Notice of Financial Default: California Develops a Mortgage Tsunami Patter Reminiscent of the 2007 Subprime Collapse. Alt-A and Option ARMs Unite.

To put it bluntly, there is major economic distress in the form of further collapsing housing heading down the California highway. You wouldn’t know this by looking at short term evidence. Future indicators are flashing red while many people simply choose to ignore bad news and pretend the bottom is in. They will get a rude awakening in a few months. The California economy is still in tatters with unemployment reaching 11.2% which is the highest in the post-War era. Yet some people think this is reason enough to call a bottom. What many fail to realize is the notice of default surge is starting to look very similar to what occurred in early 2007 when we were still reaching peak home prices. The only difference this time is median prices are down by 50% and there is no buffer anymore. First, let us discuss notice of defaults and foreclosures:

*Click for sharper image

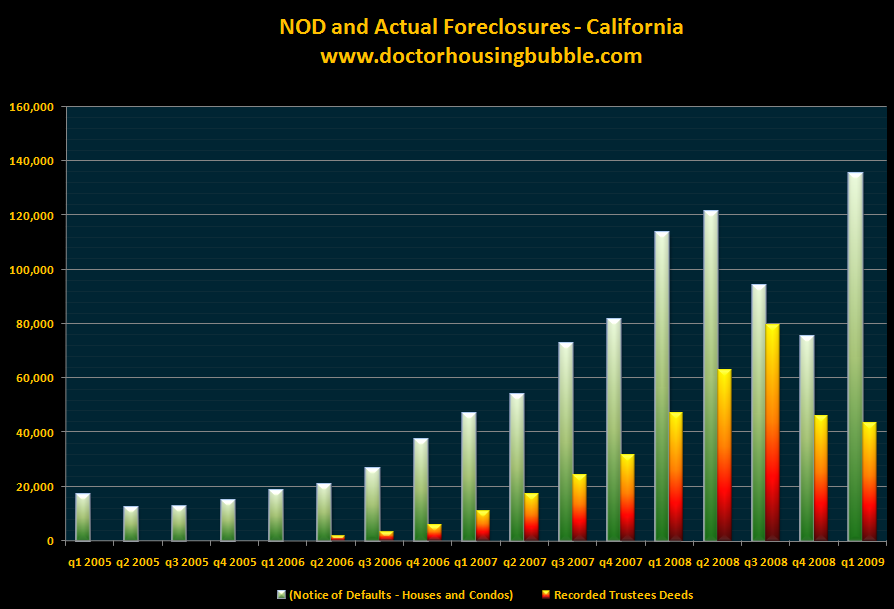

The first thing I want you to notice is that in Q4 of 2006, we had 37,273 notice of defaults (NODs) and only 6,078 actual foreclosures. If you go back further, say Q2 of 2006 you will have 20,752 NODs and only 1,936 actual foreclosures. What happened here? This is one of the quirky things about bubbles. People still faced distress during these times. Divorces happened. Job losses occurred. Life went on. Yet if someone needed to get out, the bubble was still moving up so someone had an option aside from foreclosure and just sold into the wind. That is, they simply sold the home for a higher price and all was well because the bubble disguised luck with business skill. Sort of like paying a few hundred bucks for a share of JDS Uniphase back in 2001. This of course has radically changed. In any bubble be it tech or housing, once people wake up from their mania, prices come down and come down fast.

Let us look at the chart again. You’ll notice that in Q1 of 2008 we saw a massive NOD surge while foreclosures only moved up slightly. The reason this pattern emerges is that NODs are basically canaries in the coalmines letting us know more foreclosures are in the pipeline. And as you can see from the chart, in Q3 of 2008 we saw a massive jump in actual foreclosures. Keep in mind that much of this was because of the subprime mess. But now we have a bigger mess with Alt-A loans and Option ARM products floating in the market. And the more disturbing thing about the chart is Q1 of 2009 is looking like a replica of Q1 of 2008 only worse. We are now in record territory. In Q1 of 2009 we had a record shattering 135,431 NODs filed. Much of this was due to lenders catching up for lost time because of moratoriums or because of SB 1137. And here I’d like to make another important point. Many pointed to this decline in NODs and foreclosures as a sign the market was getting healthier. Well of course if it happened organically and not because lenders stopped sending NODs and expected to go under the covers for 6 months and wake up and expect everything to be 2007 again. This isn’t Kansas Dorothy so stop clicking those red slippers your broker bought for you.

Looking at the chart, you’ll see that NODs and actual foreclosures fell in the last 2 quarters. That is no longer the case. If these patterns hold, we can expect a gigantic tsunami of foreclosures hitting the market in Q3 and Q4 of 2009. And there is no reason to believe otherwise. Let us see how many of these loans are going bad:

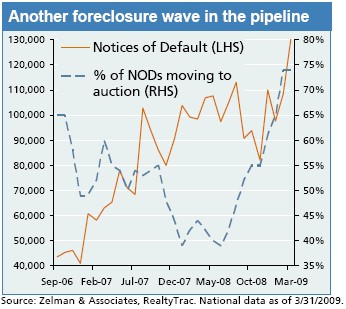

This is a very important chart. A NOD is basically a notice of default stating that if you do not bring your mortgage current, foreclosure action will occur in a few months. It also means you are missing payments (not a good thing). In the past as the chart above shows, a lower number of NODs ever made it to auction. Now, nearly 75% of NODs will go to auction. This on top of many of the homes being directly taken back by lenders in the form of REOs. In some quarters 80 to 90 percent of all NODs went to foreclosure. Look at the first chart again for Q3 of 2008. NODs and foreclosures nearly matched up which is a sign of massive market distress.

The U.S. Treasury and Federal Reserve have been ill guided in trying to attack this problem either through buying down mortgage rates or looking to buy up toxic junk through the public private investment program. The reason these programs won’t work is because the assets underlying the mortgages are troubled. Just look at a few examples of Real Homes of Genius and tell me what you would pay for these places? This is similar to those in Holland buying up tulips after the bust because there was some sort of market mispricing hundreds of years ago. No, prices collapsed because collectively as a society people went nuts in the mania.

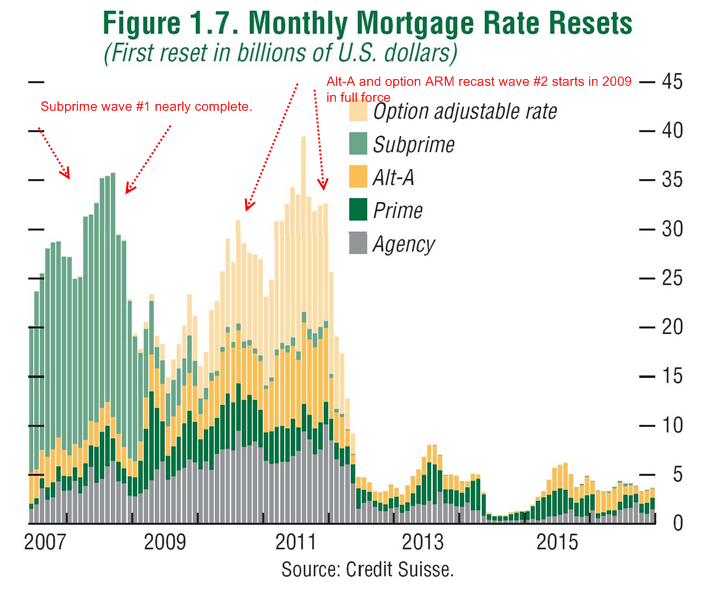

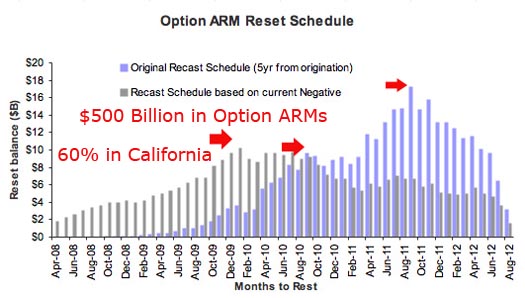

Q1 of 2009 NODs is an ominous sign. You also need to remember that for Alt-A and Option ARMs the average balance is much larger than a subprime loan. Meaning, for each default banks are going to take more of a loss. Plus, banks are still too optimistic about these loans. So even if we had half the amount of loans defaulting in this category compared to subprime, the actual bottom line losses would be larger. But we actually have NODs surpassing the subprime NOD wave! And this right here is another reason why I don’t believe we will have a housing bottom in California until 2011. Many Alt-A and Option ARMs are on more higher priced homes. So while people are getting into bidding wars in prime locations they are blowing their down payment which they saved for years, not looking at the bigger picture realizing the market is going be flooded at the end of the year during the worst seasonal time. That is, many people putting in that 10, 15, or 20 percent down may have it all gone by 2010/11.

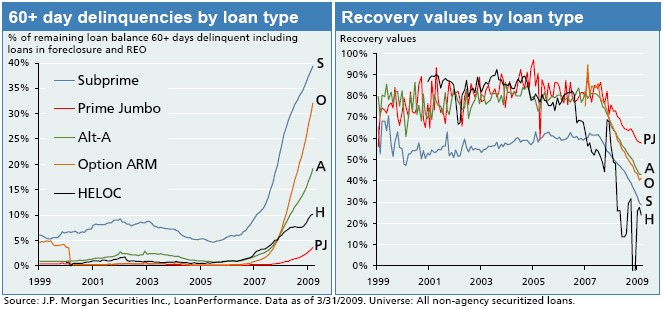

People may argue that these loans are nothing to worry about. They are nothing like the subprime loans. In fact, these are even worse. And yes, they have all the patterns of subprime loans:

Subprime loans have default rates in the 40 percent range which is insane. But Option ARMs are quickly catching up followed by Alt-A. I think this new data warrants two charts that have been out for a very long time:

The foolish bet many analyst made was default rates of these more exotic mortgages wouldn’t be defaulting at such high rates. They also never envisioned prices dropping so fast but what would you expect from people that depend on higher real estate for their money? So now, we are in wave 2 of this mess and what the NOD chart above shows, is we are gearing up for a second thrashing. Keep in mind that these loans are on higher priced properties thus it would make sense that we should see more higher priced foreclosures hitting the market toward the end of the year. But many people feel that they were left out of the bubble mania and can’t wait to sit on the sidelines for a few more months or another year. What do I tell them? Go ahead and buy but get yourself prepared to flush that down payment down the toilet. If you think waiting 1 year isn’t worth $50,000, $75,000, or even $100,000 them by all means jump in.  You are flying in the face of the macro trend and jumping again with the sheep getting ready for the second slaughter.

The pattern is unmistakable. This is subprime redux. The main difference is that prices are already weak and the employment situation is horrible. There is no reason to believe prices will be going up so the only reason I can attribute to these bidding wars is more of a psychological rush to buy. An impatient move to jump in. I can understand many have been saving for years and now they are itching to buy seeing record low rates and thinking, “well what if we do have another run up?” This is a gamblers psychology where you have busted numerous times on blackjack but feel going all in with the next hand will make you break even. But how do you convince people just wanting to throw their money down the drain not to do it? If this bubble has taught us anything it is people will make wildly irrational moves with their money. To think that people are somehow acting rationally now in the state with the biggest bubble is probably the real insanity.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

42 Responses to “Notice of Financial Default: California Develops a Mortgage Tsunami Patter Reminiscent of the 2007 Subprime Collapse. Alt-A and Option ARMs Unite.”

Let me guess. No one saw this one coming, either.

I’m in SW Ohio, the pressure on home prices has been terrific, for the area. I live in a rural area and immediately surrounding me, 4 of 5 homes/farms went to foreclosure since I moved there. This happened in 3 years. When they went up on the market, some resold for 50% of their original listed value. The fight is on now to reduce the taxes…people had the value of their homes inflated by the state of Ohio, in defiance of the current home values. I’m lucky as I have recourse in getting a zoning change to part Ag/Business instead of all residential. These other suckers are not. What’s happening to the tax rate out there? Is California adjusting the rates based on the actual market value? And not something dreamed up on paper?

OK… this is a dumb question:

Would the gov’t/banks NOT raise the interest rates on these alt A/option ARMs and keep the rates where they are/recently were to help slow the foreclosures/inventory of homes? Especially after the subprime fiasco?

Is this a remote possibility… to attempt to try to keep people in their homes?

@ChipChick – Not sure what CA is doing right now, but CA property taxes are fairly low due to prop 13. The state of CA makes most of its $ from personal income and sales tax.

CA CAN’T adjust the rates based on actual market value. I believe the rates will be based on current market value if you bought recently. But if you bought awhile ago (pre-bubble) those rates are strictly limited by Prop 13, your property could double in market value and the taxes couldn’t go up barely at all. And so hence we have a nearly 10% income tax, a soon to be over 10% sales tax in Los Angeles, car taxes and special fees on everything out the ying yang. And the state is still completely bankrupt and has the worst credit rating of any state in the country. They’ll bleed a poor renter dry.

To ChipChick,

One of the good things about California is that they can’t do that out here. Houses generally only get re-assessed when they are sold. There are strict caps on how much property taxes can go up each year. Instead we get hit with every other type of tax in the book.

Dr HB, yet again another timely warning about a potentially mistaken bottom-feeding frenzy.

If you save just one person from making a mistake that will cost their family dearly, you are a champion!

Keep up the good work, and keep warning people – there just aren’t enough voices yet to overcome the cacophony of “things are looking up!” beat-ups.

wincompetent: It isn’t the interest rate that is the problem. It’s the inability of the owner to make a real payment in the first place. Many of these soon-to-be-foreclosed houses were bought with no-doc option ARM’s (“liar’s loans.”) The buyer was allowed to make any payment they wanted to during the initial period, including no payment at all (the most-often chosen payment, of course.)

~

Naturally, it is these people that are clamoring the loudest for a “bailout.” They’ve been caught in their lie and will try to get taxpayers to somehow buy their house for them. That’s because their true $25K/year income won’t cover the PITI payment on their $750K McMansion with uranium countertops.

~

This upcoming group of loans must go through foreclosure before any sanity can return to the real estate market. Any political scheme to defer this will only prolong the agony. Houses simply are not worth $600 per foot even if that’s what someone “paid” with their liar’s loan.

“Would the gov’t/banks NOT raise the interest rates on these alt A/option ARMs and keep the rates where they are/recently were to help slow the foreclosures/inventory of homes?”

They can keep rates low until they stop buying mortgage backed securities. Once they stop rates are going to shoot up but I doubt they plan on stopping any time soon. I’m sure when thing deteriorate more we’ll see more moratoriums and other things to kick the can a little bit more.

Shouldn’t the coming wave of NOD’s for AltA and Option Arms be stacked? That would mean an even worse wave…

Keep up the great work

Whos is doing bidding wars???? I see prices dropping almost every Sunday. But, a Realtor@ did tell me that “now is the time to buy, prices are very affordable and real estate mortgage loans interest rates were at historical lows” LOL……. I think that Realtors@ practice this statement before they leave their homes every morning, I wonder if they actually believe that line of cr*p.

If you think about it, areas with property taxes above 2% like Dallas,TX is 3%+, cannot have bubbles like CA, here is a quick scenario

Top of bubble in socal 550k

550K house at 3% is $16,500 / yr or $1,375 / month

This is in addition to your mortgage of a 550k house, however the state will not give you a 1% teaser or an Option-ARM to pay taxes, so basically among other things a higher property tax would have easily stopped this bubble cold.

Don’t get me wrong I am in favor of reasonable property taxes and a supporter of prop 13, I’m just making an observation that is not mentioned much…

Hey everyone, the end is near! I heard it myself on Cramerica the other night! Cramer had Robert Toll on and the two of them together called the bottom of the housing market to occur on June 30th! So thank the good Lord! Only 5 more weeks and we can all jump in and watch housing prices sail up to the heavens again! Yippie! Yahoo! Walla!!

WHAT BULLCRAP!!! These people DISGUST me!!!

Yes, but the dark side to Prop 13 is that taxes on new development and recently purchased properties tend to be far higher. Many of the underwater homeowners in the IE have tax bills that are way out of whack with current prices (some areas charge up to 2% with local/subdivision assessments). These people need to be proactive to get their tax bills reduced – that is if they don’t just walk away altogether.

Given Dr. Housing Bubble’s excellent assessment of the coming wave of foreclosures, I think it’s a safe bet we’ll see further price declines, most pronounced in the areas not yet severely affected. A drive through Santa Monica and Brentwood will reveal an astonishing amount of “fore sale” signed popping up over the past month. I’ve also never seen this many rental signs on apartment buildings – including during the downturn in the mid 90’s.

The UCLA Anderson Forecast projects a prolongued “L-shaped” or flat recovery, meaning there is really no rational incentive to try and jump in before prices rebound. It is far more rational to wait and make sure the bottom has been reached. At that point, odds are you will have several years to a decade of flat pricing to find the right house for you. If you actually have cash for a down payment at that point, you’ll be sitting pretty.

If you act impulsively, you will likely take a bath. And let’s not forget that interest rates are at their lowest point since the ’50s and are inevitably going to rebound. When they do, housing could well be flat and thus suffer yet another decline due to affordability issues. This could in turn lead to more underwater homeowners, more defaults, and so on. If I had to put money on it, I would guess we’re in fort another 6-8 years before we return to even normal housing appreciation.

Another great article from the good Doctor, should be widely quoted in the blogosphere…

And more problems – CNN had a report that one third of foreclosures are damaged so badly by previous owners, thieves, vandals, etc. they aren’t worth fixing. Unemployment will continue to rise. Government services are going to decrease – more towns and cities are going to go bankrupt. Commercial real estate is cratering – malls, strip malls, restaurants, etc. Luxury apartments, condos, etc. are in big trouble too. Owners who by 5000+ sq ft Mcmansions, even if they are bought at a discount, aren’t going to be able to afford the maintenance and tax costs, and will end up in foreclosure again. The list goes on and on, we ain’t seen nothin’ yet.

The realturds are telling people that “now is the time to buy.”

Some people actually believe them!

Come to think of it, I wonder how much of a role Proposition 13 plays in the unaffordability of homes in CA. Oh I know there was a bubble, the median earning responsible person was kept out of housing by inflated values caused by non-standard loans. And the Feds want nothing more than to maintain the charade and forever keep houses from becoming affordable. Yes there is a circle in hell for them.

But CA has some 10% less turnover in houses than other states due to Prop 13. So 10% of housing kept off the market (reduced supply) and the same demand. Prices go up of course- adjust the supply curve and keep the demand curve constant and you don’t need a Nobel prize to figure that one out. The potential first time buyer is out of luck.

Also Prop 13 has been said to lead away from building affordable housing and even housing in general. Oh I know even a small 50 year old home is not affordable in Los Angeles. But as for new housing even the condos they are building these days are over a million dollars (I’m not kidding, I have seen those). Although some of those biases would exist even with a real property tax.

Also years of ever diminishing in real inflation adjusted terms property taxes will drive up the price of CA housing by itself. Since it has real value to the person who holds that deed so you bid up the price to get that value. But what good does that do if your a young couple that wants to buy their home and is forever priced out in CA, because of that inflated home price.

Younger generations have been royally screwed by their elders and Prop 13 is just another example. The bumper sticker that says “we’re spending our kids inheritance” is an obscenity. You’ve already spend their FUTURE INCOME (national debt) and @#!# them in countless ways (prop 13), leaving them an inheritance just makes them about break even.

This article is prophetic from 1988

“In time, the twisted legacy of Proposition 13 could leave us with yet another novel idea from the nation’s trendiest state: apartheid, California-style.”

Yea we have apartheid between rich and poor like few places in the nation.

http://www.nytimes.com/1988/06/17/opinion/the-curse-of-california-s-proposition-13.html

CA rest in peace.

Will the last middle class person to leave CA please close the door.

When prices were going up, I thought it took several years for people to accept the rise in prices. What I keep expecting with the bubble burst is the reverse, where home sellers universally come to accept that homes are worth dramatically less than the peak. When I look at homes for sale in the upper-middle class areas, I see a mixture. There are homes that have been on the market for a year and have fallen through escrow so many times that the prices are becoming more reasonable (yet still aren’t selling). But there are still a lot of homes on the market that have hardly budged with their bubble prices. Are there just a lot of sellers waiting for prices to swing back up soon? Or is this some kind of tactic: price it high and start the price haggling from there?

PSPS-

Great points… I’ve held out since I sold my OC house in ’05, I sometimes wonder if I might miss out on buying again in SoCal.

Dr HB and you are right.

I guess just ’cause someone lives in a $750k house doesn’t mean they can make a payment, even if they make $100k a year.

Thanks for setting me straight!!

Gotta go get sucked in again by CNBC, hee, hee 🙂

re: prop 13— I remember when the State of California was raising property taxes at such a tremendous rate that many people were actually being taxed out of their homes. Yes, right here in California. Property taxes were a huge expense for many people and, believe it or not, many were forced to sell because, even though they had paid off their homes, the taxes were unaffordable. Take a look at what the state legislature is doing now with any other tax they can get their hands on. California finances have been horribly mismanaged. If the legislature could, they would gladly raise property taxes sky high tomorrow to alleviate their own fiscal irresponsibility. The Jarvis-Gann initiative (Prop 13) stops this and has actually saved most homeowners from unreasonable tax levies on their property by the state. To blame any part of this current subprime fiasco on Prop 13 is ludicrous. I’ve heard a lot of complaints on Prop 13, but I’ve lived through both sides of this issue and I’ll take Prop 13 any time over the ever increasing property taxes from California politicians. Remember, be careful what you ask for, you might get it!

Can somebody explain to me the mechanism by which they think prop 13 caused affordability problems? So, if property taxes had been higher than they are now, that would have made property more affordable? I don’t think so. Whatever disadvantages have come with prop 13 (and of course, everything comes with disadvantages), it has helped buffer property taxes against recession. Property taxes on almost every property that has been held long-term continue to go up 2% per year, even as the market value of the properties declines. I’d venture a guess that the property taxes on most parcels in California went up last year, even though their value went down. This effect of prop 13 buffers the impact of “down markets” on property tax revenue, and that’s a good thing.

“No one ever went broke underestimating the intelligence of the American public.”

— Henry Mencken

@Karen – This is, of course, price elasticity. It is much easier for prices to go up than down. Sellers will hang on for dear life trying to get out because they either don’t have enough equity to sell at market or they will lose what they foolishly put into the house during the bubble.

Many Americans think saving is getting 30% off on a pair of shoes or a lawnmower. They have no idea how money really works. “How can I be out of money? I still have checks!” We have all gone past’ money doesn’t grow on trees’ to where money just comes out of thin air…or at least federal reserve notes do.

As the bear-market stock rallies indicate, hope springs eternal. Maybe if you make a realistic offer, someone might sell before it goes to auction, but this is a siege. As the DHB charts indicate, the sellers will starve the next two years or die from their mad-cow escrow disease. Hold out and buy when the sellers capitulate in 2011. Buy when there is blood in the streets (figuratively, I hope) Good luck.

Comrades,

Be scared, be very scared! We are witnessing by far the greatest bubble bursting ever seen by mankind and we are still early in the game. Let’s take the good Doctor’s line of reasoning to the next level. If the subprime wave created a financial meltdown, the option-arm/alt-a wave (not to mention the consumer credit/auto loan and commercial real estate defaults) will create a financial implosion. The next wave will be bigger and more vicious and there will be no taxpayer safety net big enough to save it. Most banks are already technically insolvent (while hiding behind enormous off-balance sheet liabilities) so the next wave will be absolutely the scariest thing one can imagine.

It’s great that this blog is keeping a few potential homebuyers from ruin but we should be much more concerned about keeping the entire financial system from ruin. Remember, we are already tracking worse than the worse case scenario in the so-called stress test. If Geithner/Summers don’t come clean with the American people in the next few weeks (which I don’t expect them to do), they should be prosecuted for crimes against the state. Only the truth can save us now.

I heard a radio interview yesterday with the real estate staff-writer from the L. A. Times. He said that the lower-end market is moving pretty well because of all the foreclosures and the drastic price reductions. There are buyers who buy these distressed properties.

However, the higher end homes are not moving at all because sellers, rather than dropping their prices to meet the market conditions, are simply taking them off the market. So they are still in denial and probably think the market will rebound soon, and they will get the price they feel like they deserve.

So there are really two markets at work here, but the higher end market is dead in the water until the sellers see reality, and come out of their daze.

Comment by polo

April 25th, 2009 at 9:58 pm

“””the lower-end market is moving pretty well”””

That’s not true, year over year, it’s way down. However, what sales there are have been recently explained by Dr HB. You need to search for the article on FHA loans on the blog here being 25% of the current market, that is, the taxpayer absorbing the losses and the private banks taking down the profits (fees, points, etc. ), as usual. Buyers can get away with a low down payment on these FHA’s, as low as 3%, and these loans are now defaulting at an increasing rate.

Curt

I can afford a 600K house, I have the cash, yet if I buy a 600K house my property tax will by 7000 a year! How is that fair in any way? Never in my life have I let the property tax burden affect my home buying decisions except for now when it comes to California, bubble pricing and Prop 13.

People aren’t getting the Prop 13 effect.

It is simple.

If I buy a 600K house my property tax will be 7000 a year. Meanwhile the guy living in a 600K house next door who bought in 1980 is paying 1000 a year.

In other words the state HAS to screw new buyers because they can’t get enough from past buyers.

Wouldn’t it be better for all if my 600K house had a 4000 dollar tax bill along with the guy who bought his house in 1980? 4000 from each home owner is 8K total. Currently it is 7K from the new buyer and 1K from the old buyer for a total of 8K.

Prop 13 has legally created two classes of people. One class gets to pay far less tax than the other.

One question – what about the inevitable massive devaluation of the dollar? The Fed is doing their best to destroy the dollar right now. The results will be delayed but must show up eventually, right? Won’t a house be a good hedge against this?

Or will the rise in interest rates cancel out the massive inflation, as far as housing prices go?

CA RE taxes are NOT low. The percentage is low, but CA has one of the highest, if not THE highest RE taxes in the nation, because the properties are so expensive. Also, tax assessment CAN be reassessed and lowered, if appropriate. Although income, sales and absolute taxes are quite high, CA incomes are not proportioonally higher, making housing cost expense % one of the nation’s highest. Couple that with higher unemployment and you have the makings of a huge disaster.

Some of you people really don’t understand Prop 13. It is initially 1%, but can escalate every year. In addition, the Prop 13 base does not include additional levies for bond issues and special assesments, which add a lot to my current taxes. Also, CA RE prices were and still are relatively high, so even with low %, there is a high tax. I had a 4 bedroom house in Camarillo with over $20,000 in annual taxes. I was fortunate to be able to sell it right before the crash.

Check out this article from the White Plains Times a local newspaper in WP New York. The Real Story on Real Estate

Hit to Local Market “Minimal,” Realtors Say

By: Pat Casey

Published: October 30, 2008

If you want to get a good sense of the state of the local economy, there are many places to look. One is the residential real estate market. The news media are full of disaster stories of areas out west and across the “Sun Belt” where the housing market has suffered tremendously during recent weeks. Houses are in foreclosure, which forces prices down; the only good news is that the inventory is at least moving. This scene, however, is not the headline news for most of the Northeast, Westchester County, or White Plains. Residential real estate here has its own story.

In a recent discussion with Peter Gorbutt, president of the White Plains-based Gorbutt Group Real Estate, we found out that “our local market took a minimal hit compared to what other areas around the nation are experiencing.”

“Our strength in this market comes from our prime location and we will always have a demand for housing here,” Gorbutt continued. “White Plains has a well-balanced economy, great quality of life, great transportation, easy commute to Manhattan, excellent schools, and a vibrant city.”

We heard the same thing on Monday evening during the White Plains Downtown Residents Association meeting at Vintage on Main Street, when Ann Bernstein, a top-producing agent for the White Plains office of Houlihan-Lawrence, told the group that the Wall Street downturn has not significantly affected the White Plains residential real estate market thus far.

Bernstein attributes White Plains’ residential housing strength to the diverse population in the city that both buys and sells housing at various levels. Based on data she had collected, Bernstein said the median price for a single-family house in White Plains had only dropped slightly from 2007 to 2008. If you look at the various real estate ads in this newspaper and others, recent listing prices do seem to bear that out.

When it comes to condo sales, Bernstein claims there has been a 9.6 percent increase in the median sale price. “That is an overall number,” she said, which includes sales of luxury condos in the Ritz-Carlton, Westchester and Trump Tower, so the number is exaggerated. Also in attendance at the WPDRA meeting was Susan Fitzpatrick, the new property manager for the Ritz-Carlton, Westchester who spoke briefly about how those luxury condo sales are going. “What we have heard from the developer [Louis Cappelli] is that Tower I is almost fully occupied; Tower II opened on Sept 24 and is nearly 50 percent occupied.” Fitzpatrick further stated that Tower II would include retail and office space—housing Cappelli Enterprises in the near future—and that construction on the upper floors of Tower II is still in progress.

Co-op sale prices in White Plains from 2007 to 2008 have remained relatively steady. Where there is a growth trend is in the rental housing market. “Much of our market slowdown comes from the tightening in mortgage lending criteria,” said Gorbutt. “Lenders are now requiring buyers to have good established credit histories and larger down payments,”—about 20 percent, according to Dean Curtis of DC Funding LLC, a boutique mortgage company based in Bronxville, who added that some lenders will not close on a mortgage if the down payment is coming from a property sale until that property has sold. “This is sending many [potential buyers] back to the rental market, which is causing a higher demand for rental units, and rental prices are increasing. The White Plains rental market is doing fabulously at the moment. Many developers and real estate investors have changed direction in projects to take advantage of the demand for rentals in our area,” Gorbutt continued.

No one can say for certain where economic markets will be three months down the road. A snapshot of today shows White Plains residential real estate prices remaining stable.

According to Bernstein, “history shows real estate is the best investment you can make,” and she stands by that claim going forward in White Plains. Gorbutt agrees. “Soon-to-be empty nesters in White Plains still have a very valuable asset. If they have been a long-time homeowner, the increase in value alone in the past seven years has been incredible. It all comes down to pricing the property right and making your home show- ready.”

As amatter of disclosureI Know one of the agents featured in this story. I can imagine what there all saying now, interest rates will never be lower you better buy NOW!

Now we have this…

Wolff/Rand Real Estate Merger

By: By Paula Markowitz Wittlin

Published: April 22, 2009

Nick Wolff’s three-office, family-owned real estate company, Century 21 Wolff, has joined with Prudential Rand to become the new Better Homes and Gardens Rand, an affiliate of the iconic media conglomerate. The White Plains office will be housed entirely at the 1 North Broadway, 10,000 square foot, Prudential Rand location, with most of the White Plains Century 21 Wolff agents joining the new team. The Rand Yonkers office will relocate to the Century 21 Wolff Central Avenue location, and the Mount Pleasant office will assume the new name at their current address.

Aileen Wolff said by phone, “We feel very good about this. Marsha and Joe [Rand] have been our friends for 25 to 30 years. It’s a good fit.†Nick is thrilled about his new role as leader of Rand’s philanthropic committee. He foresees continuing to work five, six and seven days per week, being involved in the community as well as in real estate owned properties (REOs), future mergers and acquisitions. “I think it’s going to be really powerful,†offered Wolff.

Greg Rand, who spoke on behalf of the family owned Prudential Rand Realty, fondly remembers Nick Wolff as his first client and mentor after his 1990 college graduation. “Nick was the first person, besides my parents, who believed in me,†offered Rand. He and Wolff both spoke fondly of the long history of friendship between the two families.

Rand explained that timing the announcement of their new identity on Earth Day was consistent with the “going green†orientation of the Better Homes and Garden Real Estate brand. Drawing on the popular jargon, Rand described the new company as more Main Street than Wall Street, a supporter of and advocate for community. The BHGRealEstate.com website has Look, Learn and Live components. Philanthropy and community involvement is a mission of the new BH&G Rand. It also is Wolff’s passion, and the way he will be spending most of his time.

Prudential Rand sponsored a Foreclosure Prevention Workshop in Rockland County last year, which resulted in 22 families being able to keep their homes. A video of the panel discussions was posted on You Tube for broader dissemination of the information. Greg Rand intends to bring that program to Westchester this summer.

“I feel the world needs optimism in real estate and everywhere,†he maintains. “I want people to view this as a strong optimistic play that shows we believe [the current housing downturn] is just a market correction and not a freefall. We’re able to do mergers and acquisitions because we saw it coming. Now is the ideal time to make a bold statement and move forward.†The largest real estate agency in Rockland and Orange counties, has now become the third largest in Westchester, with eyes open toward the future.

Just amazing,.

@Carlivar

There are three differences between US and a banana republic printing money out of thin air:

1) Our money is backed by oil. All oil contracts in the world, until recently, were denominated in dollars.

2) We are too big to fail. If we go down, the whole world economy goes with us, so the charade must go on, despite ze emperor sans pantolones.

3) We have enough nuculur (that’s a fun way to say nuclear, ala W) WMD’s to take out this planet, the moon and the rest of the solar system. Ask the last guy what happens if you don’t think FRN’s are legal tender…

If 30 years of being underwater hasn’t broken the dollar, what makes you think this will? It might…and it might not. The scarier the scenario the more flight to ‘quality’ and the more vicious the fighting for the last chair when the music stops.

Dr. HB excellent article once again. It is very good news for the patient buyers out there. One big question I have for you, is CA Foreclosure Prevention Act, do you think this will have adverse affect to what is mentioned in this post?

For others, here is more information about it. http://piggington.com/this_never_ends_quotca_foreclosure_prevention_act_coming_upquot

My argument was that prop 13 withholds some housing stock from the market (because there is significant benefit in staying put) this equals reduced supply thus driving up prices. Some have also argued it leads to building commercial property rather than housing (above all affordable housing) because since the cities/state can’t get much from property taxes they have to get it from sales taxes, but those are more indirect arguments.

So Prop 13 may play it’s roll in high housing prices in CA, as perhaps does the lack of land (there’s really nowhere else to urban sprawl to in L.A.) and population and all that. I know the Dr says housing prices are still coming down more, but currently I haven’t noticed that much of a movement. I have my doubts whether housing will ever be affordable in CA, well that is unless you want to live in Compton, some very affordable houses with trash cans there I guess.

And yes of course proposition 13 is extremely unfair to people buying in different periods, and probably somewhat unfair to renters as well, in shifting the tax burden entirely on to the income and sales taxes. NO other states have the combined income and sales taxes we do, these taxes are just very high in CA. Of course people are been driven out of their houses in other states due to property tax increases (whereas in CA you just can’t get into a house because of cost). But the property taxes should at least adjust by inflation, not this 2% a year (when has inflation ever been that low), even social security payments adjust by inflation, so even if you were living on those you could afford it.

But then again prop 13 is just another bastard child of another housing bubble (one long ago in the 1970s) and even then you could probably blame inflationary policies at the Fed for that one too. Oh what a tangled web …

Thank you, good Doctor. Just thank you.

Regarding the effects of Prop 13…When we bought our home (Temecula area, Jan 2007), the tax rate was ~ 2%. $4500 for taxes based on assessed value and $4500 in Mello-Roos and community development bonds. The purchase price was ~$500k. Now the homes in our hood are selling for ~$250k which means we effectively have a 3-4% tax rate. Even if the assessor’s office was to lower the assessed value of the home down to $250k, our taxes would only drop by ~$2250 a year for a total due of $6750. If the value of the home is $250k, the tax rate would be 2.7%. Problem is, the assessor’s office won’t lower the assessed value to what homes are actually selling for so you end up with a tax rate between 3 and 4%.

Based on what I have learned about this situation through calls to the city and conversations with neighbors, the builders used to pay for things like sidewalks, grading, drainage, etc., and then roll the costs into the price of the home. Now what they do is ask the city to pay for those things and include the cost into property tax assessments. Theoretically, this would result in a lower “home price” but it did not. It was just another way for the builder to increase their profit margins. Now the city is on the hook to pay off the bond which was used to finance the initial construction through property taxes, but the homes are foreclosing left and right because the values are down so far and the taxes remain so high. Bad decisions on all levels combined with builder greed and emotional buyers falling in love with a beautiful home and insane financing directly led to the housing problems in my subdivision.

Napa/Sonoma area RE is very active below 400K and on fire less then 300K.

Best buys are REO’s since they are not short sales other then that the banks are playing the market and getting good prices with multiple bids. Large share of the market is short sales due to the bubble prices or refi activity, either way today is not a good time to buy and I have been looking for over a year hard but will wait now on the sideline.

What is really moving the market now is FHA buyers. 3.5% down up to 625K loan, its crazy.

stan: before Prop 13, mortgages were seen as bad investments. Homeownership in the 70s was seen as onerous, by lowering taxes, people hang on to properties, lowering supply, and also the you cause speculation in property if taxes are low. Look at what happened to property after Bush II lowered Capital Gains tax in 2002. After Prop 13 passed a great bubble occurred in the 80s, driving up prices to insane levels. Housing that had been previously built for WWII working class vets in the valley and westside was now out of reach.

Comrades,

The latest housing data released today show that total homeownership rates have fallen from a high of 69.2% a couple of years ago to just over 67%. Just to give you a sense of the magnitude of the number, for the past 30+ years, the rate has hovered around 62%. Let’s do some math: total housing stock in the US is approximately 130 million units. If homeownership rates must drop 5% more to reach the average, that would equate to another 6.5 million more homes have to be converted from ownership to rental. Now Comrades, what would an additional 6.5 million homes on the market mean for prices and the liabilities to the banks?

Dontcha worry yer purdy little head…Arnie and the Dems are gonna pump YOU up…they’ll propose another round of tax increases….yeah, that’s the ticket!

I second Doctor HB’s motion.

Charlie Crist recently told Floridians that there never will be a better time to buy real estate in Florida then right now. That people will say, “I bought in April 2009” as a brag in the future. And we are one of the four about to go through foreclosure hell and have four of the top ten cities for projected unemployment by Forbes. People tend to trust the governor, and this would not be acting impulsively. Really disgusting, the payoffs now in Florida for scam developments no one needs and the ripoffs to the taxpayer and boosts to the ‘people’s governor’ from rich GOP buddies. Crist won’t address any of the issues headon. God help us.

Find one time in history when a Realtor claimed it wasn’t a great time to buy. They use the same line no matter what the circumstance.

Leave a Reply