Will Millennials save the housing market? 92 million strong and many still living at home and renting but will this change?

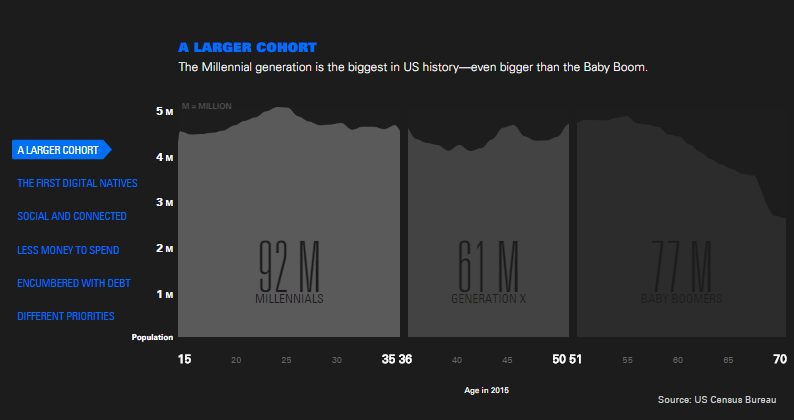

If you want to see what baby boomers are buying, just watch the commercials on 60 Minutes. Between Viagra and Prostate commercials, you will also get ads on remote destination cruises. This is a much older audience that isn’t buying new homes. Many already own homes. Yet they bought during a time when the housing market was much more stable and less prone to the machinations of Wall Street. Now we are in the midst of a renter revolution and are witnessing the lowest homeownership rate in a generation. The baby boomer cohort is 77 million strong but the Millennial generation is 92 million strong. You would think that there would be plenty of fresh bodies to replace the Taco Tuesday baby boomers but it simply hasn’t materialized. Can Millennials save the housing market?

Millennials as a group and buying trends

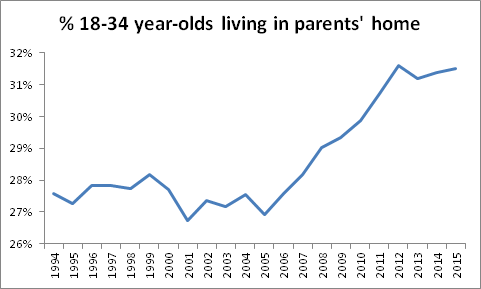

Millennials are much more focused on lifestyle design than having a McMansion. Crossfit, paleo diets, and travel are much more important to this group than taking on a health destroying commute just so you can have a big home. It is also the case that many Millennials are deep in student debt and are suck living at home with parents after embarking on a very expensive college journey. A journey that I would imagine would open up their eyes to things beyond simply buying a crap shack as the end all goal in life.

Here are the numbers:

Millennials are a massive group. Generation X has slightly followed in the footsteps of baby boomers when it comes to home buying. But not so with Millennials. Many are opting to live at home or with roommates. Many are also marrying later and having much smaller families which goes against the needs of a giant McMansion.

This is a new trend:

This is probably being brought on largely by necessity but also changing wants and desires. It is also nonsense that most people stay put in their home for 30 years. The average works out to be 13 years:

Source: Â NAHB

In California, with more than 2.3 million Millennials living at home, you do have many people locked down in Prop 13 protected properties having their boomerang adult children moving back in. In many cases, the adult children are definitely not earning enough to purchase the current property. In many cases they were born during a time of bigger families, you have multiple adult children coming back home.

I was at an open house for what you would call a crap shack in a nice neighborhood. The place was definitely a starter home. What was interesting was most of the people there were much older, say late 40s or early 50s. And some much older. For the few younger people, those in their 30s you could tell they were professional working couples. For this property, a couple would need to make $200,000 a year at minimum. It was an interesting open house. But Millennials were not the target crowd although this was a starter home.

Will Millennials save the housing market? Well the housing market doesn’t need saving. Prices are in the stratosphere so even a minor correction is probably warranted. I suppose when that question is asked people are looking to see if current prices are the “new normal†and that things will remain the same.

The market is simply juiced on low interest rates.  We’ve been in a solid bull market since early 2009 (a solid 7 years). Even last year, probably 5 percent of the population would have forecasted this political season. So to think things can’t adjust in a market that seems frothy is simply naïve. Also, just look at the economic numbers on incomes for Millennials. There is more than $1 trillion in student debt being carried by this group largely. Many already have mini-mortgages. The recent price movement has been pushed by investors, foreign buyers, and very low inventory. But Millennials are not the group saving this market, at least for now.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

93 Responses to “Will Millennials save the housing market? 92 million strong and many still living at home and renting but will this change?”

Housing to Stabilize Soon!

It’s starting! A close Millennial friend of my daughter just bought a house! Millennials to save us soon!

This blog stats are based on California Market, and it is real. if you say Millennial could easily buy a home then they must be the top 1% or they are located in Taxes or so…$200K single family? you can get a mobile home in Anaheim.

I’ll be honest and correct my post. The millennial friend of a daughter did not buy in coastal S. CA. They are a dual income couple with stable jobs outside of S. CA.. I’ll correct my statement to “Millennials to move out of S. CA soon!”!

Housing To Tank Hard in 2016!!

In 2016?

2016 is about 67% over.

33% Percent of the year left is more than enough 😉

Housing in my neighborhood (Riverside, CA Orangecrest neighborhood) has hit the $700000 back in 2006 ($835K present value) for homes that are in the $550,000 to $600,000 range today. Until prices hit even 85% of that there’s much more room to go up. Will millennials continue to drive the market? As long as inventory and interest stays low, why not? Plenty of decent paying jobs available that pay enough to cover the mortgage. PMI for a $500K home in suburbs 1 hour outside LA, OC or SD is about $3000/month which is doable for a $90,000 dual income family. Sure millennials aren’t doing as well as their preceding generations on an individual level but they’re big enough in numbers to pick up the slack. Don’t underestimate them as new players in the housing market.

Wait, by dual income, do you mean $180K per year total? Surely you don’t mean $90K total. A big down payment and 40% of income sounds crazy to me on only $90K per year.

Top line income of $90k/annually in CA means the couple takes home ~$60k after taxes and mandatory Doh-bamacare plan payments. The mortgage payment of $3000 is 60% of that monthly check.

I’m the kind of buyer you describe. Dual incomes in the low six figures, no kids. The idea of spending my entire life working and commuting to “enjoy” home ownership in Riverside of all places seems bonkers. This isn’t the dream, friend.

Yes, I’m talking about $90K combined not $180K. And it might not seem like a good idea to YOU but it is definitely a good idea for other couples. And what’s wrong with Riverside? Either way, my numbers are fairly conservative. You could get a brand new house in Winchester, CA just south of Hemet bordering Murrieta for $400K so you’re looking at ~$2300/month PMI which comes out to under 50% of take home pay which is very reasonable by today’s wage standards. You’ll most likely commute to San Diego which is about an hour away and the traffic in that direction is no where near as dreadful as the IE to OC/LA commute. But hey, if you would rather dump that money in rent for the rest of your life just so you can Snapchat how close you live to the beach be my guest!

Exactly. We’re a single income family, we have no debt, and I make close to $200K, and we’re still trying to keep it at $500K or lower up here in Portland (that’s why we left LA.)

p.s. I loved reading an article about the house that Lena Headey bought a couple of years ago for $790K in Sherman Oaks. Now, she was coming off of a divorce, and she put a lot of renovation money into the place, but the fact that a major character from the #1 TV show (among other projects) only spent that much on a house, yet I see people barely making over six figures buying similar houses in LA, shows me how detached from reality many are.

I mean, Lena Headey makes $300K…per episode on just that show alone!

NewAge, that’s exactly the problem that so many of us worry about. People in California over leverage themselves, and then don’t have anything to fall back on when a recession comes and takes jobs/lowers home values. Then we hear all the cries about how unfair is, which leads to intervention.

If I was spending 50% of take home on my mortgage, I would either rent for about half that, I’d look for ways to substantially increase my salary/change jobs, or I’d move out of state. Making $90K in the greater L.A. area is about like making $45K in Indiana, or maybe even less…or do you Snapchat about how cool it is to live the “dream” in California?

DH, I read a while ago that Lena Headey dislikes living in L.A. She said there’s no sense of community, unlike London or New York, where you can just step outside your “flat” and walk off to meet “your mates at a pub.” Headey apparently spends most of her time in London. Her L.A. house is just a place to stay when she’s here on business.

And she make $500,000 an episode — or about 340,000 Pounds in English money (according to the IMDb).

GH, another reason that Headey refused to over-spend on her Sherman Oaks house is that she and her ex sold their Hollywood Hills house at a loss in 2012. Headey was burned when the last bubble popped. Now she’s house cautious.

@New Age

I would rather live close to work, be able to break a lease (since you can’t get even close to rental parity buying in most parts of OC) and not just be near the beach, but be near the OCEAN which helps keep the climate more moderate, and the air cleaner. Specifically, I can’t fathom being stuck in traffic for more than 15 minutes at a time, since I am originally from Anchorage, AK, where traffic is bad when you don’t have a lane to yourself, or someone is in front of you.

Yes it sucks not building equity, but I don’t need a large house, and I am saving the difference for not if, but WHEN the market tanks again. In the meantime, I can bike, or even walk to work, go home on my lunch breaks, etc.

Millennials continuing to drive what market? The policies behind the current economic “expansion” have unjustifiably subsidized the asset owning generations at the expense of new buyers. Can’t simply make the RE pyramid top heavy and not expect it to wobble under its own sheer weight.

I had to search who Lena Headey is.

Game of Thrones..

“When you play the game of homes you win or you die; there is no middle ground.”

https://www.youtube.com/watch?v=rdsYE7i3DVU

You have to be a real kind of stupid to get into a 500k mortgage with 90k combined income. I suppose you just want to pay for a home and do nothing else. Have you ever heard of the term “house poor”.

I grew up in OC and have lots of family in the IE including Riverside. I’m not going to dog it, it has gotten a lot better than when I was a kid. I still would not pay 500k for the IE unless it was located in an amazing neighborhood and if my job was actually there. Any type of commuting sucks but most of us do it, I would rather do it in a nicer County though if I had to endure anything over 1 hour each way.

To each their own but going back to 500k mortgage on a 90k combined income, is just a terrible idea. I can’t even list everything that is wrong with that but I don’t think you will care anyways! Good luck!

I do care otherwise I wouldn’t be on this website several times a day! Please entertain me…

I thought we were talking about a 500K house on a 90K income. If the buyer puts 20% down (the gold standard), then it’s a walk in the park. On a monthly basis, it will likely be cheaper than renting. Running some quick numbers, your monthly housing nut is 35% of your gross income. Totally normal here in socal. When accounting for principal and tax savings, the numbers say buy. I wouldn’t want to commute 2 hours per day, but that’s certainly not stopping many other people.

$500K mortgage on $90K income… you don’t own the house, the house owns you.

Check your stats, today Millennials make an average salary that is higher than any previous generation….

the issue is homes are overpriced by 30%….so they can’t afford them on PTI, DTI, LTV ratios…

market is softening already…..it has begun….

Its called inflation, or alternatively, debasement of the currency. Tis but a hollow victory when everything around you costs 10x what the previous generation paid.

If banks make across the board lowering of down payments and relax credit rating than the market will move led by Millennials. Matter of fact, if banks get a interest rate hike and mortages go to 4.5 to 5 % then they will lessen the rules, under 4% loans at 30 years makes banks very nervous and they are unwilling to loan to the borderline public with such low mortages rates.

They don’t make decisions that way…..millennials are like every generation, the make more money than any other generation at this age….

the problem is overpriced real estate, larger govt. transfers such as taxes, property taxes, county etc…. Homes are not going higher, its over……good luck creating inflation out of no air……deflation still rules, what everyone forgets is the first depression had a recovery and then the economy went to hell…..same applies here…..

anyone buying a home at today’s prices needs there ass handed to them….as they say

their is an ass for every seat and now an ass for every sofa in an overpriced asset

It is money honey and the millennials living with mom don’t have it because mom does not have the money. The millennials spend what little money their Starbucks job pays, on fun, like the young Japanese kids, except ours have babies out of wedlock, thus dooming most of them and their offspring to the servant class. Poor old mom has to support her babymama daughter and her offspring from Carlos, who is a good lover, I am told, but little income.

The Donald is posting on here now?!?!?!?!

Millennials are much more focused on lifestyle design?

What does that even mean?

They don’t want hideous McMansion that are huge but don’t follow good design principles in far flung locales on streets that are so dead they look like circuit boards.

I love your comments.

Oh. Ok. Well can’t fault them for naivete. They will eventually grow up.

If my personal experience is any indication, my starter home was bought at the age of 45 years old. I’m a native Californian, and know many people in my age range who remain renters, or who could only buy with help from the Bank of Mom and Dad. The idea of a person buying property in their twenties seems so flyover country, where real estate might actually bear a relationship to incomes. Statistics and forecasting are also oriented more toward dual-income couples, yet we are in an era where more and more people are going solo, staying single for the long haul. That in itself is a major shift in economics.

Another issue rarely written about is that Millennials are becoming [un]willing live-in caregivers for parents.

Senior care centers are incredible expensive and who can afford?

Are we raising an entire generation of live-in non-home owners?

YES! The enormous cost of caring for our ever growing population of seniors, 80% of whom have no real savings is a generation busting, economy busting , heart wrenching fact. !0.00 people a day in the USA are turning 65 every DAY …and they can expect with todays medicine to live into their 90’s. How do I know this? because I am the Sales Director of a major Senior Living Center where the cost is 14k a month and MUCH more for any type of dementia patient. Imagine the burden of that monthly on any type of income earner. This is an exposition waiting to happen and no one is paying the slightest bit of attention.

10,000 people a day…sorry

Well a good amount of people are working into their 70’s now so the full effects of what the Baby Boomer generation will bear on the economy hasn’t really taken hold yet so not many people are doing anything about it. That’ll change very soon. I’m calling it right now…2017 will be the year.

I’m in my 60’s, taking care of my 91 year old mom. She owns her home and will pass it on to me and my sister. Those who think the boomers are dying off are wrong, it’s the parents of the boomers who are dying off, in their 90’s. So those homes will be willed to the boomer. The boomers have another 20-25 years before they begin dying off and change the home-price equation.

this month or next is when more people will be retiring than entering the workforce, thus the amnesty and immigration calls…..

that too will be vetted out……

For Senior living/health it all depends on where you live. The cost you mentioned is about half in other states. However I am assuming that depends on what age you go to this facility and what type of amenities comes with it.

Gentrification in LA, LA, LAnd

interactive map informing on areas in LA experiencing gentrification. Other link at bottom shows LA County. Nothing new here though, Venice, Playa Vista, Highland Park as well other parts of LA

Looks like some areas have seen surges in different time periods.

http://la.curbed.com/2016/8/30/12712942/gentrification-map-los-angeles-county

I am a landlord to Millennials, and parent of 2. Both were encouraged and went to DC area for college, because it is one of the area with relatively high income, recession proof jobs, and relatively affordable (to the income) housing. Had they stayed in SoCal they would not make enough on their own to buy anything on westside (where home is), not until they have my help, marry rich, or save 20% of $1-2 million, plus a damn good salary. LA will always be home but being in DC meant they don’t have to defer life (travel, marriage, kids, savings, careers, etc.), and I don’t have to wait to enjoy having independent adult children and a grandparent.

What’s a “Taco Tuesday Baby Boomer”? And how does this demographic subset, defined by Dr. H.B., play a role in the ludicrous California housing market?

From my limited perspective here in New England, those millennials living at home realize that that buying into the over-hyped, stratospheric housing market is playing into greed. Looks like a smart strategy.

it is smart and sound! I have bought more paper than I ever want to see back in the first bubble..this is no different outside of govt. interference is making up for the loss of exotic MBS packages……

I own a home in San Francisco, without a doubt it’s priced 30% higher than it should be, I expect it to come back to neutral.

This bubble will burst, it’s starting to happen already in sections of CA….Housing is now an investment, thus expect it to be treated like one……landlords, flippers and specs are about to get some shitstorm sandwiches to munch on…..many will lose……

same story, different time, same cycle, just enhanced by your banker buddies the FED….

The housing market doesn’t need to be “SAVED.” It is what it is. It’s either overpriced or underpriced. At the end of the day salaries have to dovetail with mortgages. In coastal counties of California you could throw a 20% weather premium on top of that. That premium has been there for years.

The housing market, despite all of the government trap doors, tax breaks, etc., will always equalize. In today’s market, this means overpriced houses.

The boomers are like pre French Revolution minor royalty in powdered whigs. They have their hot rod in the garage, they have a retirement invested in stocks. They have an ex-meth addict kid still in his bedroom. All the prerequisites for being plowed under in a debt superstorm. And, they deserve it. They deserve to be eating dirt in their last years for what they’ve done to this country. For jazzercising their arses off while they just piled on more debt. They destroyed our future. They were handed a first class country and turned it into a third world one. And did they ever “find themselves?” Who cares…

McMansions are for Indian-Americans who live five generations under one roof and pay cash for everything.

“The boomers are like pre French Revolution minor royalty in powdered whigs. They have their hot rod in the garage, they have a retirement invested in stocks. They have an ex-meth addict kid still in his bedroom. All the prerequisites for being plowed under in a debt superstorm. And, they deserve it. They deserve to be eating dirt in their last years for what they’ve done to this country. For jazzercising their arses off while they just piled on more debt. They destroyed our future. They were handed a first class country and turned it into a third world one. And did they ever “find themselves?†Who cares…”

Bitter much?

The only part he got wrong was there’s no such thing as an “ex” meth addict.

Just put in offer on a home in Oxnard. Fixer upper 2BR historic home @370k using 5% conventional loan. I tried getting down payment Calhome assistance but was such a nightmare, the state rather loan to people who might not be able to pay it back. Wanted to do a new condo by marina but I could not do HOA and PMI.

Congrats B,

No one here knows what the market is going to do…I came on these boards about 4 years ago and one of the first posts I saw and loved was one of the first you see on this thread. TANK HARD TAYLOR, well 3 years later, the reason for the run up is still existing, lack of inventory, and the reason and it could still go higher and at the very least steady as opposed to drop, lenders are lending, and people are borrowing.

the last bubble did not pop overnight, it arguably peaked and began a decline in late 2005 and early 2006. it took until late 2007 until the off the cliff drop began. the market is still rising at this point.

Now I am not going to argue fundamentals because they arent great by historic means, but with interest rates this low, despite the principle being high monthly payments are almost the same as they would be in a higher interest lower principle environment.

Buying and renting are not as different as some may think here. Either way So. Cal is an expensive place to LIVE, but people want to be here so they pay the price. Niether is truly ideal here because of the costs, but long term buying will always make more sense than renting, so even during these seemingly uncertain times I applaud your willingness to sift through the noise and see the long term benefit, even if in the short term it may turn out to be bad timing. But remember it is never a bad time to make a good decision.

I can understand trying to wait out a market but I have many around here say they are waiting for the next drop and all they have done is seen 4 years of huge appreciation, that would have earned them equity and a huge insulation from a future potential drop.

The last bubble peaked around 2006. The true bottom was not reached until late 2011/early 2012. This just goes to show that unwinding a bubble takes a LONG time. I don’t see how it will be different this time. For those still waiting, their patience will be tested in a big way.

Yeah I have been waiting a while, since 2009. I thought it would go down much lower, wrong for now. My lease was up 5 months ago and been with my parents with my wife while we looked around. Found this fixer upper in need of flooring, landscape, int/ext paint, new kitchen and bathroom. Going to be lots of work though, screw it.

I am waiting until next year before buying any more property. I am not part of the “Tank Hard” camp, but I do feel that inventory will increase in 2017, which in turn will stabilize the market and possibly bring about a small correction. It seems like the current inventory consists of depressing leftovers that have already been picked over by the vultures at least once if not more.

When I was a bit younger a spent a month wandering around S. California drinking and chasing women. When I finally sobered up I looked around and thought I was in Mexico, but it turns out I was just in Oxnard.

Oxnard ain’t that bad. Could be worse. We just got a new Marina and beautiful outdoor mall. Least it ain’t Gardena.

Thats funny, but I realize the joke there. B is right Oxnard is not that bad. Definitely not as bad as most make it out to be. The way some talk about they make it sound like its south central in the late 80s and early 90s. Granted, its not as nice as the surrounding area, but if you throw Oxnard into most places in southern CA, it would be a nice place to live.

In all honesty it is the surrounding cities that make people think it is worse than it is, the surrounding area is so so nice that the imperfections Oxnard has are glaring.

Beach access crime is relatively low, town is fairly spread out although there is a little congestion at busy times, but for only being 25 minutes south of Malibu you can pay only $500k and get a very nice place to leave within minutes of the ocean.

It is my imagination that oxnard will change dramatically in the next 30 years and property values will increase dramatically over that time as it is the last beach community to really be affordable to the average joe.

“Least it ain’t Gardena.” That’s something to aspire to.

Maybe that could be their new motto, “Come to Oxnard, at least it ain’t Gardena.”

@noregrets lmao, that was good. Clearly you ended up in Colonia while drunk in Oxnard and woke up next to a toothless chola hooker.

In Oxnard. Oops I would’ve waited till next year. If Trump wins oh chit he will deport a lot of Mexicans that have a DUI or misdeminor or were gang related. It will bring rents down in certain Mexican towns creating downward pressure on prices

Aside from that possibility. Why would you buy on election year? It’s all fixed to show good times…

Oh desperation!!! You’re buying leftovers. There will be other buying opportunities there always are. The economy is a cycle. 380k fixer in O town. Ay aya ay

32 year old here. I make $80k salary and 20% bonus. I bought back in 2014 with only a $74k salary thanks to a VA loan.

Millennials have the income and money with dual incomes. I have well off friends who simply refuse to buy because it means buying away from the beach. There’s affordable housing in San Diego, but some people simply refuse to buy for whatever reason. Also, if you’re a young single male with no kids, you can get by living in a room in a 3br apartment with friends for way cheap. Why blow excess money on a mortgage when expenses are low.

Housing can go a lot higher in my opinion on the simple fact that there’s a lot of singles out there and people can double up with a girl eventually. It’s not a crisis yet except for the minimum wagers.

Congrats Eric! Do you happen to know what the avg household income is in your area? Could it be you make significantly more than the avg joe in your area? Just curious, what’s your job title and the industry you work in?

median household income in San Diego is like $66k or something like that. But SD county is huge. Once you’re in the coastal areas with dual incomes I would imagine a lot of people are 6 figures ++ easy. I a VP Portfolio Manager in banking. I oversee about $1+ billion in commercial real estate with my team.

Even co-workers prefer to rent for flexibility and ease of sharing a lease. California is built for renters imho. My goal is to never sell my current place since the tax advantage alone is worth $500/year already in carrying costs.

This is exactly what I’ve been preaching. Millennials operate off of trends and right now the prime age group within the millennial generation still haven’t come off their Snapchat and Instagram “look at my awesome life, I live next to the beach” high. It’ll be only a matter of time when they sober up and decide living a real adult, homeowning life is what they want and what do you know?!?! We can do it at these prices! Especially with dual incomes at rates unseen in the past. To me, it’s common sense…you got a huge generation with a much higher percentage of dual income households. So high, that it will be the market norm. I know sooooo many people that make the $80K range and if they group their salaries up, you get $160K household which means a house is EASILY within reach. I don’t understand this bubble talk at all. Housing to SPIKE HARD SOON!

Seriously!?! The median price for a home in most of LA/OC is back to its pre-recession high as of this year. Since as we all know housing has been turned into an investment vehicle, there is no reason to think that this is by any means a good time to buy. Couple that with 3 x $160k gross income gets you about $200 less than that pesky median home price of $670k. I know some people say the new gauge should be 4-5x gross income, but even if that’s true, why would anyone want to buy a depreciating asset at the potential height of what has historically been 10 year cycles, and with the statistical probability of a major market correction in an election cycle, especially with candidates that the majority of voters hate.

As soon as you factor the low interest rates, and inability to write off PMI anymore, you lose any compelling financial reason to buy now, and for those that ‘missed out’ buying a home in 2011/2012, keep in mind that the Vanguard Total Stock Market Index Fund is up 100% since then, and you could sell at any time, unlike a fixed asset

If you think housing is going to ‘spike soon’ your brain is small. Very small.

This is a medical issue, you should leave the housing forum.

seriously jon?! vg tsm is up 100% since 2011/2012

and you want to buy it now at all time highs? what are you thinking?

had you purchased cali re in 2011/2012 you’d be up an inordinate amount

plus you’d have all your mortgage interest write off + if it was your primary, completely untaxed gains or a fixed housing cost for 30y/peace of mind

get off it

@same false equivalence-

I think I wrote that without enough qualifiers or context. No, I do not recommend buying into the stock market right now, it has clearly been inflated (like housing) over the past 4+ years. My point was just that buying into housing bubbles wasn’t the only play. For right now for instance, commodities are looking pretty good still.

To add. If I believe Redfin I’m up about $50k on a townhome I bought at $325k. Another year or two i can likely “move-up” a tier in housing.

Oh, and my commute is 15 minutes in the morning and up to 30 mins at night if I leave at rush hour [15 no rush hour]. I generally work later as my old job was an hour each way, so j consider the hours save from that to be time I can put into productive work.

I think this is a good example of “how to do it.” While I do think a downturn is coming in the next year or two, when talking about a private residence (not an investment property,) you buy when you can afford the house you want. The problem lies in people who make similar money to you but think they can afford a big $500K+ home. You’re smart and living within your means, IMO, so it doesn’t really matter if you bought at low or high point in the market. You’re just living. Nice!

Redfin says my condo is worth $521k.

Zillow says it’s worth $823k.

Who knows what anything is worth in this market?

I find Zillow and Redfin valuations to both be inaccurate, sometimes by a large margin either way. I look at it, but don’t give it too much credit. The Zillow zestimate can be easily manipulated. And I’ve seen identical condos in the same building with vastly different valuations on Redfin.

Condo’s are the easiest thing to price. Just look at recent sales in the same building. It’s not like a SFR where each is bult a different year, different sq. footage, different construction, etc.

The only homes under $500K near the beach in LA, LA, LAnd are Gardena, Hawthorne, Lawndale. ie, 15 minutes drive to the beach in no traffic. However, these are not desirable areas. I did not include Oxnard because it is not in LA.

Are there any other parts of LA with homes under $500K (under 15min) drive to the beach?

https://www.redfin.com/CA/Lakewood/5722-Pearce-Ave-90712/home/7553425

It’s really closer to 20 minutes from there to Belmont Shore on the weekends. The traffic is actually pretty light down Bellflower and Studebaker. Then again when I lived in West LA it could take me longer than that to go to SaMo or Venice, go figure. This is the edge of LA though, very near OC border.

Not sure you could do Gardena to beach in 15, traffic is worse the more west you go…but who knows.

Nice place in Torrance… maybe not 15min but plenty left in the budget for an hgtv style reno: https://www.redfin.com/CA/Torrance/2220-Del-Amo-Blvd-90501/home/7649999

Def some stuff in San Pedro… might need a CCW

https://www.redfin.com/CA/Los-Angeles/2625-S-Pacific-Ave-90731/home/7695762

How is San Pedro? I’ve only been there a few times, long ago as a young adult. I’m very familiar with LB but I didn’t venture much into San Pedro, Harbor City, Palos Verdes etc.

An old dump for almost $400K and that is located on busy Del Amo Blvd? It will take deep pockets to make turn that dump into a HGTV show place.

This is to Josh….It’s not $200,000 for the house…it states that

is the income necessary to buy the crap shack.

Gotta love Millennials:

https://www.youtube.com/embed/hLpE1Pa8vvI?autoplay=1&autohide=1&showinfo=0&iv_load_policy=3&rel=0

Ha! That’s funny. To be honest, though, I think that sentiment is simply there because older generations haven’t embraced self employment and working from home, so they assume people waste their days in coffee shops. I live in Portland, spend my days at coffee shops with a laptop, have a “man bun,” have a beard, have tattoos, and I’ve run my own growing company for the past six years (which currently puts me in the top 5%.)

A lot of the people I meet in coffee shops that are similar to me are graphic designers, copywriters, programmers, etc. and many of them make good salaries…at least until the tech bubble pops. I’m fortunate that I don’t work in tech and my business is relatively recession proof. “Knock on wood.”

I still haven’t bought a house, though. This thing is coming down, so I’m trying to be patient.

My wife and I are in our mid thirties. On the fence between being a Millennial and being a Gen-X-er. We both have decent jobs in the Bay Area and have a nice nest egg saved up for a down payment. We are renting at the moment.

The math says that we can afford an “OK” home in the area but with one kid and another on the way I am not comfortable blowing our life’s saving on a down payment while taking on an big mortgage… AND also paying $3k/mo in child care. Doing so just seems like a recipe for disaster if/when a recession comes around.

I imagine a lot of the recent “normal” buyers in the Bay Area and Socal are in a similar situation and a part of me feels guilty waiting and hoping for a “correction” and the resulting hardship that will come just so we can buy.

Please don’t feel guilty. The people who should feel guilty are the policymakers who knowingly have created a monetary regime that is eroding the value of your earnings, destroying savers like yourself as well as seniors, making housing unaffordable to both buyers and renters, and greatly magnifying risk to equity and debt investors. Our inflationary policies are pushing evermore people into poverty and homelessness in the G20 countries, while making long-term investment in productive enterprises increasingly a bad bet.

If our markets were allowed to correct, and price discovery were allowed to happen, those who purchases these assets, whether overpriced houses or overvalued stocks & debt securities, would suffer losses, yes. But their suffering would be relatively brief, while many hundreds of millions more would be able to purchase houses and make investments at prices that reflected the true worth of the asset, and everyone would benefit from an honest financial system.

I am in the same boat as you last year of Gen X but also a Millenial 37 yrs old. Out of my group of friends only the ones with very good jobs roughly 80+ a year or 190+ dual income can afford any type of housing in LA County / LA. Most of my friends which are around the same age either room together in a rental or live at home. My friends no longer want to have children, get married or even start a family. Life is to good for them, living at home or renting out and meeting others who do the exact same way of life. Majority of millenials love the single life and enjoy the finer things in life. No way does any one want a crap shack that is overpriced. Most of the millenials I know who have extra income rent and throw the rest in the market mainly index funds. They rather spend there extra monthly income for enjoyment and whats left stick in a index fund. Most millenials are waiting for there parents to pass and eventually live in there homes. Millenials have more minority driven thinking. Minorities tend to live at home with family and extended families. No way will millenials save the housing market. Think about it from there point of view, you pushed housing way up and you want us to be the suckers to pay for it, screw it well just live at home and wait till you pass, it will be ours anyways !

“it will be ours anyways!”

Only for those Millennials who chose their parents wisely. Some Millennials will get mansions in Malibu. Some will get crapshacks in Van Nuys. And some will inherit a rusty pot to piss in.

‘Zombie’ foreclosures decline across the country, except in some states where they’ve built strongholds:

http://www.marketwatch.com/story/zombie-foreclosures-decline-across-the-country-except-in-some-states-where-theyve-built-strongholds-2016-09-08

Home Sales July 2016

California Home Sale Activity by City

http://www.corelogic.com/downloadable-docs/dq-news/ca-home-sale-activity-by-city-july-2016.pdf

Isn’t it really a simple math problem? As the price of real estate rises significantly faster than incomes, creating a growing ‘affordability’ gap, fewer and fewer people will be able to by a home! And, given that ultra-low interest rates haven’t triggered more of a housing boom, also tells me, that homeownership will stagnate and/or continue to decline! The $1 million dollar question, at what point will the unlucky homeowner who paid a dear price for that roof over their head, suddenly find themselves holding an asset that isn’t worth what they paid for it!

http://la.curbed.com/2016/9/8/12852570/freeway-overpass-co-working-space

I’m certain this is because Millennials simply prefer to work outdoors versus a disconnect between pricing and reality. But, where are the restrooms?

Real Estate Turning Down

Martin Armstrong: I have explained that ‘watch the core regions in real estate and you will forecast the rest’. Real estate booms and busts always begin in the core regions. As that property rises sharply, people begin to buy what is cheaper the next two over. This is the process of the economic wave in real estate which is very much like putting a drop of water from above into a standing pool of water. The waves will spread from the epic center outward and gradually diminish.

In the United States, the three main regions for this rally in the high-end market has been New York, Miami, and Los Angles. All three markets have begun the decline and we are now watching this slowly spreading outward. Chicago real estate has begun to turn and so has the Vancouver market as well as in London, no less Paris as well as Hong Kong. The outer regions even in Britain never exceeded the 2007 high as was the case for the average market in the United States. In fact, home ownership has fallen to a 51.6 year low from the 1965 high.

Some of the outlying regions are still ok, but that will gradually change.

(more)

https://www.armstrongeconomics.com/markets-by-sector/real_estate/real-estate-turning-down/

(segue Jim Taylor)

I just don’t see it. I look at RE listings daily in LA, SD, and IE and all I see is low inventory and any halfway decent properties being bid up by house-horny buyers and yield-horny investors. I do see extremely low inventory in the entry level price brackets.

I would agree that there does not appear to be any “obvious” market down trend in SF Bay Area. The inventory is lower than last year. Prices higher than last year.

It is from AU, but it is interesting: http://www.news.com.au/finance/economy/australian-economy/australia-six-weeks-from-a-housing-collapse-us-report-warns/news-story/866d2fdee41b1227ce654f66ed8d9837

Millennials may participate in the housing market soon, but they have very different priorities as a whole than generations prior. Millennials tend to be more convenience, lifestyle, and relationship oriented. They prefer neighborhoods close to their jobs, and homes with character and great amenities nearby. Also, millennials prefer to live in smaller and more personalized spaces. All this adds up to certain neighborhoods seeing a revival, and others languishing as their baby boomer owners downsize or die. Riverside county is never going to be attractive to millennials en masse. (if they are looking for cheaper housing further out, Temecula valley is more likely to be attractive, as it offers better lifestyle amenities). I also think that the “90s McMansion” parts of Orange County–Laguna Niguel, Anaheim Hills, etc. are going to suffer. No one wants an oversized home on a small lot decorated by their mother.

Leave a Reply