What constitutes a healthy housing market? 7 charts Examining where we are today in the housing market. Will the current housing rebound continue into 2013?

Perceptions are guided by recent events. History is easily forgotten and our hardwiring makes us prone to trend following. The housing boom that started in 2012 is still the story today. In 2012 I noticed on various forums that new housing related shows were on the uptick. The headlines were largely positive. It is hard to see how the pace of appreciation can continue without a similar underlying real growth in household wages or a continued flood of investor money. Yet in markets were investors dominate, local families are outbid by global money and big funds. What makes up a healthy housing market? Today we’ll examine seven charts and try to put this current housing market into a longer-term perspective.

Normal housing market

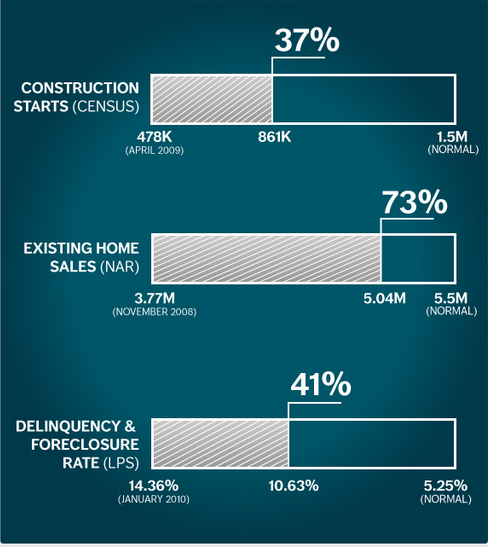

There are many factors to examine when it comes to a normal housing market. I would argue that it is more important to focus on having a healthy economy and allowing housing to follow instead of focusing on housing and expecting the economy to follow. For over a decade the focus has been on housing and the Fed with QE3 is not disrupting that trend. Trulia has an interesting barometer on a few key housing metrics:

Source:Â Trulia

According to the above barometer, a normal market would have 1.5 million construction starts. We are at 861k. We’re making progress here but still a good distance from 1.5 million. The next item is existing home sales. We’re at 5.04 million whereas a more normal market would be at 5.5 million. On this metric we are inching closer to a more normal market. The number of mortgages in some sort of distress is up to 10.63 percent. This is still very high compared to the normal rate of 5.25 percent.

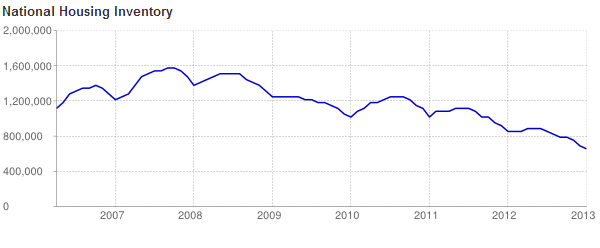

Low inventory

The number of homes for sales is extremely low:

While existing home sales are still short from a more normal level (not by much) housing inventory on the other hand is down by record levels. At a certain point you would expect this to carry over into housing starts and we are seeing this occur.

Housing starts

Housing starts are definitely on their way up. This should be expected given the very low inventory. Yet as we have discussed in previous articles, many younger Americans are saddled with high levels of college debt and are looking for lower priced housing options. In 2012 31 percent of housing starts were for multi-unit properties. Stronger rental demand but also, the new clientele base is likely pushing this trend.

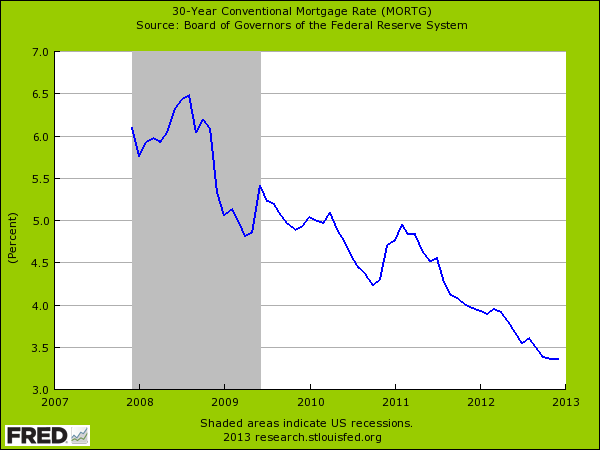

30 year fixed rate mortgage

The drop in interest rates is truly historical:

People calmly talk about this as if we have a historical reference point for this. We do not. The Fed now has a balance sheet that is well over $3 trillion. This is not normal either:

Fed’s balance sheet as of 1/16/13 (source: FRB)

Prior to the recession, the Fed balance sheet was well under $1 trillion. We are a very long way from that and the Fed with QE3 is basically eating up MBS from the market. It is interesting that some would like to discount this activity yet the Fed is dictating interest rates and is the major player in the mortgage market. In other words, the Fed is the housing market.

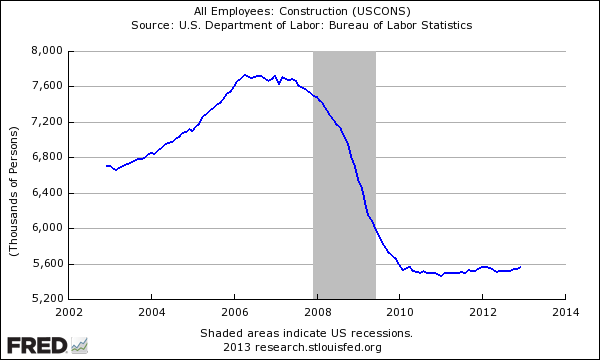

Construction jobs

Now this is a trend that I found interesting. While housing starts are up, construction jobs are still lagging:

What is going on here? Is it because multi-unit properties require less labor? I doubt it. Are construction crews making due with less? That could be one reason. This is probably one of the more interesting trends here. In this category we are also very far away from a normal market.

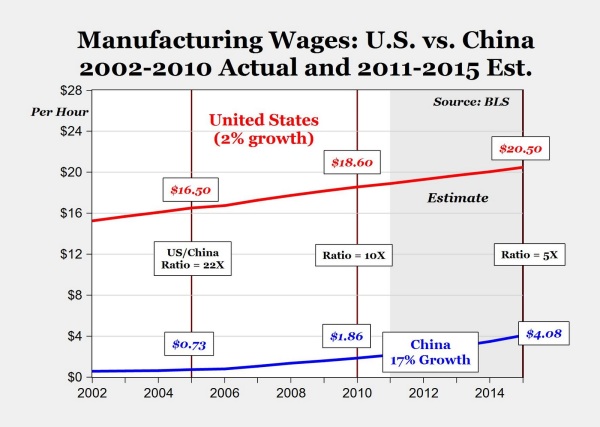

China wages

In a global system inflation can be exported. While US wage growth is anemic and inflation adjusted household income is now back to levels last seen in the 1990s, wage growth in China is definitely occurring:

It should come as no surprise then that money is rushing back into places like California and Canada propping up prices in select areas. Foreign demand is incredibly strong as the wealthy class rises abroad. In an open market, money can travel as it sees fit. Inflationary pressure is charging back in.

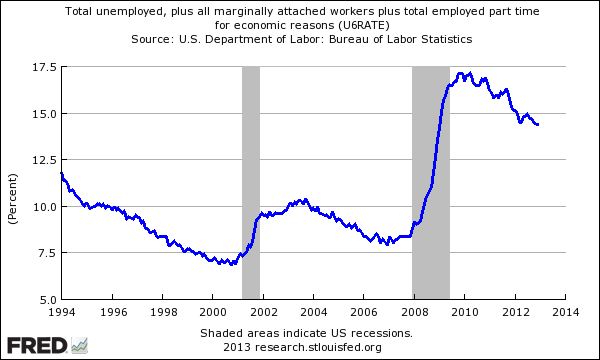

Part-time workers

Another trend we are facing is the growth of a permanent part-time workforce. Many workers now work under contracts or projects. This is another reason why we have seen the U6 unemployment figure remain high:

This is unlikely to be positive for wage growth but does help companies earn more as they slash costs. It also makes a tougher case for sustained home value growth. The last few years have seen a large amount of buying come from investors. Nearly one third of all sales were investor based. This is incredibly high. It is hard to find historical data on a normal figure here but I would venture to guess that it is around the 10 percent range for the nation. In California, foreign demand makes up this portion alone:

“(OC Register) The National Association of Realtors estimated that foreign buyers accounted for 11 percent of California home sales.

The California Association of Realtors, however, pegged foreign sales at 5.8 percent of the state’s transactions. Of those, 39 percent of the buyers come from China, followed by buyers from Canada (13 percent), and from India and Mexico (8.7 percent each), CAR reported.â€

Last month over 33 percent of buyers in Southern California paid all cash for their purchases, tying a previous historical record set a few months ago. The monthly average since 2000 is closer to 17 percent so we are nearly double that.

The above trends show that we really are in a different housing market today. Will these trends continue into 2013?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

89 Responses to “What constitutes a healthy housing market? 7 charts Examining where we are today in the housing market. Will the current housing rebound continue into 2013?”

A lot of factory jobs don’t pay 20 per hr. It will include machnists and engineers in the totals. The average low skilled factory worker in La without benerfits makes 9 per hr to 15 per hr not 20 per hr. I’ve seen the want adds.

Cynthia, I don’t remember where I got my source but last year when I did my taxes I was curious how many households in California above the 100k range and the source stated it was 25%. That means 1 in 4 households in SoCal are over 100k/year income. I remember 15 years ago when I was 21 making six figures I thought I was a badass. Back then TurboTax would actually tell you your percentile based on other Turbotax submissions and at that time I was in the 2%. Now, I’m in the 25%. I don’t know why people are claiming that salaries are not rising , although mine hasn’t , it appears at least 23% of the population around me is.

A nearly useless statistic w/out a breakout of gov’t vs. private sector jobs. The .gov sector is mostly UNsustainable make-work jobs (hence Cali’s nearly $30,000,000,000(!) deficit). But this also includes county and municipal levels, which also involve many “fluff” jobs that pay six figures. They’re broke too. Add in Fire “Engineers” making $200k and it’s more kicking the collapse down the road.

In ‘Brave New World’, Aldous Huxley had a great example of Central Gov make-work, embodied in the outlandish and complex equipment needed for young children to play the game known far and wide as “Centrifugal Bumble Puppy”, LMAO!!

Acording to her, the world is filled with Mexican and Asian people that are hell bent on destroying her vision of the clean/white California.

Everyone works at Wal Mart and everyone has a subprime loan.

I guess you could say she is a glass is half empty kinda gal………

I couldn’t find anything regarding households making over $100K in income solely in CA, but most figures put the national level at just under 20% –

http://finance.yahoo.com/news/inflation-makes-big-incomes-smaller-070038493.html

In the same article, an apples – to – oranges comparison is conducted with the $100K benchmark being used for different households located across the country.

As expected, housing costs make a dramatic difference in a household’s overall debt levels and ability to pay their mortgages.

IOW, I don’t see any data to confirm your statement, and given the high costs of buying a home in CA right now, it’s difficult to believe any other conclusions you posted, such as this howler:

“Now, I’m in the 25%. I don’t know why people are claiming that salaries are not rising , although mine hasn’t , it appears at least 23% of the population around me is.”

Yeah, sure.

Liars can figure and figures can lie. In the last 15 years, around half the people do not have to file tax returns due to credits and deductions. Romney was right. Of the remaining taxpayers, sure, a household of two wage earning making 50k a piece is not unusual. Taxes are going up in California, because the half of the population who legally do not have to pay taxes, want government services, and you will have to pay for it.

DMAC, you lost me on that last quote. Please explain

BB – your last quote has no substance and/or factual evidence to support it. Please explain.

An easy way to check income/percentile is on the US Census site, but this NY Times interactive map is good too.

http://www.nytimes.com/interactive/2012/01/15/business/one-percent-map.html

If you made 100k/yr you’d be in the top 40% in SF/Oakland/Vallejo

If you made 100k/yr you’d be in the top 44% in San Jose

If you made 100k/yr you’d be in the top 25% in LA/Long Beach/Santa Ana

If you made 100k/yr you’d be in the top 35% in Orange County

If you made 100k/yr you’d be in the top 28% in San Diego

All this information is good, but it ONLY measures household income, and not wealth. Many people that are purchasing property are utilizing wealth not necessarily household income.

DMAC, you sound like a very bitter person. I feel sorry for you and hopefully you’ll find a home of your own 🙂

@blahblah: The CPI over the past 20 years has averaged a little over 3%. I’ll round to 3 1/4. If someone making 40,000 in 1993 (reasonable for an entry-to-mid-level engineer) had their wages increased for 20 years at 3 1/4%, they would have been at almost 47,000 in 1998 and about 76,000 today. It is interesting to not that entry level engineers today are in a position to earn something closer to about 50,000. Mid-levels might be closer to the 70-something mark, depending on personal history.

A government employee, making something around 35,000-45,000 (teachers, firefighters, police, etc.) in 1998 and receiving raises of 4-6% per year would now be somewhere between 65,000 and 95,000. Each of those occupation has chances for bonuses, however, such as OT, multilingual training, or assignment to higher-threat aspects of their professions. In the case of OT for firefighters, there was a lot of noise a couple years ago about some individuals in LA county making better than 6 figures in OT alone, above and beyond the base salary. I recall a freind working for the LAUSD as a new teacher (a fluent spanish speaker working in an inner city school), saying he expected to be pulling in over 90 K in his 3rd year of employment. I’m not aiming to demonize the individuals who take advantage of these opportunities. Ultimately, they’re looking out for #1 and doing it well. I will lament that the system that allows this to happen is self-conflicted and inherently broken but that is an argument for another thread and another day.

The point I’m going to home in on is that the CPI is cooked. It is a falsification. It is not a valid statement of inflation. Rather, it is device used to make apparent inflation appear to be closer to the nominally targeted levels as stated by the federal reserve. The proof of this is the fact that wages rising with the CPI have left a larger income gap between the affluent and wages for governmental agencies (presumably negotiated by individuals who receive knowledge of these figures closer to their sources) have risen at nearly double the rate of private wages over the last 20-30 years. Apart from the moral hazard (the government, who is meant to serve the public and is providing a major disservice by their management and reporting of the money supply), there is the simple mathematical fact that due to the exponential nature of growth figures, a small mismatch perpetuated for a significant length of time produces major disparities, typically necessitating a catastrophic adjustment.

Neither bitter nor looking for a home right now, BB – sold my condo in Chicago for a modest profit and am now renting in Portland. OTOH, your non – response and projection indicates that you are indeed just another troll.

JohnCPA, that is a very surprising statement coming from a CPA. For those ~47% that do not pay taxes, those that get away with it due to having enough deductions – These people DO have to file a tax return.

@MB: Thank you for the stats I think that makes my statement very plausible (25% of California households have greater than $100k income). The really strange thing about DMAC’s bitter response is that in his own words he said *nationwide* the official statistic is 20% of all households make > $100k. With that said, why would he think it’s far fetched that California (the country’s greatest GDP state by a large margin) would have a 25% rate, I wonder.

Forbes Mag stated that according to Indeed.com without benefits welders make 36,000 and Machinsts 41,000, a lot of hourely stats on manufactoring include even engineering jobs which take a 4 year degree to up the hourly wages of manufactoring. During the housing boom lots of hispanics left the low skilled factory jobs in La for construcation since they were more likely to get the 20 per hr there.

Hello Doc. There has been a lot of talk about the weakness is wages as a factor to consider in long term house prices. Here is an article from Zero Hedge “What the end of cheap oil means” on wages and oil prices: ‘wages are very unlikely to ever return to a relationship to energy costs that would make the US economy into a happy economic story once again’

http://www.zerohedge.com/news/2013-01-20/guest-postgregor-macdonald-what-end-cheap-oil-means

I respect what ZeroHedge says most of the time, but they aren’t focusing on the reality that the US is going to be energy independent about 20 years earlier than expected.

http://money.cnn.com/2012/11/12/news/economy/us-oil-production-energy/index.html

This welcome development will have far – reaching implications for the US economy, primarily due to lower energy prices across the board, not to mention that the US will become an energy exporter, specifically in natural gas. You can see the effects of increasing US energy development already in lower natural gas prices for much of the country over the past two years, due to exponentially higher production.

The reason for the glut of natural gas is due to the economic downturn and hydraulic fracking. Energy use is way down in USA since 2008 and as a result natural gas consumption is down. At the same time hydraulic fracking has increased supply However fracking is short lived and the average well produces natural gas for 18 months! Many communities are pushing back on fracking due to large amount of water and undisclosed chemicals used to extract the natural gas.

U.S. oil production is up due to shale oil but the net energy returned on energy invested is very low. You need cheap abundant energy to make a difference to become energy independent. We lost that claim in 1971!

Another good read that debunks the U.S. Energy independence is the following link:

http://www.businessinsider.com/arthur-berman-shale-is-magical-thinking-2013-1?op=1

Jeff – no underlying substance to any of your increasingly hysterical talking points. You sound like a bot – try harder next time.

http://iea.org/publications/freepublications/publication/English.pdf

The source of the American energy independence by 2030 is the IEA. They project that the combination of better efficiency and fracking will result in a net import/export of oil/gas of zero by 2030. They don’t mention the cost of such.

It’s my understanding the gas fracking is in a bubble, where investors went wild a few years ago, and now are stuck with a product that is so cheap, that they are making negative profits selling it.

The IEA also mentions the problem of running low on water, with regard to fossil energy production. I don’t think they mention the problem with fracking is that it is water intensive and the well cement has a huge failure rate within a short period of time, making fracking a hard sell to places like NY.

What is not being talked about is a new University of Delaware study that says that if we max out our grid with wind, and optimize storage solutions, we could be running 90-99% of the grid with wind AT A COST COMPARABLE WITH TODAY”S cost of electricity.

http://www.sciencedirect.com/science/article/pii/S0378775312014759

I happen to think a storage solution will involve a smart grid using the combined battery capacity of plugged in electric vehicles.

If you investigate the IEA claims outside of MSM, you’ll see that almost all the independent experts on this subject say it’s not going to happen. They shoot holes in it all over the place. From environmental hazards to huge amounts of water needed for small returns of fuel. It sounds like the policy guys are pushing the holy grail of “energy independence” in the US in order to get around all the road blocks that are coming up for fracking.

If you go to http://www.financialsense.com/ and scroll through all the articles you can find quite a few that discuss this subject.

CAE – that’s a good collection of articles on the subject, but I’m wondering if the estimates are so wildly overrated then why are the Saudis and their compatriots in OPEC spending all those millions on PR efforts in order to convince US citizens of the alleged evils of fracking. They’ve even gone so far as to fund the recent Matt Damon film “Promised Land,” which has been torn apart by critics on both sides of the political ledger for featuring one whopping lie after another in the screenplay. That doesn’t sound like a real solid vote of confidence for the opposing argument – it appears a lot more like someone is quite concerned that their honey pot’s going to go to seed in due course.

Dmac,

Based on the subsequent replies from others that agree with my (w/links) debunking IEA’s government propaganda, it looks you must be living in your parent’s basement working for Obama as a troll.

Based on that last response, Jeff – you’re showing all indications of a bad case of projection.

Here you go, Jeff –

http://www.forbes.com/sites/larrybell/2013/01/13/promised-lands-fracking-fictions-opec-goes-hollywood-with-crocudrama/2/

Nothing to see here, just move along, folks.

I’ll stop posting on this subject after this one, since we’ve already gone far afield regarding the POV of this blog. One more source as grist for the mill:

http://thediplomat.com/2013/01/23/america-the-worlds-new-petrostate/

I don’t know who’s right about our future energy estimates regarding domestic production. I posted one widely – quoted source and then got some pushback to the contrary – which is fair; we’ll have to wait a few years to see which estimates pan out at this point.

The bottom is behind us. At some time we need to take off our end of the world signs and buy that home, have some kids, and move on. If you can’t afford at these levels consider getting a new career or moving to a state where you can afford a home if that is what you desire.

But when I see ads for Laguna Altura on the bubble site the writing is on the wall. They have no fear of not having future sales. The homes are selling great. That means they are priced right and people have the incomes to afford them.

I sincerely feel life will go on, prices will rise slowly, and the world will be a better place. I want to enjoy it in SoCal and if that means I need to spend 600k to 800k so be it, as the new 400k single family home in Irvine isn’t going to happen.

“The bottom is behind us.”

Um, OK – if you say it is. Thanks for the update.

“…At some time we need to take off our end of the world signs and buy that home, have some kids, and move on. If you can’t afford at these levels consider getting a new career or moving to a state where you can afford a home if that is what you desire.”

No one has suggested anyone doing otherwise here – have you actually read the blog before today?

“I want to enjoy it in SoCal and if that means I need to spend 600k to 800k so be it, as the new 400k single family home in Irvine isn’t going to happen.”

Well then go right ahead and buy that home – again, no one has told you you can’t do whatever you desire with your money. But why so insistent on telling us that everything is just peachy? Why bother? Just plunge right in, buy that home and come back in a few years and let us know how it’s all working out for you.

I’ve posted here since 2006 or 2007. I read many posts but don’t post all that often. I would be willing to place a bet on your 2014 forecast. Since we can’t enforce anything more than a Gentlemans bet, let’s book mark this and come back in 1 year and two. If the average selling price is lower next year or two years from now I will declare you victorious.

The economy is getting better, I work in corporate IT and I compare to the past 5 years we have so much work in the pipeline it’s very promising. I don’t look at the macro picture I look at the jobs that people who buy homes hold.

The RE trolls are coming out of their caves LOL. Ohhh the memories of 2005. I doubt will see them when viewing the wreckage of this pump and dump in mid/late 2014. Amazingly these guys still don’t get that it’s not about RE per say, but what out of control money creation and market manipulation are going to do to the jobs market. No job=No mortgage payment=foreclosures=us right back where we started.

Do you also believe in conspiracy theories and UFOs? If you really think jobs aren’t coming back then should be looking for cave, not a home. You’re just using fear tactics, I think US population a lot more resilient than you give us credit for.

It’s not a theory if the conspiracy is real and documented. The FED, the feds and the RE industry have taken very specific actions to prop up prices. Those actions, just like those that inflated the bubble, cannot continue indefinitely. When they come to an end the underlying fundamentals will have to support the current prices for them to hold. I highly doubt they will as real incomes have been on a slight downward trajectory for some time. If you disagree please offer some empirical evidence to support an increase in real wages, immigrant influx far and away above current projections or a ZIR environment that does not ultimately lead to asset DEFLATION.

Your facts may be correct but your timeline may take 20+ years. The market is uncertain. I have given up almost 10 years of my life waiting for a correction. Looking back, I would easily give up 200k of savings for the last 10 years of my life back.

There’s more to these decisions and financial numbers. I don’t care if the house goes to zero by the time I am one day from death. I will have enjoyed my life in an area I wanted to live.

If you used this investment thought process on everything you own your own absolutely nothing. How much is a BMW worth after 5 years of use? That new set of golf clubs? The cute younger girlfriend? You enjoy it while you have it, but none are investments.

Sean,

I couldn’t agree more. There are just going to be the negative naysayers out there no matter what the price of a house is or what the unemployment level is.

If you love Cali, stay there!

I agree with you. If people are so dead set on affordable housing, there are tons of places to move to.

But, people don’t want to do that. They just want to complain behind a random screen name on some website.

Exactly – who needs facts and figures? Let’s just turn to an Oija board, chant at the moon and all will be well. To suggest otherwise is just stinkin’ thinkin’.

I haven’t had to qual for a mortgage in a while… what are “borrowers” in Cali getting away with TODAY, as far as PITI as % of income, or selling price X times income?

Have LIAR loans returned yet? THAT is how we’ll know “happy” days are here again, LOL. Have a friend in the origination biz, but he’s not near Cali. Will ping him anyway.

“The homes are selling great. That means they are priced right and people have the incomes to afford them. ”

Really? It seems as if your definition of affordability differs from that of others. The same thing was being said back on 2008 when people were putting very little down (this is not an inference as to how much you did put down) to purchase their piece of the American Dream. If I recall, that did not end very well.

To come to the conclusion that homes are priced right simply because they are selling is a little naive (see 2003 – 2008). Weren’t homes selling well back then too? Were those homes priced right? If your answer is ‘yes’ then perhaps you should buy a second home in Irvine. I do, however, see this attitude quite a bit from people that have to convince themselves that they didn’t overpay for their purchase.

I know a few people that had the same attitude back on 2006 when they paid 300k+ for an 800 sq ft. condo with little or nothing down. They went around telling everyone now is the right time to buy and that prices will only go higher. Sound familiar?

But if you do feel like prices will never come down again then go ahead and buy. No one will stop you. Not the realtor that wants their commission nor the bank that will eventually sell your loan to Uncle Ben if it ever goes down in value (see QE4 or whatever one they are currently on). It just seems a little pretentious to come on here and try to convince people to do likewise.

It seems as if housing affordability is now defined as levering yourself up 7x’s or even higher as opposed to the 3-4 times the historical average. And please don’t try to use the low interest rate argument as another bullet point. That’s just way too easy refute.

As Dmac said, …”buy that home and come back in a few years and let us know how it’s all working out for you.”

I’ve not had the impression that this blog is promoting “end of the world” scenarios, but rather simply pointing out that some things don’t make sense. It seems as if you’re tinting the message with a sensational tone.

The moving to another state and looking for a new career comment simply comes across as unnecessarily flippant, arrogant, and presumptuous.

“That means they are priced right and people have the incomes to afford them.”

Or it could mean that they are priced to the point where people have enough leverage to afford the monthly debt service on them.

Good points and well taken. I did not mean to come across as arrogant, but there are the haves and have-nots in this world and we learned what happens when you give homes to the have-nots – they can’t pay the bills. It’s the Haves who are going to buy the next set homes and we have to look at their incomes, not a general income for everybody in the country or even the OC.

Life isn’t fair, and waiting for lower prices sounds like an expectation that some point life will be fair.

“At some time we need to take off our end of the world signs and buy that home”

You’re missing the point of this blog Sean.. You’re about to make the biggest purchase of your lifetime. Choose wisely…

Yes, it is a huge purchase. But at some point I want a bigger safer place to raise a family. There isn’t enough time left in life to wait for a recovery.

Sean, I appreciate your follow-up responses as they seem to come across from a genuine point of view. Your perspective illustrates quite well that the decision to buy or sell can largely depend on where you stand financially. For myself, taking a wait and see approach would be an investment and financial decision. I don’t know if the other commenters here view the market from a fair vs. unfair perspective.

Whatever people want to do in respect to buying property is their prerogative. Just because some of us are debating outcomes doesn’t mean that others can’t move forward. We’ll continue to make critical assessments in order to help shape our decision making.

The largest development in Laguna Altura, Toscana, was sold-out a couple months ago. These are million dollar boxes with no front yards and strips for backyards. The others are selling well too. It’s crazy. All of these buyers are either qualified by income and/or cash to buy though.

We’ll see how the new blocks in University Park and Woodbridge start selling this year with 2,600+ sq foot homes in the $900s+.

It is the property tax in Calif that takes your breath away. Even paying cash for your house, the property tax goes on forever.

Some of the take-aways from the recent LA Times interview on RE market with Zillow, USC and Dataquick:

low inventory an issue all through 2012 and predicted to remain in 2013; fewer foreclosures in 2012; prices up 5%-10% YOY for Socal. Forecast is for ‘strong appreciation’ in 2013; negative equity is causing tight inventory; home value decline is not expected in 2013, but the YOY increases will not sustain at 5%-10% YOY; the big wave in foreclosures expected for 2012 did not happen; amazing how many people did not default; 90% of all mortgage holders are not in default, but Vegas, Corona, and Inland Empire are severe underwater regions, break-even point to buy is 3-years in many regions now (Phoenix, Vegas, part of SoCal); record number of cash buyers in Dec. 2012, therefore difficult to compete. Trends for 2013: job market in SoCal slightly better than US avg, California budget surplus, fundamentals strong for housing market for 2013, negative equity holding down inventory, home price appreciation will free up sellers and moderation in home price appreciation.

here is the 17min video

http://www.latimes.com/business/money/la-fi-mo-home-prices-20130115,0,934836.story?track=rss

“Trends for 2013… California budget surplus”

They lost me right there. Amazing these rosy projections when here on the ground EVERYONE is just holding on getting by. Sure a few specuvestors are gonna do great but does that REALLY do jack for the economy? Is it going to help the local Papa Johns sell enough Pizzas to cover the Obamacare requirements? This whole thing is going to collapse AGAIN. The only question is how similar it will look to the 2007/8 collapse.

“… California budget surplus…” WTH? Did Sacramento, in the dead of night, convert their bonds/IOUs/etc. into Mortgage Backed Securities, and sell them to Helicopter Ben??? [roll]

The FED has it’s back against the wall with only 2 options. Let the system collapse on it’s own, or inflate it’s way into longterm stagflation. Either way, people in this country lose and ultimately will lose confidence in their government. The real question is how long wil it take. History ALWAYS repeats itself. The banks have been recapitalized at the expense of taxpayers, but nothing has changed our fundamental problem of BANKSTERS above the law since our last financial disaster. If anything it has made it worse. Don’t buy into the “multiple offers, this is your only chance to get in” mentality AGAIN.

http://www.westsideremeltdown.blogspot.com

Hello Latesummer2009:

I am actively making offers to purchase a home in Western LA and there is some truth to what you are saying about multiple offers. Some homes that come on the market dont get any offers and some do get multiple offers on the day or day after the open house. As I have written before, 3bed 2 ba houses with some of all of these traits (quiet street, not near a freeway or busy street or school, good floor plan, wood floors, detached 2car garage with decent size front and backyard) are getting multiple offers after the first open house. I notice it is sometimes the houses with no remodels that get multiple offers and sometimes the houses with remodels, but a remodel alone on a busy street with lousy floorplan wont get any offers. I was prepared to make offers on 2 of these types of homes in Baldwin Hills and Baldwin Vista but these houses each had several offers over asking. They have both closed back down at around asking price (due to credits for repairs or appraisal, etc). Some open houses have over a hundred people walk through on a Sunday afternoon and some are relatively quiet. All in all, I think that the crowd that shows up at the open house (and how many offers it gets) is dictated by: a) list price, b) location, c) outer image of the home (does it appear well kept) and d) floorpan as it appears in the multiple. One house we looked was in escrow with 6 backup offers. The brokers I am working with admit it is only because of the low inventory that this is happening. Doesnt mean it is going away anytime soon.

I really don’t think history ALWAYS repeats itself. If that was true then we could predict the future. In reality the world is going global and there are a lot of Americans that don’t like it, because we stand to lose the most. Maybe it’s flawed to expect the old ratios of income to housing. Especially when foreign money and a global economy are the new norm. Southern Ca is desirable to live, have any of you been outside today? I will gladly continue to pay higher then every other state in the union to have Jan weather like this. I had my toes in the ocean this morning! No I don’t have a big grassy water wasting yard for my kids but I have all of outdoors all year round. I think, after following this nonsense since 2005 that these prices are the new normal and people will figure out how to pay for it.

The problem is when you leverage 10x, your trying to be a bank..banks go insolvent too..The historical average is 3x income, it will find its way back. The great deleveraging is just beginning as baby boomers are getting scaling down and selling assets to cover their retirements. After the fed price fixing is over with and rates go up because were no longer the reserve currency, houses will revert back to a roof over your head. I’ll sit and watch as taxes are going to be going up including property taxes.

Homes are way overpriced! Prices are up because of 5 trillion in fed printing. Just like stocks, the PTB can manipulate a stock for a long time until it can’t..APPLE was 700, lots of people thought it was going to 1000, it’s now at 500 and heading lower. Demand for product can be artificial or real for only so long…

This predicting history topic, specifically, comes up often, and is actually very simple. Instead of saying history repeating, i’ll just use “trend” for simplicity. Trends happen all the time and it CAN be predicted. The difference between winning predictors and losing predictors is simply on timing. E.g. For a particular trend, the winning predictors are those that executed their predictions on the first half of the period, and losing predictors are those that executed their predictions on the latter half of the period. And it’s the losing predictors’ actions that skews the trend, and sets forth the new trend.

You wrote:

“I really don’t think history ALWAYS repeats itself”

“Maybe it’s flawed to expect the old ratios of income to housing”

“I will gladly continue to pay higher then every other state in the union to have Jan weather like this”

“…these prices are the new normal and people will figure out how to pay for it”

I vividly recall similar quotes pre 2008…the New normal, it’s different this time, people “figure out a way” to buy a house, weather everywhere else in the world unbearable, everybody wants to live in Cali. Wasn’t the old catch phrase “paradigm shift” back in the day? Water no longer finds its level? Maybe it really is different this time. Godspeed.

Good God, when will people stop tying these discussions to the weather as if that’s the only factor of desirability to consider when it comes to finding a place to live. Yes, we all know how warm it is today. We probably also remember how cold it was last week. It’s also warm on the coast of Haiti year round.

Interest rates reflect the demand for borrowing money. The Fed’s 4 year ZIRP policy and now mortgage rates at 3.4% should tell us all we need to know…..the patient is on life support. Does anyone really think that a 3% mortgage rates will get our economy growin again?

CAE asked, “Does anyone really think that a 3% mortgage rates will get our economy growin again?”

Mortgage rates are typically a few percentage points ABOVE money market interest rates, and about 1% or 2% ABOVE 10-yr USA Treasury Bond yields. In other words, with mortgage rates where they are, savers cannot get more than 1% or 2% risk free return on their savings.

This discourages savings and encourages riskier forms of investment. Another problem is that when interest rates inevitably start rising, that is going to put the financial system under incredible stress. The Fed can attempt to cap any and all rises in rates, but then there is a big risk of inflation.

I think we need a controlled restructuring of all USA debt and obligations, including promised social security and medicare benefits, since clearly there is no money to keep all the promises that have been made. Unfortunately, there does not exist the political will to fix anything. I think we need term limits at the national level before there will be any progress on anything.

Unfortunately, there will probably be some sort of financial accident before that happens. One possible trigger would be the failure of the Winter Wheat crop. If the weather in the Wheat Belt doesn’t turn within 3 or 4 months, we’re probably looking at hyperinflation.

My guess is Fed continues QE games until banks can unload most of their shadow inventory in a rising price environment to cash investors chasing yields and FHA lemmings, probably a year or two. Also throw in people with the “I’ll buy a house and if I lose my job or the house tanks in value I’ll just stop making payments, squat for months, years” deadbeat mentality buying as well, why not, especially in CA, Kamala’s got their back…

Oh that’s spot on I think. Let us hope this game ONLY plays out over a couple of years. Once the internal inventory is closer to acceptable levels, they’ll let the market fall and all the folks who bought in will suffer. We’ll have another round of foreclosures but this time on government insured or owned loans (they’ll just print up some $ to bail it out). Everyone will tighten again, falling knife will start falling again… maybe the next major price fall will put stuff into an affordable range, but I’m not counting on it.

I hope the game does end soon. All the 2008 foreclosures should come through in 2013, except if the banks request another 5 year extenstion. It all depend on how many more gifts the Fed gives. I’m not holding my breath that this will end anytime soon and have decided to be content with what I have now. Don’t get me wrong, I’m still looking and following what’s happening (like here on Dr. Housing Bubble), but without the irritation I was feeling about the situation.

I think most buyers our doing so do to the low rates I feel the low down payment also is fuleing all this .I myself think when the rates rise again the market will slow down again .I know we looked at a community and there up 39,000 in less than a year if I brought a home now I be 39,000 in the hole if the house next door sold for the 39,000 less .I really don’t think this can hold up the income is not there to support this kind of rise in home prices imho. It almost feels like 2005 again imho

The houses being bought today are being bought with at least a 20% down payment. The FHA low down payment sales offers are not even looked at anymore, the sellers don’t even look at them. If you don’t have a down payment, forget about buying.

When did this start? In my area, they seem to be pushing the Fannie Mae Homepath properties or all cash offers, just a couple of months ago.

Now that is a comment that warrants some solid data behind the claim being made.

I know of several low-down FHA and no-down USDA buyers who have closed over the past few months. Their offers got accepted by offering way over asking. These have been in different regions of the country.

That comment came from a mortgage broker to me.

I used to think that government is allowing long term interest rates to stay low in order to protect the financial statements of banks and other lending institutions. I think that is partly the case inasmuch as the mark-to-market rules were suspended, allowing banks to hold onto foreclosed real estate without that affecting their loan reserves, allowing banks to continue to lend to customers.

There is something else, however, in play here, that we need to consider. The federal debt due to all of the quantitative easing has increased substantially since 2008. Guess what? That debt eventually has to be paid. Associated with that debt is interest expense. So, if l/t interest rates are kept low, as long as Europe is screwed up, the United States can cut its debt service substantially by keeping interest rates low. Of course, this has the effect of lower mortgage interest rates, and you know the rest of the story. When Europe comes back, it will be harder for the United States to keep l/t interest rates low because European nations will increase their interest rates, thus attracting foreign investors that would otherwise park their cash in the United States. So, watch for the point where Europe comes back from the dead. When that happens, mortgage rates will start to rise.

I live in Southern California. I remember not too long ago, when the Japanese investors came in and started buying everything in site. What was the result of all that investing for the Japanese? Not so great….property values plummeted and they sold off properties as quickly as they acquired them.

As someone on this listserve once said, you don’t make money in real estate on the financing end. You make it on the purchase price/buy side. As I tell my wife, be patient. Our day will come. With real wages not increasing, and student debt ever increasing, the bubble must break at some point.

Sorry for the long comment, but one more observation. There is a reason why 1/3 of all home purchases are all cash. Financial institutions now must document all sources of income. Homebuyers today just cannot qualify for loans because they cannot document their income. At some point, these investors are going to realize that they can’t sell their properties because there is no one out there that can qualify to take them out of their investment.

I think your going to be waiting a long time. I use to think that way but now I changed my mind. Interest rates are never going up again, they simply can’t. The fed is in way to deep. They are creating another bubble and it would be the end of the United States if it collapsed. At some point in the future, just wait and see, mortgage rates won’t be tied to anything so they can go really low so house prices can rise. The fed won’t be buying MBS’s anymore because it can just make interest rate policy. I am talking less than 1%. Inflation won’t be counted, not really. The 5 pound bag of sugar that is now 4 pounds is not counted. It will go to 3 pounds, 2 pounds and 1 pound so they can say there is no inflation.

My mom (in her 80’s) states when she was a kid, no one owned homes, everyone rented. That is our future or you might say the past. Student debt will be eliminated through bankruptcy. That is just my opinion. My mind changed when I realized that the banks would hold off inventory to keep prices high and they were creating the bubble again.

Tricia, Where did your mom grow up ? My mother is in her mid 70’s, she grew up in Los Angeles, they were below middle class and owned a home. When I grew up here in the 1960’s, we and everyone we knew all owned homes. I did not know any renters until I got out of college.

Still thrilled my husband and I sold our home in the Palisades 4 years ago, love renting because it makes financial sense. Home prices are so out of control here in LA, with no inventory and crap construction, and the fact that english is not a 1st language anymore confirms we will never buy in LA again.

There is a case for piling on Student Loans. They’ve already planned to forgive them after some time, but even if not the IBR program gives you a limited payment for an unlimited borrowing capacity. At the Masters level, this is about 17k/year sent directly to the student for 1 class / quarter at a cheap online school. The GradPlus covers any amount and has no lifetime limits (this is why: law school / medical school can be covered 300-500k). For someone who already has capped their loan payment relative to their expected income, it’s a no-brainer; your payments don’t increase after that point.

Do a Masters or MBA over 4 years part time, get about 70k$, buy a house in a cheaper state. This is the handout to the younger generation (although pretty much anyone with a 4 year degree can do it regardless of age). But it is also a sign of how desperate the future is for them that is it the best source of financing: if you lose your job the payments drop to $0 usually, and you don’t lose your home. In fact it’s assured that you will pay only 10-15% of your income for housing to IBR if funded this way.

I think if you check pre-WWII home ownership levels across the US, it is something like 30 or 40%. But all the pro-home purchase programs from the federal govt brought it up to the mid 60% level by the mid 1960’s. And it’s pretty much stayed withing +- 5% ever since.

But the stats do in fact show that home ownership in the US used to under 50% .

My mom grew up in New Hampshire. I was referring to when she was a kid and her parents rented. The landlord owned the most of the homes on the streets. My mother always owned a home.

Waiting for house prices to decline to “what I think they oughta be” may be a long wait. Though we may be bitter about it our federal monetary policy clearly involves inflating/devaluing our way out of debt and explicitly encouraging higher home prices. This may not be a normal healthy market, but it’s the market we’ll be living with for quite a while.

It’s now been an even 10 years since I put in an offer on a home, was outbid, saw that a bubble was forming and decided to wait for a more opportune time to buy. Should I wait another 5 years? 10? If you wait your whole life for a better buying opportunity who wins?

Yeah I’ve considered that possibility. I’d rather own rentals in a state where CA money buys it easily. Then if it’s only 50-100k, it’s much easier to live through a 10-20% loss (a larger crash is less likely in many states that had more regulation/sanity to begin with, not CA though). So looking at only ROI or CAP rates vs. price and if it’s still a good deal go for it despite inflated prices. The shell games can continue indefinitely.

Yup, exactly. You lose either way and the irresponsible win BOTH ways. Here’s an example. I did the same as you in 2000 passed out on what I thought was a .com ubble (which it was) and then the twin towers falling greasing the Fed to lower interest rates fueled the bubble fire. I was then out priced because I was being far too conservative and not jumping in to the fire like everyone else. 2009 bottom of the crash I bought a house at an ideal price. Keep in mind my family and I rented apartments and small homes all the while paying top dollar rent. Last month, neighbor moves into the foreclosed home next door. They are nice people but they were one of the irresponsible who bought more than they should, pulled double equity (they told me straight out) and short sold after many years of not having to pay mortgage at all and instead saved up cash, waited 2 years and bought this home near bottom. My area hasn’t inflated much they paid ~$50k more than I did – big deal.

Apolitical, I’m honestly curious here – since you were outbid back when prices were soaring and then decided to wait, why did you sit out the implosion that occurred less than five years later? Surely most signs would have indicated to you that that time period in question was a good time to buy, and you probably would’ve saved more for your down payment.

Dmac,

I did look – quite a lot. I just watched and waited through the bubble pop in 2007-08. Unfortunately, like many I found the financial situation a bit too uncertain and precarious in 2009 when the best opportunities came along. By 2010 I was actively looking again, but didn’t find much that met my criteria of size, location and price. Perhaps I was too choosy and/or greedy, and perhaps I really believed that housing was about to take another leg down and regress to 2001 pricing. I realize now that there were 4 or 5 houses I passed on in the 2010-2011 time frame that actually would have suited me well enough and if still available would now sell for close to $100K more. My current home’s value has reflated somewhat as well during that time, so it’s not a total loss, but I’m probably still a solid $50K worse off on the exchange than I would have been 3 years ago.

One thing I did observe during that time was that the best deals always seemed to be “insiders only”. A distressed property would be listed for a great price and I would call (on the same day the listing hit) only to find it had already gone pending to someone with prior knowledge. This happened 3 times in just the small subset of Ventura County neighborhoods on which I was concentrating. Perhaps these quasi-fictitious great deals also fed into my unrealistic price expectations.

Anyway, I don’t mean to whine about this. I’m still in the market and am simply trying to evaluate where prices go from here. Of late this has led me to a view that, while hardly rosy, somewhat contradicts the prevailing wisdom on this blog.

Apolitical, your story is unfortunately not uncommon, at least based on the many postings here from frustrated buyers that have indicated that the insider selling has continued unabated. In my own hometown (Portland) it’s transparently obvious, as even realtors are complaining openly about not having any kind of access to the foreclosure process. People can claim whatever they wish about this statement being some kind of conspiracy theory, but people on the ground right now are proving the point.

OK, Sorry to break the news but real estate and equity will not crash. (and i’m not an real estate agent, trust me). I welcome anyone arguing against or for my points and appreciate all responses.

1. Real estate will not crash. Those argue once interest rates rise, housing will crash. Yes, mathematically and theoretically, interest rates rising should push home values lower. But, simply google “mortgage rates and home prices chart”, you’ll see that when rates rise, home prices rise, on more periods than not. That’s because mortgage rates are controlled, and the controller won’t allow rates to rise until economy booms. Then you’ll argue, if rates don’t rise, that leads to inflation, then read point 3 below. Another point is, asset classes’ price drops when sellers exceed buyers, when sellers are desperate. What’s happening now is high percentage of buyers are cash buyers. Cash buyers are not as predisposed to sell as the buyers during the 2004-2007 housing boom where they borrowed everything and had no skins in the game.

2. Equity (stock market) will not crash. The brainy bloggers at zero hedge has been praying for equity to crash for the past three years, and it hasn’t happened, it won’t and here’s why. @ 0%, the Fed essentially wiped out asset classes such as CD’s. So all the money in CD’s, and other low interest bearing instruments has been flowed out and it only takes a small percentage of this wealth transfer from these asset classes into real estate and equity to keep the latter two asset classes afloat. I’m not arguing whether those are rational decisions as no one can predict the market. Many simply want cash flow and are forced to pick the least worst instrument. And the comparisons against Japan, yes some are legitimate, but lets face it, the japanese, asian cultures, are savers, and low risk investors. Low risk folks would be more complacent leaving money in CD’s (even at close to 0%) than equity and real estate. But, western culture has a higher risk tolerance, meaning, at 0%, they’d more likely take on the risk and embark on the wealth transfer from CD’s onto real estate and equity. Huge cultural discrepancy.

3. Inflation is not happening, because what’s one way to resolve inflation?.. debt forgiveness. Those that argue inflation in certain commodities, asset classes, are like those that argue certain neighborhoods are either crashing now or withstood housing during the crash. Inflation at the high level is not happening simply due to principal forgiveness. So much attention and fear has been focused on inflation and equity crashing, that nobody is realizing principal forgiveness, or debt forgiveness, is happening in the shadow inventory. Every short sale, every foreclose, marks down and forgives several hundred thousand debt borrowed. This huge asset deflation counters any inflation taking place.

What does this all mean? If ur a responsible saver and have been sitting on the fence, uve been fcked, and ur ok with it since ur not doing anything about it.

You mean charts like this?

http://static.seekingalpha.com/uploads/2010/9/27/saupload_housing_and_interest_rates.png

Or this!

http://static.seekingalpha.com/uploads/2010/9/27/saupload_long_bond_against_housing.png

Thanks for posting those charts…with the exception of his point #3 (which I agree explains why there hasn’t been hyperinflation to date) I think Jason’s arguments disregard too many factors.

Jason, since your post indicated opinions only, I’ll try to take on each of your points with only my own opinions as well.

“Cash buyers are not as predisposed to sell as the buyers during the 2004-2007 housing boom where they borrowed everything and had no skins in the game.”

– You’re making a blanket assumption that the majority of cash buyers are buying those homes to live in as their principal residence, where all indications are that the exact opposite is happening. Hedge funds and investment firms are buying the majority of the homes available on the market, which means they’re banking on a acceptable level of return on those homes regarding the rental market. If those returns fail to materialize on an annual level, look for these owners to begin dumping them ASAP. I’m not saying that’s necessarily going to happen, but that’s a might big variable that you completely left out of the equation.

– “but lets face it, the japanese, asian cultures, are savers, and low risk investors.”

True, and they also make terrible real estate investment decisions. Just take a quick look at the Japanese RE frenzy that occurred during the 80’s, when they began buying up commercial space at astronomical multiples, only to watch them all crash and burn shortly afterward (btw, Sony finally unloaded their last giant Manhattan office albatross only this week – only took them three decades to finally get that off their books!).

– “Every short sale, every foreclose, marks down and forgives several hundred thousand debt borrowed. This huge asset deflation counters any inflation taking place.”

OK, but where exactly are all these massive foreclosures taking place? This site has amply documented the reality of sudden inventory reductions for all kinds of REO’s and foreclosures, with no logical explanation other than the banks are holding off on selling their assets with the hope that they’ll get better prices later in the year (or the next).

“What does this all mean? If ur a responsible saver and have been sitting on the fence, uve been fcked, and ur ok with it since ur not doing anything about it.”

Hilarous! OK, Swami, thanks for the tea leaves reading. Tarot anyone?

Only a fool can look at RE in the last 5 years and answer that question with any kind of certainty.

These are unchartered waters, with all of the government intervention in housing and finance/fiscal policy. There are no solid predictions simply because the magnitude of the intervention by the Fed and Treasury have never been attempted previously.

For those who can’t wait to buy a house, by all means do it. Perhaps I should give out my requirements now, in the expectation that within two years but IMO (notice: “opinion” which we are all entitled to) I will be able to scoop it up at my price point (which is way lower than some people’s comfortability level in terms of paying for shelter). For now, I love that I have limited my risks going forward with a sum certain lease. I have even considered buying a loaded Winnebago, so I can’t be scared that “buy now or be priced out forever.” It’s a bit small, but I don’t spend much time at home anyway. That’s only if the very reasonable rents go too high, which I don’t anticipate at all (been the same for me for 6 years). Good luck, all of you home owners hoping to sell your places in the next 5-10 years at the price you are dreaming about now (you have heard all of the reasons again and again: demographics, boomers not needing the big house and needing $$ for retirement, student loan debt, etc.). I have plenty of cash to buy a house and a stable job that would qualify me for a loan up to 1.0MM. Why would I want to buy an overpriced house now, with so little to choose from? I will wait until inventory and price are to my liking for now – and I bet there are many folks who will be doin g the same exact thing.

While housing starts are up, construction jobs are still lagging

Illegals don’t show up in the stats.

Didn’t housing bottom in US?

Hello James. Did housing bottom in the US?… that is the healthy debate on this blog. Many in the audience believe it has bottomed and many believe a bigger bottom is yet to arrive. As a potential home buyer now, I use this information in evaluating for myself what the prospects are for home value appreciation or depreciation. Since I have chosen to purchase a home that is in an area I can live in the rest of my life with a floorplan that can accomodate one of the children needing to live back at home and a price that is less than 3 times my wife and I annual salary, I have decided to go ahead and purchase a home. If prices rise and drop 5% here or there over the course of 3 years, I dont mind.

When looking at median prices adjusted for inflation since the 1970’s, the answer is yes, outside select coastal areas, the housing market in the U.S. has completely bottomed. Also, national historical nominal rents are in alignment with nominal prices (after a huge divergence 1999-2009), indicating that “rental parity” has landed once again in the U.S.

The delta on California median prices versus the rest of the country has vacillated in a range since the 1970’s. We’re at another high point now. History says we’ll get more in line with the rest of the country over time.

Bay Area home prices surge — fastest pace in decades

The median price paid for a home in the nine-county Bay area climbed to $442,750 last month from $335,500 in December 2011, according to the San Diego-based data provider. The median was the highest since August 2008, when it was $447,000, and the year-over-year gain was the largest in DataQuick records going back to 1988.

“At least half that increase is due to a change in market mix, with sales shifting away from low-cost distress homes toward more mid-market and move-up homes,†DataQuick said today in a statement.

I don’t know. I missed the last bubble and bust and it looks like I missed this bubble and soon to be bust too. Sigh! In hindsight, wish I had just bought a million dollar mansion for zero down and squatted in it for three years with no payments.

As Liberal Fascism continues from TPTB in Washington, look for more of the same in the coming years. Housing is done going down, at least for now…

Leave a Reply