Where did all the real estate inventory go? – Orange County inventory down 29 percent over the last year and sales are up 25 percent. What is causing the current market dynamic in Orange County?

2012 has certainly provided a boost to the US housing market. Incredibly low interest rates combined with declining inventory have certainly pushed prices higher. Low interest rates have served as a method of giving US households more leverage to purchase homes. I was taking a look at sales volume in places like Los Angeles County and Orange County and they are up year over year in the double-digits range. Orange County has seen the biggest jump in sales volume in SoCal going up nearly 25 percent and home prices are up by 2.9 percent bringing the median home price up to $450,000. Even with this jump inventories continue to decline by record levels. Let us take a closer look at Orange County given it has seen the biggest year over year jump in sales volume.

The jump in sales

Orange County sales are certainly up over the last year:

July 2011 sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,455

July 2012 sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3,087 (up 25.7 percent)

This has pushed the median home price up from $437,500 up to $450,000. With so many homes being purchased with FHA insured loans, even though interest rates are low the cost is likely to increase:

“(Housing Wire) A House committee voted unanimously to pass a bill that looks to give a boost to the Federal Housing Administration through increased mortgage insurance premium caps and other changes.

The FHA, under the bill, could charge up to 2.05% for its annual mortgage premium, up from a current 1.55% maximum. It also sets a minimum of 0.55% for the yearly payment.â€

So workout the numbers. On a $400,000 loan (near the median price) this will increase payments from $400 to $683 per month on top of principal, interest, and taxes. That is a good amount of money. Why are premiums going up? For one, FHA insured loans are facing high defaults in spite of a housing market that appears on the surface to be stabilizing.

You would think that this kind of market would draw out inventory but it has not:

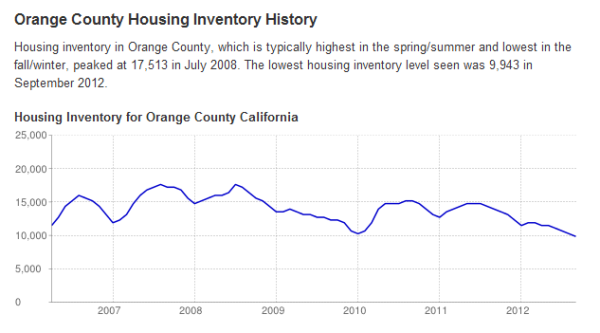

Source:Â Department of Numbers

Orange County inventory is down a stunning 29 percent:

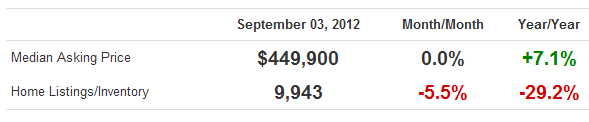

This is certainly an interesting market dynamic. So you have 9,943 homes listed for sale. How many homes are in the distressed pipeline currently?

Over 10,494 homes are in the foreclosure process, most of these do not show up on the MLS. Many fall out of the process via the growing number of short sales and we are seeing this even in markets like Irvine. Things are down in this pipeline:

January 2010 distressed pipeline:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 17,790

September 2012 distressed pipeline:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 10,494Â (41 percent drop)

In spite of what appears to be better conditions, new defaults are still very high:

1,360 new notice of defaults were filed in July. The fact remains that many of the loans made during the bubble years are still going bad but more troubling, even loans made post-bubble bust are going bad. Keep in mind that in June of 2007 the median home price in OC hit $645,000. The current $450,000 median price is off nearly $200,000 from this peak reached five years ago. So what you have are many home owners unable to sell given that they are underwater. You also have banks slowly leaking out shadow inventory and using the low interest rate leverage to unload houses in a supply constrained market.

If you want a quick timeline of price in Orange County here you go:

Median home price OC

June 1991:Â Â Â Â Â Â Â Â Â Â $220,000

Jan 1996:Â Â Â Â Â Â Â Â Â Â Â Â Â $184,000

May 1998:Â Â Â Â Â Â Â Â Â Â $221,500

June 2007:Â Â Â Â Â Â Â Â Â Â $645,000

Jan 2008:Â Â Â Â Â Â Â Â Â Â Â Â Â $520,000

Aug 2012:Â Â Â Â Â Â Â Â Â Â Â $450,000

Current OC median household income? $74,000. 2000 household income? $61,899. If you go back to 2000, the income-to-home price ratio was 3.5 which doesn’t seem so off base for California. Today, even with the median home price down by $200,000 the income-to-home ratio is at 6. Without a doubt low interest rates and the accessibility of FHA insured loans are driving a good portion of the market. Back in 2000 the 30 year fixed rate mortgage was around 8 percent. Today it is down to 3.5 percent (a 56 percent drop). On a $400,000 loan this is the difference:

$400,000 PI at 8%:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,935

$400,000 PI at 3.5%: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,796

The leverage isn’t coming from bigger incomes but ridiculously low rates and a market constrained by low inventory. You still have people that bought at inflated prices looking for the day high prices come back. So where did the inventory go? It is still there just not for sale. For the quality homes that are for sale expect some rush to buy given the mini mania.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

58 Responses to “Where did all the real estate inventory go? – Orange County inventory down 29 percent over the last year and sales are up 25 percent. What is causing the current market dynamic in Orange County?”

Orange county house prices fell in August

Looks like the bull trap has sprung and prices have resumed their fall to affordability

http://lansner.ocregister.com/2012/09/08/166087/166087/

Great news for the buyer watching and waiting.

Low rates increases demand. Low inventory decreases supply. There you have it.

In my area there has been pretty low inventory for the last 3 years and still homes stayed on the market for many months. Once the interest rates came down to sub 4%, the inventory started moving very rapidly….and still is.

Unfortunately this is not a case of markets supply and demand principles. The banksters that robbed the equity already, are hiding most of the inventory on their books at the old bubble prices so that they will appear solvent . It is all entirely manipulated by the thieves that profit from the manipulations 100% of the time while stealing the wealth and assets from the suckers, er middle class. If we have had mark to market the homes would be plentiful and the costs would be extremely affordable and that would be a real free market.

Truthteller. Excellent post. That is why the depression continues.

Dilution of currency aka inflation is another way banksters steal from us. To make matters even worse the government CPI is a sham while true inflation is 4-5 times higher. To make matters the worst, nearly everyone is anti-union and/or government employee, persons just trying to get some kind of raise and protect most of their benefits. Meanwhile in front of our blinded eyes, the largest transfer of wealth in the history of the World occurred in USA from the middle class to the wealthy. According to US census 90% of the entire wealth is now in the top 20%. Used to be that 90% of that wealth was in the middle class 30-40 years ago. The middle class or truly those barely making it, have to rely on debt, two incomes.

Yes, the banksters are manipulating the currency and interest rates and the market. Necessarily, there will be a currency crisis at some point, in perhaps the not-too-distant future, and how it is managed will determine if we find ourselves in hard times or utterly catastrophic times. However, the possible return of a free market in real estate does not mean that “costs would be extremely affordable”. In a free market the costs will be extremely affordable for some and unaffordable for others.

Where did the inventory go? I think we should ask an even more fundamental question. Where is the demand coming from? Are we in a healthy economy? Are we even in a real economic recovery? When was the last time we had near zero percent interest? Is a jobless recovery really a recovery? Is this “recovery” sustainable? National averages say that housing has bottomed. Is it not possible that housing has over corrected is many areas and is still in bubbles in others? Tell me what has changed over the past year that created this housing recovery? I would guess market manipulation strangely close to an election but I am sure this is mear coincidence…

I think it’s misleading to look at economic data on a grand scale and then apply it only to a small group, those who are employed and shopping for loans. There are many people out there who recognized the obsurdity of the prices in ’06 so they waited, but they can’t wait forever and many of those people are satisfied with this drop in prices and are coming of the sidelines, including myself. I’m not saying prices won’t or shouldn’t come down and I cannot afford the ideal location or house but I cannot afford to rent that either. The house I bought is down 300K from peak, my family has not seen an income increase in 5 years but it didn’t stop us from buying. There are people out there with decent jobs and everyone needs somewhere to live.

Candace, you ought to say that the market is overvalued, and the bottom is far below, and our income is not going up, we are doomed, renting is better than buying, real value not nominal etccc…. You can also say that you are a smart buyer and that’s why you are renting now.

The reality is that everything is going up in price, probably except for income. If you bought house in the past three years, your property is up in price today. It really doesn’t matter what people say. Everyone is living in a nominal world, and the price tag on the market today is the reality, and that’s the price you have to pay to get that pound of chicken, not the one in a perceived world that it should be so and so. Many people on this board are renting and waiting to buy at the better price. They are probably kicking themselves not to put an offer in 2009 or 2010 or even 2011 when there were a lot inventory on the market. It’s been 6 years without much new constructions, and we do have population growth. But no one wants to talk about that.

I dont have a crystal ball to tell where the housing is going, but The government will have no choice but print endlessly. The dollar will lose purchasing power over time. The system is set up against savers. To illustrate how much the dollar lost the purchasing power, see this

http://www.zerohedge.com/news/historic-demise-ever-shrinking-dollar-infographic

Candace, I agree with Pete. Everyone of the market forces is beyond your control. Therefore, control what little you can.

e.g. We bought in Irvine in 2007 knowing all of the bubble risks. We bought a house < 3x our household income. We've been fortunate over the last few years with nice annual raises, and were able to pay-down the mortgage ~20% a couple months ago. We're refinancing into a 15Y 3% mortgage right now (so long as the appraisal doesn't come in ridiculously below recent comps). We controlled ourselves and bought less house than the housing/mortgage industry would allow, and are now in a good position.

I hate when people justify their home purchase on this site. I am open to discussing economics/math/ markets/ reality/etc. I have no desire to discuss personal issues. I am neither a counselor nor a psychotherapist. Here is a site where you can discuss the reasons behind your decision making…

http://www.onlinecounseling.org/

No whining What!

Alic,

Great site for you to check out…

http://www.onlinecounseling.org/

I’m with you. It’s annoying and rarely ever relevant.

Huh? So, the discussions should solely surround data and interpretation thereof? How boring.

Perspective,

You win the online counseling award! Yippie! You are a winner!!! Don’t ever let facts and math get in the way of financial decisions!!! It is so much more fun to base financial decisions on feelings or emotions or euphoria!!!

http://www.onlinecounseling.org/

The demand partly, is coming from the 10000 daily baby doomers retiring, realizing that their 0 interest bearing CD provides no cash flow, so some will elevate their risk level and purchase a property. Buying a property and renting it out has higher probability of generating cash flow than a 0 interest CD. Yes, you can argue cost of maintenance, but its either that or no cash flow. It’s not easy having $100-$200k sitting in a CD somewhere doing nothing.

Anyone has any better idea on where to park a couple hundred thousand dollars?

How about barrels of oil? I bet oil will keep up with currency devaluation. I am not convinced that the principle investment on housing will keep up with currency devaluation any better than cash. I am using the term currency devaluation as opposed to inflation because I am not convinced that we are going to see wage inflation a necessary component of inflation anytime soon…

BTW,

I am half joking but the economics are true…

There are still some CEFs out there that are trading 10% under NAV – good ones that aren’t burning up all their NAV to pay some crazy yield. Those and blue chip dividenders with stop losses. Everything with stop losses. And maybe covered calls to make it worth their while. But don’t forget the stop losses. Oh, and farmland. If you can work out a deal with a wind company, then windy farmland is the way to go.

So what will get interest rates back up? We just have to wait forour stupid government to raise rates?

I can answer this with two words “Hyper” and “Inflation”. Otherwise, we will be in this deadlock for some time to come…

So I have to wait for my money to lose it’s value first, haha….great!

One can argue hyperinflation in cash, but deflation in other asset classes can offetset that. I agree there’s inflation, but hyperinflation is a stretch. Every default on a mortgage on the GSE’s books lowers the deficit. Principal reduction and moral hazard in mortgages is happening and has been happening.

Just thinking out loud here..

Let’s say John, Jack, Jane has $10 each, total available cash is $30. Let’s say John’s selling a can of coke for $1 and builds a house over valued at $10.

Jane buys a can of coke from John for $1.

Jack gets ripped off and buys the house for $10. At this point, total cash is $30.

Then here come’s Ben, he prints and hands everyone $10. Total cash is now $60. So you’d think coke now cost $2. Perhaps, but now Jack sells house to Jane for $5.

Total available cash now drops to $55.

Doesnt the loss in value of the house suppress the rising cost of coke?

Jason,

I am not suggesting hyperinflation as a likely outcome rather the only way in the current circumstance that I can see interest rates rising.

You bring up a very interesting point that I have thought about quite a bit recently. What is really the effect of the current monetary policy when you have debt evaporation? This is why I believe that the Fed has been fighting deflation over the past few years. One other moving part is the demand for money. I believe the demand for money has also gone down along with the debt evaporation. I believe this along with monetary policy is offsetting the deflation effect on the supply and demand curve. Just a guess, I have no data to back this idea. This would explain why we have not seen real inflation during this period of very loose monetary policy. We seem to have currency devaluation for items we bid for on the world market like food and fuel.

The government doesn’t set interest rates… A private bank called “The Federal Reserve” sets interest rates. The Federal Reserve is considered an independent central bank. It is independent since its decisions do not have to be ratified by the President or Congress. The Federal Reserve System was created by Congress in 1913 “to provide for the establishment of Federal reserve banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes.”

READ MORE AT: http://www.thisnation.com/question/033.html

The old REO rule was that banks had to get foreclosures off their books in 12 months. The Feds changed the REO rule last year so that banks now have 48 months to get REOs off their books. That in a nutshell explains the disappearing inventory.

Does it mean that we need to wait until the housing price to drop to appropriate price for our income level? Will that ever happen? Or is the high housing price and low interest rate a new trend that will not be fixed, and we just need to accept the change?

Just be patient. Mortage rates will rise and housing prices will drop because of that. I do not know why the government is propping up housing prices. Any housing appreciation will not make that big of a difference to underwater owners because they are extremely underwater. But lower prices will bring first time buyers into the market. If move up owners want to sell, then there needs to be move up buyers to allow them to do that. You need new homeowners entering home ownership.

Of course they would prefer to keep status quo until there is a recovery, which will also be when hyper inflation hits.

#1 higher prices mean more property tax

#2 lower interest means less tax deductions (vs lower home prices and higher interest)

#3 lower prices mean more underwater loans, which would increase instability in the housing market.

They have the power and means to manipulate the market, just as they have been doing all along.

Well, I ain’t never gonna buy no more CA RE. I bought in 2005 for 255k. Under ‘normal’ circumstances, if RE would have gone up about 3% per year, that would mean my place would have appreciated to 313k by now. I currently owe 155k so that would have left me with 158k in equity. For some reason (wink, wink), junk didn’t work out like that. I currently have about 20 or 30k in equity. 158 – 20 = 138k loss that ain’t gonna go back into buying more junky CA RE.

Or if you look at it from another angle: If junk hadn’t of got outta control, I could’ve bought my place for 140k in 2005, and with the money I’ve dumped in so far, could have been livin’ free and clear hear in a couple years. By that time, the junk would have appreciated to 188K (again assuming 3% annual appreciation to 2015) and I would-a been ready to buy some more o’ that CA RE, or at least some solar panels and a new Prius. So let me make my junk perfectly clear: I ain’t never gonna buy no more o’ dat CA RE.

Oh, and my HOA’s fund? It ain’t makin’ no CD or money market appreciation with dis zero interest rate junk goin’ on, so I get to be paying an extra $1,500 this year in special assessments. That makes me think: I sure as heck ain’t gonna never buy no more o’ dat darn CA RE.

Whoops – sorry. Meant to post that on the thread below about demand reduction, by ‘We don’t make those drinks’….

I believe the dynamic of CA housing has changed; buyers “moving up” every five years is over. People will stay in houses for a much longer time frame as multigenerational housing becomes the norm in SoCal. Retirees won’t sell homes, downsize… kids/grandkids are moving home, many forever; inherit the house when grandparents/parents die…it’s the only way they can afford to live in SoCal, they can’t/won’t live elsewhere. Most twenty somethings I know work retail/hospitality jobs (some with college degrees)…endless talk about “moving to Vietnam to teach English” or “move to LA for my music”…one even fantasizes about “riding trains”… most don’t have ambition/income to go anywhere. Also aging parents are moving in with kids…they’ve lost their retirement savings or never saved anything…transition into live in babysitters who can contribute an SS check to the family pot. Welcome to the new norm.

Also all those NOD’s and foreclosures in the pipeline…I’ll bet Kamala’s wants everyone to stay in the house they deserve; govt and banks will craft forever programs for bailouts, workouts, fresh starts; coupled with QE2,3,4,5,6….all problems printed away, papered over. Scared money continues to seek hard assets…RE, metals, etc. My guesses.

Absolutely spot on. Same in the SF Bay Area. Multigenerational families. Seniors will die in their house. Live in nannies, typically low income family members. 20 something’s moving back for good. That’s why rents are up, more income present in each rental.

As you all know, we’re in escrow on a 4+2+pool L shaped rancher (FR & Master open to the courtyard pool area-very private), and it needs $70K from the get go sunk into it. Goodbye $! Hello homeownership again, and this time no mortgage. We’re older, but not dead. LOL

Prices in Ventura County are insanely high, yet incomes have tumbled. We will overpay as well. Our competition on this home were FHA buyers, not willing to start off in a more modest place, yet they are 3% down, and finance their closing costs.

I see no end in sight to govt housing market interference. They have an ocean of underwater risk, and don’t want a tsunami of live frees.

Some say bullish. I say “it’s a bunch of bull-ish”…

PapaToBe

I wish the maket would be allowed to go back to equalibrium, and get back to the real value in relations to incomes, GDP, CPI, etc… It is an elect-tile dysfunction year, so that doesn’t help, and of course, all the lobbyist groups think nose bleed prices are good.

I’ll tell you one thing, as we follow home on a subscriber foreclosure website, we are seeing most go cancelled or postponed, so evidently the extend and pretend is still going strong. We would have preferred to buy at auction, but those prices are up as well, with the beneficiaries bidding against the highest bidder. The auction market is dead for what we are willing to live in.

This housing market is FUBAR for now.

Hi Doc:

Was that a joke?

“Source: Department of Numbers”

Is this a division of the Ministry of Truth?

http://www.deptofnumbers.com/

I live in Orange County and have actively been trying to acquire a rental property. My experience is even though I am a cash buyer I can not buy a property because of the competition for entry level condo units. I work with a realtor that puts offers in on any new listing as they get listed on MLS before I even see the unit. Even with this quick action plan, I have not been able to open escrow on any of the 5 units that I have tried to get. I was bidding 5,000 less, then full price and now 5,000 over and still no luck. Each property gets 10 or more offers first 3 days. If you need any kind of financing at this level forget it. Everyone is a cash buyer. The people who need financing bid 20 to 30 thousand over and they do get the deal but appraisals become a problem. The owners are thrilled to get 20-30 thousand over asking but from what I hear these deals blow up because the bank won’t write the loan because the appraisal is out of whack. Maybe appraisers are back to the same ole tricks of writing appraisals for what ever the market will bear not what the current comps are. Really frustrating for everyone. If you need a loan in this market the only way to get a deal is to way over bid. Everything is out of whack again!

This low interest rate phase will probably last through the end of the decade, or, until the last mortgage from the bubble is safely cleared out. The Fed appears to be intentionally reflating home values to save the banks from their own insolvency. Can’t wait to see how this easy money monetary experiment ends. Look out below in 2020!

Says it all. Incomes and don’t support the bubble that just wont die.

3.5 seems reasonable. 6 = debt pauper house poor.

June 1991: $220,000

Jan 1996: $184,000

May 1998: $221,500

June 2007: $645,000

Jan 2008: $520,000

Aug 2012: $450,000

Current OC median household income? $74,000. 2000 household income? $61,899. If you go back to 2000, the income-to-home price ratio was 3.5 which doesn’t seem so off base for California. Today, even with the median home price down by $200,000 the income-to-home ratio is at 6.

The bubble lives on.

I have yet to see this discussed but the inventory is also being snatched up by large hedge and private equity funds chasing a cap rate that is better than their standard yield.

This is also the backhanded way the inventory is being held back from the individual in order to bolster prices. As a result consumers pay more while the Funds are picking up homes oftentimes at a discount to market.

There are no less than 17 multi-billion dollar hedge funds (that I know of) picking up this inventory. Even the Government is getting involved in selling direct to the funds and bypassing the consumer. The FHFA Pilot program for this is an example.

All of the major banks are even setting up warehouse lines to these funds to further their capacity to buy (Reuters article from last week). This is a very big development that I rarely see discussed as Funds pick up thousands of homes each month.

It may be that the consumer never sees the full reward of falling prices as the large Funds are picking it all up through the back door.

So how does this equate with the 6 times income ration of current So Cal housing prices? The funds are going to get the houses at or below what they are truly valued and keep pumping them to the middle class at bubble prices? How long is that sustainable? I would think that eventually not enough buyers will be in the pipeline to match these prices.

Assuming this is true, what are these fund/private equity firms doing with this inventory? Are “thousands of homes each month” ending up on the rental market? If so, wouldn’t this increase rental inventory? Housing inventory is inventory. It doesn’t matter if it is a rental or an owner occupy. Assuming that the rental market is flooded with all this new inventory there would be downward pressure on rent. This would then make it cheaper to rent then buy for those in the rental parity camp. This would then put downward pressure on the housing market. I believe that housing is strategically being held off the market, period. This is the only way to keep MBS’s (held by the Fed) and GSE’s (held by the federal government) solvent.

Those hedge funds and investment banks are also buying up land around the globe in a resource (water, farmland) scarcity play. Those folks see the economy slowing over the long run, do to permanent increases in energy prices. Real long term returns are gonna clock in at 5%/year in the equity market, which sucks. But they remember a time before all that cheap energy when the only thing that could keep a man rich was being a land owner to tenant farmers – a Lord. Perhaps they’re making a play towards that line of thinking….

Jason

Great post. One of the first deals of REO Bulk Sale To Rent was Carrington Mortgage, under the business savvy of Rick Sharga, their VP, who formerly was with RealtyTrac (as VP), a data cruncher and information firm for Foreclosures. They cut a $450M deal for cents on the dollar. Then I started reading about other deals. That is a one reason the inventory is so low, but I think the “live frees” is even a bigger data point. We belong to Foreclosure Radar and we’ve seen 5+ years of no pymts.

If banks are now allowed 48 months to clear their books, there must be a !@#$%load of foreclosures about ready from 2008. That’s why the number of short sales has increased lately. Still seeing some good discounts on the Westside due to these sales. In some cases, 40-50% off the 2007 peak.

http://www.westsideremeltdown.blogspot.com

late summer,

I am looking at Culver City and do not see anything near 40-50% off.

Everything looks to be selling for about 20% off and a bunch of stuff is selling for over double 2003 prices. what areas are you talking about?

Thomas – be highly skeptical of anything LS2009 posts. As much as I want to believe there are tons of 2003 prices around, the reality is LS2009 is a classic cherry picker. Im not sure why he does this. I mean, I too would like to believe that 2003 prices is the reality of today. However, I am not going to try and decieve myself (and others) when this is so far from the truth.

The increased number of short sales is also most likely due to the expiration of the tax relief on the amount that is forgiven as part of a short sale. It expires at the end of the year, so sellers will have to pay taxes on the difference if Congress does not extend it.

Oh so many little government tricks are keeping property values propped up. Let’s hope this changes after the election.

Doc pointed out:

“Back in 2000 the 30 year fixed rate mortgage was around 8 percent. Today it is down to 3.5 percent (a 56 percent drop). On a $400,000 loan this is the difference:

California $211,500 median house price in 2000

$400,000 PI at 8%: $2,935

$400,000 PI at 3.5%: $1,796”

I found in looking at statistics on Orange county that the avg value for loans orginated in Orange county fha va, etc + conv. was 197,000 and in another metric $211,000

State avg has $211,000

Doc is showing the loan cost on $400,000 dollars. Today that loan will buy you less than the median home in Orange county. In 2000 it wouldeasily buy double the median or the equivalent of homes selling for $792,000.00 today.

My point is, if you haven’t gotten it, is that you get a heck of a lot less house for your $1800 a month today. You would have to spend $3564.00 a month, just in PI today to purchase what $925 would have bought you in $2000. With median wages in the low 70s we’ve got a long way to go to get back what we have lost in the bubble as home purchasers.

Interesting about 5 years ago retail/hospitality are jobs that Americans will not do. Granted, some are still done by immigrants maid jobs and a lot of restaurant in OC and La ,coffee shops have not hired a non-immigrant in 30 years to do the cooking.

“Interesting about 5 years ago retail/hospitality are jobs that Americans will not do. ”

Can’t do. If you are going to live somewhere and pay taxes, you won’t survive with the salary those jobs are paying: They are tailor-made for those people who don’t pay taxes. Usually illegal immigrants.

Being a law abiding citizen is very expensive in any so called Western world countries.

….unless you have a couple kids and are only making 20k per year. 20k per year for a single mother of two means about $2,500 Fed taxes. But each child wipes out like $1,000 in taxes, leaving her with $500 Fed taxes. And of course, she probably also qualifies for free or cheap state healthcare (at least for the kids). My numbers may be off, but the idea is there. I read somewhere that 50% of Americans don’t pay Fed taxes because of the child waivers, etc…

No one knows how our Federal Reserve’s “experiment” with our economy will turn out. Sometimes it looks like it’s working and then suddenly it looks otherwise. Hence, the recent calls for more stimulus. Stay tuned.. This is about to get very interesting….

Well, there was a study that a lot of the manufactoring employment in La or Orange shifted into construction a lot of your factory work from assembler to machinists was done by Mexican men and assembly also by women, La was number one in garment work. Anyways to keep the man at least employed the housing bubble added a lot construction jobs. This doesn’t explain the high prices but that the construction work kept Hispanic La or OC employed. About a few years before the bubble burst Hispanic towns in La like Maywood or Huntington Park or those in OC like Anaheim and Santa Ana had unemployment rates about 2 percentage points higher.

It’s very simple. No one is listing their houses right now because they see no point in selling at what they see as “the bottom.” I mean heck, if prices are just going to start climbing from here on out (ha), why not hold out and wait 6 months to sell your house? The only people listing are those who absolutely have to move, or those who have been trying to sell for about 5 years and are smart enough to know that there is actually too little supply to meet demand right now (and therefore, they can get a good price).

What sellers are too stupid to realize is that now is the IDEAL time to sell. There will be lots of buyers competing for very few properties. When prices start to collapse again (this winter), those sellers will be kicking themselves.

House prices won’t ever rise until incomes go up (not likely for 10-20 years). In the meantime, any nominal rise in values will immediately bring new properties to the market, suppressing values once again.

I’m not a gold bug, but OC house prices measured in gold and oil are dirt cheap.

OC Median Oct 2002 – $366 K Au – $320 oz WTI $30

OC Median July 2007 – $634 K AU – $654 oz WTI $71

OC Median July 2012 – $443 K AU – $1556 oz WTI $86

In terms of oz’s of gold, it takes about 25% to 30% les gold to now buy an OC median priced home. Using WTI it takes about 40%-60% less oil to now purchase a home.

I think that ZIRP and deliberate devaluation of the dollar by government issue of massive amounts of debt and QE-1 to infinity has to to be taken into consideration as to why homes are 6x the average income.

Leave a Reply