s hard for me to dig up information and present a sound case for it.

It’s not that I would use it to sound superior, it’s just that I think you provide a valuable real world education here that will help people wake up to the real estate game – the more people, the better our country will be for future generations.

I’ve helped many a family member, friend or associate avoid mainstream brainwashing by suggesting that they would benefit immensely by spending a few hours with “The Doctor.” The Doctor’s posts are the best medicine for those afflicted by the propaganda machine.

That’s how I found this blog about five years ago from Bull-Not Bull and a link to renting vs buying, where it became so obvious that the giant bubble had made owning a house in SoCal such an bad financial decision–before the collapse and everyone finally new the score, Doc was pointing out the clouds on the horizon.

I’d be very interested to see some “dollars flushed” scenarios on this.

For instance, let’s say I am an average person who pays an average rent in California, but I could buy an average house now with a standard mortgage (or maybe FHA) if I wanted. If I were to buy now, what would be the greater loss, the amount of money my house would depreciate before it stabilizes, or the amount of money I’d be throwing away in rent? And at what point does buying a house become worth it?

I am in exactly this position. I can either continue to throw away money every month (which is dirt cheap at $450/month), or I could buy a house, knowing full well that its value will depreciate. But is the value that it will depreciate more than the amount of rent I will pay for, say, 5 years?

Or perhaps a better way to think of it is as follows: My rent is $450 per month, but my mortgage would be, let’s say, hypothetically speaking, $1200. Renting therefore allows me to pocket $750 each month, while the rest is burned, but if I buy now, I will burn X% in the value that my house depreciates and keep Y%. So which is greater, Y%, or the amount I am able to pocket?

Help me out here if I missed something. I think you all probably know what I’m talking about. I’m in this position, myself, and my gut instinct tells me that right now I should just save.

It seems we are being forced to participate in risky investing to break even as our currency wastes away. x-amount of any house is ‘rent’–you never get all of your money back, except during the steepest part of a government sponsered housing bubble when you make no down payment, take out a heloc for more than the house is worth and the rest of the game. We may have missed this one for a generation though.

It sounds like you are saying that if your rent was ( to make this easy I am using round numbers) 1000 a month and your house was 2000 a month and your house falls 24K over two years you are in the same boat had you just owned for those two years. You “through” 24K in rent out or lost 24K in home value, same thing.

It is NOT the same thing! Over the 24 months you paid 48K in payments, you lost 24K in equity and you spent at least 2500 on maintenance. Yes, during that time you did make about 2K in principal reduction.

Maybe I misunderstand you and if I do, sorry, but it came accross that way to me.

They only way your thinking would work is if you were paying cash. If you get a loan there is no way it makes sense to eat a loss.

Right. That is sort of what I am saying, but of course interest and maintenance costs would be involved in such a calculation. Part of the problem is that I don’t know what those would be.

That is a good point, however. If I had to choose between 24k in lost equity or 24k in rent thrown away, I’d go with the rent, because I don’t have to pay for maintenance and other costs as a renter.

The biggest challenges would be predicting equity and inflation. rent can probably be expected to rise with inflation while mortgage payments stay constant. As the dollar devaules over time, it can amount to equity on the house but inflation could also lead to higher interest rates which hold prices down.

That said, most of the loose models I’ve seen suggest renting for at least several years when fed with what I would believe to be reasonable assumptions for what the near-to-mid term holds.

Try this calculator. You can learn a lot by changing the parameters.

No way I am buying anything!

http://www.nytimes.com/interactive/business/buy-rent-calculator.html#

OK, this is hilarious. To quote the calculator, and using current trends: “If you stay in your home for 10 years, renting is better. It will cost you $132,368 less than buying, an average savings of $13,237 each year.”

Interestingly, in my situation, buying NEVER becomes better than renting until the house starts appreciating in value at least 5% per year. And when’s that going to start happening? Not any time soon.

“

I’d say it really depends on what you mean by “maintenance costs.” If maintaining a hot tub, wine room, lawn sprinkler system, and hot-rod kitchen appliances is what you’re talking about, well, that’s not maintenance. That’s consumerism.

As for buying and keeping up a snug house, why would anyone buy a house that required that much maintenance in the first place? Everything in life requires upkeep–look at your midriff–and costs something for that. Not just owner-occupied houses.

The vast majority of work and money we’ve put into our place have revolved around the numbers we’ve run on becoming more productive and using the house as a way to therefore save money.

I.e., if you have a huge pantry and ability to put by or store food windfalls (harvest or bulk purchase), the food budget suddenly is only half of what it was in the ’90s. If you have facilities for energy production and conservation, those pay back over the long haul well over the initial investment. If you have shop facilities, and learn skills, you suddenly no longer have to hire a wide range of service providers and can even make a little enterprise or barter opportunities. There are hundreds of ways to use one’s own home to replace for-fee services, and it’s rare that a landlord will allow you to build this capacity at their property…and more likely they’d evict you eventually for the greenhouse, the sauna, the pantry, etc.

Sorry to repeat myself, but the missing element in this discussion of renting versus buying is the productive, rather than consumerist, one.

Over the course of 2 years it is very possible to have zero maintenance cost.

But, over 15 years you have huge costs. Likely a roof, paint job, remodeling this or that, appliance repair, broken pipes, termites, furnace maintenance and perhaps replacement, air cond too and on and on. So even though you may have zero maintenance costs over 24 months your average over the years is easily 200 a month for even the most modest house.

If you want to plant nicer plants or do anything with the yard tack on more.

Simply rent and save, for all the reasons DHB give, but also a few others. The equity you are gaining in the house subtracted from your monthly payment is likely far greater than your rent! In the first five or even ten years of a 30 year mortgage you are only getting maybe a third of your payment going to equity; the other two-thirds is going to rent money (just as much a throw away as renting a house). So in your calculation, with zero appreciation or depreciation, you have 1200 – 800 (interest/renting money) = 400.00 going into equity. So you are paying almost twice the amount to rent money from a bank as to rent your current house. With the 750.00 difference even in a low-yield CD, say 2% for ten years, you are not only going to have a huge sum to perhaps buy a depressed property outright, but you will have avoided the hassle, risk, and expense of having to sell your house to buy another. If buying costs 3 times more than renting (all costs included, transfer fees, taxes, maintenance), it would never make sense to buy, unless the house appreciated some amazing amount, and that would not happen because houses don’t become so far priced above rent unless they are still sitting on top of a bubble poised to plummet. Does anyone look at fundamentals any more or is that simply an exercise of pessimism in the minds of those holding to the old materialist American Dream. Figure out what you want to do with your life first, and then see if owning makes sense. Right now it is a debt trap and a geographical prison, neither of which lend themselves to the good life, which is the ultimate purpose after all, isn’t it?

Hi,

We are in same position, renting in Thousand Oaks, and going to wait until prices come down to about 200,000 or so less then the are priced at now. There is no reason to buy a dump or an overpriced home in TO right now. Homes in Lang Ranch are ridiculously overpriced for the lots and they way those homes were built. Good luck realtors selling those for 700,000 or more. You can rent a nicer home in TO, cheaper then buying a home right now, so it makes perfect sense to continue to rent. Plus, the flexibility of moving. Our kids are entering high school, we may want to retire on the beach, which would be more difficult if we buy right now in Thousand Oaks, since we would have to sell in 7 years. I totally agree, until prices become realistic, renting is the best option.

I don’t understand why LOW interest rates are a reason NOT to buy. Most buyers put 10-20% down and finance the rest. As long as principal+interest is the same, what does it matter whether the principal is $100000 and interest is 4.5% or principal is $63000 and interest is 9%. The mortgage payments are the same. At the end of 30 years, you’ve paid the same amount.

Also, as long as the monthly mortgage (including the mortgage tax deduction) aren’t that much higher than monthly rent, isn’t buying a better idea?

People have to live somewhere. Why not live somewhere where you build equity?

One has to wonder how the 25% of ‘homeowners’ who are underwater, owing more on their mortgages and HELOCS, etc, than their houses are worth, can be earning equity. Meanwhile, I am a renter. I sold my nice executive home in June 2008, moved into a very nice rental property on saltwater (Puget Sound) and am flush with cash, earning lots of equity in a diverse portfolio. I am renting and earning a heck of a lot more equity than I would have earned if I was still owning my own home.

What does it matter?

It matters because rates are at a historic low due to our FED printing money, then buying u.s. treasuries to cause long rates to decline. It is artificially low! And in fact it can be argued that rates will eventually be much much higher in the future because of what they are doing today. So instead of rates returning to the average of 7% the FEDS actions could take it to 10 or 12%.

If you stay in that home for the rest of your life you may have a point. But if you are like most people you will buy today and sell in a few years when rates are much much higher and you will have a huge loss of equity to eat.

Which jobs are going to last “for the rest of your life”?

They are currently working on robots, which can be controlled by people on the other side of the world in sweatshops.

These will be the few remaining jobs that people think are “safe” because they can’t be outsourced because they must be done here in the US.

Well, they can. With robots. Controlled by third world country workers for 1/10th of what it costs here.

Think this can’t happen in the next 20 years? Go ahead and buy your house and DREAM ON about living there the “rest of your life”.

CAMBRIDGE

If you would kindly reread my post I said most people sell after a few years. I said nothing about a job lasting forever.

I am a realist, not a dreamer. I realize our FED is destroying the monetary unit known as the dollar and am taking action. A dreamer would believe the FEDs bull.

You’re basically a fortune-teller and a palm reader. Do you know what the Fed is going to do in the next few years? We’ve been hearing “hyperinflation is just around the corner” from chicken-littles like yourself for years. Japan is going into their third decade of QE and they’re still deflating. Printing money doesn’t cause inflation when credit contracts because there is always exponentially more credit outstanding on the actual cash printed in a fractional reserve banking system. Spare us your alarmism.

On another thread you were telling us we should buy because prices are cheap here relative to the Third World. What’ll be the next reason?

Ryan, as you picked up, when you buy in a high-interest environment, buyers will not be able to borrow as much, and will offer (and pay) a lower price for the home. The interest rate is higher, as you noted, but historically rates can change a lot. If the buyer accelerates principal payments, the full 30 years of interest payments are avoided. If/when rates drop, the buyer can refinance and avoid the high interest payments. Basically, buying in a high-interest rate environment gives the buyer a lot of flexibility. But buying when rates are pegged to the floor means you are locked in forever. Heaven forbid if the economy hasn’t recovered, and you must sell later when rates have crept up, and bidders offer less than you paid. The mitigation here is to buy when the purchase provides positive cash flow when the full PITI is accounted for (as well as cost of money borrowed). Hope this helps.

– signed, a patient and happy renter

Ryan,

The reality is that it matters hugely if you ever need to sale or get liquid. As a seller you only receive the value of the home, as a buyer who is financing you are financing the home price with the interest. An increase in the interest (i.e. rates) decreases the value of the home. You are correct in that on the buyer’s side it doesn’t matter at purchase, BUT once you buy you are now an owner and a potential seller at some point. If rates rise and the value of your home declines, you are on the hook for that inflated purchase price not the current price of the home.

Assuming the relationship holds it would be far better to buy at very high interest rates and depressed principal values for one reason – the optionality of rates going down. Rates go down, affordability increases, and someone can pay more for your property (values rise). You can also refinance at the lower rate and increased equity levels thereby lowering your payment (or shortening the mtg). When you look at all the huge returns to real estate over the last 30 years – it’s pretty easy to make the declining rates connection. 18%+ rates in the early 1980s going to 6% early during the last decade. Combine that with demographics and you have your answer for historic appreciation. Problem is…where do you think rates and demographics are going from 4% today? The experience will likely be different and I can promise you rates aren’t going down by 12% from here.

Hope that helps.

And the statistical probability of you staying that house 30 years is????

In fact most people only stay in a house 5-7 years. And THAT means you will have to sell to move. And when (when – not if) interest rates rise, your price has to drop to keep the same payment for your buyer.

Don’t count only staying there for 30 years. Things happen. Job changes. Divorce. Needing to move to help your parents as they age. The neighborhood changes. And any and all can happen to you.

Live somewhere you build equity? Renting flushing money down the toilet? Let me show you the numbers and reality of the current situation.

My wife and I are 30. We married in late 2005, and bought a house in early 2006 because that is what married people looking to start a family do. It is a nice, but smallish 1600 sq foot house with a very good view of the Chesapeake Bay here in Maryland, great for a newly wed couple. We paid $325,000 for the place, putting 10% down on a 30 year conventional loan at 5.75%. Out of pocket with closing costs we put up about 40k. My credit union was even able to pull this off with no PMI, because I think they keep it on their books. Our payments with pretty cheap property taxes are at about $1950 a month. I have been paying an extra $50 to $100 in principal payments every month.

Fast forward 5 years. We have kid number 2 on the way, a mother with needs and it is time to move into a bigger place, and settle in for the next twenty or so years. Our income is 50% higher than it was 5 years ago. I want to move a few towns away where things are cheaper away from the water, and buy a house for about $300,000, but even a $250k place would do the job. The moon is not what I am asking for!

However, I can’t sell my house! It has been on the market for a year. We have it priced so that we would bring 5k to the table to pay off the note, and I still can’t sell it. After the tax credits expired in April we have not even had a showing!

Unable to sell this place, and without the saved up down payment money anymore, I can’t buy my next place. The house I desire is 2x our annual income.

So, on the bright side, I will be completing the move that I have been attempting for a year, in the next few days. I am renting the house with the water view out for $200 a month less than my mortgage. I am renting my next house, in the neighborhood I wanted to buy in, from a couple in the exact same situation.

In the rental game as a tenant and landlord the past few months, I can tell you there are many folks caught in these situations. They made perfectly reasonable decisions at the time, and can’t do reasonable lateral moves. This market has a lot more unwinding to do. People talk about hidden foreclosures, but there are also a bunch of houses being rented out by reluctant landlords who will place the house on the market as soon as they think their equity situation has leveled.

When I look back on the last 5 years, I sure am glad I didn’t throw money away on rent! /sarcasm

Thanks everyone for the input. I agree that rising interest rates will mean lower home purchase prices. But my understanding is that housing price decreases are “sticky”. It may happen, but it’s probably not a proportional increase.

For example, rates have dropped from 5.5% to 4.5% recently but home prices haven’t increased in direct proportion.

Also, my impression is that rents won’t fall as greatly as home purchase prices. Even if interest rates rise (and purchase prices fall), monthly rental values should stay the same. If anything they’ll increase with time.

So my approach was to find a smaller home priced close to rental parity now, esp. taking into account the home mortgage deduction. Keep a lot of cash in savings, so that when interest rates ultimately rise and purchase prices fall even further, I can buy another home, and then rent out the first one — hopefully at a monthly rent rate to pay the first home’s mortgage. But at least I take advantage of the home mort. deduction, plus build equity for the next 30 years (again, we all have to live somewhere)

Does that seem reasonably prudent? Or are there fundamental flaws and risks in this strategy that I’m missing?

Ryan – there’s a new thread but I thought I’d answer your most recent question. Hopefully you read it.

1) Your assumption on sticky prices might ussually be sound but there is a problem. People are simply maxed out. Most have seen dramatic equity declines on their balance sheets through housing and the stock market. A good number have had years of equity wiped out and are negative. Income growth and employment is and has been horrendous. Less disposable/discretionary income is the rule as higher priced necessities squeeze people. Flat out, there’s not capacity for increased payments. Principal and interest have to offset at this point. Actually that should have been in the case from 2000 and on as the situation wasn’t much different (better employment though but no real income growth). That whole mania was driven by cheap finance, government pushing housing to lower incomes to boost demand, and irrational speculation. Sucks, but that’s far closer to reality than believing in any kind of fundamental underpinning.

In regard to this observation: “For example, rates have dropped from 5.5% to 4.5% recently but home prices haven’t increased in direct proportion.” This is exactly the issue. Housing is out of balance, people have no money to pay more. Even at lower rates its out of balance. So while housing is “sticky down” right now, I can assure you it won’t be sticky up. The reality is that for the market to balance prices need to decline significantly but therein lies the problem. It’s a debt deflationary spiral because you wipe people out the more you draw down housing making it less affordable as most people’s remaining equity drops quickly in the decline. Hence the long drawn out policy of supporting prices and letting people try to earn out. Trust me, there’s nothing that says we won’t be at this for a while. Figure in baby boomer divesting large houses and investment property, foreclosure pipeline, those stuck in their home who want to move, and those holding out for a better price and you have a satiated market for years. There is no quick fix.

2) Rent is supply/demand. There’s a lot of people who will want to rent but there’s also a lot of property which is available to become rental. We have lots of housing and units available. Even if rents increase, it just entices more “stuck” people to become landlords. Lots of pressure here too.

4) As far as your approach, that can work. Honestly no one knows the exact way this all works out but being conservative generally helps in these environments unless you have serious wealth compared to the value of the house (i.e. you sit on 10m in assets with 6m liquid and are looking at a 2m house – you are driver’s seat then and even if you ate 50% on the house it wouldn’t destroy you). While the points above I had an issue with, I don’t think your strategy is bad. You do need to live somewhere and providing you have a nest egg, secure job, and can potentially find another job in reasonable driving distance from the home, it can work.

Best of luck.

Thanks, slim.

Whenever somebody tells me renting is flushing money away, I ask them what do they think paying interest on a mortgage is. Considering that’s 95% of your payments for the first 10 years, we’re all flushers.

Which is why, Danny, it’s prudent to

–take a modest (no more than 2 : 1 mortgage : income) fixed 30

–with a solid down payment (say 40-50%), then

–pay the mortgage ahead rapidly in the first 6 years.

With no prepayment penalty, and the possibility of a refi to 15, one can save while still jettisoning the lion’s share of the interest, and come out with an effective 2 to 3% mortgage. Much of which is deductible.

I realize this basically means waiting to buy until you can effectively pay 80% or more cash. Most people don’t want to wait that long.

We’ve made a much higher rate of return on being able to live more productively than consumerishly in our house.

Debt works great if you can work it, rather than it working you. Most people don’t understand this, or know the difference. In any case, run the numbers. Sometimes there are simple answers. Other times there aren’t.

Doc,

Thanks for another great article! I’ve been renting a home in So Cal for almost 4 years. It was valued at $540,000 when we moved in and Zillow has it at $385,000 today! I feel great every time I pay my $2400.00 monthly rent! Hoping to buy this place for $275,000 in about 18 months when the owner sells it short just to get out.

When comparing renting vs owning, one should also take into account property tax, HOA, etc fixed costs. In California, the former is linked to the purchasing price of the house, and these costs do not go away either (just like rent), unlike the traditional mortgage. (Try not paying your property tax for a year!) Therefore, at the point when property tax plus HOA plus upkeep plus … equal what you pay for the rent, you know you are screwed for owning the place, since as far as I can tell, there is no difference between paying a rent to a landlord vs paying all those fixed costs to the county, to the HOA, to the insurance company, etc….. unless there is hyperinflation down the road when rent goes higher very quickly. Does anyone see an inflationary scenario here?

Please look at impact foreign demand for so.calif real estate may have on inflation in so calif realestate market. Real estate is cheap here vs asia for example.

That is the bottom line Dr. HB. Renting makes sense right now, compared to buying. You don’t own a home UNTIL you actually pay for it. Buyina home is a losing proposition in California, if you consider all the variables:

Price Decline

Job Loss

Over Inflated Prices

Artifical low Interest Rates

Taxes

Insurance

Maintenace

Renting at 1/2 the current cost

Lack of Mobility

etc….etc……

Hopefully people are finally waking up, after being hoodwinked lately. the next 10 years will not be any better for buying a home in Southern California. If you buy now, it will take that long, just to break even. Just rent a nice house and enjoy life for now.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Title: “The new California Dream involves renting…” No, renting sucks, however it may make more sense financially to rent.

It’s sad that banker and governmental corruption and manipulation of the market has led to ARTIFICIALLY HIGH HOUSING PRICES.

Sadly, the American Dream of homeownership has turned into a nightmare in many cities and states. The bankers don’t care. They are rich, fat, lazy pigs.

Instead of using Household income data I would use Personal income data. Household income hasn’t kept pace with Personal income because the size of the average household has declined considerably since 1964.

“Does anyone see an inflationary scenario here?”

Yes. It’s inevitable. Central banks cannot just run the printing press at 110% capacity for years without some serious blowback. All the industrialized economies are going to monetize their way out of debt.

Buying still makes more sense because the banks throw in 2 years free lodging after you quit paying on the loan.

Good point!

Yes, the housing bubble is alive and well in SoCal. I expect this to continue into the foreseeable future until home sellers get a dose of reality. Sellers are still looking for peak bubble prices in many areas thanks to the low interest rates. Why in the world would I pay $919k for a house that sold at $472k in 2002? For a $447k mark-up over 8 years, there better be some incredible updates! And since it was built in 1991, how bad a shape could it have been in after 10 yrs when they bought it? Would 450k worth of repairs be needed? Doubtful. Of course, it is on that ginormous 5000sf lot, so…

http://www.redfin.com/CA/Cypress/4890-Ariano-Dr-90630/home/3994553

Buying in CA now, even if “affordable” with historically low mortgage rates, also means locking in a very high tax basis. thanks, but no thanks. When the old lady across the street pays $600/yr and any new purchase in the neighborhood would run upwards of $8000/yr. screw that.

Yep, California’s Prop 13, while it seemed to many like a good idea at the time, has turned into a nightmare. First of all, as you pointed out, it has created a massively inequitable divide between what the richest generation (the “greatest generation” who have been in their houses since the 1960s) pays in property taxes and what the poorest generation (young people just starting out) pay in property taxes. The idea that identical houses across the street from each other pay $600 and $6000 in property taxes is evil and absurd.

Secondly, it has destroyed our standing as a great state. California used to lead the nation in education. Now, thanks to Prop 13, we are 49th or 50th.

What do we, as a people, aspire to? Clearly, we do not expect greatness anymore.

Stop the Prop 13 nonsense….10’s of billions in Commiefornia spending (and a huge % of the budget) is for ‘programs’ that were small or didn’t exist when Prop 13 was passed. Education still gets nearly half of the budget. Check out the Administrative payouts at schools though…it’s not the janitors that are getting rich. The head coach at UC Bizerkley gets $2.5 million/yr.

But the rest of those statistics also show Calif Teachers Are the highest paid in all 50 states. (www.nea.org) But calif ranks 48th in overall student performance( this includes esl, lunch programs- everything being equal) So now lets recap. You have 50 companies. One pays their CEO’s the highest compensation. But in productivity year after year rank almost last! If it was a private company they would be out of business!

You’re complaining that the average California teacher’s salary is too high? According to that link, the average makes just under 60K… hardly what I consider overpaid. Also in that same link, California teachers are ranked near the bottom (44th) for “salary comfort index” meaning their effective salary adjusted for the cost-of-living is actually very low.

I don’t think Prop 13 is all bad. Afterall, it has allowed retired seniors to stay in their homes — the problem is that their children and their children’s children still live with them.

If you get a 15 year mortgage, after 10 years you have paid off nearly half of the mortgage. Stick it out 5 more years, and you can own your house free and clear by your late 30’s, then bank what would have been your house payments, for the next 25 years. Retire in luxury!

Yes and how many people do you really think have enough money to do a 15 year loan in Southern CA at current houses prices. Not many.

My dad ‘s family rented in Glendale in the mid 1930’s during the Depression 1. He said only 2 people OWNED a home on his block. Everyone else rented. The banks in those days could not pawn off foreclosed homes. The Glass-Steagle was actively in effect then. Welcome to Depression II.

Who is paying all the property tax on this bank owned stealth inventory? Has anyone added up how much it is per month?

Bought a condo with 20% down in ’94, traded up to a house in ’02 with 33% down and nothing out of pocket. Current loan to value ratio on the house is 42%. I never took money out of the house until now to do a kitchen remodel (value add). I’ll still have 52% equity, a new 30K kitchen plus other fixings around the house, not a dime out of my pocket, a 3% loan, a monthly payment below $1,500 per month, interest deduction and real estate tax deduction and a $705 a month principle reduction (which goes up every month). The condo was in Sherman Oaks and the house is in Encino. Got to look at the big picture. Stay consistent, see your home as a place to live and not an investment and don’t recklessly take money out of the house. Renting sucks…no control.

Exactly. Discipline is the key.

But, you (like me) also got lucky and bought pre-bubble. People that are trying to just start out now face a whole different set of problems. My first house cost me $150k in 1998, and it was in a decent neighborhood.

Precisely. And that discipline in the modern market is expressed by not giving in to the hype and desire of purchasing a house in the still overpriced market while saving a nice little nest egg to seize the opportunity when it finally arises.

You can’t find a decent house for less than about $300,000 right now and at a recent college graduate entry level pay rate (between 40 and 60 grand), that price would be a big stretch and we are still at a point where continue price declines are virtually guaranteed.

Renting is surely better today. I personally know people who have houses worth $150,000 lesss than they owe on the mortgage. One is a guy who has income over $100,000. He is 60 and has a NEGATIVE net worth! He cannot dump his gorgeous house, his wife will leave him. So, he can slave away paying it off until he drops dead. This is when his younger pretty wife will have the next guy move in.

On that mortgage rate chart, the upswing in the ’70s represents Baby Boomers clogging a limited housing market. Real wages were eroding, but people were willing to agree to insane mortgage terms to form their households. (I well remember the 18% mortgages, and the scolding people subjected me and my then-partner to because I refused to hop on that wagon. They were just shoveling their eroding wages over to their lenders!)

Look at the curve in the Age of Reaganismo. We know that wages continued to erode from 1980 on even as Americans became incredibly productive. We know about the recessionary forces. We know that housing prices skyrocketed.

So of course the cost of debt was suppressed, because too many people couldn’t run the arithmetic on what a house was really costing! Principal/price became all anyone cared about, with the dream of the killer flip.

The unwinding is going to be terribly painful.

My wife and I went out looking for a home about a year ago in Cerritos, CA, a small well-kept suburb in southeastern Los Angeles County and quickly realized we were looking at homes way beyond our means. Small three bedroom homes were going for over $500k and the four bedrooms were listed for over $700k.

If those prices weren’t shocking enough, the attempt of the real estate agent to deceive us into buying a home was. The real estate agent, a well-dressed middle-aged woman with a wide smile and sales trophies which covered her office walls, kept trying to convince us that with both of our incomes (together less than $100k) we could afford to buy one of the three bedrooms at over half a million dollars. But, she warned, that if we didn’t act quickly and buy one of these bargain homes we would never see such affordable prices again.

The degree of duplicity this real estate agent engaged in with us was simply astonishing. She wanted to sell us a home regardless of whether or not we could afford one or not, knowing quite well that she would be at least partially responsible for the financial disaster that purchase would have brought us. Her conscience didn’t seem to mind the fact that she was attempting to manipulate us into making a very bad decision, one that would have life-long ramifications.

I had assumed that this type of behavior on the part of real estate agents was no longer practiced after the first flood of foreclosures and notice of defaults came crashing down on the market a few years ago, but evidently the same misleading and manipulative tactics are still being employed. The sad part of it is that 99% of the people these real estate agents speak to are not reading DoctorHousingBubble.com and have no idea what the facts are and what is best for their financial futures. They are complete amateurs playing a game against professionals, lambs being devoured by wolves, and they don’t even know it.

What I hope begins to happen, thanks to blogs like this one, is that more and more potential home buyers understand that real estate agents are looking to secure their own interests, not ours. I would love to meet just one real estate agent who would politely teach me the 3 to 1 rule, that I should never purchase a home that is three times more than the gross annual income and that, unfortunately, none of the properties he or she has listed falls under that number and tactfully advises that I am in no position to buy.

But something tells me that I am not going to meet that kind of real estate agent, one who is completely truthful with me and is genuinely concerned that I don’t overspend on a house worth far less than its listing price, one that exceeds the calculation of the 3 to 1 metric.

Since the real estate agents aren’t eager to share this 3 to 1 formula with their “customers”, all of us here should, sharing it with any of our family, friends, or co-workers who are considering buying a house. Lets make the 3 to 1 metric fundamental and common sense to every potential home buyer we come into contact with. The real estate industry certainly hopes this powerful rule of thumb which kept most of our parents in their homes for their entire lives a well-guarded secret.

Yeah… but the 3-to-1 ratio isn’t borne out by historical data, either. It’s more like 4-to-1.

http://www.oftwominds.com/blogsept10/housing-bottom09-10.html

Regardless, housing prices still “should” come down in real terms. Keep in mind, massive inflation can accomplish this, rather than only price deflation. All governments are ramping up for massive inflation right now. Just take a look at Gold.

My parents live next to Cerritos, and while it is a fairly nice neighborhood, you definitely did the right thing by ignoring the agent. What is there to justify the 500-700K prices? They have decent schools and parks, and a fantastic public library, but that’s about all I can think of. There are no universities nearby, not a lot of businesses, and most of its neighboring cities are working class cities like Norwalk and Hawaiian Gardens. The prices simply aren’t justified.

On a side note, I’ve observed that many of the homes in Cerritos seem to be multi-generational homes where aging parents are living with adult children.

With all due respect, isn’t 3-to-1 (price-to-annual income ratio) a bit simplistic b/c it doesn’t factor interest rates? If the interest rates are 12% (as in the early 90s), then 3-to-1 might be too high. If interest rates are 4.25% (like now), then 4-to-1 might be doable, no?

My view on buying any home is based on whether the rent will cover the taxes, interest and insurance. When I look at homes I ask the realtor about the rent. They hate me when I ask this but this is to protect my investment. If I have financial problems I know I will be able to rent the home and not have to come out of pocket for monthly expenses. Maintenance expense I pay out of pocket.

Peter-

Several good points, but the job a real estate agent is to move inventory, not be your financial advisor or friend. Do you think a car salesman cares whether you can afford that new Mercedes? Of course not! If he can get you qualified, he earns a commision. Period.

Reminds me of my elderly relatives who commented on “He was such a nice young man!”

Of course was

I have observed thoughout my life that people will do the most amazing things and often rationalize them in the name of making money. Anyone who stands to gain from action that you take, should be considered “conflcted”.

FHA loans are transferable so that can be a big advantage when selling in a higher rate environment.

Another option besides renting is to change your target buying region. We bought in the California desert at $18K less than your example should-be-median home price for 2010. Our mortgage for a 2 bedroom on a half acre with a huge workshop is less than our rent was for a tiny 1 bedroom on the coast (for which rent had escalated $500 a month in 3 years). I am working from home, still making my coastal Calif. salary, beginning to grow our own veggies, composting, grey watering, and really enjoying our new life – in short, I am happier owning and having more control over my living environment. But I understand that some people want and need to live in higher-priced areas; our solution is not for everybody.

um..read an article about 0% interest rate (How low can it go?)

What if….a big WHAT IF…. Fed keeps on buying the treasury to a point we reach 0% interest rate….

what’s gonna happen???? I know friends in auditing field telling me that people with modification program in LA still cannot afford a regular fix 30 year rate. instead those bank rewrite and give them another balloon rate. (what a mess)

Hi, newbie here. I recently bought a townhouse for $330K in a prime area (blue-ribbon schools, low crime, 30 minutes to downtown LA, adjacent to elite area). Put 25% down on a 30-yr FRM at 4.375%. Total monthly housing costs (PITI + HOA) are $1880. Another unit in our complex recently rented out for $1750. I think a $130 monthly premium to own is not too bad a deal, but the Doc’s articles are making me worried. Did I just do something incredibly stupid?

Other stats for this area: median home price $615K, median condo price $335K, median household income probably about $90K. I realize the home prices are inflated, but what about the condo prices?

I guess my real question is, When is it safe(ish) to buy?

Can we narrow down “California”. There are comments about La Jolla and comments about Cerritos and farms. The blanket statement doesn’t account for a lot of the reasons why people (families) buy homes. Location and schools. In LA those two factors are huge.

I’m a former equity analyst and have been reading this and other similar blogs for 12-18 months. Today I signed a counter offer agreeing to buy a home in the South Bay.

why? My landlord (a home builder) got in a predicament and has to move back into the incredible rental we have been in for two years. We pay $2500 for 1300 sq feet. We’re in a great neighborhood w great schools, close to my wife’s work and a few miles to the beach.

My search for rentals turned up 50 year old SFHs that haven’t been updated since the 60s or I could up my rent to ~$3000 to find a comparable house to rent.

that prompted us to start looking for options to buy and we’ve found a nice, turn-key 2000 sqt ft house in our same neighborhood that will cost me $3500 for PITI.

Why pay someone else’s note at $3000/ month when i can pay my own for $500 more and enjoy a tax break that will bring me to parity with the $3000/month rent.

Investment/appreciation aren’t a factor. I want stability, safety and a good education for my daughter and unborn son. Will our house depreciate in the next 12-24 months? Who cares (I assume it will). With the current rates I have locked in my rent to $3500.

Which is waaaaay too much money. You are taking a great financial risk and it is irresponsible when you have children to care for.

How can you say that to chuck, when he stated neither his income, nor how secure that income is? He implies that both are pretty good. Not even implied–but pretty easy to infer–is that it was upsetting/disruptive to one or more members of his family to be FORCED TO MOVE from their rented digs. He has put a price on that NOT happening again, and is willing to pay that price. He has run the numbers, and stated his intent to stay in his new house for an extended number of years. (Presumably, if things do go awry in his well-laid plan, he can “structurally default” and return to renting.)

I’m totally down with DrHB in GENERAL, but your response to chuch was of a “knee-jerk” variety. Chuck provided hard numbers, both $$ and sq. footage, plus neighborhood value-added factors; you provided the word “waaaay”, and no familiarity with the areas in question. That’s hardly objective.

There ARE niche and singular buying opportunities out there. e.g. So-Fla peeps are picking up foreclosures at DEEP discounts, and even after reno costs, are renting for 10-20% more than the PITI–nice profit for risk-takers and hard-workers.

Without knowing any income data you can’t say anything is too much.

If I wasn’t forced into a situation of moving in the next few months and possibly going through this disruption again in 12-24 months I’d have stayed renting for at least another year.

What’s the “price” you place on renting from a landlord who isn’t required to disclose his current financial situation. Will he have to move back in to his house like my current landlord? Is he renting based on his desire to keep the property and possibly sell later?

In the south bay there are tons of people who are underwater and holding on to hope by renting out their homes because they can’t get what they were asking as a sale. They hope and pray that the market will come back and they can sell or refinance the house. Most of them are just delaying the inevitable.

what happens to that renter when the landlord can’t afford the negative cash flow? Or decides to stop paying the mortgage?

What’s my recourse as a renter? Try finding a SFH in los angeles in an area that provides great public schools, is in your price range, geographically close to friends, family and business. Now do that under duress. Hope you have 30 days. Good luck with that.

Chuck, you have most likely done the correct thing for yourself.

Just do this much: do NOT look at the real estate market after you have bought your place. Because no matter how strong or weak the market is, it never fails- the day after you buy a place, you see a better deal around the corner. So don’t look.

If you got the place you want for a rental parity or just-above parity price, in the location and school district you want, and can well afford it, it’s nice to be spared the instability of the small-landlord rental market. I only rent from professional rental property owners, never from some amateur who really never wanted to be a landlord. You are well out of that situation.

Great blog, great comments. No gloom and doom, buy some gold, the end of the world is near and also no pie in the sky Pollyanna nonsense. Just nice common sense observations and clear articulation by almost everyone involved. Impressive and refreshing!

I agree with you, Doc, on most of this except for the bit about deals being available on rents. I just helped my girlfriend find and move into a place in LA and it was an eye-opening experience. The deals that I thought would be there pretty much weren’t. Rental rates are still in a bubble, my friends. They will have to come down, too. It’s something to keep in mind when making those own/rent calculations to try to find “rental parity.” You may think, at some point, that parity has finally been reached and it’s time to buy…but what if rents go down?

Peter – it’s good you didn’t listen to that greedy, misleading real estate vulture lady. She’s just trying to put thousands of dollars into HER pocket. She wouldn’t care if she sold you a house for $500,000 one day and its value fell to $250,000 the next. She’s your “friend” up until you sign the papers. After that, she only cares about finding more victims.

PermaBear – go back and look at your graph again @ ofttwominds.com – look at how many years the value fell below the red line (the mean). Besides the housing bubble era (starting in about 2002) the only time the value went to 4.1 or above was for a time in the late 1980’s and early 1990’s. If you exclude this short period and the housing bubble and its aftermath, the line fell well below the 4.1 value. I think if you exclude the housing bubble era, the mean value would be quite a bit lower.

Your “Reason #1” is very misleading for many reasons. Here is one, it assumes that the average house in 1968 is the same as 2010. This is not true and the average house in California has more than doubled in square footage over that time.

Therefore on a per-square-foot basis houses are cheaper (in real terms) today than 1968.

And I have more reasons…

Leave a Reply