Small homes of Orange County: What half a million dollars will buy you in Orange County.

Most housing reports leave out examples of what you are actually getting for with your money. That is understandable but the press does a poor job of looking beyond the overall trend. Maybe if they showed a picture of the property, they would actually knock some common sense into people. They can still ask questions like “how much did you pay for that crap shack?â€Â That might be a starting point. Instead, what you get is a play-by-play commentary of where we are at. The market today is inflated and we are living through a rental revolution. The stock market has been on a non-stop move upwards since 2009. We have yet to face any small correction and as many people are seeing this year, expect the unexpected. One easy way to see the mania in the market is to look at small homes for sale and how they are being pitched. Today we take a look at a small home in Orange.

The Orange Crush

Orange County is the most expensive county in Southern California. In fact, prices are now at a new peak level. So what is a first time buyer to do? You can listen to Taco Tuesday Baby Boomers and purchase what you can afford. Buying always makes sense unless you are one of the nearly 8 million completed foreclosures since the housing bubble popped (of which 1 million were in California).

Take a look at this home in Orange:

318 N Waverly St,

Orange, CA 92866

2 beds, 1 bath at 667 square feet

The ad is wonderful here, including the mandatory “Granite Counter Tops – GCT†and updated appliances:

“Old town orange Charmer! This adorable turnkey home features a very large front yard, upgraded fixtures, newer energy efficient windows, fresh paint and carpet throughout. The home has been tastefully upgraded and includes laundry, automatic sprinkler system, updated appliances and Granite counter tops. Conveniently located just a quick stroll to the Orange Circle and Chapman University.â€

This place is small. More lawn than home:

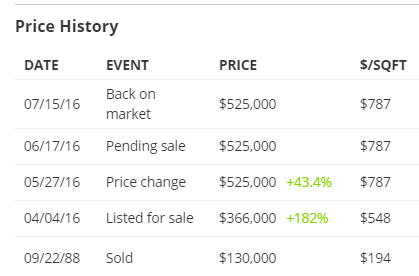

The pricing here shows you how out of whack the market is:

The sellers bought this home in 1988 for $130,000. So they listed this tiny pad for $366,000 in April. Surely a near tripling of price was going to be a nice windfall. But the house horny shoppers must have been pounding on one or two of these bedrooms because clearly it was “underpriced†– so in May, one month later they listed the place at $525,000. What the hell happened in one month to change the price from $366,000 to $525,000? Then some lemming almost bought this place in June but it looks like it is now back on the market.

This kind of ridiculous seesaw pricing is indicative of a market where sellers are pushing the limits on desperate buyers. You can’t blame the sellers, they are simply trying to squeeze out every nickel they can get out of a 667 square foot home that was built in 1923. You know what else was built around this time? The Walt Disney Company.

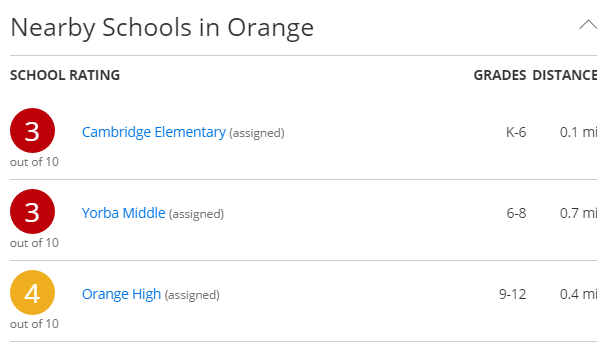

Oh, and the schools don’t exactly have great ratings:

So who is ready to drop $525,000 on this place?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

115 Responses to “Small homes of Orange County: What half a million dollars will buy you in Orange County.”

Who needs a stinking garage? For 525K you can park your Prius on the provided dirt lot just off the street and schlep your bags up to the house. Now your getting exercise too. Only 667 sq. ft? No problem, that’s 300 more then one needs. You could probably rent out a couple futons in the corner for a easy couple Benjamin’s a month to supplement your mortgage. Schools suck? No problem. With multiple people living in this shoebox, there isn’t going to be enough privacy to procreate. This house and lifestyle sells itself. Nice!

2 bedrooms and 667 sq. ft?

More like alcovies than bedrooms. Or the living room is a shoe box.

Looks like rental parity all the way for this tiny crap shack. An easy comparable would be a 2 bedroom apartment that likely rents for ~$1800+/month. Looks like you get the bonus of sharing no walls, having a garage, your own laundry and a nice yard. Now the trick is coming up with that 100K down payment!

Rental parody.

134 E Everett Pl,

Orange, CA 92867

2 beds 1 bath 864 sqft

http://www.zillow.com/homes/for_rent/Orange-CA/house,mobile_type/25131393_zpid/33252_rid/2-_beds/33.904331,-117.693959,33.715201,-117.942524_rect/11_zm/

https://goo.gl/maps/u6rnktma6822

Better curb appeal than the home for sale -> https://goo.gl/maps/om5eDUHDDQ32

Comes with a back yard, a real garage, and included maintenance. The buyer of the other property will likely purchase with max leverage after parting with around $15K up front, whilst the renter a few blocks up the street pays around $1K less a month and a fraction out of pocket, refundable.

Ten years later the buyer will have totally hacked life with $13K in principal paid down. Oh boy, a prudent decision to rent for less a couple of years while the bubble deflates is going to miss out on absolutely crushing it!

Did I mention soaring rents is yesterday’s news?

this is what the bulls always do, they use fuzzy math to keep the charade alive.

$100K down, $425K mortgage at 4% with PMI = $2,836.31/mo

not fucking $1,800….and never mind that house is going to needs tons of work every fucking year.

Slow down there Mr. Mumbojumbo. I have not held a math lesson in quite some time, clearly there is a need since we have students who haven’t paid attention.

Assuming buyer puts down 20% there will be no PMI. So let’s run the numbers…

Purchase price = 525,000

20% down payment = 105,000

30 year fixed loan at 3.43% (per bankrate.com) for 420,000

Principal = $669/month

Interest = $1201/month

Property Tax @1.2% = $525/month

Insurance = $100/month

Maintenance = $200/month

Gross monthly outlay = $2695/month

When factoring in the $669/month principal and likely several hundred dollars in tax saving we are not only at rental parity, we are below it. To add insult to injury, this shit box should rent for $2295/month according to Zillow (Hotel guy likes to quote numbers from that site).

So there you have it, the numbers are hard to argue with. People who don’t understand basic math are absolutely going to get steamrolled in this world…especially in ultra competitive places like socal.

325/425 is 76.5% so there’d be pmi because ?

rates are also much better than 4% today but at 4%, 325 is 1550/mo

i agree that it’s more than 1800 w taxes and ins but also nowhere near your fuzzy 2800

nvm misread that, delete the previous

not that it matters this is the internet here

You can’t compare gross numbers when doing the buy vs. rent calculation. Buying this house with 20% down (the gold standard) makes it below rental parity. You need to account for the almost $700 principal per month and likely several hundred dollars a month tax savings. Do this and it is at or below rental parity. This is not rocket science.

“Assuming buyer puts down 20%”

LOL, and there you go, highest down payment possible, lowest interest rate possible!!!

LOL, you are proving my point……PROMISE us you will stick around when reality hits??

@Mumbo,

The 20% down was and is the gold standard that was used for decades. It protects both lenders and borrowers. If 20% were required, the meltdown in 2008 would have never happened.

This shit box will sell. You may not like it and you may not be able to save for the down payment, but somebody else will. Regarding rates, we will likely see 2.x rates in the near future. Deal with it, low rates are here to stay. Those that bet against the Fed got smashed.

And don’t worry about me being here. I’m looking to add another property when we get a pull back.

Doc, you have a method for discovering the funds used on the eventual sale of this place? I hope you revisit after this place closes and let us know if it was a 20% down deal.

LMAO… no person or couple who has 100K downpayment is going to like or want to live in that shack… I can almost guarantee you that they’d rather keep the 100K in the bank and rent an apt for $2500/mo. than buy this.

LB,

Correct me if I am wrong but most people probably wouldnt get any tax benefit from this as the buyers in this price range have lower incomes and their standard deductions will be higher than any itemized deductions.

Also although I would agree that mortgage pay down should be considered in rent vs buy calculator, one must also consider that equity gained from mortgage pay downs could easily be erased from price declines. Although I am not one to predict how homes prices will go, I dont think anyone could fault me for thinking prices have risen significantly and there is a growing chance prices may fall, especially for that beater of a house featured today.

Oh BTW,

there is no way in hell that thing rents for 2300 a month. I know the area and it wont…

“The 20% down was and is the gold standard that was used for decades. It protects both lenders and borrowers. If 20% were required, the meltdown in 2008 would have never happened.”

Yes, a hard 20% down requirement would have prevented prices from reaching a meltdown point, back then and now. The current bubble is simply extension from the last.

“This shit box will sell. You may not like it and you may not be able to save for the down payment, but somebody else will. Regarding rates, we will likely see 2.x rates in the near future. Deal with it, low rates are here to stay. Those that bet against the Fed got smashed.”

Most likely will sell due to the continuation of the cheap and easy credit. As stated before, the low rates cannot prevent the economic cycle from asserting itself.

@oh boy,

The tax savings could be significant in this case. The standard deduction is $6300 for single and $12600 for being married. The mortgage interest and property taxes is over $20000. When factoring in other itemized criteria (state income tax, donations, vehicle license fees, potential medical bills, etc), the total itemized deductions will be between $25000 and $30000. Obviously it is a bad idea to buy a home solely for the tax savings, but it definitely needs to get factored into the equation.

Good job ignoring the reality that very few can come up with a massive down payment. Those that can save that much are not going to live in this dump because of rental parity or whatever sissy nonsense you keep harping on. Maybe Lord nutless would live here and sink over $100,000 to appease his wife. Seriously, why would you buy something like this unless you are a neutered person trying to appease someone for their nesting instinct? What single male with a good paying job and an ounce of self worth would buy this place?

No one with any sense is going to place a $100K bet on this garbage. Dollars to donuts it’s going to be a 3% down with PMI and more like => 4% rate.

That comparable rental up the street is one month’s rent out of pocket, with landlord tenant law backstopping its return.

nobody that’s who, I’ve seen this movie before and i know how it ends. The same way it always has. Like I’ve said, my X bought in 2005 and just sold that house for a $30K loss….to be fair she did enjoy some tax saving along the way but she put $80K down on that property so……..

timing is EVERYTHING in socal real-estate and that ship left the dock in 2010.

this show will end in tears like it always has, this time is no different. And one final note as every realtor has told me “just buy and if the ‘value’ drops by too much, just walk away” that my friends is socal real-estate

I know this is the internet, but I’m an average adult female who likes to keep up with housing news and insights, and comments like this really make this site seem hostile.

Humans are humans, right?

lalalandia: Humans are humans, right?

And cars are cars. Both statements are is true, as far as they go.

Even so, a Mustang is not a Corvette, is not a Beetle, is not a Jeep, is not a Rolls Royce. Cars differ by make and model and year and mileage.

Likewise, humans are humans. But even so, humans differ by sex and … well, by many other factors we’re not supposed to notice.

Political correctness preaches that all humans are completely identical to all other humans. That men and women are completely identical. Reality reveals this to be untrue, but political correctness teaches us to ignore reality.

Totally agree with Lalalandia. In my household, it’s me and not my husband who desperately resists overpaying (if that is possible!) and reads up on CA RE market. My husband would be that one ready to dive in in order to satisfy that “nesting instinct” as Jay so aggressively put it.

“comments like this really make this site seem hostile”

lalalandia sounds like a passive aggressive snowflake who needs a safe space to protect her from anyone who dares to disagree with her.

fresh paint and carpet throughout.

I hate it when flippers paint and carpet a house. It’s usually white paint in every room. And the carpeting is almost always an ugly beige, though in some cases it can be an ugly gray.

I get it. Flippers choose neutral colors so as to not repel buyers. White and beige might not be everyone’s favorite colors, but most people can live with them.

But were I to buy a house, I’d want to repaint the walls to my preferred color scheme. And I’d only tear up that new carpeting for hardwood. I don’t want to pay extra for the flipper’s paint and carpet costs, when I’m only going to redo it anyway.

If you’re gonna flip a house, don’t be a cheapskate. Do it right. No beige carpeting. Hardwood. Most buyers want hardwood.

Or knock some money off the list price and let the buyer choose flooring/paint and offer that as a reason for the price discount!

I’ve heard it called “real estate beige” but that was a good choice decades ago, now everyone wants hardwood.

“Builder Beige” is the correct color name.

Found the Brit.

You’re forgetting that most people are total morons and are without any imagination. Most people live in unbelievably shitty conditions and don’t even have the motivation to clean their house once every month or so. Doing what flippers do is the best bet. Just make it look presentable for the lowest cost and you’ll find buyers.

Uber strong hands.

“Crime rose 23 percent in Orange County last year – the greatest single-year jump in at least a decade – with the steepest increases coming in stolen vehicles, aggravated assaults, theft and burglaries, according to law enforcement records compiled by The Orange County Register.”

http://www.ocregister.com/articles/crime-710203-county-police.html

Well the increase in crime is entirely due to prop 47 or, lol, Safe Neighborhoods and Schools Act.

Who would have anticipated that making it a misdemeanor to steal anything under $950 would have increased crime? Or that drug addicts would not voluntarily want to attend drug treatment classes.

I voted yes on prop 47 because i believed the hype. I feel pretty dumb now.

You nailed it, that is precisely what happened with prop 47, you nailed it. it was one of the biggest smoke and mirrors shows ever. violent offenders everywhere in public now because of it.

well i think that the anti prop 47 morons must have added that part into the law so that it will eventually get repealed. The real purpose of prop 47 was stop throwing people in jail for having a crumb of drugs on your person. I have no idea why they would include robbery in that law…..that makes zero sense as that isn’t a victim-less crime like drug possession is.

Housing to tank hard soon!

When housing eventually tanks hard, we need to arrange a big block party, with fireworks and everything.

Decades and Decades of building bigger and bigger homes has led to the massive price inflation and making these smaller homes more valuable as well.

My parents just sold their home in Nellie Gail Ranch ( Laguna Hills CA) for 1,775,000 they bought it for 675,000 in 1996. 5 Bedroom 6 Bath 5,300 sq foot

But the homes above, just compare the price per sq foot in the article to my parents home that just sold.

Goodness

As always building bigger and bigger homes while family size get smaller and smaller

“Why Building More Homes Won’t Help Housing Affordability”

https://loganmohtashami.com/2016/07/25/why-building-more-homes-wont-help-housing-affordability/

Logan just curious, where and what did your parents buy?

Robert they made 2 offers on 2 homes in the area and lost both bids because they had a contingency to sale on their offer even though the offer was for the same price.

It was a 30 day escrow so they had to leave because no rent back on the offer. So they’re renting on a 6 month lease and trying to see if they can buy something in that time frame.

The 2 bids were Condos 750K one and 825K for the other that they didn’t get. The homes are much much smaller as you can imagine

This is a house on the margins and I expect will be one of the first to “correct”. The high end stuff in Costa Mesa I expect will have its sails trimmed a bit too. The solid middle will move the least and last.

I know many expect this bubble will bring us another 2008 and I see your wallets salivating already. Unless there are a lot of job losses I think this is unlikely. There isn’t the large quantity of NINJA loans and the hedge funds aren’t going to dump inventory on the market and kill their own values. Prices will adjust downward, maybe as much as 15%. Keep a careful eye out for the area and type of property that strikes you so you can move in at the right time.

I find it amusing when the good “Doctor” here or any other blogs breathlessly exclaims that the crap shack of the day is our overvalued poster child. Everybody was aghast when the ordinary 1500 square foot family crap shack was worth over $170,000 back in the late 80’s. Everyone was forcasting a big drop in prices and the inevitable blood bath.

When this happens now for the 4th time in my fortunate existence you’ll have to pardon me for being a bit skeptical and jaundiced.

The good thing is that this market is like a 747 turning around. It happens slowly over time and we all have a ring side seat.

Well, I have my checkbook warmed up and will be happy to pick up a thing or two but I won’t be terribly surprised if the market adjustment is soft and short.

You are correct. People have been aghast about S. CA home prices since the mid-80’s. The only record of sanity that I remember in my lifetime was in the early 70’s my parents sold a house in Milwaukee WI and bought the same size house in S. CA for the same price. I was only 10 years old at the time so I couldn’t take advantage of that and ended up buying a house in 1988 for a little over $200K. By today’s standards, it was a bargain but back then, people were aghast.

What’s the point in coming here if you’ve got it all figured out and all of the skepticism is unfounded?

Must be some chance of more than a 15% correction.

Real estate price always go up forever. This time it’s different.

“hedge funds aren’t going to dump inventory on the market and kill their own values”

i guess you missed the article here about this very thing, they are ALREADY unloading. And selling to the people that are renting the house.

as you said this is the 4th time and i agree but the other 3 times prices NEVER JUST FELL BY 15%.

when the tide goes out on this bubble, and it will, we’ll finally see all the skeletons hiding in the closets.

Ah yes, another this time is different post through the perpetuation of economic myths:

– The current cycle is devoid of cheap and easy credit.

– Subprime and exotic loans caused the last downturn.

– Hedge funds don’t have to concern themselves with redemptions or margin calls.

– The next down cycle is guaranteed to stop at 15% max.

– Prospective buyers with suitcases full of cash are eager to get off the sidelines and be the first to soften the fall.

It is truly baffling to me how these people think the current cycle will slide precisely 15% and then level out. It is hairbrained logic. You are correct that prices do not stop there when the part ends. This one will be no different.

Ford warns of slowing car sales:

http://money.cnn.com/2016/07/28/investing/ford-earnings-warns-us-auto-slowdown/index.html

From the article:

Ford’s credit arm also stumbled amid concerns about auto loan deterioration. Profits at Ford Credit slumped 21% during the quarter due to rising defaults, higher delinquencies and lower resale values in auctions.

Guess that working for Uber isn’t enough to cover the monthly payments of new, overpriced cars.

They can just go to a buy-here pay-here lot, same way they bought their house.

From the creators of Rocket Mortgage, here comes Rocket Auto Loans!

Which is why I have to travel 800 miles to see my grandchild.

CA is highly over rated and very expensive. The quality of life is dismal unless you are very very rich.

Anyone buying at this prices are fool as the downside potential is way more than the upside potential.

Buy only if you want to stay put for years to come and money does not matter to you meaning you can easily throw couple of million dollars on housing.

Its not just CA, its most coastal areas and many cities/suburbs. I thought to myself this morning what a strange eCONomy/market we have – I live in a very desirable area where there are trophy homes everywhere, minimum 1M and they sit mostly empty save for 3-6 weeks out of the year – not even rented out. There are hundreds of them in a relatively small populated area. Then you have at least a couple of homes in every neighborhood that were foreclosed on years ago (up to 5) and have sat vacant all that time, although some have been coming to market since the fall. Then you have much of the inventory being 30-50 year old shack like places, some actually leaning over and rotting that are rented out. I’m lucky in that I have a decent quality rental for very cheap – coworkers rent the same for 2-3x as much, but I really feel for the younger generations, they are the ones most screwed by this frankenstein economy.

Absolutely not true. Most of my friends have modest jobs and homes but have an awesome quality of life. Beach days, barbeques, concerts in the park, kids sporting events, etc. They are loving life here. All admit to the passing thought of “gee should we consider moving to be close to family/cheaper housing/etc.” but they blow off that thought quickly. You definitely do not need to be rich to have a fantastic quality of life in SoCal.

Modest job == working for anything Government and Unionized, so postal service, DMV, water treatment plant, work for the crazy house next to Harbor Boulevard, etc. $100+ salary, great bennies, no need to job-hop to get raises. Often you get house-buying subsidies in these types of jobs.

Hell yeah, you have family barbecues and all that. It’s the poor stupid-ass suckers who went into high tech who may make good money for a few years, but will be living in a dog house, an old van, or your local homeless encampment and saying SoCal is impossible to live in.

Good on your friends, Falconator!

Alex, in the late 1990s (i.e., the height of the first Dotcom Bubble), radio ads in Los Angeles were touting all the Riches to be made by becoming a “Microsoft Certified” programmer or software technician. It seemed everyone was enrolling in school to earn their “Microsoft Certification” in Windows servers or whatever.

I thought at the time: So many ads. So many Microsoft Certified Technicians graduating. There can’t be enough jobs for all of them?

Then lets hear you name the ‘hoods where your buddies have modest jobs and homes while enjoying beach bbqs, etc. In coastal CA it – to my knowledge – doesn’t exist, unless you define modest income as >100K and modest home as >500K. As the saying goes, put up or shut up.

A simple middle class can no way enjoy life in socal close to beach unless you have govt or unionized job along with property bought quite sometime back

This is a blatant lie.

Middle class is getting wiped away from USA and much faster in SoCal.

to answer Junior’s question, the neighborhoods are located in Encinitas, Carlsbad, Clairemont, Pacific Beach, Scripps Ranch and La Mesa. Modest sized homes, dual income w/modest jobs (for instance 2 teachers in Encinitas) or single income professional (engineer) with stay at home mom.

Beach days almost every weekend, cookouts, camping trips, concerts, birthday parties, yearly Vegas trip, Maui or Kuaui every 2-3 years, Costa Rica next year, backyard parties with fire pits and guitars, bike rides, lots of out of town friends in for visits, on and on.

@Faconator

Been there. Done that. Encinitas style. Problem is, every one of my couple friends or young family friends was either:

1) renting and deep deep DEEP in debt

2) had family money and family with houses in the Encinitas area, which acted as a source of reverse mortgage trust fund account

“Modest homes” in Encinitas start at 600k+. No way a family of 2 teachers or a single income engineer family can afford that.

Hint hint :: it’s all an ILLLLUSION.

It would take me hours to go through everyone’s unique financial situation, including when they purchased, downpayment amount, rolling over of equity from prior purchase, family assistance, side hobby business providing income, cashing in stock options, on and on. Sorry SoCal but its not an illusion, I know many people who are making it happen in great areas and are having great lives, these are people I have known for 25 years, I get it that there are people who frequent this site who have not been able to make it happen and they cannot grasp how anyone can, but it has and will continue to happen. Sorry but it’s true.

I come from a lower middle class family and went to High School with lots of Doctor and lawyer kids. My family struggled and did all they could to pay for my college education. My rich friends were given credit cards and all of there college was funded. They lived in nice condos by campus and had new cars. When these kids got older there parent bought them nice homes. It is extremely common for upper class people to pay for their children’s schooling and help them with down payments or even buy their children homes…the idea that a college grad with student debt or even if they have no student debt is going to be able to find a good job and save up for a down payment for a 500k home in California is nonsense. The only people under the age of 30 buying homes in desirable locations in CA are those with wealthy parents.

Give me a break. Yes, the cost of living is high. Traffic is bad, but it’s manageable if you’re not living in LA. I live in Orange County, but I’m from Colorado. My wife is from here and I dragged my feet coming here because of the cost. But the quality of life is not terrible. The weather, entertainment, wildlife, nature, etc. are fantastic.

I’m young and my wife and I live off of a gross salary of less than 80K. A kid on the way. Rent for around $1600 within a few miles from the beach. My commute to work is less than 45 minutes. Like any place, there are tradeoffs.

Buying a home is a different story. Like many of you, I’m just waiting for a correction. If there isn’t a substantial correction, we will probably eventually move somewhere else. But I do think there will be a correction eventually.

Skyrocketing rents.

“Receive 4 weeks free rent on select units at Villas at Playa Vista.”

https://www.irvinecompanyapartments.com/promo/playa-vista

Those places start at $2,500 for a 1 bdrm 740 sq ft. I’m not sure what your trying to prove with this. Many large complexes have move-in specials to entice new renters. The rental market is VERY competitive right now. There are limited rental units available in the densely occupied cities of S. Cali and way too many people to fill them. I predict the rental market will become even tighter as the new minimum wage laws take effect. The average rent in LA as of June 2016 was $2,585. So yes, rent is increasing and being a renter is becoming more and more difficult every year.

I’m not sure who you’re trying to fool with this. The Irvine Company wouldn’t be giving away a free month of rent in one of the “hottest” areas of L.A. if there was enough demand.

Agree with @LA’r. Have been renting from the Irvine Company since I moved down here from Alaska in 2011. They weren’t offering any promotions at the time, but since I have seen them periodically offer 4-6 weeks for new tenants in their new complexes, and anywhere from $800-$1500 cash for referrals to existing tenants. That being said, having watched them build out here near the spectrum, and along the ‘great park’ has been amazing. Irvine has had steady YoY population growth of about 10%. If the new 20 something story office towers 200, and 300 spectrum are fully leased out by the end of 2017, I would say Irvine rent, and housing prices aren’t going anywhere anytime soon. And with Google, and Broadcom here now, and whatever incentives they are giving companies to move their corporate headquarters here, I think they will only suffer a modest correction when it happens.

Unless the dollar fails, or some other calamity like the one they were able to temporarily stave off by printing a #@^ load of $$$ (aka Quantitative Easing), then I think its going to be “more of the same” , which should be Hillary’s campaign slogan

Nice cherry picking. The rental market is socal is brutal. This is backed up by stats showing year of year increases in rent while wages remain stagnant. Hasn’t it been shown on this site that many people pay 50% of their take home pay on rent. I would call that brutal!

As I’ve pointed out before many times, rent price stats are unreliable. Perhaps someday when you become a landlord, you’ll find out first hand that the county recorder doesn’t keep records of your rent contracts and renewals.

Cherry picking? Playa Vista fits perfectly with your relentless prime costal exception flag raising. The truth is that rents aren’t soaring and the Irvine Company is reluctantly providing a huge tell.

I’ll let you keep thinking that rent prices are falling off a cliff. Everybody on this blog knows they are not. They may not be skyrocketing anymore, but they sure have for the last 5 years. Five years of 4%+ plus rent increases will bring lots of people off of the fence, that is a fact. It’s been proven time and again that renting for the long term in socal is a very bad plan. Life happens, most people do not have an unlimited time horizon to sit in a rental and hope home prices align with their liking.

And you can keep grossly misrepresenting my point. I have never claimed rents were “falling off a cliff”. FFS man get a grip.

If you think the rental market in populated S. Cali cities is in decline and/or struggling, then you are delusional my friend. The property manager I use has a waiting list for available units. I don’t know why your trying to paint a dismal picture of the rental market in S. Cal. Maybe it makes you feel better about renting? The one thing we all have in common is that we all need a place to live. Being a landlords is one of the oldest professions/investments in the world for a reason. In fact LA is losing more rental units then gaining every year as they are converted to condos, knocked down, or sold to owner-occupiers. Large complexes like the one you mentioned have hundreds of units and therefore always have turn-over, vacancies, and “move-in specials”. Do I really need to explain this?

I suppose you didn’t read the fine print

“Offers valid with a minimum 15-month lease term and valid for new applicants only. The offer is subject to satisfactory credit and application and cannot be combined with other offers; pet deposit not included.”

I’ll bet anyone with less then perfect credit score will not “qualify” for the free month rent. Furthermore, these places start at $2,500 for a 740 sq ft 1 bedroom 1 bath. I would give a month away too if someone agreed to sign a 15 month lease at $2,500 a month for a small 1 bedroom apartment.

This is a poor attempt to prove your point that rents are in decline in any way shape or form.

Golf clap for LA’r.

Here is my antidotal evidence of the rental market in the South Bay. One of my acquaintances has a 3/2 1100 sq ft shit box rental in Torrance. His old tenants moved out and guess how many applications he got this time around? 89 applicants. You read that correctly, 89 people wanted the pleasure to rent his shit box out for $2900/month. And according to him, the overwhelming majority were very qualified. A rental market truly in chaos!

I’ve never once claimed the rental market in SoCal declining nor struggling. What I have pointed out is that the momentum has been stalled out for at least a year.

I’m not responsible for your misinterpretation.

Irvine Company would not be offering free rent in one of the “hottest” areas of L.A. if the demand was strong enough to support soaring rents, period. It’s not some sort of a bait and switch nor run of the mill promotion as you suggest.

More evidence the rental market is strong (I’m just trying to debunk some of the BS and mis-information currently being spread here).

https://www.inman.com/2016/07/20/apartment-list-releases-july-rent-report-for-los-angeles/

“L.A. rents grew 3.3 percent year-over-year since June 2015, outpacing California’s rent growth of 2.2 percent over the same time period.

Rents in L.A. sat at $2,630 for a two-bedroom and $1,930 for a one-bedroom in June.

L.A. and Pasadena were the two most expensive cities for rents in the L.A. metro.”

And here’s another:

http://therealdeal.com/la/2016/07/28/rents-rising-fastest-for-las-cheapest-apartments-zillow/

“Developers continue to focus on the construction of high-end multi-family housing despite a chronic lack of supply on the low-end, a trend that experts say is driving up rents for smaller homes to historic highs.”

The only thing you’re (inadvertently) debunking is the false narrative that rents are currently skyrocketing and always move upward. “Strong” is not the vague term I’ve put into question, it’s hyperbolic assertions such as “skyrocketing” and “soaring”. Assuming 3.3% YoY is accurate and on balance, that’s not exactly a to the moon price increase.

For example, from the apartmentlist report – “Rents in Westwood decreased 1.5 percent month-over-month in June.”

Last time I checked, Westwood is prime coastal everyone wants to live there land. After all, the report states “Westwood takes the lead as most expensive neighborhood in LA.”

Looking even further, the report shows other selected locales in the region have negative MoM and YoY numbers which demonstrates that 3.3% figure to have varied weight of applicability and therefore, limited usefulness.

Of course all of their numbers should be taken with a giant asterisk because the other major point I have made, and it is an unambiguous fact, is that the reliability of any rental price source is limited to the extent that they have recorded actual rent contract prices and renewals.

“A detailed report explaining the survey’s methodology, analysis, and findings is available upon request.” Makes one wonder why it wasn’t provided.

That other “article” has no link to source and is basically an unknown real estate shill zine written like a short blog post.

You know, it should be interesting to anyone reading this back and forth to note that my original comment was a one liner which simply questioned the idea of “skyrocketing” the face of a well established high end apartment developer advertising an effective rent reduction in one of the most popular coastal neighborhoods of L.A. Certainly makes one wonder why some feel the need to put up straw mans as a result.

I give up. Your obviously very well informed and have your finger on the pulse of the RE market, unlike the rest of us. Welcome to bizzaro world where up is down and down is up and the rental market is so weak in LA that landlords are giving them away.

I have not used the word weak. There’s a distinction between that and stalled. I’m waiting for more data over the coming months, but for now, it’s certainly is not skyrocketing.

For kicks, I decided to follow an open house sign on Saturday. It led me to this:

https://www.redfin.com/CA/Los-Angeles/6650-W-81st-St-90045/home/6610565

Right by the airport! Decent elementary school, but not junior high or high school. $1.2M.

Already under contract!

Right by the airport!

This Entertainer’s Delight offers easy airport access for International Jet-Setting Celebrities. Westchester is the new Bel Air.

Westchester??? A dumpy, trapped in the 1950s white enclave in Inglewood? Breathe the jet exhaust….

I lived there for a bit. It’s …. ok.

I live a couple of blocks north-east of that house. We have lived here for over 35 years and like the area a lot. We live far enough north of LAX so the noise doesn’t bother us. The only negative is the schools, so we sent our son to private schools.

The growth in the last 5-10 years in the Playa area (near Jefferson and Lincoln) has been absolutely amazing. Houses for sale go quickly (usually less than one month), and the original style one-story ones are usually torn down and a 2-1/2 story house (garage plus two stories) put up.

We are semi-retired (me yes, wife no) boomers, and I hope to never move.

Dont underestimate Westchester (worstchester). I grew up in Westchester and my brother bought a home near LMU for $385K way back when. It is now worth about $900K.

And I think much of Westchester does get loud plane noise and has some even lesser desireable areas such as the eastern edge where it approaches the 405 fwy.

There are 2 things that are driving high home prices in Westchester.

a) Investors bought tons of homes in Westchester in 2010-2012 only to remodel, fill with bunk beds and rent out to college students at LMU – packing 6 or more students into a 3bd 1 ba house and collecting gobs of rent.

b) Silicon Beach – due to the higher home prices of SM, Venice, Playa Del Rey, WestLA, Del Rey, Mar Vista, Palms, Culver City,,, Westchester has become the go-to location for techies who work in Venice and Playa Vista.

c) lets face it, even though the plane noise, Westchester is within 15 min drive of the beach, so toss it does qualify as coastal.

If you want to be near the coast but not pay coastal prices, try Oxnard, Gardena or Lawndale….ugh.

Silicon Beach – due to the higher home prices of SM, Venice, Playa Del Rey, WestLA, Del Rey, Mar Vista, Palms, Culver City,,, Westchester has become the go-to location for techies who work in Venice and Playa Vista.

Are techies really moving to Westchester because they can’t afford Del Rey or Palms? Neither of those places seem better to me than Westchester, and arguably even worse.

Westchester is getting VERY expensive as QEA mentioned. The part near Inglewood will never be good. Have you driven through the neighborhoods near LMU? The amount of tear downs and McMansion building rivals Manhattan Beach. Just like the other coastal cities in socal, the middle class and blue collar roots are disappearing at an alarming rate.

“Just like the other coastal cities in socal, the middle class and blue collar roots are disappearing at an alarming rate.”

Buy now or be priced out forever!

1.2% GDP growth today (before they revise down probably) How can any uber bull lemming tell me that these numbers are encouraging for further price movement north?

Our GDP is approx. 20% real estate and 70% consumer spending. With stocks and RE in a total bubble, the wealth effect is in FULL SWING as evidenced by consumer spending being the only thing that was positive and thus contributed to a 1.2% GDP. The takeaway is that we will be negative soon, no question. With our without insane quantitative easing which will ultimately destroy our currency. Better think long and hard about this coming election IMO. The future of our country hangs in the balance.

Market – both stocks and RE are going to get taken out back and shot regardless of who wins IMO. Trump knows you have to purge all the imbalances in order to build on a solid foundation, and the dems/hillary know based on the “great recession” that they and their puppeteers can cash in via bailouts courtesy of the american taxpayers. The boom-bust economy alongg with crony capitalism is how the rich get richer. Work is for suckers!

Except apparently restaurant business is down and sub-prime car loans are being defaulted on.

To paraphrase somebody, who needs consumer to have discretionary income when the wealth effect is in full swing? Wealth = house/stock values.

Predictably, Wall Street shrugged enough the bad economic news knowing that the Fed’s asset reflation program will be working overtime.

Every once in a while you would come across a tiny $500,000 house and it would be worth every penny. They were usually called a ‘carriage house’ and sat on the grounds of an elegant mansion in Georgetown or Pacific Heights.

The first photo of this place had me thinking that with a little Teutonic trim and a cauldron in the kitchen it could be turned into a Hansel and Gretel style witches home. Alas it is not sitting by itself in the woods nor is it own the grounds of a Newport Mansion.

Witches House

http://surlalunefairytales.com/illustrations/hanselgretel/images/ford_hansel2.jpg

I guess being a witch in the 18th century was a well paid position if they could afford this home.

This house is advertised as “Old Town Orange”. Well, in fact, it’s one block outside “Old Towne” with an e on the end the real old district of Orange. We owned a 820 sq ft Victorian cottage (1910 remodeled in the late ’70s) in Old Towne back in the ’80s, and it had its problems from some bad remodeling of the plumbing. But the thing was absolutely beautiful, and I almost cried when we had to move for enough space for kid #2. This may be a faux old town house , or it may actually be old. In general, in Old Towne, the older the better. Back 100+ years ago they tended to build tiny or huge. You either had bucks or you didn’t. But they didn’t build crap, except in hobo jungles and shantytowns.

The folks who eventually wound up with our old place in the real Old Towne were trying to sell it a year or so ago for about this much. They had to take it off the market as I recall.

This is true, my rent did not go up when I renewed this year in Point Loma San Diego. I pay $1350 for a 1 bedroom. The overpriced new apartment complex next door wants obscene $2500 for same place!

http://www.livedylan.com/

Who is paying this? I see mostly low income section 8 folks moving there because they get free rent!

Well. If I was to pay 2500/mo. You better believe that I’d check that the building would NOT take section 8 people… else I won’t live there…

We all know how the game ends! Just as this current group of owners gets their hopes up for a ‘golden’ payday, something will trigger another correction in housing, prices will dip 15 – 25% or more, and people in over their heads will once again walk away! Those that hold on, will wait another 10 years or so to see the values claw back and go higher again, only to have the cycle repeat over and over again! Everyone playing at this chasing your tail game misses the one fundamental that makes this all unsustainable, an increasingly stagnating economy, not just in America, but in China and many other places! Economic GROWTH is the driver of all thing and it is increasingly anemic just about everywhere!

To create big wealth over decades, you buy the best coastal location you can afford, then you stay in during the ups and downs. The up cycles will be bigger than the down cycles, and after a few decades, you will have a free 7 figure profit. But, that takes decades.

after a few decades, you will have a free 7 figure profit. But, that takes decades.

After a few decades, any one of us — indeed, all of us — might be dead.

Such long-longterm advice could be accurate, but that doesn’t make it helpful.

You forgot to mention the part where you sell and move to a lower cost area.

Well, I am waiting for this bubble to pop! Hopefully sooner than later.

Barring more insane government intervention, this market will be circling the toilet bowl this winter. “I guarantee it” -George Zimmer, Men’s Warehouse

I am having a hard time understand the strength of the market in eastside Costa Mesa. People are paying 1.3 million for nicely remolded 1950s homes with backyards. The biggest surprise is these prices happening on super busy 19th street. What are people thinking?

They don’t need to think when cheap and easy credit does all of the thinking for them.

Hi everyone! I haven’t read through all of the comments yet, but I just wanted to mention that in my area the inventory of homes has been increasing a lot. Particularly high end homes that have price tags higher than prices were even in 2005. There are quite a few on the market and they have been listed for several weeks, some with price drops.

What do you all make of that? Is it just random increase/decrease of inventory that occurs in a typical market, or is it something else more meaningful? I’m talking about the Phillips Ranch area.

I remember in 2005 that houses would list and there would be 8 people making offers in the first week. Now there are more listings (at least it seems that way to me) and they tend to sit on the market for a little while, but are listed at even higher prices.

I really like this home.

https://www.redfin.com/CA/Santa-Ana/1727-N-Bush-St-92706/home/3054685

I know the area all too well to be paying 800k, something close to 500k, yeah what the flipper paid for it lol. This home will probably go for about 775k if a buyer negotiates.

That is a nice home. I’m not familiar with the area though. School ratings are pretty poor. Looks like they have been trying to sell it for over a year with no luck and numerous price decreases. Is this a bad area or is the home just over-priced? Maybe it doesn’t show well in person?

The area is not good, a little better if you are Hispanic because you won’t get attacked, in the 90’s it was as bad as Compton but like many neighborhoods in the 2000’s, it has gotten a lot better with gentrification. If you look at street view, you will see the cars and homes, you will know what type of people still live there that have stayed from back in the day.

That being said, lots of hipsters living near by because of the new developments.

Excuse me I live down the street and Old Town Orange is NOT a bad area. It is very much sought after because the homes craftsman homes very old some 100 years. We have a old town traffic circle. My house has wood floors and a pedestal bath tub and is down from Chapman University one of the best film schools in the nation right now.

Meanwhile, in flyover country a nice house 2 miles from the “beach” (Lake Michigan) goes for half the $500K. I read that this house came immaculately furnished with “antique” 1970’s furniture and appliances. It was described as a Time Capsule. 🙂

http://www.realtor.com/realestateandhomes-detail/5200-S-Mallard-Cir_Greenfield_WI_53221_M81501-48021

Note that this house sold for $85/sq foot and not $800/sq foot as the house above. Location, location…. and possibly the 70’s decor.

Most people don’t want to live in Wisconsin, Bob, sorry.

Oh I was going to post this crap shack because it is right down the street from me. I don’t care how good the market is. Anyone who buys this is going to be underwater fast unless they guy it and build up.

The owners didn’t list it for 366,000 is was in default that’s is what the repo price was.

perhaps a second floor could be added so it could be a Phd Ed house! @ 1300+ sq’ it would be better priced per square ft

Leave a Reply