The death of the new home market: First time buyers, reaching the edge of affordability, and investor disruption.

Given every headline we have seen over the last few years you would think that home builders would be out in droves adding new supply to the market. What building is occurring is focused on multi-family units to cater to the trend of rental Armageddon. The new home market does well when the economy is recovering evenly and wages are moving up across the board. New home sales come with a heftier sticker price and most investors are interested in deals, not marked up new homes. But prices are pushing up in most metro areas and rents are steadily moving up. Yet this push is more of a constraint of investor demand for existing homes and not regular families competing with one another as was the case for a few generations. That is why the homeownership rate of today is what it was back in 1984, over 30 years ago. It is also the reason why new home sales are pathetically low. The new home sale market is really the place to look at for a true housing recovery for the masses and nothing is really happening there.

New home sales

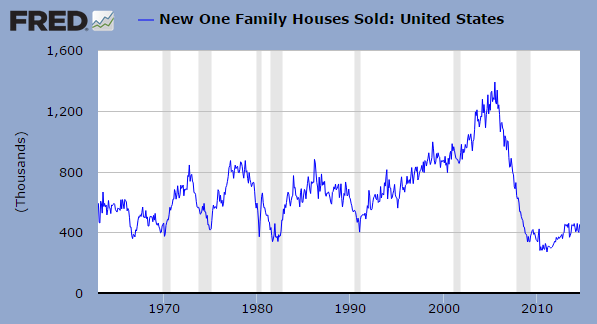

Looking at new home sales we realize that the hunger for new homes is near all-time lows. Why? For one, new homes carry a higher price tag and also, investors and flippers have little demand for these. New homes usually push the higher range of a market and are designed for the regular home buyer. Of course this category of buyer is fully tapped out of the market.

If we look at the new home sales data we really don’t see any housing recovery in this segment:

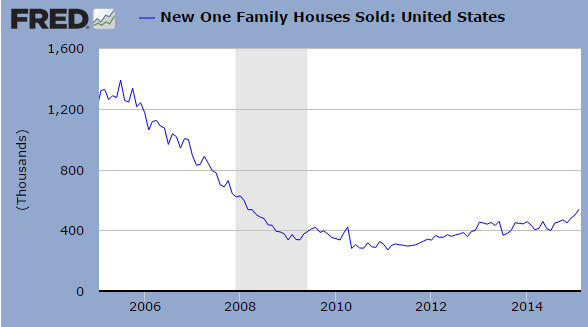

Even in the 1970s and 1980s we routinely had 800,000 home sales per year. During the housing mania we were routinely over 1,000,000 per year. Today we are hovering near 400,000. That is incredibly low especially when you look at home prices. But the push is coming largely from big money. If we look at new home sales over the last 10 years, it becomes clearer:

You’ll notice that there is a minor move up in new home sales but this is only starting to occur after a few years of significant pressure on prices and rents. It also relies on artificially low rates to draw in buyers. Inventory is still very low.

Inventory

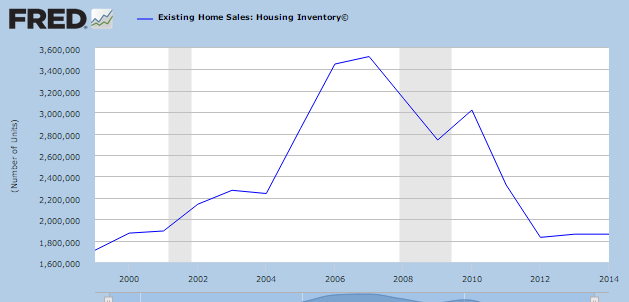

There is still a lack of inventory out in the market:

The Taco Tuesday baby boomers are unlikely to move for a few reasons. One, many have their kids moving back home because they can’t afford to buy or rent. Next, many have deeper aspirations for buying more expensive homes in the property ladder game. The only problem is prices went up across the board. It is all relative. Inventory also remains low because of the lack of new home building that simply did not come back after the crash in 2007-08.

Median price

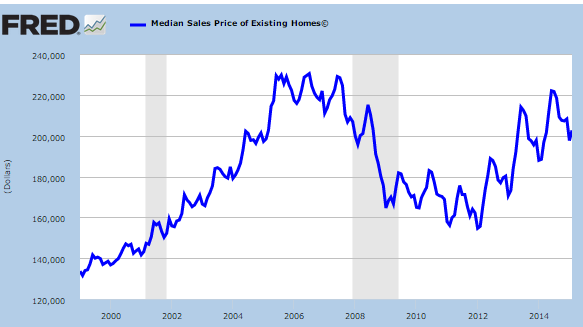

The median price of homes across the country has recovered but seems to be hitting a ceiling:

The median home price of existing homes is oscillating between $200,000 and $220,000 across the country. This sounds about right given household incomes and interest rates in the 3 to 4 percent range. It is all fully dependent on low interest rates. Yet new home sales carry a higher price tag and even slight price variations are pricing out those new home buyers.

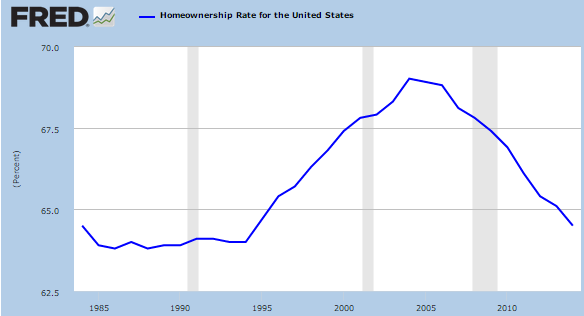

Homeownership

When we look at it in full context, we then see how the homeownership rate is now down to levels last seen in 1984 with prices still moving up:

A net loss of 1 million homeowner households but adding 10 million renter households over the last decade will do that. It should be obvious that investors have crowded out many buyers in the single family home market in an already inventory poor environment. New builders have to make a profit but if you only have cash strapped regular buyers, why will you build? The demand has been on existing homes were investors could dive in and turn them into rentals or flips. There is little desire on new homes which serve as a clear reflection on the income health of the masses.

A robust recovery in new home sales will be a better signal that things are turning around for most families. Simply looking at new home sales, builders that look forward are basically betting on rental Armageddon to continue. The days of the ubiquitous McMansion seem to be at a standstill for now.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

84 Responses to “The death of the new home market: First time buyers, reaching the edge of affordability, and investor disruption.”

“Recovery” “Hope and change” “You can keep your policy” Etc etc..

How will the spin doctors work this?

Please. Off-topic ideologically charged snarks can be bantered both ways.

How you like: “Mission Accomplished”

or

“Read my lips, no new taxes”

or

“A few months ago I told the American people I did not trade arms for hostages. My heart and my best intentions still tell me that’s true. But the facts and the evidence tell me it is not”

I rent in the 91602 zipcode. It’s called Toluca Lake. There is prime 91602 which is south of Moorpark and there is Toluca Lake adjacent, which is where I live. Nice but not really that much different than better parts of North Hollywood. In December Amanda Pays and Corbin LA Law actor bought a house near me for 877K. They’ve spent the last 3 months working on it. Every day but Sunday. It went on the market today for 1.5MM. It’s on an alley and on a street with broken yellow lines across from a condo building. It is incredibly small. It will be fascinating to see what it sells at. It will sell. I beginning to think there will be no tanking. The system has been finely tuned and engineered. Water will only got to the wealthy. Zoning laws aid the wealthy. To the wealthy 1.5MM is 500K to me. I could never buy here. I rent for less than what the rent amount would buy me in a bad area. I’d be interested to read your thoughts. Here’s a link to the house, http://www.zillow.com/homedetails/4443-Strohm-Ave-Toluca-Lake-CA-91602/20044020_zpid/

I laughed when I read this. My oldest friend bought a house years ago from the same duo. They were walking through Ikea a month after the purchase and noticed that the cabinets there were strikingly similar to the ones in their new house’s kitchen and bathroom. Bwahahahahaha. I’m sure the house you mention is no different and the floors have a ton of formaldehyde in them. 95% of people can’t see past the granite and stainless. 60K for lipstick and they net a cool half million plus. People are really stupid.

I met her. She didn’t look happy. A reminder that a high standard of living does not necessarily equate to a high quality of life.

As a schoolboy, I used to have a crush on younger Amanda Pays. Some movies like the one with Rob Lowe, Oxford Blues. I’m so sick of flippers.

Keep us informed please, tolucatom – well perhaps you can let us know what it actually sells for.

The big bad wolf is out there somewhere… it’s me, and others, waiting…. not to huff and puff and blow down… but to buy at much lower prices.

The Big Bad Wolf signify life’s genuine challenges. The wolf is hungry, and envious being. It stalks, strikes when you least expect it. It would like to steal away your happiness, almost everything which you hold so dear… It leaves absolutely no clue as to whenever it may come, and the only thing we can do about it is actually to get prepared, simply because Hard work along with enterprise triumphs above evil forces and misfortune. [..]The 2nd meaning of the story is actually that prioritizing your life will always be important.

Did you see the school rates, 6 for elementary, 7 for jr high, and 3 for high. These homes usually go for around 900K, They would be lucky to get 1mil from a childless couple(straight or gay).

Couples with children can easily pay 20K a year per pupil in a private school. Marlborough School in Hancock Park over the hill, goes for 40k per pupil.

Don’t forget the MB S class, or the BMW 750iL. The house is only the beginning of expenses for this lifestyle.

tolucan

Gotta love The Magical Christmas Caroling Truck “parade”, that has been going on for over 30 years. We journey to it every year from east Ventura County. I grew up in NoHo and was just there (Bellaire@Magnollia) yesterday, helping my widowed mother.

I went to HS with Bob Hope’s late wonderfully nice niece. I partied at Bob Hope’s former residence. Toluca Lake is a GREAT area, and some parts of Valley Village is as well. Bummer to hear the housing flipper a-holes are up to no good. It represents the downside of Capitalism. Can’t people grow their $ in other ways? Like the Commercial sector. It prices us out of downsizing for a long time. We were renting, and don’t get me started on the absurd rents… Insanely expensive.

prices s/b priced. It’s early!

Will do @Galaxy Brain. Hard to imagine someone paying 1.5MM to live on this block but what do I know.

“New builders have to make a profit but if you only have cash strapped regular buyers, why will you build?”

Doc,

That is a very good observation. Builders are not building because they have to sell houses at cost to move them. In conclusion the current trend of no building will continue till you have massive scarcity of housing and rents will continue to increase due to scarcity. All inputs for construction went way up: good lots, materials and SKILLED labor. People know about the grocery prices because they buy them everyday. Builders know about input prices for construction because they buy them everyday.

I was saying for a long time – when you see construction everywhere that means builders make a good profit and is time to stay a away till mania slows down.

Currently I am building 100% multifamily residences for cash flow because there are no money in single family housing. If nobody is buying, eventualy multi family will do well because not all people will live under the bridge.

California is not Texas. California has so many green and environmental regulations that Texas does not have, which means that Californians pay higher prices to have the feeling that they are fighting global warming. It is values and trade offs. Texans don’t give a crap about the environment like Marin county Californians(e.g. Barbara B and Nancy P). Californians pay more for gasoline for the same reasons, they rather put their money on green and environmental things than in a new house. Different priorities for different folks. Diversity is our strength, I have been told by Marin county folks(the same ones who do not vaccinate).

It’s more than climate change, Tex. Green is also clean air and water. Regulations passed by California have had a huge impact on cleaner air across the country — things like higher EPA standards, which lowers pollution, and, ironically, means more oil in the ground for Texas to utilize.

“Texans don’t give a crap about the environment…”

Intelligent people that care about future generations will always care about the environment, whether they are from Texas or elsewhere. Only a complete and utter fool would not care about the environment. After all, we live in it.

I just retired my 330,000 miles 1995 Volvo 940, and sold it to the state of Ca’s Vehicle Retirement Program. It was a “Gross Polluter” according to its final Smog Certificate. Interesting stat: 10%-15% of vehicles (Smog Certificate qualified) are the origin of 50% of our smog. As a recovered Repuke, I am all for, our Ca EPA laws.

Also, we once had a wild cat on our new construction property, up in the hills. We were intruding on the animal’s “turf”. Builders has littered many great natural greenbelts, and buy off city governments. The BIA meetings I’ve attended, were pretty interesting.

Diversity is our strength say the liberal Marin county folks. Marin County is where the median home price is $1,000,000 and there are few poor folks.

http://www.mercurynews.com/business/ci_27390342/marin-median-home-price-nearly-1-million-2014

I am very familiar with the So. Cal. market as I owned a home there up until 2014. I live in Colorado. I live on the very northwest edge of the city and up until a year ago, it was wide open spaces to the foothills. Now there are subdivisions full of new home construction filling that void, and home are selling briskly. While Californian’s may consider $500k – $750k a bargain, that seems overpriced for cookie-cutter, albeit, spacious new homes, where you can lean out your bathroom window and shake hands with you neighbor! One of the main differences between Denver and a place like L.A. … there is still quite a bit of vacant land … but disappearing fast. That isn’t the case in L.A., where every square inch has been built on. Unless you go to the inland empire, existing homes, or tear downs, are your only choice in L.A.. However it is the similarities between Denver and L.A. that are disheartening! Denver is on its way to becoming another L.A. type urban sprawl … soon there will be 125 stretch of non-stop city along the front range of Colorado. And all the same problems will follow, the infrastructure, including water supply, will not be able to keep up with growth or demand!

Yes Denver has a lot of land but be careful buying a new home there. Many basements crack and upheave in a few years, my brother paid a pretty penny in Highlands Ranch after a lawsuit court ruled buyer beware, and his basement had to be re poured cost was over 30k.

I know this is a blog about SoCal, but here in Denver, inventory is so low that it’s really hard to tell what a “good deal” is anymore. Because choices are so few, everything feels artificially inflated. Thus, rents have soared here because of population growth and a lack of housing options between $150,000 and $350,000. Some affordable options are available, but these are in areas that are pretty undesirable, unsafe, and with low-performing schools.

Those that own here and want to sell and “move up” are finding it difficult because even if they sell their current home for a good profit, it’s very competitive to turn around and secure a newer, better home…not only because of higher costs, but because there are so few homes on the market.

imfromcolorado,

Over here on the east coast, just about any location that is within 15 mile radius of NYC is suffering from a very similar situation. If you are lucky and willing to settle maybe you can find something around $500k with a $20k a year property tax…

We’ve had the same problem in NorCal. In fact, the prices are so ridiculous, rural areas have rent and prices that rival the urban areas. When it all comes toppling down they will try and blame the buyers like the last time, only this time, they can’t control the investor panic. We are starting to see the panic already. Stupid is as stupid does!

Similar story in San diego. We have about 2 months of inventory in general.

We just went into escrow in Corona, CA. Market is starting to slow down. We had about 5 properties to choose from at 500k for 4 br. The fall should see some pretty good deals. Market is looking better than it has in about 5 years in terms of inventory and quality.

Jw: since when is 500k in corona a good deal?

Delusional is the new norm. Scary.

imfromcolorado…Serious problem for sure, many are seeing a great price increase and asking why not sell now, the big question, after we sell where do you go for a deal? Looks like sellers are saying no thanks I won’t list, thus few house on market there.

And inventory will remain low in the bubble areas. Older people are convinced their $600K crap shack will soon be worth $15 Million dollars in their gentrifying neighborhood so they will never sell.

What I am seeing now is the proliferation of reverse mortgages by early retirees in the 310 area code. These people have zero intention of eating cat food and shopping at the 99 cent store so they are pulling every penny of equity out of their property via reverse mortgages. So their Gen-X/Gen-Y kids will be shocked to discover that mommy and daddy sucked all of the equity out of their crap shack and junior/juniorette will inherit nothing.

In the Bay Area, builders are building housing tracts in Manteca, Mountain House, Stockton and Vacaville, 60 miles out. The problem is you are an hours drive from work, and in the worst traffic in the nation. You can buy their least expensive house for 450K and pay mello roos.

Or buy a 850 sq ft. condo in the bay area for 475K, pay big HOA, and shorten the commute. Many I know who bought the big houses in Manteca back in 2002, later sold or walked away because the commute was too expensive and they spent too much time on the road. Better to rent an apartment in the Bay than to have the Mc Mansion in Manteca.

I’m sure the same was true in So Cal areas like San Bernardino and Hemet.

That’s why I rent in the Bay.

If gas prices go up again, or interest rates go up, the crash will come to Cali houses again like it did the last time.

Really? Please explain why.

Back in 2004 I was going through a divorce and became a renter. At first I felt I missed out on the appreciation getting rid of my house. In 2005 I was put in charge of a government agency real estate fraud unit. Having access to all kinds of data within a month I could see the trend that prices were going to peak very soon, (I predicted 2006), foreclosures were going to start big time, banks would fail and the crash would be devastating. Realtors laughed at me. My own bosses laughed at me. Against advice my ex bought a house end 2006 (closed January 2007). I kept renting. We know what happened.next. I did well shorting those bank stocks and bought a house at the rock bottom in 2011. My ex lost hers to foreclosure and about $250,000 upside down. Since then my house is up somewhere around 65%.

The market is in flux right now. Overall prices are going up around here about 1% a month. If you are in the market you either must know what you are doing or you need a very good agent to help you buy the good one that pops up and sells in a week or less. They need to be able to peg market value very accurately, because if you buy too high it will take a long time to make it up once rates rise and appreciate drops to maybe 4% annual. You can still do well, but you can also get killed very easily in this market because you don’t buy overall, you buy one particular house that may not fit the trend.

Be picky. Buy only what you can afford. Don’t fall for realtor hype. But don’t be afraid to buy now.

Gas prices will probably go up again (but they will fall a bit more before that), but interest rates will definitely go up by 2016. The real question is how fast and by how much. The interest rates are artificially down now, so it is the politics that keep them low and who knows how long that will last?

I live on Topanga Canyon in Chatsworth, and they are building building BUILDING these massive “farmhouse” McMansions that obscure the hillside. Yet they call one big tract “Stoney Point View” Ha! Perhaps the future buyers won’t notice the bumper to bumper traffic on Topanga every morning and afternoon? Here is a link to but ONE of the huge tracts going up.

http://www.planethomeliving.com/communities/stoney-point-estates

Those houses look nice enough, but the prices are curiously missing (or very well hidden). I’m assuming the prices must be ridiculous.

No offense, but I could never live in the Valley. The summers are brutal. Also, the former Santa Susana nuclear facility is about 4-5 miles upwind from this development. I doubt there is any significant current risk, but no one really knows the exact impact to the vicinity from historical nuclear accidents at the facility.

Hot summers shouldn’t be a problem, provided one has reliable air conditioning and a pool.

That is, provided SoCal isn’t hit with some major electrical blackouts and drought.

Marty,

I’ve been stuck in Topanga Canyon traffic, heading north to the 118 (Ronal Reagan Fwy), and it was 4:00PM, not even rush hour. Parking Lot, for sure.

I don’t recall the outcome of the building permits on the radioactive areas of Simi Valley, but the thought of glowing in the dark evidently is less important than building new residences. (Rocketdyne issue from decades ago)

That’s what happens when the government taxes the people into oblivion. They don’t have enough to own a home to live in. It’s a strategy to keep the people powerless and enslaved to a system that keeps them in debt from all angles.

It’s called theft.

Jay, I hate to break it to you, but the US is not a high personal income tax country. See http://www.theatlantic.com/business/archive/2013/01/how-low-are-us-taxes-compared-to-other-countries/267148/

Stagnant/declining wages for the masses while the 0.1% are swimming in $ is due primarily to crony capitalism. Politics are controlled by the monied interests, and you and I ain’t them.

Wow Jeff. I sure would hate to live in another country you are talking about that’s worse than American taxation considering what we pay.

Some of the Taxes Americans Pay Each Year

If you don’t read it all, go to the ending then you may want to. Isn’t this amazing?

1. Accounts Receivable Tax

2. Building Permit Tax

3. Capital Gains Tax

4. CDL license Tax

5. Cigarette Tax

6. Corporate Income Tax

7. Court Fines (indirect taxes)

8. Cat and Dog License Tax

9. Federal Income Tax

10. Federal Unemployment Tax (FUTA)

11. Fishing License Tax

12. Food License Tax

13. Fuel permit tax

14. Gasoline Tax (42 cents per gallon)

15. Hunting License Tax

16. Inheritance Tax Interest expense (tax on the money)

17. Inventory tax IRS Interest Charges (tax on top of tax)

18. IRS Penalties (tax on top of tax)

19. Liquor Tax

20. Local Income Tax

21. Luxury Taxes

22. Marriage License Tax

23. Medicare Tax

24. Property Tax

25. Real Estate Tax

26. Septic Permit Tax

27. Service Charge Taxes

28. Social Security Tax

29. Road Usage Taxes (Truckers)

30. Sales Taxes

31. Recreational Vehicle Tax

32. Road Toll Booth Taxes

33. School Tax

34. State Income Tax

35. State Unemployment Tax (SUTA)

36. Telephone federal excise tax

37. Telephone federal universal service fee tax

38. Telephone federal, state and local surcharge taxes

39. Telephone minimum usage surcharge tax

40. Telephone recurring and non-recurring charges tax

41. Telephone state and local tax

42. Telephone usage charge tax

43. Toll Bridge Taxes

44. Toll Tunnel Taxes

45. Traffic Fines (indirect taxation)

46. Trailer registration tax

47. Utility Taxes

48. Vehicle License Registration Tax

49. Vehicle Sales Tax

50. Watercraft registration Tax

51. Well Permit Tax

52. Workers Compensation Tax

Note a complete list some states, counties and cities may have additional taxes.

And anything that is a “FEE†is also a TAX!

And anything that is a “PENALTY†is also a TAX!

Not one of these taxes existed 100 years ago and our nation was the most prosperous in the world, had absolutely no national debt had the largest middle class in the world and Mom stayed home to raise the kids. What the heck happened?

Jay, did you follow Jeff’s link?

If you did, you would have seen that out of 34 OECD countries, when you look at the TOTAL share of taxes in proportion to GDP (which is what you are getting at with your list of 50+ kinds of taxes), we pay very nearly the lowest in total taxes. We are #31 out of 34, and the only OECD countries that have a lower tax “take” are Turkey, Chile, and Mexico.

Nobody likes paying taxes, but please don’t exaggerate how much we pay. If you really think life is no better now than 100 years ago, I can’t help you, I guess you’re out of luck. Maybe there’s an island for you somewhere?

Jeff,

I am afraid Jay is a 100% correct in his assessment. The fact that we have crony capitalism is also correct. One does not exclude the other; actually they go hand in hand. The more we tax, the bigger the government grows and more leaches will be around it. All this wealth transfer from the productive private sector of the economy to the central government and all the leaches/lobists around it takes all the demand out from the middle class.

Obamacare is also a tax (Supreme Court said so and it is the only legal leg to stand on). As any other tax it is enforced by the IRS. It is the most regressive form of taxation slammed on the back of the middle class. It is the biggest wealth transfer from the middle class to the insurance companies owned by the banking cabal from Wall Street. For this tax, the democrats are 100% responsible since no republican voted for it. It is just a fact not that I keep the RINOs in high regard. I am just a political atheist who is looking at the facts.

All these taxes make it almost impossible for the middle class to save for a downpayment to buy a house. It is just going to get worse.

Etherist,

We don’t live better today because we pay more taxes. It is because of technological development.

Jay did not exagerate anything. He stated the taxes we pay which are facts not exagerations. Just because another country is worse managed than US and taxes more does not make the taxation we have in US right. Another thing you don’t mention is the fact that those countries who tax more or the same as US at least give something back to the population like free higher education (so young people will not be buried under a mountain of debt with no way out like bankruptcy), free medical assistance and others.

In US most of the taxes go to the banker’s wars for world supremacy (enslavement of all for the benefit of few psychopaths).

As much as you like to see higher taxes, I believe they should be way less and the government way smaller. What we have now is suffocating the private sector – kill the goose who is laying the golden egg. The functions delegated by the constitution to the federal government should be all allowed. The rest it must be up to the states if they want to tax more or less.

Jay, you can make a list as long as Route 66, America overall is still the best bang for the buck. many folks in this country never pay taxes they are scam artist and will never see a fine or jail time

” share of taxes in proportion to GDP”

And there’s the lie: GDP isn’t income to anyone so taxes related to GDP is irrelevant random number which has no connection at all to tax burden for a wage earner.

Big money (like stock exchange or currency trade) rotate hundreds of billions with 0 tax, all accounted into GDP, lowering tax-% by not paying any taxes. It’s a blatant lie to use that % and claim it is any way related to taxes wage earner pays.

Total tax burden for a wage earner around here it’s about 55%(not US obviously): So for every dollar you earn, about 55 cents is straight out of your pocket as tax, in one form or another.

That 45% pays your house and living … not much left for those and no wonder we are second poorest in OECD, when measured by actual net income relative to cost of living.

Jay and Builder: there wasn’t much of a middle class. That started in the late 40s/early 50s. I wonder how much income tax rates were around then … hmm, if only there was some sort of search engine that could help you figure it out.

Guess you’re out of luck. Oh, wait, I found something.

http://www.google.com/imgres?imgurl=http://www.aei.org/wp-content/uploads/2012/04/041812wsj.jpg&imgrefurl=http://www.aei.org/publication/why-we-cant-go-back-to-sky-high-1950s-tax-rates/&h=450&w=783&tbnid=t6F06Pl-EIgrvM:&zoom=1&tbnh=105&tbnw=184&usg=__j1bsby3BbhIxxwtBjK2QoJdg7no=&docid=E45rFzfskQvffM

1951-1963: the lowest tax rate was 20%, the highest was 91% (I know, nobody paid the highest rate, blah blah blah)

Seriously. Bring data next time?

Just a little over the top; that list of yours. Seriously, how many of these taxes or fees affects you. If all of these taxes disappeared tomorrow housing prices would factor that in and rise according to how much cash you had to spend each month. Not to mention that all the services you take for granted would disappear. America was prosperous 100 years ago because it had a massive reserve of natural resources and a manufacturing base that distributed those refined resources both within the US and abroad. Those resources are now depleted and we have marginal manufacturing output.

“Seriously, how many of these taxes or fees affects you. ”

The answer is: most of them affects most of the people one way or another.

In terms of natural resources we still have plenty and Canada at the north still has enough for our manufacturing.

Clinton should not have signed NAFTA (he had a pen to VETO).

If we don’t have enough natural resources, why do the liberals want to give amnesty to over 10 million more and promote immigration??? Those millions more, aren’t they going to drain more resources?

Let Jay cut and paste in peace.

In Denver it is ridiculous. I bought some property in a desirable mountain community close to The metro area and am building my own house. So grateful to have my property and house. the prices on houses and rent for apartments is out of control. There are so many people moving here it is crazy. The one good thing is our economy here in Denver is better than great. But… it’s just a matter of time before the bubble bursts. This is not sustainable. In a neighborhood in North Denver which the yuppies call the “Highlands” tiny houses are going for 4 to 500k. And they are selling like hotcakes. Idiots… these tiny little houses are not worth a half million dollars. It ought to be interesting when the stuff hits the fan and we see things worse than the first housing crisis.

Would this be the same Highlands neighborhood as defined here: http://www.denver.org/about-denver/denver-neighborhoods/highlands/

And would any of those hotcakes include these properties that aren’t selling and reducing ask?

https://www.redfin.com/CO/Denver/3338-Pecos-St-80211/home/34074765#property-history

https://www.redfin.com/CO/Denver/2538-W-37th-Ave-80211/home/57171629#property-history

https://www.redfin.com/CO/Denver/3536-Tejon-St-80211/home/63071053#property-history

https://www.redfin.com/CO/Denver/3721-Lipan-St-80211/home/34074388#property-history

https://www.redfin.com/CO/Denver/3515-Tejon-St-80211/home/34074692#property-history

https://www.redfin.com/CO/Denver/2200-W-29th-Ave-80211/unit-205/home/34032207#property-history

There are more, but you get the point.

Yes, you are correct. The properties you linked to are in the neighborhood in and around the trendy Highlands neighborhood on the north west end of Denver. I live nearby and drive through on my way to work. Many of these homes have had signs in the yard for several weeks; seems it’s only a matter of time before prices soften a bit.

check the HOA on that one on 29th st. Really 360 a month – look at this as an added tax / levy for living there. And what does one get for an HOA of that magnitude.

I worked in Highlands many years ago in the early 80’s – the place struggled – mostly latinos in what are called I think the Denver duplex – generally a brick bungalow double up. Nabe was quite poor at the time. The nabe was rough at best. No idea what it is like these days.

Yep – just a matter of time – if you go south of the 470 loop there are high end homes there stacking up like cord wood with more and more inventory in that high end realm coming on line each week.

I was in Denver a month ago looking about and the new inventory when it is available is way out of line on a s.f. basis than what a normal market would bear – many of these homes – think Leyden Ranch in Arvada are prices near 250.00 a s.f. and up – this for new construction – historically this cannot be sustained.

Spoke with a builder there about a development south near Larkspur. Seems that as land continues to escalate in price builders move further and further out looking for value – deal is it is difficult to justify an extra 30 to 40 mins a day on the road to simply get to a job. Makes me wonder when the bubble will pop and what will happen to all the land / homes currently held by the big home builders who now are in essence bankrupt based on earnings.

My entire family is from North Denver and still lives in that area, but only because their homes have been paid off since the mid-1990’s. Likewise, we have been renting a small place in that area for the last three years and got in before rent went crazy. Our rent has not increased, but our landlord is selling, so we are moving into my parents’ home in order to save money for having a family. I don’t know if we will ever buy in Denver, and I think I’m okay with that for now. You are right: Prices are too high for what choices are available.

As usual, another great post from the doctor.

This is a must read article from the OC Register titled, “Home prices hamper job recruitment in Orange County.” It touches on everything people are discussing on this blog regarding young adults and rising home prices.

http://www.ocregister.com/articles/county-656720-orange-housing.html

Article hits so close to home.. Thanks for sharing

“Orange County’s 25- to 34-year-old population fell 7 percent from 2000 to 2013, while the total population increased 9 percent, U.S. census figures show… Meanwhile, Riverside County’s 25- to 34-year-old population jumped 49 percent from 2000 to 2013, census figures show.”

Describes me to a T. Spent a big chunk of my childhood in the OC, did my undergrad and master’s there. Spent 7 years of my professional life living and working there. But when it came time to buy a house for the wife and kid, there was absolutely nothing affordable.

So found a comparable job in Riverside and waved goodbye.

I always love reading the blog posts here and all of the comments. Together we have a lot of sources of data and information that help us stay informed about what is really going on. Awhile back I wrote a letter to Mark Takano who is the district 41 representative for Riverside. He is championing the cause in Congress for more oversight and investigation into rental backed securities. You can google the security product that was first released by private equity firms back in November of 2013. It’s a new version of mortgage backed securities only this time it’s rental backed. Unfortunately you have two forces working against the average homebuyer: investor demand for rentalhouses that can be packaged and sold into the securities market and a shortage in housing due to baby boomers and their children wanting separate housing. If you think about it many baby boomer children lived at home up until about 6 years ago when the majority reached the age to get a job and look for a place to live. While many stay at home at first, eventually they move out and find a place. There are many articles that highlight the housing shortage in la which is mostly due to young people finally moving out even if that means sharing a room with another person (by 25 most people are willing to do anything to move out). Those two issues have created the worst housing scenario in la and other areas of SoCal. I do think a correction of some sort will happen, hopefully sooner rather than later. I like to keep track of the yelp reviews for invitation homes and American homes for rent as these were some of the funds that own many rental units in SoCal. Google it for yourself. The tenants have nothing good to say and based on glass door reviews the employees aren’t impressd either. I think its a matter of time before we see the housing volume currently owned by rental backed securities come back to the market. These funds can’t perform if they don’t maintain 94% occupancy in all of their units. Read the reviews of the tenants and make your own judgement call about when the next housing dip will return.

You might be interested to check out Vernon Smith’s theory on balance sheet recessions if you’re not already familiar with it. My take is that there are a lot of mortgagors in SoCal still stuck upside down and owners not in a good position to sell due to out of whack pricing combined with lackluster inventory they’d have to choose from for a replacement property. Low inventory and therefore inflated pricing has been and continues to be reinforced by the shadow inventory situation.

Still a lot of uncertainty out there so many choose to rent or some other alternative because they don’t want to become one of those upside down or stuck mortgagors.

There are many articles that highlight the housing shortage in LA which is mostly due to young people finally moving out? Maybe a bigger factor is the surge in legal immigrants and undocumented immigrants (aka illegal aliens) who are pouring into California thanks to open borders and California’s generous entitlement benefits? In Los Angeles County an estimated 1 in 10 residents is here illegally.

http://www.csmonitor.com/USA/Politics/2013/0508/In-Los-Angeles-1-in-10-residents-is-an-illegal-immigrant-study-says

30 Yr. Mortgage Under Chem Trail Spraying ?

Putting aside the anecdotes, here’s where the lower half of the L.A. county market stands:

Doc’s last post: 15,060 properties for sale; 4,010 have had at least one reduction.

This post: 13,980 properties for sale; 4,050 have had at least one reduction.

Flips in Venice and Highland Park with multiple ask reductions month after month – check.

> $1MM properties in “prime” coastal areas with multiple ask reductions month after month – check.

Puts into question the “rising home prices” narrative in its continuing sense.

As for the Denver market which keeps getting mentioned, I’m not very familiar with it but a quick check of pricing activity tells a very similar story. Loads of price reductions all over the map from low to high-end which hardly makes for a bullish tale of home prices continuing to rise in the near term. It appears that there is a lot of crowding around the exits.

My wife and I have been looking at new homes here in the Inland Empire and you definitely get allot more for your money with the new home. We looked at a 2800+ sq foot 4 bdrm 2.5 bath new home for $528,000. Then we decided to see what used homes would cost. The used homes were priced a good $60k more! The new homes come with solar, tank less water heaters, three car garage, all the latest energy efficient bells and whistles, granite counter tops, tons of kitchen cabinets, etc. I even saw used homes in pricier areas like Diamond Bar going for $788,000. This is for a 1970, 1700 sq foot piece of shit. I will be buying new as it seems the builders are throwing everything in to sell their new homes. Used home prices here in Socal are still in a delusional state as far as I’m concerned. But I guess if you still have morons buying these overpriced termite hotels then we will never see an end to this madness.

Are you and your wife both employed in that area, or telecommute? If not, the commute to OC or LA would not be worth it.

Just make sure you’re not one of those morons who buys an overpriced home. Maybe new homes are a relatively better value than used, but that doesn’t necessarily mean that buying now is a smart thing to do.

You’re delusional if you are comparing Diamond Bar to the IE. Also, if you are looking at new home construction vs. resale you are going to eat it in Mello Roos, higher tx rates and/or HOA dues.

Agree 100%.

1. Diamond Bar is not in the IE.

2. Diamond Bar is on the want list for wealthy Asian buyers.

3. The Diamond Bar home would have sold if priced at $888,888.88. 🙂

Diamond Bar is not the IE? Yet if you go a mile east into Chino, you are in the IE.

So….

Josh, Chino to Diamond Bar is 9 miles. Read Blankfein’s post. Judging by your response, you don’t know the area.

Diamond Bar is where one of my favorite female US Soccer players grew up (with her two pretty sisters); Alex Morgan.

Paying 500K plus to live in the IE just doesn’t sound right to me. If things take another tank, rest assured the IE will go down the hardest…just like last time. Most of socal is built out so “used” homes are the only ones you’ll find in many areas. Just because a house is new, doesn’t mean it is better. Builders are in it to make a profit, every corner that can legally be cut will!

Houston Texas real estate market is still hot despite low oil prices,more homes have sold this march than march of last year even though oil companies are laying off people.seems like the experts who said houston has a diverse economy are correct,while others said there is gonna be doom and gloom.more people overseas with big money are buying up real estate and houston is the fastest growing state in america.plu. the american and overseas investors are buying up properties.people are complaining about the traffic in Houston,dallas and austin and since texas will add 30 million plus people by 2050 traffic is gonna be even worse.high speed rail will ease the problem.and real estate will be even more pricey.

Runon sentence runon sentence obviosly typed from phone or by someone who doesn’t care if people can even read what is typed.

Seriously dude?

Not to pick on you but according to Redfin, less homes sold this past March in Harris county than in March of 2013. Aside from that, if it’s such a hot market, why would 30% of properties presently on the market resort to reducing ask?

A quick perusal of properties with ask reductions reveal a similar story as what’s being told in SoCal and Denver. Loads of homes from lower to higher end, in various nabes (including the currently hot and trendy) of various types and styles, organics, flips and new construction with ask reductions week after week and month after month.

We keep getting anecdotal reports of how hot things are and how there is so much money rushing in, but when one takes a look at what’s out there actually listed on the market, plenty of homes to be had are not flying off of the shelves. And this is in a ZIRP environment with historically low inventory.

February home sales was down from last year due to lack of inventory,but march home sales are way up from last March because of more homeowners putting their homes on the market.in 2013 there was way more inventory than in 2014 2015.the hot neighborhoods in houston houses cost way more than in 2011,even with a price reduction in montrose,the galleria,etc doesn’t mean your getting the same deal of two years ago.popular hoods in houston home values have gone up a $100K or more per year.and u still have to make money to buy in those hoods.gentrification is taking place in Houston i bought a big house before the neighborhood got popular,know builders are charging $100’s and they are selling even if they reduced the price your not going to get the same deal i got in 2011,im a urban pioneer and the new homes that cost way more and are smaller.that’s the great benefit of buying in a neighborhood before it gets very popular.go check out houston.culturemap.com real estate to read the march sales report.156k people moved to Houston last year and they are still coming here in droves.since oil is down the petrol chemicals industry is going to be huge.google bizjournals.com Houston to read the story.

So what you’re claiming is that Redfin’s numbers are incorrect?

Theres more rich people ever before due to the run up in the stock market,skyrocketing home values so people can use that equity to buy second homes.google:the rise of the non working rich,we are experiencing the biggest wealth transfer in u.s. history.the kids didn’t do nothing but being born into the right family.these are the people thats buying up real estate in cali,texas and other popular cities.many are so rich they have a ccouple of homes in different cities.and rich foreigners are coming here in droves.its true buying a new house cost way more than just a few years ago and only people who make money are are the builders mind since materials and land has gone up,also population growth is driving up home values.so the builders are ignoring the lower class home buyers.buying a new house is becoming a luxury for only the higher classes of America and overseas.

I missed up some of my sentences,getting a lil sleepy.lol

Recent stats from Corelogic;

Home prices, including distressed sales, rose by 5.6% from February 2014 to February 2015, according to CoreLogic. On a month-over-month basis, prices were up 1.1%. “Since the second half of 2014, the dwindling supply of affordable inventory has led to stabilization in home price growth with a particular uptick in the low-end home price growth over the last two months,†said a CoreLogic spokesperson.

I meant to say builders are charging SEVERAL $100’s more in my hood.i bought way before gentrification,some people don’t like buying a house when the area isn’t popular are going to pay way more when the neighborhood becomes hot,the investors want a piece of the action and the demand from homebuyers drive up prices too.being a urban pioneer is like the same way if a person bought Apple stock before it got real hot and took off $$$.lol

Well maybe California is not overpriced:

Average house price in Vancouver will climb to $2.1 million within 15 years.

https://ca.finance.yahoo.com/news/vancouver-homes-prices-climb-2-044114809.html

A new housing report from the VanCity Credit Union says the average house price in Vancouver will climb to $2.1 million within 15 years.

Andy Broderick, Vancity’s vice-president of community investment, says future homebuyers who want to stay in the Lower Mainland should lower their expectations of what they’ll be able to afford to buy.

“We’ll be looking at more and more comfort with condo ownership, with living in denser conditions,” says Broderick.

Crystal ball reading.

It’s a new paradigm, plywood only goes up in value!! Anyone who doesn’t buy now will be priced out forever!!!

Compare and contrast what the Dr and all of you are saying on this blog with what the Establishment media is telling us: little green shoots, economy is fine and growing, no discussion of bubbles in the stock market, sub prime auto loans and personal debt. Just keep buying over-priced houses, cars and diplomas. You all recognize the disconnect. Proceed with caution or refuse to play this game.

But in the same vein, I see few questions about the actual added “value” of rape and tape, cheap and cheerful Home Depot style “high end” re-muddles as if that flash ensures a “decent” place to live because it’s “updated”.

I question the quality of the work done in these “flips”. Another part of the minefield and the bubble. New paint and granite counter tops distract and suddenly it’s okay to buy what is still a crap shack with a little lip gloss at a 50% mark up.

Readers are right to be cautious in this market and to not let yourselves fall prey to emotional decision making. Somehow the raw crap shack looks a lot more honest, as does a rental that meets one’s needs.

Leave a Reply