Parts of Los Angeles have higher population densities than New York: Over 200,000 people live in informal housing pushing population densities to levels that surpass Queens, The Bronx, and Brooklyn.

High housing costs have put extreme financial strain on working families in Los Angeles County. There has been a rental revolution over the last few years causing rents to increase. Despite the idea that this is being driven by income, this is merely being pushed by limited housing options. Income has been stagnant for many years. Since the crash, housing values have been pushed up by investors, flippers, and foreign buyers. Starting in 2015, the economy slowed down and housing hit a wall. 2016 is off to a poor start. What few realize is that many in L.A. County are living in densely packed areas through options like: living with parents, roommates, converted rooms, and pseudo-housing like garages. We can label converted rooms as “informal housing†and in Los Angeles we have over 200,000 people living in these units. In fact, parts of Los Angeles have population densities that beat out Queens, The Bronx, and Brooklyn. And you wonder why street parking sucks.

The rental revolution drives informal housing

Housing cheerleaders only see one thing and they are fixated on price. They don’t really care about longer term challenges or the impact this is having on families immediately. Environmental issues, poor schools, and living like sardines seems to be perfectly fine so long as price is driven up. But many people are renting because this is all they can afford. Informal housing actually shows that many can’t even afford to rent a home or apartment. So they need to find roommates, modified rooms, or converted garages.

A really interesting article by KCET focuses on South Gate but has some good figures that apply to many working class areas of Los Angeles:

“(KCET) Shrinking levels of housing production left residents of cities like South Gate in dire housing straights. A dearth of affordable housing meant many residents turned to informal housing. By the late 1990s, estimates suggested that anywhere from 50,000 to 100,000 residents across the Los Angeles region lived in informal housing units. By 2001, the Los Angeles Times argued some 200,000 residents lived in approximately 42,000 units of formal housing with rents ranging from $200 to $600 per month.â€

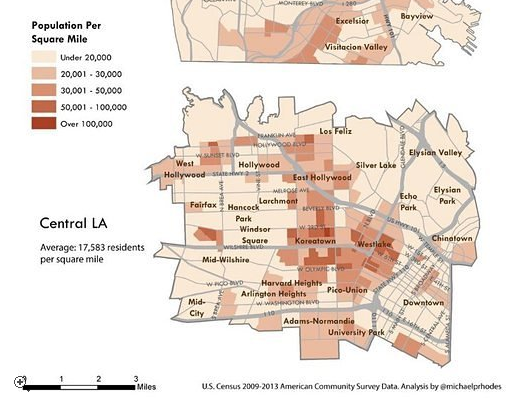

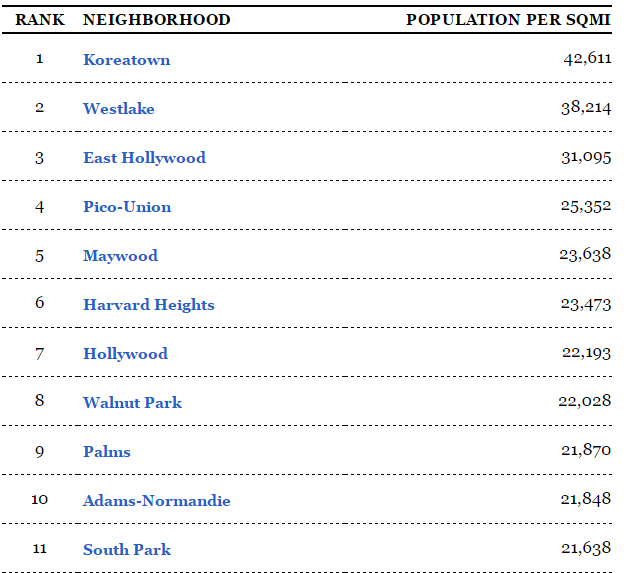

This was based on data from 2001 and the problem has only gotten worse. Take a look at population densities for parts of L.A. in recent Census data:

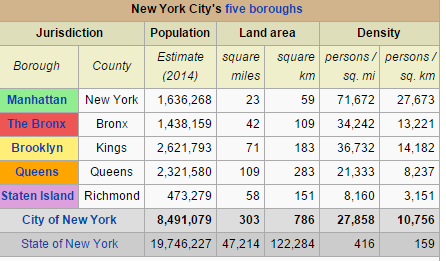

Koreatown and Westlake have population densities that actually surpass some of the boroughs of New York. Take a look at their densities:

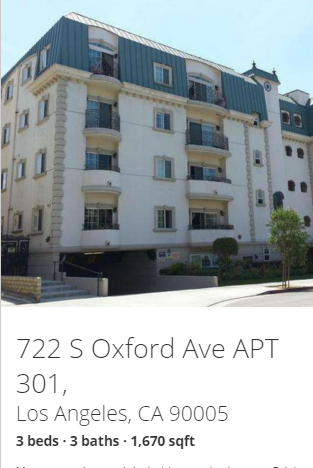

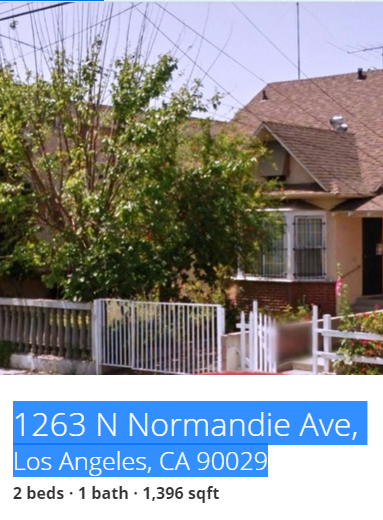

So Koreatown and Westlake actually have higher population densities than Queens, The Bronx, and Brooklyn. So you want to live in one of these highly dense areas. Here is what you can buy:

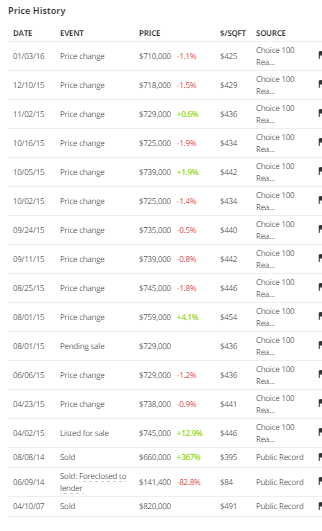

Let us look at the sales history here:

It sold in 2007 for $820,000. It then went into foreclosure. It sold for $660,000 in 2014. Now someone is trying to get out but look at all that pricing action. They started at $745,000 and now it is down to $710,000. For a glorified apartment. In an area that has a population density higher than some parts of New York.

This is the kind of delusional pricing that is going on in Los Angeles thanks to the rental revolution and the mania we’ve had over the last few years. In more of the working class areas, informal housing is big. And of course safety is of concern:

“Finally, and most importantly, there is the issue of safety. Every so often a tragedy unfolds and lives are lost. In 1996, five children died in Watts, when a fire broke out in a garage conversion. In March 2014, another fire in South Los Angeles killed a mother and her son. Similar stories unfolded in Riverside and Orange County the same year. “There is nothing noble in creating and perpetuating unsafe housing,” noted former Zoning Enforcement planner Bell in 2014. “To suggest so is absurd. It is unethical to ignore those property owners who rent out unsafe housing units and risk everyone’s safety.”

Or say you want to live in East Hollywood. Here is the street of where a home is currently for sale:

This place is yours for $645,000. Some people are right saying that Los Angeles is becoming like New York (at least in population density). However we definitely don’t have the public transportation infrastructure of New York and informal housing units and adults living with kids is only adding to the traffic problem.

Then again, this is how you build a utopian housing market. The stock market is a big thing to watch now. Stocks were on a tear since 2009. Last year was neutral. So far this year, we are seeing some extreme volatility. We are hearing about layoffs and companies closing. Oil went below $30 a barrel. The stock market is off to its weakest start ever. China’s stock market is in worse shape and their growth is slowing. To think that housing values will only continue to go up is absurd especially with currently inflated prices. Stocks down. Employment growth slowing. GDP ticking lower. Oil crashing. Yet somehow, housing values to the moon. Typically stocks get hit, the economy adjusts, and housing follows. But some think housing is decoupled from the rest of the economy as if you pay your rent and mortgage from promises.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

113 Responses to “Parts of Los Angeles have higher population densities than New York: Over 200,000 people live in informal housing pushing population densities to levels that surpass Queens, The Bronx, and Brooklyn.”

Just like Jim Taylor says, housing to TANK HARD soon. I can only hope! I want to pick up another property and will not pay current prices. A 20% reduction in prices by 2018 would line up perfectly with my financial plan.

20% Reduction no problem you got it. But I think a better use f your money would be buying gold.

go ahead, 20% ain’t shit and still means housing i so far beyond the reach of the young that prices simply MUST CORRECT to what local incomes can bear.

all my RE buddies are hip to this and are unloading in mass. They all realize that the best thing that could ever happen to millennials is a major price correction that lines up with those incomes.

and another aside, the only people i know who are getting house, and i say getting NOT BUYING are people in their late 30’s or 40’s who are getting the inheritance house……they simply couldn’t afford it any other way. I was recently talking to a buddy who’s been ‘waiting’ for grand ma to pass since that’s going to be “his house” BUT it turns out grandma got a reverse mortgage so he has no clue A: what that means and B: how much it’s going to cost him to keep the home once that company rapes the equity that’s left.

eventually real-estate must reflect local incomes….the next decade will be very interesting indeed.

who cares…Good post, first of all most people in this country can only afford up to 350k for a home and at $350k that is pushing it with a small loan from family and close friend to make the down payment.

Reverse Montages are at a all time high because retired folks are hurting badly so taking equity out of the home leaves little to nothing for the kids. Look, I think parents have no obligation to leave on food stamps for the kids to get their home and sell it for a profit, but now the economy is so bad the parents really need these mortgages, so go for it seniors.

What the public needs is higher paying jobs with security, with lower cost health care,and a reversal from America being a service industry economy, good luck with that.

Companies are very happy shopping and buying overseas and leaving American workers to wonder why they don’t get a piece of the pie, the Wash belt way and Wall Street could care less about good solid Americans who just want a chance to live better??

What we are seeing is social mobility becoming very low, and most of what’s left is downward. Owning a house depends on what your parents did, and how they did depends on how their parents did. Hell I’m in my early 50s and it’s been this way all my life. Intelligence, capability, hard work, have very little to do with what station you achieve in life.

20 percent would work quite nicely for me as well. Although, I think 20% is about the minimum I would have to see in order entice me to buy somewhat quickly. Anything less than that, and I would likely take a wait and see approach.

LB. Most of us are just waiting to get into our first property.

You may get a 30% deduction man! I have been shopping for houses for two months now. I nearly bought one but I retreated two days ago when signing the offer. The seller is very motivated and he already chopped up 50 grands for a 650k nice neighborhood nice school property. But the economy is just a shaking boat in the wind. I am afraid prices will fall sharply after I buy it.

Let us count the ways Los Angeles now resembles a 3rd world country:

People packed like sardines into substandard housing…..check

Crumbling infrastructure (broken streets, sidewalks, water-main breaks, etc)….check

Large numbers of homeless and mentally ill…..check

Crime and graffiti on the increase…check

Lakers losing: Check

rampant political corruption ~ check

Hunan…Yep that is true about LA and SO Ca. in general, that said, St Louis Rams moved backed as well most likely the San Diego Chargers, I can’t imagine the type of fans in the stands for those games?

There is a point when beaches and nice weather will not be enough. Prices far outstripping what people make is a recipe for disaster.

I wonder what impact the new stadium the Rams will play in will have on housing prices in the surrounding areas?

I lived in the vicinity of a sports stadium and convention center for a while. It sucks. Tons of transient crowds flooding into the area creating congestion with little regard for impact on the surrounding area and that quickly gets old.

I currently live in the near vicinity of a convention center, two stadiums, and the happiest (read: expensive and annoying) place on earth. I agree with HC- the traffic and crowds get old quickly.

One thing that baffles me is this: in 2016, traffic planners (or whoever oversees this stuff) cannot conceive a better way to regulate event traffic (such as for baseball games, conventions, etc.) than to have humans directing traffic with hand signals and setting up cones. Really? That is the best way to manage event traffic? That the cones and the whole charade have to be carried out for each event is totally ridiculous (including 20+ police officers standing around doing very little). Maybe they like making everything confusing and unorganized so they can generate revenue (lots of traffic tickets)? I can’t really think of many other reasons for this thoughtlessness. Anyway, just my little rant on the subject.

“And you wonder why street parking sucks”

what an understatement, if i don’t get home by 5 forget about it there will be no parking until 7 am.

i’m going to go out on a limb here and say the average density is 3 people per bedroom in the apartment complex i live at…..and that may an underestimation.

i have a buddy that live in Santa Ana and the streets from one end to the other is nothing but cars. The density is so packed full they have laws that don’t allow one to park their car on the front lawn.

That’s why I have to have a 2-car garage wherever I live: I (and my wife) always have a convenient and secure place to park. An additional benefit is that my car is never 120° F baking in the sun so that I burn my hands touching stuff, and it is never freezing cold in the winter so that I have numb fingers on my commute. Surprisingly, even OC gets pretty cold at certain times in the winter.

Which is pretty dumb. What’s wrong with bricking over your lawn with green bricks and planting some shade trees? Get those cars off of the street, and would not look too bad. Why are lawns so sacred?

the easy answer is, then that wouldn’t be enough either, the streets and the front lawns would be full of cars and just invite more density per house….keep in mind (and no offense it’s the truth) this is basically Mexico we’re talking about here.

Alex. The new lawn ornament, a car, motorhome, motorcycle??? Oh well, have a nice MLK day.

Except tons of white people have to live that way too.

I like living on the mainland. I like being of the race that’s mostly in power. I like not being assumed to be a thief, robber, or worse. I can only recall one time I was followed around in a store here, by a (black) security guard, and I just found d it humorous. I *was* kind of wandering g around in a suspicious way…

But over here the assumptions go the other way. For some reason, because I’m white, I’m supposed to know a lot about computers (I don’t) and I’m supposed to live on the set of The Brady Bunch or Bewitched. Anyone who’s been on here for a while knows I lived in a building zoned as storage with no running water and make about ten grand a year and feel very fortunate to be doing so. It’s kind of fun to see the astonished faces when a truck full of Mexicans drive by and see me out in front pulling weeds, sweeping, etc.

Even “deepest darkest” Santa Ana has quite a few white people living there. And yes, crowded together.

I believe that tenants vacated for change of use are compensated in LA. My understanding is that WeHo has adjusted their rent control ordinance more in line with LA’s RSO. There has been an increase of investors who buy apt buildings, pay under-mkt tenants to relocated and renovated the unit and re-rent at market rate. There is a large shadow demand of renters now living with parents & roommate situations in SFRs that would rather be in their own unit.

And for all the beanstalkers out there – 15x to 19x GIMs won’t last forever. Just got back from London – now that is a seriously expensive RE market.

So many people decided to put their money in the stock or bond market and rent. What a mistake. Houses continue to rise while stocks drop. Inflationary recession straight ahead. Interest rates are falling very fast and mortgages will be down below 3% within months. The 3% rates will trigger another buying panic in real estate that will push prices higher again. Imagine how high real estate will be if mortgage rates drop to 2%.

@jt

Your prognostications would be miraculous to say the least. Recessions lead to massive job and wealth losses, precipitating severe spending cutbacks from both consumers and investors. The real estate sales in oil cities are already faltering, and pricing will follow shortly. Wait till a real recession hits the entire nation.

What would also be miraculous is if the past premise was accurate. In order for there to be another buying panic, there would have been a preceding one. Everything but the whole kitchen sink and all we got was the lowest home ownership rate in decades.

@HC

Touche. Expectations have been severely lowered due to acutely shortened attention spans. I must have missed the memo citing real estate as a safe haven investment during recessions. Or that lending for those who rely the most on low interest rates — organic buyers — will expand during recessions.

How is it a mistake if they cash out and lock-in their gains, never mind having the benefit of not needing to move in order to sell? Additionally beneficial is that the transaction costs don’t increase in kind with the asset price. The smarter ones will successfully short the market on the way down. Can’t do that with your house.

So, buy now or be priced out forever “within months” ?

I cashed out of a home I owned in So. Cal. in 2014. The thing is, I didn’t live there, but live in Denver, so it was easy to take a sizable profit as I didn’t need to find another place to live. I think the notion that you have to find another place to live is preventing a number of people from cashing out! I am sitting tight and waiting for the next recession/housing correction at which time, I will look for another property, perhaps Hawaii this time!

“So many people decided to put their money in the stock or bond market and rent. What a mistake.â€

While I agree that going all in on stocks at the moment is probably exercising questionable judgment, I would posit that buying a house now in many areas of So Cal might also be exercising questionable judgment. Everything is inflated, including housing. You don’t make money, save money, etc. by buying at inflated prices (near the top).

“Imagine how high real estate will be if mortgage rates drop to 2%.â€

Imagine how high real estate will be if mortgage rates rise to 6%.

Oops, I meant to state: Imagine how LOW real estate will be if mortgage rates rise to 6%.

jt..Last summer, I told a mortgage broker did he think that 30 year mortgages could go to 2.5% in mid 2016 if the wall street goes way south. He not only said very well could happen but if Iran and Saudi Arabia get on a collision course, gas could be under $2 come Jan. that I didn’t believe but it is here. So jt I think you may have something, 2% couple that with Obama putting in this new loan program of 3% down and 620 credit scores, and total family member income for qualifying for a mortgage and it is hold onto your hat what may be coming this spring in housing.

umm no. We are entering a deflationary spiral that will suck the housing bubble down with it.

One of the inconvenient truths about living in Los Angeles is the amount of overcrowding fatigue. It’s not something always immediately apparent on the surface, but doing just about anything in L.A. beyond a few blocks from home involves battling inefficient lines or crowds. That’s a significant part of what makes rhetoric such as the casual ski and surf in the same day meme such a ridiculously laughable suggestion.

During the day, it can take a half hour just to drive from one end of Santa Monica to another. Another half hour to drive back.

It’s always a hassle, sometimes a nightmare, driving toward the 405. Lots of traffic going to the 405 or the 10.

Just driving to Culver City takes about 50 minutes during rush hour, something I do monthly. And Culver City is close. Forget about attending events in the Valley or Hollywood or Downtown or Pasadena.

It’s laughable when people say “There’s so much to do in L.A.! Every night, every weekend, so much going on!” Sure there is — if you don’t mind paying for it with 100s of lost hours sitting in traffic, and stress, every year of your life.

Like most Angelinos, I stay in my neighborhood bubble, content with what’s available there, only rarely venturing far out for “fun.”

I’ve spent tons of time e in the Los Angeles basin and loved there for a while too and I agree. So. Spread. Out. and So. Many. People!e.

Silicon valley isn’t nearly as bad, and the public transportation here works pretty well. Downtown is pretty walkable and I can actually access fun things to do even on a low budget. The cities here have neat downtowns that are older and walkable.

LIVED GODDAMN IT seriously fuck this thing. Oh to have 1995 internet back.

Indeed. We were up in Wrightwood at a friend’s place a couple weekends ago, just after the big snowstorm. We got on the road right after the kids got finished with school on Friday, so we got up there without too much trouble, though it still took ~2X what it would have off-peak.

We left on Sunday at ~2:30. The traffic coming UP the hill (again, on a Sunday afternoon) was backed up all the way down the 2, and then ~2 or 3 miles down the 138, probably 10 miles in total. It was bumper-to-bumper, and just barely crawling along! All this for what looked like people wanting to take their kids sledding on the side of the road. There was absolutely no way these people were going to get to the snow before the sun went down. It was completely insane!

My wife and I looked at each other and asked what the hell we’re still doing here.

I think one major thing to think about here is OVER population.. and what are we going to do to stop America from being over populated.

I mentioned population once or twice as an issue and got shouted down each time labelled as a Nazi. It’s not going to end well. The Smithsonian Institute has calculated 2030 as crunch date when there is no longer enough resources available to match the population no matter how equally it’s distributed. Expect to see refugee waves of 20 Million or more. And death. Lots of death. All thanks to the misguided bleeding hearts of some cushy living types.

Reference:

http://www.smithsonianmag.com/science-nature/looking-back-on-the-limits-of-growth-125269840/?no-ist

Waft a body of heavy inert gas into the path of the invaders and they peacefully go to sleep. Think things won’t come to this?

nice post hid. But i think it will take longer than 2030. and i dont think it will be as dramatic. but i do think that we will run out of resources.. particular in the food industry such as meat.

Soylent Green

It was predicted in 1960. And during the Seventies. And now again 40 years later. Eventually it may come true, but predictions and computer models are just as reliable as the latest using Psychic Friends.

A new generation comes along and there are always willing tools to buy into the fear mongering. For the last 60 years or more. I am sure I could look further back than just 1960 and find such visions from the 30s and 40s as well.

I’ll get my “Doom Porn” from Zero Hedge. I’ve already heard these proclamations too many times during my life on Earth.

History always seems to begin on the day one was born.

Limits to Growth ran many scenarios. A few extreme, unlikely scenarios showed the end of growth before the end of the 20th century. Those who had a vested interest in discrediting this study cherry-picked these scenarios and depicted them as what Limits to Growth predicted. Well Limits to Growth didn’t make any one prediction. However the majority of their scenarios strongly suggested the end of growth around the middle to later part of the 21st century. We aren’t out of the woods yet!

The predictions of Limits To Growth have proved to be stubbornly true. Also look up the Olduvai Theory, an off the cuff prediction a guy came up with, that if anything is coming right along and a bit ahead of schedule.

Most of the country is not over populated even with wide open borders. It’s welfare magnet states like California and sanctuary cities like Los Angeles that are over crowded.

Exactly, the Lincoln Institute Atlas of Global Land Consumption, shows the percentage of urbanised land relative to the whole, and relative to arable land, for most countries. The USA is indeed among the most lightly populated. Western Europe’s nations are among the most populated, even compared to China, India and most Asian countries. Japan is one of the most highly populated, and they are not starving to death there, or in Western Europe. The Netherlands is one of the densest of all.

There is probably no correlation between population density nationwide and economic and socio-economic outcomes. Nations that we think of as having an “overpopulation” problem mostly suffer from excess concentration of population in cities with inadequate infrastructure networks. While developing nations have problems with corruption in the process by which cities are enabled to grow at all, the majority of people will be trapped in over-crowded poverty.

But “developed nation” cities with a problem with horizontal growth, tend to be retrograding over time, back in a general convergence of living conditions for much of the populace, with conditions in developing countries. There are people living crammed into garages and basements and lofts in London. As I say in a comment below, this is the dirty secret of “successful intensification” in all “smart growth” cities. It is not smart growth at all, it is an immoral cram-and-gouge racket.

seismic…Very true, most of America is a waste land of nothing. You drive thru many states not much going land abounds. Companies want to move to foreign countries, if keeping them here were made attractive all this empty land would be converted to new towns and great opportunities for the masses, but the power players want to keep Americans in decaying cities and low quality of life like So Ca. The banks have to much invested to create new modern mega cities, they want to keep property values up in hell hole cities and not a mass flight to a better life for many.

Come on now Robert, I’m a native of so. CA, and I could live quite well there as long as I didn’t play by the rules. If I went back down there, I’d be a bum. I know a nice park and a few other nice places to sleep in Newport Beach, and I’d play music or draw portraits or a bit of a few different things and live like a king. There are even cheap places on the Peninsula because there’s absolutely no parking, which is zero worry when you get around by bike. I could do sign painting for all the small businesses in a ten miles radius, and people would welcome me. Fishing off the pier, or buying fish fresh from the dory fleet, geez you’re making me miss the place.

Prices will not fall until inventory increases. Inventory will not increase until people start defaulting in higher numbers. Currently I do not see a increase in inventory, especially in the lower-end starter homes. Few people are upsizing in the current SoCal market, some may be downsizing. I have noticed banks are moving faster to foreclose then they were a few years ago. But with help from the new fed programs many homeowners can delay the foreclosure process for years and live for free. I currently know someone who has not made a mortgage payment in over 2 years.

Except when housing prices fell in the mid 90’s and again in 2006, yet there were no significant amount of housing starts.

Sometimes bubbles exist for no reason (see Dutch tulip mania). Extremely low interest rates helped cause the last housing bubble, but that trick has run it’s course. Prices should correct to the Case-Shiller average for the area – so in west L.A. – prices should tank hard – 30-40%, like they did after the last bubble.

why is the only scenario for increased inventory related to foreclosures? Has foreclosures been historically the only way inventories increased?

Actually, inventories will increase when elderly home owners come to the realization that their $700K crap shack is not going to sell for $3 Million dollars.

There are massive numbers of people over the age of 60 in the Mar Vista-Palms-Culver City-Cheviot Hills-Westchester-Marina Del Rey region who are not selling their homes because they believe this region is the next Malibu / Bel Air / Holmby Hills / Newport Coast / Manhattan Beach. (no I am not kidding).

They refuse to part with their lotto ticket because of this belief.

When prices stagnate and reverse, which they always do in recessions in SoCal, you will see the inevitable flood of homes hit the market.

The current lack of inventory is driven by the belief that median home prices will soon blow past $2 Million.

In many recent posts I see the belief that “if stocks fall, SoCal real estate must fall”. Historically, that has only true half of the time.

Evidence:

1980 Stock Market Drop. Result interest rates are very high which causes SoCal real estate to fall 25%.

1987 Stock Market Crash. Result .. Interest rates drop which causes SoCal real estate to rise until 1990. After 1990, real estate fell 25% because of Aerospace job cuts.

2000 Stock Market Drop. Result … Interest rates drop and SoCal real estate rockets ahead.

2008 Stock Market Crash. Result … No mortgage money available and SoCal real estate falls 25%.

SoCal real estate fell after 1980 and 2008 stock market drop. However, SoCal real estate rose after 1987 and 2000 stock market drops.

So what happens this time? 50% chance real estate falls, and 50% chance real estate rises. It all depends on the direction of interest rates.

In your possibilities you never had a situation of stocks down while interest is close to zero.

If stocks collapse in close to zero interest what can propel prices? Forget about price increases. How can you keep prices from collapsing when the interest is close to zero and the stock market collapsing? Not only US stock market, but global stock market.

How can you keep prices the same in a world wide deflationary environment???

If 7 years of ZIRP has helped produce the lowest home ownership rate in decades, what would another 7 years do? In addition, Wall Street and the stock market are closely intertwined — unlike the years prior to the 2000’s. Wall Street banks were the architects of price run ups during the 2000’s. Now, Wall Street REIT’s are the front runners for the more recent price run ups. Any guess what happens when their stock or bond prices falter?

While the focus is always on living conditions and prices in California, the impacts of California’s mess, is felt much more widely. I live in the suburbs of Denver. Because we still have open-spaces, the entire region is undergoing a housing boom and my guess is that people fleeing California are a major reason. Sadly, just like L.A. we will soon have a 150 mile swath of homes, apartments, and shopping centers from Colorado Springs to Ft. Collins, as every last piece of vacant land is filled in!

JNS…My I a give you a argument, true many Ca. folks venture to CO but the stats show many are not happy there and want to leave. The boom in houses guess what, ask many owners why they are selling and most will tell you they want out of Co. Liberal laws, drugs (legal), high property taxes, crazy weather, traffic, weird transient people in and out of town, hang in there, the boom is ending as I type, real estate is crashing in Denver as well as Austin Tex.

I’ve lived in AZ and CO. There’s a reason flyover country is cheap.

AZ and CO aren’t what I’d consider flyover country, but, either way, once you get out of nicer parts of LA, San Francisco, etc., California isn’t any better, which is why I can’t understand why people spend so much to live in California. I’d rather live in Beverly Hills or West Hollywood more than Denver, but I’d rather live in Denver than many (most?) parts of Los Angeles.

Saw Big Short last night…. more clear than that, impossible. We (and the system) will continue to be manipulated by few disgusting greedy sharks who are going to continue laughing at all of us while their bank accounts continue to sore…. and stupid people continue to pay high prices for crap shacks…. how stupid SOME people are…

It’s not just Los Angeles, it is happening in unexpected area such as South Orange County. I live in Laguna Niguel and there is open class warfare between SFH “Owners” vs Apartment dwellers in my area and it is over street parking.

I live in a moderately priced apartment complex (Hidden Hills Condominium Rentals). There are very few affordable options in this area… but plenty of low pay jobs at the Resorts (Ritz-Carlton, St Regis and Montage are all nearby) as well as low-pay retail jobs are the nearby Malls. In the last 5 years, I’ve seen my complex go from singles and small families to doubled up families with 8-10+ people living in 1,000 sqf 2 bedroom apartments. The management has done their best to handle it… they have evicted tenants breaking the lease through overcrowding (one apartment had 16 people living in it!).

Back to the original point… all these people have cars but no permit to park in the complex, thus spilling out onto the surrounding streets. The adjacent homeowners had made headway on requiring a permit for street parking. Didn’t we all move down here to escape LA? And we brought it with us!

Amazing, we are practically neighbors. I live in the apartments between Hidden Hills and Marina Hills and have experienced the same thing. A few months back I received a notice that the homeowners living on Springwood near the park were petitioning for permitted parking. Speaking with the Civil Engineer in charge of the request, it was clear that they understand that population density is rising as more people are living in each household and therefore more cars on the streets. I agree that this is class warfare and voiced my opinion that if homeowners want to privatize parking, they can pay for it with a gated community to keep us out.

Thank you for posting this, Doctor. This effect is the dirty little secret of all contemporary “urban intensification” in cities with planning or zoning or geographic or other factors “preventing sprawl”. It is always through crowding, not through “redevelopment” or building “up” as the utopian planners and advocates like to assume.

In contrast, cities like New York evolved with a lot of building “up” in an appropriate location because of the way the local economy was evolving, and to enable actors to be “priced in” to where the agglomeration effects were spatially concentrated. Floor space was added (something like tenfold over 7 decades) even as the population fell 50% – creating vastly more living space per person for similar income-related cost. This is possible in urban land markets with free-sprawling fringes, which create an anchor to the urban land price curve. Locations are substitutable all the way from the fringe to the centre. Exurban land competes with fringe land; fringe land competes with outer suburban land, outer suburban land competes with inner suburban land, and so on. Multiple nodes of activity compete with the CBD.

When there is no exurban land competing for supply, all land values start to behave completely differently, they are effectively a “monopoly good” and theories of monopolistically derived prices are absolutely appropriate. Under these conditions, it is not necessary for “landlords” to provide more floor space – they can increase their returns through crowding. Tenants are paying more and more for less and less floor space anyway.

When there is “competitive land supply” and people can choose housing options of all types and locations at a fair cost, there will be far less willingness for people to “crowd” to achieve a location near evolving clusters of economic activity. Site owners will have to build more floor space – that is, build “up” – if they want more income by having more tenants. This is how Houston is evolving right now, a LOT more “multi-unit” housing is being constructed there, proportionally to the size of the urban area, than in Portland or Seattle or San Francisco or New York (NY in the 1990’s flipped to a growth-contained urban area because of the fringes finally coming up against rural zoning in surrounding municipalities, which might as well be a growth boundary). Houston is also adding stand-alone family homes at twice the rate of multi-unit housing, making its total housing supply an order of magnitude greater than any “smart growth” city.

Cities in the UK are (for a given population) significantly denser than Western Europe’s, and 6 to 10 times denser than US cities – and this is nearly ALL due to overcrowding, not built-upwards floor space. Certain advocates blame “height restrictions” for UK cities housing shortage problems, but this is nonsense, as massive swathes of these cities have been “upzoned” repeatedly in successive “Plans”, yet minimal redevelopment is ever actually caused to happen as a result.

So the heart of Los Angeles is more dense than Manhattan’s suburbs?

If you look at the census data, the residents per housing unit is about 3, which is the same as most of California. The census data would include illegal units, but density/housing unit is not more than average and is not getting worse.

Rents for new units are simply in dire need of a correction. Actual (rent controled rent) still propably needs to go up.

I believe the rent control laws in LA are actually contributing to the problems. Rent control enables people to live for many years in rental units far below market value. When a landlord is unable to offset the costs of maintaining and paying for the property due to low rents, he becomes a slumlord and neglects the property. It should be a open market set by supply and demand. If landlords were allowed to charge whatever they wanted for rent, there would be a competition to attract the best tenants and the rentals would not be in such poor shape. Surrounding counties have no rent control and seem to lack the ghetto slums which have taken over large parts of LA.

I used to believe this too. But now as a long term renter with little opportunity to buy anytime soon in this inflated asset environment, I feel differently. Also, when one realizes that CA rent control came into effect as a consolation to prize to renters when the great gift of prop 13 tax rate freezes were given to home owners, then you have much less pity for the landlords. They are enjoying low property taxes and so…the pass on of rent control to some long term tenants cannot be disputed as welfare.

I would only agree to undo rent control if and when Prop 13 for home and property owners were repealed. They go hand in hand.

You are right that they both, prop 13 and rent control, create distortions with many unfortunate losers. But to only punish the winners from rent control and not the real winners, the property owners, is ludicrous.

As to rent control in city of LA, I am a benefactor, and maybe there is an upside: I rented in a dense LA neighborhood that was impacted by the ’92 riots, my rent started at $700 and when I moved out 12 years later, my rent was $923. As my career advanced I saved and was finally able to buy a place. So I benefited from a manageable pattern of rent increases, and now I pay in to the city.

Laura, while homeowners wouldn’t want to get rid of Prop 13, I’m sure landlords would love to dump Prop 13 IF rent control went with it. Higher property taxes would be just another expense to pass along to tenants.

Abolish rent control, your rent might double.

Abolish rent control and Prop 13, you rent might triple.

The above increases are just illustrative, to show that either way, landlords would get the same net increase.

“Higher property taxes would be just another expense to pass along to tenants.”

It’s not that simple. Price is set by what the marketplace will bear.

“Abolish rent control, your rent might double.”

No, it’s a rebalancing effect.

The rent control beneficiaries would face significant increases but the majority non-rent control tenants would not.

Abolishing rent control removes the subsidy paid for by non-beneficiaries. What would be more likely to happen is that overall rents would experience downward pressure as the previously subsidized units readjust to non-subsidized pricing.

Another thing to keep in mind is that many landlords simply don’t improve rent-controlled units to the same extent as non-subsidized units. This means that landlords would take on added expense of improving these units if they were to demand optimal market rents.

Prop 13 is the same deal. Later entrants are subsidizing earlier entrants. Both are moronic short-sighted feel good in the moment policy. Of course the beneficiaries don’t want the party to end and will come up with any argument imaginable in order to stave off the inevitable.

Rent control applies to units that were built on or before October 1, 1978 in the Los Angeles City area. So most of the units in LA metro are no longer under control.

Santa Monica and West Hollywood had some of the most restrictive rent control ordinances in the country. Landlords would use the Ellis Act to bypass this.

ernst blofeld: “Santa Monica and West Hollywood had some of the most restrictive rent control ordinances in the country. Landlords would use the Ellis Act to bypass this.”

Landlords still Ellis out when beneficial — and possible. The city’s latest pro-tenants tactic is to place “landmark status” on buildings. Crappy 20th century rental units are suddenly “historical landmarks” in order to prevent their being Ellised out.”

SOL

What is Ellis Act?

Flyover: “What is Ellis Act?”

It’s a “Landlord Liberation Act.” A state law that recognizes a landlord’s right to “get out of the rental business.” So if a landlord own an apartment building — even if it’s rent controlled — the landlord can say, “I no longer wish to use my property for the rental business.” He can evict the tenants and do something else with the property: https://en.wikipedia.org/wiki/Ellis_Act

A great way for landlords to transform an unprofitable rent controlled building into lucrative condo development.

After the state of California passed the Ellis Act, many Santa Monica landlords “Ellised Out” their rent controlled buildings in Santa Monica. This decreased the number of rent controlled units in Santa Monica. Some were turned into condos. Many were tore down, with new, nicer condos built on the land.

So the Santa Monica city council — which is elected by tenants — sought ways to create new rent controlled apartments. One method was to waive height restrictions for new buildings — hotels, condos, even office towers — provided that the building include some “low income rental units.”

Another method is to declare a rent-controlled building a landmark, so the landlord can’t tear it down. That limits the options that a landlord has for the property.

Thanks, SOL

Millions aged 50+ living in SoCal 600K+ properties they’ve owned for decades who believe there are millions of high earning Millennials eager to marry, settle down, start families who can/will buy their houses one day at current or higher valuations.

Millions aged 40- struggling to make above $15/hr with little/no job security, living with parents/relatives/roommates, many far more interested in travel, food, entertainment and life experiences than saving up a six figure down payment for a bland stucco crapshack, marrying, and having kids.

What could go wrong?

Mexicans are leaving. Wonder why?

http://www.huffingtonpost.com/entry/immigration-reverse-more-mexicans-are-leaving-us-than-coming-in_564e04a4e4b031745cf02dfb

Better hope for a continuing influx of wealthy immigrants with cash stuffed suitcases, kids with generous Helicopter parents bearing large cash gifts, and trust fund babies to buy all those SoCal houses, because this is a very imbalanced situation.

In the city of Chicago we have a similar problem. In a lot of Hispanic neighborhoods you can have a single family home and they convert the basement to another unit and add in a shower and a kitchen and boom, three single guys or three single women can live there.

We have a lot of street parking. Now, even though each single family home has a two car garage. It is still not enough and street parking is impossible to find. Between 5:30 PM and 8 AM you won’t be able to park your car.

In other areas of the city that people deem trendy, they have the same issues. Young professionals may share a three bedroom apartment and for each unit each person probably has a car. Unless if they work in the city in which case they take public transportation. At least in Chicago we have a wonderful public transportation system and traffic is not much of a problem like L.A. because we have so many highways and so many major streets.

Part of the reason parking is and always has been a problem in Chicago’s high-density neighborhoods is that this is a traditional Eastern-type city mostly built up in the 20s, when most people relied on public transit and lived in “walkable” neighborhoods. Planners built for 1 car every 4 households, and couldn’t have imagined planning for 3-car households.

That’s what I love about this city- all the high-density neighborhoods with ample retail, services, and entertainment within easy walking or busing distance of my apartment, that enabled me to ditch my car when I moved here 30 years ago. It seemed like the best of all worlds- a place where you could easily dispense with a car, but where you could move out to the bungalow belt where rents are relatively cheap and parking ample, if keeping a car meant that much to you. I wouldn’t want to run a car in my area, West Ridge, where it is impossible to get a space on the street after 5 pm. Permit parking has not helped, but only made life difficult for everyone. I hate it because it enables people in the notion that they own the public street parking in front of their homes, and makes it very difficult to have visitors to your home who live elsewhere- a permit parking ticket for $30 a suburban friend of mine received when she visited me, had a very chilling effect on our friendship, let me tell you.

Cities designed before the motorcar kick ass! San Jose was a big bicycle town, with something like six professional racing teams back in the day, and I can cover the whole town on my bike. It’s not even a skinny tire bike, it’s an Electra cruiser. I’m not riding this winter and using public transit and that works well too. Honolulu is like this too, you can get all over just walking.

While supply is tight in certain markets, prices are way out of line with salaries.

The primary reason rents shot into the stratosphere is that Wall Street bought all the properties and is doing what they always do. Investors are buying properties and pushing up rents, while doing the bare minimum to keep the properties up. Renters can complain about slumlords cutting corners but Wall Street types know they just need a couple of really good lawyers to keep them tied up in red tape until they give up. While finding alternative housing takes a while it is worth it.

“The Coming Nightmare of Wall Street-Controlled Rental Markets”

http://www.alternet.org/hard-times-usa/game-homes-coming-nightmare-wall-street-controlled-rental-markets

Alternet.org is a far-left, political activist site. Its “news stories” are about as objective as those of Fox News on the right.

From today’s LA Times “LA’s hottest zip codes”

areas where there have been large price increases.

Of course, we all know that places like SM and Manhattan Beach would be in the article, but also places like Lincoln Heights and Compton….

“…….To gauge L.A. County’s hottest neighborhoods, The Times ranked them by the change in the median price per square foot for a single-family home. The median is the point at which half the homes are sold for more and half for less. The per-square-foot metric was chosen to best account for changes in the sizes of homes selling, such as older smaller houses that are desirable but have relatively lower price tags.

Sales and median prices reflect transactions involving existing single-family houses. The comparison is for the 11 months ended November 2015 with the same period a year earlier. All neighborhoods had at least 30 sales. (Source: CoreLogic)……

http://www.latimes.com/business/realestate/la-fi-la-county-top-neighborhoods-20160117-pictures-htmlstory.html

Housing to tank hard…. someday.

Don’t shoot the messenger, looks like Manhattan Beach RE is doing quite well:

Manhattan Beach | 90266 (Photo: Jay L. Clendenin / Los Angeles Times)

Median price per square foot: $1,021, +21.4%

Median price: $2,100,000, +10.1%

Sales: 288, -18.9%

Manhattan Beach long ago ditched its reputation as a sleepy beach town. Professional athletes, tech executives, Hollywood types and other high-income earners are drawn to this city by its beach lifestyle, good schools and gourmet restaurants.

But buyers on the hunt for a home find all that competition means there are few for sale and at top prices.

The median price for an existing single-family home hit $2.1 million last year, up 10.1%. The median price per square foot grew about twice as fast to $1,021.

Developers are also playing a role in driving up prices, buying a dwindling supply of cottages and throwing McMansions up at a rapid pace.

Real estate agent David Keller said he sees the dynamic holding steady, given the extremely low inventory in the city and lack of room for new development.

“I don’t think anything will change dramatically anytime soon — unless there’s some sort of economic catastrophe,†he said.

http://www.corelogic.com/downloadable-docs/dq-news/ca-home-sale-activity-by-city-november-2015.pdf

LAT is using “The comparison is for the 11 months ended November 2015 with the same period a year earlier.”

The problem with this is that earlier in the year activity can add skew which isn’t apparent in the aggregate number.

Manhattan Beach median property prices were down 6% in November 2015 compared to November 2014.

The mention of Santa Monica and Manhattan Beach is curious because something about these two markets caught my eye in the CoreLogic report of which the link was kindly provided by another commenter a couple DHB posts ago.

When overall median price is examined without the per sq ft overlay, the story changes:

– Manhattan Beach YoY 11/15 -6%

– Santa Monica YoY 11/15 -4.6%

This begs further context be given to the “hot†conclusion this article suggests because a higher subunit cost attribute is occurring in-kind with a declining property price midpoint. This doesn’t necessarily parse all that well with the globally desirable wealth parking demand memes so often conferred to these two locations.

It also doesn’t line-up with the assertions of “If you were a seller, the Southern California housing market was a good one last year”, nor “Affordability is dulling demand”, since each transaction is by property, not by sq ft and the demand as measured by price appears to be trending toward lower priced properties. Again, this is regarding Santa Monica and Manhattan Beach.

This dovetails into the story on ghetto locales such as Compton being on the list, because just like in the last bubble, these crapshack fields bared the final fruit of the season.

Yep, last bubble the high end started slowing down in 2003. Fed started raising rates first quarter of 2004, which is when my neighborhood peaked and I sold a few months later. But in lower end hoods, the bubble was still active into early 2005. I was telling people of the bubble and they were saying I was an idiot because they could point to hot sales in some areas. But inventory exploded during that time, up probably 3 fold inside of a year. I speak of San Diego County, was different elsewhere I’m sure – I moved out of Cali end of 2006 to a state where the bubble was just peaking then, so it takes a while to travel.

I own in Koreatown (Los Angeles) and chose the neighborhood specifically because it is high density. It’s near a subway, and i can walk to every errand and dozens of bars/restaurants. My building included parking, so that is not a significant concern for me.

It is awful that there is a lack of affordable housing and that many are being gouged by large investors with high rents. However, I don’t see real estate falling by huge percentages this year, and most predictions seem to be opposite, with real estate increasing MORE if anything.

My question to all the people hoping for/predicting a huge (20-50%) correction is this- is this based on your own desire to profit off lower real estate prices, or is there good evidence for this? Why such glee for homeowners to lose? Rent decreases are another story, and easier to sympathize with.

@ Lalandian I think the majority of people on this blog are hoping for a huge correction so they may buy – become homeowners; while a minority are investors/flippers. Some are confirmed renters (ie said they would never own a home) and perhaps have some morbid wish for the market to tank but still would not buy. And some of the majority mentioned (owner/occupiers hoping for a huge correction) were arrogantly sitting on the sidelines in 2010, 2011, 2012, believing that a dead-cat bounce was on its way.

And some of us are just bemused observers. I’d probably have been able to buy if I’d stayed the hell away from college. Jesus God, I already knew a finishing nail from a Brad from a roofing nail, was handy with a saw, knew how to solder, etc. when I was in high school, and the GED I got was fine. (I could not afford to stay in high school, I had to work so I could eat.)

“You’re smart, you should go to college”== ” Fuck you”.

@QE Abyss, “buy low, sell high”, duh!!!

I went heavy into the stock markets in 2010 when everything bottomed out. There’s no way I would buy stocks in 2014, 2015 or 2016. Ditto for real estate in SoCal.

“My question to all the people hoping for/predicting a huge (20-50%) correction is this- is this based on your own desire to profit off lower real estate prices, or is there good evidence for this? Why such glee for homeowners to lose?â€

People that want to buy a house (me included) want lower prices- duh! I would say that accounts for a large portion of the sentiment here. @QE Abyss did a good job on summarizing other reasons. Btw, it’s not that I can’t afford to buy something I want at current prices- it’s that I feel that there will be a significant correction at some point in the coming year(s), so I’m content waiting it out to see what happens.

This should be obvious to most people (except maybe the uber rich to whom expensive housing means little): expensive housing is a drain on everyone, existing owners included. Drawbacks to existing owners include increased property taxes and interest payments, and limited upward mobility (everywhere local they could move is also expensive, so it’s of little significance that their house is worth X amount). There are some circumstances in which expensive housing might be beneficial, such as if an owner sells and moves to a less expensive state/area, or if the owner dies and the heirs receive more money from the house sale. Other than that, though, I see little benefit to most people regarding expensive housing.

Wouldn’t it be nice to spend 10% of your income on housing instead of 20-40%? I don’t understand why the concept of lower housing prices being a good thing is such a difficult concept to grasp.

Basically Lalalandian many on this blog wish doom and gloom on the current housing market so maybe they can pick up their own crapshack at a discount. Once that happens they will join the other side and sing the joys of Pop 13 while looking down upon the lowly renters of which they were once. It’s the circle of life.

As opposed to a “nirvana” where taxpayers are forced to subsidize a real estate market to the point that it becomes unaffordable to not only them but to future generations? A utopia where the richest .0001% are bailed out while the remaining 99.999% (you and me) scrounge for scraps? That .0001% can reliably count on factions of the 99.999% to act against their own self-interest.

Hypocritical that you mock one form of subsidy (prop 13) but defend a real estate market propped up by the largest government and Fed programs in recent history.

Many commenters here want a real estate market based on free market principles where prices are determined by real demand and supply rather than by exclusive access to cheap borrowed money and financial gimmicks.

I am grown up enough to know the difference between wishes and reality. My wish is that Real Estate in Oregon would take off like a rocket, especially rural areas within commuting distance of Willamette Valley University towns. Then I’d like to see SoCal R.E. plummet so I could do a 1031 without having to pony up a lot of cash. But realistically, even $2 a gallon gas isn’t going to help rural RE, as the back to nature scene is truly passe. (Sooooo 60s and 70s, you know, like in TV’s “Green Acres”.) The SoCal plummet is a possibility if we have another deflationary bubble pop somewhere, but I really need a coordinated boom and bust for my own selfish gain. So there!

Honestly, your situation is probably the direction Los Angeles should go, the problem is that there are lots of competing interests. The NIMBY crowd will try to stop any development they can get their hands on, those folks are the real culprits. For all the problems with subsidizing mortgage interest, Prop 13, etc., if you just built more housing, home prices would stabilize. But as you can see on the front page of the LA Biz Journal this week, NIMBY folks are trying to stop any zoning variance in LA for future development and they also want to stop “mansionization”, which is folks tearing down crap shacks in nice neighborhoods and building larger, nicer homes. So basically, what these folks are saying is NO NEW HOUSING FOR THE POOR OR THE RICH IN LA. Well, guess what’s going to happen now guys if you don’t build any new housing stock? People here like to blame greedy developers for building over priced homes, well, now they’re not going to build any homes at all, so at least you have that consolation. What the city of LA should do is fast track a ton of new housing all along the new metro lines, Expo, Expo 2, etc. It’s a no brainer for the same reasons that Lalalandian bought in K-town.

@dean, I completely agree with you. I’m from the east coast originally and the attitude against density is so confusing to me- Beverley Hills spending public resources to fight against public transit? High rises next to metro stations blocked in parts of Los Angeles? Why? LA worships cars, and I obviously don’t get it. But there are costs to all this car worship… And thank you for all the commenters who responded to my query! I’ve been on both sides of this issue and as a potential buyer I had that hope “maybe the prices will crash this month or next” but no luck. I bought high but plan to stay forever.

Regarding landmark status are as way of getting around the Ellis Act, here are some examples:

http://www.jewishjournal.com/community_briefs/article/teriton_landmark_status_upheld_but_residents_still_face_eviction_20070622/

http://www.santamonicadispatch.com/2009/06/down-with-garden-apartments-up-with-%E2%80%98luxury%E2%80%9D-condos/

http://www.smmirror.com/articles/News/Stretch-Of-San-Vicente-Blvd-Designated-As-Santa-Monicas-Third-Historic-District/44791

I fail to see how apartment buildings are historic landmarks, just like I fail to see how Norm’s in West Hollywood is a historic landmark. I do see how we are becoming a less-free society where people are dictated what they can and can not do with privately owned land.

Geez I miss Norm’s. Imagine a Denny’s that’s open 24 hours and has better food. I used to go to the one on Harbour Blvd every day after work, repairing airless paint sprayers. We had to keep a shop rag handy at all times there, and I’d reach for my wallet to pay and there would be that darned shop rag, tucked in my pocket and I knew it’d been flapping in the wind as I rode my motorcycle from work…. I think all Norm’s restaurants should be declared landmarks.

You have a number of gorgeous 20s vintage apt complexes in older L.A. neighborhoods like Los Feliz, that are totally landmark-worthy. It looks to me like most of the housing in Los Feliz is worthy of landmark status. What a beautiful old neighborhood that is. It saddens me to hear that it has become dangerous. We don’t take good care of our cities in this country.

LA, Bay Area….all the same. Impossible to raise kids, homeless all around. I would settle my mind with expensive home prices, if this area would offer good schools, clean streets and safety for my kids to walk to school and back, play outside with other kids. All the tax we pay goes to all of those section 8 pot smokers, lazy people I see on the streets hanging out in the day time. My God! Why do I have to work my ass off to support them? Why do I have to sacrifice time with my kids and come back home tired and see homeless pushing carts around and yelling bad words? Its some sort of endless circle – move to better place and have no work, stay where work is and live in HELL…

Yeah, that’s why we finally got the gumption to leave. It would be one thing if we were paying exorbitant prices in LA for luxurious neighborhoods and great schools, but that isn’t the case. Sure, to stay close to our family and friends, I’d pay something like 25%-35% more to live in LA over another medium to large size city in the US, but for 200%-400% more, no way.

I have come to the conclusion that LA is only for the uber-rich. When I say that I mean multi-millionaires with FU money. It is a playground for them and a third world shithole for everyone else.

Section 8 takes years to get, and more years to find a place. Many homeless people have disabilities that are not obvious, I’ve seen broken collarbones, all sorts of grisly things. Many are mentally ill and first world countries have this thing called mental health care, I think we should try it.

How many homeless people have you talked to? I make a point of doing so. Many have tech skills and one guy I know was ordered to train his replacement, immigrant, workers and then fired.

One or two missed paychecks and you’ll be out there too. This is why I advise all yuppies to befriend their local hopeless population, spread a few sandwiches around etc. because after one small mishap, health or financial, they’ll end up in the homeless camp themselves.

OK I’m going to let that fucking typo stand, because homeless really does mean hopeless in the caste society the USA has become. I like to say, you’d better have 100 friends, because 99 of them will turn their backs on you.

“Why do I have to sacrifice time with my kids and come back home tired and see homeless pushing carts around and yelling bad words? Its some sort of endless circle – move to better place and have no work, stay where work is and live in HELL…”

Escape,

There is life outside of SoCal. I found it for myself – a very good life. I used to live there and it is true that you might find a job paying better but how much you make is irrelevant. People get blinded by the income per year which is meaningless. You want a high income? In billions per year? Go to Zimbabwe. Everyone there is a billionaire.

What counts the most for income is – after taxes, what is the purchasing power (for house, rent, services and other things). If the purchasing power after taxes is so low in SoCal, then it is time to move like millions before you. I am one of those and never regret it. Maybe I can make less than in CA. But I live in a super nice neighborhood in lower cost of living, take my family every year to Hawaii for a month or two, have time to enjoy my children, and never get stuck in traffic regardless of time of the day and still get money left over to save for college and retirement. All because I made logical decisions without getting my feelings in the way.

Don’t get me wrong, there are still few nice places in CA that I like – La Jolla and south part of OC along the ocean. However, to enjoy that natural beauty and have a nice lifestyle I need at least $5,000,000. Not just to buy a nice house in a safe neighborhood, but to afford so much in life besides a house.

The outcome for everything in life is a cumulative effect of many choices. The market conditions are what they are – you can not change them. However, you can change your decisions in regard to those circumstances.

Denver housing is getting up there with So Cal. A 100 year old house, 3200sq ft for $1.1 million? Not a crap shack but certainly not a mansion and not close to the ocean with So Cal weather.

http://www.zillow.com/homes/for_sale/Denver-CO/pmf,pf_pt/13345820_zpid/11093_rid/40.057577,-104.426079,39.470125,-105.284386_rect/10_zm

All that shows is their generic page for condos in Denver.

But I agree, I see rentals in new Orleans at California rates, rentals in Prescott, Arizona at California rates, etc.

What I think the problem is, is Californians getting old and a bit senile, and start dipping into the Rush Limbaugh, and convincing themselves that they should leave California. I saw a lot of this when I was in Arizona. People who’d blown their wad buying in Scottsdale or Prescott, and six months or so later wondering what the hell they’d done. Living on the set of Hee-Haw gets old fast.

Just a quick note on the college thing before I get to my main point – I know you don’t believe it’s smart, but income statistics don’t lie, college CAN still be done on the cheap, and it depends greatly on what your degree is in. Out of ~20 working friends that we see semi-regularly, all but myself and two others have degrees, and most of the rest make more than I do (wifey is slumming it at $74k with her communications degree). Some significantly more, like $120-150k. Those are engineers and senior developers. Not counting the wealthier ones because they’re in another league (still degreed). The degreed developers at my work make THREE TIMES that of the people with degrees in literature (lol), media, and marketing, regardless of age or intelligence. Luckily I’m in a position now where the degree doesn’t matter as much anymore, but I still wish I had one, and not having it early in my career was a big roadblock both in salary and finding work. All that said, my best friend did not go to college, is a 25-year veteran at Costco part time, lives a simple life in a small paid-off inland condo with no debt, and I envy his life more than the wealthy ones.

The set of Hee-Haw is appealing to some people. And it depends on your stage in life. Once my kids are done with school, I plan to split my time between so-cal near the office and a second home in a tiny northern Idaho town, where I would telecommute and take a walking tour of the breweries every weekend. Heaven on Earth to me is being able to walk from one end of town to the other in 10 minutes. An old, quiet, laid back, remote town with friendly people, no traffic, and silly low-budget parades. Big cities are places to drive through periodically to remind myself how much I despise them.

Having lived in Denver area in my ‘ute’ – this nabe is in a primo area of town – one of maybe a half dozen nabes that can justify 1 mil for a shack. Deal is – this is a bungalow – most likely has a basement and a one car garage off an alley in the back. 3200 s.f. may include the basement s.f. This is NOT a 1.1 mil house by any stretch of the imagination as is.

What I think is going on here is this house is located just a few blocks to the northwest of several streets with larger homes – very nicely appointed with alot of 1920’s 30’s character and much larger – small estate homes that were for the uber wealthy back in the day. WE are talking brick walls and gates. The shack listed may be waiting for a scrape to start to build/ expand value in this area – a risky play.

Area is a 10 min drive down 1st ave / Speer Blvd to downtown – easy breezy drive and next to a very high end shopping district in the Denver area. Very desireable geographically.

Bottom line – this property reflects the crazy in the Denver market. Just yesterday in the BoCo (Boulder County) News the chamber of commerce there has indictated that the entire front range could very well be in a bubble. Ya think?!

Leave a Reply