The economics of new home sales: New home prices near record highs but builders are reluctant to build on low sales volume.

Housing inventory continues to remain tight across the United States. It would seem logical that home builders would be taking the plunge to build homes for future buyers. But that is a bet that is looking into the future. Builders continue to bet with their budgets that the United States is deep in a rental trend. Keep in mind that new home prices are going up steadily. Yet the push up is coming on lower volume and higher priced homes going to a smaller portion of the population. Investors are largely not interested in new homes with higher premium prices. They are largely focused on discounted prices from existing home sales. The big investors are largely out of the real estate play. Going back to every recovery from the 1960s, new home sales typically take off once the recession is officially over. This recession officially ended in the summer of 2009, nearly six years ago and still there is no sign that new home sales are leading this recovery.

New home prices up on tight supply

I think it is important to fully understand why new home sales are bucking a 60 year trend here. After a recession, with jobs and incomes picking up, family formation leads to the desire of buying new homes. The pattern is really unmistakable and new home building is a large catalyst for the economy: construction jobs boom, big ticket item purchases surge, and new communities rise in the McMansionvilles across the US. Yet this isn’t happening during this recovery.

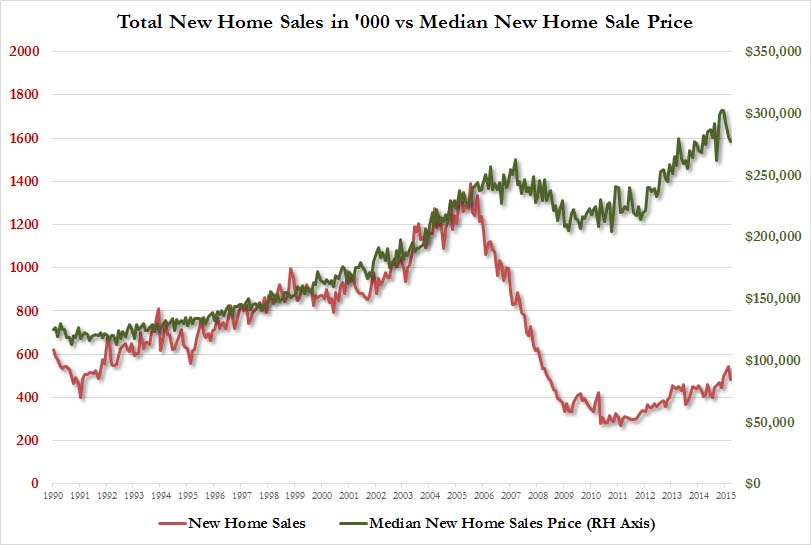

The real estate market recovered largely because of big investor money surging into the market. What we now see is low supply pushing up prices. The new home sale market is a clear example:

Prices are up significantly for new homes but volume remains weak. This is at a time when the population rate continues to grow. What gives? Try adding 10 million new rental households in the last decade while losing a net of 1 million homeowner households. You have Millennials moving back home because they can’t afford local market rents.

Builders are not fools here and those that survived the last crash are extremely cautious in moving forward with big expansions.

Builders not jumping in

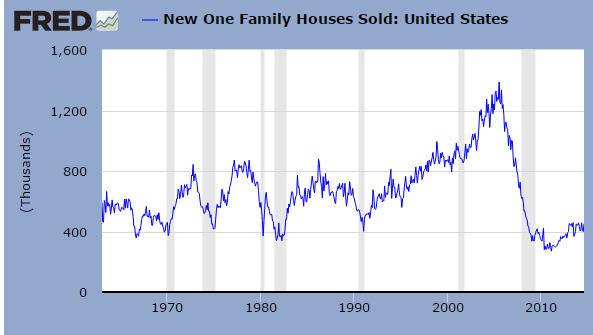

The pattern over the last 60 years is worth looking at carefully:

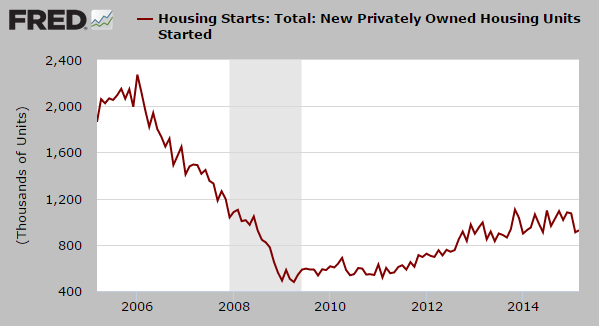

The grey bars signify recessions. Virtually in every case, new home sales jumped right when the recession was officially over. It isn’t even a subtle move. This is a clear movement. Yet this is not happening this time. And housing starts are a better forward looking indicator of what is coming down the pipeline:

Housing starts remain weak despite the healthy trend in rising prices for new homes. Builders are betting on a continuation of more rental household formation.

Rental nation building

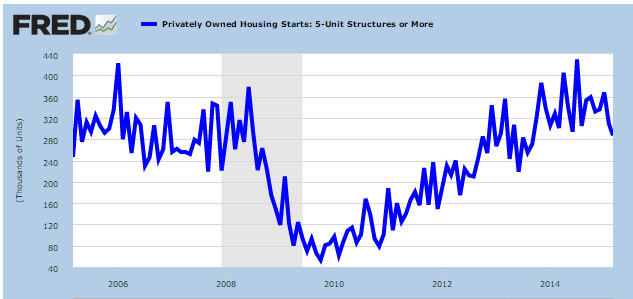

While housing starts remain weak, mulit-unit housing starts are doing fairly well:

The demand is for more rental units and builders are placing their money here. It is fascinating that for the first time in 60 years, this recovery is not seeing any significant jump in new home sales or housing starts. This should be a very telling sign of how odd this “market†has become. All indicators would suggest that builders should dive in and build (low supply, higher prices). Yet builders realize the underlying funny money math here – artificially low rates, investor demand, and stagnant household wages. In the end, this becomes a pseudo-market and builders protecting their money are doing what you would logically expect, chasing the trend with what data they have. And to them, the money is to be had on building more rental units.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

109 Responses to “The economics of new home sales: New home prices near record highs but builders are reluctant to build on low sales volume.”

Well… 30 years ago it was in the interest of the huge boomer generation to have less zoning and cheap housing. Today the interest of the huge boomer generation is to have a lot of zoning so that millenials have to pay some significant entrance fee to get into the housing market, and of course that fee partly ends up in the pockets of the boomers who see their house prices go up. Or their tax go down as cities earn lots of money selling tiny bits of land. Could that explain something? I’m living in Europe, it’s a trend I’m seeing over there so it might be the same.

The pseudo-market market has reached local TV advertising. (Los Angeles/Orange County)

An investment group is offering to pay cash, quick escrow, etc for “any” home.

Are these folks low-balling for a quick turn? Or, do they see something for the long term?

Underwater folks and many regular sellers continue see that there is no buyers market, because there really are no buyers, what you have is no traffic at all! The investors are really smelling blood and hope the thought of cash and as is will entice many to say something is better then sitting a year with no lookers and take the big hit.

Makes all perfect sense. Thanks Dr. HB for the excellent article.

@Octal77 Anyone or group offering to buy your home for cash will want it a fairly good discount to going prices.

This entire conversation revolves around peoples lack of income to keep up with current prices. Everybody understands this issue, so why would builders over produce a commodity in a environment where rates may increase soon and what few sales there are drop of a cliff next.

Working in the mortgage biz, my phones have gone silent with just a .50% increase in rates. Going from 3.5% to 4.5% (we are half way there) could mean a very quiet summer for me and others in the RE industries.

Time to wax up my surfboards and hit the beach so I don’t go bonkers with boredom.

jim.. I’m sure you have seen this scenario, a friend of ours went to buy a home about 770k. They can put down (140k), have a 695 credit score he says, a $155k combine income and about $65k left in the bank. No children, they are 42 and 38 years old.

They always get a denial for a loan, they say the ratio doesn’t meet guidelines at this time. I say the banks don’t want to loan unless it is a total sure thing causing a lot of this housing problem what do you think of their portifiio?

robert, I can easily see why your friends keep getting denied.

For starters, a $600K mortgage is really too much for people with a $155K combined income. I don’t give a damn how low the interest rates are- a mortgage that is 4X your income is too large…

… especially when your credit rating is marginal. While 695 is not a bad credit rating, it is also not a good one.

Thirdly, how much “back end” debt do they have? Do they have car loans? Credit card debt? Lingering college loans? If they have no other debt, they might be able to slip in under the door on a large mortgage with mediocre credit, especially with their large down payment, but additional debt such as car loans and card debt could be the determining factor that kills their loan.

Lastly, anything the least bit negative will quash their chances at these low interest rates, because, as other posters have pointed out, the lenders know that these extremely low rates are unsustainable, and they do not want to be bagged with a portfolio stuffed with 4% loans in a time when they might be needing to pay 5% or more interest to savers.. which time could be coming upon us sooner than anyone things, and could happen much faster than anyone can imagine- how well do I remember how quickly Volker ramped up rates to levels unimaginable in the early 80s – I knew people who were paying 16% for mortgages at that time, and I met other, much luckier, people who were able to buy tax -exempt AAA pre-sunk municipal bonds with no call, and maturities 20 years out, that paid over 10%. Can you even imagine that?

The debt ratios are 28/36. 28% for PITI and 8% for short term debts like credit cards and car loans. Student loans are lumped in here, also. If the amount is over 8%, it is subtracted from the 28% allowed for the house.

I am in the lending industry (broker).

That is an easy deal, whether it is “high balance” conventional or “Jumbo”. The ratios are more than adequate, and the credit score is sufficient. Tell them to go to a broker or another lender/bank.

With a 695 and that much cash on hand, it seems apparent that they’ve been much better at saving than paying back existing obligations.

Very accurate assesment, Doc!

As a builder I stated on this blog many times how a builder thinks. At the present time I am not building any SFH. I build 100% multi family.

People complain about the high prices for new SFH, without considering that all input prices went up year after year. If people can’t buy, they have to rent unless they move back with their parents or sleep under the bridge. You don’t have to be a rocket scientist to get to that conclusion.

New SFH can not be sold for less unless the builder goes bankrupt and the bank sells them below cost.

So just exactly how much profit do builders have to make in order to start building SFH again?

Where I live (north SD county) there are no new SFH under $1mil being built. And $1mil is a 2,000 sq ft basic builder home on a postage stamp lot.

It’s a little hard to believe that there is ZERO profit if these homes were selling for $800k. That’s already $400/sq ft.

I have never met a builder who doesn’t have a $80k work truck, several luxury cars and a ridiculously ostentatious McMansion.

Regarding this: “New SFH can not be sold for less unless the builder goes bankrupt and the bank sells them below cost” …. Maybe it’s a little more accurate to say that builder profit at $400/sq ft SFH just doesn’t support the ostentatious lifestyle that builders have become accustomed to for the last 20 years?

And don’t try to say that it’s “high labor costs” that drive down construction costs. I’ve seen the labor crews building the $1mil new construction around here. They may as well have been scooped up each morning at the local Home Depot parking lot.

Land cost? Sure, these postage size lots cost as much as $100k when purchased in bulk and sub divided (15+ homes on a few acres). Maybe $200k for the small developments closer to the beach.

Permit cost? Sure, building in SoCal is expensive. But have permit costs really increased 400% in the last 15 years?

Materials costs? Ditto. 400% increase in last 15 years? Please.

I rehab homes. For all the builders who blame their lack of building on “high materials cost” …. even the yahoo flippers who shop at home depot see right through that one.

The builders have the money to start with or they would not have money to buid. They would afford the big truck with or without building.

I told you the reality. If you don’t believe me, be my guest and start building. You don’t have to work; just hire people since based on your opinion the profits are so high. Do you think that I see profit in building SFH and I just refuse to take the profit?!!!!….Your comments do not make any sense if you understand business 101. I do have capital and I can borrow. That is not the issue. I hate to leave profit on the table but unfortunately there is no profit to leave at current prices. Yes, if you bought land long time ago at lower prices, you can make money – on the land not on the building. You might as well sell the land; why bother with the construction and liability.

I actually worked for a private equity fund that invested in for sale residential development, so I can explain to you exactly why even though home prices have gone up a lot, you are seeing only a moderate increase in new SFH construction, the reason is a combination of all the things you listed and the cost of capital. You have to include the cost of raising the equity and the debt for large scale residential projects. There are very few folks out there willing to provide you with those funds given what happened just a few years ago, and those that will are going to charge you for it. The problem is, in development in general, you have to predict future cash flows going several years out, over your entitlement and construction timeline. In CA, that could be years and years and years depending on the exactly jurisdiction. What are home prices going to be 3 years from now? 5 years from now? What will mortgage rates be? Who knows. With multifamily development, apartment rents in most cities are typically very predictable, ever several years out, and not as susceptible to large fluctuations. So you can find investors much more willing to fund those kinds of projects. So in order to compensate investors for taking what they perceive to be increased risk in financing the development of SFR and condo projects, you need higher returns which translate into higher prices.

Dean,

Thank you for adding your comments to the dilema the builders face. They are true for SoCal. If it would be so easy like some blogger think it is, then everyone would get into building. They know where the cheap labor is (outside Home Depot), they know where the cheap materials are (inside Home Depot), I don’t know what stops them from making the trip to Home Depot and get rich with those $400/sf buildings.

Now, in my case I can get financing. That is not my issue. The problem is that I don’t see how I can pay for interest and loan fees given the price of inputs and house prices. Most of what the buyer pays in Socal is land and regulatory compliance cost not the construction per se.

The same bloggers who suggest using the labor in front of Home Depot complain about the crappy workmanship on some houses they can afford. If you pay peanuts you get monkies. You can’t hire skilled labor for peanuts. Those skilled laborers are expensive and in high demand, especialy if they are drug free and reliable. But they are worth what they ask.

Land is expensive because the population in desirable areas is very high and they are plenty of people with resources to bid up the price of land. Where the demand is lower the cost of land decreases but so the price of homes. So, the builder is back to square one.

It’s almost cute how builders and their like-minded followers have taken to this blog to defend their role in the current housing debacle.

Hey traditionally middle class wage earners who want to own an average family home in California! You’re not alone! The builders are victims too!

It’s not the builders’ fault they are only building high density crap towers! It’s the only way they can afford to pay for their extravagant homes and cars, er, ex-wives and child support, er, modest middle class home and families? Seriously?

Are you really buying this, blog readers? Cause if so, I know a Builder who will build ya a real nice house for over market value. He’s got the lot all picked out for you and everything!

“Investors are largely not interested in new homes with higher premium prices.” There you have it, low investor demand = weak market. It appears that is becoming the case in the resale market as well. This should be a slow summer.

The problem is that these new houses are way too expensive for 90% of the people. It’s not just the price of the land + the price of the build. $700000 is a lot. Even $600000 is a lot. Property taxes are high with these high prices. Tustin is putting something like $4000/yr mello-roos on their new small sfrs and condos. Add the HOA and you are looking somewhere around $1200/mo for Property Tax+Mello-Roos+HOA. Basically, you need over $4000/mo to pay for your house on a 30 year loan for something under 1800sqft. Good luck if you have a family with kids.

@Jamaal Johnson: I agree, a 1.6 to 1.8 percent tax rate (standard property tax + Mello-Roos) + HOA can add up to a ridiculous cost just to “own” a house/condo. $1,200 per month (a very realistic figure you noted) can pay for a big chunk of a condo rental, especially if you don’t need to live in a premium area. The money you save by renting versus buying can probably be put to better use under the mattress (savings, CDs, whatever) until prices deflate.

And … minimum wage, at least in LA, just went up to $15/hr. Good luck affording those tacos on Tuesday!

^^^one of the main reasons resale homes with the standard tax rate in desirable areas continue to sell

^^^ At a certain point an equilibrium occurs between the two on pricing, so it’s a moot point.

Could the reason that the builders are not building, because there is no more open large undeveloped pieces of land in the areas with low inventory?

You can see the same thing in New York City and San Francisco. Prices increasing, and no more land to develop new homes.

Could this be the reason why the trend is being broken for the first time in 60 years?

Actually….

No…

Blert- how long before the yuan becomes the new world reserve currency. I think there was an article on Barron’s.

Thanks

i heard that in order to be a reserve currency you need a large bond market which china does not have

Why don’t you ask that question on a China economics blog? Try Michael Pettis’ blog for intelligent debate around that subject.

No.

Something I don’t understand, and I hope someone here can enlighten me, is why people in SoCal think housing should be “affordable.” I don’t see other prime locations, and I’m thinking outside the US here, that provide housing at prices affordable to the locals. Once an area is “discovered” as a great place to be, then prices go through the roof as wealthy people buy second homes, investors jump in, etc. Isn’t this how it always goes? The locals get displaced as the wealthy people buy them out, and the locals move further away and commute in?

Actually, the city of Santa Monica insists that with every new multi-unit construction, a few units be set-aside for low-income rentals.

So wealthy Santa Monicans do indeed import a certain amount of section 8 poor people every year. They don’t get houses, but they do get cheap rentals.

Some might say it’s because rich but progressive Santa Monicans want to share their city’s wealth. But a cynic might say it’s because the ruling Santa Monicans for Renters Rights political party want to ensure their voter base keeps growing.

Not sure who those people are you’re referring to but the main point of contention on this blog revolves around perceived value. There are those willing to pay for anything at any price, so what?

There’s actually quite a bit of land in the Bay Area – it’s just not being used for housing. People complain about the environmentalists stopping construction. Wildlife preserves are a pretty small part of the equation – you can actually see some of these along the highways in the Bay Area and it’s paltry. There is still rural land near Silicon Valley over the hills near the ocean, land in the hills above Oakland and San Jose, Marin has plenty of land, south of SF there is a lot of empty land as well. Smaller municipalities also have semi-developed areas that could take more housing like a big part of the Tri-Valley.

It’s a combination of other factors that’s making it expensive to buy land to build. Positive feedback loops sellers holding for greater profits, owners locked in at a high price (can’t sell at reasonable price so they hold on), low holding costs to keep property empty (prop 13), AirBNB effect, investors, low interest rates, etc. There’s also this “The Bay Area is the only place in the entire world that’s worth living in” thinking that keeps people holding on for dear life in this place.

In LA all one needs to do is make the drive on La Cienega between Jefferson and La Tijera to see that the supposition of LA being built out is total bullshit.

I wonder what will happen when the Chinese finally stop buying up America?

tick tock tick tock

Oh almost forgot I hope you all prepped for the new recession?

Its gonna be a fun one!

Been in construction for over 25 years in SoCal, and have seen it all. Our work presently is ONLY in high income enclave neighborhoods.. Bev Hills, Palisades, Manhatttan Beach, etc. OR massive condo development projects such as Playa Vista/DTLA jobs..This ‘boom’ is different this time, way different, in that the work is not evenly spread out to outlying areas east of us, as was the case 10ish years ago. Very little bank sponsored work, no mom and pop credit lines..owners or investors paying cash for our services predominantly.

Good comment.

Could you please explain to our fellow bloggers since the profits for builders are so high why they refuse to take advantage of those high prices/high profits?

According to the bloggers the builders are not greedy enogh to build houses and they just let the profits “on the table”

I don’t know about your situation. In my case the financing is not an issue. Lenders beg me to borrow. I don’t borrow because I don’t see any profit in it and can’t pay the interest on the loan even if I build for free.

I can still make money in multifamily and that is what I am doing.

If other bloggers are better and smarter than me, by all means go in and build SFR and get rich. No envy from my part.

I’ve noticed several instances wherein someone (a builder, I suppose) is offering a plot of land on Redfin, along with a pre-approved architectural plan/building permit for a house. You can buy the land and the hire the builder at the same time.

Sometimes the lot is empty. Sometimes there’s a tear-done house on it, but the seller/builder has already obtain a demolition permit.

It seems an interesting way for the builder to avoid the risk of actually building the house before selling it.

SOL,

You are right. I did that many times and there were very few bites bites. Once in a blue moon, if the location is unbeatable, a milionaire comes along and pays for it, usualy above the market, just to get what he wants.

The fact remains that in most locations the cost of land plus building cost is above the market. That is part of the reason (not the whole reason) why we saw so much investor activity in RE. They know that if the builders can’t build for many years, eventually you have shortage and rents go through the roof.

Isn’t it neat how everyone blames someone else for the current housing situation? The realtors blame the builders for not building and the lenders for not lending. The lenders blame the builders. The builders blame… well, whatever is most convenient. And of course everyone blames CA and the Fed.

It’s funny how “materials costs are just too high to build†yet houses get built and sold in other states for $50/sq ft.

And how builders are apparently so wealthy that they can self-finance, but still don’t, even though they’re being “begged†to do so, because financing at the lowest rates _ever_ is “just too expensiveâ€.

Gosh, I wish we could all work in an industry where you don’t take a project unless it has absolutely “no risk†at all.

“I only take a job if I’m guaranteed millions in profit. I’m a builder. My job is so hard!”

I forgot to mention, that once in a while a millionaire ask me to bring his dream house and I’m glad to do it because they can pay and there is no risk from my part. It doesn’t matter that the house cost is going to be higher than the market value. If they like it, they pay. It is their dream house not a spec. They don’t build it for profit.

As a business, if there is no profit I will leave it for non-profit organizations such as Habitat for Humanity. I am just stating the obvious for those bloggers who expect businesses to work for free although they expect a pay check every month from their employer.

What I meant was that I do not build SFH as specs in this market.

A lot of people work for free. They’re called “exempt” employees. You probably have a few.

All I know is that in the paper today, the April numbers came out and it was the 3rd best April in a decade, and prices are up again. It said the flippers are gone, the prices are real, and May will probably be stronger.

I just don’t know how much longer I can hang on here, it’s getting more and more expensive and harder to live. I can’t be a slave to home prices, this isn’t right. But I don’t see it ending any time soon.

Low inventory is indeed keeping prices up.

I went to this Open House in Woodland Hills a few weeks ago: https://www.redfin.com/CA/Woodland-Hills/21824-San-Miguel-St-91364/home/4205212

I arrived a few minutes before the opening. A dozen or so cars were parked in the street, with buyers sitting inside the cars, waiting for the Open House to commence.

Some people were waiting on the sidewalks. One woman said to the guy she was with, “This is crazy, there’s already ten thousand people out here.”

An exaggeration, but she had a point.

Sigh…that’s a really, really nice house and backyard. Wow. And it’s very expensive.

We have been looking in only Woodland Hills this year. We lost a house to an all cash buyer in April and have not seen another once since. We contacted our agent this week to see the house below. We did not like it very much, but thought we would check it out anyway. It’s an obvious flip. The owners bought it in foreclosure last June for $500,000 and now less than a year later want $698,000. There is no backyard and all the cabinet upgrades look like fake woodgrain from Ikea.

https://www.redfin.com/CA/Woodland-Hills/4720-Escobedo-Dr-91364/home/4211151

Our agent told us the owner had already had multiple offers, but wanted more so we could see it Wednesday. That was when I told my husband, we are out of this madness. I want no part of it. We are not overpaying for some crap shack with no backyard.

I told my agent we are in a huge bubble now and we are done for now. She agreed we are in a bubble and when rates go up, homes will adjust. I really have no idea what will happen and I’m not too sure prices will go down for a long while. We will sit on our pile of cash and wait it out. We don’t need to buy, we have no kids and are not having any and we like where we live now, although we would love to own our own home, but are not going to join the sheeple in this bubble insanity.

To make matters worse, by father keeps telling us to buy anything with a roof on it since his Realtor friend said the prices are just going to keep going up. We told him that is horrible advice and this was the same friend that did not see the last bubble. The worse time to buy is at the top of a bubble, it’s just stupid and I ain’t stupid. We have no debt and a lot of cash, although not as much as the super rich who seem to be EVERYWHERE when it comes to buying homes. Can’t compete with all cash buyers or the stupid people that will way overpay for a house for fear of being priced out forever.

Kind of Scared…Don’t care what they say prices are up but traffic to buy is way down. RE agents are taking listings and telling many unsuspecting sellers they can get out from there homes and make a profit??? . Of course after 60 days little to no showings the agents tell them to lower the price they told them 60 days was a cinch to get.

The sellers now are at even or worse and still their house will probably not sell. The agent doesn’t care, they took a chance they get a 5% commission and a free sign advertising, when you keep lowering they don’t go under the 5% it is a lose lose for the seller at this time in the market.

I look at many closed sales and believe me sellers are getting killed or just plain delist, don’t believe anything the NAR says or the FEDS, the economy overall is terrible.

I agree with that. My old rental they wanted to sell and asked $615k for me to buy it off them. I was thinking closer to $500k and I have a friend that is a RE investor and said it was $530 max and to do it without an agent and it would be good for everyone. They balked at that offer so I left and found a much better place to rent. I watched their sale. They ended up listing for $585 and then selling for $550k. Probably would have made more with the $530 no agent deal. The new buyer is also underwater already according to Zillow (for whatever they are worth) at $543k. Pretty sure the agent sold them on selling too, as they were out of state and bought originally from her. I think they might regret it now as they had a decent cash flow going and got no where near what she sold them on.

I hope it’s the early beginnings of this. Just need someone to pull a real trigger somewhere, or collapse under its own weight.

_____

Paul – ( not a Realtor )

October 4, 2014 at 4:18 pm

….EXACTLY CORRECT ….

This spike in escalating home prices was due to temporary lack of inventory,

but the prices and sales are declining slowly.

Once the reductions TAKE HOLD .. the price reductions will escalate …. WHY?????

Because the REAL ESTATE SALES PEOPLE (Agents/Brokers)

MUST MAKE A LIVING .. THEY WILL TELL THE SELLERS ANYTHING …

†Sorry — I can’t get you Top Dollar for your house… Sales are DECLININGâ€

What the R.E. Agent/Broker is really saying is :

†I really need to SELL SOMETHING, I have bills to pay and I need to make

a quick sale on your p.o.s. House — I need my money FIRST … You can take

your FANTASY PROFIT that we promised you when you signed the Listing Agreement

and just “eat your heart out†….. TOUGH LUCK FOR YOU…. I NEED MY COMMISSION,

IT’S TIME TO DISCOUNT YOUR damn PROPERTYâ€.

*** AND THAT IS EXACTLY HOW THIS WILL PLAY OUT.****

Just go back and take a look at 1991 to 1996 California R.E. Statistics,

I lived through it and bought a house at 75% discount. I saw how

desperate and hungry the Agents and Brokers were — THEY ONLY CARED

ABOUT THEIR COMMISSION….. REALITY RETURNS TO US AGAIN.

You’re either young and inexperienced or weren’t paying attention during previous cycles. Prices go up and down. California is boom bust central. Patience rewards. Unless you’re about to become homeless, there’s no reason to be scared about housing.

I don’t really read ZeroHedge often, but found this story there the other day.

Welcome To The Bubble State, Where Everything Is Unsustainable

Submitted by Tyler Durden on 05/19/2015

Do you see what I’m getting at here? California is the pump and dump state. The history of California is a cascade of overlapping economic bubbles and ridiculous lies, each one bigger than the last. It’s the only thing that sustains us. The get rich quick scheme is our oldest trick, and it has never failed suck up an abundance of money and talent that would have never arrived here otherwise. The ever-changing Cali graft continues to operate to this day, though it’s finally starting to get repetitive.

more http://www.zerohedge.com/news/2015-05-19/welcome-bubble-state-where-everything-unsustainable

_____

Oh and there’s a couple of amusing/ chillingly realistic comments there too. Like my Mom told me, “If you’ve got no money, you’ve got few friends.” (but filter out the overly grudge comments in article/comments re California)

This one below, and I enjoyed the one with the guy who was living in a van, working at a bakery, in the late 70s.

JetsettingWelfareMom

JetsettingWelfareMom’s picture

Lived in LA for eight years that was enough for me. On the one hand I liked all the fruity nutty attractive people (at least as compared to the Midwest) who talked about their dreams and ideas and being proactive about life. Seemed like everyone in the Midwst was wallowing in some personal misery at that time, “My son’s an alcoholic, husband’s got cancer, my back hurts so bad I can’t even get out of bed blah blah blah” stuff. I tried to be sympathatic to these things but I kinda had to tune out the poor me story after awhile, it just wasn’t that interesting. Talking about trips to Thailand and business startups, now that’s interesting!

Then I had a poor me happen–a bad breakup and nowhere to live in SoCal. What happened to my old California friends, the ones I’d ran marathons with and sang in choirs? Gone! I should have figured the 30+ taxi rides I’d taken to and from LAX, with nobody offering to pick me up or drop me off, should have told me that I didn’t have a real friend there. Turns out you’re either rich or homeless, and in LA, oddly, they live side by side and are hard to tell apart until the SHTF.

I can attest to this. I sold a home in So. Cal. in 2014. I did quite a bit of investigation into sales back to the 80’s and found several so-called busts. Like anything, buyer beware! What is hot today, may be cold tomorrow. I think there is this undertone especially in California that homes will always appreciate, even in the face of the worst recession since the Great Depression, and that even though many are buying to live in, the majority of home buyers are still counting on a return! Personally, I think anything that is an investment these days, needs to be highly liquid … you need to be able to cut and run at a moments notice. Owning real estate doesn’t necessarily afford that opportunity.

I would assume that the money behind housing also realizes the plum that they have with low supply and high demand, which is rising prices for rent or ownership. They can increase their bottom line without doing much! Managing this to favor demand, seems like a smart business strategy! Unfortunately, it is bad for individuals who need a place to live, and may be bad for other parts of the economy … the more of your paycheck that goes to housing, the less you have to spend in other parts of the economy that need your dollars to survive! It seems like an inevitable catch 22 … as more goes to housing and less to other sectors of our economy, those begin to suffer, meaning further tightening which costs jobs, wages, etc.

What you say is true. It is a sad reality brought to you by the FED via QE and politicians via Obamacare.

For those who can not understand the relationship between Obamacare and housing read again the relationship explained by Blert in previous postings. He did a good job connecting the dots. For those who still can not understand the relationship, it doesn’t matter. If you understand it or not it will affect you nevertheless.

Obamacare is a massive wealth transfer from the middle class to the Wall Street. You don’t have to understand the relationship. You will feel the effects more and more every year, especially when fully implemented (all the law points on HOLD will expire).

So, if you understand or believe what Blert was saying is irrelevant. You will feel it anyway.

Whats happening here in the Bay Area, Landlords are jacking the rents up 500-900 per month as soon as the lease expires. Most renters are are forced out to the burbs in the central valley, Tracy, Manteca, Modesto & Stockton, to find houses for 1500-2000 per month rent.

Now you have the commute from hell on the 205/580 to get to the good jobs in the bay.

The same probably holds true in LA/OC, find cheaper rents in Lancaster or San Bernardino.

Riverside or Hemet.

A repeat of bubble 1.0.

Manteca, Ripon & N Modesto built up like crazy in 2005-07. By 2009 these “bedroom communities” were more like ghost towns .. every 4th or 5th house sporting a dead front lawn.

Who really wants a 1-2 hr commute 2x a day?

No one would choose to live in Stockton – yuck! – if more affordable housing/commute options existed. Chances are the Bay Area tide will recede again at some point.

It’s insane. I rent in a house in Alameda and do the reverse commute out to San Ramon (or work from work home like today).

It’s truly shocking the amount of traffic coming in on 580. Every morning that backs up from San Leandro all the way to Tracy. A single flat tire or cops pulling someone over creates a stand still. Same for the folks driving in from Antioch/Pittsburg area. I used to have a co-worker when I worked in Berkeley that bought a house out there and would brag about what a great deal he got in 2009 and they love the space now that they have kid…..but if you caught him early in the morning he was a miserable person from waking up at 4am to beat the worst of the traffic down 24.

It wasn’t this bad 4 years ago. I’ve noticed a huge uptick in traffic. Also the Berkeley flats on 80 is a mess at all times of the day. Tons and tons of people driving in from Fairfield, Vacaville and Vallejo.

I am seriously looking at moving Sacramento if I can continue to work from home. I’ve been having meetings out there a few times a week and see really nice houses in good areas for less than 400K (I’m 36 and only have a girlfriend and a dog…we’re getting close to not caring about the Bay Area any more. We enjoy hiking in the Sierra more than we go out bars. Plus saving money for more vacations over paying rent sounds nice). Sac seems big enough to have enough restaurants and entertainment…obvious not at the Bay Area level. But at certain point…who cares.

No that’s not happening in LA or OC to any significant degree. What the tide bring in, the tide taketh back out. An old story with new actors and props, that’s the only thing different this time.

Report I read the other day had 425,000 new jobs/hires created in California last 12 months.

This market is total attrition. I’m beginning to agree with the tiny home movement, thinking very small homes but planned-out smartly is the way to go. As in some of Kirsten Dirksen’s videos on YouTube. Yet even tiny hipster homes costing a fortune now in any decentish area.

_____

May 19, 2015

“This is the first time since ’08 that we’ve actively been pursuing new opportunities,†said Shaadi Faris, vice-president of Intergulf. “All of the stuff we’re doing in California now is rental, but we’ve found the rental market to be exceedingly strong.†Intergulf’s projects include a 172-unit wood-frame complex in Santee, east of San Diego, as well as a site in Long Beach, acquired before the financial crisis, which is proceeding with 216 market rental units rather than condos. It’s also scouting opportunities in Arizona. The payoff lies in better returns than Vancouver affords.

source: https://www.biv.com/article/2015/5/california-rental-housing-market-lures-local-devel/

Looking at some of intergulf’s past projects (outside of Canada)

_____

ASTORIA AT CENTRAL PARK

Irvine, California

240 luxury condominums

Construction Period: 2006-2008

ALICANTE

San Diego, California

95 condominium high-rise development

Construction Period: 2004-2006

BREEZA AT NORTH EMBARCADERO

San Diego, California

162 apartment-style condominums

Construction Period: 2006-2008

LA VITA

San Diego, California

304 condominium high-rise development

Construction Period: 2002-2004

TREO AT KETTNER

San Diego, California

328 condominium high-rise development

Construction Period: 2000-2002

http://www.intergulf.com/communities/past-projects.html

Bankers Monday morning meetings ” Keep up the denying of loans, we don’t want to lock in 30 years at 4% do we, when we can get 5% and above then we start the loaning understand, no lending till we get higher rates”.

If you think that a bank is truly selling a 30-year loan, you do not understand how these things really work.

What are you suggesting?

It would be cool if the banks were doing that.

It appears that maybe banks and Fed figure that one way to get buyers to get back in is to taunt them with rising interest rates . Last time I saw this was when interest rates started going back up in 2004. People started buying while rates went up before getting locked out. buyers must be calling the bank /Fed bluff on rising rates. They probably figure they can keep holding off buying if they think the rate increases or news of anticipated fed rate changes are just fluff. – all imo

Not sure it will play out like that. Mark Hanson has done a good job explaining how on a monthly payment basis, it’s more expensive than the last bubble. There was some wiggle room left in 2004 to stretch out a monthly payment. Right now, unless some other parameters are loosened up, prices will have to adjust down.

Re Hmmm’s response:

The majority (80%+) of those builders who own a Mc Mansion and fancy cars will be bankrupt/divorced within 10 yrs. The best way to make 1 million dollars in construction is to start out with 2 million. It’s not the builders that get people in trouble, its the market. In 2004 the war cry was, ‘we are running out of land to build on!’, today’s sentiments are unfortunately the same….but a bigger abyss lies ahead this time when the 7s will be rolled. Big gubment can’t handle another downturn like 2008. Which is why every trade out there in construction is unwilling to go all in, if they have been around a while.

It’s not the builders that get people in trouble, it’s the builders, the realtors, the lenders, the mainstream media AND the buyers with little financial know-how. Aka “the market”.

I agree that prices are high (in a bubble). We are on the same page here.

I don’t agree that prices are high because of builders, RE agents, loan officers or appraisers. If that is your point, you are delusional with no understanding of the market, business or money system. If you don’t understand these three you will will be frustrated all your life with no chance of escape. I feel sorry for you.

When I don’t understand something I go to school, I read a lot, and in the end I get it because I have a brain that I use. Blaiming it on RE agents and builders is so lame; they provide a service for you. They don’t get paid to think for you. I used RE agents all my life, but I never expect them to think for me . They inform me and provide feedback. If they are not honest I fire them like I fire any dishonest employee or sub. About 10% of the agents are honest and provide an excellent job. I am glad for them. Ussually they make most of the money long term. It is the same for lawyers, loan officers and others.

Where did I say that “prices are high” because of builders, RE agents, loan officers or appraisers? Sounds like you’re the delusional one with no understanding of basic reading comprehension.

I’m not one of the posters who is looking to buy an affordable house in SoCal. I’m only posting here to get you, Mr Builder, to start actually using the brain you claim to have.

Thx Builder

For years builders have been accused of making obscene profits, that simply is not the case. If you run a licensed legal business you know how absurd the cost of doing business in this state has become. And what dollars you need to bring in to take on the risk of development. That being said, only the rich and big corps are going to pay that wage, which is why you see what is going on today. A massive build up of income /real estate inequality. Builders are going where the money is, which is why Los Angeles will soon look like a South American city, with no more middle class.

if it took japan 20 years to come out of their mortgage recession ,,even the good dr,hb said it would take that long for us ,,,,now we are out of recession???? already?? in less than 8 years? honestly devaluation of the dollar by printing more only puts the price of everyday goods up that much higher(4$ a gallon for gas) hmmmmmmm,a 20$ ounce of gold in 1800’s got you ,,new boots, new pants, shirt ,haircut and a shave, oh and drinks and room for the night ,,,,,seems as if an ounce of gold will still get you about the same thing today or lil less ,,anyone check spot this morning? i invest that paper in durable goods that serve my purposes as fast as i can while it has value ,,,,sad that they repealed the laws that prevented these ( think Great Depression) things from happening again,, sad we are not backed by gold anymore,,,,,hey Ken where did the money go? ans. to pay for g.b’s election,,, i digress …but no apologies,, leaving as fast as i can

Builder:: not sure where these people get their info but i am very sure none has paid the materials cost,, or employee ,ins,, workmans comp, or equipment cost ,(they paint the big tools yellow so they look like gold, thats what it takes to maintain them lots of $$$$) and none have built a home their self,,i have seen over triple the cost in materials, drywall from $1.25 a sheet in 1999 up to $6 a sheet in 2015 ,,1/2 inch ply has gone $6.00 a sheet to over $20.00 a sheet,,,, plus if in Ca. you get the wonderful $1.00 per 100 board ft tax on top of lumber,,,,,yes Builder, i feel your pain all to well,, capable of building? home depot durable goods? BTW Hmmm, if you scooped your workers from home depot i wouldn’t let them near my site or tools,, i get what you mean but those are illegal employers,,also i use reliable builders supplies not wanting to have go backs ,, as for open houses i witnessed 2 homes go on market this last friday and it was a madhouse,,,,also showings every day on numerous others (with energy spent a paradise can be built almost anywhere ) are you willing to spend the energy folks? ,,,leaving as soon as i can

Enjoy the show as long as it lasts

No one knows when the music stops

When it stops, some people would lose their shirts..

But be-aware of herd mentality in general

Good. These ego maniacs paying extreme high prices have stolen my shirt. I want a nice shirt back.

Doc – been following your blog from the beginning and this most recent bubble has been increasingly bizarre. I have rented in Culver City since 1995 and currently live in a 3 br/den with yard for about a third of the PITI costs for the same house, although if I moved today my rent would jump about 60%.

Every once and a while I think – oh no what if this is the future? What if rents just keep doubling and these shacks are $2 million in a few years? Then I see a listing like this and realize they are just making this up now.

https://www.redfin.com/CA/Culver-City/9026-Hubbard-St-90232/home/6721611

Dump. Total dump. The ad copy basically says because the train (you can walk to it from this house) will soon open for the Santa Monica route the price will just keep going up. I figure I could hire a private driver for 40K a year for the next 20 years and still make out better than having a mortgage like this. And I could get dropped off wherever I want to be vs. a few stations between here and the beach.

Ads like this show me just how deluded people are about the value of certain things. Really? A train stop is worth 1M?

And what does “like a duplex” even mean? Apparently it’s a duplex if you can spend a nice chunk of change dividing it, adding another kitchen and all that plumbing, and dealing with Culver City permitting (nightmare!).

Ugh. It’s just insane.

@Vera: $2M is absolutely absurd for that junker, regardless of whether or not it’s priced at current market value. In fairness regarding the duplex thing, the listing does say it has 2 kitchens, 2 living rooms and 2 laundry hookups.

What really surprised me is that this place sold in 1990 for $133k. So in 25 years, this house has appreciated 1,500+ percent!? Ridiculous!

Just because, I tried to find a window sticker for an average 1990 car. Best I could find with a cursory search was a 1991 Toyota Tercel sticker, which was $10,718 (for argument sake, let’s pretend it’s a 1990). So applying that same rate of inflation to a car, a small compact car should cost over $160k today!

How can this not be a bubble? Maybe the reasons for the bubble are different, but it will probably pop just like the last one (and the one before that). And if it’s not a bubble, I will probably have to find a more sane place to live.

Being very well acquainted with Culver City, I nearly died with laughter reading that downtown is “prestigious.” But seriously this is one of the best real homes of genius ever posted on here, good find!

The other day my dbag neighbor pitched me some sort of rental property investment scheme he’s getting involved with and I basically told him that being a landlord is a major PITA, as I know all too well from firsthand experience. Then he tells me that he got his real estate agent license. When he left I thought, yep, this is one of those unquantifiable signs that the top is in. Yesterday I was doing some work at a Starbucks in Alhambra and this Chinese guy is having a full-on speakerphone conversation with an agent going on and on about how he’s willing to do whatever it takes to fix-up some properties to get renters. Some lessons just have a way of never being learned.

The top is in for a few of the bubbles. 2 examples.

1. I went to a startup hiring event in SF last month. Ostensibly, the companies there were looking to hire but all they did was pitch – I don’t think anybody got hired. The companies were really scraping the bottom of the barrel for ideas yet were still funded. I don’t think they were funded for much though because they didn’t hire anyone and it seemed that they got funded simply because they knew someone or were owed a favor. Doesn’t seem there are good ideas left to invest in. Some were laughable in that even if they succeeded, there was no end buyer for their service. One was described as a “sharing layer on top of the various music platforms”. Huh? Who cares?

2. Portland, OR real estate is blowing up. Last time it was the last to the party and peeps up there kept talking about how the bubble passed them until it didn’t after it already started popping everywhere else. If there is a bubble in No-Jobs, OR, the end is nigh.

I’ve seen nicer houses, in better areas of Culver City, for about million.

Their CRAZY! This is what you get for 2 million in Florida

https://www.redfin.com/city/26037/FL/Trinity/real-estate#!min_price=2000000&v=8&sst=®ion_id=26037®ion_type=6&market=centralflorida

On the flipside, you’ve been in the same area for twenty yeras. If only you had purchased a house in 1995, or 1998, or 2000 or 2004… you’d be well into having it paid off. (not even counting the appreciation) Twenty years of renting sucks. I know. I did it.

State of the housing market, sales down 3.3%, inventory down, prices up, okay so what does it really mean, the surgery went fine, but the patient still died?

News articles are stating that Auction.com in partnership with Zillow is now catering to China in order to sell distressed homes. Less homes will make it to the market cheaply now that there’s much more buyers… China has millions of millionaires who want to buy houses outside of their country.

So if a Chinese recession hits full swing; and liquidity dries up; don’t those chinese millionaires (all of whom have businesses) need to liquidate some of their US RE holdings to stay in business thereby creating a property firesale?

They probably have backup plans. There’s a reason they are investing outside their country. They will probably bail China if shit hits the fan.

No, I have some somewhat well-off Chinese friends and a few are the children of the mega-rich ones. They tell me that wealthy Chinese don’t care what they pay for a house because they trade them back and forth as untraceable payment for stuff. So if they buy a house for $2 million when going price is $500K, it doesn’t affect them because the purpose of that house is not to rent or sell, but to use as payment for $2 million in goods. They do this to get around the government and so forth. For them, the price they pay is value but it’s not based on the regular market value that we see.

These guys are going to have one hell of a reality check when they find out that what it means to become a tax target in the United States. Oh yes, it will happen, and they will either be forced pay the piper or liquidate and run. Only then will it become apparent that the grass isn’t always greener.

All of that “0-care” blert rambles on about, who’s going to pay for it? Taxes on hard assets have nowhere to go but up.

I have a question I wanted somebody else’s take on. I have a condo I’d like to unload so I can sit on the equity and my savings for a while and rent, theoretically waiting for the bubble to burst and go back in and try to get a duplex or some multifamily of that sort. But what if the next bust is also coupled with a general inflationary spiral which leads to an evaporation of the dollar’s purchasing power as some argue? What do people on this blog see as the likelihood of such a scenario? Is it a danger? Thanks.

I’ve long worried about coming hyperinflation, due to all the deficit spending and printing of money.

Others tell me that money isn’t actually “printed.” And that federal deficit spending, and the growing federal debt, don’t matter, because the banks aren’t releasing any of that money into the economy; they’re just keeping that money their books.

But won’t they release it eventually?

So I dunno. Our national finances seem so weird, built on such unsubstantial fundamentals, I figure something’s gotta give. Hyperinflation feels like a looming threat, at least to me.

I see inflation at the supermarket. The price of food goes up. Others tell me this has nothing to do with housing prices. That small commodities can easily inflate, while housing prices and wages deflate.

Common sense and gut instinct tell me there’s hyperinflation coming. But who really knows?

“Common sense and gut instinct tell me there’s hyperinflation coming. But who really knows?”

SOL,

You are right. EVENTUALLY it will happen but not in the near future. First, all gods which can be shipped overseas will increase. With wages stagnant due to globalization that leaves less for people to save for downpayment and houses. That is going to put downward pressure.

Due to lack of construction (cost above market), eventually rents will explode along with house prices. However, for that to happen it is going to be while.

So, yes you are right short term for everything which can be shipped.

The lack of hyperinflation for housing is also going to happen due to higher interest to stay above inflation for everything else. It is going to be a double whammy due to government sending all collected taxes to the interest. That is going to affect all other government spending and the economy. Try to read what happened to Weimar Republic.

or we could have deflation like japan

US banks are sitting on $Trillions in liquid reserves now over and above their loan books. They’re so bulked up against a real estate crash, and financial market crash. Pump and dump, imo.

Sat on $2.4 Trillion at beginning of 2014. Thus:

On an absolute basis the gap between deposits and loans is now at some $2.4 trillion and growing. This divergence seems completely unique to the post-financial crisis environment.

http://soberlook.com/2014/01/how-bank-reserves-make-gap-between.html

And liquidity vs asset prices. Do yourself a favor and search engine up these articles, but with the banks having shed so much of their own exposure to any crash outcome. The way it reads, the banks have shed all risks onto the wider markets, or still in final process of shedding last parts.

Wall Street Journal

Why Liquidity-Starved Markets Fear the Worst

Bankers, investors and hedge-fund managers are rattled by the lack of liquidity in the markets

May 20, 2015

..Talk to almost any banker, investor or hedge-fund manager today and one topic is likely to dominate the conversation. It isn’t Greece, or the U.S. economy, or China, let alone the U.K.’s referendum on European Union membership. It is the lack of liquidity in the markets and what this might mean for the world economy—and their businesses.

_____

It has been calm for so long – a storm must be brewing

Jan Straatman

25 Jun 2014

Common sense tells me there is a severe correction to come, followed by breaking up of many positions, and assets sold at much much cheaper prices to those left standing and positioned for it (with fresh bank debt on offer), to get some velocity going.

Reason food goes up when there is an increase in money supply is because asset managers put money in safe haven assets like food and oil during uncertain times. All the QE’s made gas and food go up like crazy. QE 3 ending crashed oil prices – it was never about supply as China’s supply was down for a year at that point. The CFMA passed in 2000 allowed financial companies to invest in commodities more easily so you have a run up in commodities during low interest rate times but magically no inflation.

For inflation to take hold you need workers being able to grab a share of that new money. I don’t think even with low unemployment we will get that. Too much NAFTA, TPP, outsourcing, and general worker insecurity for that to happen anymore. In Germany where unions are strong, regular workers are booking 3-4% wage increases annually, therefore taking a piece of European QE home with them. We’re not going to see that in the US.

Ron unload the condo now, put the money in a CD when the rates climb later this year. A real bust won’t happen but there is always buys out there. I feel if you are in CA. and a decent location to sell the condo now.

I think that somewhat already happened in the last 4 years. The cost of living has gone up substantially. Inflation is happening. Min wages are going up. Rent probably costs more than mortgage with 20% down. It’s hard to figure out. Nothing makes sense. The Chinese are buying up everything nice within 30 miles of the coast in California.

You could hedge against inflation by investing, but investing seems quite risky now too.

Invest some of it in precious metals then and protect some of your purchasing power.

A bursting bubble is price deflation in action, otherwise no burst has occurred.

The hyperinflation-is-coming crowd has been proven wrong for 15 years now. Strong, sustained inflation requires a wage-price spiral. That in turn requires a labor shortage and companies bidding against each other for scarce workers. There is so much excess labor in the world (partly due to automation and robotics) that a wage-price spiral is just not feasible. Even if a labor shortage took hold in the U.S. it wouldn’t last long as the price of domestically produced goods would be undercut by cheaper excess labor overseas.

As long as there is a global labor surplus coupled with low wages, QE cannot ignite inflation because excess bank reserves just sit there unspent and remain outside of the general economy. Keynes’ “liquidity trap” and Hansen’s “secular stagnation” from decades ago warned of this outcome if zero interest rates are used to try to stimulate the economy: you end up with a glut of cash sitting around uninvested.

Sorry I meant Rob not Ron.

Thank you to all for your thoughtful posts. One reads and hears so much on the web, it becomes a cause for confusion. Whether it’s the Austrian school economists like Peter Schiff, or somebody like Harry Dent who believes that we’re approaching a demographic cliff which will lead instead to drastic deflationary pressures, it’s hard to get a handle on this stuff. Then there is the talk of China, Russia, and the rest of the BRICS nations rotating out of the dollar and slowly divesting from American treasuries, threatening the dollar’s hegemony. I bought some physical gold and silver at around 1500/ounce, and about a week later is when it collapsed in price. Still holding it though, just in case. I don’t want to make an even bigger mistake going forward with my plan to sell the condo, only to end up seeing my cash devalued and then really getting priced out of the market forever. A lot to consider here. Again, thank you for all your intelligent and well considered replies.

Hmmmm,

You have reading comprehention problems and zero understanding of business; on top of total lack of logic. If I would be in your place I would be as frustrated as you are.

I told you the *MAIN* driver of cost in SoCal in nice desirable areas is cost of BUILDABLE land and regualtory compliance (usualy they go hand in hand). If you still don’t understand so far, I give up.

According to your “LOGIC” builders don’t build because they can’t make a million per house. Why don’t you, so smart and logic and without being greedy, go out there and learn how to build a house and sell it for $500,000 in profit – all the inputs cost so low for you!!!!…. You’ll be rich, too. You’ll be so busy you will not be able to stay on this blog complaining that you can not get $1,000,000 per house. Then you can retire a millionaire.

For such a simple mind I have to lower my level of discusion. Maybe, and that is a big MAYBE you will get it. You sound so ridiculuous.

Thanks for showing your true colors. I knew you could do it!

Agree with your comment that only about 10% of RE agents “are honest”. But fewer than 10% of realtors “provide an excellent job”. Based on your comments, clearly the same holds true for Builders.

Even if 90% of RE agents are not honest and clueless, remember that they are not there to think for you. They don’t set the sold price or the value.

If a buyer pays an arm and a leg for house that is their problem – they set the price. The builder can price a 100k house for 100 mil. If the buyer can not think straight, that is his problem. He will suffer the consequences of his foolish decisions. Every seller is free to ask whatever they want for their house – it is theirs. Every buyer is free to buy whatever they want or not to buy – it is his decision.

That being said, I agree that prices in good areas of SoCal are very high due to high cost of land. Nobody argues with that.

The whole point of the article was that builders are not building. Again everyone agrees with that. Why they are not building is where the debate starts. I told you my perspective and you disagree because you don’t understand the construction business. I’m in this business everyday and I know more than you do about my field.

Common sense is telling you that if investors don’t invest in something, there are no money to be made. Your argument is that builders they want too much profit. If one builder wants too much another more realistic one will take his place. If no one sees profit , none builds. What is so hard to understand??

Yes, there are shady builders, plenty of them. They would hire those illegals from Home Depot to build crappy homes. I don’t want to do that because I have an excellent reputation in my community and I will keep it that way. I don’t need your approval. It is enough to have happy clients who refer me to others.

Frustrated? Me?

“Cynical” is perhaps the word you’re looking for.

I think you missed it earlier, but I actually am in the building industry. And it’s interesting that you bring up the topic of frustration. Frustration with the current market is a key motivator for how many readers come across this blog.

“Frustration” is probably what a lot of these blog readers feel when they read your earlier comment: “when I don’t understand something I go to SCHOOL”.

A lot of the audience here can’t afford to simply “go to school.” School is freaking expensive.

And lot of people can’t buy housing in SoCal because they actually DID go to school and find themselves with incredible student loan burdens weighing down their debt:income ratios.

It’s fine for you to post here and say you’re the only one who understands anything at all about building anything. But it’s pretty condescending to presume that ANY readers of this blog would allow a RealtorTM to “think” for them.

You’ve done a pretty good job exposing the hypocrisy that you espouse, without even realizing it. So I’ll lay off you for now, Builder.

But it sure is a good thing (for you) that none of your “happy clients” read this blog!

Developers are frothing at the mouth in Costa Mesa CA. Many are building SFH infill projects on the Westside/Eastside of town like crazy. Also, there are hundreds of new tri-level 3bd 2ba 1900sqft+ w/ rooftop ocean-view decks (typically attached & detached townhomes for high $800k- $1mil) which are being built on former commerciallly-zoned land. The City’s Economic Development Dept. has a new branding motto: “Costa Mesa is cool place to live”(i.e. cool ocean breezes & hipster friendly businesses such as The Camp and The Lab, the Boathouse restaurant, and tons of trendy shops and bars). The CM Mayor & Mayor Pro Tem are both developers and they appointed their friends to the Planning Commission, so now they get almost every new development easily passed even w/ multiple variances for looser parking req’s and smaller setbacks. These trendy new developments are intended change the Westside to the Bestside. So, hopefully all these targeted hipsters have dual incomes, and no children for a few more years…

In case of my area, central coast, builders are building. Benchmarket is developing East Garrison Community, and Shear Homes are building near the ocean. We will see whether the homes will sell because there are not many good employers here except the government agency (DOD). East Garrison said that phase 1 homes are almost sold out. The smallest one is in high 400k. Old and undesirable houses are about the same in terms of prices, so people may buy new homes. Shear homes are a bit more pricy, but there is no yard, even for a sfh.

Leave a Reply