Option ARM: No one saw it Coming According to the Mainstream Media. The Alt-A and Pay Option ARM Tsunami Quickly Approaches. Charting the Option ARM and Alt-A Wave.

Option ARMs are arguably the most toxic mortgage product on the market. I remember having this discussion with people many years ago. Without fail, you would get someone throwing out the hypothetical unicorns in the sky case, “well what if you are a doctor with a side business and don’t want to document your income? This product makes sense.” Yet that is the exception and not the rule as we are now painfully learning. I’m sure some of these people were sincere but the vast majority were simply delusional and licking their gluttonous chops for a fat commission. Never were they looking out for the client. To ease their conscience they tell themselves, “well at least I warned the client about the risks of the mortgage.”

These loans were setup for that unicorn pie in the sky scenario of the wealthy business owner who simply does not want to document income but instead, became the primary product for many brokers in states like California and Florida for those who needed that extra pinch of leverage to buy that over priced home. Back in June of 2008 I wrote a detailed articled called:

In it I talk about the dangers of the option ARM mortgages. I don’t think the article could have been clearer. Many of you saw the CBS 60 Minutes piece this weekend. I know because I have gotten a lot of e-mails regarding the piece:

*Click to read/watch segment

It is a good piece although late to the game. Yet I give CBS credit because I have yet to see ABC or NBC have any substantive piece regarding this matter. Last night I was wondering why there was a surge in traffic to the site around 6:00PM Pacific Standard Time and when I looked at the logs, I saw Google search queries of option ARM, Alt-A, and NINJA mortgages. Ironically the query was pulling up articles some older than two years old while the CBS piece made it seem that this option ARM thing was new. Seeing the traffic, I think many people are going to be caught off guard just like the initial stages of the subprime debacle. These are the articles that were pulled up:

When will my home cost me an ARM and a leg? – October 12th, 2006

“As you can see, 2006 and 2007 will be peak years in terms of subprime and jumbo loans. Given that many of these loans have prepayment penalties many folks will not be able to refinance given the limitation inherent in the loans. The reason we have not seen the impact of the current ARM resets is that the real estate market has been hot. So hot in fact that even with a prepayment penalty many were able to cash out or even sell homes before facing the piper. This circular system keeps working until appreciation stops. Not only that, rates are much higher than they were in 2004. Keep in mind that most ARMs and interest only loans are pegged to short-term rates such as the LIBOR. Basically they go in tandem with the feds short-term rates.”

Ponzi Financing – The House that Credit Built. – October 24th, 2006

“This was the start of the Securities and Exchange Company (sound familiar?). The ironic thing was that Ponzi was losing money daily. The thing that kept him going? Debt. Basically he was paying out his investors with money that was coming in. In fact, so many people bought into the hype that widows were mortgaging their homes to get a piece of the action. When someone from Barron’s decided to examine Ponzi more closely, they realized that the company was completely unsustainable. They realized that 160 million postal coupons would need to be in circulation when only 27,000 were estimated to be in use. By August 13 Ponzi was under arrest. Even at this time, so many people had blind faith in Ponzi that they cried and held anger toward the officers who arrested him. They bought into the dream Ponzi was selling even though economically it had no basis in fundamentals.”

“”The following chart shows the percentage of Bay Area loans that were interest only or Option ARMs (know as negative amortization).”**

Year Interest Only Option Arm

2005 42.6% 29.1%

2004 43.7% 9.6%

2003 20.3% 0.8%

2002 12.0% 1.7%

2001 2.9% 1.6%”

Press Zero for Reset: Are we out of the Subprime Mess? – September 25th, 2007

“The solution to this, even though people do not want to hear this, is a market correction. This means that local income levels and the new tighter credit standards will dictate future housing prices. In some areas this means 10 percent drops while in others this can reach 50 percent or higher. Will this happen? The data is already pointing toward this. Even if property drops 30 percent over 5 years, combined with inflation adjustments this is close to a 50 percent drop. Some areas in Los Angeles are already seeing 20 percent adjustments year-over-year.”

Stage Two of the Mortgage Collapse: $500 Billion in Pay Option ARMs Meet the Piper in 2008 with 60 Percent Being in California. – June 14th, 2008

“Many of these owners are going to be highly tempted to moonwalk away from their mortgages. Does Bank of American really want to assume this option ARM time bomb? They are scheduled to close their deal with Countrywide sometime in the third quarter yet I simply do not see how they avoid astronomical losses on the current mortgage portfolios and REO properties. Unless California suddenly goes into another bubble and prices start going up, we are in for a tough few years and the current California multi-billion dollar budget short fall isn’t pretty either. Keep in mind the California budget which has now been revised to a $17 billion short fall is going to force us to make some hard decisions. Either raise taxes to plug budget gaps or cut spending (aka jobs) and only increase the unemployment numbers and thus depress the economy further.

No matter how you slice it, California housing is going lower and pay Option ARMs will be the next crisis that will send the credit markets stumbling. You can bank on that.”

I bring these articles back to the forefront because nothing really has changed at its core. The option ARM fiasco is going to be big especially for states like California and Florida. Given that California is 12% of the nationwide GDP, this will impact the entire country to a certain degree. In addition, you can see that this isn’t new. Back in 2006 we saw problems. In fact, I wrote an article back in 2006 about the wonderful Charles Ponzi which now has a modern day huckster who seems to have managed to outperform him by billions of dollars in Bernard Madoff. Charles Ponzi operated in the Roaring 20s right before the Great Depression and here we have another character right in the midst of our own collapse.

I want to bring the option ARM issue up again because this will be a big (if not bigger) story than the subprime debacle. In addition, we already know prime mortgages are now going bad but you haven’t seen anything until you see an option ARM recast in California. I have. A few people that I have talked to who were unfortunate enough to be placed in option ARMs are already geared up to stop making payments once their rates recast on their underwater homes. They are not alone.

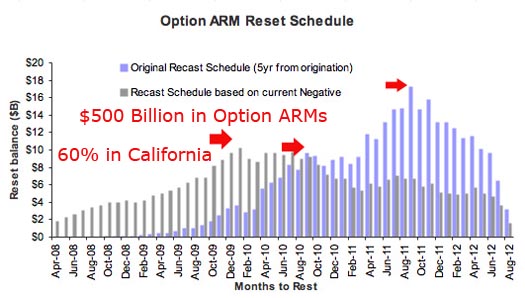

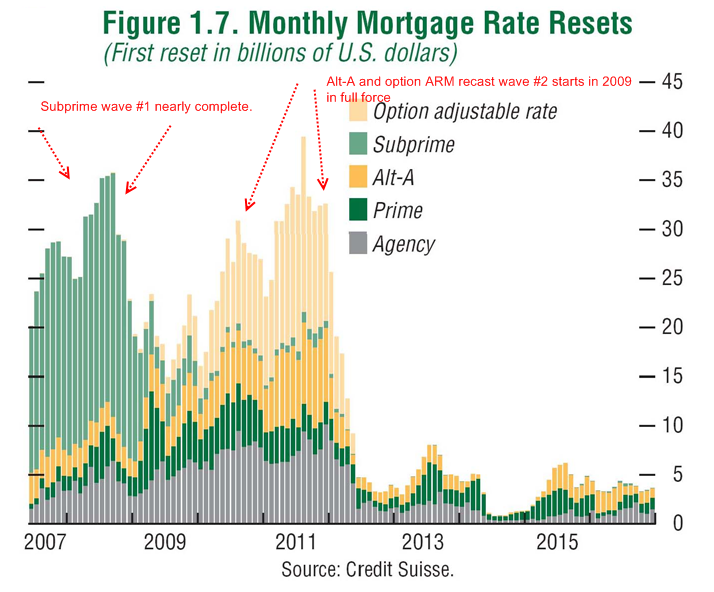

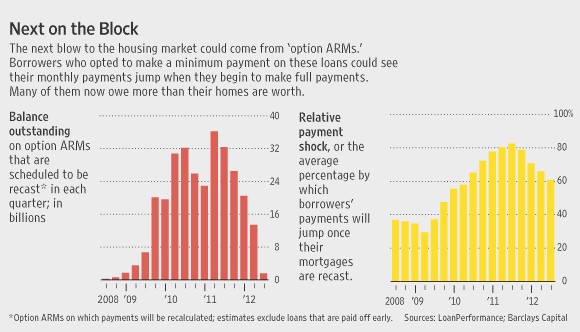

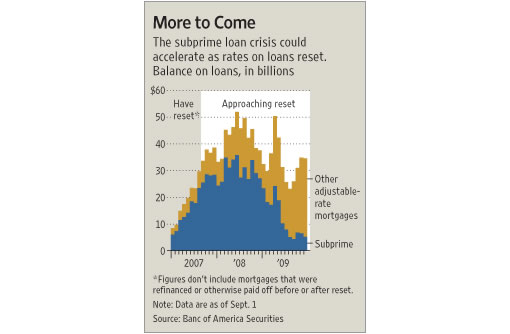

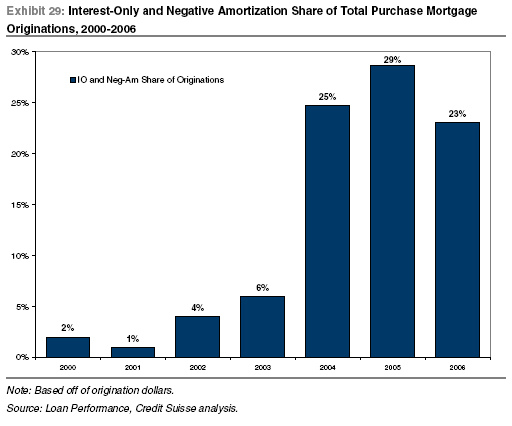

Let us now take a look at multiple charts produced regarding this major issue:

60 Minutes used a similar chart to the first one. What you’ll first notice is the subprime wave is essentially done. That is why it was such a frustrating thing to hear people say that this economic collapse was a subprime problem. No. Subprime was merely the canary in the coal mine. It went down first. The amount of subprime loans made compared to the $50 trillion in global wealth that has disappeared actually looks like peanuts now. I remember when I would write an article stating the stunning $35 billion a month in resets and thought to myself what an incredible number it was. Now, $35 billion is a capital injection into a crony capitalist bank on a weekend after eating a Mr. Goodbar or posting a private Facebook message to your buddy saying, “the deal iz done!”

What is more important with the chart above is now you see a second wave coming. The Alt-A and option ARM wave. The problem is many of these loans are securitized outside of Fannie Mae and Freddie Mac. Short of the government becoming a default toxic mortgage dealer, these loans will recast starting in heavy numbers in early 2009. California has over 50% of the pay option ARM market. Take a look at the median prices in our sidebar and you’ll get an idea how that is going to play out.

These charts show how the recasting of loans will actually hurt borrowers on a montly level. Not only will their payment jump, but it will jump significantly. 2009 will see the first flurry of recasts with many payments jumping up approximately 40%. In 2010 payments are jumping up closer to 50%. 2011 and 2012 see payments jump up in some cases by 80%! My gut tells me upwards of 80% of all underwater pay option ARMs in California will default. Bookmark it like the other articles linked above. And why wouldn’t they default? Prices are not going to jump up. If IndyMac is any sign of loan modification success, we already know over 50% re-defaulted within 6 months. And IndyMac was an option ARM specialist! The market is only getting worse here in California and Florida, the 2 primary option ARM states.

The problem is that these toxic mortgages became mainstream and a large part of the market. They were essentially ticking time bombs betting that real estate would appreciate at levels it could never maintain. 2, 3, and even 5 year teaser rates. Well, look at the above chart. 2004, 2005, and 2006 were the biggest years. Like clockwork they are exploding. The only problem is that they are turning sour when the market is already battered. Sadly, option ARMs provide very few options to those now stuck with them.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Â

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

32 Responses to “Option ARM: No one saw it Coming According to the Mainstream Media. The Alt-A and Pay Option ARM Tsunami Quickly Approaches. Charting the Option ARM and Alt-A Wave.”

Great article as usual. The truth of the matter is that the banking system used to be prettypaternalistic…which is a feature, not a bug. There was a time in this country when getting a loan was difficult, and did people bitch about it. Well, we done the experiment, and have proven that most people, and apparently most bankers (or bond rating agencies) can’t figure out that people’s income doesn’t always go up, that you need some reserve, and that you shouldn’t spend every possible dime on real estate…wait for it…HOUSING DOES NOT ALWAYS GO UP. And honestly, how bright do you have to be to know that??? There have been far more real estate booms and busts than stock market collapses.

But as you so ably show time and time again, its not just housing – its the belief that debt is wealth. People do not now have the resources to pay back loans at zero percent – they do not have the income to manage current debt levels. 2 years ago my townhouse – 300,000$, now 175,000. 401k 600,000 – now 400,000k (and its only that high because I keep contributing (maybe it will come back, than again, maybe it won’t – this is what its like to be in a depression, the vast majority get poorer). I’m close to owning my house, and no other debt, but most people are not going to be able to pay for their SUV and overpriced house.

Isn’t it safe to assume that adjustables, Alt-A, etc are sort -term products, used by borrowers who planned on only holding property for few years or less? I’d guess the inventory for sale TODAY contains many of alt-a mortgage holders, or are they just dumb and “wait” for the re-set to try to sell??

Great post doc! I saw the 60 minutes segment and felt blessed that I’ve been reading your rants for over a year so I’m safely out of the market and only dealing with the more general economic malaise that is spinning off this debacle. I recently moved from Orange County California to Southwestern Florida… you are right: these two regions hold a disproportionate optimism for Real Estate. That being said, it is California that is going to create the most pain. California’s trouble ripple out due to the sheer volume of loans and then the absurd peak valuations relative to incomes. Florida is small potatoes in comparison. Just think: 50% decline on $300,000 value doesn’t touch a 50% devaluation on $700K ($150K vs $350K multiplied by the huge population difference). Welcome to the new economic disaster: Designed in Orange County, exported from California and enjoyed by everyone.

I live in LA and first entertained the idea of buying a house in 2003. I got approved by a conservative credit union with traditional standards – 3 times documented income, sizable down payment. It didn’t go very far. I knew that I made more than double the median household income in LA and I was being priced into sketchy areas. That was my first inkling that something was amiss. I decided to shelve it for a while. Got married in 04, looked again in 05 for a house. This time it was completely absurd. Talked to a friend of my wife – a mortgage broker who peddled this stuff. I was appalled at the leverage and risk that she advocated (she thought real estate only went up). I told her the market would crash when people are asked to actually pay back the principal on the loans. She thought I was crazy and not aggressive enough. So I opted not to talk real estate with her anymore.

So I got hooked on this subject in 05. Just about everybody thought I was delusional until this year. They still don’t really get that the nicer neighborhoods are just as leveraged. The evidence is overwhelming in my view and yet there is still some denial left (which may be the most fascinating aspect of all of this).

Anyway, I read a handful of blogs daily and must say that the biggest lesson is how much better the information is on the internet (if you do your own research and think for yourself) than what the mainstream media puts out. Nice piece on 60 minutes, but amazing that they just discovered alt-a / option arm in December of 08! I’m guessing most people still get their news from TV and so they will be surprised when this storm hits the nicer areas. However, once the MSM starts banging away on this story in earnest, it shouldn’t take people long to realize that we’re all subprime now.

How about fed force the lender to adjust the rate of ARM to an affordable level? e.g. from 7% to 5%?

@ Norman: I think that’s one of the main reasons we now have a target prime of 0%-.25% ZERO PERCENT = LOL.

Whatever situation is setting up, you can bet the the mainstream media lapdogs, each and every one of them licking the hands of corporate masters, will be the very last people to take notice.

Many astute people saw our current debacle setting up as early on as 2003, and they were voices in the wilderness. Many others saw the problems inherent in these loan products all along, but what were their voices against the yowlings and rants of Greenspan and Bernanke, and their handmaids like Kudlow and Kramer, and all the other media “feel good” mavens. Almost alone among all the financial media giants, The Economist magazine was the ONLY major financial rag that called the situation that is playing out before our eyes today.

What else won’t they see? Well, Peak Oil occurred in 2005, and we are only getting a temp reprieve in prices because every financial concern out there is unloading every salable asset on their books, including their oil forward contracts, to offset losses from the toxic mortgage garbage and derivatives based on it. So when oil hits $200 a barrel, you’ll once more hear “WE NEVER SAW IT COMING.”

Dr. Housing Bubble, you, Irvine Renter, Mish Shedlock, Tanta (God Rest her great soul) and other astute financial bloggers have saved those willing to learn a world of pain and grief. Your efforts are not wasted. If we had only the mainstream media to turn to, God knows how many more underwater buyers and failing institutions we would have.

Hi Doc. Another good post, thanks.

You have a good mix of contributors. “fresno dan”, I remember my first mortgage. A tough nut; 151/2% interest and had to use my VA loan to get the place. Wouldn’t have bought but there were no decent rentals at the time; 1982 in oil country; little-town America. Lost 12% on that place when I sold 3 years later.

“el guapo”. Been there too. My second tried to lasso me into a get rich property scheme her boss came up with in Tucson 3 years back. She was a civil engineer and should a had more on the ball.

Anyone look at the demographics of old geezers like me wanting to cash out (no joke intended), and get a smaller place? What do we do? Open the borders to let those with (our) money buy these places we won’t want?

@norman: A 2% reduction in interest isn’t going to help much when the principal is far beyond both the real value of the house and one’s ability to make the payment.

~

In other words, if your $750K McMansion requires a $5K/month PITI payment at 7%, going down to 5% changes the monthly payment to a little more than $4K/month. That’s OK if you’re earning $130K/year and have no other debt whatsoever, otherwise you’re still out of luck. And this doesn’t take into account the fact that the house is now really worth only $300K because it was fraudulently appraised and thus overpriced to begin with.

I must say Hi to all newbies and visitors and good for you for coming here and you are VERY MUCH in the right place if you want to do something for your self and your families by finally pulling your head out of the sand and getting some EDUCATION about the realities unfolding around you now.

I cannot strongly enough recommend to you the Doc’s extended series you can find on this site and how much they can help you if you simply admit you cannot afford not to take the time to read them. “Lessons from the Great Depression” etc…

Again welcome and all the best and after you’ev learned better what’s going on here go out and share the news-

Although I am glad 60 minutes ran this story and partially explained the Alt A / Option ARM problem. It pissed me off that the gentlemen that they presented as the expert on this subject talked his book at the end. He suggested that people should jump into the stock market. That’s like jumping out of the frying pan into the fire.

It was very irresponsible of CBS to let this guy give investment advice at the end of the story without a disclaimer of some sort.

Stop paying your mortgage and use your monthly payment money to buy and hoard gold and a few months’ worth of cash expenses. If the banks take/steal free money from the government then let them take the loss on all the toxic bullshit they were peddling. If you don’t walk away soon in Cali, the non-recourse loophole will be closed and you’ll be a lifelong debt slave. Forget so-called morality – make the economic decision that is best for you and your family’s bottom line just like the banks do. You think when you lose your job next month as Great Depression II picks up steam that the bank will feel sorry for you? Bwahahahahaha!

Doc, as usual you were ahead of the Bureau of Information (MSM) and Planet of the Alt Apes has opened to rave reviews. I think it’s just a rip-off of Psycho though, only much scarier, lots more blood, and we’re all taking a bath rather than a shower.

Is it still true that nobody knows where the TARP has gone, is going, what it’s doing; and no freedom of misinformation act is going to reveal any of that, or the other 2 or so Giga-Bucks?

Seems like there are a lot more Lionel Barrymore Mr. Potter’s and not so many James Stewart George Bailey’s in the world. I think this is playing out like Clarence’s dream sequence and not so much like beautiful Donna Reed waiting at home with Christmas cheer…With so much possible, it should really be a wonderful life for all. Maybe the human race needs an upgrade to our operating system.

Talk about voodoo economics. As though interest rates and lack of credit are the problem. The future will look back (if there is a future) at these methods like we look back at doctors bleeding George Washington to death trying to cure him. As an engineer, I know that you can’t solve the problem until you understand it, and the PTB are going down what is obvious to the most causal observer, the wrong road.,

problem is they never could afford the house. as another blogger noted, they never intended to own the house long-term, they just wanted to flip it

Why are resets currently a threat? Aren’t LIBOR and 11th District Cost of Funds (both common bases for determining the reset interest rate) at incredible lows? Won’t most of these loans adjust downward?

Good comments Dan. debt=wealth; therefore, 2+2=5

I think we’ve seen this movie before…

Great read.

The reality is very depressing. My wife and I have been renting for years and want to buy a property. We live in the 90277 and have seen some $ reductions but nothing like other areas of LA.

At the moment, we can afford the low end of this community. Our rent is super cheap and we would be paying double if we got into a property.

My question is when do you know it is the right time to buy?

I know realestate is local and it is impossible to predict the bottom, but when I look at the graphs of the resets, it looks like another 2 years before we see something of a bottom. I really want out of renting but do not want to overpay for anything.

The reason these resets are such a threat is because the “teaser” interest rate on them is so low, like as low as 1%, that the borrower is deferring both the interest and the principal, meaning that most of these loans have accrued NEGATIVE AMORTIZATION, meaning the borrowers arrive at the reset even deeper in the hole than when they started. MUCH deeper.

Worse, they only took these loans to begin with because paying the “teaser” rate and taking the option to make really super low payments was what made them buy a house they could never come near in two lifetimes otherwise. So, if it resets to anything like a normal interest rate- let’s say 5.75%- the payments will often equal or exceed their monthly incomes. Here in IL , one couple with a combined income of $60,000 a year bought a $900,000 house with one of these loans. How long do you think it took the loan balance to equal 125% of the value of the house? Especially since the loan balance is increasing, while the house value is dropping? I mean, you could get a 20% pay raise at work and still be behind it when the balloon payment comes due, or when the mortgage shifts to a much bigger payment because the balance has been increased and interest is much higher.

The Pay Option ARM is the most diabolical financial product ever offered to the common consumer. There is worse stuff, mainly the derivative crap based on said toxic mortgages that collapsed our financial system.

Tim:

Easy answer, this is how I do it > Assume worse case scenarios, like you lose your job/ or one of you in a 2-income household lose your job> Can you still make the payment? If you have to “leave” or have no job, would you be able to rent-out the place to cover the mortgage? Know what the potential rents are in the neighborhood. In your case, you know what the answer is, as you said a mortgage would be twice what you are paying in rent. That only means your downpayment isnt large enough (oppertunity cost) , or you arent shopping in area you can afford. Its a simple algebra equation, play with all the variables until they equal. Your current assumtions are showing you a NEGATIVE answer.

Tim: Surfaddict is right. Try a crappy neighborhood where you won’t want to walk at night or let your kids play outside or attend school and your equation will balance. Or, er, wait….that’s my situation. See what you get when you’re only in the top ten percent of income earners in our country?

Laura: Good points about mainstream media. TV news is dead. Just like newspapers, the internet is the present and future. I’m pretty sure anyone under 50 would agree. Don’tcha think? Or am I off?

Surfaddict,

Thanks for you input. When I take your points into consideration, we can buy and make it work. We have a pretty large down. Taking in worse case senerios, we loose one or both jobs, we could move and rent out the property for the mortgage (not including taxes).

Recently, our market has slowed down – 90277. But a few months ago people were coming in with all cash in my area – buying bungalows/townhomes for 450K – 700K and renting them out.

I know beach communities will not depreciate as much as other areas but after reading different blogs and seeing the data, all things point to my area to continue to go down. Anxious to buy and can, but will wait.

Thanks again!

A lot of people here commenting still aren’t seeing the problem. The interest rate reset is NOT the issue. Loan rates are still really low.

These loans are getting RECAST. The amount owed is hitting the %125 limit of the original loan because people are aren’t even paying the interest only payment. When it hits this point the loan is basically recast into a new loan and then minimum payment jumps to pay off the new BALANCE at the 30 year rate. The minimum payment quadruples overnight and it has little to do with the interest rate.

The default rates on these time bombs is going to make the subprime debacle look like a pleasant memory.

gael, let’s hope the internet is the present and future, and lets hope our authorities don’t do anything to screw it up, like taxing email messages or some such.

This is where TV always wanted to go. I’m over 50, and I remember that during my childhood, my mother lamented the bust that television program was and how television had not lived up to its potential. Well, all it needed was a typewriter, a comm line, and the kind of processors that had many years to go before their advent, for the medium to yield up the technology we have available to us now. I believe it was headed this way all along, and that all we need to do is get rid of the FCC with its 1924 mentality, that lets the big 3 networks hog half the bandwidth that was given them as a gift back then, and we will see wireless realize its potential. May the day be soon.

That’s crazy. I thought the peak of Option arms was in March of this year. We’re in for a wild ride. Or perhaps the end of the world.

@laura

Unfortunately, every keystroke is capable of being logged in the BBDB. The Internet and cellphones exploded globalism. If we somehow get through this mess, the next super grand cycle collapse will surely be the last. Just like global warming the situation will correct, eventually–just maybe not in our lifetimes…

Tim:

I know 90277, so-bay local that I am. Dont be anxious. Keep saving $$ & continue looking, the more you do, the smarter youll get. After looking at 1000 places in next 2 years, you’ll know when the right place at the right price comes up. Check out this site for some great laughs and practical advice. http://www.longislandbubble.com/sheeplesguide.html

“Worse, they only took these loans to begin with because paying the “teaser†rate and taking the option to make really super low payments was what made them buy a house they could never come near in two lifetimes otherwise.”

Agreed. People need to buy homes that they can afford instead of just buying their dream home and then going in to massive debt. This is the reason why the american economy is doing so bad.

While the dollars involved in the second round are staggering I don’t think it will have as large an effect as the first round of subprime. The subprime unwound years of increasing homeownership. Renters became buyers with toxic debt and when they defaulted they went back to renting. The next round involves fairly high earners who moved up and on default will probably buy again depending on lending standards regarding default. Maybe the same size house (50% off and 55 interest rates). I see the bonds taking another hit next year but the housing market supply and demand not changing. The only wildcards I see are second homes purchased with Option ARMS and rising unemployment of the relatively high earners.

Let me know if I’m missing something

With the prime rate now at a historical low of between 0-0.25, won’t this make the resetting of Alt-A’s virtually a non-event (since rates are lower than when any of these mortgages were put in place?)

I would like to bring a very important bit of information to your attention that relates to this economic crisis that was overlooked until now.

On Sunday, 12/14/08, CBS 60 Minutes aired a segment “The Mortgage Meltdown”.

Scott Pelley’s piece on the 2nd Wave of Foreclosures overlooked a critical fact.

The segment missed the fact that this next wave of Foreclosures in 2009 Will Take Self-Employed and Smaller Businesses who have these TOXIC mortgages. In fact, ALT-A, Option ARMS, Interest-Only, the TOXIC Mortgages that are considered the “Troubled” assets in TARP were specifically marketed to the self-employed who fell prey to them.

The upcoming defaults on these risky “Toxic Mortgages” will result in an increase in foreclosures. But worse, once these small businesses fail, the resulting loss of jobs will cause millions to add to the ranks of the unemployed. Note that self-employed business owners (16.2 million according to the SBA) employ between 1-10 employees.

An NASE survey at http://www.nase.org , was the first to provide compelling evidence of small business involvement in the upcoming toxic mortgage crisis. The survey was created by Prof. Samuel D. Bornstein and Jung I. Song, CPA of BornsteinSong Consultants in Oakhurst,NJ,and was conducted by the National Association for the Self-Employed (NASE) which issued a Press Release on November 21, 2008.

According to this survey, it is estimated that 3,709,800 small business owners hold Alt-A and other toxic mortgages, and 1,279,800 are already delinquent as they have missed one to three or more monthly mortgage payments at mid-November, before the expected Resets that are scheduled to begin in 4th Quarter 2008 through 2012.

These small business owners will be at-risk of payment shock and default as their monthly mortgage payments skyrocket. Small business owners were especially targeted for these Alt-A loans which required little or no documentation of income which appealed to many small business owners who previously were unable to qualify.

The resulting defaults will be the cause of the upcoming second tsunami wave of foreclosures that will dwarf the subprime crisis and will take many homeowners, small business owners, and their employees when our economy can least afford it..

I

Thank you,

Samuel D. Bornstein

Professor of Accounting & Taxation

Kean University, School of Business, Union, NJ

Tel: (732) 493 – 4799

Email: bornsteinsong@aol.com

I live in Mass and the prices are not going down very much at all. Most homes are being priced for 2010 what the assessments were two years ago. There is a good amount of shadow inventory being sat on by the banks. I’m wondering if our market is going to bottom out in 2012-2013. I know that Cal and Fla had the lions share of Option ARMS but what about the other states. I would love a breakdown of Option ARMS and Alt A Mortgages throughout the US to understand which States are going to get hit the hardest. Does anyone know where to get this data????? I read that Realty Track stated that 70% of their foreclosure listings are shadow inventory that has not even been listed on the open market by the banks yet???? This is highly disturbing if we are getting ready for the next wave. It also allow the bank to control the market.

Leave a Reply